FALSEFY20200001401521December 31926,714869,59847,5358,0670.00010.0001——————0.00010.000150,000,00050,000,00043,250,73143,056,31043,075,87743,028,074212,083212,08314016538625620141P7Y—2,1801,4856,317P6Y1MP3Y3MP6Y8MP4Y4MP5Y7MP1Y11MP8Y9MP8Y9MP7Y11MP7Y11M00014015212020-01-012020-12-31iso4217:USD00014015212020-06-30xbrli:shares00014015212021-03-0100014015212020-12-3100014015212019-12-310001401521us-gaap:FixedMaturitiesMember2020-12-310001401521us-gaap:FixedMaturitiesMember2019-12-31iso4217:USDxbrli:shares00014015212019-01-012019-12-3100014015212018-01-012018-12-310001401521us-gaap:CommonStockMember2017-12-310001401521us-gaap:AdditionalPaidInCapitalMember2017-12-310001401521us-gaap:TreasuryStockMember2017-12-310001401521us-gaap:ComprehensiveIncomeMember2017-12-310001401521us-gaap:RetainedEarningsMember2017-12-310001401521us-gaap:ParentMember2017-12-310001401521us-gaap:NoncontrollingInterestMember2017-12-3100014015212017-12-310001401521us-gaap:CommonStockMember2018-01-012018-12-310001401521us-gaap:AdditionalPaidInCapitalMember2018-01-012018-12-310001401521us-gaap:TreasuryStockMember2018-01-012018-12-310001401521us-gaap:ComprehensiveIncomeMember2018-01-012018-12-310001401521us-gaap:RetainedEarningsMember2018-01-012018-12-310001401521us-gaap:ParentMember2018-01-012018-12-310001401521us-gaap:NoncontrollingInterestMember2018-01-012018-12-310001401521us-gaap:AccumulatedOtherComprehensiveIncomeMemberus-gaap:AccountingStandardsUpdate201802Member2018-12-310001401521us-gaap:RetainedEarningsMemberus-gaap:AccountingStandardsUpdate201802Member2018-12-310001401521us-gaap:CommonStockMember2018-12-310001401521us-gaap:AdditionalPaidInCapitalMember2018-12-310001401521us-gaap:TreasuryStockMember2018-12-310001401521us-gaap:ComprehensiveIncomeMember2018-12-310001401521us-gaap:RetainedEarningsMember2018-12-310001401521us-gaap:ParentMember2018-12-310001401521us-gaap:NoncontrollingInterestMember2018-12-3100014015212018-12-310001401521us-gaap:CommonStockMember2019-01-012019-12-310001401521us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310001401521us-gaap:TreasuryStockMember2019-01-012019-12-310001401521us-gaap:ComprehensiveIncomeMember2019-01-012019-12-310001401521us-gaap:RetainedEarningsMember2019-01-012019-12-310001401521us-gaap:ParentMember2019-01-012019-12-310001401521us-gaap:NoncontrollingInterestMember2019-01-012019-12-310001401521us-gaap:CommonStockMember2019-12-310001401521us-gaap:AdditionalPaidInCapitalMember2019-12-310001401521us-gaap:TreasuryStockMember2019-12-310001401521us-gaap:ComprehensiveIncomeMember2019-12-310001401521us-gaap:RetainedEarningsMember2019-12-310001401521us-gaap:ParentMember2019-12-310001401521us-gaap:NoncontrollingInterestMember2019-12-310001401521us-gaap:CommonStockMember2020-01-012020-12-310001401521us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001401521us-gaap:TreasuryStockMember2020-01-012020-12-310001401521us-gaap:ComprehensiveIncomeMember2020-01-012020-12-310001401521us-gaap:RetainedEarningsMember2020-01-012020-12-310001401521us-gaap:ParentMember2020-01-012020-12-310001401521us-gaap:NoncontrollingInterestMember2020-01-012020-12-310001401521us-gaap:RetainedEarningsMemberus-gaap:AccountingStandardsUpdate201613Member2020-12-310001401521us-gaap:AccountingStandardsUpdate201613Memberus-gaap:ParentMember2020-12-310001401521us-gaap:AccountingStandardsUpdate201613Member2020-12-310001401521us-gaap:CommonStockMember2020-12-310001401521us-gaap:AdditionalPaidInCapitalMember2020-12-310001401521us-gaap:TreasuryStockMember2020-12-310001401521us-gaap:ComprehensiveIncomeMember2020-12-310001401521us-gaap:RetainedEarningsMember2020-12-310001401521us-gaap:ParentMember2020-12-310001401521us-gaap:NoncontrollingInterestMember2020-12-3100014015212020-01-012020-06-30xbrli:pure0001401521us-gaap:USTreasuryAndGovernmentMember2020-12-310001401521us-gaap:ForeignGovernmentDebtSecuritiesMember2020-12-310001401521us-gaap:USStatesAndPoliticalSubdivisionsMember2020-12-310001401521us-gaap:PublicUtilityBondsMember2020-12-310001401521us-gaap:AllOtherCorporateBondsMember2020-12-310001401521us-gaap:MortgageBackedSecuritiesMember2020-12-310001401521us-gaap:AssetBackedSecuritiesMember2020-12-310001401521us-gaap:RedeemablePreferredStockMember2020-12-310001401521us-gaap:USTreasuryAndGovernmentMember2019-12-310001401521us-gaap:ForeignGovernmentDebtSecuritiesMember2019-12-310001401521us-gaap:USStatesAndPoliticalSubdivisionsMember2019-12-310001401521us-gaap:PublicUtilityBondsMember2019-12-310001401521us-gaap:AllOtherCorporateBondsMember2019-12-310001401521us-gaap:MortgageBackedSecuritiesMember2019-12-310001401521us-gaap:AssetBackedSecuritiesMember2019-12-310001401521us-gaap:RedeemablePreferredStockMember2019-12-310001401521us-gaap:MutualFundMember2020-12-310001401521us-gaap:MutualFundMember2019-12-310001401521us-gaap:PublicUtilityEquitiesMember2020-12-310001401521us-gaap:PublicUtilityEquitiesMember2019-12-310001401521us-gaap:CommonStockMember2020-12-310001401521us-gaap:CommonStockMember2019-12-310001401521us-gaap:NonredeemablePreferredStockMember2020-12-310001401521us-gaap:NonredeemablePreferredStockMember2019-12-310001401521us-gaap:EquitySecuritiesMember2020-12-310001401521us-gaap:EquitySecuritiesMember2019-12-310001401521us-gaap:FixedMaturitiesMember2020-01-012020-12-310001401521us-gaap:FixedMaturitiesMember2019-01-012019-12-310001401521us-gaap:FixedMaturitiesMember2018-01-012018-12-310001401521us-gaap:EquitySecuritiesMember2020-01-012020-12-310001401521us-gaap:EquitySecuritiesMember2019-01-012019-12-310001401521us-gaap:EquitySecuritiesMember2018-01-012018-12-310001401521us-gaap:ShortTermInvestmentsMember2020-01-012020-12-310001401521us-gaap:ShortTermInvestmentsMember2019-01-012019-12-310001401521us-gaap:ShortTermInvestmentsMember2018-01-012018-12-310001401521us-gaap:DebtSecuritiesMember2020-01-012020-12-310001401521us-gaap:DebtSecuritiesMember2019-01-012019-12-310001401521us-gaap:DebtSecuritiesMember2018-01-012018-12-310001401521us-gaap:EquitySecuritiesMember2020-01-012020-12-310001401521us-gaap:EquitySecuritiesMember2019-01-012019-12-310001401521us-gaap:EquitySecuritiesMember2018-01-012018-12-310001401521uihc:CashCashEquivalentsAndShortTermInvestmentsMember2020-01-012020-12-310001401521uihc:CashCashEquivalentsAndShortTermInvestmentsMember2019-01-012019-12-310001401521uihc:CashCashEquivalentsAndShortTermInvestmentsMember2018-01-012018-12-310001401521srt:PartnershipInterestMember2020-01-012020-12-310001401521srt:PartnershipInterestMember2019-01-012019-12-310001401521srt:PartnershipInterestMember2018-01-012018-12-310001401521us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2020-01-012020-12-310001401521us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2019-01-012019-12-310001401521us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2018-01-012018-12-31uihc:security0001401521us-gaap:CorporateDebtSecuritiesMember2020-12-310001401521us-gaap:CorporateDebtSecuritiesMember2019-12-310001401521us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel1Member2020-12-310001401521us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasuryAndGovernmentMember2020-12-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:USTreasuryAndGovernmentMember2020-12-310001401521us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2020-12-310001401521us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2020-12-310001401521us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2020-12-310001401521us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel1Member2020-12-310001401521us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel2Member2020-12-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:USStatesAndPoliticalSubdivisionsMember2020-12-310001401521us-gaap:PublicUtilityBondsMemberus-gaap:FairValueInputsLevel1Member2020-12-310001401521us-gaap:FairValueInputsLevel2Memberus-gaap:PublicUtilityBondsMember2020-12-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:PublicUtilityBondsMember2020-12-310001401521us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2020-12-310001401521us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2020-12-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2020-12-310001401521us-gaap:MortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Member2020-12-310001401521us-gaap:FairValueInputsLevel2Memberus-gaap:MortgageBackedSecuritiesMember2020-12-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:MortgageBackedSecuritiesMember2020-12-310001401521us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Member2020-12-310001401521us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Member2020-12-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:AssetBackedSecuritiesMember2020-12-310001401521us-gaap:RedeemablePreferredStockMemberus-gaap:FairValueInputsLevel1Member2020-12-310001401521us-gaap:RedeemablePreferredStockMemberus-gaap:FairValueInputsLevel2Member2020-12-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:RedeemablePreferredStockMember2020-12-310001401521us-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel1Member2020-12-310001401521us-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel2Member2020-12-310001401521us-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel3Member2020-12-310001401521us-gaap:MutualFundMemberus-gaap:FairValueInputsLevel1Member2020-12-310001401521us-gaap:FairValueInputsLevel2Memberus-gaap:MutualFundMember2020-12-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:MutualFundMember2020-12-310001401521us-gaap:PublicUtilityEquitiesMemberus-gaap:FairValueInputsLevel1Member2020-12-310001401521us-gaap:PublicUtilityEquitiesMemberus-gaap:FairValueInputsLevel2Member2020-12-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:PublicUtilityEquitiesMember2020-12-310001401521us-gaap:FairValueInputsLevel1Memberus-gaap:CommonStockMember2020-12-310001401521us-gaap:FairValueInputsLevel2Memberus-gaap:CommonStockMember2020-12-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:CommonStockMember2020-12-310001401521us-gaap:NonredeemablePreferredStockMemberus-gaap:FairValueInputsLevel1Member2020-12-310001401521us-gaap:NonredeemablePreferredStockMemberus-gaap:FairValueInputsLevel2Member2020-12-310001401521us-gaap:NonredeemablePreferredStockMemberus-gaap:FairValueInputsLevel3Member2020-12-310001401521us-gaap:FairValueInputsLevel1Memberus-gaap:EquitySecuritiesMember2020-12-310001401521us-gaap:FairValueInputsLevel2Memberus-gaap:EquitySecuritiesMember2020-12-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:EquitySecuritiesMember2020-12-310001401521us-gaap:OtherLongTermInvestmentsMember2020-12-310001401521us-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueInputsLevel1Member2020-12-310001401521us-gaap:FairValueInputsLevel2Memberus-gaap:OtherLongTermInvestmentsMember2020-12-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:OtherLongTermInvestmentsMember2020-12-310001401521us-gaap:FairValueInputsLevel1Member2020-12-310001401521us-gaap:FairValueInputsLevel2Member2020-12-310001401521us-gaap:FairValueInputsLevel3Member2020-12-310001401521us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel1Member2019-12-310001401521us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasuryAndGovernmentMember2019-12-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:USTreasuryAndGovernmentMember2019-12-310001401521us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2019-12-310001401521us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2019-12-310001401521us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2019-12-310001401521us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel1Member2019-12-310001401521us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel2Member2019-12-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:USStatesAndPoliticalSubdivisionsMember2019-12-310001401521us-gaap:PublicUtilityBondsMemberus-gaap:FairValueInputsLevel1Member2019-12-310001401521us-gaap:FairValueInputsLevel2Memberus-gaap:PublicUtilityBondsMember2019-12-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:PublicUtilityBondsMember2019-12-310001401521us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2019-12-310001401521us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2019-12-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2019-12-310001401521us-gaap:MortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Member2019-12-310001401521us-gaap:FairValueInputsLevel2Memberus-gaap:MortgageBackedSecuritiesMember2019-12-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:MortgageBackedSecuritiesMember2019-12-310001401521us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Member2019-12-310001401521us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Member2019-12-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:AssetBackedSecuritiesMember2019-12-310001401521us-gaap:RedeemablePreferredStockMemberus-gaap:FairValueInputsLevel1Member2019-12-310001401521us-gaap:RedeemablePreferredStockMemberus-gaap:FairValueInputsLevel2Member2019-12-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:RedeemablePreferredStockMember2019-12-310001401521us-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel1Member2019-12-310001401521us-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel2Member2019-12-310001401521us-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel3Member2019-12-310001401521us-gaap:MutualFundMemberus-gaap:FairValueInputsLevel1Member2019-12-310001401521us-gaap:FairValueInputsLevel2Memberus-gaap:MutualFundMember2019-12-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:MutualFundMember2019-12-310001401521us-gaap:PublicUtilityEquitiesMemberus-gaap:FairValueInputsLevel1Member2019-12-310001401521us-gaap:PublicUtilityEquitiesMemberus-gaap:FairValueInputsLevel2Member2019-12-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:PublicUtilityEquitiesMember2019-12-310001401521us-gaap:FairValueInputsLevel1Memberus-gaap:CommonStockMember2019-12-310001401521us-gaap:FairValueInputsLevel2Memberus-gaap:CommonStockMember2019-12-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:CommonStockMember2019-12-310001401521us-gaap:NonredeemablePreferredStockMemberus-gaap:FairValueInputsLevel1Member2019-12-310001401521us-gaap:NonredeemablePreferredStockMemberus-gaap:FairValueInputsLevel2Member2019-12-310001401521us-gaap:NonredeemablePreferredStockMemberus-gaap:FairValueInputsLevel3Member2019-12-310001401521us-gaap:FairValueInputsLevel1Memberus-gaap:EquitySecuritiesMember2019-12-310001401521us-gaap:FairValueInputsLevel2Memberus-gaap:EquitySecuritiesMember2019-12-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:EquitySecuritiesMember2019-12-310001401521us-gaap:OtherLongTermInvestmentsMember2019-12-310001401521us-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueInputsLevel1Member2019-12-310001401521us-gaap:FairValueInputsLevel2Memberus-gaap:OtherLongTermInvestmentsMember2019-12-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:OtherLongTermInvestmentsMember2019-12-310001401521us-gaap:FairValueInputsLevel1Member2019-12-310001401521us-gaap:FairValueInputsLevel2Member2019-12-310001401521us-gaap:FairValueInputsLevel3Member2019-12-310001401521us-gaap:LimitedPartnerMember2020-12-310001401521us-gaap:CertificatesOfDepositMember2020-12-310001401521us-gaap:ShortTermInvestmentsMember2020-12-310001401521us-gaap:OtherLongTermInvestmentsMember2020-12-310001401521us-gaap:LimitedPartnerMember2019-12-310001401521us-gaap:CertificatesOfDepositMember2019-12-310001401521us-gaap:ShortTermInvestmentsMember2019-12-310001401521us-gaap:OtherLongTermInvestmentsMember2019-12-310001401521us-gaap:LandMember2020-12-310001401521us-gaap:LandMember2019-12-310001401521us-gaap:BuildingMember2020-12-310001401521us-gaap:BuildingMember2019-12-310001401521us-gaap:ComputerEquipmentMember2020-12-310001401521us-gaap:ComputerEquipmentMember2019-12-310001401521us-gaap:OfficeEquipmentMember2020-12-310001401521us-gaap:OfficeEquipmentMember2019-12-310001401521us-gaap:LeaseholdImprovementsMember2020-12-310001401521us-gaap:LeaseholdImprovementsMember2019-12-310001401521us-gaap:VehiclesMember2020-12-310001401521us-gaap:VehiclesMember2019-12-310001401521us-gaap:IntangibleAssetsArisingFromInsuranceContractsAcquiredInBusinessCombinationMember2020-12-310001401521us-gaap:CustomerRelationshipsMember2020-12-310001401521us-gaap:TradeNamesMember2020-12-310001401521us-gaap:IntangibleAssetsArisingFromInsuranceContractsAcquiredInBusinessCombinationMember2019-12-310001401521us-gaap:CustomerRelationshipsMember2019-12-310001401521us-gaap:TradeNamesMember2019-12-310001401521us-gaap:CustomerRelationshipsMember2020-01-012020-12-310001401521us-gaap:TradeNamesMember2020-01-012020-12-310001401521us-gaap:CustomerRelationshipsMember2019-01-012019-12-310001401521us-gaap:TradeNamesMember2019-01-012019-12-3100014015212019-06-012020-05-310001401521us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2009Member2011-12-310001401521us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2009Member2012-12-310001401521us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2009Member2013-12-310001401521us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2009Member2014-12-310001401521us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2009Member2015-12-310001401521us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2009Member2016-12-310001401521us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2009Member2017-12-310001401521us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2009Member2018-12-310001401521us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2009Member2019-12-310001401521us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2009Member2020-12-31uihc:claim0001401521us-gaap:ShortdurationInsuranceContractsAccidentYear2010Memberus-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMember2012-12-310001401521us-gaap:ShortdurationInsuranceContractsAccidentYear2010Memberus-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMember2013-12-310001401521us-gaap:ShortdurationInsuranceContractsAccidentYear2010Memberus-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMember2014-12-310001401521us-gaap:ShortdurationInsuranceContractsAccidentYear2010Memberus-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMember2015-12-310001401521us-gaap:ShortdurationInsuranceContractsAccidentYear2010Memberus-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMember2016-12-310001401521us-gaap:ShortdurationInsuranceContractsAccidentYear2010Memberus-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMember2017-12-310001401521us-gaap:ShortdurationInsuranceContractsAccidentYear2010Memberus-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMember2018-12-310001401521us-gaap:ShortdurationInsuranceContractsAccidentYear2010Memberus-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMember2019-12-310001401521us-gaap:ShortdurationInsuranceContractsAccidentYear2010Memberus-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMember2020-12-310001401521us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2011Member2013-12-310001401521us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2011Member2014-12-310001401521us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2011Member2015-12-310001401521us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2011Member2016-12-310001401521us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2011Member2017-12-310001401521us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2011Member2018-12-310001401521us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2011Member2019-12-310001401521us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2011Member2020-12-310001401521us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2012Member2014-12-310001401521us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2012Member2015-12-310001401521us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2012Member2016-12-310001401521us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2012Member2017-12-310001401521us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2012Member2018-12-310001401521us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2012Member2019-12-310001401521us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2012Member2020-12-310001401521us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2013Member2015-12-310001401521us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2013Member2016-12-310001401521us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2013Member2017-12-310001401521us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2013Member2018-12-310001401521us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2013Member2019-12-310001401521us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2013Member2020-12-310001401521us-gaap:ShortdurationInsuranceContractsAccidentYear2014Memberus-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMember2016-12-310001401521us-gaap:ShortdurationInsuranceContractsAccidentYear2014Memberus-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMember2017-12-310001401521us-gaap:ShortdurationInsuranceContractsAccidentYear2014Memberus-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMember2018-12-310001401521us-gaap:ShortdurationInsuranceContractsAccidentYear2014Memberus-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMember2019-12-310001401521us-gaap:ShortdurationInsuranceContractsAccidentYear2014Memberus-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMember2020-12-310001401521us-gaap:ShortdurationInsuranceContractsAccidentYear2015Memberus-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMember2017-12-310001401521us-gaap:ShortdurationInsuranceContractsAccidentYear2015Memberus-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMember2018-12-310001401521us-gaap:ShortdurationInsuranceContractsAccidentYear2015Memberus-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMember2019-12-310001401521us-gaap:ShortdurationInsuranceContractsAccidentYear2015Memberus-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMember2020-12-310001401521us-gaap:ShortdurationInsuranceContractsAccidentYear2016Memberus-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMember2018-12-310001401521us-gaap:ShortdurationInsuranceContractsAccidentYear2016Memberus-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMember2019-12-310001401521us-gaap:ShortdurationInsuranceContractsAccidentYear2016Memberus-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMember2020-12-310001401521us-gaap:ShortDurationInsuranceContractsAccidentYear2017Memberus-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMember2019-12-310001401521us-gaap:ShortDurationInsuranceContractsAccidentYear2017Memberus-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMember2020-12-310001401521us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMemberus-gaap:ShortDurationInsuranceContractsAccidentYear2018Member2020-12-310001401521us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMember2020-12-310001401521us-gaap:ShortdurationInsuranceContractsAccidentYear2008Memberus-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMember2020-12-310001401521us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMember2019-12-310001401521uihc:A150MSeniorNotesMember2020-01-012020-12-31utr:Rate0001401521uihc:A150MSeniorNotesMember2020-12-310001401521uihc:A150MSeniorNotesMember2019-12-310001401521us-gaap:NotesPayableOtherPayablesMember2020-01-012020-12-310001401521us-gaap:NotesPayableOtherPayablesMember2020-12-310001401521us-gaap:NotesPayableOtherPayablesMember2019-12-310001401521uihc:BBTTermNotePayableMember2020-01-012020-12-310001401521uihc:BBTTermNotePayableMember2020-12-310001401521uihc:BBTTermNotePayableMember2019-12-310001401521us-gaap:NotesPayableOtherPayablesMember2006-09-220001401521uihc:BBTTermNotePayableMember2016-05-260001401521uihc:FederalMember2020-12-310001401521uihc:StateMember2020-12-3100014015212015-12-310001401521uihc:UpcSubsidiaryMember2020-12-310001401521uihc:AmericanCoastalInsuranceCompanyMember2020-12-310001401521uihc:FamilySecurityHoldingsFSHMember2020-12-310001401521uihc:InterboroInsuranceCompanyMember2020-12-310001401521uihc:JourneyMember2020-12-310001401521uihc:LegalFeesMember2018-01-012018-12-310001401521uihc:LegalFeesMemberus-gaap:ImmediateFamilyMemberOfManagementOrPrincipalOwnerMember2020-01-012020-12-310001401521uihc:LegalFeesMemberus-gaap:ImmediateFamilyMemberOfManagementOrPrincipalOwnerMember2018-01-012018-12-310001401521srt:DirectorMemberuihc:AmRiscgrosswrittenpremiumsMember2019-01-012019-12-310001401521srt:DirectorMemberuihc:AmRiscgrosswrittenpremiumsMember2018-01-012018-12-310001401521uihc:AmRiscFeesandCommissionMembersrt:DirectorMember2019-01-012019-12-310001401521uihc:AmRiscFeesandCommissionMembersrt:DirectorMember2018-01-012018-12-310001401521uihc:AmRisccededpremiumswrittenMembersrt:DirectorMember2019-01-012019-12-310001401521uihc:AmRisccededpremiumswrittenMembersrt:DirectorMember2018-01-012018-12-3100014015212018-01-010001401521uihc:ConsolidatedEntityExcludingNoncontrollingInterestsMember2018-01-012018-12-310001401521uihc:ConsolidatedEntityExcludingNoncontrollingInterestsMember2019-01-012019-12-310001401521uihc:ConsolidatedEntityExcludingNoncontrollingInterestsMember2020-01-012020-12-3100014015212020-01-012020-03-3100014015212019-01-012019-03-3100014015212018-01-012018-03-3100014015212020-04-012020-06-3000014015212019-04-012019-06-3000014015212018-04-012018-06-3000014015212020-07-012020-09-3000014015212019-07-012019-09-3000014015212018-07-012018-09-3000014015212020-10-012020-12-3100014015212019-10-012019-12-3100014015212018-10-012018-12-310001401521uihc:EmployeeMember2020-01-012020-12-310001401521uihc:EmployeeMember2019-01-012019-12-310001401521uihc:EmployeeMember2018-01-012018-12-310001401521srt:DirectorMember2020-01-012020-12-310001401521srt:DirectorMember2019-01-012019-12-310001401521srt:DirectorMember2018-01-012018-12-310001401521uihc:EmployeeMember2020-12-310001401521srt:DirectorMember2020-12-310001401521us-gaap:RestrictedStockMember2020-01-012020-12-310001401521us-gaap:RestrictedStockMember2019-01-012019-12-310001401521us-gaap:RestrictedStockMember2018-01-012018-12-310001401521us-gaap:RestrictedStockMember2017-12-310001401521us-gaap:RestrictedStockMember2018-12-310001401521us-gaap:RestrictedStockMember2019-12-310001401521us-gaap:RestrictedStockMember2020-12-310001401521us-gaap:SubsequentEventMember2021-01-062021-01-06uihc:numberOfShares0001401521us-gaap:SubsequentEventMember2021-01-180001401521us-gaap:SubsequentEventMember2021-01-182021-01-180001401521us-gaap:SubsequentEventMember2021-02-162021-02-160001401521us-gaap:SubsequentEventMember2021-02-190001401521us-gaap:SubsequentEventMember2021-02-242021-02-240001401521us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2020-12-310001401521us-gaap:DebtSecuritiesMember2020-12-310001401521srt:ParentCompanyMember2020-12-310001401521srt:ParentCompanyMember2019-12-310001401521srt:ParentCompanyMember2020-01-012020-12-310001401521srt:ParentCompanyMember2019-01-012019-12-310001401521srt:ParentCompanyMember2018-01-012018-12-310001401521srt:ParentCompanyMember2018-12-310001401521srt:ParentCompanyMember2017-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________________________

FORM 10-K

___________________________________

☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2020

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period _____ to _____

Commission File Number 001-35761

United Insurance Holdings Corp.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | | | | | | | | | | |

| Delaware | | | 75-3241967 | |

| (State or Other Jurisdiction of

Incorporation or Organization) | | (IRS Employer Identification Number) | |

| | | | | |

| 800 2nd Avenue S. | | 33701 | |

| St. Petersburg, | Florida | | (Zip Code)

| |

| (Address of Principal Executive Offices)

| | | |

727-895-7737

(Telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock, $0.0001 par value per share | UIHC | Nasdaq Stock Market LLC |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No R

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No R

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes R No £

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes R No £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | £ | | Accelerated filer | þ |

| Non-accelerated filer | £ | | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. £

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No R

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

The aggregate market value of shares of the registrant’s common stock held by non–affiliates of the registrant was approximately $152,328,904 as of June 30, 2020, calculated using the closing sales price reported for such date on the Nasdaq Stock Market. For purposes of this disclosure, shares of common stock held by persons who hold more than 10% of the outstanding shares of common stock and shares held by executive officers and directors of the registrant have been excluded because such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of March 1, 2021, 43,086,883 shares of the registrant’s common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this Form 10-K incorporates by reference certain information from the Proxy Statement for the 2021 Annual Meeting of Stockholders to be filed with the Securities and Exchange Commission within 120 days after the end of our fiscal year ended December 31, 2020.

UNITED INSURANCE HOLDINGS CORP.

| | | | | | | | |

| Forward-Looking Statements | |

| |

| | |

| Item 1A. Risk Factors | |

| Item 1B. Unresolved Staff Comments | |

| Item 2. Properties | |

| Item 3. Legal Proceedings | |

| Item 4. Mine Safety Disclosures | |

| Part II. | |

| Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |

| Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

| Item 7A. Quantitative and Qualitative Disclosures about Market Risk | |

| Item 8. Financial Statements and Supplementary Data | |

| Auditor’s Report | |

| Consolidated Balance Sheets | |

| Consolidated Statements of Comprehensive Loss | |

| Consolidated Statements of Stockholders’ Equity | |

| Consolidated Statements of Cash Flows | |

| Notes to Consolidated Financial Statements | |

| Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |

| Item 9A. Controls and Procedures | |

| Item 9B. Other Information | |

| Part III. | |

| Item 10. Directors, Executive Officers and Corporate Governance | |

| Item 11. Executive Compensation | |

| Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

| Item 13. Certain Relationships and Related Transactions, and Director Independence | |

| Item 14. Principal Accountant Fees and Services | |

| Part IV. | |

| Item 15. Exhibits and Financial Statement Schedules | |

| Exhibit Index | |

| Item 16. Form 10-K Summary | |

| Signatures | |

Throughout this Annual Report on Form 10-K (Form 10-K), we present amounts in all tables in thousands, except for share amounts, per share amounts, policy and claim counts or where more specific language or context indicates a different presentation. In the narrative sections of this Form 10-K, we show full values rounded to the nearest thousand.

UNITED INSURANCE HOLDINGS CORP.

FORWARD-LOOKING STATEMENTS

Statements in this Form 10-K or in documents incorporated by reference contain or may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements about anticipated growth in revenues, gross written premium, earnings per share, estimated unpaid losses on insurance policies, investment returns, and diversification and expectations about our liquidity, our ability to meet our investment objectives and our ability to manage and mitigate market risk with respect to our investments. Without limiting the generality of the foregoing, words such as “may,” “will,” “expect,” “endeavor,” “project,” “believe,” “plan,” “anticipate,” “intend,” “could,” “would,” “estimate,” or “continue” or the negative variations thereof or comparable terminology are intended to identify forward-looking statements. These statements are based on current expectations, estimates and projections about the industry and market in which we operate, and management’s beliefs and assumptions. Forward-looking statements are not guarantees of future performance and involve certain known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. The risks and uncertainties include, without limitation:

•our exposure to catastrophic events and severe weather conditions;

•the regulatory, economic and weather conditions present in Florida, Texas and Louisiana, the states in which we are most concentrated;

•our ability to cultivate and maintain agent relationships, particularly our relationship with AmRisc, LLC (AmRisc);

•our reliance on certain agencies that account for a substantial portion of our policies-in-force;

•the possibility that actual claims incurred may exceed our loss reserves for claims;

•assessments charged by various governmental agencies;

•our ability to implement and maintain adequate internal controls over financial reporting;

•our ability to maintain information technology and data security systems, and to outsource relationships;

•our reliance on key vendor relationships, and the ability of our vendors to protect the personally identifiable information of our customers, claimants or employees;

•our ability to attract and retain the services of senior management;

•risks and uncertainties relating to our acquisitions, mergers and other strategic transactions;

•risks associated with joint ventures and investments in which we share ownership or management with third parties;

•our ability to generate sufficient cash to service all of our indebtedness and comply with covenants and other requirements related to our indebtedness;

•our ability to increase or maintain our market share;

•changes in the regulatory environment present in the states in which we operate;

•the impact of new federal or state regulations that affect the insurance industry;

•the cost, viability and availability of reinsurance;

•our ability to collect from our reinsurers on our reinsurance claims;

•dependence on investment income and the composition of our investment portfolio and related market risks;

•the possibility of the pricing and terms for our products to decline due to the historically cyclical nature of the property and casualty insurance and reinsurance industry;

•the outcome of litigation pending against us, including the terms of any settlements;

•downgrades in our financial strength or stability ratings;

•the impact of future transactions of substantial amounts of our common stock by us or our significant stockholders on our stock price;

•our ability to pay dividends in the future, which may be constrained by our holding company structure;

•the ability of our subsidiaries to pay dividends in the future, which may affect our liquidity and our ability to meet our

obligations;

•the ability of R. Daniel Peed and his affiliates to exert significant control over us due to substantial ownership of our common stock, subject to certain restrictive covenants that may restrict our ability to pursue certain opportunities;

•the impact of transactions by R. Daniel Peed and his affiliates on the price of our common stock;

•provisions in our charter documents that may make it harder for others to obtain control of us;

•the impact of the novel strain of coronavirus (COVID-19) and related business disruption and economic uncertainty on

our business, results of operations and financial condition; and

•other risks and uncertainties described in this report, including under “Risk Factors” in Part I, Item 1A.

We caution you to not place reliance on these forward-looking statements, which are valid only as of the date they were made. Except as may be required by applicable law, we undertake no obligation to update or revise any forward-looking statements to reflect new information, the occurrence of unanticipated events or otherwise.

UNITED INSURANCE HOLDINGS CORP.

PART I

Item 1. Business

INTRODUCTION

Company Overview

United Insurance Holdings Corp. (referred to in this Form 10-K as we, our, us, the Company or UPC Insurance) is a holding company primarily engaged in the personal residential and commercial residential property and casualty insurance business in the United States. Our largest insurance subsidiary is United Property & Casualty Insurance Company (UPC), and we also write business through American Coastal Insurance Company (ACIC), Family Security Insurance Company, Inc. (FSIC), Interboro Insurance Company (IIC), and Journey Insurance Company (JIC). Our insurance subsidiaries provide personal residential and commercial property and casualty insurance products that protect our policyholders against losses due to damages to structures and their contents. Some of our insurance subsidiaries sell policies that protect against liability for accidents as well as property damage. Our non-insurance subsidiaries support our insurance and investment operations.

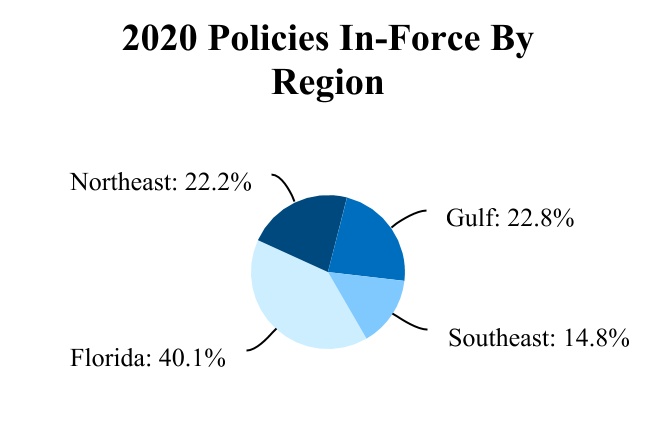

As of December 31, 2020, approximately 40.1% of our policies in-force were written in Florida. We also write in Connecticut, Georgia, Hawaii, Louisiana, Massachusetts, New Jersey, New York, North Carolina, Rhode Island, South Carolina, and Texas. We are licensed to write, but have not commenced writing business, in Alabama, Delaware, Maryland, Mississippi, New Hampshire, and Virginia. Our strategy is to write in multiple states where the perceived threat of natural catastrophe has caused large national insurance carriers to reduce their concentration of policies. We believe an opportunity exists for UPC Insurance to write profitable business in such areas.

Effective December 31, 2020, we have entered into a property quota share reinsurance contract with Homeowners Choice Property & Casualty Insurance Company, Inc. (HPC). According to the terms of this reinsurance contract, UPC Insurance will cede and HPC will assume a 69.5% quota share of our personal lines homeowners business in Connecticut, Massachusetts, New Jersey and Rhode Island on an in-force, new and renewal basis for the period from December 31, 2020 through May 31, 2021. In consideration for the reinsurance, HPC will pay UPC Insurance a provisional ceding commission of 25% of premium earned during the term of the contract that could increase up to 31.5% depending on the direct loss ratio results for the reinsured business. When coupled with the 30.5% cessions from our current quota share reinsurance agreement, we will no longer retain any risk associated with these states. In connection with the reinsurance contract, we have also entered into a renewal rights agreement with HPC and HCI Group, in which we have agreed to sell the renewal rights to the same business.

We manage our risk of catastrophic loss primarily through sophisticated underwriting procedures and pricing algorithms, powerful modeling software and exposure management tools, and the use of a comprehensive catastrophe reinsurance program. UPC Insurance has been operating continuously since 1999, and has successfully managed its business through various hurricanes, tropical storms, and other weather-related events. During 2020, the company faced an unprecedented increase in the frequency of catastrophic activity which had a material impact on the financial results of the company. Despite this challenge, our underlying results are continuing to improve through the implementation of our risk management strategy.

On August 30, 2018, the Company, in strategic partnership with RJ Kiln & Co. (No. 3 Limited) (Kiln), a subsidiary of Tokio Marine Kiln Group Limited, formed JIC. The Company owns 66.7% of JIC, while Kiln owns 33.3%.

On April 3, 2017, the Company acquired AmCo Holding Company (AmCo) and its subsidiaries through a series of mergers that ultimately resulted in the Company issuing 20,956,355 shares of its common stock as merger consideration to the equity holders of RDX Holding, LLC, the former parent company of AmCo.

Financial strength or stability ratings are important to insurance companies in establishing their competitive position and may impact an insurance company’s ability to write policies. We are rated by Demotech, AM Best, and Kroll Bond Rating Agency (Kroll). Demotech maintains a letter-scale financial stability rating system ranging from A’’ (A double prime) to L (licensed by insurance regulatory authorities). AM Best maintains a letter-scale financial strength rating system ranging from A++ (Superior) to S (suspended). Kroll maintains a letter-scale financial strength rating system for insurance companies ranging from AAA (extremely strong operations and no risk) to R (operating under regulatory supervision). The financial strength or stability ratings of our insurance company subsidiaries as of December 31, 2020 are listed below. With these ratings, we expect our property insurance policies will be acceptable to the secondary mortgage marketplace and mortgage lenders.

UNITED INSURANCE HOLDINGS CORP.

| | | | | | | | | | | | | | | | | | | | |

| Subsidiary | | Demotech Rating | | AM Best | | Kroll Rating |

| UPC | | A | | | | A- |

| ACIC | | A’ | | | | A- |

| FSIC | | A | | | | A- |

| IIC | | A | | | | A- |

| JIC | | | | A- | | A- |

| UIHC | | | | | | BBB- |

Impact of COVID-19 and Financial Status

The COVID-19 pandemic has resulted in governments worldwide enacting emergency measures to combat the spread of

the virus. These measures, which include the implementation of travel bans and restrictions, self-imposed quarantine periods,

state and local shelter-in-place orders, business and government shutdowns and social distancing, have caused and continue to

cause material disruption to businesses and economies globally. In addition, global equity markets have experienced and

continue to experience significant volatility and weakness.

We are committed to maintaining a stable and secure business for our employees, agents, customers and stockholders. During the second half of 2020, we were able to resume hiring activities, despite the limits on in-person interviews

and on-boarding procedures resulting from COVID-related protocols. In addition, we have converted to virtual sales processes

to enable our agents to continue their activities. We believe these activities, collectively, help ensure the health and safety of

our employees through adherence to CDC, state and local government work guidelines.

We have not experienced a material impact from COVID-19 on our business operations, financial position, liquidity or our

ability to service our policyholders to date, with the exceptions of fluctuations in our investment portfolios due to volatility of

the equity securities markets, as further described in Part II, Item 7. "Management's Discussion and Analysis of Financial

Condition and Results of Operations" of this Form 10-K. We reduced the size of the equity securities portfolio during the second half of 2020, which has reduced the impact of fluctuations in the markets on our financial condition. The COVID-19

pandemic and resulting global disruptions did not have a material impact on our access to credit and capital markets needed to

maintain sufficient liquidity for our continued operating needs during the year ended December 31, 2020.

The scope, severity and longevity of any business shutdowns and economic disruptions as a result of the COVID-19

outbreak are highly uncertain and cannot be predicted at this time, as new information may continue to emerge concerning the

actions governments may take to contain or mitigate the spread of the virus or address its impact on individuals, businesses and

the economy. We did not incur material claims or significant disruptions to our business for the year ended December 31, 2020, as a result of COVID-19. At this time, it is not possible to reasonably estimate the extent of the impact of the economic uncertainties on our business, results of operations and financial condition in future periods, due to uncertainty regarding the duration of the COVID-19 pandemic, but we will continue to respond to the COVID-19 pandemic and take reasonable measures to make sure customers continue to be served without interruption.

Our Strategy

Our vision is to be the premier provider of property insurance in catastrophe exposed areas. Historically, we have advanced our vision through strong organic growth complemented by strategic acquisitions. Going forward, we plan to optimize our portfolio by growing premiums via rate change while reducing risk exposures.

Our portfolio is concentrated in areas with an ongoing threat of natural catastrophes which exposes our company to risk and volatility. We manage the inherent volatility associated with our risk profile in three primary ways: strategically, financially and operationally.

Strategic Risk Management

UPC Insurance uses a strategic approach to manage inherent volatility and improve results through underwriting changes and exposure optimization. During 2020, we assessed our risk profile and determined that underwriting changes were necessary to increase our profitability. Where possible,we increased rates in each state and product offering and will continue this practice into 2021 for those states where actuarial data supports a rate change. We have increased the minimum deductible requirements for new and renewal business. We have utilized risk scoring technology which includes restrictions for roof age and condition.

UNITED INSURANCE HOLDINGS CORP.

Finally, we have increased our use of proprietary inspection technology to enhance our risk selection during the underwriting process.

In order to optimize our exposure to have a probable maximum loss within our risk tolerance, we have restricted business in certain geographies and peak exposure areas. We have exited products and territories that lack scale and/or profitability. During 2020, we have actively raised eligibility standards for new business. these actions have slowed our growth of policies in-force, but have allowed the company to focus on building a portfolio that has lower exposure to loss activity.

Financial Risk Management

We take a financial approach to manage risk using robust reinsurance programs, low financial leverage and a conservative investment approach. UPC Insurance has several reinsurance programs in place including quota share, catastrophe excess-of-loss, and aggregate catastrophe. During 2020, our excess-of-loss reinsurance program covered all four of our wholly-owned insurance subsidiaries and JIC, gaining synergies in reinsurance costs and increasing our coverage limits for the June 1, 2020 to May 31, 2021 program year. Refer to Note 8 in our Notes to Consolidated Financial Statements in Part II, Item 8 of this report for further details on our reinsurance program.

We also limit our financial leverage. We have a debt covenant in place on our $150,000,000 senior notes which requires us to maintain a financial leverage of less than 30%, and we believe that this is a conservative limit to our leverage. As of December 31, 2020, our financial leverage was 29%. Refer to Note 10 in our Notes to Consolidated Financial Statements in Part II, Item 8 of this report for further details on our debt offerings.

We follow a conservative investment approach using two outside investment management companies. Each manager has the authority and discretion to manage our investments, subject to the investment guidelines established by the Investment Committee of our Board of Directors and the direction of management. Our portfolio is primarily invested in short-term and intermediate-term, investment-grade fixed-income securities. Our investment portfolio had a fair value of $995,051,000 at December 31, 2020, compared to $1,011,723,000 at December 31, 2019 with approximately 87.6% of our fixed maturities invested in U.S. Treasuries, or corporate bonds rated “A” or better. Refer to Note 3 in our Notes to Consolidated Financial Statements in Part II, Item 8 of this report for further information on our investment policies.

Operational Risk Management

Finally, we use an operational approach to manage risk by in-sourcing a number of key insurance functions and increasing our leverage of technology. During 2020, we continued to focus on the expansion and development of our internal claims department function through our robust “UPC University” training program for our incoming claims adjusters which is focused on teaching our adjusters to provide world class service to our policyholders. In 2020, we created a Client Experience Center where employees are trained to provide underwriting and policy administration services to our policyholders while focusing on customer satisfaction.

In addition, we have taken two initiatives to monitor our risk management strategy related to loss activity. We have a 14-person actuarial and analytics team whose primary focus is to manage risk for our company. Expanding Skyway Reinsurance Services, LLC, has allowed us to continue to insource our reinsurance intermediary function as part of our risk management strategy.

Finally, we have leveraged our investments in an internally developed claims and policy administration system, both of which were put in service in 2020. These systems aid our employees in providing better service to our policyholders and agents and have improved our data analytics for monitoring company performance. This will continue our efforts to manage operational risk as all policy administration services will be managed internally over the next two years.

UNITED INSURANCE HOLDINGS CORP.

PRODUCTS AND DISTRIBUTION

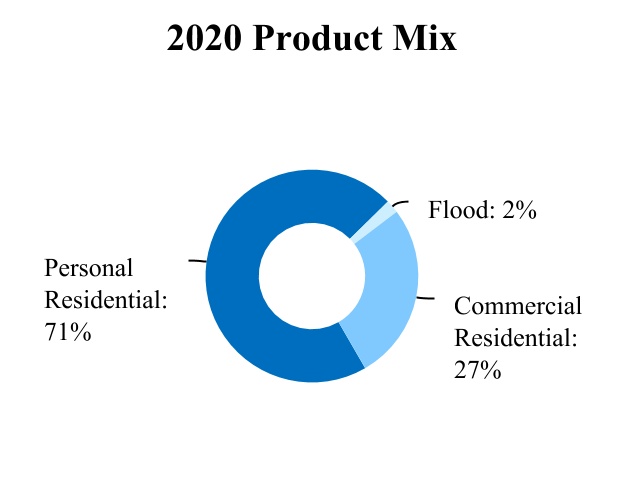

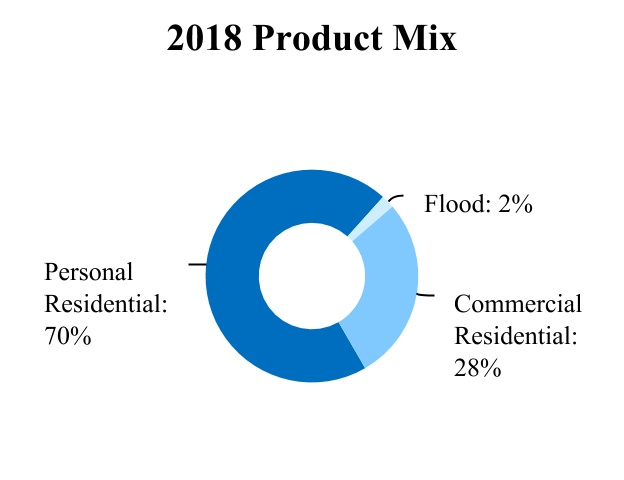

Throughout the years ended 2020, 2019, and 2018, we maintained our diverse product mix through rate increases in multiple states and organic growth. The graph below shows our product mix distribution based on gross written premium.

Personal Residential Products

Policies we issue under our homeowners’ program provide structure, content and liability coverage for standard single-family homeowners, renters and condominium unit owners. Personal residential products are offered in all states in which we write business.

In 2020, personal residential property policies (by which we mean both standard homeowners’, dwelling fire, renters and condo owners’ policies) produced written premium of $1,040,597,000 and accounted for 71% of our total gross written premium. Approximately 54% of the personal residential gross written premium was written outside of Florida.

We have developed a unique and proprietary homeowners’ product. This product uses a granular approach to pricing for catastrophe perils. Our objective is to create specific geographic areas such that within each area or “catastrophe band” the expected losses are within a specified range of error or approximation from a central estimate. These areas may have millions of data points that help us create distance-to-coast factors that provide a sophisticated market segmentation that is highly correlated to our risk exposure and reinsurance costs.

UNITED INSURANCE HOLDINGS CORP.

Loss and loss adjustment expenses related to our personal residential products tend to be higher during periods of severe or inclement weather, which varies from state to state.

Commercial Residential Products

We primarily provide commercial multi-peril property insurance for residential condominium associations and apartments in Florida. We include coverage to policyholders for loss or damage to buildings, inventory or equipment caused by covered cause of loss such as fire, wind, hail, water, theft and vandalism. During 2020, we began writing this commercial residential coverage in South Carolina and Texas.

In 2020, commercial policies produced written premium of $393,264,000 and accounted for 27% of our total gross written premium.

Not-At-Risk Offerings

On our equipment breakdown, identity theft, and flood policies (excluding our inland flood policies) we earn a commission while retaining no risk of loss, since all such risk is ceded to the federal government via the National Flood Insurance Program (flood risk) and other private companies (other risks). We offer flood policies in all states in which we write business. Flood policies produced written premium of $23,002,000 and accounted for 2% of our total gross written premium at December 31, 2020.

Other Offerings

In addition to our personal and commercial residential products, in December 2019, we began offering Inland Flood and Cyber Security insurance. These products did not comprise a material portion of our written business at December 31, 2020.

Underwriting

We price our products at levels that we project will generate an acceptable underwriting profit. We aim to be granular in our approach, so that our price can accurately reflect the risk and profitability of each potential customer. In our proprietary pricing algorithm, we consider insurance credit scores (where allowable) and historical attritional loss costs for the rating territory in which the customer resides, as well as projected reinsurance costs based on the specific geographic and structural characteristics of the home. In addition to the specific characteristics of the policy being priced, we also evaluate the reinsurance costs of each incremental policy on our portfolio as a whole. In this regard, we seek to optimize our portfolio by diversifying our geographic exposure in order to limit our probable maximum loss, total insured value and average annual loss. As part of this optimization process, we use the output from third-party modeling software to analyze our risk exposures, including wind exposures, by zip code or street address.

We have established underwriting guidelines designed to provide a uniform approach to our risk selection and designed to achieve acceptable underwriting profitability. Our underwriters review the property inspection report during their risk evaluation and, if the policy does not meet our underwriting criteria, we have the right to cancel the policy within 90 days in Florida and within 60 days in all other states in which we operate.

We measure our underwriting profitability by the combined ratio, which is a sum of the ratios of losses, loss adjustment expenses, and underwriting expenses to either gross or net earned premiums. A combined ratio under 100% indicates an underwriting profit. Refer to Management’s Discussion and Analysis of Financial Condition and Results of Operations in Part II, Item 7 of this report for further details on our combined ratio.

Distribution Channels

As of December 31, 2020, we market and distribute our policies to consumers through approximately 7,200 independent agents representing over 6,400 agencies, with only one agency, Allstate, representing more than 10% of our revenue. UPC Insurance has focused on the independent agency distribution channel since its inception, and we believe independent agents and agencies build relationships in their communities that can lead to profitable business and policyholder satisfaction. We believe we have built significant credibility and loyalty with the independent agent communities in the states in which we operate through (i) our extensive training for full-service insurance agencies that distribute our products, (ii) periodic business reviews using established benchmarks and goals for premium volume and profitability, and (iii) regular visits from the Company’s executives to strengthen the personal relationships with our agents and agencies. Also, each state is assigned a sales

UNITED INSURANCE HOLDINGS CORP.

representative from UPC Insurance who lives in the community, recruits new agents and agencies, and provides direct support for existing agents and agencies.

Typically, a full-service agency is small to medium in size and represents several insurance companies for both personal and commercial product lines. We depend on our independent agents to produce new business for us. We compensate our independent agents primarily with fixed-rate commissions that we believe are consistent with those generally prevailing in the market. In 2018, we expanded our commission program in order to allow agents and brokers to be eligible to earn a bonus commission based on the overall profitability of policies they place with UPC Insurance in a particular year.

In addition to our relationships with individual agencies, we have important partnerships with other insurance companies and industry associations. The largest of these relationships are with Allstate and GEICO. In Florida, Allstate’s Ivantage program refers Allstate auto insurance customers to our Company and other partner companies to provide homeowners’ insurance. We partner with GEICO to underwrite homeowners’ policies for some of their auto customers. We also have a partnership with the Florida Association of Insurance Agents (FAIA) to serve as a conduit between UPC Insurance and many smaller insurance agencies in Florida with whom we do not have direct relationships.

GEOGRAPHIC MARKETS

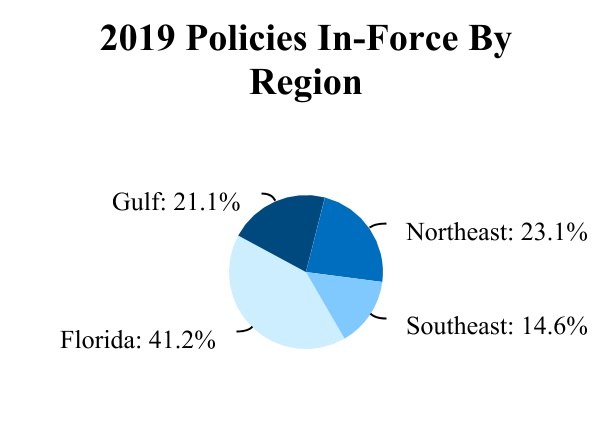

The table below shows the geographic distribution of our policies in-force as of December 31, 2020, 2019 and 2018.

| | | | | | | | | | | | | | | | | | | | |

Policies In-Force By Region (1) | | 2020 | | 2019 | | 2018 |

| Florida | | 253,244 | | | 258,487 | | | 239,725 | |

| Gulf | | 144,121 | | | 132,480 | | | 130,808 | |

| Northeast | | 140,043 | | | 144,880 | | | 126,285 | |

| Southeast | | 93,583 | | | 91,383 | | | 85,278 | |

| Total | | 630,991 | | | 627,230 | | | 582,096 | |

(1) “Northeast” is comprised of Connecticut, Massachusetts, New Jersey, New York and Rhode Island; “Gulf” is comprised of Hawaii, Louisiana and Texas; and “Southeast” is comprised of Georgia, North Carolina and South Carolina.

UNITED INSURANCE HOLDINGS CORP.

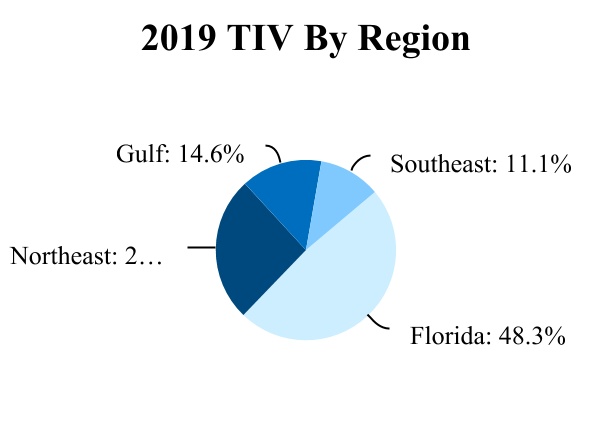

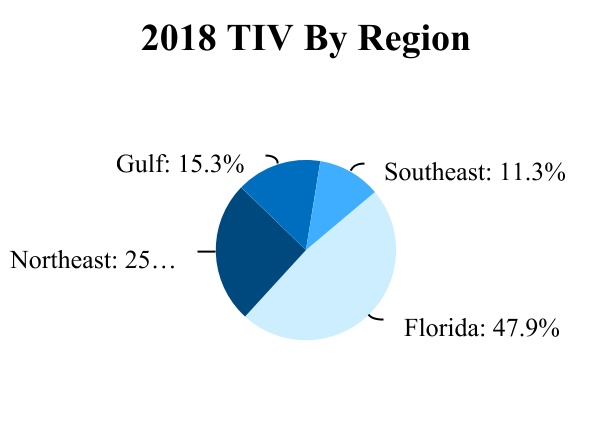

The table below shows the geographic distribution of our total insured value (TIV) of all polices in-force as of December 31, 2020, 2019 and 2018.

| | | | | | | | | | | | | | | | | | | | |

TIV By Region(1) | | 2020 | | 2019 | | 2018 |

| Florida | | $ | 178,268,495 | | | $ | 179,924,925 | | | $ | 160,406,387 | |

| Northeast | | 94,633,077 | | | 96,776,972 | | | 85,296,121 | |

| Gulf | | 60,347,058 | | | 54,307,883 | | | 51,219,071 | |

| Southeast | | 43,790,464 | | | 41,450,816 | | | 37,913,396 | |

| Total | | $ | 377,039,094 | | | $ | 372,460,596 | | | $ | 334,834,975 | |

(1) “Northeast” is comprised of Connecticut, Massachusetts, New Jersey, New York and Rhode Island; “Gulf” is comprised of Hawaii, Louisiana and Texas; and “Southeast” is comprised of Georgia, North Carolina and South Carolina.

UNITED INSURANCE HOLDINGS CORP.

COMPETITION

The property and casualty insurance market in the United States is highly competitive and rapidly changing. Our primary competitors range from large national property and casualty insurance companies that write most classes of business using traditional products and pricing to small and mid-size regional insurance companies who provide specialty coverages.

We compete primarily on the basis of product features, the strength of our distribution network, the quality of our services to our agents and policyholders, and our long-term financial stability. Our long and successful track record writing homeowners’ insurance in catastrophe-exposed areas has enabled us to develop sophisticated pricing techniques that endeavor to accurately reflect the risk of loss while allowing us to be competitive in our target markets. This pricing segmentation approach allows us to offer products in areas that have a high demand for property insurance yet are under-served by the national carriers. However, we face the risk that policyholders may be able to obtain more favorable terms from competitors rather than renewing coverage with us.

Our ability to compete is dependent on a number of factors. One factor is the financial strength or stability ratings assigned to our insurance subsidiaries by independent rating agencies. A downgrade in these ratings could negatively impact our position in the market. Another, is that we must attract and retain key employees and highly skilled people in order to be successful in the market. There is intense competition in our industry which could lead to higher than expected employee turnover or difficulty attracting new employees. Finally, technological advancements and innovation in the insurance industry provide opportunities for a competitive advantage. Advancements and innovation are being used in all aspects of the industry including digital-based distribution methods, underwriting and claims handling. We continue to leverage the technology that we have and have made substantial investments into new technology in efforts to gain an advantage over our competitors.

REGULATION

We are subject to extensive regulation in the jurisdictions in which our insurance company subsidiaries are domiciled and licensed to transact business, primarily at the state level. UPC, ACIC, and JIC are domiciled in Florida, FSIC is domiciled in Hawaii, and IIC is domiciled in New York. UPC Insurance is also regulated by the NAIC. In general, these regulations are designed to protect the interests of insurance policyholders.

Such regulations have a substantial effect on certain areas of our business, including:

•insurer solvency,

•reserve adequacy,

•insurance company licensing and examination,

•agent and adjuster licensing,

•rate setting,

•investments,

•assessments or other surcharges for guaranty funds,

•transactions with affiliates,

•the payment of dividends,

•reinsurance,

•protection of personally identifiable information,

•risk solvency assessment and enterprise risk management,

•cyber security,

•statutory accounting methods, and

•numerous requirements relating to other areas of insurance operations, including policy forms, underwriting standards and claims practices.

Our insurance subsidiaries provide audited statutory financial statements to the various insurance regulatory authorities. With regard to periodic examinations of an insurance company’s affairs, insurance regulatory authorities, in general, defer to the insurance regulatory authority in the state in which an insurer is domiciled; however, insurance regulatory authorities from any state in which we operate may conduct examinations at their discretion.

In 2020, the Florida Office of Insurance Regulation (FLOIR) performed regularly scheduled statutory examinations of UPC and ACIC, for the five years ended December 31, 2019. In addition, in 2020 the FLOIR performed a regularly scheduled statutory examination of JIC for the year ended December 31, 2019. Finally, in 2020 the New York State Department of Financial Services performed a regularly scheduled statutory examination of IIC for the five years ended December 31, 2019. There have been no significant findings to date regarding any of these examinations. In 2018, the Hawaii Insurance Division of

UNITED INSURANCE HOLDINGS CORP.

the Department of Commerce and Consumer Affairs finished performing a regularly scheduled statutory examination of FSIC for the five years ended December 31, 2016. There were no significant findings resulting from this examination.

Three of our insurance subsidiaries, UPC, FSIC and ACIC, are members of an intercompany property and casualty reinsurance pooling arrangement. Pooling arrangements permit the participating companies to rely on the capacity of the entire pool’s statutory capital and surplus rather than just on their own statutory capital and surplus. Under such arrangements, the participating companies share substantially all insurance business that is written and allocate the combined premiums, losses and expenses.

For a discussion of statutory financial information and regulatory contingencies, see Note 13 to our Notes to Consolidated Financial Statements in Part II, Item 8 of this report.

Risk-Based Capital Requirements

To enhance the regulation of insurer solvency, the NAIC has published risk-based capital (RBC) guidelines for insurance companies designed to assess capital adequacy and to raise the level of protection statutory surplus provides for policyholders. The guidelines measure three major areas of risk facing property and casualty insurers: (i) underwriting risks, which encompass the risk of adverse loss developments and inadequate pricing; (ii) declines in asset values arising from credit risk; and (iii) other business risks. Most states, including Florida, Hawaii and New York, have enacted the NAIC guidelines as statutory requirements, and insurers having less statutory surplus than required will be subject to varying degrees of regulatory action, depending on the level of capital inadequacy.

The level of required risk-based capital is calculated and reported annually. The table below outlines each of our subsidiary’s RBC ratios, all of which were in excess of minimum requirements, as of December 31, 2020.

| | | | | | | | |

| Subsidiary | | RBC Ratio |

| UPC | | 302 | % |

| ACIC | | 323 | % |

| FSIC | | 323 | % |

| IIC | | 935 | % |

| JIC | | 2,189 | % |

Underwriting and Marketing Restrictions

During the past several years, various regulatory and legislative bodies have adopted or proposed new laws or regulations to address the cyclical nature of the insurance industry, catastrophic events and insurance capacity and pricing. These regulations: (i) created “market assistance plans” under which insurers are induced to provide certain coverage; (ii) restrict the ability of insurers to reject insurance coverage applications, to rescind or otherwise cancel certain policies in mid-term, and to terminate agents; (iii) restrict certain policy non-renewals and require advance notice on certain policy non-renewals; and (iv) limit rate increases or decrease rates permitted to be charged.

Most states also have insurance laws requiring that rate schedules and other information be filed with the insurance regulatory authority, either directly or through a rating organization with which the insurer is affiliated. The insurance regulatory authority may disapprove a rate filing if it finds that the rates are inadequate, excessive or unfairly discriminatory.

Most states require licensure or insurance regulatory authority approval prior to the marketing of new insurance products. Typically, licensure review is comprehensive and includes a review of a company’s business plan, solvency, reinsurance, rates, forms and other financial and non-financial aspects of a company, such as the character of its officers and directors. The insurance regulatory authorities may prohibit entry into a new market by not granting a license or by withholding approval.

Limitations on Dividends by Insurance Subsidiaries

As a holding company with no significant business operations of our own, we rely on payments from our insurance subsidiaries as one of the principal sources of cash to pay dividends and meet our obligations. Our insurance affiliates are regulated as property and casualty insurance companies and their ability to pay dividends is restricted by Florida, Hawaii and New York law.

UNITED INSURANCE HOLDINGS CORP.

The state laws of Florida, Hawaii, and New York permit an insurer to pay dividends or make distributions out of that part of statutory surplus derived from net operating profit and net realized capital gains or adjusted net investment income. The state laws further provide calculations to determine the amount of dividends or distributions that can be made without the prior approval of the insurance regulatory authorities and the amount of dividends or distributions that would require prior approval of the insurance regulatory authorities in those states. Statutory risk-based capital requirements may further restrict our insurance subsidiaries’ ability to pay dividends or make distributions if the amount of the intended dividend or distribution would cause statutory surplus to fall below minimum risk-based capital requirements.

Insurance Holding Company Regulation

As a holding company of insurance subsidiaries, we are subject to laws governing insurance holding companies in Florida, Hawaii and New York. These laws, among other things: (i) require us to file periodic information with the insurance regulatory authority, including information concerning our capital structure, ownership, financial condition and general business operations; (ii) regulate certain transactions between our affiliates and us, including the amount of dividends and other distributions and the terms of surplus notes: and (iii) restrict the ability of any one person to acquire certain levels of our voting securities without prior regulatory approval. Any purchaser of 5% or more of the outstanding shares of our common stock could be presumed to have acquired control of us unless the insurance regulatory authority, upon application, determines otherwise.

Insurance holding company regulations also govern the amount any affiliate of the holding company may charge our insurance affiliates for services (i.e., management fees and commissions). We have a long-term management agreement among our managing company, United Insurance Management L.C., UPC, JIC, and FSIC which presently provides for monthly management fees. The Florida Office of Insurance Regulation and the Hawaii Insurance Division must approve any changes to this agreement.

AmRisc, a managing general underwriter, handles the underwriting, claims processing and premium collection for our AmCo commercial business and JIC’s commercial businesses written in Florida. In return, AmRisc is reimbursed through monthly management fees.

International Catastrophe Insurance Managers, a managing general underwriter, handles the underwriting, claims processing, and premium collection for JIC’s commercial business written in South Carolina and Texas. In return, they are reimbursed through monthly management fees.

The Company does not utilize a managing general agent structure in New York. Instead, UPC Insurance allocates a portion of relevant expenses to IIC for statutory accounting purposes at cost.

HUMAN CAPITAL MANAGEMENT

Diversity and Employment Statistics

As of December 31, 2020, we had 478 employees, of which 244, 50, and 13, worked in Claims, the Client Experience Center, and Underwriting, respectively. These employees have regular direct contact with our vendors, agencies, or customers. We are not party to any collective bargaining agreements and we have not experienced any work stoppages or strikes as a result of labor disputes.

The following table shows the diversity in our workforce population at December 31, 2020 and how this diversity has changed from December 31, 2019.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Gender (1) | | Change from

December 31, 2019 | | Race (1) | | Change from

December 31, 2019 |

| Executive Officers | | 14.3% | | 14.3 pts | | 14.3% | | — |

Management Team (2) | | 35.3% | | 2.9 pts | | 21.2% | | 0.6 pts |

| All Other Employees | | 48.6% | | (0.6) pts | | 31.2% | | (1.4) pts |

(1) Information regarding gender and race is based on information provided by employees.

(2) Our management team is comprised of employees in supervisory roles at the manager and director level or above.

UNITED INSURANCE HOLDINGS CORP.

Oversight and Management

We recognize the diversity of our policyholders, team, and geographic markets, and believe in creating an inclusive environment that represents a variety of backgrounds. Working under these principles, our Employee Success Department is tasked with recruiting and hiring, onboarding, performance management, and managing employee-related matters. In addition, we have developed “UPC University”, a robust training program for our incoming claims adjusters. With this development, we have created a full-time Training Department, whose focus is on harboring success in our claims adjusters while continuously improving the training curriculum and experience for the company as a whole.

We believe in transparency at all levels at UPC Insurance. On a monthly basis, an all employee meeting is held where our Executive Officers recognize employees for their continued success, discuss new and ongoing company initiatives, and address any concerns our employees may have. In addition to this, the leaders in each department assist our Executive Officers in maintaining our culture and implementing our core values at all levels of the organization.

Total Rewards

We believe that our future success largely depends upon our ability to attract and retain highly skilled employees. To ensure we are successful in this, we provide our employees with the following:

•Competitive salaries and bonuses;

•Tuition reimbursement;

•Paid parental leave; and

•Robust employee benefit packages that include:

◦Health care

◦Vision

◦Dental

◦Retirement program

◦Paid time off

◦Employee assistance program that provides emotional support, legal services and financial services.

As a part of our retention efforts, we also invest in ongoing development for all employees, and attempt to fill vacant senior or leadership roles through internal promotion when possible. We believe we are successful in our employee retention initiatives, as voluntary attrition was 11.0% for the year ended December 31, 2020.

CORPORATE INFORMATION

United Insurance Holdings Corp. was incorporated in Delaware in 2012. Our principal executive offices are located at 800 2nd Avenue S., St. Petersburg, FL 33701 and our telephone number at that location is (727) 895-7737. We are listed on the Nasdaq stock exchange under ticker symbol “UIHC.”

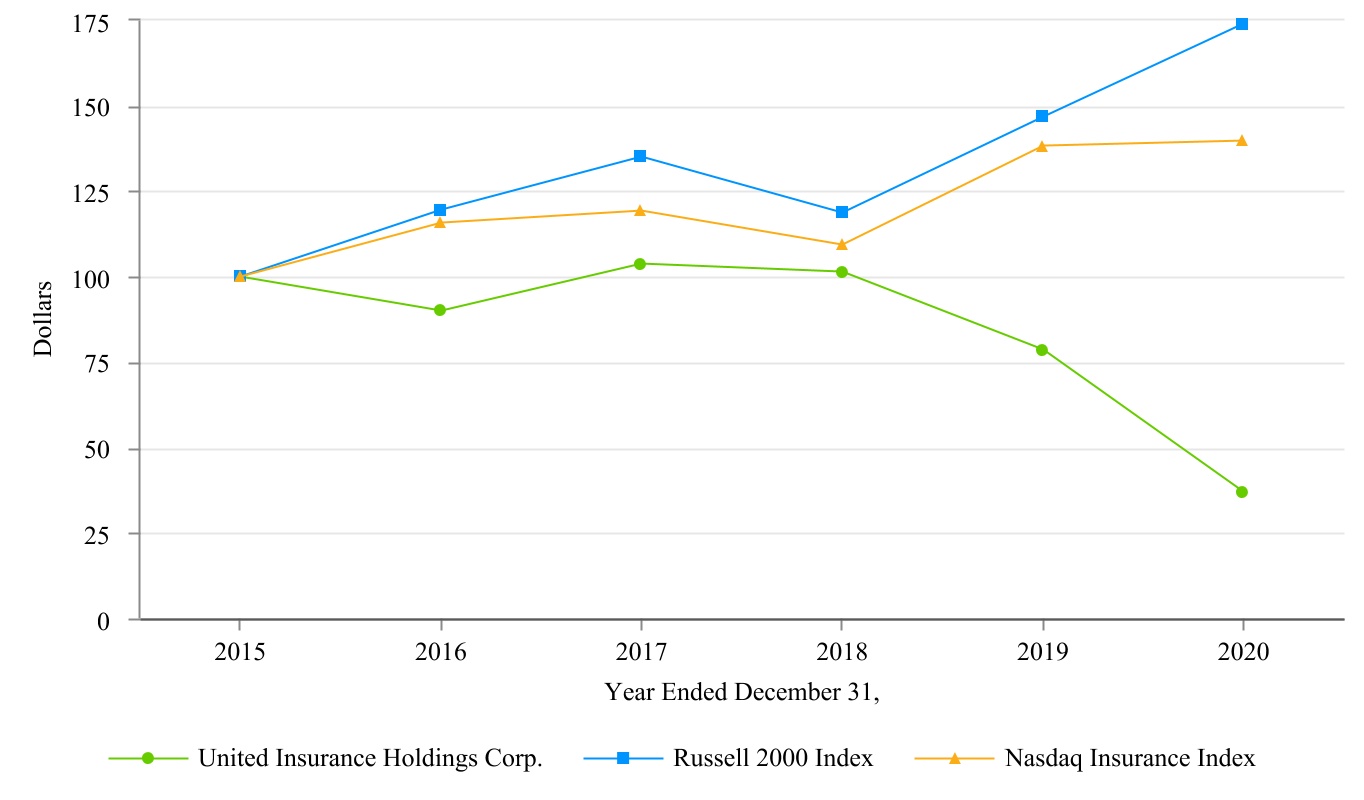

Segments