UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES ACT OF 1934

For the fiscal year ended August 31, 2013

[ ] TRANSACTION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____________________ to _____________________

Commission File Number: 000-53267

IRONWOOD GOLD CORP.

(Exact

name of registrant as specified in charter)

| Nevada | 74-3207792 |

| State or other jurisdiction of incorporation or organization | (I.R.S. Employee I.D. No.) |

| 123 West Nye Ln., Ste. 129 | |

| Carson City, Nevada | 89706 |

| (Address of principal executive offices) | (Zip Code) |

888-356-4942

(Registrant’s telephone number,

including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered |

| None | None |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value of $0.001 per share

(Title of Class)

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined by Rule 405 of the Securities Act.

[

] Yes [X] No

Indicate by check mark if the registrant is not required to

file reports pursuant to Section 13 or Section 15 (d) of the Act.

[

] Yes [X] No

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the past 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

[X] Yes

[ ] No

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Website, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (§229.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files).

[X] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy information statements incorporated by reference in Part III of this Form 10-K or any amendments to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See definition of “large accelerated filer,” “accelerated filer” and “small reporting company” Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] (Do not check if a small reporting company) |

Small reporting company [X] |

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Exchange Act).

Yes [

] No [X]

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of February 28, 2013 was approximately $1,037,000 based upon the closing price of $0.0680 per share reported for such date on the OTCQB. Shares of common stock held by each officer and director and by each person who is known to own 10% of more of the outstanding Common Stock have been excluded in that such persons may be deemed to be affiliates of the Company. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date:

As of December 10, 2013, there were 31,819,353 shares of the registrant’s $0.001 par value common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

-i-

PART 1

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Some discussions in this Annual Report on Form 10-K contain forward-looking statements that have been made pursuant to the provisions of the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainties and relate to future events or future financial performance. A number of important factors could cause our actual results to differ materially from those expressed in any forward-looking statements made by us in this Form 10-K. Forward-looking statements are often identified by words such as “believe,” “expect,” “estimate,” “anticipate,” “intend,” “project,” “plans,” “seek” and similar expressions or words which, by their nature, refer to future events. In some cases, you can also identify forward-looking statements by terminology such as “may,” “will,” “should,” “plans,” “predicts,” “potential” or “continue” or the negative of these terms or other comparable terminology.

These forward-looking statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” below that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. In addition, you are directed to factors discussed in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section and as well as those discussed elsewhere in this Form 10-K.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results. However, readers should carefully review the risk factors set forth in other reports or documents the Company files from time to time with the Securities and Exchange Commission (the “SEC”), particularly the Company’s Quarterly Reports on Form 10-Q and any Current Reports on Form 8-K.

As used in this Form 10-K, “we,” “us,” and “our” refer to Ironwood Gold Corp., which is also sometimes referred to as the “Company” or “Ironwood.” In addition, references to “dollars” and “$” are to United States dollars.

ITEM 1. BUSINESS.

Overview

Ironwood Gold Corp. was incorporated on January 18, 2007 under the laws of the State of Nevada under the name Suraj Ventures, Inc. for the purpose of acquiring, exploring and developing mineral properties. On October 27, 2009, we changed our name to Ironwood Gold Corp.

We are a mineral exploration company building a portfolio of exploration properties containing known deposits of gold. We have targeted several prospective locations in Nevada, where approximately 80% of all gold in America is produced today.

On January 25, 2011, we entered into a lease agreement with The Falcon Group Claims (“Falcon”) for the development of a gold-silver mining project known as the Falcon Mine Property (the “Falcon Property”) located in the northern end of the Carlin Trend gold belt in Nevada (the “Lease”). The Lease includes an earn-in joint venture agreement option, to be negotiated by the parties, for further development of the Falcon Property. Such joint venture option was exercisable anytime on or before November 30, 2012, unless such option period is extended pursuant to the terms and conditions of the Lease. The Company is currently in default on this agreement. The Falcon Property consists of six patented claims and between 60-100 newly staked claims that join the patented claims on which the mine is situated. In accordance with the Lease, we are obligated to make certain expenditures on the Falcon Property, including drilling a minimum of four (4) drill holes for the purpose of obtaining soil samples and conducting field survey work on the Falcon Property. In September 2011, we announced that Snowden Mining Industry Consultants Inc. (“Snowden”) has commenced the 2011 field exploration program on the Falcon Property. On February 21, 2012, we announced that based on the results from surface mapping, sampling and a geophysical program, Snowden has identified a number of significant mineralization targets that are recommended as warranting a follow up exploration drilling program. As such, we have announced plans to proceed with an 18-hole, 6,000 meter drilling program after receiving Snowden’s favorable assessment.

The Lease calls for cash payments of $225,000 by September 1, 2012, issuance of 75,000 shares of common stock by January 28, 2011, issuance of another 75,000 shares of common stock by November 30, 2011, and a minimum of 8 drill holes by November 30, 2012, with 4 holes completed by November 30, 2011. As of February 29, 2012, we had paid $75,000, and had issued the initial 75,000 shares of our common stock to Falcon.

1

On February 22, 2012, we entered into Amendment No. 1 to the Lease (“Amendment No. 1”) with Falcon. In consideration for Falcon’s agreement to extend the due dates of the cash payments and share issuances due to Falcon in November 2011 to April 6, 2012, we paid Falcon $10,000 and agreed to issue to Falcon 500,000 shares of common stock. As of August 31, 2012, we have paid $75,000 under the original Lease and $5,000 under Amendment No. 1, and we have issued 75,000 shares of common stock under the original Lease and 500,000 shares of common stock under Amendment No. 1.

Our Falcon Property is discussed in further detail below.

Background

On October 27, 2009, we effected a 50-for-1 forward stock split. Effective October 28, 2011, we completed a 1-for-20 reverse stock split of both our authorized and issued and outstanding shares of our common stock. As a result of the reverse split, our authorized share capital is now 25,000,000 shares of common stock, with the same par value of $0.001. Unless otherwise noted, all references to share info contained in this Form 10-K are to figures and numbers post-reverse stock split.

We expect to continue to incur operating losses in the near future as we initiate mining exploration operations at our property through the remainder of 2012. We have funded our operations primarily through sales of our common stock and debt offerings, including the issuance of a $550,000 secured convertible promissory note to Alpha Capital Anstalt in August 2011.

On April 20, 2012 and February 1, 2013, we entered into an Amendment Agreemenst (the “Amendments”) with Alpha to the Note, previously disclosed in our Current Reports on Form 8-K. In connection therewith, we also agreed to Allonges to the Note (the “Allonges”) pursuant to which an additional $200,000 was issued to us under the Note. In accordance with the Amendments and the Allonges, (i) the original principal amount under the Note has increased from $550,000 to $750,000; (ii) the conversion price under the Note has been reduced from $0.40 per share to $0.05 per share; (iii) the number of warrants to purchase shares of our common stock issuable to Alpha has increased from 1,375,000 to 8,000,000; and (iv) the exercise price of the warrants has been reduced from $0.60 per share to $0.05 per share. The expiry date of the warrants issuable to Alpha was extended to February 1, 2021.

In addition, we issued an aggregate of $117,500 in secured convertible promissory notes to Asher Enterprises in September 2012, November 2012 and March 2013. The notes have maturity dates nine months from the dates of issue, and bear annual interest at aree rate of 8%. The notes is convertible at the holder’s option, during the period beginning 180 days following the date of the note and ending on the later of (i) the maturity date and (ii) the date of payment of the default amount, at a variable conversion price equal to the lowest trading price for the common stock during the 60 trading day period ending on the latest complete trading day prior to the conversion date and discounted by 55%.

We intend to explore for undiscovered deposits on these properties and to acquire and explore new properties, all with the view to enhancing the value of such properties.

Our ability to satisfy the cash requirements of our mining development and exploration operations will be dependent upon future financing. No assurance can be made that that additional financing will be obtained.

Industry

By industry standards, there are generally four types of mining companies. We are considered an “exploration stage” company. Typically, an exploration stage mining company is focused on exploration to identify new, commercially viable gold deposits. “Junior mining companies” typically have proven and probable reserves of less than one million ounces of gold, generally produce less than 100,000 ounces of gold annually, and/or are in the process of trying to raise enough capital to fund the remainder of the steps required to move from a staked claim to production. “Mid-tier” and large mining “senior” companies may have several projects in production plus several million ounces of gold in reserve.

The gold mining and exploration industry has experienced several factors recently that are favorable to our Company, as described below.

The spot market price of an ounce of gold has increased from a low of $253 in February 2001 to a high of $1,895 in September 2011 and $1,252.10 at the end of November 2013 This current price level has made it economically more feasible to produce gold, as well as making gold a more attractive investment for many. Accordingly, the gross margin per ounce of gold produced per the historical spot market price range above provides significant profit potential if we are successful in identifying and extracting gold at our properties.

Further, gold reserves have generally been declining for a number of years for the following reasons:

- the extended period of low gold prices from 1996 to 2001 made it economically unfeasible to explore for new deposits for most mining companies, and

- the demand for and production of gold products have exceeded the amount of new reserves added over the last several consecutive years.

2

Reversing the decline in lower gold reserves is a long term process. Due to the extended time frame it takes to explore, develop, and bring new production on-line, the large mining companies are facing an extended period of lower gold reserves. Accordingly, junior companies that are able to increase their gold reserves more quickly should directly benefit with an increased valuation.

Additional factors causing higher gold prices over the past several years have come from a weakened U.S. dollar. Reasons for the lower dollar compared to other currencies include, but are not limited to, the historically low U.S. interest rates, the weak U.S. economy, the increasing U.S. budget and trade deficits, and the general worldwide political instability caused by the war on terrorism.

Recent Events

Some of our more significant recent events include the following:

On April 20, 2012, we entered into an Amendment Agreement (the “Amendment”) with Alpha to the Note, previously disclosed in our Current Report on Form 8-K filed on August 18, 2011. In connection therewith, effective April 20, 2012 we also agreed to an Allonge to the Note (the “Allonge”) pursuant to which an additional $100,000 was issued to us under the Note. In accordance with the Amendment and the Allonge, (i) the original principal amount under the Note has increased from $550,000 to $650,000; (ii) the conversion price under the Note has been reduced from $0.40 per share to $0.08 per share; (iii) the number of warrants to purchase shares of our common stock issuable to Alpha has increased from 1,375,000 to 6,000,000; and (iv) the exercise price of the warrants has been reduced from $0.60 per share to $0.08 per share. The expiry date of the warrants issuable to Alpha remains unchanged at August 16, 2016.

On February 1, 2013, we entered into an Amendment Agreement (the “Amendment”) with Alpha to the Note, previously disclosed in our Current Report on Form 8-K filed on August 18, 2011, amended on April 20, 2012 and disclosed in ou Quarterly Report on Form 10-Q filed on April 27, 2012. In connection therewith, effective February 1, 2013 we also agreed to an Allonge to the Note (the “Allonge”) pursuant to which an additional $100,000 was issued to us under the Note. In accordance with the Amendment and the Allonge, (i) the outstanding principal amount under the Note has increased from $650,000 to $750,000; (ii) the conversion price under the Note has been reduced from $0.08 per share to $0.05 per share; (iii) the number of warrants to purchase shares of our common stock issuable to Alpha has increased from 6,000,000 to 8,000,000; and (iv) the exercise price of the warrants has been reduced from $0.08 per share to $0.05 per share. The expiry date of the warrants issuable to Alpha remains unchanged at August 16, 2016.

In addition, we issued an aggregate of $117,500 in secured convertible promissory notes to Asher Enterprises in September 2012, November 2012 and March 2013. The notes have maturity dates nine months from the dates of issue, and bear annual interest at aree rate of 8%. The notes is convertible at the holder’s option, during the period beginning 180 days following the date of the note and ending on the later of (i) the maturity date and (ii) the date of payment of the default amount, at a variable conversion price equal to the lowest trading price for the common stock during the 60 trading day period ending on the latest complete trading day prior to the conversion date and discounted by 55%.

Sources of Available Land for Mining and Exploration

There are at least five sources of land available for exploration, development and mining: public lands, private fee lands, unpatented mining claims, patented mining claims, and tribal lands. The primary sources for acquisition of these lands are the United States government, through the Bureau of Land Management and the United States Forest Service, state governments, tribal governments, and individuals or entities that currently hold title to or lease government and private lands.

There are numerous levels of government regulation associated with the activities of exploration and mining companies. Permits include “Notice of Intent” to explore, “Plan of Operations” to explore, “Plan of Operations” to mine, “Reclamation Permit,” “Air Quality Permit,” “Water Quality Permit,” “Industrial Artificial Pond Permit,” and several other health and safety permits. These permits are and will be subject to amendment or renewal during our operations. Although there is no guarantee that the regulatory agencies will timely approve, if at all, the necessary permits for our current operations or other anticipated operations, we have no reason to believe that necessary permits will not be issued in due course. The total cost and effects on our operations of the permitting and bonding process cannot be estimated at this time. The cost will vary for each project when initiated and could be material.

The Federal government owns public lands that are administered by the Bureau of Land Management or the United States Forest Service. Ownership of the subsurface mineral estate can be acquired by staking a twenty (20) acre mining claim granted under the General Mining Law of 1872, as amended (the “General Mining Law”). The Federal government still owns the surface estate even though the subsurface can be controlled with a right to extract through claim staking. Private fee lands are lands that are controlled by fee-simple title by private individuals or corporations. These lands can be controlled for mining and exploration activities by either leasing or purchasing the surface and subsurface rights from the private owner. Unpatented mining claims located on public land owned by another entity can be controlled by leasing or purchasing the claims outright from the owners. Patented mining claims are claims that were staked under the General Mining Law, and through application and approval the owners were granted full private ownership of the surface and subsurface estate by the Federal government. These lands can be acquired for exploration and mining through lease or purchase from the owners. Tribal lands are those lands that are under control by sovereign Native American tribes. Areas that show promise for exploration and mining can be leased or joint ventured with the tribe controlling the land.

3

Competitive Business Conditions

We compete with many companies in the mining business, including larger, more established mining companies with substantial capabilities, personnel and financial resources. Of the four types of mining companies, we believe junior mining companies represent the largest group of gold companies that are publicly listed. All four types of mining companies may have projects located in any of the gold producing continents of the world and many have projects located in Nevada. Further, there is a limited supply of desirable mineral lands available for claim-staking, lease or acquisition in the United States and other areas where we may conduct exploration activities. Because we compete with individuals and companies that have greater financial resources and larger technical staffs, we may be at a competitive disadvantage in acquiring desirable mineral properties. From time to time, specific properties or areas that would otherwise be attractive to us for exploration or acquisition are unavailable due to their previous acquisition by other companies or our lack of financial resources.

Competition in the mining industry is not limited to the acquisition of mineral properties but also extends to the technical expertise to find, advance, and operate such properties; the labor to operate the properties; and the capital needed to fund the acquisition and operation of such properties. Competition may result in our company being unable not only to acquire desired properties, but to recruit or retain qualified employees, to obtain equipment and personnel to assist in our exploration activities or to acquire the capital necessary to fund our operation and advance our properties. Our inability to compete with other companies for these resources would have a material adverse effect on our results of operation and business.

As noted above, we compete with other mining and exploration companies, many of which possess greater financial resources and technical facilities than we do, in connection with the acquisition of suitable exploration properties and in connection with the engagement of qualified personnel. The gold and silver exploration and mining industry is fragmented, and we are a very small participant in this sector. Many of our competitors explore for a variety of minerals and control many different properties around the world. Many of them have been in business longer than we have and have established more strategic partnerships and relationships and have greater financial accessibility than we have. Accordingly, given the significant competition for gold and silver exploration properties, we may be unable to continue to acquire interests in attractive gold and silver mineral exploration properties on terms we consider acceptable.

While we compete with other exploration companies in acquiring suitable properties, we believe that there would be readily available purchasers of gold and/or silver and other precious metals if they were to be produced from any of the properties we acquire an interests in. The price of precious metals can be affected by a number of factors beyond our control, including:

- fluctuations in the market prices for gold and silver;

- fluctuating supplies of gold and silver;

- fluctuating demand for gold and silver; and

- mining activities of others.

If we find gold and/or silver mineralization that is determined to be of economic grade and in sufficient quantity to justify production, we may then seek significant additional capital through equity or debt financing to develop, mine and sell our production. Our production would probably be sold to a refiner that would in turn purify our material and then sell it on the open market or through its agents or dealers. In the event we should find economic concentrations of gold or silver mineralization and were able to commence production, we do not believe that we would have any difficulty selling the gold or silver we would produce.

We do not engage in hedging transactions and we have no hedged mineral resources.

Compliance with Government Regulations

Various levels of governmental controls and regulations address, among other things, the environmental impact of mineral exploration and mineral processing operations and establish requirements for decommissioning of mineral exploration properties after operations have ceased. With respect to the regulation of mineral exploration and processing, legislation and regulations in various jurisdictions establish performance standards, air and water quality emission standards and other design or operational requirements for various aspects of the operations, including health and safety standards. Legislation and regulations also establish requirements for decommissioning, reclamation and rehabilitation of mineral exploration properties following the cessation of operations and may require that some former mineral properties be managed for long periods of time.

4

Our exploration activities are subject to various levels of federal and state laws and regulations relating to protection of the environment, including requirements for closure and reclamation of mineral exploration properties. Some of the laws and regulations include the Clean Air Act, the Clean Water Act, the Comprehensive Environmental Response, Compensation and Liability Act, the Emergency Planning and Community Right-to-Know Act, the Endangered Species Act, the Federal Land Policy and Management Act, the National Environmental Policy Act, the Resource Conservation and Recovery Act, and all the related state laws in Nevada, some of which are discussed in more detail below.

The state of Nevada adopted the Mined Land Reclamation Act (the “Nevada Act”) in 1989 that established design, operation, monitoring and closure requirements for all mining operations in the state. The Nevada Act has increased the cost of designing, operating, monitoring and closing new mining facilities and could affect the cost of operating, monitoring and closing existing mining facilities. New facilities are also required to provide a reclamation plan and financial assurance to ensure that the reclamation plan is implemented upon completion of operations. The Nevada Act also requires reclamation plans and permits for exploration projects that will result in more than five acres of surface disturbance.

We plan to secure all necessary state and federal permits for our exploration activities and we intend to file for the required permits to conduct our exploration programs as necessary. These permits are usually obtained from either the Bureau of Land Management or the United States Forest Service. Obtaining such permits usually requires the posting of small bonds for subsequent remediation of trenching, drilling and bulk-sampling.

We do not anticipate discharging water into active streams, creeks, rivers, lakes or any other bodies of water without an appropriate permit. We also do not anticipate disturbing any endangered species or archaeological sites or causing damage to the properties in which we have an interest. Re-contouring and re-vegetation of disturbed surface areas will be completed pursuant to the applicable permits. The cost of remediation work varies according to the degree of physical disturbance. It is difficult to estimate the cost of compliance with environmental laws since the full nature and extent of our proposed activities cannot be determined at present.

Environmental Regulation

As noted above, mining activities at and on our properties are subject to various environmental laws, both federal and state, including but not limited to the federal National Environmental Policy Act, CERCLA (as defined below), the Resource Recovery and Conservation Act, the Clean Water Act, the Clean Air Act and the Endangered Species Act, and certain state laws governing the discharge of pollutants and the use and discharge of water. Various permits from federal and state agencies are required under many of these laws. Local laws and ordinances may also apply to such activities as construction of facilities, land use, waste disposal, road use and noise levels.

These laws and regulations are continually changing and, as a general matter, are becoming more restrictive. Our policy is to conduct our business in a manner that safeguards public health and mitigates the environmental effects of our business activities. To comply with these laws and regulations, we have made, and in the future may be required to make, capital and operating expenditures.

The Comprehensive Environmental Response, Compensation, and Liability Act of 1980, as amended (“CERCLA”), imposes strict, joint, and several liability on parties associated with releases or threats of releases of hazardous substances. Liable parties include, among others, the current owners and operators of facilities at which hazardous substances were disposed or released into the environment and past owners and operators of properties who owned such properties at the time of such disposal or release. This liability could include response costs for removing or remediating the release and damages to natural resources. The properties in which we have certain interests, because of past mining activities, could give rise to potential liability under CERCLA.

Under the Resource Conservation and Recovery Act (“RCRA”) and related state laws, mining companies may incur costs for generating, transporting, treating, storing, or disposing of hazardous or solid wastes associated with certain mining-related activities. RCRA costs may also include corrective action or clean up costs. The majority of the waste which is produced by such operations is “extraction” waste that Environmental Protection Agency (“EPA”) has determined not to regulate under RCRA’s “hazardous waste” program. Instead, the EPA is creating a solid waste regulatory program specific to mining operations under the RCRA. Of particular concern to the mining industry is a proposal by the EPA entitled “Recommendation for a Regulatory Program for Mining Waste and Materials Under Subtitle D of the Resource Conservation and Recovery Act” (“Strawman II”) which, if implemented, would create a system of comprehensive Federal regulation of the entire mine site. Many of these requirements would be duplicates of existing state regulations. Strawman II as currently proposed would regulate not only mine and mill wastes but also numerous production facilities and processes which could limit internal flexibility in operating a mine. To implement Strawman II the EPA must seek additional statutory authority, which is expected to be requested in connection with Congress’ reauthorization of RCRA.

Mining operations may produce air emissions, including fugitive dust and other air pollutants, from stationary equipment, such as crushers and storage facilities, and from mobile sources such as trucks and heavy construction equipment. All of these sources are subject to review, monitoring, permitting, and/or control requirements under the federal Clean Air Act and related state air quality laws. Air quality permitting rules may impose limitations on our production levels or create additional capital expenditures in order to comply with the permitting conditions.

5

Under the federal Clean Water Act, point-source discharges are regulated by the National Pollution Discharge Elimination System program. Stormwater discharges also are regulated and permitted under that statute. Section 404 of the Clean Water Act regulates the discharge of dredge and fill material into waters of the United States, including wetlands. All of those programs may impose permitting and other requirements on our operations.

The National Environmental Policy Act (“NEPA”) requires an assessment of the environmental impacts of major federal actions. The federal action requirement must be satisfied if the project involves federal land or if the federal government provides financing or permitting approvals. NEPA does not establish any substantive standards, but requires the analysis of any potential impacts. The scope of the assessment process depends on the size of the project. An Environmental Assessment (“EA”) may be adequate for smaller projects. An Environmental Impact Statement, which is much more detailed and broader in scope than an EA, is required for larger projects. NEPA compliance requirements for any of our proposed projects could result in additional costs or delays.

The Endangered Species Act (“ESA”) is administered by the U.S. Fish and Wildlife Service of the U.S. Department of Interior. The purpose of the ESA is to conserve and recover listed endangered and threatened species and their habitat. Under the ESA, endangered means that a species is in danger of extinction throughout all or a significant portion of its range. The term threatened under such statute means that a species is likely to become endangered within the foreseeable future. Under the ESA, it is unlawful to take a listed species, which can include harassing or harming members of such species or significantly modifying their habitat. Future identification of endangered species or habitat in our project areas may delay or adversely affect our operations.

U.S. federal and state reclamation requirements often mandate concurrent reclamation and require permitting in addition to the posting of reclamation bonds, letters of credit or other financial assurance sufficient to guarantee the cost of reclamation. If reclamation obligations are not met, the designated agency could draw on these bonds or letters of credit to fund expenditures for reclamation requirements. Reclamation requirements generally include stabilizing, contouring and re-vegetating disturbed lands, controlling drainage from portals and waste rock dumps, removing roads and structures, neutralizing or removing process solutions, monitoring groundwater at the mining site, and maintaining visual aesthetics.

Capital Equipment and Expenditures

During the year ended August 31, 2013, our efforts were primarily focused on exploring potential mining opportunities; therefore, no material capital equipment was acquired by us.

Employees

We currently use the services of subcontractors for manual labor exploration work on our claims. At present, we have no employees as such although each of our officers and directors devotes a portion of his time to the affairs of the Company. None of our officers and directors has an employment agreement with us. We presently do not have pension, health, annuity, insurance, profit sharing or similar benefit plans; however, we may adopt such plans in the future. There are presently no personal benefits available to any employee.

Investment Policies

We do not have an investment policy at this time. Any excess funds the Company has on hand will be deposited in interest bearing notes such as term deposits or short term money instruments. There are no restrictions on what the directors are able to invest or additional funds held by our Company. Presently we do not have any excess funds to invest.

Corporate Information

Our principal executive office is located at: 123 West Nye Ln., Ste. 129, Carson City, Nevada, 89706. Our telephone number is 888-356-4942. Our website address is www.ironwoodgold.com. The information on our website is not a part of this Annual Report on Form 10-K.

ITEM 1A. RISK FACTORS.

You should carefully consider the risks described below together with all of the other information included in our public filings before making an investment decision with regard to our securities. The statements contained in or incorporated into this document that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following events described in these risk factors actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Related to our Business

6

Because of the unique difficulties and uncertainties inherent in mineral exploration ventures, we face a high risk of business failure.

Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications, and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, environmental permitting difficulties and delays, and additional costs and expenses that may exceed current estimates. The expenditures to be made by us in the exploration of the mineral claim may not result in the discovery of mineable mineral deposits. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. If the results of our exploration do not reveal viable commercial mineralization, we may decide to abandon our claims. If this happens, our business will likely fail.

Because of the speculative nature of exploration of mineral properties, we may never discover a commercially exploitable quantity of minerals, our business may fail and investors may lose their entire investment.

We have been conducting and plan to conduct mineral exploration on our mineral properties. The search for valuable minerals as a business is extremely risky. We can provide investors with no assurance that additional exploration on our properties will establish that commercially exploitable reserves of minerals exist on our property. Additional potential problems that may prevent us from discovering any reserves of minerals on our property include, but are not limited to, unanticipated problems relating to exploration, environmental permitting difficulties and delays, and additional costs and expenses that may exceed current estimates. If we are unable to establish the presence of commercially exploitable reserves of minerals on our properties our ability to fund future exploration activities will be impeded, we will not be able to operate profitably and investors may lose all of their investment in our company.

The nature of mineral exploration and production activities involves a high degree of risk and the possibility of uninsured losses that could materially and adversely affect our operations.

Exploration for minerals is highly speculative and involves greater risk than many other businesses. Many exploration programs do not result in the discovery of mineralization and any mineralization discovered may not be of sufficient quantity or quality to be profitably mined. Few properties that are explored are ultimately advanced to the stage of producing mines. Our current exploration efforts are, and any future development or mining operations we may elect to conduct will be, subject to all of the operating hazards and risks normally incident to exploring for and developing mineral properties, such as, but not limited to:

-

economically insufficient mineralized material;

-

fluctuations in production costs that may make mining uneconomical;

-

labor disputes;

-

unanticipated variations in grade and other geologic problems;

-

environmental hazards;

-

water conditions;

-

difficult surface or underground conditions;

-

industrial accidents;

-

metallurgical and other processing problems;

-

mechanical and equipment performance problems;

-

failure of pit walls or dams;

-

unusual or unexpected rock formations;

-

personal injury, fire, flooding, cave-ins, and landslides; and

-

decrease in reserves due to a lower gold price.

7

Any of these risks can materially and adversely affect, among other things, the development of properties, production quantities and rates, costs and expenditures, and production commencement dates. We currently have no insurance to guard against any of these risks. If we determine that capitalized costs associated with any of our mineral interests are not likely to be recovered, we would incur a write-down of our investment in these interests. All of these factors may result in losses in relation to amounts spent which are not recoverable.

The potential profitability of mineral ventures depends in part upon factors beyond the control of our company and even if we discover and exploit mineral deposits, we may never become commercially viable and we may be forced to cease operations.

The commercial feasibility of mineral properties is dependent upon many factors beyond our control, including the existence and size of mineral deposits in the properties we explore, the proximity and capacity of processing equipment, market fluctuations of prices, taxes, royalties, land tenure, allowable production, and environmental regulation. These factors cannot be accurately predicted and any one or a combination of these factors may result in our company not receiving an adequate return on invested capital. These factors may have material and negative effects on our financial performance and our ability to continue operations.

Mineralized material is based on interpretation and assumptions and may yield less mineral production under actual conditions than is currently estimated.

Unless otherwise indicated, mineralized material presented in our filings with securities regulatory authorities, including the SEC, press releases, and other public statements that may be made from time to time are based upon estimates made by our consultants. When making determinations about whether to advance any of our projects to development, we must rely upon such estimated calculations as to the mineralized material on our properties. Until mineralized material is actually mined and processed, it must be considered an estimate only. These estimates are imprecise and depend on geological interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be unreliable. We cannot assure you that these mineralized material estimates will be accurate or that this mineralized material can be mined or processed profitably. Any material changes in estimates of mineralized material will affect the economic viability of placing a property into production and such property’s return on capital. There can be no assurance that minerals recovered in small scale tests will be recovered at production scale. The mineralized material estimates have been determined and valued based on assumed future prices, cut-off grades, and operating costs that may prove inaccurate. Extended declines in market prices for gold and silver may render portions of our mineralized material uneconomic and adversely affect the commercial viability of one or more of our properties and could have a material adverse effect on our results of operations or financial condition.

The construction of mines are subject to all of the risks inherent in construction.

These risks include potential delays, cost overruns, shortages of material or labor, construction defects, and injuries to persons and property. While we anticipate taking all measures which we deem reasonable and prudent in connection with the construction, there is no assurance that the risks described above will not cause delays or cost overruns in connection with such construction. Any delay would postpone our anticipated receipt of revenue and adversely affect our operations. Cost overruns would likely require that we obtain additional capital in order to commence production. Any of these occurrences may adversely affect our ability to generate revenues and the price of our stock.

An adequate supply of water may not be available to undertake mining and production at our property.

The amount of water that we are entitled to use from wells must be determined by the appropriate regulatory authorities. A determination of these rights is dependent in part on our ability to demonstrate a beneficial use for the amount of water that we intend to use. Unless we are successful in developing a property to a point where it can commence commercial production of gold or other precious metals, we may not be able to demonstrate such beneficial use. Accordingly, there is no assurance that we will have access to the amount of water needed to operate a mine at our properties.

Exploration and exploitation activities are subject to comprehensive regulation which may cause substantial delays or require capital outlays in excess of those anticipated causing an adverse effect on our company.

Exploration and exploitation activities are subject to federal, state, and local laws, regulations, and policies, including laws regulating the removal of natural resources from the ground and the discharge of materials into the environment. Exploration and exploitation activities are also subject to federal, state, and local laws and regulations which seek to maintain health and safety standards by regulating the design and use of drilling methods and equipment.

Various permits from government bodies are required for drilling operations to be conducted, and no assurance can be given that such permits will be received. Environmental and other legal standards imposed by federal, state, or local authorities may be changed and any such changes may prevent us from conducting planned activities or increase our costs of doing so, which would have material adverse effects on our business. Moreover, compliance with such laws may cause substantial delays or require capital outlays in excess of those anticipated, thus causing an adverse effect on us. Additionally, we may be subject to liability for pollution or other environmental damages which we may not be able to or elect not to insure against due to prohibitive premium costs and other reasons. Any laws, regulations, or policies of any government body or regulatory agency may be changed, applied, or interpreted in a manner which will alter and negatively affect our ability to carry on our business.

8

As we face intense competition in the mineral exploration industry, we will have to compete with our competitors for financing and for qualified managerial and technical employees.

Our property rights are in Nevada and our competition there includes large, established mining companies with substantial capabilities and with greater financial and technical resources than we have. As a result of this competition, we may have to compete for financing and be unable to acquire financing on terms we consider acceptable. We may also have to compete with the other mining companies in the recruitment and retention of qualified managerial and technical employees. If we are unable to successfully compete for financing or qualified employees, our exploration programs may be slowed down or suspended, which may cause us to cease operations as a company.

Title to mineral properties can be uncertain and we are at risk of loss of ownership of one or more of our properties.

Our ability to explore and operate our properties depends on the validity of title to that property. Unpatented mining claims provide only possessory title and their validity is often subject to contest by third parties or the federal government, which makes the validity of unpatented mining claims uncertain and generally more risky. These uncertainties relate to such things as the sufficiency of mineral discovery, proper posting and marking of boundaries, assessment work, and possible conflicts with other claims not determinable from descriptions of record. We have not obtained a title opinion on any of our properties, with the attendant risk that title to some claims, particularly title to undeveloped property, may be defective. There may be valid challenges to the title to our property which, if successful, could impair development and/or operations. We remain at risk that the mining claims may be forfeited either to the United States or to rival private claimants due to failure to comply with statutory requirements as to location and maintenance of the claims or challenges to whether a discovery of a valuable mineral exists on every claim.

Government regulation may adversely affect our business and planned operations.

Mineral exploration and development activities are subject to various laws governing prospecting, development, taxes, labor standards and occupational health, mine safety, toxic substances, land use, water use, land claims of local people, and other matters. We cannot assure you that new rules and regulations will not be enacted or that existing rules and regulations will not be applied in a manner which could limit or curtail our exploration or development of our properties.

Legislation has been proposed that could significantly affect the mining industry in the United States of America.

Members of the U.S. Congress have repeatedly introduced bills which would supplant or alter the provisions of the Mining Law of 1872. If enacted, such legislation could change the cost of holding unpatented mining claims and could significantly impact our ability to develop mineralized material on unpatented mining claims.

A significant portion of the present Falcon/Redwood Property projects’ land position is located on unpatented mining claims located on U.S. federal public lands. The rights to use such claims are granted under the Mining Law of 1872. Unpatented mining claims are unique property interests in the United States, and are generally considered to be subject to greater title risk than other real property interests because the validity of unpatented mining claims is often uncertain. This uncertainty arises, in part, out of the complex federal and state laws and regulations under the 1872 Mining Law and the interaction of the 1872 Mining Law and other federal and state laws, such as those enacted for the protection of the environment.

In recent years, the U.S. Congress has considered a number of proposed amendments to the 1872 Mining Law. If adopted, such legislation could, among other things:

-

impose a royalty on the production of metals or minerals from unpatented mining claims;

-

reduce or prohibit the ability of a mining company to expand its operations; and

-

require a material change in the method of exploiting the reserves located on unpatented mining claims.

All of the foregoing could adversely affect the economic and financial viability of future mining operations at the Cobalt Canyon Project. Although it is impossible to predict at this point what any legislated royalties might be, enactment could adversely affect the potential for development of such federal unpatented mining claims.

Amendments to current laws, regulations, and permits governing operations and activities of mining and exploration companies, or more stringent implementation thereof, could have a material adverse impact on our business and cause increases in exploration expenses, capital expenditures, or production costs or reduction in levels of production at producing properties or require abandonment or delays in development of new mining properties.

9

Our operating costs could be adversely affected by inflationary pressures especially to labor, equipment, and fuel costs.

The global economy is currently experiencing a period of high commodity prices and as a result the mining industry is attempting to increase production at new and existing projects, while also seeking to discover, explore and develop new projects. This has caused significant upward price pressures in the costs of mineral exploration companies, especially in the areas of skilled labor and drilling equipment, both of which are in tight supply and whose costs are increasing. Continued upward price pressures in our exploration costs may have an adverse impact to our business.

We may not have sufficient funding for exploration which may impair our profitability and growth.

The capital required for exploration of mineral properties is substantial. From time to time, we will need to raise additional cash, or enter into joint venture arrangements, in order to fund the exploration activities required to determine whether mineral deposits on our projects are commercially viable. New financing or acceptable joint venture partners may or may not be available on a basis that is acceptable to us. Inability to obtain new financing or joint venture partners on acceptable terms may prohibit us from continued exploration of such mineral properties. Without successful sale or future development of our mineral properties through joint venture, we will not be able to realize any profit from our interests in such properties, which could have a material adverse effect on our financial position and results of operations.

We have no reported mineral reserves and if we are unsuccessful in identifying mineral reserves in the future, we may not be able to realize any profit from our property interests.

We are an exploration stage company and have no reported mineral reserves. Any mineral reserves will only come from extensive additional exploration, engineering, and evaluation of existing or future mineral properties. The lack of reserves on our mineral properties could prohibit us from sale or joint venture of our mineral properties. If we are unable to sell or joint venture for development our mineral properties, we will not be able to realize any profit from our interests in such mineral properties, which could materially adversely affect our financial position or results of operations. Additionally, if we or partners to whom we may joint venture our mineral properties are unable to develop reserves on our mineral properties we may be unable to realize any profit from our interests in such properties, which could have a material adverse effect on our financial position or results of operations.

Severe weather or violent storms could materially affect our operations due to damage or delays caused by such weather.

Our exploration activities are subject to normal seasonal weather conditions that often hamper and may temporarily prevent exploration activities. There is a risk that unexpectedly harsh weather or violent storms could affect areas where we conduct exploration activities. Delays or damage caused by severe weather could materially affect our operations or our financial position.

Our business is extremely dependent on gold, commodity prices, and currency exchange rates over which we have no control.

Our operations will be significantly affected by changes in the market price of gold and other commodities since the evaluation of whether a mineral deposit is commercially viable is heavily dependent upon the market price of gold and other commodities. The price of commodities also affects the value of exploration projects we own or may wish to acquire. These prices of commodities fluctuate on a daily basis and are affected by numerous factors beyond our control. The supply and demand for gold and other commodities, the level of interest rates, the rate of inflation, investment decisions by large holders of these commodities, including governmental reserves, and stability of exchange rates can all cause significant fluctuations in prices. Such external economic factors are in turn influenced by changes in international investment patterns and monetary systems and political developments. The prices of commodities have fluctuated widely and future serious price declines could have a material adverse effect on our financial position or results of operations.

Fluctuating gold prices could negatively impact our business plan.

The potential for profitability of our gold mining operations and the value of our mining properties are directly related to the market price of gold. The price of gold may also have a significant influence on the market price of our shares. If we obtain positive drill results and progress one of our properties to a point where a commercial production decision can be made, our decision to put a mine into production and to commit the funds necessary for that purpose must be made long before any revenue from production would be received. A decrease in the price of gold at any time during future exploration and development may prevent our property from being economically mined or result in the write-off of assets whose value is impaired as a result of lower gold prices. The price of gold is affected by numerous factors beyond our control, including inflation, fluctuation of the United States dollar and foreign currencies, global and regional demand, the purchase or sale of gold by central banks, and the political and economic conditions of major gold producing countries throughout the world. The volatility of mineral prices represents a substantial risk which no amount of planning or technical expertise can fully eliminate. In the event gold prices decline and remain low for prolonged periods of time, we might be unable to develop our properties or produce any revenue.

10

The volatility in gold prices is illustrated by the following table, which sets forth, for the periods indicated (calendar year), the high and low prices in U.S. dollars per ounce of gold, based on the daily London P.M. fix.

Gold Price per Ounce ($)

| Year | High | Low | ||||

| 1999 | $ | 326 | $ | 253 | ||

| 2000 | 312 | 263 | ||||

| 2001 | 293 | 256 | ||||

| 2002 | 349 | 278 | ||||

| 2003 | 416 | 320 | ||||

| 2004 | 454 | 375 | ||||

| 2005 | 537 | 411 | ||||

| 2006 | 725 | 525 | ||||

| 2007 | 691 | 608 | ||||

| 2008 | 1,011 | 713 | ||||

| 2009 | 1,213 | 810 | ||||

| 2010 | 1,421 | 1,058 | ||||

| 2011 | 1,895 | 1,319 | ||||

| 2012 | 1,791 | 1,540 | ||||

| 2013 | 1,716 | 1,211 |

Estimates of mineralized materials are subject to geologic uncertainty and inherent sample variability.

Although the estimated resources at our existing properties will be delineated with appropriately spaced drilling, there is inherent variability between duplicate samples taken adjacent to each other and between sampling points that cannot be reasonably eliminated. There also may be unknown geologic details that have not been identified or correctly appreciated at the proposed level of delineation. This results in uncertainties that cannot be reasonably eliminated from the estimation process. Some of the resulting variances can have a positive effect and others can have a negative effect on mining and processing operations. Acceptance of these uncertainties is part of any mining operation.

Our business is dependent on key executives and the loss of any of our key executives could adversely affect our business, future operations and financial condition.

We are dependent on the services of our sole executive officer, Behzad Shayanfar. The foregoing officer has many years of experience and an extensive background in the mining industry in general. We may not be able to replace that experience and knowledge with other individuals. We do not have “Key-Man” life insurance policies on Mr. Shayanfar. The loss of Mr. Shayanfar or our inability to attract and retain additional highly skilled employees may adversely affect our business, future operations, and financial condition.

Risks Associated with our Company

We have incurred losses in prior periods and may incur losses in the future.

We cannot be assured that we can achieve or sustain profitability on a quarterly or annual basis in the future. Our operations are subject to the risks and competition inherent in the establishment of a business enterprise. There can be no assurance that future operations will be profitable. We may not achieve our business objectives and the failure to achieve such goals would have an adverse impact on us.

Our future is dependent upon our ability to obtain financing. If we do not obtain such financing, we may have to cease our exploration activities and investors could lose their entire investment.

There is no assurance that we will operate profitably or generate positive cash flow in the future. We will require additional financing in order to proceed beyond the first few months of our exploration program. We will also require additional financing for the fees we must pay to maintain our status in relation to the rights to our properties and to pay the fees and expenses necessary to become and operate as a public company. We will also need more funds if the costs of the exploration of our existing projects are greater than we have anticipated. We will also require additional financing to sustain our business operations if we are not successful in earning revenues. We may not be able to obtain financing on commercially reasonable terms or terms that are acceptable to us when it is required. Our future is dependent upon our ability to obtain financing. If we do not obtain such financing, our business could fail and investors could lose their entire investment.

11

Because we may never earn revenues from our operations, our business may fail and then investors may lose all of their investment in our company.

We have no history of revenues from operations. We have yet to generate positive earnings and there can be no assurance that we will ever operate profitably. Our company has a limited operating history and is in the exploration stage. The success of our company is significantly dependent on the uncertain events of the discovery and exploitation of mineral reserves on our properties or selling the rights to exploit those mineral reserves. If our business plan is not successful and we are not able to operate profitably, then our stock may become worthless and investors may lose all of their investment in our company.

Prior to completion of the exploration and pre-feasibility and feasibility stages, we anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from the exploration of our mineral claims in the future, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide no assurance that we will generate any revenues or ever achieve profitability. If we are unsuccessful in addressing these risks, our business will fail and investors may lose all of their investment in our company.

We are subject to new corporate governance and internal control reporting requirements, and our costs related to compliance with, or our failure to comply with existing and future requirements, could adversely affect our business.

We may face new corporate governance requirements under the Sarbanes-Oxley Act of 2002, as well as new rules and regulations subsequently adopted by the SEC and the Public Company Accounting Oversight Board. These laws, rules, and regulations continue to evolve and may become increasingly stringent in the future. In particular, under rules proposed by the SEC on August 6, 2006, we are required to include management’s report on internal controls as part of our annual report pursuant to Section 404 of the Sarbanes-Oxley Act. We strive to continuously evaluate and improve our control structure to help ensure that we comply with Section 404 of the Sarbanes-Oxley Act. The financial cost of compliance with these laws, rules, and regulations is expected to remain substantial. We cannot assure you that we will be able to fully comply with these laws, rules, and regulations that address corporate governance, internal control reporting, and similar matters. Failure to comply with these laws, rules and regulations could materially adversely affect our reputation, financial condition, and the value of our securities.

Risks Related to an Investment in Our Securities

Our stock is categorized as a penny stock. Trading of our stock may be restricted by the SEC’s penny stock regulations which may limit a shareholder’s ability to buy and sell our stock.

Our stock is categorized as a penny stock. The SEC has adopted Rule 15g-9 which generally defines “penny stock” to be any equity security that has a market price (as defined) less than US$ 5.00 per share or an exercise price of less than US$ 5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and accredited investors. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock.

FINRA sales practice requirements may also limit a shareholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described above, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

To date, we have not paid any cash dividends and no cash dividends will be paid in the foreseeable future.

12

We do not anticipate paying cash dividends on our common stock in the foreseeable future and we may not have sufficient funds legally available to pay dividends. Even if the funds are legally available for distribution, we may nevertheless decide not to pay any dividends. We presently intend to retain all earnings for our operations.

A limited public trading market exists for our common stock, which makes it more difficult for our stockholders to sell their common stock in the public markets.

Our common shares are currently traded under the symbol “IROG,” but currently with low or no volume, based on quotations on the “Over-the-Counter Bulletin Board,” meaning that the number of persons interested in purchasing our common shares at or near bid prices at any given time may be relatively small or non-existent. This situation is attributable to a number of factors, including the fact that we are a small company which is still relatively unknown to stock analysts, stock brokers, institutional investors, and others in the investment community that generate or influence sales volume, and that even if we came to the attention of such persons, they tend to be risk-averse and would be reluctant to follow an unproven company such as ours or purchase or recommend the purchase of our shares until such time as we became more viable. Additionally, many brokerage firms may not be willing to effect transactions in the securities. As a consequence, there may be periods of several days or more when trading activity in our shares is minimal or nonexistent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on share price. We cannot give you any assurance that a broader or more active public trading market for our common stock will develop or be sustained, or that trading levels will be sustained.

Shareholders should be aware that, according to SEC Release No. 34-29093, the market for “penny stocks” has suffered in recent years from patterns of fraud and abuse. Such patterns include (1) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (2) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (3) boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; (4) excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and (5) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequent investor losses. Our management is aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to our securities. The occurrence of these patterns or practices could increase the future volatility of our share price.

The elimination of monetary liability against our directors, officers and employees under Nevada law and the existence of indemnification rights to our directors, officers and employees may result in substantial expenditures by our company and may discourage lawsuits against our directors, officers and employees.

Our Articles of Incorporation contain a provision permitting us to eliminate the personal liability of our directors to our company and shareholders for damages for breach of fiduciary duty as a director or officer to the extent provided by Nevada law. The foregoing indemnification obligations could result in the Company incurring substantial expenditures to cover the cost of settlement or damage awards against directors and officers, which we may be unable to recoup. These provisions and resultant costs may also discourage our company from bringing a lawsuit against directors and officers for breaches of their fiduciary duties, and may similarly discourage the filing of derivative litigation by our shareholders against our directors and officers even though such actions, if successful, might otherwise benefit our company and shareholders.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

None.

ITEM 2. PROPERTIES.

Our principal executive office is located at: 123 West Nye Ln., Ste. 129, Carson City, Nevada, 89706. See further discussion below for a description of our mineral properties.

Mineral Properties

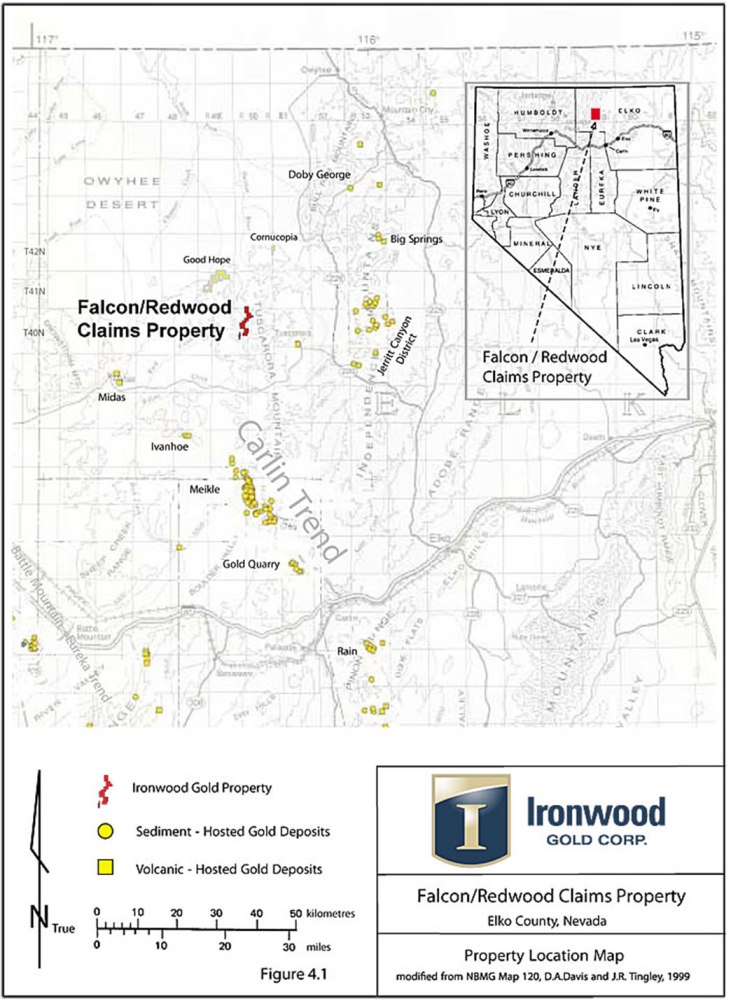

We currently have rights to one significant property located in Nevada - the Falcon/Redwood Property. Figure 1 displays the mining property discussed in this Annual Report. See below for further description as well as “Item 1. Business” for details on our acquisition of certain rights and interest in the property.

13

Figure 1. Map showing the location of the Nevada mining property discussed in this Annual Report.

Falcon/Redwood Property

Location

The Falcon Mine and Redwood Claims properties (Falcon / Redwood) are located in the northern part of the Carlin Trend and indicates similar geology and deep seated structures found in the mineralized zones within the more southern part of the trend. Specifically, the Falcon / Redwood project area is located in the Tuscarora Mountains of north-central Nevada, in Elko County (see Figure 4.1 below). The center of the Falcon / Redwood project area is approximately about 12 miles northwest of the old mining town of Tuscarora, which in turn is about 38 miles northwest of the town of Elko. Elko is the county seat, and lies on Interstate Highway I-80 about halfway between Reno, Nevada and Salt Lake City, Utah. The property consists of 6 patented claims and 60-100 newly staked claims that join the patented claims on which the mine is situated.

14

Figure 4.1

Claims

15

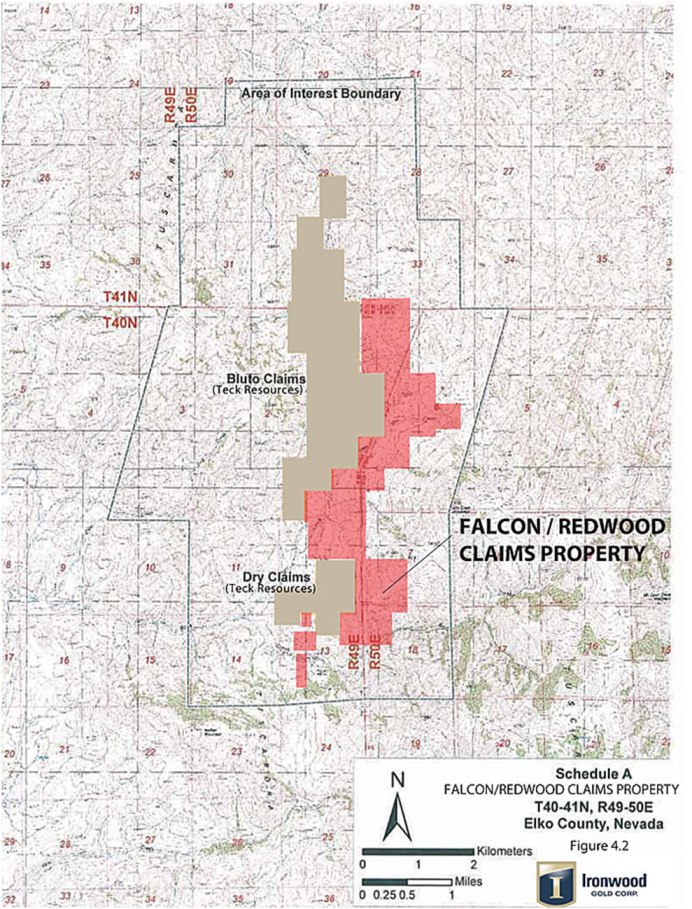

The Falcon / Redwood claims will consist of a minimum of 100 unpatented lode mining claims adjacent to the “Bluto” and “Red Cow” claim area held by Teck Resources Ltd. and are contiguous with the “Falcon” area (named after the adjacent Falcon mine) (see Figure 4.2 below).

Figure 4.2

History

16

The Falcon / Redwood Claims Project area is within a historic mining district, where mineralization was first discovered in the 1870’s. The mining district produced silver (32,000 ounces), gold (55 ounces), mercury (26 flasks) and antimony, mainly from the old Falcon mine, and from the Teapot mercury prospect located between the Dry and Bluto claim groups (see Figure 4.2) .. The Falcon mine, which exploited a volcanic hosted vein deposit is a significant part of Ironwood’s Falcon / Redwood claim property.

A silver deposit was discovered in 1876 and initially two 300 foot shafts called the Falcon and Scorpion were sunk to access the high grade silver vein. By 1901 over $10 million in gold and silver ore had been produced from the mine. In 1965 the mine owner at the time produced a 30 lb. vein sample that assayed at 1403g/t silver (94.3% recovery) and 0.3 g/t gold. The ore had accessory arsenic and antimony mineralization commonly associated with gold mineralization.

Mineralization

The mineralization of interest on the Falcon / Redwood Claims Property is within or adjacent to known structures that control the alteration haloes in Eocene volcanic rocks and the alteration observed in outcropping Paleozoic rocks (caldera slide blocks, or horsts). Generally, this mineralization is typical high level, volcanic hosted, epithermal systems.

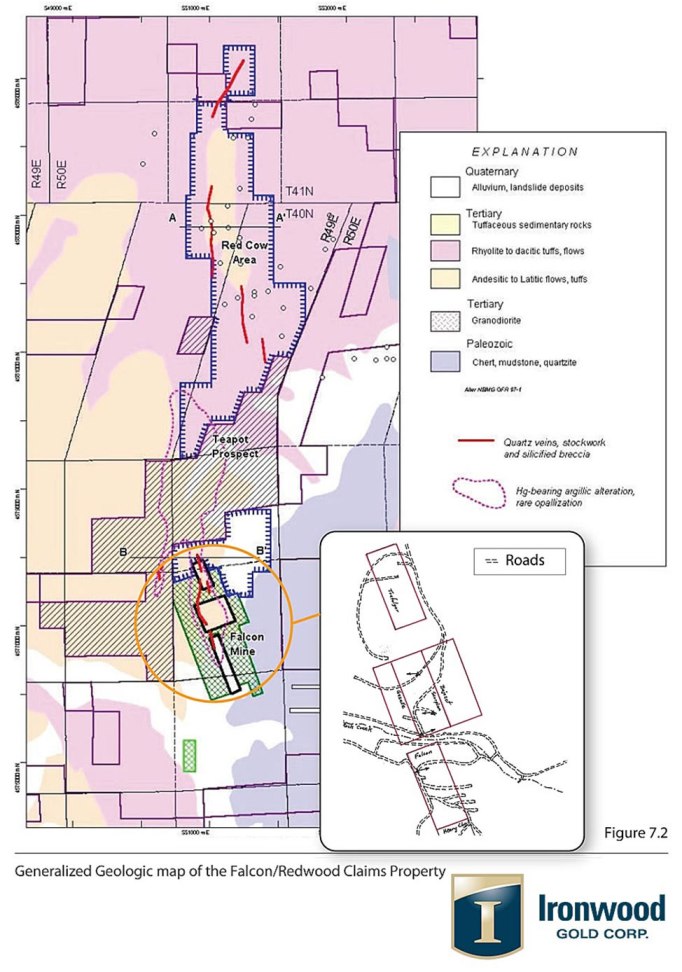

Mineralization and alteration can be divided into the south and north parts of the general area, specifically the Falcon and Red Cow structural zones (or vein systems) respectively (see Figures 7.2 and 7.3 below).

In the Falcon area, mineralization hosted by andesitic flows is strongly controlled by a series of sub parallel north-northwest, mostly steeply west dipping faults. Within the Falcon mine area, these faults are occupied by fine-grained quartz to chalcedony veins, often with banded textures. Rare quartz after bladed calcite occurs locally. The zone of sub-parallel veins locally reaches widths of at least 100 feet and extends northwards from the Falcon mine for 1 mile. Surface samples of vein silicification typically carry 100 to 1000 ppb Au and 1 to 200 ppm Ag.

In the nearby Red Cow area, a series of steeply east to west dipping fault zones strike north-south to northeast for an aggregate strike length of at least 3 miles (see Figure 7.2) . These faults, mostly within lithic rhyolite tuffs, contain locally extensive silicified breccias, fine-grained quartz-barite stockworks, and irregular zones of banded quartz to chalcedony veins. These silicified zones vary along strike in width from 3 to greater than 15 feet. Samples indicate that the silicified zones carry minor anomalous gold (50 – 250 ppb) with local samples up to 2.1 ppm Au. Unlike the Falcon area, silver is only weakly anomalous, although As, Hg and Sb are strongly anomalous. Previous shallow drilling has intersected up to 20m averaging 0.5 ppm Au. Most of the anomalous gold is near the bottom of these 500 ft. (150m) holes.

Limited soil and rock sampling has revealed large areas highly anomalous in As, Sb, Hg, Ag, and Au. Wide spread drilling has detected thick intercepts of enriched gold and silver values. Two holes (CC-10 and CC-11) encountered approximately 100 feet of economically significant gold mineralization.

17

Figure 7.2

18

Figure 7.3

19

ITEM 3. LEGAL PROCEEDINGS.