UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 001-33556

SPECTRA ENERGY PARTNERS, LP

(Exact name of registrant as specified in its charter)

Delaware | 41-2232463 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

5400 Westheimer Court, Houston, Texas | 77056 | |

(Address of principal executive offices) | (Zip Code) | |

713-627-5400

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Units Representing Limited Partner Interests | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

Estimated aggregate market value of the Common Units held by non-affiliates of the registrant at June 30, 2015: $2,607,000,000.

At January 31, 2016, there were 285,147,734 Common Units and 5,819,342 General Partner Units outstanding.

SPECTRA ENERGY PARTNERS, LP

FORM 10-K FOR THE YEAR ENDED

DECEMBER 31, 2015

TABLE OF CONTENTS

Item | Page | |

1. | ||

1A. | ||

1B. | ||

2. | ||

3. | ||

4. | ||

5. | ||

6. | ||

7. | ||

7A. | ||

8. | ||

9. | ||

9A. | ||

9B. | ||

10. | ||

11. | ||

12. | ||

13. | ||

14. | ||

15. | ||

2

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This document includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements represent management’s intentions, plans, expectations, assumptions and beliefs about future events. These forward-looking statements are identified by terms and phrases such as: anticipate, believe, intend, estimate, expect, continue, should, could, may, plan, project, predict, will, potential, forecast, and similar expressions. Forward-looking statements are subject to risks, uncertainties and other factors, many of which are outside our control and could cause actual results to differ materially from the results expressed or implied by those forward-looking statements. Factors used to develop these forward-looking statements and that could cause actual results to differ materially from those indicated in any forward-looking statement include, but are not limited to:

• | state, provincial, federal and foreign legislative and regulatory initiatives that affect cost and investment recovery, have an effect on rate structure, and affect the speed at and degree to which competition enters the natural gas and oil industries; |

• | outcomes of litigation and regulatory investigations, proceedings or inquiries; |

• | weather and other natural phenomena, including the economic, operational and other effects of hurricanes and storms; |

• | the timing and extent of changes in interest rates and foreign currency exchange rates; |

• | general economic conditions, including the risk of a prolonged economic slowdown or decline, or the risk of delay in a recovery, which can affect the long-term demand for natural gas and oil and related services; |

• | potential effects arising from terrorist attacks and any consequential or other hostilities; |

• | changes in environmental, safety and other laws and regulations; |

• | the development of alternative energy resources; |

• | results and costs of financing efforts, including the ability to obtain financing on favorable terms, which can be affected by various factors, including credit ratings and general market and economic conditions; |

• | increases in the cost of goods and services required to complete capital projects; |

• | growth in opportunities, including the timing and success of efforts to develop U.S. and Canadian pipeline, storage, gathering and other related infrastructure projects and the effects of competition; |

• | the performance of natural gas transmission, storage and gathering facilities, and crude oil transportation and storage; |

• | the extent of success in connecting natural gas and oil supplies to transmission and gathering systems and in connecting to expanding gas and oil markets; |

• | the effects of accounting pronouncements issued periodically by accounting standard-setting bodies; |

• | conditions of the capital markets during the periods covered by forward-looking statements; and |

• | the ability to successfully complete merger, acquisition or divestiture plans; regulatory or other limitations imposed as a result of a merger, acquisition or divestiture; and the success of the business following a merger, acquisition or divestiture. |

In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than Spectra Energy Partners, LP has described. Spectra Energy Partners, LP undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

3

PART I.

Item 1. Business.

The terms “we,” “our,” “us,” and “Spectra Energy Partners” as used in this report refer collectively to Spectra Energy Partners, LP and its subsidiaries unless the context suggests otherwise. These terms are used for convenience only and are not intended as a precise description of any separate legal entity within Spectra Energy Partners.

General

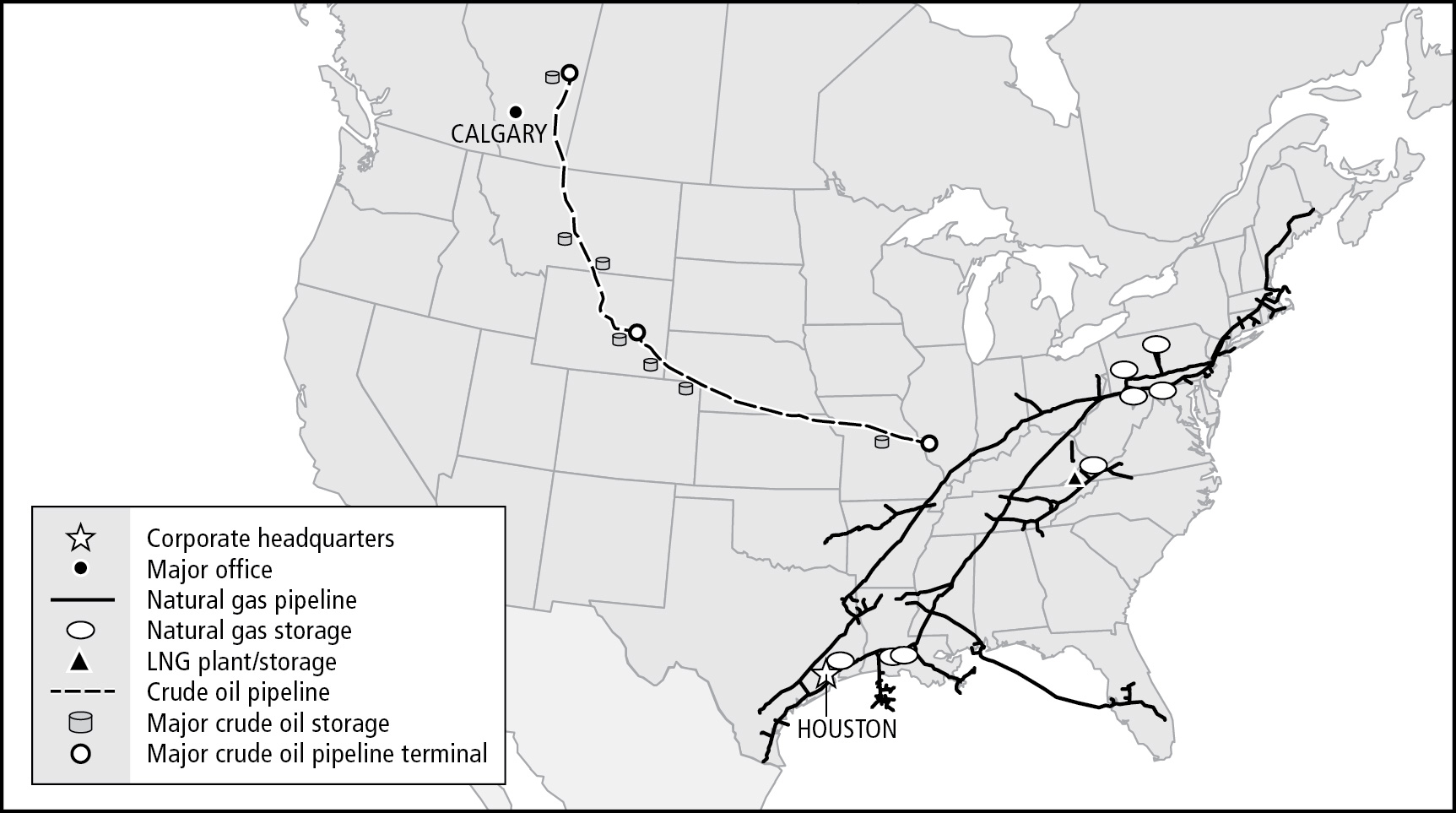

Spectra Energy Partners, LP, through its subsidiaries and equity affiliates, is engaged in the transmission, storage and gathering of natural gas, and the transportation and storage of crude oil, through interstate pipeline systems in the United States and Canada with over 15,000 miles of transmission and transportation pipelines and the storage of natural gas in underground facilities with aggregate working gas storage capacity of approximately 170 billion cubic feet (Bcf).

We own and operate natural gas transmission, gathering and storage assets, and crude oil transportation and storage assets in central, southern and eastern United States as well as western Canada. Our assets are strategically located in geographic regions of the United States and Canada where demand, primarily for natural gas used in electricity generation, and crude oil, is expected to increase steadily. We have a broad mix of customers, including local gas distribution companies (LDC), municipal utilities, interstate and intrastate pipelines, direct industrial users, electric power generators, marketers and producers, oil refineries, and exploration and production companies. Our interstate gas transmission pipeline and storage operations and our crude oil transportation and storage operations are regulated by either the Federal Energy Regulatory Commission (FERC), the U.S. Department of Transportation (DOT), or the National Energy Board (NEB) with the exception of Moss Bluff intrastate storage operations and Ozark gathering facilities, which are subject to oversight by various state commissions.

Our operations and activities are managed by our general partner, Spectra Energy Partners (DE) GP, LP, which in turn is managed by its general partner, Spectra Energy Partners GP, LLC, (the General Partner). The General Partner is wholly owned by a subsidiary of Spectra Energy Corp (Spectra Energy). Spectra Energy is a separate entity, the common stock of which trades on the New York Stock Exchange (NYSE) under the symbol “SE.” As of December 31, 2015, Spectra Energy and its subsidiaries collectively owned 78% of us and the remaining 22% was publicly owned.

In March 2013, Spectra Energy acquired 100% of the ownership interests in the Express-Platte crude oil pipeline system (Express-Platte) from third-parties. Later in 2013, we acquired a 40% ownership interest in the U.S. portion of Express-Platte

4

(Express US) and a 100% ownership interest in the Canadian portion of Express-Platte (Express Canada) (collectively, Express-Platte) from subsidiaries of Spectra Energy (the Express-Platte acquisition).

In November 2013, we acquired substantially all of Spectra Energy’s remaining U.S. transmission, storage and liquids assets, including Spectra Energy’s remaining 60% interest in Express US (the U.S. Assets Dropdown). The pipeline systems include Texas Eastern Transmission, LP (Texas Eastern), Algonquin Gas Transmission, L.L.C. (Algonquin), the remaining ownership interest in Express US, an additional 39% interest in Maritimes & Northeast L.L.C. (M&N U.S.), 33% interests in both DCP Sand Hills Pipeline, LLC (Sand Hills) and DCP Southern Hills Pipeline, LLC (Southern Hills), an additional 1% interest in Gulfstream Natural Gas System, LLC (Gulfstream) and a 24.95% interest in Southeast Supply Header, LLC (SESH). The natural gas and crude oil storage businesses include Bobcat Gas Storage (Bobcat), the remaining 50% interest in Market Hub Partners Holding (Market Hub), a 49% interest in Steckman Ridge, LP (Steckman Ridge), and Texas Eastern's and Express-Platte's storage facilities.

In November 2014, we completed the second of the three planned transactions related to the U.S. Assets Dropdown. This transaction consisted of acquiring an additional 24.95% ownership interest in SESH and an additional 1% interest in Steckman Ridge from Spectra Energy.

The final transaction related to the U.S. Assets Dropdown occurred on November 4, 2015, and consisted of the acquisition of Spectra Energy's remaining 0.1% interest in SESH.

On October 30, 2015, Spectra Energy acquired our 33.3% ownership interests in Sand Hills and Southern Hills.

The Express-Platte acquisition and the U.S. Assets Dropdown have been accounted for as acquisitions under common control, resulting in the recast of our prior results. See Note 2 of Notes to Consolidated Financial Statements for further discussion of the transactions.

Businesses

We manage our business in two reportable segments: U.S. Transmission, and Liquids. The remainder of our business operations is presented as “Other,” and consists mainly of certain corporate costs. The following sections describe the operations of each of our businesses. For financial information on our business segments, see Note 4 of Notes to Consolidated Financial Statements.

U.S. Transmission

Our U.S. Transmission business primarily provides transmission, storage, and gathering of natural gas for customers in various regions of the northeastern and southeastern United States. Our pipeline systems consist of approximately 14,000 miles of pipelines with eight primary transmission systems: Texas Eastern, Algonquin, East Tennessee Natural Gas, LLC (East Tennessee), M&N U.S., Ozark Gas Transmission, L.L.C. (Ozark Gas Transmission), Big Sandy Pipeline, L.L.C (Big Sandy), Gulfstream and SESH. The pipeline systems in our U.S. Transmission business receive natural gas from major North American producing regions for delivery to their respective markets. A majority of contracted transportation volumes are under long-term firm service agreements, where customers reserve capacity in the pipeline. Interruptible services, where customers can use capacity if it is available at the time of the request, are provided on a short-term or seasonal basis.

U.S. Transmission provides natural gas storage services through Saltville Gas Storage Company L.L.C. (Saltville), Market Hub, Steckman Ridge, Bobcat and Texas Eastern’s facilities. Gathering services are provided through Ozark Gas Gathering, L.L.C. (Ozark Gas Gathering). In the course of providing transportation services, U.S. Transmission also processes natural gas on our Texas Eastern system.

Demand on the natural gas pipeline and storage systems is seasonal, with the highest throughput occurring during colder periods in the first and fourth quarters, and storage injections occurring primarily during the summer periods. Actual throughput and storage injections/withdrawals do not have a significant effect on revenues or earnings.

Most of U.S. Transmission’s pipeline and storage operations are regulated by the FERC and are subject to the jurisdiction of various federal, state and local environmental agencies.

5

Texas Eastern

The Texas Eastern natural gas transmission system extends approximately 1,700 miles from producing fields in the Gulf Coast region of Texas and Louisiana to Ohio, Pennsylvania, New Jersey and New York. It consists of two parallel systems, the first of which has one to four large-diameter parallel pipelines and the other with one to three large-diameter pipelines. Texas Eastern’s onshore system consists of approximately 8,700 miles of pipeline and associated compressor stations (facilities that increase the pressure of gas to facilitate its pipeline transmission). Texas Eastern also owns and operates two offshore Louisiana pipeline systems, which extend approximately 100 miles into the Gulf of Mexico and include approximately 400 miles of pipeline. Texas Eastern has two storage facilities in Pennsylvania held through joint ventures and one 100%-owned and operated storage facility in Maryland. Texas Eastern’s total working joint venture capacity in these three facilities is 74 Bcf. In addition, Texas Eastern’s system is connected to Steckman Ridge, a 12 Bcf joint venture storage facility in Pennsylvania, and three affiliated storage facilities in Texas and Louisiana, aggregating 77 Bcf, owned by Market Hub and Bobcat.

6

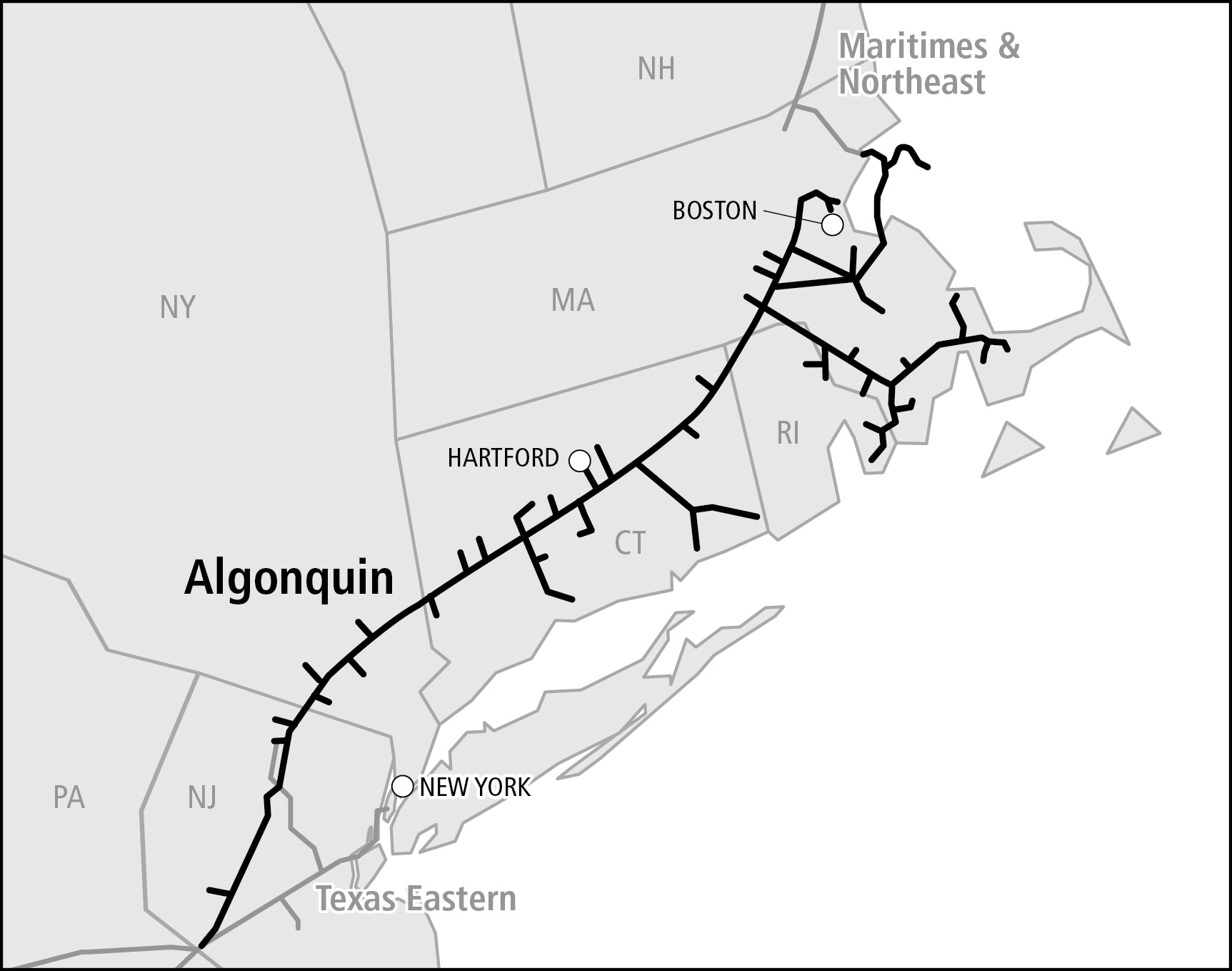

Algonquin

The Algonquin natural gas transmission system connects with Texas Eastern’s facilities in New Jersey and extends approximately 250 miles through New Jersey, New York, Connecticut, Rhode Island and Massachusetts where it connects to M&N U.S. The system consists of approximately 1,130 miles of pipeline with associated compressor stations.

7

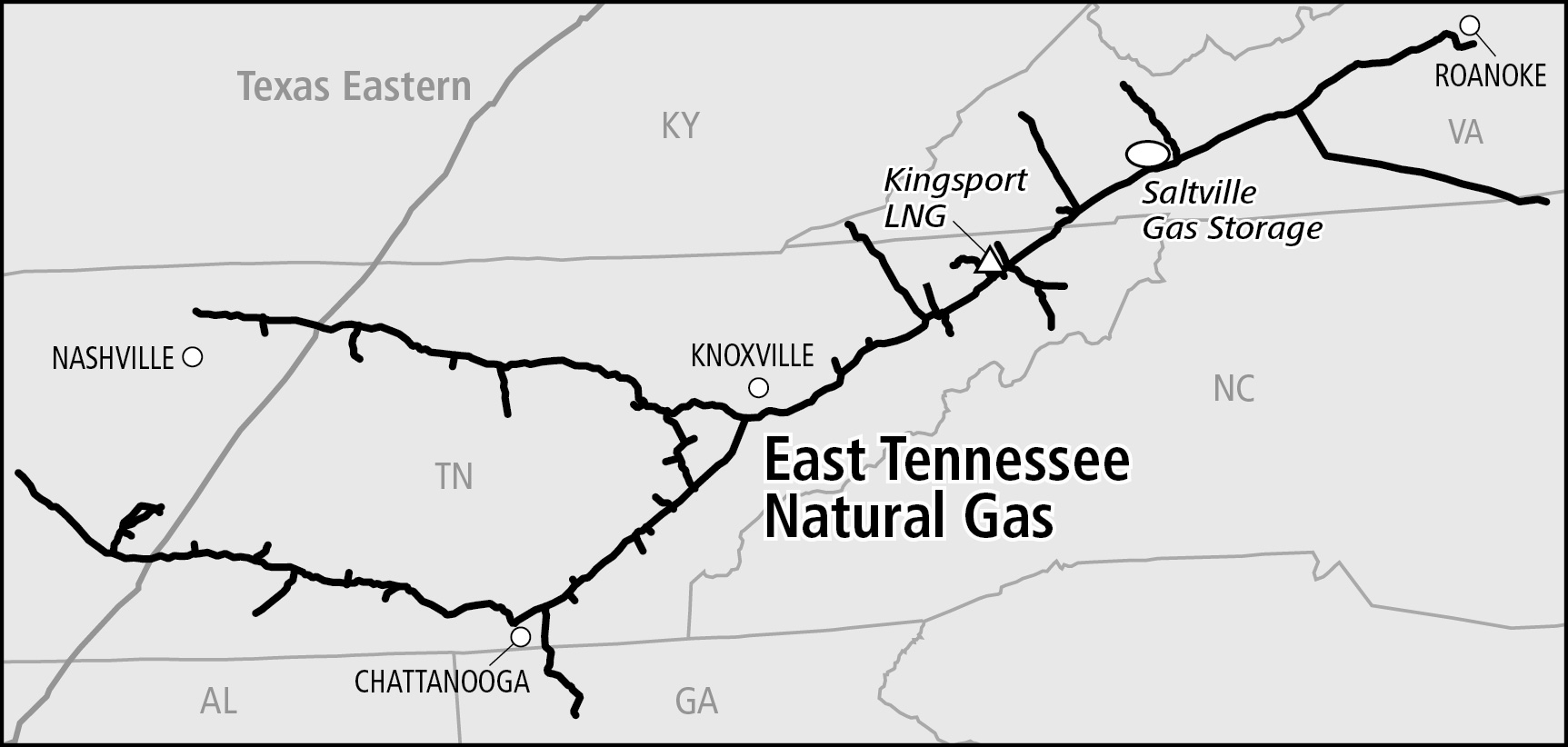

East Tennessee

East Tennessee’s natural gas transmission system crosses Texas Eastern’s system at two locations in Tennessee and consists of two mainline systems totaling approximately 1,500 miles of pipeline in Tennessee, Georgia, North Carolina and Virginia, with associated compressor stations. East Tennessee has a liquefied natural gas, (LNG), natural gas that has been converted to liquid form, storage facility in Tennessee with a total working capacity of 1 Bcf. East Tennessee also connects to the Saltville storage facilities in Virginia that have a working gas capacity of approximately 5 Bcf.

8

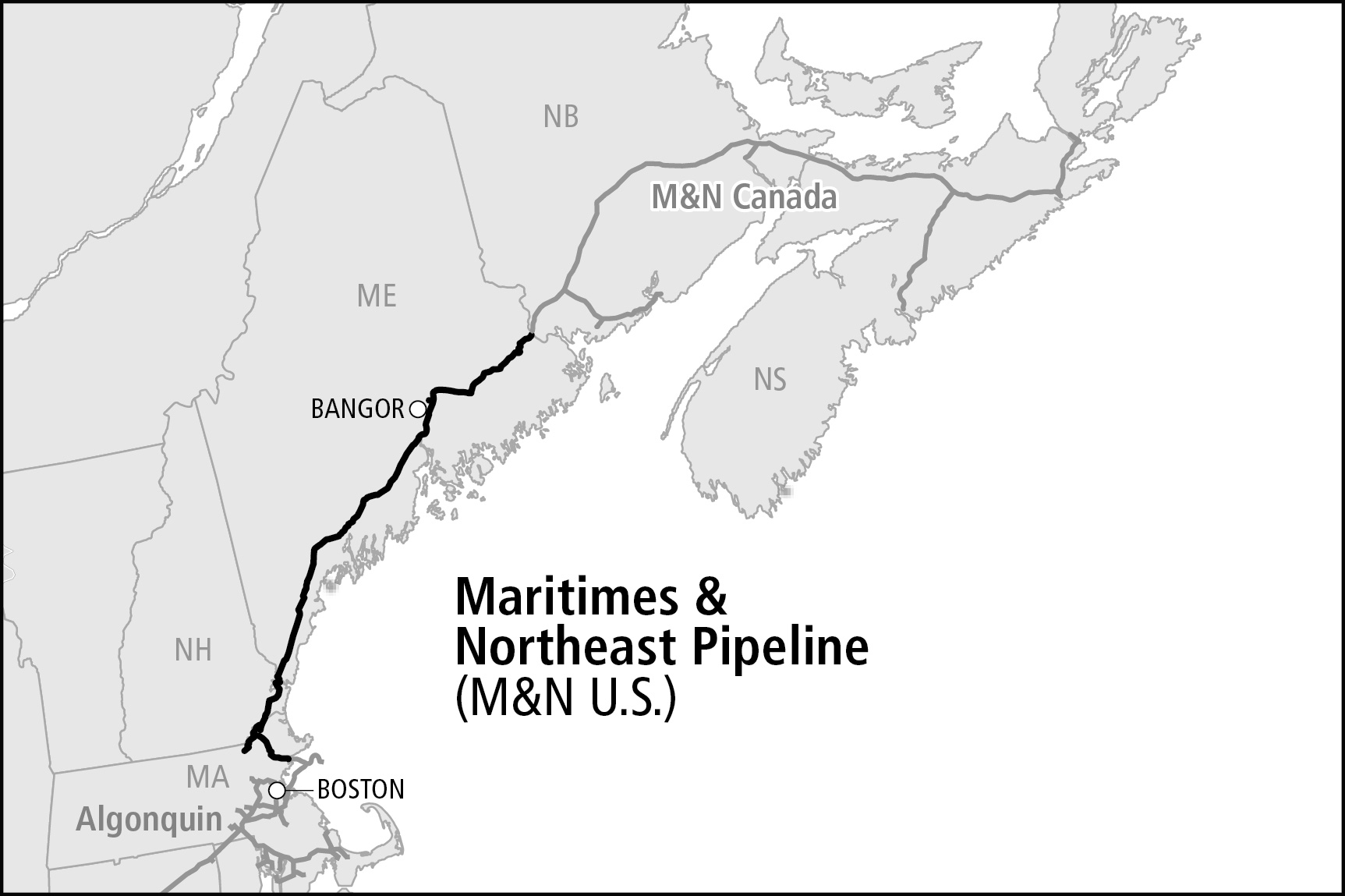

Maritimes & Northeast Pipeline

We acquired 39% of M&N U.S. from Spectra Energy in 2012. In 2013, Spectra Energy contributed its remaining 39% ownership in M&N U.S. to us in the U.S. Assets Dropdown. M&N U.S. is owned 78% directly by us, with affiliates of Emera, Inc. and Exxon Mobil Corporation directly owning the remaining 13% and 9% interests, respectively. M&N U.S. is an approximately 350-mile mainline interstate natural gas transmission system which extends from the border of Canada near Baileyville, Maine to northeastern Massachusetts. M&N U.S. is connected to the Canadian portion of the Maritimes & Northeast Pipeline system, Maritimes & Northeast Pipeline Limited Partnership, which is owned 78% by Spectra Energy. M&N U.S. facilities include compressor stations, with a market delivery capability of approximately 0.8 billion cubic feet per day (Bcf/d) of natural gas. The pipeline’s location and key interconnects with our transmission system link regional natural gas supplies to the northeast U.S. markets.

9

Ozark

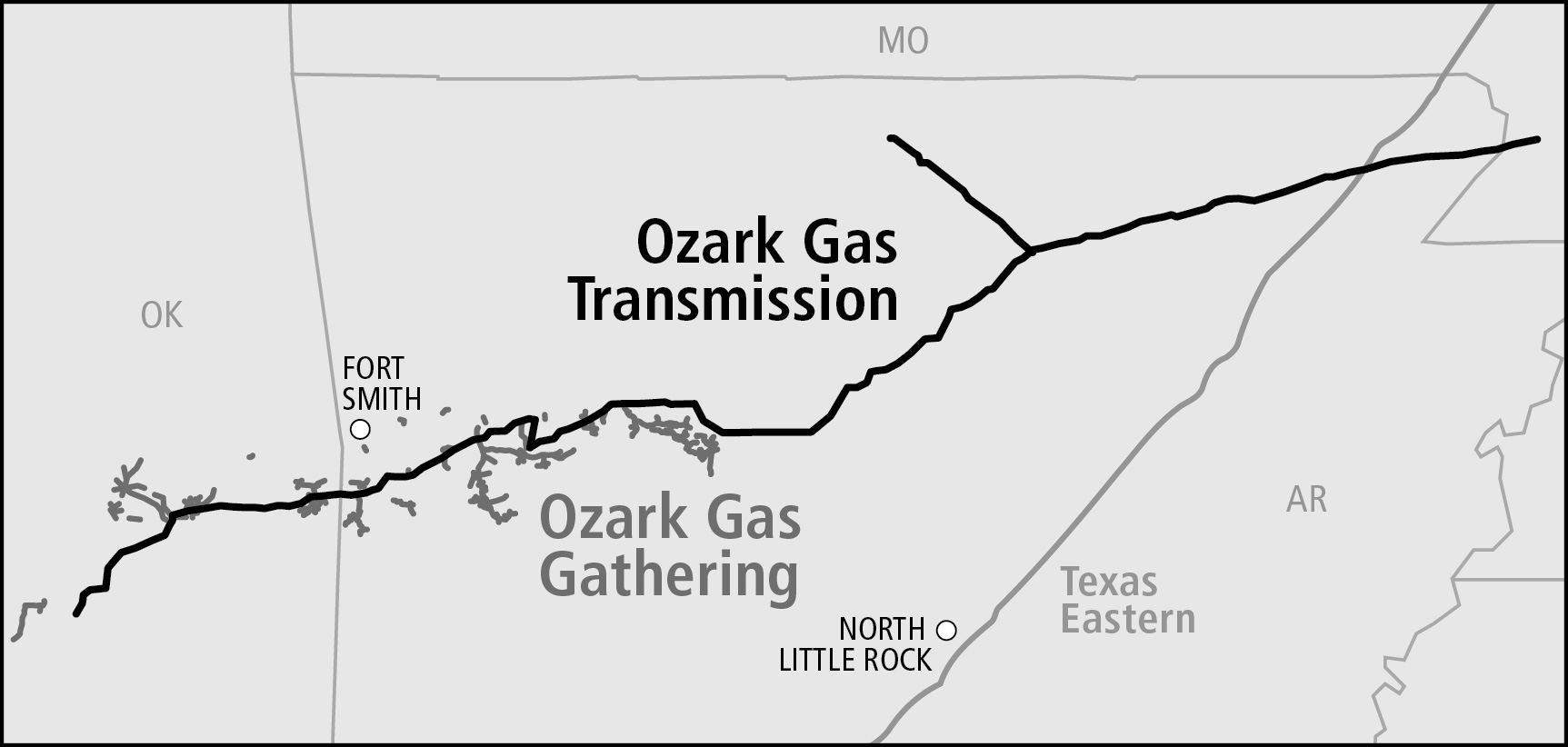

Ozark Gas Transmission consists of an approximately 365-mile natural gas transmission system extending from southeastern Oklahoma through Arkansas to southeastern Missouri. Ozark Gas Gathering consists of an approximately 330-mile natural gas gathering system, with associated compressor stations, that primarily serves Arkoma basin producers in eastern Oklahoma.

10

Big Sandy

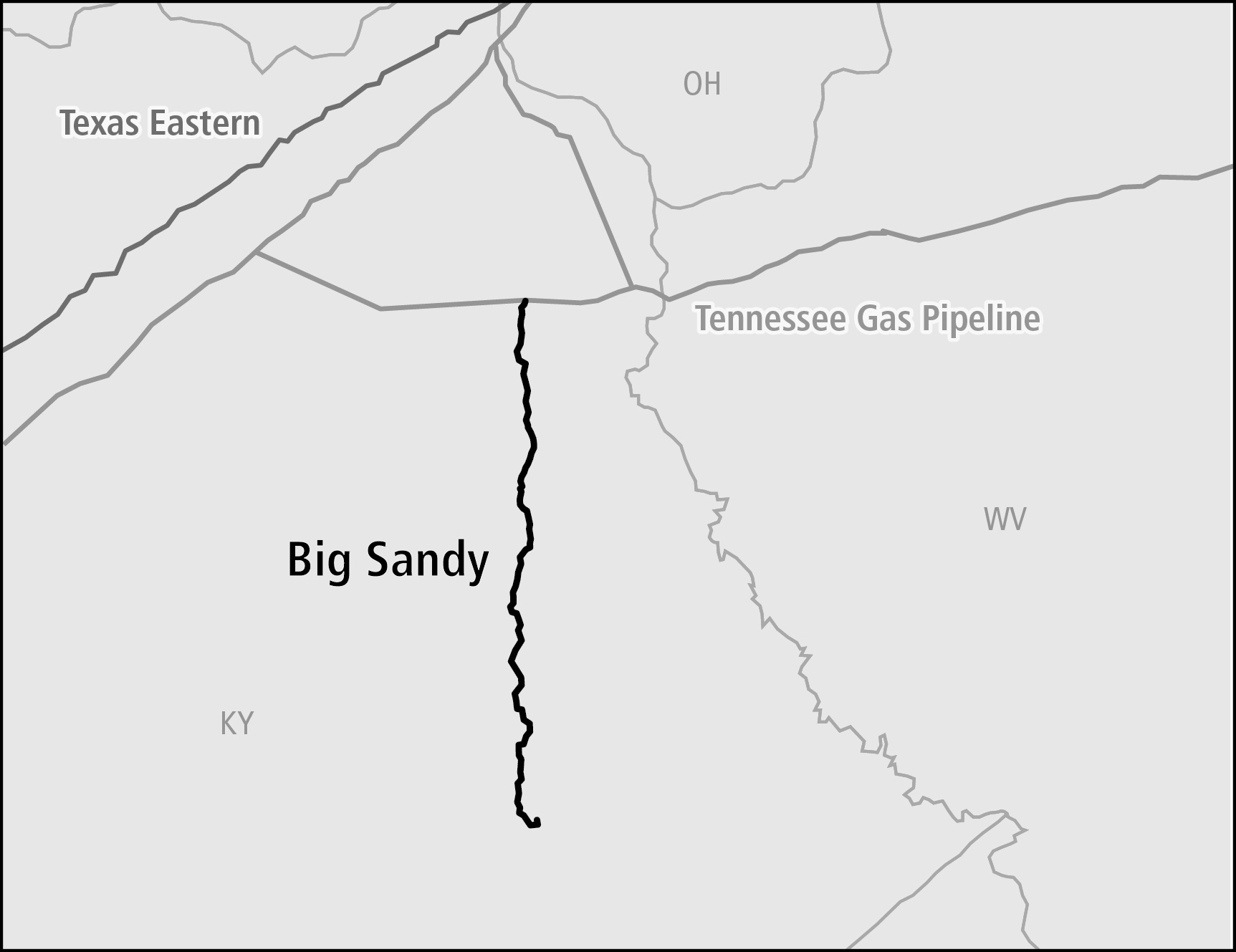

We acquired Big Sandy in 2011. Big Sandy is an approximately 70-mile natural gas transmission system, with associated compressor stations, located in eastern Kentucky. Big Sandy’s interconnection with the Tennessee Gas Pipeline system links the Huron Shale and Appalachian Basin natural gas supplies to the mid-Atlantic and northeast markets.

11

Gulfstream

In 2013, Spectra Energy contributed its remaining 1% ownership in Gulfstream to us in the U.S. Assets Dropdown to increase our ownership to 50%. Gulfstream is an approximately 745-mile interstate natural gas transmission system, with associated compressor stations, operated jointly by us and The Williams Companies, Inc. (Williams). Gulfstream transports natural gas from Mississippi, Alabama, Louisiana and Texas, crossing the Gulf of Mexico to markets in central and southern Florida. Gulfstream is owned 50% directly by us and 50% by affiliates of Williams. Our investment in Gulfstream is accounted for under the equity method of accounting.

12

SESH

SESH, an approximately 290-mile natural gas transmission system, with associated compressor stations, is operated jointly by Spectra Energy and CenterPoint Energy Southeastern Pipelines Holding, LLC (CenterPoint). SESH extends from the Perryville Hub in northeastern Louisiana where the emerging shale gas production of eastern Texas, northern Louisiana and Arkansas, along with conventional production, is reached from five major interconnections. SESH extends to Alabama, interconnecting with 14 major north-south pipelines and three high-deliverability storage facilities. SESH is owned 50% directly by us and 50% by Enable Midstream Partners, LP, collectively. Our investment in SESH is accounted for under the equity method of accounting.

Market Hub

Market Hub owns and operates two natural gas storage facilities, Moss Bluff and Egan, with a total storage capacity of approximately 47 Bcf. The Moss Bluff facility consists of four salt dome storage caverns located in southeast Texas, with access to five pipeline systems including the Texas Eastern system. The Egan facility consists of four salt dome storage caverns located in south central Louisiana, with access to ten pipeline systems, including the Texas Eastern system.

Saltville

Saltville owns and operates natural gas storage facilities in Virginia with a total storage capacity of approximately 5 Bcf, interconnecting with East Tennessee’s system. This salt cavern facility offers high-deliverability capabilities and is strategically located near markets in Tennessee, Virginia and North Carolina.

Bobcat

Bobcat, an approximately 30 Bcf salt dome facility, is strategically located on the Gulf Coast near Henry Hub, interconnecting with five major interstate pipelines, including Texas Eastern.

13

Steckman Ridge

Steckman Ridge is an approximately 12 Bcf depleted reservoir storage facility located in south central Pennsylvania that interconnects with the Texas Eastern and Dominion Transmission, Inc. systems. Steckman Ridge is owned 50% by us and 50% by NJR Steckman Ridge Storage Company. Our investment in Steckman Ridge is accounted for under the equity method of accounting.

Competition

Our natural gas transmission and storage businesses compete with similar facilities that serve our supply and market areas in the transmission and storage of natural gas. The principal elements of competition are location, rates, terms of service, flexibility and reliability of service.

The natural gas transported in our transmission business competes with other forms of energy available to our customers and end-users, including electricity, coal, propane and fuel oils. Factors that influence the demand for natural gas include price changes, the availability of natural gas and other forms of energy, levels of business activity, long-term economic conditions, conservation, legislation, governmental regulations, the ability to convert to alternative fuels, weather and other factors.

Customers and Contracts

In general, our natural gas pipelines provide transmission and storage services for LDCs (companies that obtain a major portion of their revenues from retail distribution systems for the delivery of natural gas for ultimate consumption), electric power generators, exploration and production companies, and industrial and commercial customers, as well as energy marketers. Transmission and storage services are generally provided under firm agreements where customers reserve capacity in pipelines and storage facilities. The vast majority of these agreements provide for fixed reservation charges that are paid monthly regardless of the actual volumes transported on the pipelines or injected or withdrawn from our storage facilities, plus a small variable component that is based on volumes transported, injected or withdrawn, which is intended to recover variable costs.

We also provide interruptible transmission and storage services where customers can use capacity if it is available at the time of the request. Interruptible revenues depend on the amount of volumes transported or stored and the associated rates for this interruptible service. New projects placed into service may initially have higher levels of interruptible services at inception. Storage operations also provide a variety of other value-added services including natural gas parking, loaning and balancing services to meet our customers’ needs.

Liquids

Our Liquids business provides transportation and storage of crude oil for customers in central United States and Canada. Our Liquids pipeline system consists of Express-Platte.

Most of Liquids’ pipeline and storage operations are regulated by the FERC and the NEB, and are subject to the jurisdiction of various federal, state and local environmental agencies.

14

Express-Platte

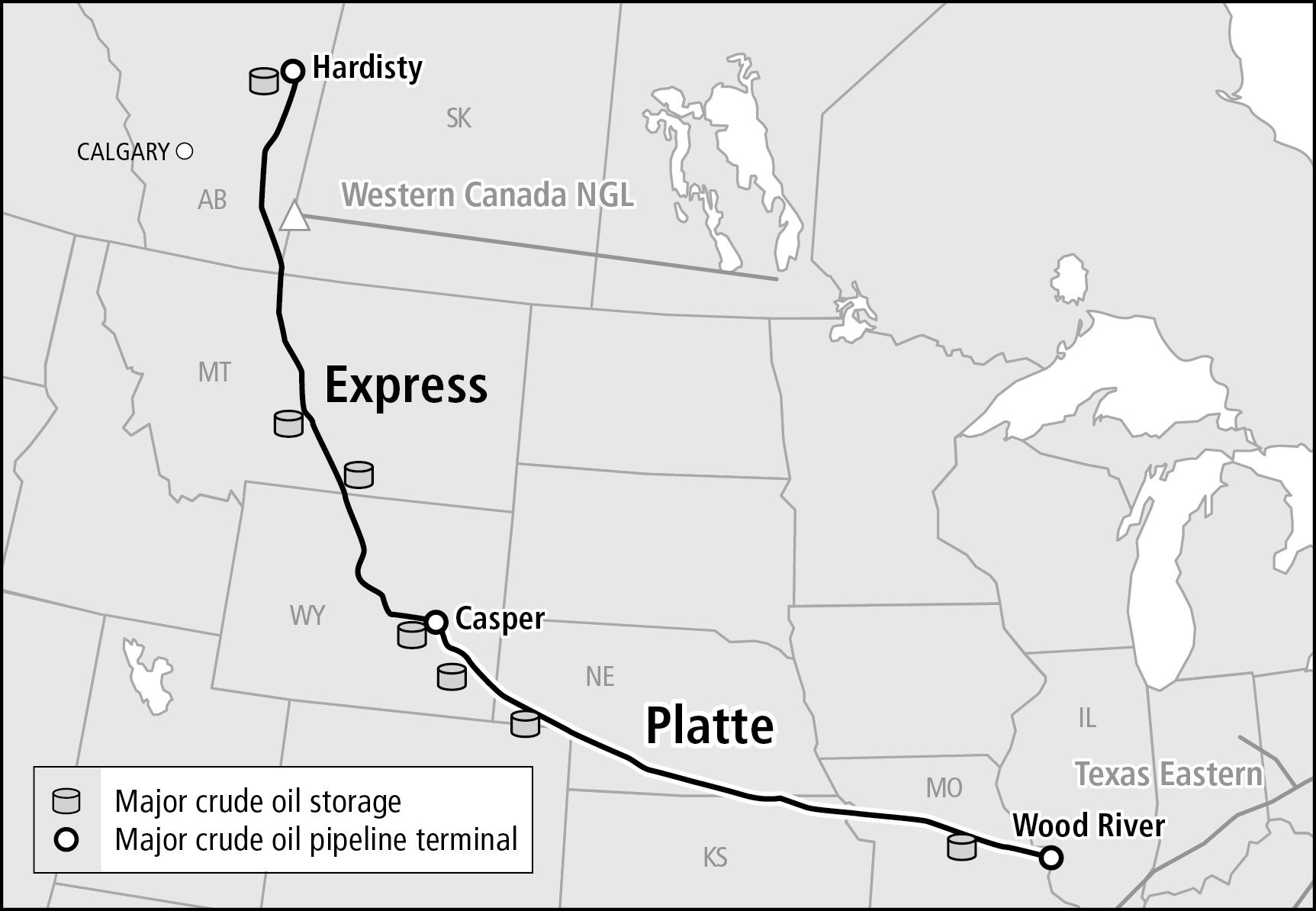

We acquired Express-Platte in 2013. The Express-Platte pipeline system, an approximately 1,700-mile crude oil transportation system, which begins in Hardisty, Alberta, and terminates in Wood River Illinois, is comprised of both the Express and Platte crude oil pipelines. The Express pipeline carries crude oil to U.S. refining markets in the Rockies area, including Montana, Wyoming, Colorado and Utah. The Platte pipeline, which interconnects with the Express pipeline in Casper, Wyoming transports crude oil predominantly from the Bakken shale and western Canada to refineries in the Midwest.

Competition

Our crude oil transportation business competes with pipelines, rail, truck and barge facilities that transport crude oil from production areas to refinery markets. The principal elements of competition are location, rates, terms of service, flexibility and reliability of service.

Customers and Contracts

Customers on the Express-Platte system are primarily refineries located in the Rocky Mountain and Midwestern states of the United States. Other customers include oil producers and marketing entities. Express capacity is typically contracted under long-term committed contracts where customers reserve capacity and pay commitment charges based on a contracted volume even if they do not ship. A small amount of Express capacity and all Platte capacity is used by uncommitted shippers who only pay for the pipeline capacity that is actually used in a given month.

Supplies and Raw Materials

We purchase a variety of manufactured equipment and materials for use in operations and expansion projects. The primary equipment and materials utilized in operations and project execution processes are steel pipe, compression engines, pumps, valves, fittings, gas meters and other consumables.

15

We utilize Spectra Energy’s supply chain management function which operates a North American supply chain management network. The supply chain management group uses the economies-of-scale of Spectra Energy to maximize the efficiency of supply networks where applicable. The price of equipment and materials may vary however, perhaps substantially, from year to year.

Regulations

Most of our U.S. gas transmission, crude oil transportation pipeline and storage operations are regulated by the FERC. The FERC regulates natural gas transmission and crude oil transportation in U.S. interstate commerce including the establishment of rates for services. The FERC also regulates the construction of U.S. interstate natural gas pipelines and storage facilities, including the extension, enlargement and abandonment of facilities. In addition, certain operations are subject to oversight by state regulatory commissions. To the extent that the natural gas intrastate pipelines that transport or store natural gas in interstate commerce provide services under Section 311 of the Natural Gas Policy Act of 1978, they are subject to FERC regulations. The FERC may propose and implement new rules and regulations affecting interstate natural gas transmission and storage companies, which remain subject to the FERC’s jurisdiction. These initiatives may also affect certain transmission of gas by intrastate pipelines.

Our gas transmission and storage operations are subject to the jurisdiction of the Environmental Protection Agency (EPA) and various other federal, state and local environmental agencies. See “Environmental Matters” for a discussion of environmental regulation. Our interstate natural gas pipelines are also subject to the regulations of the DOT concerning pipeline safety.

Express-Platte pipeline system rates and tariffs are subject to regulation by the NEB in Canada and the FERC in the United States. In addition, the Platte pipeline also operates as an intrastate pipeline in Wyoming and is subject to jurisdiction by the Wyoming Public Service Commission.

Under current policy, the FERC permits pipelines and storage companies to include a tax allowance in the cost-of-service used as the basis for calculating their regulated rates. For pipelines and storage companies owned by partnerships or limited liability company interests, the tax allowance will reflect the actual or potential income tax liability on the FERC jurisdictional income attributable to all partnership or limited liability company interests if the ultimate owner of the interest has an actual or potential income tax liability on such income. This policy was upheld in 2007 by the Court of Appeals for the District of Columbia Circuit. Whether the owners of a pipeline or storage company have such actual or potential income tax liability will be reviewed by the FERC on a case-by-case basis. In a future rate case, the pipelines and storage companies in which we own an interest may be required to demonstrate the extent to which inclusion of an income tax allowance in the applicable cost-of-service is permitted under the current income tax allowance policy. Some entities have authority to charge market-based rates and therefore this tax allowance issue does not affect the rates that they charge their customers.

16

Environmental Matters

We are subject to various U.S. federal, state and local laws and regulations, as well as Canadian federal and provincial regulations regarding air and water quality, hazardous and solid waste disposal and other environmental matters.

Environmental laws and regulations affecting our U.S. based operations include, but are not limited to:

• | The Clean Air Act (CAA) and the 1990 amendments to the CAA, as well as state laws and regulations affecting air emissions (including State Implementation Plans related to existing and new national ambient air quality standards), which may limit new sources of air emissions. Our natural gas transmission, storage and gathering assets are considered sources of air emissions and are thereby subject to the CAA. Owners and/or operators of air emission sources, like us, are responsible for obtaining permits for existing and new sources of air emissions and for annual compliance and reporting. |

• | The Federal Water Pollution Control Act (Clean Water Act), which requires permits for facilities that discharge wastewaters into the environment. The Oil Pollution Act (OPA) amended parts of the Clean Water Act and other statutes as they pertain to the prevention of and response to oil spills. The OPA imposes certain spill prevention, control and countermeasure requirements. Although we are primarily a natural gas business, the OPA affects our business primarily because of the presence of liquid hydrocarbons (condensate) in our offshore pipelines. |

• | The Comprehensive Environmental Response, Compensation and Liability Act (CERCLA), which imposes liability for remediation costs associated with environmentally contaminated sites. Under CERCLA, any individual or entity that currently owns or in the past owned or operated a disposal site can be held liable and required to share in remediation costs, as well as transporters or generators of hazardous substances sent to a disposal site. Because of the geographical extent of our operations, we have disposed of waste at many different sites and therefore have CERCLA liabilities. |

• | The Solid Waste Disposal Act, as amended by the Resource Conservation and Recovery Act, which requires certain solid wastes, including hazardous wastes, to be managed pursuant to a comprehensive regulatory regime. As part of our business, we generate solid waste within the scope of these regulations and therefore must comply with such regulations. |

• | The Toxic Substances Control Act, which requires that polychlorinated biphenyl (PCB) contaminated materials be managed in accordance with a comprehensive regulatory regime. Because of the historical use of lubricating oils containing PCBs, the internal surfaces of some of our pipeline systems are contaminated with PCBs, and liquids and other materials removed from these pipelines must be managed in compliance with such regulations. |

• | The National Environmental Policy Act, which requires federal agencies to consider potential environmental effects in their decisions, including site approvals. Many of our capital projects require federal agency review, and therefore the environmental effects of proposed projects are a factor in determining whether we will be permitted to complete proposed projects. |

Environmental laws and regulations affecting our Canadian-based operations include, but are not limited to:

• | The Canadian Environmental Protection Act, which, among other things, requires the reporting of greenhouse gas (GHG) emissions from our operations in Canada. Additional regulations to be promulgated under this Act may require the reduction of GHGs, nitrogen oxides, sulphur oxides, volatile organic compounds and particulate matter. |

• | The Canadian Environmental Assessment Act, 2012 (CEAA 2012) requires the NEB to consider potential environmental effects in their decisions for designated projects. The NEB under its enabling statute also conducts environmental assessments for projects that are not specifically designated under CEAA 2012. In either case, prior to receiving an approval to construct or operate a federally-regulated pipeline or facility, the NEB must consider a series of environmental factors, in particular whether the project has the potential to have adverse environmental effects. These types of assessments occur in relation to both maintenance and capital projects. |

For more information on environmental matters, including possible liability and capital costs, see Part II. Item 8. Financial Statements and Supplementary Data, Notes 5 and 16 of Notes to Consolidated Financial Statements.

Except to the extent discussed in Notes 5 and 16, compliance with international, federal, state, provincial and local provisions regulating the discharge of materials into the environment, or otherwise protecting the environment, is incorporated into the routine cost structure of our partnership and is not expected to have a material effect on our competitive position or consolidated results of operations, financial position or cash flows.

17

Geographic Regions

For a discussion of our Canadian operations and the risks associated with them, see Notes 4 and 15 of Notes to Consolidated Financial Statements.

Employees

We do not have any employees. We are managed by the directors and officers of our general partner. As of December 31, 2015, our general partner and its affiliates have approximately 2,400 employees performing services for our operations, and are solely responsible for providing the employees and other personnel necessary to conduct our operations.

Our Partnership Agreement

Set forth below is a summary of the material provisions of our partnership agreement that relate to available cash and operating surplus:

Available Cash. For any quarter ending prior to liquidation:

(a) the sum of:

(1) all cash and cash equivalents of the partnership and our subsidiaries on hand at the end of that quarter; and

(2) if our general partner so determines, all or a portion of any additional cash or cash equivalents of our partnership and our subsidiaries on hand on the date of determination of Available Cash for that quarter;

(b) less the amount of cash reserves established by our general partner to:

(1) provide for the proper conduct of the business of the partnership and our subsidiaries (including reserves for future capital expenditures and for future credit needs of the partnership and our subsidiaries) after that quarter;

(2) comply with applicable law or any debt instrument or other agreement or obligation to which we or any of our subsidiaries or a part of our assets are subject; and

(3) provide funds for minimum quarterly distributions and cumulative common unit arrearages for any one or more of the next four quarters;

provided, however, that our general partner may not establish cash reserves pursuant to clause (b)(3) immediately above unless our general partner has determined that the establishment of reserves will not prevent us from distributing the minimum quarterly distribution on all common units and any cumulative common unit arrearages thereon for that quarter; and provided, further, that disbursements made by us or any of our subsidiaries or cash reserves established, increased or reduced after the end of that quarter but on or before the date of determination of Available Cash for that quarter shall be deemed to have been made, established, increased or reduced, for purposes of determining Available Cash, within that quarter if our general partner so determines.

Operating Surplus. For any period prior to liquidation, on a cumulative basis and without duplication:

(a) the sum of:

(1) an amount equal to the sum of (A) two times the amount needed for any one quarter for us to pay the minimum quarterly distribution on all units (including the general partner units) and (B) two times the amount in excess of the minimum quarterly distribution for any quarter to pay a distribution on all Common Units at the same per unit amount as was distributed on the Common Units in excess of the minimum quarterly distribution in the immediately preceding quarter, provided the amount in (B) will be deemed to be Operating Surplus only to the extent that the distribution paid in respect of such amounts is paid on Common Units, and

(2) all cash receipts of our partnership and our subsidiaries for the period beginning on the closing date of our initial public offering and ending with the last day of the period, other than cash receipts from interim capital transactions; less

18

(b) the sum of:

(1) operating expenditures for the period beginning on the closing date of our initial public offering and ending with the last day of that period; and

(2) the amount of cash reserves (or our proportionate share of cash reserves in the case of subsidiaries that are not wholly owned) established by our general partner to provide funds for future operating expenditures; provided however, that disbursements made (including contributions to us or our subsidiaries or disbursements on behalf of us or our subsidiaries) or cash reserves established, increased or reduced after the end of that period but on or before the date of determination of Available Cash for that period shall be deemed to have been made, established, increased or reduced for purposes of determining operating surplus, within that period if our general partner so determines.

Additional Information

We were formed on March 19, 2007 as a Delaware master limited partnership. Our principal executive offices are located at 5400 Westheimer Court, Houston, Texas 77056 and our telephone number is 713-627-5400. We electronically file various reports with the Securities and Exchange Commission (SEC), including annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to such reports. The public may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an internet site that contains reports and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov. Additionally, information about us, including our reports filed with the SEC, is available through our website at http://www.spectraenergypartners.com. Such reports are accessible at no charge through our website and are made available as soon as reasonably practicable after such material is filed with or furnished to the SEC. Our website and the information contained on that site, or connected to that site, are not incorporated by reference into this report.

19

Item 1A. Risk Factors.

Discussed below are the material risk factors relating to us.

Risks Related to our Business

We may not have sufficient cash from operations to enable us to make cash distributions to common unitholders.

In order to make cash distributions at our minimum distribution rate of $0.30 per common unit per quarter, or $1.20 per unit per year, we will require Available Cash of approximately $87 million per quarter, or $349 million per year, depending on the actual number of common units outstanding. We may not have sufficient Available Cash from operating surplus each quarter to enable us to make cash distributions at the minimum distribution rate. The amount of cash we can distribute on our units principally depends upon the amount of cash we generate from operations, which will fluctuate based on, among other things:

• | the rates charged to, and the volumes contracted by customers for natural gas transmission, storage and gathering services and crude oil transportation; |

• | the overall demand for natural gas in the southeastern, mid-Continent, and Northeast regions of the United States, and the quantities of natural gas available for transport, especially from the Gulf of Mexico, Appalachian and mid-Continent areas, as well as the overall demand for crude oil in central United States and Canada; |

• | regulatory action affecting the demand for natural gas and crude oil, the supply of natural gas and crude oil, the rates we can charge, contracts for services, existing contracts, operating costs and operating flexibility; |

• | changes in environmental, safety and other laws and regulations; |

• | regulatory and economic limitations on the development of import and export LNG terminals in the Gulf Coast region; and |

• | the level of operating and maintenance, and general and administrative costs. |

In addition, the actual amount of Available Cash will depend on other factors, some of which are beyond our control, including:

• | the level of capital expenditures to complete construction projects; |

• | the cost and form of payment of acquisitions; |

• | debt service requirements and other liabilities; |

• | fluctuations in working capital needs; |

• | the ability to borrow funds and access capital markets; |

• | restrictions on distributions contained in debt agreements; and |

• | the amount of cash reserves established by our general partner. |

Our subsidiaries and equity investments conduct operations and own our operating assets, which may affect our ability to make distributions to our unitholders. In addition, we cannot control the amount of cash that will be received from our equity investments, and we may be required to contribute significant cash to fund their operations.

We are a partnership holding company and our operating subsidiaries conduct all of our operations and own all of our operating assets. We have no significant assets other than the ownership interests in our subsidiaries and our equity investments. As a result, our ability to make distributions to our unitholders depends on the performance of these subsidiaries and equity investments and their ability to distribute funds to us. The ability of our subsidiaries and equity investments to make distributions to us may be restricted by, among other things, the provisions of existing and future indebtedness, applicable state partnership and limited liability company laws and other laws and regulations, including FERC policies.

Our equity investments generated approximately 17% of our distributable cash flow in 2015. Spectra Energy operates Steckman Ridge. Spectra Energy shares operations of SESH with CenterPoint and shares operations of Gulfstream with Williams. Accordingly, we do not control the amount of cash distributed to us nor do we control ongoing operational decisions, including the incurrence of capital expenditures that we may be required to fund.

Our lack of control over the operations of our equity investments may mean that we do not receive the amount of cash we expect to be distributed to us. In addition, we may be required to provide additional capital, and these contributions may be material. The equity investments are not prohibited from incurring indebtedness by the terms of their respective limited liability

20

company agreement and general partnership agreements. If they were to incur significant additional indebtedness, it could inhibit their respective abilities to make distributions to us. This lack of control may significantly and adversely affect our ability to distribute cash.

Our natural gas transmission pipeline systems, crude oil transportation pipeline systems and certain of our storage facilities and related assets are subject to regulation by the FERC and the NEB, which could have an adverse effect on our ability to establish transmission, transportation, storage and gathering rates that would allow us to recover the full cost of operating our pipelines, including a reasonable return, and our ability to make distributions.

Our natural gas transmission pipeline systems, crude oil transportation pipeline systems and certain of our storage facilities and related assets are subject to regulation by the FERC and the NEB. The regulators have authority to regulate natural gas pipeline transmission and crude oil pipeline transportation services, including; the rates charged for the services, terms and conditions of service, certification and construction of new facilities, the extension or abandonment of services and facilities, the maintenance of accounts and records, the acquisition and disposition of facilities, the initiation and discontinuation of services, and various other matters.

Action by the FERC and the NEB on currently pending regulatory matters as well as matters arising in the future could adversely affect our ability to establish or charge rates that would cover future increase in their costs, such as additional costs related to environmental matters including any climate change regulation, or even to continue to collect rates that cover current costs, including a reasonable return. We cannot assure unitholders that our pipeline systems will be able to recover all of their costs through existing or future rates.

In addition, we cannot give assurance regarding the likely future regulations under which we will operate our natural gas transmission, crude oil transportation, storage and gathering businesses or the effect such regulation could have on our business, financial condition, results of operations or cash flows, including our ability to make distributions.

Certain transmission services are subject to long-term, fixed-price “negotiated rate” contracts that are not subject to adjustment, even if our cost to perform services exceeds the revenues received from such contracts, and, as a result, our costs could exceed our revenues received under such contracts.

Under FERC policy, a regulated service provider and a customer may mutually agree to sign a contract for service at a “negotiated rate” which may be above or below the FERC-regulated “recourse rate” for that service. For 2015, 51% of U.S. Transmission’s firm revenues were derived from such negotiated rate contracts. These negotiated rate contracts are not subject to adjustment for increased costs which could be produced by inflation or other factors relating to the specific facilities being used to perform the services. It is possible that the costs to perform services under these negotiated rate contracts will exceed the negotiated rates. If this occurs, it could decrease cash flows from U.S. Transmission.

Increased competition from alternative natural gas transmission, storage and gathering options and alternative fuel sources could have a significant financial effect on us.

We compete primarily with other interstate and intrastate pipelines, storage and gathering facilities in the transmission, storage and gathering of natural gas. Some of these competitors may expand or construct transmission, storage and gathering systems that would create additional competition for the services we provide to our customers. Moreover, Spectra Energy and its affiliates are not limited in their ability to compete with us. Further, natural gas also competes with other forms of energy available to our customers, including electricity, coal and fuel oils.

The principal elements of competition among natural gas transmission, storage and gathering assets are location, rates, terms of service, access to natural gas supplies, flexibility and reliability. The FERC’s policies promoting competition in natural gas markets are having the effect of increasing the natural gas transmission, storage and gathering options for our traditional customer base. As a result, we could experience some “turnback” of firm capacity as existing agreements expire. If our pipelines and storage facilities are unable to remarket this capacity or can remarket it only at substantially discounted rates compared to previous contracts, they may have to bear the costs associated with the turned back capacity. Increased competition could reduce the volumes of natural gas transported, stored or gathered by our systems or, in cases where we do not have long-term fixed rate contracts, could force us to lower our transmission, storage or gathering rates. Competition could intensify the negative effect of factors that significantly decrease demand for natural gas in the markets served by our pipeline systems, such as competing or alternative forms of energy, a recession or other adverse economic conditions, higher fuel costs and taxes or other governmental or regulatory actions that directly or indirectly increase the cost or limit the use of natural gas. Our ability to renew or replace existing contracts at rates sufficient to maintain current revenues and cash flows could be adversely affected by the activities of our competitors. All of these competitive pressures could have an adverse effect on our business, results of operations, financial condition or cash flows, including our ability to make distributions.

21

The lack of availability of natural gas and oil resources may cause customers to seek alternative energy resources, which could materially affect our revenues, earnings and cash flows.

Our natural gas and oil businesses are dependent on the continued availability of natural gas and oil production and reserves. Prices for natural gas and oil, regulatory limitations on the development of natural gas and oil supplies or a shift in supply sources could adversely affect development of additional reserves and production that are accessible by our pipeline and gathering assets. Lack of commercial quantities of natural gas and oil available to these assets could cause customers to seek alternative energy resources, thereby reducing their reliance on our services, which in turn would materially affect our revenues, earnings and cash flows, including our ability to make distributions.

We may be unable to secure renewals of long-term transportation agreements, which could expose our transportation volumes and revenues to increased volatility.

We may be unable to secure renewals of long-term transportation agreements in the future for our natural gas transmission and crude oil transportation businesses as a result of economic factors, lack of commercial gas supply available to our systems, changing gas supply flow patterns in North America, increased competition or changes in regulation. Without long-term transportation agreements, our revenues and contract volumes would be exposed to increased volatility. The inability to secure these agreements would materially affect our business, earnings, financial condition and cash flows.

If third-party pipelines and other facilities interconnected to our pipelines become unavailable to transport natural gas, our revenues and Available Cash could be adversely affected.

We depend upon third-party pipelines and other facilities that provide delivery options to and from our pipelines and storage facilities. Because we do not own these third-party pipelines or facilities, their continuing operation is not within our control. If these or any other pipeline connection were to become unavailable for current or future volumes of natural gas due to repairs, damage to the facility, lack of capacity or any other reason, our ability to operate efficiently and continue shipping natural gas to end-markets could be restricted, thereby reducing revenues. Any temporary or permanent interruption at any key pipeline interconnect could have an adverse effect on our business, results of operations, financial condition or cash flows, including our ability to make distributions.

If we do not complete expansion projects or make and integrate acquisitions our future growth may be limited.

A principal focus of our strategy is to continue to grow the cash distributions on our units by expanding our business. Our ability to grow depends on our ability to complete expansion projects and make acquisitions that result in an increase in cash generated. We may be unable to complete successful, accretive expansion projects or acquisitions for any of the following reasons:

• | an inability to identify attractive expansion projects or acquisition candidates or we are outbid by competitors; |

• | an inability to obtain necessary rights-of-way or government approvals, including regulatory agencies; |

• | an inability to successfully integrate the businesses we build or acquire; |

• | we are unable to raise financing for such expansion projects or acquisitions on economically acceptable terms; |

• | incorrect assumptions about volumes, reserves, revenues and costs, including synergies and potential growth; or |

• | we are unable to secure adequate customer commitments to use the newly expanded or acquired facilities. |

We rely on access to short-term and long-term capital markets to finance capital requirements and support liquidity needs, and access to those markets can be affected, particularly if we or our rated subsidiaries are unable to maintain an investment-grade credit rating, which could affect our cash flows or restrict business.

Our business is financed to a large degree through debt. The maturity and repayment profile of debt used to finance investments often does not correlate to cash flows from assets. Accordingly, we rely on access to both short-term and long-term capital markets as a source of liquidity for capital requirements not satisfied by cash flows from operations and to fund investments originally financed through debt. Our senior unsecured long-term debt is currently rated investment-grade by various rating agencies. If the rating agencies were to rate us or our rated subsidiaries below investment-grade, our borrowing costs would increase, perhaps significantly. Consequently, we would likely be required to pay a higher interest rate in future financings and our potential pool of investors and funding sources could decrease.

We maintain a revolving credit facility to provide back-up for our commercial paper program, for borrowings and/or letters of credit. This facility requires us to maintain a consolidated leverage ratio of consolidated indebtedness to consolidated earnings from continuing operations before interest, taxes, and depreciation and amortization (EBITDA), as defined in the

22

agreement. Failure to maintain this covenant could preclude us from issuing commercial paper or letters of credit or borrowing under the revolving credit facility which could affect cash flows or restrict business. Furthermore, if Spectra Energy Partner’s short-term debt rating were to be below tier 2 (for example, A-2 for Standard and Poor’s, P-2 for Moody’s Investor Service and F2 for Fitch Ratings), access to the commercial paper market could be significantly limited. Although this would not affect our ability to draw under our credit facility, borrowing costs could be significantly higher.

If we are not able to access capital at competitive rates, our ability to finance operations and implement our strategy may be affected. Restrictions on our ability to access financial markets may also affect our ability to execute our business plan as scheduled. An inability to access capital may limit our ability to pursue improvements or acquisitions that we may otherwise rely on for future growth. Any downgrade or other event negatively affecting the credit ratings of our subsidiaries could make their costs of borrowing higher or access to funding sources more limited, which in turn could increase our need to provide liquidity in the form of capital contributions or loans to such subsidiaries, thus reducing the liquidity and borrowing availability of the consolidated group.

We may incur significant costs and liabilities as a result of pipeline integrity management program testing and any necessary pipeline repair or preventative or remedial measures.

The DOT has adopted regulations requiring pipeline operators to develop integrity management programs for transmission pipelines located where a leak or rupture could do the most harm in “high consequence areas.” The regulations require operators to:

• | perform ongoing assessments of pipeline integrity; |

• | identify and characterize applicable threats to pipeline segments that could affect a high consequence area; |

• | improve data collection, integration and analysis; |

• | repair and remediate the pipeline as necessary; and |

• | implement preventive and mitigating actions. |

Our actual implementation costs may be affected by industry-wide demand for the associated contractors and service providers. Additionally, should we fail to comply with DOT regulations, we could be subject to penalties and fines.

Our operations are subject to pipeline safety laws and regulations, compliance with which may require significant capital expenditures, increase our cost of operations and affect or limit our business plans.

Our interstate pipeline operations are subject to pipeline safety laws and regulations administered by the Pipeline and Hazardous Materials Safety Administration (PHMSA) of the DOT. These laws and regulations require us to comply with a significant set of requirements for the design, construction, maintenance and operation of our interstate pipelines. These regulations, among other things, include requirements to monitor and maintain the integrity of our pipelines. The regulations determine the pressures at which our pipelines can operate.

PHMSA is designing an Integrity Verification Process intended to create standards to verify maximum allowable operating pressure, and to improve and expand integrity management processes. There remains uncertainty as to how these standards will be implemented, but it is expected that the changes will impose additional costs on new pipeline projects as well as on existing operations. In this climate of increasingly stringent regulation, pipeline failures or failures to comply with applicable regulations could result in reduction of allowable operating pressures as authorized by PHMSA, which would reduce available capacity on our pipelines. Should any of these risks materialize, it may have an adverse effect on our operations, earnings, financial condition or cash flows.

In Canada, our pipeline operations are subject to pipeline safety regulations overseen by the NEB. Applicable legislation and regulation require us to comply with a significant set of requirements for the design, construction, maintenance and operation of our pipeline. Among other obligations, this regulatory framework imposes requirements to monitor and maintain the integrity of our pipelines.

As in the U.S., several legislative changes addressing pipeline safety in Canada have recently come into force. The changes evidence an increased focus on the implementation of management systems to address key areas such as emergency management, integrity management, safety, security and environmental protection. Other legislative changes have created authority for the NEB to impose administrative monetary penalties for non-compliance with the regulatory regime it

administers.

Compliance with these legislative changes may impose additional costs on new Canadian pipeline projects as well as on

23

existing operations. Failure to comply with applicable regulations could result in a number of consequences which may have an adverse effect on our operations, earnings, financial condition and cash flows.

Restrictions in our credit facility may limit our ability to make distributions and may limit our ability to capitalize on acquisition and other business opportunities.

The operating and financial restrictions and covenants in our credit facility and any future financing agreements could restrict our ability to finance future operations or capital needs or to expand or pursue business activities associated with our subsidiaries and equity investments. Our credit facility contains covenants that restrict or limit our ability to:

• | make distributions if any default or event of default, as defined, occurs; |

• | make other restricted distributions or dividends on account of the purchase, redemption, retirement, acquisition, cancellation or termination of partnership interests; |

• | incur additional indebtedness or guarantee other indebtedness; |

• | grant liens or make certain negative pledges; |

• | make certain loans or investments; |

• | engage in transactions with affiliates; |

• | make any material change to the nature of our business from the midstream energy business; |

• | make a disposition of assets; or |

• | enter into a merger, consolidate, liquidate, wind up or dissolve. |

The credit facility contains covenants requiring us to maintain certain financial ratios and tests. The ability to comply with the covenants and restrictions contained in the credit facility may be affected by events beyond our control, including prevailing economic, financial and industry conditions. If market or other economic conditions deteriorate, our ability to comply with these covenants may be impaired. If we violate any of the restrictions, covenants, ratios or tests in our credit facility, the lenders will be able to accelerate the maturity of all borrowings under the credit facility and demand repayment of amounts outstanding, the lenders’ commitment to make further loans to us may terminate, and the operating partnership may be prohibited from making any distributions. We might not have, or be able to obtain, sufficient funds to make these accelerated payments. Any subsequent replacement of our credit facility or any new indebtedness could have similar or greater restrictions.

The credit and risk profile of our general partner and its owner, Spectra Energy, could adversely affect our credit ratings and risk profile, which could increase our borrowing costs or hinder our ability to raise capital.

The credit and business risk profiles of our general partner and Spectra Energy may be factors considered in credit evaluations of us. This is because our general partner controls our business activities, including our cash distribution policy, acquisition strategy and business risk profile. Another factor that may be considered is the financial condition of Spectra Energy, including the degree of its financial leverage and its dependence on cash flow from the partnership to service its indebtedness.

Our credit rating could be adversely affected by the leverage of our general partner or Spectra Energy, as credit rating agencies may consider the leverage and credit profile of Spectra Energy and its affiliates because of their ownership interest in and control of us, and the strong operational links between Spectra Energy and us. Any adverse effect on our credit rating would increase our cost of borrowing or hinder our ability to raise financing in the capital markets, which would impair our ability to grow our business and make distributions.

We are involved in numerous legal proceedings, the outcome of which are uncertain, and resolutions adverse to us could negatively affect our earnings, financial condition and cash flows.

We are subject to numerous legal proceedings. Litigation is subject to many uncertainties, and we cannot predict the outcome of individual matters with assurance. It is reasonably possible that the final resolution of some of the matters in which we are involved could require additional expenditures, in excess of established reserves, over an extended period of time and in a range of amounts that could have a material effect on our earnings and cash flows.

Protecting against potential terrorist activities, including cyber-terrorism, requires significant capital expenditures and a successful terrorist attack could affect our business.

Acts of terrorism and any possible reprisals as a consequence of any action by the U.S. and its allies could be directed against companies operating in the U.S. This risk is particularly relevant for companies, like ours, operating in any energy

24

infrastructure industry that handles volatile gaseous and liquid hydrocarbons. The potential for terrorism, including cyber-terrorism, has subjected our operations to increased risks that could have an adverse effect on our business. In particular, we may experience increased capital and operating costs to implement increased security for our facilities and pipelines, such as additional physical facility and pipeline security, and additional security personnel. Moreover, any physical damage to high profile facilities resulting from acts of terrorism may not be covered, or covered fully, by insurance. We may be required to expend material amounts of capital to repair any facilities, the expenditure of which could adversely affect our business and cash flows. A cyber attack could also lead to a significant interruption in our operations or unauthorized release of confidential or otherwise protected information, which could damage our reputation or lead to financial losses.

Changes in the insurance markets attributable to terrorist attacks may make certain types of insurance more difficult for us to obtain. Moreover, the insurance that may be available to us may be significantly more expensive than our existing insurance coverage. Instability in the financial markets as a result of terrorism or war could also affect our ability to raise capital.

Reductions in demand for natural gas and oil and low market prices of commodities adversely affect our operations and cash flows.

Our regulated businesses are generally economically stable; they are not significantly affected in the short term by changing commodity prices. However, our businesses can all be negatively affected in the long-term by sustained downturns in the economy or long-term conservation efforts, which could affect long-term demand and market prices for natural gas and oil. These factors are beyond our control and could impair the ability to meet long-term goals.

Most of our revenues are based on regulated tariff rates, which include the recovery of certain fuel costs. However, lower overall economic output could reduce the volume of natural gas transported or gathered, and the volume of oil transported, resulting in lower earnings and cash flows. Transmission revenues could be affected by long-term economic declines, resulting in the non-renewal of long-term contracts at the time of expiration. Lower demand, along with lower prices for natural gas and oil, could result from multiple factors that affect the markets where we operate, including:

• | weather conditions, such as abnormally mild winter or summer weather, resulting in lower energy usage for heating or cooling purposes, respectively; |

• | supply of and demand for energy commodities, including any decrease in the production of natural gas and oil could negatively affect our processing and transmission businesses due to lower throughput; and |

• | capacity and transmission service into, or out of, our markets. |

Our business is subject to extensive regulation that affects our revenues, operations and costs.

Our U.S. assets and operations are subject to regulation by various federal, state and local authorities, including regulation by the FERC and by various authorities under federal, state and local environmental laws. Our operations in Canada are subject to regulation by the NEB, and by federal and provincial authorities under environmental laws. Regulation affects almost every aspect of our business, including, among other things, the ability to determine terms and rates for services provided by some of our businesses, make acquisitions, construct, expand and operate facilities, issue equity or debt securities, and make distributions.

In addition, regulators in the U.S. have taken actions to strengthen market forces in the gas pipeline industry, which have led to increased competition. In a number of key markets, natural gas pipeline and storage operators are facing competitive pressure from a number of new industry participants, such as alternative suppliers, as well as traditional pipeline competitors. Increased competition driven by regulatory changes could have a material effect on our business, earnings, financial condition and cash flows.

Execution of our capital projects subjects us to construction risks, increases in labor and material costs, and other risks that may affect our financial results.

A significant portion of our growth is accomplished through the construction of new pipelines and storage facilities as well as the expansion of existing facilities. Construction of these facilities is subject to various regulatory, development, operational and market risks, including:

• | the ability to obtain necessary approvals and permits by regulatory agencies on a timely basis and on acceptable terms and to maintain those approvals and permits issued and satisfy the terms and conditions imposed therein; |

• | the availability of skilled labor, equipment and materials to complete expansion projects; |

25

• | potential changes in federal, state and local statutes and regulations, including environmental requirements, that may prevent a project from proceeding or increase the anticipated cost of the project; |

• | impediments on our ability to acquire rights-of-way or land rights on a timely basis and on acceptable terms; and |

• | the ability to construct projects within anticipated costs, including the risk of cost overruns resulting from inflation or increased costs of equipment, materials or labor, weather, geologic conditions or other factors beyond our control, that may be material; and |

•general economic factors that affect the demand for natural gas infrastructure.

Any of these risks could prevent a project from proceeding, delay its completion or increase its anticipated cost. As a result, new facilities may not achieve their expected investment return, which could affect our earnings, financial position and cash flows.

Market-based storage operations are subject to commodity price risk, which could result in a decrease in our earnings and reduced cash flows.

We have market-based rates for some of our storage operations and sell our storage services based on natural gas market spreads and volatility. If natural gas market spreads or volatility deviate from historical norms or there is significant growth in the amount of storage capacity available to natural gas markets relative to demand, our approach to managing our market-based storage contract portfolio may not protect us from significant variations in storage revenues, including possible declines, as contracts renew.

Our operations are subject to numerous environmental laws and regulations, compliance with which may require significant capital expenditures, increase our cost of operations and affect or limit our business plans, or expose us to environmental liabilities.

We are subject to numerous environmental laws and regulations affecting many aspects of our present and future operations, including air emissions, water quality, wastewater discharges, solid waste and hazardous waste. These laws and regulations can result in increased capital, operating and other costs. These laws and regulations generally require us to obtain and comply with a wide variety of environmental licenses, permits, inspections and other approvals. Compliance with environmental laws and regulations can require significant expenditures, including expenditures for cleanup costs and damages arising out of contaminated properties. In particular, compliance with major Clean Air Act regulatory programs is likely to cause us to incur significant capital expenditures to obtain permits, evaluate offsite impacts of our operations, install pollution control equipment, and otherwise assure compliance. Some states in which we operate are implementing new emissions limits to comply with 2008 ozone standards regulated under the National Ambient Air Quality Standards. In 2015, the ozone standards were lowered even further from 75 parts per billion (ppb) to 70 ppb, which may require states to implement additional emissions regulations. The precise nature of these compliance obligations at each of our facilities has not been finally determined and may depend in part on future regulatory changes. In addition, compliance with new and emerging environmental regulatory programs is likely to significantly increase our operating costs compared to historical levels.

In the U.S., climate change action is evolving at state, regional and federal levels. The Supreme Court decision in Massachusetts v. EPA in 2007 established that GHGs were pollutants subject to regulation under the Clean Air Act. Pursuant to federal regulations, we are currently subject to an obligation to report our GHG emissions at our largest emitting facilities, but are not generally subject to limits on emissions of GHGs, (except to the extent that some GHGs consist of volatile organic compounds and nitrous oxides that are subject to emission limits). Proposed regulation may extend our reporting obligations to additional facilities and activities. In addition, a number of Canadian provinces and U.S. states have joined regional GHG initiatives, and a number are developing their own programs that would mandate reductions in GHG emissions. Public interest groups and regulatory agencies are increasingly focusing on the emission of methane associated with natural gas development and transmission as a source of GHG emissions. However, as the key details of future GHG restrictions and compliance mechanisms remain undefined, the likely future effects on our business are highly uncertain.

For its part, Canada has reaffirmed its strong preference for a harmonized approach with that of the United States. While federal GHG related regulatory design details remain forthcoming, provincial authorities have been actively pursuing related initiatives.

Failure to comply with environmental regulations may result in the imposition of fines, penalties and injunctive measures affecting our operating assets. In addition, changes in environmental laws and regulations or the enactment of new environmental laws or regulations could result in a material increase in our cost of compliance with such laws and regulations. We may not be able to obtain or maintain all required environmental regulatory approvals for our operating assets or development projects. If there is a delay in obtaining any required environmental regulatory approvals, if we fail to obtain or

26

comply with them or if environmental laws or regulations change or are administered in a more stringent manner, the operations of facilities or the development of new facilities could be prevented, delayed or become subject to additional costs. Costs we may incur to comply with environmental regulations in the future may have a significant effect on our earnings and cash flows.

Due to the speculative outlook regarding any U.S. federal and state policies, we cannot estimate the potential effect of proposed GHG policies on our future consolidated results of operations, financial position or cash flows. However, such legislation or regulation could materially increase our operating costs, require material capital expenditures or create additional permitting, which could delay proposed construction projects.

Natural gas transmission and storage and crude oil transportation and storage activities involve numerous risks that may result in accidents or otherwise affect our operations.

There are a variety of hazards and operating risks inherent in natural gas gathering and processing, transmission and storage activities, and crude oil transportation and storage, such as leaks, explosions, mechanical problems, activities of third parties and damage to pipelines, facilities and equipment caused by hurricanes, tornadoes, floods, fires and other natural disasters, that could cause substantial financial losses. In addition, these risks could result in significant injury, loss of life, significant damage to property, environmental pollution and impairment of operations, any of which could result in substantial losses. For pipeline and storage assets located near populated areas, including residential areas, commercial business centers, industrial sites and other public gathering areas, the level of damage resulting from these risks could be greater. Therefore, should any of these risks materialize, it could have a material effect on our business, earnings, financial condition and cash flows.

We do not maintain insurance coverage against all of these risks and losses, and any insurance coverage we might maintain may not fully cover the damages caused by those risks and losses. We may elect to self insure a portion of our asset portfolio. Moreover, we do not maintain offshore business interruption insurance. Therefore, should any of these risks materialize, it could have a material effect on our business, earnings, financial condition, results of operations or cash flows, including our ability to make distributions.

We are exposed to the credit risk of our customers.