Ff f

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2015 Commission file number: 001-33841

VULCAN MATERIALS COMPANY (Exact Name of Registrant as Specified in Its Charter)

|

||

|

New Jersey (State or other jurisdiction of incorporation or organization) |

20-8579133 (I.R.S. Employer Identification No.) |

|

|

1200 Urban Center Drive, Birmingham, Alabama 35242 (Address of Principal Executive Offices) (Zip Code)

(205) 298-3000 (Registrant’s telephone number, including area code) |

||

|

Securities registered pursuant to Section 12(b) of the Act:

|

||

|

Title of each class Common Stock, $1 par value

|

Name of each exchange on which registered New York Stock Exchange

|

|

|

Securities registered pursuant to Section 12(g) of the Act: None |

||

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act (Check one):

Large accelerated filer ☒ Accelerated filer ☐ Non-accelerated filer ☐ Smaller reporting company ☐ (Do not check if a smaller reporting company) Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒ |

||

|

Aggregate market value of voting and non-voting common stock held by non-affiliates |

$9,464,531,960 |

|

Number of shares of common stock, $1.00 par value, outstanding as of February 11, 2016: |

133,181,057 |

|

DOCUMENTS INCORPORATED BY REFERENCE |

|

|

Portions of the registrant’s annual proxy statement for the annual meeting of its shareholders to be held on May 13, 2016, are incorporated by reference into Part III of this Annual Report on Form 10-K. |

|

|

VULCAN MATERIALS COMPANY

ANNUAL REPORT ON FORM 10-k CONTENTS |

|||

|

|

|||

|

Part |

Item |

|

Page |

|

I |

1 |

3 | |

|

1A |

18 | ||

|

1B |

21 | ||

|

|

2 |

22 | |

|

|

3 |

25 | |

|

4 |

25 | ||

|

II |

5 |

26 | |

|

|

6 |

27 | |

|

|

7 |

Management’s Discussion and Analysis of Financial Condition |

28 |

|

|

7A |

57 | |

|

|

8 |

58 | |

|

|

9 |

Changes in and Disagreements with Accountants on Accounting and |

109 |

|

|

9A |

109 | |

|

9B |

111 | ||

|

III |

10 |

112 | |

|

|

11 |

112 | |

|

|

12 |

Security Ownership of Certain Beneficial Owners and |

112 |

|

|

13 |

Certain Relationships and Related Transactions, and Director Independence |

112 |

|

14 |

112 | ||

|

IV |

15 |

113 | |

|

|

— |

114 | |

Unless otherwise stated or the context otherwise requires, references in this report to "Vulcan," the "Company," "we," "our," or "us" refer to Vulcan Materials Company and its consolidated subsidiaries.

|

Table of Contents |

i |

PART I

"SAFE HARBOR" STATEMENT UNDER THE PRIVATE SECURITIES

LITIGATION REFORM ACT OF 1995

Certain of the matters and statements made herein or incorporated by reference into this report constitute forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934. All such statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements reflect our intent, belief or current expectation. Often, forward-looking statements can be identified by the use of words, such as "anticipate," "may," "believe," "estimate," "project," "expect," "intend" and words of similar import. In addition to the statements included in this report, we may from time to time make other oral or written forward-looking statements in other filings under the Securities Exchange Act of 1934 or in other public disclosures. Forward-looking statements are not guarantees of future performance, and actual results could differ materially from those indicated by the forward-looking statements. All forward-looking statements involve certain assumptions, risks and uncertainties that could cause actual results to differ materially from those included in or contemplated by the statements. These assumptions, risks and uncertainties include, but are not limited to:

|

§ |

general economic and business conditions |

|

§ |

the timing and amount of federal, state and local funding for infrastructure |

|

§ |

changes in our effective tax rate that can adversely impact results |

|

§ |

the increasing reliance on information technology infrastructure for our ticketing, procurement, financial statements and other processes could adversely affect operations in the event that the infrastructure does not work as intended or experiences technical difficulties or is subjected to cyber attacks |

|

§ |

the impact of the state of the global economy on our business and financial condition and access to capital markets |

|

§ |

changes in the level of spending for private residential and private nonresidential construction |

|

§ |

the highly competitive nature of the construction materials industry |

|

§ |

the impact of future regulatory or legislative actions |

|

§ |

the outcome of pending legal proceedings |

|

§ |

pricing of our products |

|

§ |

weather and other natural phenomena |

|

§ |

energy costs |

|

§ |

costs of hydrocarbon-based raw materials |

|

§ |

healthcare costs |

|

§ |

the amount of long-term debt and interest expense we incur |

|

§ |

changes in interest rates |

|

§ |

the impact of our below investment-grade debt rating on our cost of capital |

|

§ |

volatility in pension plan asset values and liabilities which may require cash contributions to the pension plans |

|

§ |

the impact of environmental cleanup costs and other liabilities relating to previously divested businesses |

|

§ |

our ability to secure and permit aggregates reserves in strategically located areas |

|

§ |

our ability to manage and successfully integrate acquisitions |

|

§ |

the potential of goodwill or long-lived asset impairment |

|

§ |

the potential impact of future legislation or regulations relating to climate change, greenhouse gas emissions or the definition of minerals |

|

§ |

the risks set forth in Item 1A "Risk Factors," Item 3 "Legal Proceedings," Item 7 "Management’s Discussion and Analysis of Financial Condition and Results of Operations," and Note 12 "Commitments and Contingencies" to the consolidated financial statements in Item 8 "Financial Statements and Supplementary Data," all as set forth in this report |

|

§ |

other assumptions, risks and uncertainties detailed from time to time in our filings made with the Securities and Exchange Commission |

|

Part I |

1 |

All forward-looking statements are made as of the date of filing or publication. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise. Investors are cautioned not to rely unduly on such forward-looking statements when evaluating the information presented in our filings, and are advised to consult any of our future disclosures in filings made with the Securities and Exchange Commission and our press releases with regard to our business and consolidated financial position, results of operations and cash flows.

|

Part I |

2 |

BUSINESS

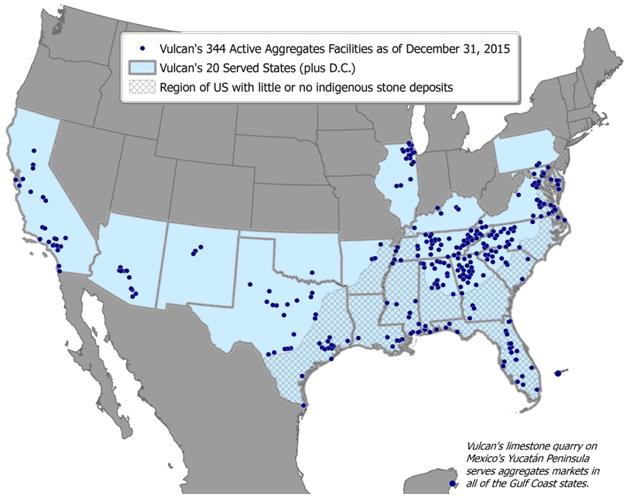

Vulcan Materials Company, a New Jersey corporation, is the nation’s largest producer of construction aggregates (primarily crushed stone, sand and gravel) and a major producer of asphalt mix and ready-mixed concrete. As of December 31, 2015, we had 344 active aggregates facilities.

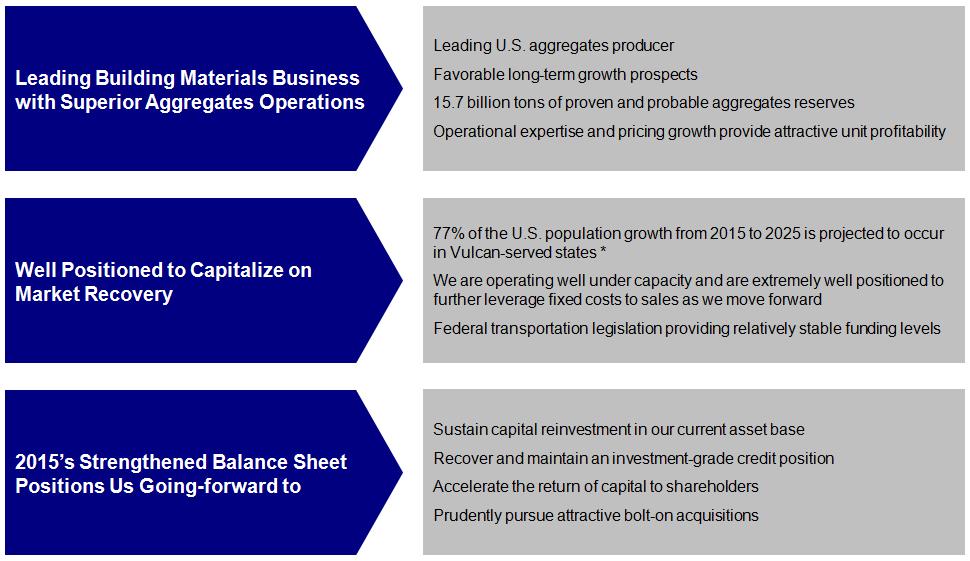

VULCAN’S VALUE PROPOSITION

We are the largest producer of construction aggregates in the country with coast-to-coast aggregates operations. Our leading position is based upon:

|

§ |

a favorable geographic footprint serving nearly all key growth corridors and the most rapidly growing population centers |

|

§ |

a pure-play aggregates business with one of the largest proven and probable reserve bases in the U.S. |

|

§ |

excellent multi-modal logistics capabilities, plus the inherent advantages of our Playa del Carmen, Mexico quarry and supporting port facilities |

These factors, together with our strong operating expertise and price discipline, allow us to deliver the highest margins per ton shipped in the industry.

PORTFOLIO MANAGEMENT

|

§ |

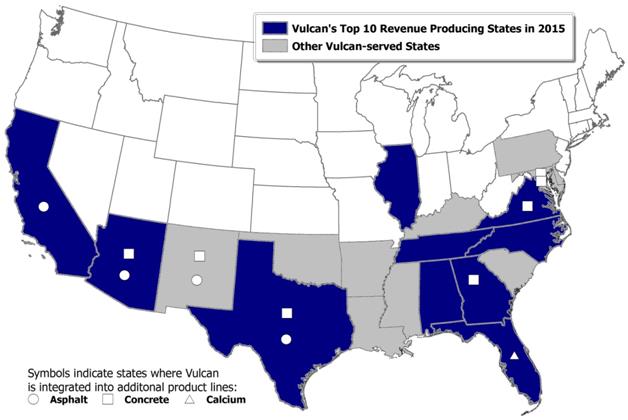

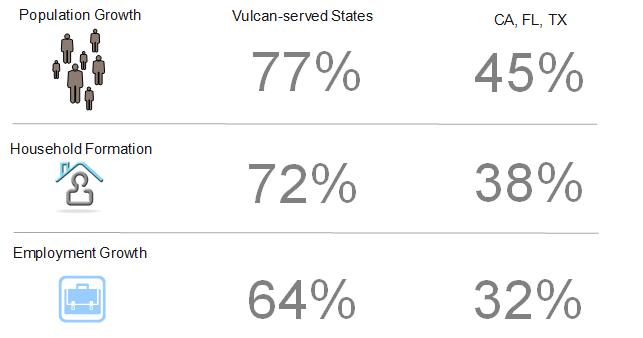

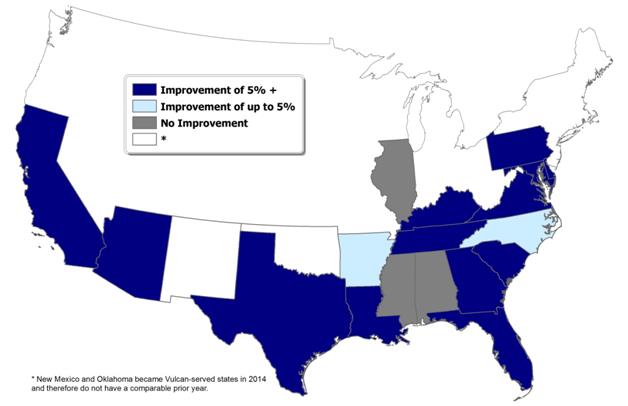

Our aggregates reserves are strategically located throughout the United States in areas that are projected to grow faster than the national average and that require large amounts of aggregates to meet construction demand. Vulcan-served states are estimated to generate 77% of the total growth in U.S. population and 72% of the total growth in U.S. household formations between 2015 and 2025. |

|

|

VULCAN’S TOP TEN REVENUE PRODUCING STATES IN 2015 |

|

||||||||||

|

|

1. |

Texas |

|

6. |

Tennessee |

|

||||||

|

|

2. |

California |

|

7. |

Arizona |

|

||||||

|

|

3. |

Virginia |

|

8. |

Illinois |

|

||||||

|

|

4. |

Georgia |

|

9. |

North Carolina |

|

||||||

|

5. |

Florida |

10. |

Alabama |

|||||||||

Our top ten revenue producing states accounted for 83% of our 2015 revenues while our top five accounted for 59%.

|

Part I |

3 |

|

§ |

We take a disciplined approach to strengthening our footprint by increasing our presence in U.S. metropolitan areas that are expected to grow more rapidly and by divesting assets that are no longer considered part of our long-term growth strategy. In 2015, we completed a swap of twelve ready-mixed concrete plants in California for thirteen asphalt plants primarily in Arizona. We also acquired three aggregates facilities and seven ready-mixed concrete plants in Arizona and New Mexico. These transactions, together with acquisitions completed in 2014, position us as the #1 aggregates supplier in the New Mexico market and a leading aggregates supplier in Arizona. |

|

§ |

Where practical, we have operations located close to our local markets because the cost of trucking materials long distances is prohibitive. Approximately 80% of our total aggregates shipments are delivered exclusively from the producing location to the customer by truck, and another 16% are delivered by truck after reaching a sales yard by rail or water. The remaining 4% of aggregates shipments are delivered directly to the customer by rail or water. |

COMPETITORS

We operate in an industry that generally is fragmented with a large number of small, privately-held companies. We estimate that the ten largest aggregates producers accounted for approximately 30% to 35% of total U.S. aggregates production in 2015. Despite being the industry leader, Vulcan’s total U.S. market share is less than 10%. Other publicly traded companies among the ten largest U.S. aggregates producers include the following:

|

§ |

Cemex S.A.B. de C.V. |

|

§ |

CRH plc |

|

§ |

HeidelbergCement AG |

|

§ |

LafargeHolcim |

|

§ |

Martin Marietta Materials, Inc. |

|

§ |

MDU Resources Group, Inc. |

|

§ |

Summit Materials, Inc. |

Because the U.S. aggregates industry is highly fragmented, with over 5,900 companies managing almost 11,000 operations during 2015, many opportunities for consolidation exist. Therefore, companies in the industry tend to grow by acquiring existing facilities to enter new markets or by extending their existing market positions.

BUSINESS STRATEGY AND COMPETITIVE ADVANTAGE

Vulcan provides the basic materials for the infrastructure needed to maintain and expand the U.S. economy. Our strategy and competitive advantages are based on our strength in aggregates. Aggregates are used in most types of construction and in the production of asphalt mix and ready-mixed concrete. Our materials are used to build the roads, tunnels, bridges, railroads and airports that connect us, and to build the hospitals, churches, schools, shopping centers, and factories that are essential to our lives and the economy.

business strategies

Our business strategies include: 1) aggregates focus, 2) coast-to-coast footprint, 3) profitable growth, 4) managing volume, product mix and price to grow profitability, and 5) effective land management.

1. AGGREGATES FOCUS

Aggregates are used in virtually all types of public and private construction and practically no substitutes for quality aggregates exist. Our focus on aggregates allows us to:

BUILD AND HOLD SUBSTANTIAL RESERVES: The locations of our reserves are critical to our long-term success because of barriers to entry created in many metropolitan markets by zoning and permitting regulations and high costs associated with transporting aggregates. Our reserves are strategically located throughout the United States in high-growth areas that will require large amounts of aggregates to meet future construction demand. Aggregates operations have flexible production capabilities and, other than energy inputs required to process the materials, require virtually no other raw material. Our downstream businesses (asphalt mix and concrete) use Vulcan-produced aggregates almost exclusively.

|

Part I |

4 |

TAKE ADVANTAGE OF BEING THE LARGEST PRODUCER: Each aggregates operation is unique because of its location within a local market with particular geological characteristics. Every operation, however, uses a similar group of assets to produce saleable aggregates and provide customer service. Vulcan is the largest aggregates company in the U.S., measured by shipments. Our 344 active aggregates facilities as of December 31, 2015 provide opportunities to standardize operating practices and procure equipment (fixed and mobile), parts, supplies and services in an efficient and cost-effective manner, both regionally and nationally. Additionally, we are able to share best practices across the organization and leverage our size for administrative support, customer service, accounting, procurement, technical support and engineering.

2. COAST-TO-COAST FOOTPRINT

Demand for construction aggregates correlates positively with changes in population growth, household formation and employment. We have pursued a strategy to increase our presence in U.S. metropolitan areas that are expected to grow the most rapidly. Our strategic locations serve nineteen of the top 25 highest-growth U.S. metropolitan areas and as shown below, we serve twenty states plus the District of Columbia.

3. PROFITABLE GROWTH

Our long-term growth is a result of strategic acquisitions and investments in key operations.

Strategic acquisitions AND DISPOSITIONS: Since becoming a public company in 1956, Vulcan has principally grown by mergers and acquisitions. For example, in 1999 we acquired CalMat Co., thereby expanding our aggregates operations into California and Arizona and making us one of the nation’s leading producers of asphalt mix. In 2007, we acquired Florida Rock Industries, Inc., the largest acquisition in our history. This acquisition expanded our aggregates business in Florida and our aggregates and ready-mixed concrete businesses in other southeastern and mid-Atlantic states. In 2014, we completed eight transactions that expanded our aggregates business in Arizona, California, New

|

Part I |

5 |

Mexico, Texas, Virginia and Washington D.C., our asphalt mix business in Arizona and New Mexico, and our ready-mixed concrete business in New Mexico. In January 2015, we completed an asset exchange transaction in which we exited our ready-mixed concrete business in California and added thirteen asphalt plant locations, primarily in Arizona.

Additionally, throughout our history we have completed many bolt-on acquisitions that have contributed significantly to our growth. For example, in 2015 we completed strategic bolt-on acquisitions in Arizona, New Mexico and Tennessee.

|

§ |

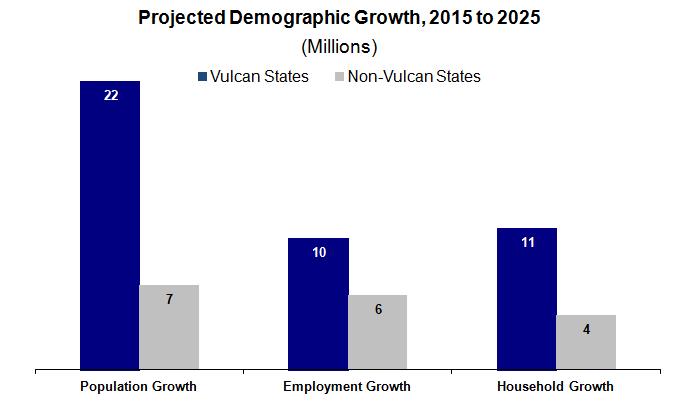

Reinvestment opportunities with high returns: During the next decade, Moody's Analytics projects that 77% of the U.S. population growth, 72% of household formation and 64% of new jobs will occur in Vulcan-served states. The close proximity of our production facilities and our aggregates reserves to this projected population growth create many opportunities to invest capital in high-return projects — projects that will add reserves, increase production capacity and improve costs. |

Source: Moody’s Analytics as of November 16, 2015

The following graphic illustrates the projected growth (2015 – 2025) by key demographics for Vulcan-served states:

Source: Moody’s Analytics as of November 16, 2015.

|

Part I |

6 |

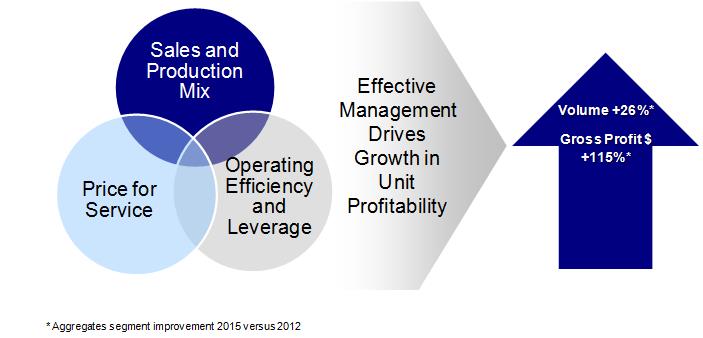

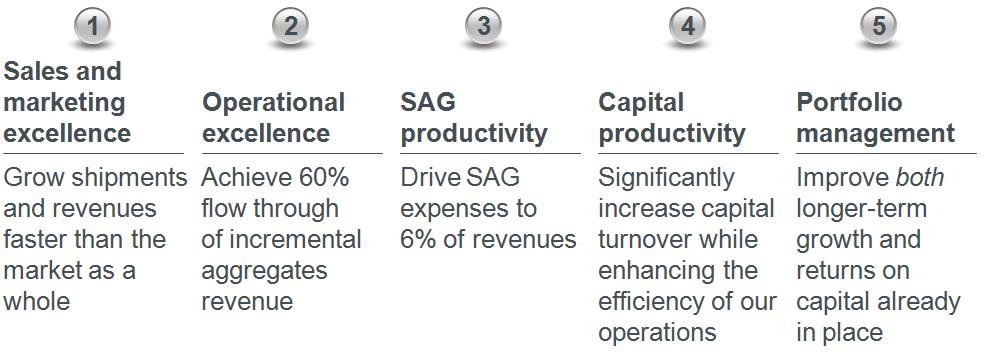

4. MANAGING VOLUME, PRODUCT MIX AND PRICE TO GROW PROFITABILITY

We focus on three major profit drivers that must be managed in combination.

|

§ |

Price for Service — We seek to receive full and fair value for the quality of products and service we provide. We should be paid appropriately for helping our customers be successful. |

|

§ |

Operating Efficiency and Leverage — We focus on rigorous cost management throughout the economic cycle. Small savings per ton add up to significant cost reductions. |

|

§ |

Sales and Production Mix — We adjust production levels to meet varying market conditions. Managing inventories responsibly results in improved cost performance and an improved return on capital. |

We manage these factors locally, and align our talent and incentives accordingly. Our knowledgeable and experienced workforce and our flexible production capabilities allow us to manage operational and overhead costs aggressively. Recovery in demand serves as a tailwind for all three major profit drivers.

While Aggregates segment gross profit has grown at a significantly greater rate than volume over the past couple of years, we expect continuing improvement in unit profitability.

|

§ |

On Price for Service — Our expanding margins have just begun to benefit from the mid-to-high single digit price gains associated with cyclical recoveries. |

|

§ |

On Operating Efficiency and Leverage — We are operating a capital-intensive business at 55-60% capacity and are extremely well positioned to further leverage fixed costs to sales as we move forward. |

|

§ |

On Sales and Production Mix — As the recovery continues and as we see a larger portion of new construction activity in the end-use mix, we will sell the entire production mix much more efficiently and at fuller value. |

5. EFFECTIVE LAND MANAGEMENT

We believe that effective land management is both a business strategy and a social responsibility that contributes to our success. Good stewardship requires the careful use of existing resources as well as long-term planning because mining, ultimately, is an interim use of the land. Therefore, we strive to achieve a balance between the value we create through our mining activities and the value we create through effective post-mining land management. We continue to focus our actions on prudent decisions regarding the life cycle management of the 120,000 acres of land we currently own.

|

Part I |

7 |

COMPETITIVE ADVANTAGes

The competitive advantages of our aggregates focused business strategy include:

COAST-TO-COAST FOOTPRINT

|

§ |

largest aggregates company in the U.S. (measured by shipments) |

|

§ |

high-growth markets requiring large amounts of aggregates to meet construction demand |

|

§ |

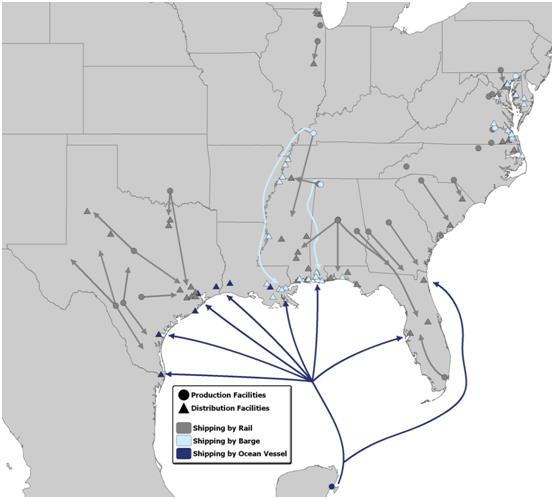

extensive and advantaged logistics network (as shown on map on page 9) |

|

§ |

diversified regional exposure |

|

§ |

benefits of scale in operations, procurement and administrative support |

|

§ |

complementary asphalt mix and concrete businesses in select markets |

|

§ |

effective land management |

PROFITABLE GROWTH

|

§ |

quality top-line growth that converts to higher-margin earnings and cash flow generation |

|

§ |

tightly managed operational and overhead costs |

|

§ |

more opportunities to manage our portfolio of locations to further enhance long-term earnings growth |

STRATEGICALLY LOCATED ASSETS

|

§ |

our reserves are primarily located in high-growth markets that require large amounts of aggregates to meet demand |

|

§ |

zoning and permitting regulations in many metropolitan markets have made it increasingly difficult to expand existing quarries or to develop new quarries |

|

§ |

such regulations, while potentially curtailing expansion in certain areas, could also increase the value of our reserves at existing locations |

PRODUCT LINES

We have four operating (and reportable) segments organized around our principal product lines:

|

1. |

Aggregates |

|

2. |

Asphalt Mix |

|

3. |

Concrete |

|

4. |

Calcium |

See Note 15 "Segment Reporting" in Item 8 "Financial Statements and Supplementary Data.”

1. AGGREGATES

Our construction aggregates are used in a number of ways:

|

§ |

as a base material underneath highways, walkways, airport runways, parking lots and railroads |

|

§ |

to aid in water filtration, purification and erosion control |

|

§ |

as a raw material used in combination with other resources to construct many of the items we rely on to sustain our quality of life including: |

|

§ |

houses and apartments |

|

§ |

roads, bridges and parking lots |

|

§ |

schools and hospitals |

|

§ |

commercial buildings and retail space |

|

§ |

sewer systems |

|

§ |

airports and runways |

|

Part I |

8 |

Factors that affect the U.S. aggregates industry and our business, include:

|

§ |

Local markets: Aggregates have a high weight-to-value ratio and, in most cases, are produced near where they are used; if not, transportation can cost more than the materials, rendering them uncompetitive compared to locally produced materials. Exceptions to this typical market structure include areas along the U.S. Gulf Coast and the Eastern Seaboard where there are limited supplies of locally available high quality aggregates. We serve these markets from quarries that have access to long-haul transportation — shipping by barge and rail — and from our Playa del Carmen quarry on Mexico’s Yucatan Peninsula with our fleet of Panamax-class, self-unloading ships. |

We operate an extensive logistics network along the U.S. Gulf Coast and the Eastern Seaboard as shown below:

|

§ |

Location and quality of reserves: We currently have 15.7 billion tons of permitted and proven or probable aggregates reserves. The bulk of these reserves are located in areas where we expect greater than average rates of growth in population, jobs and households, which require new infrastructure, housing, offices, schools and other development. Zoning and permitting regulations in some markets have made it increasingly difficult for the aggregates industry to expand existing quarries or to develop new quarries. These restrictions curtail expansion in certain areas, but they also increase the value of our reserves at existing locations. |

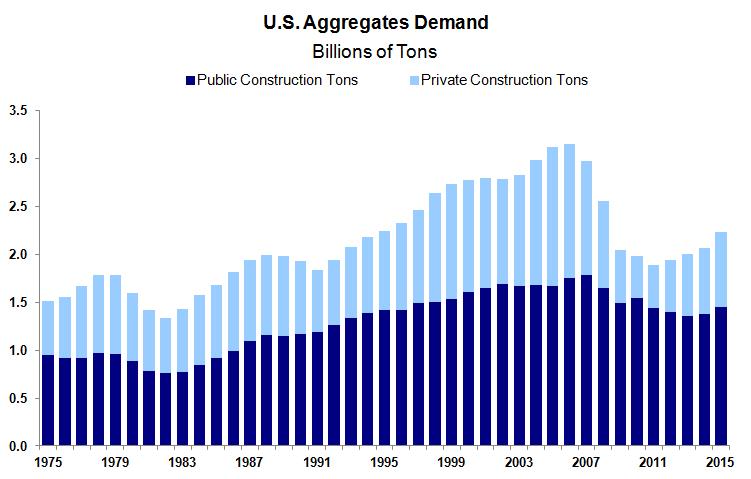

|

§ |

Demand cycles: Long-term growth in demand for aggregates is largely driven by growth in population, jobs and households. While short- and medium-term demand for aggregates fluctuates with economic cycles, declines have historically been followed by strong recoveries, with each peak establishing a new historical high. |

|

Part I |

9 |

|

§ |

Flexible production capabilities: The production of aggregates is a mechanical process in which stone is crushed and, through a series of screens, separated into various sizes depending on how it will be used. Production capacity can be flexible by adjusting operating hours to meet changing market demand. |

|

§ |

Highly fragmented industry: The U.S. aggregates industry is composed of over 5,900 companies that manage almost 11,000 operations. This fragmented structure provides many opportunities for consolidation. Companies in the industry commonly enter new markets or expand positions in existing markets through the acquisition of existing facilities. |

|

§ |

Limited product substitution: There are limited substitutes for quality aggregates. Recycled concrete and asphalt have certain applications as a lower-cost alternative to virgin aggregates. However, due to technical specifications many types of construction projects cannot be served by recycled concrete, but require the use of virgin aggregates to meet specifications and performance-based criteria for durability, strength and other qualities. Moreover, the amount of recycled asphalt included in asphalt mix as a substitute for aggregates is limited due to specifications. |

|

§ |

raw material inputs largely under our control: Unlike typical industrial manufacturing industries, the aggregates industry does not require the input of raw material beyond owned or leased aggregates reserves. Stone, sand and gravel are naturally occurring resources. However, production does require the use of explosives, hydrocarbon fuels and electric power. |

AGGREGATES MARKETS

We focus on the U.S. markets with above-average long-term expected population growth and where construction is expected to expand. Because transportation is a significant part of the delivered cost of aggregates, our facilities are typically located in the markets they serve or have access to economical transportation via rail, barge or ship to a particular end market. We serve both the public and the private sectors.

Public sector construction activity has historically been more stable and less cyclical than privately-funded construction, and generally requires more aggregates per dollar of construction spending. Private sector construction (primarily residential and nonresidential buildings) typically is more affected by general economic cycles than publicly funded projects (particularly highways, roads and bridges), which tend to receive more consistent levels of funding throughout economic cycles.

|

Part I |

10 |

PUBLIC SECTOR CONSTRUCTION

Public sector construction includes spending by federal, state, and local governments for highways, bridges, buildings and airports as well as other infrastructure construction for sewer and waste disposal systems, water supply systems, dams, reservoirs and other public construction projects. Construction for power plants and other utilities is funded from both public and private sources. In 2015, publicly funded construction accounted for approximately 49% of our total aggregates shipments.

|

§ |

Public Sector Funding: Generally, public sector construction spending is more stable than private sector construction because public sector spending is less sensitive to interest rates and has historically been supported by multi-year legislation and programs. For example, the federal surface transportation bill is a principal source of funding for public infrastructure and transportation projects. For over four decades, a portion of transportation projects has been funded through a series of multi-year bills. Some 35% of transportation projects are federally-funded, with special emphasis given to the largest and most complex projects. The long-term nature of such legislation is important because it provides state departments of transportation with the ability to plan and execute long-range, complex highway projects. Federal highway spending is governed by multi-year authorization bills and annual budget appropriations using funds largely from the Federal Highway Trust Fund. This Trust Fund receives funding from taxes on gasoline and other levies. The level of state spending on infrastructure varies across the United States and depends on individual state needs and economies. In 2015, approximately 26% of our aggregates sales by volume were used in highway construction projects. |

|

§ |

federal highway funding: On December 4, 2015, the President signed a new, long-term federal highway bill into law. The final legislation, Fixing America’s Surface Transportation Infrastructure Act (FAST Act), received strong, bipartisan support in both the House and the Senate. |

The Federal-Aid Highway Program is the largest component of the law and has provided, on average, 52% of all state capital investment in roads and bridges over the last 10 years. The FAST Act increases Federal-Aid Highway Program funding from $41 billion in the federal fiscal year (FFY) 2015 to $47 billion in FFY 2020. This spending is supported by the current user-fee revenue streams (excise taxes on gasoline and diesel fuels, taxes on heavy truck sales and use, and heavy truck tire taxes, totaling some $208 billion) and by a $70 billion transfer of general funds to the Federal Highway Trust Fund. The funding levels and five years of stability will help to rebuild America’s aging infrastructure and protect millions of jobs.

The FAST Act also contains important policy changes. To further accelerate the project delivery process, it augments the environmental review and permitting process reforms contained in the prior law, Moving Ahead for Progress in the 21st Century Act (MAP-21). The new law also provides assistance for states making investments in major capital projects—particularly freight projects. In states where Vulcan operates, we are well-positioned to serve the large general contractors who will compete for new freight and other major capacity projects that will move forward with this FAST Act funding.

Although the Transportation Infrastructure Finance & Innovation Act (TIFIA) program was reduced to $275 million, growing to $300 million by 2020, the authorization is still in line with the previous program outlays and remains an important additional component of overall spending. The FAST Act also created a new National Surface Transportation and Innovative Finance Bureau to provide technical assistance to states seeking to pursue public-private partnerships and other financing arrangements.

|

§ |

WATER INFRASTRUCTURE: In 2014 we, along with numerous business allies, strongly supported the Water Resources Reform and Development Act (WRRDA) for its importance to the U.S. economy and the pressing need to upgrade U.S. harbors, ports and inland waterways. Congress created a five-year pilot program to promote private-sector participation in water projects: the Water Infrastructure Financing and Innovation Act (WIFIA). Modeled after the highly popular TIFIA program in the surface transportation sector, WIFIA allows for federal credit assistance to water resources projects in the form of low-cost loans, loan guarantees and lines of credit. |

Unlike TIFIA, WIFIA as originally crafted did not allow for federal credit assistance to projects financed, in whole or in part, by tax exempt municipal bonds. The FAST Act lifts that restriction and should make it easier for project sponsors to use the credit program and advance water projects that would otherwise go unaddressed due to the lack of resources.

|

Part I |

11 |

Private sector CONSTRUCTION

The private sector construction markets include both nonresidential building construction and residential construction and are considerably more cyclical than public construction. In 2015, privately-funded construction accounted for approximately 51% of our total aggregates shipments.

|

§ |

Nonresidential Construction: Private nonresidential building construction includes a wide array of projects. Such projects generally are more aggregates intensive than residential construction. Overall demand in private nonresidential construction generally is driven by job growth, vacancy rates, private infrastructure needs and demographic trends. The growth of the private workforce creates demand for offices, hotels and restaurants. Likewise, population growth generates demand for stores, shopping centers, warehouses and parking decks as well as hospitals, churches and entertainment facilities. Large industrial projects, such as a new manufacturing facility, can increase the need for other manufacturing plants to supply parts and assemblies. Construction activity in this end market is influenced by a firm's ability to finance a project and the cost of such financing. This end market also includes capital investments in public nonresidential facilities to meet the needs of a growing population. |

Nonresidential construction is expected to continue to be a stable source of volume growth in 2016 based on the following assumptions: (1) continuing employment growth should provide support, as it has in the past, (2) current backlogs that our customers and industry groups are reporting should continue to be a source of demand in 2016 and (3) growing state and local tax revenues should provide local governments with the funds to make capital investments in schools and other public nonresidential facilities to meet the needs of a growing population.

|

§ |

Residential Construction: The majority of residential construction is for single-family houses with the remainder consisting of multi-family construction (i.e., two family houses, apartment buildings and condominiums). Public housing comprises only a small portion of housing demand. Household formations in our markets continue to outpace household formations in the rest of the United States. Construction activity in this end market is influenced by the cost and availability of mortgage financing. |

U.S. housing starts, as measured by Dodge Analytics data, peaked in early 2006 at over 2 million units annually. By the end of 2009, total housing starts had declined to less than 0.6 million units, well below prior historical lows of approximately 1 million units annually. In 2015, total annual housing starts increased to more than 1.1 million units. The growth in residential construction bodes well for continued recovery in our markets.

ADDITIONAL AGGREGATES PRODUCTS AND MARKETS

We sell aggregates that are used as ballast for construction and maintenance of railroad tracks. We also sell riprap and jetty stone for erosion control along roads and waterways. In addition, stone can be used as a feedstock for cement and lime plants and for making a variety of adhesives, fillers and extenders. Coal-burning power plants use limestone in scrubbers to reduce harmful emissions. Limestone that is crushed to a fine powder can be sold as agricultural lime.

We sell a relatively small amount of construction aggregates outside of the United States, principally in the areas surrounding our large quarry on the Yucatan Peninsula in Mexico. Nondomestic sales and long-lived assets outside the United States are reported in Note 15 "Segment Reporting" in Item 8 "Financial Statements and Supplementary Data."

|

Part I |

12 |

2. ASPHALT MIX

We produce and sell asphalt mix in Arizona, California, New Mexico and Texas. This segment relies on our reserves of aggregates, functioning essentially as a customer to our aggregates operations. Aggregates are a major component in asphalt mix, comprising approximately 95% by weight of this product. We meet the aggregates requirements for our Asphalt Mix segment primarily through our Aggregates segment. These product transfers are made at local market prices for the particular grade and quality of material required.

Because asphalt mix hardens rapidly, delivery typically is within close proximity to the producing facility. The asphalt mix production process requires liquid asphalt cement, which we purchase from third-party producers. We do not anticipate any significant difficulties in obtaining the raw materials necessary for this segment to operate. We serve our Asphalt Mix segment customers from our local production facilities.

3. CONCRETE

We produce and sell ready-mixed concrete in Arizona, Georgia, Maryland, New Mexico, Texas, Virginia, Washington D.C. and the Bahamas. In May 2015, we entered the Arizona ready-mixed concrete market through the acquisition of ready-mixed concrete operations in conjunction with the acquisition of aggregates operations in Arizona and New Mexico. In January 2015, we swapped our ready-mixed concrete operations in California for asphalt mix operations, primarily in Arizona. In March 2014, we sold our cement and concrete businesses in the Florida area. For additional details see Note 19 “Acquisitions and Divestitures” in Item 8 “Financial Statements and Supplementary Data.”

This segment relies on our reserves of aggregates, functioning essentially as a customer to our aggregates operations. Aggregates are a major component in ready-mixed concrete, comprising approximately 80% by weight of this product. We meet the aggregates requirements of our Concrete segment primarily through our Aggregates segment. These product transfers are made at local market prices for the particular grade and quality of material required.

We serve our Concrete segment customers from our local production facilities or by truck. Because ready-mixed concrete hardens rapidly, delivery typically is within close proximity to the producing facility.

Ready-mixed concrete production also requires cement which we purchase from third-party producers. We do not anticipate any significant difficulties in obtaining the raw materials necessary for this segment to operate.

4. CALCIUM

As previously noted, in March 2014, we sold our cement and concrete businesses in the Florida area. For additional details see Note 19 “Acquisitions and Divestitures” in Item 8 “Financial Statements and Supplementary Data.” We retained our former Cement segment’s calcium operation in Brooksville, Florida. This facility produces calcium products for the animal feed, paint, plastics, water treatment and joint compound industries with high quality calcium carbonate material mined at the Brooksville quarry.

OTHER BUSINESS-RELATED ITEMS

SEASONALITY AND CYCLICAL NATURE OF OUR BUSINESS

Almost all of our products are produced and consumed outdoors. Seasonal changes and other weather-related conditions can affect the production and sales volumes of our products. Therefore, the financial results for any quarter do not necessarily indicate the results expected for the year. Normally, the highest sales and earnings are in the third quarter and the lowest are in the first quarter. Furthermore, our sales and earnings are sensitive to national, regional and local economic conditions and particularly to cyclical swings in construction spending, primarily in the private sector. The levels of construction spending are affected by a number of factors including changing interest rates and demographic and population fluctuations.

|

Part I |

13 |

CUSTOMERS

No material part of our business depends upon any single customer whose loss would have a significant adverse effect on our business. In 2015, our five largest customers accounted for 7.0% of our total revenues (excluding internal sales), and no single customer accounted for more than 2.3% of our total revenues. Our products typically are sold to private industry and not directly to governmental entities. Although approximately 45% to 55% of our aggregates shipments have historically been used in publicly funded construction, such as highways, airports and government buildings, relatively insignificant sales are made directly to federal, state, county or municipal governments/agencies. Therefore, although reductions in state and federal funding can curtail publicly funded construction, our business is not directly subject to renegotiation of profits or termination of contracts with state or federal governments.

ENVIRONMENTAL COSTS AND GOVERNMENTAL REGULATION

Our operations are subject to numerous federal, state and local laws and regulations relating to the protection of the environment and worker health and safety; examples include regulation of facility air emissions and water discharges, waste management, protection of wetlands, listed and threatened species, noise and dust exposure control for workers, and safety regulations under both Mine Safety and Health Administration (MSHA) and Occupational Safety and Health Administration (OSHA). Compliance with these various regulations requires a substantial capital investment, and ongoing expenditures for the operation and maintenance of systems and implementation of programs. We estimate that capital expenditures for environmental control facilities in 2016 and 2017 will be approximately $12.5 million and $15.4 million, respectively. These anticipated expenditures are not expected to have a material impact on our earnings or competitive position.

Frequently, we are required by state and local regulations or contractual obligations to reclaim our former mining sites. These reclamation liabilities are recorded in our financial statements as a liability at the time the obligation arises. The fair value of such obligations is capitalized and depreciated over the estimated useful life of the owned or leased site. The liability is accreted through charges to operating expenses. To determine the fair value, we estimate the cost for a third party to perform the legally required reclamation, which is adjusted for inflation and risk and includes a reasonable profit margin. All reclamation obligations are reviewed at least annually. Reclaimed quarries often have potential for use in commercial or residential development or as reservoirs or landfills. However, no projected cash flows from these anticipated uses have been considered to offset or reduce the estimated reclamation liability.

For additional information regarding reclamation obligations (referred to in our financial statements as asset retirement obligations), see Notes 1 and 17 to the consolidated financial statements in Item 8 "Financial Statements and Supplementary Data."

PATENTS AND TRADEMARKS

We do not own or have a license or other rights under any patents, registered trademarks or trade names that are material to any of our reporting segments.

OTHER INFORMATION REGARDING VULCAN

Vulcan is a New Jersey corporation incorporated on February 14, 2007, while its predecessor company was incorporated on September 27, 1956. Our principal sources of energy are electricity, diesel fuel, natural gas and coal. We do not anticipate any difficulty in obtaining sources of energy required for operation of any of our reporting segments in 2016.

As of January 1, 2016, we employed 6,799 people in the United States. Of these employees, 589 are represented by labor unions. Also, as of that date, we employed 387 people in Mexico and 1 in the Bahamas, 315 of whom are represented by a labor union. We do not anticipate any significant issues with any unions in 2016.

We do not use a backlog of orders to evaluate and understand our business at a Company level.

|

Part I |

14 |

EXECUTIVE OFFICERS OF THE REGISTRANT

The names, positions and ages, as of February 20, 2016, of our executive officers are as follows:

|

Name |

Position |

Age |

|

J. Thomas Hill |

Chairman and Chief Executive Officer |

56 |

|

John R. McPherson |

Executive Vice President, Chief Financial and Strategy Officer |

47 |

|

Stanley G. Bass |

Chief Growth Officer |

54 |

|

Michael R. Mills |

Chief Administrative Officer |

55 |

|

Jerry F. Perkins |

General Counsel |

46 |

|

David P. Clement |

President – Central Division |

55 |

|

William K. Duke |

President – Mideast Division |

60 |

|

David J. Grayson |

President – Southeast Division |

57 |

|

C. Brockway Lodge, Jr. |

President – Western Division |

43 |

|

Jeffery G. Lott |

President – Southwest Division |

57 |

|

David B. Pasley |

President – Mountain West Division |

57 |

|

Jason B. Teter |

President – Southern and Gulf Coast Division |

41 |

|

Ejaz A. Khan |

Vice President, Controller and Chief Information Officer |

58 |

The principal occupations of the executive officers during the past five years are set forth below:

J. Thomas Hill was elected Chairman of the Board of Directors effective January 1, 2016. He was elected President and Chief Executive Officer in July 2014. Prior to that he served as Executive Vice President and Chief Operating Officer (January 2014 – July 2014), Senior Vice President – South Region (December 2011 – December 2013) and President, Florida Rock Division (September 2010 – December 2011).

John R. McPherson was elected Executive Vice President, Chief Financial and Strategy Officer in July 2014. Prior to that he served as Executive Vice President and Chief Financial Officer (January 2014 – July 2014), Senior Vice President – East Region (November 2012 – December 2013) and Senior Vice President, Strategy and Business Development (October 2011 – November 2012). Before joining Vulcan in October 2011, Mr. McPherson was a senior partner at McKinsey & Company, a global management consulting firm, from 1995 to 2011.

Stanley G. Bass was elected Chief Growth Officer in February 2016. He served as Senior Vice President – Western and Mountain West Divisions from January 2015 to February 2016. He served as Senior Vice President – West Region from September 2013 to December 2014. Prior to that, he served as Senior Vice President – Central and West Regions (February 2013 – September 2013), Senior Vice President – Central Region (December 2011 – February 2013) and President, Midsouth and Southwest Divisions (September 2010 – December 2011).

Michael R. Mills was elected Chief Administrative Officer in February 2016. He served as Senior Vice President and General Counsel from November 2012 to February 2016; and as Senior Vice President – East Region from December 2011 to October 2012. Prior to that, he was President, Southeast Division.

Jerry F. Perkins, Jr. was elected General Counsel in February 2016. He served as Assistant General Counsel since 2011.

David P. Clement was named President – Central Division effective January 1, 2015. He served as Senior Vice President – Central Region from September 2013 through December 2014. During the five years prior to such role, he served in a number of positions with Vulcan including Vice President and General Manager, Midwest Division and Vice President of Operations, Midwest Division.

William K. Duke was named President – Mideast Division effective January 1, 2015. Prior to that, he served in a number of roles over the past five years for Vulcan, including: Vice President and General Manager, Florida (August 2012 – December 2014) and Vice President and General Manager, Aggregates – Florida Rock Division (January 2010 – August 2012).

|

Part I |

15 |

David J. Grayson began serving as President – Southeast Division on January 1, 2015. Before assuming that role, he served as Vice President and General Manager, Georgia for the preceding five years.

C. Brockway (Brock) Lodge, Jr. was named President – Western Division in February 2016. He served as Vice President and General Manager, Western Division from April 2015 to February 2016. Before that, he was Senior Area General Manager – Central Division (June 2013 – March 2015) and Director of Sales and Marketing – Midsouth Division (April 2010 – May 2013).

Jeffery G. Lott was named President – Southwest Division effective January 1, 2015. Prior to that, he served in a number of roles over the past five years for Vulcan, including Vice President and General Manager, Texas (July 2010 – December 2014).

David B. Pasley began serving as President – Mountain West Division in January 2015. Before that, he was Vice President and General Manager of Central and Northern California (February 2013 – December 2014); Vice President and General Manager of Arizona and Central and Northern California (February 2012 – January 2013); and Vice President and General Manager of Arizona and New Mexico (August 2010 – January 2012).

Jason P. Teter began serving as President – Southern and Gulf Coast Division on January 1, 2015. Prior to that, he served as Vice President – Business Development from October 2013 to December 2014. Before joining Vulcan, for four years he was the Vice President and General Manager, Georgia Aggregates for Lafarge North America.

Ejaz A. Khan was elected Vice President and Controller in February 1999. He was elected Chief Information Officer in February 2000.

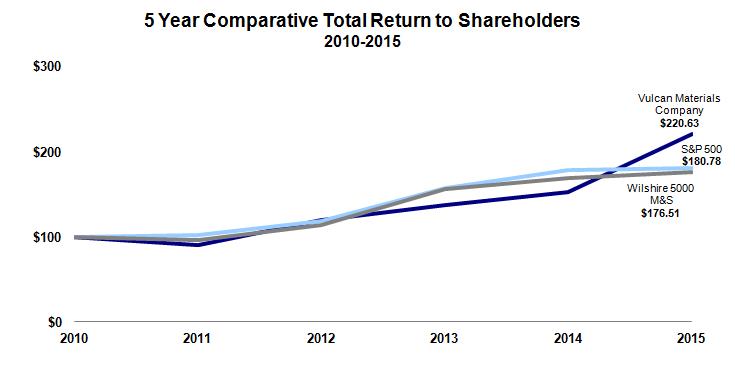

shareholder return performance presentation

Below is a graph comparing the performance of our common stock, with dividends reinvested, to that of the Standard & Poor’s 500 Stock Index (S&P 500) and the Materials and Services Sector of the Wilshire 5000 Index (Wilshire 5000 M&S) from December 31, 2010 to December 31, 2015. The Wilshire 5000 M&S is a market capitalization weighted sector containing public equities of firms in the Materials and Services sector, which includes our company and approximately 1,300 other companies.

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | |||||||||||||||||

|

Comparative Total Return 1 |

||||||||||||||||||||||

|

Vulcan Materials Company |

$ 100.00 |

$ 90.60 |

$ 119.95 |

$ 136.99 |

$ 152.06 |

$ 220.63 |

||||||||||||||||

|

S&P 500 |

$ 100.00 |

$ 102.11 |

$ 118.45 |

$ 156.81 |

$ 178.28 |

$ 180.78 |

||||||||||||||||

|

Wilshire 5000 M&S |

$ 100.00 |

$ 96.60 |

$ 114.18 |

$ 155.51 |

$ 168.42 |

$ 176.51 |

||||||||||||||||

|

1 |

Assumes an initial investment at December 31, 2010 of $100 in each stock/index, with quarterly reinvestment of dividends. |

|

|

Part I |

16 |

INVESTOR INFORMATION

We make available on our website, www.vulcanmaterials.com, free of charge, copies of our:

|

§ |

Annual Report on Form 10-K |

|

§ |

Quarterly Reports on Form 10-Q |

|

§ |

Current Reports on Form 8-K |

We also provide amendments to those reports filed with or furnished to the Securities and Exchange Commission (SEC) pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as well as all Forms 3, 4 and 5 filed with the SEC by our executive officers and directors, as soon as the filings are made publicly available by the SEC on its EDGAR database (www.sec.gov).

The public may read and copy materials filed with the SEC at the Public Reference Room of the SEC at 100 F Street, NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-732-0330. In addition to accessing copies of our reports online, you may request a copy of our Annual Report on Form 10-K, including financial statements, by writing to Jerry F. Perkins Jr., Secretary, Vulcan Materials Company, 1200 Urban Center Drive, Birmingham, Alabama 35242.

We have a:

|

§ |

Business Conduct Policy applicable to all employees and directors |

|

§ |

Code of Ethics for the CEO and Senior Financial Officers |

Copies of the Business Conduct Policy and the Code of Ethics are available on our website under the heading "Corporate Governance." If we make any amendment to, or waiver of, any provision of the Code of Ethics, we will disclose such information on our website as well as through filings with the SEC.

Our Board of Directors has also adopted:

|

§ |

Corporate Governance Guidelines |

|

§ |

Charters for its Audit, Compensation, Executive, Finance, Governance and Safety, Health & Environmental Affairs Committees |

These documents meet all applicable SEC and New York Stock Exchange (NYSE) regulatory requirements.

The Audit, Compensation and Governance Charters are available on our website under the heading, "Corporate Governance," or you may request a copy of any of these documents by writing to Jerry F. Perkins Jr., Secretary, Vulcan Materials Company, 1200 Urban Center Drive, Birmingham, Alabama 35242.

Information included on our website is not incorporated into, or otherwise made a part of, this report.

CERTIFICATIONS AND ASSERTIONS

The certifications of our Chief Executive Officer and Chief Financial Officer made pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 are included as exhibits to this Annual Report on Form 10-K. Additionally, on June 2, 2015 our Chief Executive Officer submitted to the NYSE the annual written affirmation required by the rules of the NYSE certifying that he was not aware of any violations of Vulcan Materials Company of NYSE corporate governance listing standards.

|

Part I |

17 |

RISK FACTORS

An investment in our common stock involves risks. You should carefully consider the following risks, together with the information included in or incorporated by reference in this report, before deciding whether an investment in our common stock is suitable for you. If any of these risks actually occurs, our business, results of operations or financial condition could be materially and adversely affected. In such an event, the trading prices of our common stock could decline and you might lose all or part of your investment. The following is a list of our risk factors.

ECONOMIC/POLITICAL RISKS

Changes in legal requirements and governmental policies concerning zoning, land use, environmental and other areas of the law may result in additional liabilities, a reduction in operating hours and additional capital expenditures — Our operations are affected by numerous federal, state and local laws and regulations related to zoning, land use and environmental matters. Despite our compliance efforts, we have an inherent risk of liability in the operation of our business. These potential liabilities could have an adverse impact on our operations and profitability. In addition, our operations are subject to environmental, zoning and land use requirements and require numerous governmental approvals and permits, which often require us to make significant capital and operating expenditures to comply with the applicable requirements. Stricter laws and regulations, or more stringent interpretations of existing laws or regulations, may impose new liabilities on us, reduce operating hours, require additional investment by us in pollution control equipment, or impede our opening new or expanding existing plants or facilities.

Our business is dependent on the timing and amount of federal, state and local funding for infrastructure — Our products are used in a variety of public infrastructure projects that are funded and financed by federal, state and local governments. Congress recently passed a five-year, fully funded bill to invest in roads, bridges and public transportation. The resulting certainty and the modestly increased investment are positive developments and mitigate risk in this area. In addition, eleven Vulcan-served states successfully increased transportation funding between 2013 and the present; similar efforts are expected in at least three other states in our service area in 2016. However, given varying state and local budgetary situations and the associated pressure on infrastructure spending, we cannot be entirely assured of the existence, amount and timing of appropriations for future public infrastructure projects.

Climate change and climate change legislation or regulations may adversely impact our business — A number of governmental bodies have introduced or are contemplating legislative and regulatory change in response to the potential impacts of climate change. Such legislation or regulation, if enacted, potentially could include provisions for a "cap and trade" system of allowances and credits or a carbon tax, among other provisions.

Other potential impacts of climate change include physical impacts, such as disruption in production and product distribution due to impacts from major storm events, shifts in regional weather patterns and intensities, and potential impacts from sea level changes. There is also a potential for climate change legislation and regulation to adversely impact the cost of purchased energy and electricity.

The impacts of climate change on our operations and the company overall are highly uncertain and difficult to estimate. However, climate change legislation and regulation concerning greenhouse gases could have a material adverse effect on our future financial position, results of operations or cash flows.

GROWTH AND COMPETITIVE RISKS

Within our local markets, we operate in a highly competitive industry which may negatively impact prices, volumes and costs — The construction aggregates industry is highly fragmented with a large number of independent local producers in a number of our markets. Additionally, in most markets, we also compete against large private and public companies, some of which are significantly vertically integrated. Therefore, there is intense competition in a number of markets in which we operate. This significant competition could lead to lower prices and lower sales volumes in some markets, negatively affecting our earnings and cash flows.

The expanded use of aggregates substitutes could have a material adverse effect on our business, financial condition and results of operations — Recycled concrete and asphalt mix are increasingly being used in a number of our markets, particularly urban markets, as a substitute for aggregates. The use of recycled concrete and asphalt mix could cause a significant reduction in the demand for aggregates.

|

Part I |

18 |

Our long-term success depends upon securing and permitting aggregates reserves in strategically located areas. If we are unable to secure and permit such reserves it could negatively affect our future earnings — Construction aggregates are bulky and heavy and, therefore, difficult to transport efficiently. Because of the nature of the products, the freight costs can quickly surpass the production costs. Therefore, except for geographic regions that do not possess commercially viable deposits of aggregates and are served by rail, barge or ship, the markets for our products tend to be localized around our quarry sites and are served by truck. New quarry sites often take years to develop; therefore, our strategic planning and new site development must stay ahead of actual growth. Additionally, in a number of urban and suburban areas in which we operate, it is increasingly difficult to permit new sites or expand existing sites due to community resistance. Therefore, our future success is dependent, in part, on our ability to accurately forecast future areas of high growth in order to locate optimal facility sites and on our ability to secure operating and environmental permits to operate at those sites.

Our future growth depends in part on acquiring other businesses in our industry and successfully integrating them with our existing operations. If we are unable to integrate acquisitions successfully, it could lead to higher costs and could negatively affect our earnings — The expansion of our business is dependent in part on the acquisition of existing businesses that own or control aggregates reserves. Disruptions in the availability of financing could make it more difficult to capitalize on potential acquisitions. Additionally, with regard to the acquisitions we are able to complete, our future results will depend in part on our ability to successfully integrate these businesses with our existing operations.

FINANCIAL/ACCOUNTING RISKS

Our industry is capital intensive, resulting in significant fixed and semi-fixed costs. Therefore, our earnings are highly sensitive to changes in volume — Due to the high levels of fixed capital required for extracting and producing construction aggregates, our profits and profit margins are negatively affected by significant decreases in volume.

Significant downturn in the construction industry may result in an impairment of our goodwill — We test goodwill for impairment on an annual basis or more frequently if events or circumstances change in a manner that would more likely than not reduce the fair value of a reporting unit below its carrying value. While we have not identified any events or changes in circumstances since our annual impairment test on November 1, 2015 that indicate the fair value of any of our reporting units is below its carrying value, a significant downturn in the construction industry may have a material effect on the fair value of our reporting units. A significant decrease in the estimated fair value of one or more of our reporting units could result in the recognition of a material, noncash write-down of goodwill.

We have substantial debt and our credit ratings are non-investment grade — Our ability to make scheduled interest and principal payments depends on our financial performance. Financial performance is, in turn, subject to general economic and business conditions, many of which are outside of our control. Our ability to refinance maturing debt depends on our financial performance and the state of the non-investment grade debt market, which is more volatile than the investment-grade debt market.

Our debt instruments contain customary covenants, including: affirmative (e.g., maintain insurance), negative (e.g., to limit our ability to incur secured debt), informational (e.g., provide financial statements) and financial (e.g., minimum EBITDA to interest ratio) covenants. If we fail to comply with any of these covenants, the related debt could become due prior to its stated maturity, and our ability to obtain alternative or additional financing could be impaired.

We use estimates in accounting for a number of significant items. Changes in our estimates could adversely affect our future financial results — As discussed more fully in "Critical Accounting Policies" under Item 7 "Management’s Discussion and Analysis of Financial Condition and Results of Operations," we use significant judgment in accounting for:

|

§ |

goodwill and goodwill impairment |

|

§ |

impairment of long-lived assets excluding goodwill |

|

§ |

reclamation costs |

|

§ |

pension and other postretirement benefits |

|

§ |

environmental compliance |

|

§ |

claims and litigation including self-insurance |

|

§ |

income taxes |

|

Part I |

19 |

We believe we have sufficient experience and reasonable procedures to enable us to make appropriate assumptions and formulate reasonable estimates; however, these assumptions and estimates could change significantly in the future and could adversely affect our financial position, results of operations, or cash flows.

PERSONNEL RISKS

Our future success greatly depends upon attracting and retaining qualified personnel, particularly in sales and operations — A significant factor in our future profitability is our ability to attract, develop and retain qualified personnel. Our success in attracting qualified personnel, particularly in the areas of sales and operations, is affected by changing demographics of the available pool of workers with the training and skills necessary to fill the available positions, the impact on the labor supply due to general economic conditions, and our ability to offer competitive compensation and benefit packages.

We are subject to various risks arising from our international business operations and relationships, which could adversely affect our business — We have international operations and are subject to both the risks of conducting international business and the requirements of the Foreign Corrupt Practices Act of 1977 (the FCPA). Failure to comply with the FCPA may result in legal claims against us. In addition, we face other risks associated with international operations and relationships, which may include restrictive trade policies, imposition of duties, taxes or government royalties impressed by foreign governments.

OTHER RISKS

We are dependent on information technology and our systems and infrastructure face certain risks, including cybersecurity risks and data leakage risks — Any significant breakdown, invasion, destruction or interruption of our systems by employees, others with authorized access to our systems or unauthorized persons could negatively impact operations. There is also a risk that we could experience a business interruption, theft of information, or reputational damage as a result of a cyber-attack, such as an infiltration of a data center, or data leakage of confidential information either internally or at our third-party providers. While we have invested in the protection of our data and informational technology to reduce these risks and periodically test the security of our information systems network, there can be no assurance that our efforts will prevent breakdowns or breaches in our systems that could adversely affect or business. Management is not aware of a cybersecurity incident that has had a material impact on our operations.

Weather can materially affect our operating results — Almost all of our products are consumed outdoors in the public or private construction industry, and our production and distribution facilities are located outdoors. Inclement weather affects both our ability to produce and distribute our products and affects our customers’ short-term demand because their work also can be hampered by weather.

Our products are transported by truck, rail, barge or ship, often by third-party providers. Significant delays or increased costs affecting these transportation methods could materially affect our operations and earnings — Our products are distributed either by truck to local markets or by rail, barge or oceangoing vessel to remote markets. The costs of transporting our products could be negatively affected by factors outside of our control, including rail service interruptions or rate increases, tariffs, rising fuel costs and capacity constraints. Additionally, inclement weather, including hurricanes, tornadoes and other weather events, can negatively impact our distribution network.

We use large amounts of electricity, diesel fuel, liquid asphalt and other petroleum-based resources that are subject to potential supply constraints and significant price fluctuation, which could affect our operating results and profitability — In our production and distribution processes, we consume significant amounts of electricity, diesel fuel, liquid asphalt and other petroleum-based resources. The availability and pricing of these resources are subject to market forces that are beyond our control. Our suppliers contract separately for the purchase of such resources and our sources of supply could be interrupted should our suppliers not be able to obtain these materials due to higher demand or other factors that interrupt their availability. Variability in the supply and prices of these resources could materially affect our operating results from period to period and rising costs could erode our profitability.

|

Part I |

20 |

We are involved in a number of legal proceedings. We cannot predict the outcome of litigation and other contingencies with certainty — We are involved in several complex litigation proceedings, some arising from our previous ownership and operation of our Chemicals and Metals businesses. Although we divested our Chemicals business in June 2005, we retained certain liabilities related to the business. As required by generally accepted accounting principles, we establish reserves when a loss is determined to be probable and the amount can be reasonably estimated. Our assessment of probability and loss estimates are based on the facts and circumstances known to us at a particular point in time. Subsequent developments in legal proceedings may affect our assessment and estimates of a loss contingency, and could result in an adverse effect on our financial position, results of operations or cash flows. For a description of our current significant legal proceedings see Note 12 "Commitments and Contingencies" in Item 8 "Financial Statements and Supplementary Data."

We are involved in certain environmental matters. We cannot predict the outcome of these contingencies with certainty — We are involved in environmental investigations and cleanups at sites where we operate or have operated in the past or sent materials for recycling or disposal. As required by generally accepted accounting principles, we establish reserves when a loss is determined to be probable and the amount can be reasonably estimated. Our assessment of probability and loss estimates are based on the facts and circumstances known to us at a particular point in time. Subsequent developments related to these matters may affect our assessment and estimates of loss contingency, and could result in an adverse effect on our financial position, results of operations or cash flows. For a description of our current significant environmental matters see Note 12 “Commitments and Contingencies" in Item 8 "Financial Statements and Supplementary Data."

UNRESOLVED STAFF COMMENTS

We have not received any written comments from the Securities and Exchange Commission staff regarding our periodic or current reports under the Exchange Act of 1934 that remain unresolved.

|

Part I |

21 |

PROPERTIES

AGGREGATES

As the largest U.S. producer of construction aggregates, we have operating facilities across the U.S. and in Mexico and the Bahamas. We principally serve markets in 20 states, Washington D.C. and the local markets surrounding our operations in Mexico and the Bahamas. Our primary focus is serving states and metropolitan markets in the U.S. that are expected to experience the most significant growth in population, households and employment. These three demographic factors are significant drivers of demand for aggregates.

Our current estimate of 15.7 billion tons of proven and probable aggregates reserves reflects a decrease of 0.1 billion tons from the prior year’s estimate. Estimates of reserves are of recoverable stone, sand and gravel of suitable quality for economic extraction, based on drilling and studies by our geologists and engineers, recognizing reasonable economic and operating restraints as to maximum depth of overburden and stone excavation, and subject to permit or other restrictions.

|

Part I |

22 |

Proven, or measured, reserves are those reserves for which the quantity is computed from dimensions revealed by drill data, together with other direct and measurable observations, such as outcrops, trenches and quarry faces. The grade and quality of those reserves are computed from the results of detailed sampling, and the sampling and measurement data are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well established. Probable, or indicated, reserves are those reserves for which quantity, grade and quality are computed partly from specific measurements and partly from projections based on reasonable, though not drilled, geologic evidence. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation.

Reported proven and probable reserves include only quantities that are owned in fee or under lease, and for which all appropriate zoning and permitting have been obtained. Leases, zoning, permits, reclamation plans and other government or industry regulations often set limits on the areas, depths and lengths of time allowed for mining, stipulate setbacks and slopes that must be left in place, and designate which areas may be used for surface facilities, berms, and overburden or waste storage, among other requirements and restrictions. Our reserve estimates take into account these factors. Technical and economic factors also affect the estimates of reported reserves regardless of what might otherwise be considered proven or probable based on a geologic analysis. For example, excessive overburden or weathered rock, rock quality issues, excessive mining depths, groundwater issues, overlying wetlands, endangered species habitats, and rights of way or easements may effectively limit the quantity of reserves considered proven and probable. In addition, computations for reserves in-place are adjusted for estimates of unsaleable sizes and materials as well as pit and plant waste.

The 15.7 billion tons of estimated proven and probable aggregates reserves reported at the end of 2015 include reserves at inactive and greenfield (undeveloped) sites. The table below presents, by division, the tons of proven and probable aggregates reserves as of December 31, 2015 and the types of facilities operated.

|

(millions of tons) |

Number of Aggregates Operating Facilities 1 |

|||||||||||||||||||||

|

Aggregates Reserves |

2015 |

Sand and |

||||||||||||||||||||

|

Proven |

Probable |

Total |

Production |

Stone |

Gravel |

Sales Yards |

||||||||||||||||

|

Central 2 |

3,052.7 | 958.9 | 4,011.6 | 36.3 | 59 | 5 | 9 | |||||||||||||||

|

International 2 |

592.2 | 0.0 | 592.2 | 14.3 | 1 | 0 | 0 | |||||||||||||||

|

Mideast 2 |

2,529.5 | 1,144.1 | 3,673.6 | 32.4 | 35 | 7 | 22 | |||||||||||||||

|

Mountain West 2 |

180.8 | 128.5 | 309.3 | 5.7 | 1 | 13 | 2 | |||||||||||||||

|

Southeast 2, 3 |

2,739.3 | 823.5 | 3,562.8 | 34.8 | 40 | 14 | 6 | |||||||||||||||

|

Southern Gulf Coast 2 |

1,172.2 | 30.7 | 1,202.9 | 11.7 | 22 | 0 | 26 | |||||||||||||||

|

Southwest 2 |

1,162.9 | 10.0 | 1,172.9 | 19.5 | 17 | 1 | 18 | |||||||||||||||

|

Western 2 |

675.8 | 508.0 | 1,183.8 | 25.8 | 7 | 14 | 1 | |||||||||||||||

|

Total |

12,105.4 | 3,603.7 | 15,709.1 | 180.5 | 182 | 54 | 84 | |||||||||||||||

|

1 |

In addition to the facilities included in the table above, we operated 24 recrushed concrete plants which are not dependent on reserves. |

|

|

2 |

The divisions are defined by states/countries as follows: Central Division — Arkansas, Illinois, Kentucky and Tennessee International Division — Mexico Mideast Division — Delaware, Maryland, North Carolina, Pennsylvania, Virginia and Washington D.C. Mountain West Division — Arizona and New Mexico Southeast Division — Florida (excluding panhandle), Georgia, South Carolina and the Bahamas Southern Gulf Coast Division — Alabama, Florida panhandle, Louisiana and Mississippi Southwest Division — Oklahoma and Texas Western Division — California |

|

|

3 |

Includes a maximum of 377.2 million tons of reserves encumbered by volumetric production payments as defined in Note 1 "Summary of Significant Accounting Policies" in Item 8 "Financial Statements and Supplementary Data" under the caption Deferred Revenue. |

|