U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the quarterly period ended June 26, 2011

[_] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from

DIVERSIFIED RESTAURANT HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

03-0606420

|

|

|

(State or other jurisdiction

of incorporation

or formation)

|

(I.R.S. employer

identification number)

|

27680 Franklin Road

Southfield, Michigan 48034

(Address of principal executive offices)

Issuer's telephone number: (248) 223-9160

Issuer's facsimile number: (248) 223-9165

No change

(Former name, former address and former

fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

APPLICABLE ONLY TO CORPORATE ISSUERS

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date: 18,936,800 shares of $.0001 par value common stock outstanding as of August 9, 2011.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large Accelerated Filer | [ ] | Accelerated Filer | [ ] | |

| Non-Accelerated Filer | [ ] | Smaller reporting company | [X] | |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PRECEDING FIVE YEARS

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes [ ] No [ ]

|

PART I. FINANCIAL INFORMATION

|

1

|

|

Item 1. Financial Statements

|

1

|

|

Consolidated Balance Sheets

|

1

|

|

Consolidated Statements of Operations

|

2

|

|

Consolidated Statements of Stockholders' Equity (Deficit)

|

3

|

|

Consolidated Statements of Cash Flows

|

4

|

|

Notes to Interim Consolidated Financial Statements

|

5

|

|

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

|

15

|

|

Item 3. Quantitative and Qualitative Disclosure About Market Risks

|

20

|

|

Item 4. Controls and Procedures

|

20

|

|

PART II. OTHER INFORMATION

|

20

|

|

Item 1. Legal Proceedings

|

20

|

|

Item 1A. Risk Factors

|

20

|

|

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

|

21

|

|

Item 3. Defaults Upon Senior Securities

|

21

|

|

Item 5. Other Information

|

21

|

|

Item 6. Exhibits

|

21

|

i

PARTI. FINANCIAL INFORMATION

Item 1. Financial Statements

DIVERSIFIED RESTAURANT HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS (UNAUDITED)

|

ASSETS

|

June 26

2011

|

December 26

2010 |

||||||

|

Current assets

|

||||||||

|

Cash and cash equivalents

|

$ | 2,108,654 | $ | 1,358,381 | ||||

|

Accounts receivable

|

12,366 | - | ||||||

|

Inventory

|

403,241 | 339,059 | ||||||

|

Prepaid assets

|

201,331 | 209,708 | ||||||

|

Other current assets

|

- | 43,348 | ||||||

|

Total current assets

|

2,725,592 | 1,950,496 | ||||||

|

Property and equipment, net - restricted assets of VIE

|

1,472,882 | 1,487,993 | ||||||

|

Property and equipment, net

|

19,340,121 | 17,252,599 | ||||||

|

Intangible assets, net

|

1,043,226 | 975,461 | ||||||

|

Other long-term assets

|

68,809 | 80,099 | ||||||

|

Deferred income taxes

|

83,266 | 607,744 | ||||||

|

Total assets

|

$ | 24,733,896 | $ | 22,354,392 | ||||

|

LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT)

|

||||||||

|

Current liabilities

|

||||||||

|

Current portion of long-term debt (including VIE debt of $89,414)

|

$ | 2,428,804 | $ | 1,947,676 | ||||

|

Accounts payable

|

719,803 | 1,388,397 | ||||||

|

Accrued liabilities

|

1,264,617 | 1,089,112 | ||||||

|

Deferred rent

|

171,208 | 127,075 | ||||||

|

Total current liabilities

|

4,584,432 | 4,552,260 | ||||||

|

Deferred rent

|

1,762,639 | 1,622,943 | ||||||

|

Other liabilities - interest rate swap

|

571,801 | 367,181 | ||||||

|

Long-term debt, less current portion (including VIE debt of $1,184,731 and $1,229,437)

|

16,695,641 | 15,936,193 | ||||||

|

Total liabilities

|

23,614,513 | 22,478,577 | ||||||

|

Commitments and contingencies (Notes 6, 10, and 11)

|

||||||||

|

Stockholders' equity (deficit)

|

||||||||

|

Common stock - $0.0001 par value; 100,000,000 shares authorized, 18,876,000 shares issued and outstanding

|

1,888 | 1,888 | ||||||

|

Additional paid-in capital

|

2,675,266 | 2,631,304 | ||||||

|

Retained earnings (accumulated deficit)

|

(1,932,896 | ) | (3,096,017 | ) | ||||

|

Total DRH stockholders' equity (deficit)

|

744,258 | (462,825 | ) | |||||

|

Noncontrolling interest in VIE

|

375,125 | 338,640 | ||||||

|

Total stockholders' equity (deficit)

|

1,119,383 | (124,185 | ) | |||||

|

Total liabilities and stockholders' equity

|

$ | 24,733,896 | $ | 22,354,392 | ||||

The accompanying notes are an integral part of these interim consolidated financial statments.

1

DIVERSIFIED RESTAURANT HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

|

Three Months Ended

|

Six Months Ended

|

|||||||||||||||

|

June 26

|

June 27

|

June 26

|

June 27

|

|||||||||||||

|

2011

|

2010

|

2011

|

2010

|

|||||||||||||

|

Revenue

|

||||||||||||||||

|

Food and beverage sales

|

$ | 14,934,687 | $ | 10,683,821 | $ | 30,029,303 | $ | 21,399,699 | ||||||||

|

Total revenue

|

14,934,687 | 10,683,821 | 30,029,303 | 21,399,699 | ||||||||||||

|

Operating expenses

|

||||||||||||||||

|

Compensation costs

|

4,276,765 | 3,397,029 | 8,503,318 | 6,434,026 | ||||||||||||

|

Food and beverage costs

|

4,195,695 | 3,137,948 | 8,447,327 | 6,475,210 | ||||||||||||

|

General and administrative

|

3,463,699 | 2,642,782 | 6,869,754 | 5,083,677 | ||||||||||||

|

Pre-opening

|

14,569 | 111,921 | 268,705 | 217,179 | ||||||||||||

|

Occupancy

|

793,790 | 573,619 | 1,590,324 | 1,333,839 | ||||||||||||

|

Depreciation and amortization

|

834,856 | 640,715 | 1,610,217 | 1,245,604 | ||||||||||||

|

Total operating expenses

|

13,579,374 | 10,504,014 | 27,289,645 | 20,789,535 | ||||||||||||

|

Operating profit

|

1,355,313 | 179,807 | 2,739,658 | 610,164 | ||||||||||||

|

Change in fair value of derivative instruments

|

(198,780 | ) | (404,921 | ) | (204,620 | ) | (404,921 | ) | ||||||||

|

Interest expense

|

(306,624 | ) | (518,143 | ) | (593,434 | ) | (687,876 | ) | ||||||||

|

Other income (expense), net

|

(11,547 | ) | (15,658 | ) | (40,513 | ) | 1,563 | |||||||||

|

Income (loss) before income taxes

|

838,362 | (758,915 | ) | 1,901,091 | (481,070 | ) | ||||||||||

|

Income tax benefit (provision)

|

(351,497 | ) | 244,463 | (661,485 | ) | 121,887 | ||||||||||

|

Net income (loss)

|

$ | 486,865 | $ | (514,452 | ) | $ | 1,239,606 | $ | (359,183 | ) | ||||||

|

Less: Net income attributable to noncontrolling interest

|

(37,985 | ) | 0 | (76,485 | ) | 0 | ||||||||||

|

Net income attributable to DRH

|

$ | 448,880 | $ | (514,452 | ) | $ | 1,163,121 | $ | (359,183 | ) | ||||||

|

Basic earnings per share - as reported

|

$ | 0.02 | $ | (0.03 | ) | $ | 0.06 | $ | (0.02 | ) | ||||||

|

Fully diluted earnings per share - as reported

|

$ | 0.02 | $ | (0.03 | ) | $ | 0.06 | $ | (0.02 | ) | ||||||

|

Weighted average number of common shares outstanding

|

||||||||||||||||

|

Basic

|

18,876,000 | 18,876,000 | 18,876,000 | 18,873,253 | ||||||||||||

|

Diluted

|

19,054,752 | 18,876,000 | 19,048,648 | 18,873,253 | ||||||||||||

The accompanying notes are an integral part of these interim consolidated financial statments.

2

DIVERSIFIED RESTAURANT HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (DEFICIT) (UNAUDITED)

|

Common Stock

|

Additional

Paid-in |

Retained

Earnings

(Accumulated |

Accumulated

Other

Comprehensive

|

Noncontrolling

|

Total

Stockholders'

|

|||||||||||||||||||||||

|

Shares

|

Amount

|

Capital

|

Deficit)

|

Income (Loss)

|

Interest

|

Equity (Deficit)

|

||||||||||||||||||||||

|

Balances - December 26, 2010, as reported

|

18,876,000 | $ | 1,888 | $ | 2,631,304 | $ | (2,728,836 | ) | $ | (367,181 | ) | $ | - | $ | (462,825 | ) | ||||||||||||

|

Reclassification of fair value of interest rate swap

|

- | - | (367,181 | ) | 367,181 | - | - | |||||||||||||||||||||

|

Initial consolidation of VIE

|

338,640 | 338,640 | ||||||||||||||||||||||||||

|

Balances - December 26, 2010, as adjusted

|

18,876,000 | 1,888 | 2,631,304 | (3,096,017 | ) | - | 338,640 | (124,185 | ) | |||||||||||||||||||

|

Share-based compensation

|

43,962 | 43,962 | ||||||||||||||||||||||||||

|

Net income

|

1,163,121 | 76,485 | 1,239,606 | |||||||||||||||||||||||||

|

Dividends

|

(40,000 | ) | (40,000 | ) | ||||||||||||||||||||||||

|

Balances - June 26, 2011

|

18,876,000 | $ | 1,888 | $ | 2,675,266 | $ | (1,932,896 | ) | $ | - | $ | 375,125 | $ | 1,119,383 | ||||||||||||||

The accompanying notes are an integral part of these interim consolidated financial statements.

3

DIVERSIFIED RESTAURANT HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

|

Six Months Ended

|

||||||||

|

June 26

2011 |

June 26

2010 |

|||||||

|

Cash flows from operating activities

|

||||||||

|

Net income (loss)

|

$ | 1,239,606 | $ | (359,183 | ) | |||

|

Adjustments to reconcile net income (loss) to net cash provided by operating activities

|

||||||||

|

Depreciation and amortization

|

1,610,217 | 1,245,604 | ||||||

|

Loss on disposal of property and equipment

|

27,043 | 217,868 | ||||||

|

Share-based compensation

|

43,962 | 16,156 | ||||||

| Change in fair value of derivative instruments | 204,620 | 404,921 | ||||||

|

Deferred income tax (provision) benefit

|

524,478 | (320,695 | ) | |||||

|

Changes in operating assets and liabilities that provided (used) cash

|

||||||||

|

Accounts receivable

|

(12,366 | ) | 376,675 | |||||

|

Inventory

|

(64,182 | ) | 1,784 | |||||

|

Prepaid assets

|

8,377 | (8,773 | ) | |||||

|

Other current assets

|

43,348 | (16,845 | ) | |||||

|

Intangible assets

|

(87,195 | ) | (88,329 | ) | ||||

|

Other long-term assets

|

11,290 | (6,864 | ) | |||||

|

Accounts payable

|

(668,594 | ) | (198,092 | ) | ||||

|

Accrued liabilities

|

175,505 | 211,001 | ||||||

|

Deferred rent

|

183,829 | 106,149 | ||||||

|

Net cash provided by operating activities

|

3,239,938 | 1,581,377 | ||||||

|

Cash flows from investing activities

|

||||||||

|

Purchases of property and equipment

|

(3,690,241 | ) | (2,500,490 | ) | ||||

|

Net cash used in investing activities

|

(3,690,241 | ) | (2,500,490 | ) | ||||

|

Cash flows from financing activities

|

||||||||

|

Proceeds from issuance of long-term debt

|

2,308,554 | 963,065 | ||||||

|

Repayments of long-term debt

|

(1,067,978 | ) | (666,491 | ) | ||||

|

Proceeds from issuance of common stock

|

- | 250,000 | ||||||

|

Distributions

|

(40,000 | ) | (552,861 | ) | ||||

|

Net cash provided by (used in) financing activities

|

1,200,576 | (6,287 | ) | |||||

|

Net increase (decrease) in cash and cash equivalents

|

750,273 | (925,400 | ) | |||||

|

Cash and cash equivalents, beginning of period

|

1,358,381 | 1,594,362 | ||||||

|

Cash and cash equivalents, end of period

|

$ | 2,108,654 | $ | 668,962 | ||||

The accompanying notes are an integral part of these interim consolidated financial statements.

4

DIVERSIFIED RESTAURANT HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO INTERIM CONSOLIDATED FINANCIAL STATEMENTS

1. BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Nature of Business

Diversified Restaurant Holdings, Inc. (“DRH”) was formed on September 25, 2006. DRH and its wholly-owned subsidiaries, including AMC Group, Inc, (“AMC”), AMC Wings, Inc. (“WINGS”), and AMC Burgers, Inc. (“BURGERS”) develop, own, and operate Buffalo Wild Wings (“BWW”) restaurants located throughout Michigan and Florida and its own restaurant concept, Bagger Dave's Legendary Burger Tavern (“Bagger Dave's”), as detailed below.

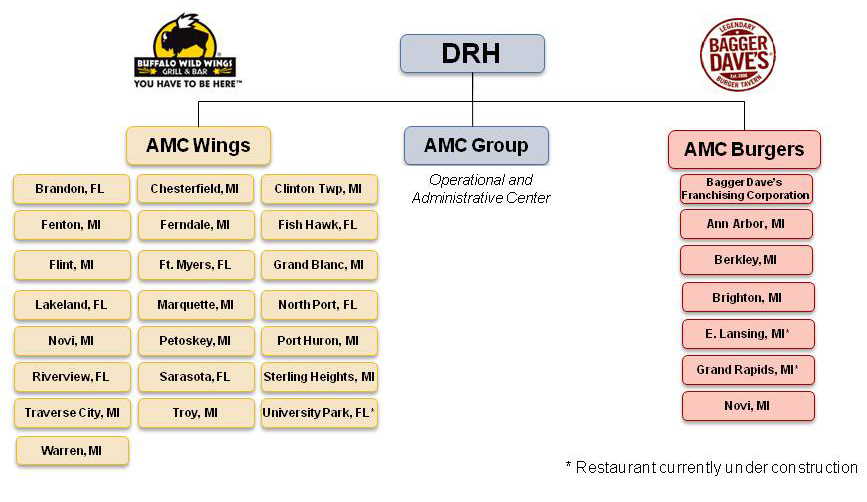

The following organizational chart outlines the corporate structure of DRH and its wholly-owned subsidiaries. A brief textual description of the entities follows the organizational chart. DRH is incorporated in the State of Nevada. All other entities are incorporated or organized in the State of Michigan.

AMC was formed on March 28, 2007 and serves as the operational and administrative center for DRH. AMC renders management and advertising services to WINGS and its subsidiaries and BURGERS and its subsidiaries. Services rendered by AMC include marketing, restaurant operations, restaurant management consultation, hiring and training of management and staff, and other management services reasonably required in the ordinary course of restaurant operations.

WINGS was formed on March 12, 2007 and serves as a holding company for its BWW restaurants. WINGS, through its subsidiaries, holds 21 BWW restaurants that are currently in operation. WINGS also executed franchise agreements with Buffalo Wild Wings, Inc. (“BWWI”) to open an additional restaurant in University Park (Bradenton), Florida, which will be held in the WINGS portfolio under the name of AMC Sarasota, Inc.

WINGS is economically dependent on retaining its franchise rights with BWWI. The franchise agreements have specific initial term expiration dates ranging from October 23, 2011 through March 25, 2031, depending on the date each was executed and its initial term. The franchise agreements are renewable at the option of the franchisor and are generally renewable if the franchisee has complied with the franchise agreement. When factoring in any applicable renewals, the franchise agreements have specific expiration dates ranging from January 29, 2019 through March 25, 2046. WINGS is in compliance with the terms of these agreements at June 26, 2011. The Company is under contract with BWWI to enter into 17 additional franchise agreements by 2017 (see Note 11 for details). WINGS held an option to purchase the nine affiliated restaurants that were managed by AMC, which it exercised on February 1, 2010 (see Note 3 for details).

BURGERS was formed on March 12, 2007 to own the Bagger Dave's restaurants, a full-service, ultra-casual dining concept developed by the Company. BURGERS' subsidiaries, Berkley Burgers, Inc., Ann Arbor Burgers, Inc., Troy Burgers, Inc., and Brighton Burgers, Inc. own restaurants currently in operation in Berkley, Ann Arbor, Novi, and Brighton, Michigan, respectively. Two locations (E. Lansing, Michigan and Grand Rapids, Michigan) are currently under construction and scheduled to open in the third and fourth quarters of 2011, respectively. BURGERS also has a wholly-owned subsidiary named Bagger Dave’s Franchising Corporation that was formed to act as the franchisor for the Bagger Dave’s concept. We have filed for rights, and been approved, to franchise in Michigan, Ohio, Indiana, Illinois, Wisconsin, and Kentucky but have not yet franchised any Bagger Dave's restaurants.

5

Principles of Consolidation

The consolidated financial statements include the accounts of DRH, its wholly-owned subsidiaries, and Ansley Group, LLC (collectively, the "Company"), a real estate entity under common control which is consolidated in accordance with Financial Accounting Standards Board ("FASB") guidance related to variable interest entities. All significant intercompany accounts and transactions have been eliminated upon consolidation.

We consolidate all variable-interest entities (“VIE”) where we are the primary beneficiary. For VIEs, we assess whether we are the primary beneficiary as prescribed by the accounting guidance on the consolidation of VIEs. The primary beneficiary of a VIE is the party that has the power to direct the activities that most significantly impact the performance of the entity and the obligation to absorb losses or the right to receive benefits that could potentially be significant to the entity. We adopted the consolidation of variable-interest entities guidance issued in June 2009 effective January 1, 2011. We consolidated Ansley Group, LLC because we lease and maintain substantially all of its assets to operate our Clinton Township, Michigan BWW restaurant and we guarantee all of its debt.

Basis of Presentation

The consolidated financial statements as of June 26, 2011 and December 26, 2010, and for the three-month and six-month periods ended June 26, 2011 and June 27, 2010, have been prepared by the Company pursuant to accounting principles generally accepted in the United States of America (“GAAP”) and the rules and regulations of the Securities and Exchange Commission (“SEC”). The financial information as of June 26, 2011 and for the three-month and six-month periods ended June 26, 2011 and June 27, 2010 is unaudited, but, in the opinion of management, reflects all adjustments and accruals necessary for a fair presentation of the financial position, results of operations, and cash flows for the interim periods.

Except as described in Note 2 to the consolidated financial statements, the financial information as of December 26, 2010 is derived from our audited consolidated financial statements and notes thereto for the fiscal year ended December 26, 2010, which is included in Item 8 in the Fiscal 2010 Annual Report on Form 10-K/A, Amendment No. 1, and should be read in conjunction with such financial statements.

The results of operations for the three-month and six-month periods ended June 26, 2011 are not necessarily indicative of the results of operations that may be achieved for the entire year ending December 25, 2011.

Fiscal Year

The Company utilizes a 52- or 53-week accounting period that ends on the last Sunday in December. Consequently, fiscal year 2010 ended on December 26, 2010, comprising 52 weeks. This quarterly report on Form 10-Q is for the three-month period ended June 26, 2011, comprising 13 weeks.

Concentration Risks

Approximately 76% and 80% of the Company's revenues during the six months ended June 26, 2011 and June 27, 2010, respectively, are generated from food and beverage sales from restaurants located in Michigan.

Use of Estimates

The preparation of consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Swap Agreements

The Company utilizes interest rate swap agreements with a bank to fix interest rates on a portion of the Company's portfolio of variable rate debt, which reduces exposure to interest rate fluctuations. The Company does not use any other types of derivative financial instruments to hedge such exposures, nor does it use derivatives for speculative purposes.

On May 5, 2010, the Company entered into a $15 million dollar debt facility with RBS Citizens Bank, N.A. (“RBS”), as further described in Note 7, in which $6 million is in the form of a development line of credit (of which $1.4 million and $2.9 million were subsequently termed out and affixed to a fixed-rate swap arrangement) and $9 million is a senior secured term loan with a fixed-rate swap arrangement.

6

These interest rate swap agreements do not qualify for hedge accounting. As such, the Company records the change in the fair value of the swap agreements in change in fair value of derivative instruments on the consolidated statements of operations.

The Company records the fair value of its interest rate swaps on the balance sheet in other assets or other liabilities depending on the fair value of the swaps. The notional value of interest rate swap agreements in place at June 26, 2011 and December 26, 2010 was approximately $12.0 million and $9.8 million, respectively.

Recent Accounting Pronouncements

There were no accounting standards or interpretations issued or recently adopted that are expected to have a material impact on the Company’s financial position, operations, or cash flows.

Reclassifications

Certain reclassifications have been made to the prior year consolidated financial statements to conform to the current year's presentation.

2. STAFF ACCOUNTING BULLETIN NO. 108

During the three months ended March 27, 2011, the Company identified an error related to its 2010 accounting for its interest rate swap agreements. The Company determined that its interest rate swap agreements effective May 2010 and September 2010 did not qualify for hedge accounting and, as a result, the change in the fair value of the swap agreements as of December 26, 2010 of $367,181 and as of June 27, 2010 of $404,921 should have been reflected in the consolidated statement of operations as change in fair value of derivative instruments instead of in the consolidated statement of stockholders’ equity.

In addition, during the three months ended March 27, 2011, the Company determined that, as a result of its August 2010 guarantee of the mortgage obligations of Ansley Group, LLC, the Company should have consolidated Ansley Group, LLC into its financial statements as of and for the year ended December 26, 2010 in accordance with FASB guidance related to consolidating variable interest entities.

The Company assessed the materiality of these errors on its December 26, 2010 financial statements in accordance with the SEC’s Staff Accounting Bulletin (“SAB”) No. 99 and concluded that the errors were not material to that period. The Company also concluded that, had the errors been adjusted within its financial statements for the three-month and six-month periods ended June 26, 2011, the impact of such adjustments would have been material to its financial statements for the period then ended and it expects the errors may be material to its full year 2011 results. In accordance with SAB No. 108, "Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements", the December 26, 2010 balance sheet and the statements of operations for the three-month and six month periods ended June 27, 2010 have been revised to correct these errors.

The Company will make additional adjustments as appropriate to the corresponding quarterly and annual financial statements the next time it files those statements.

The impact of the errors on the December 26, 2010 balance sheet is as follows:

|

Balances at December 26, 2010

|

||||||||||||

|

Previously

Reported

|

Adjustment

|

As

Adjusted

|

||||||||||

|

Cash and cash equivalents

|

$ |

1,305,031

|

$ |

53,350

|

$ |

1,358,381

|

||||||

|

Property and equipment, net - restricted assets of VIE

|

-

|

1,487,993

|

1,487,993

|

|||||||||

|

Other long-term assets

|

63,539

|

16,560

|

80,099

|

|||||||||

|

Current portion of long-term debt

|

1,858,262

|

89,414

|

1,947,676

|

|||||||||

|

Deferred rent (long-term)

|

1,722,531

|

(99,588

|

)

|

1,622,943

|

||||||||

|

Long-term debt, less current portion

|

14,706,756

|

1,229,437

|

15,936,193

|

|||||||||

|

Retained earnings (accumulated deficit)

|

(2,728,836

|

)

|

(367,181

|

)

|

(3,096,017

|

)

|

||||||

|

Accumulated other comprehensive income (loss)

|

(367,181

|

)

|

367,181

|

-

|

||||||||

|

Noncontrolling interest in VIE

|

-

|

338,640

|

338,640

|

|||||||||

7

The impact of the errors on the consolidated statements of operations for the three-month and six-month periods ended June 27, 2010 are as follows:

|

Three Months Ended June 27, 2010

|

Six Months Ended June 27, 2010

|

|||||||||||||||||||||||

|

Previously

Reported

|

Adjustment

|

As

Adjusted

|

Previously

Reported

|

Adjustment

|

As

Adjusted

|

|||||||||||||||||||

|

Change in fair value of derivative instruments

|

$ | - | $ | (404,921 | ) | $ | (404,921 | ) | $ | - | $ | (404,921 | ) | $ | (404,921 | ) | ||||||||

|

Income (loss) before income taxes

|

(353,994 | ) | (404,921 | ) | (758,915 | ) | (76,149 | ) | (404,921 | ) | (481,070 | ) | ||||||||||||

|

Net income (loss)

|

(109,531 | ) | (404,921 | ) | (514,452 | ) | 45,738 | (404,921 | ) | (359,183 | ) | |||||||||||||

|

Basic earnings per share

|

(0.01 | ) | (0.02 | ) | (0.03 | ) | 0.00 | (0.02 | ) | (0.02 | ) | |||||||||||||

|

Fully diluted earnings per share

|

(0.01 | ) | (0.02 | ) | (0.03 | ) | 0.00 | (0.02 | ) | (0.02 | ) | |||||||||||||

|

Weighted average number of common shares outstanding

|

||||||||||||||||||||||||

|

Basic

|

18,876,000 | - | 18,876,000 | 18,873,253 | - | 18,873,253 | ||||||||||||||||||

|

Diluted

|

29,020,000 | (10,144,000 | ) | 18,876,000 | 29,020,000 | (10,146,747 | ) | 18,873,253 | ||||||||||||||||

The Company's SAB 99 evaluation considered that the interest rate swap has no impact on the liability that was already recorded, is non-cash in nature, and is not material given the Company's overall volume of activity in 2010. Regarding consolidation of the Ansley Group, LLC the impact on the 2010 statement of operations would be insignificant and the 2010 balance sheet impact, disclosed in the table above, is not material given that the restaurant's operating results related to the assets that should have been consolidated were already included in operations and the potential debt obligation was previously disclosed. In the aggregate, the Company does not believe it is probable that the view of a reasonable investor would be changed by the correction in 2010 of these items.

3. SIGNIFICANT BUSINESS TRANSACTIONS

On June 7, 2011, the Company, together with its wholly-owned subsidiaries, entered into a First Amended and Restated Development Line of Credit Agreement (the "DLOC Agreement") with RBS, N.A. ("RBS"). The DLOC Agreement provides for an $8 million credit facility with RBS (the "Credit Facility"). The Credit Facility consists of a $7 million development line of credit (“DLOC”) and a $1 million revolving line of credit (“Revolving Line of Credit”). The Credit Facility is secured by a senior lien on all Company assets. Refer to Exhibit 10.1 for complete details on this Credit Facility.

The Company plans to use the Credit Facility to increase its number of BWW franchise restaurant locations in the states of Michigan and Florida and to develop additional Bagger Dave’s restaurant locations in the Midwest. The DLOC is for a term of 18 months (the “Draw Period”) and amounts borrowed bear interest at between 3% - 4% over LIBOR as adjusted monthly, depending on the Lease Adjusted Leverage Ratio (as defined in the DLOC). During the Draw Period, the Company may make interest-only payments on the amounts borrowed. The Company may convert amounts borrowed during the Draw Period into one or more term loans bearing interest at 3% - 4% over LIBOR as adjusted monthly, with principal and interest amortized over seven years (20 years for real estate) and with a maturity date of June 7, 2018. Any amounts borrowed by the Company during the Draw Period that are not converted into a term loan by December 7, 2012, will automatically be converted to a term loan on the same terms as outlined above. The DLOC includes a carrying cost of .25% per year of any available but undrawn amounts, payable quarterly; however, RBS has granted a zero carrying cost on the unused DLOC through December 25, 2011. The Company also secured a $1 million Revolving Line of Credit, which has a maturity date of June 7, 2012. Advances on the Company’s Revolving Line of Credit must be repaid within ninety consecutive days.

On February 1, 2010, the Company, through its WINGS subsidiary, acquired nine affiliated BWW restaurants it previously managed (“Affiliates Acquisition”). The Affiliates Acquisition was approved by resolution of the disinterested directors of the Company, who determined that the acquisition terms were at least as favorable as those that could be obtained through arms-length negotiations with an unrelated party. The Company paid the purchase price for each of the affiliated restaurants to each selling shareholder by issuing an unsecured promissory note for the pro-rata value of the equity interest in the affiliated restaurants. The promissory notes bear interest at 6% per year, mature on February 1, 2016, and are payable in quarterly installments, with principal and interest fully amortized over six years.

In accordance with FASB ASC 805-50, Business Combinations: Transactions Between Entities Under Common Control, the Company accounted for the Affiliates Acquisition, a transaction between entities under common control, as if the transaction had occurred at the beginning of the period (i.e., December 28, 2009) using the historical cost basis of the acquired affiliates. Further, prior years amounts also have been retrospectively adjusted to furnish comparative information while the entities were under common control.

8

4. PROPERTY AND EQUIPMENT

Property and equipment are comprised of the following assets:

|

June 26

2011 |

December 26

2010 |

|||||||

|

Land

|

$

|

385,959

|

$

|

385,959

|

||||

|

Land (restricted assets of VIE)

|

520,000

|

520,000

|

||||||

|

Building

|

2,254,018

|

2,255,246

|

||||||

|

Building (restricted assets of VIE)

|

1,570,967

|

1,570,967

|

||||||

|

Equipment

|

9,343,011

|

8,140,417

|

||||||

|

Furniture and fixtures

|

2,634,850

|

2,216,347

|

||||||

|

Leasehold improvements

|

16,216,433

|

13,925,216

|

||||||

|

Restaurant construction in progress

|

801,462

|

1,247,265

|

||||||

|

Total

|

33,726,700

|

30,261,417

|

||||||

|

Less accumulated depreciation

|

(12,295,612)

|

(10,917,851

|

)

|

|||||

|

Less accumulated depreciation attributable to restricted assets of VIE

|

(618,085)

|

(602,974

|

)

|

|||||

|

Property and equipment, net

|

$

|

20,813,003

|

$

|

18,740,592

|

||||

5. INTANGIBLES

Intangible assets are comprised of the following:

|

June 26

2011 |

December 26

2010 |

|||||||

|

Amortized Intangibles:

|

||||||||

|

Franchise fees

|

$

|

373,750

|

$

|

373,750

|

||||

|

Trademark

|

8,025

|

7,475

|

||||||

|

Loan fees

|

164,429

|

155,100

|

||||||

|

Total

|

546,204

|

536,325

|

||||||

|

Less accumulated amortization

|

(134,676)

|

(115,246

|

)

|

|||||

|

Amortized Intangibles, net

|

411,528

|

421,079

|

||||||

|

Unamortized Intangibles:

|

||||||||

|

Liquor licenses

|

631,698

|

554,382

|

||||||

|

Total Intangibles, net

|

$

|

1,043,226

|

$

|

975,461

|

||||

Amortization expense for the three months ended June 26, 2011 and June 27, 2010 was $9,705 and $10,210, respectively. Amortization expense for the six months ended June 26, 2011 and June 27, 2010 was $19,430 and $17,263, respectively. Based on the current intangible assets and their estimated useful lives, amortization expense for fiscal years 2011, 2012, 2013, 2014, and 2015 is projected to total approximately $48,900 per year.

6. RELATED PARTY TRANSACTIONS

The Affiliates Acquisition (see Note 3) was accomplished by issuing unsecured promissory notes to each selling shareholder that bear interest at 6% per year, mature on February 1, 2016, and are payable in quarterly installments of approximately $157,000, with principal and interest fully amortized over six years.

Fees for monthly accounting and financial statement compilation services are paid to an entity owned by a director and stockholder of the Company. Fees paid during the three months ended June 26, 2011 and June 27, 2010 were $82,730 and $49,160, respectively. Fees paid during the six months ended June 26, 2011 and June 27, 2010 were $152,085 and $109,594, respectively.

Current debt (see Note 7) also includes a promissory note to a DRH stockholder in the amount of $250,000. The note is a demand note that does not require principal or interest payments. Interest is accrued at 8% per annum and is compounded quarterly. The Company has 180 days from the date of demand to pay the principal and accrued interest.

See Note 10 for related party operating lease transactions.

9

7. LONG-TERM DEBT

Long-term debt consists of the following obligations:

|

June 26

2011 |

December 26

2010 |

|||||||

|

Note payable to a bank secured by a senior lien on all company assets. Scheduled monthly principal and interest payments are approximately $120,000 through maturity in May 2017. Interest is charged based on a swap arrangement designed to yield a fixed annual rate of 7.10%.

|

$

|

7,878,564

|

$

|

8,399,538

|

||||

|

Note payable to a bank secured by a senior mortgage on the Brandon Property and a personal guaranty. Scheduled monthly principal and interest payments are approximately $8,000 for the period beginning July 2010 through maturity in June 2030, at which point a balloon payment of $413,550 is due. Interest is charged based on a fixed rate of 6.72%, per annum, through June 2017, at which point the rate will adjust to the U.S. Treasury Securities Rate plus 4% (and every seven years thereafter).

|

1,131,854

|

1,141,188

|

||||||

|

Note payable to a bank secured by a junior mortgage on the Brandon Property. Matures in 2030 and requires monthly principal and interest installments of approximately $6,100 until maturity. Interest is charged at a rate of 3.58% per annum.

|

899,253

|

915,446

|

||||||

|

DLOC to a bank, secured by a senior lien on all company assets. Scheduled interest payments are charged at a rate of 4% over the 30-day LIBOR (the rate at June 26, 2011 was approximately 4.19%). In November 2011, the DLOC will convert into a term loan bearing interest at 4% over the 30-day LIBOR and will mature in May 2017. The DLOC includes a carrying cost of .25% per year of any available but undrawn amounts.

|

833,233

|

1,424,679

|

||||||

|

Note payable to a bank secured by a senior lien on all company assets. Scheduled monthly principal and interest payments are approximately $15,000 through maturity in May 2017. Interest is charged based on a swap arrangement designed to yield a fixed annual rate of 5.91%.

|

1,289,293

|

1,379,098

|

||||||

|

Note payable to a bank secured by a senior lien on all company assets. Scheduled monthly principal and interest payments are approximately $33,000 through maturity in May 2017. Interest is charged based on a swap arrangement designed to yield a fixed annual rate of 6.35%.

|

2,800,792

|

-

|

||||||

|

Unsecured note payable that matures in August 2013 and requires monthly principal and interest installments of approximately $2,200, with the balance due at maturity. Interest is 7% per annum.

|

236,972

|

241,832

|

||||||

|

Note payable to Ford Credit secured by a vehicle purchased by Flyer Enterprises, Inc. to be used in the operation of the business. This is an interest-free loan under a promotional 0% rate. Scheduled monthly principal payments are approximately $430. The note matures in April 2013.

|

9,442

|

12,016

|

||||||

|

Notes payable -- variable interest entity. Note payable to a bank secured by a senior mortgage on the property located at 15745 15 Mile Road, Clinton Township, Michigan 48035, a DRH corporate guaranty, and a personal guaranty. Scheduled monthly principal and interest payments are approximately $12,500 through maturity in 2025. Interest is charged at a rate of 4% over the 30-day LIBOR (the rate at June 26, 2011 was approximately 4.19%).

|

1,274,145

|

1,318,851

|

||||||

|

Notes payable – related parties

|

2,770,897

|

3,051,221

|

||||||

|

Total long-term debt

|

19,124,445

|

17,883,869

|

||||||

|

Less current portion (includes VIE debt of $89,414)

|

(2,428,804)

|

(1,947,676

|

)

|

|||||

|

Long-term debt, net of current portion

|

$

|

16,695,641

|

$

|

15,936,193

|

||||

10

Scheduled principal maturities of long-term debt for the next five calendar years, and thereafter, are summarized as follows:

|

Year

|

Amount

|

|||

|

2011

|

$

|

2,428,804

|

||

|

2012

|

2,463,627

|

|||

|

2013

|

2,829,340

|

|||

|

2014

|

2,757,738

|

|||

|

2015

|

2,750,245

|

|||

|

Thereafter

|

5,894,691

|

|||

|

Total

|

$

|

19,124,445

|

||

Interest expense was $306,624 and $518,143 (including related party interest expense of $45,291 and $52,581) for the three months ended June 26, 2011 and June 27, 2010, respectively. Interest expense was $593,434 and $687,876 (including related party interest expense of $102,371 and $61,220) for the six months ended June 26, 2011 and June 27, 2010, respectively.

On May 5, 2010, DRH entered into a credit facility (the “Credit Facility”) with RBS Citizens, N.A. (“RBS”), a national banking association. The Credit Facility consists of a $6 million development line of credit (“DLOC”) and a $9 million senior secured term loan (“Senior Secured Term Loan”). The Credit Facility is secured by a senior lien on all Company assets.

On August 30, 2010, Ansley Group, LLC entered into a $1.3 million mortgage refinance agreement with RBS. This agreement is secured by a senior mortgage on the property located at 15745 15 Mile Road, Clinton Township, Michigan 48035, a DRH corporate guaranty, and a personal guaranty. Ansley Group, LLC was formed for the sole purpose of acting as landlord for this property. DRH leases this property through its wholly-owned subsidiary, Bearcat Enterprises, Inc. In accordance with ASC 810, Ansley Group, LLC is considered a variable interest entity and, accordingly, its activities are consolidated into DRH’s interim consolidated financial statements.

The above agreements contain various customary financial covenants generally based on the performance of the specific borrowing entity and other related entities. The more significant covenants consist of a minimum debt service coverage ratio and a maximum lease adjusted leverage ratio, both of which we are in compliance with as of June 26, 2011.

8. CAPITAL STOCK (INCLUDING PURCHASE WARRANTS AND OPTIONS)

In 2011, the Company established the Stock Incentive Plan of 2011 (“Stock Incentive Plan”) to attract and retain directors, consultants and employees and to more fully align their interests with the interests of the Company’s shareholders through the opportunity for increased stock ownership. The plan permits the grant and award of 750,000 shares of common stock by way of stock options and/or restricted stock. Stock options must be awarded at exercise prices at least equal to or greater than 100% of the fair market value of the shares on the date of grant. The options will expire no later than 10 years from the date of grant, with vesting terms to be defined at grant date, ranging from a vesting schedule based on performance to a vesting schedule that extends over a period of time as selected by the Compensation Committee of the Board of Directors or other committee as determined by the Board (the “Committee”). The Committee also determines the grant , issuance, retention, and vesting timing and conditions of awards of restricted stock. The Committee may place limitations, such as continued employment, passage of time, and/or performance measures, on restricted stock. Awards of restricted stock may not provide for vesting or settlement in full of restricted stock over a period of less than one year from the date the award is made. The Stock Incentive Plan was approved by our shareholders on May 26, 2011. At June 26, 2011, there were no outstanding stock options or restricted awards under the Stock Incentive Plan, with 750,000 shares available for future awards. On July 18, 2011, 60,800 restricted stock grants were awarded

On July 31, 2010, prior to the Stock Incentive Plan, DRH granted options for the purchase of 210,000 shares of common stock to the directors of the Company. These options vest ratably over a three-year period and expire six years from issuance. Once vested, the options can be exercised at a price of $2.50 per share.

Stock option expense of $21,981 and $8,078, as determined using the Black-Scholes model, was recognized, during the three-month period ended June 26, 2011 and June 27, 2010, respectively, as compensation cost in the consolidated statements of operations and as additional paid-in capital on the consolidated statement of stockholders' equity to reflect the fair value of shares vested as of June 26, 2011. Stock option expense for the six-months ended June 26, 2011 and June 27, 2010, respectively, was $43,962 and $16,156.The fair value of unvested shares, as determined using the Black-Scholes model, is $175,851 as of June 26, 2011. The fair value of the unvested shares will be amortized ratably over the remaining vesting term. The valuation methodology used an assumed term based upon the stated term of three years and a risk-free rate of return represented by the U.S. 5-year Treasury Bond rate and volatility factor of 30% based on guidance as defined in FASB ASC 718, Compensation–Stock Compensation. A dividend yield of 0% was used because the Company has never paid a dividend and does not anticipate paying dividends in the reasonably foreseeable future.

In October 2009, one member of the Board of Directors exercised 6,000 vested options at a price of $2.50 per share. Consequently, at June 26, 2011, 354,000 shares of authorized common stock are reserved for issuance to provide for the exercise of the Company’s stock options.

The Company has authorized 10,000,000 shares of preferred stock at a par value of $0.0001. No preferred shares are issued or outstanding as of June 26, 2011. Any preferences, rights, voting powers, restrictions, dividend limitations, qualifications, and terms and conditions of redemption shall be set forth and adopted by a board of directors' resolution prior to issuance of any series of preferred stock.

11

9. INCOME TAXES

The benefit (provision) for income taxes consists of the following components for the three-month and six-month periods ended June 26, 2011 and June 27, 2010, respectively:

|

Three Months Ended

|

Six Months Ended

|

|||||||||||||||

|

June 26

2011

|

June 27

2010

|

June 26

2011

|

June 27

2010

|

|||||||||||||

|

Federal

|

||||||||||||||||

|

Current

|

$ |

0

|

$ |

0

|

$ |

0

|

$ |

0

|

||||||||

|

Deferred

|

(203,394

|

) |

295,744

|

(427,382

|

) |

190,607

|

||||||||||

|

State

|

||||||||||||||||

|

Current

|

(104,299

|

) |

(36,502)

|

(137,006

|

) |

(86,603)

|

||||||||||

|

Deferred

|

(43,804

|

) |

(14,779)

|

(97,097

|

) |

17,883

|

||||||||||

|

Income tax benefit (provision)

|

$

|

(351,497

|

) |

$

|

244,463

|

$ |

(661,485

|

) |

$

|

121,887

|

||||||

The benefit (provision) for income taxes is different from that which would be obtained by applying the statutory federal income tax rate to loss before income taxes. The items causing this difference are as follows:

|

June 26

2011

|

June 27

2010

|

|||||||

|

Income tax benefit (provision) at federal statutory rate

|

$

|

(646,371

|

) |

$

|

25,891

|

|||

|

State income tax benefit (provision)

|

(234,104

|

) |

(68,720)

|

|||||

|

Permanent differences

|

(50,559

|

) |

22,554

|

|||||

|

Tax credits

|

211,257

|

70,000

|

||||||

|

Other

|

58,292

|

72,162

|

||||||

|

Income tax benefit (provision)

|

$

|

(661,485

|

) |

$

|

121,887

|

|||

Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. The Company expects the deferred tax assets to be fully realizable within the next several years. Significant components of the Company's deferred income tax assets and liabilities are summarized as follows:

|

June 26

2011

|

December 26

2010

|

|||||||

|

Deferred tax assets:

|

||||||||

|

Net operating loss carry forwards

|

$

|

316,214

|

$

|

1,252,609

|

||||

|

Deferred rent expense

|

55,681

|

68,509

|

||||||

|

Start-up costs

|

190,077

|

190,076

|

||||||

|

Tax credit carry forwards

|

739,422

|

540,533

|

||||||

|

Other – including state deferred tax assets

|

574,837

|

487,139

|

||||||

|

Total deferred tax assets

|

1,876,230

|

2,538,866

|

||||||

|

Deferred tax liabilities:

|

||||||||

|

Other

|

281,640

|

425,322

|

||||||

|

Tax depreciation in excess of book

|

1,511,325

|

1,505,800

|

||||||

|

Total deferred tax liabilities

|

1,792,965

|

1,931,122

|

||||||

|

Net deferred income tax assets

|

$

|

83,266

|

$

|

607,744

|

||||

If deemed necessary by management, the Company establishes valuation allowances in accordance with the provisions of FASB ASC 740 ("ASC 740"), "Income Taxes". Management continually reviews realizability of deferred tax assets and the Company recognizes these benefits only as reassessment indicates that it is more likely than not that such tax benefits will be realized.

The Company expects to use net operating loss and general business tax credit carryforwards before its 20-year expiration. A significant amount of net operating loss carry forwards were used when the Company purchased nine affiliated restaurants in 2010, which were previously managed by DRH. Net operating loss carry forwards of $901,430 and $28,611 will expire in 2029 and 2030, respectively. General business tax credits of $210,627, $341,156, $122,850, $59,722 and $5,067 will expire in 2031, 2030, 2029, 2028 and 2027, respectively.

The Company applies the provisions of ASC 740 regarding the accounting for uncertainty in income taxes. There are no amounts recorded on the Company's consolidated financial statements for uncertain positions. The Company classifies all interest and penalties as income tax expense. There are no accrued interest amounts or penalties related to uncertain tax positions as of June 26, 2011.

The Company files income tax returns in the United States federal jurisdiction and various state jurisdictions.

12

10. OPERATING LEASES (INCLUDING RELATED PARTY)

Lease terms range from four to 15 years, generally include renewal options, and frequently require us to pay a proportionate share of real estate taxes, insurance, common area maintenance, and other operating costs. Some restaurant leases provide for contingent rental payments based on sales thresholds.

Total rent expense was $650,736 and $435,809 for the three-month period ended June 26, 2011 and June 27, 2010, respectively (of which $22,529 and $82,538, respectively, were paid to a related party). Total rent expense was $1,264,047 and $1,068,236 for the six-month period ended June 26, 2011 and June 27, 2010, respectively (of which $43,400 and $164,904, respectively, were paid to a related party).

Scheduled future minimum lease payments for each of the five years and thereafter for non-cancelable operating leases with initial or remaining lease terms in excess of one year at December 26, 2010 are summarized as follows:

|

Year

|

Amount

|

|||

|

2011

|

$

|

2,682,568

|

||

|

2012

|

2,806,774

|

|||

|

2013

|

2,871,487

|

|||

|

2014

|

2,738,572

|

|||

|

2015

|

2,434,249

|

|||

|

Thereafter

|

7,911,286

|

|||

|

Total

|

$

|

21,444,936

|

||

11. COMMITMENTS AND CONTINGENCIES

The Company assumed, from a related entity, an "Area Development Agreement" with BWWI in which the Company undertakes to open 23 BWW restaurants within its designated "development territory", as defined by the agreement, by October 1, 2016. On December 12, 2008, this agreement was amended, adding nine additional restaurants and extending the date of fulfillment to March 1, 2017. Failure to develop restaurants in accordance with the schedule detailed in the agreement could lead to potential penalties of $50,000 for each undeveloped restaurant, payment of the initial franchise fees for each undeveloped restaurant, and loss of rights to development territory. As of June 26, 2011, of the 32 restaurants required to be opened, 15 of these restaurants had been opened for business.

The Company is required to pay BWWI royalties (5% of net sales) and advertising fund contributions (3% of net sales) for the term of the individual franchise agreements. The Company incurred $677,300 and $491,898 in royalty expense for the three-month period ended June 26, 2011 and June 27, 2010, respectively, and $1,378,264 and $994,728 for the six-month period ended June 26, 2011 and June 27, 2010, respectively. Advertising fund contribution expenses were $432,928 and $296,556 for the three-month period ended June 26, 2011 and June 27, 2010, respectively, and $848,968 and $612,620 for the six-month period ended June 26, 2011 and June 27, 2010, respectively.

The Company is required by its various BWWI franchise agreements to modernize the restaurants during the term of the agreements. The individual agreements generally require improvements between the fifth year and the tenth year to meet the most current design model that BWWI has approved. The modernization costs can range from approximately $50,000 to approximately $500,000 depending on the individual restaurants’ needs.

The Company is subject to ordinary, routine, legal proceedings, as well as demands, claims and threatened litigation, which arise in the ordinary course of its business. The ultimate outcome of any litigation is uncertain. While unfavorable outcomes could have adverse effects on the Company's business, results of operations, and financial condition, management believes that the Company is adequately insured and does not believe that any pending or threatened proceedings would adversely impact the Company's results of operations, cash flows, or financial condition.

12. SUPPLEMENTAL CASH FLOWS INFORMATION

Other Cash Flows Information

Cash paid for interest was $306,624 and $518,143 during the three-month period ended June 26, 2011 and June 27, 2010, respectively, and $593,434 and $687,876 for the six-month period ended June 26, 2011 and June 27, 2010, respectively.

Cash paid for income taxes was $37,943 and $15,457 during the three-month period ended June 26, 2011 and June 27, 2010, respectively, and $37,943 and $110,436 for the six-month period ended June 26, 2011 and June 27, 2010, respectively.

13

13. FAIR VALUE OF FINANCIAL INSTRUMENTS

The guidance for fair value measurements, ASC 820 Fair Value Measurements and Disclosures, establishes the authoritative definition of fair value, sets out a framework for measuring fair value, and outlines the required disclosures regarding fair value measurements. Fair value is the price that would be received to sell an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants at the measurement date. We use a three-tier fair value hierarchy based upon observable and non-observable inputs as follows:

| • | Level 1 | — |

Quoted market prices in active markets for identical assets and liabilities;

|

| • | Level 2 | — |

Inputs, other than level 1 inputs, either directly or indirectly observable; and

|

| • | Level 3 | — |

Unobservable inputs developed using internal estimates and assumptions (there is little or no market data) which reflect those that market participants would use.

|

As of June 26, 2011 and December 26, 2010, respectively, our financial instruments consisted of cash equivalents, accounts payable, and debt. The fair value of cash equivalents, accounts payable and short-term debt approximate its carrying value, due to its short-term nature.

The fair value of our interest rate swaps is determined based on valuation models, which utilize quoted interest rate curves to calculate the forward value and then discount the forward values to the present period. The Company measures the fair value using broker quotes which are generally based on market observable inputs including yield curves and the value associated with counterparty credit risk. Our interest rate swaps are classified as a Level 2 measurement as these securities are not actively traded in the market, but are observable based on transactions associated with bank loans with similar terms and maturities.

There were no transfers between levels of the fair value hierarchy during the three months ended June 26, 2011 and the fiscal year ended December 26, 2010, respectively.

The following table presents the fair values for those assets and liabilities measured on a recurring basis as of June 26, 2011:

|

FAIR VALUE MEASUREMENTS

|

||||||||||||||||||||

|

Asset/(Liability)

|

||||||||||||||||||||

|

Description

|

Level 1

|

Level 2

|

Level 3

|

Total

|

Total

|

|||||||||||||||

|

Interest Rate Swaps

|

$

|

—

|

$ |

(571,801

|

)

|

$ |

—

|

$ |

(571,801

|

)

|

$

|

(571,801

|

)

|

|||||||

The following table presents the fair values for those assets and liabilities measured on a recurring basis as of December 26, 2010:

|

FAIR VALUE MEASUREMENTS

|

||||||||||||||||||||

|

Asset/(Liability)

|

||||||||||||||||||||

|

Description

|

Level 1

|

Level 2

|

Level 3

|

Total

|

Total

|

|||||||||||||||

|

Interest Rate Swaps

|

$

|

—

|

$ |

(367,181

|

)

|

$ |

—

|

$ |

(367,181

|

)

|

$

|

(367,181

|

)

|

|||||||

As of June 26, 2011, our total debt, less related party debt, was approximately $16.4 million and had a fair value of approximately $14.5 million. As of December 26, 2010, our total debt, less related party debt, was approximately $14.8 million and had a fair value of approximately $12.7 million. Related party debt at June 26, 2011 was approximately $2.8 million and had a fair value of approximately $2.6 million. Related party debt as of December 26, 2010 was approximately $3.1 million and had a fair value of approximately $2.8 million. The Company estimates the fair value of its fixed-rate debt using discounted cash flow analysis based on the Company’s incremental borrowing rate.

14

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

(The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our consolidated interim financial statements and related notes included in Item 1 of Part 1 of this Quarterly Report and the audited consolidated financial statements and related notes and Management’s Discussion and Analysis of Financial Condition and Results from Operations contained in our Form 10-K, as amended, for the fiscal year ended December 26, 2010.)

INFORMATION REGARDING FORWARD-LOOKING STATEMENTS

Statements contained in this “Quarterly Report on Form 10-Q” may contain information that includes or is based upon certain “forward-looking statements” relating to our business. These forward-looking statements represent management’s current judgment and assumptions, and can be identified by the fact that they do not relate strictly to historical or current facts. Forward-looking statements are frequently accompanied by the use of such words as “anticipates,” “plans,” “believes,” “expects,” “projects,” “intends,” and similar expressions. Such forward-looking statements involve known and unknown risks, uncertainties, and other factors, including, while it is not possible to predict or identify all such risks, uncertainties, and other factors, those relating to our ability to secure the additional financing adequate to execute our business plan; our ability to locate and start up new restaurants; acceptance of our restaurant concepts in new market places; the cost of food and other raw materials. Any one of these or other risks, uncertainties, other factors, or any inaccurate assumptions may cause actual results to be materially different from those described herein or elsewhere by us. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date they were made. Certain of these risks, uncertainties, and other factors may be described in greater detail in our filings from time to time with the Securities and Exchange Commission, which we strongly urge you to read and consider. Subsequent written and oral forward-looking statements attributable to us or to persons acting on our behalf are expressly qualified in their entirety by the cautionary statements set forth above and elsewhere in our reports filed with the Securities and Exchange Commission. We expressly disclaim any intent or obligation to update any forward-looking statements.

OVERVIEW

Diversified Restaurant Holdings, Inc. (“DRH” or the “Company”) is a leading Buffalo Wild Wings® ("BWW") franchisee that is rapidly expanding through organic growth and acquisitions. It operates 21 BWW restaurants; 14 in Michigan and seven in Florida. We plan to open an additional location in University Park (Bradenton), Florida during the fourth quarter of 2011. DRH also created and launched its own unique, full-service, ultra-casual restaurant concept, Bagger Dave’s Legendary Burger Tavern® (“Bagger Dave’s”), in January 2008. As of June 26, 2011, the Company owned and operated four Bagger Dave’s® restaurants in Southeast Michigan with the most recent store opening, in Brighton, Michigan, in February 2011. Our fifth and sixth Bagger Dave's locations are currently under construction. We plan to open these locations in the third and fourth quarters of 2011. We also plan to franchise the Bagger Dave’s concept in Michigan, Indiana, Illinois, Ohio, Wisconsin, and Kentucky.

Our organic growth strategy is dependent on three key components. First is the continued development of our BWW concept as a franchisee. Under the terms of our current area development agreement, we expect to open two to three BWW stores each year through 2017 with a combined total of 38 by the end of 2017. Second is our continued development of our own Bagger Dave’s concept throughout Michigan and potentially in other areas in the Midwest consistent with the current capabilities of our supply base. We intend to open a total of three Bagger Dave’s restaurants in 2011 (one of which was opened in February) and, depending on our ability to find real estate and fund new development, we intend to open a minimum of three to five corporate stores next year. Third is our desire to franchise our Bagger Dave’s concept throughout the Midwest. We have made significant investments, including the hiring of a veteran in the franchise community to seek qualified multi-unit operators, support the development of new franchisee-owned stores, and ultimately manage the franchisee system.

ACQUISITION OF NINE AFFILIATED BWW RESTAURANTS

On February 1, 2010, the Company, through its WINGS subsidiary, acquired nine affiliated BWW restaurants it previously managed (“Affiliates Acquisition”). The Affiliates Acquisition was approved by resolution of the disinterested directors of the Company, who determined that the acquisition terms were at least as favorable as those that could be obtained through arms-length negotiations with an unrelated party. The Company paid the purchase price for each of the affiliated restaurants to each selling shareholder by issuing an unsecured promissory note for the pro-rata value of the equity interest in the affiliated restaurants. The promissory notes bear interest at 6% per year, mature on February 1, 2016, and are payable in quarterly installments, with principal and interest fully amortized over six years.

In accordance with FASB ASC 805-50, Business Combinations: Transactions Between Entities Under Common Control, the Company accounted for the Affiliates Acquisition, a transaction between entities under common control, as if the transaction had occurred at the beginning of the period (i.e., December 28, 2009) using the historical cost basis of the acquired affiliates. Further, prior years amounts also have been retrospectively adjusted to furnish comparative information while the entities were under common control.

15

RESTAURANT OPENINGS

The following table outlines the restaurant unit information for the years indicated. “Total owned restaurants” reflects the number of restaurants owned and operated by DRH for each year. From the Company’s inception to February 1, 2010, it managed nine BWW restaurants that were owned by affiliated parties. On February 1, 2010, these restaurants were acquired by the Company. “Total managed restaurants” reflects the total number of restaurants managed and/or owned by the Company. Our 2009 comparative results are a consolidation of owned and managed restaurants based on the accounting of an acquisition of entities under common control (refer to Note 3 in the notes to consolidated financial statements for further details).

|

2011

|

2010

|

2009

|

2008

|

2007

|

||

|

Beginning of year

|

22

|

9

|

8

|

2

|

0

|

|

|

Acquisitions

|

0

|

9

|

0

|

0

|

0

|

|

|

Openings

|

3

|

4

|

1

|

6

|

2

|

|

|

Planned Openings

|

3

|

N/A

|

N/A

|

N/A

|

N/A

|

|

|

Total owned restaurants

|

28

|

22

|

9

|

8

|

2

|

|

|

Affiliate restaurants under common control

|

0

|

0

|

9

|

9

|

9

|

|

|

Total managed restaurants

|

28

|

22

|

18

|

17

|

11

|

|

RESULTS OF OPERATIONS

For the three months ended June 26, 2011 ("Second Quarter 2011") and the six months ended June 26, 2011 (“Year to Date 2011”), revenue was generated from the operations of 21 BWW restaurants (two of which opened in February 2011) and four Bagger Dave’s restaurants (one of which opened in late February 2011). For the three months ended June 27, 2010 ("Second Quarter 2010") and six months ended June 27, 2010 (“Year to Date 2010”), revenue was generated from the operations of 17 BWW restaurants (one of which opened in June 2010) and three Bagger Dave’s restaurants (one of which opened in February 2010).

Results of Operations for the Three Months Ended June 26, 2011 and June 27, 2010

Our operating results below are expressed as a percentage of total revenue on the basis of comparison to prior periods.

|

Three Months Ended

|

||||||||

|

June 26

|

June 27

|

|||||||

|

2011

|

2010

|

|||||||

|

Total revenue

|

100.0 | % | 100.0 | % | ||||

|

Operating expenses

|

||||||||

|

Compensation costs

|

28.6 | % | 31.8 | % | ||||

|

Food and beverage costs

|

28.1 | % | 29.4 | % | ||||

|

General and administrative

|

23.2 | % | 24.7 | % | ||||

|

Pre-opening

|

0.1 | % | 1.0 | % | ||||

|

Occupancy

|

5.3 | % | 5.4 | % | ||||

|

Depreciation and amortization

|

5.6 | % | 6.0 | % | ||||

|

Total operating expenses

|

90.9 | % | 98.3 | % | ||||

|

Operating profit

|

9.1 | % | 1.7 | % | ||||

Total revenue for Second Quarter 2011 was $14.9 million, an increase of $4.3 million or 39.8% over the $10.7 million of revenue generated during Second Quarter 2010. The increase was primarily attributable to two factors. First, approximately $3.7 million of the increase was attributable to revenues generated from the opening of three new restaurants in 2011 (one Bagger Dave’s restaurant and two BWW restaurants) and revenues generated by four restaurants (one Bagger Dave’s restaurant and three BWW restaurants) that opened prior to 2011 but did not meet the criteria for same-store sales for all or part of the three-month period. Second, we believe the remaining $530 thousand increase was related to a 5.1% increase in same-store sales for 16 BWW restaurants opened prior to 2010 and a 9.4% increase in same-store sales for two Bagger Dave’s restaurants opened prior to 2010.

16

Compensation cost increased by $880 thousand or 25.9% to $4.3 million in Second Quarter 2011 from $3.4 million in Second Quarter 2010. The increase was primarily due to the addition of six restaurants. Compensation cost as a percentage of sales decreased to 28.6% in Second Quarter 2011 from 31.8% in Second Quarter 2010 primarily due to a reduction in hourly labor costs and because our proportional increase in revenue exceeded the increase of management compensation.

Food and beverage cost increased by $1.1 million or 33.7% to $4.2 million in Second Quarter 2011 from $3.1 million in Second Quarter 2010. The increase was primarily due to the addition of six restaurants. Food and beverage cost as a percentage of sales decreased to 28.1% in Second Quarter 2011 from 29.4% in Second Quarter 2010 primarily due to lower bone-in chicken wing cost, menu price increases and efficiencies in food preparation. This decrease was partially offset by increases in other food and beverage costs.

General and administrative cost increased by $821 thousand or 31.1% to $3.5 million in Second Quarter 2011 from $2.6 million in Second Quarter 2010. This increase was primarily due to the addition of six restaurants. General and administrative cost as a percentage of sales decreased to 23.2% in Second Quarter 2011 from 24.7% in Second Quarter 2010 due to cost reduction initiatives and because the proportional increase in revenue was greater than that of fixed general and administrative overhead expenses.

Pre-opening cost decreased by $97 thousand or 87.0% to $15 thousand in Second Quarter 2011 from $112 thousand in Second Quarter 2010. The difference in pre-opening cost was due to the timing and overall cost to build and open new stores during the period. The company did not have any new store openings in the Second Quarter 2011 versus one store opening in June 2010. Pre-opening cost as a percentage of sales decreased to 0.1% in Second Quarter 2011 from 1.0% in Second Quarter 2010 for the same reason.

Occupancy cost increased by $220 thousand or 38.4% to $794 thousand in Second Quarter 2011 from $574 thousand in Second Quarter 2010. This increase was primarily due to the addition of six new stores. Occupancy cost as a percentage of sales decreased to 5.3% in Second Quarter 2011 from 5.4% in Second Quarter 2010.

Depreciation and amortization cost increased by $194 thousand or 30.3% to $835 thousand in Second Quarter 2011 from $641 thousand in Second Quarter 2010. This increase was primarily due to the addition of six restaurants. Depreciation and amortization cost as a percentage of sales decreased to 5.6% in Second Quarter 2011 from 6.0% in Second Quarter 2010 primarily due to the increase in sales.

Our operating results below, for the six months ended June 26, 2011 and June 27, 2010, are expressed as a percentage of total revenue on the basis of comparison to prior periods.

Results of Operations for the Six Months Ended June 26, 2011 and June 27, 2010

|

Six Months Ended

|

||||||||

|

June 26

|

June 27

|

|||||||

|

2011

|

2010

|

|||||||

|

Total revenue

|

100.0 | % | 100.0 | % | ||||

|

Operating expenses

|

||||||||

|

Compensation costs

|

28.3 | % | 30.0 | % | ||||

|

Food and beverage costs

|

28.1 | % | 30.3 | % | ||||

|

General and administrative

|

22.9 | % | 23.8 | % | ||||

|

Pre-opening

|

0.9 | % | 1.0 | % | ||||

|

Occupancy

|

5.3 | % | 6.2 | % | ||||

|

Depreciation and amortization

|

5.4 | % | 5.8 | % | ||||

|

Total operating expenses

|

90.9 | % | 97.1 | % | ||||

|

Operating profit

|

9.1 | % | 2.9 | % | ||||