Table of Contents

As filed with the Securities and Exchange Commission on September 26, 2011.

Registration No. 333-175597

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CDW CORPORATION*

(Exact name of registrant as specified in its charter)

| Delaware | 5961 | 26-0273989 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Number) |

(I.R.S. Employer Identification No.) |

200 N. Milwaukee Avenue

Vernon Hills, Illinois 60061

Telephone: (847) 465-6000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Christine A. Leahy

Senior Vice President, General Counsel and Corporate Secretary

CDW Corporation

200 N. Milwaukee Avenue

Vernon Hills, Illinois 60061

Telephone: (847) 465-6000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

James S. Rowe

Kirkland & Ellis LLP

300 N. LaSalle

Chicago, Illinois 60654

Telephone: (312) 862-2000

| * | The co-registrants listed on the next page are also included in this Form S-4 Registration Statement as additional registrants. |

Approximate date of commencement of proposed sale of the securities to the public: Each exchange will occur as soon as practicable after the effective date of this Registration Statement.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||

| Non-accelerated filer | x | (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | ||||

Table of Contents

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

| Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) | ¨ | |

| Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) | ¨ |

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be |

Proposed Maximum Offering Price Per Unit (1) |

Proposed Offering Price |

Amount of Registration Fee (1) | ||||

| 8.0% Senior Secured Notes due 2018, Series B |

$ 500,000,000 | 100% | $ 500,000,000 | $ 58,050.00(2) | ||||

| 8.5% Senior Notes due 2019, Series B |

$1,175,000,000 | 100% | $1,175,000,000 | $136,417.50(2) | ||||

| Guarantees on 8.0% Senior Secured Notes due 2018, Series B |

$ 500,000,000 | — | — | (3) | ||||

| Guarantees on 8.5% Senior Notes due 2019, Series B |

$1,175,000,000 | — | — | (3) | ||||

|

| ||||||||

|

| ||||||||

| (1) | Previously paid. |

| (2) | Calculated in accordance with Rule 457 under the Securities Act of 1933, as amended. |

| (3) | Pursuant to Rule 457(n), no separate fee is payable with respect to the guarantees being registered hereby. |

The registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

| Exact Name of Additional Registrants* |

Primary Standard Industrial Classification Number |

Jurisdiction of Formation |

I.R.S. Employer Identification No. | |||

| CDW LLC |

5961 | Illinois | 36-3310735 | |||

| CDW Finance Corporation |

5961 | Delaware | 90-0600013 | |||

| CDW Technologies, Inc. |

5961 | Wisconsin | 39-1768725 | |||

| CDW Direct, LLC |

5961 | Illinois | 36-4530079 | |||

| CDW Government LLC |

5961 | Illinois | 36-4230110 | |||

| CDW Logistics, Inc. |

5961 | Illinois | 38-3679518 |

| * | The address for each of the additional registrants is CDW Corporation, 200 N. Milwaukee Avenue, Vernon Hills, Illinois 60061. The name, address and telephone number of the agent for service for each of the additional registrants is Christine A. Leahy, Senior Vice President, General Counsel and Corporate Secretary of CDW Corporation, 200 N. Milwaukee Avenue, Vernon Hills, Illinois 60061, telephone: (847) 465-6000. |

Table of Contents

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the SEC is effective. This prospectus is not an offer to sell nor is it an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED SEPTEMBER 26, 2011

PROSPECTUS

CDW LLC

CDW Finance Corporation

Exchange Offers for

8.0% Senior Secured Notes due 2018 and

8.5% Senior Notes due 2019

We are offering to exchange, upon the terms and subject to the conditions set forth in this prospectus and the accompanying letter of transmittal, up to $500,000,000 in aggregate principal amount of our new 8.0% Senior Secured Notes due 2018, Series B and up to $1,175,000,000 in aggregate principal amount of our new 8.5% Senior Notes due 2019, Series B (collectively, the “exchange notes”), each of which has been registered under the Securities Act of 1933, as amended (the “Securities Act”), for any and all of our outstanding 8.0% Senior Secured Notes due 2018 and 8.5% Senior Notes due 2019 (collectively, the “outstanding notes,” and such transactions, collectively, the “exchange offers”).

We are conducting the exchange offers in order to provide you with an opportunity to exchange the unregistered notes you hold for freely tradable notes that have been registered under the Securities Act.

The principal features of the exchange offers are as follows:

| • | The terms of the exchange notes to be issued in the exchange offers are substantially identical to the outstanding notes, except that the transfer restrictions, registration rights and additional interest provisions relating to the outstanding notes will not apply to the exchange notes. |

| • | You may withdraw your tender of outstanding notes at any time before the expiration of the exchange offers. We will exchange all of the outstanding notes that are validly tendered and not withdrawn. |

| • | Based upon interpretations by the staff of the Securities and Exchange Commission (the “SEC”), we believe that subject to some exceptions, the exchange notes may be offered for resale, resold and otherwise transferred by you without compliance with the registration and prospectus delivery provisions of the Securities Act, provided you are not an affiliate of ours. |

| • | The exchange offers expire at 12:00 a.m., midnight, New York City time, on , 2011, unless extended. |

| • | The exchange of notes will not be a taxable event for U.S. federal income tax purposes. |

| • | We will not receive any proceeds from the exchange offers. |

| • | There is no existing public market for the outstanding notes or the exchange notes. We do not intend to list the exchange notes on any securities exchange. |

Except in very limited circumstances, current and future holders of outstanding notes who do not participate in the exchange offers will not be entitled to any future registration rights, and will not be permitted to transfer their outstanding notes absent an available exemption from registration.

For a discussion of certain factors that you should consider before participating in the exchange offers, see “Risk Factors” beginning on page 19 of this prospectus.

Neither the SEC nor any state securities commission has approved the exchange notes to be distributed in the exchange offers, nor have any of these organizations determined that this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

, 2011

Table of Contents

You should rely only on the information contained in this prospectus. The prospectus may be used only for the purposes for which it has been published. We have not authorized anyone to provide any information not contained herein. If you receive any other information, you should not rely on it. We are not making an offer of these securities in any state where the offer is not permitted.

This prospectus contains summaries of the terms of several material documents. These summaries include the terms we believe to be material, but we urge you to review these documents in their entirety. We will provide without charge to each person to whom a copy of this prospectus is delivered, upon written or oral request of that person, a copy of any and all of these documents. Requests for copies should be directed to: CDW Corporation, 200 N. Milwaukee Avenue, Vernon Hills, Illinois 60061; Attention: Investor Relations (telephone (847) 465-6000).

MARKET, RANKING AND OTHER INDUSTRY DATA

This prospectus includes industry and trade association data, forecasts and information that we have prepared based, in part, upon data, forecasts and information obtained from independent trade associations, industry publications and surveys and other information available to us. Some data is also based on our good faith estimates, which are derived from management’s knowledge of the industry and independent sources. Industry publications and surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of included information. We have not independently verified any of the data from third-party sources nor have we ascertained the underlying economic assumptions relied upon therein. Statements as to our market position are based on market data currently available to us. While we are not aware of any misstatements regarding the industry data presented herein, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this prospectus. Similarly, we believe our internal research is reliable, even though such research has not been verified by any independent sources.

This prospectus includes our trademarks such as “CDW,” which are protected under applicable intellectual property laws and are the property of CDW Corporation or its subsidiaries. This prospectus also contains trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks and trade names.

i

Table of Contents

This summary highlights selected information contained in greater detail elsewhere in this prospectus. You should carefully read the entire prospectus, including the section entitled “Risk Factors” and the consolidated financial statements and notes related to those statements included elsewhere in this prospectus, before deciding whether to participate in the exchange offers. On October 12, 2007, CDW Corporation, an Illinois corporation (“Target”), was acquired by CDW Corporation, a Delaware corporation formerly known as VH Holdings, Inc. (“Parent”), a then-newly formed entity indirectly controlled by investment funds affiliated with Madison Dearborn Partners, LLC (“Madison Dearborn”) and Providence Equity Partners L.L.C. (“Providence Equity”), in a transaction valued at approximately $7.4 billion, including fees and expenses (the “Acquisition”). For financial reporting purposes, we refer to Target and its subsidiaries prior to the Acquisition as the “Predecessor” and we refer to Parent and its subsidiaries (including Target) following the Acquisition as the “Successor.” On December 31, 2009, Target merged into CDWC LLC, a limited liability company wholly owned by Parent, with CDWC LLC as the surviving company in the merger (the “CDW LLC Merger”). On December 31, 2009, CDWC LLC was renamed CDW LLC and on August 17, 2010, VH Holdings, Inc. was renamed CDW Corporation. Unless otherwise indicated or the context otherwise requires, the terms “we,” “us,” “the Company,” “our,” “CDW” and other similar terms refer to the business of Parent and its consolidated subsidiaries.

Our Business

Overview

CDW is a leading multi-brand technology solutions provider to business, government, education and healthcare customers in the U.S. and Canada. We provide comprehensive and integrated solutions for our customers’ technology needs through our extensive hardware, software and value-added service offerings. We serve over 250,000 customers through our experienced and dedicated sales force of more than 3,400 coworkers. We offer over 100,000 products from over 1,000 brands and a multitude of advanced technology solutions. Our broad range of technology products includes leading brands such as Hewlett-Packard, Microsoft, Cisco, Lenovo, EMC, IBM, Apple and VMware. Our offerings range from discrete hardware and software products to complex technology solutions such as virtualization, collaboration, security, mobility, data center optimization and cloud computing. Our sales and operating results have been driven by the combination of our large and knowledgeable selling organization, highly skilled technology specialists and engineers, extensive range of product offerings, strong vendor partner relationships, and fulfillment and logistics capabilities. For the year ended December 31, 2010, our net sales, net loss and Adjusted EBITDA were $8,801.2 million, $29.2 million and $601.8 million, respectively. For the six months ended June 30, 2011, our net sales, net loss and Adjusted EBITDA were $4,541.7 million, $39.0 million and $343.0 million, respectively. Adjusted EBITDA is a non-GAAP financial measure. See “—Summary Historical Financial Data” for the definition of Adjusted EBITDA, the reasons for its inclusion and a reconciliation to net income (loss).

We have two reportable segments:

Corporate. Our Corporate segment customers are primarily in the small and medium business category, which we define as customers with up to 1,000 employees at a single location. We also serve larger customers, including FORTUNE 1000 companies, that value our broad offerings, brand selection and flexible delivery model. We have over 200,000 active accounts, well diversified across numerous industries. Our Corporate segment is divided into a small business customer channel, primarily serving customers with up to 100 employees, and a medium-large business customer channel, primarily serving customers with more than 100 employees. Our Corporate segment sales team is primarily organized by geography and customer size. We believe this enables us to better understand and serve customer needs, optimize sales resource coverage, and strengthen relationships with vendor partners to create more sales opportunities. Our Corporate segment generated net sales of $4,833.6 million and $2,617.7 million for the year ended December 31, 2010 and for the six months ended June 30, 2011, respectively.

Public. Our Public segment is divided into government, education and healthcare customer channels. The government channel serves federal as well as state and local governments. Our education channel serves higher education and K-12 customers. The healthcare channel serves customers across the healthcare provider industry. We have built sizable businesses in each of our three Public customer channels as annual net sales are equal to or exceed $1 billion for each customer channel. Our Public segment sales teams are organized by customer channel, and within each customer channel, they are generally organized by geography, except our federal government sales teams, which are organized by agency. We believe this enables our sales teams to address the specific needs of their customer channel while promoting strong customer relationships. Our Public segment generated net sales of $3,560.6 million and $1,675.1 million for the year ended December 31, 2010 and for the six months ended June 30, 2011, respectively.

Other. We also have two other operating segments, CDW Advanced Services and Canada, which do not meet the reportable segment quantitative thresholds and, accordingly, are combined together as “Other.” The CDW Advanced Services

1

Table of Contents

business is comprised of customized engineering services, delivered by CDW professional engineers, as well as managed services, including hosting and data center services. The other services components of solutions sales, including custom configuration and other third party services, are not recorded in “Other,” but are recorded in our Corporate and Public segment net sales. Advanced services provided by CDW professional engineers are recorded in CDW Advanced Services. Our CDW Advanced Services and Canada business segments generated net sales of $407.0 million and $248.9 million for the year ended December 31, 2010 and for the six months ended June 30, 2011, respectively.

History

CDW was founded in 1984. In 2003, we purchased selected U.S. assets and the Canadian operations of Micro Warehouse, which extended our growth platform into Canada. In 2006, we acquired Berbee Information Networks Corporation, a provider of technology products, solutions and customized engineering services in advanced technologies primarily across Cisco, IBM and Microsoft portfolios. This acquisition increased our capabilities in customized engineering services and managed services. In 2007, we were acquired by Parent. For a description of the acquisition, see “—The Acquisition Transactions and Related Financing Events.”

Industry Overview

According to International Data Corporation (“IDC”), the overall U.S. technology market generated approximately $536 billion in sales in 2010, including $176 billion in hardware sales, $144 billion in software sales and $216 billion in services sales. The channels through which these products and services are delivered are highly fragmented and served by a multitude of participants. These participants include original equipment manufacturers (“OEMs”), software publishers, wholesale distributors and resellers. Wholesale distributors, such as Ingram Micro Inc., Tech Data Corporation and SYNNEX Corporation, act as intermediaries between OEMs and software publishers, on the one hand, and resellers, on the other hand, providing logistics management and supply-chain services. Resellers, which include direct marketers, value-added resellers, e-tailers and retailers, sell products and/or services directly to the end-user customer, sourcing products sold to their customers directly from OEMs and software publishers or from wholesale distributors. CDW is a technology solutions provider with both direct marketer and value-added reseller capabilities.

Two key customer groups within our addressable market are the small and medium business market and the public sector market. The small and medium business market is highly fragmented and is generally characterized by companies that employ fewer than 1,000 employees. The public sector market is also fragmented and is generally divided into market verticals, each with specialized needs that require an adaptive and flexible sales, services and logistics model to meet customer needs. We believe that many vendors rely heavily on channel partners like CDW to efficiently serve small and medium business and public sector customers.

Our Competitive Strengths

We believe the following strengths have contributed to our success and enabled us to become an important strategic partner for both our customers and our vendor partners:

Significant Scale and Scope

We are a leading multi-brand technology solutions provider in the U.S. and Canada. Based upon publicly available information, we believe that our net sales are significantly larger than any other multi-brand direct marketer or value-added reseller in the U.S. Our significant scale and scope create competitive advantages through:

| • | Breadth of solutions for our customers. The breadth and depth of knowledge that our direct selling organization, specialists and engineers have across multiple industries and technologies position us well to anticipate and meet our customers’ needs. Our size allows us to provide our customers with a broad selection of over 100,000 technology products from over 1,000 brands and a multitude of advanced technology solutions at competitive prices. We have leveraged our scale to provide a high level of customer service and a breadth of technology options, making it easy for customers to do business with us. |

| • | Broad market access for our vendor partners. We believe we are an attractive route to market for our vendor partners in part because we provide them with access to a cost-effective and highly knowledgeable sales and marketing organization that reaches over 250,000 customers. Our vendor partners recognize that, in addition to providing broad customer reach, our scale and scope enables us to sell, deliver and implement their products and services to customers with a high level of knowledge and consistency. |

2

Table of Contents

| • | Operational cost efficiencies and productivity. Our large scale provides us with operational cost efficiencies across our organization, including purchasing, operations, IT, sales, marketing and other support functions. We leverage these advantages through our two modern distribution centers, our efficient business processes and constant focus on productivity improvements, and our proprietary information systems, which has enabled us to provide cost-efficient service to our customers. |

Coworker Culture

Our steadfast focus on serving customers and investing in coworkers has fostered a strong, “get it done” culture at CDW. Since our founding, we have adhered to a core philosophy known as the Circle of Service, which places the customer at the center of all of our actions. We have consistently and cost effectively invested in our coworkers by providing broad and deep coworker training, supplying resources that contribute to their success, and offering them broad career development opportunities. This constant focus on customers and coworkers has created a customer-centric, highly engaged coworker base, which ultimately benefits our customers and fosters customer loyalty.

Large and Knowledgeable Direct Selling Organization

We have a large and experienced sales force, consisting of more than 3,400 coworkers, including more than 2,700 account managers and field account executives. We believe our success is due, in part, to the strength of our account managers’ dedicated relationships with customers that are developed by calling on existing and new customers, providing advice on products, responding to customer inquiries and developing solutions to our customers’ complex technology needs. The deep industry knowledge of our dedicated sales, marketing and support resources within each of our customer channels allows us to understand and solve the unique challenges and evolving technology needs of our customers. Multiple customer surveys administered by independent parties consistently show that customers view CDW as a leader in customer service compared to other multi-brand resellers and solution providers.

Highly Skilled Technology Specialists and Engineers

Our direct selling organization is supported by a team of more than 700 technology specialists and approximately 500 service delivery engineers with more than 3,000 industry-recognized certifications who bring deep product and solution knowledge and experience to the technology challenges of our customers. We believe our technology specialists, who work with customers and our direct selling organization to design solutions and provide recommendations in the selection and procurement process, are an important resource and differentiator for us as we seek to expand our offerings of value-added services and solutions.

Large and Established Customer Channels

We have grown our customer channels within the Corporate and Public segments to sizeable businesses. Our government, education, healthcare and small business channels each has net sales that equal or exceed $1 billion. Our scale allows us to create specialized sales resources across multiple customer markets, which enables us to better understand and meet our customers’ evolving IT requirements. Our scale also provides us diversification benefits. For instance, our Public segment, which is comprised of our government, education and healthcare channels, has historically been less correlated to economic cycles, as evidenced by its 5% net sales growth in 2009 while overall technology spending declined in the U.S. market, according to IDC.

Strong, Established Vendor Partner Relationships

We believe that our strong vendor partner relationships differentiate us from other multi-brand technology solutions providers. In addition to providing a cost-effective route to market for vendor partners, we believe that many of our competitive strengths enhance our value proposition to our vendor partners. We believe we are an important extension of our vendor partners’ sales and marketing capabilities as we are the largest U.S. reseller for many of our vendor partners, including Hewlett-Packard. We have three vendor partners with whom we have annual $1 billion-plus relationships, and we have 14 vendor partners with whom we have relationships exceeding $100 million a year. As such, we are able to provide technology resources and insights to our customers that might otherwise be difficult for them to access independently or through other technology providers. Our direct selling organization, technology specialists and large customer channels allow us to develop intimate knowledge of our customers’ environments and their specific needs. Frequently, vendor partners will select CDW as a partner to develop and grow new customer solutions. We are regularly recognized with top awards from our vendor partners. We were recently named Microsoft’s Volume Licensing Partner of the Year for the second straight year and received Cisco’s Partner Summit global awards for U.S. and Canada Partner of the Year.

3

Table of Contents

Our Business Strategies

Our goal is to continue to strengthen our position as a leading multi-brand national provider of technology products and solutions by growing our revenues and driving profitability. We plan to achieve this objective by capitalizing on our competitive strengths and pursuing the following strategies:

Focus on Customer Requirements and Market Segmentation

We have grown our revenues faster than the market, which we attribute in large part to our focus on customer requirements and market segmentation. We believe our customer intimacy enables us to better understand our customers’ needs and to better identify profitable growth opportunities. We intend to maintain this focus with a goal of continuing to outpace our competitors in revenue growth in the markets we serve through increased “share of wallet” from existing customers, sales to new customers and expanded IT services offerings to both new and existing customers. We believe our efforts in these areas will be augmented as we improve our sales coverage and further segment our customer base, further leverage our knowledge of our customers’ environments and continue to help our customers adopt proven technologies that meet their needs and make the most of their IT investments.

Leverage our Superior Sales and Marketing Model

We intend to continue to leverage our large, highly productive sales and marketing organization to serve existing customer requirements, effectively target new customer prospects, improve our product and solutions offerings, maximize sales resource coverage, strategically deploy internal sales teams, technology specialists and field sales account executives, and strengthen vendor partner relationships, all with the end goal of creating profitable sales opportunities. Some of the initiatives we have implemented within the last few years, including our realignment of our medium and large corporate account managers into geographic regions, our addition of selling resources to our federal and healthcare customer channels and our addition of more technology specialists to facilitate sales of newer and more profitable technology solutions, have contributed to an increase in our annualized net sales per coworker from $1.338 million for the quarter ended March 31, 2007 to $1.507 million for the quarter ended June 30, 2011. We plan to continue to identify and pursue opportunities that further enhance productivity. Recently, we have added sales operations supervisors to handle administrative tasks for our direct sales force coworkers, which we believe will further enhance their productivity, and we have continued to align our compensation programs to drive profitable revenue growth.

Meet our Customers’ Changing Needs through Expanded Service Offerings and Solutions

We intend to expand the range of technology solutions we offer to continue to keep pace with the technology marketplace. As customers increasingly demand more elaborate services and solutions in addition to traditional hardware and software products, we believe that expanding the range of technology solutions that we offer will enhance our value proposition to our customers and help us to maximize our revenue and profit growth potential. We have quadrupled our number of technology specialists since mid-2004 and added over 400 services delivery engineers since mid-2006. CDW currently has more than 700 technology specialists, organized around core solutions and aligned with our selling organization, and more than 1,000 coworkers in 19 geographic markets across the U.S. focused on delivering customized engineering solutions. We plan to continue to invest resources and training in our technology specialists and services delivery coworkers to provide our customers with the expert advice and experience they need to make the most of their technology expenditures.

Leverage Relationships with Leading Vendor Partners

We intend to continue to leverage our long-standing relationships with major vendor partners to support the growth and profitability of our business. We plan to use our vendor partner relationships to ensure that our sales organization remains well-positioned and well-trained to market new and emerging technologies to end users. As one example, we are currently working with several large vendor partners to assist them in the development and sales of cloud solutions to the small and medium business marketplace. We believe our strong vendor partner relationships will also provide collaborative opportunities for our sales organization and vendor field sales representatives to identify and fulfill additional customer requirements, creating increased sales to both new and existing customers. In addition, we plan to leverage our significant scale to maximize the benefits from volume discounts, purchase or sales rebates, vendor incentive programs and marketing development funds.

Risk Factors

Our business is subject to a number of risks. These risks include, but are not limited to, the following:

| • | General economic conditions could negatively affect technology spending by our customers and put downward pressure on prices, which may have an adverse impact on our business, results of operations or cash flows. |

| • | Our financial performance could be adversely affected by decreases in spending on technology products and services by our Public segment customers. |

| • | Our business depends on our vendor partner relationships and the availability of their products. |

| • | Our sales are dependent on continued innovations in hardware, software and services offerings by our vendor partners and the competitiveness of their offerings. |

| • | Substantial competition could reduce our market share and significantly harm our financial performance. |

| • | Our substantial indebtedness could limit our operating flexibility, place us at a competitive disadvantage compared to our less leveraged competitors and increase our vulnerability to both general and industry-specific adverse economic conditions. |

If these or any of the other risks described in the section entitled “Risk Factors” were to occur, the trading price of the exchange notes would likely decline and we may become unable to make payments of interest and principal on the exchange notes, as a result of which you may lose all or part of your original investment.

The Acquisition Transactions and Related Financing Events

On October 12, 2007, Parent acquired Target in the Acquisition, a transaction having an aggregate value of approximately $7.4 billion, including fees and expenses. Parent is owned directly by CDW Holdings LLC (“CDW Holdings”), a company controlled by investment funds affiliated with Madison Dearborn and Providence Equity (collectively, the “Equity

4

Table of Contents

Sponsors”). The Acquisition was effected through the merger of VH MergerSub, Inc. (“MergerSub”), a newly formed, wholly owned subsidiary of Parent, with and into Target, which was the surviving corporation. Immediately following the merger, Target became a wholly owned direct subsidiary of Parent.

Substantially all of the equity interests of CDW Holdings are owned by investment funds affiliated with the Equity Sponsors, certain other co-investors and certain members of our management (the “Management Investors,” and together with the Equity Sponsors and certain other co-investors, the “Equity Investors”).

In order to fund the Acquisition, on October 12, 2007, MergerSub entered into an $800.0 million senior secured revolving credit facility (as in effect at the time of the Acquisition and as subsequently refinanced, the “ABL Facility”), a $2,200.0 million senior secured term loan facility (as in effect at the time of the Acquisition and as subsequently amended, the “Term Loan Facility,” and together with the ABL Facility, the “Senior Credit Facilities”), a $1,040.0 million senior bridge loan agreement (the “Senior Bridge Loans”) and a $940.0 million senior subordinated bridge loan agreement (the “Senior Subordinated Bridge Loans,” and together with the Senior Bridge Loans, the “Bridge Loans”). CDW has subsequently assumed this indebtedness as successor in interest to MergerSub. We were required to pay cash interest on $520.0 million of the outstanding principal of the Senior Bridge Loans (the “Senior Cash Pay Loans”) and could elect to pay cash or PIK interest on the remaining $520.0 million of the outstanding principal amount (the “Senior PIK Election Loans”). On June 24, 2011, we refinanced the ABL Facility, which, among other things, extended the final maturity of the ABL Facility from 2012 to 2016 and increased the size of the facility from $800.0 million to $900.0 million (the “ABL Facility Refinancing”). For a summary of the material terms of the ABL Facility, see “Description of Certain Indebtedness.” In 2008, we amended and restated the Term Loan Facility and in 2009, we entered into an additional amendment. In 2010, we entered into a further amendment of the Term Loan Facility to, among other things, extend the final maturity of a portion of the Term Loan Facility (the “Extended Loans”) and reduce the principal amounts outstanding thereunder, and in connection with this amendment, we issued $500.0 million of 8.0% senior secured notes due 2018 (the “Senior Secured Notes”) and used the proceeds to prepay a portion of indebtedness under the Term Loan Facility. For a summary of the material terms of the Term Loan Facility, see “Description of Certain Indebtedness.” In 2008, we amended and restated the Bridge Loans to, among other things, change the principal amounts outstanding thereunder, and in connection with these amendments, we prepaid a portion of our Senior Subordinated Bridge Loans. Under the terms of the Bridge Loans, holders were entitled to request the conversion of their Bridge Loans into notes. At the request of these holders, we issued $890.0 million of 11.00% senior cash pay exchange notes due 2015 (the “Existing Senior Cash Pay Notes”), $317.0 million of 11.50%/12.25% senior PIK election exchange notes due 2015 (the “Existing Senior PIK Election Notes,” and together with the Existing Senior Cash Pay Notes, the “Existing Senior Notes”) and $721.5 million of 12.535% senior subordinated exchange notes due 2017 (the “Existing Senior Subordinated Notes,” and together with the Existing Senior Notes, the “Existing Notes”) in exchange for all of our outstanding Bridge Loans, a process we completed on October 14, 2010. For a summary of the material terms of our Existing Notes, see “Description of Certain Indebtedness.”

On April 13, 2011, we completed a tender offer to purchase a total of $665.1 million in aggregate principal amount of the Existing Senior Notes. In connection with the tender offer, CDW Escrow Corporation, a wholly owned subsidiary of Parent (the “Original Escrow Issuer”), issued $725.0 million in aggregate principal amount of 8.5% senior notes due 2019 (the “Senior Notes”) in order to pay the consideration in the tender offer. On May 20, 2011, we completed a tender offer to purchase a total of $412.8 million in aggregate principal amount of the Existing Senior Notes. In connection with this tender offer, CDW Escrow Corporation, a newly formed, wholly owned subsidiary of Parent (the “New Escrow Issuer,” and together with the Original Escrow Issuer, the “Escrow Issuers”), issued an additional $450.0 million in aggregate principal amount of Senior Notes in order to pay the consideration in the tender offer. Following each issuance of Senior Notes, CDW LLC and CDW Finance Corporation (“CDW Finance”) assumed the Escrow Issuers’ respective obligations under the Senior Notes. The ABL Facility Refinancing, the tender offers, the purchase of Existing Senior Notes pursuant thereto and the issuances of the Senior Notes are collectively referred to herein as the “2011 Refinancing Transactions.” The indentures governing the Existing Notes, the Senior Secured Notes and the Senior Notes are collectively referred to herein as the “Indentures.”

5

Table of Contents

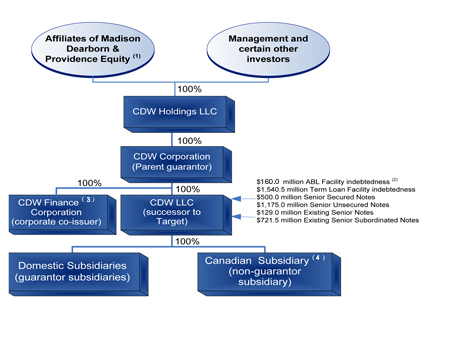

Corporate Structure

The following chart summarizes our current corporate structure and our indebtedness as of June 30, 2011.

| (1) | Investment funds affiliated with Madison Dearborn and Providence Equity, along with two limited partnerships created by the Equity Sponsors to facilitate an investment in CDW Holdings, own approximately 94.8% of the outstanding voting interests of CDW Holdings as of July 31, 2011. |

| (2) | As of June 30, 2011, we had approximately $160.0 million of outstanding indebtedness under our $900.0 million ABL Facility, could have borrowed an additional $705.9 million under this facility and had $21.8 million of issued and undrawn letters of credit and $12.3 million of reserves related to our floorplan sub-facility. |

| (3) | Formed in 2010 for the sole purpose of serving as a corporate co-issuer, CDW Finance is a co-issuer of the Existing Notes and the outstanding notes and will be a co-issuer of the exchange notes offered hereby. CDW Finance does not hold any material assets or engage in any business activities or operations. |

| (4) | Our non-guarantor subsidiary, CDW Canada, Inc., held approximately 1.8% of our total assets as of June 30, 2011 and generated approximately 4.2% of our net sales, approximately 6.9% of our net loss and approximately 2.7% of our Adjusted EBITDA (a non-GAAP financial measure defined below in “—Summary Historical Financial Data”) for the six months ended June 30, 2011. |

6

Table of Contents

Corporate Information

CDW LLC is an Illinois limited liability company and a subsidiary of CDW Corporation, a Delaware corporation. CDW Finance is a Delaware corporation and a subsidiary of CDW Corporation.

Our principal executive offices are located at 200 N. Milwaukee Avenue, Vernon Hills, Illinois 60061, and our telephone number at that address is (847) 465-6000. Our website is located at http://www.cdw.com. The information on our website is not part of this prospectus.

Equity Sponsors

Madison Dearborn, based in Chicago, is one of the most experienced and successful private equity investment firms in the United States. Madison Dearborn has raised over $18 billion of capital since its formation in 1992 and has invested in more than 100 companies. Madison Dearborn-affiliated investment funds invest in businesses across a broad spectrum of industries, including basic industries, communications, consumer, energy and power, financial services and health care.

Providence Equity is a leading global private equity firm focused on media, entertainment, communications and information investments. Providence Equity has over $22 billion of equity under management and has invested in more than 100 companies over its 20-year history. Providence Equity is headquartered in Providence, Rhode Island and has offices in New York, Los Angeles, London, Hong Kong and New Delhi.

7

Table of Contents

Summary of the Exchange Offers

| The Initial Offerings of Outstanding Notes |

We sold the Senior Secured Notes on December 17, 2010 to J.P. Morgan Securities LLC, Deutsche Bank Securities Inc., Barclays Capital Inc. and Morgan Stanley & Co. Incorporated. We sold $725,000,000 in aggregate principal amount of Senior Notes on April 13, 2011 to J.P. Morgan Securities LLC, Merrill Lynch, Pierce, Fenner & Smith Incorporated, Barclays Capital Inc., Deutsche Bank Securities Inc. and Morgan Stanley & Co. Incorporated. We sold an additional $450,000,000 in aggregate principal amount of Senior Notes on May 20, 2011 to J.P. Morgan Securities LLC. Both issuances of Senior Notes have identical terms and are treated as a single class of notes. We refer to the initial purchasers of the outstanding notes in this prospectus collectively as the “initial purchasers.” The initial purchasers subsequently resold the outstanding notes to qualified institutional buyers pursuant to Rule 144A and Regulation S under the Securities Act. |

| Registration Rights Agreements |

Simultaneously with the initial sales of the outstanding notes, we entered into three registration rights agreements (together, the “Registration Rights Agreements”), one with respect to each issuance of outstanding notes, pursuant to which we have agreed, among other things, to use commercially reasonable efforts to file with the SEC and cause to become effective a registration statement relating to offers to exchange the outstanding notes for SEC-registered notes with terms identical to the outstanding notes. The exchange offers are intended to satisfy your rights under the applicable Registration Rights Agreement. After the exchange offers are complete, you will, subject to only limited exceptions in limited circumstances, no longer be entitled to any exchange or registration rights with respect to your outstanding notes. |

| The Exchange Offers |

We are offering to exchange: |

| • | up to $500,000,000 aggregate principal amount of our new 8.0% Senior Secured Notes due 2018, Series B, which have been registered under the Securities Act (“Senior Secured Exchange Notes”), for any and all of our outstanding Senior Secured Notes; and |

| • | up to $1,175,000,000 aggregate principal amount of our new 8.5% Senior Notes due 2019, Series B, which have been registered under the Securities Act (“Senior Exchange Notes”), for any and all of our outstanding Senior Notes. |

| In order to be exchanged, an outstanding note must be properly tendered and accepted. All outstanding notes that are validly tendered and not validly withdrawn will be exchanged. We will issue exchange notes promptly after the expiration of the exchange offers. |

| Interest on the outstanding notes accepted for exchange in the exchange offers will cease to accrue upon the issuance of the exchange notes. The exchange notes will bear interest from the date of issuance, and such interest will be payable, |

8

Table of Contents

| together with accrued and unpaid interest on the outstanding notes accepted for exchange, on the first interest payment date following the closing of the exchange offers. Interest will continue to accrue on any outstanding notes that are not exchanged for exchange notes in the exchange offers. |

| Resales |

Based on an interpretation by the staff of the SEC set forth in no-action letters issued to third parties, we believe that the exchange notes issued to you in the exchange offers may be offered for resale, resold and otherwise transferred by you without compliance with the registration and prospectus delivery requirements of the Securities Act provided that: |

| • | the exchange notes are being acquired by you in the ordinary course of your business; |

| • | you are not participating, do not intend to participate, and have no arrangement or understanding with any person to participate, in the distribution of the exchange notes issued to you in the exchange offers; and |

| • | you are not an affiliate of ours. |

| If any of these conditions are not satisfied and you transfer any exchange notes issued to you in the exchange offers without delivering a prospectus meeting the requirements of the Securities Act or without an exemption from registration of your exchange notes from these requirements, you may incur liability under the Securities Act. We will not assume, nor will we indemnify you against, any such liability. |

| Each broker-dealer that is issued exchange notes in the exchange offers for its own account in exchange for outstanding notes that were acquired by that broker-dealer as a result of market-making or other trading activities must acknowledge that it will deliver a prospectus meeting the requirements of the Securities Act in connection with any resale of the exchange notes. A broker-dealer may use this prospectus for an offer to resell, resale or other retransfer of the exchange notes issued to it in the exchange offers. |

| Expiration Date |

The exchange offers will expire at 12:00 a.m., midnight, New York City time, on , 2011, unless we decide to extend the expiration date. |

| Conditions to the Exchange Offers |

Each exchange offer is subject to customary conditions, which we may waive. See “Exchange Offers—Conditions.” |

| Procedures for Tendering Outstanding Notes |

If you wish to tender your outstanding notes for exchange in the exchange offers, you must transmit to the exchange agent on or before the expiration date either: |

| • | an original or a facsimile of a properly completed and duly executed copy of the letter of transmittal, which accompanies this prospectus, together with your outstanding notes and any other documentation required by the letter of transmittal, at the address provided on the cover page of the letter of transmittal; or |

| • | if the outstanding notes you own are held of record by |

9

Table of Contents

| The Depository Trust Company (“DTC”) in book-entry form and you are making delivery by book-entry transfer, a computer-generated message transmitted by means of the Automated Tender Offer Program System of DTC (“ATOP”), in which you acknowledge and agree to be bound by the terms of the letter of transmittal and which, when received by the exchange agent, forms a part of a confirmation of book-entry transfer. As part of the book-entry transfer, DTC will facilitate the exchange of your outstanding notes and update your account to reflect the issuance of the exchange notes to you. ATOP allows you to electronically transmit your acceptance of the exchange offers to DTC instead of physically completing and delivering a letter of transmittal to the exchange agent. |

| In addition, you must deliver to the exchange agent on or before the expiration date: |

| • | a timely confirmation of book-entry transfer of your outstanding notes into the account of the exchange agent at DTC if you are effecting delivery of book-entry transfer, or |

| • | if necessary, the documents required for compliance with the guaranteed delivery procedures. |

| Special Procedures for Beneficial Owners |

If you are the beneficial owner of book-entry interests and your name does not appear on a security position listing of DTC as the holder of the book-entry interests or if you are a beneficial owner of outstanding notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender the book-entry interest or outstanding notes in the exchange offers, you should contact the person in whose name your book-entry interests or outstanding notes are registered promptly and instruct that person to tender on your behalf. |

| Withdrawal Rights |

You may withdraw the tender of your outstanding notes at any time prior to 12:00 a.m., midnight, New York City time, on , 2011. |

| Effect of Not Tendering in the Exchange Offers |

Any notes now outstanding that are not tendered or that are tendered but not accepted will remain subject to the restrictions on transfer set forth in the outstanding notes and the Indenture under which they were issued. Since the outstanding notes have not been registered under the federal securities laws, they may bear a legend restricting their transfer absent registration or the availability of a specific exemption from registration. Upon completion of the exchange offers, we will have no further obligation to register, and currently we do not anticipate that we will register, the outstanding notes under the Securities Act except in limited circumstances with respect to specific types of holders of outstanding notes. |

| Federal Income Tax Considerations |

The exchange of outstanding notes will not be a taxable event for United States federal income tax purposes. |

10

Table of Contents

| Use of Proceeds |

We will not receive any proceeds from the issuance of exchange notes pursuant to the exchange offers. We will pay all of our expenses incident to the exchange offers. |

| Exchange Agent |

U.S. Bank National Association is serving as the exchange agent in connection with the exchange offers. |

11

Table of Contents

Summary of Terms of the Exchange Notes

The form and terms of the exchange notes are the same as the form and terms of the outstanding notes, except that the exchange notes will be registered under the Securities Act. As a result, the exchange notes will not bear legends restricting their transfer and will not contain the registration rights and liquidated damage provisions contained in the outstanding notes. The exchange notes represent the same debt as the outstanding notes. Both the outstanding notes and the exchange notes are governed by the same indentures. Unless the context otherwise requires, we use the term “notes” in this prospectus to collectively refer to the outstanding notes and the exchange notes.

| Issuers |

CDW LLC, an Illinois limited liability company, and CDW Finance Corporation, a Delaware corporation, as co-issuers. |

| Securities |

Up to $500,000,000 in aggregate principal amount of Senior Secured Exchange Notes and up to $1,175,000,000 in aggregate principal amount of Senior Exchange Notes. |

| Maturity |

The Senior Secured Exchange Notes will mature on December 15, 2018 and the Senior Exchange Notes will mature on April 1, 2019. |

| Interest |

The Senior Secured Exchange Notes will bear interest at 8.0% per annum, payable semi-annually in arrears on June 15 and December 15 of each year until maturity, beginning on . |

| The Senior Exchange Notes will bear interest at 8.5% per annum, payable semi-annually in arrears on April 1 and October 1 of each year until maturity, beginning on . |

| Security |

The Senior Secured Exchange Notes and the guarantees will initially be secured equally and ratably with the Term Loan Facility by a first priority security interest in substantially all of our and the Guarantors’ assets, other than (i) cash, accounts receivable, deposit accounts, inventory and proceeds thereof (the “ABL Priority Collateral”), as to which the notes will be secured by a second priority security interest, (ii) certain accounts receivable and inventory securing certain trade financing agreements, as to which the notes will be secured by a third priority security interest, and (iii) certain excluded assets. We refer to the collateral securing the notes offered hereby as the “Non-ABL Priority Collateral.” See “Description of Senior Secured Exchange Notes—Security.” |

| Optional Redemption |

In the case of Senior Secured Exchange Notes: |

| • | We may redeem all or part of the Senior Secured Exchange Notes at any time prior to December 15, 2014 at a price equal to 100% of the principal amount of the notes redeemed plus accrued and unpaid interest to the redemption date and a “make-whole” premium, as described under “Description of Senior Secured Exchange Notes—Optional Redemption.” |

| • | We may redeem all or part of the Senior Secured Exchange Notes at any time on or after December 15, 2014 at the redemption prices specified in “Description of Senior Secured Exchange Notes—Optional Redemption.” |

| • | In addition at any time prior to December 15, 2013, we may redeem up to 35% of the aggregate principal amount of the Senior Secured Exchange Notes at a redemption price equal to 108.0% of the face amount thereof plus accrued and unpaid interest, if any, to the redemption date, with the net cash proceeds that we raise in one or more equity offerings. |

12

Table of Contents

| In the case of Senior Exchange Notes: |

| • | We may redeem all or part of the Senior Exchange Notes at any time prior to April 1, 2015 at a price equal to 100% of the principal amount of the notes redeemed plus accrued and unpaid interest to the redemption date and a “make-whole” premium, as described under “Description of Senior Exchange Notes—Optional Redemption.” |

| • | We may redeem all or part of the Senior Exchange Notes at any time on or after April 1, 2015 at the redemption prices specified in “Description of Senior Exchange Notes—Optional Redemption.” |

| • | In addition at any time prior to April 1, 2014, we may redeem up to 40% of the aggregate principal amount of the Senior Exchange Notes at a redemption price equal to 108.5% of the face amount thereof plus accrued and unpaid interest, if any, to the redemption date, with the net cash proceeds that we raise in one or more equity offerings. |

| Mandatory Offers to Purchase |

Upon the occurrence of specific kinds of changes of control, you will have the right, as holders of the notes, to cause us to repurchase some or all of your notes at 101% of their face amount, plus accrued and unpaid interest, if any, to the repurchase date. |

| If we sell assets following the issue date, under certain circumstances, we will be required to use the net proceeds to make an offer to purchase the notes at an offer price in cash in an amount equal to 100% of the principal amount of the notes, plus accrued and unpaid interest, if any, to the repurchase date. |

| Guarantees |

On the issue date, our obligations under the Senior Secured Exchange Notes will be fully and unconditionally guaranteed on a joint and several and senior secured basis, and our obligations under the Senior Exchange Notes will be fully and unconditionally guaranteed on a joint and several and senior unsecured basis, in each case, by Parent and each of our direct and indirect wholly owned domestic subsidiaries that guarantees our existing indebtedness or the existing indebtedness of the guarantors. If we fail to make payments on any series of the notes, our guarantors must make the payments instead. Each person that guarantees our obligations under the notes and the indentures is referred to as a “Guarantor.” |

| As of and for the six months ended June 30, 2011, our non-guarantor subsidiary represented 1.8% of our total assets, 0.4% of our total liabilities, including trade payables, 4.2% of our net sales, 6.9% of our net loss and 2.7% of our Adjusted EBITDA, a non-GAAP financial measure, in each case after intercompany eliminations. |

| Ranking |

The Senior Secured Exchange Notes and the guarantees thereof will be our and the Guarantors’ senior secured obligations and will: |

13

Table of Contents

| • | rank senior in right of payment to any of our and the Guarantors’ existing and future subordinated indebtedness, including our Existing Senior Subordinated Notes and the associated guarantees; |

| • | rank equal in right of payment with all of our and the Guarantors’ existing and future senior indebtedness, including our Term Loan Facility, ABL Facility, Existing Senior Notes and Senior Notes and the associated guarantees; |

| • | be secured equally and ratably with indebtedness under our Term Loan Facility and effectively senior to all other indebtedness to the extent of the value of the Non-ABL Priority Collateral; |

| • | be effectively subordinated to indebtedness under our ABL Facility to the extent of the value of the ABL Priority Collateral securing such indebtedness on a first-priority basis and to obligations under our trade financing agreements to the extent of the value of the inventory securing such arrangements on a first-priority basis and the value of the accounts receivable securing such arrangements on a second-priority basis; and |

| • | be structurally subordinated to all existing and future indebtedness and other liabilities of the issuers’ non-guarantor subsidiaries. |

| The Senior Exchange Notes and the guarantees thereof will be our and the Guarantors’ unsecured senior obligations and will: |

| • | be effectively subordinated to all of our and the Guarantors’ existing and future secured debt, including our Senior Secured Notes, our ABL Facility and our Term Loan Facility, and to our trade financing agreements we have entered into with certain financial intermediaries in order to facilitate the purchase of certain inventory, in each case to the extent of the value of the assets securing such debt or other obligations; |

| • | be structurally subordinated to all existing and future indebtedness and other liabilities of the issuers’ non-guarantor subsidiaries; |

| • | rank equal in right of payment with all of our and the Guarantors’ existing and future unsecured senior debt, including our Existing Senior Notes and the related guarantees; and |

| • | rank senior in right of payment to all of our and the Guarantors’ existing and future subordinated debt, including our Existing Senior Subordinated Notes and the related guarantees. |

14

Table of Contents

| In addition, the exchange notes and the guarantees of our obligations under the exchange notes will be effectively subordinated to all of the existing and future liabilities and obligations (including trade payables, but excluding intercompany liabilities) of each of our non-guarantor subsidiaries. |

| As of June 30, 2011, we had $721.5 million in aggregate principal amount of outstanding Existing Senior Subordinated Notes, $1,540.5 million outstanding under our Term Loan Facility, $160.0 million outstanding under our ABL Facility, $129.0 million in aggregate principal amount of outstanding Existing Senior Notes, $1,175.0 million in aggregate principal amount of outstanding Senior Notes, $500.0 million in aggregate principal amount outstanding of Senior Secured Notes and $118.0 million of obligations outstanding under our trade financing agreements. |

| Covenants |

The indentures under which the outstanding notes were issued will govern the exchange notes. These indentures contain certain covenants that, among other things, limit our ability to: |

| • | incur or guarantee additional indebtedness, or issue disqualified stock or preferred stock; |

| • | pay dividends on or make other distributions in respect of our membership interests or capital stock or make other restricted payments; |

| • | create liens on certain assets to secure debt; |

| • | make certain investments; |

| • | sell certain assets; |

| • | place restrictions on the ability of restricted subsidiaries to make payments to us; |

| • | consolidate, merge, sell or otherwise dispose of all or substantially all of our assets; |

| • | enter into transactions with our affiliates; and |

| • | designate our subsidiaries as unrestricted subsidiaries. |

| These covenants are subject to a number of important exceptions and qualifications. For more details, see “Description of Senior Secured Exchange Notes” and “Description of Senior Exchange Notes.” |

| If the exchange notes are assigned an investment grade rating by Standard & Poor’s Rating Services (“Standard & Poor’s”) and Moody’s Investors Service, Inc. (“Moody’s”) and no default has occurred or is continuing, certain covenants will be suspended. If either rating on the exchange notes should subsequently decline to below investment grade, the suspended covenants will be reinstated. |

15

Table of Contents

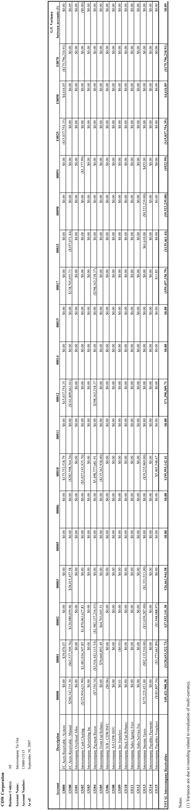

Summary Historical Financial Data

The following table sets forth our summary historical financial data for the periods ended and as of dates indicated below. We have derived the summary historical financial data presented below as of December 31, 2009 and December 31, 2010 and for the years ended December 31, 2008, December 31, 2009 and December 31, 2010 from our audited consolidated financial statements and related notes, which are included elsewhere in this prospectus. The summary historical financial data as of June 30, 2011 and for the six months ended June 30, 2011 and 2010 have been derived from the unaudited consolidated financial statements included elsewhere in this prospectus. Our summary historical financial data may not be a reliable indicator of future results of operations.

The summary historical financial data set forth below is only a summary and should be read in conjunction with “Selected Historical Consolidated Financial and Operating Data,” “Risk Factors,” “Use of Proceeds,” “Capitalization,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our historical consolidated financial statements and related notes appearing elsewhere in this prospectus.

| Year Ended December 31, | Six Months Ended June 30, |

|||||||||||||||||||

| (in millions) | 2008 | 2009 | 2010 | 2010 | 2011 | |||||||||||||||

| Statement of Operations Data: |

||||||||||||||||||||

| Net sales |

$ | 8,071.2 | $ | 7,162.6 | $ | 8,801.2 | $ | 4,157.4 | $ | 4,541.7 | ||||||||||

| Cost of sales |

6,710.2 | 6,029.7 | 7,410.4 | 3,491.7 | 3,788.4 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

1,361.0 | 1,132.9 | 1,390.8 | 665.7 | 753.3 | |||||||||||||||

| Selling and administrative expenses |

894.8 | 821.1 | 932.1 | 454.0 | 474.8 | |||||||||||||||

| Advertising expense |

141.3 | 101.9 | 106.0 | 44.8 | 58.6 | |||||||||||||||

| Goodwill impairment |

1,712.0 | 241.8 | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (Loss) income from operations |

(1,387.1 | ) | (31.9 | ) | 352.7 | 166.9 | 219.9 | |||||||||||||

| Interest expense, net |

(390.3 | ) | (431.7 | ) | (391.9 | ) | (183.5 | ) | (157.8 | ) | ||||||||||

| Net gain (loss) on extinguishments of long-term debt |

— | — | 2.0 | 9.2 | (118.9 | ) | ||||||||||||||

| Other income, net |

0.2 | 2.4 | 0.2 | 0.1 | 0.5 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss before income taxes |

(1,777.2 | ) | (461.2 | ) | (37.0 | ) | (7.3 | ) | (56.3 | ) | ||||||||||

| Income tax benefit |

12.1 | 87.8 | 7.8 | 2.5 | 17.3 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss |

$ | (1,765.1 | ) | $ | (373.4 | ) | $ | (29.2 | ) | $ | (4.8 | ) | $ | (39.0 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Balance Sheet Data (at period end): |

||||||||||||||||||||

| Cash, cash equivalents and marketable securities |

$ | 94.4 | $ | 88.0 | $ | 36.6 | $ | 26.1 | $ | 44.6 | ||||||||||

| Working capital |

877.6 | 923.2 | 675.4 | 725.4 | 775.7 | |||||||||||||||

| Total assets |

6,276.3 | 5,976.0 | 5,943.8 | 6,005.8 | 6,021.9 | |||||||||||||||

| Total secured debt (1) |

2,693.5 | 2,681.9 | 2,361.5 | 2,434.3 | 2,200.5 | |||||||||||||||

| Total debt and capitalized lease obligations (2) |

4,633.5 | 4,621.9 | 4,290.0 | 4,362.8 | 4,226.0 | |||||||||||||||

| Total shareholders’ equity (deficit) |

262.2 | (44.7 | ) | (43.5 | ) | (49.4 | ) | (69.3 | ) | |||||||||||

| Other Financial Data: |

||||||||||||||||||||

| Capital expenditures |

$ | 41.1 | $ | 15.6 | $ | 41.5 | $ | 10.5 | $ | 16.7 | ||||||||||

| Depreciation and amortization |

218.4 | 218.2 | 209.4 | 105.1 | 102.4 | |||||||||||||||

| Gross profit as a percentage of net sales |

16.9 | % | 15.8 | % | 15.8 | % | 16.0 | % | 16.6 | % | ||||||||||

| Ratio of earnings to fixed charges (3) |

(a | ) | (a | ) | (a | ) | (a | ) | (a | ) | ||||||||||

| EBITDA (4) |

(1,168.5 | ) | 188.7 | 564.3 | 281.3 | 203.9 | ||||||||||||||

| Adjusted EBITDA (4) |

570.6 | 465.4 | 601.8 | 292.3 | 343.0 | |||||||||||||||

| Statement of Cash Flows Data: |

||||||||||||||||||||

| Net cash provided by (used in): |

||||||||||||||||||||

| Operating activities (5) |

$ | 215.4 | $ | 107.6 | $ | 423.7 | $ | 161.8 | $ | 129.8 | ||||||||||

| Investing activities |

(60.3 | ) | (82.6 | ) | (125.4 | ) | (55.8 | ) | (26.5 | ) | ||||||||||

| Financing activities (5) |

(75.8 | ) | (31.9 | ) | (350.1 | ) | (167.7 | ) | (95.7 | ) | ||||||||||

| (1) | Excludes secured borrowings of $34.1 million, $25.0 million, $9.6 million, $123.5 million and $57.7 million, as of December 31, 2008, December 31, 2009, December 31, 2010, June 30, 2010 and June 30, 2011, respectively, under our inventory floorplan arrangements. We do not include these borrowings in total secured debt because we have not in the past incurred, and in the future do not expect to incur, any interest expense or late fees under these agreements. For more information, see “Description of Certain Indebtedness.” |

| (2) | Excludes items in footnote (1) and unsecured borrowings of $18.6 million and $60.3 million as of December 31, 2010 and June 30, 2011, respectively, under our inventory financing agreements. We do not include these borrowings in total debt because we have not in the past incurred, and in the future do not expect to incur, any interest expense or late fees under these agreements. For more information, see “Description of Certain Indebtedness.” |

16

Table of Contents

| (3) | For purposes of calculating the ratio of earnings to fixed charges, earnings consist of earnings before income taxes minus income from equity investees plus fixed charges. Fixed charges consist of interest expensed and the portion of rental expense we believe is representative of the interest component of rental expense. |

(a) For the years ended December 31, 2008, 2009 and 2010, and the six months ended June 30, 2010 and 2011, earnings available for fixed charges were inadequate to cover fixed charges by $1,777.2 million, $461.2 million, $37.0 million, $7.2 million and $56.2 million, respectively.

| (4) | EBITDA is defined as consolidated net income (loss) before interest income (expense), income tax benefit (expense), depreciation, and amortization. Adjusted EBITDA, which is a measure defined in our Senior Credit Facilities, is calculated by adjusting EBITDA for certain items of income and expense including (but not limited to) the following: (a) non-cash equity-based compensation; (b) goodwill impairment charges; (c) sponsor fees; (d) certain consulting fees; (e) debt-related legal and accounting costs; (f) equity investment gains and losses; (g) certain severance and retention costs; (h) gains and losses from the early extinguishment of debt; (i) gains and losses from asset dispositions outside the ordinary course of business; (j) Acquisition-related costs; (k) equity compensation payroll taxes; and (l) non-recurring, extraordinary or unusual gains or losses or expenses. |

We have included a reconciliation of EBITDA and Adjusted EBITDA in the table below. Both EBITDA and Adjusted EBITDA are considered non-GAAP financial measures. Generally, a non-GAAP financial measure is a numerical measure of a company’s performance, financial position or cash flows that either excludes or includes amounts that are not normally included or excluded in the most directly comparable measure calculated and presented in accordance with GAAP. We believe that EBITDA and Adjusted EBITDA provide helpful information with respect to our operating performance and cash flows including our ability to meet our future debt service, capital expenditures and working capital requirements. Adjusted EBITDA also provides helpful information as it is the primary measure used in certain financial covenants contained in our Senior Credit Facilities.

The following unaudited table sets forth reconciliations of net loss to EBITDA and EBITDA to Adjusted EBITDA for the periods presented:

| Year Ended December 31, | Six Months Ended June 30, |

|||||||||||||||||||

| (in millions) | 2008 | 2009 | 2010 | 2010 | 2011 | |||||||||||||||

| Net loss |

$ | (1,765.1 | ) | $ | (373.4 | ) | $ | (29.2 | ) | $ | (4.8 | ) | $ | (39.0 | ) | |||||

| Depreciation and amortization |

218.4 | 218.2 | 209.4 | 105.1 | 102.4 | |||||||||||||||

| Income tax benefit |

(12.1 | ) | (87.8 | ) | (7.8 | ) | (2.5 | ) | (17.3 | ) | ||||||||||

| Interest expense, net |

390.3 | 431.7 | 391.9 | 183.5 | 157.8 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EBITDA |

(1,168.5 | ) | 188.7 | 564.3 | 281.3 | 203.9 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Non-cash equity-based compensation |

17.8 | 15.9 | 11.5 | 8.4 | 8.1 | |||||||||||||||

| Sponsor fees |

5.0 | 5.0 | 5.0 | 2.5 | 2.5 | |||||||||||||||

| Consulting and debt-related professional fees |

4.3 | 14.1 | 15.1 | 5.6 | 4.1 | |||||||||||||||

| Goodwill impairment |

1,712.0 | 241.8 | — | — | — | |||||||||||||||

| Net (gain) loss on extinguishments of long-term debt |

— | — | (2.0 | ) | (9.2 | ) | 118.9 | |||||||||||||

| Other adjustments (a) |

— | (0.1 | ) | 7.9 | 3.7 | 5.5 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA |

$ | 570.6 | $ | 465.4 | $ | 601.8 | $ | 292.3 | $ | 343.0 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (a) | Other adjustments include certain severance and retention costs, equity investment gains and losses and the gain related to the sale of Informacast software and equipment in 2009. |

17

Table of Contents

The following unaudited table sets forth a reconciliation of EBITDA to net cash provided by operating activities for the periods presented:

| Year Ended December 31, | Six Months Ended June 30, |

|||||||||||||||||||

| (in millions) | 2008 | 2009 | 2010 | 2010 | 2011 | |||||||||||||||

| EBITDA |

$ | (1,168.5 | ) | $ | 188.7 | $ | 564.3 | $ | 281.3 | $ | 203.9 | |||||||||

| Depreciation and amortization |

(218.4 | ) | (218.2 | ) | (209.4 | ) | (105.1 | ) | (102.4 | ) | ||||||||||

| Income tax benefit |

12.1 | 87.8 | 7.8 | 2.5 | 17.3 | |||||||||||||||

| Interest expense, net |

(390.3 | ) | (431.7 | ) | (391.9 | ) | (183.5 | ) | (157.8 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss |

(1,765.1 | ) | (373.4 | ) | (29.2 | ) | (4.8 | ) | (39.0 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Depreciation and amortization |

218.4 | 218.2 | 209.4 | 105.1 | 102.4 | |||||||||||||||

| Goodwill impairment |

1,712.0 | 241.8 | — | — | — | |||||||||||||||

| Equity-based compensation expense |

17.8 | 15.9 | 11.5 | 8.4 | 8.1 | |||||||||||||||

| Amortization of deferred financing costs |

38.6 | 16.2 | 18.0 | 9.0 | 7.7 | |||||||||||||||

| Allowance for doubtful accounts |

0.4 | (0.2 | ) | (1.3 | ) | (1.3 | ) | 0.9 | ||||||||||||

| Deferred income taxes |

(39.9 | ) | (94.4 | ) | (4.3 | ) | (29.3 | ) | (17.5 | ) | ||||||||||

| Realized loss on interest rate swap agreements |

18.6 | 103.2 | 51.5 | 12.8 | 2.8 | |||||||||||||||

| Mark to market loss on interest rate derivatives |

— | — | 4.7 | 3.5 | 2.0 | |||||||||||||||

| Net (gain) loss on extinguishment of long-term debt |

— | — | (2.0 | ) | (9.2 | ) | 118.9 | |||||||||||||

| Net loss (gain) on sale and disposals of assets |

0.5 | (1.7 | ) | 0.7 | — | — | ||||||||||||||

| Changes in assets and liabilities |

14.1 | (18.0 | ) | 165.3 | 67.6 | (55.9 | ) | |||||||||||||

| Other |

— | — | (0.6 | ) | — | (0.6 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net cash provided by operating activities (5) |

$ | 215.4 | $ | 107.6 | $ | 423.7 | $ | 161.8 | $ | 129.8 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (5) | Amounts have been revised. See Notes 1 and 20 to the Audited Financial Statements and Note 1 to the Unaudited Interim Financial Statements included in this prospectus for further information. |

18

Table of Contents

You should carefully consider each of the following risk factors and all of the other information set forth in this prospectus prior to participating in the applicable exchange offer. Any of the following risks could materially and adversely affect our business, financial condition or results of operations. They are not, however, the only risks we face. Additional risks and uncertainties not presently known to us or that we currently believe not to be material may also adversely affect our business, financial condition or results of operations. If that were to occur, the trading price of the notes would likely decline and we may not be able to make payments of interest and principal on the notes, and you may lose all or part of your original investment.

Risks Relating to the Exchange Offers

Because there is no public market for the exchange notes, you may not be able to resell your exchange notes.

The exchange notes will be registered under the Securities Act, but will constitute a new issue of securities with no established trading market, and there can be no assurance as to:

| • | the liquidity of any trading market that may develop; |

| • | the ability of holders to sell their exchange notes; or |

| • | the price at which the holders would be able to sell their exchange notes. |

If a trading market were to develop, the exchange notes might trade at higher or lower prices than their principal amount or purchase price, depending on many factors, including prevailing interest rates, the market for similar securities and our financial performance.

Any holder of outstanding notes who tenders in the exchange offers for the purpose of participating in a distribution of the exchange notes may be deemed to have received restricted securities, and if so, will be required to comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale transaction.

Your outstanding notes will not be accepted for exchange if you fail to follow the exchange offer procedures and, as a result, your outstanding notes will continue to be subject to existing transfer restrictions and you may not be able to sell your outstanding notes.