UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ý | Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |

For the Fiscal Year Ended December 31, 2014

or

o | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |

For the transition period from to

Commission file number 001-33761

PZENA INVESTMENT MANAGEMENT, INC.

(Exact Name of Registrant as Specified in its Charter)

Delaware | 20-8999751 | |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

120 West 45th Street

New York, New York 10036

(Address of Principal Executive Offices)

Registrant’s telephone number, including area code: (212) 355-1600

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Class A Common Stock, par value $.01 per share | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | Accelerated filer x | Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes o No ý

The aggregate market value of the common equity held by non-affiliates of the registrant as of June 30, 2014, the last business day of its most recently completed second fiscal quarter, was approximately $130,265,234 based on the closing sale price of $11.16 per share of Class A common stock of the registrant on such date on the New York Stock Exchange. For purposes of this calculation only, it is assumed that the affiliates of the registrant include only directors and executive officers of the registrant.

As of March 9, 2015, there were 13,002,267 outstanding shares of the registrant’s Class A common stock, par value $0.01 per share.

As of March 9, 2015, there were 53,257,891 outstanding shares of the registrant’s Class B common stock, par value $0.000001 per share.

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

Page | ||

i

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K, or Annual Report, contains forward-looking statements. Forward-looking statements provide our current expectations, or forecasts, of future events. Forward-looking statements include statements about our expectations, beliefs, plans, objectives, intentions, assumptions and other statements that are not historical facts. Words or phrases such as “anticipate,” “believe,” “continue,” “ongoing,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project” or similar words or phrases, or the negatives of those words or phrases, may identify forward-looking statements, but the absence of these words does not necessarily mean that a statement is not forward-looking.

Forward-looking statements are subject to known and unknown risks and uncertainties and are based on potentially inaccurate assumptions that could cause actual results to differ materially from those expected or implied by the forward-looking statements. Our actual results could differ materially from those anticipated in forward-looking statements for many reasons, including the factors described in Item 1A, “Risk Factors” in Part I of this Annual Report. Accordingly, you should not unduly rely on these forward-looking statements, which speak only as of the date of this Annual Report. We undertake no obligation to publicly revise any forward-looking statements to reflect circumstances or events after the date of this Annual Report, or to reflect the occurrence of unanticipated events. You should, however, review the factors and risks we describe in the reports we will file from time to time with the Securities and Exchange Commission, or SEC, after the date of this Annual Report.

Forward-looking statements include, but are not limited to, statements about:

• | our anticipated future results of operations and operating cash flows; |

• | our business strategies and investment policies; |

• | our financing plans and the availability of short- or long-term borrowing, or equity financing; |

• | our competitive position and the effects of competition on our business; |

• | potential growth opportunities available to us; |

• | the recruitment and retention of our employees; |

• | our expected levels of compensation for our employees; |

• | our potential operating performance, achievements, efficiency and cost reduction efforts; |

• | our expected tax rate; |

• | changes in interest rates; |

• | our expectation with respect to the economy, capital markets, the market for asset management services and other industry trends; and |

• | the impact of future legislation and regulation, and changes in existing legislation and regulation, on our business. |

The reports that we file with the SEC, accessible on the SEC’s website at www.sec.gov, identify additional factors that can affect forward-looking statements.

ii

Preliminary Notes

In this Annual Report, “we,” “our,” “us,” and "the Company" refer to Pzena Investment Management, Inc. and its consolidated subsidiaries.

Each Russell Index referred to in this Annual Report is a registered trademark or trade name of The Frank Russell Company®. The Frank Russell Company® is the owner of all copyrights relating to these indices and is the source of the performance statistics of these indices that are referred to herein.

Information with respect to Morgan Stanley Capital International, which we refer to as MSCI, requires a license from MSCI. All MSCI brands and product names are the trademarks, service marks, or registered trademarks of MSCI or its subsidiaries in the United States and other jurisdictions. MSCI is the owner of all copyrights relating to these indices and is the source of the performance statistics of these indices that are referred to in this Annual Report.

iii

PART I.

ITEM 1. | BUSINESS |

Overview

Pzena Investment Management, Inc. was formed in 2007 and is the sole managing member of Pzena Investment Management, LLC, which is our operating company. Founded in 1995, Pzena Investment Management, LLC is a value-oriented investment management company. We believe that we have established a positive, team-oriented culture that enables us to attract and retain highly qualified people. Over the past nineteen years, we have built a diverse, global client base of respected and sophisticated institutional investors and select third-party distributed mutual funds for which we act as sub-investment adviser. During 2014, we expanded our product offerings by launching three SEC-registered mutual funds for which we act as investment adviser.

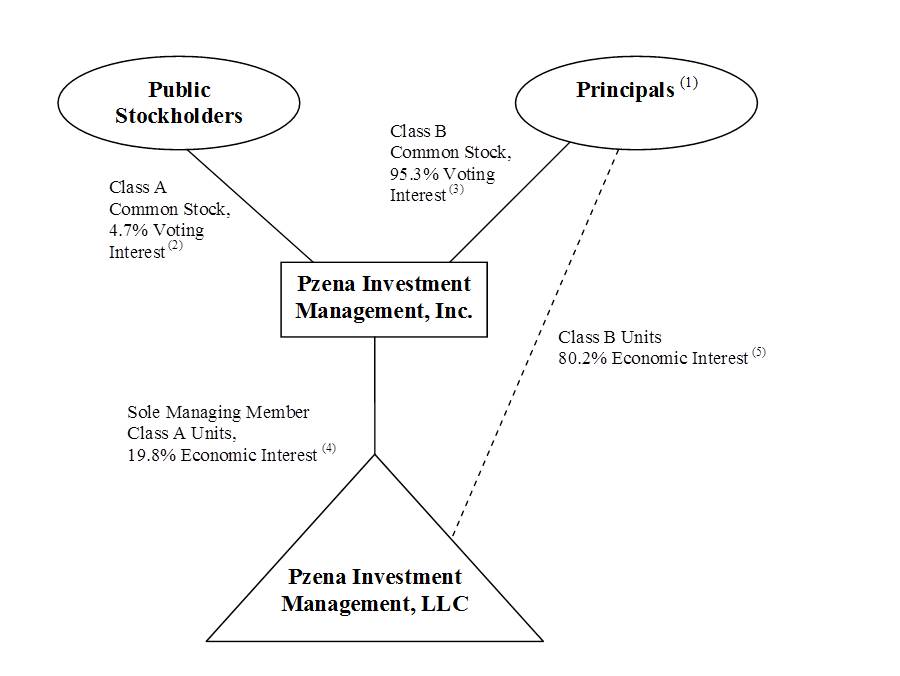

The graphic below illustrates our holding company structure and ownership as of December 31, 2014.

(1) | As of December 31, 2014, the members of Pzena Investment Management, LLC, other than us, consisted of: |

• | Four of our named executive officers and their estate planning vehicles, who collectively held approximately 55.8% of the economic interests in Pzena Investment Management, LLC. For more detail on executive officer ownership, see "Item 12 — Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters”. |

• | 32 of our other employee members, who collectively held approximately 4.2% of the economic interests in Pzena Investment Management, LLC. |

• | Certain other members of our operating company, including one of our directors and his related entities, and former employees, who collectively held approximately 20.2% of the economic interests in Pzena Investment Management, LLC. |

(2) | Each share of Class A common stock is entitled to one vote per share. Class A common stockholders have 100% of the rights of all classes of our capital stock to receive distributions. |

(3) | Each share of Class B common stock is entitled to five votes per share for so long as the number of shares of Class B common stock outstanding represents at least 20% of all shares of common stock outstanding. Holders of Class B common stock have the right to receive the par value of the Class B common stock held by them upon our liquidation, dissolution or winding up, but do not share in dividends. |

(4) | As of December 31, 2014, we held 13,044,719 Class A units of Pzena Investment Management, LLC, which represented the right to receive 19.8% of the distributions made by Pzena Investment Management, LLC. |

(5) | As of December 31, 2014, the principals collectively held 52,980,812 Class B units of Pzena Investment Management, LLC, which represented the right to receive 80.2% of the distributions made by Pzena Investment Management, LLC. |

1

We utilize a classic value approach to investing and seek to make investments in good businesses at low prices. Our approach and process have helped us achieve attractive returns over the long term. As of December 31, 2014, we managed assets in fifteen value-oriented investment strategies across a wide range of market capitalizations in both U.S. and non-U.S. capital markets. Our assets under management, or AUM, were $27.7 billion at December 31, 2014, and we managed money on behalf of institutions and acted as sub-investment adviser to a variety of SEC-registered mutual funds and offshore funds as well as investment adviser to certain Pzena SEC-registered mutual funds and offshore funds.

Our investment discipline and our commitment to a classic value approach have been important elements of our success. We construct concentrated portfolios selected through a rigorous fundamental research process. Our investment decisions are not motivated by short-term results or aimed at closely tracking specific market benchmarks. Generating excess returns by utilizing a classic value investment approach requires:

• | willingness to invest in companies before their stock prices reflect signs of business improvement, and |

• | significant patience, based upon our understanding of the business’ fundamentals, and our long-term investment horizon. |

As of December 31, 2014, we had 81 employees, including 36 employee members who collectively owned 60.0% of the ownership interests in our operating company. Our operating company is led by a committee, consisting of our Chief Executive Officer (CEO), Mr. Richard S. Pzena, each of our Presidents, Messrs. John P. Goetz and William L. Lipsey, and our Executive Vice President, Mr. Michael D. Peterson (the "Executive Committee").

Our Competitive Strengths

We believe that the following are our competitive strengths:

• | Focus on Investment Excellence. We recognize that we must achieve investment excellence in order to attain long-term business success. All of our business decisions, including the design of our investment process and our willingness to limit AUM in our investment strategies, are focused on producing attractive long-term investment results. We believe that our long-term investment performance, together with our willingness to close our strategies to new investors in order to optimize the prospects for future performance, has contributed to our positive reputation among our clients and the institutional consultants who advise them. |

• | Consistency of Investment Process. Since our inception over nineteen years ago, we have utilized a classic value investment approach and a systematic, disciplined investment process to construct portfolios for our investment strategies in U.S. and non-U.S. markets across all market capitalizations. The consistency of our process has allowed us to leverage the same investment team to launch new strategies. We believe that our consistent investment process has resulted in our strong brand recognition in the investment community. |

• | Diverse and High Quality Client Base. We believe that we have developed a favorable reputation in the institutional investment community. This is evidenced by our strong relationships with institutional investors, investment consultants, and mutual fund providers, as well as the diversity and sophistication of our investors. For more information concerning our client base, see “Our Client Relationships and Distribution Approach” below. |

• | Experienced Investment Professionals and a Team-Oriented Approach. We believe that our greatest asset is the experience of the individuals on our team. For more information on our investment team, see “Our Investment Team” below. |

• | Employee Retention. We have focused on building an environment that we believe is attractive to talented investment professionals. Important among our practices are our team-oriented approach to investment decisions, rotation of coverage areas among individuals, and our culture of employee ownership. |

• | Culture of Ownership. We believe in significant ownership of our business by the key contributors to our success. Since our inception, we have communicated to all our employees that they have the opportunity to become members of our operating company. As of December 31, 2014, we had 36 employee members positioned within all of our functional areas. We believe this ownership model results in a shared sense of purpose with our clients and their advisers. We intend to continue fostering a culture of ownership through our equity incentive plans, which are designed to align our team’s interests with those of our stockholders and clients. We believe this culture of ownership contributes to our team orientation and connection with clients. |

2

Our Business Strategy

The key to our success is continued long-term investment performance. In conjunction with this, we believe the following strategies will enable us to grow our business over time.

• | Unwavering Focus on Classic Value Investing. We view our unwavering focus on long-term classic value investment excellence to be the key driver of our business success. |

• | Capitalize on Growth Opportunities Created By Our Global Strategies. Among both institutional and retail investors industry-wide, over the past few years, there have been increasing levels of investments in portfolios including non-U.S. equities. As of December 31, 2014, the total AUM in our Global Value strategies, International (ex-U.S.) Value strategies, Emerging Markets Focused Value strategy, and other non-U.S. strategies was $10.9 billion, or 39.4% of our overall AUM. Our global capability provides opportunity for all of our strategies around the world. |

• | Apply Our Proven Process to Introduce New Strategies. We anticipate continuing to offer new investment strategies over time, on a measured basis, consistent with our past practice, utilizing our proven investment process. |

• | Work with Our Strong Consultant Relationships. We believe that we have built strong relationships with the leading investment consulting firms who advise potential institutional clients. Historically, new accounts sourced through consultant-led searches have been a large driver of our inflows and are expected to be a major component of our future inflows. |

• | Expand Our Non-U.S. Client Base. In recent years, we have increased our efforts to develop our non-U.S. client base. Through our strong relationships with global consultants, we have been able to accelerate the development of our relationships with their non-U.S. branches. Over time, we aim to achieve growth of this client base through these relationships and by directly calling on the world’s largest institutional investors. We have also sought to expand our non-U.S. base through our relationships with non-U.S. mutual funds and other investment fund advisers. During 2010, we opened a representative office in Melbourne, Australia to more effectively service existing clients and develop new relationships in the geographic area. To date, these marketing efforts have resulted in client relationships in more than fifteen non-U.S. countries, such as the United Kingdom, Australia and Canada. As of December 31, 2014, we managed $8.2 billion in separate accounts, commingled funds and sub-advised funds on behalf of non-U.S. clients. |

• | Provide Access To Our Strategies Through a Range of Investment Vehicles. Our clients access our investment strategies through a range of investment vehicles, including separately managed accounts, mutual funds that we sub-advise, and certain private placement vehicles and offshore funds that we offer to institutional investors. During the year ended December 31, 2014, we launched three SEC-registered Pzena mutual funds for which we act as investment adviser in an effort to expand the access investors have to our strategies. For more information concerning access to our strategies, see “Our Client Relationships and Distribution Approach” below. |

• | Employ Global Team to Deliver Content-Based Information to Clients and Prospects. Our marketing and client service team is currently a team of 18 people, including marketing and client service professionals, associates, and support staff. The marketing and client services professionals are focused geographically, along with one individual focused on the sub-advisory and investment-only defined contribution distribution channels. In addition to our representative office in Melbourne, Australia, we have two professionals dedicated to business development and client service throughout Europe and the Middle East. |

Our Investment Team

We believe we have built an investment team that is well-suited to implementing our classic value investment strategy. The members of our investment team have a diverse set of backgrounds, including former corporate management, private equity, management consulting, accounting and Wall Street professionals. Their diverse business backgrounds are instrumental in enabling us to make investments in companies where we would be comfortable owning the entire business for a three- to five-year period. We look beyond temporary earnings shortfalls that result in stock price declines, which may lead others to forego investment opportunities, if we believe the long-term fundamentals of a company remain attractive.

As of December 31, 2014, we had a 24-member investment team. Each member serves as a research analyst, and certain members of the team also have portfolio management responsibilities. There are generally three portfolio managers for each investment strategy. These three managers have joint decision-making responsibility, and each has “veto authority” over all decisions regarding the relevant portfolio. Research analysts have sector and company-level research responsibilities which span all of our investment strategies, including those with a non-U.S. focus. In order to facilitate the professional development of our team, and to keep a fresh perspective on our portfolio companies, our research analysts generally rotate industry coverage every three to four years.

3

We follow a collaborative, consensus-oriented approach to making investment decisions, such that all members of our investment team, irrespective of their seniority, can play a significant role in this decision making process. We hold weekly research review meetings attended by all portfolio managers and relevant research analysts, and are open to other employees, at which we openly discuss and debate our findings regarding the normalized earnings power of potential portfolio companies. In addition, we hold daily morning meetings, attended by our portfolio managers, research analysts, portfolio implementation, and client service personnel, in order to review developments in our holdings and set a trading strategy for the day. These meetings are critical for sharing relevant developments and analysis of the companies in our portfolios. We believe that our collaborative culture is attractive to our investment professionals.

Our Investment Strategies

As of December 31, 2014, our approximately $27.7 billion in AUM was invested in a variety of value-oriented investment strategies, representing differing degrees of concentration and capitalization segments of U.S. and non-U.S. markets. The following table describes the largest of our current U.S. and non-U.S. investment strategies, and the allocation of our approximately $27.7 billion in AUM among them, as of December 31, 2014.

Strategy | AUM | |||

(in billions) | ||||

U.S. Strategies | ||||

Large Cap Focused Value | $ | 5.8 | ||

Large Cap Expanded Value | 5.7 | |||

Focused Value | 1.8 | |||

Small Cap Focused Value | 1.3 | |||

Mid Cap Expanded Value | 1.3 | |||

Mid Cap Focused Value | 0.5 | |||

Other U.S. Strategies | 0.4 | |||

Non-U.S. Strategies | ||||

Global Focused Value | 4.1 | |||

International (ex-U.S.) Expanded Value | 2.4 | |||

Global Expanded Value | 1.5 | |||

Emerging Markets Focused Value | 1.1 | |||

International (ex-U.S.) Focused Value | 1.0 | |||

European Focused Value | 0.7 | |||

Other Non-U.S. Strategies | 0.1 | |||

Total | $ | 27.7 | ||

We follow the same investment process for each of these strategies. Our investment strategies are distinguished by the market capitalization ranges from which we select securities for their portfolios, which we refer to as each strategy’s investment universe, as well as the regions in which we invest. In addition, the number of holdings typically found in the portfolios of each of our investment strategies may vary, with the Focused Value strategies being more concentrated in fewer positions.

Our largest investment strategies as of December 31, 2014 are further described below.

U.S. Strategies

Large Cap Focused Value. This strategy reflects a portfolio composed of approximately 30 to 40 stocks drawn from a universe of 500 of the largest U.S. listed companies, based on market capitalization. This strategy was launched in October 2000.

Large Cap Expanded Value. This strategy reflects a portfolio composed of approximately 50 to 80 stocks drawn from a universe of 500 of the largest U.S. listed companies, based on market capitalization. This strategy was launched in July 2012.

Focused Value. This strategy reflects a portfolio composed of a portfolio of approximately 30 to 40 stocks drawn from a universe of 1,000 of the largest U.S. listed companies, based on market capitalization. This strategy was launched in January 1996.

4

Small Cap Focused Value. This strategy reflects a portfolio composed of approximately 40 to 50 stocks drawn from a universe of U.S. listed companies ranked from the 1,001st to 3,000th largest, based on market capitalization. This strategy was launched in January 1996.

Mid Cap Expanded Value. This strategy reflects a portfolio composed of approximately 50 to 80 stocks drawn from a universe of U.S. listed companies ranked from the 201st to 1,200th largest, based on market capitalization. This strategy was launched in April 2014.

Mid Cap Focused Value. This strategy reflects a portfolio composed of approximately 30 to 40 stocks drawn from a universe of U.S. listed companies ranked from the 201st to 1,200th largest, based on market capitalization. This strategy was launched in September 1998.

Non-U.S. Strategies

Global Focused Value. This strategy reflects a portfolio composed of approximately 40-60 stocks drawn from a universe of 2,000 of the largest companies across the world, based on market capitalization. This strategy was launched in January 2004.

International (ex-U.S.) Expanded Value. This strategy reflects a portfolio composed of approximately 60-80 stocks drawn from a universe of 1,500 of the largest companies across the world excluding the United States, based on market capitalization. This strategy was launched in November 2008.

Global Expanded Value. This strategy reflects a portfolio composed of approximately 60-95 stocks drawn from a universe of 2,000 of the largest companies across the world, based on market capitalization. This strategy was launched in January 2010.

Emerging Markets Focused Value. This strategy reflects a portfolio composed of approximately 40 to 80 stocks drawn from a universe of 1,500 of the largest emerging market companies, based on market capitalization. This strategy was launched in January 2008.

International (ex-U.S.) Focused Value. This strategy reflects a portfolio composed of approximately 30-50 stocks drawn from a universe of 1,500 of the largest companies across the world excluding the United States, based on market capitalization. This strategy was launched in January 2004.

European Focused Value. This strategy reflects a portfolio composed of approximately 40-50 stocks drawn from a universe of 750 of the largest European companies, based on market capitalization. This strategy was launched in August 2008.

We believe that our ability to retain and grow assets has been, and will continue to be, driven primarily by delivering attractive long-term investment results to our clients. We have therefore prioritized, and will continue to prioritize, investment performance over asset accumulation. Where we have deemed it necessary, we have, at times, closed certain products to new investors in order to preserve capacity to effectively implement our concentrated investment strategies for the benefit of existing clients. Currently, all of our investment strategies are open to new investors.

Our Strategy Development Approach

Historically, a major component of our growth has been the development of new strategies. Prior to incubating a new strategy, we perform in-depth research on the potential market for the product, as well as its overall compatibility with our investment expertise. This process involves analysis by our client team, as well as by our investment professionals. We will only launch a new product if we believe that it can add value to a client’s investment portfolio. In the past, as appropriate, we have created partnerships with third parties to enhance the distribution of a strategy or add expertise that we do not have in-house. Prior to marketing a new strategy, we generally incubate the product for a period of one to five years, so that we can test and refine our investment strategy and process before actively marketing the product to our clients.

Furthermore, we continually seek to identify opportunities to extend our investment process into new markets or to apply it in different ways to offer clients additional strategies. We are currently incubating several strategies which we believe may be attractive to our clients in the future.

Our Investment Performance

Since we are long-term fundamental investors, we believe that our investment strategies yield the most benefits and are best evaluated, over a long-term timeframe. For more information on our performance, see “Item 7 — Management’s Discussion and Analysis of Financial Condition and Results of Operations — Operating Results.”

5

Advisory Fees

We earn advisory fees on the accounts that we manage for institutional clients, for retail clients which are generally sub-advised mutual funds, and for other investment funds.

On our institutional accounts, we are paid fees according to a schedule which varies by investment strategy. The substantial majority of these accounts pay us management fees pursuant to a schedule in which the rate we earn on the AUM declines as the amount of AUM increases. Certain of our clients pay us performance fees according to the performance of their accounts relative to certain agreed-upon benchmarks, which results in a lower base fee, but allows for us to earn higher fees if the relevant investment strategy outperforms the agreed-upon benchmark.

As of December 31, 2014, we sub-advised thirteen SEC-registered mutual funds that each have an initial two-year term and are thereafter subject to annual renewal by each fund’s board of directors pursuant to the Investment Company Act of 1940, as amended (the “Investment Company Act”). Ten of these thirteen sub-investment advisory agreements are beyond their initial two-year terms as of December 31, 2014. In addition, we sub-advise sixteen offshore funds. Under these agreements, we are generally paid a management fee according to a schedule, pursuant to which the rate we earn on the AUM declines as the amount of AUM increases. Certain of these funds pay us fixed-rate management fees. Due to the substantially larger account size of certain of these accounts, the average advisory fees we earn on them, as a percentage of assets under management, are lower than the advisory fees we earn on our institutional accounts. The majority of the advisory fees we earn on institutional accounts are based on the value of AUM at a specific date on a quarterly basis. Advisory fees on certain of our institutional accounts, and with respect to all of the mutual funds that we sub-advise, are calculated based on the average of the monthly or daily market value of the account. Advisory fees are also generally adjusted for any cash flows into or out of a portfolio, where the cash flow represents greater than 10% of the value of the portfolio. While a specific group of accounts may use the same fee rate, the method used to calculate the fee according to the fee rate schedule may differ, as described above.

Our Client Relationships and Distribution Approach

As of December 31, 2014, in addition to managing separate accounts on behalf of institutions and acting as sub-investment adviser for SEC-registered mutual funds and offshore funds, we also acted as investment adviser for Pzena-branded SEC-registered mutual funds ("Pzena Mutual Funds"), private placement vehicles, and offshore funds. We believe that strong relationships with our clients are critical to our ability to succeed and to grow our AUM. In building these relationships, we have focused our efforts where we can efficiently access and service large pools of sophisticated clients with our team of dedicated marketing and client service professionals. We distribute our products to institutional and retail clients primarily through the efforts of our internal sales team, who communicate directly with our clients and with the consultants who serve them, as well as through the marketing programs of our sub-investment advisory partners. Since our objective is to attract long-term investors with an investment horizon in excess of three years, our sales and client service efforts focus on educating our investors regarding our disciplined value investment process and philosophy.

Our marketing and client service effort is led by our 18-person business development team, which is responsible for:

• | identifying and marketing to prospective institutional clients; |

• | responding to requests for investment management proposals; and |

• | developing and maintaining relationships with independent consultants. |

Direct Institutional Relationships

Since our inception, we have directly offered institutional investment products to public and corporate pension funds, endowments, foundations and Taft-Hartley plans. Wherever possible, we have sought to develop direct relationships with the largest U.S. institutional investors, a universe we define to include plan sponsors with greater than $300 million in plan assets. Over the past few years, we have focused on expanding our direct calling effort to potential institutional clients outside of the United States.

Investment Consultants

We estimate that approximately 70% of all retirement plan assets are advised by investment consultants, with a relatively small number of these consultants representing a significant majority of these relationships. As a result of a consistent servicing effort over our history, we have built strong relationships with those consulting firms that we believe are the most important and believe that most of them rate our investment strategies favorably. New accounts sourced through consultant-led searches have been a large driver of our historical growth and are expected to be a major component of our future growth. We seek to develop direct relationships with accounts sourced through consultant-led searches by our ongoing marketing and client service efforts, as described below under “Client Service.”

6

Sub-Investment Advisory Distribution

We have established relationships with mutual fund and fund providers domestically and internationally, that offer us opportunities to efficiently access new market segments through sub-investment advisory roles. The funds that we sub-advise are generally either multi-manager funds, in which we manage only a portion of the fund's portfolio, or funds for which we are the sole sub-adviser.

We currently sub-advise four funds that are advised by The Vanguard Group. We manage a portion of each of the Vanguard Windsor Fund, Vanguard Selected Value Fund, and Vanguard Emerging Markets Select Stock Fund, and are the sole sub-adviser of the Vanguard U.S. Fundamental Value Fund. As of December 31, 2014, these four funds represented $6.9 billion, or 25.0%, of our AUM. For the years ended December 31, 2014, 2013, and 2012, approximately 9.4%, 6.9%, and 3.1%, respectively, of our total revenue was generated from our sub-investment advisory agreements with The Vanguard Group.

We sub-advise a mutual fund that is advised by John Hancock Advisers, namely the John Hancock Classic Value Fund. As of December 31, 2014, this fund represented $2.7 billion, or 9.6%, of our AUM. For the years ended December 31, 2014, 2013, and 2012 approximately 7.6%, 7.7%, and 7.0%, respectively, of our total revenue was generated from our sub-investment advisory agreement with John Hancock Advisers.

Pzena Funds

U.S. investors that do not meet our minimum account size for a separate account, or who otherwise prefer to invest through a mutual fund, can invest in certain of our strategies through our Pzena Mutual Funds, which were launched during 2014. We act as investment adviser to each of three Pzena Mutual Funds: the Pzena Emerging Markets Focused Value Fund, Pzena Long/Short Value Fund, and Pzena Mid Cap Focused Value Fund that offer no-load, open-end share classes designed to meet the needs of a range of institutional and other investors.

In addition, we serve as investment manager and promoter of Pzena Value Funds plc and its respective sub-funds, a family of Irish-based UCITS funds. Pzena Value Funds plc began operations in 2005 and offers shares to non-U.S. investors. We currently offer a sub-fund corresponding to our Emerging Markets Focused Value, Global Expanded Value, Global Focused Value, and Large Cap Expanded Value strategies.

We also offer access to certain of our Global and non-U.S. strategies through private placement vehicles and collective investment trusts.

We generally earn investment management fees based on average daily net assets of each fund for serving as investment adviser to these funds.

Client Service

Our client service team’s efforts are instrumental to maintaining our direct relationships with institutional and individual separate account clients, and developing direct relationships with separate accounts sourced through consultant-led searches. We have a dedicated client service team, which is primarily responsible for addressing all ongoing client needs, including periodic updates and reporting requirements. Our business development team assists in providing ongoing client service to existing institutional accounts. Our institutional distribution, sales and client service efforts are also supported, as necessary, by members of our investment team.

Our client service team consists of individuals with both general business backgrounds and investment research experience. Our client service team members are fully integrated into our research team, attending both research and company management meetings to ensure our clients receive primary information. As appropriate, we introduce members of our research and portfolio management team into client portfolio reviews to ensure that our clients are exposed to the full breadth of our investment resources. We also provide quarterly reports to our clients in order to share our investment perspectives with them. We additionally meet and hold conference calls regularly with clients to share perspectives on the portfolio and the current investment environment.

Competition

We compete in all aspects of our business with a large number of investment management firms, commercial banks, broker-dealers, insurance companies and other financial institutions.

In order to grow our business, we must be able to compete effectively to maintain existing AUM and attract additional AUM. Historically, we have competed for AUM principally on the basis of:

• | the performance of our investment strategies; |

7

• | our clients’ perceptions of our drive, focus and alignment of our interests with theirs; |

• | the quality of the service we provide to our clients and the duration of our relationships with them; |

• | our brand recognition and reputation within the investing community; |

• | the range of strategies and investment vehicles we offer; and |

• | the level of advisory fees we charge for our investment management services. |

Our ability to continue to compete effectively will also depend upon our ability to attract highly qualified investment professionals and retain our existing employees. For additional information concerning the competitive risks that we face, see “Item 1A — Risk Factors — Risks Related to Our Business — The investment management business is intensely competitive.”

Employees

At December 31, 2014, we had 81 full-time employees, consisting of 26 research department personnel; 3 traders; 18 client service and marketing personnel; 19 employees in operations; and 15 legal, compliance and finance personnel.

Available Information

We maintain a website at www.pzena.com and provide information on our Pzena Mutual Funds at www.pzenafunds.com. The contents of our website are not part of, nor are they incorporated by reference into, this Annual Report.

We make available through our website our annual reports on Form 10-K, our quarterly reports on Form 10-Q and our current reports on Form 8-K, as well as amendments to those reports, as soon as reasonably practicable after they are electronically filed with the Securities and Exchange Commission. To retrieve these reports, and any amendments thereto, visit the Investor Relations section of our website.

Regulatory Environment and Compliance

Our business is subject to extensive regulation in the United States at both the federal and state level, as well as by self-regulatory organizations. Under these laws and regulations, agencies that regulate investment advisers have broad administrative powers, including the power to limit, restrict or prohibit an investment adviser from carrying on its business in the event that it fails to comply with such laws and regulations. Possible sanctions that may be imposed include the suspension of individual employees, limitations on engaging in certain lines of business for specified periods of time, revocation of investment adviser and other registrations, censures and fines.

SEC Regulation

Our operating company, Pzena Investment Management, LLC, is registered as an investment adviser with the SEC. As a registered investment adviser, it is subject to the requirements of the Investment Advisers Act of 1940, as amended, which we refer to as the Investment Advisers Act, and the SEC’s regulations thereunder, as well as to examination by the SEC’s staff. The Investment Advisers Act imposes substantive regulation on virtually all aspects of our business and our relationships with our clients. Applicable requirements relate to, among other things, fiduciary duties to clients, engaging in transactions with clients, maintaining an effective compliance program, performance fees, solicitation arrangements, conflicts of interest, advertising, recordkeeping, reporting and disclosure requirements. Thirteen of the U.S. funds for which Pzena Investment Management, LLC acts as the sub-investment adviser and three of the U.S. funds for which Pzena Investment Management, LLC acts as investment adviser, are registered with the SEC under the Investment Company Act. The Investment Company Act imposes additional obligations, including detailed operational requirements for both the funds and their advisers. Moreover, the Investment Company Act requires that an investment adviser’s contract with a registered fund may be terminated by the fund on not more than 60 days’ notice, and is subject to annual renewal by the fund’s board after an initial two-year term. Both the Investment Advisers Act and the Investment Company Act regulate the “assignment” of advisory contracts by the investment adviser. The SEC is authorized to institute proceedings and impose sanctions for violations of the Investment Advisers Act and the Investment Company Act, ranging from fines and censures to termination of an investment adviser’s registration. The failure of Pzena Investment Management, LLC, or the registered funds for which Pzena Investment Management, LLC acts as sub-investment adviser, to comply with the requirements of the SEC could have a material adverse effect on us.

Pzena Financial Services, LLC, our SEC registered broker-dealer subsidiary, is subject to the SEC's Uniform Net Capital Rule, which requires that at least a minimum part of a registered broker-dealer's assets be kept in relatively liquid form. At December 31, 2014, Pzena Financial Services, LLC had net capital of $244,496, which was $234,079 in excess of its net capital requirement of $10,417.

8

ERISA-Related Regulation

To the extent that Pzena Investment Management, LLC is a “fiduciary” under the Employment Retirement Act of 1974, or ERISA, with respect to benefit plan clients, it is subject to ERISA, and to regulations promulgated thereunder. ERISA and applicable provisions of the Internal Revenue Code impose certain duties on persons who are fiduciaries under ERISA, prohibit certain transactions involving ERISA plan clients and provide monetary penalties for violations of these prohibitions. Our failure to comply with these requirements could have a material adverse effect on our business.

Foreign Regulation

Pzena Investment Management, LLC currently avails itself of the international adviser exemption in Ontario, Canada. In addition, Pzena Investment Management, LLC is registered as an exempt market dealer in Ontario, Canada. As an exempt adviser, Pzena Investment Management, LLC is only permitted to provide advice in Ontario to certain institutional and high net worth individual clients. As an exempt market dealer, Pzena Investment Management, LLC is permitted to act as a market intermediary for only certain types of trades, and is permitted to market, sell and distribute prospectus-exempt securities to accredited investors. An exempt adviser and market dealer must, upon the request of the Ontario Securities Commission, or OSC, produce all books, papers, documents, records and correspondence relating to its activities in Ontario, and inform the OSC if it becomes the subject of an investigation or disciplinary action by any financial services or securities regulatory authority or self-regulatory authority.

Pzena Investment Management, LLC maintains a representative office in Melbourne, Australia, and maintains an exemption from the Australian Financial Services license requirement under the Corporations Act 2001 of the Commonwealth of Australia.

We operate in various other foreign jurisdictions without registration in reliance upon applicable exemptions under the laws of those jurisdictions.

Compliance

We maintain a Legal and Compliance department with three full-time lawyers, including our General Counsel/Chief Compliance Officer. Other members of the department, as well as certain of our other employees, also devote significant time to compliance matters.

ITEM 1A. | RISK FACTORS |

We face a variety of significant and diverse risks, many of which are inherent in our business. Described below are the risks we currently believe could materially and adversely affect our business, financial condition, results of operations or cash flow.

Risks Related to Our Business

Our primary source of revenue is derived from management fees, which are directly tied to our assets under management. Fluctuations in AUM may directly impact our revenue.

Substantially all of our revenue is derived from management fees paid by our clients, based on a percentage of the market value of our AUM. Any decline and/or significant impairment in AUM may greatly affect our revenue, and could occur due to a variety of factors, including:

• | Poor performance of our strategies: Poor performance of our investment strategies may result in decreased market value of AUM. In addition, underperformance could impact our ability to maintain our existing client base and develop new relationships, both of which could negatively impact AUM. |

• | Poor market environment: We could expect our business to generate lower revenue in a depressed equities market or general economic downturn. Any decline in the market value of securities held in client portfolios due to such adverse conditions could lower AUM significantly and lead to a decrease in revenue. Investor sentiment in a poor equities market environment could also decrease inflows and increase outflows from our investment strategies in favor of investments perceived as more attractive. |

• | Geo-political conditions: As a company that invests in both U.S. and non-U.S. markets, and with a global client base, our business is subject to changing conditions in the global financial markets, and may also be affected by worldwide political, social and economic conditions, any of which could negatively impact AUM. |

• | Termination of significant relationships: Our clients can generally terminate our advisory agreements or reduce assets under management upon short notice and for any reason. Investors in the pooled funds that we manage may also |

9

redeem their investments in the funds at any time without prior notice. As of December 31, 2014, three client relationships represented 41% and 22% of our AUM and revenue, respectively. The termination of any of these relationships and outflow of money from our pooled funds could significantly reduce our revenue, and we may not be able to establish relationships with other clients in order to replace the lost revenue. There can also be no assurance that our agreements with respect to these relationships will remain in place going forward.

• | Defined benefit plans are declining: Defined benefit plans are declining as corporate plan sponsors are decreasing their liabilities and shifting employee enrollment to defined contribution plans. We currently do not have significant exposure to the defined contribution market but are actively trying to gain new assets in this market, including through our recently launched Pzena Mutual Funds. There is no guarantee that we will be successful in increasing our penetration of the defined contribution market, which could impact our AUM. |

• | Intermediary dependence: New accounts sourced through consultant-led searches have been a large driver of our inflows in the past, and are expected to be a major component of our inflows going forward. We have also established relationships with certain mutual fund providers who have offered us opportunities to access certain market segments through sub-investment advisory roles. Our intermediaries routinely review and evaluate our organization and the services we offer, and poor evaluations may result in client outflows and impact our ability to attract new assets through such intermediaries. |

• | Passive strategies have grown substantially in relation to active strategies: During the past decade, investors have generally exhibited a preference for passive investment products, such as index and exchange traded funds, over active strategies managed by asset managers such as ourselves. If this market preference continues our AUM may be negatively impacted. |

Market pressures to lower our advisory fees could lead to a decline in our profit and earnings.

Market pressures in recent years have created a trend towards lower fees in the asset management industry and there can be no assurance that we will be able to maintain our current fee structure going forward. Additionally, a shift in the composition of our AUM from higher to lower fee-generating client relationships may result in a decrease in revenue, even if our aggregate level of AUM remains unchanged or increases. A portion of our investment advisory revenue is also derived from performance fees. We generally earn performance fees under certain client agreements according to the performance relative to an agreed-upon benchmark. This fee structure results in a lower base fee but allows for us to earn higher fees if the investment strategy outperforms the benchmark. Some performance-based fee arrangements include high-water mark provisions, which generally provide that if a client account underperforms relative to its performance target, it must gain back such underperformance before we can collect future performance-based fees. Therefore, if we fail to achieve the performance target for a particular period, we may not earn a performance fee for that period and for accounts with a high-water mark provision, our ability to earn future performance fees may be impaired. During fiscal years 2014 and 2013, we earned $3.8 million and $3.9 million in performance fees, respectively. An increase in performance-based fee arrangements with clients could create greater fluctuations in our revenue and earnings.

Increases in our expenses could lead to a decline in our profit margin and increase the volatility of our earnings.

Our expenses are subject to increase based on a variety of factors such as higher operating expenses resulting from product development and expanded marketing efforts; higher compensation expense due to increased headcount and seniority level; and related expenses to meet business and regulatory needs. Some or all of these expenses may remain at higher levels for the foreseeable future, leading to higher costs for our business. Fluctuations in expenses could impact our profit margins and contribute to earnings volatility.

Loss of key employees, and difficulties in attracting qualified investment professionals, could have a material adverse effect on the performance of our strategies, which may lead to a decrease in revenue and profitability.

The success of our business largely depends on the participation of Richard S. Pzena, John P. Goetz, William L. Lipsey, and Michael D. Peterson, our CEO, two Presidents, and Executive Vice President, respectively. Their professional reputations, expertise in investing, and relationships with our clients and within the investing community in the U.S. and abroad are critical to executing our business strategy and attracting and retaining clients. The retention of these individuals is crucial to our future success. There is no guarantee that they will not resign, join our competitors or form a competing company. The terms of the current operating agreement of our operating company restrict each of these individuals from competing with us or soliciting our clients or employees during the term of their employment with us and for a certain period thereafter. The penalty for breach of these restrictive covenants may be the forfeiture of a number of Class B units held by the individual and his permitted transferees as of the earlier of the date of his breach or the termination of his employment. Although we may also seek specific performance of these restrictive covenants, there can be no assurance that we would be successful in obtaining this relief. After this post-employment restrictive period, we may not be able to prohibit them from competing with us or soliciting our clients or

10

employees. Furthermore, we do not carry any "key man" insurance that would provide us with proceeds in the event of the death or disability of any of the above mentioned employees.

In addition to the participants mentioned above, our success also depends on our ability to retain the senior members of our investment team and to recruit additional qualified investment professionals. We may not be successful in our efforts to retain and recruit such individuals as the market for investment professionals is extremely competitive. Our portfolio managers possess substantial experience and expertise in classic value investing and maintain significant relationships with our clients. The loss of any of our senior investment professionals could limit our ability to successfully execute our investment approach and to sustain the performance of our investment strategies, which, in turn, could have a material adverse effect on our reputation, client relationships and our revenue and earnings.

Future growth of our business may place significant demands on our resources and employees, and may increase our expenses, risks and regulatory oversight.

Future growth of our business may place significant demands on our infrastructure, our investment team and other employees, which may increase our expenses. In addition, we are required to continuously develop our infrastructure in response to the increasing sophistication of the investment management market, as well as compliance with legal and regulatory developments. We may face significant challenges in maintaining and developing: adequate financial and operational controls; implementing new or updated information and financial systems, and procedures and training; and managing and appropriately sizing our work force, and other components of our business on a timely and cost-effective basis. There can be no assurance that we will be able to manage the growth of our business effectively, or that we will be able to continue to grow, and any failure to do so could adversely affect our ability to generate revenue and control expenses.

The potential inability of our systems to accommodate an increasing volume of transactions could also constrain our ability to expand our businesses. In recent years, we have substantially upgraded and expanded the capabilities of our data processing systems and other operating technology, and we expect that we may need to continue to upgrade and expand these capabilities in the future to avoid disruption of, or constraints on, our operations.

We face risks, and corresponding potential costs and expenses, associated with conducting operations and growing our business in numerous countries.

We offer investment management services in many different regulatory jurisdictions around the world, and intend to continue to expand our operations internationally. In order to remain competitive, we must be proactive and prepared to deploy necessary resources when growth opportunities present themselves. The necessary resources and/or personnel may be unavailable to take full advantage of strategic opportunities when they appear, or that strategic decisions can be efficiently implemented. Local regulatory environments may vary widely, as well as the adequacy and sophistication of each. Local requirements or needs may also place additional demands on sales and compliance personnel and resources, such as meeting local requirements and complying with local industry standards. Finding and hiring additional, well-qualified personnel and crafting and adopting policies, procedures and controls to address local or regional requirements remain a challenge as we expand our operations internationally. Moreover, regulators in non-U.S. jurisdictions could also change their policies or laws in a manner that might restrict or otherwise impede our ability to offer our investment products in their respective markets. Any of these local requirements, activities, or needs could increase the costs and expenses we incur in a specific jurisdiction without any corresponding increase in revenue and income from operating in such jurisdiction.

The investment management business is intensely competitive.

Competition in the investment management business is based on a variety of factors, including investment performance; investor perception of an investment manager’s drive, focus and alignment of interests; quality of service provided to clients and duration of client relationships; business reputation; and level of fees charged for services. We compete in all aspects of our business with a large number of investment management firms, commercial banks, broker-dealers, insurance companies and other financial institutions. Our competitive risks are heightened by the fact that some of our competitors may implement investment styles that are viewed more favorably than ours or they may invest in alternative asset classes which the markets may perceive as more attractive than the public equity markets. If we are unable to compete effectively, our revenue could be reduced, and our business could be materially affected.

11

A change of control could result in termination of our investment advisory or sub-investment advisory agreements.

Pursuant to the Investment Company Act, each of the investment advisory or sub-investment advisory agreements for the SEC-registered mutual funds that we advise will automatically terminate upon their deemed “assignment,” and a fund’s board and shareholders must approve a new agreement in order for us to continue to act as its investment adviser or sub-investment adviser. In addition, pursuant to the Investment Advisers Act, each of our investment advisory agreements for the separate accounts we manage contains a provision that states that the agreement may not be “assigned” without the consent of the client. An "assignment," pursuant to both the Investment Company Act and the Investment Advisers Act, could be deemed to occur upon a sale or transfer of a controlling block of our voting securities. Such an assignment may be deemed to occur in the event that the holders of the Class B units of our operating company exchange enough of their Class B units for shares of our Class A common stock such that they no longer own a controlling interest in us. If such a deemed assignment occurs, there can be no assurance that we will be able to obtain the necessary consents from clients whose assets are managed pursuant to separate accounts, or the necessary approvals from the boards and shareholders of the SEC-registered funds that we sub-advise. An assignment, actual or constructive, would trigger these termination and consent provisions and, unless the necessary approvals and consents are obtained, could adversely affect our ability to continue managing client accounts, resulting in the loss of AUM and a corresponding loss of revenue.

Extensive regulation of our business has been and will be expensive and time consuming, and exposes us to the potential for significant penalties, including fines or limitations on our ability to conduct our business.

We are subject to extensive regulation of our investment management business and operations. As a registered investment adviser, the SEC oversees our activities pursuant to its regulatory authority under the Investment Advisers Act. In addition, we must comply with certain requirements under the Investment Company Act with respect to the SEC-registered funds for which we act as investment adviser or sub-investment adviser. Pzena Financial Services, LLC, our SEC registered broker dealer subsidiary is regulated by the Financial Industry Regulatory Authority ("FINRA"). Each of the regulatory bodies with jurisdiction over us has the authority to regulate various aspects of financial services, including the authority to grant, and, in specific circumstances to cancel, permissions to carry on particular businesses. Our failure to comply with applicable laws or regulations could result in fines, censure, suspensions of personnel or other sanctions, including revocation of our registration as an investment adviser. Even if a sanction imposed against us is small in monetary amount, the adverse publicity arising from the imposition of such sanctions by regulators could harm our reputation, result in withdrawal by our clients and/or impede our ability to retain clients and develop new client relationships. As we continue to expand into the international market, we may also be under the regulatory scope of local regulatory authorities and non-compliance with any of these authorities may result in fines, sanctions and inability to operate in that local market.

We also face the risk of significant intervention by regulatory authorities, including extended investigation and surveillance activity, adoption of costly or restrictive new regulations, and judicial or administrative proceedings that may result in substantial penalties. The requirements imposed by our regulators are designed to ensure the integrity of the financial markets and to protect customers and other third parties who deal with us, and are not designed to protect our stockholders. Any regulatory and legislative actions and reforms affecting the investment advisory industry may negatively impact earnings by increasing our costs of operations.

In addition, the regulatory environment in which we operate is subject to ongoing modification and further regulation. The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (“the Dodd-Frank Act”), and regulations to be promulgated pursuant to it, is one such example. Certain provisions of the Dodd-Frank Act may have unintended consequences on the financial market as a whole that could negatively affect our business.

Changes in tax laws or exposure to additional income tax liabilities could have a material impact on our financial condition, results of operations and liquidity.

We are subject to income- as well as non-income-based taxes, in both the U.S. and non-U.S. jurisdictions. We are also subject to potential tax audits in various jurisdictions and in such event, tax authorities may disagree with certain positions we have taken and assess penalties or additional taxes. We regularly assess the likely outcomes of these potential audits in order to determine the appropriateness of our tax provision; however, there can be no assurance that we will accurately predict the outcomes of these potential audits. The actual outcomes of these potential audits could have a material impact on our net income or financial condition and any changes in tax laws or tax rulings could materially impact our effective tax rate and earnings.

12

Certain changes in accounting and/or financial reporting standards issued by the Financial Accounting Standards Board (“FASB”), the SEC or other standard-setting bodies could have a material impact on our financial position or results of our operations.

We are subject to the application of generally accepted accounting principles in the United States (“GAAP”), which are periodically revised and/or expanded. As such, we are required to adopt new or revised accounting and/or financial reporting standards issued by recognized accounting standard setters or regulators, such as the FASB and the SEC.

In addition, the FASB is currently working with the International Accounting Standards Board (“IASB”) to converge certain accounting principles and to facilitate more comparable financial reporting between companies that are required to follow GAAP and those that are required to follow International Financial Reporting Standards (“IFRS”). These projects may result in different accounting principles under GAAP, which may have a material impact on the way in which we report financial results.

Inadequate business continuity plans could lead to material financial loss, reputational harm and inability to continue business.

We rely heavily on our financial, accounting, trading, compliance and other data processing systems. Any failure or interruption of these systems, whether caused by natural disaster, power or telecommunications failure, act of terrorism or war or otherwise, could result in a disruption of our business, liability to clients, regulatory intervention or reputational damage, and thus materially adversely affect our business. The back-up systems that we have in place and other protective measures that we have taken may not be adequate in the event of a failure or interruption.

We depend on our headquarters in New York City for the continued operation of our business. A disaster or a disruption in the infrastructure that supports our business, or directly affecting our headquarters, may have a material adverse impact on our ability to continue to operate our business without interruption. We have a detailed business continuity plan in place that is tested on a quarterly basis, but there can be no assurance that this plan will be sufficient to mitigate the harm that may result from such a disaster or disruption.

Any significant security breach of our software applications, technology or other systems critical to our operations, may disrupt our business or cause us to lose sensitive and confidential information which in turn may cause reputational and financial harm.

We are dependent on the effectiveness of our information and cyber security policies, procedures and capabilities to protect our computer and telecommunications systems and the data that resides in or is transmitted through them. As part of our normal operations, we maintain and transmit confidential information about our clients as well as proprietary information relating to our business operations. We maintain a system of internal controls designed to provide reasonable assurance that fraudulent activity, including misappropriation of assets, fraudulent financial reporting, and unauthorized access to sensitive or confidential data is either prevented or detected in a timely manner. Our information technology systems may still be vulnerable to unauthorized access or may be corrupted by cyber-attacks, computer viruses or other malicious software code, or authorized persons could inadvertently or intentionally release confidential or proprietary information. Although we take precautions to password protect and/or encrypt our electronic hardware, if such hardware is stolen, misplaced or left unattended, it may become vulnerable to hacking or other unauthorized use, creating a possible security risk and resulting in potentially costly consequences to us. A breach of our technology systems could result in the loss of valuable information, liability for stolen assets or information, remediation costs to repair damage caused by the breach, additional security costs to mitigate against future incidents and legal costs resulting from the incident. Moreover, loss of confidential customer information could harm our reputation, result in the termination of contracts by our existing customers and subject us to liability under laws that protect confidential data, resulting in loss of revenue.

Operational risk, such as trade errors or system limitations or failures, may create significant financial impact to us, hamper future growth and cause potential reputational harm.

We face potential operational risk from our management of client assets and daily business. Risks include errors that may occur during the execution, confirmation or settlement phase of transactions and such errors may cause material financial loss, which in turn may cause material financial and reputational harm to us. We also face the potential of inaccurate recording of transactions in our internal systems, caused by human error, system limitations or system malfunctions. Such errors may involve client and public reporting, execution, confirmation and settlement of trades, and billing. The potential for operational risk could have significant regulatory, financial or reputational impact. There can be no assurance that all risks and errors can be prevented.

13

The investment management industry faces substantial litigation risks which could materially adversely affect our business, financial condition or results of operations or cause significant reputational harm to us.

We depend to a large extent on our relationships with our clients and our reputation for integrity and high-caliber professional services to attract and retain clients. As a result, dissatisfaction with our services could be more damaging to our business than to other types of businesses. If our clients suffer significant losses, or are otherwise dissatisfied with our services, such as for breach of trading guidelines and/or perceived conflicts of interest, we could be subject to the risk of legal liabilities or actions alleging negligent misconduct, breach of fiduciary duty, or breach of contract. These risks are often difficult to assess or quantify and their existence and magnitude often remain unknown for substantial periods of time. We may incur significant legal expenses in defending against litigation. Substantial legal liability or significant regulatory action against us could materially adversely affect our business, financial condition or results of operations, or cause significant reputational harm to us.

Insurance coverage may not protect us from all of the liabilities that could arise from the risks inherent in our business.

We maintain insurance coverage focused on reducing potential losses related to our operations. We purchase insurance in amounts, and against risks, that we consider appropriate. There can be no assurance, however, that a claim or claims will be completely covered by insurance or, if covered at all, will not exceed the limits of our existing insurance coverage. If a loss occurs that is partially or completely uninsured, we may be exposed to substantial liability. Insurance costs are impacted by market conditions and our risk profile, and may increase significantly over relatively short periods. Renewals of insurance policies may result in additional costs through higher premiums or the assumption of higher deductibles or co-insurance liability. In addition, insurance and other safeguards might only partially reimburse us for our losses in the event our business continuity plan fails and our operations are significantly disrupted.

Our non-US holdings consist primarily of investments in the securities of issuers located outside of the United States, which may involve foreign currency exchange, political, social and economic uncertainties and risks.

Our international strategies, which together represented $10.9 billion and $9.9 billion of our AUM as of December 31, 2014 and 2013, respectively, are primarily invested in securities of companies located outside the United States. Investments in non-U.S. issuers may be affected by political, social and economic uncertainty affecting a country or region in which we are invested. Many emerging financial markets are not as developed, or as efficient, as the U.S. financial market, and, as a result, liquidity may be reduced and price volatility may increase. The legal and regulatory environments, including financial accounting standards and practices, may also be different, and there may be less publicly available information in respect of such companies. These risks could adversely impact the performance of our strategies that are invested in securities of non-U.S. issuers. In addition, fluctuations in foreign currency exchange rates may affect investment return and AUM since we do not engage in currency hedging for these portfolios. Due to these factors, our AUM may fluctuate from one reporting period to another causing volatility in earnings.

Risks Related to Our Investment Strategies

Our classic value investment style subjects us to the risk that the companies in which we invest may not achieve the level of earnings recovery that we initially expect, or at all.

We generally invest in companies after they have experienced, or are expected by the market to soon experience, a shortfall in their historic earnings, due to an adverse business development, management error, accounting scandal or other disruption, and before there is clear evidence of earnings recovery or business momentum. While investors are generally less willing to invest when companies lack earnings visibility, our classic value investment approach seeks to capture the return that can be obtained by investing in a company before the market has confidence in its ability to achieve earnings recovery. However, our investment approach entails the risk that the companies included in our portfolios are not able to execute as we had expected when we originally invested in them, thereby reducing the performance of our strategies. Since our positions in these investments are often substantial, there is the risk that we may be unable to find willing purchasers for our investments when we decide to sell them.

Since we apply the same investment process across all of our investment strategies, utilizing one analyst team, and given the overlapping universes of many of our investment strategies, we could have common positions and industry or sector concentrations across many of our investment strategies at the same time. As such, factors leading one of our investment strategies to underperform may lead other strategies to underperform simultaneously.

Our investment approach may underperform other investment approaches during certain market conditions.

Our products are best suited for investors with long-term investment horizons. In accordance with our classic value investment approach, we typically hold securities for an average of three to five years. Our investment strategies may not

14

perform well during certain periods of time. For example, the disruption in the global credit markets and the deterioration of the economy and the financial markets beginning in the second half of 2007, and continuing through early 2009, created difficult conditions for most companies, including many of those in which we invest. In addition, our strategies may not perform well during points in the economic cycle when value-oriented stocks are relatively less attractive. For instance, during the late stages of an economic cycle, investors may purchase relatively expensive stocks in order to obtain access to above average growth, as was the case in the late 1990s. Value-oriented strategies may also experience weakness during periods when the markets are focused on one investment thesis or sector.

Even when securities prices are rising generally, portfolio performance can be affected by our investment approach. The classic value approach has outperformed the market in some economic and market environments and underperformed it in others. In particular, a prolonged period in which the growth style of investing outperforms the value style may cause our investment strategy to go out of favor with clients, consultants and sub-advised relationships. Our investment strategy may be less favored during certain time periods for other reasons as well, including due to perceived riskiness or volatility of our approach. Poor performance relative to peers, coupled with changes in personnel, extensive periods in particular market environments, or other difficulties may result in a decline in our AUM.

Our investment process requires us to conduct extensive fundamental research on any company before investing, which may result in missed investment opportunities and reduce the performance of our investment strategies.

We take a considerable amount of time to complete the in-depth research projects that our investment process requires before adding any security to our portfolio. Our process requires that we take this time to understand the company and the business well enough to make an informed decision as to whether we are willing to own a significant position in a company that does not yet have earnings visibility. However, the time we take to make this judgment may cause us to miss the opportunity to invest in a company that has a sharp and rapid earnings recovery. Any such missed investment opportunities could adversely impact the performance of our investment strategies.

Risks Related to Our Structure

We are dependent upon distributions from our operating company to make distributions to our Class A stockholders, and to pay taxes and other expenses.