Exhibit 1.1

NEOVASC INC.

ANNUAL INFORMATION FORM

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2016

March 23, 2017

| GLOSSARY | 1 |

| TERMS OF REFERENCE | 3 |

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS AND RISK FACTORS | 3 |

| CORPORATE STRUCTURE | 6 |

| Intercorporate Relationships | 6 |

| GENERAL DEVELOPMENT AND DESCRIPTION OF THE BUSINESS | 6 |

| Three Year Development | 8 |

| Additional Products and Third-Party Sales | 14 |

| Product Development | 15 |

| Specialized Skill & Knowledge | 15 |

| Intangible Property | 15 |

| New Products/Components/Cycles | 16 |

| Economic Dependence | 17 |

| Foreign Operations | 17 |

| Lending | 18 |

| Reorganizations | 18 |

| Employees | 18 |

| Social or Environmental Policies | 19 |

| RISK FACTORS | 19 |

| DIVIDEND POLICY | 33 |

| DESCRIPTION OF CAPITAL STRUCTURE AND MARKET FOR SECURITIES | 33 |

| PRIOR SALES | 34 |

| ESCROWED SECURITIES | 35 |

| DIRECTORS AND OFFICERS | 35 |

| CEASE TRADE ORDERS, BANKRUPTCIES, PENALTIES OR SANCTIONS | 39 |

| Cease Trade Orders and Bankruptcies | 39 |

| Penalties and Sanctions | 39 |

| Individual Bankruptcies | 40 |

| CONFLICTS OF INTEREST | 40 |

| AUDIT COMMITTEE INFORMATION | 40 |

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 41 |

| MATERIAL CONTRACTS | 42 |

| LEGAL PROCEEDINGS | 42 |

| NAMES AND INTEREST OF EXPERTS | 44 |

| TRANSFER AGENT AND REGISTRAR | 45 |

| ADDITIONAL INFORMATION | 45 |

| ADDITIONAL FINANCIAL INFORMATION | 45 |

| SCHEDULE “A” AUDIT COMMITTEE CHARTER | A-1 |

GLOSSARY

This glossary contains general terms used in the discussion of the cardiovascular medical device industry, as well as specific technical terms used in the descriptions of the Company’s technology and business.

Angioplasty: a procedure for the elimination of areas of narrowing in blood vessels.

Aortic: of or pertaining to the aorta or aortic heart valve.

Artery: blood vessel that carries oxygenated blood from the heart to the body’s organs.

Atrium: chamber in the heart.

Balloon catheter: hollow tube with a tiny balloon on its tip, used for gaining access to the arteries; once the catheter is in position, the balloon is inflated in order to push open a section of artery that is obstructed (see Angioplasty).

Biocompatible: materials that can be implanted or used in a patient without the body reacting adversely to the material.

Bovine: of or derived from or pertaining to a cow.

Cardiac reconstruction: procedure to repair damaged portions of the heart in order to improve its function.

Cardiovascular: system encompassing the heart, veins and arteries.

Cardiovascular disease: disease that restricts blood flow within the arteries, generally due to a build-up of Plaque; may refer to coronary or peripheral arteries, or both.

Catheter: hollow tube used for gaining access to the arteries, either to deliver medications or devices, or to withdraw fluids or samples from the body.

CE Mark: designation used to signify regulatory approval for the sale of a product in the European Union.

Coronary Artery: artery that supplies oxygen-rich blood to the heart muscle.

Coronary Artery Disease: disease that affects the Coronary Arteries (the arteries that provide oxygenated blood to the heart muscle); also called cardiovascular disease. (See Cardiovascular Disease).

COSIRA: the Company’s Coronary Sinus Reducer for Treatment of Refractory Angina clinical trial - a multi-center, double blinded sham controlled study intended to assess the safety and efficacy of the Reducer in a rigorous, controlled manner.

FDA: U.S. Food and Drug Administration; governing body that regulates approval for the sale of medical devices in the United States.

French: The French size is a measure of the external diameter of a catheter, a catheter of 1 French has a diameter of ⅓ mm.

Health Canada: the federal department of health of Canada responsible for the regulation of drugs, natural health products, cosmetics and medical devices and includes the Therapeutic Products Directorate, which in turn includes the Medical Devices Bureau.

IDE: an investigational device exemption, which allows the investigational device to be used in a U.S. clinical study in order to collect safety and effectiveness data required to support a Premarket Approval (PMA) application or a Premarket Notification 510(k) submission to the FDA. All clinical evaluations of investigational devices in the United States, unless exempt, must have an approved IDE before the study is initiated.

Interventional Cardiology: practice of treating Coronary Artery Disease intravascularly; that is, through the arterial system using minimally invasive techniques, rather than with open-heart surgery.

Mitral: of or pertaining to the mitral heart valve.

Mitral Regurgitation: inadequate function of the mitral valve allowing blood to leak back through the closed valve. This is a severe and debilitating medical condition.

Nasdaq: the NASDAQ Stock Market.

Pericardium: sac in the chest cavity that contains the heart; pericardial tissue is the soft tissue that forms the sac.

Peripatch: tissue material made from bovine or Porcine pericardium; used to repair damaged/diseased vessels or organs by working as an internal bandage or as a component in the manufacture of heart valves.

Plaque: deposit of fats, cholesterol and other substances on artery walls that eventually causes arteries to become narrowed, restricting proper blood flow.

Porcine: of or derived from or pertaining to a swine or pig.

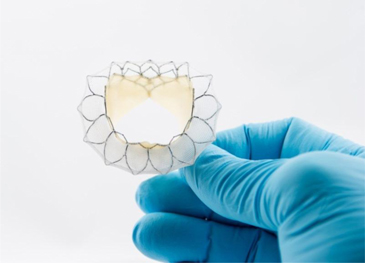

Reducer: the Neovasc Reducer™, Neovasc’s proprietary technology for the treatment of refractory angina.

Stent: expandable, metallic tube inserted into a diseased artery to hold vessel open and maintain proper blood flow; may be used to deliver medication to the artery wall (a “drug-eluting stent”).

Tiara: the Tiara™, Neovasc’s proprietary transcatheter mitral valve system in development for the transcatheter treatment of mitral valve disease.

TIARA-I: the Company’s multinational, multicenter early feasibility study being conducted to assess the safety and performance of the Tiara in high risk surgical contexts.

TIARA-II: the Company’s multinational, multicenter study evaluating the Tiara’s safety and performance. It is expected that data from this study will be used to file for CE Mark approval.

Transcatheter: implanted or completed via a catheter or small tube instead of surgically.

Transcatheter heart valves: specialized artificial heart valves which are implanted via a catheter rather than a traditional surgical approach.

TSX: the Toronto Stock Exchange.

Vein: blood vessel that carries de-oxygenated blood from the body organs to the heart.

Vessel: artery, vein or duct that carries blood through the body.

| 2 |

TERMS OF REFERENCE

The information set forth in this Annual Information Form is as of March 23, 2017, unless another date is indicated. All references to dollars ($) in this document are expressed in U.S. funds, unless otherwise indicated.

References to “Neovasc” or “the Company” refer to Neovasc Inc. and its subsidiaries, unless otherwise noted.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS AND RISK FACTORS

This Annual Information Form contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws. The words “expect”, “anticipate”, “may”, “will”, “estimate”, “continue”, “intend”, “believe” and other similar words or expressions are intended to identify such forward-looking statements. Forward-looking statements are necessarily based on estimates and assumptions made by us in light of our experience and perception of historical trends, current conditions and expected future developments, as well as the factors we believe are appropriate. Forward-looking statements in this Annual Information Form include, but are not limited to, statements relating to:

| · | our ability, in an appeal of the verdict, to reduce the amount of the $70 million damages award made following a jury trial in Boston, Massachusetts on certain trade secret claims made by CardiAQ Valve Technologies Inc. (CardiAQ) and the $21 million enhanced damages award following post-trial hearings and the approximate $21 million interest award following post-trial hearings (see “Legal Proceedings” herein); |

| · | the conduct or possible outcomes of any actual or threatened legal proceedings, including the Company’s ongoing litigation with CardiAQ and the other matters described in “Legal Proceedings” herein; |

| · | our ability to continue as a going concern; |

| · | the amount of estimated additional litigation expenses required to defend the Company in lawsuits filed by CardiAQ; |

| · | the Company’s expectations with respect to the length of the appellate process in the litigation with CardiAQ; |

| · | our need for significant additional financing and our estimates regarding our capital requirements and future revenues, expenses and profitability; |

| · | our intention to expand the indications for which we may market the Tiara (which does not have regulatory approval and is not commercialized) and the Reducer (which has CE Mark approval for sale in the European Union); |

| · | clinical development of our products, including the results of current and future clinical trials and studies; |

| · | our intention to apply for CE Mark approval for the Tiara in the next one to two years; |

| · | the anticipated timing and locations of the first implantations in the TIARA-II trial and our intention to initiate additional investigational sites in 2017 as required approvals are obtained; |

| · | our plans to develop and commercialize products, including the Tiara, and the timing and cost of these development programs; |

| · | our strategy to refocus our business towards development and commercialization of the Reducer and the Tiara; |

| · | our ability to replace declining revenues from the tissue business with revenues from the Reducer and the Tiara in a timely manner; |

| · | whether we will receive, and the timing and costs of obtaining, regulatory approvals for the Tiara and the Reducer; |

| · | the cost of post-market regulation if we receive necessary regulatory approvals; |

| · | our ability to enroll patients in our clinical trials, studies and compassionate use cases in Canada, the United States and in Europe; |

| · | our intention to continue directing a significant portion of our resources into sales expansion; |

| · | the expected decline of consulting services revenue in the long-term as our consulting customers become contract manufacturing customers or cease being customers; |

| 3 |

| · | our ability to get our products approved for use; |

| · | the benefits and risks of our products as compared to others; |

| · | our estimates of the size of the potential markets for our products including the anticipated market opportunity for the Reducer; |

| · | our potential relationships with distributors and collaborators with acceptable development, regulatory and commercialization expertise and the benefits to be derived from such collaborative efforts; |

| · | sources of revenues and anticipated revenues, including contributions from distributors and other third parties, product sales, license agreements and other collaborative efforts for the development and commercialization of products; |

| · | our creation of an effective direct sales and marketing infrastructure for approved products we elect to market and sell directly; |

| · | the rate and degree of market acceptance of our products; |

| · | the timing and amount of reimbursement for our products; and |

| · | the impact of foreign currency exchange rates. |

Forward-looking statements are based on estimates and assumptions made by the Company in light of its experience and its perception of historical trends, current conditions and expected future developments, as well as other factors that the Company believes are appropriate in the circumstances. Many factors could cause the Company's actual results, performance or achievements to differ materially from those expressed or implied by the forward-looking statements, including, without limitation:

| · | risks relating to our litigation with CardiAQ, including the Company’s ability to successfully appeal the validity of the awards as well as the ruling on inventorship, which create material uncertainty and which cast substantial doubt on our ability to continue as a going concern; |

| · | the substantial doubt about our ability to continue as a going concern. |

| · | risks relating to our need for significant additional future capital and our ability to raise additional funding; |

| · | risks relating to claims by third parties alleging infringement of their intellectual property rights; |

| · | our ability to establish, maintain and defend intellectual property rights in our products; |

| · | risks relating to results from clinical trials of our products, which may be unfavorable or perceived as unfavorable; |

| · | our history of losses and significant accumulated deficit; |

| · | risks associated with product liability claims, insurance and recalls; |

| · | risks relating to competition in the medical device industry, including the risk that one or more competitors may develop more effective or more affordable products; |

| · | risks relating to our ability to achieve or maintain expected levels of market acceptance for our products, as well as our ability to successfully build our in-house sales capabilities or secure third-party marketing or distribution partners; |

| · | our ability to convince public payors and hospitals to include our products on their approved products lists; |

| · | risks relating to new legislation, new regulatory requirements and the efforts of governmental and third party payors to contain or reduce the costs of healthcare; |

| · | risks relating to increased regulation, enforcement and inspections of participants in the medical device industry, including frequent government investigations into marketing and other business practices; |

| · | risks associated with the extensive regulation of our products and trials by governmental authorities, as well as the cost and time delays associated therewith; |

| · | risks associated with post-market regulation of our products; |

| · | health and safety risks associated with our products and our industry; |

| · | risks associated with our manufacturing operations, including the regulation of our manufacturing processes by governmental authorities and the availability of two critical components of the Reducer; |

| · | risk of animal disease associated with the use of our products; |

| · | risks relating to the manufacturing capacity of third-party manufacturers for our products, including risks of supply interruptions impacting the Company’s ability to manufacture its own products; |

| 4 |

| · | risks relating to breaches of anti-bribery laws by our employees or agents; |

| · | risks associated with future changes in financial accounting standards and new accounting pronouncements; |

| · | our dependence upon key personnel to achieve our business objectives; |

| · | our ability to maintain strong relationships with physicians; |

| · | risks relating to the sufficiency of our management systems and resources in periods of significant growth; |

| · | risks associated with consolidation in the health care industry, including the downward pressure on product pricing and the growing need to be selected by larger customers in order to make sales to their members or participants; |

| · | our ability to successfully identify and complete corporate transactions on favorable terms or achieve anticipated synergies relating to any acquisitions or alliances; |

| · | anti-takeover provisions in our constating documents which could discourage a third party from making a takeover bid beneficial to our shareholders; |

| · | risks relating to conflicts of interests among the Company’s officers and directors as a result of their involvement with other issuers; and |

| · | risks relating to the influence of significant shareholders of the Company over our business operations and share price. |

Forward-looking statements reflect our current views with respect to future events and are subject to risks and uncertainties and are necessarily based upon a number of estimates and assumptions that, while considered reasonable by us, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies, many of which, with respect to future events, are subject to change. The material factors and assumptions used by us to develop such forward-looking statements include, but are not limited to:

| · | our ability, in an appeal of the verdict, to reduce or successfully defend against the amount of the $70 million damages award, $21 million enhanced damages award and approximate $21 million interest award and reverse the ruling on inventorship in connection with our litigation with CardiAQ; |

| · | our ability to continue as a going concern; |

| · | our regulatory and clinical strategies will continue to be successful; |

| · | our current positive interactions with regulatory agencies will continue; |

| · | recruitment to clinical trials and studies will continue; |

| · | the time required to enroll, analyze and report the results of our clinical studies will be consistent with projected timelines; |

| · | current and future clinical trials and studies will generate the supporting clinical data necessary to achieve approval of marketing authorization applications; |

| · | the regulatory requirements for approval of marketing authorization applications will be maintained; |

| · | our current good relationships with our suppliers and service providers will be maintained; |

| · | our estimates of market size and reports reviewed by us are accurate; |

| · | our efforts to develop markets and generate revenue from the Reducer will be successful; |

| · | genericisation of markets for the Tiara and the Reducer will develop; and |

| · | capital will be available on terms that are favorable to us. |

By their very nature, forward-looking statements or information involve known and unknown risks, uncertainties and other factors that may cause our actual results, events or developments, or industry results, to be materially different from any future results, events or developments expressed or implied by such forward-looking statements or information. In evaluating these statements, prospective purchasers should specifically consider various factors, including the risks outlined herein, under the heading “Risk Factors”. Should one or more of these risks or uncertainties or a risk that is not currently known to us materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein. These forward-looking statements are made as of the date of this Annual Information Form and we do not intend, and do not assume any obligation, to update these forward-looking statements, except as required by law. Investors are cautioned that forward-looking statements are not guarantees of future performance and investors are cautioned not to put undue reliance on forward-looking statements due to their inherent uncertainty.

| 5 |

CORPORATE STRUCTURE

Neovasc was incorporated on November 2, 2000 under the laws of the Province of British Columbia and was continued to federal jurisdiction under the Canada Business Corporations Act on April 19, 2002.

On July 1, 2008, the Company completed the acquisition of two Israel-based vascular device development companies, concurrently raising C$8.3 million in equity financing in a non-brokered private placement, completing a 20 for 1 share consolidation and changing its name from Medical Ventures Inc. to Neovasc Inc.

The registered and records office of the Company is located at Suite 2600, 595 Burrard Street, Three Bentall Center, Vancouver, British Columbia, V7X 1L3, and its head office and principal place of business is located at Suite 5138 – 13562 Maycrest Way, Richmond, British Columbia, V6V 2J7.

Intercorporate Relationships

The Company has five wholly-owned subsidiaries as follows:

| Name: | Date of Incorporation: | Jurisdiction of Incorporation: | ||

| Neovasc Medical Inc. (formerly PM Devices Inc.) |

May 7, 1998 | British Columbia | ||

| Neovasc Tiara Inc. | March 11, 2013 | Canada (federal) | ||

| Neovasc Medical Ltd. | September 9, 2002 | Israel | ||

| Neovasc (US) Inc. (formerly Medical Ventures (US) Inc.) |

July 2, 2007 | United States | ||

| B-Balloon Ltd. | March 30, 2004 | Israel |

B-Balloon Ltd. is in the process of being voluntarily liquidated. Angiometrx Inc., a wholly-owned subsidiary of Neovasc, amalgamated with Neovasc Medical Inc. (NMI) on January 1, 2015.

GENERAL DEVELOPMENT AND DESCRIPTION OF THE BUSINESS

Neovasc is a specialty medical device company that develops, manufactures and markets products for the rapidly growing cardiovascular marketplace. Its products include the Tiara technology in development for the transcatheter treatment of mitral valve disease and the Reducer for the treatment of refractory angina.

In 2009, Neovasc started initial activities to develop novel technologies for catheter-based treatment of mitral valve disease. Based on the early positive results of these activities, the Company formally launched a program to develop the Tiara. Neovasc established a separate entity, Neovasc Tiara Inc. (NTI), in March 2013 to develop and own the intellectual property related to the Tiara (Neovasc has transferred all intellectual property related to the Tiara to NTI). On February 3, 2014, Neovasc announced the first human implant of the Tiara under special access compassionate use exemptions. Subsequently 25 additional patients have been implanted with the Tiara bringing the total number of patients treated with the device to 26 as of this date. In December 2014, the Company announced that it had received approval from the FDA to initiate the TIARA-I study in the United States. The TIARA-I study is a multinational, multicenter early feasibility study being conducted to assess the safety and performance of the Tiara and implantation procedure in high risk surgical patients suffering from severe Mitral Regurgitation. The study will include up to 15 patients enrolled at centers in the United States and up to 15 patients at centers in Canada and Europe. The first European patient was enrolled in the study in Antwerp, Belgium in late 2014 and the first patient in the United States was enrolled in mid 2015. The Tiara is currently available in two sizes (35mm and 40 mm); additional sizes are under development (45mm). Following completion of the TIARA-I study the Company intends to continue advancing the Tiara to commercialization and will be undertaking additional studies to support authorization to affix the CE Mark and FDA approval as appropriate. On November 28, 2016, the Company announced that it had received both regulatory and ethics committee approval to initiate the Tiara Transcatheter Mitral Valve Replacement Study (TIARA-II) in Italy. The TIARA-II study is a 115 patient, non-randomized, prospective clinical study evaluating the Tiara’s safety and performance. It is expected that data from this study will be used to file for CE Mark approval. It is anticipated that the first implantations in the TIARA-II trial will be conducted by the medical team at San Raffaele Hospital in Milan, Italy in the first half of 2017. The Company will be initiating additional investigational sites in 2017 as required approvals are obtained.

| 6 |

In July 2008, Neovasc acquired Neovasc Medical Ltd. (NML), a pre-commercial vascular device company based in Israel. NML developed and owned intellectual property related to a novel catheter-based treatment for refractory angina, a debilitating condition resulting from inadequate blood flow to the heart muscle. The Company estimates that there are approximately 600,000 to 1.8 million Americans, with 50,000 to 100,000 new cases per year in the United States who are potential candidates for this treatment. The Company has completed development of the Reducer and obtained authorization to affix the CE Mark, which allows for marketing of the Reducer in the European marketplace. The Company initiated commercial sales of the Reducer in early 2015. In March 2014 the Company announced that results of its COSIRA trial had been presented at the ACC.14 medical conference. The COSIRA trial was a sham-controlled randomized, double-blinded study of the Reducer device in 104 patients with moderate to severe refractory angina. The results presented at ACC.14 confirmed that the COSIRA trial had met its primary endpoint demonstrating the efficacy of the Reducer device with statistical significance. The COSIRA trial results were published in the New England Journal of Medicine in February 2015.

Neovasc’s business operations started in March 2002, with the acquisition of NMI. NMI manufactured a line of collagen-based surgical patch products made for use in cardiac reconstruction and vascular repair procedures as well as other surgeries. Neovasc, through NMI, also sells biological tissue to industry partners and other customers who incorporate this tissue into their own products such as transcatheter heart valves. Neovasc’s biological products are made from chemically treated biocompatible pericardial tissue. In 2012, Neovasc sold the rights to manufacture a specific line of conventional surgical patch products to LeMaitre Vascular, Inc. (LeMaitre) for $4.6 million, but retained rights to the underlying tissue technology for all other uses. Neovasc has refocused its use of this treated pericardial tissue to constitute key components in third-party medical products, such as transcatheter heart valves. The Company also provides customers with consulting services related to the development of these products with specific expertise related to the transcatheter heart valve field as well as contract manufacturing services for these valves at all stages of development through to commercial scale production.

Neovasc’s Strategy

The Company’s core strategy is to focus on the continued development and commercialization of its products, the Tiara and the Reducer, providing minimally invasive medical devices for a cardiovascular market that the Company believes is both growing and under-served by current treatment solutions.

Key elements of this strategy include:

| · | Tiara - continuing the Company’s initial clinical experience of the Tiara, continuing enrollment of a multi-center feasibility study, and initiating a CE Mark study in 2017. |

| · | Reducer - continuing development of the Reducer, initiating a FDA IDE study in 2017 and supporting the successful COSIRA trial with additional experience through the Company’s targeted commercial launch of the Reducer in Europe; and |

| · | Tissue Products - continuing efforts to support Neovasc customers through their regulatory pathways and commercialization of their products. |

| 7 |

Three Year Development

Recent Developments Subsequent to December 31, 2016

On January 18, 2017, the Company announced an update in its ongoing litigation with CardiAQ, all as more fully described herein under the heading “Legal Proceedings”.

Year Ended December 31, 2016

On December 2, 2016, the Company and Boston Scientific Corporation (Boston Scientific) entered into a definitive agreement for Boston Scientific to acquire Neovasc’s advanced biologic tissue capabilities and certain manufacturing assets and make a 15% equity investment in Neovasc, for a total of $75 million in cash. Under the terms of the asset purchase agreement Neovasc has been granted a license to the purchased assets and access to the sold facilities to allow it to continue its tissue and valve assembly activities for its remaining customers, and continue its own tissue-related programs, including advancing the Tiara through its clinical and regulatory pathways. Under the terms of the equity investment, Boston Scientific acquired 11,817,000 common shares in the capital of Neovasc at a price of $0.60 per share, for gross proceeds of $7,090,200.

On November 28, 2016, the Company announced that it had received both regulatory and ethics committee approval to initiate the TIARA-II study in Italy. The TIARA-II study is a 115 patient, non-randomized, prospective clinical study evaluating the Tiara’s safety and performance. It is expected that data from this study will be used to file for CE Mark approval.

On July 5, 2016, the Company received written notification (the "Notification Letter") from The NASDAQ Stock Market LLC ("Nasdaq") notifying the Company that it was not in compliance with the $1.00 minimum bid price requirement set forth in the Nasdaq Listing Rules. On December 19, 2016, the Company received written notification that it had regained compliance with the minimum bid price requirement. This non-compliance did not affect the listing of the Company’s common shares.

On May 13, 2016, the Company filed a short form base shelf prospectus with certain securities regulatory authorities in Canada and a corresponding shelf registration statement with the United States Securities and Exchange Commission. The filing was intended to restore the original capacity which was available to Neovasc under its previous base shelf prospectus and registration statement (which expired on June 13, 2016), as well as to provide Neovasc with flexibility to take advantage of financing opportunities when market conditions are favorable.

On January 11, 2016, the Company announced that the FDA had granted approval for participating physicians to treat patients with its 40mm Tiara in the TIARA-I study.

Year Ended December 31, 2015 Developments

On February 3, 2015, the Company closed an equity financing for gross proceeds to the Company of $74,883,850. The financing was underwritten by Leerink Partners LLC as sole book-running manager for a syndicate of underwriters, which placed 10,415,000 common shares of Neovasc from treasury and 1,660,000 common shares sold by certain directors, officers and employees of the Company each at a price per common share of $7.19. Neovasc is using the net proceeds received by the Company (i) to enroll patients in the TIARA-I study; (ii) to initiate a CE Mark study and FDA IDE study for the Tiara; (iii) to further develop and refine the Tiara; (iv) to advance the commercialization of the Reducer in Europe; (v) to initiate a FDA IDE study for the Reducer; and (vi) for general corporate purposes.

On February 5, 2015, the final results from the Company’s COSIRA trial assessing the efficacy and safety of the Reducer for treatment of Refractory Angina, were published in the New England Journal of Medicine.

In October 2015, the Tiara was featured in a “live case” broadcast to the 27th Annual Transcatheter Cardiovascular Therapeutics scientific symposium, the world's largest educational meeting specializing in interventional cardiovascular medicine. During the live broadcast, Dr. Anson Cheung and Dr. John Webb of St. Paul’s Hospital (Vancouver, Canada) implanted a 35mm Tiara in a patient suffering from severe Mitral Regurgitation.

| 8 |

Year Ended December 31, 2014 Developments

On February 3, 2014, Neovasc announced the first human implant of the Tiara and, on February 20, 2014, a second human implant was completed, both under special compassionate use exemptions. Subsequently 25 additional patients have been implanted with the Tiara in early feasibility and compassionate use cases bringing the total number of patients treated with the device to 26 as of the date of this Annual Information Form.

On March 26, 2014, the Company closed a bought deal equity financing for gross cash proceeds of C$25,152,000. The financing was underwritten by Cormark Securities Inc., which placed 4,192,000 common shares of Neovasc at a price of C$6.00 per common share.

The Company submitted applications for listing of its common shares on the TSX and the Nasdaq Capital Market. Our Common Shares began trading on the TSX on June 23, 2014 and on Nasdaq on May 21, 2014.

On October 9, 2014, the Company received conditional IDE approval from the FDA to initiate the U.S. arm of its TIARA-I study for the Tiara and on November 27, 2014, the first patient was enrolled in the European arm of the study.

Additionally, throughout the years 2014 to 2016, the Company announced a number of developments pertaining to litigation, all as more fully discussed herein under the heading “Legal Proceedings”.

Neovasc’s Products

Tiara

In the second quarter of 2011, the Company formally initiated a new project to develop the Tiara, a product for treating mitral valve disease. The Tiara is in preclinical / early clinical stage development to provide a minimally invasive transcatheter device for the millions of patients who experience Mitral Regurgitation as a result of mitral heart valve disease (in 2014 it was estimated that Mitral Regurgitation affects approximately 4.1 million people in the United States). Mitral Regurgitation is often severe and can lead to heart failure and death. Unmet medical need in these patients is high. Currently, a significant percentage of patients with severe Mitral Regurgitation are not good candidates for conventional surgical repair or replacement due to frailty or comorbidities. There are approximately 1.7 million patients suffering from significant Mitral Regurgitation in the United States. Currently there is no transcatheter mitral valve replacement device approved for use in any market.

Clinical experience to date has been with the 35mm Tiara and the 40mm Tiara. First clinical use of the 40mm Tiara occurred in the fourth quarter of 2015 and first use of the 45mm Tiara is targeted for 2018. The additional sizes will allow Neovasc to expand treatment to a broader population of patients.

To date, 26 patients have been implanted with the Tiara in early feasibility and compassionate use cases and Neovasc believes that early results have been encouraging. The 30-day survival rate for the first 24 patients implanted with the Tiara (i.e. those implanted more than 30 days ago) is 21/24 or 88% with one patient now over three-years post implant and another over two-years post implant. The Tiara has been successfully implanted in both functional and degenerative Mitral Regurgitation patients, as well as patients with pre-existing prosthetic aortic valves and mitral surgical rings.

The results from these early feasibility and compassionate use cases have been instrumental in helping to demonstrate the potential of the Tiara as well as refining the implantation procedure, patient selection criteria and the device itself. Careful patient selection continues to be critical as the Company and clinical community continue to learn more about treating this population of very sick patients.

| 9 |

While many challenges remain prior to achieving commercial production (including, but not limited to, positive clinical trial and study results and obtaining regulatory approval from the relevant authorities), the Company believes the Tiara is being widely recognized as one of the leading devices exploring this new treatment option for patients who are unable or unsuited to receive an open heart surgical valve replacement or repair. There are several other transcatheter mitral valve replacement devices in development by third parties; some of which have been implanted in early feasibility type studies and CE mark studies with varying results.

Neovasc believes that there are several unique attributes of the Tiara that may provide advantages over other approaches to mitral valve replacement. There is no certainty that the Tiara will successfully proceed through clinical testing and ultimately receive regulatory approval to treat these patients, nor is it possible to determine at this time if any of the other development-stage devices will succeed in obtaining regulatory approval.

The Tiara valve is made up of two major components: the leaflets and skirt, which are made from the Company’s Peripatch tissue, and the nitinol frame (to which the leaflets and skirt are attached), which is manufactured by a well-established specialty manufacturer in the medical device industry. If this supplier were unable to provide the nitinol frame in the future, it would seriously impact the further development of the Tiara. The Tiara delivery system is manufactured in-house by the Company using components that are readily available.

Regulatory Status

The Tiara is an early-stage development product without regulatory approvals in any country. The Company intends to continue to fund development of the product as cash flow allows and anticipates applying for CE Mark approval in Europe in the next one to two years. As at December 31, 2016, the Company has spent approximately $39.0 million developing the product and anticipates that it may require an additional $20-25 million as it moves forward to achieve CE Mark approval. There is no assurance that European regulatory approval will be granted in the time frame anticipated by management, or granted at any time in the future. There is no expectation that this product will be revenue-generating in the near term, although management believes that the product is addressing an important unmet clinical need and that the demand for the product is high.

On October 9, 2014 Neovasc announced that it received conditional IDE approval from the FDA to initiate the U.S. arm of its TIARA-I study for the Tiara. The TIARA-I study is a multinational, multicenter early feasibility study being conducted to assess the safety and performance of Neovasc’s Tiara mitral valve system and implantation procedure in high-risk surgical patients suffering from severe Mitral Regurgitation. Severe Mitral Regurgitation is a critical condition that affects millions of patients and, if left untreated, can lead to heart failure or death. This FDA conditional approval allows clinical investigators to begin enrolling patients at participating U.S. medical centers once local hospital and related approvals are in place. This is an important step towards Tiara becoming one of the first transcatheter mitral valve replacement devices available for treating U.S. patients. The TIARA-I study will enroll up to 30 patients globally and is being overseen by a multidisciplinary committee of internationally recognized physicians. The Tiara has also been implanted under compassionate use approvals in Canada and implantations under similar approvals are anticipated in other countries in the future.

| 10 |

On November 28, 2016, the Company announced that it had received both regulatory and ethics committee approval to initiate the TIARA-II study in Italy. The TIARA-II study is a 115 patient, non-randomized, prospective clinical study evaluating the Tiara’s safety and performance. It is expected that data from this study will be used to file for CE Mark approval. It is anticipated that the first implantations in the TIARA-II trial will be conducted by the medical team at San Raffaele Hospital in Milan, Italy in the first half of 2017. The Company will be initiating additional investigational sites in 2017 as required approvals are obtained.

Reducer

The Reducer is a treatment for patients with refractory angina, a painful and debilitating condition that occurs when the coronary arteries deliver an inadequate supply of blood to the heart muscle, despite treatment with standard revascularization or cardiac drug therapies. It affects approximately 600,000 to 1.8 million Americans, with 50,000 to 100,000 new cases per year in the United States who are not eligible for conventional treatments and typically lead severely restricted lives as a result of their disabling symptoms, and its incidence is growing. The Reducer provides relief of angina symptoms by altering blood flow in the heart’s venous system, thereby increasing the perfusion of oxygenated blood to ischemic areas of the heart muscle.

The pain associated with refractory angina can make it difficult for patients to engage in routine activities, such as walking or climbing stairs. Using a catheter-based procedure, the Reducer is implanted in the coronary sinus, the major blood vessel that sends de-oxygenated blood from the heart muscle back to the right atrium of the heart. Pilot clinical studies demonstrate that the Reducer provides significant relief of chest pain in refractory angina patients. There are approximately 600,000 to 1.8 million Americans, with 50,000 to 100,000 new cases per year in the United States who are potential candidates for the Reducer, either because they cannot be revascularized or because they are otherwise poorly managed using conventional medical therapies. These patients represent a substantial market opportunity for the Reducer. If physicians adopt the Reducer for use in these refractory patients, it is expected that there will be a natural spillover into the broader recurrent angina market, which represents a substantially larger patient population.

The Reducer is targeting a currently untreatable patient population. A refractory patient by definition is resistant to other therapies. A patient who has refractory angina is not a surgical candidate, cannot benefit from existing interventional cardiology therapies and is not receiving adequate relief from available drug regimens to manage their chest pain. As such there are currently no direct competitors to the Reducer as the patient will have exhausted all other treatment options before the Reducer is considered. Once the Reducer is established as a standard of care for the refractory angina patient, Neovasc believes that the Reducer may also be considered for use in the larger population of recurrent angina patients (patients who are receiving repeat treatments for angina pain) and thus increase its market potential.

The Company has completed a COSIRA trial to assess the efficacy of the Reducer device. The COSIRA trial’s primary endpoint was a two-class improvement six months after implantation in patients’ ratings on the CCS angina grading scale, a four-class functional classification that is widely used to characterize the severity of angina symptoms and disability. Only patients with severe angina, CCS Class 3 or 4, were enrolled in the COSIRA trial. The COSIRA trial analysis showed that the study met the primary endpoint, with patients receiving the Reducer achieving a statistically significant improvement in CCS scores (two classes or better) compared to patients receiving a sham control (18 of 52 (34.6%) of the Reducer patients improved ≥ 2 CCS classes compared to 8 of 52 (15.4%) of the control patients (p-value = 0.024)). The analysis also showed that patients treated with the Reducer showed a statistically significant improvement of one or more CCS classes compared to the sham control patients (37 of 52 (71.2%) of the Reducer patients showed this improvement compared to 22 of 52 (42.3%) of the control patients (p-value = 0.003)). The COSIRA trial results were published in the New England Journal of Medicine in February 2015.

| 11 |

The Reducer is an hourglass-shaped, balloon-expandable, stainless steel, bare metal device, which is implanted in the coronary sinus, creating a restriction in venous outflow from the myocardium (the muscular layer of the heart wall). It is implanted using conventional percutaneous, or needle puncture, techniques. The Reducer is provided sterile and pre-loaded on a balloon catheter system. The system is 9 French sheath compatible and operates over a .035 inch guide wire. The implantation procedure is quick and requires minimal training. Once guide wire access to the coronary sinus is achieved, implantation typically takes less than 20 minutes.

Following implantation, the Reducer is incorporated into the endothelial tissue and creates a permanent (but reversible) narrowing in the coronary sinus. The coronary sinus is narrowed from a typical diameter of 10-12mm to approximately 3mm at the site of implantation. This narrowing slightly elevates the venous outflow pressure, which restores a more normal ratio of epicardial to endocardial blood flow between the outer and inner layers of the ischemic areas of the heart muscle. This results in improved perfusion of the endocardium, which helps relieve ischemia and chest pain. The physiological mechanism behind this effect is well documented in medical literature.

The clinical utility of this approach was demonstrated by a number of analogous approaches used in the past that achieved positive clinical outcomes for angina patients by constricting or intermittently blocking the coronary sinus to improve perfusion to the heart muscle. However, these therapies required the use of highly invasive surgery, or leaving a catheter in the heart for a prolonged period, making them impractical or clinically unacceptable for use in modern medical practice. The Reducer was developed to deliver this therapy in a safe, simple and effective manner via a minimally invasive catheter that is consistent with contemporary medical practice.

The Reducer has demonstrated excellent results in multiple animal studies and in a clinical trial of 15 patients suffering from chronic refractory angina who were followed for three years after implantation. The six-month results from this clinical trial were published in the Journal of the American College of Cardiology and three-year follow-up data was presented at the annual scientific meeting of the American College of Cardiology in March 2010. In this clinical trial, implantation of the Reducer resulted in significant clinical improvements in stress test and perfusion measurements, as well as in overall quality of life in the majority of the patients. These improvements were maintained for the three years of the study. During this period, the Reducer appeared safe and well tolerated in these patients. More recently, the Company completed the COSIRA trial – a multi-center, double blinded sham controlled study intended to assess the safety and efficacy of the Reducer in a rigorous, controlled manner. The results of COSIRA trial were positive and are discussed in more detail below. More recently, additional studies conducted by third parties and showing positive results from the Reducer implantations have been published and presented in medical forums. It is anticipated that as the commercial use of the Reducer continues to expand, additional third party studies, investigations and presentations will be undertaken. If the results from such third-party activities continue to show positive results from the product they will provide additional data to support expanded adoption of the Reducer for the intended patient population.

| 12 |

Following this positive data from the COSIRA trial, the Company initiated a pilot launch of the Reducer in select European markets in early 2015. The Company has signed distribution agreements in a number of European countries as well as Saudi Arabia and has initial sales into these countries. Based on the initial results from the targeted launch, Neovasc is presently developing an expanded sales plan and strategy for 2017 and beyond. It is anticipated that sales of the product in the United States would follow obtaining U.S. regulatory approval, if such approval is granted, as described further below.

Regulatory Status

The Reducer is approved for sale in Europe, having received CE Mark designation in November 2011. In preparation for product launch, Neovasc has completed development of the commercial-generation Reducer and the product is currently being transferred to commercial scale manufacture. The Company has completed the COSIRA trial that is expected to provide data to support broad commercialization of the Reducer. The COSIRA trial is a double-blinded, randomized, sham controlled, multi-center trial of 104 patients at 11 clinical investigation sites. The study completed enrollment in early 2013 and on November 6, 2013, the Company reported topline results for its COSIRA trial assessing the efficacy and safety of the Reducer. In February 2015, the COSIRA trial results were published in the New England Journal of Medicine. As discussed above, the data shows that the Reducer achieved its primary endpoint, significantly improving the symptoms and functioning of patients disabled by previously untreatable refractory angina. The COSIRA trial also confirmed that the Reducer is safe and well tolerated. The safety and efficacy data from the randomized, controlled COSIRA trial is consistent with results seen in previous non-randomized pilot studies of the Reducer. Placement of the Reducer is performed using a minimally-invasive transvenous procedure that is similar to implanting a coronary stent and takes approximately 20 minutes. Neovasc has begun discussions with the FDA on the development of a randomized IDE trial in the United States. The Company is currently evaluating the timing for starting this trial. U.S. marketing approval is expected about two to four years after the clinical trial begins. There is no assurance that U.S. regulatory approval will be granted in the time frame anticipated by management, or granted at any time in the future. The cost of the U.S. clinical trial is expected to be $15-20 million.

Tissue Products

Neovasc produces Peripatch, an advanced biological tissue product that is manufactured from pericardium, which is the protective sac that surrounds the heart of an animal. Neovasc uses a proprietary process licensed from Boston Scientific to convert raw pericardial tissue from animal sources into sheets of implantable tissue that can be incorporated into third-party medical devices (for example, for use as the material for artificial heart valve leaflets). Peripatch tissue retains the mechanical characteristics of natural tissue and is readily incorporated into the body without rejection. Peripatch tissue was originally developed to fabricate artificial heart valves and has a 25-year history of successful implantation for heart valve and other surgical applications. Peripatch tissue can be manufactured to meet the mechanical and biological characteristics required for a wide variety of applications, such as heart valve leaflets.

The Company also provides a range of custom Peripatch products to industry customers for incorporation into their own products, such as transcatheter heart valves and other specialty cardiovascular devices. These include Peripatch tissue fabricated from bovine and porcine sources and offered in a wide variety of shapes and sizes. Neovasc works closely with its industry customers to develop and supply tissue to meet their specific needs, such as for transcatheter heart valve leaflets. This often includes providing tissue in custom shapes or molded to three dimensional configurations. The Company also provides product development and specialized manufacturing services related to Peripatch tissue-based products such as transcatheter heart valves. The Company actively consults with a range of heart valve programs in order to refine their products and provide tissue to meet their needs and also provides transcatheter valve prototyping, pilot manufacture and commercial manufacture services to a range of customers.

| 13 |

Although the generic method of processing tissue in a way similar to the Peripatch is widely used, the Company’s competitive position stems from a proprietary process that is supported by a 25-year implant history for use as a surgical heart valve. A company that establishes its own process will have to go through a significant and costly series of studies to prove that their process produces tissue that is suitable as a medical device. The Peripatch product has already met these requirements and has already been validated through many years of successful use in multiple applications. Neovasc’s customers make the decision to use the Peripatch tissue rather than take on the demanding and lengthy process of developing their own tissue processing operation.

The basic Peripatch technology was established over 25 years ago by a third party that was a predecessor company to NMI, when the material was used to fashion the leaflets and other components in surgical heart valves. The processing of the material is a trade secret and was proprietary to the Company prior to the transaction with Boston Scientific. Neovasc sold the Peripatch technology and trade secrets to Boston Scientific in 2016 and Boston Scientific has licensed the technology back to the Company in a perpetual, fully paid, royalty free license. Appropriate testing is conducted to ensure the appropriateness and durability of the tissue for a new application before the medical device can be approved for use, and there is some additional risk when applying the technology to a new product or when amending to, or adding to, the fixation process to meet a new demand, such as for three-dimensional shape setting of the tissue.

The supply of Peripatch products and the associated product development, consulting and specialized manufacturing services related to Peripatch tissue-based products represents 89% of the Company’s current revenues.

In December 2016, the Company entered into an agreement for Boston Scientific to acquire the Company’s advanced biologic tissue capabilities and certain manufacturing assets and make a 15% equity investment in Neovasc, for a total of $75 million in cash. Under the terms of the approximate $68 million asset purchase agreement the Company has been granted a license to the purchased trade secrets and know-how and access to the sold facilities to allow it to continue its tissue and valve assembly activities for its remaining customers, and continue its own tissue-related programs, including advancing the Tiara through its clinical and regulatory pathways.

Regulatory Status

While the Company does not maintain stand-alone marketing approval for its tissue products, a number of third-party products which incorporate Peripatch tissue are approved for sale (i.e. such products have obtained regulatory approval, such as a CE Mark or Canadian medical device license) or have pending approvals in various markets. There is no assurance that further regulatory approvals for third-party products will be obtained.

Additional Products and Third-Party Sales

Neovasc provides consulting and original equipment manufacturing services to other medical device companies when these services fall within the scope of the Company’s expertise and capabilities. These activities are substantially focused on providing specialized development and manufacturing services for industry customers who incorporate the Company’s Peripatch tissue into their vascular device products such as heart valves. The goal of these activities is to drive near-term revenues as well as support development of a long-term revenue stream through the ongoing provision of tissue and manufacturing services to customers with commercially successful devices that incorporate Neovasc tissue. Revenue earned from various contract agreements varies throughout the year depending on customer needs.

| 14 |

Product Development

Product development at the Company is currently focused on completing commercialization of the Reducer as well as clinical stage and pre-commercialization development work on the Tiara. The Company may also investigate other potential new internal or external projects that leverage the Company’s existing technologies, infrastructure and expertise.

Specialized Skill & Knowledge

Tiara

The team that developed the Tiara has extensive background experience developing medical devices and heart valves. As the product has progressed through the clinical and regulatory pathways, and to broaden its specialized staff, the Company opened an office in Minnesota. Since opening this office, the Company has been successful in attracting talent and filling out the team supporting the Tiara. The office in Minnesota now employs the majority of our clinical and regulatory affairs groups, as well as an engineering and project management group. The opening of this office was an important milestone in the ongoing development of the Tiara.

Reducer

The manufacture of the Reducer requires basic catheter and stent manufacturing techniques that are common in the industry. The one component that is more complex is the manufacture of the hour glass shaped balloon and the Company works closely with an industry partner who manufactures this component. The Reducer is assembled and sterilized by well-known medical device contract manufacturers. While the device is not manufactured in-house, the product is supported by a team with specialized background knowledge of refractory angina and the clinical and regulatory requirements for the device. Our Medical Director, Shmuel Banai, has been involved in the Reducer since its inception.

Peripatch

The Company employs a proprietary process to manufacture Peripatch owned by Boston Scientific and licensed to the Company. The process has been improved over time and can be adapted to meet the needs of our customers. The Company has an engineering team that is skilled and knowledgeable in the process and the product has a 25-year implant history that differentiates it from other processing techniques.

The Company’s management team has developed specific skills and knowledge based on each individual’s experiences. A description of each of their qualifications can be found under the heading “Directors and Officers”, below.

Intangible Property

Patents

The Company’s ability to protect its products from unauthorized or infringing use by third parties depends substantially on its ability to obtain and maintain valid and enforceable patents. Neovasc has issued and pending patent applications in Canada, the United States, Europe and other select countries covering certain aspects of the technology that Neovasc intends to commercialize (including the Reducer and the Tiara). Accordingly, rights under any of Neovasc’s issued patents may provide it with commercially meaningful protection for its products or afford it a commercial advantage against the Company’s competitors or their competitive products or processes. However, patents that have been issued to Neovasc or that may be issued in the future may not be valid upon challenge or enforceable. Further, even if valid and enforceable, Neovasc’s issued patents may not be sufficiently broad to prevent others from marketing products like the Company’s own, despite these patent rights. In addition, patents are country/jurisdiction specific, i.e. the rights afforded under a patent are limited to the jurisdiction of the government which granted the patent. Thus, the rights afforded by a U.S. patent are limited to the United States or its territories, and are unenforceable elsewhere. In general, the exclusive rights provided by a patent begin on the date the patent issues and expires 20 years from the filing date of the application, though this term may differ slightly depending on the specific patent laws in the applicable jurisdiction (for example, U.S. patents may have a patent term adjustment granted by the U.S. Patent and Trademark Office to compensate for certain delays in examining an application). The Company also relies on trade secret protection to protect its interests in proprietary know-how and for processes for which patents are difficult to obtain or enforce.

| 15 |

Trademarks

The Company owns registrations and/or pending applications for, the trademark NEOVASC, TIARA, and NEOVASC REDUCER in the United States, Canada, and the European Union.

New Products/Components/Cycles

Tiara

The Tiara is an early stage development product that will require several more years of development before it obtains regulatory approval, if ever, for use in any jurisdiction. A first-in-human implantation of the Tiara was successfully performed on January 30, 2014 by physicians at St. Paul’s Hospital in Vancouver, British Columbia. The transapical procedure resulted in the elimination of Mitral Regurgitation and significantly improved heart function in the patient, without the need for cardiac bypass support and with no procedural complications. Subsequently 25 additional patients have been successfully implanted with the Tiara bringing the total number of patients treated with the device to 26 as of this date. In December 2014, the Company announced that it had received approval from the FDA to initiate the TIARA-I study in the United States. The TIARA-I study is a multinational, multicenter early feasibility study being conducted to assess the safety and performance of the Tiara and implantation procedure in high risk surgical patients. The study will include up to 15 patients enrolled at centers in the United States and up to 15 patients at centers in Canada and Europe. The first European patient was enrolled in the study in Antwerp, Belgium in late 2014 and the first U.S. patient was enrolled in mid 2015. The Tiara is currently available in two sizes (35mm and 40 mm); additional sizes are under development (45mm). Following completion of the TIARA-I study the Company intends to continue advancing the Tiara to commercialization and will be undertaking additional studies to support authorization to affix the CE Mark and FDA approval as appropriate. Further information about the Tiara can be found above under the heading “Neovasc’s Products”.

Reducer

The Reducer is a late-stage product with European CE Mark approval. The Company initiated a pilot launch of the Reducer in select European markets in 2015. The Company has also been exploring initiation of the Reducer sales in other non-US markets and has signed distribution agreements in several countries. It is anticipated that sales of the product in the United States would follow once U.S. regulatory approval has been granted, as described further below.

A well-known and well-established medical device contract manufacturer will manufacture the Reducer for the Company. The Reducer is already in pilot production in preparation for commercial launch. The majority of the components that make up the Reducer are readily available; however, two critical components of the device are not. The balloon portion of the delivery system is technically challenging to manufacture and the Reducer device, whilst a basic technology, must be manufactured in Israel due to restrictions on the transfer of intellectual property and manufacturing out of Israel stemming from certain research grants received by NML prior to the acquisition in July 2008. Further information about the Reducer can be found above under the heading “Neovasc’s Products”.

Peripatch Products

The basic Peripatch technology was established over 25 years ago, when the material was used to fashion the leaflets and other components in surgical heart valves.

| 16 |

Neovasc sources its porcine tissue from one abattoir in Canada. The bovine tissue is sourced from abattoirs in the United States for sale of tissue destined for the U.S. market and from abattoirs in both Australia and New Zealand for the sale of tissue destined for Europe. There is a degree of capacity constraint related to the supply of raw tissue but with multiple approved suppliers for each type of tissue the risk of disruption is minimized.

While a definitive pattern of demand has not yet been established and the effect is expected to be minimal, the cyclical nature of the meat industry could conceivably have an impact on the quality and availability of raw tissue and could potentially impact the yields and margins for the product over the course of any given year. Further information about Peripatch can be found above under the heading “Neovasc’s Products”.

Economic Dependence

For the year ended December 31, 2016, revenues from the Company’s three largest customers accounted for 36%, 32% and 15% of the Company’s sales. Some of these customers are either development-stage companies or do not have established markets for their products. In addition, 50% of the Company’s revenues for the year ended December 31, 2016 are derived from consulting services. The Company’s consulting service revenues are contract-driven and they can fluctuate from quarter to quarter and year to year as current projects are completed and new projects start.

The Company anticipates that it will be able to convert more of its consulting services customers, whose products are currently in product development and clinical trials, into contract manufacturing customers as they commercialize their own products. This process is dependent on the product development and regulatory success of these existing customers, so revenues are therefore difficult to project. A change in the economic outlook of these three largest customers could have a material adverse impact on the anticipated revenues of the Company. Factors that may impact these customers may include, among others, the stage of development; additional capital requirements; the impact of any global economic downturn; the ability to develop, manufacture and commercialize its products in a cost-effective manner; the ability to integrate newly-acquired businesses and the ability to protect their intellectual property.

Foreign Operations

While the Company’s headquarters are in Vancouver, British Columbia and a large part of all its operations are in Vancouver, the Company is exposed to factors that influence its revenue from customers located in foreign locations and revenues that are denominated in foreign currencies. The majority of the Company’s revenues are derived from product sales in the United States and Europe, primarily denominated in U.S. dollars and Euros, while the majority of the Company’s costs are denominated in Canadian dollars. The Company expects that foreign currency denominated international sales will continue to account for a significant portion of its revenues. Consequently, a decrease in the value of a relevant foreign currency in relation to the Canadian dollar will have an adverse effect on the Company’s results of operations, with lower than expected revenue amounts and gross margins being reported in the Company’s Canadian dollar financial statements prior to translation into the U.S. dollar presentation currency. In addition, any decrease in the value of the U.S. dollar or Euro occurring in between the time a sale is consummated and the time payment is received by Neovasc will lead to a foreign exchange loss being recognized on the foreign currency denominated trade account receivable. The fluctuation of foreign exchange may impose an adverse effect on the Company’s results of operations and cash flows in the future. The Company does not conduct any hedging activities to mitigate these foreign exchange risks.

Additionally, Neovasc may be materially and adversely affected by increases in duty rates, exchange or price controls, repatriation restrictions, or other restrictions on foreign currencies. The Company’s international operations are subject to certain other risks common to international operations, including, without limitation: government regulations, import restrictions and, in certain jurisdictions, reduced protection for the Company’s intellectual property rights. Foreign currency translation gains and losses arising from normal business operations are credited to or charged to operations in the period incurred. To date, the Company has not entered into any foreign exchange forward contracts. For the year ended December 31, 2016, approximately 51% of the Company’s revenue was generated from customers in the United States, 45% from customers in the European Union and 4% from customers in the rest of the world. Approximately 64% of the Company’s revenue was denominated in U.S. dollars and 34% was denominated in Euros. Substantially all of the Company’s long-lived assets are located in Canada.

| 17 |

Lending

The Company’s cash management policy is to maintain sufficient cash on hand to meet forecast expenditures and to invest any excess capital according to the Company’s investment policy. The Company’s investment policy for these excess cash balances will follow a conservative investment philosophy based on three fundamentals: preservation of capital, liquidity, and best available net return on invested capital.

The Company prohibits speculation on currencies. If there are insufficient foreign funds, foreign currencies will be purchased on an ad hoc basis at the spot rate to fund expenditures. If there are surplus foreign funds, foreign currencies will be converted to Canadian dollars.

The Company has not been involved in any bankruptcy, receivership or similar proceedings within the three most recent completed financial years.

Reorganizations

As described under the heading “Corporate Structure” above, the Company acquired two Israeli companies on July 1, 2008; B-Balloon Ltd. is in the process of being voluntarily liquidated and NML continues to operate as an intellectual property holding company. On September 30, 2013, Neovasc transferred the intangible assets, including patents, trademarks and other know-how, for the Tiara to its 100% wholly-owned subsidiary NTI. On January 1, 2015, Angiometrx Inc. was amalgamated with NMI.

The Company and its subsidiaries now operate as follows: Neovasc Inc. is the Canadian public company and 100% owner of each of the subsidiary entities. NMI is the operating company for the group. It holds all of the Canadian tangible assets and employs all of the Canadian employees of the Company. Neovasc (US) Inc. (NUS) holds all of the US tangible assets and employs all of the US employees of the Company. NTI holds all the intangible assets related to the Tiara and NML holds all the intangible assets related to the Reducer program. NUS charges NMI for development and clinical services conducted in the US. NMI charges both NTI and NML for the development services performed by its employees and employees of NUS to develop the Tiara and the Reducer respectively. NML received a royalty based on the Reducer revenues generated by NMI.

Employees

The Company has seen rapid growth in its employee numbers. The Company has added additional staff in production to meet growing demand for the Company’s services and products, in research and development and clinical and regulatory affairs to accelerate the development of the Tiara and the Reducer and in support areas such as biology, chemistry, risk management, human resources and quality affairs to better assist the commercial and development activities. At the end of each of the last five years and as at March 23, 2017 the number of employees was as follows:

| Year ended December 31: | Number of Employees: | |||||

| 2012 | 77 | |||||

| 2013 | 119 | |||||

| 2014 | 146 | |||||

| 2015 | 197 | |||||

| 2016 | 151 | |||||

| Current | 147 | |||||

| 18 |

Social or Environmental Policies

The Company’s processing of its pericardial tissue involves the use of some controlled and/or hazardous materials. The use and disposal of these materials is controlled by the Company’s quality control procedures and systems. Environmental factors are considered when disposing of these materials and the Company takes steps to ensure it is in compliance with the appropriate regulations surrounding disposal of these materials.

RISK FACTORS

This document contains forward-looking statements regarding the Company, business, prospects and results of operations that involve risks and uncertainties. Neovasc’s actual results could differ materially from the results that may be anticipated by such forward-looking statements and discussed elsewhere in this Annual Information Form. Factors that could cause or contribute to such differences include, but are not limited to, those discussed below, as well as those discussed elsewhere in this Annual Information Form. If any of the following risks occur, the Company’s business, financial condition or operating results could be harmed. In that case, the trading price of Neovasc common shares could decline.

Investment in the common shares of the Company is speculative and involves a high degree of risk, is subject to the following specific risks among others, and should be undertaken only by purchasers whose financial resources are sufficient to enable them to assume such risks. The common shares of the Company should not be purchased by persons who cannot afford the possibility of the loss of their entire investment. Prospective purchasers should review these risks as well as other matters disclosed elsewhere in this Annual Information Form with their professional advisors.

The Company is subject to lawsuits that could divert its resources and result in the payment of significant damages and other remedies.

The Company is engaged in litigation with CardiAQ, as further described below. Litigation resulting from CardiAQ’s claims has been, and is expected to continue to be, costly and time-consuming and could divert the attention of management and key personnel from our business operations. We cannot assure that we will succeed in defending any of these claims and that further judgments will not be entered against us with respect to the litigation resulting from such claims. If we are unsuccessful in our defense of these claims (including any appeal to the verdict in the Massachusetts litigation with CardiAQ), or unable to settle the claims in a manner satisfactory to us, we may be faced with significant monetary damages that could exceed our resources and/or loss of intellectual property rights that could have a material adverse effect on the Company and its financial position. These circumstances create material uncertainty and cast substantial doubt about the Company’s ability to continue as a going concern.

On June 6, 2014, Neovasc was named in a lawsuit filed by CardiAQ in the U.S. District Court for the District of Massachusetts concerning intellectual property rights ownership, unfair trade practices and a breach of contract relating to Neovasc’s transcatheter mitral valve technology, including the Tiara. On May 19, 2016, a jury awarded $70 million in favour of CardiAQ on certain trade secret claims. On October 31, 2016, a judge awarded an additional $21 million in enhanced damages to the jury’s award. On January 18, 2017, a judge granted CardiAQ’s motion for pre- and post-judgment interest, all as more particularly described in the section titled “Legal Proceedings”, below. The judgment in the District of Massachusetts case, including the pre- and post- judgment interest amounts, is currently stayed pending completion of the upcoming appeal pursuant to a court order of December 23, 2016. Under the terms of the stay, Neovasc has deposited $70 million into a joint escrow account and entered into a general security agreement related to the remaining damages awarded by the court. Neovasc will also require court approval for transactions outside the course of normal business until such time that an appeal is decided in Neovasc’s favor or the Company posts the remaining amount of money judgment into the joint escrow account. The Company intends to seek an expedited appeal of the judgment, including the underlying damages award upon which these figures were calculated, before the United States Court of Appeals for the Federal Circuit.

| 19 |

On June 23, 2014, CardiAQ also filed a complaint against Neovasc in Germany requesting that Neovasc assign its right to one of its European patent applications to CardiAQ. On July 7, 2014, the Company was made aware through a press release issued by CardiAQ of a stay in proceedings for Neovasc’s European patent application that is the subject of the German lawsuit. This stay of proceedings was granted without an opportunity for Neovasc to respond to CardiAQ’s allegations. The Company requested that the stay be lifted, but the request was denied by the European Patent office pending resolution of the German lawsuit. Neovasc filed its response to the German lawsuit in December 2014. On December 14, 2016, a hearing took place in Munich, Germany regarding the German lawsuit. Further arguments were heard in court and no decision has been rendered by the court at this time.

The Company intends to continue to vigorously defend itself in the litigation with CardiAQ. The outcome of these matters, including whether the Company will be required to pay some or all of the damages awarded is not currently determinable.

When the company assesses that it is more likely that a present obligation exists at the end of the reporting period and that the possibility of an outflow of economic resources embodying economic benefits is probable, a provision is recognized and contingent liability disclosure is required. As at December 31, 2016, the Company has fully provided for the damages awards described above.

There is substantial doubt about our ability to continue as a going concern.