Exhibit 10.23

LEASE AGREEMENT

Between

ARHC UHPTHMN01 LLC, as Landlord And

SILK ROAD MEDICAL, INC., as Tenant

Property:

Plymouth West Business Center Plymouth, Minnesota

TABLE OF CONTENTS (Continued)

Page

Section 1 – Summary; Premises, Term1

|

1.1 |

|

1.2 |

|

1.4 |

|

1.6 |

|

2.1 |

|

2.2 |

|

2.3 |

|

3.1 |

|

3.2 |

|

3.3 |

|

3.4 |

|

4.1 |

|

4.2 |

|

4.4 |

Section 5 – Repairs and Maintenance; Compliance; Services12

|

5.5 |

|

5.6 |

|

5.8 |

Section 6 – Damage to Premises15

|

6.2 |

|

7.1 |

|

7.3 |

Section 8 – Assignment and Subletting16

-i-

TABLE OF CONTENTS (Continued)

Page

Section 10 – Defaults and Remedies18

|

10.2 |

Section 11 – Covenant of Quiet Enjoyment21

|

12.2 |

|

12.3 |

Section 13 – Indemnification22

|

13.4 |

Section 15 – Hazardous Materials23

|

15.1 |

|

15.2 |

|

15.3 |

Section 18 – Broker’s Representation24

Section 19 – Rights Reserved to Landlord24

|

20.1 |

|

20.2 |

|

20.3 |

|

20.4 |

|

20.5 |

|

20.6 |

|

20.9 |

|

20.10 |

|

20.11 |

-i-

TABLE OF CONTENTS (Continued)

Page

|

20.12 |

|

20.13 |

|

20.14 |

|

20.15 |

|

20.16 |

|

20.17 |

|

20.18 |

|

20.19 |

|

20.20 |

|

20.22 |

|

20.23 |

|

20.24 |

|

20.25 |

|

20.26 |

|

20.27 |

|

EXHIBITS |

|

|

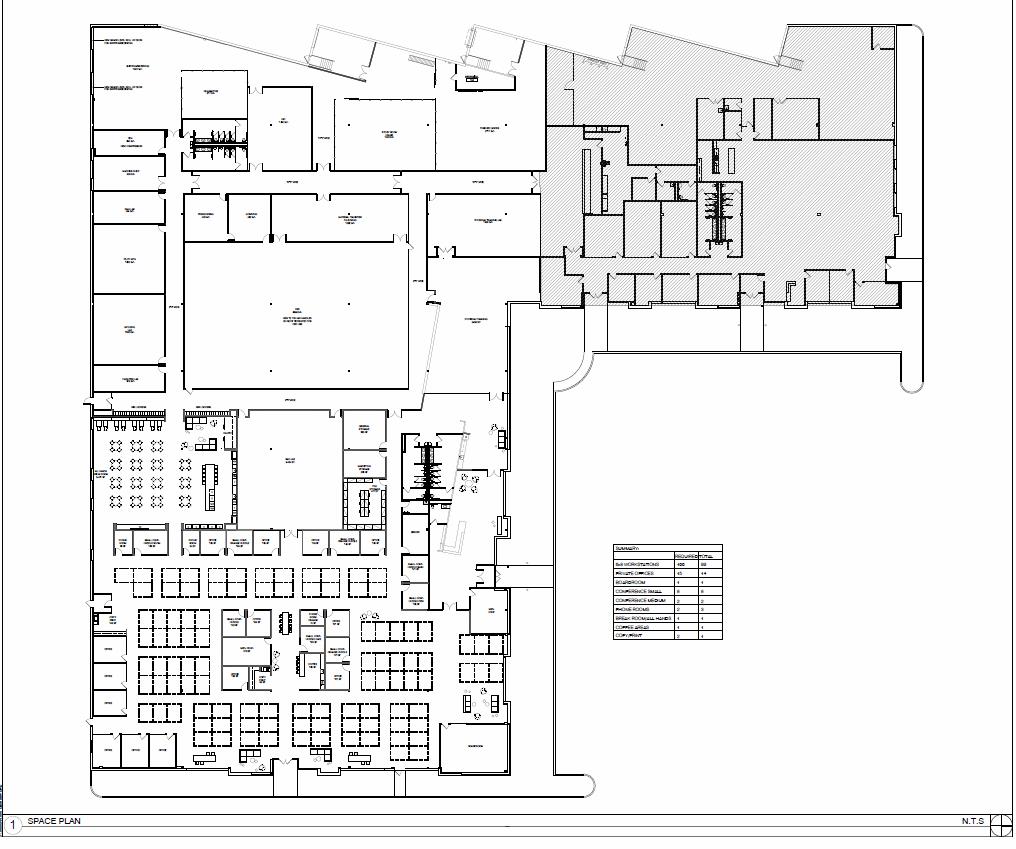

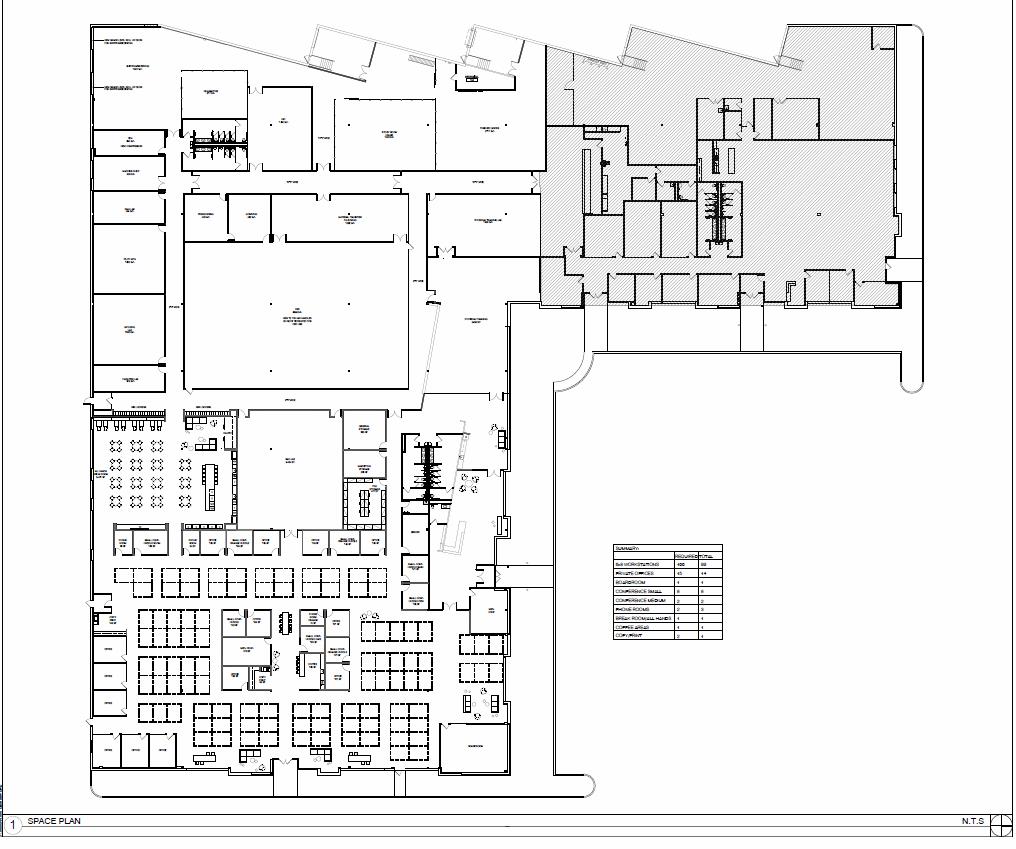

Exhibit A |

Floor Plans |

|

Exhibit B |

Rules and Regulations |

|

Exhibit C |

Work Letter |

|

Exhibit D |

Acceptance of Occupancy |

|

Exhibit E |

Parking Rules & Regulations |

|

Exhibit E-1 |

Reserved Parking |

|

Exhibit F |

Form of Rooftop Use Agreement |

|

Exhibit G |

Block Plan |

|

Exhibit G-1 |

Works to be Removed |

|

SCHEDULES |

|

|

1.1 |

Definitions |

|

15 |

Rules and Regulations |

-i-

SUMMARY OF TERMS

(“Summary of Terms”)

TENANT: Silk Road Medical, Inc., a Delaware corporation, whose address is 1213 Innsbruck Drive, Sunnyvale, CA 94089, Attention: General Counsel.

LANDLORD: ARHC UHPTHMN01, LLC, a Delaware limited liability company, whose address is c/o Lillibridge Healthcare Services, Inc., 353 North Clark Street, Suite 3300, Chicago, IL 60654, Attention: Asset Management.

EFFECTIVE DATE: The latest date of execution of this Lease, as set forth on the signature page.

PREMISES: Suite 1

BUILDING: The industrial building located at 14755 27th Avenue, in the City of Plymouth, State of Minnesota.

BUSINESS HOURS: 8:00 a.m. - 6:00 p.m. Monday through Friday and 8:00 a.m. - 1:00 p.m. Saturday, holidays excluded.

RENTABLE SQUARE FEET: Approximately 63,118 square feet.

TENANT’S PRO RATA SHARE: Approximately 77.10%.

TERM: The period beginning on the Commencement Date and ending on the final day of the 102nd full calendar month (approximately 8.5 Lease Years).

EXTENSION OPTIONS: 2 extension options, of 5 years each.

INITIAL BASE RENT: $13.00 per Rentable Square Foot of the Premises per annum.

ANNUAL ESCALATOR: 2.5%.

POSSESSION DATE: As described in Section 1.2 hereof.

COMMENCEMENT DATE: The Possession Date.

RENT COMMENCEMENT DATE: The first to occur of the following two dates: (1) the date on which

(a) the Tenant’s Work is substantially completed, (b) Tenant has completed installation of its furniture, fixtures and equipment and (c) a certificate of occupancy has been issued, or (2) the last to occur of the following two dates: (a) January 1, 2022 or (b) 8 months after the Commencement Date.

BROKER: Colliers International, as broker for Landlord, and Newmark Southern Region, LLC, a Georgia limited liability company, doing business as Newmark Knight Frank, as broker for Tenant.

IMPROVEMENT ALLOWANCE: $25.00 multiplied by the number of Rentable Square Feet in the Premises, subject to the Work Letter, together with up to an additional $20,000.00 exclusively for the purpose of funding the cost of the Demising Work (as defined below)

SECURITY DEPOSIT: $68,377.83

THIS LEASE AGREEMENT (this “Lease”) is executed as of the Effective Date by and between ARHC UHPTHMN01, LLC, a Delaware limited liability company (“Landlord”), and SILK ROAD MEDICAL, INC., a Delaware corporation (“Tenant”).

W I T N E S S E T H:

That in consideration of the rents, covenants and conditions herein set forth, Landlord and Tenant agree as follows:

Section 1 – Summary; Premises, Term

Prior to the Rent Commencement Date, Tenant’s occupancy of the Premises shall be governed by the terms of this Lease except for the covenant to pay Base Rent and Additional Rent; except that (a) Tenant shall pay for all electricity, gas, heating, ventilation and air conditioning usage and trash removal incurred in connection with Tenant’s performance of Tenant’s Work (defined below) or otherwise preparing the Premises for Tenant’s occupancy and (b) if Tenant occupies greater than 10,000 Rentable Square Feet in the Premises prior to the Rent Commencement Date, then Tenant shall be required to pay Additional Rent for the Premises in accordance with Section 2.2 below.

As used herein, “Possession Date” shall mean the date on which Landlord delivers the Premises to Tenant. Landlord shall, subject to events of Force Majeure, use commercially reasonable efforts to cause the Possession Date to occur on or before May 11, 2021 (the “Anticipated Possession Date”). Upon Tenant’s occupancy of the Premises, Tenant shall execute an Acceptance of Occupancy certificate in the form of Exhibit D attached hereto.

If the Possession Date does not occur by the Anticipated Possession Date, this Lease shall not be void or voidable, nor shall Landlord be liable to Tenant for any loss or damage resulting therefrom. Under those circumstances, as Tenant’s sole remedy, if Landlord cannot cause the Possession Date to occur within thirty (30) days after the Anticipated Possession Date, Tenant may terminate this Lease by giving written notice to Landlord within thirty (30) days after the expiration of the thirty (30)-day period with the understanding that if the notice is not timely provided, the right to terminate shall be deemed waived. If Tenant timely elects to terminate this Lease, Tenant’s notice must provide a date for termination which shall be not less than thirty (30) days after the date of Tenant’s notice. Landlord shall have the right to nullify Tenant’s termination notice by causing the Possession Date to occur on or prior to the effectiveness

-1-

of the termination. The Anticipated Possession Date shall be extended because of any delay caused by a Tenant Delay or events of Force Majeure.

Landlord shall deliver the Premises to Tenant (i) in good operating condition and repair, (ii) free and clear of debris and with the restrooms professionally cleaned, and (iii) ready for Tenant to commence construction of Tenant’s Work. Landlord represents and warrants to Tenant that to Landlord’s actual knowledge, (x) the Premises is free from mold or other Hazardous Materials (excepting de minimis amounts stored in compliance with Environmental Requirements, (y) the Building systems serving the Premises (e.g., the mechanical, electrical, plumbing and heating and ventilation systems) (together, the “Building Systems”), are in good working order and repair, and (y) the roof of the Building is in good working order and repair. Should the roof of the Building not remain in good condition and repair for the aforementioned twelve (12) month period following the Possession Date or fail or require maintenance and/or repair during such twelve (12)-month period (in each case, except due to the occurrence of casualty, which shall be governed by Section 6 below), Landlord shall perform such maintenance and/or repair at Landlord’s sole cost and expense without charge or pass-through to Tenant. Except as specifically provided in this paragraph, Tenant acknowledges that it is leasing the Premises “as is” without any representations or warranties.

Tenant acknowledges as of the Effective Date, the Premises are not fully demised from the space adjacent to the Premises in the Building. The work necessary to physically demise the Premises from such adjacent space is required to be part of “Tenant’s Work” under the Work Letter (the “Demising Work” and the portion of the Premises to be so demised from the adjacent space is referred to herein as the “Additional Premises”). In performing such demising work, Tenant hereby agrees to use reasonable efforts to avoid unreasonable interference with the adjacent tenant’s operations during the performance of such demising work, and Tenant hereby agrees to reasonably coordinate such demising work with such adjacent tenant to achieve the same, including limiting Tenant’s access to only such portion of the premises leased to such adjacent tenant as may be reasonably necessary to perform the Demising Work. Tenant further acknowledges and agrees that it shall not commence the Demising Work until after May 28, 2021, and that the adjacent tenant shall continue to occupy the Additional Premises until such date (and the same shall not delay the Possession Date).

At Tenant’s direction, Landlord has caused the prior tenant of the Premises to abandon (i) certain server room racks and cabling located within the Premises, and (ii) that certain 60 kW standby generator located on the roof the Building that provides emergency power to portions of the Premises (with the associated cabling, the “Roof Generator”). As of the Effective Date, Tenant shall be deemed the owner of all such equipment and Landlord hereby disclaims any ownership interest in the same. Tenant is taking possession of all such equipment in its as-is, where-is condition and Landlord hereby disclaims any representation or warranty as to the same. With respect to the Roof Generator, (1) Landlord shall have no obligation to maintain, repair or replace the Roof Generator, (2) Tenant is not required to replace the Roof Generator if the same becomes inoperable during the Term, but Tenant is responsible for providing, at its sole cost and expense, all maintenance and repair required to keep the Roof Generator in a safe condition and in compliance with any applicable code requirements, and (3) if the Roof Generator becomes inoperable during the Term, Landlord shall have the right to require Tenant to remove and dispose of the Roof Generator and repair all damage arising from such removal.

-2-

|

(A) Permitted Use. Tenant shall continuously occupy and use the Premises for general office use, tech, medical manufacturing, and warehouse and any other related use permitted by law. Tenant acknowledges that Landlord has not granted Tenant the right to be the exclusive provider of any use in the Project. |

|

(B) Compliance. At its cost, Tenant shall observe and comply, and shall cause the Tenant Parties to observe and comply, with the rules and regulations attached hereto as Exhibit B, together with any reasonable modifications or additions thereto (the “Rules and Regulations”), and with all Governmental Regulations. Notwithstanding the foregoing, neither the Rules and Regulations attached hereto as Exhibit B nor any reasonable modifications or additions thereto shall unreasonably interfere with the rights granted to Tenant under this Lease. In addition to the foregoing, Landlord shall use commercially reasonable efforts to enforce all rules and regulations with respect to the Project against all tenants of the Project in a uniform and non-discriminatory manner. |

|

(A) |

Grant of Options. Subject to the terms of this Section 1.6, Tenant shall have two |

|

(2) sequential options to extend the term of this Lease for additional periods of five (5) years each (each an “Option Period” and collectively, the “Option Periods”), with each Option Period to begin upon the expiration of the Term (as the same may have been extended). No concessions, abatements or allowances granted with respect to the Term shall be applicable to any Option Period, and the Option Periods, once exercised, cannot be exercised again. |

|

(B) Conditions to Exercise of Option. In order for Tenant to exercise its option to extend under this Section 1.6, the following conditions must be satisfied on the date that Tenant delivers its Extension Notice (defined below) as well as on the date that the Option Period is to commence: (1) there exists no Event of Default under this Lease that remains uncured after receipt of written notice and expiration of the applicable cure period, and (2) the originally named Tenant shall not have assigned this Lease (except to an Approved Transferee). |

|

(C) Procedure. So long as the conditions specified in Section 1.6(B) are satisfied, Tenant shall provide Landlord with notice of its desire to extend the Term for an Option Period not less than nine (9) months nor more than twelve (12) months prior to the scheduled expiration of the Term (as the same may have been previously extended by an Option Period) (each such notice, a “Exercise Notice”). If Tenant fails to timely deliver an Exercise Notice, Tenant shall be deemed to have waived its right to extend the Term. |

|

(D) Notice and Determination of Base Rent. Concurrently with Tenant’s delivery of the Exercise Notice, Tenant shall deliver to Landlord Tenant’s calculation of the Fair Market Base Rent for the first year of the applicable Option Period (the “Tenant’s Option Rent Calculation”). Landlord shall deliver notice (the “Landlord Response Notice”) to Tenant on or before the date which is thirty (30) days |

-3-

after Landlord’s receipt of the Exercise Notice and Tenant’s Option Rent Calculation, stating that

|

(a) Landlord is accepting Tenant’s Option Rent Calculation as the Fair Market Base Rent, or (B) rejecting Tenant’s Option Rent Calculation and setting forth Landlord’s calculation of the Fair Market Base Rent (the “Landlord’s Option Rent Calculation”). Within ten (10) business days of its receipt of the Landlord Response Notice, Tenant may, at its option, accept the Fair Market Base Rent contained in the Landlord’s Option Rent Calculation. If Tenant does not affirmatively accept or Tenant rejects the Fair Market Base Rent specified in the Landlord’s Option Rent Calculation, then Landlord and Tenant shall commence negotiations to attempt to agree on each party’s determination of the Fair Market Base Rent within thirty |

(30) days after Landlord’s delivery of Landlord’s Response Notice to Tenant. If the parties cannot reach agreement within that time period, each acting in good faith but without any obligation to agree, then the Fair Market Base Rent for the Premises shall be determined by a board of three (3) licensed commercial real estate brokers, one of whom shall be named by Landlord, one of whom shall be named by Tenant, and the two so appointed shall select a third. Each real estate broker so selected shall be licensed in the jurisdiction in which the Building is located as a real estate broker specializing in the field of commercial office leasing in the Metropolitan Area, area having no less than ten (10) years’ experience in such field, and recognized as ethical and reputable within the field. Landlord and Tenant agree to make their appointments promptly within ten (10) days after the expiration of the thirty (30)-day period, or sooner if mutually agreed upon. The two (2) brokers selected by Landlord and Tenant shall promptly select a third broker within ten (10) days after they both have been appointed, and each broker, within fifteen (15) days after the third broker is selected, shall submit his or her determination of the Fair Market Base Rent. The Fair Market Base Rent shall be the mean of the two closest rental rate determinations. Landlord and Tenant shall each pay the fee of the broker selected by it, and they shall equally share the payment of the fee of the third broker.

|

(E) Option Period Base Rent Increases. On the commencement of each Lease Year during an Option Period (excluding the first day of the first Option Period), Base Rent shall increase as set forth in Section 2.1(A). |

|

(F) Condition of Premises. Landlord shall have no obligation to refurbish or otherwise improve the Premises for any Option Period. The Premises shall be tendered on the commencement date of the Option Period in “as-is where is” condition. |

|

(A) During the Term, including any extension thereof, Landlord hereby grants to Tenant a right of first refusal (the “Right of First Refusal”) to lease, on the terms and conditions hereinafter set forth, all space in the Building not leased by Tenant under this Lease (the “ROFR Space”) and for which Landlord receives a signed bona fide third-party offer (an “Offer”) that Landlord desires to accept. Landlord shall not grant to any existing or future tenants any rights superior to Tenant’s with respect to the ROFR Space. Landlord shall give Tenant notice (the “ROFR Notice”) of (a) the location and size of the ROFR Space subject to the applicable Offer; and (b) the material economic terms of the Offer. |

|

(B) Tenant shall (if it so elects) exercise its Right of First Refusal to lease the ROFR Space on the terms and conditions set forth in the ROFR Notice and the terms hereof by delivering to Landlord notice of its election (the “Election Notice”) not later than ten (10) business days after the ROFR Notice is given. Once given, Tenant’s Election Notice shall be irrevocable. If Tenant validly exercises its Right of First Refusal in accordance with the terms hereof, Landlord and Tenant shall enter into a written amendment to the Lease within fifteen (15) days after the delivery of Tenant’s Election Notice confirming the terms, conditions and provisions applicable to the ROFR Space as determined in accordance with this Section 1.7. Notwithstanding the foregoing, if Tenant delivers an Election Notice during the initial thirty |

(30) months of the Term, then the terms and conditions in this Lease (including the Base Rent on a cost per

-4-

square foot basis) shall be applied to the ROFR Space subject to equitable and proportionate adjustments to the Improvement Allowance, early occupancy terms and rent abatement provisions, based on the rentable square footage of the ROFR Space and the Term remaining on this Lease.

|

(C) If Tenant does not timely deliver its Election Notice or elects not to lease the ROFR Space or if the amendment is not executed by Tenant within that fifteen (15) day period, then Landlord will have the right to lease the applicable ROFR Space on terms substantially similar to the Offer without reoffering the ROFR Space to Tenant. For purposes hereof, the phrase “terms substantially similar to the Offer” means terms that have a net economic benefit to Landlord of at least ninety-five percent (95%) of the net economic benefit that Landlord would realize under the Offer. |

|

(D) Tenant may only exercise its Right of First Refusal if, at the time of Tenant’s exercise of that right and on the commencement date for the ROFR Space (the “ROFR Space Commencement Date”), (i) this Lease is in full force and effect and there does not then exist an Event of Default under this Lease that remains uncured after receipt of written notice and expiration of the applicable cure period, and (ii) Tenant has not assigned this Lease (other than to an Approved Transferee) nor sublet the entirety of the Premises. If any of the conditions set forth in the immediately preceding sentence are not satisfied, then the Right of First Refusal shall be deemed waived and of no further force or effect with respect to such Offer but shall survive with respect to any future Offer for any ROFR Space. |

|

(E) If Tenant timely and validly exercises its Right of First Refusal, then effective as of the ROFR Space Commencement Date, all of the applicable ROFR Space shall be deemed to be included in the Premises, subject to all of the terms, conditions and provisions of the Lease and Offer Notice, except as follows: |

|

(1) The rentable square footage of the Premises shall be increased by the rentable square footage of the ROFR Space and Tenant’s Proportionate Share shall be recalculated based upon the increased rentable square footage of the Premises; and |

|

(2) The ROFR Space shall be rented in its “As-Is” and “Where-Is” condition; except for (a) any work to be performed by Landlord, if any, as provided in the Offer Notice, and (b) the warranties offered by Landlord in the Offer Notice, if any. |

|

(A) Amount. Tenant shall pay to Landlord the annual rentals (the “Base Rent”) set forth in this Section 2.1(A). Base Rent shall be paid in equal monthly installments on or before the first day of each month, in advance, commencing upon the Rent Commencement Date and continuing through the last calendar month that falls within the Term. If the Rent Commencement Date is not the first day of a calendar month, then the Base Rent due for the month in which the Rent Commencement Date occurs shall be prorated based upon the number of days in that month falling on or after the Rent Commencement Date. |

Base Rent from the Rent Commencement Date through the end of the first Lease Year shall be the Initial Base Rent set forth on the Summary of Terms. Commencing with the second Lease Year and on the commencement of each Lease Year thereafter during the Term, Base Rent shall be increased to an amount equal to the sum of:

-5-

|

(1) the Base Rent amount (as increased by any prior rental adjustments pursuant to these provisions) in effect immediately prior to that increase, plus |

|

(2) the product of (a) the Base Rent amount (as increased by any prior rental adjustments pursuant to these provisions) in effect immediately prior to that increase, multiplied by (b) the Annual Escalator set forth on the Summary of Terms. |

Prior to each annual Base Rent adjustment, Landlord shall prepare a statement reflecting the Base Rent as adjusted in accordance herewith.

|

(B) |

Rent Abatement. |

|

(1) Base Rent Abatement. Notwithstanding Section 2.1(A) to the contrary, Base Rent shall be abated in its entirety for the first six (6) months following the Rent Commencement Date. For the avoidance of doubt, if the Rent Commencement Date is not the first day of a calendar month, then such abatement shall apply to the entirety of the first month following the Rent Commencement Date, which shall be a partial month, the entirety of the second through sixth calendar months following the Rent Commencement Date and a portion of the seventh calendar month following the Rent Commencement Date, with the unabated Base Rent attributable to such partial calendar month being due on the first day of such calendar month. |

|

(2) Inducement Recapture. The agreement for abated Base Rent set forth in Section 2.1(B)(1) above (the “Inducement Provision”) shall be deemed conditioned on Tenant’s full and faithful performance of all provisions of this Lease. Should Tenant commit an Event of Default beyond any applicable notice and cure period that results in a termination of this Lease, the Inducement Provision shall automatically be deemed deleted from this Lease and of no further force or effect, and any unamortized Base Rent (with the same amortized on a straight-line basis over the initial Term of this Lease) abated thereunder shall be immediately due and payable by Tenant to Landlord. Landlord’s acceptance of Base Rent or the cure of such breach shall not be deemed a waiver by Landlord of the provisions of this Section 2.1(B)(2) unless specifically so stated in writing by Landlord at the time of such acceptance. |

|

(C) Manner of Payments. The payment of Base Rent, Additional Rent and any other sums due from Tenant to Landlord under this Lease (collectively, “Rent”) shall be made in lawful money of the United States of America and made payable to Landlord or another person designated by Landlord in writing from time to time, and at the place Landlord designates in writing from time to time. Landlord may require that Tenant pay Landlord Rent electronically through an online portal, ACH payments or another method as Landlord may reasonably require. Tenant’s obligation to pay Rent is independent of any obligation of Landlord hereunder and shall be paid without abatement, reduction, demand or set-off, except as otherwise specifically provided herein. |

|

(D) Late Payments. If any payment of Rent is more than ten (10) days past due, Tenant shall pay to Landlord on demand an administrative charge equal to five percent (5%) of the past due amount. In addition, any Rent payment more than thirty (30) days past due shall accrue interest from the due date at the rate (the “Default Rate”) of 15% per annum until paid in full, and Tenant shall pay interest to Landlord on demand. |

|

(A) Amount. Commencing on the Rent Commencement Date (or earlier as described in Section 1.2 above), Tenant shall pay to Landlord at the same time as it is required to make payment of Base Rent, an amount (the “Additional Rent”) equal to Tenant’s Pro Rata Share of Expenses attributable to |

-6-

the Project for any full or partial calendar year during the Term; provided, however, that Tenant such Additional Rent calculated for any full or partial calendar year shall be divided into twelve (12) equal installments and Tenant shall only pay to Landlord 1/12 of such Additional Rent each month.

|

(B) Payment. Prior to any calendar year and from time to time during any calendar year, Landlord may notify Tenant of monthly installments of Additional Rent payable by Tenant based on Landlord’s reasonable estimate of each of Taxes and Expenses for that calendar year. On the first day of the calendar month after Landlord’s notice of any increase in these installments, Tenant shall pay to Landlord (in addition to the revised monthly estimate) a lump sum payment in an amount so that Tenant’s total payments for the calendar year will equal Landlord’s revised estimate of Additional Rent. Additional Rent for the calendar year in which the Rent Commencement Date occurs (if the Rent Commencement Date is other than January 1) shall be prorated based upon the number of days in that year falling on or after the Rent Commencement Date. Additional Rent for the last calendar year in which the Term falls (if the Term ends on a date other than December 31) shall be prorated based upon the number of days in the Term falling within that year. |

|

(C) Reconciliation. After Landlord has ascertained the actual amount of Taxes and Expenses for the prior calendar year, Landlord shall notify Tenant of the actual Additional Rent due from Tenant for that year (an “Annual Additional Rent Notice”). If the Additional Rent actually due exceeds total estimated payments of Additional Rent made by Tenant for that calendar year, then Tenant shall pay Landlord the deficiency within ten (10) days after receiving the Annual Additional Rent Notice. If the Additional Rent actually due is less than the total estimated payments made by Tenant for that calendar year, then Landlord shall, at its option, credit any excess to Rent next owing by Tenant or refund the excess to Tenant (though if the Term has expired, then Landlord may only refund the excess to Tenant). Neither Landlord nor Tenant shall be liable to the other for any retroactive Tax adjustments made more than six (6) months after the expiration of this Lease. |

|

(D) Rent Taxes; Taxes on Tenant Property. Tenant shall pay to Landlord, at the same time as Tenant is required to pay Rent, an amount equal to all federal and state taxes (collectively, “Rent Taxes”) now or hereafter levied or assessed upon that Rent, or the payment or receipt thereof, or that Landlord will be required to pay as a result of its receipt of Tenant’s payment thereof; provided, however, that Tenant such Rent Taxes calculated for any full or partial calendar year shall be divided into twelve (12) equal installments and Tenant shall only pay to Landlord 1/12 of such Rent Taxes each month. Tenant shall be responsible for and shall pay before delinquent all municipal, county, state and federal taxes assessed during the Term against any leasehold interest of Tenant or any property owned by Tenant and located in the Premises. The provisions of this Section 2.2 shall survive the expiration or earlier termination of this Lease. |

|

(E) Right to Audit. So long as Tenant has paid in full any amount owing under an Annual Additional Rent Notice, Tenant may, at any time after at least ten (10) days’ notice to Landlord given within six (6) months after Tenant receives that Annual Additional Rent Notice from Landlord, review Landlord’s records of Expenses and Taxes for the time period covered by that Annual Additional Rent Notice. The review must be performed by a qualified independent certified public accountant (“CPA”) or commercial brokerage firm that is not paid on a contingency fee basis, and shall be completed at Landlord’s corporate offices unless all such information is made available on-line (and no information other than real estate tax bills may be removed from that location), unless Landlord in its sole discretion permits Tenant to conduct its review electronically. If Tenant does not complete the review and deliver to Landlord a report requesting correction of Landlord’s determination of Expenses and Taxes within ninety (90) days after Tenant delivers to Landlord notice of its intent to audit, Tenant shall be deemed to have waived its right to object set forth in this Section 2.2(E). If Tenant’s review of Landlord’s books and records discloses that Tenant’s Pro Rata Share of Expenses and Taxes paid by Tenant for the period under review exceeded |

-7-

the actual amount properly allocable to Tenant, then, so long as Landlord agrees with that determination, Landlord shall credit against Tenant’s next accruing Rent obligations an amount equal to the excess (or shall deliver to Tenant a refund of that excess amount, if the excess relates to the last year of the Term), and, if Tenant’s Pro Rata Share of Expenses and Taxes paid by Tenant for the period under review exceeded one hundred five percent (105%) of the actual amount properly allocable to Tenant, Landlord shall reimburse Tenant for any and all reasonable out-of-pocket costs incurred by Tenant in connection with such audit.

If Landlord and Tenant are unable to agree on the amount of the excess paid by Tenant within sixty

(60) days after Tenant delivers to Landlord notice of its intent to audit, then Tenant shall have the right, within five (5) days after the expiration of that period to submit the dispute for resolution by binding arbitration with a mutually acceptable CPA having not less than five (5) years’ experience with respect to the auditing and review of operating expense statements for similar buildings in the Metropolitan Area. If Landlord and Tenant cannot agree on a CPA within fifteen (15) days after Landlord’s receipt of Tenant’s election to submit the dispute to arbitration, then five (5) days thereafter, each shall select a CPA and within ten (10) days thereafter, the two (2) appointed CPAs shall select a third CPA and the third CPA shall be the arbitrator to resolve the dispute.

|

(F) Tenant shall cause all information disclosed in Landlord’s books and records as well as the information disclosed in any audit or review of the books and records to be kept confidential and shall not retain any copy of that information and shall not disclose that information to any other party, including any other tenant in the Project. Tenant shall, and Tenant shall cause any party engaged by Tenant to review the books and records to, execute and deliver to Landlord a confidentiality agreement in form and substance reasonably acceptable to Landlord prior to performing any review or audit. |

$1,000 of the service for which it receives the full benefit. In no instance, however, shall Tenant pay more than the actual cost of the service for which an Equitable Adjustment is made. Landlord may incorporate the Equitable Adjustment in its estimates of Expenses.

|

(A) Alterations. All improvements or alterations in or additions, changes or installations to the Premises (“Alterations”) performed by or on behalf of Tenant or any of its subtenants shall be governed by the terms of this Section 3. Tenant shall not permit any Alteration to be performed without first obtaining Landlord’s prior consent. Landlord’s consent shall not be unreasonably withheld, |

-8-

conditioned or delayed but may be withheld in Landlord’s sole discretion if (1) there exists an Event of Default under this Lease that remains uncured after receipt of written notice and expiration of the applicable cure period or (2) the Alteration (i) impacts the structural components of the Project or (ii) impacts the utility or mechanical systems of the Project or (iii) impacts any other tenant’s premises or is visible from the outside of the Premises. Notwithstanding any contrary provision of this Lease, without securing Landlord’s prior written consent, but with at least ten (10) business days’ prior written notice to Landlord, Tenant shall be permitted to perform interior, cosmetic, non-structural alterations not exceeding an aggregate amount of One Hundred Thousand Dollars ($100,000) during any calendar year (provided that Tenant complies with all pertinent code, fire, safety and other such governmental regulations and Tenant does not take any action that could in any way interfere with the structural components, or have a material adverse effect on the mechanical, electrical, maintenance, HVAC or plumbing systems in the Premises) (collectively, “Cosmetic Alterations”). If any Cosmetic Alteration requires the consent of a lender under any mortgage or deed of trust secured by the Project, Landlord shall notify Tenant of the same and reasonably cooperate with Tenant to obtain such consent (at Tenant’s sole cost and expense), and Tenant shall not commence such Cosmetic Alteration until the necessary consents have been obtained by Landlord.

|

(B) Procedures. Prior to the commencement of any Alteration, Tenant shall submit detailed plans and specifications for Landlord’s review and approval. Landlord shall notify Tenant of its approval or disapproval of those plans and specifications and the work described therein within ten (10) business days after receipt thereof. Landlord shall state in writing and in reasonable detail any objection to the proposed Alteration. Tenant may revise its plans and specifications to incorporate those comments and, if Tenant does so, it may again request Landlord’s consent pursuant to the process described above. Neither approval of the plans and specifications nor supervision of the Alteration by Landlord shall constitute a representation or warranty by Landlord as to the accuracy, adequacy, sufficiency or propriety of the plans and specifications or the quality of workmanship or the compliance of the Alteration with Governmental Regulations. If Tenant desires to revise any plans and specifications after obtaining Landlord’s approval thereof, Tenant shall re-submit the revised plans and specifications to Landlord for its approval as provided above. |

|

(C) Performance. Tenant shall pay the entire cost of any Alteration permitted hereunder, including Landlord’s reasonable charges for review of the plans and specifications for any Alteration and Landlord’s reasonable charge for supervision of any approved Alteration (not to exceed three percent (3%) for the cost of any such Alteration). If requested by Landlord, Tenant shall provide evidence reasonably satisfactory to Landlord of Tenant’s financial ability to pay the cost of the Alteration. All Alterations shall be performed in a good and workmanlike and first-class lien free manner, using new materials and in accordance with the plans and specifications submitted to and approved by Landlord as well as in accordance with all applicable Governmental Regulations. All Alterations shall be performed by contractors and subcontractors who possess the requisite experiences, personnel, financial strength and other resources necessary to perform and complete the proposed Alteration in a good and workmanlike lien free manner, and who are approved by Landlord in advance in its reasonable discretion; provided, however, that for the design and construction of Tenant’s Work, Landlord approves Nelson as an architect and Arco Murray as a general contractor. Tenant shall provide to Landlord evidence reasonably satisfactory to Landlord that those contractors and subcontractors satisfy the aforementioned requirements and possess the insurance required under Section 4. Prior to commencing any Alteration, Tenant shall obtain and deliver to Landlord complete copies of all permits and approvals required by applicable Governmental Regulations to commence and complete that Alteration. |

-9-

remove those portions of the Tenant’s Work as set forth on the Block Plan attached hereto as Exhibit G (the “Block Plan”) at the expiration or termination of this Lease, except for those works described on Exhibit G-1; and, provided further, that Landlord shall advise Tenant by delivery of written notice to Tenant within ten (10) days after receipt of final plans and specifications relating to those portions of Tenant’s Work not shown on the Block Plan, whether any portions of such Tenant’s Work not shown on the Block Plan are required to be removed at the expiration or termination of this Lease, and, should Landlord notify Tenant that no such portions of the Tenant’s Work not shown on the Block Plan are required to be removed, then Tenant shall not be required to do so at the expiration or termination of this Lease. To the extent specifically requested in writing by Tenant, Landlord shall inform Tenant at the time Landlord consents to any Alteration whether Landlord requires removal of that Alteration at the expiration or termination of this Lease. If Landlord does not so notify Tenant that Landlord is requiring such removal as requested in writing by Tenant, then Tenant shall not be required to remove any such Alteration upon the expiration or earlier termination of this Lease. When removing an Alteration, Tenant shall bear the expense of removal and restore the Premises to the condition existing immediately prior to the Alteration at the expiration or termination of this Lease.

|

3.4 Survival. Tenant’s obligations in this Section 3 shall survive the expiration or termination of this Lease. |

|

(A) Commercial property insurance (1) insuring 100% of the full replacement cost on an agreed amount basis of all Alterations made at Tenant’s expense or direction during the performance of and when completed, and all other property owned or used by Tenant and located in the Premises, including at least twelve (12) months of business interruption coverage, and (2) written on an “all risk” or “special perils” policy form, including coverage for windstorm. The proceeds of Tenant’s commercial property insurance shall be used for the repair or replacement of the property so insured, except that if this Lease is terminated following a casualty, the proceeds applicable to Alterations shall be paid to Landlord and the proceeds applicable to Tenant’s personal property shall be paid to Tenant. |

|

(B) Commercial general liability insurance written on an occurrence policy form that is at least as broad as the coverage provided by ISO Form CG 00 01 04 13, covering damages because of |

-10-

bodily injury, property damage and personal and advertising injury, arising out of Tenant’s premises, operations or products-completed operations, with limits of liability of not less than $1,000,000 for bodily injury and property damage per occurrence and $2,000,000 general annual aggregate and a $3,000,000 products-completed operations aggregate.

|

(C) Commercial automobile liability insurance covering liability arising from the use or operation of any auto, including those owned, hired, leased, rented, borrowed, non-owned or otherwise operated or used by or on behalf of Tenant. The coverage shall be on an occurrence form with combined single limits of not less than $1,000,000 per accident for bodily injury (including death) and property damage. Alternatively, Tenant may insure for the risks required to be insured against under this Section 4.1(C) through its commercial general liability insurance policy. |

|

(E) Umbrella/excess liability insurance covering in excess of (and written on a form at least as broad as) the primary commercial general liability, employer’s liability and automobile liability insurance policies with limits not less than $1,000,000 each occurrence and $1,000,000 annual aggregate. |

|

(F) During the performance of all Alterations, Tenant shall also cause its contractor or subcontractor, as appropriate, performing the Alteration to maintain, (1) commercial general liability insurance as described in Section 4.1(B), but with limits not less than $1,000,000 for bodily injury and property damage per occurrence and $2,000,000 general annual aggregate and a $2,000,000 products- completed operations aggregate; (2) commercial automobile liability insurance as described in Section 4.1(C); (3) workers’ compensation insurance and employer’s liability insurance as described in Section 4.1(D); and (4) umbrella/excess liability insurance covering in excess of (and written on a form at least as broad as) the primary commercial general liability, employer’s liability and automobile liability insurance policies with limits not less than $1,000,000 each occurrence and $1,000,000 annual aggregate. In addition, if design, engineering or other professional services are provided in connection with the Alteration, Tenant shall cause the party providing those services to maintain professional liability insurance with limits not less than $1,000,000 each claim and $1,000,000 in the aggregate. |

(c) contain a waiver of any rights of subrogation and all rights of recovery in favor of and against the Landlord Indemnified Parties; and (d) be primary and non-contributing with any insurance maintained by the Landlord Indemnified Parties. With respect to Tenant’s commercial general liability insurance, additional insured coverage shall be provided via the ISO CG 20 11 endorsement or its equivalent. Tenant shall, on or before the Commencement Date, and within ten (10) days before the expiration of each policy, deliver to Landlord certificates of insurance on the industry standard Accord Form showing compliance with the insurance requirements set forth above. Tenant shall provide thirty (30) days’ prior written notice to Landlord (10) days for non-payment of premium) in the event of cancellation or non-renewal of any insurance referred to therein. The insurance policies and limits required under this Lease shall not limit the liability of Tenant under this Lease, and Landlord makes no representation that these types or amounts of insurance are sufficient or adequate to protect Tenant’s interests or liabilities.

-11-

|

4.4 Failure to Carry. Without limiting Landlord’s remedies set forth in Section 10.2, if Tenant fails to carry and maintain the insurance coverages set forth in this Section 4, Landlord may, upon |

(10) days’ prior notice to Tenant (unless the coverages will lapse within that time period, in which event no notice shall be necessary), procure those policies of insurance and Tenant shall promptly reimburse Landlord the cost thereof with interest thereon at the Default Rate from the date incurred until the date paid.

|

4.5 Landlord’s Insurance. Landlord shall, during the Term, maintain commercial property insurance for 100% of the full replacement costs of the Building (exclusive of land, foundations and footings). |

Section 5 – Repairs and Maintenance; Compliance; Services

(i) any floor leased by Tenant, (ii) any Building Systems, or (iii) any Emergency Condition, which event or circumstance materially and adversely affects the conduct of Tenant’s business from the Premises or Tenant’s access to the Premises, without Tenant being obligated to take extraordinary measures or incur material expense, and Landlord fails to commence corrective action within a reasonable period of time, given the circumstances, after the receipt of such notice, but in any event not later than ten (10) business days after receipt of such notice and to diligently prosecute the corrective action to completion, then Tenant may proceed to take the required action upon delivery of an additional five (5) days’ notice to Landlord specifying that Tenant is taking such required action (provided, however, that the initial ten (10) business day notice and the subsequent five (5) day notice shall be replaced with a single twenty-four (24) hour notice in the event of an Emergency Condition) and if such action was required under the terms of this Lease to be taken by Landlord and was not commenced by Landlord within such ten (10) business day period (or within twenty-four (24) hours in the event of an Emergency Condition) and thereafter diligently pursued to completion, then Tenant shall be entitled to prompt reimbursement by Landlord of Tenant’s reasonable out-of-pocket costs and expenses in taking such action. Notwithstanding anything contained herein to the contrary, in no event shall Tenant be permitted to take any action under this Section 5.3 that relates to the Building Structure.

|

5.4 Emergency Condition Defined. For purposes of Section 5.3, the term “Emergency Condition” shall mean any event or circumstance which requires repair or maintenance by Landlord under |

-12-

this Lease and which (i) creates an immediate material risk (a) of physical harm to any Tenant Party, or (b) to the protection, safety, operation and preservation of Tenant’s mission-critical or business-critical personal property in the Premises (including, for example, server rooms), or (ii) prevents Tenant from accessing the Premises on a commercially reasonable basis.

|

(A) Heating and Cooling. Heating and air conditioning (“HVAC”) to provide a comfortable temperature for office and industrial business operations, assuming customary density for industrial usage with respect to the number of people per Rentable Square Foot. Tenant shall have operational control of the HVAC for the Premises. To the extent Tenant conducts business at the Premises outside Business Hours or uses above normal capacity of HVAC to the Premises, Tenant shall pay any additional costs actually incurred and paid by Landlord in connection with that use. Landlord shall repair and provide quarterly maintenance services to any HVAC units currently serving the Premises. Upon at least thirty (30) days prior written notice to Landlord, Tenant shall have the right to replace the vendor providing maintenance services to the HVAC units serving the Premises with a vendor selected by Tenant and approved by Landlord, which approval shall not be unreasonably withheld, conditioned or delayed. |

|

(B) Janitorial Service. Landlord provide no janitorial services for the Premises but all janitorial services shall be the responsibility of Tenant, at its sole cost and expense. |

|

(C) Water. Landlord shall furnish cold water for drinking and toilet purposes and cold and hot water for lavatory purposes. To the extent Tenant needs water for any other purposes and the purpose is approved by Landlord, Tenant shall pay, as Additional Rent, the cost of installing separate meters for that water as well as the cost for that water at rates specified by the water utility without markup. |

|

(D) Electricity and Natural Gas. Electricity for outlets and overhead lights used in the Premises and natural gas supplied to the Premises for heating purposes is supplied through a separate meter. Tenant shall be responsible for contracting directly with the electric and natural gas utilities chosen by Landlord to serve the Project and shall pay, as and when due, the cost of those services. |

|

(A) Communication Services. The installation or change of any signal, communication, data, alarm or other utility or similar service connections by Tenant must be made in accordance with the requirements relating to Alterations. Tenant shall not install in the Premises and equipment that requires more dedicated electrical current than for which the current Building Systems are currently rated without the prior consent of Landlord, which consent shall not be unreasonably withheld, conditioned or delayed. Notwithstanding the foregoing, it shall be reasonable for Landlord to condition its approval on, among other things, Tenant installing at its cost and expense and in accordance with the |

-13-

requirements relating to Alterations those meters and other equipment as required by Landlord (and paying the cost of the electricity consumed by Tenant’s equipment). Tenant shall ascertain from Landlord the maximum amount of load or demand for use of electrical current that can safely be permitted in the Premises, taking into account the capacity of the electric wiring in the Building and the needs of other tenants of the Building, and shall not in any event connect a greater load than that safe capacity. Tenant shall not tamper with any other Building utility system, or run cable or pipe between suites, without Landlord’s prior consent.

|

(B) Telephone. Tenant shall arrange for telephone service in the Premises directly with the telephone service provider selected by Landlord. Tenant shall pay directly to that provider, as and when due, the costs related to the installation and service. |

|

(C) Separate Service. If Landlord is not required to provide a particular service to all tenants of the Project, but provides that service to Tenant, or to Tenant and some but not all tenants of the Project, then the cost of that service shall be apportioned among the tenants provided with that service. If Tenant is the sole party to whom Landlord provides a service, Tenant shall pay to Landlord the entire cost of that service. |

-14-

such portion of the Premises. Landlord shall use commercially reasonable efforts to minimize the duration of an Abatement Event within Landlord’s reasonable control, provided that in addition to such right to abate Base Rent and Additional Rent, Tenant shall have the right to commence appropriate legal proceedings (including, without limitation, an action for injunctive relief, but excluding any action or claim for damages) against Landlord in connection with an Abatement Event following expiration of the Eligibility Period. Except as provided in this Section 5.8, nothing contained herein shall be interpreted to mean that Tenant is excused from paying Rent due hereunder. For purposes of this Section 5.8, a “material restriction” shall mean a restriction of services, utilities or access such that Tenant cannot reasonably use the Premises as permitted by this Lease.

Section 6 – Damage to Premises

|

(A) Subject to Section 6.2, if the Project is damaged by fire or other casualty, Landlord shall restore the damage to the Premises to the same condition as existed on the Rent Commencement Date exclusive of any Alterations. Landlord shall commence the repair, restoration or rebuilding thereof within ninety (90) days after that damage and shall substantially complete the restoration, repair or rebuilding as promptly as practicable after the commencement thereof, subject to delays caused by events of Force Majeure or by the acts or omissions of Tenant or any Tenant Party. Landlord shall promptly and diligently seek adjustment of insurance proceeds after any casualty. |

|

(B) If the fire or other casualty or the repair, restoration or rebuilding required by Landlord shall render the Premises untenantable in whole or in part, then Base Rent and Additional Rent shall proportionately abate from the date when the damage occurred until the date on which the Premises are in the condition required by this Section 6.1. The proportion shall be computed on the basis that the Rentable Square Feet of the portion of the Premises rendered untenantable and not occupied by Tenant bears to the aggregate Rentable Square Feet of the Premises. |

|

(A) If the casualty results in damage to the Premises that Landlord reasonably estimates will take in excess of (i) twelve (12) months after the beginning of restoration to restore the Premises to the same condition as existed on the Rent Commencement Date (but excluding Alterations) and occurs at any time during the Term or (ii) three (3) months after the beginning of restoration to restore the Premises to the same condition as existed on the Rent Commencement Date (but excluding Alterations) and occurs during the last two (2) years of the Term, as extended, then in either case either Landlord or Tenant may elect to terminate this Lease upon giving notice of its election to the other party within sixty |

(60) days after the casualty. If the casualty results in damage to the Project that results in the same restoration periods as set forth above, or the restoration is prohibited by any Governmental Regulation or the insurance proceeds are insufficient or not available, then Landlord may elect to terminate this Lease upon giving notice of the election to Tenant within sixty-five (65) days after the casualty.

|

(B) If this Lease is terminated as provided above, the termination shall be effective on the date specified in the first notice received by the other party, but no earlier than thirty (30) days after the occurrence of the event causing the damage. In such event, Tenant shall be obligated to pay the Rent accrued to the effective date of the termination, less any Rent abated pursuant to Section 6.1, which obligation shall survive termination. Unless this Lease is terminated by either party as provided in this Section 6, this Lease shall remain in full force and effect, notwithstanding the damage or casualty. |

-15-

|

7.1 Total Condemnation. In the event of a Substantial Taking of the Project (defined below), both Landlord and Tenant shall have the right to terminate this Lease by notice to the other within thirty |

(30) days after the date of the effectiveness of that taking. “Substantial Taking of the Project” means a Taking (defined below) either of the entire Project or a portion thereof, and in Landlord’s commercially reasonable opinion, the remainder of the Project cannot be restored to an economically viable first-class industrial and office building without either substantial alteration of the Project or relief from Governmental Regulation. “Taking” means a taking or condemnation for a public or quasi-public use by a competent governmental authority. If this Lease is terminated pursuant to this Section 7.1, the Term shall terminate upon the delivery of possession to the condemning authority and Tenant shall pay the Rent accruing to the date of termination. If neither Landlord nor Tenant terminates this Lease within the applicable time period, this Lease shall continue in full force and effect, as modified pursuant to Section 7.2.

|

7.2 Partial Condemnation. If a Taking occurs that does not entitle Landlord or Tenant to terminate this Lease under Section 7.1 or if neither Landlord nor Tenant exercises a right to terminate this Lease granted under Section 7.1, then Landlord shall repair and restore the Project to the extent practicable, to the condition as existed on the Rent Commencement Date, excluding any Alterations, except that Landlord is not required to expend for repair and restoration any sum in excess of an amount equal to the Award (defined below). If as a result of the Taking, the Rentable Square Feet of the Premises is permanently reduced, Base Rent and Additional Rent shall proportionately abate from the date when possession of the portion of the Premises is given to the condemning authority. In addition, if the repair, restoration or rebuilding required by Landlord as a result of that Taking renders the Premises untenantable in whole or in part, Base Rent and Additional Rent shall proportionately abate from the date when possession of the Premises is given to the condemning authority until the date on which the Premises are, as nearly as practicable, in the condition as existed on the Rent Commencement Date, excluding any Alterations. The proportionate abatement shall be computed on the basis that the Rentable Square Feet of the Premises either reduced or rendered untenantable and not occupied by Tenant bears to the aggregate Rentable Square Feet of the Premises. |

Section 8 – Assignment and Subletting

|

(A) Tenant shall not assign, pledge or encumber this Lease or any interest under it or sublet all or any portion of the Premises (individually or collectively, a “Transfer”), without Landlord’s (and, if required by the terms of a mortgage or ground lease, the mortgagee’s and ground lessor’s) consent. Landlord’s consent shall not be unreasonably withheld, conditioned or delayed with respect to a Transfer. Each of the following shall also constitute a Transfer (excluding in each instance the transfer of any publicly traded stock): the dissolution, merger or consolidation of Tenant; any issuance, sale, gift, transfer or redemption of any ownership interest in Tenant or any entity holding a direct or indirect ownership interest in Tenant (whether voluntary, involuntary or by operation of law, or any combination of the foregoing) that causes a change in any of the direct or indirect power to affect the management or policies of Tenant; or any direct or indirect change in 25% or more of the ownership interest in Tenant. |

-16-

|

8.4 Approved Transferees. Notwithstanding the foregoing, Tenant may assign its interest in this Lease or sublet any portion of the Premises without Landlord’s consent to any of the following (collectively, “Approved Transferees”): (i) any corporation which controls, is controlled by, or is under common control with Tenant, provided that the net worth of such corporation at the time of the proposed sublease or assignment is equal to or greater than Tenant’s net worth as of the Effective Date; (ii) any corporation resulting from the merger or consolidation of Tenant, provided that the resulting corporation has a net worth equal to or greater than Tenant’s net worth as of the Effective Date; (iii) any person or entity which acquires all the assets of Tenant as a going concern of the business that is being conducted on the Premises, provided that the resulting person or entity has a net worth equal to or greater than Tenant’s net worth as of the Effective Date. At least ten (10) business days prior to any transfer to an Approved Transferee, Tenant shall provide written notice to Landlord of such transfer along with information reasonably necessary for Landlord to verify that such transferee constitutes an Approved Transferee. |

|

8.5 Transfer Premium. Except with respect to an Approved Transfer, if Tenant shall Transfer this Lease or any part of the Premises for consideration in excess of the pro-rata portion of Rent applicable to the space subject to the Transfer, then Tenant shall pay to Landlord as Additional Rent, fifty percent (50%) of any such excess within ten (10) days after Tenant has recouped its out-of-pocket costs and expenses incurred on account of attorneys’ fees, market brokerage commissions and reasonable tenant improvement costs granted in connection with such Transfer including, but not limited to key money, bonus money or other cash consideration paid by an Approved Transferee to Tenant in connection with such Transfer, and any payment in excess of fair market value for services rendered by Tenant to such Approved |

-17-

Transferee or for assets, fixtures, inventory, equipment, or furniture transferred by Tenant to such Approved Transferee in connection with such Transfer.

|

9.2 Exterior Signage. Tenant shall have (i) the nonexclusive right to have its name or its trade name or such other name as Landlord may reasonably approve displayed on the Building’s current monument signage and (ii) the right to install Building top signage in a location mutually agreed upon by Landlord and Tenant (collectively, “Tenant’s Exterior Signage”), subject to the following: |

|

(A) Tenant’s Exterior Signage must (i) comply with all applicable governmental laws, statutes, rules, codes and ordinances, (ii) be approved in advance by all appropriate governmental authorities, (iii) be approved in advance by Landlord, in Landlord’s reasonable discretion, and (iv) comply with all other matters of record affecting the Building. Without limiting the generality of the foregoing, Landlord shall have the right to specifically approve the size, location, design, fabrication material and lighting of Tenant’s Exterior Signage prior to the installation thereof, which approval shall not be unreasonably withheld, conditioned or delayed. |

|

(B) Once all required approvals have been obtained for Tenant’s Exterior Signage pursuant to Section 9.2(A), Tenant shall cause the fabrication and installation of Tenant’s Exterior Signage, all at Tenant’s cost and expense. Tenant shall also be responsible for the cost of any changes to Tenant’s Exterior Signage (which changes must be pre-approved by Landlord in its reasonable discretion). |

|

(C) Tenant shall maintain, at Tenant’s sole cost and expense, Tenant’s Exterior Signage in good repair and condition during the Term. |

|

(D) Tenant’s right to display its name on the monument signage at the Building or on the Building exterior shall expire concurrently with the expiration or earlier termination of this Lease. |

|

(E) Landlord shall have the right to re-locate, re-design or re-construct the Building’s monument signage from time to time. |

|

(F) Other than to an assignee of this Lease that is either permitted hereunder or to which Landlord’s consents, Tenant’s right to display its name on the monument signage at the Building on the Building exterior pursuant to this Section 9.2 may not be assigned, transferred or otherwise conveyed to any other party. |

Section 10 – Defaults and Remedies

|

10.1 Tenant Events of Default. Each of the following constitutes an event of default (an “Event of Default”) hereunder: |

-18-

|

(A) Rent. If Tenant fails to pay Rent on the date due and that failure continues for a period of five (5) days after written notice from Landlord; or |

|

(B) Insurance. If Tenant fails to maintain the insurance required to be maintained by Tenant hereunder and that failure is not cured within the time period set forth in Section 4.4; |

|

(C) |

Abandonment. Tenant abandons the Premises; or |

|

(D) Transfer. A Transfer (other than an Approved Transfer) occurs without Landlord’s consent as provided herein; or |

|

(E) |

Bankruptcy. One of the following credit defaults occurs: |

|

(1) Tenant or any guarantor of this Lease commences any proceeding under any law relating to bankruptcy, insolvency, reorganization or relief of debts, or seeks appointment of a receiver, trustee, custodian or other similar official for Tenant or any guarantor of this Lease or for any substantial part of its respective property, or any of those proceedings is commenced against Tenant or any guarantor of this Lease and either remains undismissed for a period of sixty (60) days or results in the entry of an order for relief against Tenant or any guarantor of this Lease that is not fully stayed within thirty (30) days after entry; or |

|

(2) Tenant or any guarantor of this Lease becomes insolvent or bankrupt, does not generally pay its respective debts as they become due, or admits in writing its inability to pay its debts, or makes a general assignment for the benefit of creditors; or |

|

(3) Any third party obtains a levy or attachment under process of law against Tenant’s leasehold interest or other property or assets or any property or assets of any guarantor; or |

|

(F) Violation of Prohibited Activities. If Tenant or any other party using or occupying the Premises engages in any of the activities prohibited under Section 1.5(B), or if a violation of any of the provisions of Section 1.5(B) otherwise occurs; or |

|

(G) Other Defaults. If Tenant is in default under any other provision of this Lease (other than those specified above) and remains so for a period of thirty (30) days after Landlord has provided notice to Tenant of that default, but if that default cannot reasonably be remedied by Tenant within thirty |

(30) days after notice of default, then Tenant shall have additional time as is reasonably necessary to remedy the default if during that time Tenant is continuously and diligently pursuing the remedy necessary to cure the default.

|

(A) Landlord’s Remedies. Upon the occurrence of an Event of Default that remains uncured after receipt of written notice and expiration of the applicable cure period, Landlord may: |

|

(1) Termination of Lease. Terminate this Lease and Tenant shall pay to Landlord, upon demand, an accelerated lump sum amount equal to the amount by which Landlord’s commercially reasonable estimate of the aggregate amount of Rent owing from the date of termination through the scheduled expiration date of the Term, plus Landlord’s commercially reasonable estimate of the aggregate expenses of reletting the Premises (including brokerage fees, unamortized leasing commissions and tenant concessions incurred or estimated to be incurred by Landlord; costs of removing and storing any property in the Premises; costs of repairing, altering, remodeling or otherwise putting the |

-19-

Premises into condition acceptable to new tenants; and all reasonable expenses incurred by Landlord in pursuing its remedies, including reasonable attorneys’ fees and court costs [collectively, “Reletting Costs”]), exceeds Landlord’s commercially reasonable estimate of the fair rental value of the Premises for the same period (after giving effect to the time needed to relet the Premises) both discounted to present value at the rate at which U.S. Treasuries are then yielding for a term closest to the scheduled expiration date of the Term; or

|

(2) Termination of Possession. Terminate Tenant’s right of possession of the Premises without termination of this Lease, re-enter the Premises by summary proceedings or otherwise, expel Tenant and remove all property therefrom, using the level of effort mandated by the laws of the state where the Premises are located to relet the Premises at market rent (and Landlord is permitted to relet any other vacant space in the Building prior to reletting the Premises) and receive the rent from reletting, and Tenant is not entitled to receive any of that rent and remains liable for the equivalent of the amount of all Rent reserved herein less the proceeds of reletting, if any, after deducting therefrom the Reletting Costs. Any and all monthly deficiencies payable by Tenant under this clause shall be paid monthly on the date herein provided for the payment of Base Rent; or |

|

(3) Application of Amounts Owed to Tenant. Apply against any amounts owed by Landlord to Tenant, any amounts then due and payable by Tenant to Landlord; or |

|

(4) Right to Cure. At its option, perform any obligations of Tenant under this Lease and all costs and expenses incurred by Landlord in performing those obligations, together with interest thereon at the Default Rate from the date incurred until paid in full, shall be reimbursed by Tenant to Landlord on demand and constitute Rent for purposes of this Lease; or |

|

(5) Property. Re-enter, seize and take possession of Tenant’s personal property, fixtures and equipment located at the Premises, all of which shall be deemed abandoned by Tenant, and to sell that property at public or private sale. |

|

(B) Additional Landlord Remedies. Tenant further agrees that the Rent constitutes the value of Tenant’s occupancy of the Premises, and if Tenant fails to pay any Rent as set forth herein, the unpaid Rent shall constitute an allowed super-priority administrative expense in favor of Landlord to which Landlord is entitled to immediate payment, in full, and Tenant shall agree to enter into an order to that effect in a bankruptcy case. |

|

(C) Landlord Remedies Cumulative. Any and all remedies of Landlord set forth in this Lease: (i) are in addition to any and all other remedies Landlord may have at law or in equity, (ii) are cumulative, and (iii) may be pursued successively or concurrently as Landlord may elect. The exercise of any remedy by Landlord does not constitute an election of remedies or preclude Landlord from exercising any other remedies in the future. |

|

(A) Landlord shall be in default under this Lease if Landlord breaches any provision of this Lease and that breach remains uncured for a period of thirty (30) days after Tenant has provided notice to Landlord of the breach, but if that breach cannot reasonably be remedied by Landlord within thirty |

(30) days after notice of breach, then Landlord shall have additional time as may be reasonably necessary to remedy the breach if during that time Landlord is continuously and diligently pursuing the remedy necessary to cure the breach.

-20-

Section 11 – Covenant of Quiet Enjoyment

Landlord covenants that Tenant, on payment of the Rent and performance of the covenants and agreements set forth herein, shall peaceably and quietly have, hold and enjoy the Premises during the Term without interference of any person claiming through Landlord.

|

(A) Unless elected otherwise by the ground lessor, ground lessee or mortgagee, as the case may be, this Lease shall be subordinate to any present or future ground lease or mortgage respecting the Project, and any amendments thereto. That subordination is effective on condition that the ground lessor, ground lessee or mortgagee and Tenant enter into a commercially reasonable subordination, nondisturbance and attornment agreement in recordable form which provides in substance that so long as Tenant is not has not committed an Event of Default under this Lease that remains uncured after receipt of written notice and expiration of the applicable cure period, its use and occupancy of the Premises shall not be disturbed, notwithstanding any default of Landlord under such mortgage. |

|

(B) If any ground lease is terminated or mortgage foreclosed or deed in lieu of foreclosure given, Tenant shall attorn to that ground lessor or mortgagee or purchaser at that foreclosure sale, and this Lease shall continue in effect as a direct lease between Tenant and the ground lessor, mortgagee or purchaser. The ground lessor, ground lessee or mortgagee or purchaser shall (1) be liable as Landlord only for the obligations of Landlord accruing after that ground lessor, ground lessee or mortgagee or purchaser has taken fee title to the Building or Project and (2) not be liable for (a) any Rent paid more than thirty (30) days in advance or (b) any offsets, claims or defenses that Tenant may have against the previous Landlord. Tenant shall within ten (10) days after request by Landlord or ground lessor, ground lessee, mortgagee or purchaser (in case of attornment), execute and deliver to the requesting party a subordination, non-disturbance and attornment agreement substantially in the form then used by the requesting party. |

|

(C) Landlord hereby confirms that as of the Effective Date, the Building is unencumbered by any mortgage financing. Notwithstanding the foregoing, the subordination of this Lease from and after the Effective Date to any future mortgage shall be subject to, and conditioned upon, Tenant’s execution and delivery of a commercially reasonable non-disturbance agreement from Landlord’s mortgagee (an “SNDA”) in recordable form which provides in substance that so long as Tenant has not committed an Event of Default under this Lease that remains uncured after receipt of written notice and |

-21-

expiration of the applicable cure period, its use and occupancy of the Premises shall not be disturbed, notwithstanding any default of Landlord under such mortgage.

|

12.3 Definitions. As used in this Section 12, “mortgage” includes “trust deed” and “deed of trust” and “mortgagee” includes “trustee,” “beneficiary” and the mortgagee of any ground lessee, and “ground lessor,” “mortgagee,” and “purchaser at a foreclosure sale” includes, in each case, all of its successors and assigns, however remote. |

|

13.2 Indemnity by Landlord. Subject to the waivers of subrogation provided for hereunder, Landlord shall protect, indemnify, defend and save harmless Tenant for, from, against and regarding any and all foreseeable or unforeseeable Claims, including reasonable attorneys’ fees, to the extent arising out of (a) a breach of this Lease by Landlord or (b) the gross negligence or willful misconduct of Landlord. |

|

13.3 Indemnity Claims Process. Tenant shall pay any amounts that become due to Landlord under this Section 13 within ten (10) days after Landlord’s demand, and if not timely paid, those amounts shall bear interest at the Default Rate from the date of demand until paid. Tenant, at its expense, shall contest, resist, and defend any claim, action, or proceeding asserted or instituted against Landlord or any Landlord Indemnified Parties, with counsel acceptable to Landlord, in its discretion, and shall not, under any circumstances, compromise or otherwise dispose of any suit, action, or proceeding without obtaining Landlord’s prior consent. Tenant shall have the right to control the defense or settlement of any Claim if |

(a) Tenant shall first confirm in writing to Landlord that Tenant is obligated under this Section 13 to indemnify Landlord and (b) Tenant pays any and all amounts required to be paid in respect of the Claim. If Tenant controls the defense or settlement of the Claim then any compromise or settlement shall require the prior approval of Landlord, which approval shall not be unreasonably withheld if Landlord (or the applicable Landlord Indemnified Party) is irrevocably released from all liabilities and losses in connection with the Claim as part of the settlement or compromise. Landlord, at its election and sole cost and expense, may, but is not obligated to, participate in the defense of any Claim. If Tenant does not act promptly and completely to satisfy its indemnification obligations, Landlord may resist and defend the Claims against Landlord or any Landlord Indemnified Party at Tenant’s sole cost.

|

13.4 Survival. The provisions of this Section 13 shall survive the expiration or termination of this Lease with respect to any Claims asserted against Landlord, or asserted by Landlord directly against Tenant, within any applicable statute of limitations. |

-22-

Upon the expiration or earlier termination of this Lease, Tenant shall peaceably leave and surrender the Premises to Landlord broom clean and otherwise in the condition in which the Premises are required to be maintained by the terms of this Lease, reasonable wear and tear and casualty and condemnation excepted. Tenant shall surrender all keys for the Premises to Landlord and shall inform Landlord of the combinations to all locks, safes and vaults in the Premises. At or prior to the expiration or termination of this Lease, Tenant shall, at its expense, remove from the Premises all furnishings, fixtures and equipment situated thereon and the Alterations that are required to be removed under Section 3.2, and repair any damage caused by that removal. However, Tenant shall not remove any equipment, conduits or fixtures providing water, plumbing, electricity, heating, ventilation, air conditioning, lighting, life safety, sprinkler or sewer service to the Premises, regardless of whether the same were installed by or on behalf of Tenant or Landlord. Any furnishings, fixtures and equipment not removed by Tenant shall (if not already) become Landlord’s property upon the expiration or earlier termination of this Lease and shall be conclusively presumed to have been conveyed to Landlord under this Lease via a bill of sale without payment or credit by Landlord to Tenant. Landlord may remove any property not removed by Tenant and store and/or retain or sell that property, and Tenant shall pay Landlord the cost of the removal, storage and disposition as well as the cost of repairing any damages caused by the removal within thirty (30) days after demand. Tenant’s obligations under this Section 14 survive the expiration or earlier termination of this Lease.

Section 15 – Hazardous Materials

|