U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

☑ |

|

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

for the fiscal year ended December 28, 2014

or

|

☐ |

|

Transition Report Under Section 13 or 15(d) of the Securities Exchange Act of 1934 |

Commission File No. 000-53577

DIVERSIFIED RESTAURANT HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

|

Nevada |

|

03-0606420 |

|

(State or other jurisdiction of incorporation |

|

(I.R.S. Employer Identification No.) |

|

or organization) |

|

|

27680 Franklin Rd., Southfield, MI 48034

(248) 223-9160

(Address, including zip code and telephone number, including area code, of Registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Exchange Act:

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $.0001 par value per share

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☑

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer☐ |

Accelerated filer☑ |

Non-accelerated filer☐ |

Smaller reporting company☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of the Registrant’s voting common stock held by non-affiliates was $64.7 million based on the per share closing price of the Company's common stock as reported on the NASDAQ stock market on June 27, 2014.

The number of shares outstanding of the registrant's common stock as of March 6, 2015 was 26,187,199 shares.

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the registrant's definitive Proxy Statement for its Annual Meeting of Stockholders to be held on or about May 21, 2015 are incorporated by reference in Part III herein. The registrant intends to file such Proxy Statement with the Securities and Exchange Commission no later than 120 days after the end of the fiscal year covered by this report on Form 10-K.

TABLE OF CONTENTS

|

|

Page |

|

|

|

|

PART I |

4 |

|

|

|

|

Item 1. Business |

5 |

|

|

|

|

Item 1A. Risk Factors |

12 |

|

|

|

|

Item 1B. Unresolved Staff Comments |

21 |

|

|

|

|

Item 2. Properties |

21 |

|

|

|

|

Item 3. Legal Proceedings |

21 |

|

|

|

|

Item 4. Mine Safety Disclosures |

21 |

|

|

|

|

PART II |

22 |

|

|

|

|

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

22 |

|

|

|

|

Item 6. Selected Financial Data |

24 |

|

|

|

|

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operation |

25 |

|

|

|

|

Item 7A. Quantitative and Qualitative Disclosures about Market Risk |

34 |

|

|

|

|

Item 8. Consolidated Financial Statements and Supplementary Data |

34 |

|

|

|

|

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

64 |

|

|

|

|

Item 9A. Controls and Procedures |

65 |

|

|

|

|

Item 9B. Other Information |

66 |

|

|

|

|

PART III |

68 |

|

|

|

|

Item 10. Directors, Executive Officers and Corporate Governance |

68 |

|

|

|

|

Item 11. Executive Compensation |

68 |

|

|

|

|

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

68 |

|

|

|

|

Item 13. Certain Relationships and Related Transactions, and Director Independence |

68 |

|

|

|

|

Item 14. Principal Accountant Fees and Services |

68 |

|

|

|

|

PART IV |

69 |

|

|

|

|

Item 15. Exhibits and Financial Statement Schedules |

69 |

|

|

|

|

SIGNATURES |

71 |

|

Exhibit 10.13 |

|

Exhibit 21 |

|

Exhibit 23 |

|

Exhibit 31.1 |

|

Exhibit 31.2 |

|

Exhibit 32.1 |

|

Exhibit 32.2 |

PART I

When used in this Form 10-K, the “Company” and “DRH” refers to Diversified Restaurant Holdings, Inc. and, depending on the context, could also be used to refer generally to the Company and its subsidiaries, which are described below.

Cautionary Statement Regarding Forward-Looking Information

Some of the statements in the sections entitled “Business,” and “Risk Factors,” and statements made elsewhere in this Annual Report may constitute forward-looking statements. These statements reflect the current views of our senior management team with respect to future events, including our financial performance, business, and industry in general. Statements that include the words “expect,” “intend,” “plan,” “believe,” “project,” “forecast,” “estimate,” “may,” “should,” “anticipate” and similar statements of a future or forward-looking nature identify forward-looking statements for purposes of the federal securities laws or otherwise.

Forward-looking statements address matters that involve risks and uncertainties. Accordingly, there are or will be important factors that could cause our actual results to differ materially from those indicated in these statements. We believe that these factors include, but are not limited to, the following:

|

● |

the success of our existing and new restaurants; |

|

● |

our ability to identify appropriate sites and develop and expand our operations; |

|

● |

changes in economic conditions, including continuing effects from the recent recession; |

|

● |

damage to our reputation or lack of acceptance of our brands in existing or new markets; |

|

● |

economic and other trends and developments, including adverse weather conditions, in the local or regional areas in which our restaurants are located; |

|

● |

the impact of negative economic factors, including the availability of credit, on our landlords and surrounding tenants; |

|

● |

changes in food availability and costs; |

|

● |

labor shortages and increases in our compensation costs, including, as a result, changes in government regulation; |

|

● |

increased competition in the restaurant industry and the segments in which we compete; |

|

● |

the impact of legislation and regulations regarding nutritional information, new information or attitudes regarding diet and health, or adverse opinions about the health of consuming our menu offerings; |

|

● |

the impact of federal, state, and local beer, liquor, and food service regulations; |

|

● |

the success of our marketing programs; |

|

● |

the impact of new restaurant openings, including on the effect on our existing restaurants of opening new restaurants in the same markets; |

|

● |

the loss of key members of our management team; |

|

● |

inability or failure to effectively manage our growth, including without limitation, our need for liquidity and human capital; |

|

● |

the impact of litigation; |

|

● |

the adequacy of our insurance coverage and fluctuating insurance requirements and costs; |

|

● |

the impact of our indebtedness on our ability to invest in the ongoing needs of our business; |

|

● |

our ability to obtain debt or other financing on favorable terms, or at all; |

|

● |

the impact of a potential requirement to record asset impairment charges in the future; |

|

● |

the impact of any security breaches of confidential guest information in connection with our electronic processing of credit/debit card transactions; |

|

● |

our ability to protect our intellectual property; |

|

● |

the impact of any failure of our information technology system or any breach of our network security; |

|

● |

the impact of any materially adverse changes in our federal, state, and local taxes; |

|

● |

our ability to main our relationship with our franchisor on economically favorable terms; |

|

● |

the impact of future sales of our common stock in the public market, the exercise of stock options, and any additional capital raised by us through the sale of our common stock; and |

|

● |

the effect of changes in accounting principles applicable to us. |

The foregoing factors should not be construed as exhaustive and should be read together with the other cautionary statements included in this Annual Report. If one or more of these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may differ materially from what we anticipate. Any forward-looking statements you read in this Annual Report reflect our views as of the date of this Annual Report with respect to future events and are subject to these and other risks, uncertainties, and assumptions relating to our operations, results of operations, growth strategy, and liquidity. You should carefully consider all of the factors identified in this Annual Report that could cause actual results to differ.

ITEM 1. BUSINESS

Business Overview

DRH is a fast-growing restaurant company operating two complementary concepts: Bagger Dave’s Burger Tavern ® (“Bagger Dave’s”) and Buffalo Wild Wings ® Grill & Bar (“BWW”). As the creator, developer, and operator of Bagger Dave’s and as one of the largest franchisees of BWW, we provide a unique guest experience in a casual and inviting environment. We were incorporated in 2006 and are headquartered in the Detroit metropolitan area. As of December 28, 2014, we had 66 locations in Florida, Illinois, Indiana, and Michigan.

In 2008, DRH became publicly owned completing a self-underwritten initial public offering for $735,000 and 140,000 shares. We subsequently completed an underwritten, follow-on offering on April 23, 2013 of 6.9 million shares with net proceeds of $31.9 million.

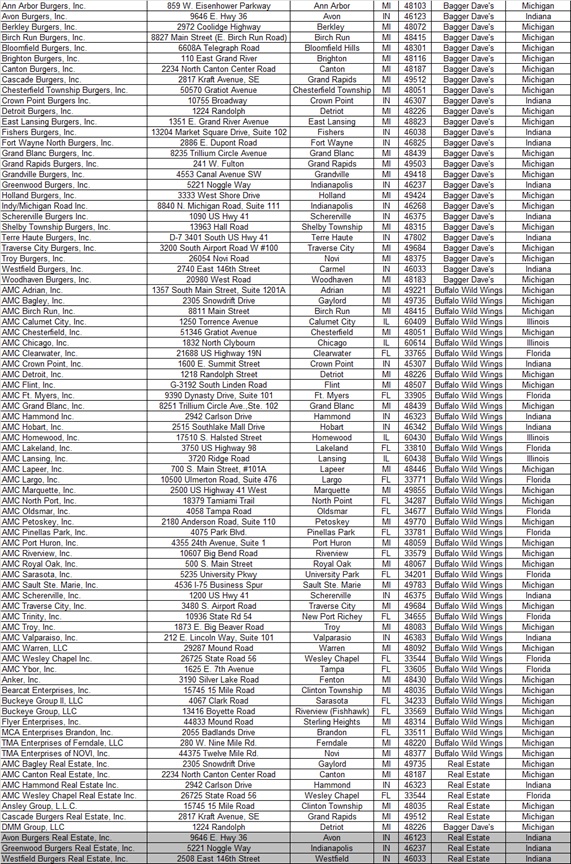

DRH and its wholly-owned subsidiaries (collectively, the “Company”), AMC Group, Inc. (“AMC”), AMC Wings, Inc. (“WINGS”), AMC Burgers, Inc. (“BURGERS”), and AMC Real Estate, Inc. (“REAL ESTATE”) own and operate Bagger Dave's and DRH-owned BWW restaurants located throughout Florida, Illinois, Indiana, and Michigan.

DRH originated the Bagger Dave’s concept with our first restaurant opening in January 2008 in Berkley, Michigan. Currently, there are 26 Bagger Dave’s, 17 in Michigan and nine in Indiana. The Company expects to operate between 47 and 51 Bagger Dave’s locations by the end of 2017.

DRH is also one of the largest BWW franchisees and currently operates 42 DRH-owned BWW restaurants (19 in Michigan, 14 in Florida, four in Illinois, and five in Indiana), including the nation’s largest BWW, based on square footage, in downtown Detroit, Michigan. We remain on track to fulfill our area development agreement (“ADA”) with BWLD and expect to operate 52 DRH-owned BWW restaurants by the end of 2017, exclusive of potential additional BWW restaurant acquisitions. In 2014 DRH was awarded the Franchisee of Year and our COO recieved the Founders’ Award by Buffalo Wild Wings International (“BWLD”).

The following organizational chart outlines the current corporate structure of DRH. A brief textual description of the entities follows the organizational chart. DRH is incorporated in Nevada.

AMC was formed on March 28, 2007 and serves as our operational and administrative center. AMC renders management, operational support, and advertising services to WINGS, BURGERS, REAL ESTATE and their subsidiaries. Services rendered by AMC include marketing, restaurant operations, restaurant management consultation, hiring and training of management and staff, and other management services reasonably required in the ordinary course of restaurant operations.

BURGERS was formed on March 12, 2007 and serves as a holding company for our Bagger Dave’s restaurants. Bagger Dave’s Franchising Corporation, a subsidiary of BURGERS, was formed to act as the franchisor for the Bagger Dave’s concept and has rights to franchise in Illinois, Indiana, Kentucky, Michigan, Missouri, Ohio, and Wisconsin. We do not intend to pursue franchise development at this time.

WINGS was formed on March 12, 2007 and serves as a holding company for our DRH-owned BWW restaurants. We are economically dependent on retaining our franchise rights with BWLD. The franchise agreements have specific initial term expiration dates ranging from March 2020 through December 2034, depending on the date each was executed and the duration of its initial term. The franchise agreements are renewable at the option of the franchisor and are generally renewable if the franchisee has complied with the franchise agreement. When factoring in any applicable renewals, the franchise agreements have specific expiration dates ranging from December 2025 through December 2049. We believe we are in compliance with the terms of these agreements.

REAL ESTATE was formed on March 18, 2013 and serves as the holding company for the real estate properties owned by DRH. REAL ESTATE’s portfolio currently includes three properties, two Bagger Dave’s restaurants, which will be sold as part of the sale leaseback transaction as described in Note 3 of the Consolidated Financial Statements, and one DRH-owned BWW restaurants. The restaurants at these locations are all owned and operated by DRH.

Our headquarters are located at 27680 Franklin Road, Southfield, Michigan 48034. Our telephone number is (248) 223-9160. We can also be found on the internet at www.diversifiedrestaurantholdings.com and www.baggerdaves.com.

Background

Restaurant Concepts

Bagger Dave’s Burger Tavern®

Launched in January 2008, Bagger Dave's is our first initiative to diversify our operations outside of the BWW concept by developing our own unique, full-service, ultra-casual restaurant and bar concept. We have worked to create a concept that provides a warm, inviting, and entertaining atmosphere through friendly and memorable guest experience. Currently, there are 26 restaurants (17 in Michigan and nine in Indiana).

Bagger Dave’s specializes in custom-built proprietary fresh prime rib recipe burgers, all-natural lean turkey burgers, hand-cut fries, locally crafted beers on draft, hand-dipped milk shakes, salads, black bean turkey chili, and much more, delivered in a warm, hip atmosphere with friendly "full" service. The concept differentiates itself from other full-service casual dining establishments by the absence of walk-in freezers and microwaves, substantiating our fresh food offerings. The concept focuses on local flair of the city in which the restaurant resides by showcasing historical photos. It also features an electric train that runs above the dining room and bar areas.

The guiding principle of the Bagger Dave’s brand is to delight guests through fresh food offerings, exceptional service, and an entertaining atmosphere. The menu is a-la-carte and focuses on burgers, with a variety of sides. Burgers are offered with a choice of four proteins; USDA, fresh premium prime-rib recipe beef (offered in 8oz patty or 4oz patty), Michigan ground turkey, farm-raised, cage-free grilled chicken breasts and black bean patties. Guests can choose from our list of burgers including the Train Wreck Burger ®, the Blues Burger ®, and Tuscan Chicken. Guests can also choose to “Create Your Own” which allows them to totally customize their experience by choosing from a variety of proteins, buns, cheeses, house-recipe sauces presenting bold and exciting new flavors, premium toppings such as bacon, egg, guacamole, and a variety of complementary toppings, such as sautéed mushrooms and onions, barbecue sauce, and other standard condiments.

To further customize their experience, guests can choose from a selection of sides including fresh-cut potato fries, Dave’s Sweet Potato Chips®, Amazingly Delicious Turkey Black Bean Chili® and our fresh, made-to-order Twisted Mac ‘N’ Cheese. The fries are cut in-house from domestic Northeastern potatoes and cooked in a cottonseed soy bean specialty oil, using a seven-step Belgian-style process producing a fry reminiscent of those served at community fairs. Dave’s Sweet Potato Chips ® are a Bagger Dave’s specialty using fresh-cut premium sweet potatoes from North Carolina. Guests can choose from our own signature dipping sauces to complement their order entrée and sides. Since our fryers are dedicated to potatoes and there are no breaded, frozen products offered at Bagger Dave’s, our potato fries and sweet potato chips are gluten free and trans-fat free.

Beyond burger offerings, Bagger Dave’s offers other entrees such as a Tomato-Basil-Onion Grilled Cheese sandwich, a California BLT sandwich, Dave’s Signature Italian Beef sandwich, and entrée sized chopped salads with grilled chicken. Bagger Dave’s also offers hand-dipped ice cream and milkshakes with a variety of free mix-ins, adult shakes, sommelier-selected wines and a full selection of liquors. For fiscal year 2014, our average Bagger Dave’s restaurant derived approximately 86.3% of its revenue from food, including non-alcoholic beverages, and 13.7% of its revenue from alcohol sales, primarily draft beer.

To reinforce the Bagger Dave’s name and brand, our fresh-cut fries and sweet potato-chips are served in natural, brown bags decorated with our logo and served in a cake tin.

Buffalo Wild Wings

With 42 DRH-owned BWW restaurants (19 in Michigan, 14 in Florida, four in Illinois, and five in Indiana), including the nation’s largest BWW, based on square footage, in downtown Detroit, Michigan, DRH is one of the largest BWLD franchisees. As of December 28, 2014, BWLD reported over 1,000 BWW restaurants in North America that were either directly owned or franchised. The restaurants feature a variety of boldly-flavored, craveable menu items in a welcoming neighborhood atmosphere with an extensive multimedia social environment, a full bar, and an open layout designed to create a distinctive dining experience for sports fans and families alike. We believe the restaurants are differentiated by the social environment we create and the connection the restaurants make with our team members, guests, and the local community. The inviting and energetic environment of the restaurants is complemented by furnishings that can easily be rearranged to accommodate parties of various sizes. Guests have the option of watching various sporting events on projection screens or approximately 50 additional televisions, competing in Buzztime Trivia, or playing video games.

BWW restaurants have won dozens of “Best Wings” and “Best Sports Bar” awards across the country. We believe the BWW menu is competitively priced between the quick-casual and casual dining segments. The menu features traditional chicken wings, boneless wings, and other items including chicken tenders, Wild Flatbreads ™ , popcorn shrimp, specialty hamburgers and sandwiches, wraps, Buffalito ® soft tacos, appetizers, and salads. The made-to-order menu items are enhanced by the bold flavor profile of 16 signature sauces and five signature seasonings, which range in flavor from Sweet BBQ ® to Blazin’ ®. The restaurants offer approximately 12 to 30 domestic and imported beers on tap, including several local or regional microbrews and a wide selection of bottled beer, wine, and liquor. We believe the award-winning food and memorable experience drives guest visits and loyalty. For fiscal year 2014, our average DRH-owned BWW restaurant derived approximately 80.9% of its revenue from food, including non-alcoholic beverages, and 19.1% of its revenue from alcohol sales, primarily draft beer.

Growth Strategy

We have a multi-layered growth strategy. We plan to grow by increasing the number of restaurants in each of the two concepts we currently offer and target opening a minimum of eight new restaurants per year.

We have successfully expanded our Bagger Dave’s restaurant base from just three restaurants in 2010 to 26 company-owned locations as of March 13, 2015. We believe that we are well positioned to grow throughout the Midwest and ultimately nationally. We expect to open additional restaurants if suitable locations are found and appropriate financing can be secured. We plan to operate between 47 and 51 Bagger Dave’s corporate locations by the end of 2017.

We currently operate 42 DRH-owned BWW restaurants: 19 in Michigan, 14 in Florida, four in Illinois, and five in Indiana. We have opened 24 DRH-owned BWW restaurants in fulfillment of our 32-resaturants ADA with BWLD. Including the remaining eight restaurants under the ADA, and two additional franchise agreements, we expect to operate 52 BWW restaurants by 2017, exclusive of potential acquisitions of additional BWW restaurants.

We believe our track record of acquiring and integrating BWW restaurants affords us with a unique opportunity to take advantage of strategic accretive acquisitions in the marketplace. Throughout our history, we have demonstrated our proven ability to leverage our operational expertise, infrastructure, and systems to drive stronger profitability and unit volumes at acquired restaurants. The combination of our size and history with the Buffalo Wild Wings brand allows us to utilize best practices and optimize the performance of any restaurants that we may acquire.

One of our guiding principles is that a happy team member translates into a happy guest. A happy guest drives repeat sales and word-of-mouth referrals – two key factors that are fundamental to our sales growth strategy. We believe that our core areas of expertise include site selection, development, management, quality guest service, and operations.

A center point in our expansion plan was opening the largest BWW, by square-footage, in downtown Detroit, Michigan, on December 23, 2012, to take advantage of the energy and positivity surrounding the revitalization and rebuilding of downtown Detroit. It occupies two stories in the Odd Fellow Building and is within walking distance of Ford Field, Comerica Park, and Joe Louis Arena. According to a New York Times article published on July 11, 2011, in the last 10 years, Downtown Detroit has experienced a 59.0% increase in the number of college-educated residents under the age of 35, creating a culture of trendy bars and restaurants. Also driving the revitalization efforts is Detroit’s “15 by 15” initiative, a program focused on getting 15,000 young and talented households to move Downtown by 2015. To complement this location and further take advantage of the growth of downtown Detroit, a new, three-story Bagger Dave’s was opened adjacent to this BWW in November of 2013.

Site Selection

We consider the real estate selection process to be a key factor in the long-term success of each restaurant, and as such, devote a significant amount of time and effort into identifying and evaluating each potential location. We consider several metrics to assess the strength of each proposed site, including daytime population, accessibility, population density, visibility and neighboring retailers.

For our restaurants, we prefer a strong end-cap position, which is a premier, highly visible corner positioned in a well-anchored shopping center or lifestyle entertainment center. We also seek to develop freestanding locations, if the opportunity meets our site selection criteria, along with specific economic thresholds.

Restaurant Operations

We believe that retaining high quality restaurant managers, valuing our team members, and providing fast, friendly service to our guests are key to our continued success. In order to retain our unique culture as we grow, we devote substantial resources to identifying, selecting, and training our restaurant-level team members. We typically have six in-restaurants trainers at each existing location who provide both front- and back-of-house training on site. We also have a seven-week training program of our restaurant managers, which consists of an average of four weeks of restaurant training and three weeks of cultural training. During their training, managers observe our established restaurants’ operations and guest interactions. We believe our focus on guest-centric training is a core aspect of our Company and reinforces our mission to delight our guests.

Management and Staffing

The core values that define our corporate culture are cleanliness, service, and organization. Our restaurants are generally staffed with one managing partner and up to six assistant managers depending on the sales volume of the restaurant. The managing partner is responsible for day-to-day operations and for maintaining the standards of quality and performance that define our corporate culture. We utilize regional managing partners to oversee our managing partners and supervise the operation of our restaurants, including the continuing development of each restaurant’s management team. Through regular visits to the restaurants and constant communication with the management team, the regional managing partners ensure adherence to all aspects of our concept, strategy, and standards of quality. We also have secret shoppers that visit our restaurants on a monthly basis and provide guest satisfaction scores for the criteria we define.

Training, Development, and Recruiting

We believe that successful restaurant operations, guest satisfaction, quality, and cleanliness begin with the team member - a key component of our strategy. We pride ourselves on facilitating a well-organized, thorough, hands-on training program. Our team members undergo classroom training followed by job shadowing in order to prepare them for their role.

We offer an incentive program which we believe is very competitive in the restaurant industry. Aside from competitive base salaries and benefits, management is incentivized with a performance-based bonus program. We also provide group health, dental, and vision insurance, a company-sponsored 401(k) plan with a discretionary matching contribution feature, a tuition reimbursement program, a referral bonus program, and opportunities for career advancement.

We emphasize growth from within the organization as much as possible, giving our team members the opportunity to develop and advance. We believe this philosophy helps build a strong, loyal management team with high team member retention rates, giving us an advantage over our competitors. We strive for a balance of internal promotion and external hiring.

Restaurants

Our typical Bagger Dave's restaurants range in size from 3,800 to 6,100 square feet, with a historical square foot average of about 4,300. We anticipate future restaurants will be approximately 4,000 to 4,500 square feet in size, plus an outside seating area where feasible. We anticipate an average cash investment per restaurant of approximately $1.1 million to $1.4 million. From time to time, our restaurants may be smaller or larger or cost more or less than our targeted range, depending on the particular circumstances of the selected site. Also, from time to time, we may elect to purchase either the building or the land and building for certain restaurants, which would require additional capital. We plan to continue development of this concept in the Michigan and Indiana and expand throughout the Midwest. Expansion outside of Michigan and Indiana will begin in 2015, as we intend to open Bagger Dave’s restaurants in Ohio.

Our typical DRH-owned BWW restaurants range in size from 5,300 to 13,500 square feet, with a historical square foot average of about 6,400. We anticipate that future restaurants will range in size from 5,500 to 6,500 square feet with an average cash investment per restaurant of approximately $1.9 million to $2.1 million. From time to time, our restaurants may be smaller or larger or cost more or less than our targeted range, depending on the particular circumstances of the selected site. Also, from time to time, we may elect to purchase either the building or the land and building for certain restaurants, which would require additional capital.

We have a continuous capital improvement plan for our restaurants and plan major renovations every five years to seven years. For a more detailed discussion of our capital improvement plans, see the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and specifically, the subsections entitled “Liquidity and Capital Resources; Expansion Plans”.

Quality Control and Purchasing

We strive to maintain high quality standards, protecting our food supply at all times.

Purchasing for DRH-owned BWW restaurants is primarily through channels established by BWLD corporate operations. We do, however, negotiate directly with most of these channels as to price and delivery terms. When we purchase directly, we seek to obtain the highest quality ingredients, products, and supplies from reliable sources at competitive prices. For Bagger Dave’s, we believe that we have been able to leverage our DRH-owned BWW purchasing power to develop supply sources at a more reasonable cost than would be expected for a smaller restaurant concept.

To maximize our purchasing efficiencies, our centralized purchasing staff negotiates, when available, fixed-price contracts (usually for a one-year period) or, where appropriate, commodity-price contracts.

Marketing and Advertising

In fiscal year 2014, we spent approximately 1.7% of all restaurant sales on marketing efforts. In addition, charitable donations and local community sponsorships help us develop local public relations and are a major component of our marketing efforts. We support programs that build traffic at the grass roots level. We also participate in numerous local restaurant marketing events for both DRH-owned BWW and Bagger Dave’s throughout the communities we serve.

Bagger Dave’s

The advertising and marketing plan for developing the Bagger Dave’s brand relies on local media, menu specials, promotions, and community events. We are also building our marketing reach with our current guests by enhancing our social media presence and our loyalty rewards program. We attribute a large part of our Bagger Dave’s growth through word-of-mouth.

BWW

We pay a marketing fee to BWLD equal to 3.0% of revenue, which is supported by national advertising designed to build brand awareness. Some examples include television commercials on ESPN and CBS during key games for the NFL, MLB, NBA, and March Madness NCAA basketball tournaments. In addition, we invest in our own marketing initiatives, including 0.5% of DRH-owned BWW revenue which is allocated to a regional cooperative of BWW franchisees in the Detroit metropolitan area (for those DRH-owned BWW restaurants in the Detroit metropolitan area). We established the DRH-owned BWW restaurants in the Florida and Michigan markets through coordinated local restaurant marketing efforts and operating strengths that focus on the guest experience.

Information Systems and Technology

We believe that technology can provide a competitive advantage and enable our strategy for growth through efficient restaurant operations, information analysis, and ease and speed of guest service. We have a standard point-of-sale system in our restaurants that is integrated to our corporate office through a web-based above-store business intelligence reporting and analysis tool. Our systems are designed to improve operating efficiencies, enable rapid analysis of marketing and financial information, and improve administrative productivity. In 2012, we launched online ordering for our Bagger Dave’s restaurants and recently launched table side ordering devices that allows servers to create orders and send orders to the kitchen while standing with the customer. We believe the table side ordering will help decrease serving time and increase customer turnover and satisfaction since these devices also accommodate credit card swipes so that the card never has to leave the customer’s sight. Beginning in 2014, we also integrated the online ordering function for BWW and the Rockbot music experience where guests get to D.J. and select music played throughout the restaurant.

We are constantly assessing new technologies to improve operations, back-office processes, and overall guest experience. This includes the implementation of mobile payment options, advanced programming of kitchen display units, tablet-based wait-listing applications, and a mobile-based loyalty program.

Competition

The restaurant industry is highly competitive. We believe we compete primarily with local and regional sports bars and national casual dining and quick-casual establishments. Competition is expected to remain intense with respect to price, service, location, concept, and type and quality of food. There is also competition for real estate sites, qualified management personnel, and hourly restaurant staff. Many of our competitors have been in existence longer than we have and may be better established in markets where we are currently located or may, in the future, be located. Accordingly, we strive to continually improve our restaurants, maintain high quality standards, and treat our guests in a manner that encourages them to return. We believe our pricing communicates value to the guest in a comfortable, welcoming atmosphere that provides full service to the guest.

Trademarks, Service Marks, and Trade Secrets

The BWW registered service mark is owned by BWLD.

Our domestically-registered trademarks and service marks include Bagger Dave’s Burger Tavern®, Sloppy Dave’s BBQ ®, Railhouse Burger Sauce ®, The Blues Burger ®, Train Wreck Burger, Dave’s Sweet Potato Chips ®, Meaningless Free Toppings ®, Sloppy Dave’s Fries ®, and Amazingly Delicious Turkey Black Bean Chili ®. We place considerable value on our trademarks, service marks, trade secrets, and other proprietary rights and believe they are important to our brand-building efforts and the marketing of our Bagger Dave’s ® restaurant concept. We intend to actively enforce and defend our intellectual property, however, we cannot predict whether the steps taken by us to protect our proprietary rights will be adequate to prevent misappropriation of these rights or the use by others of restaurant features based upon or similar to our concepts. Although we believe we have sufficient protections concerning our trademarks and service marks, we may face claims of infringement that could interfere with our ability to market our restaurants and promote our brand.

Government Regulations

The restaurant industry is subject to numerous federal, state, and local governmental regulations, including those relating to the preparation and sale of food and alcoholic beverages, sanitation, public health, nutrition labeling requirements, fire codes, zoning, and building requirements and to periodic review by state and municipal authorities for areas in which the restaurants are located. Each restaurant requires appropriate licenses from regulatory authorities allowing it to sell beer, wine, and liquor and each restaurant requires food service licenses from local health authorities. Majority of our licenses to sell alcoholic beverages must renewed annually and may be suspended or revoked at any time for cause, including violation by us or our team members of any law or regulation pertaining to alcoholic beverage control, such as those regulating the minimum age of team members or patrons who may serve or be served alcoholic beverages, the serving of alcoholic beverages to visibly intoxicated patrons, advertising, wholesale purchasing, and inventory control. In order to reduce this risk, restaurant team members are trained in standardized operating procedures designed to assure compliance with all applicable codes and regulations. We have not encountered any material problems relating to alcoholic beverage licenses or permits to date.

We are also subject to laws governing our relationship with team members. Our failure to comply with federal, state, and local employment laws and regulations may subject us to losses and harm our brands. The laws and regulations govern such matters as wage and hour requirements; workers’ compensation insurance; unemployment and other taxes; working and safety conditions; overtime; and citizenship and immigration status. Significant additional government-imposed regulations under the Fair Labor Standards Act and similar laws related to minimum wages, overtime, rest breaks, paid leaves of absence, and mandated health benefits may also impact the performance of our operations. In addition, team member claims based on, among other things, discrimination, harassment, wrongful termination, wage, hour requirements, and payments to team members who receive gratuities, may divert financial and management resources and adversely affect operations. The losses that may be incurred as a result of any violation of such governmental regulations by the Company are difficult to quantify. To our knowledge, we are in compliance in all material respects with all applicable federal, state, and local laws affecting our business.

Compliance with these laws and regulations may lead to increased costs and operational complexity and may increase our exposure to governmental investigations or litigation. We may also be subject, in certain states, to “dram shop” statutes, which generally allow a person injured by an intoxicated person to recover damages from an establishment that wrongfully served alcoholic beverages to the intoxicated person. We carry liquor liability coverage as part of our existing comprehensive general liability insurance which we believe is consistent with coverage carried by other companies in the restaurant industry of similar size and scope of operations. Even though we carry liquor liability insurance, a judgment against us under a “dram shop” statute in excess of our liability coverage could have a material adverse effect on our operations.

ITEM 1A. RISK FACTORS

This Form 10-K, including the discussions contained in Items 1 and 7, contains various “forward-looking statements” that are based on current expectations or beliefs concerning future events. Such statements can be identified by the use of terminology such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “could,” “possible,” “plan,” “project,” “will,” “forecast” and similar words or expressions. Our forward-looking statements generally relate to our growth strategy, financial results, sales efforts, franchise expectations, restaurant openings and related expense, and cash requirements. Although we believe there is a reasonable basis for the forward-looking statements, our actual results could be materially different. While it is not possible to foresee all of the factors that may cause actual results to differ from our forward-looking statements, such factors include, among others, the risk factors that follow. Investors are cautioned that all forward-looking statements involve risks and uncertainties and speak only as of the date on which they are made, and we do not undertake any obligation to update any forward-looking statement.

Risks Related to Our Business and Industry

Our Financial Results Depend Significantly Upon the Success of Our Existing and New Restaurants

Future growth in our revenue and profits will depend on our ability to maintain or grow sales and efficiently manage costs in our existing and new restaurants. Currently, we have 26 Bagger Dave’s restaurant and 42 DRH-owned BWW restaurants. The results achieved by our current restaurants may not be indicative of longer-term performance or the potential market acceptance of our restaurant concepts in other locations. Additionally, the success of one restaurant concept may not be indicative or predictive of the success of the other.

The success of our restaurants depends principally upon generating and maintaining guest traffic, loyalty, and achieving positive margins. Significant factors that might adversely affect guest traffic and loyalty and profit margins include:

|

● |

economic conditions, including housing market downturns, rising unemployment rates, lower disposable income, credit conditions, fuel prices and consumer confidence and other events or factors that adversely affect consumer spending in the markets we serve; |

|

● |

competition in the restaurant industry, particularly in the casual and fast-casual dining segments; |

|

● |

changes in consumer preferences; |

|

● |

our guests’ failure to accept menu price increases that we may make to offset increases in certain operating costs; |

|

|

|

|

● |

our reputation and consumer perception of our concepts’ offerings in terms of quality, price, value, ambience and service; and |

|

|

|

|

● |

our guests’ actual experiences from dining in our restaurants. |

Our restaurants are also susceptible to increases in certain key operating expenses that are either wholly or partially beyond our control, including:

|

● |

food and other raw materials costs, many of which we cannot effectively hedge; |

|

● |

compensation costs, including wage, workers’ compensation, health care and other benefits expenses; |

|

● |

rent expenses and construction, remodeling, maintenance and other costs under leases for our new and existing restaurants; |

|

● |

compliance costs as a result of changes in regulatory or industry standards; |

|

● |

energy, water and other utility costs; |

|

● |

costs for insurance (including health, liability and workers’ compensation); |

|

● |

information technology and other logistical costs; and |

|

● |

expenses due to litigation against us. |

We May Not Be Able to Manage Our Growth

Our expansion strategy will depend upon our ability to open and operate additional restaurants profitably. The opening of new restaurants will depend on a number of factors, many of which are beyond our control. These factors include, among others, the availability of management, restaurant staff, and other personnel, the cost and availability of suitable restaurant locations, cost-effective and timely planning, design and build out of restaurants, acceptable leasing terms, acceptable financing, and securing required governmental permits. Although we have formulated our business plans and expansion strategies based on certain estimates and assumptions we believe are reasonable, we anticipate that we will be subject to changing conditions that will cause certain of these estimates and assumptions to be incorrect. For example, our restaurants may not open at the planned time due to factors beyond our control, including, among other factors, site selection, BWLD’s approval with respect to new BWW openings, negotiations with landlords, and construction or permitting delays.

We May Not Be Successful When Entering New Markets

When expanding the Bagger Dave's and BWW concepts, we will enter new markets in which we may have limited or no operating experience. There can be no assurance that we will be able to achieve success and/or profitability in our new markets or in our new restaurants. The success of these new restaurants will be affected by the different competitive conditions, consumer tastes, and discretionary spending patterns within the new markets, as well as by our ability to generate market awareness of the Bagger Dave's and BWW brands. New restaurants typically require several months of operation before achieving normal levels of profitability. When we enter highly competitive new markets or territories in which we have not yet established a market presence, the realization of our revenue targets and desired profit margins may be more susceptible to volatility and/or more prolonged than anticipated.

Competition in the Restaurant Industry May Affect Our Ability to Compete Effectively

The restaurant industry is intensely competitive. We believe we compete primarily with regional and local sports bars, burger establishments, casual dining concepts, and fast-casual establishments. Competition from “better burger” establishments has recently been particularly intense. Many of our direct and indirect competitors are well-established national, regional, or local chains with a greater market presence than us. Further, some competitors have substantially greater financial, marketing, and other resources than us. In addition, independent owners of local or regional establishments may enter the wing-based or burger-based restaurant businesses without significant barriers to entry and such establishments may provide price competition for our restaurants. Competition in the casual dining, fast-casual, and quick-service segments of the restaurant industry is expected to remain intense with respect to price, service, location, concept, and the type and quality of food. We also face intense competition for real estate sites, qualified management personnel, and hourly restaurant staff.

New Restaurants Added to Our Existing Markets May Take Sales From Existing Restaurants

New restaurants added to our existing markets, whether by us or others, may take sales away from our existing restaurants. Because we intend to open restaurants in our existing markets, and others may intend the same, this may impact revenue earned by our existing restaurants.

Higher-Than-Anticipated Costs Associated With the Opening of New Restaurants or With the Closing, Relocating, or Remodeling of Existing Restaurants May Adversely Affect Our Results of Operations

Our revenue and expenses may be significantly impacted by the location, number, and timing of the opening of new restaurants and the closing, relocating, and remodeling of existing restaurants. We incur substantial pre-opening expenses each time we open a new restaurant and will incur other expenses if we close, relocate or remodel existing restaurants. These expenses are generally higher when we open restaurants in new markets, but the costs of opening, closing, relocating, or remodeling any of our restaurants may be higher than anticipated. An increase in such expenses could have an adverse effect on our results of operations.

Future Acquisitions May Have Unanticipated Consequences That Could Harm Our Business and Our Financial Condition

We may seek to selectively acquire existing BWW restaurants. To do so, we would need to identify suitable acquisition candidates, negotiate acceptable acquisition terms, and obtain appropriate financing as needed. Any acquisitions we pursue, whether successfully completed or not, may involve risks, including:

|

● |

material adverse effects on our operating results, particularly in the fiscal quarters immediately following the acquisition as the acquired restaurants are integrated into our operations; |

|

|

|

|

● |

customary closing and indemnification risks associated with any acquisition; |

|

|

|

|

● |

funds used pursuing acquisitions we are ultimately unable to consummate because the transaction is subject to a right of first refusal in favor of our franchisor, BWLD; and |

|

|

|

|

● |

diversion of management’s attention from other business concerns. |

Future acquisitions of existing restaurants, which may be accomplished through a cash purchase transaction, the issuance of our equity securities, or a combination of both, could result in potentially dilutive issuances of our equity securities, the incurrence of debt and contingent liabilities, and impairment charges related to intangible assets, any of which could harm our business and financial condition.

We May Suffer Negative Consequences if New Restaurants Do Not Open in a Timely Manner

If we are unable to successfully open new restaurants in a timely manner, our revenue growth rate and profits may be adversely affected. We must open restaurants in a timely and profitable manner to successfully expand our business. In the past, we have experienced delays in restaurant openings and we may face similar delays in the future. These delays may trigger material financial penalties assessed against us by BWLD as provided in our ADA. These delays may also not meet market expectations, which may negatively affect our stock price. Our ability to expand successfully and in a timely manner will depend on a number of factors, many of which are beyond our control. A few of the factors are listed below:

|

● |

Locating and securing quality locations in new and existing markets; |

|

● |

Negotiating acceptable leases or purchase agreements; |

|

● |

Securing acceptable financing for new locations; |

|

● |

Cost-effective and timely planning, design, and build-out of restaurants; |

|

● |

Attracting, recruiting, training, and retaining qualified team members; |

|

● |

Hiring reputable and satisfactory construction contractors; |

|

● |

Competition in new and existing markets; |

|

● |

Obtaining and maintaining required local, state, and federal government approvals and permits related to the construction of sites and the sale of food and alcoholic beverages; |

|

● |

Creating brand awareness in new markets; and |

|

● |

General economic conditions. |

The Loss of Key Executives Could Affect Our Performance

Our success depends substantially on the contributions and abilities of key executives and other team members. The loss of any of our executive officers could jeopardize our ability to meet our financial targets. In particular, we are highly dependent upon the services of T. Michael Ansley, David G. Burke, and Jason T. Curtis. We do not have employment agreements with these individuals or any of our other team members. Our inability to retain the full-time services of any of these people or to attract other qualified executives could have an adverse effect on us, and there would likely be a difficult transition period in finding suitable replacements for any of them.

We May Not Be Able to Attract and Retain Qualified Team Members to Operate and Manage Our Restaurants

The success of our restaurants depends on our ability to attract, motivate, develop, and retain a sufficient number of qualified restaurant team members, including managers and hourly team members. The inability to recruit, develop, and retain these individuals may delay the planned openings of new restaurants or result in high team member turnover in existing restaurants, thus increasing the cost to efficiently operate our restaurants. This could inhibit our expansion strategy and business performance and negatively impact our operating results

Fluctuations in the Cost of Food Could Impact Operating Results

Our primary food products are fresh bone-in chicken wings, ground beef, and potatoes. Our food, beverage, and packaging costs could be significantly affected by increases in the cost of fresh chicken wings and ground beef, which can result from a number of factors, including but not limited to, seasonality, cost of corn and grain, animal disease, drought and other weather phenomena, increase in demand domestically and internationally, and other factors that may affect availability. Additionally, if there is a significant rise in the price of chicken wings or ground beef, and we are unable to successfully adjust menu prices or menu mix or otherwise make operational adjustments to account for the higher wing and beef prices, our operating results could be adversely affected. We also depend on our franchisor, BWLD, as it relates to chicken wings, to negotiate prices and deliver product to us at a reasonable cost. Chicken wing prices per pound averaged $1.53 in 2014, $0.23 lower than the average of $1.76 in 2013. BWLD currently purchases and secures for its franchisees chicken wings at market price.

Shortages or Interruptions in the Availability and Delivery of Food and Other Supplies May Increase Costs or Reduce Revenue

Possible shortages or interruptions in the supply of food items and other supplies to our restaurants caused by inclement weather, terrorist attacks, natural disasters such as floods, drought, and hurricanes, pandemics, the inability of our vendors to obtain credit in a tightened credit market, food safety warnings or advisories, or the prospect of such pronouncements, or other conditions beyond our control, could adversely affect the availability, quality, and cost of items we buy and the operations of our restaurants. Our inability to effectively manage supply chain risk could increase our costs and limit the availability of products critical to our restaurant operations.

Our Success Depends Substantially on the Value of Our Brands and Unfavorable Publicity Could Harm Our Business

Multi-unit restaurant businesses such as ours can be adversely affected by publicity resulting from complaints, litigation, or general publicity regarding poor food quality, food-borne illness, personal injury, food tampering, adverse health effects of consumption of various food products or high-calorie foods (including obesity), or other concerns. Negative publicity from traditional media or online social network postings may also result from actual or alleged incidents or events taking place in our restaurants.

There has been a marked increase in the use of social media platforms and similar devices, including weblogs (blogs), social media websites, and other forms of Internet-based communications which allow individuals access to a broad audience of consumers and other interested persons. Consumers value readily available information concerning goods and services that they have or plan to purchase, and may act on such information without further investigation or authentication. The availability of information on social media platforms is virtually immediate as is its impact. Many social media platforms immediately publish the content their subscribers and participants can post, often without filters or checks on accuracy of the content posted. The opportunity for dissemination of information, including inaccurate information, is seemingly limitless and readily available. Information concerning our Company may be posted on such platforms at any time. Information posted may be adverse to our interests or may be inaccurate, each of which may harm our performance, prospects, or business. The harm may be immediate without affording us an opportunity for redress or correction. Such platforms also could be used for dissemination of trade secret information, compromising valuable company assets. In sum, the dissemination of information online could harm our business, prospects, financial condition, and results of operations, regardless of the information’s accuracy.

Regardless of whether any public allegations or complaints are valid, unfavorable publicity relating to a number of our restaurants, or only to a single restaurant, could adversely affect public perception of the entire brand. Adverse publicity and its effect on overall consumer perceptions of food safety, or our failure to respond effectively to adverse publicity, could have a material adverse effect on our business. We must protect and grow the value of our brands to continue to be successful in the future. Any incident that erodes consumer trust in or affinity for our brands could significantly reduce their value. If consumers perceive or experience a reduction in food quality, service, ambiance, or in any way believe we failed to deliver a consistently positive experience, the value of our brands could suffer.

Increases in Our Compensation Costs, Including as a Result of Changes in Government Regulation, Could Slow Our Growth or Harm Our Business

We are subject to a wide range of compensation costs. Because our compensation costs are, as a percentage of revenue, higher than other industries, we may be significantly harmed by compensation cost increases. Unfavorable fluctuations in market conditions, availability of such insurance, or changes in state and/or federal regulations could significantly increase our insurance premiums. In addition, we are subject to the risk of employment-related litigation at both the state and federal levels, including claims styled as class action lawsuits, which are more costly to defend. Also, some employment-related claims in the area of wage and hour disputes are not insurable risks.

Significant increases in health care costs may also continue to occur, and we can provide no assurance that we will be able to effectively contain those costs. Further, we are continuing to assess the impact of recently-adopted federal health care legislation on our health care benefit costs, and significant increases in such costs could adversely impact our operating results.

In addition, many of our restaurant personnel are hourly team members subject to various minimum wage requirements or changes to existing tip credit laws. Mandated increases in minimum wage levels and changes to the tip credit laws, which dictate the amounts an employer is permitted to assume an team member receives in tips when calculating the team member’s hourly wage for minimum wage compliance purposes, have recently been and continue to be proposed and implemented at both federal and state government levels. Continued minimum wage increases or changes to allowable tip credits may further increase our compensation costs or effective tax rate.

Various states in which we operate are considering or have already adopted new immigration laws, and the U.S. Congress and Department of Homeland Security from time to time consider or implement changes to federal immigration laws, regulations, or enforcement programs as well. Some of these changes may increase our obligations for compliance and oversight, which could subject us to additional costs and make our hiring process more cumbersome, or reduce the availability of potential team members. Although we require all team members to provide us with government-specified documentation evidencing their employment eligibility, some of our team members may, without our knowledge, be unauthorized team members. Unauthorized team members are subject to deportation and may subject us to fines or penalties, and if any of our team members are found to be unauthorized, we could experience adverse publicity that negatively impacts our brand and may make it more difficult to hire and keep qualified team members. Termination of a significant number of team members that, unbeknownst to us, were unauthorized team members may disrupt our operations, cause temporary increases in our compensation costs as we train new team members and result in additional adverse publicity. Our financial performance could be materially harmed as a result of any of these factors.

Changes in Public Health Concerns and Legislation and Regulations Requiring the Provision of Nutritional Information May Impact Our Performance

Government regulation and consumer eating habits may impact our business as a result of changes in attitudes regarding diet and health or new information regarding the health effects of consuming our menu offerings. These changes have resulted in, and may continue to result in, the enactment of laws and regulations that impact the ingredients and nutritional content of our menu offerings, or laws and regulations requiring us to disclose the nutritional content of our food offerings. For example, a number of states, counties, and cities have enacted menu labeling laws requiring multi-unit restaurant operators to disclose certain nutritional information available to guests, or have enacted legislation restricting the use of certain types of ingredients in restaurants. The U.S. health care reform law included nation-wide menu labeling and nutrition disclosure requirements as well, and our restaurants will be covered by these national requirements when they go into effect. The final rule was published on December 1, 2014 and requires implementation by December 1, 2015. Although the federal legislation is intended to preempt conflicting state or local laws on nutrition labeling, until we are required to comply with the federal law, we will be subject to a patchwork of state and local laws and regulations regarding nutritional content disclosure requirements. Many of these requirements are inconsistent or are interpreted differently from one jurisdiction to another. The effect of such labeling requirements on consumer choices, if any, is unclear at this time. We cannot make any assurances regarding our ability to effectively respond to changes in consumer health perceptions or our ability to successfully implement the nutrient content disclosure requirements and to adapt our menu offerings to trends in eating habits. The imposition of menu-labeling laws could have an adverse effect on our results of operations and financial position, as well as the restaurant industry in general.

Multiple jurisdictions in which we operate could adopt recently enacted new requirements that require us to adopt and implement a Hazard Analysis and Critical Control Points (“HACCP”) system for managing food safety and quality. HACCP refers to a management system in which food safety is addressed through the analysis and control of potential hazards from production, procurement, and handling, to manufacturing, distribution, and consumption of the finished product. We expect to incur certain costs to comply with these regulations and these costs may be more than we anticipate. If we fail to comply with these laws or regulations, our business could experience a material adverse effect.

Further, growing movements to change laws relating to alcohol may result in a decline in alcohol consumption at our restaurants or increase the number of dram shop claims made against us, either of which may negatively impact operations or result in the loss of liquor licenses.

Changes in Consumer Preferences or Discretionary Consumer Spending Could Harm Our Performance

Our success depends, in part, upon the continued popularity of our chicken and boneless wings, hamburgers and turkey burgers, other food and beverage items, and the appeal of our restaurant concepts. We also depend on trends toward consumers eating away from home. Shifts in these consumer preferences could negatively affect our future profitability. Such shifts could be based on health concerns related to the cholesterol, carbohydrate, fat, calorie, or salt content of certain food items, including items featured on our menu. Negative publicity over the health aspects of such food items may adversely affect consumer demand for our menu items and could result in a decrease in guest traffic to our restaurants, which could materially harm our business. In addition, our success depends, to a significant extent, on numerous factors affecting discretionary consumer spending, general economic conditions (including the continuing effects of the recent recession), disposable consumer income, and consumer confidence. A decline in consumer spending or in economic conditions could reduce guest traffic or impose practical limits on pricing, either of which could harm our business, financial condition, operating results, or cash flow.

Actions by Our Franchisor Could Negatively Affect Our Business and Operating Results

We are economically dependent on retaining our franchise rights with BWLD. Our DRH-owned BWW restaurant operations depend, in part, on decisions made by our franchisor, including changes of distributors, food menu items and prices, policies and procedures, and advertising programs. Business decisions made by BWLD could adversely impact our operating performance and profitability. Under our ADA, BWLD has the right to immediately terminate the ADA if, among other things, we are unable to comply with the development schedule or if one of the Franchise Agreements entered into pursuant to the area ADA is terminated. Termination of the ADA could adversely affect our growth strategy and, in turn, our financial condition. Additionally, the ADA and the individual Franchise Agreements provide BWLD with the authority to approve the location selected for our future BWLD franchises, as well as approve the design of the individual restaurant. BWLD must give its consent prior to the opening of a new BWW restaurant and, once the restaurant is open, we are subject to various operational requirements, including the use of specific suppliers and products. Delays in the approval of our locations or pre-opening approval, as well as changes to the operational requirements, may impact our operating performance.

Our Operating Results May Fluctuate Due to the Timing of Special Events

Our operating results depend, in part, on special events, such as the Super Bowl® and other sporting events viewed by our guests in our restaurants, including those sponsored by the National Football League, Major League Baseball, National Basketball Association, National Hockey League, and National Collegiate Athletic Association. Interruptions in the viewing of these professional sporting league events due to strikes or lockouts may impact our business and operating results. Additionally, our results are subject to fluctuations based on the dates of sporting events and their availability for viewing through broadcast, satellite, and cable networks. Historically, sales in most of our restaurants have been higher during fall and winter months based on the relative popularity and extent of national, regional, and local sporting and other events in the geographic regions in which we currently operate.

Our Inability to Renew Existing Leases or Enter Into New Leases For New or Relocated Restaurants on Favorable Terms May Adversely Affect Our Results of Operations

As of the date of December 28, 2014, 67 of our 68 restaurants are located on leased premises and are subject to varying lease-specific arrangements. For example, some of the leases require base rent that is subject to increase based on market factors, and other leases include base rent with specified periodic increases. Some leases are subject to renewals which could involve substantial increases. Additionally, a few leases require contingent rent based on a percentage of gross sales. When our leases expire in the future, we will evaluate the desirability of renewing such leases. While we currently expect to pursue all renewal options, no guarantee can be given that such leases will be renewed or, if renewed, that rents will not increase substantially. The success of our restaurants depends in large part on their leased locations. As demographic and economic patterns change, current leased locations may or may not continue to be attractive or profitable. Possible declines in trade areas where our restaurants are located or adverse economic conditions in surrounding areas could result in reduced revenue in those locations. In addition, desirable lease locations for new restaurant openings or for the relocation of existing restaurants may not be available at an acceptable cost when we identify a particular opportunity for a new restaurant or relocation.

Economic Conditions Could Have a Material Adverse Impact on Our Landlords in Retail Centers in Which We Are Located

Our landlords may be unable to obtain financing or remain in good standing under their existing financing arrangements, resulting in failures to pay required construction contributions or satisfy other lease covenants to us. If our landlords fail to satisfy required co-tenancies, such failures may result in us terminating leases or delaying openings in these locations. Also, decreases in total tenant occupancy in retail centers in which we are located may affect guest traffic at our restaurants. All of these factors could have a material adverse impact on our operations.

A Decline in Visitors to Any of the Business Districts Near the Locations of Our Restaurants Could Negatively Affect Our Restaurant Sales

Some of our restaurants are located near high-activity areas such as retail centers, big-box shopping centers, and entertainment centers. We depend on high visitor rates at these businesses to attract guests to our restaurants. If visitors to these centers decline due to economic conditions, closure of big-box retailers, road construction, changes in consumer preferences or shopping patterns, changes in discretionary consumer spending or otherwise, our restaurant sales in these areas could decline significantly and adversely affect the results of our operations.

Because Many of Our Restaurants are Concentrated in Local or Regional Areas, We are Susceptible to Economic and Other Trends and Developments, Including Adverse Weather Conditions, in These Areas

Our financial performance is highly dependent on restaurants located in Florida, Illinois, Indiana, and Michigan. As a result, adverse economic conditions in any of these areas could have a material adverse effect on our overall results of operations. In recent years, certain of these states have been more negatively impacted by the housing decline, high unemployment rates, and the overall economic crisis than other geographic areas. In addition, other regional occurrences such as local strikes, terrorist attacks, increases in energy prices, adverse weather conditions, hurricanes, droughts, or other natural or man-made disasters have occurred. In particular, adverse weather conditions can impact guest traffic at our restaurants, cause the temporary underutilization of certain seating areas, and, in more severe cases, cause temporary restaurant closures, sometimes for prolonged periods. As of December 28, 2014, approximately 78.8% of our total restaurants are located in Illinois, Indiana and Michigan, which are particularly susceptible to snowfall, and approximately 21.2% of our total restaurants are located in Florida, which is particularly susceptible to hurricanes.

Legal Actions Could Have an Adverse Effect on Us

We could face legal action from government agencies, team members, guests, or other parties. Many state and federal laws govern our industry, and if we fail to comply with these laws, we could be liable for damages or penalties. Further, we may face litigation from guests alleging that we were responsible for an illness or injury they suffered at or after a visit to our restaurants, or alleging that we are not complying with regulations governing our food quality or operations. We may also face employment-related litigation, including claims of age discrimination, sexual harassment, gender discrimination, immigration violations, or other local, state, and federal labor law violations.

We May Not Be Able to Obtain and Maintain Licenses and Permits Necessary to Operate Our Restaurants

The restaurant industry is subject to various federal, state, and local government licensure and permitting requirements, including those relating to the sale of food and alcoholic beverages. The failure to obtain and maintain these licenses, permits, and approvals, including food and liquor licenses, could adversely affect our operating results. Difficulties or failure to obtain any required licenses, permits, or other government approvals could delay or result in our decision to cancel the opening of new restaurants. Local authorities may revoke, suspend, or deny renewal of our food and liquor licenses if they determine that our conduct violates applicable regulations.

The Sale of Alcoholic Beverages at Our Restaurants Subjects Us to Additional Regulations and Potential Liability

For fiscal year 2014, approximately 18.2% of our consolidated restaurant sales were attributable to the sale of alcoholic beverages. Our restaurants sell alcoholic beverages, as such, we are required to comply with the alcohol licensing requirements of the federal government, states, and municipalities where our restaurants are located. Alcoholic beverage control regulations require applications to state authorities and, in certain locations, county and municipal authorities for a license and permit to sell alcoholic beverages on the premises and to provide service for extended hours and on Sundays. Typically, the licenses are renewed annually and may be revoked or suspended for cause at any time. Alcoholic beverage control regulations relate to numerous aspects of the daily operations of the restaurants, including minimum age of guests and team members, hours of operation, advertising, wholesale purchasing, inventory control and handling, storage, and dispensing of alcoholic beverages. If we fail to comply with federal, state, or local regulations, our licenses may be revoked and we may be forced to terminate the sale of alcoholic beverages at one or more of our restaurants.

In certain states, we are subject to “dram shop” statutes, which generally allow a person injured by an intoxicated person the right to recover damages from an establishment that wrongfully served alcoholic beverages to the intoxicated person. Some dram shop litigation against restaurant companies has resulted in significant judgments, including punitive damages.

We May Not Be Able to Protect Our Trademarks, Service Marks, and Trade Secrets

We place considerable value on our trademarks, service marks, and trade secrets. We intend to actively enforce and defend our intellectual property, although we may not always be successful. We attempt to protect our recipes as trade secrets by, among other things, requiring confidentiality agreements with our suppliers and executive officers. However, we cannot be sure that we will be able to successfully enforce our rights under our marks or prevent competitors from misappropriating our recipes, nor can we be sure that out methods of safeguarding our information are adequate and effective. We also cannot be sure that our marks are valuable; that using our marks does not, or will not, violate others' marks; that the registrations of our marks would be upheld if challenged; or that we would not be prevented from using our marks in areas of the country where others might have already established rights to them. Any of these uncertainties could have an adverse effect on us and our expansion strategy.

We Are Dependent on Information Technology and Any Material Failure of That Technology Could Impair Our Ability to Efficiently Operate Our Business

We rely on information systems across our operations, including, for example, point-of-sale processing in our restaurants, management of our supply chain, collection of cash, payment of obligations, and various other processes and procedures. Our ability to efficiently manage our business depends significantly on the reliability and capacity of these systems. The failure of these systems to operate effectively, problems with maintenance, upgrading or transitioning to replacement systems, or a breach in security of these systems could cause delays in guest service and reduce efficiency in our operations. Significant capital investments might be required to remediate any problems.

Our Ability to Raise Capital in the Future May Be Limited, Which Could Adversely Impact Our Business

Changes in our restaurant operations, lower than anticipated restaurant sales, increased food or compensation costs, increased property expenses, acceleration of our expansion plans, or other events, including those described in this Annual Report, may cause us to seek additional debt or equity financing on an accelerated basis. Financing may not be available to us on acceptable terms, and our failure to raise capital when needed could negatively impact our restaurant growth plans as well as our financial condition and the results of operations. Additional equity financing, if available, may be dilutive to the holders of our common stock. Debt financing may involve significant cash payment obligations, covenants, and financial ratios that may restrict our ability to operate and grow our business.