AmCo Holding Company

Consolidated Financial Statements with Independent

Auditor’s report thereon for the reporting periods ended

December 31, 2016 and 2015

Independent Auditor's Report 1

Financial Statements

Consolidated Balance Sheets 2

Consolidated Statements of Comprehensive Income 3

Consolidated Statements of Changes in Stockholders' Equity 4

Consolidated Statements of Cash Flows 5

Notes to the Consolidated Financial Statements 6

Contents

Report of Independent Registered Public Accounting Firm

To the Board of Directors

AmCo Holding Company

We have audited the accompanying consolidated balance sheets of AmCo Holding Company and

Subsidiary (the Company) as of December 31, 2016 and 2015, and the related consolidated statements

of comprehensive income, changes in stockholders’ equity, and cash flows for the years then ended.

These consolidated financial statements are the responsibility of the Company’s management. Our

responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight

Board (United States). Those standards require that we plan and perform the audits to obtain reasonable

assurance about whether the consolidated financial statements are free of material misstatement. An

audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the

consolidated financial statements. An audit also includes assessing the accounting principles used and

significant estimates made by management, as well as evaluating the overall financial statement

presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material

respects, the financial position of AmCo Holding Company and Subsidiary as of December 31, 2016 and

2015, and the results of their operations and their cash flows for the years then ended in conformity with

accounting principles generally accepted in the United States of America.

Omaha, Nebraska

May 18, 2017

2

2016 2015

ASSETS

Investments available for sale, at fair value:

Fixed maturities (amortized cost of $215,744,865 and

$166,368,581, respectively) 213,344,858$ 166,173,984$

Equity securities (adjusted cost of $2,986,987 and

$1,497,087, respectively) 3,531,075 1,513,503

Other investments (adjusted cost of $2,029,488 and $0,

respectively) 2,029,488 -

Total investments 218,905,421 167,687,487

Cash and cash equivalents 77,032,346 105,982,292

Accrued investment income 1,307,219 908,419

Premiums receivable, net 24,152,060 23,752,210

Reinsurance recoverable on paid and unpaid losses 24,817,505 30,173,187

Prepaid reinsurance 50,525,944 67,699,453

Income tax receivables 4,453,885 9,218,733

Deferred policy acquisition costs 28,242,245 31,332,600

Other assets 125,099 136,027

Total assets 429,561,724$ 436,890,408$

LIABILITIES AND STOCKHOLDERS' EQUITY

Liabilities:

Unpaid losses and loss adjustment expenses 57,754,782$ 50,076,393$

Unearned premiums 119,896,248 132,259,143

Reinsurance payable 41,479,257 45,561,000

Deferred income taxes 3,429,560 6,080,331

Other liabilities 7,820,378 7,090,860

Total liabilities 230,380,225$ 241,067,727$

Commitments and Contigencies (Note 14)

Stockholders' Equity:

Common Stock, $0 par value; 100,000 shares authorized;

100 issued and outstanding -$ -$

Additional paid-in capital 55,713,171 50,025,000

Accumulated other comprehensive (loss) (1,148,764) (109,449)

Retained earnings 144,617,092 145,907,130

Total Stockholders' Equity 199,181,499 195,822,681

Total Liabilities and Stockholders' Equity 429,561,724$ 436,890,408$

December 31,

Consolidated Balance Sheets

AmCo Holding Company

See Notes to Consolidated Financial Statements.

3

2016 2015 2014

REVENUE:

Gross premiums written 268,678,053$ 308,512,353$ 311,397,187$

Decrease (Increase) in gross unearned premiums 12,362,895 4,785,732 (1,614,135)

Gross premiums earned 281,040,948 313,298,085 309,783,052

Ceded premiums earned (110,596,248) (137,887,022) (129,850,178)

Net premiums earned 170,444,700 175,411,063 179,932,874

Investment income 4,572,950 2,867,223 2,222,701

Net realized gains on sales of investments 13,972 3,436 -

Total revenue 175,031,622 178,281,722 182,155,575

EXPENSES:

Losses and loss adjustment expenses 49,738,470 33,369,523 32,463,714

Policy acquisition costs 67,194,678 75,618,314 74,495,504

General and administrative expense 11,286,010 9,419,135 7,933,145

Total expenses 128,219,158 118,406,972 114,892,363

Income before income taxes 46,812,464 59,874,750 67,263,212

Provision for income taxes 14,852,502 23,398,706 22,300,324

Net income 31,959,962 36,476,044 44,962,888

OTHER COMPREHENSIVE INCOME

Change in unrealized (loss) gain on investments (1,663,767) (243,921) 111,726

Reclassification adjustment for net realized

investment (gains) (13,972) (3,436) -

Income tax benefit (expense) related to items of

other comprehensive income 638,424 93,172 (38,743)

Total comprehensive income 30,920,646$ 36,321,859$ 45,035,871$

Weighted average shares outstanding

Basic 100 100 100

Diluted 100 100 100

Earnings per share

Basic 319,600$ 364,760$ 449,629$

Diluted 319,600$ 364,760$ 449,629$

Dividends declared per share 332,500$ 478,902$ 464,354$

Years Ended December 31,

AmCo Holding Company

Consolidated Statements of Comprehensive Income

See Notes to Consolidated Financial Statements.

4

Additional Paid-in

Shares Amount Capital

December 31, 2013 100 -$ 50,025,000$ (28,247)$ 158,793,879$ 208,790,632$

Net Income - - - - 44,962,888 44,962,888

Other comprehensive income - - - 72,983 - 72,983

Dividends - - - - (46,435,441) (46,435,441)

Balance at December 31, 2014 100 - 50,025,000 44,736 157,321,326 207,391,062

Net Income - - - - 36,476,044 36,476,044

Other comprehensive (loss) - - - (154,185) - (154,185)

Dividends - - - - (47,890,240) (47,890,240)

Balance at December 31, 2015 100 - 50,025,000 (109,449) 145,907,130 195,822,681

Additional Paid in Capital - - 5,688,171 - - 5,688,171

Net Income - - - - 31,959,962 31,959,962

Other comprehensive (loss) - - - (1,039,315) - (1,039,315)

Dividends - - - - (33,250,000) (33,250,000)

Balance at December 31, 2016 100 -$ 55,713,171$ (1,148,764)$ 144,617,092$ 199,181,499$

Common Stock

Accumulated Other

Comprehensive

Income (Loss)

Total

Stockholders'

EquityRetained Earnings

AmCo Holding Company

Consolidated Statements of Changes in Stockholders' Equity

See Notes to Consolidated Financial Statements.

5

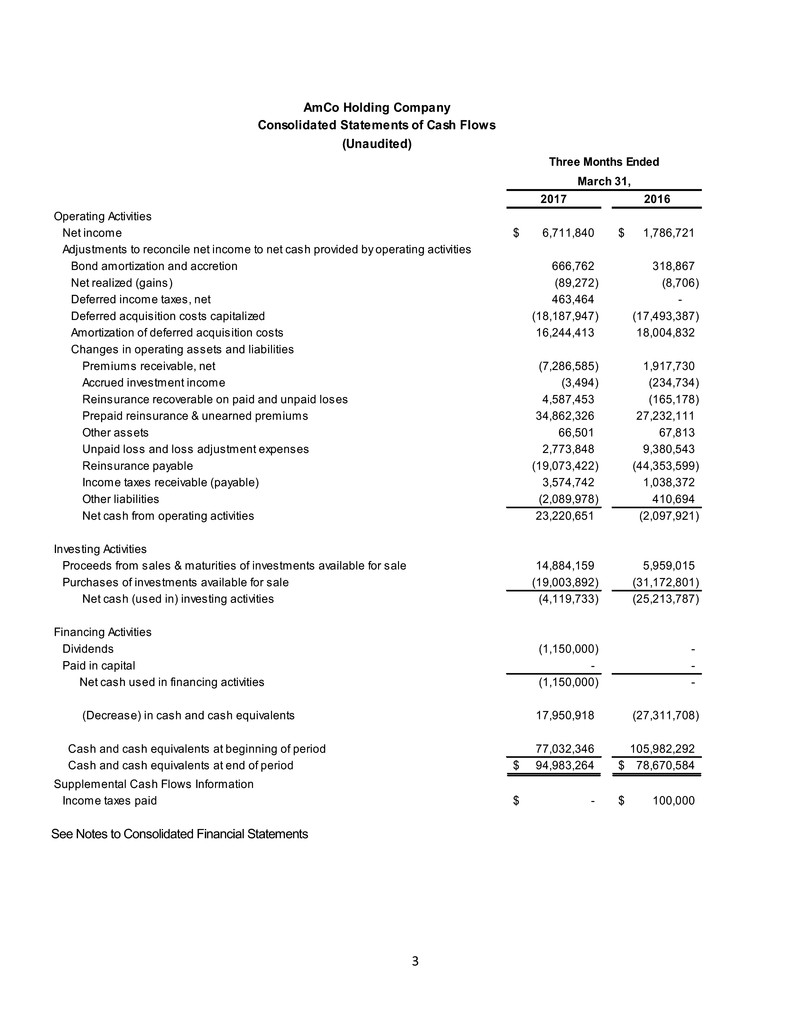

2016 2015 2014

Operating Activities

Net income 31,959,962$ 36,476,044$ 44,962,888$

Adjustments to reconcile net income to net cash provided by operating activities:

Bond amortization and accretion 1,432,056 262,877 -

Net realized (gains) (13,972) (3,436) -

Deferred income taxes, net (2,012,347) 4,089,348 (1,085,852)

Deferred acquisition costs capitalized (64,104,323) (73,786,349) (74,954,639)

Amortization of deferred acquisition costs 67,194,678 75,618,314 74,495,504

Changes in operating assets and liabilities:

Premiums receivable, net (399,850) 1,050,225 3,641,101

Accrued investment income (398,800) 30,505 (17,090)

Reinsurance recoverable on paid and unpaid loses 5,355,682 (2,891,424) 2,399,964

Prepaid reinsurance and unearned premiums 4,810,614 6,895,563 7,388,660

Other assets 10,927 (133,997) 141

Unpaid loss and loss adjustment expenses 7,678,389 (1,180,607) 13,177,709

Reinsurance payable (4,081,743) 15,479,816 (7,841,207)

Income taxes receivable (payable) 4,764,848 (4,802,760) (6,955,924)

Other liabilities 729,518 (428,967) (602,651)

Net cash from operating activities 52,925,639 56,675,152 54,608,604

Investing Activities

Proceeds from sales and maturities of investments available for sale 37,038,131 77,470,434 3,159,013

Purchases of investments available for sale (91,351,887) (155,506,584) (2,188,920)

Net cash (used in) provided by investing activities (54,313,756) (78,036,150) 970,093

Financing Activities

Dividends (33,250,000) (47,890,240) (46,435,441)

Paid in capital 5,688,171 - -

Net cash used in financing activities (27,561,829) (47,890,240) (46,435,441)

(Decrease) increase in cash and cash equivalents (28,949,946) (69,251,238) 9,143,256

Cash and cash equivalents at beginning of period 105,982,292 175,233,530 166,090,274

Cash and cash equivalents at end of period 77,032,346$ 105,982,292$ 175,233,530$

Supplemental Cash Flows Information

Income taxes paid 12,100,000$ 24,112,118$ 30,342,100$

AmCo Holding Company

Consolidated Statements of Cash Flows

Years Ended December 31,

See Notes to Consolidated Financial Statements.

AmCo Holding Company

Notes to Consolidated Financial Statements

6

1. Description of Business

AmCo Holding Company (“Company” or “AmCo"), is wholly owned by RDX Holdings, LLC (RDX), a

Delaware Limited Liability Company as of June 1, 2015. Previously, the Company was owned by BB&T

Corporation (BB&T). See Note 8, Related Parties, for a discussion regarding the change in ownership that

occurred during 2015. The Company was incorporated in North Carolina on June 1, 2007.

The Company owns American Coastal Insurance Company (ACIC), which is licensed in the State of Florida

and provides commercial multi-peril property insurance, including wind, for residential condominium

associations since 2007. The Company has been writing Allied Lines since 2011.

AmRisc, LLC (AmRisc), a Managing General Underwriter, handles the underwriting, claims processing,

premium collection and reinsurance review for the Company.

The Company also owns BlueLine Cayman Holdings (BlueLine Holdings), a Cayman Islands holding

company that owns BlueLine Re. BlueLine Re is a protected cell (also known as a separate account) of

Horseshoe Re Limited. Horseshoe Re Limited is a licensed Bermuda Class 3 separate account reinsurer

incorporated under a Bermuda Private Act. The purpose of acquiring a protected cell was to allow the

Company through BlueLine Re to participate in the AmRisc excess and surplus book of business.

Effective June 1, 2016, the Company entered into a quota share reinsurance agreement through BlueLine

Re with Lexington Insurance Company (Lexington) a subsidiary of American International Group, Inc. to

participate in the AmRisc excess and surplus book of business. The AmRisc excess and surplus book of

business consists of commercial property and related coverages throughout the United States.

The Company attempts to mitigate its exposure to losses from storms by purchasing catastrophe

reinsurance coverage. However, a catastrophe, depending on its path and severity, could result in losses

to the Company exceeding its reinsurance protection and could have a material adverse effect on the

financial condition and results of operations of the Company. The Company has purchased catastrophe

reinsurance protection based upon expected losses during hurricane season, which are derived from

sophisticated models approved for use in the State of Florida. Further detail regarding the Company’s

reinsurance programs can be found in Note 12.

The Company also purchases catastrophe reinsurance coverage for its participation in the excess and

surplus market through BlueLine Re. The Company has purchased catastrophe reinsurance protection

based upon expected losses which are derived from sophisticated models. Further detail regarding the

Company’s reinsurance programs can be found in Note 12.

2. Consolidation and Presentation

The accompanying consolidated financial statements have been prepared in conformity with generally

accepted accounting principles (GAAP) in the United States of America. While preparing the consolidated

financial statements, management has made estimates and assumptions that affect the reported amounts

of assets and liabilities and disclosure of contingent assets and liabilities, and the reported amounts of

revenues and expenses during the reporting periods. Actual results could differ materially from those

estimates.

The consolidated financials of the Company include all of its subsidiaries. All significant intercompany

balances and transactions are eliminated during consolidation.

AmCo Holding Company

Notes to Consolidated Financial Statements

7

3. Summary of Accounting Policies

Cash and cash equivalents

Cash and cash equivalents include demand deposits with financial institutions and other highly liquid investments with

original maturities of three months or less when purchased. The carrying amounts reported in the Consolidated

Balance Sheets for interest bearing deposits approximate their fair value because of the short maturity of these

investments.

Investments

The Company currently classifies all investments in fixed maturities, equity securities and other investments

as available-for-sale, and reports them at fair value. Changes in fair value through the date of disposition

are recorded as unrealized holding gains and losses, net of tax effects, and included as a component of

other comprehensive income.

The Company includes realized gains and losses, which are calculated using the specific – identification

method for determining the cost of securities sold, in net income. Any premium or discount on fixed maturities

is amortized over the remaining maturity period of the related securities using the effective interest method,

and reported in net investment income. Dividends and interest income is recognized as earned.

Quarterly, the Company performs an assessment of its investments to determine if any are other-than-

temporarily impaired. An investment is impaired when the fair value of the investment declines to an amount

less than the cost or amortized cost of that investment. As part of the assessment process, the Company

determines whether the impairment is temporary or other-than-temporary. The Company bases its

assessments on both quantitative criteria and qualitative information, considering a number of factors

including, but not limited to: how long the security has been impaired; the amount of the impairment;

whether, in the case of equity securities, the Company intends to hold, and has the ability to hold, the security

for a period sufficient to recover the cost basis, or whether, in the case of debt securities, the Company

intends to sell the security or it is more likely than not that the security will be required to be sold before

complete recovery of the amortized cost; the financial condition and near-term prospects of the issuer;

whether the issuer is current on contractually-obligated interest and principal payments; key corporate

events pertaining to the issuer and whether the market decline was affected by macroeconomic conditions.

If it is determined that an equity security has incurred an other-than-temporary impairment, the Company

permanently reduces the cost of the security to fair value and recognizes an impairment charge in net

income. If a debt security is impaired and either there is an intent to sell the security or it is more likely than

not that the security will have to be sold before recovery of the amortized cost, then the Company records

the full amount of the impairment in net income. If it is determined that an impairment of a debt security is

other-than-temporary and the Company neither intends to sell the security nor is it more likely than not that

the security will be sold before amortized cost is recovered, then the impairment is separated into (a) the

amount of impairment related to credit loss and (b) the amount of impairment related to all other factors. The

Company records the amount of the impairment related to the credit loss as an impairment charge in net

income, and the amount of the impairment related to all other factors in accumulated other comprehensive

income.

A large portion of the Company’s investment portfolio consists of fixed maturities, which may be adversely

affected by changes in interest rates as a result of governmental monetary policies, domestic and

international economic and political conditions and other factors beyond its control. A rise in interest rates

would increase the net unrealized holding losses of the investment portfolio, offset by an ability to earn higher

rates of return on funds reinvested. Conversely, a decline in interest rates would decrease the net unrealized

holding losses in investment portfolio, offset by lower rates of return on funds reinvested.

AmCo Holding Company

Notes to Consolidated Financial Statements

8

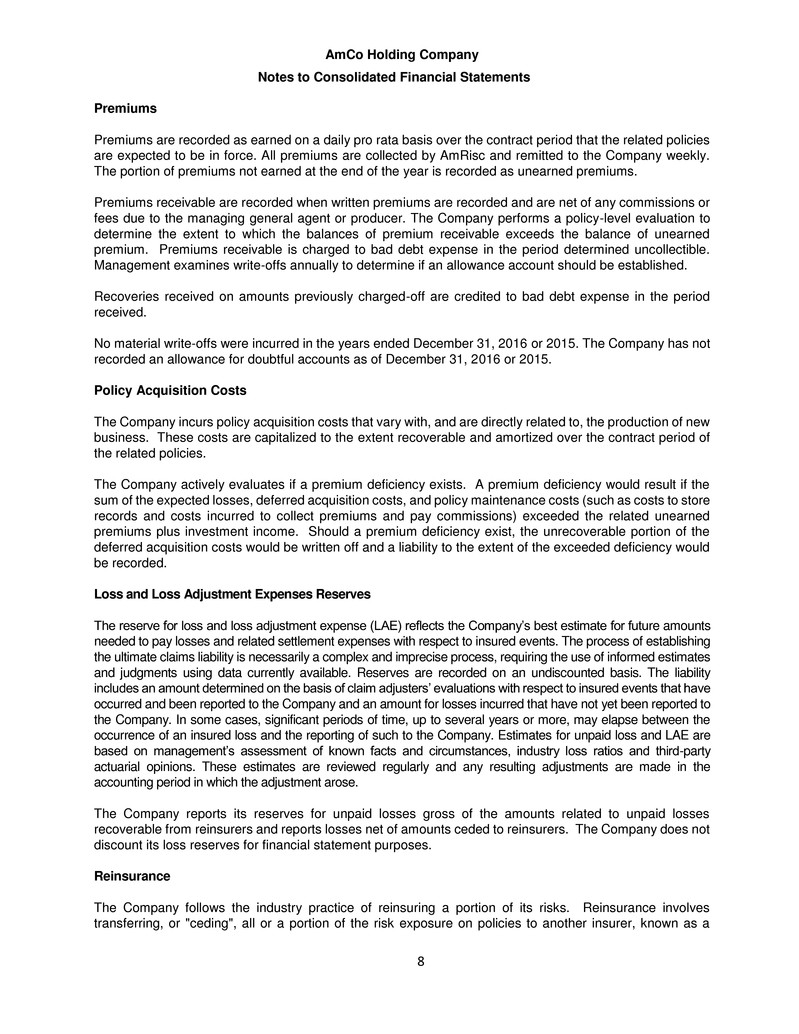

Premiums

Premiums are recorded as earned on a daily pro rata basis over the contract period that the related policies

are expected to be in force. All premiums are collected by AmRisc and remitted to the Company weekly.

The portion of premiums not earned at the end of the year is recorded as unearned premiums.

Premiums receivable are recorded when written premiums are recorded and are net of any commissions or

fees due to the managing general agent or producer. The Company performs a policy-level evaluation to

determine the extent to which the balances of premium receivable exceeds the balance of unearned

premium. Premiums receivable is charged to bad debt expense in the period determined uncollectible.

Management examines write-offs annually to determine if an allowance account should be established.

Recoveries received on amounts previously charged-off are credited to bad debt expense in the period

received.

No material write-offs were incurred in the years ended December 31, 2016 or 2015. The Company has not

recorded an allowance for doubtful accounts as of December 31, 2016 or 2015.

Policy Acquisition Costs

The Company incurs policy acquisition costs that vary with, and are directly related to, the production of new

business. These costs are capitalized to the extent recoverable and amortized over the contract period of

the related policies.

The Company actively evaluates if a premium deficiency exists. A premium deficiency would result if the

sum of the expected losses, deferred acquisition costs, and policy maintenance costs (such as costs to store

records and costs incurred to collect premiums and pay commissions) exceeded the related unearned

premiums plus investment income. Should a premium deficiency exist, the unrecoverable portion of the

deferred acquisition costs would be written off and a liability to the extent of the exceeded deficiency would

be recorded.

Loss and Loss Adjustment Expenses Reserves

The reserve for loss and loss adjustment expense (LAE) reflects the Company’s best estimate for future amounts

needed to pay losses and related settlement expenses with respect to insured events. The process of establishing

the ultimate claims liability is necessarily a complex and imprecise process, requiring the use of informed estimates

and judgments using data currently available. Reserves are recorded on an undiscounted basis. The liability

includes an amount determined on the basis of claim adjusters’ evaluations with respect to insured events that have

occurred and been reported to the Company and an amount for losses incurred that have not yet been reported to

the Company. In some cases, significant periods of time, up to several years or more, may elapse between the

occurrence of an insured loss and the reporting of such to the Company. Estimates for unpaid loss and LAE are

based on management’s assessment of known facts and circumstances, industry loss ratios and third-party

actuarial opinions. These estimates are reviewed regularly and any resulting adjustments are made in the

accounting period in which the adjustment arose.

The Company reports its reserves for unpaid losses gross of the amounts related to unpaid losses

recoverable from reinsurers and reports losses net of amounts ceded to reinsurers. The Company does not

discount its loss reserves for financial statement purposes.

Reinsurance

The Company follows the industry practice of reinsuring a portion of its risks. Reinsurance involves

transferring, or "ceding", all or a portion of the risk exposure on policies to another insurer, known as a

AmCo Holding Company

Notes to Consolidated Financial Statements

9

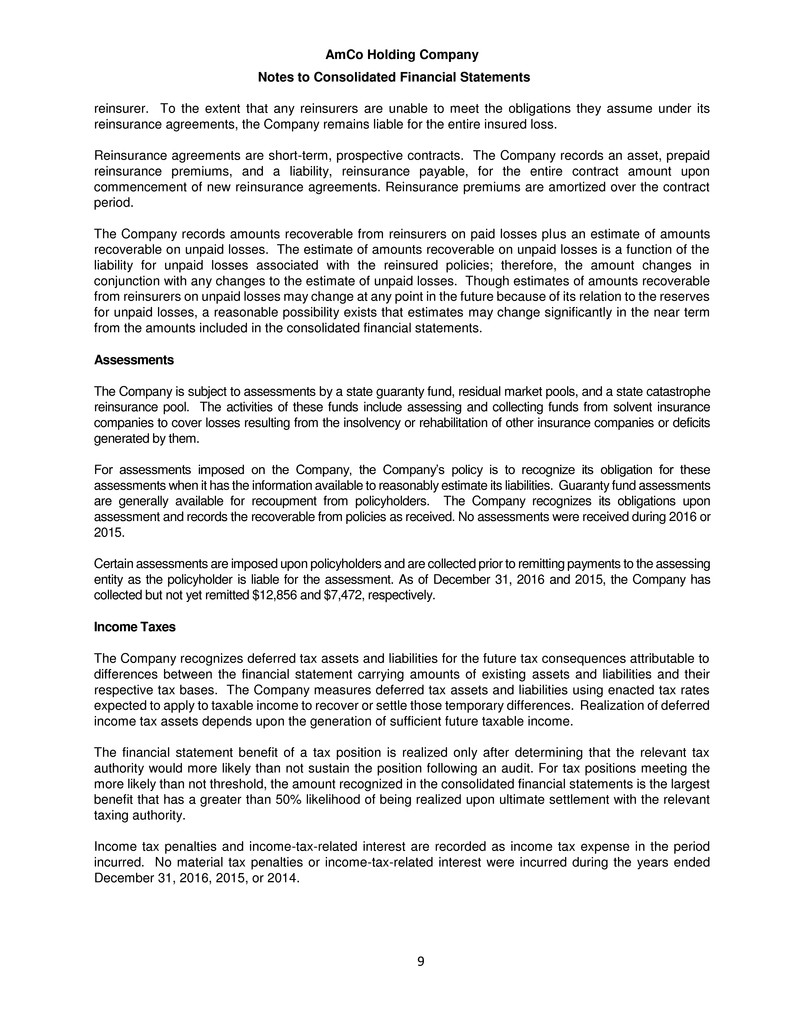

reinsurer. To the extent that any reinsurers are unable to meet the obligations they assume under its

reinsurance agreements, the Company remains liable for the entire insured loss.

Reinsurance agreements are short-term, prospective contracts. The Company records an asset, prepaid

reinsurance premiums, and a liability, reinsurance payable, for the entire contract amount upon

commencement of new reinsurance agreements. Reinsurance premiums are amortized over the contract

period.

The Company records amounts recoverable from reinsurers on paid losses plus an estimate of amounts

recoverable on unpaid losses. The estimate of amounts recoverable on unpaid losses is a function of the

liability for unpaid losses associated with the reinsured policies; therefore, the amount changes in

conjunction with any changes to the estimate of unpaid losses. Though estimates of amounts recoverable

from reinsurers on unpaid losses may change at any point in the future because of its relation to the reserves

for unpaid losses, a reasonable possibility exists that estimates may change significantly in the near term

from the amounts included in the consolidated financial statements.

Assessments

The Company is subject to assessments by a state guaranty fund, residual market pools, and a state catastrophe

reinsurance pool. The activities of these funds include assessing and collecting funds from solvent insurance

companies to cover losses resulting from the insolvency or rehabilitation of other insurance companies or deficits

generated by them.

For assessments imposed on the Company, the Company’s policy is to recognize its obligation for these

assessments when it has the information available to reasonably estimate its liabilities. Guaranty fund assessments

are generally available for recoupment from policyholders. The Company recognizes its obligations upon

assessment and records the recoverable from policies as received. No assessments were received during 2016 or

2015.

Certain assessments are imposed upon policyholders and are collected prior to remitting payments to the assessing

entity as the policyholder is liable for the assessment. As of December 31, 2016 and 2015, the Company has

collected but not yet remitted $12,856 and $7,472, respectively.

Income Taxes

The Company recognizes deferred tax assets and liabilities for the future tax consequences attributable to

differences between the financial statement carrying amounts of existing assets and liabilities and their

respective tax bases. The Company measures deferred tax assets and liabilities using enacted tax rates

expected to apply to taxable income to recover or settle those temporary differences. Realization of deferred

income tax assets depends upon the generation of sufficient future taxable income.

The financial statement benefit of a tax position is realized only after determining that the relevant tax

authority would more likely than not sustain the position following an audit. For tax positions meeting the

more likely than not threshold, the amount recognized in the consolidated financial statements is the largest

benefit that has a greater than 50% likelihood of being realized upon ultimate settlement with the relevant

taxing authority.

Income tax penalties and income-tax-related interest are recorded as income tax expense in the period

incurred. No material tax penalties or income-tax-related interest were incurred during the years ended

December 31, 2016, 2015, or 2014.

AmCo Holding Company

Notes to Consolidated Financial Statements

10

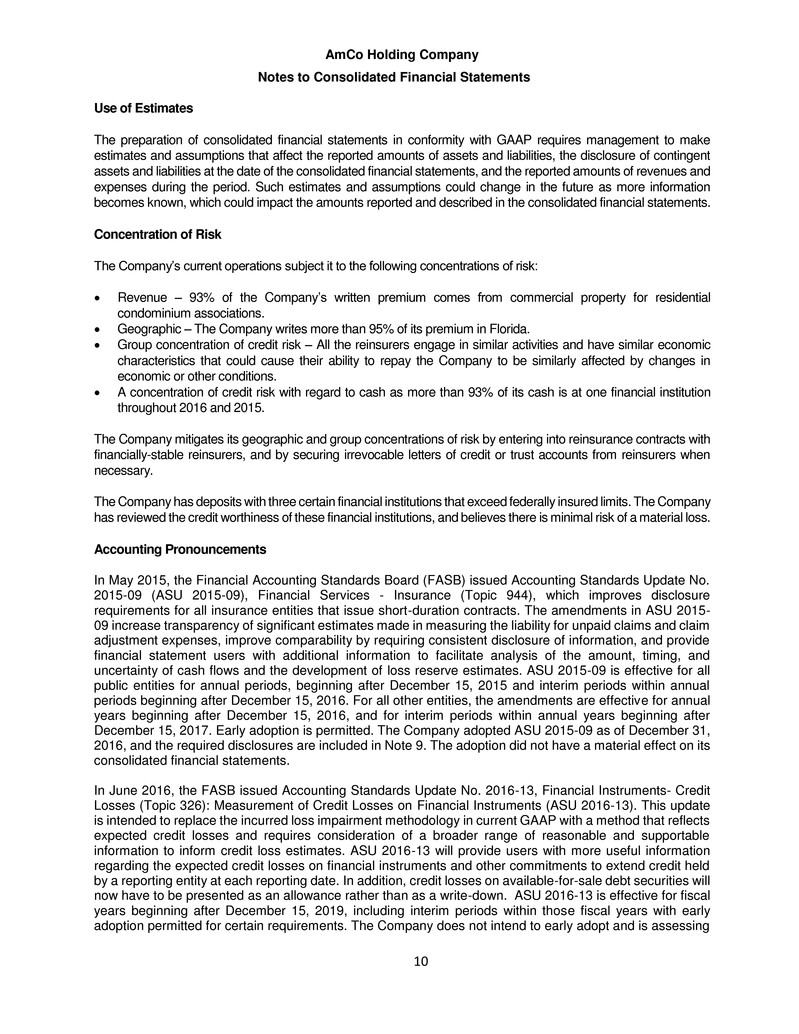

Use of Estimates

The preparation of consolidated financial statements in conformity with GAAP requires management to make

estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent

assets and liabilities at the date of the consolidated financial statements, and the reported amounts of revenues and

expenses during the period. Such estimates and assumptions could change in the future as more information

becomes known, which could impact the amounts reported and described in the consolidated financial statements.

Concentration of Risk

The Company’s current operations subject it to the following concentrations of risk:

• Revenue – 93% of the Company’s written premium comes from commercial property for residential

condominium associations.

• Geographic – The Company writes more than 95% of its premium in Florida.

• Group concentration of credit risk – All the reinsurers engage in similar activities and have similar economic

characteristics that could cause their ability to repay the Company to be similarly affected by changes in

economic or other conditions.

• A concentration of credit risk with regard to cash as more than 93% of its cash is at one financial institution

throughout 2016 and 2015.

The Company mitigates its geographic and group concentrations of risk by entering into reinsurance contracts with

financially-stable reinsurers, and by securing irrevocable letters of credit or trust accounts from reinsurers when

necessary.

The Company has deposits with three certain financial institutions that exceed federally insured limits. The Company

has reviewed the credit worthiness of these financial institutions, and believes there is minimal risk of a material loss.

Accounting Pronouncements

In May 2015, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update No.

2015-09 (ASU 2015-09), Financial Services - Insurance (Topic 944), which improves disclosure

requirements for all insurance entities that issue short-duration contracts. The amendments in ASU 2015-

09 increase transparency of significant estimates made in measuring the liability for unpaid claims and claim

adjustment expenses, improve comparability by requiring consistent disclosure of information, and provide

financial statement users with additional information to facilitate analysis of the amount, timing, and

uncertainty of cash flows and the development of loss reserve estimates. ASU 2015-09 is effective for all

public entities for annual periods, beginning after December 15, 2015 and interim periods within annual

periods beginning after December 15, 2016. For all other entities, the amendments are effective for annual

years beginning after December 15, 2016, and for interim periods within annual years beginning after

December 15, 2017. Early adoption is permitted. The Company adopted ASU 2015-09 as of December 31,

2016, and the required disclosures are included in Note 9. The adoption did not have a material effect on its

consolidated financial statements.

In June 2016, the FASB issued Accounting Standards Update No. 2016-13, Financial Instruments- Credit

Losses (Topic 326): Measurement of Credit Losses on Financial Instruments (ASU 2016-13). This update

is intended to replace the incurred loss impairment methodology in current GAAP with a method that reflects

expected credit losses and requires consideration of a broader range of reasonable and supportable

information to inform credit loss estimates. ASU 2016-13 will provide users with more useful information

regarding the expected credit losses on financial instruments and other commitments to extend credit held

by a reporting entity at each reporting date. In addition, credit losses on available-for-sale debt securities will

now have to be presented as an allowance rather than as a write-down. ASU 2016-13 is effective for fiscal

years beginning after December 15, 2019, including interim periods within those fiscal years with early

adoption permitted for certain requirements. The Company does not intend to early adopt and is assessing

AmCo Holding Company

Notes to Consolidated Financial Statements

11

the impact of adopting this new accounting standard on the consolidated financial statements and related

disclosures.

In August 2016, the FASB issued Accounting Standards Update No. 2016-15, Statement of Cash Flows

(Topic 230) (ASU 2016-15). This update is intended to address eight specific cash flow issues with the

objective of reducing the existing diversity in practice in how certain cash receipts and cash payments are

presented and classified in the statement of cash flows under Topic 230. ASU 2016-15 is effective for annual

periods beginning after December 15, 2017, including interim periods within those annual periods, with early

adoption permitted. We do not intend to early adopt and are assessing the impact of adopting this new

accounting standard on our consolidated financial statements and related disclosures.

In February 2016, the FASB issued Accounting Standards Update No. 2016-02, Leases (Topic 842) (ASU

2016-02). This updated is intended to replace existing lease guidance by requiring a lessee to recognize

substantially all leases (whether operating or finance leases) on the balance sheet as a right-of-use asset

and an associated least liability. Short-term leases of 12 months or less are excluded from this amendment.

ASU 2016-02 is effective for fiscal years beginning after December 15, 2018, including interim periods within

those fiscal years, with early adoption permitted. We do not intend to early adopt and are assessing the

impact of adopting this new accounting standard on our consolidated financial statements and related

disclosures.

In January 2016, the FASB issued Accounting Standards Update No. 2016-01, Recognition and

Measurement of Financial Assets and Financial Liabilities (ASU 2016-01). This update substantially revises

standards for the recognition, measurement and presentation of financial instruments. This standard revises

an entity's accounting related to (1) the classification and measurement of investments in equity securities

and (2) the presentation of certain fair value changes for financial liabilities measured at fair value. It also

amends certain disclosure requirements associated with the fair value of financial instruments. ASU 2016-

01 is effective for annual periods beginning after December 15, 2017, including interim periods within those

annual periods, with early adoption permitted for certain requirements. We are assessing the impact of

adopting this new accounting standard on our consolidated financial statements and related disclosures.

In March 2017, the FASB issued Accounting Standards Update No. 2017-08, Premium Amortization on

Purchased Callable Debt Securities (ASU 2017-08). This update amends the amortization period for certain

purchased callable debt securities held at a premium. This standard will shorten the amortization period for

the premium to the earliest call date from the current amortization over the contractual life of the instrument.

ASU 2017-08 is effective for fiscal years beginning after December 15, 2018, including interim periods within

those annual periods, with early adoption permitted. We are assessing the impact of adopting this new

accounting standard on our consolidated financial statements and related disclosures.

AmCo Holding Company

Notes to Consolidated Financial Statements

12

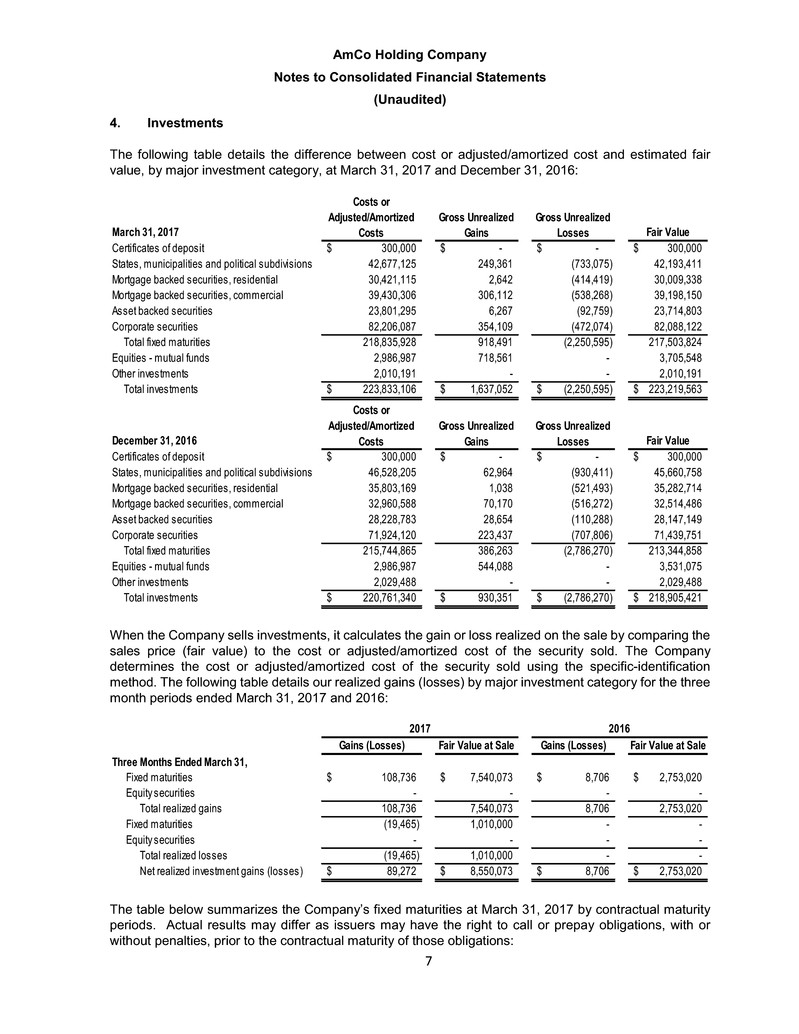

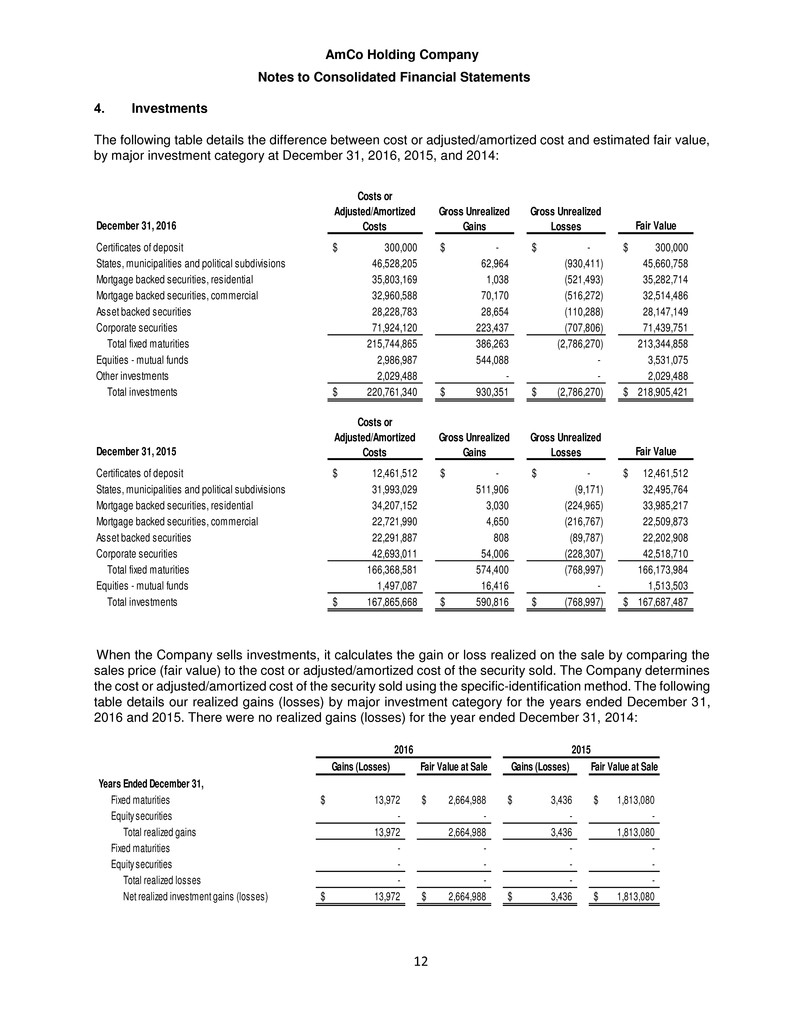

4. Investments

The following table details the difference between cost or adjusted/amortized cost and estimated fair value,

by major investment category at December 31, 2016, 2015, and 2014:

December 31, 2016 Fair Value

Certificates of deposit 300,000$ -$ -$ 300,000$

States, municipalities and political subdivisions 46,528,205 62,964 (930,411) 45,660,758

Mortgage backed securities, residential 35,803,169 1,038 (521,493) 35,282,714

Mortgage backed securities, commercial 32,960,588 70,170 (516,272) 32,514,486

Asset backed securities 28,228,783 28,654 (110,288) 28,147,149

Corporate securities 71,924,120 223,437 (707,806) 71,439,751

Total fixed maturities 215,744,865 386,263 (2,786,270) 213,344,858

Equities - mutual funds 2,986,987 544,088 - 3,531,075

Other investments 2,029,488 - - 2,029,488

Total investments 220,761,340$ 930,351$ (2,786,270)$ 218,905,421$

December 31, 2015 Fair Value

Certificates of deposit 12,461,512$ -$ -$ 12,461,512$

States, municipalities and political subdivisions 31,993,029 511,906 (9,171) 32,495,764

Mortgage backed securities, residential 34,207,152 3,030 (224,965) 33,985,217

Mortgage backed securities, commercial 22,721,990 4,650 (216,767) 22,509,873

Asset backed securities 22,291,887 808 (89,787) 22,202,908

Corporate securities 42,693,011 54,006 (228,307) 42,518,710

Total fixed maturities 166,368,581 574,400 (768,997) 166,173,984

Equities - mutual funds 1,497,087 16,416 - 1,513,503

Total investments 167,865,668$ 590,816$ (768,997)$ 167,687,487$

Gross Unrealized

Losses

Gross Unrealized

Gains

Gross Unrealized

Gains

Gross Unrealized

Losses

Costs or

Adjusted/Amortized

Costs

Costs or

Adjusted/Amortized

Costs

When the Company sells investments, it calculates the gain or loss realized on the sale by comparing the

sales price (fair value) to the cost or adjusted/amortized cost of the security sold. The Company determines

the cost or adjusted/amortized cost of the security sold using the specific-identification method. The following

table details our realized gains (losses) by major investment category for the years ended December 31,

2016 and 2015. There were no realized gains (losses) for the year ended December 31, 2014:

Gains (Losses) Fair Value at Sale Gains (Losses) Fair Value at Sale

Y r En d December 31,

Fix d aturiti s 13,972$ 2,664,988$ 3,436$ 1,813,080$

Equity securities - - - -

Total realized gains 13,972 2,664,988 3,436 1,813,080

Fixed maturities - - - -

Equity securities - - - -

Total realized losses - - - -

Net realized investment gains (losses) 13,972$ 2,664,988$ 3,436$ 1,813,080$

20152016

AmCo Holding Company

Notes to Consolidated Financial Statements

13

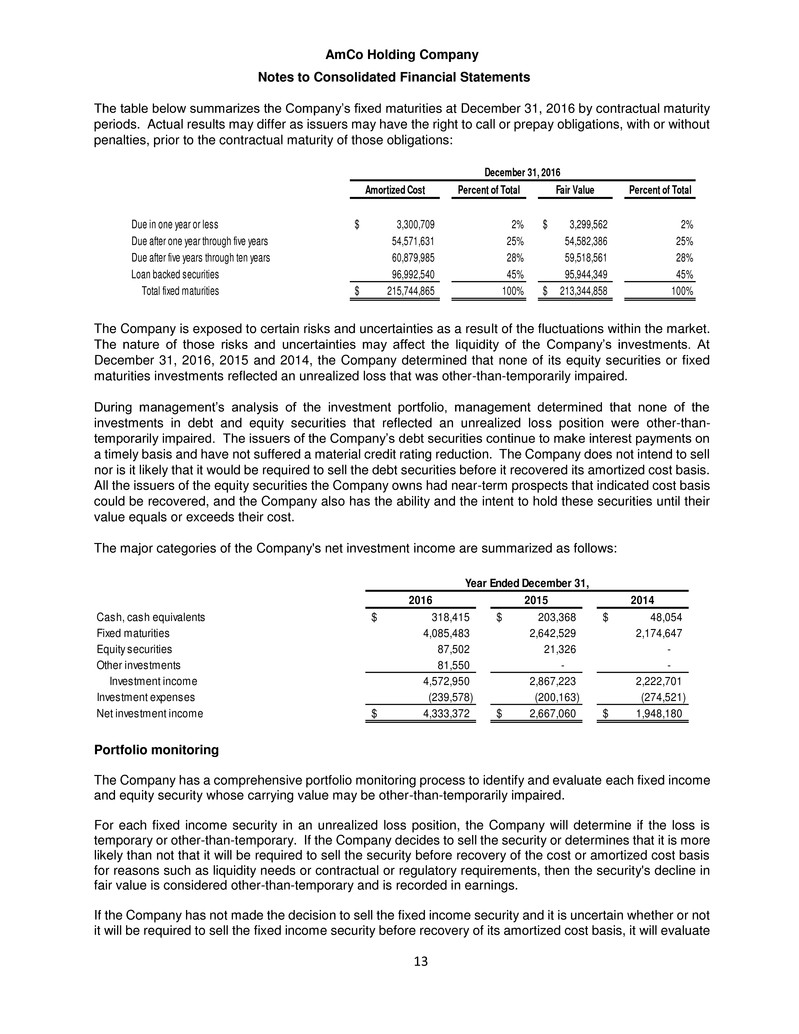

The table below summarizes the Company’s fixed maturities at December 31, 2016 by contractual maturity

periods. Actual results may differ as issuers may have the right to call or prepay obligations, with or without

penalties, prior to the contractual maturity of those obligations:

Amortized Cost Percent of Total Fair Value Percent of Total

Due in one year or less 3,300,709$ 2% 3,299,562$ 2%

Due after one year through five years 54,571,631 25% 54,582,386 25%

Due after five years through ten years 60,879,985 28% 59,518,561 28%

Loan backed securities 96,992,540 45% 95,944,349 45%

Total fixed maturities 215,744,865$ 100% 213,344,858$ 100%

December 31, 2016

The Company is exposed to certain risks and uncertainties as a result of the fluctuations within the market.

The nature of those risks and uncertainties may affect the liquidity of the Company’s investments. At

December 31, 2016, 2015 and 2014, the Company determined that none of its equity securities or fixed

maturities investments reflected an unrealized loss that was other-than-temporarily impaired.

During management’s analysis of the investment portfolio, management determined that none of the

investments in debt and equity securities that reflected an unrealized loss position were other-than-

temporarily impaired. The issuers of the Company’s debt securities continue to make interest payments on

a timely basis and have not suffered a material credit rating reduction. The Company does not intend to sell

nor is it likely that it would be required to sell the debt securities before it recovered its amortized cost basis.

All the issuers of the equity securities the Company owns had near-term prospects that indicated cost basis

could be recovered, and the Company also has the ability and the intent to hold these securities until their

value equals or exceeds their cost.

The major categories of the Company's net investment income are summarized as follows:

2016 2015 2014

Ca h, cash equivalents 318,415$ 203,368$ 48,054$

Fixed maturities 4,085,483 2,642,529 2,174,647

Equity securities 87,502 21,326 -

Other investments 81,550 - -

Investment income 4,572,950 2,867,223 2,222,701

Investment expenses (239,578) (200,163) (274,521)

Net investment income 4,333,372$ 2,667,060$ 1,948,180$

Year Ended December 31,

Portfolio monitoring

The Company has a comprehensive portfolio monitoring process to identify and evaluate each fixed income

and equity security whose carrying value may be other-than-temporarily impaired.

For each fixed income security in an unrealized loss position, the Company will determine if the loss is

temporary or other-than-temporary. If the Company decides to sell the security or determines that it is more

likely than not that it will be required to sell the security before recovery of the cost or amortized cost basis

for reasons such as liquidity needs or contractual or regulatory requirements, then the security's decline in

fair value is considered other-than-temporary and is recorded in earnings.

If the Company has not made the decision to sell the fixed income security and it is uncertain whether or not

it will be required to sell the fixed income security before recovery of its amortized cost basis, it will evaluate

AmCo Holding Company

Notes to Consolidated Financial Statements

14

whether there is an expectation that cash flows will be sufficient to recover the entire cost or amortized cost

basis of the security. The estimated recovery value is calculated by discounting the best estimate of future

cash flows at the security's original or current effective rate, as appropriate, and compare this to the cost or

amortized cost of the security. If the Company does not expect to receive cash flows sufficient to recover

the entire cost or amortized cost basis of the fixed income security, the credit loss component of the

impairment is recorded in earnings, with the remaining amount of the unrealized loss related to other factors

recognized in other comprehensive income.

For equity securities, the Company considers various factors, including whether it has the intent and ability

to hold the equity security for a period of time sufficient to recover its cost basis. If the Company lacks the

intent and ability to hold to recovery, or if it is expected that the recovery period is extended, the equity

security's decline in fair value is considered other-than-temporary and is recorded in earnings.

The portfolio monitoring process includes a quarterly review of all securities to identify instances where the

fair value of a security compared to its cost or amortized cost (for fixed income securities) or cost (for equity

securities) is below established thresholds. The process also includes the monitoring of other impairment

indicators such as ratings, ratings downgrades and payment defaults. The securities identified, in addition

to other securities for which there may be a concern, are evaluated for potential other-than-temporary

impairment using all reasonably available information relevant to the collectability or recovery of the security.

Inherent in the evaluation of other-than-temporary impairment for these fixed income and equity securities

are assumptions and estimates about the financial condition and future earnings potential of the issue or

issuer. Some of the factors that may be considered in evaluating whether a decline in fair value is other-

than-temporary are: (1) the financial condition, near-term and long-term prospects of the issue or issuer,

including relevant industry specific market conditions and trends, geographic location and implications of

rating agency actions and offering prices; (2) the specific reasons that a security is in an unrealized loss

position, including overall market conditions which could affect liquidity; and (3) the length of time and extent

to which the fair value has been less than amortized cost or cost.

The following table presents an aging of the Company’s unrealized investment losses by investment class:

Fair Value Gross Unrealized Losses Fair Value Gross Unrealized Losses

December 31, 2016

Asset backed 8,809,086$ (101,226)$ 1,241,650$ (9,062)$

CMO 25,462,651 (515,643) 255,305 (628)

Corporate 36,095,053 (690,205) 1,284,790 (17,601)

Mort ag acked 28,871,439 (511,527) 2,207,815 (9,966)

Muni 33,612,836 (930,412) - -

T t l f x d mat rities 132,851,065 (2,749,013) 4,989,560 (37,257)

Mutual Funds - - - -

Tot l 132,851,065$ (2,749,013)$ 4,989,560$ (37,257)$

De emb r 31, 2015

Asset backed 20,705,021$ (89,787)$ -$ -$

CMO 25,508,635 (216,767) - -

Corporate 29,382,620 (228,307) - -

Mortgage backed 25,164,483 (224,965) - -

Muni 2,281,962 (9,171) - -

Total 103,042,721$ (768,997)$ -$ -$

Less Than Twelve Months Twelve Months or More

The Company determined during its quarterly evaluations of securities for impairment that no investments

held in debt and equity securities reflected an unrealized loss position that would be considered other-than-

temporarily impaired. The issuers of the Company’s debt securities continue to make interest payments on

a timely basis and there is no intent to sell nor is it likely that the Company would be required to sell the debt

AmCo Holding Company

Notes to Consolidated Financial Statements

15

securities before the recovery of its amortized cost basis. The near-term prospects of all the issuers of the

equity securities currently held indicate that the company could recover its cost basis.

The issuers of the Company’s debt securities continue to make interest payments on a timely basis and

there is no intent to sell nor is it likely that the Company would be required to sell the debt securities before

the recovery of its amortized cost basis. The near-term prospects of all the issuers of the equity securities

currently held indicate that the company could recover its cost basis.

During the years ended December 31, 2016, 2015, and 2014, the Company recorded no other-than-

temporary impairment charges.

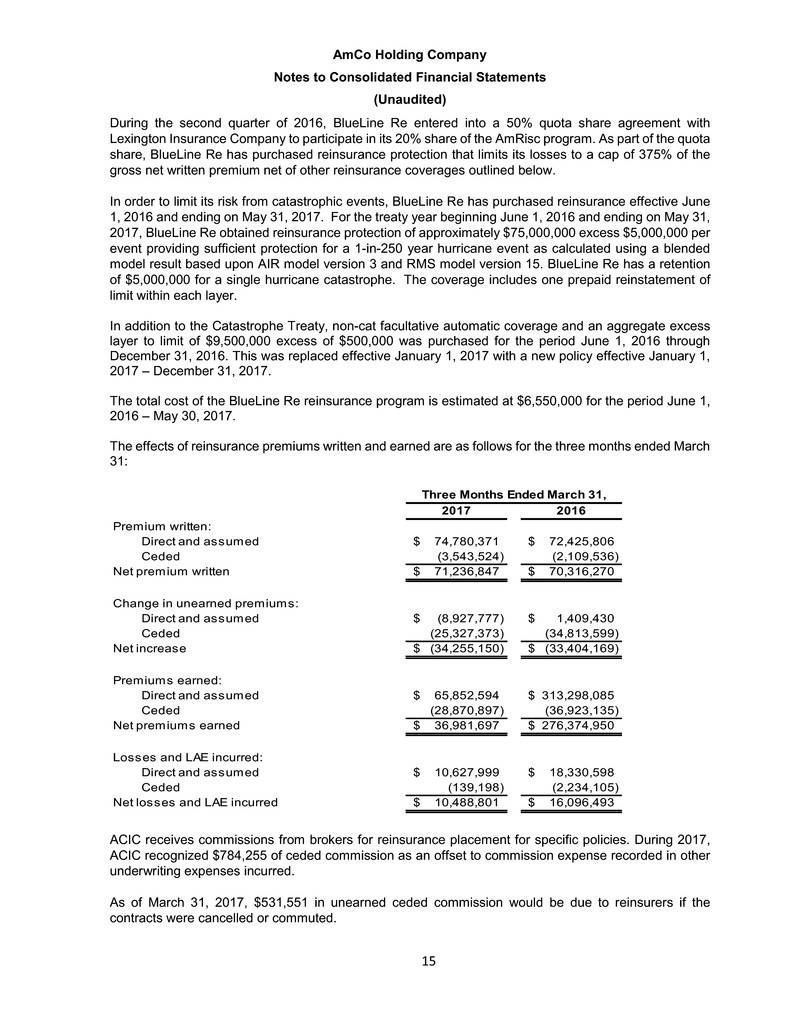

5. Fair Value Financial Instruments

The fair value for equity securities are obtained from active markets. The fair value for fixed maturity

securities are estimated based on values received from third-party securities dealers. The Company’s

estimates of fair value reflect the interest rate environment that existed as of the close of business on

December 31, 2016, 2015, and 2014. Changes in interest rates subsequent to December 31, 2016 may

affect the fair value of the fixed maturity securities.

The fair value estimates presented herein are based on pertinent information available to management as

of December 31, 2016, 2015, and 2014. Although management is not aware of any factors that would

significantly affect the estimated fair value amounts, such amounts have not been comprehensively revalued

for purposes of these statutory financial statements since that date, and current estimates of fair value may

differ significantly from the amounts presented herein.

The following methods and assumptions were used to estimate the fair value of each class of significant

financial instruments for which it is practical to estimate that value:

Cash and cash equivalents: The carrying amounts reported in the Consolidated Balance Sheets

approximate their fair value due to their short maturity.

Fixed maturities and mutual funds: Fair values are based on quoted market prices, or dealer quotes. For

bonds not actively traded, fair values are estimated using values obtained from independent pricing services.

Other investments are accounted for at fair value which is estimated to be equal to its cost basis.

The Company’s financial assets and liabilities carried at fair value have been classified, for disclosure

purposes, based on a hierarchy that prioritized the inputs to valuation techniques used to measure fair value

into three broad levels. The hierarchy gives the highest priority to fair values determined using unadjusted

quote prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to fair values

determined using unobservable inputs (Level 3). An asset’s or liability’s classification is determined based

on the lowest level input that is significant to its measurement. For example, a Level 3 fair value

measurement may include inputs that are both observable (Levels 1 and 2) and unobservable (Level 3).

The levels of the fair value hierarchy are as follows:

Level 1: Unadjusted quoted prices in active markets for identical assets or liabilities that the Company has

the ability to access at the measurement date.

Level 2: Valuations derived from inputs other than quoted market prices included within Level 1 that are

observable for the asset or liability, either directly or indirectly, such as:

• Quoted prices for similar assets or liabilities in active markets.

• Quoted prices for identical or similar assets or liabilities in markets that are not active.

• Inputs other than quoted prices that are observable for the asset or liability.

AmCo Holding Company

Notes to Consolidated Financial Statements

16

• Inputs that are derived principally from or corroborated by observable market data by correlation or other

means.

Level 3: Valuations are derived from techniques that require significant unobservable inputs. The

unobservable inputs reflect the Company’s own assumptions about the assumptions that market participants

would use in pricing the asset or liability.

The following table presents the Company’s fair value hierarchy for securities carried at fair value on a

recurring basis:

December 31, 2016 Fair Value Level 1 Level 2 Level 3

Certificates of deposit $ 300,000 $ - $ 300,000 $ -

States, municipalities and political subdivisions 45,660,758 - 45,660,758 -

Mortgage Backed Securities, Residential 35,282,714 - 35,282,714 -

Mortgage Backed Securities, Commercial 32,514,486 - 32,514,486 -

Asset Backed Securities 28,147,149 - 28,147,149 -

Corporate securities 71,439,751 - 71,439,751 -

Total Fixed Maturities 213,344,858 - 213,344,858 -

Equities -Mutual Funds 3,531,075 3,531,075 - -

Other Investments 2,029,488 - 2,029,488 -

Total Investments $ 218,905,421 $ 3,531,075 $ 215,374,346 $ -

December 31, 2015 Fair Value Level 1 Level 2 Level 3

Certificates of deposit $ 12,461,512 $ - $ 12,461,512 $ -

Stat s, municipalities and political subdivisions 32,495,764 - 32,495,764 -

Mortgage Backed Securities, Residential 33,985,217 - 33,985,217 -

Mortgage Backed Securities, Commercial 22,509,873 - 22,509,873 -

Asset Backed Securities 22,202,908 - 22,202,908 -

Corporate securities 42,518,710 - 42,518,710 -

Total Fixed Maturities 166,173,984 - 166,173,984 -

Equities -Mutual Funds 1,513,503 1,513,503 - -

Total Investments $ 167,687,487 $ 1,513,503 $ 166,173,984 $ -

The fair values of certificates of deposits included in fixed maturities are at fair value. Fair values of fixed

maturity securities and mutual funds are based on quoted market prices, where available. The Company

also utilizes an independent third-party valuation service to gather, analyze, and interpret market information

to derive fair value estimates for individual investments, based upon market-accepted methodologies and

assumptions. The methodologies used by these independent third-party valuation services are reviewed

and understood by management, through periodic discussion with, and information provided by, the

valuation services.

Other investments

In March 2016, the Company acquired investments in a limited partnership, recorded in the other

investments line of our Consolidated Balance Sheets. These are currently accounted for at fair value which

is estimated to be equal to its cost basis. The cost and carrying value of the Company’s investments in the

limited partnership DCR Partners, VII, L. P. was $2,029,488 at December 31, 2016.

AmCo Holding Company

Notes to Consolidated Financial Statements

17

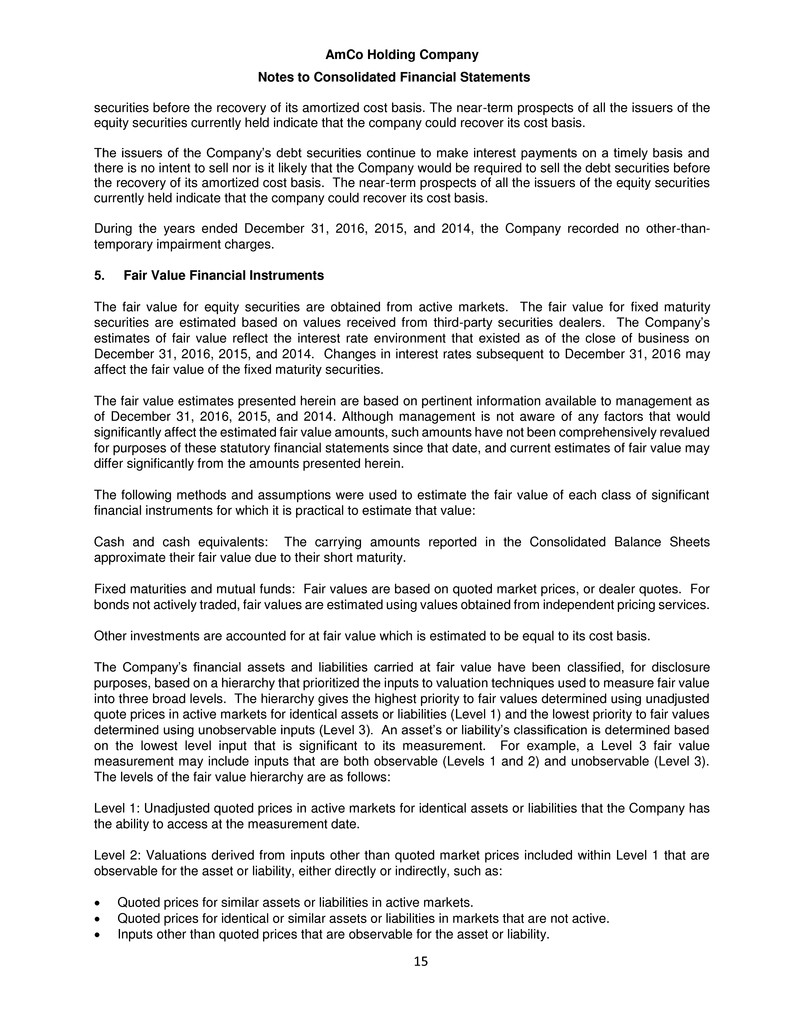

6. Deferred Policy Acquisition Costs

The Company anticipates that the deferred policy acquisition costs will be fully recoverable in the near term.

The table below depicts the activity with regard to deferred policy acquisition costs:

2016 2015

Balance at January 1, 31,332,600$ 33,164,565$

Policy acquisition costs deferred 64,104,323 73,786,349

Amortization (67,194,678) (75,618,314)

Balance at December 31, 28,242,245$ 31,332,600$

7. Income Taxes

The following table summarizes the provision for income taxes:

2016 2015 2014

F deral:

Curr nt 14,483,586$ 18,154,071$ 23,015,854$

Deferred (1,799,011) 3,475,946 (922,974)

Pr vision for F deral income tax expense 12,684,575 21,630,017 22,092,880

State:

Current 2,381,263 1,155,287 370,322

Deferred (213,336) 613,402 (162,878)

Provision for State income tax expense 2,167,927 1,768,689 207,444

Provision for income taxes 14,852,502$ 23,398,706$ 22,300,324$

December 31,

The actual income tax expense differs from the expected income tax expense computed by applying the

combined applicable effective federal and state tax rates to income before the provision for income taxes as

follows:

2016 2015 2014

Expected income tax expense at federal rate 16,384,363$ 20,956,163$ 23,542,124$

State tax expense, net of federal deduction benefit 1,602,758 1,149,647 134,839

Prior period adjustment (1,436,193) 1,278,196 (1,278,196)

Other, net (1,698,426) 14,700 (98,443)

Reported income tax expense 14,852,502$ 23,398,706$ 22,300,324$

December 31,

Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of

assets and liabilities for financial reporting purposes and the amounts used for income tax purposes.

AmCo Holding Company

Notes to Consolidated Financial Statements

18

The table below summarizes the significant components of net deferred tax liability:

2016 2015

Deferred tax assets:

Unearned premiums 5,408,711$ 5,298,043$

Tax-related discount on loss reserve 736,639 520,142

Ceding commission 507,572 726,554

Unrealized loss 707,156 68,734

T tal deferred tax assets 7,360,078 6,613,473

Deferred tax liabilities:

Deferred acquisition costs (10,789,638) (12,086,550)

Intangible asset - (607,254)

Total deferred tax liabilities (10,789,638) (12,693,804)

Net deferred tax liability (3,429,560)$ (6,080,331)$

December 31,

In assessing the net realizable value of deferred tax assets, management considers whether it is more likely

than not that the Company will not realize some portion or all of the deferred tax assets. The ultimate

realization of deferred tax assets depends upon the generation of future taxable income during the periods

in which those temporary differences become deductible. Management considers the scheduled reversal

of deferred tax liabilities, projected future taxable income and tax planning strategies in making this

assessment.

The statute of limitations related to the Company’s consolidated Federal income tax returns and its Florida

income tax returns expired for all tax years up to and including 2012; therefore, only the 2013 through 2016

tax years remain subject to examination by taxing authorities. No taxing authorities are currently examining

any of the Company’s federal or state income tax returns.

As of December 31, 2016, 2015 and 2014, the Company has not taken any uncertain tax positions with

regard to its tax returns.

8. Related Parties

ACIC is a wholly owned subsidiary of AmCo which was wholly owned by BB&T through May 31, 2015. BB&T

entered into an agreement with AmCo and RDX whereby effective at 12:01 a.m. June 1, 2015, RDX acquired

100% of the stock of AmCo. RDX is 67.2% owned by Dan Peed or an entity controlled by Dan Peed, the

Chief Executive Officer of the Company. Leah Peed owns 16.8% and no other investor owns 5% or more

of RDX. BlueLine Re is a wholly owned subsidiary of BlueLine Cayman Holdings, which is a wholly owned

subsidiary of AmCo.

AmRisc, a Managing General Underwriter, handles the underwriting, claims processing, premium collection

and reinsurance review for the Company. Dan Peed owns approximately 7.7% of AmRisc. In addition, he

is also the Chief Executive Officer of AmRisc.

Peed Management provides accounting services for the Company through a consulting services contract

entered into effective June 1, 2015. $573,518 and $350,000 was incurred through December 31, 2016 and

2015, respectively.

The Company (ACIC) recorded $250,212,939 of direct written premiums for 2016 in accordance with the

managing general agent underwriting contract with AmRisc, resulting in fees and commission (including a

AmCo Holding Company

Notes to Consolidated Financial Statements

19

profit commission) of $78,283,102 paid to AmRisc. Receivables are stated net of the commission and fees

due per the contract.

In addition to the direct premiums written, the Company (ACIC) recorded $6,642,584 in ceded premiums to

AmRisc as a reinsurance intermediary. An additional $63,256 was incurred for rent per the sublease with

AmRisc.

The Company (BlueLine Re) recorded $18,465,114 in assumed premiums in accordance with the Quota

share agreement with Lexington. The assumed premium through the quota share agreement resulted in

an estimated $4,062,325 in commissions and fees due to AmRisc as of December 31, 2016.

The Company (AmCo) paid dividends of $33,250,000, $47,890,240 and $46,435,441 during 2016, 2015

and 2014 respectively.

Net premiums receivable of $16,711,989, $23,752,210, and $24,802,435, are due from AmRisc, as of

December 31, 2016, 2015, and 2014, respectively, and are net of commission. Premiums are forwarded to

a premium trust account for the Company (ACIC) by wire transfer within 15 days of collection.

Net premiums receivable of $7,440,071 are due from AmRisc, as of December 31, 2016 and are net of

commission. Premiums are forwarded to a trust account for the Company (BlueLine Re) on a quarterly basis

consistent with the quota share agreement entered into effective June, 1 2016.

The Company (ACIC) owes AmRisc an estimated $5,891,216, $5,517,055, and $5,095,288 in contingent

commission based on the profitability of the Company as of December 31, 2016, 2015, and 2014,

respectively. The Company owes AmRisc, as reinsurance intermediary, $1,130,460, $1,646,380, and

$2,805,897 for ceded premiums as of December 31, 2016, 2015, and 2014, respectively.

9. Loss and Loss Adjustment Expense Reserves

The Company establishes reserves for both reported and unreported unpaid losses that have occurred at

or before the balance sheet date for amounts it estimates it will be required to pay in the future. The policy

is to establish these loss reserves after considering all information known at each reporting period. At any

given point in time, the Company’s loss reserve represents management’s best estimate of the ultimate

settlement and administration cost of insured claims incurred and unpaid. Since the process of estimating

loss reserves requires significant judgment due to a number of variables, such as fluctuations in inflation,

judicial decisions, legislative changes and changes in claims handling procedures, the ultimate liability will

likely differ from these estimates. Reserves are revised for unpaid losses as additional information becomes

available, and reflect adjustments, if any, in earnings in the periods in which it is determined the adjustments

are necessary.

General Discussion of the Loss Reserving Process

Reserves for unpaid losses fall into two categories: case reserves and reserves for claims incurred but not

reported.

• Case reserves - When a claim is exported, the Company establishes a minimum case reserve for that

claim type that represents management’s initial estimate of the losses that will ultimately be paid on the

reported claim. Management’s initial estimate for each claim is based upon averages of loss payments

for prior closed claims made for that claim type. Then, claims personnel perform an evaluation of the

type of claim involved, the circumstances surrounding each claim and the policy provisions relating to

the loss and adjust the reserve as necessary. As claims mature, reserve estimates are increased or

decreased as deemed necessary by the claims department based upon additional information received

AmCo Holding Company

Notes to Consolidated Financial Statements

20

regarding the loss, the results of on-site reviews and any other information gathered while reviewing the

claims.

• Reserves for losses incurred but not reported (IBNR reserves) - IBNR reserves include true IBNR

reserves plus “bulk” reserves. Bulk reserves represent additional amounts that cannot be allocated to

particular claims, but which are necessary to estimate ultimate losses on reported and unreported

claims. IBNR reserves are estimated by projecting the ultimate losses using the methods discussed

below and then deducting actual loss payments and case reserves from the projected ultimate losses.

Management reviews and adjusts IBNR reserves on a quarterly basis based on information available at

the balance sheet date.

When reserves are established, management analyzes various factors such as historical loss experience

and that of the insurance industry, claims frequency and severity, business mix, claims processing

procedures, legislative enactments, judicial decisions and legal developments in imposition of damages, and

general economic conditions, including inflation. A change in any of these factors from the assumptions

implicit in the estimates will cause the ultimate loss experience to be better or worse than indicated by the

reserves, and the difference could be material. Due to the interaction of the aforementioned factors, there is

no precise method for evaluating the impact of any one specific factor in isolation, and an element of

judgment is ultimately required. Due to the uncertain nature of any projection of the future, the ultimate

amount the Company will pay for losses will be different from the reserves recorded. However, in

management’s judgment, the Company employs techniques and assumptions that are appropriate, and the

resulting reserve estimates are reasonable, given the information available at the balance sheet date.

The Company determines ultimate losses by using multiple actuarial methods to determine an actuarial

estimate within a relevant range of indications calculated using generally accepted actuarial techniques.

Selection of the actuarial estimate is influenced by the analysis of historical loss and claim experience since

inception. For each accident year, the Company estimates the ultimate incurred losses for both reported and

unreported claims. In establishing this estimate, management reviewed the results of various actuarial

methods discussed below.

Estimation of the Reserves for Unpaid Losses and Allocated Loss Adjustment Expenses

The Company calculates estimates of ultimate losses by using the following actuarial methods. The

Company separately calculates the methods using paid loss data and incurred loss data. In the versions of

these methods based on incurred loss data, the incurred losses are defined as paid losses plus case

reserves. For this discussion of the loss reserving process, the word “segment” refers to a subgrouping of

claims data, such as by geographic area and/or by particular line of business; it does not refer to operating

segments.

• Incurred Development Method - The incurred development method is based upon the assumption that

the relative change in a given year’s incurred loss estimates from one evaluation point to the next is

similar to the relative change in prior years’ reported loss estimates at similar evaluation points. In

utilizing this method, actual annual historical incurred loss data is evaluated. Successive years can be

arranged to form a triangle of data. Loss development factors (LDFs) are calculated to measure the

change in cumulative incurred costs from one evaluation point to the next. These historical LDFs and

comparable industry benchmark factors form the basis for selecting the LDFs used in projecting the

current valuation of losses to an ultimate basis. This method’s implicit assumption is that the relative

adequacy of case reserves has been consistent over time, and that there have been no material changes

in the rate at which claims have been reported. The paid development method is similar to the incurred

development method. While the paid development methods have the disadvantage of not recognizing

the information by current case reserves, it has the advantage of avoiding potential distortions in the

AmCo Holding Company

Notes to Consolidated Financial Statements

21

data due to changes in case reserving methodology. The paid development method’s implicit

assumption is that the rate of payment of claims has been relatively consistent over time.

• Expected Loss Method - In the expected loss method, ultimate loss projections are based upon some

prior measure of the anticipated losses, usually relative to some measure of exposure (e.g., earned

house years). An expected loss cost is applied to the measure of exposure to determine estimated

ultimate losses for each year. Actual losses are not considered in this calculation. This method has the

advantage of stability over time, because the ultimate loss estimates do not change unless the

exposures or loss costs change. However, this advantage of stability is offset by a lack of

responsiveness, since this method does not consider actual loss experience as it emerges. This method

is based on the assumption that the loss cost per unit of exposure is a good indication of ultimate losses.

It can be entirely dependent on pricing assumptions (e.g., historical experience adjusted for loss trend).

• Bornhuetter-Ferguson Method - The incurred Bornhuetter-Ferguson (B-F) method is essentially a

blend of two other methods. The first method is the loss development method whereby actual incurred

losses are multiplied by an expected LDF. For slow reporting coverages, the loss development method

can lead to erratic and unreliable projections because a relatively small swing in early reporting can

result in a large swing in ultimate projections. The second method is the expected loss method whereby

the IBNR estimate equals the difference between a predetermined estimate of expected losses and

actual incurred losses. The incurred B-F method combines these two methods by setting ultimate losses

equal to actual incurred losses plus expected unreported losses. As an experience year matures and

expected unreported losses become smaller, the initial expected loss assumption becomes gradually

less important. Two parameters are needed to apply the B-F method: the initial expected loss cost and

the expected reporting pattern (LDFs). This method is often used for long-tail lines and in situations

where the incurred loss experience is relatively immature or lacks sufficient credibility for the application

of other methods. The paid B-F method is analogous to the incurred B-F method using paid losses and

development patterns in place of incurred losses and patterns.

• Paid-to-Paid Development Method - In addition to the aforementioned methods, the Company also

relies upon the paid-to-paid development method to project ultimate unallocated loss adjustment

expense (ULAE). Ratios of paid ULAE to paid loss and allocated loss adjustment expense (ALAE) are

compiled by calendar year and a paid-to-paid ratio selection is made. The selected ratio is applied to

the estimated IBNR amounts and one half of this ratio is applied to case reserves. This method is derived

from rule of thumb that half of ULAE is incurred when a claim is opened and the other half is incurred

over the remaining life of the claim.

Reliance and Selection of Methods

The various methods used have strengths and weaknesses that depend upon the circumstances of the

segment and the age of the claims experience analyzed. The nature of the Company’s book of business

allows it to place substantial, but not exclusive, reliance on the loss development methods, the selected

LDFs, represent the most critical aspect of the loss reserving process.

Reasonably-Likely Changes in Variables

As previously noted, the Company evaluates several factors when exercising judgment in the selection of

the loss development factors that ultimately drive the determination of loss reserves. The process of

establishing reserves is complex and necessarily imprecise, as it involves using judgment that is affected by

many variables. The Company believes a reasonably-likely change in almost any of these aforementioned

factors could have an impact on reported results, financial condition and liquidity. However, the Company

AmCo Holding Company

Notes to Consolidated Financial Statements

22

does not believe any reasonably-likely changes in the frequency or severity of claims would have a material

impact.

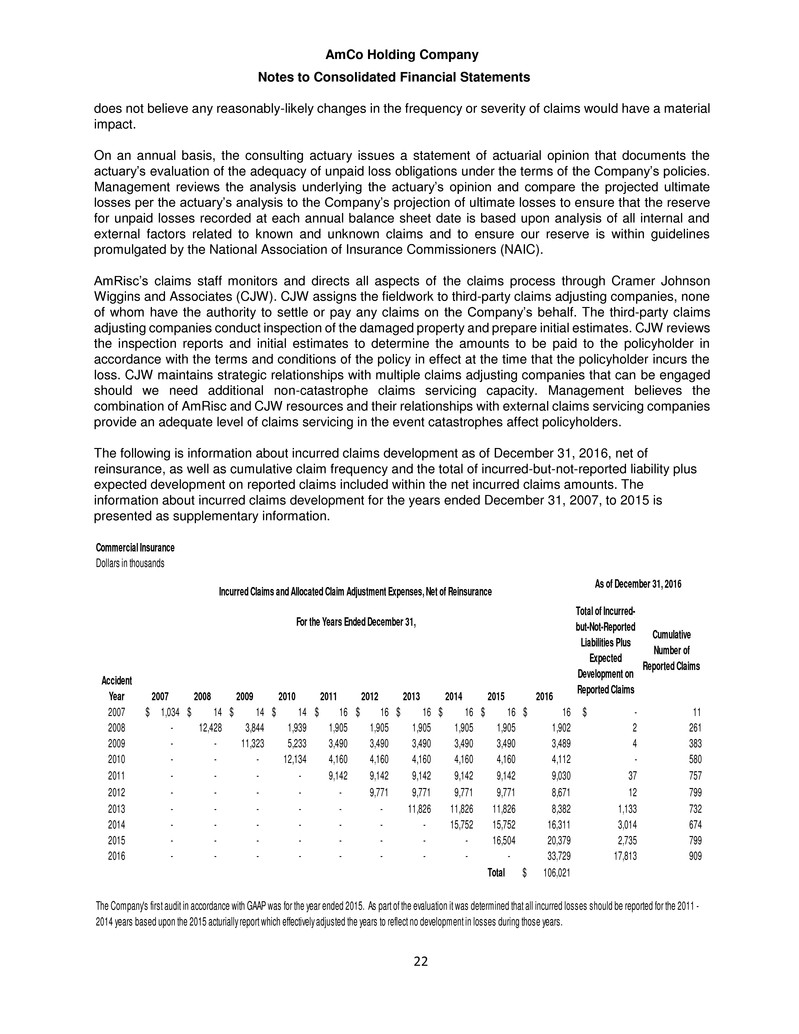

On an annual basis, the consulting actuary issues a statement of actuarial opinion that documents the

actuary’s evaluation of the adequacy of unpaid loss obligations under the terms of the Company’s policies.

Management reviews the analysis underlying the actuary’s opinion and compare the projected ultimate

losses per the actuary’s analysis to the Company’s projection of ultimate losses to ensure that the reserve

for unpaid losses recorded at each annual balance sheet date is based upon analysis of all internal and

external factors related to known and unknown claims and to ensure our reserve is within guidelines

promulgated by the National Association of Insurance Commissioners (NAIC).

AmRisc’s claims staff monitors and directs all aspects of the claims process through Cramer Johnson

Wiggins and Associates (CJW). CJW assigns the fieldwork to third-party claims adjusting companies, none

of whom have the authority to settle or pay any claims on the Company’s behalf. The third-party claims

adjusting companies conduct inspection of the damaged property and prepare initial estimates. CJW reviews

the inspection reports and initial estimates to determine the amounts to be paid to the policyholder in

accordance with the terms and conditions of the policy in effect at the time that the policyholder incurs the

loss. CJW maintains strategic relationships with multiple claims adjusting companies that can be engaged

should we need additional non-catastrophe claims servicing capacity. Management believes the

combination of AmRisc and CJW resources and their relationships with external claims servicing companies

provide an adequate level of claims servicing in the event catastrophes affect policyholders.

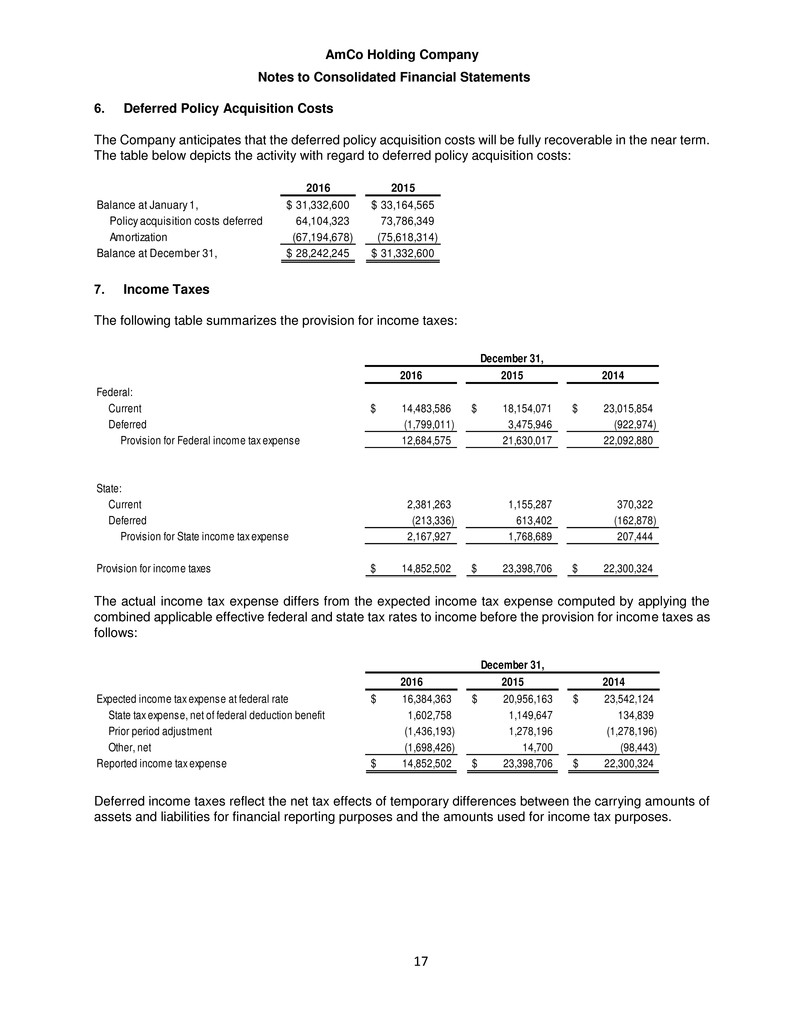

The following is information about incurred claims development as of December 31, 2016, net of

reinsurance, as well as cumulative claim frequency and the total of incurred-but-not-reported liability plus

expected development on reported claims included within the net incurred claims amounts. The

information about incurred claims development for the years ended December 31, 2007, to 2015 is

presented as supplementary information.

Commercial Insurance

Dollars in thousands

Accident

Year 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

2007 $ 1,034 $ 14 $ 14 $ 14 $ 16 $ 16 $ 16 $ 16 $ 16 $ 16 $ - 11

2008 - 12,428 3,844 1,939 1,905 1,905 1,905 1,905 1,905 1,902 2 261

2009 - - 11,323 5,233 3,490 3,490 3,490 3,490 3,490 3,489 4 383

2010 - - - 12,134 4,160 4,160 4,160 4,160 4,160 4,112 - 580

2011 - - - - 9,142 9,142 9,142 9,142 9,142 9,030 37 757

2012 - - - - - 9,771 9,771 9,771 9,771 8,671 12 799

2013 - - - - - - 11,826 11,826 11,826 8,382 1,133 732

2014 - - - - - - - 15,752 15,752 16,311 3,014 674

2015 - - - - - - - - 16,504 20,379 2,735 799

2016 - - - - - - - - - 33,729 17,813 909

Total $ 106,021

The Company's first audit in accordance with GAAP was for the year ended 2015. As part of the evaluation it was determined that all incurred losses should be reported for the 2011 -

2014 years based upon the 2015 acturially report which effectively adjusted the years to reflect no development in losses during those years.

Incurred Claims and Allocated Claim Adjustment Expenses, Net of Reinsurance

As of December 31, 2016

Total of Incurred-

but-Not-Reported

Liabilities Plus

Expected

Development on

Reported Claims

Cumulative

Number of

Reported Claims

For the Years Ended December 31,

AmCo Holding Company

Notes to Consolidated Financial Statements

23

E&S Insur nce

Dollars i thousands

Accident

Year 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

2016 n/a n/a n/a n/a n/a n/a n/a n/a n/a $ 1,818 $ 526 115

Total $ 1,818

Incurred Claims and Allocated Claim Adjustment Expenses, Net of Reinsurance

As of December 31, 2016

Total of Incurred-

but-Not-Reported

Liabilities Plus

Expected

Cumulative

Number of

Reported Claims

For the Years Ended December 31,

The following is information about paid claims development as of December 31, 2016, net of reinsurance.

The information about paid claims development for the years ended December 31, 2007, to 2015, is

presented as supplementary information.

Commercial Insurance

Dollars in thousands

Accident

Year

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

2007 $ - $ 14 $ 14 $ 14 $ 14 $ 16 $ 16 $ 16 $ 16 $ 16

2008 - 700 1,619 1,678 1,665 1,897 1,927 1,902 1,902 1,900

2009 - - 1,639 3,616 3,410 3,415 3,920 3,446 3,471 3,485

2010 - - - 1,968 3,127 3,461 3,966 3,909 3,909 4,112

2011 - - - - 3,541 6,241 7,605 7,846 8,825 8,851

2012 - - - - - 4,583 6,942 6,893 7,543 8,552

2013 - - - - - - 2,958 5,127 5,317 7,248

2014 - - - - - - - 6,379 9,452 13,212

2015 - - - - - - - - 10,188 17,134

2016 - - - - - - - - - 10,434

Total $ 74,944

-

$ 56,159

I

Dollars in thousands

Accident

Year

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

2016 n/a n/a n/a n/a n/a n/a n/a n/a n/a $ 222

Total $ 222

-

$ 1,596

Cumulative Paid Claims and Allocated Claim Adjustment Expenses, Net of Reinsurance

For the Years Ended December 31,

All outstanding liabilities before 2007, net of reinsurance

Liabilities for claims and claim adjustment expenses, net of reinsurance

All outstanding liabilities before 2007, net of reinsurance

Liabilities for claims and claim adjustment expenses, net of reinsurance

Cumulative Paid Claims nd Allocated Claim Adjustment Expenses, Net of Reinsura ce

For the Years Ended December 31,

AmCo Holding Company

Notes to Consolidated Financial Statements

24

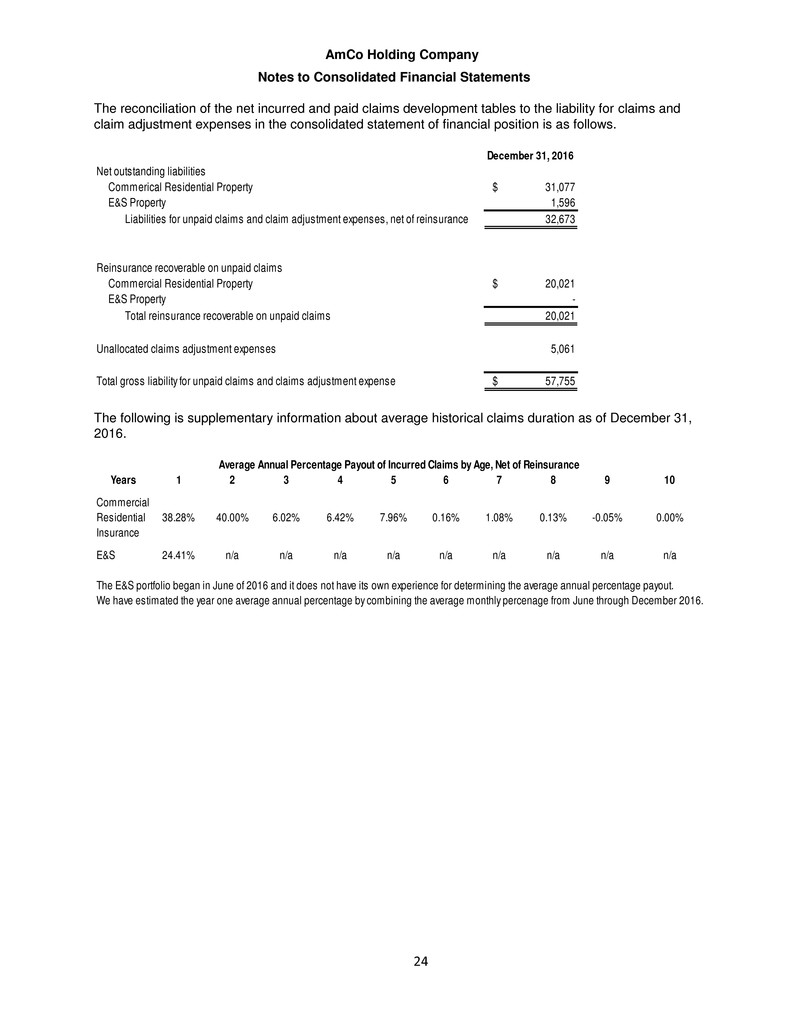

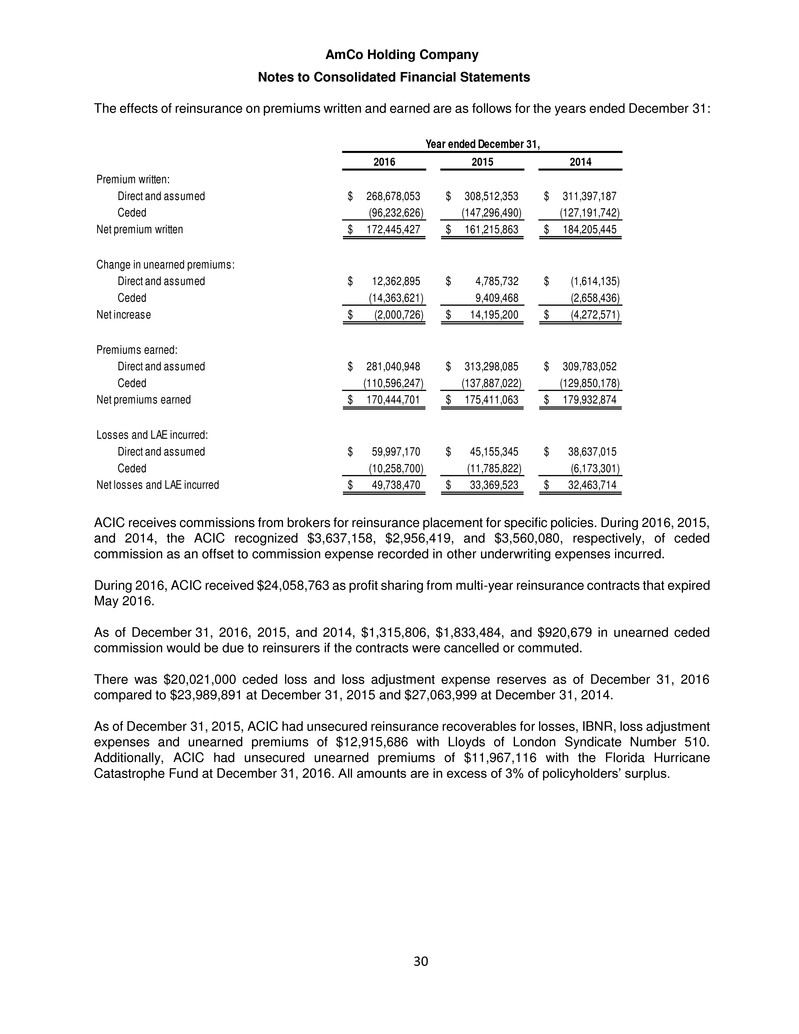

The reconciliation of the net incurred and paid claims development tables to the liability for claims and

claim adjustment expenses in the consolidated statement of financial position is as follows.

December 31, 2016

Net outstanding liabilities

Commerical Residential Property $ 31,077

E&S Property 1,596

Liabilities for unpaid claims and claim adjustment expenses, net of reinsurance 32,673

Reinsurance recoverable on unpaid claims

Commerci l Resi ential Property $ 20,021

E&S Property -

Total reinsurance recoverable on unpaid claims 20,021

Unallocated claims adjustment expenses 5,061

Total gross liability for unpaid claims and claims adjustment expense $ 57,755

The following is supplementary information about average historical claims duration as of December 31,

2016.

Years 1 2 3 4 5 6 7 8 9 10

Co erci l

Residential

Insurance

38.28% 40.00% 6.02% 6.42% 7.96% 0.16% 1.08% 0.13% -0.05% 0.00%

E&S 24.41% n/a n/a n/a n/a n/a n/a n/a n/a n/a

The E&S portfolio began in June of 2016 and it does not have its own experience for determining the average annual percentage payout.

We have estimated the year one average annual percentage by combining the average monthly percenage from June through December 2016.

Average Annual Perc tage Payout of Incurred Claims by Age, Net of Reinsurance

AmCo Holding Company

Notes to Consolidated Financial Statements

25

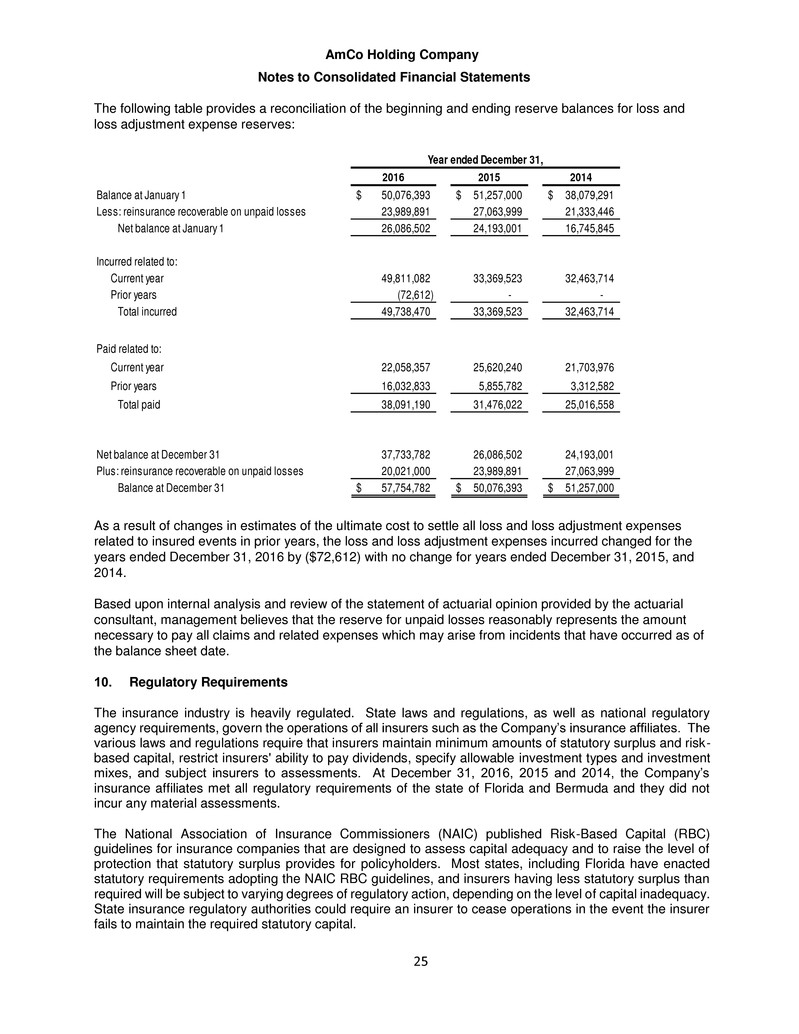

The following table provides a reconciliation of the beginning and ending reserve balances for loss and

loss adjustment expense reserves:

2016 2015 2014

Balance at January 1 50,076,393$ 51,257,000$ 38,079,291$

Less: reinsurance recoverable on unpaid losses 23,989,891 27,063,999 21,333,446

Net balance at January 1 26,086,502 24,193,001 16,745,845

Incurred related to:

Current year 49,811,082 33,369,523 32,463,714

Prior years (72,612) - -

Total incurred 49,738,470 33,369,523 32,463,714

Paid related to:

Current year 22,058,357 25,620,240 21,703,976

Pri r years 16,032,833 5,855,782 3,312,582

Total paid 38,091,190 31,476,022 25,016,558

Net balance at December 31 37,733,782 26,086,502 24,193,001

Plus: reinsurance recoverable on unpaid losses 20,021,000 23,989,891 27,063,999

Balance at December 31 57,754,782$ 50,076,393$ 51,257,000$

Year ended December 31,

As a result of changes in estimates of the ultimate cost to settle all loss and loss adjustment expenses

related to insured events in prior years, the loss and loss adjustment expenses incurred changed for the

years ended December 31, 2016 by ($72,612) with no change for years ended December 31, 2015, and

2014.

Based upon internal analysis and review of the statement of actuarial opinion provided by the actuarial

consultant, management believes that the reserve for unpaid losses reasonably represents the amount

necessary to pay all claims and related expenses which may arise from incidents that have occurred as of

the balance sheet date.

10. Regulatory Requirements

The insurance industry is heavily regulated. State laws and regulations, as well as national regulatory

agency requirements, govern the operations of all insurers such as the Company’s insurance affiliates. The

various laws and regulations require that insurers maintain minimum amounts of statutory surplus and risk-

based capital, restrict insurers' ability to pay dividends, specify allowable investment types and investment

mixes, and subject insurers to assessments. At December 31, 2016, 2015 and 2014, the Company’s

insurance affiliates met all regulatory requirements of the state of Florida and Bermuda and they did not

incur any material assessments.

The National Association of Insurance Commissioners (NAIC) published Risk-Based Capital (RBC)