UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2010

Commission file number: 000-53491

ANHUI TAIYANG POULTRY CO., INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

65-0918608

|

|

|

(State or Other Jurisdiction

of Incorporation)

|

(IRS Employer

Identification No.)

|

|

No. 88, Eastern Outer Ring Road, Ningguo City, Anhui Province, 242300, People’s Republic of China

|

|

(Address of principal executive offices)

|

Registrant’s telephone number, including area code: (+86) 0563-430-9999

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 12(g) of the Act: Common Stock, par value $0.001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934.

Yes o No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

Accelerated filer o

|

||

|

Non-accelerated filer o

|

Smaller reporting company x

|

||

|

(Do not check if a smaller reporting company)

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No þ

The aggregate market value of the voting common equity held by non-affiliates as of June 30, 2010, based on the closing sales price of the Common Stock as quoted on the OTC Bulletin Board was $250,807.50. For purposes of this computation, all officers, directors, and 5 percent beneficial owners of the registrant are deemed to be affiliates. Such determination should not be deemed an admission that such directors, officers, or 5 percent beneficial owners are, in fact, affiliates of the registrant.

As of April 14, 2011, there were 10,440,033 shares of registrant’s common stock outstanding.

EXPLANATORY NOTE

The purpose of this Amendment No. 1 on Form 10-K/A (the “Amended Filing”) to the Annual Report on Form 10-K for the year ended December 31, 2010 (the “Original Filing”) of Anhui Taiyang Poultry Co., Inc. (the “Company”), filed with the Securities and Exchange Commission on April 15, 2011 (“the Form 10-K”), is to make the following corrections:

|

a)

|

The Company incorrectly applied the provisions of ASC Topic 805-40, “Reverse Acquisitions” with respect to the following: (i) the combination, elimination, and restatement of the shareholders’ equity section of the Company’s balance sheet and the related statement of shareholders’ equity were not appropriately applied as of November 10, 2010, and (ii) previously, the Company had reflected the operating results and financial positions of The Parkview Group, Inc. in periods prior to the Reverse Merger Transaction (as defined under the heading “Company History” on page 1 hereto), whereas such results should not be reflected since The Parkview Group, Inc. is the accounting acquiree;

|

|

|

b)

|

The Company recognizes discounts against certain bank loan instruments that do not bear interest and have a stated maturity date. The Company previously recognized these discounts as interest income on the statement of operations. The discounts, amounting to $42,785 in the year ended December 31, 2008 and $42,061 in the year ended December 31, 2010, were reclassified from interest income to additional paid-in capital to reflect the appropriate accounting;

|

|

|

c)

|

The Company has restated its financial results for the year ended December 31, 2010 to record a charge of $165,431 to interest expense, with an offsetting adjustment to additional paid in capital, to reflect the fair value of 988 ordinary shares of Dynamic Ally Limited that were issued to holders of convertible loans issued in March 2010. The convertible loans were issued by Anhui Taiyang Poultry Co., Ltd. to fund the costs associated with the Reverse Merger Transaction, and provided that the Company should issue the equivalent of one share of common stock of the public entity for each dollar invested in the convertible loans;

|

|

|

d)

|

Liquidated damages in the amount of $562,746 related to the November 2010 financing should have been accrued as a contingent liability in the year ended December 31, 2010. The Company has adjusted the December 31, 2010 appropriated retained earnings and accrued liabilities to reflect this adjustment, and also removed $241,227 of liquidated damages accrual that was charged to interest expense in the three months ended March 31, 2011;

|

|

|

e)

|

The Company has restated its financial results for the year ended December 31, 2010 to reclassify $95,000 of amortization of a discount on convertible loans from general and administrative expense to interest expense.

|

|

|

f)

|

The Company has restated its financial results for the year ended December 31, 2010, the Company to record additional income tax expense of $198,631 resulting from termination of operating agreements between Ningguo Taiyang Incubation Plant Co., Ltd. and Dynamic Ally Limited.

|

For the convenience of the reader, this Amended Filing sets forth the Original Filing as modified and superseded where necessary to reflect the restatement. The following items have been amended as a result of, and to reflect, the restatement:

|

●

|

Part II — Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations;

|

|

|

●

|

Part II — Item 8. Consolidated Financial Statements and Supplementary Data; and

|

|

|

●

|

Part II — Item 9A. Controls and Procedures.

|

In accordance with applicable SEC rules, this Amended Filing includes certifications from our Chief Executive Officer and Chief Financial Officer dated as of the date of this filing.

Except for the items noted above, no other information included in the Original Filing is being amended by this Amended Filing. The Amended Filing continues to speak as of the date of the Original Filing and we have not updated the filing to reflect events occurring subsequently to the Original Filing date other than those associated with the restatement of the Company’s consolidated financial statements. Accordingly, this Amended Filing should be read in conjunction with our filings made with the SEC subsequent to the filing of the Original Filing.

TABLE OF CONTENTS

|

1

|

||

|

1

|

||

|

11

|

||

|

25

|

||

|

25

|

||

|

25

|

||

|

26

|

||

|

26

|

||

|

26

|

||

|

27

|

||

|

27

|

||

|

34

|

||

|

34

|

||

|

35

|

||

|

35

|

||

|

37

|

||

|

38

|

||

|

38

|

||

|

41

|

||

|

42

|

||

|

42

|

||

|

44

|

||

|

46

|

||

|

46

|

||

|

BUSINESS.

|

This Annual Report on Form 10-K (including the section regarding Management’s Discussion and Analysis of Financial Condition and Results of Operations) contains forward-looking statements regarding our business, financial condition, results of operations and prospects. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” and similar expressions or variations of such words are intended to identify forward-looking statements, but are not deemed to represent an all-inclusive means of identifying forward-looking statements as denoted in this Annual Report on Form 10-K. Additionally, statements concerning future matters are forward-looking statements.

Although forward-looking statements in this Annual Report on Form 10-K reflect the good faith judgment of our Management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, those specifically addressed under the heading “Risks Factors” below, as well as those discussed elsewhere in this Annual Report on Form 10-K. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report on Form 10-K. We file reports with the Securities and Exchange Commission (“SEC”). You can read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. You can obtain additional information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including us.

We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this Annual Report on Form 10-K. Readers are urged to carefully review and consider the various disclosures made throughout the entirety of this annual Report, which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

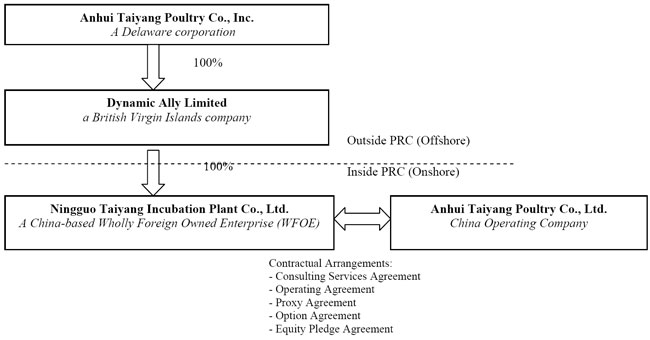

This Annual Report on Form 10-K includes the accounts of Anhui Taiyang Poultry Co., Inc. (“Anhui”) and its wholly-owned subsidiaries, Dynamic Ally Limited, a British Virgin Islands company (“Dynamic Ally”), Ningguo Taiyang Incubation Plant Co., Ltd., a Chinese wholly foreign owned enterprise (“Ningguo”) and Anhui Taiyang Poultry Co., Ltd., (“Taiyang”) a Chinese limited liability company that has entered into a series of contractual obligations with Ningguo, collectively referred to as “we”, “us” or the “Company”.

Company History

Anhui Taiyang Poultry Co., Inc. was incorporated in the State of Delaware on April 7, 1999 as The Parkview Group, Inc. From inception through November 2010, we were in the business of providing management consulting services to corporate clients.

On November 10, 2010 (the “Closing Date” and the closing of the reverse merger transaction, the “Closing”), we executed and consummated a share exchange agreement by and among Dynamic Ally and the stockholders of 100% of Dynamic Ally’s common stock (the “Dynamic Ally Shareholders”), on the one hand, and certain holders of our issued and outstanding common stock (the “Representative Shareholders”) on the other hand (the “Share Exchange Agreement” and the transaction, the “Reverse Merger Transaction”).

In the Reverse Merger Transaction, Dynamic Ally’s shareholders exchanged their shares of Dynamic Ally for newly issued shares of our common stock. As a result, upon completion of the Reverse Merger Transaction, Dynamic Ally became our wholly-owned subsidiary.

-1-

Dynamic Ally owns 100% of Ningguo, which is a wholly foreign owned enterprise (“WFOE”) under the laws of the People’s Republic of China (“China” or the “PRC”). Ningguo has entered into a series of contractual arrangements (as further described below under the heading “Organizational Structure”) with Taiyang, a limited liability company headquartered in, and organized under the laws of, the PRC.

As a result of the Reverse Merger Transaction, we acquired 100% of the capital stock of Dynamic Ally and consequently, control of the business and operations of Dynamic Ally, Ningguo, and Taiyang.

Effective January 20, 2011, we changed our name from “The Parkview Group, Inc.” to “Anhui Taiyang Poultry Co., Inc.”

Organizational Structure

Dynamic Ally is a holding company incorporated in British Virgin Islands. Since incorporation, Dynamic Ally has not conducted any substantive operations of its own except for holding 100% equity interests of Ningguo.

Ningguo is a limited liability company organized in the PRC on May 25, 2010. Ningguo was formed by Dynamic Ally. Other than the activities relating to its contractual arrangements with Taiyang as described below, Ningguo has no other business operations.

Taiyang is a limited liability company organized in the PRC in June 1996. Taiyang holds the government licenses and approvals necessary to operate the duck farming business in China. We do not own any equity interests in Taiyang, but control and receive the economic benefits of its business operations through contractual arrangements. Through Ningguo, we have contractual arrangements with Taiyang and its owners pursuant to which we provide consulting and other general business operation services. We will receive distributions from our consolidated affiliates only to the extent service fees are paid to Ningguo under these series of agreements and further distributed as dividends or other shareholder distributions by Ningguo through Dynamic Ally. Through these contractual arrangements, we also have the ability to substantially influence their daily operations and financial affairs, since we are able to appoint their senior executives and approve all matters requiring approval of the equity owners. As a result of these contractual arrangements, which enable us to control Taiyang and to receive, through Ningguo, all of its profits, we are considered the primary beneficiary of Taiyang. Accordingly, we consolidate its results, assets and liabilities in our financial statements.

Contractual Arrangements with Taiyang and its Stockholders

Our relationships with Taiyang and its owners are governed by a series of contractual arrangements, as we (including our subsidiaries) do not own any equity interests in Taiyang. The contractual arrangements constitute valid and binding obligations of the parties of such agreements. Each of the contractual arrangements and the rights and obligations of the parties thereto are enforceable and valid in accordance with the laws of the PRC. Under Chinese laws, each of Ningguo and Taiyang is an independent legal entity and neither of them is exposed to liabilities incurred by the other party. Other than pursuant to the contractual arrangements between Ningguo and Taiyang, Taiyang does not transfer any other funds generated from its operations to Ningguo.

On May 26, 2010, Ningguo entered into the following contractual arrangements with Taiyang:

Consulting Services Agreement. Pursuant to the exclusive consulting services agreement between Ningguo and Taiyang, Ningguo has the exclusive right to provide to Taiyang general services related to the current and proposed operations of Taiyang’s business in the PRC (the “Services”). Ningguo also sends employees to Taiyang and Taiyang bears the costs and expenses for such employees. Under this agreement, Ningguo owns the intellectual property rights developed through the Services provided to Taiyang. Taiyang pays a quarterly consulting service fee in Renminbi (“RMB”) to Ningguo that is equal to all of Taiyang’s net income for such quarter. The consulting services agreement is in effect unless and until terminated by written notice of either party in the event that: (a) Taiyang causes a material breach of this agreement, provided that if the breach does not relate to a financial obligation of the breaching party, that party may attempt to remedy the breach following the receipt of the written notice; (b) the other party becomes bankrupt, insolvent, is the subject of proceedings or arrangements for liquidation or dissolution, ceases to carry on business, or becomes unable to pay its debts as they become due; (c) Ningguo terminates its operations; or (d) circumstances arise which would materially and adversely affect the performance or the objectives of the consulting services agreement. Additionally, Ningguo may terminate the consulting services agreement without cause.

-2-

Operating Agreement. Pursuant to the operating agreement among Ningguo, Taiyang and the owners of Taiyang who collectively hold 100% of the issued and outstanding equity interests of Taiyang (collectively the “Taiyang Owners”), Ningguo provides guidance and instructions on Taiyang’s daily operations, financial management and employment issues. The Taiyang Owners must designate the candidates recommended by Ningguo as their representatives on Taiyang’s board of directors. Ningguo has the right to appoint senior executives of Taiyang. In addition, Ningguo agrees to guarantee the performance of Taiyang under any agreements or arrangements relating to Taiyang’s business arrangements with any third party. Taiyang, in return, agrees to pledge its accounts receivable and all of its assets to Ningguo. Moreover, Taiyang agrees that without the prior consent of Ningguo, Taiyang will not engage in any transactions that could materially affect the assets, liabilities, rights or operations of Taiyang, including, without limitation, incurrence or assumption of any indebtedness, sale or purchase of any assets or rights, incurrence of any encumbrance on any of its assets or intellectual property rights in favor of a third party or transfer of any agreements relating to its business operation to any third party. The term of this agreement shall last for the maximum period of time permitted by law from May 26, 2010, and may be terminated only upon Ningguo’s thirty (30) day prior written notice to Taiyang.

Equity Pledge Agreement Under the equity pledge agreement between the Taiyang Owners and Ningguo, the Taiyang Owners pledged all of their equity interests in Taiyang to Ningguo to guarantee Taiyang’s performance of its obligations under the consulting services agreement. If Taiyang or the Taiyang Owners breach their respective contractual obligations, Ningguo, as pledgee, will be entitled to certain rights, including, but not limited to, the right to sell the pledged equity interests, the right to vote and control the pledged assets. The Taiyang Owners also agreed, that upon occurrence of any event of default, Ningguo shall be granted an exclusive, irrevocable power of attorney to take actions in the place and instead of the Taiyang Owners to carry out the security provisions of the equity pledge agreement and take any action and execute any instrument that Ningguo may deem necessary or advisable to accomplish the purposes of the equity pledge agreement. The Taiyang Owners agreed not to dispose of the pledged equity interests or take any actions that would prejudice Ningguo’s interest. The equity pledge agreement will expire in two years after Taiyang’s obligations under the exclusive consulting services agreement have been fulfilled.

Option Agreement. Under the option agreement between the Taiyang Owners and Ningguo, the Taiyang Owners irrevocably granted Ningguo or its designated person an exclusive option to purchase, to the extent permitted under Chinese law, all or part of the equity interests in Taiyang for the cost of the initial contributions to the registered capital or the minimum amount of consideration permitted by applicable Chinese law. Ningguo or its designated person has sole discretion to decide when to exercise the option, whether in part or in full. The term of this agreement shall last for the maximum period of time permitted by law from May 26, 2010.

Voting Rights Proxy Agreement. Pursuant to the voting rights proxy agreement among Ningguo, the Taiyang Owners, and Taiyang, the Taiyang Owners agreed to entrust all the rights to exercise their voting power to designee(s) of Ningguo. Such designee(s) shall have the right to exercise the Taiyang Owners’ voting and other rights, including the attendance at and the voting of their shares at Taiyang’s shareholders meetings (or by written consent in lieu of meetings) in accordance with applicable laws and Taiyang’s Article of Association. This agreement may not be terminated without the unanimous consent of all parties, except that Ningguo may, by giving a thirty (30) day prior written notice to the Taiyang Owners, terminate the voting rights proxy agreement, with or without cause.

Current Corporate Structure

We conduct substantially all of our business operations through Taiyang. Chinese law currently has limits on foreign ownership of certain businesses which prohibit non-Chinese persons from having direct ownership interests. To comply with these foreign ownership restrictions, neither we nor our subsidiaries own any equity interests in Taiyang, but control and receive the economic benefits of its business operations through contractual arrangements.

-3-

The following diagram illustrates our current corporate structure:

Operations

Our operations are carried out in the PRC by Taiyang. Founded in 1996, Taiyang raises, processes and markets ducks and ducks related food products.

|

●

|

Breeding Unit – breeds, hatches, and cultivates ducklings for resale and processing by food processing unit;

|

|

|

●

|

Feed Unit – produces duck feed for internal use and external sale; and

|

|

|

●

|

Food Processing Unit – processes ducklings into frozen raw food product for commercial resale.

|

Our units are fully integrated to maximize production efficiency and profits. By manufacturing our own feed to nourish our livestock, and by using our internal production stock to supply our food unit, we reduce both our cost and our reliance on the quality of product provided by outside vendors. We save by leveraging shared overhead, reduced marketing and distribution costs, and reduced transportation costs, to name a few savings derived from our structure.

Breeding Unit

Duck breeding is generally comprised of a system of grandparent, parent and production stock. Grandparent ducks are master breeding stock that we import from Cherry Valley Farms in the United Kingdom. Cherry Valley SM3 grandparent ducks are well-known worldwide for their breeding abilities. These grandparent ducks produce offspring parent ducks, which in turn produce offspring that will either mature into additional parent ducks to breed, or will not be capable of reproduction and will be used for production stock. Once the breeding ducks have exceeded their breeding period, they are then used in production stock.

We currently have production capacity to support approximately 8,400 grandparent ducks, which are capable of producing approximately 150,000 parent ducks annually. These parent ducks in turn could produce an estimated 30,000,000 ducklings per year.

-4-

Our Cherry Valley Grandparent Duck Breeding Center is the only Cherry Valley grandparent breed duck cultivation and incubation center in Anhui Province. It was established in 1999, with an area of nearly 30,000 square meters and can produce 600,000 parent breed duck seedlings per year.

Our parent duck breeding center consists of six large-scale parent duck breeding plants.

The commercial duck incubation center is equipped with advanced intelligent temperature controlled incubation equipment. The central computer controlled equipment maintains sealed incubation and sterilization. We have has implemented epidemic prevention procedures according to international Duck Incubation Standards.

We contract with surrounding farmer households in the raising of ducks outside the province of Anhui to supplement our current capacity. Utilizing this method, we have instituted standardized housing, raising, feeding, disease control, immunization and waste removal for these outside locations. We plan to expand farmer households to eventually raise 50 million commercial ducks annually.

Feed Unit

The Feed Processing Plant is a highly advanced computerized facility that processes, packages and loads / unloads various types of feed. It has annual production capacity of 100,000 metric tons and has an attached production development and quality testing institution. It develops and manufactures and sells a variety of different feeds utilized at various times in the life cycle of an animal.

Food Processing Unit

The Duck Slaughter Processing Plant operates in accordance with European, Japanese and Korean standards. It has an annual slaughtering capacity of 15,000,000 ducks and distributes in excess of 100 different kinds of products.

Sales

Sales to external customers during the years ended December 31, 2010 and 2009 by unit were as follows:

|

|

2010

|

2009

|

||||||

|

Breeding Unit

|

$ | 12,596,488 | $ | 7,704,942 | ||||

|

Feed Unit

|

13,886,122 | 50,592 | ||||||

|

Food unit

|

15,206,128 | 21,104,165 | ||||||

|

|

$ | 41,688,738 | $ | 28,859,699 | ||||

We also transact a substantial amount of intercompany feed product sales from the Feed Unit to the Breeding Unit, as well as sales of other products between units. Intercompany sales during the years ended December 31, 2010 and 2009 by unit were as follows:

|

|

Buying Unit

|

|||||||||||||||||||||||

|

Year Ended December 31, 2010

|

Year Ended December 31, 2009

|

|||||||||||||||||||||||

|

Breeding

|

Feed

|

Food

|

Breeding

|

Feed

|

Food

|

|||||||||||||||||||

|

Selling Unit

|

Unit

|

Unit

|

Unit

|

Unit

|

Unit

|

Unit

|

||||||||||||||||||

|

Breeding Unit

|

$ | — | $ | — | $ | 218,016 | $ | — | $ | — | $ | — | ||||||||||||

|

Feed Unit

|

13,241,455 | — | — | 12,387,362 | — | — | ||||||||||||||||||

|

Food unit

|

— | 8,681 | — | 51,137 | — | — | ||||||||||||||||||

|

|

$ | 13,241,455 | $ | 8,681 | $ | 218,016 | $ | 12,438,499 | $ | — | $ | — | ||||||||||||

-5-

During 2009, the Feed Unit did not have any sales to external customers. During 2010, the Feed Unit made substantially all of its external sales to one customer.

Customers

Our major seedling clients include provincial level duck breeding farms which are located in Shandong province (Dezhou, Bingzhou, Hezhe), Jiangsu province (Nanjing, Xuzhou, Suzhou, Lianyungong), Henan (Zhengzhou, Zhumadian), Anhui (Hefei, Wuhu, Tonglin, Anqing, Huibei, Chuzhou, Pengbu), Zhejiang province (Huzhou, Jiaqing, Lishui, Baoshan), Shanghai, Guangdong (Guangzhou, Nanhai), Guangxi province, Liaoning province, Hebei province and Jiangxi province.

Our major commercial duck clients include two individual distributors, as well as fair trade markets in big or middle cities, such as Nanjing, Jiujiang, Wuhu, Hangzhou and Shanghai.

Our feed products have been historically sold primarily to one distributor, who is an individual.

Major processed duck meat clients include meat food wholesale markets in big or middle cities, such as Hangzhou, Nanjing, Wuhan, Nanchang, Kunming, Guangzhou, Bengbu and Huainan.

Competition

Major competitors include Henan Huaying Company and Shangdong Weifang Legong Company.

Government Regulations

Compliance with Circular 106 and the 2006 M&A Regulations

On May 29, 2007, SAFE issued an official notice known as “Circular 106”, which requires the owners of any Chinese companies to obtain SAFE’s approval before establishing any offshore holding company structure in so-called “round-trip” investment transactions for foreign financing as well as subsequent acquisition matters in China. Likewise, the “Provisions on Acquisition of Domestic Enterprises by Foreign Investors”, issued jointly by Ministry of Commerce (“MOFCOM”), State-owned Assets Supervision and Administration Commission, State Taxation Bureau, State Administration for Industry and Commerce (“SAIC”), China Securities Regulatory Commission and SAFE in August 2006, impose approval requirements from MOFCOM for “round-trip” investment transactions, including acquisitions in which equity was used as consideration.

Dividend Distribution

The principal laws, rules and regulations governing dividends paid by our PRC operating subsidiary include the Company Law of the PRC (1993), as amended in 1999, 2004 and 2005 respectively, Wholly Foreign Owned Enterprise Law (1986), as amended in 2000, and Wholly Foreign Owned Enterprise Law Implementation Rules (1990), as amended in 2001. Under these laws and regulations, our operating subsidiary Ningguo may pay dividends only out of its accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, Ningguo is required to set aside at least 10% of its after-tax profit based on PRC accounting standards each year to its statutory surplus reserve fund until the accumulative amount of such reserve reaches 50% of its respective registered capital. These reserves are not distributable as cash dividends. The board of directors of a WFOE has the discretion to allocate a portion of its after-tax profits to its staff welfare and bonus funds. After the allocation of relevant welfare and funds, the equity owners can distribute the rest of the after-tax profits provided that all the losses of the previous fiscal year have been made up.

-6-

Taxation

The applicable income tax laws, regulations, notices and decisions (collectively referred to as “Applicable PRC Enterprises Tax Law”) related to foreign investment enterprises and their investors mainly include the following:

|

● Notice Relating to Taxes Applicable to Foreign Investment Enterprises / Foreign Enterprises and Foreign Nationals in Relation to Dividends and Gains obtained from Holding and Transferring of Shares promulgated by State Tax Bureau on July 21, 1993;

|

||

|

● Amendments to the Income Tax Law Applicable to Individuals of the PRC promulgated by Standing Committee of the National People’s Congress (“NPC”) on October 31, 1993;

|

||

|

● Notice on Relevant Policies Concerning Individual Income Tax issued by Ministry of Finance and the State Tax Bureau on May 13, 1994;

|

||

|

● Notice on Reduction of Income Tax in Relation to Interests and Gains Derived by Foreign Enterprises from the PRC, promulgated by the State Council on November 18, 2000; and

|

||

|

● Enterprise Income Tax Law of the PRC (“New EIT Law”) issued by NPC on March 16, 2007, which came into effect on January 1, 2008.

|

||

Enterprise Income Tax

We are subject to income, withholding, business and other taxes on income generated in the jurisdictions in which we do business.

Taiyang is exempt from corporate income tax due to the nature of its business. Beginning 2006, the PRC government instituted a tax exemption policy for certain aspects of the agricultural industry. Taiyang’s business qualifies as tax exempt. The exemption relates to unprocessed agricultural products and is granted by the relevant taxing authority on a year-by-year basis. There is no stated expiration to the exemption, and while Taiyang expects to continue to receive favorable tax treatment, changes in government policy or the nature of Taiyang’s operations could result in Taiyang being required to pay income taxes.

Ningguo is subject to corporate income tax in the PRC at a rate of 10% as a non-resident enterprise, as well as business tax at a rate of 5% on service income.

Under the laws of the BVI, Dynamic Ally is not subject to tax on its income or capital gains.

Anhui is subject to United States income tax at a rate of 35%.

Because all of the profits of Taiyang are owed to Ningguo pursuant to the Consulting Services Agreement between Taiyang and Ningguo, and all of the profits of Ningguo are in turn owed to Dynamic Ally pursuant to a similar agreement between Ningguo and Dynamic Ally, such income is subject to 5% business tax and 10% PRC non-resident income tax.

Value Added Tax

The Provisional Regulations of the PRC Concerning Value Added Tax promulgated by the State Council came into effect on January 1, 1994 and were amended in 2008. Under these regulations and the Implementing Rules of the Provisional Regulations of the PRC Concerning Value Added Tax, value added tax is imposed on goods sold in or imported into the PRC and on processing, repair and replacement services provided within the PRC.

Value added tax payable in the PRC is charged on an aggregated basis at a rate of 13% or 17% (depending on the type of goods involved) on the full price collected for the goods sold or, in the case of taxable services provided, at a rate of 17% on the charges for the taxable services provided but excluding, in respect of both goods and services, any amount paid in respect of value added tax included in the price or charges, and less any deductible value added tax already paid by the taxpayer on purchases of goods and service in the same financial year.

-7-

Taiyang has been recognized as an ordinary value added tax payer by the Development Zone Branch of State Taxation Bureau in Ningguo City since May 1, 2006, with the following exceptions:

|

●

|

According to the written certificate issued by the Development Zone Branch of State Taxation Bureau in Ningguo City on April 29, 2010, the feed products of Taiyang are exempted from value added tax; and

|

|

|

●

|

In accordance with the Provisional Regulations on value added tax, duck seedlings and duck eggs produced by Taiyang are classified as farm produce which are exempted from value added tax.

|

Business Tax

According to the Provisional Regulations of the PRC Concerning Business Tax promulgated by the State Council on December 13, 1993 and came into effect on January 1, 1994, which was revised by the State Council on November 10, 2008 and enforced from January 1, 2009, business that provides services, assigns intangible assets or sells immovable property became liable to business tax at a rate ranging from 3 to 5% of the charges of the services provided, intangible assets assigned or immovable property sold, as the case may be. Consulting services of Ningguo are subject to business tax at a rate of 5%.

WFOE

WFOEs are governed by the Law of the PRC Concerning Enterprises with Sole Foreign Investments, which was promulgated on April 12, 1986 and amended on October 31, 2000, and its Implementation Regulations promulgated on December 12, 1990 and amended on April 12,2001 (together the “Foreign Enterprises Law”).

|

(a)

|

Procedures for establishment of a WFOE

|

|

|

The establishment of a WFOE will have to be approved by the MOFCOM (or its delegated authorities). If two or more foreign investors jointly apply for the establishment of a WFOE, a copy of the contract between the parties must also be submitted to the MOFCOM (or its delegated authorities) for its record. A WFOE must also obtain a business license from the SAIC before it can commence business.

|

||

|

(b)

|

Nature

|

|

|

A WFOE is a limited liability company under the Foreign Enterprises Law. It is a legal person which may independently assume civil obligations, enjoy civil rights and has the right to own, use and dispose of property. It is required to have a registered capital contributed by the foreign investor(s). The liability of the foreign investor(s) is limited to the amount of registered capital contributed. A foreign investor may make its contributions by installments and the registered capital must be contributed within the period as approved by the MOFCOM (or its delegated authorities) in accordance with relevant regulations.

|

||

|

(c)

|

Profit distribution

|

|

|

The Foreign Enterprise Law provides that after payment of taxes, a WFOE must make contributions to a reserve fund, an enterprise development fund and an employee bonus and welfare fund. The allocation ratio for the employee bonus and welfare fund may be determined by the enterprise. However, at least 10% of the after tax profits must be allocated to the reserve fund. If the cumulative total of allocated reserve funds reaches 50% of an enterprise’s registered capital, the enterprise will not be required to make any additional contribution. The reserve fund may be used by a WFOE to make up its losses and with the consent of the examination and approval authority, can also be used to expand its production operations and to increase its capital. The enterprise is prohibited from distributing dividends unless the losses (if any) of previous years have been made up. The development fund is used for expanding the capital base of the company by way of capitalization issues. The employee bonus and welfare fund can only be used for the collective benefit and facilities of the employees of the WFOE.

|

-8-

Catalogue for the Guidance of Foreign Investment Industries

China issued the Catalogue for the Guidance of Foreign Investment Industries (“Guidance Catalogue”) in 1995, which was amended in 2002, 2004 and 2007 respectively. The current version of the Guidance Catalogue was promulgated by the MOFCOM and the National Development and Reform Commission (“NDRC”) on October 31, 2007 and became effective as of December 1, 2007, which retains the classification methodology and organizational structure used in the previous versions without significant changes. The Guidance Catalogue divides foreign investments into four categories:

(i) Encouraged Category. There are various incentives and preferential treatments for “encouraged” projects, mainly tax exemptions and rebates. Most foreign investment projects in the “encouraged” sector are allowed to take the form of WFOE;

(ii) Permitted Category. Sectors not listed therein belong to the “permitted” category and they are determined by the rule of exception. Therefore, unless the items are transferred among the “encouraged”, “restricted” and “prohibited” categories, any addition to or deletion from the “encourage”, “restricted” and “prohibited” categories would consequently affect the scope of the “permitted” category. Like those in the “encouraged” sector, foreign investment projects in the “permitted” sector are allowed to take the form of WFOE. However, they are generally not eligible for extra incentives and preferential treatments;

(iii) Restricted Category. There are stricter approvals or filing requirements for “restricted” projects. Furthermore, foreign investment projects in the “restricted” sectors may be required to take the form of Joint Venture. The foreign investors may only hold a minority interest in the investment projects; and

(iv) Prohibited Category. Foreign investments are not allowed in these sectors.

Foreign Exchange Controls

Major reforms have been introduced to the foreign exchange control system of the PRC since 1993.

On December 28, 1993, the People’s Bank of China (“PBOC”), with the authorization of the State Council issued the Notice on Further Reform of the Foreign Exchange Control System which came into effect on January 1, 1994. Other new regulations and implementation measures include the Regulations on the Foreign Exchange Settlement, Sale and Payments which were promulgated on June 20, 1996 and took effect on July 1, 1996 and which contain detailed provisions regulating the settlement, sale and payment of foreign exchange by enterprises, individuals, foreign organizations and visitors in the PRC and the regulations of the PRC on Foreign Exchange Control which were promulgated on January 1, 1996 and took effect on April 1, 1996 and which contain detailed provisions in relation to foreign exchange control.

The foreign exchange earnings of all PRC enterprises, other than those foreign investment enterprises (“FIE”), who are allowed to retain a part of their regular foreign exchange earnings or specifically exempted under the relevant regulations, are to be sold to designated banks. Foreign exchange earnings obtained from borrowings from foreign institutions or issues of shares or bonds denominated in foreign currency need not be sold to designated banks, but must be kept in foreign exchange bank accounts of designated banks unless specifically approved otherwise.

At present, control of the purchase of foreign exchange is relaxed. Enterprises within the PRC which require foreign exchange for their ordinary trading and non-trading activities, import activities and repayment of foreign debts may purchase foreign exchange from designated banks if the application is supported by the relevant documents. Furthermore, FIEs may distribute profit to their foreign investors with funds in their foreign exchange bank accounts kept with designated banks. Should such foreign exchange be insufficient, enterprises may purchase foreign exchange from designated banks upon the presentation of the resolutions of the directors on the profit distribution plan of the particular enterprise.

-9-

Although the foreign exchange control over transactions under current accounts has decreased, enterprises shall obtain approval from SAFE before they accept foreign-currency loans, provide foreign currency guarantees, make investments in foreign countries or carry out any other capital account transactions involving the purchase of foreign currencies.

In foreign exchange transactions, designated banks may freely determine applicable exchange rates based on the rates publicized by PBOC and subject to certain governmental restrictions.

On October 21, 2005, SAFE issued the Notice of the State Administration of Foreign Exchange on Exchange Control Issues Relating to Financing and Reverse Investment by Persons Resident in the People’s Republic of China Through Offshore Special Purpose Vehicles (“SAFE Notice No. 75”), which became effective as of November 1, 2005. According to the SAFE Notice No. 75, prior registration with the local SAFE branch is required for PRC residents to establish or to control an offshore company for the purposes of financing that offshore company with assets or equity interests in an onshore enterprise located in the PRC. An amendment to registration or filing with the local SAFE branch by such PRC resident is also required for the injection of equity interests or assets of an onshore enterprise in the offshore company or overseas funds raised by such offshore company, or any other material change involving a change in the capital of the offshore company.

Moreover, the SAFE Notice No. 75 applies retroactively. As a result, PRC residents who have established or acquired control of offshore companies that have made onshore investments in the PRC in the past are required to complete the relevant registration procedures with the local SAFE branch by March 31, 2006. Under the relevant rules, failure to comply with the registration procedures set forth in the SAFE Notice No. 75 may result in restrictions being imposed on the foreign exchange activities of the relevant onshore company, including the increase of its registered capital, the payment of dividends and other distributions to its offshore parent or affiliate and the capital inflow from the offshore entity, and may also subject relevant PRC residents to penalties under PRC foreign exchange administration regulations. PRC residents who control our Company from time to time are required to register with the SAFE in connection with their investments in us.

Compliance with Environmental Laws

We are required to comply with several domestic environmental protection laws and regulations, including Environmental Protection Law of the People’s Republic of China, Law of the People’s Republic of China on Prevention and Control of Water Pollution, Law of the People’s Republic of China on the Prevention and Control of Atmospheric Pollution, Law of the People’s Republic of China on the Prevention and Control of Environmental Pollution by Solid Waste, Law of the People’s Republic of China on Prevention and Control of Pollution From Environmental Noise, Law of the People’s Republic of China on Appraising of Environment Impact and Regulations on the Administration of Construction Project Environmental Protection.

In accordance with the Environmental Protection Law of the People’s Republic of China adopted by the Standing Committee of the National People’s Congress on December 26, 1989, the bureau of environmental protection of the State Council sets the national guidelines for the discharge of pollutants. The provincial and municipal governments of provinces, autonomous regions and municipalities may also set their own guidelines for the discharge of pollutants within their own provinces or districts in the event that the national guidelines are inadequate. The subdivision environmental protection laws on control of pollution of water, air, solid waste and noise set more detailed rules, standards and specifications with respect to their areas of regulation.

-10-

Pursuant to the Environmental Protection Law and its subdivision laws, a company or enterprise which causes environmental pollution and discharges other polluting materials which endanger the public should implement environmental protection methods and procedures into their business operations. This may be achieved by setting up a system of accountability within the company’s business structure for environmental protection; adopting effective procedures to prevent environmental hazards such as waste gases, water and residues, dust powder, radioactive materials and noise arising from production, construction and other activities from polluting and endangering the environment. The environmental protection system and procedures should be implemented simultaneously with the commencement of and during the operation of construction, production and other activities undertaken by the company. Any company or enterprise which discharges environmental pollutants should report and register such discharge with relevant bureaus of environmental protection and pay any fines imposed for the discharge. A fee may also be imposed on the company for the cost of any work required to restore the environment to its original state. Companies which have caused severe pollution to the environment are required to restore the environment or remedy the effects of the pollution within a prescribed time limit.

In addition, the Law of the People’s Republic of China on Appraising of Environment Impact Issued by the National People’s Congress of China which came into effect on September 1, 2003 provides the methods and institutions for analyzing, predicting and appraising the impact of operation and construction projects that might incur after they are carried out. In case a construction project of any company or enterprise fails to pass the examination, the construction may not be started. Regulations on the Administration of Construction Project Environmental Protection Issued by the State Council of China which came into effect on November 29, 1998 provide that the building of construction projects having impacts on the environment within the territory of the People’s Republic of China shall compile or submit a report on environmental impact, a statement on environmental impact or a registration form on environmental impact in accordance with the extent of environmental impact of construction projects.

Employees

As of March 31, 2011, we had four full-time employees, which are all officers. As of March 31, 2011, Taiyang had 529 full-time employees, including 213 in the Breeding Unit, 43 in the Feed Unit, and 273 in the Food Unit. We and Taiyang consider relations with our employees to be good.

|

RISK FACTORS.

|

RISKS RELATED TO OUR BUSINESS

We may be unable to sustain our past growth or manage our future growth, which may have a material adverse effect on our future operating results.

We have generally experienced growth since our inception, and realized revenues of approximately $41.7 million and $28.9 million in the years ended December 31, 2010 and 2009, respectively. If we are unable to manage our growth effectively, we may not be able to take advantage of market opportunities, develop new products, enhance our technological capabilities, satisfy customer requirements, execute our business plan or respond to competitive pressures. To effectively manage growth, we need to:

|

●

|

Hire, train, integrate and manage additional qualified technicians and breeding farm directors and sales and marketing personnel;

|

|

|

●

|

Implement additional, and improve existing, administrative, financial and operations systems, procedures and controls;

|

|

|

●

|

Continue to enhance manufacturing and customer resource management systems;

|

|

|

●

|

Continue to expand and upgrade our feed ingredient composition, poultry immunization system and breeding technology;

|

|

|

●

|

Manage multiple relationships with distributors, suppliers and certain other third parties; and

|

|

|

●

|

Manage our financial condition.

|

-11-

Our success also depends largely on our ability to anticipate and respond to expected changes in future demand for our products, and our ducks’ performance and disease resistance ability. If the timing of our expansion does not match market demand, our business strategy may need to be revised. If we over-expand and demand for our products does not increase as we may have projected, our financial results will be materially and adversely affected. However, if we do not expand, and demand for our products increases sharply, our business could be seriously harmed because we may not be as cost-effective as our competitors due to our inability to take advantage of increased economies of scale. In addition, we may not be able to satisfy the needs of current customers or attract new customers, and we may lose credibility and our relationships with our customers may be negatively affected. Moreover, if we do not properly allocate our resources in line with future demand for our products, we may miss changing market opportunities and our business and financial results could be materially and adversely affected. We cannot assure you that we will be able to successfully manage our growth in the future.

Outbreaks of poultry disease, such as avian influenza, or the perception that outbreaks may occur, can significantly restrict our ability to conduct our operations.

Taiyang takes precautions to ensure that its flocks are healthy and that its production facilities operate in a sanitary and environmentally sound manner. While Taiyang has ability and experience in product quality improvement as well as poultry disease resistance, events beyond its control, such as the outbreak of avian influenza in 2006, may restrict its ability to conduct its operations and sales. An outbreak of disease could result in governmental restrictions on the import and export of products from Taiyang’s customers, or require it to destroy one or more of its flocks. This could result in the cancellation of orders by its customers and create adverse publicity that may have a material adverse effect on our business, reputation and prospects.

Worldwide fears about avian diseases, such as avian influenza, have depressed, and may continue to adversely impact, Taiyang’s sales. Avian influenza is a respiratory disease of birds. The milder forms occur occasionally around the world. Recently, there has been substantial publicity regarding a highly pathogenic strain of avian influenza, known as H5N1, which has affected Asia since 2002. It is widely believed that H5N1 is spread by migratory birds, such as ducks and geese. There have also been some cases where H5N1 is believed to have passed from birds to humans as humans came into contact with live birds that were infected with the disease. Although there are vaccines available for H5N1 and other forms of avian influenza, and the PRC government mandates, and Taiyang vaccinates its breeding stock against avian influenza, there is no guarantee that the disease can be completely prevented as the virus continues to mutate. Taiyang’s livestock have never been infected with avian influenza. Taiyang is required to maintain an immunization permit on an annual basis issued by the provincial Animal Husbandry Bureau.

Taiyang does not typically have long-term purchase contracts with its customers and its customers have in the past and could at any time in the future, reduce or cease purchasing products from them, harming our operating results and business.

Taiyang typically does not have long-term volume purchase contracts with their customers, and they are not obligated to purchase products from Taiyang. Accordingly, their customers could at any time reduce their purchases from Taiyang or cease purchasing their products altogether. In addition, any decline in demand for Taiyang’s products and any other negative development affecting its major customers or the poultry industry in general, would likely harm our results of operations. For example, if any of Taiyang’s customers experience serious financial difficulties, it may lead to a decline in sales of Taiyang’s products to such customer and our operating results could be harmed through, among other things, decreased sales volumes and write-offs of accounts receivable related to sales to such customer.

-12-

Competition in the poultry industry with other poultry companies, especially companies with greater resources, may make us unable to compete successfully, which could adversely affect our business.

The Chinese poultry industry is highly competitive. In general, competitive factors in the Chinese duck industry include price, product quality, brand identification, breadth of product line and customer service. Taiyang’s success depends in part on its ability to manage costs and be efficient in the highly competitive poultry industry. Many of Taiyang’s competitors have greater financial and marketing resources. Because of this, we may not be able to successfully increase Taiyang’s market penetration or Taiyang’s overall share of the poultry market.

Increased competition may result in price reductions, increased sales incentive offerings, lower gross margins, sales expenses, marketing programs and expenditures to expand channels to market. Taiyang’s competitors may offer products with better market acceptance, better price or better quality. We may be adversely affected if Taiyang is unable to maintain current product cost reductions, or achieve future product cost reductions.

Taiyang competes against a number of other suppliers of ducks. Although it attempts to develop and support high-quality products that its customers demand, products developed by competing suppliers could render its products noncompetitive. If Taiyang fails to address these competitive challenges, there could be a material adverse effect upon our business, consolidated results of operations and financial condition.

Taiyang derives a significant portion of its revenues from a single distributor, the loss of which would significantly reduce Taiyang’s revenues and may impair its ability to operate profitably.

Taiyang has derived, and believes that it will continue to derive, a significant portion of its revenues from a single distributor, Yu Qigui. Revenue from Taiyang’s Feed Unit, which was $13.9 million in the year ended December 31, 2010, was almost exclusively a result of sales to this distributor. As a result, to the extent that such distributor continues to accounts for a large percentage of Taiyang’s revenue, the loss of this distributor could materially affect Taiyang’s ability to operate profitably. Since Yu Qigui accounted for approximately 33% of our revenue for the year ended December 30, 2010, the loss of this distributor would have a material adverse effect upon Taiyang’s business and may impair its ability to operate profitably.

Taiyang anticipates that this primary dependence on a single distributor will continue for the foreseeable future. There is a risk that the existing distributor will elect not to do business with us in the future or will experience financial difficulties. Furthermore, this distributor could experience financial difficulties, business reverses or the loss of orders or anticipated orders which reduces or eliminates the need for the products that it orders from Taiyang. If Taiyang does not develop relationships with new distributors, it may not be able to increase, or even maintain, its revenue, and its financial condition, results of operations, business and/or prospects may be materially adversely affected.

If demand for Taiyang’s products declines in the markets that it serves, its selling prices and overall sales will decrease. Even if the demand for its products increases, when such increase cannot outgrow the decrease in its selling price, our overall sales revenues may decrease.

Demand for Taiyang’s products is affected by a number of factors, including the general demand for the products in the end markets that it serves and the price attractiveness. A vast majority of its sales are derived directly or indirectly from end users who are duck raisers and large integrated duck companies whose duck seedling production is not sufficient for their own use. Any significant decrease in the demand for ducks may result in a decrease in Taiyang’s revenues and earnings. A variety of factors, including economic, health, regulatory, political and social instability, could contribute to a slowdown in the demand for ducks because demand for duck is highly correlated with general economic activities. As a result, even if the demand for Taiyang’s products increases, when the increase of demand cannot outgrow the decrease of selling price, our overall sales revenues may decrease.

-13-

Industry cyclicality can affect our earnings, especially due to fluctuations in commodity prices of feed ingredients and breeding stock.

Currently, all Taiyang’s raw materials are domestically procured. Profitability in the poultry industry is materially affected by the supply of parent breeding stocks and the commodity prices of feed ingredients, including corn, soybean cake, and other nutrition ingredients from numerous sources, mainly from wholesalers who collect the feed ingredients directly from farmers. As a result, the poultry industry is subject to wide fluctuations and cycles. These prices are determined by supply and demand factors. Prices for raw materials have been volatile in recent years. For instance, our average unit price for corn, one of our principal raw materials, increased from approximately $0.18 (RMB 1.44) per kilogram in 2006 to approximately $0.30 (RMB 1.97) per kilogram in March 2011, showing an increase of 67%. Historically, Taiyang’s financial results have improved when duck prices are high and feed prices are low and feed ingredients are in adequate supply. However, it is very difficult to predict when feed price spiral cycles will occur.

Various factors can affect the supply of corn and soybean meal, which are the primary ingredients of the feed Taiyang uses for parent breeding stocks. In particular, weather patterns, the level of supply inventories and demand for feed ingredients, and the agricultural policies of the Chinese government affect the supply of feed ingredients. Weather patterns often change agricultural conditions in an unpredictable manner. A sudden and significant change in weather patterns could affect supplies of feed ingredients, as well as both the industry’s and Taiyang’s ability to obtain feed ingredients, grow ducks or deliver products. Increases in the prices of feed ingredients will result in increases in raw material costs and operating costs.

Increased water, energy and gas costs would increase Taiyang’s expenses and reduce its profitability.

Taiyang requires a substantial amount, and as it expands its business it will require additional amounts, of water, electricity and natural gas to produce and process its duck products. The prices of water, electricity and natural gas fluctuate significantly over time. One of the primary competitive factors in the Chinese duck market is price, and it may not be able to pass on increased costs of production to its customers. As a result, increases in the cost of water, electricity or natural gas could substantially harm our business and results of operations.

Taiyang’s products might contain undetected defects that are not discovered until after shipping.

Although Taiyang has strict quality control over its products and it produces high-quality ducks supported by its know-how in feed ingredient composition, immunization system and breeding techniques gained through many years of business and continuous research and development, its products may contain undetected problems. Problems could result in a loss or delay in market acceptance of its products and thus harm our reputation and revenues.

The loss of key personnel or the failure to attract or retain specialized technical and management personnel could impair our ability to grow our business.

We rely heavily on the services of our key employees, including Wu Qiyou, our founder, Chief Executive Officer, and chairman of our board of directors. In addition, our engineers and other key technical personnel are a significant asset and are the source of Taiyang’s technological and product innovations. Taiyang depends substantially on the leadership of a small number of farm directors and technicians who are devoted to research and development. Additionally, all of Taiyang’s packaged food products, accounting for approximately 36% and 73% of our revenue in 2009 and 2010, respectively, are sold through third party distributors. The loss of these distributors could have a material adverse effect on our business, results of operations and financial condition. We believe Taiyang’s future success will depend upon its ability to retain these key employees and sales distributors. We may not be successful in attracting and retaining sufficient numbers of technical personnel to support Taiyang’s anticipated growth. Despite the incentives we provide, our current employees may not continue to work for Taiyang, and if additional personnel are required for Taiyang’s operations, we may not be able to obtain the services of additional personnel necessary for Taiyang’s growth. In addition, we do not maintain “key person” life insurance for any of Taiyang’s senior management or other key employees. The loss of the key employees or the inability to attract or retain qualified personnel, including technicians, could delay the development and introduction of, and have an adverse effect on Taiyang’s ability to sell, its products, as well as its overall growth.

-14-

In addition, if any other members of Taiyang’s senior management or any of its other key personnel join a competitor or form a competing company, we may not be able to replace them easily and we may lose customers, business partners, key professionals and staff members.

We have made inter-enterprise loans that may be in violation of PRC lending regulations.

As of December 31, 2010 and 2009, the Company had outstanding $4,268,057 and $2,816,943, respectively, of unsecured loans receivable from unrelated parties. These loans, and other loans made by the Company during the years ended December 31, 2009 and 2010 that were repaid prior to the end of the respective reporting period, constitute inter-enterprise lending that violate the PRC General Lending Rules. A fine in the amount of one to three times the income generated by the Company from such inter-enterprise loans may be imposed by the People’s Bank of China, at their discretion, if the Company were found to be in violation of the PRC General Lending Rules.

We do not have any registered patents or other registered intellectual property on our production processes and we may not be able to maintain the confidentiality of our processes.

While we have four design patents relating to package bags for our products, we have no patents or registered intellectual property covering our production processes and we rely on the confidentiality of our production processes in producing a competitive product. The confidentiality of our know-how may not be maintained and we may lose any meaningful competitive advantage which might arise through our proprietary processes. Due to the lack of such protection, unauthorized parties may attempt to copy or otherwise obtain and use our proprietary production technology. Monitoring unauthorized use of our production process is difficult, particularly in China. This may have a material adverse effect on our competitive advantage.

We do not presently maintain product liability insurance, and our property and equipment insurance does not cover the full value of our property and equipment, which leaves us with exposure in the event of loss or damage to our properties or claims filed against us.

We currently do not carry any product liability or other similar insurance. Unlike the U.S. and other countries, product liability claims and lawsuits are extremely rare in the PRC. However, we cannot guarantee that we would not face liability in the event of any problems with our products, including disease or contamination. We cannot assure you that, especially as China’s domestic consumer economy and industrial economy continues to expand, product liability exposures and litigation will not become more commonplace in the PRC, or that we will not face product liability exposure or actual liability as we expand our sales into international markets, like the United States, where product liability claims are more prevalent.

Except for property and automobile insurance, we do not have other insurance such as business liability or disruption insurance coverage for our operations in the PRC.

-15-

RISKS RELATED TO OUR CORPORATE STRUCTURE

We conduct our business through Taiyang by means of contractual arrangements. If the Chinese government determines that these contractual arrangements do not comply with applicable regulations, our business could be adversely affected. If the PRC regulatory bodies determine that the agreements that establish the structure for operating our business in China do not comply with PRC regulatory restrictions on foreign investment, we could be subject to severe penalties. In addition, changes in such Chinese laws and regulations may materially and adversely affect our business.

There are uncertainties regarding the interpretation and application of PRC laws, rules and regulations, including but not limited to the laws, rules and regulations governing the validity and enforcement of the contractual arrangements between Ningguo and Taiyang. Although we have been advised by our PRC counsel, that based on their understanding of the current PRC laws, rules and regulations, the structure for operating our business in China (including our corporate structure and contractual arrangements with Taiyang and its owners) comply with all applicable PRC laws, rules and regulations, and do not violate, breach, contravene or otherwise conflict with any applicable PRC laws, rules or regulations, we cannot assure you that the PRC regulatory authorities will not determine that our corporate structure and contractual arrangements violate PRC laws, rules or regulations. If the PRC regulatory authorities determine that our contractual arrangements are in violation of applicable PRC laws, rules or regulations, our contractual arrangements will become invalid or unenforceable. In addition, new PRC laws, rules and regulations may be introduced from time to time to impose additional requirements that may be applicable to our contractual arrangements. For example, the PRC Property Rights Law that became effective on October 1, 2007 may require us to register with the relevant government authority the security interests on the equity interests in Taiyang granted to us under the equity pledge agreements that are part of the contractual arrangements. If we are required to register such security interests, failure to complete such registration in a timely manner may result in such equity pledge agreements to be unenforceable against third party claims.

The Chinese government has broad discretion in dealing with violations of laws and regulations, including levying fines, revoking business and other licenses and requiring actions necessary for compliance. In particular, licenses and permits issued or granted to us by relevant governmental bodies may be revoked at a later time by higher regulatory bodies. We cannot predict the effect of the interpretation of existing or new Chinese laws or regulations on our businesses. We cannot assure you that our current ownership and operating structure would not be found in violation of any current or future Chinese laws or regulations. As a result, we may be subject to sanctions, including fines, and could be required to restructure our operations or cease to provide certain services. Any of these or similar actions could significantly disrupt our business operations or restrict us from conducting a substantial portion of our business operations, which could materially and adversely affect our business, financial condition and results of operations.

If Ningguo or Taiyang are determined to be in violation of any existing or future PRC laws, rules or regulations or fail to obtain or maintain any of the required governmental permits or approvals, the relevant PRC regulatory authorities would have broad discretion in dealing with such violations, including:

|

●

|

revoking the business and operating licenses of our PRC consolidated entities;

|

|

|

●

|

discontinuing or restricting the operations of our PRC consolidated entities;

|

|

|

●

|

imposing conditions or requirements with which we or our PRC consolidated entities may not be able to comply;

|

|

|

●

|

requiring us or our PRC consolidated entities to restructure the relevant ownership structure or operations;

|

|

|

●

|

restricting or prohibiting our use of the proceeds from our initial public offering to finance our business and operations in China; or

|

|

|

●

|

imposing fines.

|

-16-

The imposition of any of these penalties would severely disrupt our ability to conduct business and have a material adverse effect on our financial condition, results of operations and prospects.

Our contractual arrangements with Taiyang and its owners may not be as effective in providing control over these entities as direct ownership.

We have no equity ownership interest in Taiyang, and rely on contractual arrangements to control and operate Taiyang and its businesses. These contractual arrangements may not be as effective in providing control over the company as direct ownership. For example, Taiyang could fail to take actions required for our business despite its contractual obligation to do so. If Taiyang fails to perform under its agreements with us, we may have to rely on legal remedies under Chinese law, which may not be effective. In addition, we cannot assure you that the owners of Taiyang will act in our best interests.

Because we rely on the consulting services agreement with Taiyang for our revenue, the termination of this agreement will severely and detrimentally affect our continuing business viability under our current corporate structure.

We are a holding company and do not have any assets or conduct any business operations other than the contractual arrangements between Ningguo, our wholly owned subsidiary, and Taiyang. As a result, we currently rely entirely for our revenues on dividends payments from Ningguo after it receives payments from Taiyang pursuant to the consulting services agreement which forms a part of the contractual arrangements. The consulting services agreement may be terminated by written notice of Ningguo or Taiyang in the event that: (a) Taiyang causes a material breach of the agreement, provided that if the breach does not relate to a financial obligation of the breaching party, that party may attempt to remedy the breach following the receipt of the written notice; (b) one party becomes bankrupt, insolvent, is the subject of proceedings or arrangements for liquidation or dissolution, ceases to carry on business, or becomes unable to pay its debts as they become due; (c) Ningguo terminates its operations; or (d) circumstances arise which would materially and adversely affect the performance or the objectives of the agreement. Additionally, Ningguo may terminate the consulting services agreement without cause. Because neither we nor our direct and indirect subsidiaries own equity interests of Taiyang, the termination of the consulting services agreement would sever our ability to continue receiving payments from Taiyang under our current holding company structure. While we are currently not aware of any event or reason that may cause the consulting services agreement to terminate, we cannot assure you that such an event or reason will not occur in the future. In the event that the consulting services agreement is terminated, this may have a severe and detrimental effect on our continuing business viability under our current corporate structure, which in turn may affect the value of your investment.

We rely principally on dividends paid by our consolidated operating entity to fund any cash and financing requirements we may have, and any limitation on the ability of our consolidated PRC entities to pay dividends to us could have a material adverse effect on our ability to conduct our business.

We are a holding company, and rely principally on dividends paid by our consolidated PRC operating entity for cash requirements, including the funds necessary to service any debt we may incur. In particular, we rely on earnings generated by Taiyang, which are passed on to us through Ningguo. If any of our consolidated operating subsidiaries incurs debt in its own name in the future, the instruments governing the debt may restrict dividends or other distributions on its equity interest to us. In addition, the PRC tax authorities may require us to adjust our taxable income under the contractual arrangements Ningguo currently have in place with Taiyang, in a manner that would materially and adversely affect our ability to pay dividends and other distributions on our equity interest.

-17-

Furthermore, applicable PRC laws, rules and regulations permit payment of dividends by our consolidated PRC entity only out of its retained earnings, if any, determined in accordance with PRC accounting standards. Under PRC laws, rules and regulations, our consolidated PRC entities are required to set aside at least 10.0% of their after-tax profit based on PRC accounting standards each year to their statutory surplus reserve fund until the accumulative amount of such reserves reach 50.0% of their respective registered capital. As a result, our consolidated PRC entity is restricted in its ability to transfer a portion of its net income to us whether in the form of dividends, loans or advances. As of December 31, 2010, we had retained earnings of approximately $21.3 million, of which approximately $2.0 million were appropriated as statutory reserves. Our retained earnings are not distributable as cash dividends. Any limitation on the ability of our consolidated operating subsidiaries to pay dividends to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our businesses, pay dividends or otherwise fund and conduct our business.

Our Chief Executive Officer has potential conflicts of interest with us, which may adversely affect our business and your ability for recourse.