U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2013

[_] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from

Commission File No. 000-53577

DIVERSIFIED RESTAURANT HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

|

Nevada |

03-0606420 | |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) | |

27680 Franklin Road

Southfield, Michigan 48034

(Address of principal executive offices)

Registrant’s telephone number: (248) 223-9160

No change

(Former name, former address and former

fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

APPLICABLE ONLY TO CORPORATE ISSUERS:

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date: 26,093,176 shares of $.0001 par value common stock outstanding as of August 14, 2013.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

[ ] |

Accelerated filer |

[ ] | |

|

Non-accelerated filer |

[ ] |

Smaller reporting company |

[X] | |

|

(Do not check if a smaller reporting company) |

|

|

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes [ ] No [ ]

INDEX

|

PART I. FINANCIAL INFORMATION |

1 |

|

Item 1. Financial Statements |

1 |

|

Consolidated Balance Sheets |

1 |

|

Consolidated Statements of Operations |

2 |

|

Consolidated Statements of Comprehensive Income (Loss) |

3 |

|

Consolidated Statements of Stockholders' Equity |

4 |

|

Consolidated Statements of Cash Flows |

5 |

|

Notes to Interim Consolidated Financial Statements |

6 |

|

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations |

18 |

|

Item 3. Quantitative and Qualitative Disclosure About Market Risks |

23 |

|

Item 4. Controls and Procedures |

23 |

|

PART II. OTHER INFORMATION |

24 |

|

Item 1. Legal Proceedings |

24 |

|

Item 1A. Risk Factors |

24 |

|

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds |

24 |

|

Item 3. Defaults Upon Senior Securities |

24 |

|

Item 5. Other Information |

24 |

|

Item 6. Exhibits |

24 |

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

DIVERSIFIED RESTAURANT HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

ASSETS June 30 2013 (unaudited) 2012 Current assets Cash and cash equivalents Investments Accounts receivable Inventory Prepaid assets Total current assets Deferred income taxes Property and equipment, net Intangible assets, net Goodwill Other long-term assets Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities Accounts payable Accrued compensation Other accrued liabilities Current portion of long-term debt Current portion of deferred rent Total current liabilities Deferred rent, less current portion Unfavorable operating leases Other liabilities - interest rate swaps Long-term debt, less current portion Total liabilities Commitments and contingencies (Notes 10 and 11) Stockholders' equity Common stock - $0.0001 par value; 100,000,000 shares authorized; 26,093,176 and 18,951,700, respectively, issued and outstanding Additional paid-in capital Accumulated other comprehensive loss Accumulated deficit Total stockholders' equity Total liabilities and stockholders' equity

December 30

$

9,770,166

$

2,700,328

12,665,720

-

307,411

248,403

1,083,512

809,084

518,116

447,429

24,344,925

4,205,244

741,956

846,746

46,662,518

40,286,490

2,912,377

2,509,337

8,578,776

8,578,776

412,795

118,145

$

83,653,347

$

56,544,738

$

2,572,005

$

3,952,017

1,647,478

1,647,075

1,034,564

1,013,369

6,902,803

6,095,684

305,161

226,106

12,462,011

12,934,251

2,882,656

2,274,753

798,441

849,478

150,381

430,751

33,342,999

38,551,601

$

49,636,488

$

55,040,834

2,580

1,888

35,125,820

2,991,526

(148,362

)

(284,294

)

(963,179

)

(1,205,216

)

34,016,859

1,503,904

$

83,653,347

$

56,544,738

The accompanying notes are an integral part of these interim consolidated financial statements.

DIVERSIFIED RESTAURANT HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

Three Months Ended Six Months Ended June 30 2013 June 24 2012 June 30 2013 June 24 2012 Revenue Operating expenses Restaurant operating costs (exclusive of depreciation and amortization shown separately below): Food, beverage, and packaging Compensation costs Occupancy Other operating costs General and administrative expenses Pre-opening costs Depreciation and amortization Loss on disposal of property and equipment Total operating expenses Operating profit Change in fair value of derivative instruments Interest expense Other income, net Income (loss) before income taxes Income tax provision (benefit) Net income (loss) Less: (Income) attributable to noncontrolling interest Net income (loss) attributable to DRH Basic earnings per share Fully diluted earnings per share Weighted average number of common shares outstanding Basic Diluted

$

26,962,970

$

16,728,991

$

54,042,084

$

34,478,809

8,001,240

5,228,330

16,577,287

10,746,302

6,882,597

4,260,052

13,931,499

8,665,486

1,571,097

910,598

3,104,102

1,825,717

5,357,337

3,356,113

10,663,971

6,778,292

1,975,825

1,447,542

3,499,955

2,722,060

803,798

218,615

1,396,524

266,486

1,813,549

957,357

3,469,033

1,930,415

25,667

6,603

60,741

6,603

26,431,110

16,385,210

52,703,112

32,941,361

531,860

343,781

1,338,972

1,537,448

-

(64,050

)

-

(43,361

)

(585,637

)

(253,103

)

(1,054,848

)

(565,644

)

22,224

13,966

24,543

47,739

(31,553

)

40,594

308,667

976,182

(35,190

)

86,155

66,630

335,545

$

3,637

$

(45,561

)

$

242,037

$

640,637

$

-

$

(38,916

)

$

-

$

(78,726

)

$

3,637

$

(84,477

)

$

242,037

$

561,911

$

0.00

$

0.00

$

0.01

$

0.03

$

0.00

$

0.00

$

0.01

$

0.03

24,680,247

18,950,153

21,820,046

18,945,930

24,810,611

19,115,453

21,931,879

19,078,126

The accompanying notes are an integral part of these interim consolidated financial statements.

DIVERSIFIED RESTAURANT HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (UNAUDITED)

Three Months Ended Six Months Ended June 30 2013 June 24 2012 June 30 2013 June 24 2012 Net income (loss) Other comprehensive income (loss) Unrealized changes in fair value of interest rate swaps, net of tax of $74,433, $111,171, $95,327, and $111,171, respectively Unrealized changes in fair value of invesments, net of tax of $25,301, $0, $25,301, and $0, respectively Total other comprehensive income (loss) Comprehensive income (loss) Less: Comprehensive (income) attributable to noncontrolling interest Comprehensive income (loss) attributable to DRH

$

3,637

$

(45,561

)

$

242,037

$

640,637

144,488

(215,802

)

185,043

(215,802

)

(49,111

)

-

(49,111

)

-

95,377

(215,802

)

135,932

(215,802

)

99,014

(261,363

)

377,969

424,835

-

(38,916

)

-

(78,726

)

$

99,014

$

(300,279

)

$

377,969

$

346,109

The accompanying notes are an integral part of these interim consolidated financial statements.

DIVERSIFIED RESTAURANT HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY

|

Common Stock |

Paid-in

Additional Capital |

Accumulated Other Comprehensive Income (Loss) |

Retained Earnings(Accumulated Deficit) |

Noncontrolling Interest |

Total Stockholders' Equity |

|||||||||||||||||||||||

|

Shares |

Amount |

|||||||||||||||||||||||||||

|

Balances - December 25, 2011 |

18,936,400 | $ | 1,888 | $ | 2,771,077 | $ | - | $ | (1,253,831 | ) | $ | 385,485 | $ | 1,904,619 | ||||||||||||||

|

Issuance of restricted shares |

20,000 | - | - | - | - | - | - | |||||||||||||||||||||

|

Forfeitures of restricted shares |

(11,000 | ) | - | - | - | - | - | - | ||||||||||||||||||||

|

Share-based compensation |

- | - | 106,948 | - | - | - | 106,948 | |||||||||||||||||||||

|

Other comprehensive loss |

- | - | - | (215,802 | ) | - | - | (215,802 | ) | |||||||||||||||||||

|

Net income |

- | - | - | - | 561,911 | 78,726 | 640,637 | |||||||||||||||||||||

|

Distributions from noncontrolling interest |

- | - | - | - | - | (40,000 | ) | (40,000 | ) | |||||||||||||||||||

|

Balances - June 24, 2012 (unaudited) |

18,945,400 | $ | 1,888 | $ | 2,878,025 | $ | (215,802 | ) | $ | (691,920 | ) | $ | 424,211 | $ | 2,396,402 | |||||||||||||

|

Balances - December 30, 2012 |

18,951,700 | $ | 1,888 | $ | 2,991,526 | $ | (284,294 | ) | $ | (1,205,216 | ) | $ | - | $ | 1,503,904 | |||||||||||||

|

Issuance of restricted shares |

145,375 | - | - | - | - | - | - | |||||||||||||||||||||

|

Forfeitures of restricted shares |

(47,899 | ) | - | - | - | - | - | - | ||||||||||||||||||||

|

Sale of common stock from follow-on offering, net of fees and expenses |

6,900,000 | 690 | 31,924,192 | - | - | - | 31,924,882 | |||||||||||||||||||||

|

Stock options exercised |

144,000 | 2 | 74,997 | - | - | - | 74,999 | |||||||||||||||||||||

|

Share-based compensation |

- | - | 135,105 | - | - | - | 135,105 | |||||||||||||||||||||

|

Other comprehensive income |

- | - | - | 135,932 | - | - | 135,932 | |||||||||||||||||||||

|

Net income |

- | - | - | - | 242,037 | - | 242,037 | |||||||||||||||||||||

|

Balances - June 30, 2013 (unaudited) |

26,093,176 | $ | 2,580 | $ | 35,125,820 | $ | (148,362 | ) | $ | (963,179 | ) | $ | - | $ | 34,016,859 | |||||||||||||

The accompanying notes are an integral part of these interim consolidated financial statements.

DIVERSIFIED RESTAURANT HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

Six Months Ended June 30 2013 June 24 2012 Cash flows from operating activities Net income Adjustments to reconcile net income to net cash provided by operating activities Depreciation and amortization Write off of loan fees Loss on disposal of property and equipment Share-based compensation Change in fair value of derivative instruments Deferred income taxes Changes in operating assets and liabilities that provided (used) cash Accounts receivable Inventory Prepaid assets Intangible assets Other long-term assets Accounts payable Accrued liabilities Deferred rent Net cash provided by operating activities Cash flows from investing activities Purchases of property and equipment Purchases of available-for-sale securities Net cash used in investing activities Cash flows from financing activities Proceeds from issuance of long-term debt Repayment of interest rate swap liability Repayments of long-term debt Proceeds from sale of common stock, net of underwriter fees Distributions from noncontrolling interest Net cash provided by financing activities Net increase in cash and cash equivalents Cash and cash equivalents, beginning of period Cash and cash equivalents, end of period

$

242,037

$

640,637

3,469,033

1,930,415

76,408

103,934

60,741

6,603

135,105

106,948

-

43,361

34,764

263,521

(59,008

)

(139,206

)

(274,428

)

57,694

(70,687

)

(247,476

)

(557,933

)

(102,458

)

(294,650

)

(3,611

)

(1,380,012

)

(307,787

)

21,598

(123,769

)

686,958

428,619

2,089,926

2,657,425

(9,878,354

)

(2,745,142

)

(12,740,132

)

-

(22,618,486

)

(2,745,142

)

52,402,101

17,699,404

-

(657,360

)

(56,803,584

)

(15,991,737

)

31,999,881

-

-

(40,000

)

27,598,398

1,010,307

7,069,838

922,590

2,700,328

1,537,497

$

9,770,166

$

2,460,087

The accompanying notes are an integral part of these interim consolidated financial statements.

DIVERSIFIED RESTAURANT HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO INTERIM CONSOLIDATED FINANCIAL STATEMENTS

1. BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Nature of Business

Diversified Restaurant Holdings, Inc. (“DRH”) is a fast-growing restaurant company operating two complementary concepts: Bagger Dave’s Legendary Burger Tavern ® (“Bagger Dave’s”) and Buffalo Wild Wings ® (“BWW”). As the creator, developer, and operator of Bagger Dave’s and one of the largest franchisees of BWW, we provide a unique guest experience in a casual and inviting environment. We are committed to providing value to our guests through offering generous portions of flavorful food in an upbeat and entertaining atmosphere. We believe Bagger Dave’s and DRH-owned BWW are uniquely-positioned restaurant brands designed to maximize appeal to our guests. Both restaurant concepts offer competitive price points and a family-friendly atmosphere, which we believe enables consistent performance through economic cycles. We were incorporated in 2006 and are headquartered in the Detroit metropolitan area. As of June 30, 2013, we have 48 locations in Florida, Illinois, Indiana, Michigan, and Missouri. Of these restaurants, 47 are corporate-owned and one is franchised by a third party.

Our roots can be traced to 1999, when our founder, President, CEO, and Chairman of the Board, T. Michael Ansley, opened his first BWW restaurant in Sterling Heights, Michigan. By late 2004, Mr. Ansley and his business partners owned and operated seven BWW franchised restaurants and formed AMC Group, LLC as an operating center for those locations. In 2006, DRH was formed and several entities, including AMC Group, LLC, were reorganized to provide the framework and financial flexibility to grow as a franchisee of BWW and to develop and grow our Bagger Dave’s concept. In 2008, DRH became public by completing a self-underwritten initial public offering for approximately $735,000 and 140,000 shares. We subsequently completed an underwritten, follow-on offering on April 23, 2013 of 6.9 million shares with net proceeds of $32.0 million.

Mr. Ansley has received various awards from Buffalo Wild Wings International, Inc. (“BWLD”), including awards for highest annual restaurant sales and operator of the year. In September 2007, Mr. Ansley was awarded Franchisee of the Year by the International Franchise Association (“IFA”). The IFA’s membership consists of over 12,600 franchisee members and over 1,100 franchisor members.

Today, DRH and its wholly-owned subsidiaries (collectively, the “Company”), which includes AMC Group, Inc. (“AMC”), AMC Wings, Inc. (“WINGS”), and AMC Burgers, Inc. (“BURGERS”), own and operate Bagger Dave's and DRH-owned BWW restaurants located throughout Florida, Illinois, Indiana, and Michigan.

DRH originated the Bagger Dave’s concept, with our first restaurant opening in January 2008 in Berkley, Michigan. Currently, there are 11 corporate-owned Bagger Dave’s in Michigan, two corporate-owned Bagger Dave’s in Indiana, and one franchised location in Missouri. The Company plans to operate approximately 50 Bagger Dave’s corporate-owned locations by the end of 2017.

DRH is also one of the largest BWW franchisees and currently operates 35 DRH-owned BWW restaurants (17 in Michigan, 10 in Florida, four in Illinois, and four in Indiana), including the nation’s largest BWW, based on square footage, in downtown Detroit, Michigan. We remain on track to fulfill our area development agreement (“ADA”) with BWLD. Per the ADA with BWLD, we expect to operate 47 DRH-owned BWW by the end of 2017. DRH also has the rights to develop another location in Indiana, which was acquired in the September 2012 acquisition. See Note 2 for details.

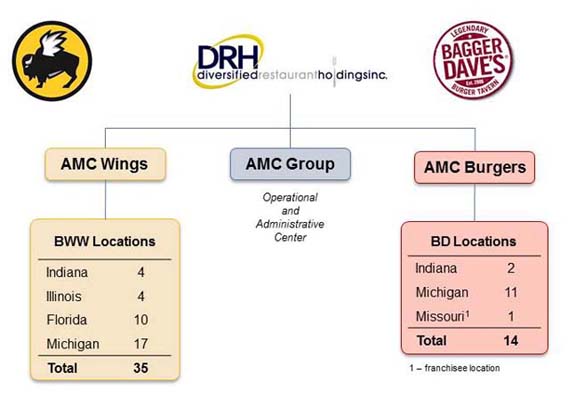

The following organizational chart outlines the current corporate structure of DRH. A brief textual description of the entities follows the organizational chart. DRH is incorporated in Nevada.

AMC was formed on March 28, 2007 and serves as our operational and administrative center. AMC renders management, operational support, and advertising services to WINGS and its subsidiaries and BURGERS and its subsidiaries. Services rendered by AMC include marketing, restaurant operations, restaurant management consultation, hiring and training of management and staff, and other management services reasonably required in the ordinary course of restaurant operations.

WINGS was formed on March 12, 2007 and serves as a holding company for our DRH-owned BWW restaurants. We are economically dependent on retaining our franchise rights with BWLD. The franchise agreements have specific initial term expiration dates ranging from January 28, 2014 through May 7, 2033, depending on the date each was executed and the duration of its initial term. The franchise agreements are renewable at the option of the franchisor and are generally renewable if the franchisee has complied with the franchise agreement. When factoring in any applicable renewals, the franchise agreements have specific expiration dates ranging from January 27, 2019 through May 3, 2048. We believe we are currently in compliance with the terms of these agreements.

BURGERS was formed on March 12, 2007 and serves as a holding company for our Bagger Dave’s restaurants. Bagger Dave’s Franchising Corporation, a subsidiary of BURGERS, was formed to act as the franchisor for the Bagger Dave’s concept and has rights to franchise in Illinois, Indiana, Kentucky, Michigan, Missouri, Ohio, and Wisconsin. We do not intend to pursue significant franchise development at this time.

Principles of Consolidation

The consolidated financial statements include the accounts of the Company. All significant intercompany accounts and transactions have been eliminated upon consolidation.

We consolidate all variable interest entities (“VIE”) where we are the primary beneficiary. For VIE, we assess whether we are the primary beneficiary as prescribed by the accounting guidance on the consolidation of VIE. The primary beneficiary of VIE is the party that has the power to direct the activities that most significantly impact the performance of the entity and the obligation to absorb losses or the right to receive benefits that could potentially be significant to the entity. Prior to our acquisition of 100.0% of its membership interests on September 25, 2012, we consolidated Ansley Group, LLC as a VIE because we leased and maintained substantially all of its assets to operate our Clinton Township, Michigan BWW restaurant and we guaranteed all of its debt. See Note 2 for details.

Basis of Presentation

The consolidated financial statements as of June 30, 2013 and December 30, 2012, and for the three-month and six-month periods ended June 30, 2013 and June 24, 2012, have been prepared by the Company pursuant to accounting principles generally accepted in the United States of America (“GAAP”) and the rules and regulations of the Securities and Exchange Commission (“SEC”). The financial information as of June 30, 2013 and for the three-month and six-month periods ended June 30, 2013 and June 24, 2012 is unaudited, but, in the opinion of management, reflects all adjustments and accruals necessary for a fair presentation of the financial position, results of operations, and cash flows for the interim periods.

The financial information as of December 30, 2012 is derived from our audited consolidated financial statements and notes thereto for the fiscal year ended December 30, 2012, which is included in Item 8 in the Fiscal 2012 Annual Report on Form 10-K, and should be read in conjunction with such financial statements.

The results of operations for the three-month and six-month periods ended June 30, 2013 are not necessarily indicative of the results of operations that may be achieved for the entire year ending December 29, 2013.

Fiscal Year

The Company utilizes a 52- or 53-week accounting period that ends on the last Sunday in December. This quarterly report on Form 10-Q is for the three-month periods ended June 30, 2013 and June 24, 2012, each comprising 13 weeks.

Concentration Risks

Approximately 61.0% and 75.0% of the Company's revenues during the three months ended June 30, 2013 and June 24, 2012, respectively, are generated from food and beverage sales from restaurants located in Michigan.

Investments

The Company’s investment securities are classified as available for sale. Investments classified as available for sale are available to be sold in the future in response to the Company’s liquidity needs, changes in market interest rates, tax strategies, and asset-liability management strategies, among other reasons. Available-for-sale securities are reported at fair value, with unrealized gains and losses reported in the accumulated other comprehensive income (loss) component of stockholders’ equity, net of deferred taxes and, accordingly, have no effect on net income. Realized gains or losses on sale of investments are determined on the basis of specific costs of the investments. Dividend income is recognized when declared and interest income is recognized when earned. Discount or premium on debt securities purchased at other than par value are amortized using the effective yield method. See Note 3 for details.

Use of Estimates

The preparation of consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclose contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Interest Rate Swap Agreements

The Company utilizes interest rate swap agreements with a bank to fix interest rates on a portion of the Company’s portfolio of variable rate debt, which reduces exposure to interest rate fluctuations. The Company does not use any other types of derivative financial instruments to hedge such exposures, nor does it use derivatives for speculative purposes.

Prior to the debt restructure on April 2, 2012 (see Note 7 for details), the interest rate swap agreements did not qualify for hedge accounting. As such, the Company recorded the change in the fair value of the swap agreements in change in fair value of derivative instruments on the consolidated statements of income. The interest rate swap agreements associated with the Company’s current debt agreements do qualify for hedge accounting. As such, the Company records the change in the fair value of its swap agreements as a component of accumulated other comprehensive income (loss), net of tax. The Company records the fair value of its interest rate swaps on the balance sheet in other assets or other liabilities depending on the fair value of the swaps. See Note 7 and Note 14 for additional information on the interest rate swap agreements.

Recent Accounting Pronouncements

We reviewed all significant newly-issued accounting pronouncements and concluded that they are either not applicable to our operations or that no material effect is expected on our consolidated financial statements as a result of future adoption.

Reclassifications

Certain reclassifications have been made to the prior year consolidated financial statements to conform to the current year's presentation.

2. SIGNIFICANT BUSINESS TRANSACTIONS

On September 25, 2012, the Company completed the acquisition of substantially all of the assets of Crown Wings, Inc., Brewsters, Inc., Valpo Wings, Inc., Buffaloville Wings, Inc., and Hammond Wings, Inc., each an Indiana corporation, and Homewood Wings, Inc., Cal City Wings, Inc., Lansing Wings, Inc., and Lincoln Park Wings, Inc., each an Illinois corporation (collectively, the “Indiana and Illinois Entities”). The purchase price for the acquisition was $14.7 million. The acquired assets consist of four BWW restaurants operating in Indiana and four operating in Illinois along with the right to develop a fifth BWW restaurant in Indiana.

On September 25, 2012, the Company also acquired 100.0% of the membership interests in the Ansley Group, LLC for approximately $2.5 million. The purchase was approved by the Company's disinterested directors who determined that the purchase price was fair to the Company based upon an independent appraisal. As a result of this acquisition, the Company has acquired full ownership rights in the Clinton Township BWW restaurant. The Ansley Group, LLC was owned by T. Michael Ansley and Thomas D. Ansley. T. Michael Ansley is the Chairman of the Board of Directors, President, and CEO and a principal shareholder of the Company. This allowed us to unwind the Ansley Group VIE accounting treatment and eliminate the related non-controlling interest in the fourth quarter of 2012.

On April 23, 2013, the Company completed an underwritten, follow-on equity offering of 6.9 million shares of common stock at a price of $5.00 per share to the public. The net proceeds to DRH from the offering were $32.0 million, after deducting underwriting discounts, commissions, and other offering expenses. A registration statement relating to these securities has been filed with the SEC. The SEC declared the registration statement effective on April 17, 2013. Refer to the follow-on offering (Form S-1/A) filed on April 15, 2013 for additional information.

The Company invested $12.7 million, using proceeds from the follow-on offering, in highly liquid short-term investments with maturities of less than one year. These are temporary investments while the Company looks to invest them in growth opportunities for new store openings. These investments are not held for trading or other speculative purposes and are classified as available-for-sale. We invested with a strategy focused on principal preservation. Changes in interest rates affect the investment income we earn on our marketable securities and, therefore, impact our cash flows and results of operations. See Note 3 for additional information.

3. INVESTMENTS

Investments consist of available-for-sale securities that are carried at fair value. Available-for-sale securities are classified as current assets based upon our intent and ability to use any and all of the securities as necessary to satisfy the operational requirements of our business. Based on the call date of the investments all securities have maturities of one year or less. Unrealized losses are charged against net earnings when a decline in fair value is determined to be other than temporary.

The cost, gross unrealized holding gains, gross unrealized holding losses, and fair value of available-for-sale securities by type are as follows:

|

June 30, 2013 |

|||||||||||||||||

|

Cost |

Unrealized Gains |

Unrealized Losses |

Estimated Fair Value |

||||||||||||||

|

Debt securities: |

|||||||||||||||||

|

U.S. government and agencies |

$ | 4,999,078 | $ | 107 | $ | (116 |

) |

$ | 4,999,069 | ||||||||

|

Obligations of states/municipals |

3,403,952 | - | (24,213 |

) |

3,379,739 | ||||||||||||

|

Corporate securities |

3,737,553 | - | (49,988 |

) |

3,687,565 | ||||||||||||

|

Other fixed income securities |

599,549 | - | (202 | ) | 599,347 | ||||||||||||

|

Total debt securities |

$ | 12,740,132 | $ | 107 | $ | (74,519 | ) | $ | 12,665,720 | ||||||||

Included in investments are securities with a fair value of $9.7 million with a cumulative loss position of $74,519. The company may incur future impairment charges if declines in market values continue and/or worsen and impairments are no longer considered temporary. All investments with unrealized losses have been in such position for less than 12 months.

Gross unrealized gains and losses on available-for-sale securities as of June 30, 2013 were as follows:

|

June 30 2013 |

December 30 2012 |

|||||||

|

Unrealized gains |

$ | 107 | $ | - | ||||

|

Unrealized losses |

(74,519 | ) | - | |||||

|

Net unrealized losses |

(74,412 | ) | - | |||||

|

Deferred federal income tax benefit |

25,301 | - | ||||||

|

Net unrealized losses on investments, net of deferred income tax |

$ | (49,111 | ) | $ | - | |||

4. PROPERTY AND EQUIPMENT

Property and equipment are comprised of the following assets:

|

June 30 2013 |

December 30 2012 |

|||||||

|

Land |

$ | 1,204,880 | $ | 989,680 | ||||

|

Building |

5,569,480 | 4,982,806 | ||||||

|

Equipment |

18,550,557 | 16,509,977 | ||||||

|

Furniture and fixtures |

4,819,048 | 4,270,159 | ||||||

|

Leasehold improvements |

36,784,828 | 31,028,860 | ||||||

|

Restaurant construction in progress |

1,864,627 | 1,462,505 | ||||||

|

Total |

68,793,420 | 59,243,987 | ||||||

|

Less accumulated depreciation |

(22,130,902 | ) | (18,957,497 | ) | ||||

|

Property and equipment, net |

$ | 46,662,518 | $ | 40,286,490 | ||||

5. GOODWILL AND INTANGIBLE ASSETS

As of June 30, 2013 and December 30, 2012, DRH had goodwill of $8.6 million, a result of the Indiana and Illinois Entities’ acquisition in September 2012. Goodwill will be tested for impairment at fiscal year-end and there were no impairment indicators warranting an interim impairment test. No adjustments to the carrying amount of goodwill were recorded during the six months ended June 30, 2013.

Intangible assets are comprised of the following:

|

June 30 2013 |

December 30 2012 |

|||||||

|

Amortized intangibles: |

||||||||

|

Franchise fees |

$ | 560,253 | $ | 555,253 | ||||

|

Trademark |

51,009 | 37,359 | ||||||

|

Non-compete |

79,600 | 79,600 | ||||||

|

Favorable lease |

239,000 | 239,000 | ||||||

|

Loan fees |

421,758 | 109,600 | ||||||

|

Total |

1,351,620 | 1,020,812 | ||||||

|

Less accumulated amortization |

(244,090 |

) |

(142,266 | ) | ||||

|

Amortized intangibles, net |

1,107,530 | 878,546 | ||||||

|

Unamortized intangibles: |

||||||||

|

Liquor licenses |

1,804,847 | 1,630,791 | ||||||

|

Total intangibles, net |

$ | 2,912,377 | $ | 2,509,337 | ||||

Amortization expense for the three months ended June 30, 2013 and June 24, 2012 was $13,745 and $4,278, respectively. Amortization expense for the six months ended June 30, 2013 and June 24, 2012 was $27,448 and $13,869, respectively. Based on the current intangible assets and their estimated useful lives, amortization expense for fiscal years 2013, 2014, 2015, 2016, and 2017 is projected to total approximately $258,457, $168,832, $119,057, $112,424, and $92,491, respectively. The aggregate weighted-average amortization period for intangible assets is 7.5 years

6. RELATED PARTY TRANSACTIONS

Fees for monthly accounting and financial statement compilation services are paid to an entity owned by a DRH Board of Directors member and stockholder of the Company. Fees paid during the three months ended June 30, 2013 and June 24, 2012, respectively, were $100,045 and $89,811. Fees paid during the six months ended June 30, 2013 and June 24, 2012 were $194,202 and $182,658, respectively.

See Note 10 for related party operating lease transactions.

7. LONG-TERM DEBT

Long-term debt consists of the following obligations:

|

June 30 2013 |

December 30 2012 |

|||||||

|

Note payable - $46.0 million term loan; payable to RBS with a senior lien on all the Company’s personal property and fixtures. Scheduled monthly principal payments are approximately $547,619 plus accrued interest through maturity in April 2018. Interest is charged based on one-month LIBOR plus an applicable margin, which ranges from 2.5% to 3.4%, depending on the lease adjusted leverage ratio defined in the terms of the agreement. The rate at June 30, 2013 was approximately 2.9%. |

|

$ |

34,904,762 |

|

|

$ |

- |

|

|

Note payable - $15.0 million development line of credit; payable to RBS with a senior lien on all the Company’s personal property and fixtures. Interest is charged based on one-month LIBOR plus an applicable margin, which ranges from 2.5% to 3.4%, depending on the lease adjusted leverage ratio defined in the terms of the agreement. The rate at June 30, 2013 was approximately 2.9%. Payments are due monthly and the note matures in April 2018. |

|

|

3,417,656 |

|

|

|

- |

|

|

Note payable - $37.0 million term loan; payable to RBS with a senior lien on all the Company’s personal property and fixtures. Scheduled monthly principal payments are approximately $440,476 plus accrued interest through maturity in September 2017. Interest is charged based on one-month LIBOR plus an applicable margin, which ranges from 2.5% to 3.7%, depending on the lease adjusted leverage ratio defined in the terms of the agreement. This note was refinanced in April 2013. |

|

- |

|

|

35,678,572 |

| ||

|

|

|

|

|

|

|

|

|

|

|

Note payable - $10.0 million development line of credit; payable to RBS with a senior lien on all the Company’s personal property and fixtures. Interest is charged based on one-month LIBOR plus an applicable margin, which ranges from 2.5% to 3.7%, depending on the lease adjusted leverage ratio defined in the terms of the agreement. This note was refinanced in April 2013. |

|

|

- |

|

|

|

7,015,555 |

|

|

|

|

|

|

|

|

|

|

|

|

Note payable to a bank secured by a senior mortgage on the Brandon Property and a personal guaranty. Scheduled monthly principal and interest payments are approximately $8,000 through maturity in June 2030, at which point a balloon payment of $413,550 is due. Interest is charged based on a fixed rate of 6.7%, per annum, through June 2017, at which point the rate will adjust to the U.S. Treasury Securities Rate plus 4.0% (and every seven years thereafter). |

|

|

1,091,873 |

|

|

|

1,102,539 |

|

|

|

|

|

|

|

|

|

|

|

|

Note payable to a bank secured by a junior mortgage on the Brandon Property. Matures in 2030 and requires monthly principal and interest installments of approximately $6,300 until maturity. Interest is charged at a rate of 3.6% per annum. |

|

|

831,511 |

|

|

|

848,903 |

|

|

|

|

|

|

|

|

|

|

|

|

Note payable to Ford Credit secured by a vehicle to be used in the operation of the business. This is an interest-free loan under a promotional 0.0% rate. Scheduled monthly principal payments are approximately $430. This note matured in April 2013. |

|

|

- |

|

|

|

1,716 |

|

|

|

|

|

|

|

|

|

|

|

|

Total long-term debt |

|

|

40,245,802 |

|

|

|

44,647,285 |

|

|

|

|

|

|

|

|

|

|

|

|

Less current portion |

|

|

(6,902,803) |

|

|

|

(6,095,684 |

) |

|

|

|

|

|

|

|

|

|

|

|

Long-term debt, net of current portion |

|

$ |

33,342,999 |

|

|

$ |

38,551,601 |

|

On April 2, 2012, the Company entered into a $24.0 million senior secured credit facility with RBS Citizens, N.A. (“RBS”) (“April 2012 Senior Secured Credit Facility”), which consisted of a $16.0 million term loan, a $7.0 million development line of credit, and a $1.0 million revolving line of credit. The April 2012 Senior Secured Credit Facility was for a term of seven years and bore interest at one-month LIBOR plus a LIBOR margin (as defined in the agreement), which ranged from 2.5% to 3.4%, depending on the Company’s lease adjusted leverage ratio. Principal and interest payments on the April 2012 term loan were to be amortized over seven years, with monthly principal payments of approximately $191,000 plus accrued interest. The April 2012 term loan was paid off in conjunction with the September 2012 credit facility discussed below.

On September 25, 2012, the Company entered into a $37.0 million senior secured credit facility with RBS (the “September 2012 Senior Secured Credit Facility”). The September 2012 Senior Secured Credit Facility consisted of a $37.0 million term loan (“September 2012 Term Loan”), a $10.0 million development line of credit, and a $1.0 million revolving line of credit. The Company used approximately $15.2 million of the September 2012 Term Loan to refinance existing outstanding debt with RBS and used approximately $3.3 million of the September 2012 Term Loan to refinance and term out the outstanding balance of the existing development line of credit loan between the Company and RBS. Additionally, on September 25, 2012, approximately $14.7 million of the September 2012 Term Loan was used to complete the acquisition of the Indiana and Illinois Entities (with rights to develop another restaurant in Indiana) and approximately $2.5 million of the September 2012 Term Loan was used to purchase 100.0% of the membership interests in the Ansley Group, LLC. The remaining balance of the September 2012 Term Loan, approximately $1.3 million, was used to pay the fees, costs, and expenses associated with either the above acquisitions or arising in connection with the closing of the loans constituting the September 2012 Senior Secured Credit Facility. The September 2012 Term Loan was for a period of five years. Payments of principal were based upon an 84-month straight-line amortization schedule, with monthly principal payments of $440,476 plus accrued interest. The interest rate for the September 2012 Term Loan was LIBOR plus an applicable margin, which ranged from 2.5% to 3.7%, depending on the lease adjusted leverage ratio defined in the terms of the agreement. The entire remaining outstanding principal and accrued interest on the September 2012 Term Loan was due and payable on the maturity date of September 25, 2017. Borrowings under the September 2012 Senior Secured Credit Facility were restructured as part of the April 2013 credit facility discussed below.

On April 15, 2013, the Company entered into a $63.0 million senior secured credit facility with RBS (the “April 2013 Senior Secured Credit Facility”). The April 2013 Senior Secured Credit Facility consists of a $46.0 million term loan (the “April 2013 Term Loan”), a $15.0 million development line of credit (the “April 2013 DLOC”), and a $2.0 million revolving line of credit (the “April 2013 RLOC”) for $2.0 million. The Company immediately used approximately $34.0 million of the April 2013 Term Loan to refinance existing outstanding debt with RBS, approximately $10.0 million of the April 2013 Term Loan to refinance and term out the outstanding balance of the existing development line of credit loan between the Company and RBS, and approximately $800,000 of the April 2013 Term Loan to refinance and term out the outstanding balance of the existing revolving line of credit loan between the Company and RBS. The remaining balance of the April 2013 Term Loan, approximately $1.2 million, was used for working capital as well as to pay the fees, costs, and expenses arising in connection with the closing of the April 2013 Senior Secured Credit Facility. The April 2013 Term Loan is for a period of five years. Payments of principal are based upon a 60-month straight-line amortization schedule, with monthly principal payments of $547,619 plus accrued interest. The entire remaining outstanding principal and accrued interest on the April 2013 Term Loan is due and payable on its maturity date of April 15, 2018. The April 2013 DLOC is for a term of two years and is convertible upon maturity into a term note. The April 2013 RLOC is for a term of two years. Amounts borrowed under the April 2013 Senior Secured Credit Facility bear interest at a rate of LIBOR plus an applicable margin, which ranges from 2.5% to 3.4%, depending on the lease adjusted leverage ratio defined in the terms of the agreement. On May 15, 2013, the Company paid down $10.0 million on its April 2013 Term Loan in satisfaction of its post-offering requirement to RBS to utilize up to 40.0% of the offering proceeds for such purpose.

Based on the long-term debt terms that existed at June 30, 2013, the scheduled principal maturities for the next five years succeeding June 30, 2013 and thereafter are summarized as follows:

|

Year |

Amount |

|||

|

2014 |

$ | 6,902,803 | ||

|

2015 |

7,179,078 | |||

|

2016 |

7,181,902 | |||

|

2017 |

7,185,269 | |||

|

2018 |

10,193,193 | |||

|

Thereafter |

1,603,557 | |||

|

Total |

$ | 40,245,802 | ||

Interest expense was $585,637 and $253,103 (including related party interest expense of $0 and $10,593) for the three months ended June 30, 2013 and June 24, 2012, respectively. Interest expense was $1.1 million and $565,644 (including related party interest expense of $0 and $52,724) for the six months ended June 30, 2013 and June 24, 2012, respectively.

The above agreements contain various customary financial covenants generally based on the performance of the specific borrowing entity and other related entities. The more significant covenants consist of a minimum debt service coverage ratio and a maximum lease adjusted leverage ratio, both of which we are in compliance with as of June 30, 2013.

At June 30, 2013, the Company has two interest rate swap agreements to fix a portion of the interest rates on its variable rate. Both of the swap agreements were entered into in 2012 and qualify for hedge accounting. The swap agreements have a combined notional amount of $18.4 million at June 30, 2013, which will amortize to zero by April 2019. Under the swap agreements, the Company pays a fixed rate of 1.4% (notional amount of $13.1 million) and 0.9% (notional amount of $5.3 million) and receives interest at the one-month LIBOR. The fair value of these swap agreements was $150,381 and $430,751 at June 30, 2013 and December 30, 2012, respectively. Since these swap agreements qualify for hedge accounting, the changes in fair value are recorded in other comprehensive income (loss), net of tax.

On July 8, 2013, the Company entered into a $15.0 million interest rate swap agreement to fix the unhedged variable rate debt. The inception date of the swap agreement is July 8, 2013, with an effective date of December 2, 2013 and a notional amount of $15.0 million which amortizes to zero at maturity on April 2, 2018. Under the swap agreement, the Company pays a fixed rate of 1.41% and receives interest at the one-month LIBOR. Because this swap agreement qualifies for hedge accounting, DRH will record the change in fair value as a component of other comprehensive income (loss), net of tax.

8. CAPITAL STOCK (INCLUDING PURCHASE WARRANTS AND OPTIONS)

In 2011, the Company established the Stock Incentive Plan of 2011 (“Stock Incentive Plan”) to attract and retain directors, consultants, and team members and to more fully align their interests with the interests of the Company’s shareholders through the opportunity for increased stock ownership. The plan permits the grant and award of 750,000 shares of common stock by way of stock options and/or restricted stock. Stock options must be awarded at exercise prices at least equal to or greater than 100.0% of the fair market value of the shares on the date of grant. The options will expire no later than 10 years from the date of grant, with vesting terms to be defined at grant date, ranging from a vesting schedule based on performance to a vesting schedule that extends over a period of time as selected by the Compensation Committee of the Board of Directors (the “Committee”) or other committee as determined by the Board of Directors. The Committee also determines the grant, issuance, retention, and vesting timing and conditions of awards of restricted stock. The Committee may place limitations, such as continued employment, passage of time, and/or performance measures, on restricted stock. Awards of restricted stock may not provide for vesting or settlement in full of restricted stock over a period of less than one year from the date the award is made. The Stock Incentive Plan was approved by our shareholders on May 26, 2011.

During fiscal years 2011 through 2013, restricted shares were issued to certain team members at a weighted-average grant date fair value between $3.10 and $7.00, respectively. Restricted shares are granted with a per share purchase price at 100.0% of the fair market value on the date of grant. Stock-based compensation expense will be recognized over the expected vesting period in an amount equal to the fair market value of such awards on the date of grant.

The following table presents the restricted shares transactions as of June 30, 2013:

|

Number of Restricted Stock Shares |

||||

|

Unvested, December 30, 2012 |

54,900 | |||

|

Granted |

145,375 | |||

|

Vested |

(13,167 | ) | ||

|

Expired/Forfeited |

(47,899 |

) | ||

|

Unvested, June 30, 2013 |

139,209 | |||

The following table presents the restricted shares transactions as of June 24, 2012:

|

Number of Restricted Stock Shares |

||||

|

Unvested, December 25, 2011 |

60,800 | |||

|

Granted |

20,000 | |||

|

Vested |

- | |||

|

Expired/Forfeited |

(11,000 | ) | ||

|

Unvested, June 24, 2012 |

69,800 | |||

Under the Stock Incentive Plan, there are 597,625 shares available for future awards at June 30, 2013.

On July 30, 2007, DRH granted options for the purchase of 150,000 shares of common stock to the directors of the Company at an exercise price of $2.50 per share. These options vested ratably over a three-year period and were set to expire six years from issuance. At June 30, 2013, all 150,000 options were fully vested and were exercised either through cash or cashless exercise at a price of $2.50 per share.

On July 31, 2010, prior to the Stock Incentive Plan, DRH granted options for the purchase of 210,000 shares of common stock to the directors of the Company. These options vest ratably over a three-year period and expire six years from issuance. Once vested, the options can be exercised at a price of $2.50 per share. Consequently, at June 30, 2013, 210,000 shares of authorized common stock are reserved for issuance to provide for the exercise of these options.

Stock-based compensation of $56,053 and $53,815 was recognized, during the three-month periods ended June 30, 2013 and June 24, 2012, and $135,105 and $106,948 for the six-month periods ended June 30, 2013 and June 24, 2012, respectively, as compensation cost in the consolidated statements of operations and as additional paid-in capital on the consolidated statement of stockholders' equity to reflect the fair value of shares vested. The fair value of stock options is estimated using the Black-Scholes model. The fair value of unvested shares is $0 and $87,926 as of June 30, 2013 and June 24, 2012, respectively. The fair value of the unvested shares was amortized ratably over the vesting term and, as of June 30, 2013, the amount is been fully vested. The valuation methodology used an assumed term based upon the stated term of three years and a risk-free rate of return represented by the U.S. 5-year Treasury Bond rate and volatility factor based on guidance as defined in Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 718, Compensation–Stock Compensation. A dividend yield of 0.0% was used because the Company has never paid a dividend and does not anticipate paying dividends in the reasonably foreseeable future.

The Company has authorized 10,000,000 shares of preferred stock at a par value of $0.0001. No preferred shares are issued or outstanding as of June 30, 2013. Any preferences, rights, voting powers, restrictions, dividend limitations, qualifications, and terms and conditions of redemption shall be set forth and adopted by a Board of Directors' resolution prior to issuance of any series of preferred stock.

9. INCOME TAXES

The (benefit) provision for income taxes consists of the following components for the three-month and six-month periods ended June 30, 2013 and June 24, 2012, respectively:

|

Three Months Ended |

Six Months Ended |

|||||||||||||||

|

June 30 2013 |

June 24 2012 |

June 30 2013 |

June 24 2012 |

|||||||||||||

|

Federal: |

||||||||||||||||

|

Current |

$ | - | $ | - | $ | - | $ | - | ||||||||

|

Deferred |

(40,407 | ) | 29,088 | 38,154 | 246,794 | |||||||||||

|

State: |

||||||||||||||||

|

Current |

6,652 | 6,437 | 31,866 | 72,025 | ||||||||||||

|

Deferred |

(1,435 | ) | 50,630 | (3,390 | ) | 16,726 | ||||||||||

|

Income tax (benefit) provision |

$ | (35,190 | ) | $ | 86,155 | $ | 66,630 | $ | 335,545 | |||||||

The (benefit) provision for income taxes is different from that which would be obtained by applying the statutory federal income tax rate to income before income taxes (loss) before income taxes. The items causing this difference are as follows:

|

June 30 2013 |

June 24 2012 |

|||||||

|

Income tax provision at federal statutory rate |

$ | 104,947 | $ | 331,904 | ||||

|

State income tax provision |

28,476 | 88,752 | ||||||

|

Permanent differences |

29,137 | 81,092 | ||||||

|

Tax credits |

(95,930 | ) | (166,203 | ) | ||||

|

Income tax provision |

$ | 66,630 | $ | 335,545 | ||||

Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. The Company expects the deferred tax assets to be fully realizable within the next several years. Significant components of the Company's deferred income tax assets and liabilities are summarized as follows:

|

June 30 2013 |

December 30 2012 |

|||||||

|

Deferred tax assets: |

||||||||

|

Net operating loss carry forwards |

$ | 1,605,421 | $ | 1,665,744 | ||||

|

Deferred rent expense |

- | 2,482 | ||||||

|

Start-up costs |

71,907 | 94,739 | ||||||

|

Tax credit carry forwards |

1,833,160 | 1,737,228 | ||||||

|

Interest rate swaps |

51,129 | 146,455 | ||||||

|

Stock-based compensation |

169,275 | 160,402 | ||||||

|

Other |

177,072 | 166,292 | ||||||

|

Total deferred tax assets |

3,907,964 | 3,973,342 | ||||||

|

Deferred tax liabilities: |

||||||||

|

Tax depreciation in excess of book |

3,166,008 | 3,126,596 | ||||||

|

Net deferred income tax asset |

$ | 741,956 | $ | 846,746 | ||||

If deemed necessary by management, the Company establishes valuation allowances in accordance with the provisions of FASB ASC 740 ("ASC 740"), Income Taxes. Management continually reviews the likelihood that deferred tax assets will be realized and the Company recognizes these benefits only as reassessment indicates that it is more likely than not that such tax benefits will be realized.

The Company expects to use net operating loss and general business tax credit carryforwards before its 20-year expiration. A significant amount of net operating loss carry forwards were used when the Company purchased nine affiliated restaurants in 2010, which were previously managed by DRH. Federal net operating loss carry forwards of $4.7 million will expire between 2029 and 2034. General business tax credits of $1.8 million will expire between 2028 and 2034.

The Company applies the provisions of ASC 740 regarding the accounting for uncertainty in income taxes. There are no amounts recorded on the Company's consolidated financial statements for uncertain positions. The Company classifies all interest and penalties as income tax expense. There are no accrued interest amounts or penalties related to uncertain tax positions as of June 30, 2013.

The Company is a member of a unitary group with other parties related by common ownership according to the provisions of the Michigan Business Tax Act. This group will file a single tax return for all members. An allocation of the current and deferred Michigan business tax incurred by the unitary group has been made based on an estimate of Michigan business tax attributable to the Company and has been reflected as state income tax expense in the accompanying consolidated financial statements consistent with the provisions of ASC 740.

The Company files income tax returns in the United States federal jurisdiction and various state jurisdictions.

10. OPERATING LEASES (INCLUDING RELATED PARTY)

Lease terms range from four to 15 years, generally include renewal options, and frequently require us to pay a proportionate share of real estate taxes, insurance, common area maintenance, and other operating costs. Some restaurant leases provide for contingent rental payments based on sales thresholds.

Total rent expense was $1.3 million and $733,124 for the three-month periods ended June 30, 2013 and June 24, 2012, respectively (of which $18,755 and $23,358, respectively, were paid to a related party). Total rent expense was $2.5 million and $1.4 million for the six-month periods ended June 30, 2013 and June 24, 2012, respectively (of which $37,574 and $46,717, respectively, were paid to a related party).

Scheduled future minimum lease payments for each of the five years and thereafter for non-cancelable operating leases with initial or remaining lease terms in excess of one year at June 30, 2013 are summarized as follows:

|

Year |

Amount |

|||

|

2013 |

$ | 5,189,750 | ||

|

2014 |

4,923,630 | |||

|

2015 |

4,766,763 | |||

|

2016 |

4,394,829 | |||

|

2017 |

4,211,018 | |||

|

Thereafter |

13,986,997 | |||

|

Total |

$ | 37,472,987 | ||

11. COMMITMENTS AND CONTINGENCIES

The Company assumed, from a related entity, an ADA with BWLD in which the Company undertakes to open 23 BWW restaurants within its designated "development territory", as defined by the agreement, by October 1, 2016. On December 12, 2008, this agreement was amended, adding nine additional restaurants and extending the date of fulfillment to March 1, 2017. Failure to develop restaurants in accordance with the schedule detailed in the agreement could lead to potential penalties of up to $50,000 for each undeveloped restaurant, payment of the initial franchise fees for each undeveloped restaurant, and loss of rights to development territory. As of June 30, 2013, of the 32 restaurants required to be opened under the ADA, 21 of these restaurants had been opened for business. The remaining 11 restaurants under the ADA agreement, along with an additional franchise agreement in Indiana, suggest that the Company will operate 47 BWW restaurants by 2017.

The Company is required to pay BWLD royalties (5.0% of net sales) and advertising fund contributions (3.0% of net sales globally and 0.5% of net sales for certain cities) for the term of the individual franchise agreements. The Company incurred $1.2 million and $728,432 in royalty expense for the three-month periods ended June 30, 2013 and June 24, 2012 and $2.4 million and $1.5 million for the six-month periods ended June 30, 2013 and June 24, 2012, respectively. Advertising fund contribution expenses were $780,659 on and $443,780 for the three-month periods ended June 30, 2013 and June 24, 2012 and $1.6 million and $905,440 for the six-month periods ended June 30, 2013 and June 24, 2012, respectively.

The Company is required, by its various BWLD franchise agreements, to modernize the restaurants during the term of the agreements. The individual agreements generally require improvements between the fifth and tenth year to meet the most current design model that BWLD has approved. The modernization costs can range from approximately $50,000 to approximately $500,000, depending on the individual restaurants’ needs.

In 2011, we launched a defined contribution 401(k) plan whereby eligible team members may contribute pre-tax wages in accordance with the provisions of the plan. We match 100.0% of the first 3.0% and 50.0% of the next 2.0% of contributions made by eligible team members. Matching contributions of approximately $59,547 and $65,232 were made by us during the three months ended June 30, 2013 and June 24, 2012, and $120,246 and $130,137 for the six-month periods ended June 30, 2013 and June 24, 2012, respectively.

The Company is subject to ordinary and routine legal proceedings, as well as demands, claims, and threatened litigation, which arise in the ordinary course of its business. The ultimate outcome of any litigation is uncertain. While unfavorable outcomes could have adverse effects on the Company's business, results of operations, and financial condition, management believes that the Company is adequately insured and does not believe that any pending or threatened proceedings would adversely impact the Company's results of operations, cash flows, or financial condition. Therefore, no separate reserve has been established for these types of legal proceedings.

12. EARNINGS PER COMMON SHARE

The following is a reconciliation of basic and fully diluted earnings per common share for the three-month and six-month periods ended June 30, 2013 and June 24, 2012:

|

Three months ended |

||||||||

|

June 30 2013 |

June 24 2012 |

|||||||

|

Income (loss) available to common stockholders |

$ | 3,637 | $ | (84,477 | ) | |||

|

Weighted-average shares outstanding |

24,680,247 | 18,950,153 | ||||||

|

Effect of dilutive securities |

130,364 | 165,300 | ||||||

|

Weighted-average shares outstanding - assuming dilution |

24,810,611 | 19,115,453 | ||||||

|

Earnings per common share |

$ | 0.00 | $ | 0.00 | ||||

|

Earnings per common share - assuming dilution |

$ | 0.00 | $ | 0.00 | ||||

|

Six months ended |

||||||||

|

June 30 2013 |

June 24 2012 |

|||||||

|

Income (loss) available to common stockholders |

$ | 242,037 | $ | 561,911 | ||||

|

Weighted-average shares outstanding |

21,820,046 | 18,945,930 | ||||||

|

Effect of dilutive securities |

111,832 | 132,196 | ||||||

|

Weighted-average shares outstanding - assuming dilution |

21,931,879 | 19,078,126 | ||||||

|

Earnings per common share |

$ | 0.01 | $ | 0.03 | ||||

|

Earnings per common share - assuming dilution |

$ | 0.01 | $ | 0.03 | ||||

13. SUPPLEMENTAL CASH FLOWS INFORMATION

Other Cash Flows Information

Cash paid for interest was $575,254 and $254,968 during the three-month periods ended June 30, 2013 and June 24, 2012, and $1.1 million and $515,898 for the six-month periods ended June 30, 2013 and June 24, 2012, respectively.

Cash paid for income taxes was $0 and 85,000 during the three-month periods ended June 30, 2013 and June 24, 2012, respectively, and $65,500 and $213,000 for the six-month periods ended June 30, 2013 and June 24, 2012, respectively.

14. FAIR VALUE OF FINANCIAL INSTRUMENTS

The guidance for fair value measurements, FASB ASC 820, Fair Value Measurements and Disclosures, establishes the authoritative definition of fair value, sets out a framework for measuring fair value, and outlines the required disclosures regarding fair value measurements. Fair value is the price that would be received to sell an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants at the measurement date. We use a three-tier fair value hierarchy based upon observable and non-observable inputs as follows:

|

● |

Level 1 |

Quoted market prices in active markets for identical assets and liabilities; |

|

● |

Level 2 |

Inputs, other than level 1 inputs, either directly or indirectly observable; and |

|

● |

Level 3 |

Unobservable inputs developed using internal estimates and assumptions (there is little or no market data) which reflect those that market participants would use. |

As of June 30, 2013 and December 30, 2012, respectively, our financial instruments consisted of cash equivalents, available-for-sale investments, accounts payable, interest rate swaps, and debt. The fair value of cash equivalents (Level 1), accounts payable, and short-term debt (Level 2) approximates their carrying value, due to their short-term nature.

The fair value of our interest rate swaps is determined based on valuation models, which utilize quoted interest rate curves to calculate the forward value and then discount the forward values to the present period. The Company measures the fair value using broker quotes which are generally based on market observable inputs including yield curves and the value associated with counterparty credit risk. Our interest rate swaps are classified as a Level 2 measurement as these securities are not actively traded in the market, but are observable based on transactions associated with bank loans with similar terms and maturities.

The estimated fair values of the Company’s investment portfolio are based on prices provided by a third party pricing service and a third party investment manager. The prices provided by these services are based on quoted market prices, when available, non-binding broker quotes, or matrix pricing. The third party pricing service and the third party investment manager provide a single price or quote per security and the Company has not historically adjusted security prices. The Company obtains an understanding of the methods, models and inputs used by the third party pricing service and the third party investment manager, and has controls in place to validate that amounts provided represent fair values. Our investments are classified as a Level 2 measurement as these securities are not actively traded in the market, but are observable based on the quoted prices provided by our Portfolio managers.

As of June 30, 2013, our total debt was approximately $40.2 million, which approximated fair value as the vast majority of this debt was entered into in April 2013 at market rates. As of December 30, 2012, our total debt was approximately $44.6 million and approximated fair value as the vast majority of this debt was entered into in September 2012 at market rates. The Company estimates the fair value of its fixed-rate debt using discounted cash flow analysis based on the Company’s incremental borrowing rate (Level 2).

There were no transfers between levels of the fair value hierarchy during the three months and six months ended June 30, 2013 and the fiscal year ended December 30, 2012, respectively.

The following table presents the fair values for those assets and liabilities measured on a recurring basis as of June 30, 2013:

|

FAIR VALUE MEASUREMENTS |

||||||||||||||||||||

|

Description |

Level 1 |

Level 2 |

Level 3 |

Total |

Asset/(Liability) Total |

|||||||||||||||

|

Interest rate swaps |

$ | - | $ | (150,381 | ) | $ | - | $ | (150,381 | ) | $ | (150,381 | ) | |||||||

|

Debt securities |

||||||||||||||||||||

|

U.S. government and agencies |

- | 4,999,069 | - | 4,999,069 | 4,999,069 | |||||||||||||||

|

Obligations of states/municipals |

- | 3,379,739 | - | 3,379,739 | 3,379,739 | |||||||||||||||

|

Corporate securities |

- | 3,687,565 | - | 3,687,565 | 3,687,565 | |||||||||||||||

|

Other fixed income securities |

- | 599,347 | - | 599,347 | 599,347 | |||||||||||||||

|

Total debt securities |

- | 12,665,720 | - | 12,665,720 | 12,665,720 | |||||||||||||||

|

Total debt securities and derivatives |

$ | - | $ | 12,515,339 | $ | - | $ | 12,515,339 | $ | 12,515,339 | ||||||||||

The following table presents the fair values for those assets and liabilities measured on a recurring basis as of December 30, 2012:

|

FAIR VALUE MEASUREMENTS |

||||||||||||||||||||

|

Description |

Level 1 |

Level 2 |

Level 3 |

Total |

Asset/(Liability) Total |

|||||||||||||||

|

Interest Rate Swaps |

$ | - | $ | (430,751 |

) |

$ | - | $ | (430,751 |

) |

$ | (430,751 |

) | |||||||

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

(The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our consolidated interim financial statements and related notes included in Item 1 of Part 1 of this Quarterly Report and the audited consolidated financial statements and related notes and Management’s Discussion and Analysis of Financial Condition and Results from Operations contained in our Form 10-K, for the fiscal year ended December 30, 2012.)

INFORMATION REGARDING FORWARD-LOOKING STATEMENTS

Statements contained in this “Quarterly Report on Form 10-Q” may contain information that includes or is based upon certain “forward-looking statements” relating to our business. These forward-looking statements represent management’s current judgment and assumptions, and can be identified by the fact that they do not relate strictly to historical or current facts. Forward-looking statements are frequently accompanied by the use of such words as “anticipates,” “plans,” “believes,” “expects,” “projects,” “intends,” and similar expressions. Such forward-looking statements involve known and unknown risks, uncertainties, and other factors, including, while it is not possible to predict or identify all such risks, uncertainties, and other factors, those relating to our ability to secure the additional financing adequate to execute our business plan; our ability to locate and start up new restaurants; acceptance of our restaurant concepts in new market places; and the cost of food and other raw materials. Any one of these or other risks, uncertainties, other factors, or any inaccurate assumptions may cause actual results to be materially different from those described herein or elsewhere by us. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date they were made. Certain of these risks, uncertainties, and other factors may be described in greater detail in our filings from time to time with the Securities and Exchange Commission, which we strongly urge you to read and consider. Subsequent written and oral forward-looking statements attributable to us or to persons acting on our behalf are expressly qualified in their entirety by the cautionary statements set forth above and elsewhere in our reports filed with the Securities and Exchange Commission. We expressly disclaim any intent or obligation to update any forward-looking statements.

OVERVIEW

Diversified Restaurant Holdings, Inc. (“DRH”) is a fast-growing restaurant company operating two complementary concepts: Bagger Dave’s Legendary Burger Tavern ® (“Bagger Dave’s”) and Buffalo Wild Wings ® (“BWW”). As the creator, developer, and operator of Bagger Dave’s and one of the largest franchisees of BWW, we provide a unique guest experience in a casual and inviting environment. We are committed to providing value to our guests through offering generous portions of flavorful food in an upbeat and entertaining atmosphere. We believe Bagger Dave’s and DRH-owned BWW are uniquely-positioned restaurant brands designed to maximize appeal to our guests. Both restaurant concepts offer competitive price points and a family-friendly atmosphere, which we believe enables consistent performance through economic cycles. We were incorporated in 2006 and are headquartered in the Detroit metropolitan area. As of June 30, 2013, we have 48 locations in Florida, Illinois, Indiana, Michigan, and Missouri. Of these restaurants, 47 are corporate-owned and one is franchised by a third party.

Our roots can be traced to 1999, when our founder, President, CEO, and Chairman of the Board, T. Michael Ansley, opened his first BWW restaurant in Sterling Heights, Michigan. By late 2004, Mr. Ansley and his business partners owned and operated seven BWW franchised restaurants and formed AMC Group, LLC as an operating center for those locations. In 2006, DRH was formed and several entities, including AMC Group, LLC, were reorganized to provide the framework and financial flexibility to grow as a franchisee of BWW and to develop and grow our Bagger Dave’s concept. In 2008, DRH became public by completing a self-underwritten initial public offering for approximately $735,000 and 140,000 shares. We subsequently completed an underwritten, follow-on offering on April 23, 2013 of 6.9 million shares with net proceeds of $32.0 million.

Mr. Ansley has received various awards from Buffalo Wild Wings International, Inc. (“BWLD”), including awards for highest annual restaurant sales and operator of the year. In September 2007, Mr. Ansley was awarded Franchisee of the Year by the International Franchise Association (“IFA”). The IFA’s membership consists of over 12,600 franchisee members and over 1,100 franchisor members.

Today, DRH and its wholly-owned subsidiaries (collectively, the “Company”), which includes AMC Group, Inc. (“AMC”), AMC Wings, Inc. (“WINGS”), and AMC Burgers, Inc. (“BURGERS”), own and operate Bagger Dave's and DRH-owned BWW restaurants located throughout Florida, Illinois, Indiana, and Michigan.

DRH originated the Bagger Dave’s concept, with our first restaurant opening in January 2008 in Berkley, Michigan. Currently, there are 11 corporate-owned Bagger Dave’s in Michigan, two corporate-owned Bagger Dave’s in Indiana, and one franchised location in Missouri. The Company plans to operate approximately 50 Bagger Dave’s corporate-owned locations by the end of 2017.

DRH is also one of the largest BWW franchisees and currently operates 35 DRH-owned BWW restaurants (17 in Michigan, 10 in Florida, four in Illinois, and four in Indiana), including the nation’s largest BWW, based on square footage, in downtown Detroit, Michigan. We remain on track to fulfill our area development agreement (“ADA”) with BWLD. Per the ADA with BWLD, we expect to operate 47 DRH-owned BWW by the end of 2017. DRH also has the rights to develop another location in Indiana, which was acquired in the September 2012 acquisition.

RESTAURANT OPENINGS

The following table outlines the restaurant unit information for the years indicated as of June 30, 2013. "Corporate-owned restaurants" reflects the number of restaurants owned and operated by DRH for each year. From our inception in 2006, we managed, but did not own, nine BWW restaurants that we subsequently acquired in February 2010. Comparative results for 2009, 2008, and 2007 are a consolidation of owned and managed restaurants based on the accounting of an acquisition of entities under common control.

|

2013 (estimate) |

2012 |

2011 |

2010 |

2009 |

2008 |

2007 |

|||||||||||||||||||||

|

Beginning of year |

|||||||||||||||||||||||||||

|

Corporate owned |

44 | 28 | 22 | 9 | 8 | 2 | - | ||||||||||||||||||||

|

Franchised restaurants |

1 | - | - | - | - | - | - | ||||||||||||||||||||

|

Acquisitions / affiliated restaurants under common control |

- | - | - | 9 | 9 | 9 | 9 | ||||||||||||||||||||

|

Summary of restaurants open at the beginning of year |

45 | 28 | 22 | 18 | 17 | 11 | 9 | ||||||||||||||||||||

|

Scheduled openings: |

|||||||||||||||||||||||||||

|

Corporate owned |

10 | 8 | 6 | 4 | 1 | 6 | 2 | ||||||||||||||||||||

|

Franchised restaurants |

- | 1 | - | - | - | - | - | ||||||||||||||||||||

|

Acquisitions |

8 | - | - | - | - | - | |||||||||||||||||||||

|

Closures |

- | - | - | - | - | - | - | ||||||||||||||||||||

|

Total restaurants at year end |

55 | 45 | 28 | 22 | 18 | 17 | 11 | ||||||||||||||||||||

RESULTS OF OPERATIONS

For the three months ended June 30, 2013 ("Second Quarter 2013"), and six months ended June 30, 2013 (“Year to Date 2013”), revenue was generated from the operations of 35 BWW restaurants (one BWW restaurant opened in April 2013 and another one in May 2013) and 12 Bagger Dave’s restaurants (one Bagger Dave’s restaurant opened in May 2013). For the three months ended June 24, 2012 ("Second Quarter 2012") and the six months ended June 24, 2012 (“Year to Date 2012”), revenue was generated from the operations of 22 BWW restaurants and seven Bagger Dave’s restaurants (one of which opened in May 2012). Quarterly and annual operating results may fluctuate significantly as a result of a variety of factors, including the timing and number of new restaurant openings and related expenses, increases or decreases in same store sales, changes in commodity prices, general economic conditions, and seasonal fluctuations. As a result, our quarterly results of operations are not necessarily indicative of the results that may be achieved for any future period.

Results of Operations for the Three Months Ended June 30, 2013 and June 24, 2012