|

Delaware

(State or other jurisdiction of

incorporation)

|

001-34133

(Commission File Number)

|

03-0606749

(IRS Employer Identification No.)

|

|

Exhibit No.

|

Description

|

|

99.1

|

Press release issued August 4, 2014

|

|

99.2

|

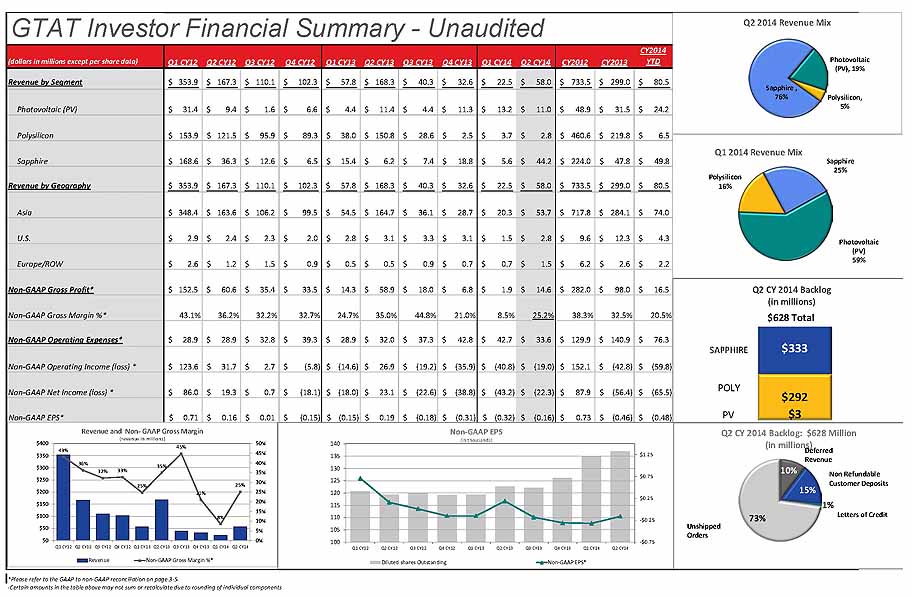

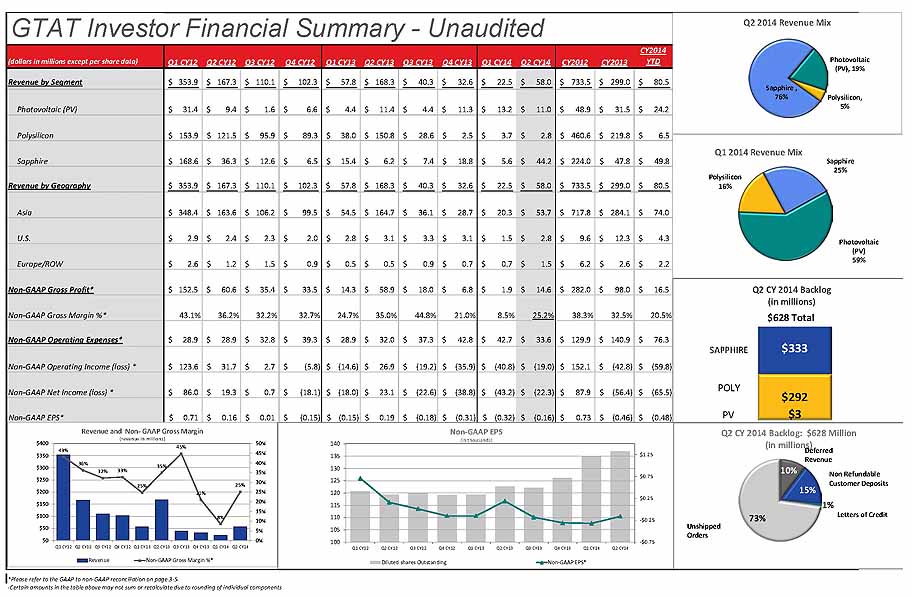

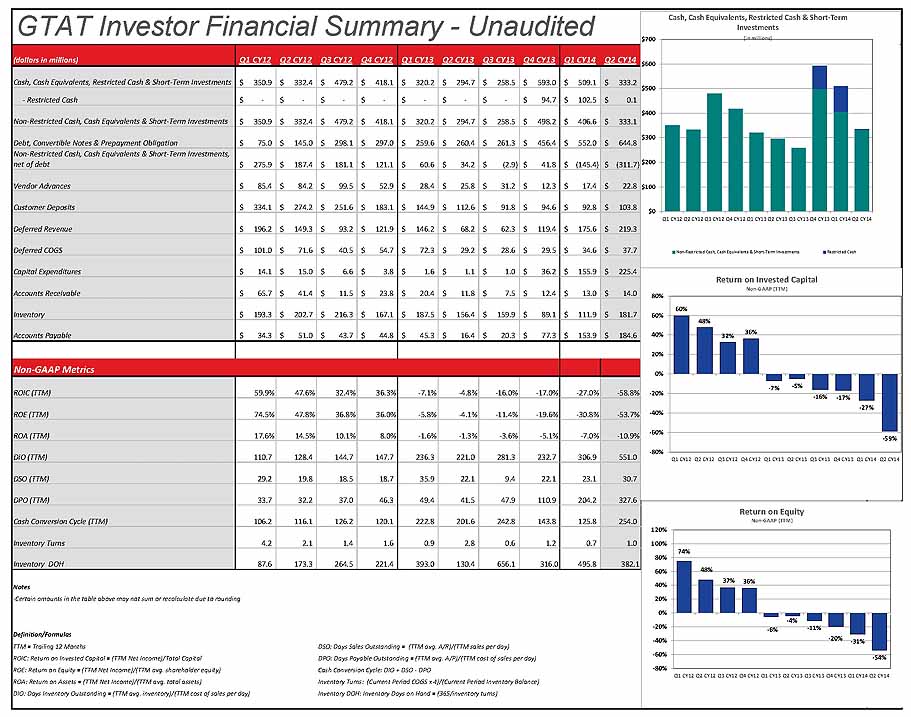

Second Quarter Fiscal Year 2014 GT Advanced Technologies Inc. Investor Financial Summary.

|

| GT ADVANCED TECHNOLOGIES INC. | |||

| /s/ Hoil Kim | |||

|

Date: August 4, 2014

|

By: |

Hoil Kim

|

|

| Its: |

Vice President, Chief Administrative Officer,

|

||

| General Counsel and Secretary | |||

|

Exhibit No.

|

Description

|

|

99.1

|

Press release issued August 4, 2014

|

|

99.2

|

Second Quarter Fiscal Year 2014 GT Advanced Technologies Inc. Investor Financial Summary.

|

EXHIBIT 99.1

MERRIMACK, N.H., Aug. 4, 2014 (GLOBE NEWSWIRE) -- GT Advanced Technologies Inc. (Nasdaq:GTAT) today reported results for the second quarter of fiscal year 2014, which ended June 28, 2014.

| Three-Months Ended | Year-to-Date | ||||

| Jun 28th, | Mar 29th, | Jun 29th, | Jun 28th, | Jun 29th, | |

| 2014 | 2014 | 2013 | 2014 | 2013 | |

| Revenue (Millions) | $58.0 | $22.5 | $168.3 | $80.5 | $226.1 |

| GAAP GM % | (62.3%) | (2.4%) | 34.8% | (45.5%) | 31.9% |

| Non-GAAP GM% | 25.2% | 8.5% | 35.0% | 20.5% | 32.3% |

| Earnings/(loss) per share | ($0.63) | ($0.31) | $0.10 | ($0.94) | ($0.06) |

| Non-GAAP Earning/(loss) per share | ($0.16) | ($0.32) | $0.19 | ($0.48) | $0.04 |

During the second quarter revenue was $58.0 million including $44.1 million in sapphire equipment and materials, $11.0 million in photovoltaic (PV), and $2.9 million in polysilicon. Revenue for the first six months of 2014 was $80.5 million including $49.7 million in sapphire equipment and materials, $24.2 million in photovoltaic (PV) and $6.6 million in polysilicon.

Non-GAAP gross profit for the second quarter was $14.6 million, or 25.2 percent of revenue. Non-GAAP gross profit for the first six months of 2014 was $16.5 million, or 20.5 percent of revenue.

During the second quarter, PV and polysilicon non-GAAP gross margins were 45 percent and 12 percent, respectively. Sapphire gross margins were 20 percent, reflecting the contribution of higher margin equipment sales partially offset by negative margins associated with the company's materials operation in Arizona.

During the quarter, the company incurred non-GAAP operating expenses of $33.6 million and for the six months ended June 28, 2014, non-GAAP operating expenses were $76.3 million.

Non-GAAP loss per share was $0.16 in the second quarter. Non-GAAP loss per share for the first six months of 2014 was $0.48.

Management Commentary

"Results during the second quarter were in line with our guidance," said Tom Gutierrez, president and chief executive officer. "We have continued to see strong interest in our suite of sapphire production tools, including our ASF™ equipment. In fact, the sapphire segment of our business accounted for over 75% of the revenue in the quarter, with the majority of it related to the sale of sapphire production equipment.

"The build-out of our Arizona facility, which has involved taking a 1.4 million square foot facility from a shell to a functional structure as well as the installation of sapphire growth and fabrication equipment, is nearly complete and we are commencing the transition to volume production," Gutierrez continued. "We remain confident about the long-term potential of the sapphire materials business for GT.

"The response from partners and potential customers for Merlin™ and Hyperion™, two of our high growth opportunities, has been very strong. We remain confident in our ability to achieve our 2016 non-GAAP earnings per share target of at or above $1.50. This is driven by the expected contributions of Merlin, Hyperion and our other new technology platforms, along with the growth of our sapphire, polysilicon and PV businesses," Gutierrez concluded.

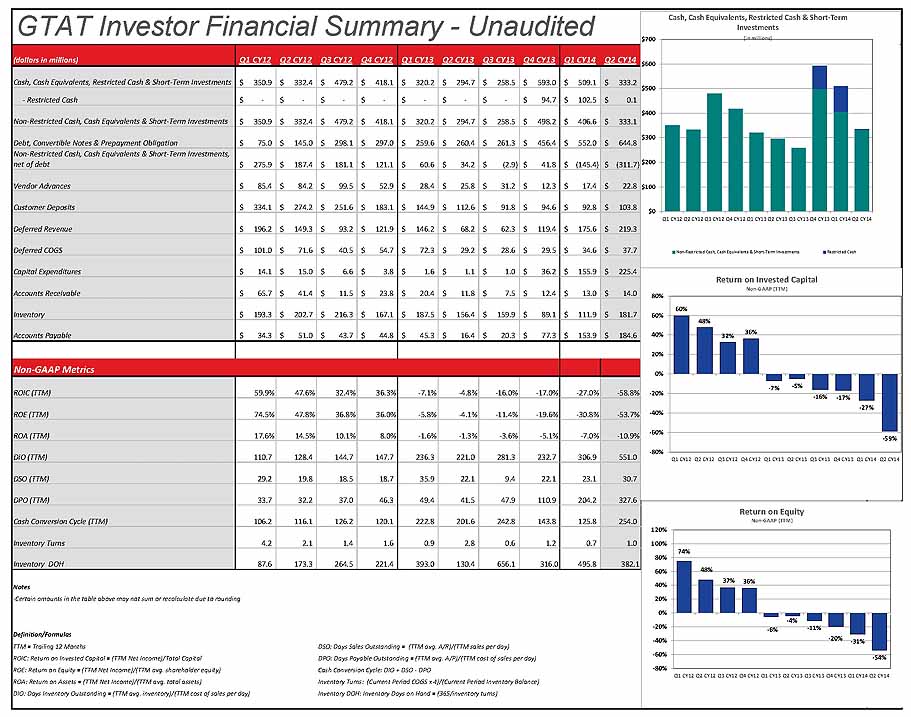

Cash, Backlog and Orders

The company ended the second quarter with $333 million of cash, cash equivalents and restricted cash, compared to $509 million at the end of the first quarter of fiscal year 2014. The second quarter ending cash balance reflects the receipt of $103 million of prepayments for the Arizona sapphire materials project.

The fourth prepayment from Apple is contingent upon the achievement of certain operational targets by GT. GT expects to achieve these targets and receive the final $139 million prepayment by the end of October 2014.

Equipment orders booked during the quarter were $75 million, including $72 million in sapphire equipment. The company ended the quarter with $628 million of equipment backlog, consisting of $333 million of sapphire equipment, $292 million of polysilicon and $3 million of PV.

Business Outlook

The company is updating its guidance for fiscal year 2014, which ends December 31, 2014, as follows:

The company also reiterated its 2016 non-GAAP EPS target at or above $1.50.

Conference Call, Webcast

On Tuesday, August 5, 2014, at 8:00am ET, the company will host a live conference call with Tom Gutierrez, president and chief executive officer, and Raja Bal, chief financial officer, to discuss its second quarter fiscal year 2014 results, general business update and outlook.

The call will be webcast live and can be accessed by logging on to the "Investors" section of GT Advanced Technologies' website, http://investor.gtat.com/. A slide presentation will accompany the call. The live call can also be accessed by dialing (631) 291-4543. No password is required to access the webcast or call.

A replay of the call will be available for 90-days. To access the webcast replay please go to http://investor.gtat.com/ and select the webcast replay link on the 'Events and Presentations' page. Or, please dial (404) 537-3406. The telephone replay will be available through August 14, 2014 and requires the passcode 76391716.

Investor Financial Summary Document

A comprehensive summary of the company's financial performance can be found on the Investor Relations section of its website on the "Q2 FY14 Earnings Call" webcast page. To access: http://investor.gtat.com.

About GT Advanced Technologies Inc.

GT Advanced Technologies Inc. is a leading diversified technology company producing advanced materials and innovative crystal growth equipment for the global consumer electronics, power electronics, solar and LED industries. Its technical innovations accelerate the use of advanced materials, enabling a new generation of products across this diversified set of global markets. For additional information about GT Advanced Technologies, please visit www.gtat.com.

| GT Advanced Technologies Inc. | ||

| Condensed Consolidated Balance Sheets | ||

| (in thousands, except per share data) | ||

| (Unaudited) | ||

| June 28, | December 31, | |

| 2014 | 2013 | |

| Assets | ||

| Current assets: | ||

| Cash and cash equivalents | $ 333,147 | $ 498,213 |

| Restricted cash | 87 | 1,330 |

| Accounts receivable, net | 14,021 | 12,377 |

| Inventories | 132,647 | 39,087 |

| Deferred costs | 11,480 | 2,977 |

| Vendor advances | 14,471 | 1,341 |

| Deferred income taxes | 24,392 | 17,881 |

| Refundable income taxes | 2,758 | 2,759 |

| Prepaid expenses and other current assets | 16,179 | 7,003 |

| Total current assets | 549,182 | 582,968 |

| Restricted cash | -- | 93,419 |

| Property, plant and equipment, net | 611,465 | 209,760 |

| Intangible assets, net | 93,896 | 95,943 |

| Goodwill | 56,888 | 54,279 |

| Other assets | 196,580 | 150,912 |

| Total assets | $ 1,508,011 | $ 1,187,281 |

| Liabilities and stockholders' equity | ||

| Current liabilities: | ||

| Current portion of prepayment obligation | $ 43,900 | $ -- |

| Accounts payable | 184,613 | 77,303 |

| Accrued expenses | 63,657 | 39,115 |

| Contingent consideration | 6,265 | 234 |

| Customer deposits | 48,165 | 38,995 |

| Deferred revenue | 46,257 | 19,724 |

| Accrued income taxes | 678 | 301 |

| Total current liabilities | 393,535 | 175,672 |

| Prepayment obligation | 306,700 | 172,475 |

| Convertible notes | 294,209 | 283,914 |

| Deferred income taxes | 16,039 | 23,448 |

| Customer deposits | 55,598 | 55,598 |

| Deferred revenue | 173,081 | 99,672 |

| Contingent consideration | 14,521 | 15,173 |

| Other non-current liabilities | 17,711 | 808 |

| Accrued income taxes | 20,787 | 28,116 |

| Total liabilities | 1,292,181 | 854,876 |

| Commitments and contingencies | ||

| Stockholders' equity: | ||

| Preferred stock, 10,000 shares authorized, none issued and outstanding | -- | -- |

| Common stock, $0.01 par value; 500,000 shares authorized, 137,346 and 134,463 shares issued and outstanding as of June 28, 2014 and December 31, 2013, respectively | 1,373 | 1,345 |

| Additional paid-in capital | 367,560 | 355,916 |

| Accumulated other comprehensive income (loss) | 789 | 1,259 |

| Retained earnings | (153,892) | (26,115) |

| Total stockholders' equity | 215,830 | 332,405 |

| Total liabilities and stockholders' equity | $ 1,508,011 | $ 1,187,281 |

| GT Advanced Technologies Inc. | |||||

| Condensed Consolidated Statements of Operations | |||||

| (In thousands, except per share data) | |||||

| (Unaudited) | |||||

| Three Months Ended | Six Months Ended | ||||

| June 28, | March 29, | June 29, | June 28, | June 29, | |

| 2014 | 2014 | 2013 | 2014 | 2013 | |

| Revenue | $58,000 | $22,510 | $168,330 | $80,510 | $226,106 |

| Cost of revenue (excluding sapphire production ramp up costs) | 48,657 | 21,152 | 109,714 | 69,809 | 153,875 |

| Sapphire production ramp up costs | 45,456 | 1,899 | -- | 47,355 | -- |

| Total cost of revenue | 94,113 | 23,051 | 109,714 | 117,164 | 153,875 |

| Gross profit | (36,113) | (541) | 58,616 | (36,654) | 72,231 |

| Operating expenses: | |||||

| Research and development | 22,721 | 24,572 | 18,523 | 47,293 | 34,964 |

| Selling and marketing | 2,522 | 4,684 | 4,088 | 7,206 | 7,374 |

| General and administrative | 17,274 | 19,490 | 16,517 | 36,764 | 31,080 |

| Contingent consideration expense (income) | (538) | 2,375 | (4,310) | 1,837 | (3,974) |

| Impairment of goodwill | -- | -- | -- | -- | -- |

| Restructuring charges | 3,256 | -- | -- | 3,256 | 2,858 |

| Amortization of intangible assets | 3,057 | 2,976 | 2,667 | 6,033 | 5,122 |

| Total operating expenses | 48,292 | 54,097 | 37,485 | 102,389 | 77,424 |

| (Loss) income from operations | (84,405) | (54,638) | 21,131 | (139,043) | (5,193) |

| Other income (expense): | |||||

| Interest income | 91 | 96 | 70 | 187 | 164 |

| Interest expense | (10,588) | (12,549) | (6,526) | (23,137) | (14,006) |

| Other, net | 320 | 508 | (179) | 828 | 11 |

| (Loss) income before income taxes | (94,582) | (66,583) | 14,496 | (161,165) | (19,024) |

| (Benefit) provision for income taxes | (8,201) | (25,186) | 2,549 | (33,387) | (12,290) |

| Net (loss) income | ($86,381) | ($41,397) | $11,947 | ($127,778) | ($6,734) |

| Net (loss) income per share: | |||||

| Basic | ($0.63) | ($0.31) | $0.10 | ($0.94) | ($0.06) |

| Diluted | ($0.63) | ($0.31) | $0.10 | ($0.94) | ($0.06) |

| Weighted-average number of shares used in per share calculations: | |||||

| Basic | 136,677 | 135,432 | 120,481 | 136,066 | 119,920 |

| Diluted | 136,677 | 135,432 | 122,749 | 136,066 | 119,920 |

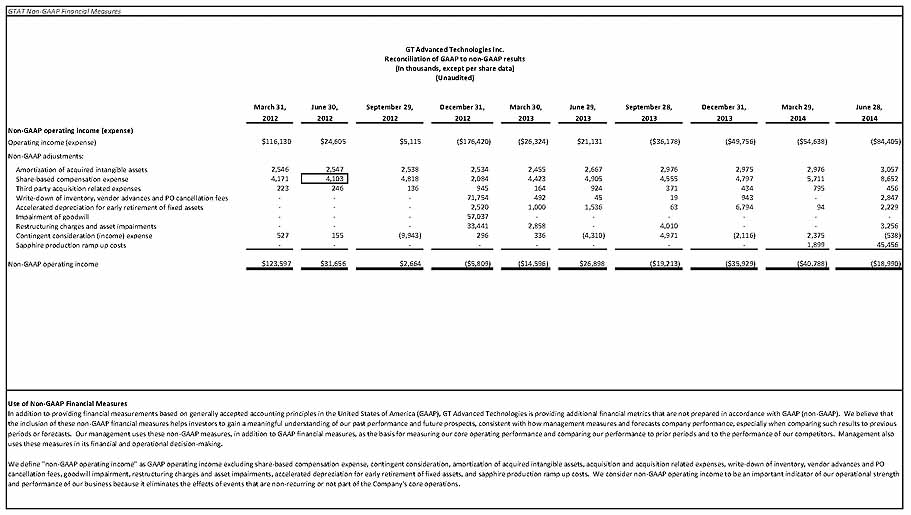

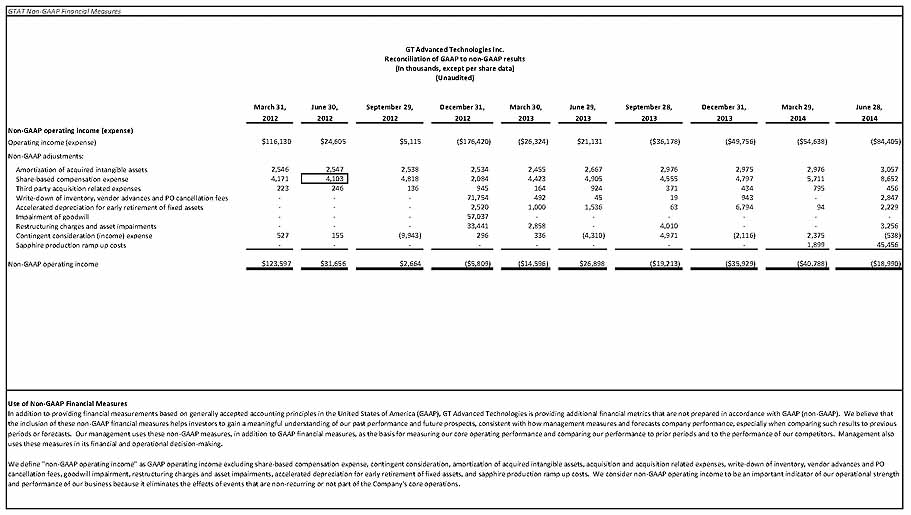

Reconciliation of Non-GAAP Financial Measures

In accordance with the requirements of Regulation G issued by the Securities and Exchange Commission, for any non-GAAP financial metrics referenced in this press release, we are also presenting the most directly comparable GAAP financial measures and reconciling the non-GAAP financial metrics to such comparable GAAP measures.

| GT Advanced Technologies Inc. | |||||

| Reconciliation of GAAP to non-GAAP results | |||||

| (In thousands, except per share data) | |||||

| (Unaudited) | |||||

| Three Months Ended | Six Months Ended | ||||

| June 28, | March 29, | June 29, | June 28, | June 29, | |

| 2014 | 2014 | 2013 | 2014 | 2013 | |

| Non-GAAP Gross Profit and Gross Margin | |||||

| Revenue | $58,000 | $22,510 | $168,330 | $80,510 | $226,106 |

| Cost of revenue (excluding sapphire production ramp up costs) | 48,657 | 21,152 | 109,714 | 69,809 | 153,875 |

| Sapphire production ramp up costs | 45,456 | 1,899 | -- | 47,355 | -- |

| Total cost of revenue | 94,113 | 23,051 | 109,714 | 117,164 | 153,875 |

| Gross profit | (36,113) | (541) | 58,616 | (36,654) | 72,231 |

| Non-GAAP adjustments: | |||||

| Share-based compensation expense | 508 | 545 | 212 | 1,053 | 373 |

| Write-down of inventory, vendor advances and PO cancellation fees | 2,847 | -- | 45 | 2,847 | 537 |

| Accelerated depreciation for early retirement of fixed assets | 1,909 | -- | -- | 1,909 | -- |

| Sapphire production ramp up costs | 45,456 | 1,899 | -- | 47,355 | -- |

| Non-GAAP gross profit | $14,607 | $1,903 | $58,873 | $16,510 | $73,141 |

| Non-GAAP gross margin | 25.2% | 8.5% | 35.0% | 20.5% | 32.3% |

| GT Advanced Technologies Inc. | |||||

| Reconciliation of GAAP to non-GAAP results | |||||

| (In thousands, except per share data) | |||||

| (Unaudited) | |||||

| Three Months Ended | Six Months Ended | ||||

| June 28, | March 29, | June 29, | June 28, | June 29, | |

| 2014 | 2014 | 2013 | 2014 | 2013 | |

| Non-GAAP Operating Income (Loss) | |||||

| Operating income (loss) | ($84,405) | ($54,638) | $21,131 | ($139,043) | ($5,193) |

| Non-GAAP adjustments: | |||||

| Amortization of acquired intangible assets | 3,057 | 2,976 | 2,667 | 6,033 | 5,122 |

| Share-based compensation expense | 8,652 | 5,711 | 4,905 | 14,363 | 9,328 |

| Third party acquisition related expenses | 456 | 795 | 924 | 1,251 | 1,088 |

| Write-down of inventory, vendor advances and PO cancellation fees | 2,847 | -- | 45 | 2,847 | 537 |

| Accelerated depreciation for early retirement of fixed assets | 2,229 | 94 | 1,536 | 2,323 | 2,536 |

| Restructuring charges | 3,256 | -- | -- | 3,256 | 2,858 |

| Contingent consideration expense (income) | (538) | 2,375 | (4,310) | 1,837 | (3,974) |

| Sapphire production ramp up costs | 45,456 | 1,899 | -- | 47,355 | -- |

| Non-GAAP operating income (loss) | ($18,990) | ($40,788) | $26,898 | ($59,778) | $12,302 |

| GT Advanced Technologies Inc. | |||||

| (In thousands, except per share data) | |||||

| (Unaudited) | |||||

| Three Months Ended | Six Months Ended | ||||

| June 28, | March 29, | June 29, | June 28, | June 29, | |

| 2014 | 2014 | 2013 | 2014 | 2013 | |

| Non-GAAP Net Income & Earnings per Share | |||||

| Net (loss) income | ($86,381) | ($41,397) | $11,947 | ($127,778) | ($6,734) |

| Non-GAAP adjustments: | |||||

| Amortization of acquired intangible assets | 3,057 | 2,976 | 2,667 | 6,033 | 5,122 |

| Share-based compensation expense | 8,652 | 5,711 | 4,905 | 14,363 | 9,328 |

| Third party acquisition related expenses | 456 | 795 | 924 | 1,251 | 1,088 |

| Write-down of inventory, vendor advances and PO cancellation fees | 2,847 | -- | 45 | 2,847 | 537 |

| Accelerated depreciation for early retirement of fixed assets | 2,229 | 94 | 1,536 | 2,323 | 2,536 |

| Restructuring charges | 3,256 | -- | -- | 3,256 | 2,858 |

| Contingent consideration expense (income) | (538) | 2,375 | (4,310) | 1,837 | (3,974) |

| Sapphire production ramp up costs | 45,456 | 1,899 | -- | 47,355 | -- |

| Non-cash portion of interest expense | 7,189 | 9,850 | 3,300 | 17,039 | 7,512 |

| Income tax effect of non-GAAP adjustments (1) | (8,544) | (25,529) | 2,089 | (34,073) | (13,210) |

| Non-GAAP net (loss) income | ($22,321) | ($43,226) | $23,103 | ($65,547) | $5,063 |

| Non-GAAP earnings per diluted share ("Non-GAAP EPS") | ($0.16) | ($0.32) | $0.19 | ($0.48) | $0.04 |

| Diluted weighted average shares outstanding | 136,677 | 135,432 | 122,749 | 136,066 | 119,920 |

| (1) For the three months ended June 28, 2014 and for all prior periods presented, the Company has modified its non-GAAP tax expense to reflect tax expense on a cash basis. Please refer to the Company's discussion regarding the use of non-GAAP financial measures for future details. |

Use of Non-GAAP Financial Measures

GT Advanced Technologies Inc.

Discussion Regarding the use of Non-GAAP Financial Measures

Our earnings release contains the following financial measures that have not been calculated in accordance with United States Generally Accepted Accounting Principles ("GAAP"): (i) non-GAAP gross profit and non-GAAP gross margin, (ii) non-GAAP operating income/loss, (iii) non-GAAP net income/loss, and (iv) non-GAAP diluted earnings/loss per share. As set forth in the "Reconciliation of Non-GAAP Financial Measures (unaudited)" tables found above, we derive such non-GAAP financial measures by excluding certain expenses and other items from the respective GAAP financial measure that is most directly comparable to each non-GAAP financial measure. Management uses these non-GAAP financial measures to evaluate our operating performance and to compare such performance against past periods, make operating decisions, forecast for future periods, compare our operating performance against peer companies and competitors and determine payments under certain compensation programs. These non-GAAP financial measures provide management with additional means to understand and evaluate the operating results and trends in our ongoing business by eliminating certain non-recurring, infrequent or unusual expenses (which may not occur in each period presented) that are not reflective of our ongoing operating results, and non-cash and other items that management believes are also not reflective of our ongoing operating results, in each case that might otherwise make comparisons of our ongoing business performance with prior periods and competitors more difficult, obscure trends in ongoing business performance or reduce management's ability to make useful forecasts.

We provide investors with these non-GAAP financial metrics because it allows our investors to understand and evaluate GT Advanced Technologies' operating results and future prospects in the same manner as management and to compare financial results across accounting periods and to those of competitors and peer companies. In addition, we believe that disclosing these non-GAAP financial measures contributes to enhanced financial reporting transparency and provides investors with added clarity about complex financial performance measures.

We calculate non-GAAP gross profit/loss by excluding from GAAP gross profit, share-based compensation expense, acquisition-related and restructuring-related expenses. We calculate non-GAAP operating income by excluding from GAAP operating income, share-based compensation expense, acquisition-related expenses, restructuring-related charges, production startup costs and impairment of goodwill. We calculate non-GAAP net (loss) income and diluted earnings per share by excluding from GAAP net (loss) income and diluted earnings per share, share-based compensation expense, acquisition-related expenses, restructuring-related charges, , production startup costs, impairment of goodwill, non-cash interest expenses and certain tax items which may not occur in all periods for which financial information is presented. For purposes of calculating non-GAAP diluted earnings per share, we calculate weighted average fully diluted share outstanding by adding the diluted impact of stock compensation using the treasury share method and evaluate the dilutive impact of our 2017 convertible notes taking into consideration the bond hedge transactions that we entered into at the time such convertible notes were issued. We exclude the items identified above from the respective non-GAAP financial measure referenced above for the reasons set forth with respect to each such excluded item below:

Share-Based Compensation - because (1) the total amount of expense is partially outside of our control because it is based on factors such as stock price volatility, market conditions at the time of grant and interest rates, which may be unrelated to our performance during the period in which the expense is incurred, (2) it is an expense based upon a valuation methodology premised on assumptions that vary over time, (3) the amount of the expense can vary significantly between companies due to factors that can be outside of the control of such companies and (4) allows investors to understand our operating performance.

Acquisition-Related Expenses – because items (such as, amortization of acquired intangible assets, fair value adjustments to contingent consideration, fair value charges incurred upon the sale of acquired inventory, acquisition-related professional fees and deemed compensation expenses) (i) are not considered by management in making operating decisions, (ii) are impacted by the timing and size of acquisitions (which may vary significantly over time) and (iii) we believe that such expenses do not have a direct correlation to our future business operations, and therefore including such charges do not accurately reflect the performance of our ongoing operations for the period in which such charges are incurred and such exclusion allows for a more useful comparison of our operating results to prior periods and to our competitors.

Sapphire production ramp up costs -Related Expenses – because these expenses, which primarily relate to costs in connection with production inefficiencies and inventory losses as a result of the qualification of sapphire growth and fabrication equipment and the establishment of related production processes. To the extent these expenses cannot be capitalized under GAAP, have no direct correlation to our future business operations and including such charges does not reflect the performance of our ongoing operations for the period in which such charges are incurred.

Restructuring / Impairment-Related Charges/Write-downs - because, to the extent such charges impact a period presented, we believe that they are not consistently recurring and do not reflect expected future operating expense, nor provide meaningful insight into the fundamentals of current or past operations and have no direct correlation to our future business operations and including such charges does not necessarily reflect the performance of our ongoing operations for the period in which such charges are incurred. Such charges include restructuring, impairment of goodwill and/or long-lived assets, accelerated depreciation for early retirement of fixed assets, write-down of inventory, vendor advances and PO cancellation fees.

Non-Cash Interest Expense – because this expense, comprised of the imputed interest recognized on interest-free customer prepayments and on amortization of the debt discount recorded at inception of the convertible debt borrowings as they relate to the adoption of ASC 470-20, is non-cash, dependent on fair value assessments and is not considered by management when making operating decisions and non-cash expense is not indicative of operating performance.

Certain Income Tax Items – including certain deferred tax charges and benefits that do not result in a current tax pay other adjustments, including but not limited to, items unrelated to the current fiscal year or that are not indicative of operations. During Q2 2014 the Company changed its method of calculating non-GAAP income taxes to reflect its cash tax liability for each period. The Company restated prior period non-GAAP results to reflect this change in all periods presented.

The non-GAAP financial measures do not replace the presentation of GT Advanced Technologies Inc.'s GAAP financial results and should only be used as a supplement to, not as a substitute for, GT Advanced Technologies Inc.'s financial results presented in accordance with GAAP. In addition, non-GAAP financial measures are likely to have limited value for purposes of drawing comparisons between companies because different companies may calculate similarly titled non-GAAP financial measures in different ways because non-GAAP measures are not based on any comprehensive set of accounting rules or principles.

Forward-Looking Statements

Some of the information in this press release relates to future expectations, plans and prospects for our business and industry that constitute "forward-looking statements" for the purposes of the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to: the Company continues to see strong interest in its suite of sapphire production tools, including our ASF™ equipment; the Company is commencing the transition to volume production at the Mesa, Arizona facility; the Company remains confident about the long-term potential of the sapphire materials business; the Company remains confident in its ability to achieve the target at or above $1.50 of non-GAAP earnings per share in fiscal year 2016 (which is driven by the expected contributions of Merlin, Hyperion and the other new technology platforms, along with the growth of the Company's sapphire, polysilicon and PV businesses); the Company expects to achieve those certain operational targets related to the fourth prepayment from Apple and receive the final $139 million prepayment by the end of October; all information under the caption "Business Outlook", this includes the Company's financial guidance for future periods, including with respect to revenue range for fiscal year 2014, fully diluted Non-GAAP earnings per share range for fiscal year 2014 (and that this range reflects an expected change in mix and more favorable gross margins in the second half of the year), and the Company's guidance with respect to non-GAAP earnings per share for 2016. These forward-looking statements are not a guarantee of performance and are subject to a number of uncertainties and other factors, many of which are outside the company's control, which could cause actual events to differ materially from those expressed or implied by these statements. These factors may include the possibility that the company is unable to recognize revenue on contracts in its order backlog, the Company may not recognize any benefits from its arrangements with Apple (including, but not limited to, receiving prepayment amounts from Apple and selling (and recognizing revenue) sapphire material to Apple), and the Company may be unable to commercialize products and technology that are under development or that such products and technologies will not gain market acceptance. Although the Company's backlog is based on signed purchase orders or other written contractual commitments in effect as of June 28, 2014, we cannot guarantee that our bookings or order backlog or our arrangement with Apple will result in actual revenue in the originally anticipated period or at all, which could reduce our revenue, profitability and liquidity. Other factors that may cause actual events to differ materially from those expressed or implied by our forward-looking statements include: the Company's ability to successfully transition its business to being a sapphire material and equipment provider; Apple purchasing sufficient quantities under its arrangements with the Company; the Company complying with the provisions of its arrangements with Apple; the impact of continued decreased demand and/or excess capacity in the markets for the output of our solar (polysilicon and photovoltaic) and sapphire equipment; general economic conditions and the tightening credit markets having an adverse impact on demand for our products; increasing trade tensions between the United States and China (and other jurisdictions); the possibility that changes in government incentives may reduce demand for solar products, which would, in turn, reduce demand for our polysilicon and photovoltaic equipment and technologies; technological changes could render existing products or technologies (including products or technologies under development by the Company) obsolete; the Company may be unable to protect its intellectual property rights or may be subject to liability for violating intellectual property rights of another party; competition from other manufacturers may increase; exchange rate fluctuations and conditions in the credit markets and economy may reduce demand for the company's products and various other risks as outlined in GT Advanced Technologies Inc.'s filings with the Securities and Exchange Commission, including the statements under the heading "Risk Factors" in the Company's Quarterly Report on Form 10-Q for the quarter ended March 29, 2014 and the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2013. Statements in this press release should be evaluated in light of these important factors. The statements in this press release represent GT Advanced Technologies Inc.'s expectations and beliefs as of the date of this press release. GT Advanced Technologies Inc. anticipates that subsequent events and developments may cause these expectations and beliefs to change. GT Advanced Technologies Inc. is under no obligation to, and expressly disclaims any such obligation to, update or alter its forward-looking statements, whether as a result of new information, future events, or otherwise.

CONTACT: Media

Jeff Nestel-Patt

jeff.nestelpatt@gtat.com

603-204-2883

Investor Relations/Analysts

Ryan Flaim

ryan.flaim@gtat.com

603-681-3869

F;2!Z<[KL7U-_J>RO[3C>C^D_3?I:;?2^S_IE#]MXWINL].W977Z

MK_:V6_HOVG]GL9ZN]EOV3_"_T/UOU;[5]H_1*S9T["LKMKLKW5WF;*R7%A)=

MZ[]E._TZ?4O_`$UOH_SMO\XGMP,2UUCGLGUFEEH!