[Forum Energy Technologies, Inc. Letterhead]

Via EDGAR and Federal Express

October 21, 2011

H. Roger Schwall

Assistant Director

United States Securities and Exchange Commission

Division of Corporate Finance

100 F Street, N.E.

Washington, D.C. 20549

| Re: | Forum Energy Technologies, Inc. |

| Registration Statement on Form S-1 |

| Filed September 1, 2011 |

| File No. 333- 176603 |

Ladies and Gentlemen:

Set forth below are the responses of Forum Energy Technologies, Inc. (the “Company,” “we,” “us” or “our”) to comments received from the staff of the Division of Corporation Finance (the “Staff”) of the Securities and Exchange Commission (the “Commission”) by letter dated October 3, 2011, with respect to the Company’s Registration Statement on Form S-1, File No. 333-176603, initially filed with the Commission on September 1, 2011 (the “Registration Statement”).

Concurrently with the submission of this letter, we are filing through EDGAR Amendment No. 1 to the Registration Statement (“Amendment No. 1”). For your convenience, we will hand deliver three full copies of Amendment No. 1, as well as three copies of Amendment No. 1 that are marked to show all changes made since the initial filing of the Registration Statement. We are also concurrently providing certain information responsive to Comments 29, 37 and 39 in a letter to the Staff (the “Supplemental Letter”) pursuant to a confidential treatment request.

For your convenience, each response is prefaced by the exact text of the Staff’s corresponding comment in bold, italicized text. All references to page numbers and captions correspond to Amendment No. 1 unless otherwise specified. Unless indicated otherwise, capitalized terms used, but not defined, herein shall have the meaning given to them in the Registration Statement.

Securities and Exchange Commission

October 21, 2011

Page 2

Registration Statement on Form S-1

General

1. Where comments on a section also relate to disclosure in another section, please make parallel changes to all affected disclosure. This will eliminate the need for us to repeat similar comments.

Response:

To the extent that comments in one section apply to similar disclosure elsewhere in the Registration Statement, we have revised all affected areas.

2. If a numbered comment in this letter raises more than one question or lists various items in bullet points, ensure that you fully respond to each question and bullet point. Make sure that your letter of response indicates precisely where responsive disclosure to each numbered comment and each point may be found in the marked version of the amendment.

Response:

To the extent a numbered comment in this letter raises more than one question or lists various items, we have fully responded to each question and item. In addition, this letter indicates by page number where responsive disclosure to each numbered comment and each point may be found within Amendment No. 1.

3. In the amended registration statement, please fill in all blanks other than the information that Rule 430A permits you to omit.

Response:

We acknowledge the Staff’s comment, and we will include in subsequent amendments to the Registration Statement all information that we are not entitled to omit under Rule 430A.

4. Prior to submitting a request for accelerated effectiveness of the registration statement, ensure that we have received a letter or call from the Financial Industry Regulatory Authority (FINRA) which confirms that it (a) has finished its review and (b) has no additional concerns with respect to the underwriting arrangements. Please provide us with a copy of that letter, or ensure that FINRA calls us for that purpose.

Response:

We will inform the Staff when the amount of compensation allowable or payable to the underwriters has received clearance from FINRA. An initial filing relating to the Registration Statement was filed with FINRA on September 1, 2011. Comments to the initial FINRA filing were received from FINRA on September 19, 2011. Counsel to the underwriters has confirmed to us that, prior to requesting accelerated effectiveness, it will provide the Staff with a copy of the FINRA no objections letter or a representative of FINRA will otherwise contact the Staff to confirm that FINRA has cleared our filing.

Securities and Exchange Commission

October 21, 2011

Page 3

5. Please submit all material exhibits, including, without limitation, the underwriting agreement and the legality opinion, in order to facilitate our review of your filing. We may have further comment upon our review.

Response:

We acknowledge the Staff’s comment and have filed with Amendment No. 1 all exhibits that are currently available. In addition, we are supplementally providing the Staff with Exhibit 5.1 – Opinion of Vinson & Elkins L.L.P. as to the legality of the securities being registered. We will undertake to file with future amendments to the Registration Statement all other omitted exhibits, including, without limitation, the underwriting agreement and the legality opinion. We will allow sufficient time for the Staff to review all exhibits and for us to respond to any comments that may result from the Staff’s review.

6. You do not yet provide a range for the potential offering price per share. Because other, related disclosure likely will be derived from the midpoint of the range, we remind you to provide the range once it becomes available so that you will have time to respond to any resulting staff comments.

Response:

We acknowledge the Staff’s comment and will include an estimated price range in a future amendment to the Registration Statement. We will allow sufficient time for the Staff to review our complete disclosure and for us to respond to any comments that may result from the Staff’s review.

7. We note your disclosure at page 8 relating to your geographic expansion into the Middle East. Please identify the countries in the Middle East in which you operate and hope to operate.

Response:

We acknowledge the Staff’s comment and we have revised our disclosure in the “Business—Our business strategy” section of Amendment No. 1 to identify the location in the Middle East in which we currently have a sales office and to disclose that we are seeking to expand our presence in the Middle East over the long-term. We do not currently have any specific locations targeted for expansion in that region. Please read page 99 of Amendment No. 1. However, given that our operations in the Middle East are not a significant part of our current business (less than 2.5% of our revenue for the year ended December 31, 2010 and less than 1.0% of total long-lived assets as of December 31, 2010) and we do not have any near-term plans to expand our presence in that region, we respectfully submit that the requested level of detail with respect to the Middle East is not warranted in the prospectus summary of the Registration Statement.

Securities and Exchange Commission

October 21, 2011

Page 4

Additionally, we are aware that certain countries in the Middle East such as Iran, Sudan and Syria are designated as state sponsors of terrorism by the U.S. Department of State, and are subject to U.S. economic sanctions and export controls. We acknowledge the obligations imposed by U.S. law and currently have certain procedures and a training program to prevent the receipt of orders from or shipments of any goods or the provision of any services directly to sanctioned countries such as Iran, Syria or Sudan or the governments thereof.

8. We note your disclosure that LESA through SCF will control the outcome of stockholder voting. We also note your disclosure that you have renounced any interest in specified business opportunities and that SCF and its director nominees on your board have no obligation to offer you these opportunities. Please expand your disclosure to discuss in further detail whether and how LESA, through SCF or otherwise, will allocate any potential transactions or financial professionals to your business in view of its relationship with various other similar companies. In this regard, we note the investments listed at http://www.scfpartners.com/?id=75. In your revised disclosure, please discuss whether LESA and/or SCF maintain a related investment, conflict of interest or similar policy in respect of its affiliates and/or portfolio companies.

Response:

We acknowledge the Staff’s comment and have revised our disclosure as requested to note that LESA has an internal policy that restricts it from investing in two or more companies with substantially overlapping industry segments and geographic areas. Pursuant to this policy, LESA may allocate any potential opportunities to its other portfolio companies where LESA determines, in its discretion, such opportunities are the most logical strategic and operational fit. As a result, LESA, or its affiliates, may become aware, from time to time, of certain business opportunities, such as acquisition opportunities, and may direct such opportunities to other portfolio companies, in which case we may not become aware of or otherwise have the ability to pursue such opportunities. Please read pages 12, 41, 178 and 179 of Amendment No. 1. Further, we have added a cross-reference to the risk factor regarding renouncement of business opportunities on page 41 in the risk factor entitled “L.E. Simmons & Associates, Incorporated (“LESA”), through SCF, will control the outcome of stockholder voting and may exercise this voting power in a manner adverse to you.” Please read page 41 of Amendment No. 1. LESA does not have a specific policy with regard to allocation of financial professionals and it is under no obligation to provide us with financial professionals, other than pursuant to the Secondment Agreement dated as of August 2, 2010 by and among LESA, W. Patrick Connelly and us, which expires on August 2, 2012. The Secondment Agreement is filed as Exhibit 10.8 to the Registration Statement.

9. We note your disclosure throughout relating to a “new credit facility.” We also note your disclosure in the table at page 77 relating to your “revolving credit facilities.” We further note that you have filed as an exhibit your senior secured revolving credit facility, as amended. Please revise your disclosure to clarify and reconcile your disclosure relating to a new facility

Securities and Exchange Commission

October 21, 2011

Page 5

with your disclosure relating to multiple facilities. To the extent that you are now a party to any credit facilities of your predecessor entities, so state (including, without limitation, by adding a footnote to the table at page 77) and provide the basis for not filing such agreements as exhibits to the registration statement.

Response:

References to a “new credit facility” in the Registration Statement were intended to reference our entry into our senior secured credit facility in connection with the Combination on August 2, 2010, which permitted us to borrow up to $450 million. In connection with the Combination, each of the predecessor entities repaid its existing credit facility and, as such, we are not a party to any credit facilities of our predecessor entities. Our senior secured credit facility is our only credit facility. We acknowledge the Staff’s comment and have revised our disclosure throughout Amendment No. 1 to remove any references to multiple “revolving credit facilities” or to a “new credit facility” in order to clarify that we have a single senior secured credit facility. Please read pages 13, 80, 89 and 119 of Amendment No. 1

Additionally, on October 4, 2011, we entered into an amended and restated credit agreement pursuant to which our senior secured credit facility was amended and restated in its entirety. We have also revised our disclosure regarding our senior secured credit facility throughout Amendment No. 1 to reflect the terms of our amended and restated credit agreement and have filed the amended and restated credit agreement as Exhibit 10.29 to Amendment No. 1.

10. We note your disclosure throughout relating to an equity commitment from SCF Partners. Please revise your disclosure to describe the terms of such commitment and file any related agreements.

Response:

Pursuant to the terms of the Subscription Agreement among Forum Energy Technologies, Inc., SCF-VII, L.P., Sunray Capital, LP, C. Christopher Gaut and W. Patrick Connelly, dated as of July 16, 2010 and entered into in connection with the Combination (the “July 2010 Subscription Agreement”), SCF-VII, L.P. made an equity commitment to purchase an additional $50.0 million of our shares of common stock on or before August 3, 2011. In June 2011, pursuant to its equity commitment under the July 2010 Subscription Agreement, SCF-VII, L.P. purchased an additional 168,236 shares of our common stock in exchange for a cash payment of $50.0 million. We have revised our existing disclosure of the July 2010 Subscription Agreement under “Certain relationships and related party transactions—Subscription and warrant agreements” on page 170 to clarify that the $50.0 million equity commitment was set forth in the July 2010 Subscription Agreement and was fulfilled in connection with SCF’s additional purchase of shares in June 2011. In addition, we have revised our disclosure on page 13 of the prospectus summary to clarify that the reference was to a $50.0 million equity commitment and to include a cross-reference to the more detailed description of the $50.0 million equity commitment set forth under the heading “Certain relationships and related party transactions—Subscription and warrant agreements.” The July 2010 Subscription Agreement has been filed as Exhibit 10.21 to the Registration Statement and there are no other agreements related to the $50.0 million equity commitment. Please read pages 13, 119 and 170 of Amendment No. 1.

Securities and Exchange Commission

October 21, 2011

Page 6

Prospectus Summary, page 1

11. We note your disclosure at page 22 that the “ongoing integration of [y]our business in connection with the Combination and the eight acquisitions [you] have completed since the Combination presents a number of risks….” Provide a brief history of the various acquisitions referenced, including those acquisitions leading up to the Combination (including those acquisitions effected by the constituent companies of the Combination) and those following the Combination. Provide a more detailed presentation under Business or MD&A.

Response:

We acknowledge the Staff’s comment and respectfully submit that we have provided a history of the eight acquisitions completed following the Combination (the “Post-Combination Acquisitions”) in the prospectus summary under the heading “Prospectus summary—Recent developments” on page 10 of Amendment No. 1 and a more detailed discussion of the eight acquisitions completed following the Combination under “Management’s discussion and analysis of financial condition and results of operations—Recent acquisitions” on page 64 of Amendment No. 1. This section also includes a cross-reference to Note 16 (Subsequent Events) to our audited consolidated financial statements, which also describes these acquisitions in detail. Additionally, the italicized language on page 1 of the prospectus summary lists the Post-Combination Acquisitions and their respective completion dates and indicates that the pro forma financial and operational data presented in the prospectus gives effect to the Post-Combination Acquisitions. We have revised our disclosure in the italicized language on page 1 of the prospectus summary to also provide a cross-reference to the description of the Post-Combination Acquisitions under “Management’s discussion and analysis of financial condition and results of operations—Recent acquisitions” on page 64 of Amendment No. 1.

With respect to the acquisitions completed prior to the Combination (collectively, the “Pre-Combination Acquisitions”), as noted on page 13 of the prospectus summary, FOT, Global Flow, Triton, Allied and Subsea completed, in the aggregate, 28 acquisitions from May 2005 to January 2009. We have expanded our description of the Pre-Combination Acquisitions under the section titled “Business—Business history” on page 118 of Amendment No. 1. In addition, we have revised our disclosure under “Prospectus summary—The combination” on page 13 of Amendment No. 1 to add a cross-reference to the description of the Pre-Combination Acquisitions following the first mention of the Pre-Combination Acquisitions. We do not believe that including more detailed information concerning the Pre-Combination Acquisitions in the prospectus is necessary as we do not believe this information is material to our investors’ general understanding of our business or prospects. All but six of the Pre-Combination Acquisitions were completed prior to 2008. The results of the business included among the Pre-Combination Acquisitions that were acquired prior to 2008 are fully reflected in our 2008 financial statements and all of the businesses included in the Pre-Combination Acquisitions are

Securities and Exchange Commission

October 21, 2011

Page 7

fully reflected in our 2009 and 2010 financial statements. Furthermore, all of the businesses acquired before the Combination have been integrated into our existing business segments and the product lines or services acquired in connection with each acquisition are reflected in the description of our business segments included in “Business—Business segments” on pages 102-118 of Amendment No. 1.

Risk Factors, page 21

General

12. Please eliminate generic risks which could apply to any public company or company in your industry, instead tailoring each risk to your particular circumstances. For example, and without limitation, we note the risk asserted under “—If we are unable to accurately predict demand….”

Response:

We acknowledge the Staff’s comment and have reviewed our entire “Risk factors” section and, to the extent necessary, have made revisions to tailor each risk to our particular circumstances. We have revised the six risk factors listed below.

| • | “We may be unable to employ a sufficient number of skilled…” – page 24 |

| • | “If we are unable to accurately predict customer demand …” – page 26 |

| • | “Our executive officers and certain key personnel …” – page 28 |

| • | “We may be impacted by disruptions in the political, regulatory…” – page 33 |

| • | “Adverse weather conditions adversely affect demand for services…” – page 33 |

| • | “A natural disaster, catastrophe or other event could result in severe…” – page 34 |

13. As appropriate, please ensure that each risk factor does not assert multiple risks that should be set forth in individual risk factors. For example, and without limitation, we note the risk factor beginning “Our non-U.S. operations will subject us…” contains a risks associated with currency exchanges fluctuations, jurisdictional disputes and variances in regulation.

Response:

We acknowledge the Staff’s comment and, to the extent necessary, have made revisions to ensure that our risk factors do not assert multiple risks that should be set forth in individual risk factors. We have revised the risk factor entitled “Our non-U.S. operations will subject us to special risks” on page 29 of Amendment No. 1 by separating the existing disclosure into the three risk factors listed below.

| • | “Our non-U.S. operations will subject us to special risks.” – page 29 |

| • | “Our exposure to currency exchange rate fluctuations….” – page 29 |

| • | “Our business operations in countries outside the United States are subject to a number of U.S. federal laws and regulations, including ….” – page 29 |

Securities and Exchange Commission

October 21, 2011

Page 8

14. We note your disclosure at page 15 regarding the restrictive covenant in your credit facility relating to dividend distributions. Please expand your risk factor disclosure to describe this and any other restrictive covenant contained in your credit facility that may materially affect your business.

Response:

We acknowledge the Staff’s comment and have expanded our disclosure to include the risk factor entitled “Our senior secured credit facility contains certain covenants that may inhibit our ability to make certain investments, incur additional indebtedness and engage in certain other transactions, which could adversely affect our ability to meet our goals,” which describes the restrictive covenants in our senior secured credit facility that may materially affect our business. Please read page 31 of Amendment No. 1.

15. We note your disclosure at page 130 suggesting that you have elected not to comply with certain NYSE corporate governance requirements. Please expand your risk factor disclosure to describe any associated risks in this regard.

Response:

We acknowledge the Staff’s comment and have revised our disclosure to indicate that we intend to comply with all applicable NYSE corporate governance requirements at the completion of the offering, despite the fact that we are eligible to utilize the NYSE’s “controlled company” exemptions. Nevertheless, recognizing that we could elect to utilize such exemptions as long as SCF continues to own a majority of our outstanding common stock, we have expanded our disclosure to include the risk factor entitled “We will be a ‘controlled company’ within the meaning of the NYSE rules and will qualify for and will have the ability to rely on exemptions from certain corporate governance requirements.” This risk factor describes the risks associated with our option to elect not to comply with certain of these NYSE corporate governance requirements. Please read pages 40 and 136 of Amendment No. 1.

Our Operations are subject to hazards inherent in the oil and gas industry …, page 27

16. We note that you manufacture products or provide services employed in hydraulic fracturing or deepwater exploration. Please expand this risk to add any material risks associated with those operations. For example, please discuss, if material and applicable, risks such as the underground migration of hydraulic fracturing fluids, spillage or mishandling of recovered hydraulic fracturing fluids and spills or blowouts in a deepwater environment. You may also, as applicable, cross-reference to any existing disclosures of such risks.

Securities and Exchange Commission

October 21, 2011

Page 9

Response:

Our exposure to material risks associated with hydraulic fracturing and deepwater exploration operations is very limited. Since we do not perform either hydraulic fracturing or deepwater drilling, our exposure is primarily limited to products liability claims on the products we sell that are employed in hydraulic fracturing and deepwater exploration activities. We have revised the risk factor entitled “Our operations are subject to hazards inherent in the oil and gas industry” to clarify that our primary exposure to the hazards inherent in the oil and gas industry is product liability and have also expanded the description of the risks inherent in our customers operations to include a description of the environments in which our customers use our products and services to conduct hydraulic fracturing and deepwater exploration operations and identify the inherent risks to surface water and drinking water resources from these operations. We respectfully submit that as a producer of specialized products employed in hydraulic fracturing and deepwater exploration activities, we are not subject to any additional material risks associated with the performance of these activities by our customers. Please read page 27 of Amendment No. 1.

Our [Non-]U.S. Operations will subject us to special risks, page 29

17. Expand your disclosure to identify any foreign jurisdictions which represent a material amount of your assets, operations or revenues.

Response:

As disclosed in the table detailing revenues by shipping location and long-lived assets by country on page F-54 of Amendment No. 1, Canada, Europe & Africa (predominantly the United Kingdom) and Asia-Pacific (predominantly Singapore) represent a material portion of our assets, operations and revenues. We acknowledge the Staff’s comment and have expanded our disclosure in the risk factor entitled “Our Non-U.S. Operations will subject us to special risks…” to identify the foreign jurisdictions in which we operate that represent a material amount of our assets, operations or revenues. Please read page 29 of Amendment No. 1.

Use of Proceeds, page 42

18. We note your disclosure relating to the intended allocation of your estimated use of proceeds. Please present the information in tabular form to facilitate clarity.

Response:

We acknowledge the Staff’s comment and have revised our disclosure to clarify that we will use all of the net proceeds from the offering to repay outstanding borrowings under our revolving credit facility. We will add tabular disclosure in a future amendment if we expect to have remaining proceeds following the repayment of outstanding borrowings, resulting in more than one use of the offering proceeds. Please read pages 15 and 44 of Amendment No. 1.

Securities and Exchange Commission

October 21, 2011

Page 10

19. We note that you intend to use the proceeds received from the offering to repay borrowings under your credit facility. Please revise to disclose whether, upon repayment of the credit facility, you have any plans to immediately draw down on the credit facility, and if so, for what purposes.

Response:

We acknowledge the Staff’s comment and have revised our disclosure to indicate that, upon repayment of outstanding borrowings under our senior secured credit facility, we do not have any immediate plans to borrow additional amounts under our senior secured credit facility. To the extent this changes, we will provide updated disclosure regarding any immediate plans to draw down on the senior secured credit facility and for what purposes. Please read page 44 of Amendment No. 1.

Pro forma condensed combined balance sheet, page 55

20. Explain to us how you have considered providing footnote disclosure showing the determination and allocation of the purchase for each of the acquisitions reflected in your pro forma balance sheet.

Response:

We acknowledge the Staff’s comment and have revised our disclosure in footnote 1(b) to the pro forma condensed combined balance sheet as of June 30, 2011 to include the preliminary allocation of the purchase price for each entity that we acquired after June 30, 2011. Please read page 58 of Amendment No. 1.

Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 59

Product and Infrastructure Segment, page 68

21. You attribute the increase in revenue to “improved market conditions, the successful additions of several new customers and expansion into geographic markets.” To the extent practicable, quantify the separate impact of each of these elements.

Response:

We acknowledge the Staff’s comment and have revised our disclosure accordingly. Please read page 72 of Amendment No. 1.

Securities and Exchange Commission

October 21, 2011

Page 11

Critical accounting policies and estimates, page 77

Business combinations, goodwill and other intangible assets, page 80

22. We note that you have recorded goodwill impairment charges in recent prior periods. In view of this, tell us whether you have any reporting units for which fair value is not substantially in excess of carrying value. If so, provide the following disclosure for each such reporting unit:

| • | Percentage by which fair value exceeded carrying value as of the date of the most recent test; |

| • | Amount of goodwill allocated to the reporting unit; |

| • | Description of the methods and key assumptions used and how the key assumptions were determined; |

| • | Discussion of the degree of uncertainty associated with the key assumptions. The discussion regarding uncertainty should provide specifics to the extent possible (e.g., the valuation model assumes recovery from a business downturn within a defined period of time); and |

| • | Description of potential events and/or changes in circumstances that could reasonably be expected to negatively affect the key assumptions. |

We believe such disclosure is required by Item 303(a)(3)(ii) of Regulation S-K, which requires a description of a known uncertainty. Additional guidance on this concept is included in Section V of Interpretive Release No. 33-8350, which states that under the existing MD&A disclosure requirements, a company should address material implications of uncertainties associated with the methods, assumptions and estimates underlying the company’s critical accounting measurements.

Response:

We performed our annual impairment tests on our four reporting units as of December 31, 2010 and determined that the estimated fair values of each of our four reporting units substantially exceeded their carrying values as of the most recent assessment date. We have revised Amendment No. 1 to disclose that determination under “Management’s discussion and analysis of financial condition and results of operations—Critical accounting policies and estimates—Business combinations, goodwill and other intangible assets.” Please read page 85 of Amendment No. 1. We do not believe that any event has occurred subsequent to December 31, 2010 that indicates that an impairment may have occurred on any of these reporting units. In future filings, to the extent that the fair value of our goodwill for our reporting unit does not substantially exceed its carrying value, we will make the necessary disclosures as outlined in the Staff’s comment.

Securities and Exchange Commission

October 21, 2011

Page 12

Business, page 86

New product development and intellectual property, page 119

23. We note the discussion of your research and development programs. Explain to us how you have considered the disclosure requirements of Item 101(c)(xi) of Regulation S-K.

Response:

We acknowledge the Staff’s comment and respectfully submit that, in accordance with Item 101(c)(xi), disclosure is required only where the amount spent on either (i) company-sponsored research and development activities, as defined in FASB Statement No. 2, Accounting for Research and Development Costs, or (ii) customer-sponsored research activities relating to the development of new products, services or techniques or the improvement of existing products, services or techniques is material for any of the last three fiscal years. During the years ended December 31, 2010, 2009 and 2008, there were no amounts spent on customer-sponsored research activities, and the amounts spent on company-sponsored research and development activities were not significant and, therefore, do not need to be disclosed under the requirements of Item 101(c)(xi) of Regulation S-K.

Operating Risk and Insurance, page 121

24. You indicate that you carry “a variety of insurance for our operations” and that you are “partially self-insured for certain claims.” Clarify for which items you carry insurance and for which items you self-insure.

Response:

We acknowledge the Staff’s comment and have revised our disclosure accordingly. Please read pages 126 and 127 of Amendment No. 1.

Legal Proceedings, page 124

25. Please identify the subsidiaries that are subject to the referenced legal proceedings. Please also identify the name of the court or agency in which the proceedings are pending. See Item 103 of Regulation S-K.

Response:

We acknowledge the Staff’s comment, but respectfully submit that our current disclosure of legal proceedings is compliant with Item 103 of Regulation S-K. We have voluntarily included in the

Securities and Exchange Commission

October 21, 2011

Page 13

Registration Statement a general description of the asbestos litigation and the Portland Harbor Superfund litigation, but have not included all information required by Item 103 with respect to these cases because they are not material. These cases do not include requests for a specific dollar amount of damages in the applicable claims; however, based on a reasonable analysis of the amounts that could ultimately be recovered, the amounts involved in such cases, individually and in the aggregate, do not exceed 10% of our consolidated current assets. We make such determinations as part of a comprehensive ongoing assessment of legal claims and actions that takes into consideration such items as changes in our pending case load (including resolved and new matters), advice of legal counsel, individual developments in court proceedings, changes in the law, changes in business focus, changes in the litigation environment, changes in opponent strategy and tactics, new developments as a result of ongoing discovery and past experience in defending and settling similar claims.

In addition, as specified in footnote 9 to our consolidated financial statements on page F-40 of Amendment No. 1, we have reviewed pending judicial and legal proceedings, reasonably anticipated costs and expenses in connection with such proceedings, and availability and limits of insurance coverage to establish reserves that are believed to be appropriate in light of those outcomes that are believed to be probable and can be estimated. The reserves associated with these legal proceedings and accrued at December 31, 2010 are insignificant, individually and in the aggregate. Based upon that review, we believe the amount of ultimate liability, if any, with respect to these actions will not have a material adverse effect on our financial statements.

Furthermore, we respectfully submit that no additional disclosure is required under Item 103 of Regulation S-K with respect to the notice letter that our subsidiary received from the EPA in March 2010 indicating that it had been identified as a potentially responsible party with respect to environmental contamination in the “study area” for the Portland Harbor Superfund Site. The referenced letter is a notice of responsibility, but does not assert any legal claims or proceedings against our subsidiary. The EPA has not currently proposed a remedy, developed a total cost estimate or attempted to allocate responsibility among the potentially responsible parties. As such, pursuant to Instruction 5 to Item 103, no disclosure is required related to the notice letter because it does not constitute an “administrative or judicial proceeding.”

For the reasons cited above, we respectfully submit that we have complied with Item 103 of Regulation S-K and no further disclosure regarding these proceedings is required.

Board of Directors, page 130

26. You indicate that you will be a “controlled company” under Section 303A of the NYSE Listed Company Manual and indicate you may “elect not to comply with certain NYSE corporate governance requirements.” You then state that “these requirements will not apply to us as long as we are a controlled company.” State clearly whether you have elected not to comply with Section 303A.

Securities and Exchange Commission

October 21, 2011

Page 14

Response:

We acknowledge the Staff’s comment and have revised our disclosure to clarify that, although we will be a “controlled company” under Section 303A of the NYSE Listed Company Manual, we intend to comply with all applicable NYSE corporate governance requirements at the completion of the offering, despite the fact that we are eligible to utilize the NYSE’s “controlled company” exemptions. Please read page 136 of Amendment No. 1. Please also see our response to Comment #15 included in this letter.

Compensation Discussion and Analysis, page 133

27. We note your disclosure at page 141 that you expect that long-term equity grants to be a “significant portion of [y]our NEO total compensation.” Please revise your disclosure to quantify in percentage form the portions of total compensation relating to each compensation component for 2011 in a manner comparable to the disclosure at page 143 in respect of 2010.

Response:

We acknowledge the Staff’s comment and have revised our disclosure accordingly. Our previous disclosure set forth charts that reflected a pay mix for our CEO and other NEOs collectively based on annual base salary for 2011, the target bonuses for 2011 and the 2010 equity grants. We have revised this disclosure to include two sets of charts, (i) charts setting out the pay mix for our CEO and other NEOs collectively based on base salary paid in 2010, bonus paid in 2010, and the grant date value of 2010 equity grants and (ii) charts setting out our current pay mix for our CEO and other NEOs collectively based on 2011 annual base salary and the target bonus for 2011. We have also disclosed that, although it is our philosophy that equity based awards should account for a significant portion of total direct compensation, given the significant equity grants made at the end of 2010, we do not presently expect to make further equity grants to our NEOs in 2011. Please read pages 149 and 150 of Amendment No. 1.

Certain relationships and related party transactions, page 161

28. Please revise your disclosure to identify the Escrow Stockholders and explain the nexus to the asbestos litigation. The section cross-referenced does not provide that information. Also, if any of the Escrow Stockholders are executive officers and/or directors and these shares represent compensation, tell us whether that compensation is addressed in your compensation disclosure.

Response:

We acknowledge the Staff’s comment and have revised our disclosure to identify the Escrow Stockholders and explain the nexus to the asbestos litigation. None of the Escrow Shares were issued as compensation to any of our executive officers or directors. Please read page 167 of Amendment No. 1.

Securities and Exchange Commission

October 21, 2011

Page 15

Index to financial statements, page F-1

General

29. We note the financial statements you have provided in connection with recent acquisitions. Provide to us, as supplemental information, a reasonably detailed analysis that demonstrates how the entities and annual and interim periods for which you have provided financial statements for the acquired entities meet the requirements of Rule 3-05 of Regulation S-X.

Response:

We are providing the Staff with a summary of the Company’s significance test calculations under Rule 3-05 of Regulation S-X with respect to the eight acquisitions completed subsequent to December 30, 2010, which is included as Schedule A to the Supplemental Letter. In accordance with the instructions set forth in Section 2015.2 of the Division of Corporation Finance Financial Reporting Manual (the “Staff Manual”), we have compared the most recent pre-acquisition annual financial statements of the eight acquired businesses (the fiscal year end of each acquiree is noted in the third column of Schedule A) to the Company’s consolidated financial statements as of December 31, 2010, the end of the Company’s most recently completed audited fiscal year prior to the acquisitions. All of the financial statements of the acquired companies were either prepared in accordance with U.S. GAAP or reconciled to U.S. GAAP for purposes of performing the significance tests. Column 4 of Schedule A details the total assets and income before taxes for each acquired company for the relevant measuring year as well as the U.S. GAAP purchase price for the acquisition, and, in column 5 of Schedule A, as a percentage of the Company’s total assets and income before taxes, as required by the applicable significance test under Rule 3-05(b)(2).

The Company’s acquisition of Davis-Lynch, LLC (“Davis Lynch”) was the only 2011 acquisition that was individually significant, exceeding 50% significance on the income test. As a result, we have included three years of audited financials of Davis Lynch and the most recent interim period prior to the acquisition in the prospectus in accordance with 3-05(b)(2)(iv).

Section 2053.3 of the Staff Manual provides that if the aggregate of either the asset, investment or income significance test of all individually insignificant acquisitions exceeds 50%, the registrant must provide financial statements for the mathematical majority (combined if appropriate) for the most recent fiscal year and the latest interim period preceding the acquisition. As shown on Schedule A, the aggregate income significance test of all seven individually insignificant acquisitions exceeded 50% significance and yielded the greatest significance on an aggregate basis (84.8%). As such, financial statements of the individually insignificant businesses adding up to in excess of 42.4% significance under the income test must be provided. Accordingly, we have provided financial statements for Wood Flowline Products, LLC (“WFP”), AMC Global Group Ltd. (“AMC Global”), P-Quip Ltd. (“P-Quip”) and Cannon Services LP (“Cannon”), which represented 65.7% significance on an aggregate basis under the income test.

Securities and Exchange Commission

October 21, 2011

Page 16

With respect to determining the appropriate interim period financials to include for these four companies, as well as Davis Lynch, we relied on the guidance set forth in Section 2045.9 of the Staff Manual, which states that “financial statements of an acquired business need not be updated if the omitted period is less than a complete quarter” and clarifies the meaning of that text with the following example: “If an acquisition subject to S-X 3-05 or S-X 8-04 (i.e., not a predecessor) was consummated on September 29, the staff generally would not require that the financial statements of the acquired entity be updated past June 30. However, disclosure of significant events occurring during the omitted interim period may be necessary.” As each of the WFP, AMC Global and P-Quip acquisitions closed on a date that was less than a complete quarter from the date of each such entity’s last audited balance sheet, we have not included any interim financials for those entities in the Registration Statement. We have provided interim unaudited financials for the six months ended June 30, 2011 for each of Davis Lynch and Cannon, representing the most recent complete interim periods for each of those entities prior to being acquired in July 2011.

Forum Energy Technologies, Inc. and Subsidiaries

Consolidated Balance Sheets at December 31, 2009 and December 31, 2010, page F-8

30. We note that you classified the value assigned to warrants sold in 2010 as a component of equity. We further note the disclosure on page 172 indicates that adjustments to the exercise price of the warrants will occur under certain circumstances. Please tell us if these potential adjustments are akin to a down round protection requiring classification of the warrants as a liability. Refer to FASB ASC 815-40-15 including ASC 815-40-15-7.

Response:

Other than the adjustment described below, the exercise price of the warrants is only subject to change as a result of a stock split, reverse stock split, rights offering, issuance of stock dividends or recapitalization. All of the potential adjustments to the exercise price of the warrants are considered anti-dilution provisions, and each of these adjustments is intended to keep the respective holder whole in terms of ownership percentage and not value of each share. The warrants do not contain any provisions that require an adjustment if the Company issues securities at an effective price per share that is lower than the exercise price of the warrant, or “down round” provisions.

We believe that the warrants sold in 2010 are indexed to the Company’s own common stock under FASB ASC 815-40, and, as such, should be classified as equity with no adjustments for changes in fair value.

ASC 815 describes a two step process for determining whether an instrument is indexed to an entity’s own common stock.

Securities and Exchange Commission

October 21, 2011

Page 17

The first step is to evaluate whether or not the instruments contain any contingent exercise provisions. Specifically, under the first step of the model, if the exercise contingency is based on (a) an observable market, other than the market for the issuer’s common stock, or (b) an observable index, other than one measured solely by reference to the issuer’s own operations, then the presence of the exercise contingency precludes an instrument from being considered indexed to an entity’s own common stock. If not, the analysis would proceed to the second step. There are no exercise contingencies for the warrants under the terms of the warrant agreements; exercise is immediately available to holders. Accordingly, we proceed to step 2 of the analysis.

Under step two of the analysis, if the settlement amount equals the difference between the fair value of a fixed number of the entity’s equity shares and a fixed monetary amount, or a fixed amount of a debt instrument issued by the entity, then the instrument would be considered indexed to an entity’s own common stock. Further, the strike price or the number of shares used to calculate the settlement amount cannot be considered fixed if the terms of the instrument allow for any potential adjustment, regardless of the probability of the adjustment being made or whether the entity can control the adjustment.

If the instrument’s strike price or the number of shares used to calculate the settlement amount are not fixed, the instrument would still be considered indexed to an entity’s own common stock if the only variables that could affect the settlement amount are variables that are typically used to determine the fair value of a fixed-for-fixed forward or option on equity shares.

The only item that is not fixed and would impact the settlement amount is that the warrants have an adjustment feature whereby the exercise price increases by 0.5% of the then-current exercise price on the last day of each month following their original issuance. The warrants are still considered to be indexed to our own common stock as the exercise price is a typical variable required in determining the fair value of an option on equity shares. This adjustment is, in effect, the calculation of the exercise price.

Further, settlement adjustments designed to protect a holder’s position from being diluted will generally not prevent an instrument from being considered indexed to the entity’s own common stock provided the adjustments are limited to the effect that the dilutive event has on the shares underlying the instruments. Adjustments for events such as the occurrence of a stock split, rights offering, dividend, or a spin-off would typically be inputs to the fair value of a fixed-for-fixed forward or option on equity shares.

We have concluded based on the requirements of ASC paragraphs 815-40-15-5 through 15-8 and the terms of the warrant agreements, as discussed above, that the warrants are indexed to our common stock and are properly classified as equity.

Securities and Exchange Commission

October 21, 2011

Page 18

Consolidated Statements of Income, page F-9

31. We note that you generate revenue from the sale of products, from rentals and from services. In view of this, explain to us how you have considered the disclosure requirements of Rules 5-03(b)(1) and 5-03(b)(2) of Regulation S-X.

Response:

Our primary business is the designing and manufacturing oilfield products. Income from rentals and revenues from services each represented less than 10% of our total revenue for each of the financial statement periods presented and were combined with our net sales of tangible products for presentation in the statement of income date in our financial statements as permitted by Rule 5-03(b). Rule 5-03(b) also states that if the categories of items listed in Rule 5-03.1 relating to revenues are combined, related costs and expenses as described under Rule 5-03.2 shall be combined in the same manner. Accordingly, we have combined expenses applicable to rental income and cost of services with our cost of tangible goods sold. As such, we respectfully submit that our current presentation of our consolidated statements of income complies with the disclosure requirements of Rules 5-03(b)(1) and 5-03(b)(2) of Regulation S-X.

Notes to consolidated financial statements, page F-15

Note 1. Nature of operations and combinations, page F-15

32. Tell us the ownership interests of SCF in FOT, Global Flow, Triton and Subsea at the time of the combination. Separately, tell us whether the financial statements of FET reflect the transferred assets and liabilities at the historical cost of the parent of the entities under common control. See FASB ASC paragraph 805-50-30-5.

Response:

Prior to the Combination, SCF owned 64.4%, 87.9%, 79.1% and 89.9% of the voting interests in FOT, Global Flow, Triton and Subsea, respectively. Because the mergers consummated in connection with the Combination were under common control, in accordance with ASC 805-50-30-5, the financial statements of the Company reflect the transferred assets and liabilities at the historical cost of the parent of the entities under common control.

Note 2. Summary of Significant Accounting Policies, page F-15

Property and equipment, page F-17

33. We note your disclosure regarding a change in the estimated useful life of marine electronic survey equipment. Explain to us, in reasonable detail, the facts and circumstances surrounding this change. As part of your response, tell us the original and revised useful lives. Also, describe the specific information you considered in connection with this change and explain why it supports the new useful life. Note that this comment also applies to the change in estimated useful lives for certain intangible assets discussed elsewhere in the notes to your financial statements.

Securities and Exchange Commission

October 21, 2011

Page 19

Response:

Change in estimated useful lives of marine electronic survey equipment

We rent marine electronic survey equipment to the oil and gas industry globally within our Drilling & Subsea segment. The useful life used for the depreciation of these rental assets was historically 4 years.

While due consideration is given to accounting estimates on at least an annual basis, the factors below and the actual operational length of use of the rental assets made the review of the depreciable lives for 2010 appropriate. As part of our review in 2010 we noted the following:

• The marine electronic survey equipment typically continued to be utilized beyond the life of 4 years. This suggested that the useful life estimated at that time was too brief. As part of our assessment, we reviewed assets that were purchased in 2005 (representing approximately 4 years of use as of December 31, 2009) to determine which items in this asset class were still in use. We determined that only 15% of those assets purchased in 2005 were no longer in use as of December 31, 2009. Conversely, 85% of those assets purchased during 2005 were still in use, indicating that a longer depreciation period may be appropriate.

• We also noted in our review that on occasions where marine electronic survey equipment was sold from the rental asset stock, it would generally result in a larger than expected gain on sale. This fact further suggested to management that the current depreciation policy for this asset class may be too short.

• When accounting estimates were reviewed with operations personnel, there was a general acknowledgment that the mechanical and technical lives of these rental assets was now 6 to 8 years on average. This was further supported by the fact that on completion of “authorization for expenditure” forms prior to purchasing new assets, current management gives their best estimate as to the useful life of the asset in question. The period given is, in all cases relating to significant purchases, 6 years or more for the value of rental assets. This is indicative of management’s view of the useful period for those new assets.

In conclusion, the new information and analysis regarding current use of assets purchased in 2005, the larger than expected gains recognized on sales of these assets, and the additional supporting views from operational management indicated that the useful life of the rental assets at these operations should be extended beyond the four years being utilized to at least six years.

Securities and Exchange Commission

October 21, 2011

Page 20

Change in estimated useful lives of certain intangible assets

Background

At the time of the Combination, various intangible assets were on the books of the individual companies related to acquisitions previously made by those companies. These intangibles were identified and valued with assistance by independent valuation firms engaged by the individual companies at the time of each acquisition.

ASC 350-30-35-9 states that “[a]n entity shall evaluate the remaining useful life of an intangible asset that is being amortized each reporting period to determine whether events and circumstances warrant a revision to the remaining period of amortization.” We believe that the merging of the companies in 2010 warranted this evaluation. Since some of the intangibles (e.g. patents, trademarks, backlog and non-compete) have discernible lives based upon underlying licenses or agreements, the focus of this analysis was on customer relationships and distributor networks. Upon review of the customer relationships and distributor networks of each of the combining companies, it was observed that the useful lives varied over a wide range between 4 years to 15 years for similar intangibles.

The identifiable intangible assets were originally valued by each of the companies using a discounted cash flow (“DCF”) approach. The parent company in the Combination, Forum Oilfield Technologies, Inc., had a practice to amortize customer relationship value on a straight-line basis over future periods using the number of periods in the DCF analysis showing positive value. As a result, the applicable life is a function of the customer attrition assumption in the DCF model (i.e. a lower attrition rate translates into a longer life and hence a longer amortization period).

For each of the customer relationship intangibles, we obtained the sales by customer for the period leading up to the respective acquisition and then compared that schedule to the respective sales by customer in the most recent period available. Based upon our review, most of the customer attrition rates actually experienced were significantly less than originally estimated at the time of each respective valuation report. The useful lives for those companies whose actual attrition rates were consistent with the original estimates were not further assessed and, therefore, were not adjusted.

Utilizing the actual attrition rates identified, we recomputed the DCF for 20 years without a terminal value for a sample of the assets for the purpose of identifying the period in which the value was less than a minimal amount. We determined that the useful life of the customer relationship intangible should be at least to the latest period that reflects more than minimal value in the DCF model, which in all cases extended to a period in excess of 15 years. We did not extend the lives beyond 15 years. Additionally, we limited any change in attrition rates to no more than 50% of the original rates used even if actual data supported a more significant reduction.

Securities and Exchange Commission

October 21, 2011

Page 21

Ultimately, the change in useful lives for these intangible assets was based upon the following:

• All of the valuation reports showed positive value in the 15th year for those that performed detailed calculations.

• Based upon actual experience, customer attrition has been less than estimated and the best customers for each of the companies are expected to be retained long-term.

• In addition to the above factors not dependent upon the Combination, the longer lives are also supported by the following factors and changes in circumstances due to the Combination in 2010:

o Greater customer loyalty due to the size and financial stability of the new organization.

o Greater customer loyalty due to the increased capitalization of the company and lower relative transaction risk. On an aggregate basis, with an updated credit facility and equity commitment from our major shareholder, the combined Company could have the capability to make many of the investments that may not have been available to the individual companies. As a result, there is increased capitalization and more stability in the overall combined organization.

o Greater product diversification which enables us to provide more products and services to existing customers. With the larger platform of products, there is more confidence from our customers in the Company in that we can service their needs in many areas such as larger capital equipment needs, consumable products, and long-term strategic supplier arrangements. This is performed with the greater diversification of products but also in the cross selling of products.

o Enhanced in-house capabilities and access to capital to perform research and development, which will enable us to stay technologically ahead of competitors attempting to take the customer base.

In conclusion, based upon the factors described above, we changed our estimate of useful life for substantially all customer relationship and distributor network intangibles to 15 years on a prospective basis as of August 1, 2010.

This treatment is consistent with the accounting guidance at ASC 250-10 stating that a change in useful life should be as a result of new information (see items discussed above) and that the change in estimate should be accounted for prospectively (not retroactively).

Securities and Exchange Commission

October 21, 2011

Page 22

Revenues recognition and deferred revenue, page F-20

34. We note your disclosure regarding contracts for which revenue is recognized using the percentage of completion method. Explain to us your reasons for concluding that the use of this method is appropriate for the contracts in question. As part of your response, tell us the nature of products or services provided. Additionally, describe material terms of the arrangements under which the services are provided, including payment, performance and acceptance provisions.

Response:

We believe that the use of the percentage of completion method to recognize revenue is appropriate for certain of our contracts. The nature of products that we are constructing and in which we use this method include:

• remote operated vehicles used in the subsea environment which typically take four months to construct.

• trencher vehicles that are used in the subsea environment which may take 18 months to construct.

• custom manufactured products primarily used in offshore oilfield operations, such as gas measurement skids and dehydration skids.

According to the ASC 605-35, Revenue Recognition-Construction Type and Production Type Contracts, the percentage-of-completion method is considered preferable as an accounting policy in circumstances in which reasonably dependable estimates can be made and in which all the following conditions exist:

• Contracts executed by the parties normally include provisions that clearly specify the enforceable rights regarding goods or services to be provided and received by the parties, the consideration to be exchanged, and the manner and terms of settlement.

• The buyer can be expected to satisfy all obligations under the contract.

• The contractor can be expected to perform all contractual obligations.

For the products mentioned above, sometimes we will build them in anticipation of an order and we may not have a contract with a customer. In these instances, we do not recognize revenue under the percentage of completion method. Rather, we will build up the inventory balance as the equipment is constructed and revenue is recognized at the time title passes to the customer.

Securities and Exchange Commission

October 21, 2011

Page 23

For the equipment where we are recognizing revenue under the percentage of completion method, we can make reasonably dependable estimates for the construction of these products. The revenue (and profit) is set out in the original estimate based on contract terms and is recognized in stages as the contract progresses on a monthly basis. The amount of costs incurred to date is taken as a percentage of the estimated costs to complete and that percentage is applied to the total revenue (and profit) to determine the income to be recognized in that period. On an on-going basis, we monitor the estimate to complete for each contract on a monthly basis and revise estimates where necessary. Whenever revisions of estimated contract costs and contract values indicate that the contract costs will exceed estimated revenue, thus creating a loss, a provision for the total estimated loss is recorded in that period.

The contracts incurred with customers normally include provisions that clearly specify the enforceable rights regarding the product to be provided, the consideration to be exchanged, and the manner and terms of settlement. Both our customer and we, as the manufacturer, can be expected to perform the obligations in the contract.

The terms in the contracts do include payment provisions. These payment provisions vary with each contract, but typically include a payment schedule based on certain milestones. For example, the payments in a typical contract may be expected upon (among others):

| • | signing the contract; |

| • | approving the drawings or specifications of the product; |

| • | satisfactory completion of various inspection points; |

| • | completion factory acceptance testing; and |

| • | upon delivery of the final product. |

The payment terms in the contract determine when we can bill the customer. However, these payment terms do not dictate when to recognize revenue. Revenue recognition is based upon the estimates of where we are in the process of the work being performed, which percentage is determined based on the ratio of costs incurred to-date to total estimated costs for the project.

As the payment terms do not necessarily match up with the advancement of the work performed, there may be instances where we have billed the customer in advance of the work performed or we have performed the work and, therefore, recognized revenue in advance of our billing. We appropriately record these transactions as discussed in ASC 605-35-45-3, which states: Under the percentage-of-completion method, current assets may include costs and recognized income not yet billed with respect to certain contracts. Liabilities, in most cases current liabilities, may include billings in excess of costs and recognized income with respect to other contracts.

Securities and Exchange Commission

October 21, 2011

Page 24

The terms in the contracts do include acceptance terms, which typically state the product must undergo factory acceptance testing. This testing typically has the buyer and seller represented at the time the product is reviewed against the specifications dictated in the contract.

35. We note your discussion regarding costs and profit in excess of billings. Describe for us the terms of the underlying arrangements or other factors that prevent you from billing your customers at the time revenue is recognized. As part of your response, tell us when, and under what circumstances, these amounts become billable.

Response:

As the accounting for the costs and profits in excess of billings is related to the revenue recognized under the percentage of completion method, we have responded to this comment within the response to Comment #34 (see above).

Note 5. Goodwill and intangible assets, page F-27

36. Explain to us how you have considered the requirement of FASB ASC 350-20-50-1 to provide specified information regarding goodwill both in total and for each reportable segment.

Response:

We acknowledge the Staff’s comment and have revised our disclosure to provide information regarding goodwill both in total and for each reportable segment. Please see footnote 5 to our consolidated financial statements on page F-27 of Amendment No. 1.

37. Explain to us, in reasonable detail, how you have identified your reporting units for purposes of your goodwill accounting. As part of your response, provide copies of the information that segment management reviews in connection with their management function.

Response:

ASC 350-20-20 defines a reporting unit as the “...level of reporting at which goodwill is tested for impairment. A reporting unit is an operating segment or one level below an operating segment (otherwise known as a component).” Based on the definition in ASC 350, we first looked to our operating segments in order to identify our reporting units. As discussed elsewhere in this comment letter response, we have identified our operating segments as Drilling & Subsea (“D&S”) and Production & Infrastructure (“P&I”). Please see our response to comment #39 for discussion on our operating segments. After identifying our operating segments, we then assessed the guidance in ASC 350-20-35-34, which states that “A component of an operating segment is a reporting unit if the component constitutes a business for which discrete financial information is available and segment management…regularly reviews the operating results of that component.”

Securities and Exchange Commission

October 21, 2011

Page 25

Our components, which are one level below our operating segments, are as follows:

The components within the Drilling & Subsea operating segment are:

(1) Drilling – led by Senior Vice President, Greg Hottle and

(2) Subsea – led by Senior Vice President, Mick Jones

The components within the P&I operating segment are:

(1) Production Equipment – led by Senior Vice President, Ryan Liles and

(2) Valve Solutions – led by President, Steve Twellman

Subsequent to June 30, 2011, due to the changes brought forth by acquisitions in July 2011, the product lines and therefore the components within the two operating segments were revised. The components within the D&S operating segment will be:

(1) Drilling – led by Senior Vice President, Greg Hottle

(2) Subsea – led by Senior Vice President, Mick Jones and

(3) Downhole – led by Senior Vice President, Lyle Williams

The components within the P&I operating segment will be:

(1) Production Equipment – led by Senior Vice President, Ryan Liles

(2) Valve Solutions – led by President, Steve Twellman and

(3) Flow Equipment – led by Senior Vice President, Chris Dorros

Given that discrete financial information is available for each of the components discussed above and because these results are reviewed on a monthly basis by our two segment managers, we have concluded that each component represents a reporting unit for goodwill impairment testing purposes. Please see Schedule B to the Supplemental Letter for examples of what segment management regularly reviews in connection with their management function. Note that the legacy name of Global Flow was still used for the Valve Solutions component, and that the legacy name of Allied Technology was still used for the Production Equipment component.

Securities and Exchange Commission

October 21, 2011

Page 26

38. Based on the disclosure under this note, it is unclear whether operating segments have been aggregated to produce your reportable segments. Revise your disclosure to clarify this. See FASB ASC paragraph 280-10-50-21(a).

Response:

We acknowledge the Staff’s comment and have revised our disclosure to clarify that our operating segments have not been aggregated to produce our reportable segments. Please read page F-52 of Amendment No. 1.

39. Tell us your operating segments and explain how those have been identified. Additionally, tell us whether operating segments have been aggregated to produce your reportable segments. To the extent that operating segments have been aggregated, provide us with a reasonably detailed analysis that supports your conclusion that aggregation is appropriate. As part of your response, identify your chief operating decision maker (CODM) and provide us with a copy of the information the CODM reviews to make resource allocation decisions and assess performance. See FASB ASC paragraphs 280-10-50-1 through 280-10-50-11.

Response:

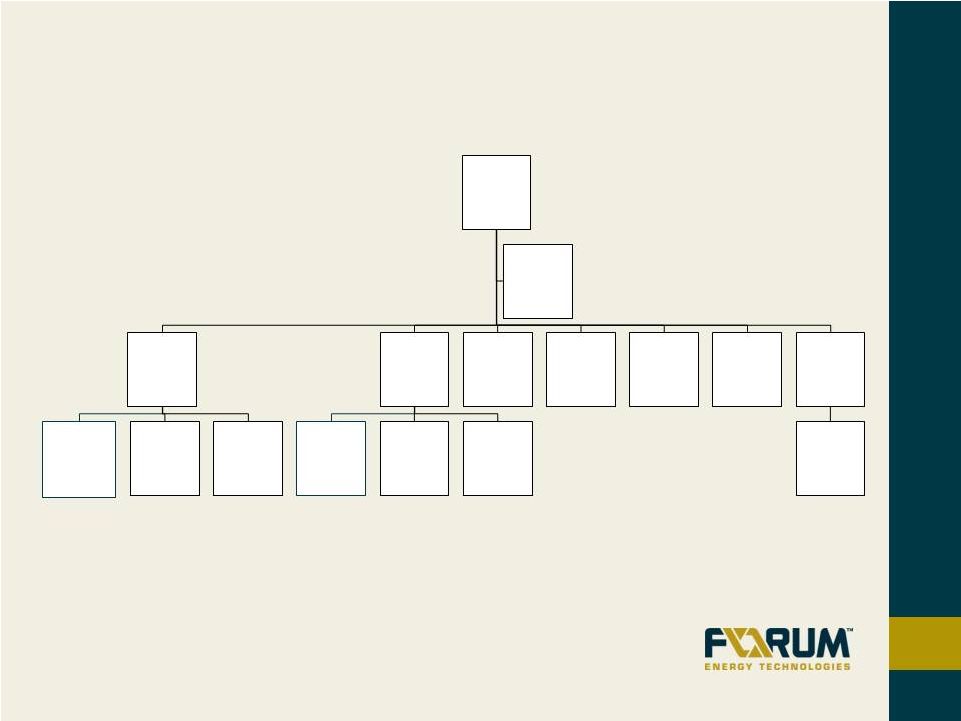

The Company conducts its business in two operating segments, which do not meet the criteria for aggregation under ASC 280-10-50-11. As a result, our operating segments are the same as our reportable segments. Our chief executive officer is the CODM for the Company. Our operating segments are led by Charles Jones, President, Drilling and Subsea (“D&S”) and Wendell Brooks, President, Production and Infrastructure (“P&I”), each of whom has significant experience in managing companies and brings that experience to our management team. See Exhibit A for our organizational structure. Given the depth of experience of our segment Presidents, our CODM focuses on, among other things, the strategic direction of the organization and any necessary resource allocations between our two operating segments. The background of each of our segment Presidents is disclosed in “Management—Executive officers and directors” of the Registration Statement. These two segment Presidents are directly accountable to and maintain regular contact with the CODM to discuss operating activities, financial results, forecasts, or plans for their respective segments. Infrastructure requirements, resource allocations, planning, financial reviews, and budgeting are evaluated at the operating segment level by the segment Presidents. As such, the segment Presidents meet the definition of ASC 280-10-50-7 for segment managers.

The CODM report has been supplied as Schedule C to the Supplemental Letter. The CODM report includes actual operating profitability financial results on a consolidated company-wide basis, for example as evidenced by pages 1 (Comments), 2 (Profit & Loss), 6 (Balance Sheet) and 7 (Cash Flow) of the CODM report. The remainder of the operating results in the CODM report are shown on a pro forma basis (giving effect to our acquisitions as if they had been effective at the beginning of the period), with the exception of a geographic revenue schedule by product line and a historical capital expenditure schedule, both of which are shown on an actual results basis. Based on the fact that the CODM is provided actual operating results only on a consolidated basis, we initially evaluated whether the Company may have only one operating segment. However, upon further consideration, we determined that presenting the Company as a single operating segment does not meet the intent of ASC 280 nor would it provide the most relevant information to the readers of our financial statements. As a result, we believe that our segment disclosure is aligned with our organizational structure, is consistent with the manner in which the CODM manages our business and should be presented with actual (not pro forma) financial data for two operating segments. Therefore, we concluded that the presentation of our segment information that would be consistent with ASC 280 is the “actual” (not pro-forma) financial data for two operating segments –D&S and P&I.

As indicated above, the information in the monthly CODM report is provided primarily on a pro forma basis. While we have presented our segment information the way the CODM assesses the performance of the business and allocates resources, we do not believe pro forma information presented in the CODM report is the information that would be consistent with the intent of ASC 280. As a result, we have disclosed in the financial statements actual operating income and other segment information based on the two operating segments.

Securities and Exchange Commission

October 21, 2011

Page 27

We also took the following factors into consideration in determining our operating segments: (i) our product offering; (ii) the principal geography into which we tend to make sales; and (iii) the types of customers to whom we sell our products and how those sales are made.

Products: The most strategically important products in the D&S segment are highly engineered capital equipment, or products/brands that compete based on the strength of their underlying technology. Examples include the automated and powered tubular handling products in the Drilling Products business, the large work class ROVs, trenchers, or ROVDrill in the Subsea Solutions group, or the proprietary, large bore cementing tools, especially those used offshore, in the Downhole Products business (added to this segment post-June 2011). By contrast, the most strategically important products in the P&I segment tend to require efficient management of supply chains, lean manufacturing practices to produce large quantities of very similar products, and typically compete on the basis of deliveries and inventory management. Examples include high quality tanks, pressure vessels, various types of process valves, and consumable flow iron and associated components.

Geography: The D&S segment is globally focused, with a significant component of their manufacturing base and inventory stocking located outside the United States, and serves end destinations around the world. By contrast, the P&I segment principally serves the United States and parts of Canada, with a core focus on the unconventional shale and tight sand resource plays in the United States. While the valves solutions products within the P&I segment are marketed globally, that effort is largely conducted through distributors.

Customers and Sales Cycle: The D&S segment sells primarily to service companies, such as drilling contractors, and offshore constructions companies, as well as technical sales to oil and gas companies. The P&I segment principally sells to producers (direct and through distribution), while the flow equipment products in the P&I segment are sold to pressure pumping and well testing service companies. While there is some overlap in customer base across our two segments, the principal difference between the segments involves how a sale is most often made. The D&S segments products are primarily technical in nature and are either critical to downhole well construction or capitalized on our customers’ balance sheets. By contrast, a majority of the P&I segment’s sales are to ensure adequate stocking levels for our customers and these products are most often expensed items from our customers’ perspective. The difference between these various types of sales processes involves different approaches and customer interactions.

Securities and Exchange Commission

October 21, 2011

Page 28

Exhibits and Financial Statement Schedules, page II-7

40. Please ensure that all exhibits, as applicable, are executed. For example, and without limitation, it appears that Amendment No. 1 to the Registration Rights Agreement is signed but that the Registration Rights Agreement is not signed.

Response:

We acknowledge the Staff’s comment and respectfully submit that the Registration Rights Agreement, which is attached as Exhibit B to the Amended and Restated Stockholders Agreement (Exhibit 4.2 to the Registration Statement), was not separately executed because it is incorporated by reference into the Amended and Restated Stockholders Agreement and is not intended to be a separately executed document. We have reviewed each of the exhibits filed with the Registration Statement and have confirmed that all other exhibits, as applicable, are executed.

Please direct any questions that you have with respect to the foregoing or with respect to the Registration Statement or Amendment No. 1 to W. Matthew Strock at Vinson & Elkins L.L.P. at (713) 758-3452.

| Very truly yours, | ||

| FORUM ENERGY TECHNOLOGIES, INC. | ||

| By: | /s/ James L. McCulloch | |

| James L. McCulloch | ||

| Senior Vice President, General Counsel and Secretary | ||

Enclosures

| cc: | Sirimal Mukerjee, Securities and Exchange Commission |

W. Matthew Strock, Vinson & Elkins L.L.P.

J. David Kirkland, Jr., Baker Botts L.L.P.

Tull R. Florey, Baker Botts L.L.P.

Documentation Provided Supplementally with the Response Letter with Amendment No. 1 to the Registration Statement on October 21, 2011

| EXHIBIT A: Supplemental Documentation for Comment #39 |

Organization Structure Chart |

EXHIBIT A

Supplemental Documentation for Comment #39

Organization Structure Chart

Organizational

Chart

–

CEO

&

COB

(October

2011)

Cris Gaut

CEO & COB

Renee Tuttle

Executive

Assistant

Charles Jones

President

Drilling and

Subsea

Wendell Brooks

President

Production and

Infrastructure

Jim McCulloch

Senior Vice

President and

General Counsel

James Harris

Senior Vice

President and

CFO

Vice President

Corporate

Development

[OPEN]

Michael Danford

Vice President

Human

Resources

Donna Smith

Director of

Corporate

Marketing and

Communications

Greg Hottle

Senior Vice

President

Drilling

Mick Jones

Senior Vice

President

SubSea

Lyle Williams

Senior Vice

President

Downhole

Ryan Liles

Senior Vice

President

Production

Equipment

Steve Twellman

President

Valve Solutions

Chris Dorros

Senior Vice

President

Flow Equipment

Patrick

Connelly

Vice President

Strategic

Development |