UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended May 31, 2013.

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from

_to

.

Commission file number: 000-52784

ABAKAN INC.

(Exact name of registrant as specified in its charter)

Nevada

98-0507522

(State or other jurisdiction of

(I.R.S. Employer

incorporation or organization)

Identification No.)

2665 S. Bayshore Drive, Suite 450, Miami, Florida 33133

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (786) 206-5368

Securities registered under Section 12(b) of the Act: None.

Securities registered under Section 12(g) of the Act: common stock (title of class), $0.0001 par value.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such

reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every

Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter)

during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not

contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule

12b-2 of the Exchange Act. Accelerated filer þ

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No þ

The aggregate market value of the registrant’s common stock, $0.0001 par value (the only class of voting stock), held by non-

affiliates (41,554,855 shares) was $106,588,203 based on the average of the bid and ask price ($2.565) for the common stock on

August 27, 2013.

At August 29, 2013, the number of shares outstanding of the registrant’s common stock, $0.0001 par value (the only class of

voting stock), was 64,284,855.

1

TABLE OF CONTENTS

PART I

Business

3

Item 1A. Risk Factors

27

Item 1B. Unresolved Staff Comments

31

Properties

31

Legal Proceedings

32

Mine Safety Disclosure

32

PART II

Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of

33

Equity Securities

Selected Financial Data

38

Management's Discussion and Analysis of Financial Condition and Results of Operations

39

Item 7A. Quantitative and Qualitative Disclosures about Market Risk

46

Financial Statements and Supplementary Data

47

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

48

Controls and Procedures

48

Item 9B. Other Information

49

PART III

Directors, Executive Officers, and Corporate Governance

50

Executive Compensation

58

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder

62

Matters

Certain Relationships and Related Transactions, and Director Independence

63

Principal Accountant Fees and Services

64

PART IV

Exhibits, Financial Statement Schedules

65

66

2

As used herein the terms “Company,” “we,” “our,” and “us” refer to Abakan Inc. unless context

indicates otherwise.

ITEM 1.

Corporate History

The Company was incorporated in the State of Nevada on June 27, 2006 under the name “Your Digital

Memories Inc.”

Waste to Energy Group Inc., a wholly-owned subsidiary of the Company, was incorporated in the State

of Nevada on August 13, 2008. Waste to Energy Group Inc., and the Company entered into an

Agreement and Plan of Merger on August 14, 2008. The board of directors of Waste to Energy Group

Inc. and that of the Company deemed it advisable in the best interests of their respective shareholders

that Waste to Energy Inc. be merged into the Company with the Company being the surviving entity as

“Waste to Energy Group Inc.”

Abakan Inc., a wholly-owned subsidiary of the Company, was incorporated in the state of Nevada on

November 6, 2009. Abakan Inc. and the Company entered into an Agreement and Plan of Merger on

November 6, 2009. The board of directors of Abakan Inc. and that of the Company deemed it advisable

in the best interests of their respective shareholders that Abakan Inc. be merged into the Company with

the Company being the surviving entity as “Abakan Inc.”

We are a development stage company.

Our corporate office is located at 2665 S. Bayshore Drive, Suite 450, Miami, Florida, 33133 and our

telephone number is (786) 206-5368. Our registered agent is EastBiz.com, Inc., located at 5348 Vegas

Drive, Las Vegas, Nevada, 89108, and their telephone number is (702) 871-8678.

Our common stock is quoted on the OTCQB electronic quotation system under the symbol “ABKI”.

The Company

The Company designs, develops, manufactures, and markets advanced nanocomposite materials,

innovative fabricated metal products, highly engineered metal composites, and engineered

reactive materials for applications in the oil and gas, petrochemical, mining, aerospace and defense,

energy, infrastructure and processing industries. Our technology portfolio currently includes high-speed,

large-area metal cladding technology, long-life nanocomposite anti-corrosion and-wear coating

materials, high-strength, lightweight metal composites, and energetic materials. Operations are

conducted through our subsidiary, MesoCoat, Inc. (“MesoCoat”) and our affiliate, Powdermet, Inc.

(“Powdermet”).

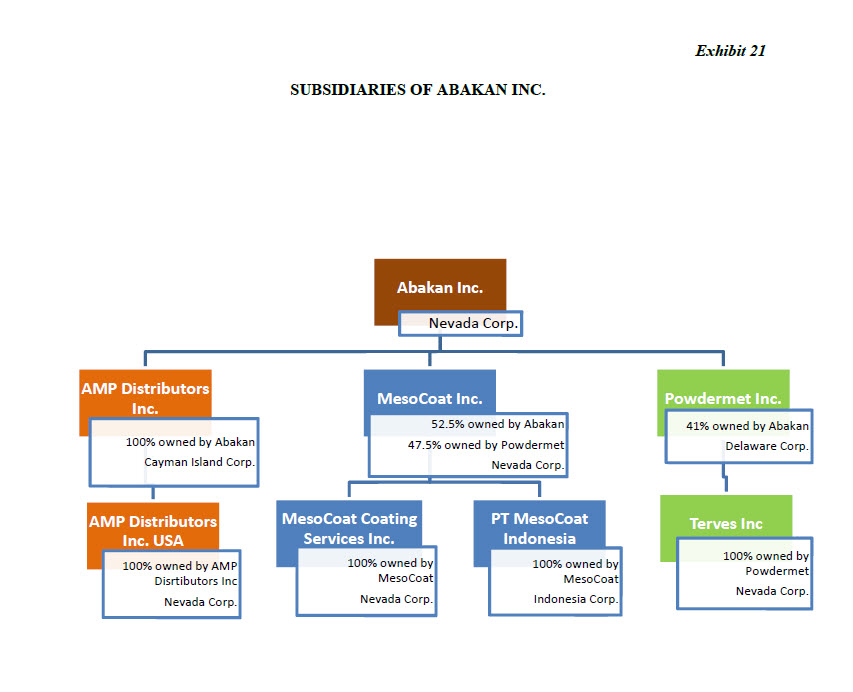

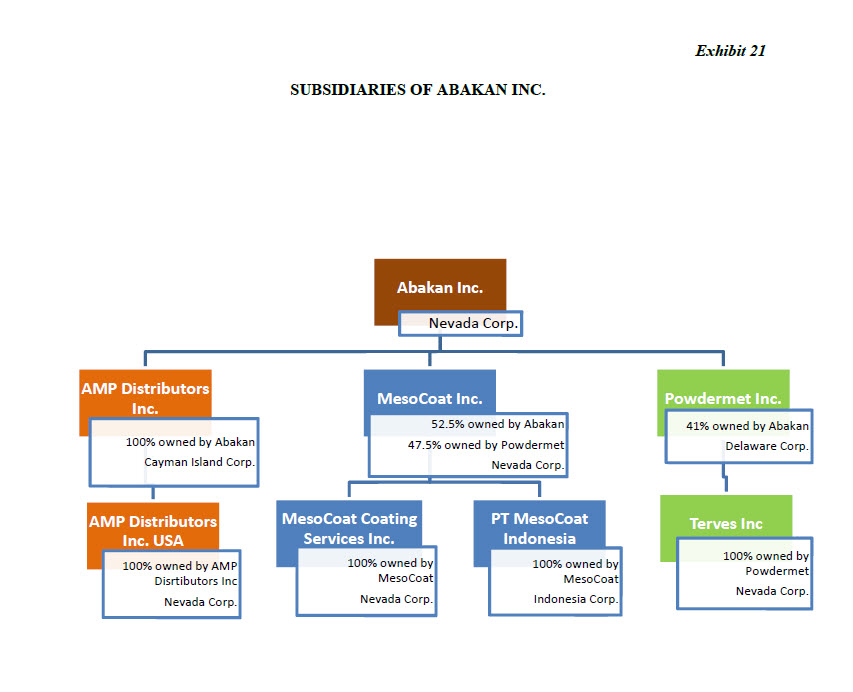

The Company holds a 52.5% controlling interest in MesoCoat and a 41% non-controlling interest in

Powdermet. Powdermet directly owns the remaining 47.5% of MesoCoat. The Company’s interest in

Powdermet represents an additional 19.5% indirect interest in MesoCoat. The combined direct and

indirect interest equals a total 72.0% ownership of MesoCoat by the Company.

3

MesoCoat, Inc.

On December 11, 2009, the Company executed an Investment Agreement, dated December 9, 2009, with

MesoCoat and Powdermet in order to purchase 79,334 newly issued MesoCoat shares, equal to a fully

diluted 34% equity interest in MesoCoat for $1,400,030. Prior to the Investment Agreement, MesoCoat

was owned 100% by Powdermet. Powdermet was owned 52% by Andrew Sherman, 41% by

Kennametal, Inc. (an unrelated company) and 7% by other unrelated parties. Andrew Sherman was the

CEO and director of both MesoCoat and Powdermet and became a director of the Company on August

20, 2010.

On March 21, 2011, the Company purchased 596,813 shares of Powdermet from Kennametal equal to a

41% interest in Powdermet.

On July 11, 2011 the Company placed MesoCoat and Powdermet on notice of its intent to complete the

purchase of an additional equity interest in MesoCoat in accordance with the Investment Agreement. The

Company completed the purchase of 86,156 newly issued shares, equal to a fully diluted 18.5% equity

interest for $2,800,000 on July 13, 2011 thereby increasing its direct ownership of MesoCoat to a fully

diluted 52.5% interest.

The Investment Agreement, as amended, provides us with additional options to increase our equity

interest in MesoCoat, as follows:

§ An option which entitles the Company to purchase an additional 24% equity interest in exchange

for $16,000,000, of which approximately $4,000,000 has been provided to MesoCoat as of May

31, 2013. The exercise of this option would increase the Company’s direct holdings to a fully

diluted 75% of MesoCoat and entitle the Company’s management to appoint a fourth member to

MesoCoat’s five person board of directors (the Company currently has a right to appoint three of

MesoCoat’s directors, one of which must be independent).

§ An option which entitles minority shareholders of MesoCoat, for a period of 12 months after the

exercise of the option detailed above, to cause the Company to pay an aggregate amount of

$14,600,000, payable in shares of the Company’s common stock or a combination of cash and

shares, in exchange for all remaining outstanding shares of MesoCoat.

MesoCoat’s Business

MesoCoat is an Ohio based materials science company intending to become a technology leader in metal

protection and repair based on its metal coating and metal cladding technologies designed to address

specific industry needs related to conventional oil and gas, oil sands, mining, aerospace, defense,

infrastructure, and shipbuilding. The company was originally formed as a wholly owned subsidiary of

Powdermet, known as Powdermet Coating Technologies, Inc., to focus on the further development and

commercialization of Powdermet’s nanocomposite coatings technologies. The company was renamed as

MesoCoat in March of 2008. Thereafter, in July of 2008, the coatings and cladding assets of Powdermet

were conveyed to MesoCoat through an asset transfer, an IP license and technology transfer, and a

manufacturing support agreement.

4

MesoCoat has exclusively licensed and developed a proprietary metal cladding application process as

well as advanced nano-composite coating materials that combine corrosion and wear resistant alloys, and

nano-engineered cermet materials with proprietary high-speed coating or cladding application systems.

The result is protective cladding solutions that will be offered on a competitive basis with existing market

solutions. The coating materials unite high strength, hardness, fracture toughness, and a low coefficient of

friction into one product structure. Ten of MesoCoat’s products (3 Corrosion Resistant Alloy (CRA)

materials (625,825, 316L), 3 Wear Resistant Alloy (WRA) material. (Tungsten Carbide (WC), Chrome

Carbide (CRC), Structurally Amorphous Metal (SAM) Alloys) and 3 PComP™ product families

(PComP™T, PComP™ S and PComP™ M) are currently undergoing extensive testing by oil and gas

majors, pipe manufacturers, oil field equipment manufacturing and service companies, original equipment

manufacturers (OEMs) and other end users.

MesoCoat’s commercial revenues are comprised of sales of the PComP™ powder and thermal spray

applications. The company also generates revenue from grants that are awarded to further the

development of various products. PComP™ is a family of nanocomposite cermet coating materials that

are used to impart wear and corrosion resistance, and to restore dimensions, of worn metal components.

CermaCladTM clad products are in the development and qualification stage and are nearing

commercialization, including the cladding of the inside of a full length pipe for the oil and gas industries.

MesoCoat has expanded its technical team to complete the various developments and is working towards

the expansion of the PComP™ powder and coating services.

PComP™

PComP™ is a family of nanocomposite cermet coating materials that are used to impart wear and

corrosion resistance and to restore dimensions of worn metal components. Named for its particulate

composite powders, PComP™, is the result of over a decade of nanoengineered materials development,

and is now one of the few commercially viable industry replacement solutions for hard chrome and

carbides.

PComP™ competes against thermally sprayed carbide and other coatings such as chrome and nickel

plating in the $32 billion dollar (source, BCC Inc.) inorganic metal finishing market. Competing

materials like hexavalent chrome, carbides and tungsten carbide-cobalt have become a major concern for

industrial producers in the metal finishing industry since these materials are on the EPA’s hazardous

materials watch list and are legally banned in many countries. While businesses grapple with the need to

transition away from these harmful products, they continue to spend billions on these materials despite the

harm done to the environment. The adoption of green products and processes such as PComP™ thermal

spray coatings would place the business at a competitive advantage over destructive solutions while at the

same time mitigating environmental liabilities. PComP™ thermal spray coatings comprise a performance

leading solution platform which has shown order of magnitude improvements in head to head wear and

corrosion performance tests while offering a significantly better value proposition over other hard chrome

alternatives.

5

Under the PComP™ platform, MesoCoat has developed and patented a family of corrosion resistant and

wear resistant coating solutions that combine extreme corrosion and/ or wear resistance, fracture

toughness (resiliency), and a low friction coefficient all in one product. In conventional materials science

toughness normally decreases as hardness and wear resistance increases. However, by combining nano-

level structure control and advanced ductile phase toughening materials science, MesoCoat has developed

a material structure that can be both very tough and very wear resistant (hard). Equally important, the

hardness of a wear coating normally limits the ease with which it can be machined. The unique

hierarchical structure of the PComP™ coating solutions results in a coating that can be machined through

a finish grinder much faster than a product with a traditional carbide coating which needs to be diamond

ground. The speed of coating application and final machining results in higher productivity and lower

costs in metal finishing operations.

The unique nano-structure of the PComP™ coatings produces a coating that is self-smoothing in service,

resulting in friction properties approaching those of diamond-like carbon films and solid lubricants, with

the ability to be used structurally and applied to large components at a fraction of the cost of coatings

such as diamond-like carbon. This low friction property reduces wear, and improves energy efficiency

and life in sliding components such as drilling rotors, plungers, mandrels, ball and gate valves, rotating

and sliding seals, and metal processing equipment.

The PComP™ product platform, combined with metal finishing applications of the large area weld

overlay technologies underlying the CermaClad™ clad steel product family provides a high degree of

product differentiation and a sustainable competitive advantage, which includes OEM components and

the maintenance, repair, and overhaul of industrial assets and machinery in the “components

manufacturing and repair” segment of MesoCoat’s business (as opposed to the clad steel business lines

discussed under the CermaClad™ product line below).

MesoCoat is completing expansion of its production capacity for PComP™ powders from 3 tons to 18

tons/year, to meet initial demand from current customers and intends to further expand the PComP™

production capacity from 18 tons to 180 tons/year to serve the expected demand of prospective customers.

The process of installing the equipment necessary to meet this objective is underway in MesoCoat’s

Euclid, Ohio plant.

MesoCoat now has a 1-cell thermal spray coating facility operational in Ohio for coating mid-sized

components that has been used for qualifying coatings with early adopters. The plan is to expand this

capacity to set-up two additional thermal spray coating cells and other pre- and post-finishing equipment

to provide full coating service for large components like mandrels, plungers, valves, rods, stabilizer rolls,

mine truck wheels and other equipment. MesoCoat’s wholly-owned subsidiary MesoCoat Coating

Services, Inc. was formed in June 2013 to extract maximum value from the PComP™ family by offering

high margin coating services starting late 2013.

6

MesoCoat is currently selling PComP™ advance coating materials through different channels that are

appropriate to the specific market. Large OEM’s and government agencies like the U.S. Air Force procure

raw powders and apply them for their specific products under license as such agencies are vertically

integrated to perform their own thermal spray and coating applications using dedicated maintenance and

repair depots. Recently, several defense organizations have been given congressional mandates to make

better use of their existing equipment (planes, helicopters, jets, tanks and other armored vehicles, etc.) as

budgets for the purchase of new equipment is to be limited over the next few years. MesoCoat’s low-cost,

long-life coating materials appeal to government buyers striving to meet budgetary restrictions.

An effort to expand geographically the market for our coating services is now underway. MesoCoat is

actively qualifying licensed application partners that have an existing customer base, in certain territories

(Houston, Alberta, and Los Angeles), to provide coating services in territories in which it is not currently

able to service directly. We believe that this strategy is the fastest way to gain market entry into these

territories, while supporting economies of scale for the powder production needed to meet product cost

targets. Eventually, we expect that the majority of MesoCoat’s commercial sector accounts will be able

to order coating application services from it on a regional basis.

The PComP™ family of nanocomposite coatings currently consists of five products, not including

variation in composition, all of which have shown in testing by third parties to provide better wear,

corrosion and mechanical properties at a lower life cycle cost than these, and several other alternatives are

as follows:

Wear and Corrosion Resistance and Dimensional Restoration

PComP™ T is a titanium carbo-nitride based high corrosion/wear resistant, low friction high velocity

oxygen fuel (HVOF) coating that competes with hard chrome and diamond like carbon PVD (physical

vapor deposition) alternatives for hydraulic cylinders, piston rings, bearings, rotating shafts, and valve

components where low stick-slip, corrosion, and modest wear resistance are required. PComP™ provides

both wear and corrosion resistance (unlike chrome), and significantly reduces environmental safety and

health liabilities. Furthermore, in many applications, thermal spray coatings such as PComP™ provide

life multiples over chrome (80 times in cylinder liner application in testing reported by Caterpillar).

Lower coefficient of friction protects seals from premature wear and reduces energy consumption in

rotating components through lower friction losses, and the lower coating stresses and higher toughness

enable thicker coatings to be applied than chrome or other alternatives, meaning component life can be

extended through enabling additional repair cycles. PComP™ T-HT has significantly higher build-up

rates than that of carbides, and grinding and finishing can be done faster and cheaper with conventional

grinding techniques compared to the expensive diamond finishing process used for competing carbide

coatings.

PComP™ S is a silicon-nitride based hard chrome replacement solution for aerospace applications that

exhibits high toughness, wear resistance and displays increased spallation resistance. PComP™ S also has

the lowest density of any chrome alternative, enabling significant fuel savings to be realized in

transportation markets.

7

PComP™ W is MesoCoat’s “nano-engineered” tungsten carbide coating solution that offers industry

leading toughness and wear resistance for thermal spray coatings, making it better for critical high wear

applications such as gate valves and downhole drilling tools. PComP™ W replaces conventional tungsten

carbide cobalt in the thermal spray industry and provides increased wear resistance, design allowable

(stress levels), and reduced friction in abrasive wear applications, with higher toughness and impact

resistance than ceramic alternatives such as alumina-titania. PComP™ W is also significantly more robust

and lower cost than competing detonation gun and alternate coatings, achieving excellent results with

much higher throughput and lower operating cost equipment such as standard HVOF guns.

Liquid Metal Corrosion

PComP™ -M is a hierarchically structured molybdenum boride coating designed for use in liquid metal

corrosion application, especially the rolls used in galvanizing baths. PComP™ -MB has completed

laboratory and initial field testing with several end users, such as CAL-steel, confirming internal results

showing more than two and one half times the life of other developmental coatings in galvanizing lines,

and ten times the resistance of widely used tungsten carbide (“WC”) coatings to molten metal erosion and

wear. MesoCoat is introducing its PComP™ -MB product line into the $150+ million primary metals

production equipment coatings market, with an initial focus on zinc pot stabilizer roll and pot bearing roll

refurbishment market in conjunction with MesoCoat’s market entry into the coating services market.

Thermal Barrier Coatings

ZComP™ is MesoCoat’s nanocomposite thermal barrier coatings that offers 50% lower thermal

conductivity, with improved toughness and cyclic thermal life compared to conventional thermal barrier

coatings in the $500 million thermal barrier coatings market. MesoCoat has been actively forming

partnerships to introduce ZComP materials into the turbine engine market, and is working with its

Powdermet affiliate under completed or in-progress contracts with the Department of Energy for power

turbines, the Air Force (Oklahoma Air Logistics Center), the Ohio Aerospace Institute (OAI), General

Dynamics Information Systems, and under a Space Act agreement with NASA for propulsion turbine

applications of engineered nanocomposite thermal barrier coatings.

CermaClad™

CermaClad™ is a multiple award winning technology used to produce coatings that protect metal,

primarily carbon steel, from wear and corrosion, that offers the benefits of corrosion resistant alloys such

as stainless steel, nickel, or titanium and wear resistant alloys such as tungsten carbide and chrome

carbide at a significantly lower cost by permanently altering, or cladding, the surface of a high strength,

low cost carbon steel with a layer of a much higher cost wear or corrosion resistant alloy. The result is a

hybrid product offering the wear and corrosion performance of costly alloys with the ease of fabrication

and the lower cost of traditional steel material.

8

Cladding refers to the process where a high performance wear or corrosion resistant metal alloy or

composite (the cladding material) is applied through the use of high pressure and/ or high temperature

processes onto another dissimilar metal (the base metal or substrate) to enhance its durability, strength or

appearance. The majority of clad products produced today use carbon steel as the substrate and nickel

alloys, stainless steel, or various hard materials such as chrome carbides as the clad layer to protect that

underlying steel base metal from the environment it resides in. MesoCoat is utilizing a unique, patented,

“High Density Infrared” or HDIR technology, exclusively licensed from Oak Ridge National Laboratory

(“ORNL”) to produce clad steel. Testing by ORNL has shown that this HDIR technology is capable of

applying a very high quality cladding at 10 to 40 times higher productivity (100’s of Kg’s versus 3-

20Kg/hr) than traditional laser bead or weld cladding techniques, in current wide commercial use.

MesoCoat believes that this HDIR process represents the first truly scalable, large area cladding

technology. Scalable, low capital cost cladding technology then enables the production of large volumes

of customized, premium, high margin clad steel products.

CermaClad™ clad steel is a premier, metallurgically bonded, clad carbon steel materials solution that is

optimized to manage the risks and consequences of wear and corrosion damage and the failure of large

assets including oil and gas risers and flowlines, refinery/chemical processing towers and transfer lines,

power plant heat exchanger tubes, and other steel infrastructure. In corrosive environments, including

seawater, road salt, mining slurry transport lines, unprocessed oil containing water, sulphides and carbon

dioxide, chemical processing and transportation equipment, metals production, and other large industrial

applications, asset owners and operators either need to continually maintain and replace major assets, or

fabricate these assets using expensive, corrosion resistant alloy (CRA) materials, which substantially

increase capital costs. Clad steel, and CermaClad™ in particular, offer a competing, lower cost solution

to these exotic alloys, allowing the owner or operator to use clad carbon steel which typically costs about

half of solid CRA. Combining the reduced material cost with reduced fabrication, installation, and

maintenance costs, cladding solutions such as CermaClad™ are estimated to save up to 75% over the cost

of using solid alloys, while still providing essentially maintenance free corrosion lifetimes equal to the life

of the asset. In the last 20 years, clad steel pipe has gained wide acceptance and continually increased its

market share in oil and gas exploration and production, marine transportation, mining, petrochemical

processing and refining, nuclear, paper and pulp, desalination, and power generation industries. The oil

and gas industry is the largest consumer of clad steel products. In order to meet growing global energy

demands, oil companies continue to extend their offshore drilling efforts into deeper waters farther from

shore. The higher temperatures and corrosivity (carbon dioxide, sea water, and hydrogen sulfide content)

of these new reserves are resulting in a significantly increased use of corrosion resistant alloys - and there

lower-cost clad steel alternatives.

Currently used cladding processes include weld overlay, roll-bonding, co-extrusion, explosion cladding,

and mechanical lining. While cladding carbon steel pipes is cheaper than using a solid stainless steel

alloy, current production technologies still have significant limitations which CermaClad is believed to

overcome. Directly comparable Metallurgical clad pipes are primarily manufactured using roll-bonded

clad plate which is then bent and welded to form a pipe. Though a higher productivity process, Roll-

bonded pipe involves a lot of welded area and the failure of that weld is the single most common reason

for pipeline leaks. Furthermore, current bimetal rolling mills are limited to around 5ft in width by 40ft in

length, limiting the size of pipe that can be fabricated without extensive welds. Expanding roll mill size

to enable the production of larger diameter pipe needed for large gas projects in Southeast Asia would

require very large investments, estimated to be in excess of a $1billion compared to a planned $40M

investment in an 8-line CermaClad™ large diameter pipe production facility expected to be constructed

on Bantam Island, Indonesia.

9

Mechanically lined (bi-metal) pipe now makes up a significant portion of the clad pipe market. Bimetal

pipe is lower in cost than metallurgically clad pipe, but provides only a mechanical attachment between

the inner and outer pipe. This reduced bonding results in a higher risk of buckling, wrinkling and

disbonding when under stress, such as during bending, reeling, or application of external coatings on

these pipes. Mechanically lined pipes also raise concerns with respect to uniformity and reliability in that

the gap between the inner and outer pipes, coupled with the mixture of materials, leads to challenges in

NDT (non-destructive testing) inspections. Co-extrusion is another process that involves extruding a

bimetal billet into a clad pipe. Co-extrusion has not been successful in producing long lengths of larger

diameter pipes, and would require significant capital investment and further technology development to

meet growing demand for the thicker wall and larger diameter clad pipes that CermaClad™ is targeted.

The remaining production process, weld overlay, does not have the productivity needed to meet clad pipe

demand, and is primarily used for smaller diameter and complex shapes, such as manifolds and

“Christmas tree’s” used in oil and gas, although weld overlay is a dominant technology for wear resistant

overlays that cannot be produced by the other techniques.

Worldwide, there is a large and growing need for clad pipes as deeper and hotter, corrosive reserves come

into production. Current production methods not only have the above limitations, but plants are

operating at capacity, creating an increasing tight supply and lead-times of 2 years or more to delivery. A

number of organizations have stated that the market for clad pipe is expected to grow from $1.5 billion to

$2 billion per year currently, to $4 billion to $8 billion within 3 to 4 years.

CermaClad™ clad steel utilizes MesoCoat’s proprietary cladding process based on the use of a high-

intensity arc lamp to rapidly melt, fuse, and metallurgically bond (make inseparable) the protective,

proprietary cladding materials onto steel pipes and tubes (internal and external surfaces), plates, sheets,

and bars. The CermaClad™ clad steel product portfolio combines this high-speed fusion cladding process

with proprietary corrosion resistant alloy (“CRA”) and wear resistant alloy (“WR”) coating materials

which incorporate patented microstructural and compositional modifications. The HDIR process melts

and fuses material onto the inside of a pipe within seconds to produce the CermaClad product that offers a

seamless metallurgical bond, a smooth surface, low porosity, and minimal dilution of the overlay, along

with good strength retention of the substrate . More importantly, CermaClad™ clad pipe is easier to

inspect and install (reel) irrespective of the size and thickness of the pipe compared to current alternatives.

Today, clad steel is a specialized, profitable segment of the steel industry where demand has outstripped

supply and margins are high as a result. Management believes that the CermaClad™ process is scalable

to large volumes with a modest capital investment that is lower than that invested in existing production

methods.

Historically, the typical contract for clad pipe was for 3 to 5 kilometers of product with larger contracts

for 20 to 30 kilometres of product. Currently, typical requirements are for tens of kilometres with growing

numbers of projects needing hundreds of kilometres per project. As a result the clad pipe market is

growing rapidly and the limitations of current solutions in terms of installation, inspectability, quality, and

availability are restraining this growth. Full commercialization of CermaClad™ clad pipes can address

these constrains to clad pipe market growth.

Management believes the competitive advantages of CermaClad™ over current competing technologies

and products are:

§ CermaClad™ and other clad steel products are typically used where they are offered at a 25% to

more than 50% lower cost than solid alloy products.

10

§ CermaClad™ clad steel provides a metallurgically bonded overlay, making the clad pipes easier

to inspect, bend, reel, and install compared to the widely used and slightly lower cost

mechanically bonded clad pipes.

§ CermaClad™ clad steel offers a seamless metallurgical cladding requiring only girth welds,

unlike the pipes made from metallurgically clad plates which have longitudinal welds

§ CermaClad™ application technology utilizes a 30cm wide, high density, infrared “lamp”

compared to a 0.7 cm wide laser “torch” for laser or inert gas welding torches, resulting in

application rates between one and two orders of magnitude higher than current weld overlay

technologies.

§ The proprietary process used to make CermaClad™ clad steel products is more flexible (it can do

both wear and corrosion resistant alloys, for example), and has relatively low capital costs for

initial and added capacity. This provides the advantage of being able to respond to customer

needs, such as meeting local content requirements, faster and with less investment risk than

currently established alternatives.

§ CermaClad™ products exceed the requirements of the defining API 5LD and DNV OS F101

standard requirements for clad pipe.

§ CermaClad™ offers a smoother surface, minimal dilution, greater flexibility in materials, and the

ability to do thinner, lower cost claddings than current production technologies.

The CermaClad™ clad steel product lines under development include:

§ CermaClad™ CRA (Corrosion Resistant Alloys). 1-4mm thick CRA clad steel that offers a lower

cost alternative to solid nickel, stainless steel, and titanium alloys for oil and gas, mining,

desalination, pulp and paper, and chemical process.

§ CermaClad™ WR (Wear Resistant). 1-15mm thick carbide, metal matrix composite, structurally

amorphous metal, and nanocomposite wear resistant clad steel that extends the life of steel

structures such as hydrotransport slurry lines, pump components, valve components, spools, T’s,

and elbows for oil sands, heavy oil, mining and mineral processing.

§ CermaClad™ HT (High Temperature). Steel clad with nickel-chromium and metal-chromium-

aluminum alloys for high temperature applications such as heat exchanger tubing, boiler

waterwalls, and other energy production components offering greater compositional control

(higher performance) and lower cost than solid alloys or traditional weld overlays.

§ CermaClad™ LT (Low Thickness). Lower cost thin-clad steel that exploits the unique high purity

capabilities of the HDIR application process to provide thin (less than 0.5mm) claddings that

provide 50-200 year corrosion free life in atmospheric and seawater corrosion environments.

This “stainless steel paint” is applicable to the outside diameter transportation pipelines, marine

structures, fuel and cargo tanks, bridges, architectural steel, and transportation structures.

Product Development Timeline

MesoCoat’s PComP™-W high performance materials are now established with initial customers and

adoption is expected to increase through qualified regional application partners, with capacity being

expanded to match growing demand. PComP™-T best-value chrome plating products are still in

qualification and limited to beta release though coating applicators have been partnered with an original

equipment manufacturer. A six fold capacity expansion and the introduction of higher value application

(component) services is underway to be completed in the second half of 2013. The CermaClad™

corrosion resistant (CRA) product is expected to enter the market in the fourth quarter of 2013.

11

PRODUCT

COMMERCIAL TIMELINE

TIME

(MONTHS)

PComP™ W

Growth and expansion

Current

PComP™ T

Partner sales

Current

PComP™ M

Market entry

2

PComP™ S

Qualification

12

ZComP™

Development

24

CermaClad™ WR

Development

14

CermaClad™ LT

Development

24

ZComP™

Development

24

CermaClad™ HT

Incubation

36

Product Commercial Expansion Timeline

Our near term plan is to expand the presence of our products into Brazil and the Asia-Pacific market. We

remain in the process of negotiating the terms of a “build to suit” agreement to construct a manufacturing

plant in the Recife, Brazil free trade zone that might give us direct access to Brazilian markets.

Meanwhile, we have incorporated an Asian operating subsidiary, PT MesoCoat Indonesia, which is

currently negotiating the terms of a “build-to-suit” agreement to construct a manufacturing plant on the

island of Batam, Indonesia. The expected time-frame for the completion of each project has not yet been

finalized.

PRODUCT

COMMERCIAL EXPANSION

TIME

TIMELINE

(MONTHS)

PComP™ Coating Services Market entry

3

CermaClad™ CRA

Market entry

4

License agreement with Powdermet, Inc.

On July 22, 2008, MesoCoat entered into a license agreement with Powdermet. The agreement gives

MesoCoat a royalty-free, exclusive, perpetual license to PComP™ intellectual property, certain

equipment, and contracts and business lists, including seven supporting patents, the trademark, and

supporting confidential and trade secret information, including formulations, processes, customer lists and

contracts, for all Powdermet technologies in the field of wear and corrosion resistant coatings. MesoCoat

was at the time of licensing a wholly owned subsidiary of Powdermet, and Powdermet currently retains a

47.50% ownership position in MesoCoat. The agreement also includes Powdermet’s commitment to

provide manufacturing expertise and technical capabilities supporting PComP™ powders on a priority

basis. Powdermet retains the exclusive manufacturing rights for producing the first 50 tons of PComP™

powders. The license agreement will end upon the last valid claim of licensed patents to expire unless

terminated earlier with the terms of the agreement.

12

MesoCoat's exclusivity agreement with Mattson Technology, Inc.

On April 7, 2011, MesoCoat and Mattson Technology Inc. (“Mattson”) entered into an Exclusivity

Agreement whereby MesoCoat agreed to exclusively purchase, and Mattson agreed to exclusively supply,

plasma arc lamps systems. The Exclusivity Agreement contemplated that the MesoCoat and Mattson

would enter into a separate supply agreement that fixed additional terms of the sale and purchase of the

plasma arc lamps. Mattson has to date failed to enter into a supply agreement with MesoCoat and has

been noticed to be in breach of the terms of the Exclusivity Agreement and related purchase orders.

Mattson has committed to rectify the problems outlined in MesoCoat’s breach letter.

MesoCoat’s exclusive patent license agreement with UT-Battelle LLC.

MesoCoat has obtained a two stage, exclusive license from UT-Battelle, LLC to utilize two patents in its

processes to develop products for wear and corrosion applications. The initial non-commercial exclusive

license was entered into on September 22, 2009, which enabled MesoCoat to conduct development work

to prove out the technology within the field of use. The second stage of the agreement comprises a

commercial exclusive license, executed on March 7, 2011, that permits MesoCoat to conduct commercial

sales utilizing the licensed process and technology. The license is valid through the expiration of the last

patent in 2024 and required that MesoCoat invest in additional research and development of the

technology and the market for products that stem from the technology by committing to a certain level of

personnel hours and $350,000 in expenditures. MesoCoat has met the aforesaid conditions of the license

agreement.

Stage I and II license fees of $50,000 have been paid against the agreement and a royalty of $15,000 or

2.5% of revenues generated in the United States that utilize the technology, minus allowable costs as

defined by contract, whichever is greater, are due March 31 on an annual basis beginning after the first

commercial sale. For the first calendar year after the achievement of a certain milestone and the following

two calendar years during the term of the agreement, MesoCoat is obligated to pay a minimum annual

royalty payment of $10,000, $15,000 and $20,000 respectively.

Cooperation agreement with Petroleo Brasileiro S.A

MesoCoat entered into a Cooperation Agreement dated January 7, 2011, with Petroleo Brasileiro S.A

(“Petrobras”) for the purpose of carrying out development work and conducting validation tests in

connection with applying the CermaClad™ process to coating the internal surfaces of pipes for use in the

oil and gas industry. The term of the Cooperation Agreement was initially for 18 months during which

MesoCoat, with the assistance of Petrobras, carried out development work and a series of tests divided

into two phases with the prospect of a third phase. Phase I was a feasibility demonstration designed to

verify that the CermaClad™ process and resultant materials were compliant with industry standards and

acceptable for clad pipe use. Phase II was the development of a prototype pipe cladding facility that could

clad the inner surface of a 10 inch diameter pipe, and then verify that the CermaClad™ process as applied

to prototype pipes was suitable for application to line pipe in accordance with current industry standards.

The prospective third phase would be to finalize the design and construction of a clad pipe manufacturing

facility in Brazil with the capacity of producing cladding on the interior diameter of pipes and tubes with

section lengths of 12 meters.

13

The immediate objective of the Cooperation Agreement, subject to obtaining successful results, in each of

Phase I and II, is that the CermaClad™ product and samples meet the American Petroleum Institute

(API) 5LD and Det Norte Veritas (DNV) OS F101 standard requirements. API and DNV approvals

would, assuming the completion of a suitable manufacturing facility as anticipated by the prospective

third phase, permit MesoCoat’s market entry into the oil and gas industry and cause full scale production

activities.

MesoCoat has successfully completed Phase I of the Cooperation Agreement by demonstrating that the

CermaClad™ process is capable of producing clad steel products that meet API 5LD and DNV OS F101 -

Specifications for CRA clad steel pipe on flat plate coupons.

MesoCoat completed the major objectives of Phase II with the design, fabrication, installation, and initial

operation of a prototype ID cladding system in our Eastlake, Ohio facility, which became operational in

April, 2012. Clad sections of pipe were prepared and tested against API and DNV standards, resulting in

proof of capability that the pipe cladding system could produce sections of clad pipe product compliant

with industry standards. To expand the time available for testing, the development agreement was

extended by six months until January, 2013. The Phase II final report was submitted in November 2012,

including equipment and facility designs and plant layouts for a 4-line Brazilian production facility.

In January of 2013 Petrobras and MesoCoat agreed to a further nine month extension and an expanded

scope of development work to include the addition of thermal modeling and imaging to enhance

instrumentation and other controls of the pipe cladding process, prior to the delivery of clad pipe sections

for qualification testing. This expanded scope was designed to provide defect-free larger sections of clad

pipe, and is part of MesoCoat’s overall manufacturing development program which continues to be

supported by Petrobras internal support. This work has been progressing and MesoCoat expects

completing the expanded program in the 4th quarter of 2013. Results to date from these activities resulted

in improvements to our ability to monitor the thermal “effects” through the use of high temperature

sensors and cameras along with developing and validating simulation software to analyze the results to

support improving the process quality. In addition to supporting prototype development and defect

elimination efforts, the added data generation, imaging, calibration, simulation, and analysis techniques

support the development of quality and manufacturing process control systems necessary to ensure the

highest quality clad products.

Outside of the Cooperative Agreement, but supporting the Phase III manufacturing objectives of the

cooperative agreement, MesoCoat further expanded the scope through the design, procurement,

installation, and ramp up of a full-scale, 12-meter clad pipe manufacturing facility in Euclid, Ohio that is

validating the production, quality, and economics of cladding the inside diameter of 10, 18 & 24 inch

diameter, 12 meter pipe. This facility is part of manufacturing scale-up, verification, and de-bugging of

full scale production equipment, and to support further automation of the cladding process to achieve high

level of process control.

A construction and installation team is being added to work on Phase III for facility design as well the

design and manufacturing of the plant operating equipment.

14

Powdermet

Powdermet’s Business

Powdermet was formed in 1996 and has since developed a product platform of advanced materials

solutions derived from nano-engineered particle agglomerate technology and derived hierarchically

structured materials. These advanced materials include energy absorbing ultra-lightweight syntactic- and

nano-composite metals, and energetic materials in addition to the PComP™ nanocomposite cermets (a

cermet is a metal-ceramic composite) exclusively licensed to MesoCoat. The business has historically

financed itself non-dilutively through revenues from corporate engineering consulting and development

fees, government and private sector contracts and grants and recently through partnerships with prime

contractors and systems integrators. Powdermet operates as a commercial technology incubator with a

subsidiary, spin-out, or license model for major commercial markets (such as with Mesocoat), while

retaining and supporting the supply of critical nanocomposite powders to licensees, spin-outs, and

through toll production, equipment sales, and engineering services. The company provides

nanoengineered materials, technology development services, and specialized production equipment in the

nano- and engineered particle space”.

While MesoCoat’s product focus is on market development and commercialization of advanced cermets

to address corrosion and wear coating needs, Powdermet’s product differentiation is based on its ability to

build advanced nano-structured metal formulations to address energy efficiency, energy absorption and

release, reduction in hazardous materials, and life cycle cost reduction. Powdermet’s technologies are

particularly useful in crash and ballistic energy management markets since they offer weight reduction

and the ability to dissipate substantially more impact energy than the aluminum alloys and foamed metals

currently available.

Powdermet has four materials solution families under development:

(1) SComP™ - A family of syntactic metal composites known for their light weight properties and

ability to absorb more impact energy than any other known material. SComP™ can provide

weight savings over aluminum and magnesium alloys without magnesium’s corrosion and wear

limitations, reducing structural weight by 10-30% in targeted aerospace, consumer electronics,

and transportation applications. One new patent applications was filed this quarter on low

density, mill product and method of manufacture.

(2) MComP™ - A family of hierarchically structured, rare earth free, nanocomposite metal and metal

matrix composites that provide higher strength and temperature capability compared to traditional

aluminium and magnesium allows. MComP™ is designed to be a market replacement for

beryllium, aluminum and magnesium in structural applications, without relying on scare and

expensive rare earths to produce high strength and thermal stability. Targeted applications include

aerospace and defense and transportation market segments, as well as electrical transmission and

distribution.

15

(3) EnComP™ - A diverse family of nano-engineered particle based solutions for energy

storage. Current developments include record setting energy density nanoparticle filled films for

capacitors, structured nanocomposite anode and cathode materials for thermal and lithium ion

batteries, and inflatable hydrogen storage media capable of energizing power fuel cells down to -

34C. A new patent application was filed related to environmentally-triggered reactive

composites, with applications to well perforation devices, reactive warheads, and dissolvable

frack balls for shale gas field completions for new product launches in the EnComP product

family

(4) SynFoam™ - A family of structural, thermally insulating syntactic ceramic composites

combining strength, high temperature functionality and low thermal conductivity into one

multifunctional material. Applications include rocket propulsion and re-entry vehicle systems,

and structural insulation for high temperature energy production and use including flowlines and

heat treatment furnaces. Two new patent applications were filed for high temperature structural

insulation, and for high temperature insulation for production flowlines to support new product

releases in the Synfoam™ Product line.

Powdermet’s two developmental products closest to commercialization are SynFoam™ syntactic foams

and EnComP™ energetic nanocomposites.

Powdermet also produces custom-engineered powders and nanopowders, provides advanced materials

contract research and development services, and derives significant revenues from tolls and contract

development and manufacturing services.

Powdermet has recently demonstrated considerable success in providing a record setting energy density

of over 10J/cc in its nanocomposite films for film-foil capacitors, and has been awarded a greater than

$1M contract for further device development and demonstration (prototyping). Powdermet continues to

receive significant interest in its nanocomposite lithium anode and cathode production capabilities, and

has secured a Department of Energy contract to develop materials for the next generation magnesium,

multivalent cationic batteries which theoretically can provide 4X the power density of lithium cells.

Working with Purdue University and Michigan State University, Powdermet is scaling up its reversible

nanocomposite liquid hydrogen storage media that has exhibited particular promise as a transportable,

renewable source for hydrogen fuel cells exposed to temperatures below -10C.

Powdermet’s MComP™ metal nanocomposite development group continues to work on reducing the cost

of record-breaking light metal nanocomposites. Nanocomposite metals which have been engineered with

specific distributions of nano- and micro-scale features have been shown to possess previously

unachievable combinations of strength and ductility, with nanocomposite aluminum approaching the

strength of steel at 11/3rd the density/weight. These nanoengineered metals are highly sought after for

weight reduction and fuel economy benefits in transportation vehicles, including armoured military, high

speed rail, and large truck applications. Powdermet has more recently made significant advances in its

joint venture with Oshkosh defense, Eck industries, and the University of Wisconsin to develop a low

cost (compared to powder metallurgy routes) castable aluminum nanocomposite exhibiting record-

breaking combinations of strength and ductility along with improved fabricability. Powdermet is

working with its partners to demonstrate scalable production, and our next major milestone is to produce

a several hundred pound casting suitable for use in a heavy transport vehicle.

16

Powdermet’s SComP™ solution addresses a large market need for crash energy management and reduced

weight for fuel economy and portability. Today’s engineered materials market offers nothing like

SComP™ and its closest competition would be engineered honeycomb structures and foamed metals,

neither of which have SComP™’s energy absorption capabilities, metal-like aesthetics and ease of use.

One of the largest benefits of these syntactic metal composites is their ability to absorb energy from

impacts and ballistic events through deformation. Powdermet is aware of one firm, APS, Inc., started by

a former employee that offers a similar product. Powdermet’s current development focus for SComP™

products are on scalable processing to reduce costs necessary to enter larger, shorter sell cycle markets, as

well as product design and insertion into defense markets which have a long acceptance cycle. Market

competition may come from nanotube companies which are attempting to build energy absorption

features using this type of technology but without the same property characteristics as Powdermet’s

products, especially in the area of thermal resistance. SComP™ is expected to fare well when introduced

to the commercial market.

Terves, Inc.

On July 23, 2013, Powdermet announced the launch of its wholly owned subsidiary Terves Inc., to

commercialize proprietary reactive materials technology for the shale gas and oil industry. Terves’

TervAlloy™ technology was initially developed by Powdermet’s ENComP™ energetic nanocomposite

development group to build reactive warheads for the US Department of Homeland Security.

TervAlloy™ technology has since been reconfigured and customized into engineered reactive materials

that can significantly improve the efficiency, oil recovery, and safety of well isolation, perforation and

completion for oil and gas companies operating in shale and tight rock formations in the United States

and across the globe.

TervAlloy™ is a class of patent pending, environmentally responsive, lightweight metallic materials

manufactured from magnesium and other light metals such as lithium that are high strength, machinable,

and also respond in an engineered and controlled manner to environmental stimuli such as changes in

fluid, pH, temperature or electrical or magnetic fields to induce material changes such as decoherence

(disintegration), gas generation, or heat generation. TervAlloy™ is engineered for various market

applications including oil and gas tools for well isolation and completion (frac-balls, sleeves, and seats),

well perforation, and fracturing, lightweight electronic packaging, beryllium replacement, airframe

structures, missile airframes and rocket motor cases, and transportation The primary application of

TervAlloy™ for oil and gas include controlled disintegration well completion tools and reactive tooling

that provides for the generation of heat and gas pressure inside a formation.

AMP Distributors Inc. SEZC and AMP Distributors, Inc.

AMP Distributors Inc. SEZC (“AMP SEZC”)(formerly AMP Distributors, Inc.) and AMP Distributors,

Inc. (“AMP FL”) were formed by the Company in June 2011 and July 2012, as a Cayman Islands

company and a Florida corporation respectively. In April 2013, AMP SEZC filed for a Trade Certificate

which was approved in full in May 2013 to begin operations as a Special Economic Zone Company. Fully

staffed offices have been established by AMP SEZC in the Cayman Enterprise City. The primary purpose

of these entities is to negotiate, execute and administer the set up of overseas operations as well as

handling some international sales of MesoCoat's products. AMP SEZC and AMP FL will also be tasked

with acquiring equipment and coating materials for the Company’s international transactions. AMP SEZC

has acquired a Work Certificate for its General Manager (with over 30 years of experience in the overseas

financial services industry) and has also retained Kariola Limited, a consultancy organization, to assist it

with technical advice and entry into Asian markets.

17

Industry Overview

External Environment: Corrosion

The U.S. Department of Commerce monitors a large number of industry sectors that face problems with

corrosion, which is a growing issue faced by companies worldwide. Metallic corrosion is the degradation

that results from interaction of metals with various environments such as air, water, naturally occurring

bacteria, chemical products and pollutants. Steel accounts for almost all of the world’s metal consumption

and therefore an astoundingly high percentage of corrosion issues involve steel products and by-products.

These issues affect many sectors of the worldwide economy. According to NACE International, the cost

of corrosion to the global economy is $2.2 trillion annually, or roughly 3% of the world’s GDP.

Although worldwide corrosion studies began in earnest in the 1970s, there has never been a standardized

way for countries to measure corrosion costs. As a result, estimates of economic damage are difficult to

compare. What is clear, however, is that the impact of corrosion is serious and severe. As a result of

corrosion, manufacturers and users of metallic products incur a wide range of costs, including:

§ painting, coating and other methods of surface preparation;

§ utilizing more expensive corrosion resistant materials;

§ downtime costs;

§ larger spare parts inventories; and

§ increased maintenance costs.

There are also related costs that may be less obvious. For instance, some of the nation’s energy demand is

generated by firms fixing metallic degradation problems. Studies have shown that this increased energy

demand would be avoidable if corrosion was addressed at the preventable stage. Some of this demand

could be reduced through the economical, best-practice application of available corrosion control

technology.

External Environment: Wear

Corrosion is not the only concern of engineers and material scientists. In most industries, the deterioration

of surfaces is also a huge problem. Wear is often distinct from corrosion and describes the deterioration of

parts or machinery due to use. The effects of wear can generally be repaired. However, it is also usually

very expensive. Prevention and wear protection is the most economical way to offset the high costs

associated with component repair or replacement. To accomplish this, hard-face coatings are applied to

problematic wear surfaces for the purpose of reducing wear and/or the loss of material through abrasion,

cavitation, compaction, corrosion, erosion, impact, metal-to-metal, and oxidation. Some companies focus

on the prevention side of the business (applying coatings to prevent wear) while others focus on the repair

side of the business (reforming metal or applying coatings to fix metal substrate problems).

In order to properly select a coating alloy for a specific requirement, it is necessary to understand what

has caused the surface deterioration. The various types of wear can be categorized and defined as follows:

§ Abrasion is the wearing of surfaces by rubbing, grinding, or other types of friction that usually

occurs due to metal-to metal contact. It is a scraping, grinding wear that rubs away metal surfaces

and can be caused by the scouring action of sand, gravel, slag, earth, and other gritty material.

§ Cavitation wear results from turbulent flow of liquids that carry small suspended abrasive

particles.

18

§ Compression is a deformation type of wear caused by heavy static loads or by slowly increasing

pressure on metal surfaces. Compression wear causes metal to move and lose dimensional

accuracy.

§ Corrosion wear is the gradual deterioration of unprotected metal surfaces, caused by the effects

of the atmosphere, acids, gases, alkalis, etc. This type of wear creates pits and perforations and

may eventually dissolve metal parts.

§ Erosion is the wearing away or destruction of metals and other materials by the abrasive action of

water, steam, slurries which carry abrasive materials. Pump parts are subject to this type of wear.

§ Impact wear is the striking or slamming contact of one object against another and this type of

wear causes a battering, pounding type of wear that breaks, splits, and deforms metal surfaces.

§ Metal–to-Metal wear is a seizing and/or galling type of wear that rips and tears out portions of

metal surfaces. It is often caused by metal parts seizing together because of lack of lubrication. It

usually occurs when the metals moving together are of the same hardness. Frictional heat

promotes this type of wear.

§ Oxidation is a type of wear causing flaking or crumbling layers of metal surfaces when

unprotected metal is exposed to a combination of heat, air and moisture. Rust is an example of

oxidation.

Generally, the initial coating selected to protect a product against wear is also the same product applied to

correct the problem once the product is worn. However, at that time, engineers can determine whether

some of the characteristics they set for the initial preventative coating have withstood the environment or

other pressures initially assumed in the product’s design. If it is determined that the initial coating

selection was not adequate, material scientists can change the application parameters of the prior coating

material (like amount or width of coating material applied) or select a new coating material that has new

properties. For instance once the type of wear is identified, a material engineer might determine that a

new coating material with better lubricity and other characteristics is needed for repair.

Presently there is no governmental standardized method to classify or specify degrees of wear. Nor is

there a central agency that collects market data on the cost of wear-based issues, primarily because firms

account for repair costs differently. Each industry sector has its own means of evaluation and approach to

repair, based on the type of part that needs repair, the urgency of that repair, the availability of a coating

solution and the cost associated with downtime. In general, companies already have plans in place on how

to fix a part once it goes down. However, if an unexpected problem occurs, firms utilize the expertise of

experienced materials engineers that have worked with numerous coating suppliers to evaluate a solution.

Sometimes this evaluation is done by reviewing vendor data only (suppliers typically provide complete

data product information worksheets which detail product properties, testing specifications, best

applications methods and conditions). If self-review is insufficient, consultants and vendors are flown it to

help assist companies in their material selection or solution repair needs. Those solutions then go through

review to determine their merit and cost benefit. Sometimes, parts cannot be repaired and new ones are

required.

Competition

The companies in which the Company has invested can expect to face intense competition within their

respective market segments upon product commercialization. The industrial coatings industry is highly

fragmented by companies with competing technologies each seeking to develop a standard for the

industry. Industrial coatings research and development has been ongoing for some time and several firms

are perceived as the industry leaders.

19

MesoCoat

PComP™

PComP™ nanoenginered cermet products have few directly comparable competitors. Although there are

established thermal spray coating material manufacturers such as Deloro Stellite, Sulzer Metco, Hoganas;

and a few emerging companies like Nanosteel, Integran, Inframat, Xtallic, and Modumetal that offer

solutions for corrosion and wear competition, no competitor has yet been able to engineer the

combination of properties that MesoCoat has built into its PComP™ product line.

MesoCoat has been able to manufacture a corrosion resistant product that has high strength, hardness, and

fracture toughness. Toughness and hardness are normally inversely proportional characteristics and no

other company has been able to reverse the nature of these properties which is what makes the PComP™

products unique in the market place. MesoCoat has also increased the ductility factor in the PComP™

products so basically not only has PComP™ shown to provide a harder coating surface, but the hard

objects are able to bend more without breaking.

One good example of how the PComP™ family of products have a competitive edge over existing

alternatives is PComP™ W, MesoCoat’s tungsten cobalt carbide replacement solution. PComP™ W

exhibits high deposition efficiency and at a Vickers hardness similar to that of tungsten carbide while

being stronger than the conventional carbide coatings it is designed to replace. Good toughness tolerates

more flexing of the part than other HVOF WC coatings without the usual cracking of the coating. The

structure of the PComP™ coatings generally also allow for conventional grinding techniques, eliminating

the expensive diamond finishing process needed for conventional materials used in tungsten carbide and

cobalt coating solutions.

The PComP™ family of products are expected to fare well among existing competitors on market entry.

CermaCladTM

A handful of large companies cater to this market segment – JSW Steel Co., Voest Alpine and Sulzer-

Metco are heavily involved in the clad plate market with a significant portion of the market share, Butting

GmbH and Cladtek International Pty Ltd. are large participants in the mechanically clad pipe market, and

ProClad Group is important in the metallurgically clad pipe market. Most of the large companies

participating in the cladding market have very similar technologies and impact the market mostly on their

scale of production (availability), relationships, and price.

Several smaller companies spread across the globe are also involved in this market segment, like Arc

Energy Resources, IODS, High Energy Metals, and Kladarc LLC (acquired by PCC), all of which offer

weld overlay services for the oil and gas industry which we believe generate less than $25 million in

annual revenues. Other examples include Matrix Wear Technologies, Cladtech Canada, Brospec LP,

Almac, and Clearwater Welding and Fabrication LP all of which offer weld overlay processes to those

working in the Canadian oil sands which we believe generate between $15-50 million in revenues. The

higher revenues for the Canadian weld overlay companies is primarily due to their presence in Canada

where oil sands operations require large amounts of clad pipe and components, and the emphasis is on

local shops and faster turnaround times

20

CermaClad™ is a seamless metallurgical clad product which is cost competitive with existing

metallurgically clad products and exhibit better properties in almost every parameter when compared to

competing technology. A superior product and the fact that several multi-billion dollar oil and gas

projects across the globe have been delayed due to availability of high-quality clad pipes may facilitate

the ready adoption of CermaClad™ clad pipes. Spearheaded by more than trillion dollars of spending to

exploit oil and gas reserves, the clad pipe market is expected to increase exponentially over the years

leading to an increasing demand-supply gap for clad pipes. Unlike our competition that have to spend

$200 million to $1 billion to set-up new clad pipe/plate manufacturing facilities or expand production

capability; the very high productivity of the CermaClad™ technology and lower equipment costs enables

MesoCoat to set-up clad pipe manufacturing facilities at a much lower capital cost than competing

technologies with similar production capacity. This competitive advantage would permit MesoCoat to set-

up multiple facilities across the globe to serve the regional market and fulfill the growing local content

requirements in the Asia Pacific, Middle East, South America, Gulf of Mexico and Africa with

significantly lower capital requirements. Even with considering the global shortage of cladding capacity

and the endemic quality problems the industry is suffering, the Company believes that it can achieve

significant sales without taking any business away from the current participants in the market.

Other specific competitive advantages supported by the application of the CermaClad™ products include:

Time and productivity

§ Much higher material application rate than weld/laser cladding, >100Kg vs 3-10Kg/hr

application rates. more scalable for production volume

§ Capital investment significantly lower than mechanical cladding or metallurgical cladding

(roll bonding) for similar capacity, reducing fixed costs

§ Ability to provide local content in scalable manner at reasonable capital investment levels

§ Reduces lead times for new capacity compared to current market, and provides high

scalability for market flexibility. Potentially enables distribution and customization of pipe

for fast-turnaround project needs

§ CermaClad™ solves many industry limitations for large diameter (14” diameter and up) and

thick walled (more than 1” wall thickness) where both the mechanically clad and

metallurgical clad plate to pipe do not provide an ideal solution.

Performance risk

§ True metallurgical bond coupled with a smoother surface enables easier inspection thus

reducing risk of failure

§ Smoother surface enables ease in fluid flow reducing operating costs incurred in

transportation of fluids

§ Crack-free hard coatings up to 15mm thickness enable performance multiples in hardfacing

§ Better properties than weld overlay due to lower dilution or dissolution.

§ Cermaclad™ enables the use of metallurgically bonded clad seamless pipe, eliminating 90%

or more of the welds compared to other product offerings.

21

Cost

§ Faster Application and high throughput lowers cost basis for metallurgically bonded clad

product

§ Technology allows the application of thinner clad layers, potentially enabling dramatic cost

reduction at sustained margins

§ High productivity and scalability can enable reduced lead times, reducing capital costs for

large projects.

§ Lower capital costs also enable the set-up of regional clad pipe manufacturing facilities to

meet the growing local content requirement, positioning us as the preferred vendor for the

region and to avoid import duties.

Powdermet

Powdermet’s SComP™ solution addresses a large market need for crash energy management and reduced

weight for fuel economy and portability. Today’s engineered materials market offers nothing like

SComP™ and its closest competition would be engineered honeycomb structures and foamed metals,

neither of which have SComP™’s energy absorption capabilities, metal-like aesthetics and ease of use.

One of the largest benefits of these syntactic metal composites is their ability to absorb energy from

impacts and ballistic events through deformation. Powdermet is aware of one firm, APS, Inc., started by

a former employee that offers a similar product. Powdermet’s current development focus for SComP™

products are on scalable processing to reduce costs necessary to enter larger, shorter sell cycle markets, as

well as product design and insertion into defense markets which have a long acceptance cycle. Market

competition may come from nanotube companies which are attempting to build energy absorption

features using this type of technology but without the same property characteristics as Powdermet’s

products, especially in the area of thermal resistance. SComP™ is expected to fare well when introduced

to the commercial market.

General Company Competitive Advantages

The following general factors serve as keys to the Company’s success:

§ Management – A well-balanced, experienced management team provides the Company and its

subsidiaries with the guidance and strategic direction to successfully gain market entry.

§ Products – The Company’s products represent innovations in multi-billion dollar markets.

§ Intellectual Property – The intellectual property of MesoCoat and Powdermet includes owned

patents, exclusive licensing rights, and proprietary processes that make market penetration

effective and feasible.

§ Qualification and Testing – As leading companies in multiple industries as well as U.S.

government agencies test and qualify MesoCoat and Powdermet’s products, significant barriers to

entry are automatically created for potential competitors.

§ Fundraising - As a publicly traded entity, the Company gains financing from public equity

markets which provide more liquidity and easier access to capital in the fundraising process.

22

The Company has also constructed the following barriers for potential competitors:

§ Product development expertise in both MesoCoat and Powdermet;

§ Exclusive global license for the high density fusion cladding process from Oak Ridge National

Laboratory; and several additional design and utility patents filed by the companies coupled with

several product and process trade secrets

§ Strong product pipeline that would be ready for market in the next 2-3 years;

§ Strong R&D.

The Company will encounter the following barriers to entry:

§ American Petroleum Institute (API) certification for its CermaClad™ products. In order to

successfully sell to the oil and gas industry, MesoCoat’s coatings must receive official approval

and certification, a process that generally requires major oil and gas entities to qualify our

products for use, followed by qualification for specific projects. MesoCoat’s Cooperation

Agreement with Petroleo Brasileiro S.A. has demonstrated product suitability at the laboratory

scale, and is in the final stages of a prototype clad pipe product qualification. The construction of

our Euclid, Ohio 12 meter pipe plant, at a cost of over $6,000,000 (including funding from Joint

Development Agreements (“JDA’s”) and federal grants) and subsequent quality certification of

the facility and its products represent the final steps towards entry of this pioneering product in

the oil and gas sector.

§ Market acceptance of MesoCoat’s CermaClad™’ product line that would encourage entry into

markets such as the oil sands development in Alberta, Canada. MesoCoat is currently pursuing

the establishment of a research and development facility in Alberta, Canada to accelerate the

acceptance of its CermaClad™ WR clad pipe and components.

§ Developing the best product with the best value.

§ Protecting proprietary technology.

Marketability

The ultimate success of any product will depend on market acceptance in its many forms, including cost,

efficiency, convenience and application. The market for MesoCoat’s prospective products is potentially

enormous and will require the Company to apply a significant portion of its focus on how to best initiate