0001398987000135500112-312023FYfalseDEMadisonNew Jersey973407-200007940http://fasb.org/us-gaap/2023#OtherNonoperatingIncomeExpensehttp://fasb.org/us-gaap/2023#CostsAndExpenseshttp://fasb.org/us-gaap/2023#CostsAndExpenseshttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#CostsAndExpenseshttp://fasb.org/us-gaap/2023#CostsAndExpensesP3YP3YP10YP4Yhttp://fasb.org/us-gaap/2023#CostsAndExpenseshttp://fasb.org/us-gaap/2023#CostsAndExpenses00013989872023-01-012023-12-310001398987hous:AnywhereRealEstateGroupLLCMember2023-01-012023-12-3100013989872023-06-30iso4217:USD00013989872024-02-15xbrli:sharesiso4217:USDxbrli:shares00013989872023-10-012023-12-310001398987us-gaap:AllowanceForCreditLossMember2022-12-310001398987us-gaap:AllowanceForCreditLossMember2023-01-012023-12-310001398987us-gaap:AllowanceForCreditLossMember2023-12-310001398987us-gaap:AllowanceForCreditLossMember2021-12-310001398987us-gaap:AllowanceForCreditLossMember2022-01-012022-12-310001398987us-gaap:AllowanceForCreditLossMember2020-12-310001398987us-gaap:AllowanceForCreditLossMember2021-01-012021-12-310001398987us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-12-310001398987us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-01-012023-12-310001398987us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-12-310001398987us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-12-310001398987us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-01-012022-12-310001398987us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-12-310001398987us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-01-012021-12-310001398987hous:GrossCommissionIncomeMember2023-01-012023-12-310001398987hous:GrossCommissionIncomeMember2022-01-012022-12-310001398987hous:GrossCommissionIncomeMember2021-01-012021-12-310001398987us-gaap:ServiceMember2023-01-012023-12-310001398987us-gaap:ServiceMember2022-01-012022-12-310001398987us-gaap:ServiceMember2021-01-012021-12-310001398987us-gaap:FranchiseMember2023-01-012023-12-310001398987us-gaap:FranchiseMember2022-01-012022-12-310001398987us-gaap:FranchiseMember2021-01-012021-12-310001398987us-gaap:ServiceOtherMember2023-01-012023-12-310001398987us-gaap:ServiceOtherMember2022-01-012022-12-310001398987us-gaap:ServiceOtherMember2021-01-012021-12-3100013989872022-01-012022-12-3100013989872021-01-012021-12-3100013989872023-12-3100013989872022-12-3100013989872021-12-3100013989872020-12-310001398987us-gaap:CommonStockMember2020-12-310001398987us-gaap:AdditionalPaidInCapitalMember2020-12-310001398987us-gaap:RetainedEarningsMember2020-12-310001398987us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001398987us-gaap:NoncontrollingInterestMember2020-12-310001398987us-gaap:RetainedEarningsMember2021-01-012021-12-310001398987us-gaap:NoncontrollingInterestMember2021-01-012021-12-310001398987us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001398987us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001398987us-gaap:CommonStockMember2021-01-012021-12-310001398987us-gaap:CommonStockMember2021-12-310001398987us-gaap:AdditionalPaidInCapitalMember2021-12-310001398987us-gaap:RetainedEarningsMember2021-12-310001398987us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001398987us-gaap:NoncontrollingInterestMember2021-12-310001398987us-gaap:AccountingStandardsUpdate202006Member2022-01-010001398987us-gaap:RetainedEarningsMember2022-01-012022-12-310001398987us-gaap:NoncontrollingInterestMember2022-01-012022-12-310001398987us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001398987us-gaap:CommonStockMember2022-01-012022-12-310001398987us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001398987us-gaap:CommonStockMember2022-12-310001398987us-gaap:AdditionalPaidInCapitalMember2022-12-310001398987us-gaap:RetainedEarningsMember2022-12-310001398987us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001398987us-gaap:NoncontrollingInterestMember2022-12-310001398987us-gaap:RetainedEarningsMember2023-01-012023-12-310001398987us-gaap:NoncontrollingInterestMember2023-01-012023-12-310001398987us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001398987us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001398987us-gaap:CommonStockMember2023-01-012023-12-310001398987us-gaap:CommonStockMember2023-12-310001398987us-gaap:AdditionalPaidInCapitalMember2023-12-310001398987us-gaap:RetainedEarningsMember2023-12-310001398987us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001398987us-gaap:NoncontrollingInterestMember2023-12-310001398987hous:FranchiseAndOwnedBrokerageGroupsMemberhous:WorldwideMember2023-12-31hous:numberOfIndependentSalesAgents0001398987country:UShous:FranchiseAndOwnedBrokerageGroupsMember2023-12-310001398987hous:OwnedBrokerageGroupMember2023-12-31hous:franchisedandcompanyownedofficeshous:Countrieshous:Brokerage_Offices0001398987hous:TitleInsuranceUnderwriterMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2022-03-290001398987hous:TitleInsuranceUnderwriterJointVentureMember2022-03-29xbrli:pure0001398987hous:TitleGroupMember2022-01-012022-03-310001398987hous:TitleInsuranceUnderwriterMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2022-01-012022-03-310001398987hous:TitleGroupMemberhous:TitleInsuranceUnderwriterJointVentureMember2022-06-300001398987hous:TitleInsuranceUnderwriterJointVentureMember2022-04-012022-06-300001398987hous:TitleGroupMemberhous:TitleInsuranceUnderwriterJointVentureMember2023-12-310001398987hous:TitleInsuranceUnderwriterJointVentureMember2023-01-012023-03-310001398987srt:MaximumMember2023-01-012023-12-310001398987us-gaap:BuildingMember2023-12-310001398987srt:MaximumMemberus-gaap:LeaseholdImprovementsMember2023-12-310001398987us-gaap:FurnitureAndFixturesMembersrt:MinimumMember2023-12-310001398987us-gaap:FurnitureAndFixturesMembersrt:MaximumMember2023-12-310001398987us-gaap:SoftwareAndSoftwareDevelopmentCostsMembersrt:MinimumMember2023-12-310001398987us-gaap:SoftwareAndSoftwareDevelopmentCostsMembersrt:MaximumMember2023-12-310001398987us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2023-12-310001398987us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2022-12-310001398987hous:FranchiseGroupMember2023-10-012023-12-310001398987us-gaap:TrademarksMemberhous:FranchiseGroupMember2023-10-012023-12-310001398987hous:OwnedBrokerageGroupMember2022-10-012022-12-310001398987hous:FranchiseGroupMember2022-10-012022-12-310001398987us-gaap:TrademarksMemberhous:FranchiseGroupMember2022-10-012022-12-310001398987hous:GrossCommissionIncomeMemberhous:FranchiseGroupMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001398987hous:GrossCommissionIncomeMemberhous:FranchiseGroupMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001398987hous:GrossCommissionIncomeMemberhous:OwnedBrokerageGroupMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001398987hous:GrossCommissionIncomeMemberhous:OwnedBrokerageGroupMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001398987hous:GrossCommissionIncomeMemberhous:TitleGroupMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001398987hous:GrossCommissionIncomeMemberhous:TitleGroupMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001398987hous:GrossCommissionIncomeMemberus-gaap:CorporateNonSegmentMember2023-01-012023-12-310001398987hous:GrossCommissionIncomeMemberus-gaap:CorporateNonSegmentMember2022-01-012022-12-310001398987us-gaap:ServiceMemberhous:FranchiseGroupMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001398987us-gaap:ServiceMemberhous:FranchiseGroupMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001398987hous:OwnedBrokerageGroupMemberus-gaap:ServiceMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001398987hous:OwnedBrokerageGroupMemberus-gaap:ServiceMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001398987hous:TitleGroupMemberus-gaap:ServiceMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001398987hous:TitleGroupMemberus-gaap:ServiceMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001398987us-gaap:ServiceMemberus-gaap:CorporateNonSegmentMember2023-01-012023-12-310001398987us-gaap:ServiceMemberus-gaap:CorporateNonSegmentMember2022-01-012022-12-310001398987hous:FranchiseGroupMemberus-gaap:FranchiseMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001398987hous:FranchiseGroupMemberus-gaap:FranchiseMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001398987hous:OwnedBrokerageGroupMemberus-gaap:FranchiseMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001398987hous:OwnedBrokerageGroupMemberus-gaap:FranchiseMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001398987hous:TitleGroupMemberus-gaap:FranchiseMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001398987hous:TitleGroupMemberus-gaap:FranchiseMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001398987us-gaap:CorporateNonSegmentMemberus-gaap:FranchiseMember2023-01-012023-12-310001398987us-gaap:CorporateNonSegmentMemberus-gaap:FranchiseMember2022-01-012022-12-310001398987us-gaap:ServiceOtherMemberhous:FranchiseGroupMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001398987us-gaap:ServiceOtherMemberhous:FranchiseGroupMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001398987hous:OwnedBrokerageGroupMemberus-gaap:ServiceOtherMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001398987hous:OwnedBrokerageGroupMemberus-gaap:ServiceOtherMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001398987hous:TitleGroupMemberus-gaap:ServiceOtherMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001398987hous:TitleGroupMemberus-gaap:ServiceOtherMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001398987us-gaap:ServiceOtherMemberus-gaap:CorporateNonSegmentMember2023-01-012023-12-310001398987us-gaap:ServiceOtherMemberus-gaap:CorporateNonSegmentMember2022-01-012022-12-310001398987hous:FranchiseGroupMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001398987hous:FranchiseGroupMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001398987hous:OwnedBrokerageGroupMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001398987hous:OwnedBrokerageGroupMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001398987hous:TitleGroupMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001398987hous:TitleGroupMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001398987us-gaap:CorporateNonSegmentMember2023-01-012023-12-310001398987us-gaap:CorporateNonSegmentMember2022-01-012022-12-310001398987hous:GrossCommissionIncomeMemberhous:FranchiseGroupMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001398987hous:GrossCommissionIncomeMemberhous:OwnedBrokerageGroupMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001398987hous:GrossCommissionIncomeMemberhous:TitleGroupMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001398987hous:GrossCommissionIncomeMemberus-gaap:CorporateNonSegmentMember2021-01-012021-12-310001398987us-gaap:ServiceMemberhous:FranchiseGroupMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001398987hous:OwnedBrokerageGroupMemberus-gaap:ServiceMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001398987hous:TitleGroupMemberus-gaap:ServiceMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001398987us-gaap:ServiceMemberus-gaap:CorporateNonSegmentMember2021-01-012021-12-310001398987hous:FranchiseGroupMemberus-gaap:FranchiseMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001398987hous:OwnedBrokerageGroupMemberus-gaap:FranchiseMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001398987hous:TitleGroupMemberus-gaap:FranchiseMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001398987us-gaap:CorporateNonSegmentMemberus-gaap:FranchiseMember2021-01-012021-12-310001398987us-gaap:ServiceOtherMemberhous:FranchiseGroupMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001398987hous:OwnedBrokerageGroupMemberus-gaap:ServiceOtherMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001398987hous:TitleGroupMemberus-gaap:ServiceOtherMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001398987us-gaap:ServiceOtherMemberus-gaap:CorporateNonSegmentMember2021-01-012021-12-310001398987hous:FranchiseGroupMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001398987hous:OwnedBrokerageGroupMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001398987hous:TitleGroupMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001398987us-gaap:CorporateNonSegmentMember2021-01-012021-12-310001398987hous:BrandMarketingFeesMemberhous:FranchiseGroupMember2023-01-010001398987hous:BrandMarketingFeesMemberhous:FranchiseGroupMember2023-12-310001398987hous:InternationalFranchiseRightsMemberhous:FranchiseGroupMember2023-12-310001398987hous:AreaDevelopmentFeesMemberhous:FranchiseGroupMember2023-01-010001398987hous:AreaDevelopmentFeesMemberhous:FranchiseGroupMember2023-12-310001398987hous:AreaDevelopmentFeesMemberhous:FranchiseGroupMember2023-01-012023-12-310001398987hous:FranchiseGroupMemberus-gaap:FranchiseRightsMember2023-12-310001398987hous:FranchiseGroupMember2023-12-310001398987hous:FranchiseGroupMember2022-12-310001398987srt:MinimumMemberhous:FranchiseGroupMember2023-01-012023-12-310001398987srt:MaximumMemberhous:FranchiseGroupMember2023-01-012023-12-310001398987hous:FranchiseGroupMemberhous:OutsourcingManagementFeesMember2023-01-010001398987hous:FranchiseGroupMemberhous:OutsourcingManagementFeesMember2023-12-310001398987hous:FranchiseGroupMemberhous:OutsourcingManagementFeesMember2023-01-012023-12-310001398987hous:FranchiseGroupMemberhous:NetworkFeesMember2023-01-010001398987hous:FranchiseGroupMemberhous:NetworkFeesMember2023-12-310001398987hous:FranchiseGroupMemberhous:NetworkFeesMember2023-01-012023-12-310001398987hous:OwnedBrokerageGroupMembersrt:MinimumMember2023-01-012023-12-310001398987srt:MaximumMemberhous:OwnedBrokerageGroupMember2023-01-012023-12-310001398987hous:OwnedBrokerageGroupMemberhous:NewDevelopmentBusinessMember2023-01-010001398987hous:OwnedBrokerageGroupMemberhous:NewDevelopmentBusinessMember2023-12-310001398987hous:OwnedBrokerageGroupMemberhous:NewDevelopmentBusinessMember2023-01-012023-12-310001398987hous:FranchiseGroupMember2023-01-010001398987hous:FranchiseGroupMember2023-01-012023-12-310001398987hous:OwnedBrokerageGroupMember2023-01-010001398987hous:OwnedBrokerageGroupMember2023-01-012023-12-3100013989872023-01-010001398987hous:TitleGroupMemberhous:GuaranteedRateAffinityMember2023-12-310001398987hous:TitleGroupMemberhous:GuaranteedRateAffinityMember2022-12-310001398987hous:TitleGroupMemberhous:TitleInsuranceUnderwriterJointVentureMember2022-12-310001398987hous:OtherTitleGroupsEquityMethodInvestmentsMemberhous:TitleGroupMember2023-12-310001398987hous:OtherTitleGroupsEquityMethodInvestmentsMemberhous:TitleGroupMember2022-12-310001398987hous:TitleGroupMember2023-12-310001398987hous:TitleGroupMember2022-12-310001398987hous:OwnedBrokerageGroupsEquityMethodInvestmentsMemberhous:OwnedBrokerageGroupMember2023-12-310001398987hous:OwnedBrokerageGroupsEquityMethodInvestmentsMemberhous:OwnedBrokerageGroupMember2022-12-310001398987hous:TitleGroupMemberhous:GuaranteedRateAffinityMember2023-01-012023-12-310001398987hous:OtherTitleGroupsEquityMethodInvestmentsMemberhous:TitleGroupMember2023-01-012023-12-310001398987hous:RealEstateAuctionJointVentureMemberhous:OwnedBrokerageGroupMember2023-12-310001398987hous:RealSureJointVentureMemberhous:OwnedBrokerageGroupMember2023-12-310001398987hous:OwnedBrokerageGroupsEquityMethodInvestmentsMemberhous:OwnedBrokerageGroupMember2023-01-012023-12-310001398987hous:TitleGroupMemberhous:GuaranteedRateAffinityMember2022-01-012022-12-310001398987hous:TitleGroupMemberhous:GuaranteedRateAffinityMember2021-01-012021-12-310001398987hous:TitleGroupMemberhous:TitleInsuranceUnderwriterJointVentureMember2023-01-012023-12-310001398987hous:TitleGroupMemberhous:TitleInsuranceUnderwriterJointVentureMember2022-01-012022-12-310001398987hous:TitleGroupMemberhous:TitleInsuranceUnderwriterJointVentureMember2021-01-012021-12-310001398987hous:OtherTitleGroupsEquityMethodInvestmentsMemberhous:TitleGroupMember2022-01-012022-12-310001398987hous:OtherTitleGroupsEquityMethodInvestmentsMemberhous:TitleGroupMember2021-01-012021-12-310001398987hous:OwnedBrokerageGroupsEquityMethodInvestmentsMemberhous:OwnedBrokerageGroupMember2022-01-012022-12-310001398987hous:OwnedBrokerageGroupsEquityMethodInvestmentsMemberhous:OwnedBrokerageGroupMember2021-01-012021-12-310001398987us-gaap:FurnitureAndFixturesMember2023-12-310001398987us-gaap:FurnitureAndFixturesMember2022-12-310001398987us-gaap:AssetsHeldUnderCapitalLeasesMember2023-12-310001398987us-gaap:AssetsHeldUnderCapitalLeasesMember2022-12-310001398987us-gaap:BuildingAndBuildingImprovementsMember2023-12-310001398987us-gaap:BuildingAndBuildingImprovementsMember2022-12-310001398987us-gaap:LandMember2023-12-310001398987us-gaap:LandMember2022-12-310001398987hous:RealestateleasesMember2023-12-31hous:real_estate_leases0001398987srt:MinimumMemberhous:RealestateleasesMember2023-12-310001398987srt:MaximumMemberhous:RealestateleasesMember2023-12-310001398987srt:MinimumMemberhous:BrokeragesalesofficesMember2023-12-310001398987srt:MaximumMemberhous:BrokeragesalesofficesMember2023-12-310001398987srt:MaximumMemberhous:ShorttermleaseMember2023-12-310001398987us-gaap:PropertyPlantAndEquipmentMember2023-12-310001398987us-gaap:PropertyPlantAndEquipmentMember2022-12-310001398987hous:FranchiseGroupMember2021-12-310001398987hous:OwnedBrokerageGroupMember2021-12-310001398987hous:TitleGroupMember2021-12-310001398987hous:FranchiseGroupMember2022-01-012022-12-310001398987hous:OwnedBrokerageGroupMember2022-01-012022-12-310001398987hous:TitleGroupMember2022-01-012022-12-310001398987hous:OwnedBrokerageGroupMember2022-12-310001398987hous:TitleGroupMember2023-01-012023-12-31hous:real_estate_brokerage_operations00013989872020-01-012020-12-3100013989872019-01-012019-12-3100013989872008-01-012008-12-3100013989872007-01-012007-12-310001398987us-gaap:OtherIntangibleAssetsMemberhous:OwnedBrokerageGroupMember2022-01-012022-12-310001398987us-gaap:FranchiseRightsMember2023-12-310001398987us-gaap:FranchiseRightsMember2022-12-310001398987us-gaap:TrademarksMember2023-12-310001398987us-gaap:TrademarksMember2022-12-310001398987us-gaap:LicensingAgreementsMember2023-12-310001398987us-gaap:LicensingAgreementsMember2022-12-310001398987us-gaap:CustomerRelationshipsMember2023-12-310001398987us-gaap:CustomerRelationshipsMember2022-12-310001398987hous:TitlePlantSharesMember2023-12-310001398987hous:TitlePlantSharesMember2022-12-310001398987us-gaap:OtherIntangibleAssetsMember2023-12-310001398987us-gaap:OtherIntangibleAssetsMember2022-12-310001398987us-gaap:CustomerRelationshipsMembersrt:MinimumMember2023-12-310001398987us-gaap:CustomerRelationshipsMembersrt:MaximumMember2023-12-310001398987us-gaap:OtherIntangibleAssetsMembersrt:MinimumMember2023-12-310001398987srt:MaximumMemberus-gaap:OtherIntangibleAssetsMember2023-12-310001398987us-gaap:FranchiseRightsMember2023-01-012023-12-310001398987us-gaap:FranchiseRightsMember2022-01-012022-12-310001398987us-gaap:FranchiseRightsMember2021-01-012021-12-310001398987us-gaap:LicensingAgreementsMember2023-01-012023-12-310001398987us-gaap:LicensingAgreementsMember2022-01-012022-12-310001398987us-gaap:LicensingAgreementsMember2021-01-012021-12-310001398987us-gaap:CustomerRelationshipsMember2023-01-012023-12-310001398987us-gaap:CustomerRelationshipsMember2022-01-012022-12-310001398987us-gaap:CustomerRelationshipsMember2021-01-012021-12-310001398987us-gaap:OtherIntangibleAssetsMember2023-01-012023-12-310001398987us-gaap:OtherIntangibleAssetsMember2022-01-012022-12-310001398987us-gaap:OtherIntangibleAssetsMember2021-01-012021-12-310001398987us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-12-310001398987us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2022-12-310001398987us-gaap:SecuredDebtMemberhous:TermLoanAFacilityMember2023-12-310001398987us-gaap:SecuredDebtMemberhous:TermLoanAFacilityMember2022-12-310001398987us-gaap:SecuredDebtMemberhous:A700SeniorSecuredSecondLienNotesMember2023-12-310001398987us-gaap:SecuredDebtMemberhous:A700SeniorSecuredSecondLienNotesMember2022-12-310001398987hous:A575SeniorNotesMemberus-gaap:SeniorNotesMember2023-12-310001398987hous:A575SeniorNotesMemberus-gaap:SeniorNotesMember2022-12-310001398987hous:A525SeniorNotesMemberus-gaap:SeniorNotesMember2023-12-310001398987hous:A525SeniorNotesMemberus-gaap:SeniorNotesMember2022-12-310001398987us-gaap:ConvertibleDebtMemberhous:A025ExchangeableSeniorNotesMember2023-12-310001398987us-gaap:ConvertibleDebtMemberhous:A025ExchangeableSeniorNotesMember2022-12-310001398987hous:AppleRidgeFundingLlcMemberhous:SecuritizationobligationMember2023-12-310001398987hous:AppleRidgeFundingLlcMemberhous:SecuritizationobligationMember2022-12-310001398987us-gaap:RevolvingCreditFacilityMemberus-gaap:LetterOfCreditMember2023-12-310001398987us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:SubsequentEventMember2024-02-140001398987us-gaap:RevolvingCreditFacilityMemberus-gaap:SubsequentEventMemberus-gaap:LetterOfCreditMember2024-02-140001398987srt:ScenarioForecastMemberus-gaap:SecuredDebtMemberhous:TermLoanAFacilityMember2024-01-012024-12-310001398987hous:SOFRMember2023-01-012023-12-310001398987hous:AbrMember2023-01-012023-12-310001398987us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberhous:Greaterthan3.50to1.00Memberhous:SOFRMember2023-01-012023-12-310001398987us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberhous:Greaterthan3.50to1.00Memberhous:AbrMember2023-01-012023-12-310001398987us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberhous:Lessthanorequalto3.50to1.00butgreaterthanorequalto2.50to1.00Memberhous:SOFRMember2023-01-012023-12-310001398987us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberhous:Lessthanorequalto3.50to1.00butgreaterthanorequalto2.50to1.00Memberhous:AbrMember2023-01-012023-12-310001398987us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberhous:SOFRMemberhous:Lessthan2.50to1.00butgreaterthanorequalto2.00to1.00Member2023-01-012023-12-310001398987us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberhous:AbrMemberhous:Lessthan2.50to1.00butgreaterthanorequalto2.00to1.00Member2023-01-012023-12-310001398987us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberhous:SOFRMemberhous:Lessthan2.00to1.00Member2023-01-012023-12-310001398987us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberhous:AbrMemberhous:Lessthan2.00to1.00Member2023-01-012023-12-310001398987srt:MaximumMemberhous:RequiredCovenantRatioMember2023-12-310001398987us-gaap:SecuredDebtMemberhous:TermLoanAFacilityMember2021-01-270001398987hous:June2021ToMarch2022Memberus-gaap:SecuredDebtMemberhous:TermLoanAFacilityMember2023-12-310001398987hous:June2022ToMarch2023Memberus-gaap:SecuredDebtMemberhous:TermLoanAFacilityMember2023-12-310001398987hous:June2023ToMarch2024Memberus-gaap:SecuredDebtMemberhous:TermLoanAFacilityMember2023-12-310001398987hous:June2024AndThereafterMemberus-gaap:SecuredDebtMemberhous:TermLoanAFacilityMember2023-12-310001398987hous:Greaterthan3.50to1.00Memberhous:SOFRMemberus-gaap:SecuredDebtMemberhous:TermLoanAFacilityMember2023-01-012023-12-310001398987hous:Greaterthan3.50to1.00Memberhous:AbrMemberus-gaap:SecuredDebtMemberhous:TermLoanAFacilityMember2023-01-012023-12-310001398987hous:Lessthanorequalto3.50to1.00butgreaterthanorequalto2.50to1.00Memberhous:SOFRMemberus-gaap:SecuredDebtMemberhous:TermLoanAFacilityMember2023-01-012023-12-310001398987hous:Lessthanorequalto3.50to1.00butgreaterthanorequalto2.50to1.00Memberhous:AbrMemberus-gaap:SecuredDebtMemberhous:TermLoanAFacilityMember2023-01-012023-12-310001398987hous:SOFRMemberus-gaap:SecuredDebtMemberhous:TermLoanAFacilityMemberhous:Lessthan2.50to1.00butgreaterthanorequalto2.00to1.00Member2023-01-012023-12-310001398987hous:AbrMemberus-gaap:SecuredDebtMemberhous:TermLoanAFacilityMemberhous:Lessthan2.50to1.00butgreaterthanorequalto2.00to1.00Member2023-01-012023-12-310001398987hous:SOFRMemberus-gaap:SecuredDebtMemberhous:Lessthan2.00to1.00Memberhous:TermLoanAFacilityMember2023-01-012023-12-310001398987hous:AbrMemberus-gaap:SecuredDebtMemberhous:Lessthan2.00to1.00Memberhous:TermLoanAFacilityMember2023-01-012023-12-310001398987us-gaap:SecuredDebtMemberhous:A700SeniorSecuredSecondLienNotesMember2023-08-240001398987hous:A575SeniorNotesMemberus-gaap:SeniorNotesMember2023-08-240001398987hous:A525SeniorNotesMemberus-gaap:SeniorNotesMember2023-08-240001398987hous:A700SeniorSecuredSecondLienNotesMemberus-gaap:SecuredDebtMemberhous:SignificantNoteholderExchangeMember2023-08-240001398987hous:A575SeniorNotesAnd525SeniorNotesMemberus-gaap:SeniorNotesMemberhous:SignificantNoteholderExchangeMember2023-08-240001398987hous:A575SeniorNotesMemberus-gaap:SeniorNotesMemberhous:SignificantNoteholderExchangeMember2023-08-240001398987hous:A525SeniorNotesMemberus-gaap:SeniorNotesMemberhous:SignificantNoteholderExchangeMember2023-08-240001398987hous:ExchangeOffersMemberhous:A700SeniorSecuredSecondLienNotesMemberus-gaap:SecuredDebtMember2023-08-240001398987hous:A575SeniorNotesMemberhous:ExchangeOffersMemberus-gaap:SeniorNotesMember2023-08-240001398987hous:A525SeniorNotesMemberhous:ExchangeOffersMemberus-gaap:SeniorNotesMember2023-08-240001398987hous:A575SeniorNotesMemberus-gaap:SeniorNotesMember2023-01-012023-12-310001398987hous:A525SeniorNotesMemberus-gaap:SeniorNotesMember2023-01-012023-12-310001398987hous:A575SeniorNotesAnd525SeniorNotesMemberus-gaap:SeniorNotesMember2023-01-012023-12-310001398987us-gaap:ConvertibleDebtMemberhous:A025ExchangeableSeniorNotesMember2021-06-020001398987us-gaap:ConvertibleDebtMemberhous:A025ExchangeableSeniorNotesMember2021-06-022021-06-020001398987us-gaap:ConvertibleDebtMembersrt:MaximumMemberhous:A025ExchangeableSeniorNotesMember2021-06-022021-06-02utr:D00013989872021-06-020001398987us-gaap:ConvertibleDebtMemberhous:A025ExchangeableSeniorNotesMember2021-06-022021-12-3100013989872021-06-022021-06-020001398987hous:AppleRidgeFundingLlcMemberhous:SecuritizationobligationMember2023-07-170001398987hous:AppleRidgeFundingLlcMemberhous:SecuritizationobligationMember2023-10-160001398987hous:SecuritizationobligationMember2023-12-310001398987hous:SecuritizationobligationMember2022-12-310001398987hous:SecuritizationobligationMember2023-01-012023-12-310001398987hous:SecuritizationobligationMember2022-01-012022-12-310001398987hous:A575SeniorNotesAnd525SeniorNotesMember2023-08-012023-08-240001398987hous:A575SeniorNotesAnd525SeniorNotesMember2023-08-252023-09-0100013989872022-04-012022-06-300001398987us-gaap:SeniorNotesMemberhous:A7625SeniorSecuredSecondLienNotesMember2023-12-310001398987hous:A9375SeniorNotesMemberus-gaap:SeniorNotesMember2023-12-310001398987hous:TermLoanBFacilityMemberus-gaap:SecuredDebtMember2021-04-280001398987hous:OwnedBrokerageGroupMember2021-01-012021-12-310001398987hous:FranchiseGroupMemberhous:Century21Member2023-12-310001398987hous:FranchiseGroupMemberhous:Century21Member2022-12-310001398987hous:FranchiseGroupMemberhous:Century21Member2021-12-310001398987hous:EraMemberhous:FranchiseGroupMember2023-12-310001398987hous:EraMemberhous:FranchiseGroupMember2022-12-310001398987hous:EraMemberhous:FranchiseGroupMember2021-12-310001398987hous:FranchiseGroupMemberhous:ColdwellBankerMember2023-12-310001398987hous:FranchiseGroupMemberhous:ColdwellBankerMember2022-12-310001398987hous:FranchiseGroupMemberhous:ColdwellBankerMember2021-12-310001398987hous:ColdwellBankerCommercialMemberhous:FranchiseGroupMember2023-12-310001398987hous:ColdwellBankerCommercialMemberhous:FranchiseGroupMember2022-12-310001398987hous:ColdwellBankerCommercialMemberhous:FranchiseGroupMember2021-12-310001398987hous:SothebysInternationalRealtyMemberhous:FranchiseGroupMember2023-12-310001398987hous:SothebysInternationalRealtyMemberhous:FranchiseGroupMember2022-12-310001398987hous:SothebysInternationalRealtyMemberhous:FranchiseGroupMember2021-12-310001398987hous:FranchiseGroupMemberhous:BetterHomesAndGardensRealEstateMember2023-12-310001398987hous:FranchiseGroupMemberhous:BetterHomesAndGardensRealEstateMember2022-12-310001398987hous:FranchiseGroupMemberhous:BetterHomesAndGardensRealEstateMember2021-12-310001398987hous:CorcoranOtherMemberhous:FranchiseGroupMember2023-12-310001398987hous:CorcoranOtherMemberhous:FranchiseGroupMember2022-12-310001398987hous:CorcoranOtherMemberhous:FranchiseGroupMember2021-12-310001398987hous:OwnedBrokerageGroupMemberhous:ColdwellBankerMember2023-12-310001398987hous:OwnedBrokerageGroupMemberhous:ColdwellBankerMember2022-12-310001398987hous:OwnedBrokerageGroupMemberhous:ColdwellBankerMember2021-12-310001398987hous:SothebysInternationalRealtyMemberhous:OwnedBrokerageGroupMember2023-12-310001398987hous:SothebysInternationalRealtyMemberhous:OwnedBrokerageGroupMember2022-12-310001398987hous:SothebysInternationalRealtyMemberhous:OwnedBrokerageGroupMember2021-12-310001398987hous:CorcoranOtherMemberhous:OwnedBrokerageGroupMember2023-12-310001398987hous:CorcoranOtherMemberhous:OwnedBrokerageGroupMember2022-12-310001398987hous:CorcoranOtherMemberhous:OwnedBrokerageGroupMember2021-12-310001398987hous:FranchiseGroupMember2020-12-310001398987hous:FranchiseGroupMember2021-01-012021-12-310001398987hous:OwnedBrokerageGroupMember2020-12-310001398987hous:FranchiseeConversionNotesandDevelopmentAdvanceNotesMember2023-12-310001398987hous:FranchiseeConversionNotesandDevelopmentAdvanceNotesMember2022-12-310001398987hous:FranchiseeConversionNotesandDevelopmentAdvanceNotesMember2023-01-012023-12-310001398987hous:FranchiseeConversionNotesandDevelopmentAdvanceNotesMember2022-01-012022-12-310001398987hous:FranchiseeConversionNotesandDevelopmentAdvanceNotesMember2021-01-012021-12-310001398987us-gaap:PensionPlansDefinedBenefitMember2023-01-012023-12-310001398987us-gaap:PensionPlansDefinedBenefitMember2022-01-012022-12-310001398987us-gaap:PensionPlansDefinedBenefitMember2023-12-310001398987us-gaap:PensionPlansDefinedBenefitMember2022-12-310001398987us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel1Member2023-12-310001398987us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel2Member2023-12-310001398987us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel3Member2023-12-310001398987us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel12And3Member2023-12-310001398987us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:EquitySecuritiesMember2023-12-310001398987us-gaap:PensionPlansDefinedBenefitMemberus-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel2Member2023-12-310001398987us-gaap:PensionPlansDefinedBenefitMemberus-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel3Member2023-12-310001398987us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel12And3Memberus-gaap:EquitySecuritiesMember2023-12-310001398987us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FixedIncomeSecuritiesMember2023-12-310001398987us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel2Member2023-12-310001398987us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel3Member2023-12-310001398987us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel12And3Memberus-gaap:FixedIncomeSecuritiesMember2023-12-310001398987us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2023-12-310001398987us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2023-12-310001398987us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2023-12-310001398987us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel12And3Member2023-12-310001398987us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2023-12-310001398987us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel1Member2022-12-310001398987us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel2Member2022-12-310001398987us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel3Member2022-12-310001398987us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel12And3Member2022-12-310001398987us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:EquitySecuritiesMember2022-12-310001398987us-gaap:PensionPlansDefinedBenefitMemberus-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel2Member2022-12-310001398987us-gaap:PensionPlansDefinedBenefitMemberus-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel3Member2022-12-310001398987us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel12And3Memberus-gaap:EquitySecuritiesMember2022-12-310001398987us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FixedIncomeSecuritiesMember2022-12-310001398987us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel2Member2022-12-310001398987us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel3Member2022-12-310001398987us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel12And3Memberus-gaap:FixedIncomeSecuritiesMember2022-12-310001398987us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2022-12-310001398987us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2022-12-310001398987us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2022-12-310001398987us-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2023-12-310001398987us-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2022-12-310001398987us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-01-012023-12-310001398987us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-01-012022-12-310001398987us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-01-012021-12-310001398987srt:MaximumMember2023-12-310001398987us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001398987us-gaap:RestrictedStockUnitsRSUMember2023-12-310001398987us-gaap:PerformanceSharesMember2023-01-012023-12-310001398987us-gaap:PerformanceSharesMemberhous:RTSRMembersrt:MinimumMember2023-01-012023-12-310001398987us-gaap:PerformanceSharesMembersrt:MaximumMemberhous:RTSRMember2023-01-012023-12-310001398987us-gaap:PerformanceSharesMemberhous:CumulativeFreeCashFlowMembersrt:MinimumMember2023-01-012023-12-310001398987us-gaap:PerformanceSharesMembersrt:MaximumMemberhous:CumulativeFreeCashFlowMember2023-01-012023-12-310001398987us-gaap:PerformanceSharesMember2023-12-310001398987us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001398987us-gaap:EmployeeStockOptionMember2023-12-310001398987hous:PersonnelRelatedMember2023-01-012023-12-310001398987hous:PersonnelRelatedMember2022-01-012022-12-310001398987hous:PersonnelRelatedMember2021-01-012021-12-310001398987hous:FacilityRelatedMember2023-01-012023-12-310001398987hous:FacilityRelatedMember2022-01-012022-12-310001398987hous:FacilityRelatedMember2021-01-012021-12-310001398987hous:OperationalEfficienciesProgramMember2023-01-012023-12-310001398987hous:PriorRestructuringProgramsMember2023-01-012023-12-310001398987hous:OperationalEfficienciesProgramMember2022-01-012022-12-310001398987hous:PriorRestructuringProgramsMember2022-01-012022-12-310001398987hous:OperationalEfficienciesProgramMemberhous:PersonnelRelatedMember2022-12-310001398987hous:OperationalEfficienciesProgramMemberhous:FacilityRelatedMember2022-12-310001398987hous:OperationalEfficienciesProgramMember2022-12-310001398987hous:OperationalEfficienciesProgramMemberhous:PersonnelRelatedMember2023-01-012023-12-310001398987hous:OperationalEfficienciesProgramMemberhous:FacilityRelatedMember2023-01-012023-12-310001398987hous:OperationalEfficienciesProgramMemberhous:PersonnelRelatedMember2023-12-310001398987hous:OperationalEfficienciesProgramMemberhous:FacilityRelatedMember2023-12-310001398987hous:OperationalEfficienciesProgramMember2023-12-310001398987hous:OperationalEfficienciesProgramMemberhous:FranchiseGroupMember2023-12-310001398987hous:OperationalEfficienciesProgramMemberhous:OwnedBrokerageGroupMember2023-12-310001398987hous:OperationalEfficienciesProgramMemberhous:TitleGroupMember2023-12-310001398987hous:OperationalEfficienciesProgramMemberus-gaap:CorporateNonSegmentMember2023-12-310001398987hous:PriorRestructuringProgramsMember2022-12-310001398987hous:PriorRestructuringProgramsMember2023-12-310001398987hous:BurnettAndMoehrlMemberus-gaap:PendingLitigationMember2023-10-012023-12-310001398987hous:BurnettAndMoehrlMemberus-gaap:PendingLitigationMemberus-gaap:SubsequentEventMember2024-01-012024-12-310001398987us-gaap:PendingLitigationMemberhous:NosalekMember2023-01-012023-12-310001398987srt:MinimumMemberhous:SothebysInternationalRealtyMember2023-01-012023-12-310001398987hous:MeredithCorporationMembersrt:MinimumMember2023-01-012023-12-310001398987hous:OwnedBrokerageGroupMemberhous:ErrorsAndOmissionsInsuranceMember2023-12-310001398987hous:AnywhereMembersrt:MaximumMemberhous:ErrorsAndOmissionsInsuranceMember2023-12-310001398987hous:AnywhereMemberhous:ErrorsAndOmissionsInsuranceMember2023-12-310001398987srt:MaximumMemberhous:OwnedBrokerageGroupMemberhous:ErrorsAndOmissionsInsuranceIncludingAdditionalRealogyGroupCoverageMember2023-12-310001398987hous:OwnedBrokerageGroupMemberhous:ErrorsAndOmissionsInsuranceIncludingAdditionalRealogyGroupCoverageMember2023-12-310001398987hous:FidelityInsuranceMembersrt:MaximumMember2023-12-310001398987hous:FidelityInsuranceMember2023-12-310001398987us-gaap:AccumulatedTranslationAdjustmentMember2020-12-310001398987us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-12-310001398987us-gaap:AccumulatedTranslationAdjustmentMember2021-01-012021-12-310001398987us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-01-012021-12-310001398987us-gaap:AccumulatedTranslationAdjustmentMember2021-12-310001398987us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-12-310001398987us-gaap:AccumulatedTranslationAdjustmentMember2022-01-012022-12-310001398987us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-01-012022-12-310001398987us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310001398987us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-12-310001398987us-gaap:AccumulatedTranslationAdjustmentMember2023-01-012023-12-310001398987us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-012023-12-310001398987us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310001398987us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-310001398987us-gaap:CommonStockMemberhous:AnywhereGroupMember2020-12-310001398987us-gaap:AdditionalPaidInCapitalMemberhous:AnywhereGroupMember2020-12-310001398987us-gaap:CommonStockMemberhous:AnywhereGroupMember2021-12-310001398987us-gaap:AdditionalPaidInCapitalMemberhous:AnywhereGroupMember2021-12-310001398987us-gaap:CommonStockMemberhous:AnywhereGroupMember2022-12-310001398987us-gaap:AdditionalPaidInCapitalMemberhous:AnywhereGroupMember2022-12-310001398987us-gaap:CommonStockMemberhous:AnywhereGroupMember2023-12-310001398987us-gaap:AdditionalPaidInCapitalMemberhous:AnywhereGroupMember2023-12-3100013989872022-02-160001398987hous:OwnedBrokerageGroupMemberhous:GeographicConcentrationRiskCaliforniaMember2023-01-012023-12-310001398987hous:OwnedBrokerageGroupMemberhous:GeographicConcentrationRiskNewYorkMember2023-01-012023-12-310001398987hous:GeographicConcentrationRiskFloridaMemberhous:OwnedBrokerageGroupMember2023-01-012023-12-310001398987hous:OwnedBrokerageGroupMemberhous:GeographicConcentrationRiskCaliforniaMember2022-01-012022-12-310001398987hous:OwnedBrokerageGroupMemberhous:GeographicConcentrationRiskNewYorkMember2022-01-012022-12-310001398987hous:GeographicConcentrationRiskFloridaMemberhous:OwnedBrokerageGroupMember2022-01-012022-12-310001398987hous:OwnedBrokerageGroupMemberhous:GeographicConcentrationRiskCaliforniaMember2021-01-012021-12-310001398987hous:OwnedBrokerageGroupMemberhous:GeographicConcentrationRiskNewYorkMember2021-01-012021-12-310001398987hous:GeographicConcentrationRiskFloridaMemberhous:OwnedBrokerageGroupMember2021-01-012021-12-310001398987us-gaap:NondesignatedMemberus-gaap:InterestRateSwapMember2022-01-012022-12-310001398987us-gaap:NondesignatedMemberus-gaap:InterestRateSwapMember2021-01-012021-12-310001398987us-gaap:FairValueInputsLevel1Memberhous:DeferredCompensationPlanAssetsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001398987hous:DeferredCompensationPlanAssetsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001398987hous:DeferredCompensationPlanAssetsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001398987hous:DeferredCompensationPlanAssetsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001398987us-gaap:FairValueInputsLevel1Memberhous:ContingentConsiderationforAcquisitionsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001398987hous:ContingentConsiderationforAcquisitionsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001398987hous:ContingentConsiderationforAcquisitionsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001398987hous:ContingentConsiderationforAcquisitionsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001398987us-gaap:FairValueInputsLevel1Memberhous:DeferredCompensationPlanAssetsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001398987hous:DeferredCompensationPlanAssetsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001398987hous:DeferredCompensationPlanAssetsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001398987hous:DeferredCompensationPlanAssetsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001398987us-gaap:FairValueInputsLevel1Memberhous:ContingentConsiderationforAcquisitionsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001398987hous:ContingentConsiderationforAcquisitionsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001398987hous:ContingentConsiderationforAcquisitionsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001398987hous:ContingentConsiderationforAcquisitionsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001398987hous:FranchiseGroupMemberus-gaap:OperatingSegmentsMember2023-12-310001398987hous:FranchiseGroupMemberus-gaap:OperatingSegmentsMember2022-12-310001398987hous:OwnedBrokerageGroupMemberus-gaap:OperatingSegmentsMember2023-12-310001398987hous:OwnedBrokerageGroupMemberus-gaap:OperatingSegmentsMember2022-12-310001398987hous:TitleGroupMemberus-gaap:OperatingSegmentsMember2023-12-310001398987hous:TitleGroupMemberus-gaap:OperatingSegmentsMember2022-12-310001398987us-gaap:CorporateNonSegmentMember2023-12-310001398987us-gaap:CorporateNonSegmentMember2022-12-310001398987country:US2023-01-012023-12-310001398987us-gaap:NonUsMember2023-01-012023-12-310001398987country:US2023-12-310001398987us-gaap:NonUsMember2023-12-310001398987country:US2022-01-012022-12-310001398987us-gaap:NonUsMember2022-01-012022-12-310001398987country:US2022-12-310001398987us-gaap:NonUsMember2022-12-310001398987country:US2021-01-012021-12-310001398987us-gaap:NonUsMember2021-01-012021-12-310001398987country:US2021-12-310001398987us-gaap:NonUsMember2021-12-31

_____________________________________________________________________________________________________________________________________________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________________

FORM 10-K

☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

| | | | | |

Commission File No. 001-35674 | Commission File No. 333-148153 |

| Anywhere Real Estate Inc. | Anywhere Real Estate Group LLC |

| (Exact name of registrant as specified in its charter) | (Exact name of registrant as specified in its charter) |

| 20-8050955 | 20-4381990 |

| (I.R.S. Employer Identification Number) | (I.R.S. Employer Identification Number) |

___________________________________________________________________________________________________ | | | | | |

| Delaware | 175 Park Avenue |

| (State or other jurisdiction of incorporation or organization) | Madison, New Jersey 07940 |

(973) 407-2000 | (Address of principal executive offices, including zip code) |

| (Registrants' telephone number, including area code) | |

| | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Anywhere Real Estate Inc. | Common Stock, par value $0.01 per share | HOUS | New York Stock Exchange |

| Anywhere Real Estate Group LLC | None | None | None |

Securities registered pursuant to Section 12(g) of the Act: None

___________________________

Indicate by check mark if the Registrants are a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Anywhere Real Estate Inc. Yes þ No ¨ Anywhere Real Estate Group LLC Yes ¨ No þ

Indicate by check mark if the Registrants are not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Anywhere Real Estate Inc. Yes ¨ No þ Anywhere Real Estate Group LLC Yes þ No ¨

Indicate by check mark whether the Registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. Anywhere Real Estate Inc. Yes þ No ¨ Anywhere Real Estate Group LLC Yes ¨ No þ

Indicate by check mark whether the Registrants have submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrants were required to submit such files).

Anywhere Real Estate Inc. Yes þ No ¨ Anywhere Real Estate Group LLC Yes þ No ¨

Indicate by check mark whether the Registrants are large accelerated filers, accelerated filers, non-accelerated filers, smaller reporting companies, or emerging growth companies. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | Accelerated filer | | Non-accelerated filer | | Smaller reporting company | | Emerging growth company |

| | | | |

| Anywhere Real Estate Inc. | þ | | ¨ | | ¨ | | ☐ | | ☐ |

| Anywhere Real Estate Group LLC | ¨ | | ¨ | | þ | | ☐ | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. þ

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b) ☐

Indicate by check mark whether the Registrants are a shell company (as defined in Rule 12b-2 of the Exchange Act).

Anywhere Real Estate Inc. Yes ☐ No þ Anywhere Real Estate Group LLC Yes ☐ No þ

The aggregate market value of the voting and non-voting common equity of Anywhere Real Estate Inc. held by non-affiliates as of the close of business on June 30, 2023 was $722 million. There were 110,488,581 shares of Common Stock, $0.01 par value, of Anywhere Real Estate Inc. outstanding as of February 15, 2024.

Anywhere Real Estate Group LLC meets the conditions set forth in General Instruction I(1)(a) and (b) of Form 10-K and is therefore filing this Form with the reduced disclosure format applicable to Anywhere Real Estate Group LLC.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement prepared for the Annual Meeting of Stockholders to be held May 2, 2024 are incorporated by reference into Part III of this report.

_____________________________________________________________________________________________________________________________________________________________________________________

| | | | | | | | |

| PART I | |

| | |

| Item 1. | | |

| Item 1A. | | |

Item 1C. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| | |

| PART II | |

| | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| | |

| PART III | |

| | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | |

| PART IV | |

| | |

| Item 15. | | |

| Item 16. | | |

| | |

| |

| |

| |

| |

FORWARD-LOOKING STATEMENTS

Forward-looking statements included in this Annual Report on Form 10-K (this "Annual Report") and our other public filings or other public statements that we make from time to time are based on various facts and derived utilizing numerous important assumptions and are subject to known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements include the information concerning our future financial performance, business strategy, projected plans and objectives, as well as projections of macroeconomic and industry trends, which are inherently unreliable due to the multiple factors that impact economic trends, and any such variations may be material. Statements preceded by, followed by or that otherwise include the words "believes," "expects," "anticipates," "intends," "projects," "estimates," "plans," and similar expressions or future or conditional verbs such as "will," "should," "would," "may" and "could" are generally forward-looking in nature and not historical facts. You should understand that important factors could affect our future results and may cause actual results to differ materially from those expressed in the forward-looking statements, including those listed directly below under "Summary of Risk Factors" and as described in more detail under "Item 1A.—Risk Factors" and those described in "Item 7.—Management’s Discussion and Analysis of Financial Condition and Results of Operations" of this Annual Report. Most of these factors are difficult to anticipate and are generally beyond our control. You should consider these factors in connection with any forward-looking statements that may be made by us and our businesses generally.

All forward-looking statements herein speak only as of the date of this report and are expressly qualified in their entirety by the cautionary statements included in or incorporated by reference into this report. Except as is required by law, we expressly disclaim any obligation to publicly release any revisions to forward-looking statements to reflect events after the date of this report. For any forward-looking statement contained in this Annual Report, our public filings or other public statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

SUMMARY OF RISK FACTORS

The following summary of risk factors is not exhaustive. We are subject to other risks discussed under "Item 1A.—Risk Factors," and under "Item 7.—Management's Discussion and Analysis of Financial Condition and Results of Operations," as well as risks that may be discussed in other reports filed with the SEC. As noted under "Forward-Looking Statements" above, these factors could affect our future results and cause actual results to differ materially from those expressed in our forward-looking statements. Investors and other readers are urged to consider all of these risks, uncertainties and other factors carefully in evaluating our business.

•The residential real estate market is cyclical, and we are negatively impacted by adverse developments or the absence of sustained improvement in the U.S. residential real estate markets, either regionally or nationally, which could include, but are not limited to factors that impact homesale transaction volume (homesale sides times average homesale price), such as:

◦prolonged periods of a high mortgage rate environment;

◦high rates of inflation;

◦continued or accelerated reductions in housing affordability, including but not limited to rising or high mortgage rates, the impact of increasing home prices, and the failure of wages to keep pace with inflation;

◦continued or accelerated declines in consumer demand;

◦continued or accelerated declines in inventory or excessive inventory;

◦homeowners retaining their homes for longer periods of time, including as a result of the high mortgage rate environment, resulting in inventory shortages in new and existing housing;

◦continued or accelerated declines, or the absence of significant increases, in the number of home sales; and

◦stagnant or declining home prices;

•We are negatively impacted by adverse developments or the absence of sustained improvement in macroeconomic conditions (such as business, economic or political conditions) on a global, domestic or local basis, which could include, but are not limited to:

◦contraction, stagnation or uncertainty in the U.S. economy;

◦economic instability, including as related to foreign conflicts;

◦continued or accelerated increases in inflation;

◦the potential or actual shutdown of the U.S. government due to a failure to enact debt ceiling legislation; and

◦monetary policies of the federal government and its agencies, particularly those that may result in unfavorable changes to the interest rate environment;

•A failure to obtain final court approval of the seller antitrust litigation settlement as well as other adverse developments or outcomes in current or future litigation, in particular pending class action antitrust litigation and litigation related to the Telephone Consumer Protection Act ("TCPA"), that may materially harm our business, results of operations and financial condition;

•We are subject to risks related to industry structure changes that disrupt the functioning of the residential real estate market, including as a result of litigation, legislative or regulatory developments, such as a change in the manner in which broker commissions are communicated, negotiated or paid, including potentially significant restrictions or bans on offers of compensation by the seller or listing agent to the buy-side agent;

•Risks related to the impact of evolving competitive and consumer dynamics, whether driven by competitive or regulatory factors or other changes to industry rules, which could include, but are not limited to:

◦meaningful decreases in the average broker commission rate (including the average buy-side commission rate);

◦continued erosion of our share of the commission income generated by homesale transactions;

◦our ability to compete against traditional and non-traditional competitors;

◦our ability to adapt our business to changing consumer preferences; and

◦further disruption in the residential real estate brokerage industry related to listing aggregator market power and concentration, including with respect to ancillary services;

•Our business and financial results may be materially and adversely impacted if we are unable to execute our business strategy, including if we are not successful in our efforts to:

◦recruit and retain productive independent sales agents and teams, and other agent-facing talent;

◦attract and retain franchisees or renew existing franchise agreements without reducing contractual royalty rates or increasing the amount and prevalence of sales incentives;

◦develop or procure products, services and technology that support our strategic initiatives;

◦successfully adopt and integrate artificial intelligence (AI) and other machine learning technology into our products and services;

◦achieve or maintain cost savings and other benefits from our cost-saving initiatives;

◦generate a meaningful number of high-quality leads for independent sales agents and franchisees; and

◦complete, integrate or realize the expected benefits of acquisitions and joint ventures;

•Our substantial indebtedness, alone or in combination with other factors, particularly heightened during industry downturns or broader recessions, could (i) adversely limit our operations, including our ability to grow our business, (ii) adversely impact our liquidity including, but not limited to, with respect to our interest obligations and the negative covenant restrictions contained in our debt agreements and/or (iii) adversely impact our ability, and any actions we may take, to refinance, restructure or repay our indebtedness or incur additional indebtedness;

•An event of default under our material debt agreements would adversely affect our operations and our ability to satisfy obligations under our indebtedness;

•Our financial condition and/or results of operations may be adversely impacted by risks related to our business structure, including, but not limited to:

◦the operating results of affiliated franchisees and their ability to pay franchise and related fees;

◦continued consolidation among our top 250 franchisees;

◦challenges relating to the owners of the two brands we do not own;

◦the geographic and high-end market concentration of our company owned brokerages;

◦the loss of our largest real estate benefit program client or multiple significant relocation clients;

◦the failure of third-party vendors or partners to perform as expected or our failure to adequately monitor them;

◦our reliance on information technology to operate our business and maintain our competitiveness; and

◦the negligence or intentional actions of affiliated franchisees and their independent sales agents or independent sales agents engaged by our company owned brokerages, which are traditionally outside of our control, and any resulting direct claims against us based on theories of vicarious liability, negligence, joint operations or joint employer liability;

•We are subject to risks related to legal and regulatory matters, which may cause us to incur increased costs and/or result in adverse financial, operational or reputational consequences to us, including but not limited to, our failure or alleged failure to comply with laws, regulations and regulatory interpretations and any changes or stricter interpretations of any of the foregoing, including but not limited to: (1) antitrust laws and regulations, (2) the Real Estate Settlement Procedures Act ("RESPA") or other federal or state consumer protection or similar laws, (3) state or federal employment laws or regulations that would require reclassification of independent contractor sales agents to employee status, (4) the TCPA and any related laws limiting solicitation of business, and (5) privacy or cybersecurity laws and regulations;

•We face reputational, business continuity and legal and financial risks associated with cybersecurity incidents;

•Our goodwill and other long-lived assets are subject to further impairment which could negatively impact our earnings;

•We could be subject to significant losses if banks do not honor our escrow and trust deposits;

•Changes in accounting standards and management assumptions and estimates could have a negative impact on us;

•We face risks related to potential attrition among our senior executives or other key employees and related to our ability to develop our existing workforce and to recruit talent in order to advance our business strategies;

•We face risks related to our Exchangeable Senior Notes and exchangeable note hedge and warrant transactions;

•We face risks related to severe weather events or natural disasters, which may be exacerbated by climate change and may cause increased homeowners insurance costs, and other catastrophic events, including public health crises;

•Increasing scrutiny and changing expectations related to corporate sustainability practices may impose additional costs on us or expose us to reputational or other risks;

•Market forecasts and estimates, including our internal estimates, may prove to be inaccurate; and

•We face risks related to our common stock, including that price of our common stock may fluctuate significantly.

TRADEMARKS AND SERVICE MARKS

We own or have rights to use the trademarks, service marks and trade names that we use in conjunction with the operation of our business. Some of the more important trademarks that we own or have rights to use that appear in this Annual Report include the CENTURY 21®, COLDWELL BANKER®, ERA®, CORCORAN®, COLDWELL BANKER COMMERCIAL®, SOTHEBY’S INTERNATIONAL REALTY®, BETTER HOMES AND GARDENS® Real Estate, and CARTUS® marks, which are registered in the United States and/or registered or pending registration in other jurisdictions, as appropriate to the needs of our relevant business. Each trademark, trade name or service mark of any other company appearing in this Annual Report is owned by such company.

PART I

Except as otherwise indicated or unless the context otherwise requires, the terms "we," "us," "our," "our company," "Anywhere" and the "Company" refer to Anywhere Real Estate Inc., a Delaware corporation, and its consolidated subsidiaries, including Anywhere Intermediate Holdings LLC, a Delaware limited liability company ("Anywhere Intermediate"), and Anywhere Real Estate Group LLC, a Delaware limited liability company ("Anywhere Group"). Neither Anywhere, the indirect parent of Anywhere Group, nor Anywhere Intermediate, the direct parent company of Anywhere Group, conducts any operations other than with respect to its respective direct or indirect ownership of Anywhere Group. As a result, the consolidated financial positions, results of operations and cash flows of Anywhere, Anywhere Intermediate and Anywhere Group are the same.

As used in this Annual Report:

•"Senior Secured Credit Agreement" refers to the Amended and Restated Credit Agreement dated as of March 5, 2013, as amended, amended and restated, modified or supplemented from time to time, that governs the senior secured credit facility, or "Senior Secured Credit Facility", which includes the "Revolving Credit Facility" and the "Term Loan B Facility" (paid in full in September 2021);

•"Term Loan A Agreement" refers to the Term Loan A Agreement dated as of October 23, 2015, as amended, amended and restated, modified or supplemented from time to time, which includes "Extended Term Loan A", also referred to as the "Term Loan A Facility";

•"7.00% Senior Secured Second Lien Notes" refers to our 7.00% Senior Secured Second Lien Notes due 2030 (issued in August 2023);

•"5.75% Senior Notes" and "5.25% Senior Notes" refer to our 5.75% Senior Notes due 2029 and 5.25% Senior Notes due 2030, respectively, and are referred to collectively as the "Unsecured Notes;"

•"4.875% Senior Notes" refers to our 4.875% Senior Notes due 2023 (redeemed in full in November 2022), "9.375% Senior Notes" refers to 9.375% Senior Notes due 2027 (redeemed in full in February 2022) and "7.625% Senior Secured Second Lien Notes" refers to our 7.625% Senior Secured Second Lien Notes due 2025 (redeemed in full in February 2022); and

•"Exchangeable Senior Notes" refers to our 0.25% Exchangeable Senior Notes due 2026.

Item 1. Business.

Our Company

A leader of integrated residential real estate services in the U.S., Anywhere includes franchise, brokerage, relocation, and title and settlement businesses, as well as mortgage and title insurance underwriter joint ventures, supporting approximately 1 million closed homesale sides (either the "buy" or "sell" side of a homesale transaction) in 2023. The diverse Anywhere brand portfolio includes some of the most recognized names in real estate: Better Homes and Gardens® Real Estate, CENTURY 21®, Coldwell Banker®, Coldwell Banker Commercial®, Corcoran®, ERA®, and Sotheby’s International Realty®. Using innovative technology, data and marketing products, high-quality lead generation programs, and best-in-class learning and support services, Anywhere fuels the productivity of its approximately 188,300 independent sales agents in the U.S. and approximately 134,200 independent sales agents in 118 other countries and territories, helping them build stronger businesses and best serve today’s consumers.

Segment Overview

We report our operations in three segments, each of which receives fees based upon services performed for our customers:

•Anywhere Brands ("Franchise Group")—franchises a portfolio of well-known, industry-leading franchise brokerage brands, including Better Homes and Gardens® Real Estate, Century 21®, Coldwell Banker®, Coldwell Banker Commercial®, Corcoran®, ERA® and Sotheby's International Realty®. This segment also includes our global relocation services operation through Cartus® Relocation Services ("Cartus") and lead generation activities through Anywhere Leads Inc. ("Leads Group").

•Anywhere Advisors ("Owned Brokerage Group")—operates a full-service real estate brokerage business under the Coldwell Banker®, Corcoran® and Sotheby's International Realty® brand names in many of the largest metropolitan areas in the U.S. This segment also includes our share of equity earnings or losses from our minority-owned real estate auction joint venture.

•Anywhere Integrated Services ("Title Group")—provides full-service title, escrow and settlement services to consumers, real estate companies, corporations and financial institutions primarily in support of residential real estate transactions. This segment also includes our share of equity earnings or losses from Guaranteed Rate Affinity, our minority-owned mortgage origination joint venture, and from our minority-owned title insurance underwriter joint venture.

* * *

Our headquarters is located at 175 Park Avenue, Madison, New Jersey 07940. Our general telephone number is (973) 407-2000. The Company files electronically with the Securities and Exchange Commission (the "SEC") required reports on Form 8-K, Form 10-Q and Form 10-K; proxy materials; registration statements and other forms or reports as required. Certain of the Company's officers and directors also file ownership reports for insiders as required by Section 16 of the Securities Exchange Act of 1934. Such materials may be accessed electronically on the SEC's Internet site (www.sec.gov). We maintain an Internet website at http://anywhere.re and make available free of charge on or through our website our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, Section 16 reports and any amendments to these reports in the Investors section of our website as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. Our website address is provided as an inactive textual reference. The contents of our website are not incorporated by reference herein or otherwise a part of this Annual Report.

MARKET AND INDUSTRY DATA AND FORECASTS

This Annual Report includes historical data, forecasts and information obtained from independent sources such as the Federal Home Loan Mortgage Corporation ("Freddie Mac"), the U.S. Bureau of Labor Statistics, the U.S. Federal Reserve Board, the National Association of Realtors ("NAR"), the Federal National Mortgage Association ("Fannie Mae"), trade associations, industry publications and surveys, and other information available to us. Some data is also based on our good faith estimates, which are derived from management’s knowledge of the industry and independent sources. While we believe that the industry data presented herein is derived from the most widely recognized sources for reporting U.S. residential housing market statistical data, we caution that such information is subject to change and do not endorse or suggest reliance on this data or information alone. For example, in 2022, NAR significantly revised its previously published average (mean) sales price (“ASP”) data for U.S. existing homes for prior periods, which resulted in discontinuing our usage of NAR ASP data in our SEC filings.

Forecasts regarding rates of home ownership, sales price, volume of homesales, and other metrics included in this Annual Report to describe the housing industry are inherently uncertain or speculative in nature and actual results for any period could materially differ. Industry publications, surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but such information may not be accurate or complete. We have not independently verified any of the data from third-party sources nor have we ascertained the underlying economic assumptions relied upon therein. Statements as to our market position are based on market data currently available to us. While we are not aware of any misstatements regarding industry data provided herein, our estimates involve risks and uncertainties and are subject to change based upon various factors, including those discussed under the headings "Risk Factors" and "Forward-Looking Statements." Similarly, we believe our internal research is reliable, even though such research has not been verified by any independent sources.

Industry Overview

Industry definition. We primarily operate in the U.S. residential real estate industry and derive substantially all of our revenues from serving the needs of buyers and sellers of existing homes rather than new homes manufactured and sold by homebuilders. Residential real estate brokerage companies typically realize revenues in the form of a commission that is based on a percentage of the price of each home sold. As a result, the real estate industry generally benefits from rising home prices and increasing homesale transactions (and conversely is adversely impacted by falling prices and lower homesale transactions). We believe that existing homesale transactions and the services associated with these transactions, such as mortgage origination, title services and relocation services, represent one of the most attractive segments of the residential real estate industry for the following reasons:

•the existing homesales segment represents a significantly larger addressable market than new homesales. Of the approximately 4.8 million homesales in the U.S. in 2023, NAR estimates that approximately 4.1 million were existing homesales, representing approximately 86% of the overall sales as measured in units;

•existing homesales afford us the opportunity to represent either the buyer or the seller and in some cases both the buyer and the seller; and

•we are able to generate revenues from ancillary services provided to our customers.

Our business model relies heavily on affiliated independent sales agents, who play a critical consumer-facing role in the home buying and selling experience for both our company owned and franchise brokerages. While substantially all homebuyers start their search for a home using the Internet, according to NAR, approximately 89% of home buyers and home sellers used an agent or broker in 2023. We believe that agents or brokers will continue to be directly involved in most home purchases and sales, primarily because real estate transactions have certain characteristics that benefit from the service and value offered by an agent or broker, including the following:

•the average homesale transaction value is very high and generally is the largest transaction one does in a lifetime;

•homesale transactions occur infrequently;

•there is a compelling need for personal service as home preferences are unique to each buyer;

•a high level of support is required given the complexity associated with the process, including specific marketing and technology services as well as assistance with the inspection process;

•the consumer preference to visit properties for sale in person, notwithstanding the availability of online images and property tours; and

•there is a high variance in price, depending on neighborhood, floor plan, architecture, fixtures, and outdoor space.

Cyclical nature of industry, long-term demographics and seasonality. The U.S. residential real estate industry exhibits a cyclical nature, characterized by periods of downturns as observed since mid-2022 and from 2006 to 2011, followed by phases of recovery and growth, exemplified from 2012 to 2021. These cycles are typically affected by broader economic shifts and conditions within the residential real estate market, factors largely beyond our control.

We believe that long-term demand for housing and the growth of our industry is impacted by various factors. Chief among these are housing affordability, the overall economic well-being of the U.S., and pivotal demographic trends, including generational transitions, and the rise in U.S. household formations. Elements such as mortgage rates and mortgage availability, tax incentives, job market dynamics, the conversion of renters to homebuyers, and the intrinsic benefits associated with homeownership further contribute to the industry's trajectory.

While the U.S. residential real estate market experienced substantial declines in 2022 and 2023, with continued uncertainty in early 2024, we maintain an optimistic outlook on the growth of the residential real estate market over the mid to long term. Our optimism is rooted in the anticipation of enduring positive fundamentals, such as U.S. population over the last decade, and the expected growth in the number of U.S. households, particularly among the millennial generation, over the coming decade. Additionally, the perpetuation of trends that gained momentum during the COVID-19 crisis, like preferences for specific geographies and the increasing acceptance of hybrid and remote work, may positively influence homesale transactions.

The U.S. residential housing market is also seasonal. Typically, a heightened volume of homesale transactions occurs in the second and third quarters of each year. Consequently, our historical data reveals stronger operating results and revenues during these periods.

Uncertainties Relating to Industry Structure and Brokerage Commissions. The U.S. residential real estate brokerage industry is currently in the midst of significant uncertainty, particularly with respect to the manner in which broker commissions are communicated, negotiated or paid. In connection with pending litigation, and in particular, injunctive relief that may result from such litigation, there may be significant changes in current practices, such as significant restrictions or bans on offers of compensation by the seller or listing agent to the buy-side agent, could result in meaningful decreases in the average broker commission rate, in the average buy-side commission rate or in the share of commission income received by us and our franchisees. In general, we and other industry participants, including industry associations and trade groups, have seen an overall increase in significant litigation and regulatory scrutiny, with a particular focus on antitrust and competition. There is significant uncertainty as to whether there will be meaningful changes in the manner in which commissions are communicated, negotiated or paid including significant restrictions or bans on offers of compensation by the seller or listing agent to the buy-side agent (and if meaningful changes occur, how quickly such changes will develop) due to injunctive relief resulting from any antitrust litigation determination, actions by DOJ or FTC or other federal, state or local governmental body finding that industry practices or developments have an anti-competitive effect on the industry or are otherwise proscribed, changes to MLS and NAR rules and legal regulations that may benefit their competitive position to the disadvantage of historical real estate brokerage models and other changes to competitive dynamics or consumer preferences, including the introduction or growth of certain competitive models. For more information, see "Item 7.—Management's Discussion and Analysis—Recent Developments" and "Item 1A.—Risk Factors—Regulatory and Legal Risks".

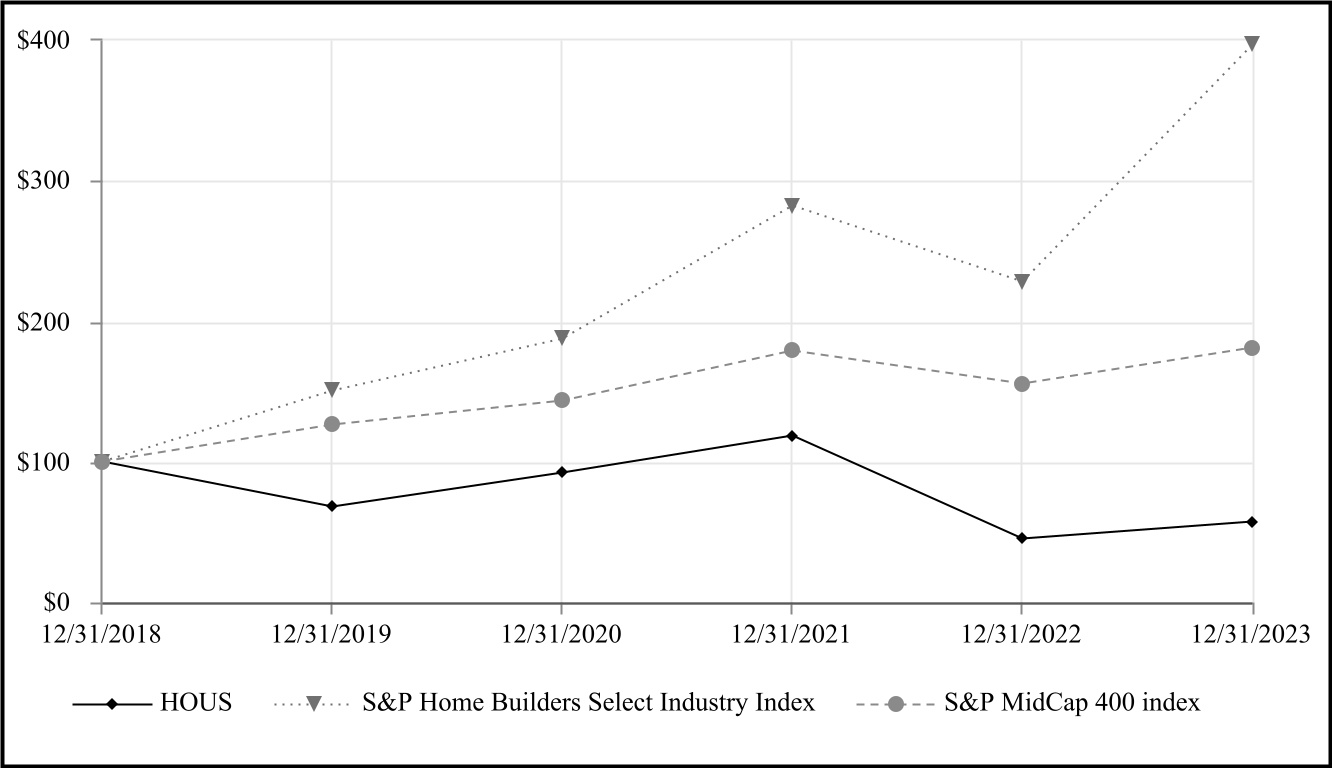

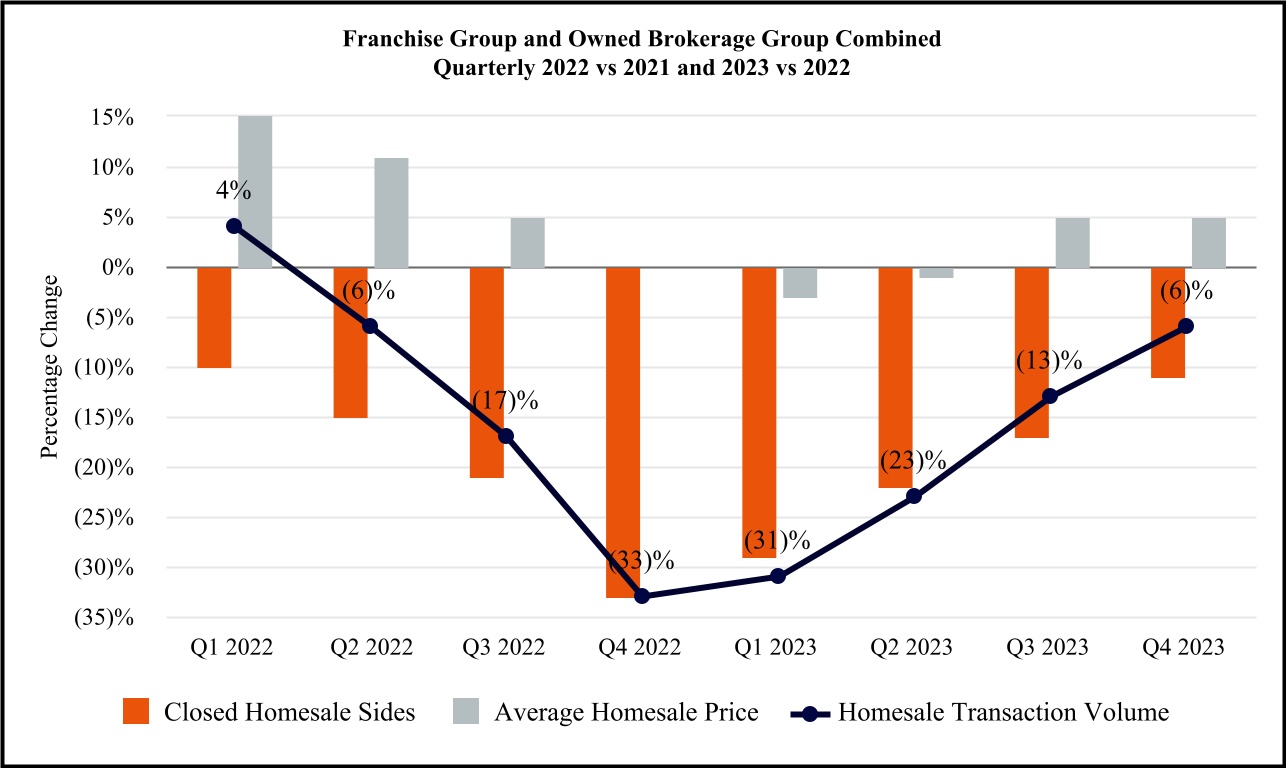

Participation in Multiple Aspects of Residential Real Estate