United States Securities and Exchange Commission

Washington , D.C. 20549

FORM 10-K

| þ | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2012

or

| ¨ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from __________ to ____________

Commission File No. 000-53285

Iveda Solutions, Inc.

(Exact name of registrant as specified in its charter)

|

Nevada (State of incorporation) |

20-2222203 (I.R.S. Employer Identification No.) |

|

1201 S. Alma School, Suite 8500 Mesa, Arizona (Address of principal executive offices) |

85210 (Zip code) |

Registrant’s telephone number, including area code: (480) 307-8700

Securities registered pursuant to Section 12(b) of the Exchange Act – None

Securities registered pursuant to Section 12(g) of the Exchange Act – Common Stock - $0.00001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o Accelerated filer o Non-accelerated filer o

Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act): Yes o No x

The aggregate market value of voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold was approximately $15,044,892 as of the last business day of the registrant’s most recently completed fiscal quarter.

As of March 15, 2013, 22,611,048 shares of the registrant’s common stock were outstanding.

IVEDA SOLUTIONS, INC.

Table of Contents

| Page | ||

| Part I | ||

| ITEM 1 – BUSINESS | 3 | |

| ITEM 1A – RISK FACTORS | 19 | |

| ITEM 1B – UNRESOLVED STAFF COMMENTS | 28 | |

| ITEM 2 – PROPERTIES | 28 | |

| ITEM 3 – LEGAL PROCEEDINGS | 28 | |

| ITEM 4 – MINE SAFETY DISCLOSURES | 28 | |

| Part II | ||

| ITEM 5 – MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 29 | |

| ITEM 6 – SELECTED FINANCIAL DATA | 30 | |

| ITEM 7 – MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 30 | |

| ITEM 7A – QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 37 | |

| ITEM 8 – FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 37 | |

| ITEM 9 – CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 38 | |

| ITEM 9A – CONTROLS AND PROCEDURES | 38 | |

| ITEM 9B – OTHER INFORMATION | 39 | |

| Part III | ||

| ITEM 10 – DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 40 | |

| ITEM 11 – EXECUTIVE COMPENSATION | 45 | |

| ITEM 12 – SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 47 | |

| ITEM 13 – CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 48 | |

| ITEM 14 – PRINCIPAL ACCOUNTANT FEES AND SERVICES | 48 | |

| Part IV | ||

| ITEM 15 – EXHIBITS AND FINANCIAL STATEMENT SCHEDULES | 49 |

| 2 |

Caution Regarding Forward-Looking Information

In addition to historical information, this Form 10-K contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (PSLRA). This statement is included for the express purpose of availing Iveda Solutions, Inc. of the protections of the safe harbor provisions of the PSLRA.

All statements contained in this Form 10-K, other than statements of historical facts, that address future activities, events or developments are forward-looking statements, including, but not limited to, statements containing the words “believe,” “expect,” “anticipate,” “intends,” “estimate,” “forecast,” “project,” and similar expressions. All statements other than statements of historical fact are statements that could be deemed forward-looking statements, including any statements of the plans, strategies and objectives of management for future operations; any statements concerning proposed new products, services, developments or industry rankings; any statements regarding future revenue, economic conditions or performance; any statements of belief; and any statements of assumptions underlying any of the foregoing. These statements are based on certain assumptions and analyses made by us in light of our experience and our assessment of historical trends, current conditions and expected future developments as well as other factors we believe are appropriate under the circumstances. However, whether actual results will conform to the expectations and predictions of management is subject to a number of risks and uncertainties described under Item 1A – Risk Factors beginning on page 19 below that may cause actual results to differ materially.

Consequently, all of the forward-looking statements made in this Form 10-K are qualified by these cautionary statements and there can be no assurance that the actual results anticipated by management will be realized or, even if substantially realized, that they will have the expected consequences to or effects on our business operations. Readers are cautioned not to place undue reliance on such forward-looking statements as they speak only of the Company’s views as of the date the statement was made. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

PART I

All references in this Form 10-K to the terms “Iveda Solutions, Inc.,” “Iveda,” “Company,” “we,” “us,” and “our” refer to Iveda Solutions, Inc. and our predecessors, unless the context otherwise requires.

ITEM 1 – BUSINESS

General

Iveda Solutions, Inc. began operations on January 24, 2005, under the name IntelaSight, Inc., a Washington corporation doing business as Iveda Solutions (“IntelaSight”). On October 15, 2009, IntelaSight completed a reverse merger with Charmed Homes, Inc., a Nevada corporation (“Charmed”), pursuant to which IntelaSight became a wholly-owned subsidiary of Charmed and Charmed changed its name to Iveda Corporation.

All Company operations were conducted through IntelaSight until December 31, 2010, at which time IntelaSight merged with and into Iveda Corporation and Iveda Corporation changed its name to Iveda Solutions, Inc.

The Company’s principal executive offices are located at 1201 S. Alma School Rd., Suite 8500, Mesa, Arizona 85210.

On April 30, 2011, the Company completed its acquisition of Sole-Vision Technologies, Inc. (doing business as MegaSys) (“MegaSys”). MegaSys was incorporated in the Republic of China (Taiwan) on July 5, 1999. MegaSys is in the business of design and manufacturing of central security management system products and providing security integration solutions. MegaSys specializes in deploying new and integrating existing video surveillance systems for airports, commercial buildings, government customers, shopping centers, hotels, banks, and Safe City initiatives in Taiwan and other neighboring countries.

MegaSys’ headquarters are located at 2F,-15, No. 14, Lane 609, Sec. 5, Chongxin Rd. ,Sanchong City, Taipei County 241, Taiwan (R.O.C.)

Business Operations

Overview

Iveda Solutions, Inc. is an established and innovative company, delivering secure, open source and enterprise class managed video services by leveraging the power of cloud computing. The Company’s robust enterprise class video hosting architecture, utilizing data centers, allows scalability, flexibility, and centralized video management, access, and storage, without the burden of buying and maintaining software and equipment. Iveda Solutions’ customers simply log in online, access their cameras and begin watching live and/or recorded video data from anywhere in the world at any time using any Internet enabled device. From one camera locally to hundreds around the world, each camera can be accessed from one secure login. Iveda Solutions delivers the true essence of video surveillance through cloud computing, like no other.

| 3 |

The Company’s open-source technology is interoperable with any existing camera system and enables multiple, simultaneous access without degradation of video quality. Utilizing video hosting technology, Iveda Solutions revolutionizes the functionality of security cameras, through a proactive real-time surveillance service rather than event or trigger-based system.

There are millions of security cameras in the U.S. today; a great majority of which run unmonitored. Oftentimes, they cannot be used to stop a crime in progress, and are merely observers keeping silent record of any illegal activity. Iveda Solutions takes security beyond boundaries by ensuring that each camera in its care remains under expertly-trained eyes. By placing a person behind the lens, a security camera goes from mute witness to active patroller, fully capable of police dispatch and assistance as events unfold. Officers can often be directed to the scene before a criminal has left the premises, leading to a higher arrest rate and greatly increasing the likelihood of recovering any stolen goods.

To management’s knowledge, at this time, Iveda Solutions is the only major provider of enterprise class real-time video surveillance in the U.S.

MegaSys, our Taiwanese subsidiary, specializes in deploying video surveillance systems for airports, commercial buildings, government customers, data centers, shopping centers, hotels, banks, and Safe City initiatives in Taiwan and other neighboring countries. MegaSys integrates security surveillance products, software and services to provide integrated security solutions to the end user. Most of MegaSys’s revenues are derived from one-time sales, which differs from Iveda’s business model of on-going video hosting, remote video storage, and real-time surveillance revenues. MegaSys does not own any proprietary technology or intellectual property other than certain trademarks in China and Taiwan used in its business.

Historically, Iveda has derived revenues from security systems integration, equipment sales and installation, conversion of analog cameras to digital, and per hour, per camera service fees from video hosting and real-time surveillance. Additional revenues are derived from extended video storage and extended maintenance contracts. Iveda has grown only through direct sales of equipment/installation and video surveillance services through its direct sales team. In June 2012, Iveda began transition from direct to indirect sales channel by signing up independent representative agents and their network of security integrators. Iveda is building its reseller distribution channels to to sell predominantly through resellers. As the reseller channel matures, Iveda’s channel partners are expected to take over its equipment sales and installation functions, and help drive Iveda’s recurring service revenue.

After months of rigorous application and due diligence process, in April 2009, Iveda Solutions was approved as a Qualified Anti-Terrorism Technology provider under a formal SAFETY Act Designation by the Department of Homeland Security (DHS). The designation gives the Company, its partners and customers certain liability protection. Iveda Solutions is the first and currently the only company, offering real-time IP video hosting and remote surveillance services with a SAFETY Act Designation.

In October 2009, the Company completed a reverse merger with a publicly traded company. The Company’s stock is now trading on the Over-The-Counter Bulletin Board (OTCBB) under the trading symbol “IVDA.”

In September 2010, Iveda Solutions acquired its first international customer. The Company is now providing IvedaOnBoard, its in-vehicle live streaming video service, and remote video storage to a government agency in Mexico.

In April, 2011, Iveda Solutions completed the acquisition of MEGAsys Taiwan. MEGAsys designs and manufactures electronic security and surveillance products, software, and services. MEGAsys was founded in 1998 by a group of sales and research and development professionals from Taiwan Panasonic Company. Iveda Solutions leverages MEGAsys’ relationships with manufacturing and software companies in Asia, potentially reducing costs and improving services and capabilities. The acquisition also opens doors to the Asian market.

In October 2011, Iveda Solutions signed a strategic collaboration agreement with Telmex, U.S.A., a subsidiary of the Mexico-based Telmex, the 4th largest telecommunications company in the world. Telmex has presence in the U.S., Latin America, Europe, and Africa. Telmex will collaborate with Iveda Solutions to build cloud-based video surveillance infrastructure in the markets they are in and resell Iveda Solutions’ services.

In November 2012, Iveda signed a cooperation agreement with Industrial Technology Research Institute (ITRI). ITRI is a research and development organization based in Taiwan. Iveda and ITRI have been co-developing cloud-video services. ITRI has given Iveda license to some of their patents being used in the development. Iveda will have exclusive rights to the products and services being co-developed.

Cloud Video Surveillance Services

Iveda has multiple recurring revenue streams based on its cloud-video management platform, including video hosting, in-vehicle mobile video streaming, real-time remote surveillance services, and live streaming video mapping service, using a combination of Internet-enabled cameras, a secure IP network infrastructure utilizing robust data centers, and intervention specialists. Iveda’s services are all web-based and accessible through any Internet-accessible device (e.g., computer, smartphone, tablets).

| 4 |

IvedaEnterprise

IvedaEnterprise is the Company’s managed video hosting platform and is the basis for the Company’s cloud-video surveillance products and service offerings. IvedaEnterprise utilizes a robust data center that is capable of hosting a massive number of live and recorded video from IP-enabled security cameras. This capability allows Iveda to offer real-time video surveillance, in-vehicle streaming video, remote simultaneous access, and data archiving services.

Hosting and remote access services are ideal for customers managing multiple locations. The user’s video is transmitted to the data center and distributed to an almost unlimited number of users simultaneously. Live and archived video can be accessed using any Internet-enabled device.

Benefits :

• One login, one interface to multiple cameras anywhere in the world

• Interoperable with most IP Cameras & CCTV with Video Encoders

• Anywhere, Anytime from any Internet-accessible Device

• Web-based, 24/7 Remote Live & Archived Video Access

• Centralized, Multiple Simultaneous Access

• Secure, High Reliability & Availability

• Fully Fault-Tolerant Data Center

IvedaXpress

IvedaXpress is a simple surveillance solution for home, office, or small business. It provides an inexpensive and easy to install enterprise-level camera management solution. While DVRs require hours of network setup and upkeep for an experienced IT professional, IvedaXpress is virtually effortless to set up. No software to install, no recording device to set up, and no configuration required. It is a plug and play video surveillance solution.

IvedaSentry

IvedaSentry is the Company’s real-time remote video surveillance service, providing remote, real-time surveillance of security cameras. Iveda’s remote surveillance facility is designed to be operational 24/7 and houses its highly trained intervention specialists who monitor its customer’s properties at any time the customers specify. Using sophisticated software, Iveda’s intervention specialists are there as events unfold and they can act accordingly on its customers’ behalf. By watching a customer’s cameras in real time, Iveda is able to notify the police more quickly than other companies that wait for an alarm to be triggered or only review tapes after-the-fact. Iveda is also able to send police a link to real-time video.

This proactive versus after-the-fact security solution monitors facilities live and analyzes and proactively responds to situations in real time. No waiting for alarms to be triggered. Human intervention behind the technology is a key component and is combined with Iveda’s DSR (Daily Surveillance Report), a proprietary reporting system that provides customers a detailed daily report of events. Real-time video surveillance provides live visual verification, eliminating costly false alarms and escalating police response priorities.

Traditional security services are classified into two types: 1) electronic or non-human; and 2) security guard-based, comprised of humans patrolling a site and human surveillance via closed-circuit television (CCTV). While the former is generally considered to be affordable to the greater market, the latter still remains rather expensive. Several factors and market dynamics have contributed to demand for Iveda’s products and services, including:

| • | The recent wide-spread availability of high-bandwidth Internet connections (known as IP-based networks); |

| • | Drastic reductions in digital camera component costs; and |

| • | The introduction of innovative “smart scanning” software. |

As a result of these dynamics, management believes that Iveda is able to offer a superior combination of human video surveillance and electronic security systems at a lower price than other currently available human-based security services.

Benefits :

| · | Proactive versus after-the-fact – With humans behind the cameras assessing situations in real-time, they can call the police when necessary to prevent a crime. Recorded video footage only helps to investigate after a crime has already been committed. |

| · | Daily Monitoring Report – Every morning, customers get an activity report in their email box, consisting of time-stamped video footage and a detailed description of events from the previous night. |

| 5 |

| · | Cost Savings – Savings of up to 75% are possible compared to traditional guard services. |

| · | Secure Data – Iveda utilizes a third party, highly secure datacenter to process, store, and protect its customers’ video footage |

| · | Live Visual Verification – Several cities nationwide have adopted ordinances that impose a substantial fine for every false alarm. An alarm system may be declared a nuisance for excessive false alarms. Live video verification can reduce or even eliminate false alarms. With live video verification, police departments of some cities escalate response priority, depending on the seriousness of the event. |

| · | Redundancy – Video data are stored in Iveda’s datacenter, remote monitoring facility, and its customers’ facilities. |

Problems with Existing Systems

Electronic security tends to be extremely error prone. False alarms are so prevalent that cities and counties have sued alarm companies for the unnecessary allocations of available resources. When police officers have to be dispatched or re-directed to provide visual verification of a property that is emitting a false alarm, the cost in time and money becomes exorbitant.

While electronic security tends to be error prone, human security is often poorly trained and expensive. Unless well-trained security guards are present, human security is not viewed as a credible counter threat to a potential crime. While a security guard can give independent verification, cost can make guards prohibitive. A single security guard cannot be in several locations at the same time, resulting in a need for multiple guards to cover the entire property, at a per guard cost of $15 to $26 per hour.

Traditional security companies are proving to be slow to adapt to high-tech, IP-based networks, simply because their core competency does not include the sophisticated software, hardware, and Internet technology required. Companies that understand the technology are missing the knowledge of the security business and lack expertise in security systems design and the actual management of a crew of intervention specialists.

What management believes has been missing from the industry is a proactive security solution that will deter crime and help the police catch criminals in the act; not merely through using video data as an after-the-fact investigative tool for solving a crime. This security solution requires a company able to competently offer superior security systems and video communications via IP-based networks.

IvedaOnBoard

IvedaOnBoard utilizes any in-car camera available in the market today with our Streaming Video Converter (SVC) and IvedaEnterprise. IvedaOnBoard allows our customers real-time situational assessment of field activities. This untethered surveillance solution utilizes Wide-area data services such as cellular, mesh wireless, and Wi-Fi. Centralized video management of an entire mobile fleet includes high quality real-time streaming video and instant review of footage remotely, thus no need to have a recording device onboard.

IvedaPinpoint

IvedaPinpoint is a live streaming video mapping application and is a video management system (VMS) consolidator and online mapping service that shows location of surveillance cameras on Google Maps(TM) or other third party mapping platforms. Through a single login, users are able to pull live streaming video feeds from a centralized video management platform. IvedaPinpoint is completely web-based, accessible from any Flash-enabled browser on your computer or smartphone.

In collaboration with Pinkerton/Securitas, Iveda Solutions conducted a successful pilot of IvedaPinpoint at the 2012 G8/NATO meeting in Chicago. IvedaPinpoint was integrated into Pinkerton's Vigilance incident & trend data monitoring system, its cloud-based, 24/7 situational awareness and risk aggregation service that gathers data and evaluates threats.

Applications for IvedaPinpoint range from safe city, , executive protection, facility protection, border protection, supply chain security, transportation, utilities, federal and local governments. When a user clicks on a “Pinpoint” the live video of the camera will appear.

IvedaXchange

IvedaXchange uses cloud-based technology to provide a suite of threat assessment dashboards and alerting capabilities to schools, school districts, government agencies—or any organization wishing to upgrade their threat monitoring capability.

IvedaXchange enables school, law enforcement, emergency personnel and others to receive targeted emergency alerts, share key information on potential threats, and locate critical assets—students, staff, and buses, in real time.

| 6 |

Products

Iveda’s core competency is based on its cloud-video management platform. Iveda focuses on recurring service revenue, but we also sell and integrate products to enable Iveda services.

Express Surveillance System (ESS)

The Express Surveillance System (ESS) is a self-contained wireless surveillance unit, equipped with an integrated cellular router for an “always on” Internet connection. The camera is shipped pre-configured and ready for deployment on leading broadband cellular networks. All that is needed is a cellular data card and power.

The ESS is portable and remotely accessible, thus well suited for applications that require temporary high-quality video surveillance, such as special events, stake outs, and construction sites. The unit is bundled with IvedaEnterprise for a complete plug-and-play system, ideal for remote surveillance, where a typical ISP (Internet Service Provider) is not available and a local server or DVR is not practical. ESS enables fast and easy video surveillance deployment.

Streaming Video Converter (SVC)

The Streaming Video Converter (SVC) is a fully integrated device that combines the functionality of a high performance video encoder and cellular broadband router. This rugged and portable unit was specifically designed for digitizing analog in-vehicle mobile video systems. This digital conversion enables live mobile streaming video using cellular data network for remote access and storage. The SVC is capable of delivering up to four simultaneous video streams.

The device allows for rapid deployment of live mobile streaming video ideal for in-vehicle applications, such as police cars, school buses, taxicabs, delivery trucks, tow trucks, and freight trucks. With the SVC, video footage that is traditionally stored inside the vehicle through a local recording device can now be virtualized and stored remotely at Iveda’s fully fault-tolerant data center with no concerns of redundancy, reliability, and lost or damaged data.

Systems Integration

Our core competency is our ability to deliver cloud video management services. We offer our customers a variety of products that enable our services and from which we create customized solutions for our customers. We call these solutions our cloud video validators.

SafeCiti®

SafeCiti is a comprehensive turnkey solution for central management and processing of critical information and surveillance technology throughout an entire metropolitan area. Our SafeCiti solution offers infrastructure owners to effectively bridge the gap between their current technology capabilities with much needed upgrades and expansion of new capabilities. Iveda’s cloud technology promotes faster, more affordable public safety and security system implementation and all with much greater sustainability. MegaSys is our expert in SafeCiti deployments, having completed a large project for the New Taipei Police Department in 2010. The police department has awarded MegaSys additional SafeCiti deployments for $2.2 million in January 2012 and $1.3 million in December 2012.

Surveillance Equipment Installation and System Integration

Iveda partners with security integrators with expertise in full deployment of new IP-based video surveillance systems and converting existing analog or CCTV systems to IP-based systems. With these integrators, Iveda designs, recommends, sells, and installs camera systems to enable video hosting, real-time surveillance services, and mobile video services.

Technology Architecture

Iveda’s infrastructure utilizes the power of cloud computing. Cloud computing refers to applications running on a remote server instead of on a local computer, and the user accesses it via the Internet. Using a web browser, the user logs onto a hosted website to access account information and all computations and data manipulations are done at the server level.

Iveda has applied the same principle to create an IP video hosting platform, which paved the way for other service offerings such as real-time surveillance services and in-vehicle mobile streaming video. By consolidating computing power into a single location at the server level, Iveda creates efficiencies due to economies of scale, and offers more features and flexibility than ever before offered.

Iveda utilizes robust data centers that are capable of centrally hosting live and recorded video from a massive number of IP-enabled security cameras. Our HA (high-availability) IP (Internet Protocol) infrastructure is scalable, redundant, and secure.

Using cloud computing is a better way to consolidate surveillance video, especially if it is coming from disparate geographic locations or facilities. Instead of running multiple video recording devices (DVR) and software (NVR), the video is centrally hosted at a data center and the user accesses it using a Web browser. This is sometimes referred to as Managed Video as a Service (MVaaS), or Video Surveillance as a Service (VSaaS). When surveillance video is in the cloud, the user logs in through any Internet-accessible device, wherever the user may be. The user does not need to install proprietary software or worry about safety of recorded video. Everything is hosted and recorded remotely and can be accessed 24/7 using a web browser.

| 7 |

Getting surveillance video into the cloud can be set up almost immediately in many cases. Plus, upgrades and patches can be achieved remotely for immediate access to enhanced security, features and performance over time.

Access to multiple properties or locations anywhere around the world has never been easier. When surveillance video is in the cloud, the user has full access to it from anywhere with an Internet connection. Also a huge advantage of bringing surveillance video into the cloud is that you never have to worry about bandwidth when multiple users want to access video simultaneously.

Cloud-based video surveillance reduces capital expenditure. User cost to deploy is captured in a predictable monthly subscription fee.

Features :

| · | Internet Access - Allows customers 24/7 secure, remote access to video. |

| · | Data Center - Iveda utilizes data centers equipped with emergency power and redundant bandwidth. |

| · | VOIP - Iveda can utilize voice-over-IP to allow a 1-way or 2-way communication between its intervention specialists and suspicious individuals on its customers’ properties. |

| · | Camera Manufacturer Agnostic - Iveda can monitor security cameras from the majority of manufacturers, whether analog (CCTV) or digital. |

| · | Carrier/ISP Neutral - Iveda can work with customers’ current Internet providers as long as minimum bandwidth requirements are met. |

Network Camera IP-Based Technology .. Network camera IP-based technology is the core of Iveda’s security solution. The cameras Iveda utilizes are not typical Web cams or CCTV. They are all mini computers with enabled Web servers. Each camera has the capability of becoming its own Web site on the Internet, which allows Iveda’s intervention specialists to log into each camera and control the cameras’ operation. When combined with “PTZ” (pan, tilt, zoom) cameras, the intervention specialist can make the camera pan, tilt, zoom or rotate as needed remotely. Clients can also log into each camera through Iveda’s web access tool, and can view the images real-time, 24/7. The software that powers the camera technology is generally open source, which allows Iveda to develop unique applications in the future to service a wide variety of industries and clients.

Security . Iveda anticipates its customers’ video networks, which will include a variety of public sector security applications, will be high-value targets for criminals. As a result, Iveda’s network security standards must be and are very high, meeting standards used by banks in providing online banking services.

As the leading online surveillance provider, the security of surveillance video is always a priority at Iveda. We are committed to implementing stringent measures to ensure data stays secure. Multiple layers of network redundancy ensure the security of video assets. Every critical network component within the Iveda’’ Cloud is redundant; including a second copy of video to ensure stability, uptime, and that video is not lost.

Iveda’ networks are protected from external threats by ICSA certified products to block unauthorized external entry. Internal data and network access is controlled by permission and policy based ACLs.

Video security between the camera and the Iveda’s Cloud can be secured utilizing the IvedaXpress product which integrates AES 256 bit encryption into the connection between the camera and our Cloud. Video security can also be secured by incorporating encrypted VPNs (Virtual Private Network).

Iveda plans to continue to develop and improve its network security protocol as it rolls out new applications of its services. Of course, any network security measure can fail, and any security breach could result in significant liability for Iveda.

Remote Surveillance Center. Iveda’s 24-hour remote surveillance facility is the nerve center of its unique IP-enabled services. It is connected to the data center through a massive pipe of redundant point-to-point broadband bandwidth, which allows streaming video, enabling real-time video surveillance. Iveda has been monitoring cameras since 2005 and has proven the effectiveness, robustness, and reliability of its service. Some of the operational features of the facility include:

• Rapid visual verification to every alert

• Full escalation to the police

• Automatic notification to clients of serious incidents

| 8 |

• Full audit trail including date and time stamped images of every incident securely stored

• Video can be used for evidence in court

• Regular updated site details

• Specially-trained intervention specialists

• Direct visual link can be sent via email to police instantly

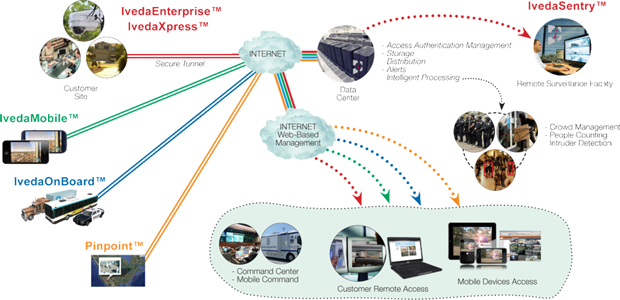

Below is a diagram of how the Iveda system works.

Pricing Strategy

Iveda’s cloud video hosting solutions provide a less expensive alternative to typical CCTV/DVR solutions and live human security guards. Iveda can affordably upgrade a standard CCTV system to an Internet-based surveillance system, through digital conversion. As a result of all of these factors, Iveda has removed several cost barriers for its customers.

| · | Less capital expenditure. No hardware or software to install. |

| · | Less operating expense, reduces overhead. No infrastructure to maintain and replace. |

| · | Reduced false alarm costs that are historically high for alarm-based security solutions. |

| · | No costly Virtual Private Network (VPN) required to link multiple cameras. |

| · | Integrating the customer’s existing cameras into its solution, reducing the high cost of purchasing and installing new cameras. |

Iveda has developed a pricing model for its products and services that will allow its resellers an attractive profit margin from residual revenues while allowing Iveda to garner about 60% profit margin when its video hosting infrastructure is fully utilized.

Equipment Sales and Installation. Iveda has historically realized a gross margin of 10% to 40% on equipment sales. Iveda does not manufacture any of the components used in its video surveillance services business. Due to the general availability of the components, Iveda is able to obtain the components of its systems from a number of different sources and to supply its customers with the latest technology generally available in the industry. Iveda is not dependent on any single source for its supplies and components and has not experienced any material shortages in the past. Typically, the Company does not maintain inventory of equipment.

In distribution channel sales, Iveda sells equipment to its resellers and integrators, who in turn sell the equipment to the end user. In certain select large corporate account sales, Iveda will sell the equipment directly to the large accounts, and in turn utilize integrators or other third parties for installation activities.

| 9 |

Cloud Video Hosting and Remote Surveillance. Upon full utilization of the current video hosting infrastructure, Iveda has implemented a pricing structure for its services at approximately a 60% gross margin. Gross margin may improve with software enhancements to enable intervention specialists to monitor more cameras at the same time, and when the cost of bandwidth drops with increased usage. Iveda compensates intervention specialists well and has historically attracted and retained high-quality and loyal employees, thus reducing the cost of turnover and training.

Video Data Storage. One day of video storage is provided free of charge with hosting service and seven days with real-time surveillance. The customer pays a minimal fee for each additional day of storage.

Maintenance Agreement. In the past, Iveda charged an additional 25% to 48% of the total equipment cost for an optional maintenance contract, payable upfront. Iveda’s maintenance agreement would cover what is not covered by the camera manufacturer’s 3-year warranty. Government customers typically request this contract. A recent new customer in Mexico has agreed to sign up for this service, along with video hosting, and extended video storage.

Government Contracts

Iveda plans to seek government contracts for its products and services. These contracts are typically awarded through a competitive bid process. Iveda intends to grow its business in part by obtaining new government contracts through the competitive bidding process. Sole-Vision has been successful in this arena and the Company has leveraged their expertise in potential Safe City projects in Mexico.

Certain agencies may also permit negotiated contracting. Contracts awarded through a competitive bidding process generally have lower profit margins than negotiated contracts because in a competitive bidding process bidders compete predominantly on price. The U.S. Federal government is the largest procurer of products and services in the world, and the Federal contract market may provide significant business opportunities for Iveda.

Private Sector Contracts

Private sector contracts can be awarded through either a competitive bidding process or a negotiating process. Unlike government contracts, the terms of private sector contracts can vary based on individual client situations. Price is not the only key element in winning contracts with this market segment. Other elements such as service quality, responsiveness and various peripheral services come into consideration. Iveda believes that the private sector represents the company’s largest growth potential. Private sector customers generally privately negotiate contracts for such services, resulting in contracts with higher profit margins because price is not always the primary basis for competition.

Customers

Iveda’s customers in 2012 included data centers, banks, storage facilities, homeowner associations, food processing plants, public pools and parks, and government agencies in Mexico and Asia. In 2012, the New Taipei City police department account for 69% of the Company’s overall revenue.

There are a large number of industries that could potentially benefit from Iveda’s video hosting, in-vehicle mobile video, and real-time surveillance services. As Iveda grows and increases public awareness of its services, it believes that it will acquire customers from a wide variety of industries.

| 10 |

The following is a sample list of the Company’s video surveillance service customers over the prior two years.

• American Security & Investigations

• City of El Mirage

• City of Mesa

• Farnsworth Realty

• Glendale Police, CA

• Green Valley Agriculture and Turf

• Helix Properties

• i/o Data Center

• Leisure World

• Mexican Government

• Pacific Coast Producers

• Porsche Dealership

• San Diego Police Department

• San Joaquin County Public Works

• Sun Eagle Corporation

• Sunland Storage

• Sunol Golf Course

• United Road Towing

• Watermark Community

• West Valley Child Crisis

The following is a sample list of SafeCiti, equipment sales, and systems integration customers over the prior two years:

• City of Glendale, CA

• Sui Industry

• New Taipei City Police Department

• Taiwan Stock Exchange

• Ystarding

• Taiwan Energy Systems

• Taoyuan County Council

• The Tivoli Cable Engineering

• Zhongxing

• Futai

• Secom Taipei

Market Segmentation

Iveda views the following markets as its primary target markets:

| · | Companies who wish to save on traditional security services, while maintaining live surveillance of their properties. |

| · | Customers who wish to integrate or enable an existing video surveillance system for hosted video and remote surveillance. |

| · | Real-time, in-vehicle streaming video accessibility for operational efficiency for transportation management and traffic safety. |

| · | Educational institutions that want to integrate surveillance systems in their facilities. |

| · | Security and remote surveillance of school playground areas, corridors, halls and classrooms. |

| · | Municipalities for Safe City projects. |

| 11 |

Business Strategy

Iveda is implementing the following business strategy:

| · | Reseller Sales: |

| o | Provide assistance to its growing reseller channel distribution to utilize resellers’ camera installed base and thereby seek to increase Iveda’s video surveillance subscribers. |

Build a high-caliber indirect channel sales team to support reps and integrators.

| o | Provide co-op marketing funds to resellers to promote Iveda products and services on our behalf utilizing their customer and prospect lists. |

| o | Fund demo units for product seeding of Iveda’s services in sales opportunities. |

| o | Fund road shows for live customer demos. |

| o | Build indirect sales channel to support |

| · | Marketing: |

| o | Conduct regional marketing campaigns in Iveda’s existing markets, while strategically launching in other key markets. |

| o | Expand online marketing and non-traditional viral marketing. |

| o | Participate in vertical and technology tradeshows. |

| o | Produce online and printed sales and marketing materials for end users and resellers. |

| o | Implement and manage PR and marketing campaigns. |

| o | Work with research firms on independent case studies, industry research, and white papers. |

| o | Enhance search engine optimization (SEO) of the Company’s websites. |

| · | Infrastructure/Security/Operations/R&D : |

| o | Develop new products with technology partners in India and Asia to enhance and enable Iveda’s video surveillance services. |

| o | Incorporate another layer of security to Iveda’s edge devices to further enhance the value of our products and services. |

| o | Fund in-house development of software for Iveda’s backend that may be patentable. |

| o | Further develop Cerebro, Iveda’s proprietary centralized security reporting system. |

| o | Fund backend equipment/hardware and software to demonstrate Iveda’s system capabilities to prospective enterprise clients (white label demos). |

| o | Qualify Iveda on safety and cyber security compliance requirements for government standards and expectations as well as fulfill customer commitment to be as secure as possible to garner customer trust and loyalty. |

| o | Provide a test lab environment which includes dedicated equipment and resources for further customer application testing, development and enhancements as well as new product and/or system evaluation. |

| 12 |

| · | International Business Development : |

| o | Form business alliances with overseas companies for revenue generation. |

| o | Fund customer demo meetings and presentations abroad. |

| o | Leverage MegaSys relationships with developers and manufacturing companies in Asia for cost reductions. |

| o | Leverage MegaSys’ acquisition to establish presence and access to the Asian market to implement Iveda’s recurring revenue model. |

| · | Mergers and Acquisition |

| o | Identify companies in Asia with broad market reach. |

| o | Explore companies with business and technologies that are complementary to ours. |

Sales Strategy

In the last two years, Iveda’s activities were geared toward building its global strategy, starting with its acquisition of MegaSys, which was completed on April 30, 2011. The Company hired a senior vice president of global sales and support to build and manage domestic and international sales.

Historically, Iveda generated sales through its direct sales force. In June 2012, Iveda began its transition to a reseller distribution channel program in the U.S. Iveda believes that leveraging resellers’ existing customer base, many of which already have cameras installed, provides a more effective strategy to grow the number of cameras the company hosts and monitors. Over the last few months, Iveda has built necessary sales and marketing tools to support the indirect sales channel including training modules, partner portal, demo program, datasheets, and co-op program. Iveda also transitioned its small direct sales team to channel sales managers and hired new members to the team with expertise in managing and developing indirect sales channel.

Management believes that once this indirect sales channel is fully trained and mobilized, it will expedite securing a larger percentage of the market by leveraging its channel partners’ customer base. This is also a potentially faster way to make Iveda a national provider of video surveillance services compared to relying solely on internal sales efforts. In October 2011, the Company signed an agreement with a large telecommunications company for them to resell Iveda’s products and services in the U.S. and Latin America. In 2012, Iveda has also signed ten independent manufacturers’ representatives which provide coverage to 42 states, the Carribean, and Canada. The names of the partner firms that have signed a partner agreement are as follows: Coaxial Systems Associates, Inc., GP Marketing, HMR Associates, IDMC Associates, Intech Sales, Langbaum & Associates, Milsk Company, R.W. Kunz & Associates, Warren Associates and SECURaGLOBE Solutions, Inc. Each rep firm has a network of security integrators that serve as their feet-on-the-street salesforce.

The Iveda Reseller Program is designed to build a community of dedicated Iveda partners to help realize its vision, while providing them with additional revenue streams and boosting their competitive edge by offering a security solution that makes sense. Iveda believes that the active partnerships between Iveda and its resellers will assist them in capturing market share before competitors are able to move into the market. The reseller receives 25% discount off of MSRP for reselling Iveda’s services. The reseller may decide to attain an even higher margin by charging its customers above MSRP.

| 13 |

Resellers are responsible for any issues regarding equipment they installed, including but not limited to: equipment maintenance, replacement, and training. Iveda will only be responsible for video surveillance service issues. It is the reseller’s responsibility to make sure that their installation is working properly to enable Iveda’s video surveillance services.

Reseller Benefits:

| · | Derive monthly recurring revenue stream from offering a complimentary service for their line of security products, without having to build network infrastructure for video surveillance services. |

| · | Camera deployments are normally a one-time sell, until it is time for a replacement. With Iveda, installers can offer a new service to their installed base to generate additional revenue from existing customers. |

| · | Leverage Iveda’s SAFETY Act Designation |

| · | Boost Competitive Edge & Value Proposition |

| · | Expand Technology Offerings & Integration Services |

Law Enforcement and Government Contracts

In 2012, Iveda sold approximately $345,653 in products and services to law enforcement, cities and municipalities in the U.S. and approximately $2,718,537 in Taiwan. In 2010 Iveda began servicing a government agency in Mexico which has opened doors for Iveda with other law enforcement agencies to implement Iveda’s services. Iveda sold $270,001 to this agency in 2012. In January 2012, MegaSys was awarded a $2.2 million Safe City contract from New Taipei City. In December of 2012 New Taipei City awarded a $1.3 million project that expands the Safe City project into the Linkou district. Iveda has already earned “preferred vendor” status from its existing police department customer as well as from the United States Department of Homeland Security (DHS).

In April 2009, Iveda was granted a Certificate of SAFETY Act Designation by the Department of Homeland Security. The SAFETY Act creates a system of “litigation management” for both Iveda and its customers by imposing important liability limitations for “claims arising out of, relating to, or resulting from an act of terrorism” where Iveda products and services have been deployed. This benefit covers all new customers and current customers dating back to January 1, 2005. Certification is required for Iveda to be able to seek certain government contracts.

| 14 |

Marketing Strategy

Over the years, Iveda has not sustained ongoing public relations and marketing campaigns due to limited resources. Limited marketing activities have not generated considerable amount of leads for sales. Marketing budget was not sufficient to launch an early-adapter product into the marketplace. In 2012, Iveda spent insignificant amounts in marketing.

In 2012, Iveda invested in demo equipment for customer seeding. The Company believes that the best way to market its products and services is to provide a hands-on demo.

Iveda recently hired a full-time PR and Marketing Communications Manager to assist the Chief Marketing Officer implement Iveda’s marketing plan, including actively pitching our press releases to trade publications and enhancing our presence in social media.

Public Relations

First, Iveda needs to establish a known presence within the security industry, with key security industry analysts and influencers being briefed on Iveda and its unique security solution. Iveda continues to generate media interest whenever it sends out a press release. The Company is internally managing its PR efforts, including proactively pitching Iveda products and services and, working with partners for joint articles and case studies on trade magazines. The Company’s internal PR efforts have proved to be more effective than utilizing a PR agency. The company’s press room section of its website contains articles, interviews, and other media coverage, which demonstrates the success of its PR efforts.

Co-op Program

As the reseller distribution channel matures, Iveda’s marketing strategy is expected to be increasingly concentrated on co-op programs, public relations, and branding instead of lead generation for its direct sales force. This strategy will mobilize resellers and utilize their existing customer base. The resellers will be encouraged to conduct direct marketing campaigns to their existing customers and prospect lists. Iveda will match their marketing spend on any lead-generation activities. Iveda expects its resellers to do the heavy lifting in lead generation.

Website

Iveda’s marketing campaign starts with its website. The company has laid the groundwork for this strategy by investing a lot of search engine optimization (SEO) development time on the Company’s website. As a result, the Company’s search ranking on Google and other search engines on certain key words have dramatically climbed to top 5 search results. With no marketing budget, majority of sales leads come from random searches of people looking for video hosting, cloud-based surveillance, in-vehicle surveillance, or real-time remote surveillance solutions.

Collateral

Iveda has developed a wide array of marketing materials to highlight the Company’s products, services, technology, and capabilities. The various pieces cater to all kinds of audiences: potential customers, partners, investors, and employees.

Online Marketing

Instead of more traditional print advertising, Iveda will use its online banner advertising on security technology websites and vertical market websites with application-specific messaging.

According to a recent study by Performics and ROI Research, 75% of shoppers use search engines to research products and services. Iveda will allocate a significant amount of its online marketing budget on Yahoo and Google Adwords pay-per-click campaign.

With the proliferation of social media as a new marketing vehicle, Iveda has established Facebook, Twitter, and Linkedin presence. Management expects that these sites will generate online buzz about the Company, which will increase the Company’s followers, and website traffic. The Company anticipates these activities to fuel lead generation and increase brand awareness. Iveda will also explore webinars which has started to become a popular sales and marketing vehicle to promote products and services.

| 15 |

The Company will continue its internal PR activities, including following editorial calendars of various trade and vertical publications, seek speaking engagements for the CEO to reach specific captive audience at a tradeshow or event, and write articles relevant to the company’s interests.

Tradeshows

Iveda intends to allocate approximately 30% of its marketing budget in tradeshow participation. Tradeshows are still very effective in generating hundreds of leads during a 2 or 3-day event, amongst a captive audience who are influencers or decision makers.

Iveda’s primary goals for exhibiting at tradeshows are to generate leads for sales and build brand in the process. We will participate at these shows with our resellers. We will identify vertical tradeshows, where the company’s services may be of high interest to both exhibitors and attendees (e.g., law enforcement, government, self-storage, hospitality). These will be local and regional tradeshows, plus one big national tradeshow.

Iveda will exhibit at International Security Convention West (ISC West) in April 2013. The show is the biggest security technology show with over 1000 companies exhibiting. Attendees include security integrators and end users. This is Iveda’s first big show and we are participating in a big way. One of our new products has been entered into New Product Showcase competition. This will provide a lot of exposure for the company before, during, and after the show.

In addition, Iveda plans to attend major industry functions and pursue various key speaking opportunities to further spread the cost savings and customer convenience of the services provided by Iveda.

Other Information

Proprietary Rights. Iveda regards certain aspects of its internal operations, products and documentation as proprietary, and relies and plans to rely on a combination of copyright and trademark laws, trade secrets, software security measures, license agreements and nondisclosure agreements to protect proprietary information. The Company does not currently hold any patents.

We cannot guarantee that our protections will be adequate, or that our competitors will not independently develop technologies that are substantially equivalent or superior to our system. Nonetheless, the Company intends to vigorously defend its proprietary technologies, trademarks, and trade secrets. The Company has generally and will in the future require existing and future members of management, employees and consultants to sign non-disclosure and invention assignment agreements for work performed on the Company’s behalf.

We also intend to secure appropriate national and international trademark protections with the intention of prosecuting any infringements, although we have not historically sought any patent protection, but have solely relied on trade secrets, software security measures and nondisclosure agreements. Iveda has trademark registrations for “Iveda Solutions,” “Iveda,” the Company’s logo, and “SafeCiti” from the U.S. Patent and Trademark Office. We are also seeking to trademark for our product names.

Iveda has developed Cerebro, a proprietary software product used internally by Iveda. Cerebro allows Iveda to manage and track all aspects of its remote monitoring service and generate reports on such items as daily monitoring, reported events, property and contact data, major incident tracking, intervention specialist performance tracking and service performance statistics. It also allows employees to participate in internal message board communications. Iveda has historically relied on trade secret protection for Cerebro, but management may consider applying for patent or copyright protection for this database or related processes in the future.

In November 2012, Iveda signed a cooperation agreement with Industrial Technology Research Institute (ITRI). ITRI is a research and development organization based in Taiwan. Iveda and ITRI have been co-developing cloud-video services. ITRI has given Iveda license to some of their patents being used in the development. Iveda will have exclusive rights to the products and services being co-developed. Some of these products will be shown at the ISC West Show in April 2013.

| 16 |

We do not believe that our proprietary rights infringe the intellectual property rights of third parties. However, we cannot guarantee that third parties will not assert infringement claims against us with respect to current or future technology or that any such assertion may not require us to enter into royalty arrangements or result in costly litigation. Furthermore, our proposed future products and services may not be proprietary and other companies may already be providing these products and services.

Government Regulation . Various states within the United States require companies performing low voltage equipment installation to be licensed. Iveda maintains active licenses in Arizona and California. Iveda transitioned all installation activities to its security integrator partners with required licenses to install equipment in the states they cover.

Employees . As of the date of this report, Iveda has 32 employees in the US and 15 in Taiwan. The Company’s future success will depend, in part, on its ability to attract, retain, and motivate highly qualified security, sales, marketing, technical and management personnel. From time to time, the Company employs independent consultants or contractors to support its development, marketing, sales and support and administrative needs. The Company’s employees are not represented by any collective bargaining unit.

Part of our business is labor intensive and, as a result, is affected by the availability of qualified personnel and the cost of labor. Although the security services industry is generally characterized by high turnover, we believe our experience compares favorably with that of the industry. We have not experienced any material difficulty in employing suitable numbers of qualified personnel, and employee turnover is low.

We believe that the quality of our intervention specialists is essential to our ability to offer effective and reliable real-time remote surveillance service, and we believe diligence in their selection and training produces the level of performance required to maintain customer satisfaction and internal growth. Our policy requires that all selected applicants for an intervention position with us undergo a detailed pre-employment interview and a background investigation. We also run a criminal background check, conducted by a third party. Personnel are selected based upon maturity, experience, personality, stability and reliability.

Our comprehensive training programs for our intervention specialists include initial training, on-the-job training and refresher training. Initial training explains the duties of an intervention specialist, report preparation, emergency procedures, ethics and professionalism, grounds for discharge, and basic post responsibilities. On-the-job training covers specific duties as required. A quarterly meeting is held with all intervention specialists to discuss any problem areas, go over new techniques, and discuss tips for effective monitoring, providing further ongoing training. The remote surveillance department’s management team also conducts a monthly meeting. Ongoing refresher training is given on an annual basis as the need arises as determined by the employee’s supervisor or quality control personnel.

Insurance. We maintain insurance, including comprehensive general liability coverage, key man, and directors’ and officers’ coverage in amounts and with types of coverage that management believes to be customary in our industry. Special coverage is sometimes added in response to unique customer requirements. We also maintain compliance with applicable state workers’ compensation laws. A certificate of insurance, which meets individual contract specifications, is made available to every customer.

| 17 |

Competition

Video Hosting Service

Iveda offers cloud-based enterprise-class and consumer-class video hosting services. Consumer-class video hosting normally provides proprietary cameras and software. Typically, only one streaming video access is allowed at one time. This kind of solution is generally not robust enough for commercial or enterprise-level video hosting solution. Iveda has direct competitors with our consumer-class video hosting service (IvedaXpress) including Securei, MyCamServer, Byremote, Envysion, Icontrol and IVR Controls . Iveda differentiates its products and services by using its enterprise-class IP infrastructure, which allows us to manage a large number of cameras, in our consumer service offerings. Our infrastructure features high availability and redundancy. We manage our own datacenter and we have end-to-end level of security from the servers hosting our video to edge devices (i.e., cameras and video encoders).

The Company’s enterprise-class video hosting service, IvedaEnterprise, allows centralized management of multiple cameras located anywhere in the world, regardless of camera type. Our open-source IP infrastructure, utilizing world-class data centers, allows hosting of unlimited number of cameras, allowing multiple, simultaneous access by users via a web browser on any Internet-accessible device. Iveda can also centrally host and manage mobile video streams from police cars, delivery trucks, and school buses. Access to remote video recording and extended storage can also be accomplished through a web browser. Iveda’s video hosting and surveillance solution reduces capital expenditure for companies by allowing companies to avoid installing servers and software, and hiring IT personnel to maintain the necessary infrastructure. Although the Company is not aware of other companies offering similar cloud-based services, the competitors identified above offer similar services based on proprietary cameras and software to enterprise-class customers.

Real-Time Surveillance Service (IvedaSentry)

Iveda’s services are based on its IP network infrastructure and utilize world-class data centers. Management believes the Company’s surveillance facility is a competitive strength, as it is capable of performing real-time video surveillance for customers without the need of an electronic alarm that prompts an alarm company to log into a specific camera to view the potential breach.

Management believes that Iveda is the only company providing enterprise-class real-time remote video surveillance in the United States as of the date of this report. The majority of monitoring companies review camera monitors after an electronic alarm has been triggered. Iveda uses specialized software analytics that allow intervention specialists to monitor customer properties and respond to incidents in real time. This technology offers configurable view-zones, programmable movement direction, and pattern-recognition to a particular user. The Company also has an in-house database management system that allows interventions specialists to record every event. This system generates a Daily Surveillance Report (DSR), emailed to the customer at the end of the surveillance shift.

Integrators and central monitoring companies, the Company’s closest competitors, provide monitoring services based on electronic alarm triggers. Examples of companies providing these competing services include Westec Interactive, Iverify, Xtreme Surveillance, Viewpoint, byRemote, and Monitoring Partners.

Some of Iveda’s current and future competitors may conduct more extensive promotional activities and may offer lower prices to customers than Iveda, which could allow them to gain greater market share or prevent Iveda from increasing its market share. In the future, Iveda may need to decrease its prices if Iveda’s competitors lower their prices. Iveda’s competitors may be able to respond more quickly to new or changing opportunities, technologies and customer requirements. To be successful, Iveda must carry out its business plan, establish and strengthen its brand awareness through marketing, effectively differentiate its services from those of its competitors and build its reseller network, while maintaining superior levels of service, which management believes is what will ultimately differentiate Iveda’s services from any similar services its competitors may develop in the future.

| 18 |

Available Information

The Company electronically files its Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments to these reports and other information with the Securities and Exchange Commission (the “SEC”). These reports can be obtained by accessing the SEC’s website at www.sec.gov. The public can also obtain copies by visiting the SEC’s Public Reference Room at 100 F Street NE, Washington, DC 20549 on official business days during the hours of 10:00 am to 3:00 pm or by calling the SEC at 1-800-SEC-0330. The Company has two websites located at www.ivedasolutions.com and www.ivedaxpress.com. Information contained on the Company’s website is not a part of this report.

ITEM 1A – RISK FACTORS

An investment in our securities is highly speculative and involves a high degree of economic risk. You should carefully consider the following risk factors along with the other matters described in this Annual Report in making an investment decision to buy our securities. If you decide to buy our securities, you should be able to afford the possibility of a complete loss of your investment.

Risk Factors Involving Our Business

Iveda’s Financial Statements Contain A Going Concern Opinion.

Iveda’s financial statements included with this report were prepared on a “going concern basis” and the audit report contains a “going concern qualification” (see the Audit Report on the Financial Statements for the year ended December 31, 2012 and Note 1 to those Financial Statements). Our financial statements assume we will continue as a going concern, but to be able to do so we will need to raise additional capital to fund our operations until positive operating cash flow is achieved. There can be no assurance that we will be able to raise sufficient additional capital to continue our operations.

Iveda Needs to Raise Significant Additional Funding.

At Iveda’s current estimated burn rate, Iveda has sufficient capital to continue its operations for only a short period of time. Accordingly, Iveda must raise capital to continue as a going concern. The Board of Directors approved the Company to engage with an investment banker to act as the Company’s financial and capital markets advisor to seek to raise up to $30 million in long term financing. The board also approved the Company to raise up to $3 million in bridge financing in advance of the long term financing. There can be no assurance that Iveda can raise sufficient funding to continue as a going concern or to even operate profitably. Any inability to obtain additional financing when needed could require Iveda to significantly curtail operations or delay its expansion plans.

Even if funding is available to the Company, Iveda cannot assure investors that additional financing will be available on terms that are favorable to the Company’s existing shareholders. Additional funding may be accomplished through the issuance of equity or debt securities that could be significantly dilutive to the percentage ownership of Iveda’s existing shareholders. In addition, these newly issued securities may have rights, preferences or privileges senior to those of existing shareholders. Accordingly, such a financing transaction could materially and adversely impact the price of our Common Stock.

Iveda Depends On Certain Key Personnel.

Iveda’s future success will be dependent on the efforts of key management personnel, particularly David Ly, Iveda’s President and CEO, Luz Berg, Iveda’s COO and CMO, Alex Kuo, Chief Strategy Officer, Richard Gibson, SVP of Global Sales & Support, and Brian Duling, Iveda’s CFO, each of whom is employed at will by Iveda. Mr. Ly’s relationships within Iveda’s industry are vital to Iveda’s continued operations, and if Mr. Ly was no longer actively involved with Iveda, Iveda would likely be unable to continue its operations. Iveda has obtained key man insurance on Mr. Ly in the amount of $1 million. The loss of one or more of Iveda’s other key employees could also have a material adverse effect on Iveda’s business, results of operations and financial condition.

| 19 |

Iveda also believes that Iveda’s future success will be largely dependent on Iveda’s ability to attract and retain highly qualified management, sales and marketing personnel. Iveda cannot assure investors that the Company will be able to attract and retain such personnel. Iveda’s inability to retain such personnel or to train them rapidly enough to meet Iveda’s expanding needs could cause a decrease in the overall quality and efficiency of Iveda’s staff, which could have a material adverse effect on Iveda’s business, results of operations and financial condition.

Rapid Growth May Strain Iveda’s Resources.

As Iveda continues the commercialization of its security and surveillance products and services, it expects to experience significant and rapid growth in the scope and complexity of its business, which may place a significant strain on the senior management team and Iveda’s financial and other resources. The proposed acceleration will expose us to greater overhead, marketing and support costs and other risks associated with growth and expansion. Iveda will need to add staff to monitor additional cameras, market its products and services, manage operations, handle sales and marketing efforts and perform finance and accounting functions. Iveda will be required to hire a broad range of additional personnel in order to successfully advance its operations.

Management has implemented strategies to handle projected growth, including increasing our leased space within Iveda’s existing building. Iveda’s existing leased space can accommodate up to 15 monitoring stations, with four employees required to monitor each station around the clock and other additional key employees. While maintaining two existing data centers, located in Phoenix and Scottsdale, Arizona, we also leased a new less expensive facility with comparable features. Iveda’s ability to manage its rapid growth effectively will require Iveda to continue to improve its operations, to improve its financial and management information systems and to train, motivate and manage its employees.

This growth may place a strain on Iveda’s management and operational resources. The failure to develop and implement effective systems, or to hire and retain sufficient personnel for the performance of all of the functions necessary to effectively service and manage Iveda’s business, or the failure to manage growth effectively, could have a materially adverse effect on Iveda’s business and financial condition. In addition, difficulties in effectively managing the budgeting, forecasting and other process control issues presented by such a rapid expansion could harm Iveda’s business, prospects, results of operations and financial condition.

Demand For Iveda’s Security And Surveillance Products And Services May Be Lower Than Iveda Anticipates.

Iveda has limited resources to undertake extensive marketing activities. Iveda cannot predict with certainty the potential consumer demand for its security and surveillance products or services or the degree to which Iveda will meet that demand. If demand for its security and surveillance products and services does not develop to the extent or as quickly as expected, Iveda might not be able to generate revenue to become profitable.

Iveda is targeting the sale of its security and surveillance products and services to the following primary customer groups: commercial entities, educational facilities, golf courses, gated residential communities, automotive lot, small unattended businesses, construction sites, municipalities, government, and law enforcement. Iveda has based its strategy to target these consumers on a number of assumptions, some or all of which could prove to be incorrect.

| 20 |

Even if markets for its products and services develop, Iveda could achieve a smaller share of these markets than Iveda currently anticipates. Achieving market share will require substantial marketing efforts and expenditure of significant funds to inform customers of the distinctive characteristics and benefits of using Iveda’s products and services. Iveda cannot assure investors that its marketing efforts will result in the attainment of sufficient market share to become profitable.

Iveda Believes Industry Trends Support Its Open Source Systems, But If Trends Reverse, Iveda May Experience Decreased Demand.

The security and surveillance industry is characterized by rapid changes in technology and customer demands. Management believes that the existing market preference for open source systems (systems capable of integrating a wide range of products and services through community and private based cooperation, such as the Internet, Linux, and certain cameras used in Iveda’s business) is strong and will continue for the foreseeable future.

While Iveda is able to convert CCTV and analog systems for use with Iveda’s monitoring services, certain systems may not be convertible in the future, and to the extent that customers prefer to install these systems, it would be more difficult to sell Iveda’s services since customers would be required to spend additional funds to acquire new cameras that Iveda would be able to monitor.

Risks Associated with the Surveillance and Remote Security Industry

As a result of providing its products and services, Iveda is exposed to risks associated with participation in the security and surveillance industry. These risks are summarized below.

Iveda Depends On Third Party Manufacturers And Suppliers For The Products It Sells.

Iveda has relationships with a number of third party manufacturers and suppliers, including Axis Communications, Milestone, Scansource, Anixter, and Dotworkz for cameras, accessories, and software and Dell for servers and network equipment, for the supply of all of the hardware components of Iveda’s products. Iveda has signed reseller and development partner agreements with Axis Communications and Milestone. For customers in Taiwan, its subsidiary purchased equipment locally and software from their partner company in Hong Kong. Risks associated with Iveda’s dependence upon third party manufacturing relationships include: (i) reduced control over delivery schedules; (ii) lack of control over quality assurance; (iii) poor manufacturing yields and high costs; (iv) potential lack of adequate capacity during periods of excess demand; and (v) potential misappropriation of Iveda’s intellectual property. Although Iveda depends on third party manufacturers and suppliers for products it sells, risks are minimized because it does not depend on one manufacturer and supplier. It utilizes an open platform, which means that in order to deliver its services, it does not discriminate based on camera brand or manufacturer and its services can be used with a wide array of products.

| 21 |

Iveda does not know if it will be able to maintain third party manufacturing and supply contracts on favorable terms, if at all, or that its current or future third party manufacturers and suppliers will meet its requirements for quality, quantity or timeliness. Iveda’s success depends in part on whether its manufacturers are able to fill the orders it places with them in a timely manner. If Iveda’s manufacturers fail to satisfactorily perform their contractual obligations or fill purchase orders Iveda places with them, Iveda may be required to pursue replacement manufacturer relationships.