UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31 , 2020

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 Or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from ______ to______

Commission file number: 001-35980

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | |||||||

(Address of principal executive offices)

(206 ) 378-6266

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Exchange on Which Registered | ||||||||||||

| The NASDAQ Stock Market LLC (The NASDAQ Global Market) | ||||||||||||||

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| ý | Accelerated filer | ¨ | |||||||||

| Non-accelerated filer | ¨ | Smaller reporting company | |||||||||

| Emerging growth company | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). (Check one): Yes ☐ No ý

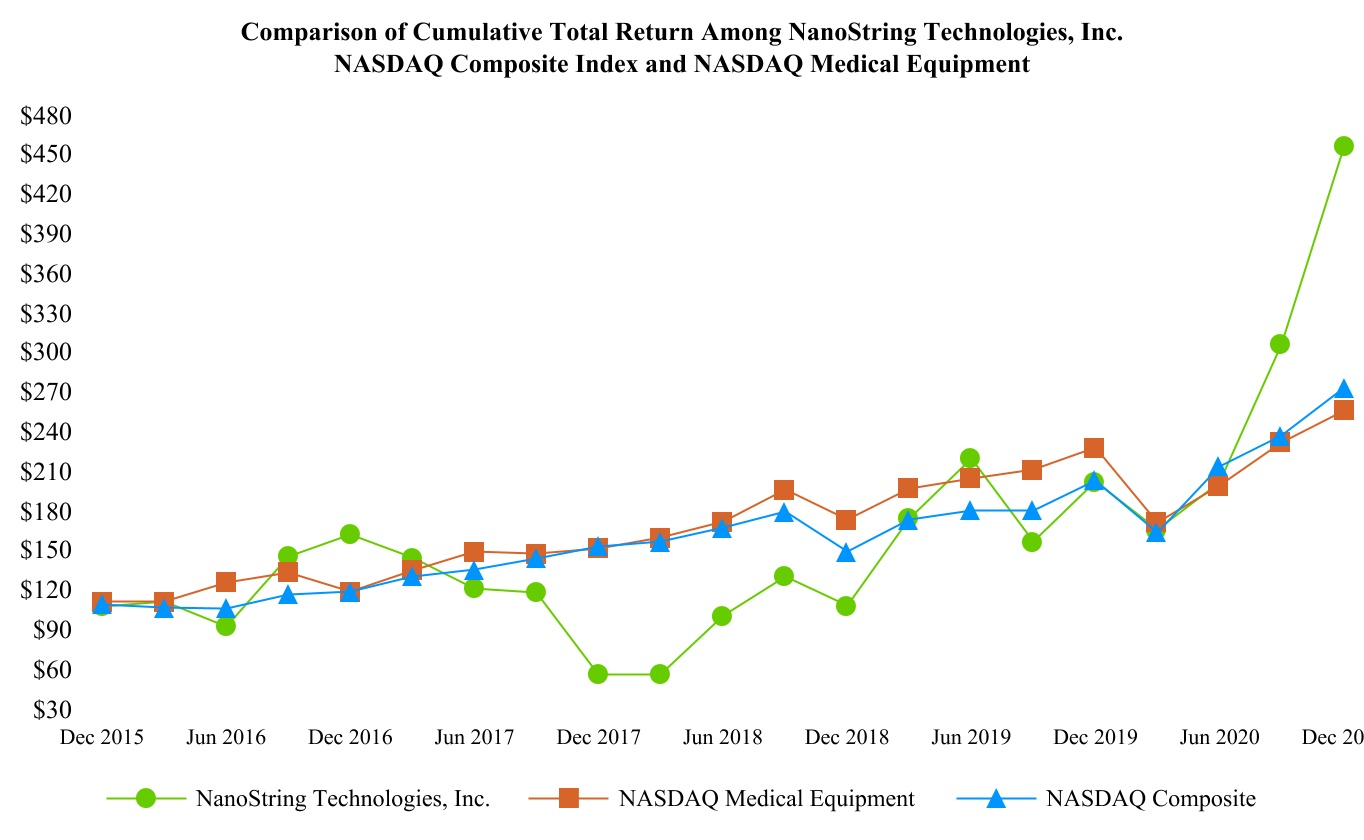

The aggregate market value of the voting and non-voting stock held by non-affiliates of the Registrant, based on the closing sale price of the Registrant’s common stock on the last business day of its most recently completed second fiscal quarter, as reported on The NASDAQ Global Market, was approximately $1.1 billion. Shares of common stock held by each executive officer and director and by each other person who may be deemed to be an affiliate of the Registrant, have been excluded from this computation. The determination of affiliate status for this purpose is not necessarily a conclusive determination for other purposes.

There were 44,582,322 shares of the Registrant’s common stock, $0.0001 par value per share, outstanding on February 22, 2021.

DOCUMENTS INCORPORATED BY REFERENCE

NANOSTRING TECHNOLOGIES, INC.

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2020

TABLE OF CONTENTS

| Page | |||||||||||

-1-

Risk Factor Summary

Our business is subject to numerous risks and uncertainties, including those highlighted in the section of this report titled “Risk Factors.” The following is a summary of the principal risks we face:

•We face risks related to health epidemics and other outbreaks, such as COVID-19, which could significantly disrupt our operations and could have a material adverse impact on us.

•We have incurred losses since we were formed and expect to incur losses in the future. We cannot be certain that we will achieve or sustain profitability.

•Our financial results may vary significantly from quarter to quarter which may adversely affect our stock price.

•If we do not achieve, sustain or successfully manage our anticipated growth, our business and growth prospects will be harmed.

•Our future success is dependent upon our ability to expand our customer base and introduce new applications and products.

•New market opportunities may not develop as quickly as we expect, limiting our ability to successfully market and sell our products.

•Our research business depends on levels of research and development spending by academic and governmental research institutions and biopharmaceutical companies, a reduction in which could limit demand for our products and adversely affect our business and operating results.

•Our sales cycle is lengthy and variable, which makes it difficult for us to forecast revenue and other operating results.

•Our reliance on distributors for sales of our products outside of the United States could limit or prevent us from selling our products and impact our revenue.

•Our future capital needs are uncertain and we may need to raise additional funds in the future.

•We may not be able to develop new products, enhance the capabilities of our systems to keep pace with rapidly changing technology and customer requirements or successfully manage the transition to new product offerings, any of which could have a material adverse effect on our business and operating results.

•We are dependent on single source suppliers for some of the components and materials used in our products, and the loss of any of these suppliers could harm our business.

•We may experience manufacturing problems or delays that could limit our growth or adversely affect our operating results.

•We expect to generate a substantial portion of our product and service revenue internationally and are subject to various risks relating to our international activities, which could adversely affect our operating results.

•Undetected errors or defects in our products could harm our reputation, decrease market acceptance of our products or expose us to product liability claims.

•If we experience a significant disruption in our information technology systems or breaches of data security, our business could be adversely affected.

•New product development involves a lengthy and complex process, and we may be unable to commercialize on a timely basis, or at all, any of the products we develop individually or with our collaborators.

•The life sciences research market is highly competitive. If we fail to compete effectively, our business and operating results will suffer.

•We are subject to ongoing and extensive regulatory requirements, and our failure to comply with these requirements could substantially harm our business.

•Healthcare policy changes, including legislation reforming the United States healthcare system, may have a material adverse effect on our financial condition and results of operations.

•If we are unable to protect our intellectual property effectively, our business would be harmed.

•The price of our common stock may be volatile, and you could lose all or part of your investment.

•Complying with the laws and regulations affecting public companies increases our costs and the demands on management and could harm our operating results.

-2-

Special Note Regarding Forward-Looking Information

This Annual Report on Form 10-K, including the “Management’s Discussion and Analysis of Financial Condition and Results of Operation” section in Item 7, and other materials accompanying this Annual Report on Form 10-K contain forward-looking statements that are based on our management’s beliefs and assumptions and on information currently available. The statements contained in this Annual Report on Form 10-K that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

Forward-looking statements can be identified by words such as “believe,” “anticipate,” “could,” “continue,” “depends,” “expect,” “expand,” “forecast,” “intend,” “predict,” “plan,” “rely,” “should,” “will,” “may,” “seek,” or the negative of these terms and other similar expressions, although not all forward-looking statements contain these words. You should read these statements carefully because they discuss future expectations, contain projections of future results of operations or financial condition, or state other “forward-looking” information. These statements relate to our future plans, objectives, expectations, intentions and financial performance and the assumptions that underlie these statements. These forward-looking statements include, but are not limited to:

•our expectations regarding our future operating results and capital needs, including our expectations regarding instrument, consumable and total revenue, operating expenses, sufficiency of cash on hand and operating and net loss;

•our expectations regarding the impact of the COVID-19 global pandemic as it relates to our ongoing operations, including our customer order activity levels and key supplier requirements;

•our ability to successfully commercialize our GeoMx DSP platform;

•our ability to successfully develop our Spatial Molecular Imager platform and pursue potential commercial applications and partnerships;

•the success, costs and timing of implementation of our business model, strategic plans for our business and future product development plans;

•the regulatory regime and our ability to secure and maintain regulatory clearance or approval or reimbursement for the clinical use of our products, domestically and internationally;

•our strategic relationships, including with patent holders of our technologies, manufacturers and distributors of our products, and collaboration partners;

•our intellectual property position;

•our ability to attract and retain key scientific or management personnel;

•our expectations regarding the competitive position, market size and growth potential for our business; and

•our ability to sustain and manage growth, including our ability to expand our customer base, develop new products, enter new markets and hire and retain key personnel.

All forward-looking statements are based on information available to us on the date of this Annual Report on Form 10-K and we will not update any of the forward-looking statements after the date of this Annual Report on Form 10-K, except as required by law. Our actual results could differ materially from those discussed in this Annual Report on Form 10-K. The forward-looking statements contained in this Annual Report on Form 10-K, and other written and oral forward-looking statements made by us from time to time, are subject to certain risks and uncertainties that could cause actual results to differ materially from those anticipated in the forward-looking statements, and you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all. Factors that might cause such a difference include, but are not limited to, those discussed in the following discussion and within Part I, Item 1A — “Risk Factors” of this Annual Report on Form 10-K. In this report, “we,” “our,” “us,” “NanoString,” and “the Company” refer to NanoString Technologies, Inc. and its subsidiaries.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Annual Report on Form 10-K, and although we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted a thorough inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

-3-

PART I

Item 1. Business

Overview

We develop, manufacture and sell products that unlock scientifically valuable and clinically actionable information from minute amounts of biological material. Our core technology includes unique, proprietary chemistries that enable the labeling and counting of single molecules. Our mission is to incorporate our core technology into proprietary product platforms that enable our customers to map the universe of biology.

We use our core technology to develop tools for scientific and clinical research, primarily in the fields of genomics and proteomics. Our proprietary chemistries may reduce the number of steps required to conduct certain types of scientific experiments and allow for multiple experiments to be conducted at once. Our platforms are also able to extract information from multiple types of biological samples, including those that are often challenging to work with, using other scientific methods or platforms. As a result, we are able to develop tools that are easier for researchers to use and that may generate faster and more consistent scientific results.

We currently offer two commercially available product platforms: our nCounter Analysis System, or nCounter, and our GeoMx Digital Spatial Profiler, or DSP, system, both of which include instruments, related consumables and software. We also have a new product platform candidate, our Spatial Molecular Imager, or SMI, currently under development.

nCounter was launched in 2008 and was our first commercially available product platform. It can be used to analyze the activity of up to 800 genes in a single experiment. nCounter is also used by clinicians to analyze gene activity relevant for diagnostic applications. nCounter is used to conduct what is known as bulk gene activity, or gene expression analysis, whereby biological samples are first reduced, and then the level of gene expression is measured at its average level throughout the totality of the sample. As of December 31, 2020, we had an installed base of approximately 950 nCounter systems, which our customers have used to publish more than 4,000 peer-reviewed scientific papers.

GeoMx DSP was launched in 2019 and is our second commercially available product platform. It is designed to enable the field of spatial biology. While nCounter and other predominantly used gene expression analysis technologies use bulk analysis approaches, GeoMx DSP is used to facilitate the analysis of specifically selected regions of an intact biological sample in order to see how gene expression might vary across those regions, or in certain cell types. As of December 31, 2020, we had an installed base of approximately 130 GeoMx DSP systems, which our customers have used to publish 35 peer-reviewed scientific papers.

GeoMx DSP operates by enabling users to prepare and select certain regions of a biological sample in which to study gene or protein expression, without the need to reduce or destroy the sample. After a researcher selects regions of interest, GeoMx DSP arranges the biological information extracted from these regions to be subsequently quantified and analyzed, or “read out,” by a platform such as nCounter, or by a next generation sequencer, or NGS, system, such as systems manufactured by Illumina, Inc. When GeoMx DSP was first made commercially available, researchers were only able to read out information on up to 96 biological targets from each of their GeoMx-selected regions of interest using nCounter. In August 2020, we added software capabilities and consumables for GeoMx that enabled information in regions of interest to be read out using Illumina NGS systems, which significantly expanded the number of biological targets researchers can choose to analyze in selected regions. Linking GeoMx DSP with NGS also significantly expands our total potential market opportunity. As of December 31, 2020 there were more than 17,000 Illumina NGS systems installed globally.

In advance of and subsequent to our recent commercial launch of GeoMx DSP, we have offered selected customers the opportunity to send biological samples to our Seattle facilities to be analyzed by us using GeoMx DSP under our technology access program, or TAP. Upon completion of each project, the raw data and analysis report is provided to the customer. As of December 31, 2020, we have conducted over 430 TAP projects for approximately 200 customers.

We have discovered other novel spatial biology applications that utilize our core technology. We are developing a new platform, the SMI, which is designed to combine the spatial profiling of a large number of biological targets with high-resolution imaging. The SMI is expected to enable the analysis of up to 1,000 biological targets directly from single cells within morphologically intact tissue samples, as compared to GeoMx DSP which typically offers such profiling across regions containing multiple cells. SMI incorporates a proprietary version of our chemistry that was originally developed as part of our NGS sequencing, or Hyb & Seq, platform development program. We currently expect the SMI instrument, consumables and software to be made commercially available in the second half of 2022.

New discoveries in genetics have generated a significant amount of scientific information and medical advancement. The decoding of the human genome and the subsequent generation of large amounts of gene sequence data have led to the emergence of pathway-based biology, whereby researchers seek to understand how networks of genes may work together to produce a biological function or condition. The desire to interpret gene sequence data and map biological pathways has led to

-4-

demand for technologies that can precisely and efficiently measure the activation state, or expression level, of hundreds of genes simultaneously.

Demand for these new or improved technologies has been driven by researchers in disease areas such as cancer, immunology and neurology. Researchers in these fields are increasingly attempting to determine which sequences of genes or mutations are important in disease-related biological pathways so that new potential treatments might be developed. For example, in the field of cancer, researchers and clinicians have learned that cancer cell behavior is impacted by multiple genes and that analysis of these factors together may be important in determining whether or not a cancer might be responsive to a certain treatment. In addition, more cancers are being detected earlier and tumor samples are becoming smaller and smaller. Tumor samples are often stored in a format known as formalin-fixed paraffin embedded, or FFPE, which complicates subsequent analysis of genetic material. Researchers and clinicians may face similar challenges with analysis of biological samples in other therapeutic areas of interest.

Our proprietary chemistries, which to date have been incorporated into our nCounter and GeoMx DSP product platforms, address many of the fundamental challenges of genetic and molecular profiling and biological pathway research. The sensitivity and precision of our chemistries allow the measurement of subtle changes in the activity of multiple genes from minute amounts of a biological sample. Our chemistries are particularly compatible with FFPE, increasing their popularity among cancer researchers. Our chemistries also support product configurations that are easy to use with simple workflow as compared to many other scientific platforms used for genetic and proteomic research, including absence of library preparation and amplification steps that can be cumbersome or time consuming or that may introduce the possibility of measurement errors. The sensitivity and workflow efficiency of our product platforms also allows for testing of many different samples in a single day, enabling our products to be potentially useful in hospital or similar settings to conduct clinical diagnostic tests.

We market and sell our systems and related consumables to researchers in academic, government and biopharmaceutical laboratories for research use, both through our direct sales force and through selected distributors in certain international markets. We generated revenue of $117.3 million, $125.6 million and $106.7 million in 2020, 2019 and 2018, respectively, while incurring net losses of $110.1 million, $40.7 million and $77.4 million in 2020, 2019 and 2018, respectively.

We are organized as, and operate in, one reportable segment. For additional information, see Note 2 of the Notes to Consolidated Financial Statements of this report. For financial information regarding our business, see Part II, Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this report and our audited consolidated financial statements and related notes included elsewhere in this report.

We were incorporated in Delaware in June 2003. Our principal executive offices are located at 530 Fairview Avenue, North, Seattle, Washington 98109 and our telephone number is (206) 378-6266. Our common stock trades on The Nasdaq Global Market under the symbol “NSTG.”

This Annual Report on Form 10-K includes our trademarks and registered trademarks, including “NanoString,” “NanoString Technologies,” “nCounter,” “nCounter SPRINT,” “nSolver,” “Hyb & Seq,” and “GeoMx.” Each other trademark, trade name or service mark appearing in this Annual Report on Form 10-K belongs to its holder.

Our Market Opportunity

Every living organism has a genome that contains a full set of biological instructions required to build and maintain life. A gene is a specific set of instructions embedded in the DNA of a cell. For a gene to be “turned on,” or “expressed,” the cell must first transcribe a copy of its DNA sequence into molecules of messenger RNA. Then, the cell translates the expressed information contained in RNA into proteins that control most biological processes. In addition to the translated RNAs, there are many types of non-coding RNAs that are involved in many cellular processes and the control of gene expression, including microRNA, or miRNA.

By analyzing the variations in genomes, genes, gene activity or expression and proteins in and between organisms, researchers can determine their functions and roles in health and disease. An improved understanding of the genome and its functions allows researchers to drive advancements in scientific discovery. As they make scientific discoveries, researchers have been able to translate some of these findings into clinical applications that improve patient care.

Biological pathways are the networks of tens or hundreds of genes that work together to produce a biological function. Understanding the activation state of pathways and disruptions in individual elements provides significant insight into the fundamental basis of health and disease and facilitates data driven treatment decisions. As a result, pathway-based biology has become a widely adopted paradigm that researchers use to understand biological processes and has assisted them in the development of diagnostic tests and drugs to treat disease.

-5-

Understanding biological pathways has become particularly important in cancer research and treatment. Cancer is a disease generally caused by genetic mutations in cells. The behavior of cancer cells is extremely complex and depends on the activity of many different genes and proteins. It is often impossible for researchers to identify a single gene or protein that adequately predicts a more or less aggressive type of cancer. In some cases, researchers have been able to identify more or less aggressive types of cancer through gene expression analysis of biological pathways, enabling oncologists to determine which specific treatments are most likely to be effective for an individual patient, monitor a patient’s response to those treatments and determine the likelihood of recurrence. Recently cancer researchers, in part based on their research of biological pathways and gene expression, have begun to demonstrate the potential of harnessing a patient’s immune system to fight cancer. A new class of therapeutics, referred to generally as immuno-oncology drugs, have begun to come to market with the promise of long-term remissions, or even cures, in certain types of cancer.

As interest in understanding biological pathways that may be relevant to medicine has increased, academic, government and biopharmaceutical company researchers have aspired to perform analyses of a larger number of genes and samples and are seeking new methods of interrogation that would allow them to:

•increase the number of molecular targets that can be analyzed simultaneously in order to understand the complete biological pathway involving multiple genes;

•provide more reliable, precise and reproducible data about targeted genes and biological pathways;

•maximize the amount of biologic information extracted from precious tissue or other biological samples;

•minimize the computational intensity of complex genomic and proteomic analysis;

•process difficult-to-work-with specimens, such as tumor biopsies stored in FFPE format;

•improve the overall efficiency of their laboratories by simplifying workflow and accelerating the rate of successfully completing their research; and

•create more systematic and reliable ways to help transition their research discoveries into future clinical products.

The interest in new methods of interrogation has led to the development of new research technologies. Certain technologies to experience rapid adoption have focused primarily on determining the sequence of a person’s or organism’s DNA, in order to assess how differences among individuals might be predictive of health or disease. In particular, a technology known as next generation sequencing, or NGS, has become widely adopted. In recent years NGS use has accelerated, as the technology has improved and the cost to sequence DNA using NGS has declined. As of December 31, 2020, there were more than 17,000 NGS systems installed in laboratories globally.

While NGS has revolutionized researchers’ ability to generate gene sequence data rapidly and cost effectively on large numbers of biological samples, other aspects of examining biological pathways are often still done using legacy techniques or new technologies that have proved less capable of providing multiplexed experimentation, ease of use and low cost. Together with determining a gene sequence via NGS, pathway-based research requires further analysis of the activity of multiple genes and small changes in their expression, or of how gene expression may vary depending on where certain cells are situated within biological tissue, which can be challenging for traditional scientific tools.

Researchers interested in multiplex gene expression or biological pathway analysis have traditionally performed experiments using microarrays or quantitative polymerase chain reaction, or qPCR, and protein expression experiments using flow cytometry, mass spectrometry, immunohistochemistry or enzyme-linked immunosorbent assay, or ELISA, assays. These techniques have been available for decades, and while suitable for analyzing the expression of a smaller number of genes, may not be cost effective or scalable enough to study biological pathways. While these types of experiments could be repeated to analyze expression of multiple genes, they are often destructive of biological samples, creating limitations given the amounts of biological sample that may be available. These methods also destroy the spatial integrity of the sample, eliminating any potential analysis of differences in how genes may be expressed based on where a cell or cells are situated in tissue, or how they may be interacting with other cells or biological functions. These types of experiments may also involve library preparation and amplification steps that can be cumbersome or time consuming or that may introduce the possibility of measurement errors.

More recently, RNA sequencing, or RNA-Seq, which is done using NGS technology, has enabled researchers to look at the entirety of the gene expression within a single sample. However, NGS systems have a more complex and time-consuming workflow than traditional methods of analyzing gene or protein expression, and RNA-Seq generates large amounts of data that may be expensive to store and may not have relevance to the scientific question being explored.

In both life sciences research and clinical medicine, there is a growing need for improved technologies that can precisely and rapidly measure the activation state of hundreds of genes simultaneously across a large number of precious samples. Furthermore, there is an emerging desire for technologies that could enable researchers and clinicians to understand gene expression activity in tissue as it is naturally situated in the body, without the need to destroy the structure of the biological sample, in order to see if gene activity might vary depending on how, or where, cells are resident in the sample.

-6-

Our Solution

We believe our proprietary chemistries and product platforms provide novel features that address the challenges and technology needs of researchers working to analyze and interpret biological pathways. Our products support experiments that typically take fewer steps as compared to traditional techniques, perform multiplexed experiments in a single run, preserve the spatial integrity of biological samples and have been shown to generate consistent and accurate results from a variety of biological samples, including FFPE embedded cancer tissue. Our proprietary chemistries and product platforms offer a number of compelling advantages, including:

•Optimized for Pathway-Based Biology and Development of Multiplexed Biomarkers. Our nCounter Analysis System can profile the activity of up to 800 genes in a single experiment, which allows customers to analyze interactions among hundreds of genes or proteins that mediate biological pathways. Our GeoMx DSP system is designed to enable the multiplex profiling of up to approximately 100 protein targets, and up to thousands of RNA targets in specifically selected regions of a biological sample.

•Digital Precision. Our molecular barcodes hybridize directly to target molecules in a sample, allowing them to be counted. This generates digital data (1 molecule = 1 count) of excellent quality over a wide, dynamic range of measurements and provides excellent reproducibility.

•Simple Workflow. Our systems are designed to offer minimal sample preparation and automated workflow, which enables the simultaneous analysis of hundreds of genes and proteins in approximately 24 hours between the time a sample is loaded and results are obtained. Our systems can generate data that customers can evaluate without the use of complex bioinformatics.

•Sample Throughput. Our nCounter system can analyze from between 24 to 96 samples per day, depending upon the system choice and configuration. GeoMx DSP allows for throughput of 10 or more biological samples per day, depending on the number of regions in the sample selected for analysis. The ability to analyze several samples in a single day facilitates the more rapid completion of scientific studies for publication, or the use of our systems for analysis of pharmaceutical clinical trial results with large numbers of patients enrolled.

•Flexible Sample Requirements. Our systems are designed to unlock biologic information from minute amounts of a variety of challenging tissue samples, including FFPE samples, cell lysates and single cells.

•Efficient Sample Requirements. Our systems also can generate scientific results using very small amounts of biological material, which may be important in settings, such as pharmaceutical product development, where multiple researchers may desire access to samples.

Our Products and Technology

nCounter Analysis System

Our nCounter Analysis System is an automated, multi-application, digital detection and counting system which directly profiles hundreds of molecules simultaneously, using our proprietary optical barcoding chemistry that is powerful enough for use in research, yet simple enough for use in clinical laboratories. Our nCounter Analysis System is based on automated instruments that prepare and analyze tissue samples using proprietary reagents which can only be obtained from us. Our research customers purchase instruments from us and then purchase our reagents and related consumables for the specific experiment they wish to conduct. Our clinical laboratory customers typically purchase instruments from us and also purchase our reagents and related consumables for tests that they intend to run.

Our nCounter Analysis System is capable of supporting a number of applications including gene expression, protein expression, gene mutation, miRNA expression, copy number variation, gene fusions and molecular diagnostics. We believe our nCounter Analysis System offers a number of advantages, including providing a simpler and faster workflow with minimal hands-on time for multiplex analysis of up to 800 RNA, DNA, or protein targets. Additionally, because nCounter is fully automated and easy-to-use, it is ideal for a range of applications requiring efficient, high-precision, simultaneous quantitation of hundreds of target molecules across a set of biological samples. Our nCounter assays generate high-quality results from challenging sample types, including FFPE and crude cell lysates.

-7-

nCounter Instrument Platforms

—————

—————The left image is the nCounter SPRINT system, the middle image is the nCounter MAX system and the right image is the nCounter FLEX system.

We currently offer three versions of our nCounter Analysis System, each targeted at a distinct user segment. Our nCounter SPRINT is designed to appeal to individual researchers running relatively smaller experiments. Our nCounter MAX is a higher throughput instrument with features appealing to larger core laboratories serving multiple researchers. Our nCounter FLEX, which is targeted toward clinical laboratories, is a version of our MAX system that has been 510(k) cleared by the FDA and CE marked by European regulatory authorities. The nCounter FLEX system was designed and is manufactured under ISO 13485:2003, the current quality standard for in vitro diagnostic platforms and medical devices. nCounter FLEX is enabled to run the Prosigna® breast cancer assay, as well as other proprietary or laboratory developed tests, or LDTs, that may be developed. Pursuant to the terms of our License and Asset Purchase Agreement, or LAPA, with Veracyte, Inc., or Veracyte, we granted to Veracyte an exclusive worldwide license to our nCounter FLEX system for in vitro diagnostic use and for the development and commercialization of in vitro diagnostic tests on the nCounter FLEX system and sold to Veracyte certain assets, including our rights with respect to the Prosigna breast cancer assay. For additional information regarding our agreement with Veracyte, see “ — License Agreements — Veracyte, Inc.” below.

The nCounter MAX and FLEX systems comprise a Prep Station and a Digital Analyzer. The Prep Station is the automated liquid handling component that processes samples after they are hybridized and prepares the samples for data collection on the Digital Analyzer. The Digital Analyzer collects data from samples by taking images of the immobilized fluorescent reporters in the sample cartridge and processing the data into output files, which include the target identifier and related count numbers along with a broad set of internal controls that validate the precision of each assay. The nCounter MAX and FLEX throughput listed in the table below can be quadrupled using sample multiplexing for experiments targeting 200 genes or fewer. The nCounter SPRINT Profiler combines the liquid handling steps and the digital analysis through use of a special microfluidic cartridge.

| nCounter SPRINT | nCounter MAX | nCounter FLEX | |||||||||||||||

| Target customer | Individual researchers | Core research labs | Clinical labs | ||||||||||||||

| Number of workflow steps | 2 | 3 | 3 | ||||||||||||||

Throughput (samples per day) (1) | 24 | 48 - 96 | 48 - 96 | ||||||||||||||

| Prep station and digital analyzer | No | Yes | Yes | ||||||||||||||

Expandable with additional prep station (1) | No | Yes | Yes | ||||||||||||||

| Diagnostic menu | No | No | Yes | ||||||||||||||

| Hands-on time (minutes) | 10 | 15 | 15 | ||||||||||||||

| U.S. list price | $149,000 | $235,000 | $265,000 | ||||||||||||||

(1)nCounter MAX and FLEX throughput may be increased to up to 96 samples per day by adding a second prep station.

nCounter Software and Data Analysis

nCounter instrument platforms also include our nSolver Analysis Software, a data analysis program that offers researchers the ability to quickly and easily quality check, normalize and analyze their data without having to use any additional software for data analysis. The FLEX system, in addition to running any of our research applications, can also be enabled with software that runs Prosigna to generate individualized patient reports.

In May 2020, we announced a collaboration with OnRamp Bioinformatics, a provider of cloud-based genomic analysis tools, for the development of new analysis tools for data generated on our nCounter Analysis System. The new analysis functionality is built into ROSALIND™, OnRamp’s cloud-based analysis suite that facilitates data visualization, exploration and collaboration. These new capabilities were offered immediately through early access to COVID-19 researchers performing

-8-

critical host response studies on our nCounter platform. ROSALIND is a cloud platform that connects researchers to differential expression and pathway exploration in a real-time collaborative environment. We are working with OnRamp to make certain features of nSolver available within ROSALIND, and we are evaluating opportunities for joint development of new analysis solutions.

nCounter Consumables

All three nCounter instruments are capable of running our research consumable products and provide comparable, high-quality data. The majority of our nCounter consumables sold are standardized off-the-shelf “panel” products that represent important gene signatures for certain disease areas. nCounter consumables can also be customized to a specific set of genes at a customer’s request.

Panels

We offer more than 50 gene expression panels for use with a broad range of sample types and species, including human, mouse, non-human primate- and other. These pre-manufactured panels contain highly-curated, thematic gene content built in collaboration with the scientific community. nCounter pre-built panels are also customizable to address specific research interests with the purchase of our custom Panel Plus product, allowing for up to 55 additional user defined genes to be added to any off-the-shelf-panel. Our panels can be used throughout the research, drug development, manufacturing and clinical biomarker discovery for oncology, immunology, infectious disease and neuroscience. Below are examples of our newer and most widely used nCounter panels.

Panels with Oncology Applications

| Panel Name | Description | ||||

| PanCancer IO 360 | •770 gene expression panel •Holistic view of tumor, microenvironment and immune response •39 signatures for understanding mechanisms of immune evasion and developing biomarkers for response to therapeutics | ||||

| PanCancer Breast Cancer 360 | •776 gene expression panel across 23 key breast cancer pathways •Holistic view specific for breast tumor, microenvironment and immune response •48 signatures with expanded evaluation of breast cancer subtypes | ||||

| PanCancer Tumor Signaling 360 | •780 gene expression panel •Holistic view specific for dysfunctional signaling pathways for tumor, microenvironment and immune response •40+ pathways for identification of targeted therapeutics and understanding of drug mechanisms of action | ||||

| CAR-T Characterization | •Measure 8 essential components of CAR-T biology with 780 genes •Standardized panel for development collaborations and manufacturing optimization •Streamlined gene expression panel for in-process QC | ||||

| Immune Exhaustion Panel | •785 gene expression panel •Deep profiling of immune cell exhaustion resulting from cancer or chronic infection •For therapeutic development studies aimed at targeting or reversing immune exhaustion | ||||

| Metabolic Pathways Panel | •768 gene expression panel •Addresses complex mechanisms behind metabolic adaptation, metabolic switching and metabolic alterations as a result of disease •For the study of disease mechanisms and targeted drug development | ||||

| PanCancer Pathways | •Novel set of 770 essential genes from 13 cancer-associated canonical pathways •For measuring cancer treatment effects on pathways | ||||

| PanCancer Immune Profiling | •Novel set of 770 genes •Focused panel for measuring the many features of immune response •Unique cell profiling feature enables profiling for 14 different immune cell types | ||||

-9-

Panels with Immunology and Infectious Disease Applications

| Panel Name | Description | ||||

| Host Response Panel | •Profile 785 genes across 5 phases of infectious disease •Study disease progression, severity, host immune response and convalescence •Serves as a core for pathogen specific Panel Plus module customization | ||||

| Coronavirus Panel Plus | •Pre-built Panel Plus with genes covering all coronavirus for viral detection •Compatible with the Host Response Panel for COVID studies | ||||

| Immunology | •594 general immunology genes •All-purpose panel for broad immunology research studies | ||||

| Fibrosis Panel | •770 gene expression panel •In-depth profiling for diseases that lead to fibrotic tissue and organ damage | ||||

| Human Organ Transplant | •770 gene expression panel •Focused content for studying organ transplant host response and organ rejection | ||||

Panels with Neuroscience Applications

| Panel Name | Description | ||||

Alzheimer’s Disease Panel | •770 gene expression panel •Useful for monitoring progression of Alzheimer’s Disease and functional screening of potential therapeutics | ||||

| Glial Panel | •770 gene expression panel •Comprehensive profiling for neuronal and peripheral immune cell types •Suitable for research of neurodegenerative and neuroinflammatory disorders and neurotrauma such as stroke, spinal cord injury and traumatic brain injury | ||||

| Neuroinflammation | •770 gene expression panel •In-depth profiling of neuroimmune interactions •Applicable for the study of neurotransmission, neuroplasticity, cell integrity, neuroinflammation and metabolism in neurological disorders | ||||

Custom CodeSets

We work with our customers to design and develop custom gene expression CodeSets to enable them to evaluate specific genes that are the subject of their study. Our customers provide us a list of targets for which we subsequently build a unique CodeSet to their specifications. Our design process leverages full length sequences for the DNA or RNA molecules that our customers are interested in detecting and prevents cross hybridization to non-target molecules in the sample. The custom CodeSet design process occurs in four distinct steps: (1) the customer selects the genes of interest, (2) we design probes and provide a design report to the customer, (3) the customer reviews and approves the design report and (4) we manufacture, test and ship the CodeSet to the customer. The manufacturing process typically takes from three to five weeks, depending on the number of genes targeted and samples to be processed by the customer.

Master Kits, Cartridges and Reagents

For our nCounter MAX or FLEX systems, the Master Kit includes all of the ancillary reagents and plasticware required for our customers to be able to setup and process samples in the nCounter Prep Station and nCounter Digital Analyzer. The components of the Master Kit include the sample cartridge, strip tubes, tips, buffers and reagent plates. For our nCounter SPRINT Profiler, customers purchase microfluidic cartridges and separate bottles of reagents which together provide the ancillary components for processing samples with CodeSets and Panels.

Molecular Diagnostics

Our nCounter Analysis System has the precision, reproducibility and simple workflow required of technologies used in clinical laboratories. We believe the precision, ease of use and flexibility of the nCounter Analysis System may allow medical technicians to conduct complex molecular diagnostic tests with minimal training.

Clinical laboratory customers use the nCounter Analysis System and our Prosigna breast cancer assay to provide clinical diagnostic services. Prosigna is based on a collection of 50 genes known as the PAM50 gene signature, which was discovered by several of our research customers. Prosigna can provide a breast cancer patient and physician with a subtype classification based on the fundamental biology of the patient’s tumor, as well as a prognostic score that indicates the probability of cancer recurrence over 10 years. Physicians use Prosigna to help guide therapeutic decisions so that patients receive a therapeutic intervention, such as chemotherapy, only if clinically warranted. In September 2013, we received 510(k) clearance from the FDA to market in the United States a version of Prosigna providing a prognostic indicator for distant recurrence-free survival at 10 years. In December 2019, we entered into an exclusive license of nCounter diagnostic assets and

-10-

rights to Veracyte, Inc. (“Veracyte”). For additional information regarding our agreement with Veracyte, see “ — License Agreements — Veracyte, Inc.” below.

GeoMx DSP

Our GeoMx DSP system, which was made commercially available in 2019, is designed to enable the field of spatial biology.

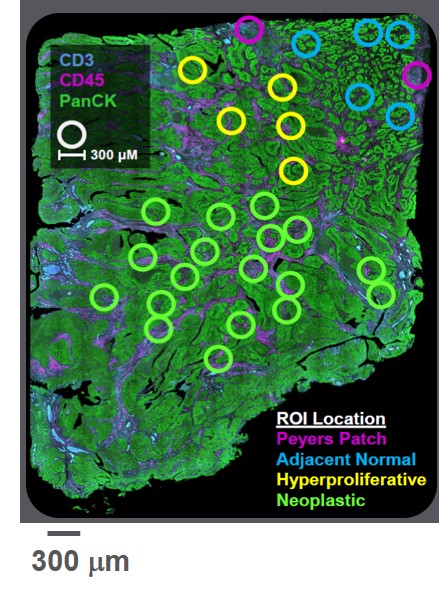

—————

The left image is the GeoMx DSP and the right image is a sample region of interest, or ROI, selection using the GeoMx DSP.

nCounter and other existing technologies typically analyze gene activity throughout the totality of a biological sample, using sample reduction or “grind and bind” approaches that analyze average gene expression levels across the entire sample. GeoMx DSP is designed to allow researchers to explore and quantify how the activity of large numbers of proteins or genes vary spatially in different selected regions of interest across the landscape of a heterogeneous tissue biopsy, retaining spatial information and providing assays that target different regions in the same sample.

The primary technologies historically used by researchers and clinicians to analyze gene activity in selected parts of a biological sample include immunohistochemistry, or IHC, which is used to estimate amounts of protein, and in-situ hybridization, or ISH, which is used to estimate amounts of RNA. Both IHC and ISH use fluorescent stains that provide the ability to identify typically four or less proteins or RNAs at a time based on assigned colors. The colors aid researchers in identifying where certain proteins or RNA may reside in a sample and provide a visual approximation of amounts. These techniques are generally limited however in their ability to only look at four proteins or RNAs at a time, and offer no ability to precisely quantify the amounts present in any given region or cell type. These limitations may lead to incomplete scientific conclusions as to the most relevant biological pathways in any given sample.

GeoMx DSP is designed to allow researchers to quantify a much larger number of genes or proteins spatially within multiple regions of interest across the landscape of a heterogeneous tissue section. Our GeoMx DSP instrument images slide-mounted or freshly cut tissue sections, allowing users to select regions of interest for subsequent quantification and analysis, or molecular profiling. The post-selection profiling or “read out,” can be performed using either our nCounter Analysis System, or an Illumina NGS system.

We believe GeoMx DSP offers a number of advantages as compared to traditional spatial technologies, including the ability to profile both protein and RNA, the ability to multiplex large numbers of different proteins or RNA simultaneously in each selected region, flexibility on the selection of regions to analyze, and the ability to process 10 or more biological samples per day.

When GeoMx DSP was first made commercially available, researchers were only able to read out information on up to 96 biological targets from each of their GeoMx-selected regions of interest using nCounter. In August 2020, we added software capabilities and consumables which enabled GeoMx region of interest data to be read out using Illumina NGS systems, which significantly expanded the number of biological targets researchers can choose to analyze in selected regions. Linking GeoMx DSP with NGS also significantly expands our total potential market opportunity. As of December 31, 2020 there were approximately 17,000 Illumina NGS systems installed globally.

-11-

We have additional GeoMx DSP software capabilities and consumables under development that would further expand the number of biological targets that may be read out on NGS systems, such that gene expression levels of all potential targets, or the “whole transcriptome,” in a region of interest may be quantified and analyzed. We expect to make these capabilities and related consumables commercially available in the first half of 2021.

GeoMx DSP Instrument and Software

Our GeoMx DSP instrument uses specialized optics to image slide-mounted tissue biopsies that have been prepared using our GeoMx DSP consumable reagents, as well as with IHC or ISH technology typically available in research or commercial laboratories. GeoMx DSP then allows a researcher to select regions of interest for analysis on screen, and then prepares samples from the selected regions of interest for molecular profiling. Like nCounter, GeoMx DSP is capable of supporting applications including gene expression and protein expression. GeoMx is also fully automated and easy-to-use, and is therefore ideal for a range of applications requiring efficient, high-precision, simultaneous quantitation of hundreds of target molecules across a set of biological samples.

The GeoMx DSP software enables the integration of the four color images acquired and the corresponding digital counts of the levels of RNA or protein as acquired using our nCounter Analysis System, or an Illumina NGS system. The GeoMx DSP data center uniquely combines system control to visualize whole tissue images at single cell resolution with automated or manual region of interest selection. The fully integrated workflow provides tracking of image data and corresponding profiling data, allowing users to easily go from data collection to data analysis. In addition to our internally developed software, in 2020 we announced a collaboration with Illumina, whereby we are jointly developing a GeoMx DSP application powered by Illumina’s DRAGEN Bio-IT platform in order to facilitate the analysis of data generated by our customers using NGS read out on Illumina systems.

GeoMx DSP Consumables

The initial portfolio of GeoMx DSP consumables focuses on RNA and protein profiling for immuno-oncology applications, and protein analysis for neurobiology applications, targeted either for nCounter read out where a set of genes and a biological pathway may be better understood or for more targeted experiments, or for NGS readout in basic discovery applications where significantly greater numbers of genes may be of interest. GeoMx DSP consumable products are currently designed as standardized panel products that represent important content for certain disease areas, with an initial “core” panel offered for purchase, and an option for researchers to add content to that core depending on the area of interest or desired number of targets for analysis. Our GeoMx DSP assays generate high-quality results from challenging sample types, including FFPE and crude cell lysates.

Our significant GeoMx DSP consumable products and products under development include:

Enabled for nCounter readout

•Immuno-Oncology Panels. An immuno-oncology-focused panel menu that comprises up to 96 protein and RNA targets for analyzing the tumor and tumor microenvironment compartments in human and mouse tissue samples. The standard, or core, panel offering is comprised of 18 targets, and researchers have the option of adding over 30 additional targets for analysis focused on specific applications such as immuno-oncology drug target proteins, or human immune activation proteins, and 23 additional targets for analyzing mouse samples for pre-clinical applications. In addition, we offer RNA panel content to allow for the analysis of up to 84 targets for human immune pathways.

•Neurobiology Panels. A neurobiology-focused menu that comprises up to 40 protein targets to profile neural cells in human tissue. The standard, or core, panel offering comprises 20 targets, and researchers have the option of adding up to 20 additional targets for analysis focused on specific applications such as proteins implicated in Alzheimer’s disease or Parkinson’s disease.

Enabled for NGS readout

Targeted:

•Cancer Transcriptome Atlas (CTA). An oncology and immuno-oncology focused panel is the first commercial GeoMx DSP product to enable read out using NGS. The CTA allows for a nearly 20-fold increase in RNA targets that may be profiled as compared to GeoMx DSP RNA panels designed for nCounter read out, providing a high-resolution spatial view of cancer biology. The CTA includes more than 1,800 genes that cover over 100 pathways critical to understanding tumor biology, the immune response and the tumor microenvironment. Biological content can be further customized with the addition of up to 60 user defined targets. The CTA panel is compatible with both fresh frozen and FFPE tissue, allowing scientists to work with a broad spectrum of samples in their research. As part of a full end-to-end solution, we are

-12-

providing library preparation reagents and NGS readout, a bioinformatics pipeline that links high-resolution, full-slide tissue images generated on GeoMx DSP with the massively parallel output of Illumina sequencers.

Universal:

•Protein Assays. A commercially available panel for NGS readout that includes greater than 50 protein targets. The currently available content covers applications in immuno-oncology and future content releases are planned to cover immunology and neuroscience. These assays will provide GeoMx CTA and WTA users complementary protein content designed for NGS read out. These new protein assays have been tested for performance on both FFPE and fresh frozen tissue. Our GeoMx DSP Protein Assays for NGS readout expanded the protein capabilities of GeoMx DSP from tens to now hundreds of validated proteins to be analyzed from a single tissue section with spatial resolution.

•Whole Transcriptome Atlas (WTA). Our WTA, a new GeoMx DSP consumable product candidate which we expect to make commercially available for use in human and mouse biological samples in the first half of 2021, is a universal panel that provides an unbiased, spatial view of approximately 18,000 RNA targets and is designed to be read out using NGS. The WTA unlocks new pathways to be explored by researchers and is designed to broaden GeoMx RNA profiling from oncology and immunology to include neuroscience, developmental biology and other diverse fields. WTA utilizes the same workflow and chemistry as our CTA.

GeoMx DSP Technology Access Program (TAP)

Selected customers can access our GeoMx DSP through our TAP service and may select panels that read out on either nCounter or NGS. Through GeoMx DSP TAP, customers submit tissue samples to our Seattle facilities where they are imaged and profiled using our instruments in house and once completed, we provide a detailed report, which includes raw data and analyzed results back to the customer. We have successfully utilized GeoMx DSP TAP prior to and during our GeoMx DSP instrument and product commercial launches and believe it may be a leading indicator of potential future commercial demand for our products. To date, we have conducted over 430 TAP projects for approximately 200 customers.

Spatial Molecular Imager (SMI)

Our SMI is a new product platform currently under development. The SMI is designed to combine the spatial profiling of a large number of biological targets with high-resolution imaging. The SMI is expected to enable the analysis of up to 1,000 biological targets directly from single cells within morphologically intact tissue samples, as compared to GeoMx DSP which typically offers such profiling across regions containing multiple cells. We expect to commence a TAP service offering for our SMI product candidate in 2021, and we currently expect the instrument, consumables, and software associated with our SMI platform to be made commercially available in the second half of 2022.

SMI incorporates a proprietary version of our chemistry that was originally developed as part of our concluded collaboration with Lam Research, under which Lam provided us with $50.0 million in funding and we modified our core nCounter chemistry to be utilized in a NGS sequencing platform and related assays. Upon the conclusion of our Lam collaboration, in 2020 we began exploring applications for this newly developed chemistry in spatial biology, specifically whether we could conduct spatial analysis of increasingly smaller regions of interest, down to the individual cell and potentially sub-cellular level. Upon completing proof of principle research and development, we announced the expected development and commercialization timeline for SMI in December 2020.

-13-

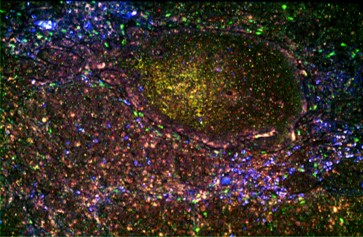

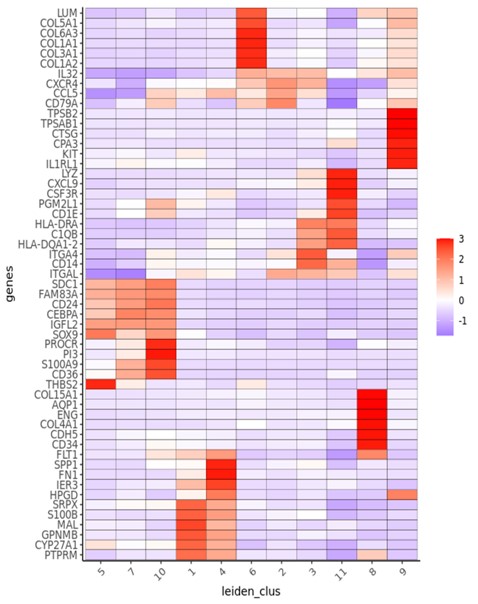

—————

The left image is a single field of view from RNA assay on FFPE melanoma tissue, showing ~600,000 RNA transcripts in ~6000 cells using the Spatial Molecular Imager. The right image is a heat map of differential RNA expression across unique cell types in the selected biological sample, as measured using the Spatial Molecular Imager.

Tissue biology takes place on several spatial scales including multi-cellular, single cell and sub-cellular levels. Our GeoMx DSP enables multi-cellular analysis at the whole transcriptome level to elucidate the behavior of populations of cells, such as those within a tumor or the tumor microenvironment. We are developing the SMI to address the unmet need for high-plex spatial analysis at single cell and sub-cellular resolution, which may be ideally suited for targeted applications such as creating cell atlases or studying cell-cell interactions. Our GeoMx DSP and the SMI platforms are synergistic, creating a spatial biology portfolio that spans the continuum from targeted to whole transcriptome analysis, and from multicellular resolutions down to single cell and sub cellular applications.

To date, our prototype SMI systems have imaged RNA from up to 1,000 genes simultaneously across thousands of individual cells in FFPE tissue. We believe in order to answer fundamental questions for the discovery, translational and clinical researcher in single cell biology, the ability to analyze the activity of at least 1,000 genes is the minimum panel requirement.

License Agreements

We have relied, and expect to continue to rely, on strategic collaborations and licensing agreements with third parties. For example, our base molecular barcoding technology is in-licensed from the Institute for Systems Biology. In addition, we have licensed technology related to the diffuse large B-cell lymphoma, or DLBCL, assay from the National Institutes of Health, and we rely on other license and supply arrangements for proprietary components which require us to pay royalties on the sale of our products. Other research customers are using our nCounter Analysis System to discover gene expression signatures that we believe could form the basis of future diagnostic products. In the future, we may consider these gene signatures for in-licensing.

Veracyte, Inc.

In December 2019, we entered into a LAPA and Service and Supply Agreements, or SSAs, with Veracyte. Pursuant to the LAPA, we completed a license of intellectual property and a sale of certain assets to Veracyte relating to our nCounter FLEX system for use in clinical diagnostic applications. Veracyte also acquired certain intellectual property rights and worldwide distribution rights relating to Prosigna and our LymphMark assay, and certain clinical diagnostic assay software modules that operate with the nCounter FLEX system. Pursuant to the LAPA, we provided Veracyte a worldwide exclusive license to market and sell clinical diagnostic tests developed for our nCounter FLEX platform for in vitro diagnostic use and for the development and commercialization of in vitro diagnostic tests, including in vitro diagnostic devices or laboratory developed tests, for use on the nCounter FLEX platform. In connection with the transaction, Veracyte agreed to assume certain liabilities associated with the assets purchased under the LAPA, including ongoing third-party royalty obligations relating to Prosigna and LymphMark. We also assigned to Veracyte our Amended and Restated Exclusive License Agreement with

-14-

Bioclassifier, LLC, effective July 7, 2010, as amended, which granted rights to certain intellectual property related to Prosigna. We also entered into a sublicense agreement with Veracyte relating to the Bioclassifier Agreement wherein we obtained certain non-exclusive rights relating to our rights to provide Prosigna to Veracyte on an ongoing basis and for other research or investigational purposes.

Upon consummation of the LAPA, Veracyte paid us total consideration of $50.0 million, consisting of (i) $40.0 million in cash and (ii) 376,732 shares of Veracyte common stock valued at $10.0 million. Pursuant to the LAPA, we are eligible to receive potential milestone payments of up to $10.0 million in the aggregate, to be paid upon the launch of additional clinical diagnostic tests by Veracyte for our nCounter FLEX platform.

Pursuant to the SSAs, we agreed to supply to Veracyte nCounter FLEX systems, and to manufacture and supply Prosigna kits, LymphMark kits and any additional clinical diagnostic tests that Veracyte may develop in the future for nCounter, for a period of at least four years subsequent to the transaction date. Pursuant to the SSAs, Veracyte will pay the designated transfer prices for nCounter FLEX systems, Prosigna kits, LymphMark kits and any other nCounter-based diagnostic tests developed by Veracyte.

Institute for Systems Biology

In 2004, we entered into an agreement with the Institute for Systems Biology pursuant to which the Institute granted to us an exclusive, subject to certain government rights, worldwide license, including the right to sublicense, to the digital molecular barcoding technology on which our nCounter Analysis System is based, including 13 patents and patent applications. Pursuant to the terms of the amended license agreement, we are required to pay the Institute for Systems Biology royalties on net sales of products sold by us, or our sublicensees, at a low single digit percentage rate, which was reduced by 50% in the third quarter of 2016 for the remainder of the license term due to the achievement of a cumulative sales threshold. Through December 31, 2020, we have paid aggregate royalties of $7.2 million under the license agreement. Unless terminated earlier in accordance with the terms of the amended license agreement, the agreement will terminate upon the expiration of the last to expire patent licensed to us. The Institute for Systems Biology has the right to terminate the agreement under certain situations, including our failure to meet certain diligence requirements or our uncured material breach of the agreement.

Collaborations

Lam Research Corporation

In August 2017, we entered into a collaboration agreement with Lam Research Corporation, or Lam, to develop a NGS sequencing platform and related assays. Under the terms of the agreement, Lam contributed an aggregate of $50.0 million towards the project. As of December 31, 2019, all committed development funding had been received from Lam, and as of December 31, 2020 all we received had been used in our continued development activities associated with our NGS sequencing platform and related assays.

In connection with the execution of the collaboration agreement, we issued Lam a warrant to purchase shares of our common stock at an exercise price for the warrant of $16.75 per share, with the number of underlying shares exercisable at any time proportionate to the amount of the $50.0 million commitment that had been provided by Lam. In January 2020, we issued an aggregate of 407,247 shares of our common stock to Lam upon the exercise of the warrant in full by Lam. In exchange for our waiver of certain lock-up restrictions, Lam agreed (i) to coordinate any sales of the shares with certain brokerage firms approved by us and (ii) not to sell more than 10% of the average daily trading volume of our common stock for the 30-day period immediately preceding any sale of the shares by Lam.

All intellectual property made or conceived solely by us pursuant to the collaboration will be owned by us and licensed to Lam solely for the purposes of the collaboration. All intellectual property made or conceived solely by Lam pursuant to the collaboration will be owned by Lam and, subject to certain restrictions on use with Lam competitors, licensed to us for the purposes of the collaboration and further development and commercialization of our products and technologies resulting from the collaboration in the field of molecular profiling. Jointly created intellectual property will be jointly owned, provided that neither we nor Lam use such jointly owned intellectual property in the other party’s competitive field. Lam is eligible to receive certain single-digit percentage royalty payments from us on net sales of certain products and technologies developed under the agreement, if any such net sales are recorded. The maximum amount of royalties we may pay to Lam will be capped at $150.0 million (three times the amount of development funding actually provided by Lam). We retain exclusive rights to obtain regulatory approval, manufacture and commercialize any products.

-15-

Celgene Corporation

In March 2014, we entered into a collaboration agreement with Celgene to develop, seek regulatory approval for, and commercialize a companion diagnostic using the nCounter Analysis System to identify a subset of patients with DLBCL. In February 2018, we entered into an amendment with Celgene to our collaboration agreement in which Celgene agreed to provide us with additional funding for work intended to enable a subtype and prognostic indication for the test being developed under the agreement for Celgene’s drug REVLIMID. In connection with this amendment, we agreed to remove the right to receive payments from Celgene in the event commercial sales of the companion diagnostic test do not exceed certain pre-specified minimum annual revenues during the first three years following regulatory approval. In addition, the amendment allows Celgene, at its election, to use trial samples with additional technologies for companion diagnostics.

Pursuant to our agreement with Celgene, we have been developing an in vitro diagnostic test, LymphMark, as a potential companion diagnostic to aid in identifying patients with DLBCL for treatment. In April 2019, Celgene announced that the trial evaluating REVLIMID for the treatment of DLBCL did not meet its primary endpoint. In May 2019, our collaboration agreement with Celgene was terminated effective July 2019, resulting in the recognition of substantially all of the remaining deferred revenue from the agreement. As a result, we do not intend to file a pre-market approval for LymphMark as a companion diagnostic for REVLIMID.

Merck & Co., Inc.

In May 2015, we entered into a clinical research collaboration agreement with Merck Sharp & Dohme Corp., a subsidiary of Merck & Co., Inc., or Merck, to develop an assay intended to optimize immune-related gene expression signatures and evaluate the potential to predict benefit from Merck’s anti-PD-1 therapy, KEYTRUDA, in multiple tumor types. In October 2017, we were notified by Merck of the decision not to pursue regulatory approval of the companion diagnostic test for KEYTRUDA. As a result, in August 2018, we and Merck agreed to mutually terminate our development collaboration agreement, effective as of September 30, 2018, following the completion of certain close-out activities. As part of the mutual termination agreement, Merck granted us a non-exclusive license to certain intellectual property that relates to Merck’s tumor inflammation signature.

Intellectual Property

We must develop and maintain protection on the proprietary aspects of our technologies in order to remain competitive. We rely on a combination of patents, copyrights, trademarks, trade secret and other intellectual property laws and confidentiality, material transfer agreements, licenses, invention assignment agreements and other contracts to protect our intellectual property rights.

As of December 31, 2020, we owned or exclusively licensed approximately 37 issued U.S. patents and approximately 26 pending U.S. patent applications, including provisional and non-provisional filings. We also owned or licensed approximately 270 pending and granted counterpart applications worldwide, including 119 country-specific validations of 18 European patents. The issued U.S. patents that we own or exclusively license are expected to expire between July 3, 2021 and February 6, 2033. We have either sole or joint ownership positions in all of our pending U.S. patent applications. Where we jointly own cases, we typically have negotiated license or assignment provisions to obtain exclusive rights. For our material nCounter Analysis System we are the exclusive licensee. We also generally protect our newly developed intellectual property by entering into confidentiality agreements that include intellectual property assignment clauses with our employees, consultants and collaborators. Our patent applications generally relate to the following main areas:

•our nCounter Analysis System or GeoMx DSP biology, chemistry, methods and hardware;

•specific applications for our nCounter Analysis System or GeoMx DSP technology;

•our gene expression markers, methods and gene signatures for recurrence and drug response in certain forms of cancer;

•methods and systems for the processing and analysis of spatial profiling and sequencing data;

•biological and chemical compositions, methods and hardware for enzyme and amplification free sequencing; and

•biological and chemical compositions, methods and hardware for multiplexed detection and quantification of protein and/or nucleic acid expression in a defined region of a tissue or cell.

We intend to file additional patent applications in the United States and abroad to strengthen our intellectual property rights; however, our patent applications may not result in issued patents, and we cannot assure investors that any patents that have issued or might issue will protect our technology. We have received notices of claims of potential infringement from third parties and may receive additional notices in the future. When appropriate, we have taken a license to the intellectual property

-16-

rights from such third parties. For additional information, see the section of this report captioned “Risk Factors — Risks Related to Intellectual Property.”

We own a number of trademarks and develop names for our new products and as appropriate secure trademark protection for them, including domain name registration, in relevant jurisdictions.

Research and Development

We have committed, and expect to continue to commit, significant resources to developing new technologies and products, improving product performance and reliability and reducing costs. We are continuously seeking to improve our product platforms, including the technology, software, accessibility and overall capability. We also seek to develop additional research consumable content, new product platforms and new product capabilities. We have assembled experienced research and development teams at our greater Seattle, Washington area facilities with the scientific, engineering, software and process talent that we believe is required to successfully grow our business. As of December 31, 2020, we had 166 employees in research and development.

Sales and Marketing

We began selling nCounter Analysis Systems to researchers in 2008 and our GeoMx DSP systems in 2019. We sell our instruments and related products primarily through our own sales force in North America and through a combination of direct and distributor channels in Europe, the Middle East, Asia Pacific and South America. We have agreements with 33 distributors, each of which is specific to a certain territory. In the event a distributor does not meet minimum performance requirements, we may terminate the distribution agreement or convert from an exclusive to non-exclusive arrangement within the territory, allowing us to enter into arrangements with other distributors for the territory.

For additional information regarding geographic distribution of revenue, see Note 3 of the Notes to Consolidated Financial Statements of this report. Revenues generated from our Lam collaboration agreement represented 4%,13% and 17% of our total revenue for the years ended December 31, 2020, 2019 and 2018, respectively.

Our sales and marketing efforts for instrumentation and in the life sciences research market are targeted at department heads, research or clinical laboratory directors, principal investigators, core facility directors and research scientists and pathologists at leading academic institutions, biopharmaceutical companies, publicly and privately-funded research institutions and contract research organizations. We seek to increase awareness of our products among our target customers through direct sales calls, trade shows, seminars, academic conferences, web presence and other forms of internet marketing.

Our instruments require a significant capital investment, and our sales process involves numerous interactions with multiple individuals within an organization, and often includes in-depth analysis by potential customers of our products, performance of proof-of-principle studies, preparation of extensive documentation and a lengthy review process. As a result of these factors, the significant capital investment required in purchasing our instruments and the budget cycles of our customers, the time from initial contact with a customer to our receipt of a purchase order can vary significantly and be up to 12 months or longer. Given the length and uncertainty of our sales cycle, we have in the past experienced, and likely will in the future experience, fluctuations in our instrument sales on a period-to-period basis.

We have continued to invest in our commercial channel to increase our reach and productivity. For example, in 2019, we added certain roles to focus specifically on the launch efforts associated with our GeoMx DSP system. We believe these investments help to drive the growth of our installed instrument base, and the continued utilization of our consumables by our installed base of instrument users.

Manufacturing and Suppliers

We use third-party contract manufacturers to produce our instruments and certain raw materials for our consumables. We build our consumables, including our Panels, Custom CodeSets and reagent packages at our facilities in the greater Seattle, Washington area.

Instruments

We outsource manufacturing of our instruments. Precision System Science, Co., Ltd. of Chiba, Japan, or PSS, is our sole source supplier for the nCounter Prep Station. Korvis Automation Inc., or Korvis, is our sole source supplier for our nCounter Digital Analyzers and our GeoMx DSP instrument at its facility in Corvallis, Oregon. Paramit Corporation, or Paramit, is our sole source supplier for our nCounter SPRINT Profiler at its facility in Morgan Hill, California.

The facilities at which our instruments are built have been certified to ISO 13485:2003 standards. Our contracts with these instrument suppliers do not commit them to carry inventory or make available any particular quantities. Under the terms of our instrument supply agreements, we are required to place binding purchase orders for instruments that will be delivered to

-17-

us by the supplier three to six months from the date of placement of the purchase order. Although qualifying alternative third-party manufacturers could be time consuming and expensive, our instruments’ design is similar to that of other instruments and we believe that alternatives would be available if necessary. However, if our instrument suppliers terminate our relationship with them or if they give other customers’ needs higher priority than ours, then we may not be able to obtain adequate supplies in a timely manner or on commercially reasonable terms.

Consumables