Exhibit (a)(1)(i)

U.S. OFFER TO PURCHASE FOR CASH

ALL OUTSTANDING ORDINARY SHARES HELD BY U.S. HOLDERS AND

ALL OUTSTANDING AMERICAN DEPOSITARY SHARES REPRESENTING ORDINARY SHARES, HELD BY ALL HOLDERS, WHEREVER LOCATED

OF

TIGENIX

FOR

€1.78 PER ORDINARY SHARE

AND

€35.60 PER AMERICAN DEPOSITARY SHARE, PAYABLE IN U.S. DOLLARS,

BY

TAKEDA PHARMACEUTICAL COMPANY LIMITED

THE U.S. OFFER AND WITHDRAWAL RIGHTS WILL EXPIRE AT 10:00 A.M., NEW YORK CITY TIME, ON MAY 31, 2018, UNLESS THE U.S. OFFER IS EXTENDED.

Takeda Pharmaceutical Company Limited, a company organized under the laws of Japan, (“Takeda”) is offering to purchase:

| • | up to 100% of the publicly-held ordinary shares (such shares collectively, the “Ordinary Shares” and each an “Ordinary Share”) of TiGenix NV, a limited liability company (naamloze vennootschap / société anonyme) incorporated and existing under the laws of Belgium (“TiGenix”), which amount shall be deemed to include such additional Ordinary Shares as may be issued from time to time as a result of the exercise of Warrants (as defined below), but to exclude any Ordinary Shares that are owned by Takeda and its affiliates and Ordinary Shares as are represented by American Depositary Shares (such shares collectively, “ADSs” and each an “ADS”), that are held by U.S. holders (as that term is defined under instruction 2 to paragraphs (c) and (d) of Rule 14d-1 under the U.S. Securities Exchange Act of 1934, as amended) (the “Exchange Act”) (such holders collectively, “U.S. Holders” and each a “U.S. Holder”), and |

| • | up to 100% of the ADSs, with each ADS representing 20 Ordinary Shares, from all holders, wherever located, excluding ADSs owned by Takeda and its affiliates, |

at a purchase price of €1.78 for each Ordinary Share (the “Price Per Ordinary Share”) and €35.60 for each ADS (the “Price Per ADS” and, together with the Price Per Ordinary Share, the “Offer Price”), in each case, in cash, without interest, upon the terms and subject to the conditions set forth in this U.S. Offer to Purchase, dated April 30, 2018 (the “U.S. Offer to Purchase”), and in the related Share Acceptance Letter, the related ADS Letter of Transmittal and the related Share Withdrawal Letter, as applicable. The Price Per Ordinary Share will be payable in Euros, while the Price Per ADS will be payable in U.S. dollars in the manner described in Section 2 — “Acceptance for Payment and Payment for Ordinary Shares and ADSs”.

TiGenix is a Belgian company having its registered office at Romeinse straat 12 box 2, 3001 Leuven, Belgium, registered with the Crossroads Bank of Enterprises under number 0471.340.123 (Register of Legal Entities Leuven), with the Ordinary Shares listed on Euronext Brussels (under ISIN-code BE0003864817), and the ADSs listed on the Nasdaq Global Select Market (the “Nasdaq”) (under ISIN-code US88675R1095).

Takeda is offering to purchase all Ordinary Shares, ADSs, warrants to subscribe for Ordinary Shares (the “Warrants” and each a “Warrant”, and together with the Ordinary Shares and ADSs, the “Securities”), in two separate, but concurrent and related, offers in Belgium (the “Belgian Offer”) and in the United States (“U.S.”) (the “U.S. Offer” or this “Offer”), respectively. The U.S. Offer and the Belgian Offer are referred to collectively as the “Offers.” Each of the Offers provides equivalent consideration for securities tendered, and each of the Offers is on substantially the same terms, except as further described herein (see Section 1 – “Terms of the Offer – Second Acceptance Period”). The U.S. Offer is open to all holders of ADSs, wherever located, and to all U.S. Holders of Ordinary Shares. The Belgian Offer is open to all holders of Ordinary Shares and to all holders of Warrants, wherever located. Holders of Ordinary Shares that are not U.S. Holders and holders of Warrants, wherever located, may not use this U.S. Offer to Purchase, and may only tender their Ordinary Shares and Warrants into the Belgian Offer. A separate prospectus, for use by holders of the Ordinary Shares and Warrants, wherever located, is being published concurrently in Belgium after having been approved by the Belgian Financial Services and Markets Authority (the “FSMA”), as required under Belgian law (including any related Belgian Offer documents, the “Belgian Offer Documents”). The Offers are being made pursuant to an Offer and Support Agreement between Takeda and TiGenix, dated as of January 5, 2018 (as it may be amended, modified or supplemented from time to time in accordance with its terms, the “Transaction Agreement”).

The Price Per ADS will be paid in U.S. dollars in the manner described in Section 2 — “Acceptance for Payment and Payment for Ordinary Shares and ADSs”. Holders of ADSs should be aware that fluctuations in the Euro to U.S. dollar exchange rate will cause the value of the cash consideration to be paid to them in respect of their ADSs to change accordingly. All payments to tendering holders of ADSs or U.S. Holders of Ordinary Shares pursuant to the U.S. Offer will be rounded to the nearest whole cent. Under no circumstances will interest be paid on the Offer Price, regardless of any extension of the U.S. Offer or any delay in making payment for the Ordinary Shares held by U.S. Holders or the ADSs.

TiGenix is required to file a Solicitation/Recommendation Statement on Schedule 14D-9 (the “Schedule 14D-9”) advising holders of ADSs and U.S. Holders of Ordinary Shares to accept or reject the tender offer or to take other action with respect to the tender offer and, if so, describe the other action recommended. Holders of ADSs and U.S. Holders of Ordinary Shares should carefully read the information set forth in the Schedule 14D-9, including the information set forth in Item 4 under the sub-headings “Background” and “Reasons for the Recommendation.”

The obligation of Takeda to accept for payment and pay for Ordinary Shares held by U.S. Holders and ADSs validly tendered (and not withdrawn) pursuant to the U.S. Offer is subject to the satisfaction of the following conditions to the offers (the “Conditions to the Offers”) (as further described in Section 15 - “Conditions to the Offers”): (i) the Minimum Acceptance Condition (as defined below), and (ii) the absence of a Material Adverse Effect (as such term is defined in the Transaction Agreement). There is no financing condition to the Offers.

Takeda intends to conduct the U.S. Offer in compliance with the applicable regulatory requirements in the U.S., including the applicable requirements of the U.S. tender offer rules under Regulations 14D and 14E under the Exchange Act. Takeda is relying on the “Tier II” exemption under the Exchange Act in respect of the U.S. Offer. The “Tier II” exemption provides partial relief from the applicability of Exchange Act rules governing third-party tender offers involving the securities of a foreign private issuer if greater than 10% but no more than 40% of the subject class of securities are held by U.S. Holders. In determining that the “Tier II” exemption applies to the U.S. Offer, Takeda has determined the percentage of outstanding shares held by U.S. Holders in accordance with Instruction 2 to Rules 14d-1(c) and (d) under the Exchange Act. Under the “Tier II” exemption, compliance with the requirements of the home jurisdiction law or practice (in this case, Belgium) will satisfy the requirements of certain of the rules applicable to third-party tender offers under the Exchange Act, including, but not limited to, rules relating to prompt payment, subsequent offering periods and withdrawal rights. Takeda has structured the U.S. Offer on the assumption that the Tier II relief from the U.S. tender rules is available in respect of the U.S. Offer.

The Board of Directors of TiGenix (the “TiGenix Board,” and, each of its members, individually, a “Director”) has unanimously: (i) determined that the Transaction Agreement and the transactions contemplated thereby, including the Offers, are advisable and in the best interests of TiGenix and the holders of the Securities, (ii) approved and adopted the Transaction Agreement and the transactions contemplated thereby, including the Offers, in accordance with the requirements of Belgian law, and (iii) recommended that holders of Securities accept the Offers and tender their Securities to Takeda pursuant to the Offers, as applicable.

A summary of the principal terms and conditions of the U.S. Offer appears in the “Summary Term Sheet” beginning on page i of this U.S. Offer to Purchase. You should read this entire document carefully before deciding whether to tender your Ordinary Shares and/or ADSs in the U.S. Offer.

THE U.S. OFFER HAS NOT BEEN APPROVED OR DISAPPROVED BY THE U.S. SECURITIES AND EXCHANGE COMMISSION (“SEC”) OR ANY STATE SECURITIES COMMISSION, NOR HAS THE SEC OR ANY STATE SECURITIES COMMISSION PASSED UPON THE FAIRNESS OR MERITS OF THE U.S. OFFER OR UPON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED IN THE U.S. OFFER TO PURCHASE, THE SHARE ACCEPTANCE LETTER, THE ADS LETTER OF TRANSMITTAL OR THE SHARE WITHDRAWAL LETTER. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL AND A CRIMINAL OFFENSE.

The date of this U.S. Offer to Purchase is April 30, 2018.

* * * * *

Questions and requests for assistance should be directed to the U.S. Information Agent (as defined herein) at its address and telephone numbers set forth below and on the back cover of this U.S. Offer to Purchase.

The U.S. Information Agent for the U.S. Offer is:

Georgeson LLC

1290 Avenue of the Americas,

9th Floor, New York, NY 10104

E-mail: TIG-offer@georgeson.com

U.S. Toll Free Number for Holders of Securities: +1 (866) 391-6921

IMPORTANT INFORMATION

We are not making the U.S. Offer to, and will not accept any tendered Ordinary Shares or ADSs from or on behalf of, holders of Ordinary Shares or ADSs residing in any jurisdiction in which the making of the U.S. Offer or acceptance thereof would not be in compliance with the laws of that jurisdiction. However, we may, at our discretion, take any actions necessary for us to make the U.S. Offer to U.S. Holders of Ordinary Shares and holders of ADSs in any such jurisdiction.

Tenders by U.S. Holders of Ordinary Shares: Any U.S. Holder of Ordinary Shares in book-entry form within Euroclear Belgium desiring to tender all or any portion of the Ordinary Shares owned by such holder can accept the U.S. Offer by delivering a Share Acceptance Letter to the custodian credit institution or financial services institution (a “Custodian Institution”) that holds their Ordinary Shares. Any U.S. Holder of Ordinary Shares whose shares are in registered form will receive a letter evidencing their ownership of the number of Ordinary Shares and describing the procedure to be followed to deposit their duly completed and signed Share Acceptance Letter.

The Custodian Institution that holds the Ordinary Shares for which acceptances of the U.S. Offer have been received will effect book-entry transfers in order to hold the tendered Ordinary Shares under a separate designated securities account for tendered Ordinary Shares within Euroclear Belgium until 10:00 a.m., New York City time, on May 31, 2018 (the “Initial Expiration Date”) or until the date and time of the expiration of any subsequent offering period (each a “Subsequent Offering Period”). For further information, please review Section 3 — “Procedures for Accepting the U.S. Offer and Tendering Ordinary Shares and/or ADSs.”

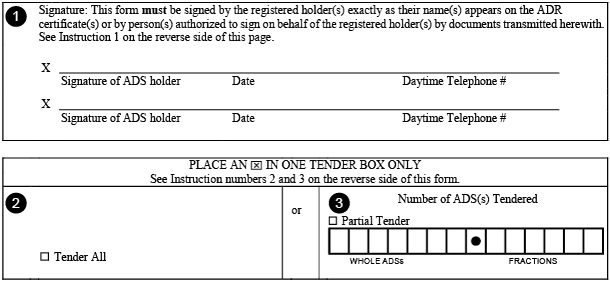

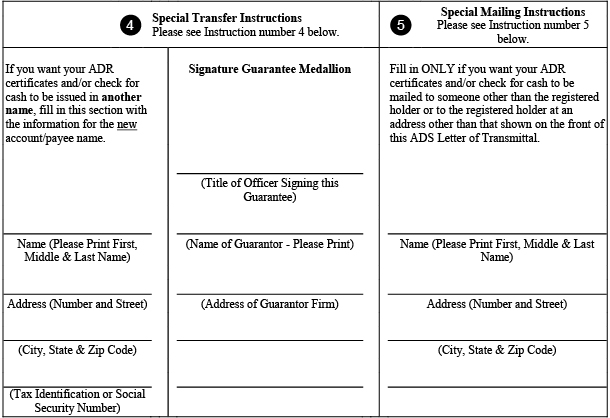

Tenders by Holders of ADSs: Any holder of ADSs desiring to tender all or any portion of the ADSs owned by such holder can accept the U.S. Offer by (1) completing and signing the ADS Letter of Transmittal (or a copy thereof, provided the signature is original) in accordance with the instructions in the ADS Letter of Transmittal and mail or deliver it together with the American Depositary Receipts (“ADRs”) evidencing such tendered ADSs and all other required documents to Computershare Inc., as tender agent of Takeda for the ADSs in the U.S. Offer (the “U.S. ADS Tender Agent”), at the address appearing on the back cover page of this U.S. Offer to Purchase, (2) tendering such ADSs pursuant to the procedures for book-entry transfer set forth in Section 3 — “Procedures for Accepting the U.S. Offer and Tendering Ordinary Shares and/or ADSs” or (3) complying with the guaranteed delivery procedures set forth in Section 3 — “Procedures for Accepting the U.S. Offer and Tendering Ordinary Shares and/or ADSs.” Any holder of ADSs whose ADSs are registered in the name of a broker, dealer, commercial bank, trust company or other nominee must contact such broker, dealer, commercial bank, trust company or other nominee if such holder desires to tender such ADSs.

Any holder of ADSs who desires to tender ADSs but cannot comply with the procedures for book-entry transfer described in this U.S. Offer to Purchase on a timely basis, may tender such ADSs by following the procedures for guaranteed delivery set forth in Section 3 — “Procedures for Accepting the U.S. Offer and Tendering Ordinary Shares and/or ADSs.”

Settlement of the Offer Price: The Price Per Ordinary Share accepted for payment pursuant to the U.S. Offer will be in Euros and the Price Per ADS accepted for payment pursuant to the U.S. Offer will be paid in U.S. dollars in the manner described in Section 2 — “Acceptance for Payment and Payment for Ordinary Shares and ADSs.”

Copies of this U.S. Offer to Purchase, the related Share Acceptance Letter, the related ADS Letter of Transmittal, the related Share Withdrawal Letter and any other tender offer materials must not be mailed to or otherwise distributed or sent in, into or from any country where such distribution or offering would require any additional measures to be taken or would be in conflict with any law or regulation of such country or any political subdivision thereof. Persons into whose possession this document comes are required to inform themselves about and to observe any such laws or regulations. This U.S. Offer to Purchase may not be used for, or in connection with, any offer to, or solicitation by, anyone in any jurisdiction or under any circumstances in which such offer or solicitation is not authorized or is unlawful.

Questions and requests for assistance including information on how U.S. Holders of Ordinary Shares may tender their Ordinary Shares or to obtain a copy of the Belgian Offer Documents, may be directed to Georgeson LLC, as U.S. information agent (the “U.S. Information Agent”), at the telephone number set forth on the back cover of this U.S. Offer to Purchase. Additional copies of this U.S. Offer to Purchase, the related Share Acceptance Letter, the related ADS Letter of Transmittal, the related Share Withdrawal Letter and other tender offer documents may be obtained free of charge from the U.S. Information Agent or from brokers, dealers, commercial banks, trust companies or other nominees.

All references to “U.S. dollars,” “USD” and “$” are to the currency which is currently legal tender in the United States and all references to “Euros,” “EUR,” and “€” are to the currency which is currently legal tender in Belgium.

We have not authorized any person to make any recommendation on our behalf as to whether you should tender or refrain from tendering your Ordinary Shares or ADSs pursuant to the U.S. Offer. You should rely only on the information contained in this U.S. Offer to Purchase, the related Share Acceptance Letter, the related ADS Letter of Transmittal and the related Share Withdrawal Letter to which we have referred you. We have not authorized anyone to provide you with information or to make any representation in connection with the U.S. Offer other than those contained in this U.S. Offer to Purchase, the related Share Acceptance Letter, the related ADS Letter of Transmittal and the related Share Withdrawal Letter. If anyone makes any recommendation or gives any information or representation regarding the U.S. Offer, you must not rely upon that recommendation, information or representation as having been authorized by us, our board of directors, BNP Paribas Fortis NV/SA (the “U.S. Share Tender Agent”) as Takeda’s U.S. tender agent for the Ordinary Shares in the U.S. Offer, the U.S. ADS Tender Agent for the ADSs in the U.S. Offer, or the U.S. Information Agent for the U.S. Offer. You should not assume that the information provided in this U.S. Offer to Purchase and the Belgian Offer Documents is accurate as of any date other than the date of this U.S. Offer to Purchase or the Belgian Offer Documents, respectively.

Subject to applicable law (including Rule 14d-4 under the Exchange Act, which requires that material changes be promptly disseminated to security holders in a manner reasonably designed to inform them of such changes), delivery of this U.S. Offer to Purchase shall not under any circumstances create any implication that the information contained or incorporated by reference in this U.S. Offer to Purchase is correct as of any time after the date of this U.S. Offer to Purchase or the respective dates of the documents incorporated herein by reference or that there has been no change in the information included or incorporated by reference herein or in the affairs of Takeda or any of its subsidiaries or affiliates since the date hereof or the respective dates of the documents incorporated herein by reference.

| 1. |

3 | |||||

| 2. |

Acceptance for Payment and Payment for Ordinary Shares and ADSs. |

7 | ||||

| 3. |

Procedures for Accepting the U.S. Offer and Tendering Ordinary Shares and/or ADSs. |

9 | ||||

| 4. |

12 | |||||

| 5. |

13 | |||||

| 6. |

18 | |||||

| 7. |

19 | |||||

| 8. |

20 | |||||

| 9. |

21 | |||||

| 10. |

22 | |||||

| 11. |

24 | |||||

| 12. |

Background of the Offers; Past Contacts or Negotiations with TiGenix. |

24 | ||||

| 13. |

29 | |||||

| 14. |

Summary of the Transaction Agreement and Related Agreements. |

31 | ||||

| 15. |

38 | |||||

| 16. |

38 | |||||

| 17. |

39 | |||||

| 18. |

40 |

FORWARD-LOOKING STATEMENTS

This filing contains “forward-looking statements.” Forward-looking statements include all statements other than statements of historical fact, including plans, strategies and expectations for the future, statements regarding the expected timing of filings and approvals relating to the transaction, the expected timing of the completion of the transaction, the ability to complete the transaction or to satisfy the various Conditions to the Offers, future revenues and profitability from or growth or any assumptions underlying any of the foregoing. Statements made in the future tense, and words such as “anticipate,” “expect,” “project,” “continue,” “believe,” “plan,” “estimate,” “pro forma,” “intend,” “potential,” “forecast,” “guidance,” “outlook,” “seek,” “assume,” “will,” “may,” “should,” and similar expressions are intended to qualify as forward-looking statements. Forward-looking statements are based on estimates and assumptions made by management of Takeda that are believed to be reasonable, though they are inherently uncertain and difficult to predict. Investors and security holders are cautioned not to place undue reliance on these forward-looking statements.

Forward-looking statements involve risks and uncertainties that could cause actual results or experience to differ materially from that expressed or implied by the forward-looking statements. Some of these risks and uncertainties include, but are not limited to: the Conditions to the Offers may not be satisfied; competitive pressures and developments; applicable laws and regulations; the success or failure of product development programs; actions of regulatory authorities and the timing thereof; changes in exchange rates; and claims or concerns regarding the safety or efficacy of marketed products or product candidates in development.

The forward-looking statements contained in this U.S. Offer to Purchase speak only as of the date of this U.S. Offer to Purchase. Neither Takeda nor TiGenix undertake any obligation to revise or update any forward-looking statements to reflect new information, future events or circumstances after the date of the forward-looking statement. If one or more of these statements is updated or corrected, investors and others should not conclude that additional updates or corrections will be made.

2

SUMMARY TERM SHEET

The information contained in this summary term sheet is a summary only and is not meant to be a substitute for the more detailed description and information contained in the remainder of this U.S. Offer to Purchase (the “U.S. Offer to Purchase”), the Share Acceptance Letter, the ADS Letter of Transmittal and the Share Withdrawal Letter. You are urged to read carefully this U.S. Offer to Purchase, the Share Acceptance Letter, the ADS Letter of Transmittal and the Share Withdrawal Letter in their entirety. The information concerning TiGenix contained in this summary term sheet and elsewhere in this U.S. Offer to Purchase has been taken from, or is based upon, publicly available documents or records of TiGenix on file with the Securities and Exchange Commission (the “SEC”), the Belgian Financial Services and Markets Authority (the “FSMA”) or other public sources at the time of the U.S. Offer. Takeda has not independently verified the accuracy and completeness of such information.

| Securities Sought |

Takeda Pharmaceutical Company Limited, a company organized under the laws of Japan, (“Takeda”) is offering to purchase (the “U.S. Offer”):

• up to 100% of the publicly-held ordinary shares (such shares collectively, the “Ordinary Shares” and each an “Ordinary Share”) of TiGenix NV, a limited liability company (naamloze vennootschap / société anonyme) incorporated and existing under the laws of Belgium (“TiGenix”), which amount shall be deemed to include such additional Ordinary Shares as may be issued from time to time as a result of the exercise of Warrants (as defined below), but to exclude any Ordinary Shares that are owned by Takeda and its affiliates and Ordinary Shares as are represented by American Depositary Shares (such shares collectively, “ADSs” and each an “ADS”), that are held by U.S. holders (as that term is defined under instruction 2 to paragraphs (c) and (d) of Rule 14d-1 under the U.S. Securities Exchange Act of 1934, as amended) (the “Exchange Act”) (such holders collectively, “U.S. Holders” and each a “U.S. Holder”), and

• up to 100% of the ADSs, with each ADS representing 20 Ordinary Shares, from all holders, wherever located, excluding ADSs owned by Takeda and its affiliates. | |

| Price Per Ordinary Share |

€1.78 for each Ordinary Share, in cash, without interest. All payments to tendering holders of Ordinary Shares pursuant to this U.S. Offer to Purchase will be rounded to the nearest whole cent. | |

| Price Per ADS |

€35.60 for each ADS, in cash, without interest. The price paid to the holders of ADSs will be paid in U.S. dollars in the manner described in Section 2 — “Acceptance for Payment and Payment for Ordinary Shares and ADSs”. All payments to tendering holders of ADSs pursuant to this U.S. Offer to Purchase will be rounded to the nearest whole cent. Holders of ADSs should be aware that fluctuations in the Euro to U.S. dollar exchange rate will cause the value of the cash consideration to be paid to them in respect of their ADSs to change accordingly. | |

| Initial Expiration Date of U.S. Offer | 10:00 a.m., New York City time, on May 31, 2018, unless the expiration of the U.S. Offer is extended to a subsequent date in accordance with U.S. and Belgian law, in which case the term “Initial Expiration Date” means the latest date to which the U.S. Offer is extended | |

i

| Dual Offer Structure |

Simultaneously with the U.S. Offer, Takeda is making an offer in Belgium to purchase all of the outstanding Ordinary Shares and warrants to subscribe for Ordinary Shares of TiGenix (“Warrants” and each a “Warrant”, and together with the Ordinary Shares and the ADSs, the “Securities”) from all holders, wherever located, for the equivalent price and on substantially the same terms as the U.S. Offer, except as further described herein (see Section 1 – “Terms of the Offer – Second Acceptance Period”) (the “Belgian Offer” and, together with the U.S. Offer, the “Offers”). | |

| TiGenix Board Recommendation |

The Board of Directors of TiGenix (the “TiGenix Board” and each of its members individually, a “Director”) unanimously recommended that holders of Securities (as defined below) accept the Offers and tender their Securities to Takeda pursuant to the Offers, as applicable. | |

ii

QUESTIONS & ANSWERS ABOUT THE OFFERS

Who is offering to buy my Ordinary Shares and/or ADSs pursuant to the U.S. Offer?

Takeda, a global, R&D-driven pharmaceutical company committed to bringing better health and a brighter future to patients by translating science into life-changing medicines. Takeda focuses its research efforts on oncology, gastroenterology (GI) and central nervous system therapeutic areas. It also has specific development programs in specialty cardiovascular diseases as well as late-stage candidates for vaccines. Takeda conducts R&D both internally and with partners to stay at the leading edge of innovation. The pharmaceutical industry is undergoing changes and Takeda is moving forward with that trend. Innovation increasingly is coming from small biotech companies, not large pharmaceutical labs.

Unless the context indicates otherwise, in this U.S. Offer to Purchase, the terms “Takeda,” “us,” “we” and “our” refer to Takeda.

See Section 1 — “Terms of the Offer” and Section 10 — “Certain Information Concerning Takeda.”

What is the Belgian Offer?

Concurrent with the U.S. Offer, Takeda is launching the Belgian Offer, whereby, Takeda is offering to purchase up to 100% of the outstanding Ordinary Shares and Warrants, from all holders, wherever located. The Belgian Offer provides equivalent consideration for securities tendered as the U.S. Offer, and the Belgian Offer is on substantially the same terms as the U.S Offer, except as further described herein (see Section 1 – “Terms of the Offer – Second Acceptance Period”).

Holders of Warrants and non-U.S. Holders of Ordinary Shares may not use this U.S. Offer to Purchase and may only tender their Warrants and Ordinary Shares into the Belgian Offer. A separate prospectus, for use by holders of the Ordinary Shares and Warrants, wherever located, is being published concurrently in Belgium after having been approved by the Belgian Financial Services and Markets Authority (the “FSMA”), as required under Belgian law (including any related Belgian Offer documents, the “Belgian Offer Documents”).

What are some of the benefits Takeda expects from the Offers?

Some of the benefits Takeda expects from the Offers include:

| • | Expanding its late stage GI pipeline and reinforcing its commitment to patients living with inflammatory bowel disease (IBD) through the development and commercialization of innovative therapies; |

| • | Continuing the positive evolution of Takeda as a strategic investor and equity holder in TiGenix, as well as the existing collaboration between Takeda and TiGenix to license, develop and commercialize Cx601, the leading treatment candidate in TiGenix’s pipeline in territories outside of the U.S.; |

| • | Demonstrating its commitment to strengthen its presence in the U.S. specialty care market and highlighting its leadership in areas of GI associated with high unmet need; |

| • | Enhancing its stem cell capabilities which may present future R&D opportunities across Takeda’s focus therapeutic areas; and |

| • | Positioning it to leverage the combined expertise and resources of the two parties to more effectively develop and commercialize TiGenix’s assets on a global basis. |

iii

Who can participate in the U.S. Offer?

All U.S. Holders of Ordinary Shares may tender their shares either into the U.S. Offer or the Belgian Offer. All holders of ADSs, wherever located, may only tender their ADSs into the U.S. Offer.

See Section 3 — “Procedures for Accepting the U.S. Offer and Tendering Ordinary Shares and/or ADSs.”

Who can participate in the Belgian Offer?

Holders of Ordinary Shares and Warrants, in each case wherever located, may tender their Ordinary Shares and Warrants into the Belgian Offer. Questions and requests for assistance including information on how U.S. Holders of Ordinary Shares may tender their Ordinary Shares or to obtain a copy of the Belgian Offer Documents, may be directed to Georgeson LLC, as U.S. information agent (the “U.S. Information Agent”) at the address and telephone number set forth on the back cover of this U.S. Offer to Purchase.

How much are you offering to pay for the Ordinary Shares and ADSs and what is the form of payment?

Takeda is offering to pay €1.78 for each Ordinary Share (the “Price Per Ordinary Share”) and €35.60 for each ADS (the “Price Per ADS” and, together with the Price Per Ordinary Share, the “Offer Price”), in each case, in cash, without interest, upon the terms and subject to the conditions set forth in this U.S. Offer to Purchase. The Price Per ADS will be paid in U.S. dollars in the manner described in Section 2 — “Acceptance for Payment and Payment for Ordinary Shares and ADSs”. Holders of ADSs should be aware that fluctuations in the Euro to U.S. dollar exchange rate will cause the value of the cash consideration to be paid to them in respect of their ADSs to change accordingly

See the “Introduction” to this U.S. Offer to Purchase and Section 1 — “Terms of the Offer.”

Will you have the financial resources to make payment?

Yes. The consummation of the Offers is not subject to any financing condition. Takeda has deposited with BNP Paribas Fortis NV/SA, as tender agent of Takeda for the Ordinary Shares in the U.S. Offer (the “U.S Share Tender Agent”), an amount sufficient to pay for all Securities which may be tendered into the Offers.

See Section 11 — “Source and Amount of Funds.”

Is there an agreement governing the Offers?

Yes. Takeda and TiGenix have entered into the Offer and Support Agreement, dated as of January 5, 2018 (as it may be amended, modified or supplemented from time to time in accordance with its terms, the “Transaction Agreement”), which provides for, among other things, the terms and Conditions to the Offers.

See Section 14 — “Summary of the Transaction Agreement and Related Agreements” and Section 15 — “Conditions to the Offers.”

Is there a minimum number of Ordinary Shares that must be tendered in order for you to purchase any Securities?

Yes. For acceptance and payment for Ordinary Shares and ADSs tendered during the Initial Acceptance Period, the following Conditions to the Offers (as defined below) shall have been satisfied or waived: (i) the Minimum Acceptance Condition, and (ii) the absence of a Material Adverse Effect (as such term is defined in the Transaction Agreement). There is no financing condition to the Offers. The “Minimum

iv

Acceptance Condition” means that there have been tendered (and not withdrawn) by holders of Ordinary Shares, Warrants and ADSs into the Offers, in the aggregate, a number of Ordinary Shares, Warrants and ADSs that, together with the Ordinary Shares, Warrants and ADSs owned by Takeda and its affiliates, represents or gives access to 85% or more of the voting rights represented or given access to by all of the outstanding Ordinary Shares, Warrants and ADSs on a fully diluted basis as of the expiration of the Initial Acceptance Period (as defined below).

See Section 15 – “Conditions to the Offers.”

How long do I have to decide whether to tender my Ordinary Shares and/or ADSs in the Offer?

You will have until 10:00 a.m., New York City time, on the Initial Expiration Date to tender your Ordinary Shares and/or ADSs in the U.S. Offer. The term “Initial Expiration Date” means May 31, 2018, unless the expiration of the U.S. Offer is extended to a subsequent date in accordance with U.S. and Belgian law, in which case the term “Initial Expiration Date” means the latest date to which the U.S. Offer is extended (the period of time from commencement through the Initial Expiration Date, the “Initial Acceptance Period”). U.S. Holders of Ordinary Shares and holders of ADSs, wherever located, tendering their securities during the Initial Acceptance Period will have withdrawal rights during the Initial Acceptance Period with respect to such tendered securities.

Custodians, banks or brokers may set an earlier deadline for communication by holders of Ordinary Shares or ADSs in order to permit such custodian, bank or broker to communicate acceptances to the U.S. Share Tender Agent or Computershare Inc., as tender agent of Takeda for the ADSs in the U.S. Offer (the “U.S. ADS Tender Agent”), as applicable, in a timely manner. Accordingly, U.S. Holders holding Ordinary Shares and holders of ADSs through a financial intermediary should comply with the dates communicated by such financial intermediary as such dates may differ from the dates and times noted in this U.S. Offer to Purchase.

See Section 1 — “Terms of the Offer” and Section 3 — “Procedures for Accepting the U.S. Offer and Tendering Ordinary Shares and/or ADSs.”

Can the U.S. Offer be extended and under what circumstances?

Yes. The Belgian Offer is currently scheduled to expire on May 31, 2018. If the Belgian Offer is extended in accordance with Belgian law, we currently intend to extend the U.S. Offer so that it will expire on the same day as, and simultaneous with, the Belgian Offer. In addition, if the U.S. Offer is extended in accordance with U.S. law, we currently intend to extend the Belgian Offer so that it will expire on the same day as, and simultaneous with, the U.S. Offer.

See Section 1 — “Terms of the Offer.”

Will there be a subsequent offering period?

Following the Initial Acceptance Period, unless the Offers have been terminated, one or more subsequent offering periods will be provided, each as described further below (each a “Subsequent Offering Period”).

The results of the Initial Acceptance Period, and Takeda’s decision to terminate the Offers due to an unwaived failure of a Condition to the Offers, if applicable, will be published within five (5) Business Days following the Initial Expiration Date. If all of the Conditions to the Offers are satisfied or waived, Takeda is contractually required under the Transaction Agreement to provide for a Subsequent Offering Period of at least ten (10) Business Days1, during which U.S. Holders of Ordinary Shares and holders of ADSs, wherever located, in

| 1 | For purposes of this U.S. Offer to Purchase, “Business Day” shall mean any day on which the Belgian banks and the banks of the State of New York are open to the public, except Saturdays and Sundays, and otherwise as defined pursuant to Exchange Act Rule 14d-1(g)(3). |

v

each case not previously tendered into the U.S. Offer prior to the expiration of the Initial Acceptance Period, may tender their Ordinary Shares and ADSs into the U.S. Offer (the “Second Acceptance Period”). With respect to the U.S. Offer, the Second Acceptance Period will commence immediately following the publication of the results of the Initial Acceptance Period. With respect to the Belgian Offer, the Second Acceptance Period will commence on the tenth (10th) Business Day following the publication of the results of the Initial Acceptance Period. The Second Acceptance Period, if applicable, would not be an extension of the U.S. Offer pursuant to this U.S. Offer to Purchase.

The Second Acceptance Period will be applicable to each of the U.S. Offer and the Belgian Offer and the expiration date of the Second Acceptance Period will be the same for each of the U.S. Offer and the Belgian Offer. U.S. Holders of Ordinary Shares and holders of ADSs, wherever located, tendering their securities during the Second Acceptance Period will have withdrawal rights during the Second Acceptance Period with respect to such tendered securities. Takeda is required to pay for Ordinary Shares and ADSs that are validly tendered and not withdrawn during the Second Acceptance Period within ten (10) Business Days following the publication of the results of the Second Acceptance Period (which publication shall occur within five (5) Business Days following the expiration of the Second Acceptance Period). The publication with the results of the Second Acceptance Period is subject to the FSMA’s prior approval.

If, following the expiration of the Initial Acceptance Period or following the expiration of the Second Acceptance Period, Takeda holds, as a result of the Offers, at least 90% of the outstanding Ordinary Shares (including Ordinary Shares represented by ADSs), Takeda must provide for a subsequent offering period of at least five (5) Business Days and no more than fifteen (15) Business Days (the “Mandatory Subsequent Offering Period”). If the Mandatory Subsequent Offering Period were required to be undertaken following the Initial Acceptance Period, Takeda will commence such Mandatory Subsequent Acceptance Period in accordance with the timing of the Second Acceptance Period, as described above, in which case such Mandatory Subsequent Offering Period would satisfy the requirements of the Second Acceptance Period. The Mandatory Subsequent Offering Period will commence immediately following the publication of the results of the Initial Acceptance Period or Second Acceptance Period, as applicable. Such results will be published within five (5) Business Days following the Initial Expiration Date or following the date and time of the expiration of the Second Acceptance Period. The Mandatory Subsequent Offering Period, if applicable, would not be an extension of the U.S. Offer pursuant to this U.S. Offer to Purchase. The Mandatory Subsequent Offering Period would be an additional period of time during which U.S. Holders would be able to tender Ordinary Shares and holders of ADSs, wherever located, would be able to tender ADSs not previously tendered into the U.S. Offer prior to 10:00 a.m., New York City time, on the Initial Expiration Date or prior to the date and time of the expiration of the Second Acceptance Period, as applicable. U.S. Holders of Ordinary Shares and holders of ADSs, wherever located, tendering their securities during the Mandatory Subsequent Offering Period will have withdrawal rights during the Mandatory Subsequent Offering Period with respect to such tendered securities. If the Mandatory Subsequent Offering Period is provided, Takeda shall pay for Ordinary Shares and ADSs that are validly tendered and not withdrawn during the Mandatory Subsequent Offering Period within ten (10) Business Days following the publication of the results of the Mandatory Subsequent Offering Period, in accordance with Belgian law. The publication with the results of the Mandatory Subsequent Offering Period is subject to the FSMA’s prior approval.

If, following a Mandatory Subsequent Offering Period, Takeda holds, as a result of the Offers, less than 95% of the outstanding Ordinary Shares (including Ordinary Shares represented by ADSs), Takeda may, in its sole discretion, and subject to certain restrictions under Belgian law, elect to provide for one or more additional Subsequent Offering Period(s) of at least five (5) Business Days in the same manner and timing as the Mandatory Subsequent Offering Period (each a “Voluntary Subsequent Offering Period”). However, we also note that under Belgian law the period starting from the first day of the Initial Acceptance Period until the last day of any Subsequent Offering Period(s) other than the Mandatory Subsequent Offering Period or Squeeze-Out Period (as defined below), cannot exceed ten (10) weeks, making it unlikely that a Voluntary Subsequent Offering Period will be provided following the Second Acceptance Period and the Mandatory Subsequent Offering Period.

vi

See Section 1 — “Terms of the Offer.”

What are the most significant conditions to the Offers?

Notwithstanding any other provision of this U.S. Offer to Purchase, Takeda is not required to accept for payment or pay for any tendered Ordinary Shares or ADSs, unless the following conditions to the offers (the “Conditions to the Offers”) have been satisfied (or waived by Takeda) (see Section 15 — “Conditions to the Offers”):

| • | the Minimum Acceptance Condition, i.e., the tender into the Offers, in the aggregate, of a number of Ordinary Shares, Warrants and ADSs that, together with all Ordinary Shares, Warrants and ADSs owned by Takeda and its affiliates, represents or gives access to 85% or more of the voting rights represented or given access to by all of the outstanding Ordinary Shares, Warrants and ADSs on a fully diluted basis as of the expiration of the Initial Acceptance Period, and |

| • | the absence of a Material Adverse Effect (as such term is defined in the Transaction Agreement) occurring at any time after January 5, 2018 and prior to the time the results of the Initial Acceptance Period are published (which shall be within five (5) Business Days following the Initial Expiration Date). |

The Offers are not subject to any financing condition.

If I do not tender my Shares and/or ADSs but the Offers are consummated, what will happen to my Ordinary Shares and/or ADSs?

If you decide not to tender, you will continue to own your Ordinary Shares or ADSs, as applicable. However, once the Offers are completed, the number of Ordinary Shares and ADSs that are publicly held may be significantly reduced and there may no longer be an active trading market for Ordinary Shares or ADSs or the liquidity of any such market may be significantly reduced. It is also possible that any Ordinary Shares or ADSs not tendered in the Offers will later be transferred to Takeda by operation of Belgian law at the same price as offered in the Offers, pursuant to a Squeeze-Out (as defined below).

It is possible that Ordinary Shares and/or ADSs may fail to meet the criteria for continued listing on Euronext Brussels or the Nasdaq Global Select Market (the “Nasdaq”), as applicable. If this were to happen, the Ordinary Shares or ADSs could be de-listed from Euronext Brussels or the Nasdaq by action taken by the respective exchange, as applicable. Further, as soon as practicable following the consummation of the Offers, to the extent permitted by applicable law, we intend to:

| • | cause TiGenix to de-list the ADSs from the Nasdaq; |

| • | cause TiGenix to de-list the Ordinary Shares from Euronext Brussels; |

| • | cause TiGenix to suspend its reporting obligations and to terminate its registration under the Exchange Act and, as applicable, under Belgian securities laws and Euronext Brussels listing rules; and |

| • | terminate the Deposit Agreement among TiGenix, Deutsche Bank Trust Company Americas (the “ADS Depositary”) and holders of ADSs. |

In accordance with Belgian law, Euronext Brussels may delist the securities if (i) it considers that, due to exceptional circumstances, a normal and regular market can no longer be maintained for these securities, or (ii) these securities would fail to comply with the rules of the regulated market, except if such a measure is likely to significantly harm investors’ interests or to impair the proper functioning of the market. Euronext Brussels must inform the FSMA of any proposed delisting. The FSMA may, in consultation with Euronext Brussels, oppose the proposed delisting in the interest of investor protection. The FSMA has indicated that it shall not oppose to a delisting if it is preceded by a successful accompanying measure for the benefit of the minority shareholders, but also that, conversely, it shall oppose to a delisting if no such successful accompanying measure would have been taken.

vii

Such de-listing or deregistration by TiGenix would substantially reduce the information required to be furnished by TiGenix to holders of Ordinary Shares and ADSs, and certain provisions of the Exchange Act, Belgian securities laws, Euronext Brussels listing rules and Belgian corporate law would no longer apply to TiGenix. To the extent that TiGenix de-lists or deregisters the Ordinary Shares and ADSs after the consummation of the Offers, the absence of an active trading market in the U.S. or Belgium would reduce the liquidity and market value of your Ordinary Shares and ADSs.

If, following the expiration of the Initial Acceptance Period or any prior Subsequent Offering Period, as applicable, Takeda (a) holds, as a result of the Offers, at least 95% of the outstanding Ordinary Shares (including Ordinary Shares represented by ADSs) and (b) acquired at least 90% of the Ordinary Shares that are the subject of the Offers, Takeda will, in accordance with Belgian law, and is required under the Transaction Agreement to, proceed with a simplified squeeze-out (the “Squeeze-Out”), organized as an additional Subsequent Offering Period (the “Squeeze-Out Period”). During the Squeeze-Out Period, holders of Ordinary Shares or ADSs would be able to tender Ordinary Shares and ADSs not previously tendered into the U.S. Offer prior to the expiration of the Initial Acceptance Period or any Subsequent Offering Period, under the same conditions as in such previous periods and at the Offer Price.

Under Belgian law, the Squeeze-Out must be commenced within three (3) months following the expiration of the Initial Acceptance Period or any prior Subsequent Offering Period, as applicable, and must remain open for at least fifteen (15) Business Days. However, it is expected that, if the thresholds for a Squeeze-Out are met under applicable Belgian law, Takeda will commence a Squeeze-Out Period immediately following the publication of the results of the Initial Acceptance Period or prior Subsequent Offering Period, as applicable. If the Squeeze-Out could be undertaken following the Initial Acceptance Period, Takeda will commence the Squeeze-Out Period in accordance with the timing of the Second Acceptance Period, as described above, in which case the Squeeze-Out Period would satisfy the requirements of the Second Acceptance Period. The Squeeze-Out Period would not be an extension of the U.S. Offer pursuant to this U.S. Offer to Purchase. The Squeeze-Out Period would be an additional period of time during which U.S. Holders would be able to tender Ordinary Shares and holders of ADSs, wherever located, would be able to tender ADSs not previously tendered into the U.S. Offer during the Initial Acceptance Period or any Subsequent Offering Period. Takeda intends to publish the results of the Squeeze-Out Period within five (5) Business Days following the expiration of the Squeeze-Out Period. The publication with the results of the Squeeze-Out Period is subject to the FSMA’s prior approval. U.S. Holders of Ordinary Shares and holders of ADSs, wherever located, tendering their securities during the Squeeze-Out Period will have withdrawal rights during the Squeeze-Out Period with respect to such tendered securities. Takeda shall pay for Ordinary Shares and ADSs that were validly tendered and not withdrawn during the Squeeze-Out Period within ten (10) Business Days following the publication of the results of the Squeeze-Out Period, in accordance with Belgian law. Pursuant to Belgian law, at the conclusion of the Squeeze-Out, any Ordinary Shares (including Ordinary Shares represented by ADSs) not tendered in the U.S. Offer shall be deemed transferred to Takeda by operation of Belgian law for the Offer Price. The funds necessary to pay for such untendered Ordinary Shares will be deposited by the U.S. Share Tender Agent with the Bank for Official Deposits (Deposito- en Consignatiekas / Caisse des dépôts et consignations) in favor of the holders of Ordinary Shares (including Ordinary Shares represented by ADSs) who did not previously tender into the Squeeze-Out. Any Ordinary Shares not tendered during the Squeeze-Out Period (including Ordinary Shares withdrawn and not properly re-tendered) will nonetheless be transferred to Takeda by operation of Belgian law at the expiration of the Squeeze-Out Period.

If, following the expiration of the Initial Acceptance Period or any prior Subsequent Offering Period, Takeda (a) holds, as a result of the Offers, at least 95% of the outstanding Ordinary Shares (including Ordinary Shares represented by ADSs) and (b) acquired at least 90% of the Ordinary Shares (including Ordinary Shares represented by ADSs) that are the subject of the Offers, any holder of Ordinary Shares (including Ordinary Shares represented by ADSs) who has not tendered such Ordinary Shares (including Ordinary Shares represented by ADSs) can obligate Takeda to acquire such Ordinary Shares (including Ordinary Shares represented by ADSs) at the Offer Price (the “Sell-Out”). A holder of Ordinary Shares (including Ordinary Shares represented by ADSs)

viii

can exercise its Sell-Out right by requesting payment from Takeda for such Ordinary Shares (including Ordinary Shares represented by ADSs) within three (3) months of the last to expire of the Initial Expiration Date or any Subsequent Offering Period, as applicable, by registered mail with acknowledgment of receipt. If a holder of Ordinary Shares (including Ordinary Shares represented by ADSs) exercises its Sell-Out right, Takeda shall inform the FSMA of such request, the purchases Takeda makes as a result of the Sell-Out and the price it pays for such purchases.

However, pursuant to the terms of the Transaction Agreement, if Takeda (a) holds, as a result of the Offers, at least 95% of the outstanding Ordinary Shares (including Ordinary Shares represented by ADSs) and (b) acquired at least 90% of the Ordinary Shares (including Ordinary Shares represented by ADSs) that are the subject of the Offers, Takeda is required to proceed with the Squeeze-Out, rendering the Sell-Out unnecessary.

See Section 1 — “Terms of the Offer.”

If I accept the U.S. Offer, how will I get paid?

If the Conditions to the Offers are satisfied (or waived, as applicable) and we accept your validly tendered Ordinary Shares and/or ADSs for payment, payment will be made by deposit of the aggregate Offer Price for the Ordinary Shares accepted in the U.S. Offer with the U.S. Share Tender Agent and ADSs accepted in the U.S. Offer with the U.S. ADS Tender Agent, as applicable. The U.S. ADS Tender Agent and the U.S. Share Tender Agent will each act as agent for tendering holders of ADSs and tendering U.S. Holders of Ordinary Shares, respectively, for the purpose of receiving payments from Takeda and transmitting payments to such holders.

See Section 1 – “Terms of the Offer – Material Terms – Squeeze-Out.”

See Section 2 — “Acceptance for Payment and Payment for Ordinary Shares and ADSs.”

Until what time may I withdraw previously tendered Ordinary Shares and/or ADSs?

You may withdraw your previously tendered Ordinary Shares and/or ADSs at any time before 10:00 a.m., New York City time, on the Initial Expiration Date or the date and time of the expiration of any Subsequent Offering Period, as applicable. If you hold your Ordinary Shares or ADSs through a broker or other security intermediary, you should be aware that such securities intermediaries may establish their own earlier cut-off times and dates for receipt of instructions to tender (or to withdraw, as applicable) to ensure that those instructions will be timely received by Euroclear Belgium, with respect to the Ordinary Shares, or The Depository Trust Company (“DTC”), with respect to the ADSs. U.S. Holders of Ordinary Shares and holders of ADSs are responsible for determining and complying with any such cut-off times and dates.

Your previously tendered Ordinary Shares may only be validly withdrawn by instructing your securities intermediary to submit, on your behalf, a properly completed Share Withdrawal Letter to the U.S. Share Tender Agent in accordance with the instructions contained therein and in this U.S. Offer to Purchase. Your previously tendered ADSs may only be validly withdrawn by instructing your securities intermediary to provide, on your behalf, a notice of withdrawal to the U.S. ADS Tender Agent and, in turn, the U.S. ADS Tender Agent will comply with the procedures of DTC (as defined below) with respect to withdrawals of ADSs and in accordance with the instructions contained in this U.S. Offer to Purchase.

It is important to note that the ability of a U.S. Holder of Ordinary Shares and a holder of ADSs to withdraw any Ordinary Shares or ADSs is limited to those tendered in a particular relevant offering period. Thus, for example, any ADSs tendered into the Initial Acceptance Period and not properly withdrawn before the Initial Expiration Date, cannot be withdrawn in the Second Acceptance Period or any other Subsequent Offering Period.

ix

See Section 4 — “Withdrawal Rights.”

Has the U.S. Offer been recommended by the TiGenix Board?

Yes. The TiGenix Board has unanimously recommended that holders of Securities accept the Offers and tender their Securities to Takeda pursuant to the Offers, as applicable.

The reasons for the TiGenix Board’s recommendation that holders of Securities accept the offers and tender their Securities to Takeda pursuant to the offers will be set forth in TiGenix’s Solicitation/Recommendation Statement on Schedule 14D-9 (the “Schedule 14D-9”) that will be mailed to you together with this U.S. Offer to Purchase. You should carefully read the information set forth in the Schedule 14D-9, including the information set forth in Item 4 thereof under the sub-headings “Background” and “Reasons for the Recommendation.”

What will happen to my Warrants in the U.S. Offer?

The U.S. Offer is being made only for Ordinary Shares held by U.S. Holders and ADSs held by all holders, wherever located. Holders of Warrants and non-U.S. Holders of Ordinary Shares may only tender their Warrants and Ordinary Shares through the Belgian Offer.

See Section 14 — “Summary of the Transaction Agreement and Related Agreements.”

What is the market value of my Ordinary Shares and/or ADSs as of a recent date?

On April 26, 2018, the last practicable trading day before publication of the Belgian Offer prospectus, the closing price of Ordinary Shares reported on the Euronext was €1.76 per Ordinary Share (or U.S. $2.13 (source of exchange rate: Factset)). On April 26, 2018, the most recent practicable trading day before publication of this U.S. Offer to Purchase, the closing price of Ordinary Shares reported on the Euronext was €1.76 per Ordinary Share (or U.S. $2.13 (source of exchange rate: the Factset)).

On April 26, 2018, the last practicable trading day before publication of the Belgian Offer prospectus, the closing price of ADSs reported on the Nasdaq was U.S. $42.60 per ADS (which when divided by twenty (20), to represent twenty Ordinary Shares for every ADS, is approximately U.S. $2.13 per Ordinary Share). On April 26, 2018, the most recent practicable trading day before publication of this U.S. Offer to Purchase, the closing price of ADSs reported on the Nasdaq was U.S. $42.60 per ADS (which when divided by twenty (20), to represent twenty Ordinary Shares for every ADS, is approximately U.S. $2.13 per Ordinary Share).

See Section 6 — “Price Range of Ordinary Shares and ADSs.”

Will I have appraisal rights in connection with the U.S. Offer?

No appraisal rights will be available to you in connection with the U.S. Offer. Belgian corporations’ law does not provide for statutory appraisal rights in the case of a tender offer.

Whom should I contact if I have questions about the U.S. Offer?

You may contact Georgeson LLC, the U.S. Information Agent, toll free at +1 (866) 391-6921 or by email at TIG-offer@georgeson.com. See the back cover of this U.S. Offer to Purchase for additional contact information.

x

TO ALL HOLDERS OF ORDINARY SHARES WHO ARE U.S. HOLDERS AND

ALL HOLDERS, WHEREVER LOCATED, OF AMERICAN DEPOSITARY SHARES REPRESENTING ORDINARY SHARES

OF

TIGENIX NV

INTRODUCTION

Takeda Pharmaceutical Company Limited, a company organized under the laws of Japan, (“Takeda”) is offering to purchase:

| • | up to 100% of the publicly-held ordinary shares (such shares collectively, the “Ordinary Shares” and each an “Ordinary Share”) of TiGenix NV, a limited liability company (naamloze vennootschap / société anonyme) incorporated and existing under the laws of Belgium (“TiGenix”), which amount shall be deemed to include such additional Ordinary Shares as may be issued from time to time as a result of the exercise of Warrants (as defined below), but to exclude any Ordinary Shares that are owned by Takeda and its affiliates and Ordinary Shares as are represented by American Depositary Shares (such shares collectively, “ADSs” and each an “ADS”), that are held by U.S. holders (as that term is defined under instruction 2 to paragraphs (c) and (d) of Rule 14d-1 under the U.S. Securities Exchange Act of 1934, as amended) (the “Exchange Act”) (such holders collectively, “U.S. Holders” and each a “U.S. Holder”), and |

| • | up to 100% of the ADSs, with each ADS representing 20 Ordinary Shares, from all holders, wherever located, excluding ADSs owned by Takeda and its affiliates, |

at a purchase price of €1.78 for each Ordinary Share (the “Price Per Ordinary Share”) and €35.60 for each ADS (the “Price Per ADS” and, together with the Price Per Ordinary Share, the “Offer Price”), in each case, in cash, without interest, upon the terms and subject to the conditions set forth in this U.S. Offer to Purchase, dated April 30, 2018 (the “U.S. Offer to Purchase”), and in the related Share Acceptance Letter, the related ADS Letter of Transmittal and the related Share Withdrawal Letter, as applicable. The Price Per Ordinary Share will be payable in Euros, while the Price Per ADS will be payable in U.S. dollars in the manner described in Section 2 — “Acceptance for Payment and Payment for Ordinary Shares and ADSs”.

TiGenix is a Belgian company having its registered office at Romeinse straat 12 box 2, 3001 Leuven, Belgium, registered with the Crossroads Bank of Enterprises under number 0471.340.123 (Register of Legal Entities Leuven), with the Ordinary Shares listed on Euronext Brussels (under ISIN-code BE0003864817), and the ADSs listed on the Nasdaq Global Select Market (the “Nasdaq”) (under ISIN-code US88675R1095).

Takeda is offering to purchase all Ordinary Shares, ADSs, warrants to subscribe for Ordinary Shares (the “Warrants” and each a “Warrant”, and together with the Ordinary Shares and ADSs, the “Securities”), in two separate, but concurrent and related, offers in Belgium (the “Belgian Offer”) and in the United States (“U.S.”) (the “U.S. Offer” or this “Offer”), respectively. The U.S. Offer and the Belgian Offer are referred to collectively as the “Offers.” Each of the Offers provides equivalent consideration for securities tendered, and each of the Offers is on substantially the same terms, except as further described herein (see Section 1 – “Terms of the Offer – Second Acceptance Period”). The U.S. Offer is open to all holders of ADSs, wherever located, and to all U.S. Holders of Ordinary Shares. The Belgian Offer is open to all holders of Ordinary Shares and to all holders of Warrants, wherever located. Holders of Ordinary Shares that are not U.S. Holders and holders of Warrants, wherever located, may not use this U.S. Offer to Purchase, and may only tender their Ordinary Shares and Warrants into the Belgian Offer. A separate prospectus, for use by holders of the Ordinary Shares and Warrants, wherever located, is being published concurrently in Belgium after having been approved by the Belgian

1

Financial Services and Markets Authority (the “FSMA”), as required under Belgian law (including any related Belgian Offer documents, the “Belgian Offer Documents”). The Offers are being made pursuant to an Offer and Support Agreement between Takeda and TiGenix, dated as of January 5, 2018 (as it may be amended, modified or supplemented from time to time in accordance with its terms, the “Transaction Agreement”).

The Price Per ADS will be paid in U.S. dollars in the manner described in Section 2 — “Acceptance for Payment and Payment for Ordinary Shares and ADSs”. Holders of ADSs should be aware that fluctuations in the Euro to U.S. dollar exchange rate will cause the value of the cash consideration to be paid to them in respect of their ADSs to change accordingly. All payments to tendering holders of ADSs or U.S. Holders of Ordinary Shares pursuant to the U.S. Offer will be rounded to the nearest whole cent. Under no circumstances will interest be paid on the Offer Price, regardless of any extension of the U.S. Offer or any delay in making payment for the Ordinary Shares held by U.S. Holders or the ADSs.

TiGenix is required to file a Solicitation/Recommendation Statement on Schedule 14D-9 (the “Schedule 14D-9”) advising holders of ADSs and U.S. Holders of Ordinary Shares to accept or reject the tender offer or to take other action with respect to the tender offer and, if so, describe the other action recommended. Holders of ADSs and U.S. Holders of Ordinary Shares should carefully read the information set forth in the Schedule 14D-9, including the information set forth in Item 4 under the sub-headings “Background” and “Reasons for the Recommendation.”

The obligation of Takeda to accept for payment and pay for Ordinary Shares held by U.S. Holders and ADSs validly tendered (and not withdrawn) pursuant to the U.S. Offer is subject to the satisfaction of the following Conditions to the Offers (as defined below) (as further described in Section 15 - “Conditions to the Offers”): (i) the Minimum Acceptance Condition (as defined below), and (ii) the absence of a Material Adverse Effect (as such term is defined in the Transaction Agreement). There is no financing condition to the Offers.

2

The U.S. Tender Offer

| 1. | Terms of the Offer. |

Transaction Background

The Offers are being made pursuant to the Transaction Agreement. Under the Transaction Agreement, subject to the satisfaction or waiver of certain conditions, among other things, Takeda agreed to launch a public tender offer for all the Securities on the terms and subject to the conditions described therein. The Price Per ADS will be paid in U.S. dollars in the manner described in Section 2 — “Acceptance for Payment and Payment for Ordinary Shares and ADSs”.

For a summary of the principal terms, conditions and covenants of the U.S. Offer, see Section 14 – “The U.S. Tender Offer -Summary of the Transaction Agreement and Related Agreements.” Please also see Section 12 – “The U.S. Tender Offer - Background of the Offers” for further information.

Dual Offer Structure

Takeda commenced two (2) tender offers: (i) the U.S. Offer, which is open to all U.S. Holders of Ordinary Shares and all holders of ADSs, wherever located, and (ii) the Belgian Offer, which is open to all holders of Ordinary Shares and Warrants, wherever located.

The Belgian Offer is a voluntary and conditional takeover bid made by Takeda in accordance with the Act of April 1, 2007 on takeover bids and Chapter II of the Royal Decree of April 27, 2007 on takeover bids. The Belgian Offer covers all Ordinary Shares and Warrants, held by holders wherever located, but does not cover ADSs. In accordance with Rule 14d-1 of the Exchange Act, Takeda must permit U.S. Holders of Ordinary Shares to participate in the transaction on terms at least as favorable as those offered in Belgium. After calculating U.S. ownership of Ordinary Shares and ADSs as of January 30, 2018, which date is between sixty (60) days prior to and thirty (30) days after the public announcement of the U.S. Offer), Takeda determined that U.S. Holders held at such time more than 10% but less than 40% of the then outstanding Ordinary Shares (including Ordinary Shares represented by ADSs). Therefore, the U.S. Offer is eligible for certain Tier II exemptions under Rule 14d-1(d) of the Exchange Act, including the commencement of a separate tender offer in the U.S. for U.S. holders of Ordinary Shares and all holders of ADSs, wherever located.

Holders of Ordinary Shares that are not U.S. Holders may not tender their Ordinary Shares into the U.S. Offer, but may tender their Ordinary Shares into the Belgian Offer. For additional information on how to tender into the Belgian Offer, please contact the U.S. Information Agent at the address and telephone number set forth on the back cover of this U.S. Offer to Purchase.

The Price Per Ordinary Share offered pursuant to the Belgian Offer is the same as the Price Per Ordinary Share offered pursuant to this U.S. Offer to Purchase.

Material Terms

Consideration and Payment

In this U.S. Offer to Purchase, Takeda is offering to pay €1.78 for each Ordinary Share and €35.60 for each ADS, in each case, in cash, without interest, upon the terms and subject to the conditions set forth in this U.S. Offer to Purchase. The Price Per Ordinary Share will be paid in Euros, while the Price Per ADS will be paid in U.S. dollars in the manner described in Section 2 — “Acceptance for Payment and Payment for Ordinary Shares and ADSs”. Holders of ADSs should be aware that fluctuations in the Euro to U.S. dollar exchange rate will cause the value of the cash consideration to be paid to them in respect of their ADSs to change accordingly. All payments to tendering holders of ADSs or U.S. Holders of Ordinary Shares pursuant to the U.S Offer will be

3

rounded to the nearest whole cent. Under no circumstances will interest be paid on the Offer Price, regardless of any extension of the U.S. Offer or any delay in making payment for the ADSs or the Ordinary Shares held by U.S. holders.

The U.S. Offer commenced on April 30, 2018 and will expire at 10:00 a.m., New York City time, on the Initial Expiration Date. The term “Initial Expiration Date” means May 31, 2018, unless the expiration of the U.S. Offer is extended to a subsequent date in accordance with U.S. and Belgian law, in which case the term “Initial Expiration Date” means the latest date to which the U.S. Offer is extended (the period of time from commencement through the Initial Expiration Date, the “Initial Acceptance Period”). U.S. Holders of Ordinary Shares and holders of ADSs, wherever located, tendering their securities during the Initial Acceptance Period will have withdrawal rights during the Initial Acceptance Period with respect to such tendered securities. Upon the terms and subject to the conditions set forth in this U.S. Offer to Purchase, the related Share Acceptance Letter, the related ADS Letter of Transmittal and the related Share Withdrawal Letter, Takeda will accept for payment Ordinary Shares held by U.S. holders or ADSs that are validly tendered and not withdrawn before 10:00 a.m., New York City time, on the Initial Expiration Date. If you hold your Ordinary Shares or ADSs through a broker or other securities intermediary, you should be aware that such securities intermediaries may establish their own earlier cut-off times and dates for receipt of instructions to tender (or to withdraw, as applicable) to ensure that those instructions will be timely received by Euroclear Belgium, with respect to the Ordinary Shares, or The Depository Trust Company (“DTC”), with respect to the ADSs. U.S. Holders of Ordinary Shares and holders of ADSs are responsible for determining and complying with any applicable cut-off times and dates.

The Belgian Offer is currently scheduled to expire on May 31, 2018. If the Belgian Offer is extended in accordance with Belgian law, we currently intend to extend the U.S. Offer so that it will expire on the same day as, and simultaneous with, the Belgian Offer. In addition, if the U.S. Offer is extended in accordance with U.S. law, we currently intend to extend the Belgian Offer so that it will expire on the same day as, and simultaneous with, the U.S. Offer.

The results of the Initial Acceptance Period, and Takeda’s decision to terminate the Offers due to an unwaived failure of a Condition to the Offers, if applicable, will be published within five (5) Business Days following the Initial Expiration Date. The results of the Initial Acceptance Period will be published in one or more national Belgian and U.S. newspapers and will be published via press release in the U.S. and Belgium. This notice will also include a statement whether the Conditions to the Offers have been satisfied or waived, the number of Securities that Takeda will hold following acceptance of the Securities tendered into the Offers during the Initial Acceptance Period and the commencement date and time of the Second Acceptance Period (as defined below) and its duration. The publication with the results of the Initial Acceptance Period is subject to the FSMA’s prior approval.

Subsequent Offering Periods and Squeeze-Out

Following the Initial Acceptance Period, unless the Offers have been terminated, one or more subsequent offering periods will be provided, each as described further below (each a “Subsequent Offering Period”).

Second Acceptance Period

If all of the Conditions to the Offers are satisfied or waived, Takeda is contractually required under the Transaction Agreement to provide for a Subsequent Offering Period of at least ten (10) Business Days, during which U.S. Holders of Ordinary Shares and holders of ADSs, wherever located, in each case not previously tendered into the U.S. Offer prior to the expiration of the Initial Acceptance Period, may tender their Ordinary Shares and ADSs into the U.S. Offer (the “Second Acceptance Period”). With respect to the U.S. Offer, the Second Acceptance Period will commence immediately following the publication of the results of the Initial Acceptance Period. With respect to the Belgian Offer, the Second Acceptance Period will commence on the tenth (10th) Business Day following the publication of the results of the Initial Acceptance Period. The Second Acceptance Period, if applicable, would not be an extension of the U.S. Offer pursuant to this U.S. Offer to Purchase.

4

The Second Acceptance Period will be applicable to each of the U.S. Offer and the Belgian Offer and the expiration date of the Second Acceptance Period will be the same for each of the U.S. Offer and the Belgian Offer. U.S. Holders of Ordinary Shares and holders of ADSs, wherever located, tendering their securities during the Second Acceptance Period will have withdrawal rights during the Second Acceptance Period with respect to such tendered securities. Takeda is required to pay for Ordinary Shares and ADSs that are validly tendered and not withdrawn during the Second Acceptance Period within ten (10) Business Days following the publication of the results of the Second Acceptance Period (which publication shall occur within five (5) Business Days following the expiration of the Second Acceptance Period). The publication with the results of the Second Acceptance Period is subject to the FSMA’s prior approval.

Mandatory Subsequent Offering Period

If, following the expiration of the Initial Acceptance Period or following the expiration of the Second Acceptance Period, Takeda holds, as a result of the Offers, at least 90% of the outstanding Ordinary Shares (including Ordinary Shares represented by ADSs), Takeda must provide for a subsequent offering period of at least five (5) Business Days and no more than fifteen (15) Business Days (the “Mandatory Subsequent Offering Period”). The Mandatory Subsequent Offering Period will commence immediately following the publication of the results of the Initial Acceptance Period or Second Acceptance Period, as applicable. Such results will be published within five (5) Business Days following the Initial Expiration Date or following the date and time of the expiration of the Second Acceptance Period. If the Mandatory Subsequent Offering Period were required to be undertaken following the Initial Acceptance Period, Takeda will commence such Mandatory Subsequent Acceptance Period in accordance with the timing of the Second Acceptance Period, as described above, in which case such Mandatory Subsequent Offering Period would satisfy the requirements of the Second Acceptance Period. The Mandatory Subsequent Offering Period, if applicable, would not be an extension of the U.S. Offer pursuant to this U.S. Offer to Purchase. The Mandatory Subsequent Offering Period would be an additional period of time during which U.S. Holders would be able to tender Ordinary Shares and holders of ADSs, wherever located, would be able to tender ADSs not previously tendered into the U.S. Offer prior to 10:00 a.m., New York City time, on the Initial Expiration Date or prior to the date and time of the expiration of the Second Acceptance Period, as applicable. U.S. Holders of Ordinary Shares and holders of ADSs, wherever located, tendering their securities during the Mandatory Subsequent Offering Period will have withdrawal rights during the Mandatory Subsequent Offering Period with respect to such tendered securities. If the Mandatory Subsequent Offering Period is provided, Takeda shall pay for Ordinary Shares and ADSs that are validly tendered and not withdrawn during the Mandatory Subsequent Offering Period within ten (10) Business Days following the publication of the results of the Mandatory Subsequent Offering Period, in accordance with Belgian law. The publication with the results of the Mandatory Subsequent Offering Period is subject to the FSMA’s prior approval.

If, following a Mandatory Subsequent Offering Period, Takeda holds, as a result of the Offers, less than 95% of the outstanding Ordinary Shares (including Ordinary Shares represented by ADSs), Takeda may, in its sole discretion, and subject to certain restrictions under Belgian law, elect to provide for one or more additional Subsequent Offering Period(s) of at least five (5) Business Days in the same manner and timing as the Mandatory Subsequent Offering Period (each a “Voluntary Subsequent Offering Period”). However, we also note that under Belgian law the period starting from the first day of the Initial Acceptance Period until the last day of any Subsequent Offering Period(s) other than the Mandatory Subsequent Offering Period or Squeeze-Out Period (as defined below), cannot exceed ten (10) weeks, making it unlikely that a Voluntary Subsequent Offering Period will be provided following the Second Acceptance Period or the Mandatory Subsequent Offering Period.

Squeeze-Out

If, following the expiration of the Initial Acceptance Period or any prior Subsequent Offering Period, as applicable, Takeda (a) holds, as a result of the Offers, at least 95% of the outstanding Ordinary Shares (including Ordinary Shares represented by ADSs) and (b) acquired at least 90% of the Ordinary Shares that are the subject

5

of the Offers, Takeda will, in accordance with Belgian law, and is required under the Transaction Agreement to, proceed with a simplified squeeze-out (the “Squeeze-Out”), organized as an additional Subsequent Offering Period (the “Squeeze-Out Period”). During the Squeeze-Out Period, holders of Ordinary Shares or ADSs would be able to tender Ordinary Shares and ADSs not previously tendered into the U.S. Offer prior to the expiration of the Initial Acceptance Period or any Subsequent Offering Period, under the same conditions as in such previous periods and at the Offer Price.

Under Belgian law, the Squeeze-Out must be commenced within three (3) months following the expiration of the Initial Acceptance Period or any prior Subsequent Offering Period, as applicable, and must remain open for at least fifteen (15) Business Days. However, it is expected that, if the thresholds for a Squeeze-Out are met under applicable Belgian law, Takeda will commence a Squeeze-Out Period immediately following the publication of the results of the Initial Acceptance Period or prior Subsequent Offering Period, as applicable. If the Squeeze-Out could be undertaken following the Initial Acceptance Period, Takeda will commence the Squeeze-Out Period in accordance with the timing of the Second Acceptance Period, as described above, in which case the Squeeze-Out Period would satisfy the requirements of the Second Acceptance Period. The Squeeze-Out Period would not be an extension of the U.S. Offer pursuant to this U.S. Offer to Purchase. The Squeeze-Out Period would be an additional period of time during which U.S. Holders would be able to tender Ordinary Shares and holders of ADSs, wherever located, would be able to tender ADSs not previously tendered into the U.S. Offer during the Initial Acceptance Period or any Subsequent Offering Period. Takeda intends to publish the results of the Squeeze-Out Period within five (5) Business Days following the expiration of the Squeeze-Out Period. The publication with the results of the Squeeze-Out Period is subject to the FSMA’s prior approval. U.S. Holders of Ordinary Shares and holders of ADSs, wherever located, tendering their securities during the Squeeze-Out Period will have withdrawal rights during the Squeeze-Out Period with respect to such tendered securities. Takeda shall pay for Ordinary Shares and ADSs that were validly tendered and not withdrawn during the Squeeze-Out Period within ten (10) Business Days following the publication of the results of the Squeeze-Out Period, in accordance with Belgian law. Pursuant to Belgian law, at the conclusion of the Squeeze-Out, any Ordinary Shares (including Ordinary Shares represented by ADSs) not tendered in the U.S. Offer shall be deemed transferred to Takeda by operation of Belgian law for the Offer Price. The funds necessary to pay for such untendered Ordinary Shares will be deposited by the U.S. Share Tender Agent with the Bank for Official Deposits (Deposito- en Consignatiekas / Caisse des dépôts et consignations) in favor of the holders of Ordinary Shares (including Ordinary Shares represented by ADSs) who did not previously tender into the Squeeze-Out. Any Ordinary Shares not tendered during the Squeeze-Out Period (including Ordinary Shares withdrawn and not properly re-tendered) will nonetheless be transferred to Takeda by operation of Belgian law at the expiration of the Squeeze-Out Period.

Sell-Out Rights