drna-2020123100013995292020FYFALSEus-gaap:AccountingStandardsUpdate201602Memberus-gaap:PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationdrna:OperatingAndFinanceLeaseLiabilityCurrentdrna:OperatingAndFinanceLeaseLiabilityNoncurrentdrna:OperatingAndFinanceLeaseLiabilityCurrentdrna:OperatingAndFinanceLeaseLiabilityNoncurrent00013995292020-01-012020-12-31iso4217:USD00013995292020-06-30xbrli:shares00013995292021-02-2200013995292020-12-3100013995292019-12-31iso4217:USDxbrli:shares00013995292019-01-012019-12-3100013995292018-01-012018-12-310001399529us-gaap:CommonStockMember2017-12-310001399529us-gaap:AdditionalPaidInCapitalMember2017-12-310001399529us-gaap:RetainedEarningsMember2017-12-3100013995292017-12-310001399529us-gaap:CommonStockMember2018-01-012018-12-310001399529us-gaap:AdditionalPaidInCapitalMember2018-01-012018-12-310001399529us-gaap:CommonStockMemberdrna:AlnylamMember2018-01-012018-12-310001399529drna:AlnylamMemberus-gaap:AdditionalPaidInCapitalMember2018-01-012018-12-310001399529drna:AlnylamMember2018-01-012018-12-310001399529us-gaap:CommonStockMemberus-gaap:CollaborativeArrangementTransactionWithPartyToCollaborativeArrangementMember2018-01-012018-12-310001399529us-gaap:AdditionalPaidInCapitalMemberus-gaap:CollaborativeArrangementTransactionWithPartyToCollaborativeArrangementMember2018-01-012018-12-310001399529us-gaap:CollaborativeArrangementTransactionWithPartyToCollaborativeArrangementMember2018-01-012018-12-310001399529us-gaap:RetainedEarningsMember2018-01-012018-12-310001399529us-gaap:CommonStockMember2018-12-310001399529us-gaap:AdditionalPaidInCapitalMember2018-12-310001399529us-gaap:RetainedEarningsMember2018-12-3100013995292018-12-310001399529us-gaap:CommonStockMember2019-01-012019-12-310001399529us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310001399529us-gaap:RetainedEarningsMember2019-01-012019-12-310001399529us-gaap:CommonStockMemberus-gaap:CollaborativeArrangementTransactionWithPartyToCollaborativeArrangementMember2019-01-012019-12-310001399529us-gaap:AdditionalPaidInCapitalMemberus-gaap:CollaborativeArrangementTransactionWithPartyToCollaborativeArrangementMember2019-01-012019-12-310001399529us-gaap:CollaborativeArrangementTransactionWithPartyToCollaborativeArrangementMember2019-01-012019-12-310001399529us-gaap:RetainedEarningsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2018-12-310001399529srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2018-12-310001399529us-gaap:CommonStockMember2019-12-310001399529us-gaap:AdditionalPaidInCapitalMember2019-12-310001399529us-gaap:RetainedEarningsMember2019-12-310001399529us-gaap:CommonStockMember2020-01-012020-12-310001399529us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001399529us-gaap:RetainedEarningsMember2020-01-012020-12-310001399529us-gaap:CommonStockMember2020-12-310001399529us-gaap:AdditionalPaidInCapitalMember2020-12-310001399529us-gaap:RetainedEarningsMember2020-12-31drna:program0001399529srt:MaximumMember2020-01-012020-12-310001399529drna:LabEquipmentMember2020-01-012020-12-310001399529srt:MinimumMemberdrna:OfficeAndComputerEquipmentMember2020-01-012020-12-310001399529srt:MaximumMemberdrna:OfficeAndComputerEquipmentMember2020-01-012020-12-310001399529us-gaap:FurnitureAndFixturesMember2020-01-012020-12-310001399529us-gaap:LeaseholdImprovementsMember2020-01-012020-12-310001399529us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2020-01-012020-12-31drna:segment0001399529us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001399529us-gaap:EmployeeStockOptionMember2019-01-012019-12-310001399529us-gaap:EmployeeStockOptionMember2018-01-012018-12-310001399529us-gaap:WarrantMember2020-01-012020-12-310001399529us-gaap:WarrantMember2019-01-012019-12-310001399529us-gaap:WarrantMember2018-01-012018-12-310001399529us-gaap:RestrictedStockMember2020-01-012020-12-310001399529us-gaap:RestrictedStockMember2019-01-012019-12-310001399529us-gaap:RestrictedStockMember2018-01-012018-12-310001399529us-gaap:USTreasurySecuritiesMember2020-12-310001399529us-gaap:USTreasurySecuritiesMember2019-12-310001399529us-gaap:MoneyMarketFundsMember2020-12-310001399529us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2020-12-310001399529us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2020-12-310001399529us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMember2020-12-310001399529us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasurySecuritiesMember2020-12-310001399529us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasurySecuritiesMember2020-12-310001399529us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel3Member2020-12-310001399529us-gaap:FairValueInputsLevel1Member2020-12-310001399529us-gaap:FairValueInputsLevel2Member2020-12-310001399529us-gaap:FairValueInputsLevel3Member2020-12-310001399529us-gaap:MoneyMarketFundsMember2019-12-310001399529us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2019-12-310001399529us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2019-12-310001399529us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMember2019-12-310001399529us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasurySecuritiesMember2019-12-310001399529us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasurySecuritiesMember2019-12-310001399529us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel3Member2019-12-310001399529us-gaap:FairValueInputsLevel1Member2019-12-310001399529us-gaap:FairValueInputsLevel2Member2019-12-310001399529us-gaap:FairValueInputsLevel3Member2019-12-310001399529drna:LabEquipmentMember2020-12-310001399529drna:LabEquipmentMember2019-12-310001399529drna:OfficeAndComputerEquipmentMember2020-12-310001399529drna:OfficeAndComputerEquipmentMember2019-12-310001399529us-gaap:FurnitureAndFixturesMember2020-12-310001399529us-gaap:FurnitureAndFixturesMember2019-12-310001399529us-gaap:LeaseholdImprovementsMember2020-12-310001399529us-gaap:LeaseholdImprovementsMember2019-12-310001399529us-gaap:ConstructionInProgressMember2020-12-310001399529us-gaap:ConstructionInProgressMember2019-12-310001399529srt:MaximumMemberdrna:AlnylamCollaborationAndLicenseAgreementMember2020-04-030001399529drna:AlnylamCollaborationAndLicenseAgreementMember2020-10-012020-12-31drna:target0001399529drna:NovoCollaborationAgreementMember2019-11-152019-11-150001399529drna:NovoCollaborationAgreementMember2019-11-150001399529drna:NovoCollaborationAgreementMembersrt:MaximumMember2019-11-150001399529drna:NovoShareIssuanceAgreementMember2019-11-152019-11-150001399529drna:NovoShareIssuanceAgreementMember2018-10-250001399529drna:NovoShareIssuanceAgreementMember2019-11-152019-11-150001399529drna:NovoCollaborationAgreementMember2020-10-012020-12-310001399529drna:NovoCollaborationAgreementAndNovoShareIssuanceAgreementMember2019-11-152019-11-150001399529drna:NovoCollaborationAgreementAndNovoShareIssuanceAgreementMember2019-11-15xbrli:pure0001399529drna:NovoCollaborationAgreementAndNovoShareIssuanceAgreementMember2020-10-012020-12-310001399529drna:NovoCollaborationAgreementMember2020-01-012020-12-310001399529drna:RocheCollaborationAgreementMember2019-10-302019-10-300001399529drna:RocheCollaborationAgreementMember2020-04-012020-04-300001399529drna:RocheCollaborationAgreementMember2020-01-310001399529srt:MaximumMemberdrna:RocheCollaborationAgreementMember2019-10-300001399529srt:MaximumMemberdrna:RocheCollaborationAgreementMember2019-11-012019-11-300001399529drna:RocheCollaborationAgreementMember2019-10-300001399529drna:RocheCollaborationAgreementMember2020-01-012020-12-310001399529drna:LillyCollaborationAndLicenseAgreementMember2018-10-252018-10-250001399529drna:LillyShareIssuanceAgreementMember2018-10-252018-10-250001399529srt:MaximumMemberdrna:LillyCollaborationAndLicenseAgreementMember2018-10-250001399529drna:LillyCollaborationAndLicenseAgreementMember2018-10-250001399529drna:LillyShareIssuanceAgreementMember2018-10-252018-10-250001399529drna:LillyShareIssuanceAgreementMember2018-10-250001399529drna:LillyShareIssuanceAgreementMember2018-10-250001399529drna:LillyShareIssuanceAgreementMember2020-10-012020-12-310001399529us-gaap:SubsequentEventMemberdrna:LillyCollaborationAndLicenseAgreementMember2021-02-012021-02-28drna:extensionOption0001399529drna:LillyCollaborationAgreementAndLillyShareIssuanceAgreementMember2018-10-252018-10-250001399529drna:LillyCollaborationAndLicenseAgreementMember2020-12-310001399529drna:AlexionCollaborativeResearchAndLicenseAgreementMember2018-10-220001399529srt:MaximumMemberdrna:AlexionCollaborativeResearchAndLicenseAgreementMember2018-10-220001399529srt:MaximumMemberdrna:AlexionCollaborativeResearchAndLicenseAgreementMember2018-10-222018-10-220001399529drna:AlexionCollaborativeResearchAndLicenseAgreementMember2018-10-222018-10-220001399529drna:AlexionShareIssuanceAgreementMember2018-10-222018-10-220001399529drna:AlexionShareIssuanceAgreementMember2018-10-220001399529drna:AlexionShareIssuanceAgreementMember2018-10-222018-10-22drna:milestone0001399529drna:AlexionCollaborativeResearchAndLicenseAgreementAmendmentMember2018-10-222018-10-220001399529drna:AlexionCollaborativeResearchAndLicenseAgreementAmendmentMember2019-12-012019-12-310001399529drna:AlexionCollaborativeResearchAndLicenseAndShareIssuanceAgreementMember2020-12-310001399529drna:AlexionCollaborativeResearchAndLicenseAgreementMember2020-01-012020-12-310001399529drna:AlexionCollaborativeResearchAndLicenseAgreementMember2019-01-012019-12-310001399529drna:AlexionCollaborativeResearchAndLicenseAgreementMember2018-01-012018-12-310001399529drna:AlexionCollaborativeResearchAndLicenseAgreementAmendmentMember2020-01-012020-12-310001399529drna:AlexionCollaborativeResearchAndLicenseAgreementAmendmentMember2019-01-012019-12-310001399529drna:AlexionCollaborativeResearchAndLicenseAgreementAmendmentMember2018-01-012018-12-310001399529drna:AlexionCollaborativeResearchAndLicenseAgreementAndAmendmentMember2020-01-012020-12-310001399529drna:AlexionCollaborativeResearchAndLicenseAgreementAndAmendmentMember2019-01-012019-12-310001399529drna:AlexionCollaborativeResearchAndLicenseAgreementAndAmendmentMember2018-01-012018-12-310001399529drna:AlexionCollaborativeResearchAndLicenseAgreementMember2020-12-310001399529drna:AlexionCollaborativeResearchAndLicenseAgreementAmendmentMember2020-12-310001399529drna:AlexionCollaborativeResearchAndLicenseAgreementAndAmendmentMember2020-12-310001399529drna:AlexionCollaborativeResearchAndLicenseAgreementMember2019-12-310001399529drna:AlexionCollaborativeResearchAndLicenseAgreementAmendmentMember2019-12-310001399529drna:AlexionCollaborativeResearchAndLicenseAgreementAndAmendmentMember2019-12-310001399529drna:BoehringerIngelheimAgreementMember2017-10-270001399529drna:BoehringerIngelheimAgreementMember2017-10-272017-10-270001399529drna:BoehringerIngelheimAdditionalTargetAgreementMember2018-01-012018-12-310001399529us-gaap:TransferredOverTimeMemberdrna:BoehringerIngelheimAgreementMember2017-10-270001399529drna:BoehringerIngelheimAdditionalTargetAgreementMember2018-10-310001399529drna:BoehringerIngelheimAdditionalTargetAgreementMember2018-10-012018-10-310001399529srt:MaximumMemberdrna:BoehringerIngelheimAdditionalTargetAgreementMember2018-10-310001399529drna:BoehringerIngelheimAdditionalTargetAgreementMember2019-01-012019-01-310001399529drna:BoehringerIngelheimAdditionalTargetAgreementMember2020-01-012020-12-310001399529drna:LillyCollaborationAndLicenseAgreementMember2020-01-012020-12-310001399529drna:BoehringerIngelheimAgreementMember2020-01-012020-12-310001399529drna:NovoCollaborationAgreementMember2019-01-012019-12-310001399529drna:NovoCollaborationAgreementMember2018-01-012018-12-310001399529drna:RocheCollaborationAgreementMember2019-01-012019-12-310001399529drna:RocheCollaborationAgreementMember2018-01-012018-12-310001399529drna:LillyCollaborationAndLicenseAgreementMember2019-01-012019-12-310001399529drna:LillyCollaborationAndLicenseAgreementMember2018-01-012018-12-310001399529drna:BoehringerIngelheimAgreementMember2019-01-012019-12-310001399529drna:BoehringerIngelheimAgreementMember2018-01-012018-12-310001399529drna:OtherCollaborativeArrangementPartnerMember2020-01-012020-12-310001399529drna:OtherCollaborativeArrangementPartnerMember2019-01-012019-12-310001399529drna:OtherCollaborativeArrangementPartnerMember2018-01-012018-12-310001399529drna:NovoCollaborationAgreementMember2020-12-310001399529drna:RocheCollaborationAgreementMember2020-12-310001399529drna:NovoCollaborationAgreementMember2019-12-310001399529drna:RocheCollaborationAgreementMember2019-12-310001399529drna:LillyCollaborationAndLicenseAgreementMember2019-12-310001399529drna:BoehringerIngelheimAgreementMember2019-12-3100013995292018-04-202018-04-200001399529us-gaap:CommonStockMemberdrna:OfferingOf2018Memberdrna:UnderwritingAgreementMember2018-09-112018-09-110001399529us-gaap:OverAllotmentOptionMember2017-12-182017-12-180001399529us-gaap:CommonStockMemberdrna:UnderwritingAgreementMemberus-gaap:OverAllotmentOptionMember2018-09-112018-09-110001399529us-gaap:CommonStockMemberdrna:UnderwritingAgreementMember2018-09-112018-09-1100013995292018-09-112018-09-110001399529drna:ShelfRegistrationMember2020-02-062020-02-060001399529drna:ShelfRegistrationMember2020-02-060001399529drna:StockOptionPlanTwoThousandAndFourteenMember2014-01-140001399529drna:StockOptionPlanTwoThousandAndFourteenMember2014-01-142014-01-140001399529drna:StockOptionPlanTwoThousandAndFourteenMember2015-05-312015-05-310001399529us-gaap:ShareBasedCompensationAwardTrancheOneMemberdrna:StockOptionPlanTwoThousandAndFourteenMember2020-01-012020-12-310001399529drna:StockOptionPlanTwoThousandAndFourteenMember2020-01-012020-12-310001399529drna:StockOptionPlanTwoThousandAndFourteenMemberdrna:AnnualPromotionalAndIncentiveRelatedGrantsMember2020-01-012020-12-310001399529us-gaap:RestrictedStockUnitsRSUMemberdrna:StockOptionPlanTwoThousandAndFourteenMember2020-12-310001399529drna:StockOptionPlanTwoThousandAndFourteenMember2020-12-310001399529drna:InducementGrantsMember2014-01-012014-12-310001399529drna:InducementGrantsMember2015-01-012015-12-310001399529drna:InducementGrantsMember2020-12-310001399529drna:TwoThousandAndSixteenInducementPlanMember2016-03-040001399529drna:TwoThousandAndSixteenInducementPlanMember2017-02-012017-02-280001399529drna:TwoThousandAndSixteenInducementPlanMember2017-05-012017-05-310001399529drna:TwoThousandAndSixteenInducementPlanMember2018-12-102018-12-100001399529drna:TwoThousandAndSixteenInducementPlanMember2018-12-112018-12-110001399529drna:TwoThousandAndSixteenInducementPlanMember2019-12-012019-12-310001399529drna:TwoThousandAndSixteenInducementPlanMember2020-01-012020-12-310001399529drna:TwoThousandAndSixteenInducementPlanMemberus-gaap:RestrictedStockUnitsRSUMember2020-12-310001399529drna:TwoThousandAndSixteenInducementPlanMember2020-12-310001399529us-gaap:ResearchAndDevelopmentExpenseMember2020-01-012020-12-310001399529us-gaap:ResearchAndDevelopmentExpenseMember2019-01-012019-12-310001399529us-gaap:ResearchAndDevelopmentExpenseMember2018-01-012018-12-310001399529us-gaap:GeneralAndAdministrativeExpenseMember2020-01-012020-12-310001399529us-gaap:GeneralAndAdministrativeExpenseMember2019-01-012019-12-310001399529us-gaap:GeneralAndAdministrativeExpenseMember2018-01-012018-12-310001399529srt:MinimumMemberus-gaap:EmployeeStockOptionMember2020-12-310001399529us-gaap:EmployeeStockOptionMembersrt:MaximumMember2020-12-310001399529srt:MinimumMemberus-gaap:EmployeeStockOptionMember2019-12-310001399529us-gaap:EmployeeStockOptionMembersrt:MaximumMember2019-12-310001399529srt:MinimumMemberus-gaap:EmployeeStockOptionMember2018-12-310001399529us-gaap:EmployeeStockOptionMembersrt:MaximumMember2018-12-310001399529srt:MinimumMemberus-gaap:EmployeeStockOptionMember2020-01-012020-12-310001399529us-gaap:EmployeeStockOptionMembersrt:MaximumMember2020-01-012020-12-310001399529srt:MinimumMemberus-gaap:EmployeeStockOptionMember2019-01-012019-12-310001399529us-gaap:EmployeeStockOptionMembersrt:MaximumMember2019-01-012019-12-310001399529srt:MinimumMemberus-gaap:EmployeeStockOptionMember2018-01-012018-12-310001399529us-gaap:EmployeeStockOptionMembersrt:MaximumMember2018-01-012018-12-310001399529us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001399529us-gaap:EmployeeStockOptionMember2019-01-012019-12-310001399529us-gaap:EmployeeStockOptionMember2018-01-012018-12-310001399529us-gaap:RestrictedStockUnitsRSUMember2019-12-310001399529us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310001399529us-gaap:RestrictedStockUnitsRSUMember2020-12-310001399529drna:TwoThousandAndFourteenEmployeeStockPurchasePlanMember2014-01-282014-01-280001399529drna:TwoThousandAndFourteenEmployeeStockPurchasePlanMember2020-12-310001399529drna:TwoThousandAndFourteenEmployeeStockPurchasePlanMember2014-01-280001399529srt:MaximumMemberdrna:TwoThousandAndFourteenEmployeeStockPurchasePlanMember2014-01-282014-01-280001399529drna:TwoThousandAndFourteenEmployeeStockPurchasePlanMember2020-01-012020-12-310001399529drna:TwoThousandAndFourteenEmployeeStockPurchasePlanMember2019-01-012019-12-310001399529drna:TwoThousandAndFourteenEmployeeStockPurchasePlanMember2018-01-012018-12-310001399529us-gaap:DomesticCountryMember2020-01-012020-12-310001399529us-gaap:DomesticCountryMember2019-01-012019-12-310001399529us-gaap:DomesticCountryMember2018-01-012018-12-310001399529us-gaap:DomesticCountryMember2020-12-310001399529us-gaap:StateAndLocalJurisdictionMember2020-12-310001399529stpr:MA2020-12-31utr:sqft0001399529drna:LexingtonMassachusettsMember2020-01-14drna:renewalOption0001399529drna:LexingtonMassachusettsMember2020-01-142020-01-140001399529srt:MinimumMemberdrna:LexingtonMassachusettsMember2020-01-140001399529srt:MaximumMemberdrna:LexingtonMassachusettsMember2020-01-140001399529drna:LexingtonMassachusettsMemberdrna:HaydenAvenueLetterOfCreditMember2020-01-1400013995292020-07-0100013995292020-07-012020-07-010001399529drna:HaydenAvenueLetterOfCreditMember2020-07-0100013995292019-01-0200013995292019-01-022019-01-020001399529drna:BoulderColoradoMember2019-08-260001399529drna:BoulderColoradoMember2020-01-012020-12-310001399529drna:BoulderColoradoMember2020-12-310001399529drna:BoulderColoradoMember2020-02-050001399529drna:BoulderColoradoMember2020-07-082020-07-080001399529drna:BoulderColoradoMember2020-07-1800013995292014-12-010001399529drna:CambridgeLeasesLetterOfCreditMember2014-12-010001399529us-gaap:SettledLitigationMemberdrna:AlnylamMember2018-04-180001399529srt:MinimumMemberus-gaap:SettledLitigationMemberdrna:AlnylamMember2018-04-182018-04-180001399529us-gaap:SettledLitigationMemberdrna:AlnylamMembersrt:MaximumMember2018-04-182018-04-180001399529us-gaap:SettledLitigationMemberdrna:AlnylamMember2018-04-182018-04-180001399529drna:AlnylamShareIssuanceAgreementMember2018-04-202018-04-200001399529us-gaap:SettledLitigationMemberdrna:AlnylamMember2018-05-310001399529drna:AlexionPharmaceuticalsMember2018-05-310001399529us-gaap:AdditionalPaidInCapitalMemberdrna:AlexionPharmaceuticalsMember2018-01-012018-12-310001399529drna:AlexionCollaborativeResearchAndLicenseAgreementMember2018-10-310001399529drna:AlexionCollaborativeResearchAndLicenseAgreementMember2018-11-012018-11-300001399529us-gaap:SettledLitigationMemberdrna:AlnylamMember2018-01-012018-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2020

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-36281

DICERNA PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 20-5993609 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

| | | | | | | | |

75 Hayden Avenue Lexington, MA | | 02421 |

(Address of principal executive offices)

| | (Zip code) |

(617) 621-8097

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock, $0.0001 Par Value | DRNA | The Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days). Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☑ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act) Yes ☐ No ☑

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant on June 30, 2020 was approximately $1.8 billion based on the last reported sale of the registrant’s common stock on The Nasdaq Global Select Market on June 30, 2020 of $25.40 per share.

As of February 22, 2021, there were 76,320,893 shares of the registrant’s common stock, par value $0.0001 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for its 2021 Annual Meeting of Stockholders are incorporated by reference into Part III hereof. Such proxy statement will be filed with the Securities and Exchange Commission not later than 120 days after the end of the fiscal year covered by this Annual Report on Form 10-K.

DICERNA PHARMACEUTICALS, INC.

2020 ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements other than statements of historical fact are “forward-looking statements” for purposes of this Annual Report on Form 10-K. In some cases, you can identify forward-looking statements by terminology such as “may,” “could,” “will,” “would,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “intend,” “predict,” “seek,” “contemplate,” “project,” “continue,” “potential,” “ongoing,” “goal,” or the negative of these terms or other comparable terminology. These forward-looking statements include, but are not limited to, statements about:

• future conduct of the business of the Company, its clinical programs, and operations, including in relation to the COVID-19 pandemic;

•the research and development plans and timelines related to the Company’s clinical programs, including the opportunity to enroll, continue, or resume clinical studies that are slowed or halted by the COVID-19 pandemic;

•the initiation, timing, progress, and results of our preclinical studies and Investigational New Drug Applications, Clinical Trial Applications, New Drug Applications and other regulatory submissions;

•our alignment with the United States (“U.S.”) Food and Drug Administration on regulatory approval requirements;

• identification and development of product candidates for the treatment of additional disease indications;

• obtaining and maintaining regulatory approval of any of our product candidates;

• the rate and degree of market acceptance of any approved product candidates;

• the commercialization of any approved product candidates;

• our ability to establish and maintain existing and additional collaborations and retain commercial rights with respect to some or all of our product candidates in the collaborations;

• the implementation of our business model and strategic plans for our business, technologies, and product candidates;

• how long we expect to maintain liquidity to fund our planned level of operations and our ability to obtain additional funds for our operations and growth;

•our estimates of our expenses, ongoing losses, future revenue, and capital requirements;

• obtaining, maintaining, and defending intellectual property protection for our technologies and product candidates and our freedom to operate our business without infringing the intellectual property rights of others;

• our reliance on third parties to conduct our preclinical studies or any clinical trials;

• the continued manufacture and supply of raw materials and components for the Company’s clinical and development programs, the availability of any of which could be significantly impaired by the COVID-19 pandemic;

• our ability to attract and retain qualified key management and personnel;

• our dependence on our existing collaborators, Novo Nordisk A/S, Roche, Eli Lilly and Company, Alexion Pharmaceuticals, Inc., Boehringer Ingelheim International GmbH, and Alnylam Pharmaceuticals, Inc. for developing, obtaining regulatory approval for, and commercializing product candidates in the collaborations;

• our receipt and timing of any potential milestone payments or royalties under our existing research collaborations and license agreements or any future arrangements with our existing collaboration partners or any other collaborators;

• the impact of changes in the government and agency leadership positions in connection with the 2020 presidential election as well as future election cycles;

•our financial performance; and

• developments relating to our competitors or our industry.

These statements relate to future events or to our future financial performance and involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by these forward-looking statements. Factors that may cause actual results to differ materially from current expectations include, among other things, those set forth in Part I, Item 1A – “Risk Factors” below and for the reasons described elsewhere in this Annual Report on Form 10-K. Any forward-looking statement in this Annual Report on Form 10-K reflects our current view with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to our operations, results of operations, industry, and future growth. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Except as required by law, we assume no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future.

This Annual Report on Form 10-K also contains estimates, projections, and other information concerning our industry, our business, and the markets for certain drugs, including data regarding the estimated size of those markets, their projected growth rates, and the incidence of certain medical conditions. Information that is based on estimates, forecasts, projections, or similar methodologies is inherently subject to uncertainties, and actual events or circumstances may differ materially from events and circumstances reflected in this information. Unless otherwise expressly stated, we obtained these industry, business, market, and other data from reports, research surveys, studies, and similar data prepared by third parties, industry, medical and general publications, government data, and similar sources. In some cases, we do not expressly refer to the sources from which these data are derived.

Except where the context otherwise requires, in this Annual Report on Form 10-K, “we,” “us,” “our,” “Dicerna,” and the “Company” refer to Dicerna Pharmaceuticals, Inc. and, where appropriate, its consolidated subsidiaries.

Trademarks

This Annual Report on Form 10-K includes trademarks, service marks, and trade names owned by us or other companies. All trademarks, service marks, and trade names included in this Annual Report on Form 10-K are the property of their respective owners. Solely for convenience, the trademarks and trade names in this report may be referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto.

Risk Factor Summary

Our business is subject to numerous risks and uncertainties. These risks represent challenges to the successful implementation of our strategy and to the growth and future profitability of our business. These risks include, but are not limited to, the following:

•Business interruptions resulting from the coronavirus disease (COVID-19) outbreak or similar public health crises could cause a disruption to the development of our product candidates and adversely impact our business.

•We will need to raise substantial additional funds to advance development of our product candidates and we cannot guarantee that we will have sufficient funds available in the future to develop and commercialize our current or future product candidates. Raising additional funds may cause dilution to our stockholders, restrict our operations, or require us to relinquish control over our technologies or product candidates.

•Our approach to the discovery and development of innovative therapeutic treatments based on novel technologies is unproven and may not result in marketable products.

•The market may not be receptive to our product candidates based on a novel therapeutic modality, and we may not generate any future revenue from the sale or licensing of product candidates.

•Our product candidates are in varied stages of development, including some in early stages, and may fail or suffer delays that materially and adversely affect their commercial viability.

•Breakthrough Therapy Designation by the FDA may not actually lead to a faster development or regulatory review or approval process.

•The approval of our marketing application may be delayed due to the failure to satisfy FDA regulatory requirements, resulting in a delay in the commercial launch of nedosiran.

•We are dependent on our collaboration partners for the successful development of product candidates and, therefore, are subject to the efforts of these partners and our ability to successfully collaborate with these partners.

•Because we rely on third-party manufacturing and supply partners, our supply of research and development, preclinical studies, and clinical trial materials may become limited or interrupted or may not be of satisfactory quantity or quality, and if the third parties on which we depend do not perform as contractually required, our development programs could be delayed with materially adverse effects on our business, financial condition, results of operations, and prospects.

•Interim and preliminary data from our clinical trials that we announce or publish from time to time may change as more patient data become available or as additional analyses are conducted and as the data are subject to audit and verification procedures that could result in material changes in the final data.

•We may be unable to successfully commercialize our products if we are unable to develop sales, marketing, and distribution capabilities on our own or enter into agreements with third parties to perform these functions on acceptable terms.

•We may be unable to successfully commercialize our products if the regulatory-approved labeling for our products does not enable us to appropriately differentiate our products from competitive products.

•Price controls imposed in foreign markets and downward pricing pressure in the U.S. may adversely affect our future profitability.

•Our current operations are largely concentrated in one location and any events affecting this location may have material adverse consequences.

•We may be unable to protect our intellectual property rights throughout the world.

•We may be unable to obtain U.S. or foreign regulatory approval and, as a result, may be unable to commercialize our product candidates.

•Our ability to obtain reimbursement or funding from the federal government may be impacted by possible reductions in federal spending.

•Recent federal legislation and actions by state and local governments may permit reimportation of drugs from foreign countries into the U.S., including foreign countries where the drugs are sold at lower prices than in the U.S., which could materially adversely affect our operating results.

•Anti-takeover provisions in our charter documents and under Delaware law could make an acquisition of us, which may be beneficial to our stockholders, more difficult and may prevent attempts by our stockholders to replace or remove our current management.

PART I

ITEM 1. BUSINESS

Overview

Dicerna Pharmaceuticals, Inc. (“we,” “us,” “our,” “the Company,” or “Dicerna”) is a biopharmaceutical company focused on discovering, developing, and commercializing medicines that are designed to leverage ribonucleic acid interference (“RNAi”) to silence selectively genes that cause or contribute to disease. Using our proprietary GalXC™ and GalXC-Plus™ RNAi technologies, Dicerna is committed to developing RNAi-based therapies with the potential to treat both rare and more prevalent diseases. By silencing disease-causing genes, Dicerna’s GalXC platform has the potential to address conditions that are difficult to treat with other modalities. Initially focused on disease-causing genes in the liver, Dicerna has continued to innovate and is exploring new applications of its RNAi technology with GalXC-Plus, which expands on the functionality and application of our flagship liver-based GalXC technology, yet has the potential to treat diseases across multiple therapeutic areas. In addition to our own pipeline of core discovery and clinical candidates, Dicerna has established collaborative relationships with some of the world’s leading pharmaceutical companies, including Novo Nordisk A/S (“Novo”), Roche, Eli Lilly and Company (“Lilly”), Alexion Pharmaceuticals, Inc. (together with its affiliates, “Alexion”), Boehringer Ingelheim International GmbH (“BI”), and Alnylam Pharmaceuticals, Inc. (“Alnylam”). Between Dicerna and our collaborative partners, we currently have more than 20 active discovery, preclinical, or clinical programs focused on rare, cardiometabolic, viral, chronic liver, and complement-mediated diseases, as well as neurodegenerative diseases and pain.

Most of our drug discovery and development efforts are based on the therapeutic modality of RNAi, a highly potent, natural, and specific mechanism that can be directed to reduce expression of a target gene. In this naturally occurring biological process, a short, synthetic, double-stranded RNA duplex induces the enzymatic destruction of the messenger ribonucleic acid (“mRNA”) of a target gene that contains sequences complementary to one strand of a double-stranded RNA. Our approach is to design proprietary RNA molecules that have the potential to engage the enzyme Dicer and direct the endogenous cellular RNAi machinery to silence a specific therapeutic target gene. Our GalXC technology utilizes a proprietary N-acetyl-D-galactosamine (“GalNAc”)-mediated conjugate to cause the liver to efficiently internalize our synthetic RNA molecules. In contrast, our GalXC-Plus technology incorporates new chemistries and secondary structures to enable targeting of genes in tissues and cell types beyond the liver. Our current clinical programs utilize the GalXC technology. Our GalXC-Plus technology utilizes modified RNA structures and various fully-synthetic conjugated ligands to deliver to non-liver tissues and is used in a number of our preclinical programs. Due to the enzymatic nature of RNAi, a single GalXC or GalXC-Plus molecule incorporated into the RNAi machinery can direct the cleavage and silencing of hundreds or thousands of mRNAs from the targeted gene.

Strategy

We are committed to delivering transformative therapies based on our GalXC platform to patients with serious diseases, and currently our focus includes rare, cardiometabolic, viral, chronic liver, and complement-mediated diseases, as well as neurodegenerative diseases and pain. We and our collaborators have identified dozens of disease-associated genes with the potential to treat clinical indications in which an RNAi-based inhibitor may provide substantial benefit to patients.

The key elements of our strategy are as follows:

•Create new programs in disease indications with high unmet medical need. We intend to continue to use our proprietary GalXC and GalXC-Plus RNAi technologies to create new, high-value pharmaceutical programs. Our areas of primary focus are: (1) rare inherited diseases involving genes in the liver; (2) other therapeutic areas involving the expression of therapeutic gene targets in the liver such as chronic liver diseases, cardiometabolic diseases, and viral infectious diseases; and (3) leveraging our GalXC-Plus constructs to explore therapeutic gene targets in complement-mediated diseases, as well as diseases impacting the central nervous system (“CNS”), adipose cells, skeletal muscle, and other tissues.

•Validate our product candidates and our platform in clinical proof-of-concept studies. In September 2018, we declared attainment of clinical proof-of-concept for nedosiran, which is in clinical development for primary hyperoxaluria (“PH”) type 1 (“PH1”), PH type 2 (“PH2”), and PH type 3 (“PH3”). In November 2020, we announced clinical proof-of-concept data and are currently conducting a clinical study for RG6346 for chronic hepatitis B virus (“HBV”) infection. We are planning to initiate a Phase 2 trial of belcesiran (formerly DCR-A1AT) in patients with alpha-1 antitrypsin (“AAT”) deficiency-associated liver disease (“AATLD”) in the first half of 2021. Based on precedent in the RNAi field, we are optimistic that our preclinical studies, which showed significant knockdown (i.e., reduction in the expression) of target mRNA activity and disease biomarker activity, may translate into beneficial clinical results for current and future programs.

•Retain significant portions of the commercial rights for select disease programs. We seek to retain, subject to the evaluation of potential licensing opportunities as they may arise, full or substantial ownership stake and to invest internally in select programs, including diseases with focused patient populations, such as certain rare diseases. Our nedosiran and belcesiran programs represent opportunities that we believe carry a higher probability of success relative to other therapeutic platforms or modalities, with genetically and molecularly defined disease markers, high unmet medical need, and a focused number of centers of excellence to facilitate reaching these patients.

•Lead United States (“U.S.”) commercialization efforts for select programs. Subject to marketing approval, we intend to lead U.S. commercialization efforts for nedosiran internally. In order to expand our sales, marketing, and distribution capabilities beyond the U.S., we plan to out-license commercialization rights to nedosiran through a collaboration with a third party. Under our RG6346 collaboration with Roche, we have an option to co-fund the development of products under the agreement in exchange for high-twenties to mid-thirties royalty rates on net sales of products in the U.S. As part of our belcesiran collaboration agreement with Alnylam, Alnylam has the opportunity to opt in to commercialize belcesiran in countries outside the U.S. Should Alnylam exercise this option, they will pay us royalties related to those territories. We seek to retain all or a substantial portion of ownership of U.S. commercial rights to future pipeline programs in both rare and prevalent diseases.

•Enter into strategic collaborations with pharmaceutical companies with either GalXC or GalXC-Plus RNAi technologies for specific indications or therapeutic areas. For more complex diseases with multiple gene dysfunctions and/or larger patient populations, we plan to pursue collaborations that can provide the enhanced scale, resources, and commercial infrastructure required to maximize these prospects. Our collaborations with Roche, Novo, Lilly, Alexion, BI, and Alnylam exemplify this element of our strategy. We may establish collaborations with pharmaceutical companies across multiple programs or specific disease areas, either before or after clinical proof-of-concept, depending on the attractiveness of the opportunities. These collaborations have the potential to provide us with further validation of our RNAi technology platform, funding to advance our proprietary product candidates, or access to development, manufacturing, and commercial capabilities.

•Expand the reach of our RNAi technology to therapeutic targets beyond the liver. Using our GalXC-Plus technology, we are expanding to target diverse tissues and cell types outside the liver, including the CNS, muscle tissue, adipose tissue, tumors-associated immune cells, and other tissues. Our collaboration with Lilly includes joint research projects to develop new platform technologies for neurodegenerative diseases and chronic pain, as well as for a limited number of non-liver-based cardiometabolic diseases. We are also pursuing research internally to expand the reach of GalXC-Plus technology in other diverse tissues and are increasing our investment in this area.

•Leverage the experience and the expertise of our executive management team. To execute on our strategy, we have assembled an executive management team that has extensive experience in the biopharmaceutical industry. In addition, various members of our management team and our Board of Directors have contributed to the progress of pharmaceutical development and commercialization through their substantial involvement in companies such as Cephalon Inc., Genta Inc., GlaxoSmithKline plc, Shire plc, Pfizer Inc., Novartis International AG, Millennium Pharmaceuticals, Inc., Takeda Pharmaceutical Company Limited, Biogen, Inc., Sirna Therapeutics, Inc. (“Sirna”), and other companies.

Development Approach

In choosing which development programs to advance internally, we apply the scientific, clinical, and commercial criteria listed below that we believe allow us to best leverage our RNAi platform and maximize value. We believe that our current development programs meet many or all of these criteria:

• Strength of therapeutic hypothesis. We seek to target genes where an RNAi approach to treatment is likely to have substantial benefit for the patient.

• Readily-identified patient population. We seek disease indications where patients can be identified readily by the presence of characteristic genetic mutations or other readily-accessible disease features. In the case of genetic diseases, these are heritable genetic mutations that can be identified with available routine genetic tests.

• Predictivity of biomarkers for early efficacy assessment. We seek these markers to allow us to determine in early stages of clinical development whether our molecules are likely to have the expected biological and clinical effects in patients.

• High unmet medical need. We seek to provide patients with significant benefit and alleviation of disease. The indications we choose to approach have high unmet medical need. The selection of these indications is intended to enable us to better access patients and qualify for pricing and reimbursement that justify our development efforts.

• Rapid development path to proof-of-concept or approval. We seek indications with the potential for rapid development to proof-of-concept or marketing approval in order to reach commercialization expeditiously and to help ensure our ability to finance development of our product candidates. When appropriate, we will seek orphan designation, fast track designation, Breakthrough Therapy Designation, as well as other expedited programs from the U.S. Food and Drug Administration (“FDA”), or similar designations or expedited programs from foreign regulatory authorities. A breakthrough therapy is a drug that is intended to treat a serious or life-threatening disease or condition for which preliminary clinical evidence indicates that the drug may demonstrate substantial improvement over existing therapies on one or more clinically significant endpoints, such as substantial treatment effects observed early in clinical development.

The Dicerna Pipeline

In choosing which development programs to advance internally, we apply the scientific, clinical, and commercial criteria that we believe allow us to best leverage our GalXC RNAi platform and maximize value. Using our GalXC RNAi technology, and applying the criteria of our development focus, we have created a pipeline of core liver-focused therapeutic programs for development by Dicerna. For opportunities that were not selected as a core program opportunity, we have sought partners to fund the discovery, and subsequently drive the development of, these non-core opportunities in exchange for upfront payments, milestone payments, royalties on product sales, and potentially other economic and operational arrangements. Our current collaborations with Novo, Lilly, Alexion, and BI resulted from this effort. For core programs targeting rare diseases, we intend to develop these programs internally through approval using GalXC and GalXC-Plus technologies, subject to collaborative opportunities that arise, such as our agreement with Alnylam. For core programs targeting larger populations, we may seek development partners, such as our collaboration with Roche on RG6346, under various economic and operational arrangements. Together, our core program pipeline and our pipeline of non-core collaborative programs constitute a broad and growing therapeutic pipeline that we believe may result in multiple valuable approved products based on our GalXC and GalXC-Plus technologies.

In addition to the programs listed in our pipeline, we are exploring a variety of potential programs involving gene targets in diverse tissues addressable with our GalXC and GalXC-Plus technologies. Some of these programs may be elevated in the future to be either a core program or a non-core collaborative program. Under our collaborations with Novo, Roche, and Lilly, our collaborators have rights to nominate additional programs for discovery by Dicerna and subsequent development by the nominating collaborator, which will become part of our non-core pipeline. In the case of our collaboration with Novo, we retain rights to opt in to deeper participation, including enhanced economic rights, at defined points in clinical development, for two programs nominated by Novo.

Our four current core GalXC development programs are: nedosiran for the treatment of PH, RG6346 for the treatment of HBV infection, belcesiran for the treatment of AATLD, and DCR-AUD for the treatment of alcohol use disorder (“AUD”).

We conduct clinical trials in various countries around the world, including the U.S. and other areas heavily impacted by the COVID-19 pandemic. The current supply of our investigational medicines is sufficient to support ongoing and planned clinical trials. Based on current evaluations, our supply chain continues to appear intact to meet at least the next 12 months of clinical, nonclinical, and chemistry, manufacturing, and control (“CMC”) supply demands across all programs. We have undertaken efforts to mitigate potential future impacts to the supply chain by increasing our stock of critical starting materials required to meet our needs and our collaborative partners’ needs through 2021 and by identifying and engaging alternative suppliers. In 2020, there were delays related to several nedosiran PHYOX trials and the belcesiran clinical trial in healthy volunteers as a result of COVID-19. As a result, and based on the most recent updates from clinical sites impacted by COVID-19 and precautionary measures related to the pandemic, we regularly evaluate our expectations related to clinical development milestones.

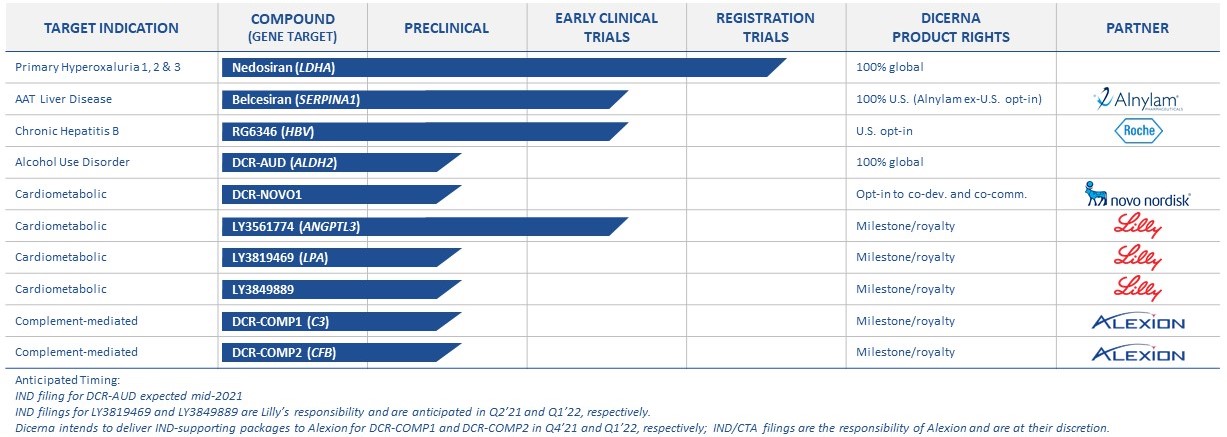

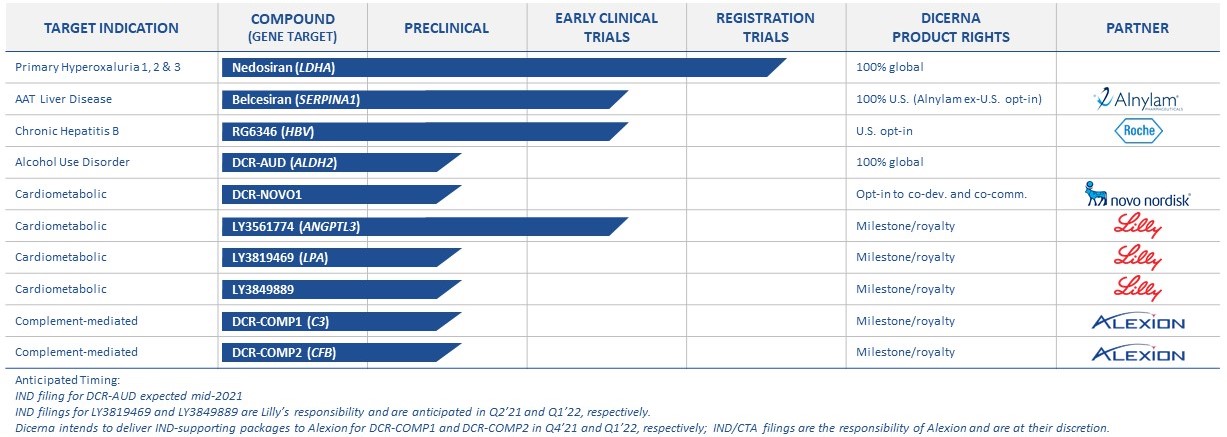

The table below sets forth the stage of development of our various GalXC RNAi platform product candidates as of February 25, 2021:

RNAi and Our GalXC Platform

The RNAi Therapeutic Modality

Most of our drug discovery and development efforts are based on the therapeutic modality of RNAi. RNAi therapeutics represent a novel advance in drug development. Historically, the pharmaceutical industry had developed only small molecules or monoclonal antibodies to inhibit the activity of disease-associated proteins. While this approach is effective for many diseases, many proteins cannot be inhibited by either small molecules or antibodies. The unique advantage of RNAi is that, instead of targeting proteins, RNAi silences the genes themselves via the targeted destruction of the mRNAs made from the gene. Rather than seeking to inhibit a protein directly, the RNAi approach is to prevent its creation in the first place, thus impacting the disease state.

The GalXC RNAi Platform

Dicerna’s GalXC platform consists of our liver-targeted GalXC technology and our GalXC-Plus technology for tissues outside the liver. Each utilizes a set of proprietary double-stranded RNA structures capable of inducing RNAi and associated chemical modifications and additions to these structures that enhance their properties and help confer useful “drug-like” properties. Our RNAi-inducing RNA structures consist of two strands of RNA. One of these strands, called the guide strand, is complementary to the mRNA sequence of the gene one is seeking to inhibit. The other strand, called the passenger strand, includes sequences complementary to the guide strand, forming a double-stranded RNA duplex with it. In the case of our GalXC and GalXC-Plus technologies, additional sequences may be added to the passenger strand, including a four-base sequence, known as a tetraloop, which is designed to enhance stability and engineer out immunostimulatory activity and can serve as an attachment point for various chemical additions that can facilitate delivery to diverse tissues.

We believe our GalXC RNAi platform provides the following qualities and has advantages compared to other therapeutic modalities:

• Our GalXC molecules have been optimized for use in humans. For therapeutic use in humans, our GalXC platform molecules are optimized both with respect to base sequence and chemical modifications to increase stability and mask them from mechanisms that recognize foreign RNA, in order to avoid inducing immune system stimulation.

•Our GalXC technology enables subcutaneous dosing for delivery to the liver. The GalXC RNAi technology is designed to enable convenient subcutaneous delivery for our growing pipeline of liver-targeted RNAi programs. Our liver-targeted GalXC molecules are conjugated on the tetraloop structure to a simple sugar, GalNAc, that is specifically recognized by a receptor on the surface of hepatocytes. With the liver-targeted GalXC technology, a full human dose may be administered via a single subcutaneous injection. After injection, the GalXC molecules enter the bloodstream and are exposed to the hepatocytes expressing the GalNAc receptor. After binding to the receptor, the GalXC molecules are internalized by the hepatocyte, ultimately enabling the GalXC molecules to access the RNAi machinery inside the hepatocyte. Our liver-targeted GalXC molecules routinely achieve high potencies, with EC50 values in the liver (i.e., the amount of material required to silence a target gene by 50 percent) typically in the 0.1 to 1.0 milligram per kilogram body weight (mg/kg) range in in vivo studies in mice. We have routinely generated GalXC molecules of this potency within 30 days of doing the initial algorithmic gene sequence analysis, which allows us to quickly explore a large number of potential target genes when selecting programs for ourselves and with our collaborators.

• Our GalXC technologies are highly specific to the gene to which they are targeted. Due to the gene-sequence-based nature of how our GalXC molecules interact with their gene mRNA targets, facilitated by the RNAi pathway proteins inside the cell, we believe our GalXC molecules generally lack any direct effect on other gene targets. This specificity compares favorably to many small-molecule-based therapeutics, which may inhibit additional proteins beyond the intended protein target.

•Our GalXC molecules have a long duration of action. Our GalXC platform was designed to, and in the case of our liver-based GalXC technology, has demonstrated in clinical studies, a duration of action that supports infrequent dosing (e.g., dosing that is on a monthly, quarterly, or potentially an even less frequent basis).

•Our GalXC molecules have demonstrated a high therapeutic index. In both preclinical and clinical studies, our GalXC molecules have been shown to be generally well-tolerated, even at dose levels far exceeding the expected efficacious dose level. We believe this property may reduce the risk that our GalXC molecules have tolerability liabilities precluding further development.

•Our GalXC molecules can be manufactured by existing, standard methods. Our GalXC molecules consist of RNA oligonucleotides, which can be manufactured with well-understood chemistries on existing readily available equipment.

•Our GalXC RNAi therapies are fully reversible after cessation of treatment and can also be modulated by dose or intervals between administration, unlike gene therapy and gene editing.

GalXC RNAi Technology Targeted to the Liver

To target the liver, we conjugate the tetraloop region of our GalXC molecules to a simple sugar, GalNAc, that is specifically recognized by a receptor on the surface of liver hepatocytes. This leads to internalization, ultimately enabling the GalXC molecules to access the RNAi machinery inside the hepatocyte and deliver our targeted oligonucleotide to the RISC complex. Due to the efficiency of this process, a full human dose may be administered via a single subcutaneous injection.

GalXC-Plus RNAi Technology for Tissues Outside the Liver

For delivering to tissues outside the liver, we have continued to innovate our GalXC platform using modified structures, chemistries, and conjugated moieties. Referred to as GalXC-Plus, these proprietary technological advances extend our expertise in RNAi silencing to address new tissues and organs outside the liver, while retaining key pharmacological features from GalXC. In 2020, we presented preclinical data demonstrating the potential application of our GalXC-Plus technology to the CNS, skeletal muscle, and adipose tissue.

Research

We continue to advance our GalXC RNAi platform as it is applied to therapeutic targets expressed in hepatocytes using GalNAc conjugates for both our collaborative research and development programs and our internal liver-targeted programs. All existing Dicerna collaborative programs include one or more liver-targeted applications of the GalXC RNAi platform.

In addition, we are exploring applications of our GalXC-Plus RNAi technology against therapeutic gene targets expressed in tissues other than the liver, including targets expressed in the CNS, muscle tissue, adipose tissue, tumor-associated immune cells, and other tissues. We have achieved significant gene target knockdown in multiple cell types and regions of the CNS and these other tissues, in both rodents and nonhuman primates. These extrahepatic applications are based on proprietary modifications to our well-characterized, clinical-stage GalXC platform that enable extrahepatic delivery and pharmacological activity.

On August 6, 2020, we presented for the first time preclinical data related to our GalXC-Plus RNAi technology in CNS, skeletal muscle, and adipose tissues. Results from preclinical studies demonstrated consistent and durable CNS-wide target mRNA knockdown using novel constructs regardless of route of administration (intrathecal [IT] or intracisterna magna [ICM]), and reduction in target mRNA in skeletal muscle and adipose tissue using optimized chemistries, resulting in equivalent and potentially highly durable target knockdown regardless of dosing regimens.

Status of Dicerna Programs

Our four current core GalXC development programs are as follows:

Nedosiran for Primary Hyperoxaluria

Nedosiran is our lead investigational product candidate for the treatment of PH1, PH2, and PH3 and is derived from our GalXC platform technology. PH is a family of rare, life-threatening genetic liver disorders characterized by the overproduction of oxalate, a highly insoluble metabolic end-product that is eliminated from the body mainly by the kidneys. In patients with PH, the kidneys are unable to eliminate fully the large amount of oxalate that is produced. This accumulation of oxalate compromises the renal system, which may result in severe damage to the kidneys and other organs.

PH encompasses three genetically distinct, autosomal-recessive, inborn errors of glyoxylate metabolism characterized by the overproduction of oxalate. PH1, PH2, and PH3 are each characterized by a specific enzyme deficiency. PH1 is caused by a deficiency of glyoxylate-aminotransferase, PH2 is caused by a deficiency of glyoxylate reductase/hydroxypyruvate reductase, and PH3 is caused by a deficiency of 4-hydroxy-2-oxoglutarate aldolase. The last step in the production of oxalate in the liver involves the enzyme product of the LDHA gene, making LDHA silencing what we believe is an ideal approach to blocking oxalate over-production in PH1, PH2, and PH3. Our nedosiran product candidate is designed to block production of the lactate dehydrogenase enzyme by silencing the LDHA gene, which is the final common pathway of oxalate production in the liver.

As PH is characterized by overproduction of oxalate in the liver, patients with PH are predisposed to the development of recurrent urinary tract (urolithiasis) and kidney (nephrolithiasis) stones, composed of calcium oxalate crystals formed from the excess oxalate. Stone formation is accompanied by diffuse deposits of calcium oxalate in the kidneys (nephrocalcinosis) of some patients with PH, which produces tubular toxicity, inflammation, and renal damage. This injury is compounded by the effects of renal calculi-related obstruction, frequent superimposed infections, and damage due to procedures needed to relieve stone-related obstruction. Compromised renal function can eventually result in the accumulation of oxalate in a wide range of organs, including the skin, bones, eyes, and heart. In the most severe cases, symptoms start in the first year of life. A combined liver-kidney transplant may be undertaken to resolve PH1 or PH2, but it is an invasive solution with limited availability and high morbidity that requires lifelong immune suppression to prevent organ rejection. Based on the evaluation of genome sequence databases, there may be as many as 16,000 people with PH in the U.S. and major European countries.

Most patients are diagnosed with PH in childhood or early adulthood. A number of supportive therapies are used in an attempt to mitigate some effects of the disease, including hyperhydration of at least three liters of fluid per day per square meter of body-surface area (5 L/day for a 70-kg adult). These regimens can be problematic in infants and toddlers, necessitating placement of a gastrostomy tube to ensure adequate nighttime fluid administration. Affected patients are at considerable risk of serious renal complications during periods of increased fluid loss (e.g., fever, diarrhea/vomiting, or urinary tract infections) or when oral hydration is compromised (e.g., following surgical procedures). Oral potassium citrate administration multiple times daily is used to potentially alleviate crystallization and alkalinize the urine. In PH1, between 10-30% of patients are partially responsive (i.e., greater than a 30% reduction of urinary oxalate (“Uox”) excretion) to high daily administration of pyridoxine (vitamin B6), but rarely do these patients reach normal or near-normal oxalate levels. A new therapy developed by a competing biopharmaceutical company for the treatment of PH1 was approved by select regulatory authorities in late 2020; however, at present, no therapies are approved by regulatory authorities for the treatment of all three genetically known subtypes of PH.

For PH1 and PH2 patients with more advanced disease, dialysis up to seven days per week may be used in an attempt to remove stored and ongoing overproduction of oxalate. Many healthcare providers now consider liver transplantation approaches earlier in the disease course to minimize the risk of irreversible tissue damage. We believe this level of unmet need provides a strong rationale for our initial focus on the treatment of PH.

Dicerna has developed nedosiran as a once-monthly fixed-dose injection for the treatment of PH. This once-monthly formulation of nedosiran is designed to avoid the sudden oxalate spikes that could occur with less frequent administration or missed dosages, which could result in the formation of kidney stones and renal failure. To maximize patient convenience, we are developing pre-filled syringes to enable self-administration by most PH patients without the need for involvement of a healthcare provider for dosing.

In 2018, nedosiran received Orphan Drug Designation from the FDA, and the European Medicines Agency’s (“EMA”) Committee for Orphan Medicinal Products (“COMP”) designated nedosiran as an orphan medicinal product for the treatment of PH. In June 2020, the FDA granted rare pediatric disease designation for nedosiran. Under the FDA’s rare pediatric disease designation program, the FDA may grant a priority review voucher to a Sponsor who receives a product approval for a rare pediatric disease on or before September 30, 2026. Subject to FDA approval of nedosiran for the treatment of PH, we believe we would be eligible to receive a voucher that may be redeemed to receive priority review for a subsequent marketing application for a different product candidate or which could be sold or transferred.

The broader PHYOX™ clinical trial program is designed to evaluate nedosiran in PH1, PH2, and PH3 patients of all ages and stages of renal health. Data from PHYOX™1, PHYOX2, PHYOX4 clinical trials, the ongoing PHYOX3 open-label extension study, and Dicerna’s PHYOX-OBX natural history study of PH3 participants are expected to support the initial nedosiran New Drug Application (“NDA”) submission.

PHYOX1 Single-Ascending-Dose Study

Data from the complete PHYOX1 trial, a Phase 1 single-ascending-dose study of nedosiran in healthy volunteers and study participants with PH1 and PH2, showed that nedosiran was generally well-tolerated in healthy volunteers and PH participants, and no serious safety concerns were identified in this study. In addition, nedosiran administration was associated with normalization or near-normalization of Uox levels in 14 of 18 participants with PH1 or PH2 following a single dose. We define normal and near-normal Uox as below 0.46 mmol/1.73m2 BSA/24 hr and from 0.46 to 0.6 mmol/1.73m2 BSA/24 hr, respectively.

The primary objective of the study was to evaluate the safety, tolerability, pharmacokinetics, and pharmacodynamics of single-ascending doses of nedosiran. Nedosiran was generally well-tolerated based on data from 18 participants (15 adults and three adolescents [participants 13-16 years old]) with PH1 (n=15) or PH2 (n=3) and 25 adult healthy volunteers. Four participants had serious treatment-emergent adverse events (“TEAEs”) that were determined by the investigator to be unrelated to nedosiran treatment. A total of seven participants dosed with nedosiran experienced mild or moderate injection-site reactions (defined as occurring four hours or more after injection), all of which resolved without intervention in a mean of 25 hours. No clinically meaningful safety signals were observed, including no clinically significant liver function test abnormalities.

Secondary endpoints included the change in 24-hour Uox excretion from baseline, defined as the mean of two 24-hour collections during screening. With respect to efficacy data in PHYOX1, nedosiran was associated with a mean maximal reduction of 24-hour Uox of 48.8% (1.5 mg/kg), 68.5% (3.0 mg/kg), and 78.0% (6.0 mg/kg) in adult patients with PH1 or PH2 following single-dose administration.

PHYOX2 Multidose, Double-Blind, Randomized, Placebo-Controlled Pivotal Trial

PHYOX2 is a multidose, double-blind, 2:1 randomized, placebo-controlled pivotal trial of nedosiran designed to evaluate the efficacy and safety of nedosiran delivered as a once-monthly subcutaneous injection in participants six years of age and older who have PH1 or PH2. This global trial includes countries across North America, Europe, and other regions, including Japan, Australia, and New Zealand. The primary endpoint of the study is the percent change from baseline in area under the curve (“AUC”) of 24-hour Uox excretion between Days 90 and 180.

Full enrollment in the PHYOX2 trial was successfully completed in late 2020 and we anticipate the last patient to complete this study in the first half of 2021. We expect to report top-line results from the study in mid-2021.

PHYOX3 Long-Term, Multidose, Open-Label Extension Study

Following positive Phase 1 data from PHYOX1 in 2019, we received clearance to proceed with the pivotal trial (PHYOX2) and PHYOX3, a long-term, multidose, open-label, extension study of nedosiran in PH. Unlike the PHYOX2 trial, which requires screening and enrollment of new participants, patients are permitted to transition into the PHYOX3 trial from any previous nedosiran trial in which they have participated and completed.

The primary endpoint of PHYOX3 is to evaluate the impact of monthly nedosiran administration on the annual rate of decline in estimated glomerular filtration rate (“eGFR”), a measure of kidney function. The PHYOX3 trial will also evaluate the long-term effect of nedosiran on Uox excretion, new stone formation, progression of nephrocalcinosis, and the potential to enable the gradual decrease or elimination of patients’ supportive hyperhydration therapies.

In total, 16 participants from the completed PHYOX1 trial entered the PHYOX3 study. In October 2020, we presented an interim analysis of data on the 13 participants who had reached Day 180 and received six monthly doses.

Three participants included in the safety analysis were not included in the efficacy analysis, as they had not yet reached Day 180 at the time of the analysis. All 13 participants (10 with PH1 and three with PH2) receiving nedosiran achieved normal (12 of 13) or near-normal (one of 13) Uox excretion levels at one or more timepoints. Of these, all 10 (100%) of the participants with PH1, and two of the three (67%) participants with PH2, achieved normal Uox excretion levels at one or more visits, and 62% of all participants achieved normal Uox excretions on at least three consecutive visits, meeting protocol-defined eligibility for gradual reduction in fluid intake requirements. In this study, we define normal and near-normal Uox as below 0.46 mmol/1.73m2 BSA/24 hr and from 0.46 to 0.6 mmol/1.73m2 BSA/24 hr, respectively.

Nedosiran was generally well-tolerated, and no serious safety concerns were identified in this study as of this interim analysis. There were no treatment discontinuations or study withdrawals during the observation period. Two participants had serious TEAEs (pyelonephritis and nephrolithiasis) that were determined by the investigator to be unrelated to nedosiran treatment. The most common TEAEs were mild to moderate administration-site reactions.

Additional PHYOX Trials: PHYOX4, PHYOX7, PHYOX8, and PHYOX-OBX

Given the fluid nature of the COVID-19 pandemic and the evolving and extraordinary actions undertaken by clinical trial sites globally, we continue to evaluate our clinical plans related to nedosiran. At this time, the status of additional PHYOX trials is as follows:

•PHYOX4: Enrollment in a study of patients with PH3 began in January 2021 and the first patient was dosed in February 2021. We anticipate top-line results from the study mid-year 2021.

•PHYOX7: A study of PH1 and PH2 patients with severe renal impairment, including those in dialysis, is expected to begin in the first quarter of 2021.

•PHYOX8: An open-label study in PH1 and PH2 patients aged 0-5 years with relatively intact renal function is expected to begin in the second quarter of 2021.

•PHYOX-OBX: We initiated an observational study in the third quarter of 2020 in participants with PH3 to evaluate the association between Uox excretion and the rate of kidney stone formation. Enrollment of participants in this study is expected in the first quarter of 2021.

In discussions with the FDA, we received feedback indicating alignment on a path to the full approval of nedosiran for the treatment of PH1 and PH2 based on achievement of substantial reduction of Uox excretion in patients with PH1 and PH2 after nedosiran administration versus those administered placebo in the PHYOX2 pivotal trial. With this feedback, we believe we have a path to seek full approval for both PH1 and PH2 based on PHYOX2 results. We received Breakthrough Therapy Designation from the FDA for the development of nedosiran for the treatment of PH1 in July 2019. We plan to continue our dialogue with the FDA regarding endpoints for studies involving patients with PH3 as part of the PHYOX clinical development program for nedosiran. We anticipate submitting an NDA for nedosiran near the end of the third quarter of 2021.

RG6346 for Chronic Hepatitis B Virus Infection

Our GalXC product candidate for the treatment of chronic HBV infection, RG6346, is currently being tested in a Phase 1 clinical trial. In order to be optimally positioned to develop and commercialize RG6346 in combination with other novel drugs, we entered into a research collaboration and licensing agreement with Roche in October 2019. Under the terms of the agreement, we are leading the development of RG6346 through the current Phase 1 trial, and pending favorable results, Roche intends to further develop RG6346 with the overall goal of developing a combination regimen to achieve a functional cure of chronic HBV in combination with additional Roche product candidates. Roche will be responsible for initiating RG6346 in a Phase 2 combination trial, which is anticipated in the first quarter of 2021. The agreement also provides an option for the companies to collaborate in the discovery, development, and commercialization of oligonucleotide therapeutics intended for the treatment of chronic HBV.

HBV is the world’s most common serious liver infection and affects an estimated 292 million people worldwide. Chronic HBV is characterized by the presence of the hepatitis B surface antigen (“HBsAg”) for six months or more. Current therapies for HBV include nucleoside analogs (“NUCs”) and pegylated interferon regimens. Interferons are less effective at suppressing viral replication and are associated with several side effects. NUCs are relatively safe to use but usually require indefinite therapy that increases the risk of non-adherence. Furthermore, the vast majority of patients treated with these agents do not achieve an immunological cure of chronic HBV infection as defined by the sustained clearance of HBsAg and HBV deoxyribonucleic acid (“DNA”) suppression in patient blood or serum. The chance of achieving a long-term immunological cure may be significantly enhanced with the introduction of novel drugs, such as RG6346, designed to reduce intrahepatic and serum HBsAg, as well as HBV DNA. These novel drugs may potentially be used in combination with each other and existing therapies, such as NUCs.

The Phase 1 trial is a randomized, placebo-controlled, double-blind study designed to evaluate the safety and tolerability of RG6346 in healthy volunteers and in patients with non-cirrhotic chronic HBV. Secondary objectives are to characterize the pharmacokinetic profile of RG6346 and to evaluate preliminary pharmacodynamic effects on markers of HBV antiviral efficacy, including reductions of HBsAg and HBV DNA levels in blood. The Phase 1 clinical trial is divided into three groups:

•Group A is a single-ascending-dose arm in which 30 healthy volunteers received a dose of RG6346.

•Group B is a single-dose arm in which eight participants with chronic HBV who are naïve to NUC therapy received a 3.0 mg/kg dose of RG6346 or placebo.

•Group C is a multiple-ascending-dose arm in which RG6346 (1.5, 3.0, or 6.0 mg/kg) or placebo was administered to 18 participants with chronic HBV who are already being treated with NUCs.

Participants in Groups B and C were eligible to enter an extended follow-up observation period if they achieved an HBsAg reduction from baseline of ≥1.0 log10 IU/mL at the end of the treatment period (12 weeks/85 days for Group B; 16 weeks/112 days for Group C). Enrollment for the originally planned cohorts was completed in June 2020. Dosing in the 6.0 mg/kg dose group was completed; however, extended follow-up observation remains ongoing for a number of Group C participants.

In agreement with Roche, we are enrolling two additional, optional, open-label Group C cohorts, Cohort 4C and Cohort 5C, for which Roche will reimburse us. Cohorts 4C and 5C will evaluate fixed dosing regimens and an extended conditional follow-up period. Cohort 4C is a single-dose cohort with a follow-up duration of up to 48 weeks. Cohort 5C is a multiple-dose cohort with a follow-up duration of up to 72 weeks.

In November 2020, we expanded upon the interim results from both Group B and Group C presented in August 2020. In particular, top-line data from the Group C cohort demonstrated that four monthly doses of RG6346 treatment resulted in substantial and durable reductions in biomarkers of HBV disease activity as measured by reductions in HBsAg levels lasting up to one year following the last dose. RG6346 was also shown to have a favorable tolerability profile in the trial.

No significant adverse events (“SAEs”) were reported for participants treated with RG6346, and there were no dose-limiting toxicities or safety-related discontinuations. The most commonly reported adverse events were mild or moderate injection-site events. There were no dose-exposure or regimen-dependent increases in frequency or severity of adverse events, safety lab values, electrocardiogram readings, or vital signs.

In April 2020, Roche nominated the first of up to five targets under the research and development portion of our collaboration agreement.

Belcesiran (DCR-A1AT) for Alpha-1 Antitrypsin Deficiency-Associated Liver Disease

Our GalXC product candidate for the treatment of AATLD, belcesiran, is currently being tested in a Phase 1 clinical study. Alpha-1 antitrypsin deficiency (“AATD”) is a rare, genetic, inherited condition that can lead to AATLD in children and adults and lung disease in adults. The condition is caused by mutations in the SERPINA1 gene. In people with AATLD, the liver produces an abnormal version of the AAT protein, which is prone to aggregation in the liver. This accumulation of mutated AAT in the liver can lead to liver disease. Individuals with AATLD also have an increased risk of having lung disease.

Research suggests that people who have the pair of gene variants called “ZZ” are most commonly identified as having AATLD. Recent epidemiology research indicates that approximately 120,000 individuals in Europe and 63,000 individuals in the U.S. carry this ZZ genotype; the genotype occurs more/most frequently in individuals of Northern European descent. Although most individuals with this pair will not develop liver disease, some will. Recent research indicates that the current diagnosis rate for AATLD in individuals with the ZZ genotype is approximately 10%, but that liver disease may remain under-diagnosed. AATLD can affect infants, children, and adults. Liver transplantation is currently the only effective treatment for AATLD.

In March 2020, the FDA granted orphan drug designation to belcesiran for the treatment of AATD. In December 2019, the European Commission granted orphan drug designation to belcesiran for the treatment of congenital AATD based on a positive opinion from the COMP of the EMA.

Our Phase 1 trial of belcesiran is an ongoing placebo-controlled study designed to evaluate the safety and tolerability of single doses of belcesiran when administered to healthy adult participants. Secondary objectives of the trial are to characterize the pharmacokinetic profile of belcesiran and to evaluate the preliminary pharmacodynamic effects on serum AAT protein concentrations.