`

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

or

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________ to _______

Commission File Number

(Exact name of Registrant as specified in its Charter)

|

|

|

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer |

|

|

|

(Address of principal executive offices, including Zip Code)

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

|

|

|

|

|

|

|

|

||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

|

Accelerated filer |

☐ |

|

|

☒ |

|

Smaller reporting company |

|

|

Emerging growth company |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes

As of June 30, 2021, the last day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant was $

As of March 17, 2022, the registrant had

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) under the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980). None

|

Auditor Firm Id: |

|

Auditor Name: |

|

Auditor Location: |

|

One Stop Systems, Inc.

FORM 10-K

For the Fiscal Year Ended December 31, 2021

Table of Contents

|

` |

|

Page |

|

|

|

|

|

Item 1. |

4 |

|

|

Item 1A. |

22 |

|

|

Item 1B. |

39 |

|

|

Item 2. |

39 |

|

|

Item 3. |

40 |

|

|

Item 4. |

40 |

|

|

|

|

|

|

|

|

|

|

Item 5. |

41 |

|

|

Item 6. |

41 |

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

42 |

|

Item 7A. |

58 |

|

|

Item 8. |

58 |

|

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

58 |

|

Item 9A. |

58 |

|

|

Item 9B. |

59 |

|

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

59 |

|

|

|

|

|

|

|

|

|

Item 10. |

60 |

|

|

Item 11. |

66 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

75 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

77 |

|

Item 14. |

78 |

|

|

|

|

|

|

|

|

|

|

Item 15. |

80 |

|

|

Item 16. |

80 |

2

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (“Annual Report”) contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact contained in this Annual Report, including statements regarding our future operating results, financial position and cash flows, our business strategy and plans and our objectives for future operations, are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. This Annual Report also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “would,” “could,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these terms or other similar expressions. The forward-looking statements in this Annual Report are only predictions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, operating results, business strategy, short-term and long-term business operations and objectives. These forward-looking statements speak only as of the date of this Annual Report and are subject to a number of risks, uncertainties and assumptions, including those described in Part I, Item 1A, “Risk Factors.” The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Moreover, we operate in a very competitive and rapidly changing environment. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

One Stop Systems, the One Stop Systems logo, and other trademarks or service marks of One Stop Systems appearing in this Annual Report are the property of One Stop Systems, Inc. This Annual Report also includes trademarks, tradenames and service marks that are the property of other organizations. Solely for convenience, trademarks and tradenames referred to in this Annual Report appear without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights, or that the applicable owner will not assert its rights, to these trademarks and tradenames.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly, and current reports, proxy statements and other information required by the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), with the Securities and Exchange Commission (the “SEC”). Our SEC filings are available to the public on the SEC’s internet site at http://www.sec.gov.

On our internet website, http://www.onestopsystems.com, we post the following recent filings as soon as reasonably practicable after they are electronically filed with or furnished to the SEC: our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K, and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act. The information in or accessible through the SEC and our website are not incorporated into, and are not considered part of, this Annual Report. Further, our references to the URLs for these websites are intended to be inactive textual references only.

3

PART I

ITEM 1. BUSINESS.

Company History

One Stop Systems, Inc. (“OSS” or the “Company”) was originally incorporated as a California corporation in 1999, after initially being formed as a California limited liability company in 1998. On December 14, 2017, the Company was reincorporated as a Delaware corporation in connection with its initial public offering of securities.

During the year ended December 31, 2015, the Company formed a wholly owned subsidiary in Germany, One Stop Systems, GmbH (“OSS GmbH”). Then, in July 2016, the Company acquired Mission Technologies Group, Inc. (“Magma”) and its operations.

On August 31, 2018, the Company acquired Concept Development Inc. (“CDI”) located in Irvine, California. CDI specializes in the design and manufacture of custom high-performance computing systems for airborne in-flight entertainment and networking systems. CDI was fully integrated into the core operations of the Company as of June 1, 2020.

On October 31, 2018, OSS GmbH acquired 100% of the outstanding stock of Bressner Technology GmbH, a limited liability company registered under the laws of Germany and located near Munich, Germany (“Bressner”). Bressner designs and manufactures standard and customized servers, panel PCs, and PCIe expansion systems. Bressner also provides manufacturing, test, sales, and marketing services for customers throughout Europe.

Our principal executive offices are located at 2235 Enterprise Street, Suite 110, Escondido, California 92029, and our telephone number is (760) 745-9883. Our website address is www.onestopsystems.com. Information contained in, or accessible through, our website is for reference purposes only.

Business Overview

One Stop Systems, Inc. (“OSS” or the “Company”) designs, manufactures, and markets specialized high-performance computing modules and systems, which are designed to target edge computing deployments. Edge computing is a form of computing that is done on site, near a particular data source or the user (rather than in the cloud), minimizing the need for data to be processed in a remote data center. This growing trend increases computing performance and security as the data does not have to travel to some distant data center location. These specialized modules and systems consist of computers and storage products that incorporate the latest state-of-the art components with our embedded proprietary software. Such modules and systems allow our customers to offer high-end computing capabilities (often integrated within their equipment) to their target markets and applications.

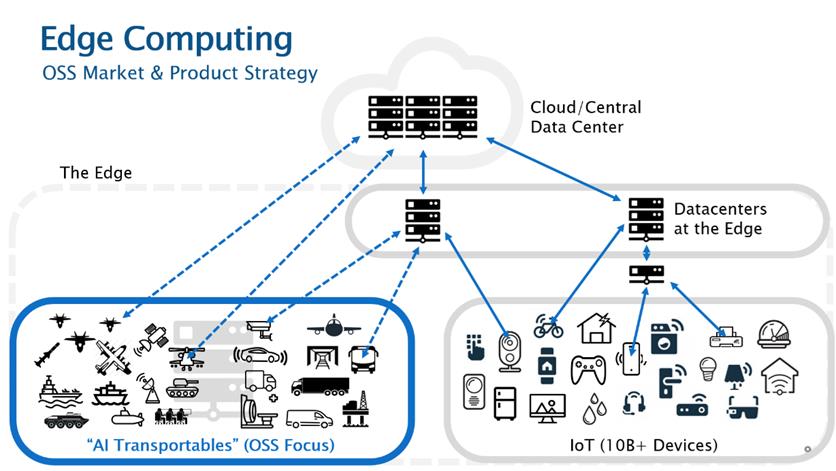

The fast-growing edge computing space consists of three major segments. The first segment is comprised of many smaller data centers that are located in close proximity to the users (or edge). These typically include compute and storage racks in environmentally controlled buildings, similar to large cloud data centers. Suppliers in this space tend to be the same large server and storage manufacturers whose products are used at cloud data centers. The second segment includes billions of Internet-of-Things (“IOT”) devices that may reside in everything from home appliances to the factory production floor. These IOT devices and applications tend not to be challenged on performance and easily communicate up to the cloud or the data centers on the edge. OSS does not focus on either of the foregoing segments. The third segment is called AI Transportables. These are primarily on land, in the air or at sea vehicles that need performance without compromise for artificial intelligence (“AI”) and Autonomous capabilities. This is where OSS’ vision and strategy is aligned, and where we believe that we offer the greatest unique value to our customers.

4

Examples of applications that utilize AI Transportables range from autonomous trucks, busses, mining equipment, and aircrafts. Less mobile applications that utilize AI Transportables include items like medical equipment and mobile command centers. There is currently a growing demand for AI/autonomous capabilities within the commercial/industrial market, as well as for military use.

The AI and/or autonomous capabilities require these demanding applications to connect to a wide array of data sources and sensors, and to have the ability to quickly access and store large ever-growing data sets. They must be able to maintain ultra-fast processing power to act on data in real time at the edge location, which is independent of whether a high-speed network, like 5G, connects the edge application back to the distant central data centers. Standard servers and storage systems available in the market do not address the AI Transportable requirements. Although the network, if it exists, may transfer data or be used for updates, the latency is not acceptable for many of these applications where time is of the essence. This increases the need for data center type performance using the latest generation of products from companies like NVIDIA, AMD and Intel. In most of these applications, available space is limited and the number of inputs from sensors and other data sources are significant, thus, requiring high speed input/output (“I/O”) expansion like the latest in PCI Express, which OSS is known for in the market. In the case of vehicles, fuel efficiency, and particularly, in the case of aircrafts, AI Transportables come into play due to the need for lower weight materials. Additionally, the mobility of these systems creates the need for the equipment to survive drops, g-forces, vibration, dust, wide temperature swings, and moisture. Once you have a system that can operate and survive in these harsh environments, you need to be able to dissipate the heat and keep it cool.

While other edge computing suppliers may adequately serve the needs of the environmentally controlled edge data centers with the latest technology, the deployment of the same performance level in the AI Transportable space requires unique capabilities and knowhow, which is where we believe that we excel. Many companies that enter this space tend to offer solutions based on older and lower performance technology, whereas we advance our proprietary state-of-the-art technologies and utilize the latest generation of products to ensure superior performance. We leverage our proven track record of delivering first-to-market advanced technologies and technical strength, working with the latest high-speed networks like PCI Express 5.0 and NVIDIA’s NVLink. This is in addition to our expertise with compute acceleration and high-performance flash array storage systems. When combined with our execution and knowhow of deploying these systems in challenging environments, we bring the latest commercially available technology and products to this market. Unlike the edge or cloud data centers in a building, these applications bring on many unique requirements playing to our strength and create opportunities for additional barriers of entry.

Business Strategy

In March 2021, after reviewing our current business, market trends, the competitive landscape, reflecting on our strengths as well as listening to feedback from current and potential customers, we determined that it would be in the best interest of the Company and our shareholders to shift our primary focus to the development and sale of AI Transportables. At that time, 20% of our business was already in the AI Transportables space. Our AI Transportables business accounts for some

5

of our highest margins, repeat business, highest closure rate, and most importantly, we believe that it represents our highest value proposition when bringing together all our skills and experience.

Although it will take some time to pursue, secure, and turn these target opportunities into increased revenue and profits, we believe our new focus provides us with a unique opportunity to drive shareholder value. We are not abandoning current business in the process, but rather focusing on this market segment for future growth. We believe the implementation of the new strategy and vision can drive this portion of our business from approximately 20% of revenues today to over 50% in the coming years by providing an opportunity for a higher growth rate, margins, and profits. This starts with identifying and closing opportunities in this space. Approximately 50% of our current pipeline of prospects, that are not yet closed, fall within the AI Transportables space.

We see opportunities in both the commercial/industrial and military/government segments. Currently, our military business accounts for approximately 20% of our overall sales, but we anticipate this will grow to 50% over the next few years. Although the overall military budget will likely vary depending on the administration and global tensions, both of which can impact how many new aircraft carriers or tanks are built, we believe the priority will remain on implementing AI throughout the military theater, and that military funding in this segment is more likely to grow than decrease as the United States continues to be competitive with China.

A key element of our product strategy is technological leadership. We believe a first-to-market strategy is key to our ability to continue to win significant original equipment manufacturer (“OEM”) opportunities. As a result, we continue to develop new state-of-the-art products, providing a unique value proposition for our customers in the targeted space. Most recently, in November 2021, we introduced Rigel, the Super Edge Computing platform. This product brings to market the latest in Graphics Processing Units (“GPU”), Central Processing Unit (“CPU”), and memory products in a rugged compact form factor, which targets the AI Transportable space and which we believe to be the first of its kind.

Our ability to drive the leading edge of technology is enabled by our strong relationships with strategic component manufactures, including NVIDIA (for GPUs), Western Digital and Micron (for flash memory), Broadcom (for PCIe switch components), Mellanox (for networking) and Intel, AMD, and Marvel (for CPUs). In many cases, we have access to product roadmaps and other technical information relating to future technology. Access to this information allows us to begin our design process well before the future components we are designing even exist.

We sell our products worldwide to industry leading customers. We service over 1,800 customers per year worldwide, with major repeat customers including disguise, Raytheon, the Navy, Thales, and Alcon. Our operations in Europe are driven by our Bressner group located near Munich, Germany, which we acquired in 2018 to help us expand within the European market. Although they are primarily a value-added reseller for the Company and other suppliers in Europe, we have a team that is focused solely on the AI Transportable portion of our business and leveraging many of their existing relationships. We anticipate continued global market growth, especially in AI Transportables, and sustaining our ability to increase market share through our leading technology, engineering expertise, supply chain management, and go-to-market innovation.

Industry Background and Market Opportunity

The notion of network-based computing dates back to the 1960s, but many believe the first use of “cloud computing” in its modern context occurred in 2006 when Google’s then-CEO, Eric Schmidt, introduced the term during an industry conference. Years later, the explosive growth of internet-connected devices (“IoT”), along with new applications that require real-time computing power, started to create the drive for edge-computing systems. As the demand for AI on the edge and autonomous vehicles grew, so did the need for high-performance solutions to operate in harsh environments.

Edge computing is one of the fastest growing markets driven by the need to do more at the edge. We estimate the edge computing market to be valued at approximately $200 to $400 million currently, and we anticipate that it will grow to $1 to $5 billion in the coming years. According to Gartner, Inc., a leader in technology research, only 10% of data was gathered and processed at the edge in 2018; however, it is expected that this number will grow to 75% by 2025. This dramatic change is driving an expected growth of over 38% per year between today and 2028, according to Grand View Research, resulting in an estimated market of $61 billion later this decade. OSS’ objective is to be the technology and market leader in the AI Transportable segment of this market.

6

Three technologies are fundamental to the edge computing space: GPU compute accelerators, flash memory-based storage, and high-speed data acquisition I/O. These technologies enable systems to ingest, process and store data at significantly higher rates than traditional systems. By harnessing large quantities of these components, companies can receive necessary data analyses much more quickly and in a more secure manner, and as a result, turn raw data into actionable intelligence. Industry experts typically divide the high-performance computing market into the following categories:

|

|

• |

Servers – This includes all high-end servers and supercomputers. |

|

|

• |

Storage – Flash-based storage devices primarily. |

|

|

• |

Middleware – A broad category of software encompassing programming environments, schedulers, and other tools outside the operating system. |

|

|

• |

Applications – Specific software applications for high-performance edge computing. |

|

|

• |

Services – All services associated with this space. |

The AI Transportable markets tend to implement AI, autonomous, and/or semi-autonomous capabilities. We believe markets for these products are large and growing. Applications deploying these technologies today, or that we expect to do so in the future, include:

|

|

• |

Commercial/Industrial - cars, trucks, buses, trains, aviation, media & entertainment, mining, video surveillance, medical, oil & gas, etc. |

|

|

• |

Military/Government – planes, watercraft, mobile command, helicopters, mobile radar, submersibles, vehicles, drones, etc. |

We expect these applications to deploy increasingly faster computing systems in order to meet industry and competitive goals.

GPU Compute Acceleration

The capabilities and speed of GPU accelerated computers are driving significant advances in AI and machine learning. Massive amounts of data are collected, stored, and analyzed by today’s sophisticated algorithms. We are enabling the growth of such AI capability.

High Density Solid-State Storage

The proliferation of larger and larger data sets used in edge computing, including AI, is feeding the need for higher capacity and higher performance storage devices. Traditionally, companies have used hard disk drives for their primary storage. Hard disk drive-based systems are being replaced by flash memory-based systems, which offer higher capacity, performance, reliability, and ruggedness. Flash-based storage systems also consume significantly less power.

High Speed Data Acquisition

At the front-end of AI Transportable systems is high speed data acquisition technology. Depending on the application, the data can be generated from a wide array of sensors. In the case of an application utilized by autonomous vehicles, data is generated through arrays of video, LIDAR, and radar sensors. In battlefield applications, cameras, radar, sonar, FLIR (infrared), and RF sensors are deployed to generate data. In Medical applications, MRI or CT sensors are deployed to generate data, and in security applications, networks of security cameras produce high volumes of video data.

Key Components of Our Business

Product Development

Our systems are built using the latest GPU and flash storage technologies that draw upon years of expertise in designing and manufacturing semi-custom as well as standard systems for OEMs. We have a history of being first-to-market with many solutions for emerging technologies. When PCIe was introduced in 2005, we were the first company to produce PCIe over cable adapters allowing system-to-system communication at the same speed as internal I/O expansion reducing latency significantly. Similarly, in 2018, we introduced the first PCIe Gen 4.0 cable adapters, and in 2019, we introduced the

7

first PCIe Gen 4.0 system building blocks and platforms in which the PCIe Gen 4.0’s ultra-high performance 16.0 GT/s (giga-transfers/second) and signal integrity challenges limits the number of players in this market and creates barriers to entry. Today, we are one of the largest providers of PCIe adapters and expansion components used worldwide. In 2022, we intend to introduce a broad set of products utilizing PCIe Gen 5.0, which once again doubles performance to 32.0 GT/s.

When GPU technology and solid-state flash were first introduced, we began designing systems that maximized the effectiveness of these technologies. We now produce compute-systems with large numbers of GPUs and flash memory that communicate over PCIe and allow faster processing, data storage, and data retrieval. The more GPUs and flash devices available to a server, the faster that system can process and store data.

We use leading edge, state-of-the art components from major technology providers to design purpose-built systems that solve customer problems in an efficient, cost-effective manner. We apply the component technology provided by Intel, AMD, NVIDIA, Western Digital, Broadcom, and others to deliver solutions to provide true value to our customers.

Worldwide Sales

We sell our products on a worldwide basis and are supported through a network of manufacturers’ representatives, resellers, and distribution partners. Sales in North America and Europe are predominately driven by our direct sales force and manufacturers’ sales representatives, whereas sales in Asia are driven through our distribution partners.

In October 2018, OSS GmbH (a wholly owned subsidiary of the Company) acquired Bressner Technology GmbH (Bressner), located in Gröbenzell, Germany (near Munch, Germany). This acquisition created a base for us to expand our European operations for sales, marketing, engineering, manufacturing, and support capabilities.

What Sets OSS Apart

Several factors differentiate OSS from other suppliers of high-performance edge computing solutions, including, without limitation the following:

|

|

• |

Our expertise in PCIe expansion and building custom systems, which allows us to design reliable systems using this challenging high-performance technology with a greater quantity of GPUs and flash storage devices than other suppliers. |

|

|

• |

We design systems that both attach to existing servers through high-performance PCIe over cable, leveraging our customers’ existing networks as well as all-in-one systems with the server, GPU computing, and flash storage devices all included in a single package. |

|

|

• |

We design the software required to operate high-capacity, low-latency storage systems used by defense systems and commercial applications. |

|

|

• |

We leverage the latest technology available in the marketplace to create the highest performance systems. |

|

|

• |

We ruggedized and hardened our systems to operate within mobile or harsh environments, including full mil-spec systems. |

|

|

• |

We design systems that can meet extreme environmental temperature ranges, while cooling extremely high power, heat generating GPUs and Field Programable Gate Arrays (“FPGAs”), and providing options of customized tuned air and liquid cooling. |

|

|

• |

We design systems that can support the wide range of power input sources found in ground, sea and airborne tactical and industrial vehicles. |

Our business model consists of developing specialized computing solutions that our customers utilize as a key component of the equipment that they sell to end users. Our niche is to provide reliable purpose-built platforms with the latest high-performance computing technology that is focused on challenging edge deployments that are mobile.

Business Strategy

We have traditionally followed a strategy of being first-to-market in leading edge deployment technologies by designing and developing products that are delivered before our competitors. This market leadership strategy is accomplished through what we term as the “Catch the Wave” approach to the market. We currently have products spanning the spectrum of

8

high-performance computing including servers, flash storage, GPU acceleration, networking and PCIe data acquisition I/O expansion. Within these product areas, the OSS “Catch the Wave” approach implies that we:

|

|

• |

Anticipate trends in these markets; |

|

|

• |

Continuously deploy resources in engineering and sales to bring innovative products to market before our competitors; |

|

|

• |

Work closely and leverage strategic vendor relationships to get early access to future products and technologies; |

|

|

• |

Seek to procure early design wins; |

|

|

• |

Continuously monitor the market for next generation technologies for which a new “Wave” may be forming; and, |

|

|

• |

Establish leadership in the fast-growing AI Transportable portion of edge computing. |

Earnings Growth Strategy

We intend to implement different strategies to continue our revenue growth, while improving earnings. We believe that earnings growth can be accomplished by taking the following actions:

Revenue growth driven by existing OEM and new design wins:

|

|

• |

Focusing on the fast-growing, higher margin AI Transportable market; |

|

|

• |

Demonstrating technology leadership with a clear value proposition; |

|

|

• |

Increasing the focus on leading edge standard products for scalability; |

|

|

• |

Targeting OEMs in need of specialized solutions; |

|

|

• |

Focusing on repeat business; |

|

|

• |

Maintaining a highly skilled direct sales force complimented by well positioned third party representatives; |

|

|

• |

Expanding worldwide sales efforts and marketing opportunities appropriately; and |

|

|

• |

Completing accretive acquisitions. |

Higher margins:

|

|

• |

OSS-designed technical content; |

|

|

• |

Increasing proprietary content, software, and differentiating features; |

|

|

• |

Continuing focus in the highest return programs/markets; |

|

|

• |

Maximizing military and other high value applications and sectors; |

|

|

• |

Leveraging economies of scale; |

|

|

• |

Lowering material costs; |

|

|

• |

Increasing operational efficiencies through automation, discipline, and process improvements; and |

|

|

• |

Additional high margin services |

Optimize expenses:

|

|

• |

Minimize spending growth and drive higher efficiency per employee; |

|

|

• |

Utilizing technology to increase efficiency; |

|

|

• |

Leveraging efficiencies of scale; and |

|

|

• |

Managing portfolio of products and business units, consolidate where efficient. |

9

Our Opportunity

The worldwide edge computing market is expected to grow at a compounded annual growth rate (“CAGR”) of 38% to $61 billion by 2028 (Grandview research, “Edge Computing Market Size,” May 2021). Within this market, we are positioned and focused on the AI/autonomous portion at the very edge, which we call AI Transportables, and we believe that this market could be as large as $5 billion within several years. The products we develop to address this market include custom compute and storage servers, as well as edge optimized PCIe expansion systems. These PCIe expansion systems can be populated with a range of high-end GPUs, FPGAs or Nonvolatile Memory Express (“NVMe”) drives to create Compute and Storage Accelerators that attach to general purpose servers.

Our Technology

We design and manufacture high performance computing systems for use on the AI Transportable edge, which are designed to increase compute performance while surviving in harsh environments. Our high-density compute accelerators connect directly to a server’s PCIe bus, delivering substantial compute performance. Our flash storage arrays support hundreds of terabytes of high-speed storage that can also be accessed by multiple servers.

Technology Drivers for OSS High-Performance Computing Business

We have developed expertise and core competencies in the three fundamental technology drivers within today’s high-performance edge computing market – high-speed serial interconnect technology, compute acceleration utilizing GPUs, and low latency flash storage. In combination, these three fundamental technologies are changing the economics of computing, bringing high-performance computing within the grasp of a wide range of new industries and commercial applications on the edge. Simultaneously, the emergence of massive amounts of data being generated in each of these industries is pushing the requirement for state-of-the-art technology. We are enabling this state-of-the-art technology to be deployed at the edge by merging these fundamental technologies with our expertise and providing system level customization for meeting requirements for ruggedization and space, weight, and power (“SWAP”) constraints. Our strategy is to be the leader in the platforms for AI Transportable applications, and our strategy is based on our unique ability to design high quality performing AI workflow compute/storage engines that can be deployed in harsh dynamic environments, which require unique system level features for vibration, cooling, and power.

We strive to not only provide competitive advantage for companies, but also to address some of the most fundamental challenges in military, life science, energy, and security applications. We believe that we are well situated to leverage these major industry forces. By exploiting our unique set of expertise in the underpinning technologies of high-performance computing, we strive to continue to deliver industry leading solutions and to take advantage of the opportunity to capture a growing market share in this rapidly expanding marketplace.

Switched Serial Interconnect

Switched serial interconnects are the data highways connecting many elements of today’s high-performance computing platforms. At ever increasing speeds, these pathways move data between system’s processing units, storage, networking, and peripheral elements. For high-performance computing, the primary processing, storage and peripheral interconnect is PCIe. Currently, PCIe Gen 4.0 has an ability to run up to 16 lanes in parallel, which allows up to 64 gigabytes (full duplex) per second bandwidth between system elements. We intend to introduce products based on PCIe Gen 5.0 during 2022, which is anticipated to double the system bandwidth.

Compute Acceleration with GPUs

GPUs have evolved from graphics display acceleration to becoming general-purpose processing workhorses for high-performance computing systems. Today, the majority of the fastest supercomputers in the world utilize GPUs as their primary compute engines. GPUs are ideal for high-performance computing workloads because of their ability to do massively parallel processing. While today traditional CPUs may have dozens of processing cores, GPUs have thousands of cores that are able to execute calculations simultaneously.

NVIDIA, a key supplier of GPUs to the market, lists more than 400 such applications across a broad set of market spaces including, without limitation:

|

|

• |

Computational finance; |

10

|

|

• |

Climate, weather and ocean modeling; |

|

|

• |

Computational chemistry and biology; |

|

|

• |

Data science and analytics; |

|

|

• |

Deep learning and machine learning; |

|

|

• |

Federal defense and intelligence; |

|

|

• |

Genomics; |

|

|

• |

Manufacturing; |

|

|

• |

Media and entertainment; |

|

|

• |

Medical imaging; |

|

|

• |

Oil and gas; and |

|

|

• |

Safety and security. |

While NVIDIA is focused on the deployment of their GPUs in data centers and for gaming purposes, we are focused on taking this capability to the edge. Many of these applications also scale performance, based on the number of GPU components utilized. We have designed multi-GPU systems, including up to 16 GPUs in a single system. Current state-of-the art GPUs provide over 7 teraflops of performance, with future products set to dramatically increase overall processing capabilities in the years to come.

GPUs also pose significant system design challenges due to their high-power requirements. High-end GPUs can require 500 watts of power or more, which generates a tremendous amount of heat. Sophisticated power distribution and cooling designs are required, especially for large-scale systems with multiple GPUs per chassis.

PCI Express Flash Storage – NVMe protocol

The use of flash memory technology for system storage has gained traction over the past decade, which we believe to be a result of the continuous decline in the cost per gigabyte. Flash memory is now becoming the ubiquitous storage technology in high-performance systems.

Combined with the move away from traditional rotating hard drive technology, there has been the trend toward eliminating traditional storage protocols in favor of low latency flash memory protocols. Newer flash memory modules utilize a protocol known as NVMe, which connects the flash memory directly to the system’s PCIe interconnect. This direct connection allows for very high bandwidth between the storage and the other system elements, which eliminates the need for protocol translation as data moves from storage subsystems to and from the compute complex.

Today, flash memory modules with capacities up to 16 terabytes and PCIe Gen 4.0 interfaces are now available. Our flash storage arrays with hundreds of terabytes of capacity are also available, enabling the scaling of high-speed storage to meet the full range of high-performance edge application requirements.

Our Core Technical Capabilities

We have developed unique expertise and core competency across the fundamental technologies of today’s rapidly expanding specialized high-performance edge computing marketplace. These valuable assets are embedded in the leading-edge engineering capabilities of our engineers, the proprietary intellectual property residing in our vast library of designs, and our brand equity based on our reputation as a high-quality producer of state-of-the-art, custom and standard solutions across a broad array of markets.

High Speed System Interconnect Design

Our electrical engineers are experts in high-speed digital signaling design. They have continually designed at the leading edge of the state-of-the-art signaling speeds, even as semiconductor technology has driven up the clock rate of digital transmission. We have consistently been among a small handful of companies able to come to market first with the latest technology. In fact, we delivered the industry’s first PCIe over cable solutions for PCIe Gen 1.0, Gen 2.0, Gen 3.0, Gen 4.0, and are currently on track to accomplish this again for Gen 5.0, which is expected to begin deployment in 2022. The expertise required includes circuit design, PCB (printed circuit board) layout and routing optimizations, all of which focus on achieving the highest levels of signal integrity. In our current systems, PCIe Gen 4.0 signals are propagated across multiple PCBs, connectors, and copper cabling, while maintaining the ability to recognize digital signal transitions at 16 billion times per second.

11

In high-performance computing systems, especially those systems that operate on the edge, the trajectory and need for ever-increasing signaling speeds is continuing; provided, however, the number of companies that have the capability to design robust, highly-reliable systems at speeds that can tolerate the harsh conditions on the edge are continuing to decline. We believe our core competency in large-scale, high-speed design, and layout will allow us to remain on the forefront of this growing industry.

Complex System Design

In addition to low-level signal integrity design expertise, we have amassed expertise and intellectual property in high-performance system architecture design. This expertise allows us to develop extremely sophisticated systems with massive scaling, while also meeting customer demands for reliability, cost, and flexibility. To do so, we have developed deep knowledge for high-capacity input/output systems, operating system adjustments, and required configuration tuning. Due to this development, our engineers are often called upon to co-design with OEM designers to create the perfect solution to fit the needs of their customers.

For highly scalable systems, a deep understanding and experience with switching topologies and interconnect fabric design is required. We have worked with serial switching technology starting with the first generation of PCIe and have been an innovator in creating unique and flexible topologies to meet the specific needs of customers. Creating custom solutions for unique customer solutions is a core competency at OSS, and we rely on this deep knowledge of switch capabilities and limitations.

For maximum system performance, design for optimizing data transfer speeds is also an important consideration. We have developed expertise in system design to leverage peer-to-peer data flows between GPUs and pioneering techniques for optimized data flows between flash storage and GPU compute-engines. Our systems optimize switch and GPU configuration topologies to optimize GPU-to-GPU communication without requiring latency-inducing data transfer between host dual processors. Our platforms feature RDMA (remote direct memory access) across compute-nodes, which support data transfer without burdening the host CPU.

We have pioneered the ability to extend the PCIe bus beyond the confines of a single enclosure, opening the possibility of flexible system expansion options. We believe we are one of the leading designers and suppliers of PCIe host bus adapters that extend PCIe signals from the host motherboard across copper or optical cables to expansion enclosures. Our adapters provide both ends of the external cable connection. Our expertise in high-speed signal design in printed circuit boards, connectors, and cables is essential to successful expansion designs. We also hold expertise in incorporating clustering and rack scale expansion into our system designs, including 200/400 gigabit Ethernet, 200/400 gigabit InfiniBand, and emerging PCIe top-of-rack switch technology.

Expertise in power, cooling, and mechanical design are required to address the requirements of the high-performance computing customers, especially while meeting the constrained time requirements of edge deployments. We have developed leadership design capability in high-power design and distribution within large rack enclosures as well as edge optimized configurations. High-end GPUs today require 500 watts or above, and in our high-end systems, up to 16 of GPUs can reside in a single chassis. Thousands of kilowatts of redundant power are required. Power stability and huge thermal loads are some of the critical design issues that must be addressed. Additionally, at the edge for AI applications, a wide range of input power sources need to be supported from standard 110-220 VAC to 270 and 48 VDC for terrestrial vehicles to three phase 400-800Hz AC for airborne applications.

We have expertise in power distribution, redundant power, and complex chassis cooling design, including materials selection, airflow simulation, fan technology, and cable routing. We have also developed extensive intellectual property to help ensure regulatory compliance of our complex high-performance computing system designs that span across emission, shock, vibration, thermal, humidity, and other environmental requirements that are required for highly reliable and highly available solutions. Our engineers are experts in design for regulatory testing for FCC (Federal Communications Commission), CE (European Conformity), UL (Underwriters Laboratories), and Mil-Spec (Military Standard) standards. Additionally, we have expertise in rapid prototyping, design for manufacturability, and design for serviceability.

Storage Management Software

Given our hardware design and integration expertise, we believe that the next step is to add a robust software capability that will allow us to offer more optimized and customized systems. Our Ion software design team provides the expertise to deliver full server and storage solutions that produce the highest performance from today’s leading-edge flash storage devices. The Ion software allows flash-based modules to be put into a variety of storage and network configurations

12

which can then be accessed by multiple servers. The Ion software can do this cost-effectively, while preserving the low latency that is vital for many business and mission-critical enterprise applications, from database and transaction processing to massive data collection programs.

Benefits of Technology and Core Capabilities to our Customers

Due to our core capabilities, we can provide our high-performance computing customers with platforms that are highly reliable and cost effective. Such performance allows our customers to solve bigger problems faster, and save the cost and time of highly-paid engineers, data scientists, and other human resources. Our technology enhances innovation by allowing more ‘what-if’ analysis in a finite amount of time. Our price/performance leadership enhances our customers’ competitiveness and lowers capital expense and total cost of ownership. We work with our OEM customers to develop custom ‘perfect fit solutions’ for their unique requirements.

Our Products

Compute Servers

Within the server sector, we have secured a niche position of building purpose-built specialty servers, which the major server suppliers choose not to supply, as they require custom tuning and special features that major OEMs cannot easily provide. Our compute servers are designed to provide the highest level of performance that can be deployed in harsh edge environments. Our extensible operating system (“EOS”) line of servers is optimized for supporting a high number of expansion chassis. Servers in this product family have a large number of slots that are compatible with the PCIe host bus interface cards that we have developed. These cards enable PCIe connection over cable between the hose processor and downstream I/O devices. These servers have custom basic input/output systems (“BIOS”) to ensure they work seamlessly with expansion chassis and support a high number of downstream I/O devices. Our software-defined storage (“SDS’) line of servers support rugged deployment in space constrained environments providing a maximum depth of 20 inches. We believe that our newly announced “Rigel Edge SuperComputer” (“Rigel”) is the highest performance, most dense, AI-compute platform that is deployable in extreme environments, including on military aircraft. We also design custom servers; for example, a server with custom connectors and 16 high-definition video media outputs that are used in the entertainment industry to provide multimedia at live performances.

GPU computing uses hardware components that are optimized to perform mathematical calculations in a rapid fashion. NVIDIA is the market leader in the design and manufacturing of these components. We work closely with NVIDIA to design and build systems which use multiple GPUs to accelerate applications.

Emerging markets and applications such as AI, image rendering and processing, autonomous vehicles, deep learning, molecular modeling, genomics, advanced visualization, machine learning, and image processing, all benefit from the ability to use GPUs to accelerate the application. We build specialized compute-servers and accelerators used in these emerging growth markets. We estimate these markets to be very large and growing. Because our strategy has been to be first-to-market with the fastest and densest compute appliances, we anticipate our addressable market to be in the hundreds of millions of dollars.

Storage Servers

We also build standard and custom flash storage arrays utilizing our unique know-how in PCIe device fan-out, packaging, cooling, and PCIe-over-cable. We deliver dense, high-performance systems that provide customers with high value and utility in the most demanding, data-intensive operations. These OSS Storage Servers complement our compute servers to provide an end-to-end edge solution for AI workflows.

Through a strategic agreement with Western Digital, we acquired a software engineering team on July 1, 2017, and entered into a license agreement to obtain rights to the appropriate source code for the Ion flash array software. This provides our flash arrays with a high level of differentiation relating to storage management, latency, and throughput. We provide standard flash array products and have the in-house hardware and software expertise to provide customized systems for demanding applications that are not suitable for standard offerings. For example, we provide products to a large military contractor for integration into military aircrafts that require us to design and manufacture a highly ruggedized mil-spec flash array. The resulting product provides high data density with low weight, a high degree of portability, and security for data protection. We believe our experience and capability in high speed, low-latency, digital signaling via PCIe gives us an edge in providing custom designs to OEMs, military programs, and other special purpose applications.

13

We believe that because our products are positively differentiated by speed, density, and management features for challenging edge applications, our offerings compete favorably in this market and provide a substantial growth opportunity.

PCIe Expansion and Adaptors

PCIe is the high-speed standard for communications within a computer. This standard defines the signals and connectors (i.e., slots) that are used for computer add-in cards (such as Ethernet or graphics). Traditionally, communication between computers in the network is completed via Ethernet. Although Ethernet is great for large networks, this introduces delays and latency challenges. To keep performance at the highest level, PCIe signaling can also be routed over a cable, allowing expansion input/output slots to be physically located in a separate chassis. This provides for high-performance and low latency, which are essential in this market.

Being able to separate the server from the I/O expansion, by using PCIe over a cable, facilitates disaggregation of server functionality. That is, with PCIe, server I/O functions no longer need to be contained in the physical server chassis, but instead, can be separated into a separate chassis and continue to operate at full speed. This offers many advantages over higher latency and power consuming traditional networking communications like Ethernet. From a practical perspective, servers can be connected directly to larger storage arrays or other peripheral devices, with the resulting group of chassis operating as if they were all in the same physical chassis.

We began developing our first PCIe-over-cable adaptor in 2006, and were one of the early providers of PCIe adaptors. We recognized this space as a prime opportunity to utilize our core strengths, such as:

|

|

• |

High-speed board design and layout; |

|

|

• |

Signal integrity masters; |

|

|

• |

Hardware tuning to improve signal integrity; |

|

|

• |

Design optimization for low cost; |

|

|

• |

Rapid design capability; |

|

|

• |

Custom BIOS to support a high number of connected PCIe I/O devices well beyond what can be supported in off the shelf BIOS; and |

|

|

• |

Manufacturing and supply chain management. |

This technology has now become a standard within the computer industry, our customers have used our adaptors to connect their custom input/output chassis and achieve performance equivalence as if the input/output was integrated into the server box. This gives designers and integrators a degree of flexibility and utility in architecting computer systems that is unprecedented. We have expanded our PCIe adaptor market in breadth and depth, including making adaptors for many OEM customers.

With our expertise developed in designing adaptor cards, the logical extension of our capability led us to develop a method for expanding the PCIe bus into an external chassis containing one or many expansion slots. This allows a customer to install multiple standard PCIe boards into a chassis and expand their system without having to add additional servers. These are typically GPUs, FPGAs or NVMe drives to create large-scale Compute and Storage appliances. For example, we have developed a product for deployment in a mobile command center, which aggregates large amounts of high frequency data from sensors and allows in the field AI algorithms to operate in real time. This is achieved through a cluster of our Compute and Storage products. A user can now connect a multiplicity of PCIe devices to a single server, and achieve performance throughput and low latency, what was not possible prior to the introduction of PCIe.

We have been a leader in PCIe expansion backplanes and chassis through generations 1.0, 2.0, 3.0, and 4.0. As PCIe evolves through generations 5.0 and 6.0, we believe that we are uniquely positioned to continue our leadership role in this market. We have introduced a full line of PCIe Gen 4.0 products, and expect to take a leadership role with PCIe Gen 5.0 as we introduce products in 2022. We currently offer what we believe to be the largest PCIe expansion product line, with chassis and backplanes that offer expansion from one to 64 slots. Due to its greater data throughput and flexibility of design, we believe this is a growing market, and we intend to maintain our leadership role within the market.

14

Additional Compute Products

Through our Bressner subsidiary, we provide small, form factor high-performance industrial and panel PCs compute-platforms customizable to meet needs in industrial applications on the edge where space constraint is a fundamental consideration. We also provide ruggedized, mobile tablets and handhelds that meet the specialized requirement for devices deployed at the edge in a diverse set of environmental conditions.

Customers

We serve a global clientele consisting of multinational companies, governmental agencies, military contractors, and leading technology providers. Some of our key customers are set forth below, illustrating the class of customers we pursue with our sales, product marketing and marketing communications efforts.

Raytheon – We work closely with many of the US Government agencies and prime contractors to bring the latest technologies to mobile edge applications. Raytheon provides an excellent example of how we adapted high-performance computing elements used in air-conditioned datacenters to the rigorous environment encountered in a US Navy aircraft. We worked closely with Raytheon to build a customized NVMe storage array, with drives installed in removable canisters for high-speed sensor data acquisition, encryption, and recording. This massive amount of mission data can then be easily off-loaded upon landing the aircraft and sent to the traditional government data center, which is a significant development given that satellite network links are too slow to handle transmitting that amount of data. To further enhance the data collected, we embarked on a second project with Raytheon to build a GPU accelerated “datacenter in the sky” system to enable mission data collected in the flash array to be analyzed and run through AI algorithms in real time while the mission was in process. This allowed the aircraft and crew to make real time decisions using the same level of processing power available in a ground-based system. Finally, we enhanced that “datacenter in the sky” with a 3-system cluster to provide large scale resources during missions and to carry out multiple AI tasks in real time. These applications are great examples of AI transportable end products. We have continued to enhance and refresh the technology for this program while working on opportunities with other prime contractors, including other mobile applications such as video surveillance, video analytics and autonomous vehicles on land, in the sea and in the air.

disguise – disguise is the leading provider of hardware and software that allows their customers to produce live events, television broadcasts, theater effects, and special effects for concert tours. In addition to its live event products, disguise is becoming a leader in the virtual world by leveraging the same technology and our products to create realistic 3D backdrops in movie and broadcast studios around the world. We have worked with disguise to design purpose-built, rugged servers that act as video controllers to create the virtual and visual effects used in these applications. These edge servers require high performance to create the most demanding effects, but also must be rugged enough to move from venue to venue every night. The edge servers operate seamlessly with disguise’s software applications on set, providing a rich array of special effects and extended reality experiences. Events like the Super Bowl halftime show, sporting events, feature films, music videos, broadcast studio, metaverse experiences and numerous musical concerts rely upon disguise controllers, designed, and produced by us to deliver a lasting impression on audiences.

National Instruments – National Instruments is a market leader and multinational company that produces automated test equipment and virtual instrumentation software. We provide several PCI Express-based interface cards that are branded by National Instruments and used in capturing and controlling sensors that produce AI datasets. We act as an extension to National Instruments’ engineering group, allowing National Instruments to complete their product roadmap in a timely and cost-effective manner.

Alcon – Alcon is a market leader in the production of computer assisted medical equipment. Our European subsidiary, Bressner, provides several rugged, purpose-built, high-performance workstations used in performing these AI assisted surgeries. Bressner works directly with Alcon engineers to co-design and assist in securing medical certifications for the products that doctors and patient trust for pinpoint accuracy and speed.

15

Sales and Marketing

Our sales and marketing efforts are focused on promoting sales, producing expert content, and brand awareness.

Sales

Our sales efforts consist of five main channels:

|

|

• |

General Sales – OSS and Bressner maintain web sites, a web store and direct sales teams that sell directly to end-users, primarily in the United States (“US”) and the European, Middle East, and African (“EMEA”) regions. This includes e-commerce sales via typical web store functionality, outbound calling and direct interaction with customers and potential customers to provide standard and unique solutions that fit their needs. |

|

|

• |

OEM Focused Sales – Our direct outside sales team, which consists of OSS employees as well as third-party manufacture representatives, is organized to best identify, target, and develop the top potential commercial OEM and government program customers in the AI Transportable Space. These OEM and government programs form the largest and fastest growing parts of our business. The OSS and Bressner direct sales teams interface directly with new potential customers at live events and, virtual industry tradeshows, and present standard solutions and/or proposals for customized solutions (as applicable) to address such customers’ high-performance AI Transportable needs at the edge. |

|

|

• |

Our Commercial Sales Team – Our commercial sales team focuses on OEM customers to whom we sell standard solutions or design and build customer specified systems based on OSS and Bressner technology expertise that are branded with the OEM’s name and label. This includes target markets like autonomous semi-trucks, farming and mining equipment deploying the latest technology. These companies, many market leaders, then resell the products through their own sales channels. We actively seek this type of relationship, which is leveraged as a sales multiplier, allowing us to grow sales at a faster rate without adding as many dedicated sales resources. |

|

|

• |

Our Government Sales Team – Our government sales team focuses on the large and growing portion of our business that provides systems to US Department of Defense programs, global government agencies, and national laboratories. Our government sales team has the knowledge and expertise to identify major program opportunities in the AI Transportables space and provide the extensive technical and business documentation to take these programs from concept to successful completion. This is a growing part of our business is one of our primary focuses, and provides a higher contribution of profit margin. Examples include compute and storage systems for aircraft, radar systems, command centers. |

|

|

• |

Channels – We have dedicated sales resources at OSS and Bressner that manage our worldwide network of resellers and distributors, including those distributors that we utilize throughout Asia. We sell a large breadth of standard products through these channels, which allow us to achieve global customer touch without requiring a physical presence in all geographies. The master distributors in several countries have dedicated sales expertise to capture additional OEM business, with both Fortune 500 and second tier OEM firms extending our international footprint. With the acquisition of Bressner, we have a greater direct presence in Europe, which allows greater access to those markets. |

Marketing Communications

Our marketing communications department is responsible for positioning OSS as an expert and visionary in the AI Transportables market. We generate expert content to support our market leading products, while also building cost effective brand/product awareness in several ways. We use traditional and non-traditional marketing communications, as well as partnerships and word of mouth, to convey the uniqueness and compelling value of our products and services. The AI Transportable market applications we target include AI inference applications in autonomous vehicles, medical equipment, commercial aerospace, defense/government, oil and gas exploration, and media and entertainment. Bressner additionally targets embedded industrial and IoT customers in the EMEA region. Among the many channels utilized are:

|

|

• |

Trade Shows – OSS and Bressner participate in several live and virtual tradeshows and events during the year to generate new relationships and foster existing relationships with customers and partners. These engagements allow us to showcase our standard and custom product expertise to our target customers. The target trade shows include AUSA (US Army), Sea-Air-Space (Navy/NASA), GPU Technology Conferences globally, DSEI (International Military), Supercomputing and International Supercomputing, Medica (medical), AUVSI (autonomous vehicle) and Embedded World. We evaluate the return on investment (“ROI”) and costs of each show on an annual basis; accordingly, participation may change from year to year. |

16

|

|

• |

Electronic Media – OSS and Bressner use various forms of electronic advertising media to market both the AI Transportable products and capabilities of the Company. Electronic media includes internal direct email campaigns such as monthly newsletters and various press releases for new products, technology developments, partnerships and significant application design wins. In addition, we use media companies relevant to our target markets to disseminate information about the Company to a larger set of potential customers. The format of the electronic advertising varies, but with the common focus on content advertising demonstrating our market expertise with a secondary focus on brand awareness. The various electronic media formats that we utilize include, but are not limited to, search engine ads and keyword campaigns, digital ads, display ads, datasheet emails, customer use cases, e-newsletters, and text ads. Our web site is key at leveraging our leadership content, positioning, and search engine optimization (“SEO”) capabilities. We will continue to invest on this front. |

|

|

• |

Social Media – OSS and Bressner regularly use Facebook, LinkedIn, and Twitter to instantly alert the Company’s followers to new events, products, services, and customer stories. |

|

|

• |

Publications – We periodically publish white papers, customer success stories, and other demand generation technology articles in printed and electronic periodicals and newsletters, including, but not limited to, InsideHPC, Military Embedded Systems, Edge Industry Review, Aerospace and Defense and HPC wire. We also invest in print ads in the EMEA region, with the highest ROI in select industry magazines for brand awareness. |

As we grow, it is anticipated our marketing efforts will likewise continue to increase in size and focus on the AI Transportable market.

Competition

Our core business is to provide specialized high-performance edge AI computing platforms to OEMs who incorporate these products into their complete solutions, which they then sell to end users in the AI Transportable market. Due to the nature of our business, there are a number of categories of potential competitors of our products.

Customer in-house design resources

Many of our target OEM customers have in-house engineering design resources, which could be used as an alternative to engaging with us. Examples of current OSS customers who have significant in-house resources include National Instruments, Raytheon, and Lockheed Martin. This potential competition is mitigated by the technical specialization that we have, especially in high-end and large-scale PCI Express switch fabrics and PCI Express over cable capabilities. OEMs can invest their in-house resources on value-add capabilities within their specific vertical market and outsource these horizontal technology capabilities to us. We have also developed a trusted partner relationship with many of these OEMs and have established a market reputation for technical expertise and a responsive and cost-effective engagement model. We win when our customers realize that together we can produce better products faster and more cost-effectively than they can by themselves. This has proven to be particularly evident when customers require state-of-the-art products that are constructed of parts available commercially. This has resulted in several program wins that demonstrate our flexibility and how we can work closely with large OEM and government customers. Interestingly, it appears that when these large companies cut back on their workforce or have limited funding, such events bolster our position, as we may become these companies’ only option to get their desired product or service deployed within a reasonable period.

Major Tier 1 & 2 Mainstream Computer, GPU and Storage Vendors

These vendors offer mainstream high-performance computing platforms, including servers and storage systems that can address some applications at the edge in our target markets. Typically, they do not; however, offer the ‘specialized’ platforms or customization capabilities that we specialize in to meet unique form factor, power, ruggedization or scale out requirements sought by OEM customers. Generally, these vendors focus on the large, air-conditioned data centers and competing with such vendors based on price/volume as differentiation is challenging. Our strategy is specifically designed to avoid head-to-head competition in this part of the market with this class of vendors. In some scenarios, we can provide a complementary specialized component or building block, which interfaces with one of these vendors’ mainstream products. Examples of companies in this space include NVIDIA, HP, Dell/EMC, IBM, SuperMicro, Pure Storage, and NetApp.

Vertical High Performance Compute Vendors – Military/Aerospace

In certain vertical markets, there are competitors who focus primarily on the high performance compute (“HPC”) military and aerospace markets. These vendors often provide complete solutions, including both hardware and software, and some specialization in terms of form factor and ruggedization. In these markets, we provide unique capability in terms of

17

scaling of PCI Express components over cable (copper and fiber) that can address unique requirements of specific military or government programs. Many of these competitors use older technologies in these more challenging environments. We are able to differentiate ourselves from such competitors due to the fact that we deploy the latest high-performance technology which enables us to provide superior products to potential customers in this space. We have also established good relationships with prime contractors or governmental agencies (Raytheon, Lockheed, Boeing, NASA, ONR, and others), which can be important influencers or decision makers on technology selection. Competitors in this space include companies such as Mercury, Crystal, Curtiss Wright, Kontron, Trenton, Core Systems and Systel. In the past, we have been able to offer the latest technology to the rugged edge, which is normally only deployed in commercial applications, well before our competitors by leveraging our “performance, without compromise” strategy.

Manufacturing and Operations

OSS and Bressner are certified under ISO 9001-2015 for “design, manufacture, and supply of industrial computers.” This means OSS and Bressner have demonstrated their ability to consistently provide products that meet both customer requirements and applicable government regulations or statutory requirements. In February 2022, OSS upgraded its ISO 9001 certification to the higher tier, AS9100, which is the pinnacle of quality management systems recognized by government and aerospace companies world-wide. It also indicates that we have programs and processes in place to ensure a high level of customer satisfaction, as well as continuous improvement and risk mitigation programs that ensure we get better over time.

While OSS and Bressner primarily utilize lean principles to drive our manufacturing and assembly process, we recognize the importance of smooth builds and strategic inventory in this current climate of sustained supply chain shortages. One of the key aspects of utilizing lean principles is our application of just-in-time principles to ensure effective ordering and utilization of inventory. This also helps optimize cash flow throughout the manufacturing cycle. Within the manufacturing process, our operations encompass three categories of “builds”:

|

|

• |

Standard Builds – These are builds of standard products that are sold with little or no customization or non-standard features. These are products that are ready to be installed or integrated by the customer upon receipt. |

|

|

• |

Custom Builds – Custom builds involve a product built to a customer specification at our facilities. Upon receipt, the customer has a unique product that performs all the functions and has the physical dimensions that match their specifications. |

|

|

• |

Engineering Project Builds – We support the product development process by building models and prototypes of products. Developed by our engineering group, the prototypes can be of standard or custom products. |

We are dedicated to quality and customer satisfaction. Our continuous improvement efforts require us to review products, services, and processes with the idea that minor changes can lead to greater outcomes for our customers. Although we serve the high-end of the rugged edge computing space, we are constantly looking for ways to become more efficient and drive down costs while driving up margins.

Research and Development

Our ability to compete successfully in our industry is heavily dependent upon our ability to ensure a continuous and timely flow of competitive products, services, and technologies to the marketplace. We continue to develop new products and technologies and to enhance existing products that will further drive commercialization. We may also expand the range of our product offerings and intellectual property through licensing and/or acquisitions of third-party businesses and technologies.

Our intellectual property research and development is focused on the exploitation of key technologies as they evolve in the marketplace. Our product roadmap reflects new technologies for CPUs, GPUs, flash storage, and advanced PCIe switches. We design first-to-market, unique implementations targeted at the AI Transportable market utilizing market leading component technologies. Accordingly, our focus lies not in the capital-intensive development of silicon implementations of technologies (i.e., chips, processors, GPUs, or storage devices), but rather leverages leading-edge technologies and building first-to-market products that fully exploit those technologies to solve customer problems in challenging environments.

Our research and development strategy can be summarized as follows: We drive customer program wins by utilizing new key technologies to develop products that are leading edge and first-to-market and that are designed to solve challenging problems in harsh environments, while working closely with our customers to understand and address their needs.

18

Intellectual Property

Our primary intellectual property value emanates from the more than 600 individual design projects that we have undertaken over the decades since our founding, experience, and knowhow, in addition to trade secrets and copyrights. These designs are archived and cataloged; we rarely begin a new design from scratch, but rather, typically use our archived and cataloged designs as a starting point to efficiently provide products to our customers. In general, we maintain intellectual property rights with respect to the components of the products we design and sell so that we may continue to use them for future sales and development efforts.