As filed with the Securities and Exchange Commission on December 7, 2023.

Registration No. 333-274589

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________

FORM

Amendment No. 1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

_____________________________________

(Exact name of registrant as specified in its charter)

_____________________________________

| | 3590 | 35-2675388 | ||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer |

315 Montgomery Street

San Francisco, CA 94104

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive office)

_____________________________________

Registered Agents Inc.

401 Ryland St. Ste. 200-A

Reno, NV 89502

Phone: (775) 401-6800

(Name, address, including zip code, and telephone number, including area code, of agent for service)

_____________________________________

Copies to:

|

Joseph M. Lucosky, Esq. |

[•] |

_____________________________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box, and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box, and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box, and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||||

| | ☒ | Smaller reporting company | | |||||

| Emerging Growth Company | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell, nor does it seek an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

|

PRELIMINARY PROSPECTUS |

SUBJECT TO COMPLETION, DATED , 2023 |

This is a firm commitment public offering of shares of common stock, par value $0.001 per share (the “Common Stock”) of Quality Industrial Corp. based on an assumed offering price of $___. Immediately prior to this offering, our Common Stock has been traded on the OTCPink marketplace operated by OTC Markets Group Inc (“OTC Pink”) under the symbol “QIND.” On December 5, 2023, the last reported sale price of the Common Stock on the OTC Market was $0.19 per share (the “Assumed Offering Price”), the average trading price for the 30 trading days preceding December 6, 2023, was $0.22 per share. The final public offering price of the shares of Common Stock in this offering will be determined through negotiation between us and the underwriters in the offering and the recent market price used throughout this prospectus may not be indicative of the final offering price.

We will apply to have our Common Stock listed on the NYSE American LLC (the “NYSE American”) under the symbol “QIND.” No assurance can be given that our application will be approved or that an active trading market on the NYSE American will develop. No assurance can be given that the trading prices of our Common Stock on the OTC Pink Market will be indicative of the prices of our Common Stock if our Common Stock were traded on the NYSE American. This offering will only occur if the NYSE American approves the listing of the Common Stock. If the NYSE American does not approve the listing of our Common Stock, we will not proceed with our offering.

We plan to effect a reverse stock split of our Common Stock at a ratio in the range of 1-for-2 and 1-for-20, as approved by written consent of our board of directors and the majority of our common shareholders by written consent, with the final ratio to be determined by our board of directors prior to the effective date of the registration statement of which this prospectus forms a part as well as the pricing of this offering.

We are a “controlled company” as defined by the corporate governance rules of the NYSE, our executive officers and directors and certain stockholders as a group collectively hold the majority of the voting control of the Company including 61.2% control held by Ilustrato Pictures International, Inc., an entity in which our director Mr. Nicolas Link has voting and dispositive control. For a more detailed description of risks related to being a “controlled company” see “Risk Factors.” As a result of being a “controlled company” within the meaning of the NYSE Rules, we may rely on exemptions from certain corporate governance requirements that provide protection to stockholders of other companies.

We are an “emerging growth company” and a “smaller reporting company,” each as defined under the federal securities laws and, as such, have elected to comply with certain reduced reporting requirements for this prospectus and may elect to do so in future filings. See the section titled “Implications of Being an Emerging Growth Company and a Smaller Reporting Company.”

Investing in our securities involves risks. See “Risk Factors” in this prospectus for a discussion of the risks that you should consider in connection with an investment in our Common Stock.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

Per Share(1) |

Total |

|||||

|

Initial public offering price |

$ |

$ |

||||

|

Underwriting discounts and commissions(2) |

$ |

$ |

||||

|

Proceeds, before expenses, to us |

$ |

$ |

||||

____________

(1) After giving effect to the reverse stock split at a ratio of 1-for-[ ], as determined by our board of directors on June 22, 2023.

(2) Underwriting discounts and commissions do not include a non-accountable expense allowance equal to [•]% of the initial public offering price payable to the underwriters. We will reimburse the underwriters for certain expenses and the underwriters will receive compensation in addition to underwriting discounts and commissions. We may also issue warrants to the representative of the underwriters (the “representative’s warrants”) as a portion of the underwriting compensation payable to the underwriters in connection with this offering. See the section titled “Underwriting” beginning on page 75 of this prospectus for additional disclosure regarding underwriter compensation and offering expenses.

We have granted to the underwriters of this offering an option for a period of [•] days from the date of this prospectus to purchase up to an additional [ ] shares of our Common Stock, an amount equal to [•]% of the number of shares offered hereby, on the same terms and conditions described herein, solely to cover over-allotments, if any. See “Underwriting” for more information.

The date of this prospectus is December [•], 2023.

TABLE OF CONTENTS

|

Page |

||

|

ii |

||

|

iii |

||

|

iv |

||

|

1 |

||

|

6 |

||

|

7 |

||

|

30 |

||

|

31 |

||

|

34 |

||

|

35 |

||

|

37 |

||

|

39 |

||

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

53 |

|

|

59 |

||

|

SECURITIES OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

60 |

|

|

61 |

||

|

66 |

||

|

69 |

||

|

71 |

||

|

72 |

||

|

75 |

||

|

79 |

||

|

79 |

||

|

79 |

||

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

81 |

|

|

F-1 |

i

ABOUT THIS PROSPECTUS

We have not, and the underwriters have not, authorized anyone to provide you with information different than that which is contained in this prospectus or in any free writing prospectus that we have authorized for use in connection with this offering. We are offering to sell, and seeking offers to buy, shares of Common Stock only in jurisdictions where offers and sales are permitted. The distribution of this prospectus and the offering of the Common Stock in certain jurisdictions may be restricted by law. This prospectus does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any Common Stock offered by this prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

You should assume that the information appearing in this prospectus and in any free writing prospectus that we have authorized for use in connection with this offering, is accurate only as of the date of those respective documents. Our business, financial condition, results of operations and prospects may have changed since those dates. You should read this prospectus and any free writing prospectus that we have authorized for use in connection with this offering, in their entirety before making an investment decision. You should also read and consider the information in the documents to which we have referred you in the sections of this prospectus entitled “Where You Can Find More Information.”

For investors outside of the United States: No action is being taken in any jurisdiction outside of the United States that would permit a public offering of the shares of our Common Stock or possession or distribution of this prospectus in any such jurisdiction. Persons outside of the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of Common Stock and the distribution of this prospectus outside of the United States.

We further note that the representations, warranties, and covenants made by us in any agreement that is filed as an exhibit to this prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

This prospectus may make reference to trademarks, service marks and trade names owned by us or other companies. All such trademarks, service marks and tradenames, if any, included in this prospectus are the property of their respective owners.

Unless otherwise indicated, market data and certain industry forecasts used throughout this prospectus were obtained from various sources, including internal surveys, market research, consultant surveys, publicly available information and industry publications and surveys. Industry surveys, publications, consultant surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. We have not independently verified any of the data from third-party sources nor have we ascertained the underlying economic assumptions relied upon therein. Similarly, internal surveys, industry forecasts and market research, which we believe to be reliable based upon our management’s knowledge of the industry, have not been independently verified. The future performance of the industry and markets in which we operate and intend to operate is necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the sections titled “Risk Factors” and “Special Note Regarding Forward-looking Statements” and elsewhere in this prospectus. These and other factors could cause results to differ materially from those expressed in these publications and reports.

Unless the context requires otherwise, references in this prospectus to “the “Company,” “we,” “us,” and “our,” mean Quality Industrial Corp. a Nevada corporation, “Quality Industrial,” or “QIND,” and its operating subsidiary Quality International Co Ltd FZC, a company formed in the United Arab Emirates or “Quality International.”

ii

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC permits us to “incorporate by reference” the information contained in documents we file with the SEC, which means that we can disclose important information to you by referring you to those documents rather than by including them in this prospectus. Information that is incorporated by reference is considered to be part of this prospectus and you should read it with the same care that you read this prospectus. Later information that we file with the SEC will automatically update and supersede the information that is either contained, or incorporated by reference, in this prospectus, and will be considered to be a part of this prospectus from the date those documents are filed.

This prospectus incorporates by reference the documents listed below, other than those documents or the portions of those documents deemed to be furnished and not filed in accordance with SEC rules:

• our Transition Report on Form 10-KT for the fiscal year ended June 30, 2023, filed with the SEC on August 21, 2023; our Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, filed with the SEC on November 20, 2023.

• our Current Reports on Form 8-K filed with the SEC on July 8, 2022, August 4, 2022, August 9, 2022, August 24, 2022, October 21, 2022, January 18, 2023, January 31, 2023, March 9, 2023, May 15, 2023, August 4, 2023, August 25, 2023, and October 30, 2023.

We will provide to each person, including any beneficial owner, to whom this prospectus is delivered, upon written or oral request, at no cost to the requester, a copy of any and all of the information that is incorporated by reference in this prospectus.

Requests for such documents should be directed by electronic mail to:

John-Paul Backwell

Chief Executive Officer

jp.backwell@qualityindustrialcorp.com

You may also access the documents incorporated by reference in this prospectus through our websites at https://qualityindustrialcorp.com and http://qualityinternational.ae/. Except for the specific incorporated documents listed above, no information available on or through our website shall be deemed to be incorporated in this prospectus or the registration statement of which it forms a part.

iii

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, which we refer to as the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, which we refer to as the Exchange Act, that relate to future events or to our future operations or financial performance. Any forward-looking statement involves known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance, or achievements to differ materially from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statement.

Words such as, but not limited to, “believe,” “expect,” “anticipate,” “estimate,” “forecast,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “targets,” “likely,” “will,” “would,” “could,” “should,” “continue,” “scheduled” and similar expressions or phrases, or the negative of those expressions or phrases, are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Although we believe that we have a reasonable basis for each forward-looking statement contained in this registration statement, we caution you that these statements are based on our estimates or projections of the future that are subject to known and unknown risks and uncertainties and other important factors that may cause our actual results, level of activity, performance, experience or achievements to differ materially from those expressed or implied by any forward-looking statement. Actual results, level of activity, performance, experience, or achievements may differ materially from those expressed or implied by any forward-looking statement as a result of various important factors, including our critical accounting policies and risks and uncertainties relating, to:

• our strategies, prospects, plans, expectations, forecasts, or objectives;

• our ability to achieve a marketable product and the costs and timing thereof;

• our ability to raise additional financing when needed and the terms and timing thereof;

• our ability to expand, protect and maintain our intellectual property rights;

• our future operations, financial position, revenues, costs, expenses, uses of cash, capital requirements, our need for additional financing or the period for which our existing cash resources will be sufficient to meet our operating requirements;

• the impact of COVID-19 and other adverse public health developments on our operations and our industry;

• regulatory developments in the United States and other countries;

• our compliance with all applicable laws, rules, and regulations, including those of the Securities and Exchange Commission, or SEC;

• our plans to list our Common Stock on the NYSE American and whether an active trading market for our Common Stock will develop;

• our ability to compete in the United States, the United Arab Emirates (the “UAE”) and internationally with larger and larger companies;

• general economic, business, political and social conditions;

• our reliance on and our ability to retain (and if necessary, timely recruit and replace) our officers, directors and key employees and their ability to timely and competently perform;

• our ability to generate significant revenues and achieve profitability;

• our ability to manage the growth of our business;

• our commercialization of the platform and marketing capabilities and strategies;

• our ability to expand, protect and maintain our intellectual property position;

• our ability to fully remediate our identified internal control material weaknesses;

• our ability to meet the initial or continuing listing requirement of the NYSE American Market;

• our ability to comply with regulatory requirements relating to our business, and the costs of compliance with those requirements;

• our ability to generate the significant amount of cash needed to service our debt obligations and our ability to refinance all or a portion of our indebtedness or obtain additional financing;

• the specific risk factors discussed under the heading “Risk Factors” set forth in this prospectus summarized below; and

• various other matters, many of which are beyond our control.

iv

Summary of Risk Factors

Investing in our common stock is speculative and involves a high degree of risk. These risks are discussed more fully in the “Risk Factors” section and elsewhere in this prospectus. We urge you to read “Risk Factors” beginning on page 7 and this prospectus in full. Our significant risks may be summarized as follows:

Risks Relating to Macro Conditions and Our Financial Condition

• We have substantial goodwill on our balance sheet, which could impact our earnings or losses through future write-offs.

• Our ability to generate sufficient cash to service debt and refinance depends on various factors, some beyond our control.

• Our projections are subject to substantial risks, including legislative changes and regulatory shifts, which may lead to significant variances in our expected revenues, market share, expenses, and profitability.

• Failing to identify, complete, and integrate acquisitions could harm our operational performance.

• The Company’s failure to make timely payments under the Quality International share purchase agreement could result in the transaction being terminated by the shareholders of Quality International, which would significantly impact the company’s revenue, including a substantial or total loss of any investment in our securities.

• Risks associated with climate change and shifting stakeholder views may have adverse effects on our business.

• We may be adversely affected by the effects of inflation.

• We are dependent on the availability of raw materials, parts, and components used in our products.

• Commodity price increases may impact our product costs and earnings sustainability.

• Performance issues, manufacturing errors, or supply shortages may lead to market share and acceptance losses.

• The markets in which we operate are highly competitive, which could reduce our sales and operating margins.

• Information systems interruptions or cybersecurity intrusions may disrupt our operations.

• Our international expansion is critical to long-term success but involves international operational risks.

• Environmental regulation uncertainty and climate change risks could impact our financial position.

• Significant fluctuations in foreign currency exchange rates may harm our financial results.

• We are dependent on financing for the continuation of our operations.

Risks Relating to Our Industry and Market

• Our long-term, fixed price contracts occasionally involve risks like cost overruns, inflation, labor and supplier issues, and potential claims for damages.

• The success of our business depends on our ability to maintain and enhance our reputation and brand.

• In the event that we are unable to successfully compete in our industry, we may see lower profit margins.

• If we are unable to successfully manage growth, our operations could be adversely affected.

• Delays or inability to adapt to market changes, customer demands, or technology trends may harm our business and intellectual property.

• Oil and natural gas price trends affect our customers’ activity and demand for our services and products, impacting our business.

• Our business relies on customer capital spending; reductions could adversely affect us.

• Supply constraints, raw material prices, and transportation availability can negatively impact our operations.

• Our ability to operate and our growth potential could be materially and adversely affected if we cannot attract, employ, and retain technical personnel at a competitive cost.

• Demand for the products we distribute could decrease if the manufacturers of those products were to sell a substantial amount of goods directly to end users in the markets we serve.

• We may experience unexpected supply shortages.

• Supplier price reductions could affect our inventory value and margins.

• A substantial decrease in the price of steel could significantly lower our gross profit or cash flow.

• If steel prices rise, we may be unable to pass along the cost increases to our customers.

• We may not have adequate insurance for potential liabilities, including liabilities arising from litigation.

• Our operations are subject to hazards inherent in the oil and gas industry and, as a result, we are exposed to potential liabilities that may affect our financial condition and reputation.

• Investments in emerging markets, especially the Middle East and UAE, involve political, social, and economic uncertainties that can affect the value of our investments.

• We are exposed to risks from potentially unpredictable legal and regulatory environments in the UAE and Middle East region.

• We are exposed to risks arising from potential changes in the UAE’s visa legislation, which could adversely impact our business operations.

• We are subject to risks associated with potential unlawful or arbitrary governmental actions in the UAE, which could negatively impact our operations and financial performance.

v

• We are subject to the risk of international sanctions, which could significantly impact our business activities, results of operations and financial condition.

Risks Related to Legal, Accounting and Regulatory Matters

• An unfavorable outcome of any pending contingencies or litigation could adversely affect us.

• The sale of our products involves potential product liability and related risks that could expose us to significant insurance and loss expenses.

• Compliance with changing regulation of corporate governance and public disclosure may result in additional expenses.

• If we fail to comply with the rules under the Sarbanes-Oxley Act related to accounting controls and procedures, or if material weaknesses or other deficiencies are discovered in our internal accounting procedures, our stock price could decline significantly.

• Failure to comply with the U.S. Foreign Corrupt Practices Act, the U.K. Bribery Act or other applicable anti-bribery laws could have an adverse effect on us.

• Changes in Tax laws or exposure to additional income tax liabilities could have a material impact on our company, the results of operations, financial conditions and cash flows.

• Laws and regulations governing international business operations could adversely impact our company.

• We are subject to changes in contract estimates in our subsidiary.

Risks Related to our Management and Control Persons

• Our largest shareholder, officer and director, Nicolas Link holds substantial control over the Company through Ilustrato Pictures International, Inc., an entity controlled by Mr. Link. Therefore his vote alone is able to influence all corporate matters, which could be deemed by shareholders as not always being in their best interests.

• We are dependent on the continued services of our director and executive chairman and officers and if we fail to keep them or fail to attract and retain qualified senior executives and key technical personnel, our business may not be able to expand.

• Our lack of adequate D&O insurance may also make it difficult for us to retain and attract talented and skilled directors and officers.

• The elimination of monetary liability against our directors, officers and employees under our Articles of Incorporation and the existence of indemnification rights to our directors, officers and employees may result in substantial expenditures by our Company and may discourage lawsuits against our directors, officers, and employees.

• Our officers may voluntarily terminate their relationship with us at any time, and competition for qualified personnel is lengthy, costly, and disruptive.

• Certain officers and directors have other business activities which might cause them to allocate less time to work on our business.

Risks Relating to our Securities

• We may conduct offerings of our equity securities in the future, in which case your proportionate interest may become diluted.

• Our common stock price may be volatile and could fluctuate, which could result in substantial losses for investors.

• Sales of a substantial number of shares of our common stock in the public market, or the perception that such sales could occur, could cause our stock price to fall.

• The issuance of shares of our common stock upon conversion or exercise of convertible notes will dilute ownership to existing shareholders and may cause our stock price to fall.

• Issuing more common or preferred stock in the future could dilute existing stockholders and discourage potential beneficial transactions for them.

• We may become involved in securities class action litigation that could divert management’s attention and harm our business.

Risk Related to COVID-19

• Our business and future operations may be adversely affected by epidemics and pandemics, such as the COVID-19 outbreak.

General Risk Factors

• Our success depends on our executive management and other key personnel.

• Challenges with respect to labor availability could negatively impact our ability to operate or grow the business.

• We are an “emerging growth company,” and we cannot be certain if the reduced reporting and disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

vi

PROSPECTUS SUMMARY

This summary highlights information about this offering and the information included in this prospectus. This summary does not contain all of the information that you should consider before investing in our securities. You should carefully read this entire prospectus, especially the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements included herein, including the notes thereto, before making an investment decision. References in this prospectus to “we,” “us,” “our,” and the “Company” refer to Quality Industrial Corp. and, where appropriate, its subsidiaries, unless expressly indicated or the context otherwise requires.

The following summary contains basic information about the offering and the common stock and is not intended to be complete. It does not contain all the information that is important to you. For a more complete understanding of the common stock, please refer to the section of this prospectus entitled “Description of Registrant’s Securities to be Registered.”

Overview

We aim to be a leader in the manufacture and assembly of heavy engineering equipment and precision engineered technology for the industrial, oil & gas, and utility sectors.

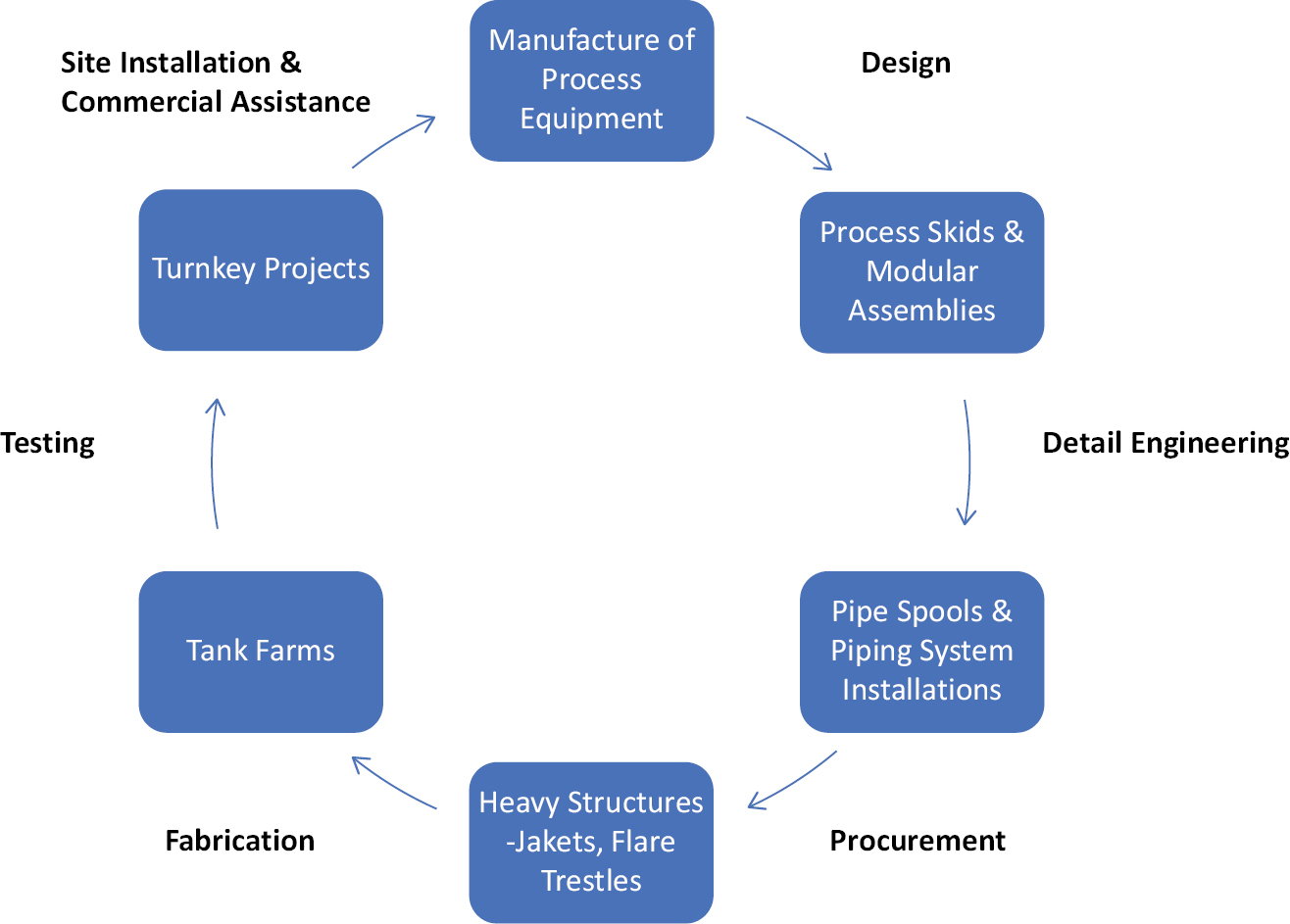

Quality International Co Ltd FZC (“Quality International”), our subsidiary and operating company, is a turnkey provider of total integrated solutions to the global energy and infrastructure market with over twenty years of operating experience. Quality International is ISO Certified with international accreditations, specializing in design, engineering, procurement, fabrication, testing, construction, manufacturing and site installation of heavy engineering equipment, process skids and modules, pipe spools and piping systems, offshore structures, and tank farms. With a wide spectrum of services, Quality International meets stringent customer demands through a broad range of competent, ultra-reliable engineering solutions and services.

Based in the United Arab Emirates (UAE), Quality International has manufacturing facilities in Sharjah with a total manufacturing area of over 220,000 square meters in Sharjah including its own waterfront facility for final assembly and loading of very large equipment/modules directly onto barges and ships.

Quality International designs projects and equipment as per customer-specific requirements in stainless steel, duplex, super duplex, carbon steel, alloy steel and clad construction. In addition to this, Quality International also manufactures equipment as per the following industry standards, American Society of Mechanical Engineers (ASME), Pressure Directive (PD) 5500, Tubular Exchange Manufacturers Association (TEMA), American Petroleum Institute (API) 650, 620 and other international standards.

Quality International’s customers are Engineering, Procurement, and Construction (“EPC”) Contractors, technology providers and multinational companies who are leaders in their respective industries. Some of Quality International’s past and present customers include EPC Contractors such as McDermott, Technip Energies, Worley, Doosan, Tecnimont, UTICO and Air Products, having required infrastructure and equipment to be manufactured for end users such as ADNOC, BP, Chevron, Shell, Sasol, Sonatrach and Total.

We aim to become a global leader in the manufacture and assembly of equipment and technology for the wider energy sector as it aims to reduce carbon in its operations and transition to greener forms of energy production. Quality International currently manufactures infrastructure and equipment for the hydrogen industry and we aim to further expand its manufacturing of the vital infrastructure and equipment required for the offshore wind industry as well as for the production of low carbon energies, decarbonization solutions such as green hydrogen, and sustainable fuels.

We changed ownership on May 28, 2022, when Ilustrato Pictures International Inc. (“ILUS”) acquired 77,669,078 of the outstanding shares in our Company, which at the time and through the date of this prospectus represent a significant controlling power. Consequently, ILUS is able to unilaterally control the election of our board of directors, all matters upon which shareholder approval is required and, ultimately, the direction of our Company. Also, during that year, Mr. Nicolas Link, the beneficial owner of ILUS, was appointed as our Executive Chairman of the Board, Mr. John-Paul Backwell was appointed as our Chief Executive Officer and Mr. Carsten Falk was appointed as our Chief Commercial Officer.

In line with the change in control and business direction, we changed our name to Quality Industrial Corp. and began trading on the OTC Market under the ticker QIND, with a market effective date of August 4, 2022.

1

Reverse Stock Split

On June 22, 2023, the board of directors approved the granting of discretionary authority to the board of directors, at any time or times for a period of up to twelve months, to adopt an amendment (the “Amendment”) to our articles of incorporation, as amended (the “Articles of Incorporation”), to effect a reverse stock split (the “Reverse Stock Split”) with a ratio within the range of 1-for-2 to 1-for-20 (the “Reverse Stock Split Ratio”). On June 22, 2023, we received a written consent in lieu of a meeting by the holder of 77,669,078 shares of our common stock (the “Majority Stockholder”) authorizing the Reverse Stock Split and Reverse Stock Split Ratio for a period of up to twelve months conditional upon and concurrent with uplisting to a national stock exchange.

Implications of Being an Emerging Growth Company and a Smaller Reporting Company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, as amended (the “JOBS Act”). As an “emerging growth company,” we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable generally to public companies. These provisions include, but are not limited to:

• requiring only two years of audited financial statements in addition to any required unaudited interim financial statements, with a correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in our periodic filings made under the Securities Act of 1933, as amended (the “Securities Act”);

• reduced disclosure about our executive compensation arrangements;

• no non-binding shareholder advisory votes on our executive compensation, including any golden parachute arrangements; and

• exemption from compliance with the auditor attestation requirement in the assessment of our internal control over financial reporting pursuant to Section 404(b) of the Sarbanes Oxley Act of 2002 (“SOX”).

We may take advantage of these exemptions for up to five years or such earlier time that we are no longer an emerging growth company. We will continue to remain an emerging growth company until the earliest of the following: (i) the last day of the fiscal year following the fifth anniversary of the date of the completion of this offering; (ii) the last day of the fiscal year in which our total annual gross revenue is equal to or more than $1.07 billion; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer under the rules of the Securities and Exchange Commission (the “SEC”).

We are also a “smaller reporting company” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and have elected to take advantage of certain of the scaled disclosures available to smaller reporting companies. To the extent that we continue to qualify as a smaller reporting company after we cease to qualify as an emerging growth company, certain of the exemptions available to us as an emerging growth company may continue to be available to us as a smaller reporting company, including exemption from compliance with the auditor attestation requirements pursuant to SOX and reduced disclosure about our executive compensation arrangements. We will continue to be a “smaller reporting company” until we have $250 million or more in public float (based on the price of our Common Stock) measured as of the last business day of our most recently completed second fiscal quarter or, in the event we have no public float or a public float that is less than $700 million, annual revenues of $100 million or more during the most recently completed fiscal year.

2

We may choose to take advantage of some, but not all, of these exemptions. We have taken advantage of reduced reporting requirements in this prospectus. Accordingly, the information contained herein may be different from the information you receive from other public companies in which you hold stock. In addition, the JOBS Act provides that an emerging growth company may take advantage of an extended transition period for complying with new or revised accounting standards, delaying the adoption of these accounting standards until they would apply to private companies. We have elected to avail ourselves of the extended transition period for complying with new or revised financial accounting standards. As a result of the accounting standards election, we will not be subject to the same implementation timing for new or revised accounting standards as other public companies that are not emerging growth companies which may make comparison of our financials to those of other public companies more difficult.

3

The Offering

|

Common Stock Offered by Us |

_____ shares of Common Stock. |

|

|

Option to Purchase Additional Shares of Common Stock |

|

|

|

Common Stock to be Outstanding Immediately Prior to this Offering |

|

|

|

Common Stock to be Outstanding Immediately After this |

|

|

|

Use of Proceeds |

We estimate that we will receive net proceeds from this offering of approximately $___million, or approximately $___ million if the representative of the underwriters exercises its option to purchase additional shares in full, in each case, after deducting underwriting discounts and our estimated offering expenses. We currently intend to use approximately [ ]% of the net proceeds of this offering for acquisition tranche payment obligations, for working capital and general corporate purposes and for repayment in full of the Sky Holding, and the 1800 Diagonal Lending Notes. See “Use of Proceeds” in this prospectus. |

|

|

Risk Factors |

Investing in our Common Stock involves significant risks. Before making a decision whether to invest in our Common Stock, please read the information contained under the heading “Risk Factors” in this prospectus. |

|

|

Representative’s Warrants |

We have agreed to issue to the representative of the underwriters warrants to purchase the number of shares of Common Stock in the aggregate equal to [•]% of the shares of Common Stock to be issued and sold in this offering (including any shares of Common Stock sold upon exercise of the over-allotment option). The warrants are exercisable for a price per share equal to [•]% of the public offering price. The warrants are exercisable at any time and from time to time, in whole or in part, during the period commencing six (6) months from the date of commencement of sales of the offering and ending on [•]. |

|

|

Lock-up Agreements |

We and our directors, officers and certain shareholders have agreed not to offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of our Common Stock or securities convertible into Common Stock for a period of 180 days after the closing of this offering as described in further detail in this prospectus. See “Underwriting Lock-Up Agreements.” |

|

|

Transfer Agent |

Pacific Stock Transfer, Inc. |

|

|

Common Stock Trading Symbol; Proposed NYSE American Trading Symbol |

|

4

The number of shares of Common Stock to be outstanding after this offering is based on ___shares outstanding as of December __, 2023, and excludes:

• 5,408,6601 shares of Common Stock issuable upon the conversion of outstanding convertible promissory notes;

• 250,000 shares of Common Stock issuable upon exercise of outstanding warrants issued prior to the offering with a weighted average exercise price of approximately $1.64 per share; and

• any securities issuable upon the exercise of the underwriters’ over-allotment option; and

• _______ shares of Common Stock issuable upon exercise by the underwriter under its underwriter’s warrant

Except as otherwise indicated, all information in this prospectus assumes:

• that the Assumed Offering Price is $ per share; and

• a reverse stock split effected on _________ __, 2023 at a ratio of 1-for_.

____________

1 The notes issued to 1800 Diagonal Lending convert at 65% multiplied by the lowest trading price for the common stock during the ten trading days prior to the conversion date. Calculation is based upon a conversion price of $0.25.

5

Summary Financial Data

The following tables summarize our financial data for the periods presented and should be read together with the sections of this prospectus titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our financial statements and related notes thereto appearing elsewhere in this prospectus. The balance sheet data and summary statements of operations data at and for the fiscal year ended June 30, 2023, and 2022, respectively, have been derived from our audited consolidated financial statements and footnotes included elsewhere in this prospectus. Our historical results are not necessarily indicative of our future results or of the results we expect in the future, nor are our results for part of the year necessarily indicative of the results to be expected for the full year.

|

Balance Sheet Data (in US thousand) |

June 30, |

June 30, |

||||

|

Cash and Cash Equivalents |

$ |

1,708 |

$ |

1,114 |

||

|

Total Assets |

$ |

205,203 |

$ |

186,601 |

||

|

Total Liabilities |

$ |

172,290 |

$ |

166,232 |

||

|

Total Stockholders’ Equity (Deficit) |

$ |

32,913 |

$ |

20,369 |

||

|

Statement of Operations (in US thousand) |

Year Ended |

Year Ended |

|||||

|

Revenue |

$ |

87,147 |

$ |

18,216 |

|

||

|

Net Income |

$ |

9,589 |

$ |

(2,596 |

) |

||

|

Earnings Per Share |

$ |

0.08 |

$ |

(0.03 |

) |

||

6

RISK FACTORS

An investment in our securities involves a high degree of risk. In addition to the other information contained in this prospectus, prospective investors should carefully consider the following risks before investing in our securities. If any of the following risks actually occur, as well as other risks not currently known to us or that we currently consider immaterial, our business, operating results and financial condition could be materially adversely affected. As a result, the trading price of our common stock could decline, and you may lose all or part of your investment in our common stock. The risks discussed below also include forward-looking statements, and our actual results may differ substantially from those discussed in these forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements” in this prospectus. In assessing the risks below, you should also refer to the other information contained in this prospectus, including the financial statements and the related notes, before deciding to purchase any of our securities.

Risks Relating to Macro Conditions and Our Financial Condition

We have a substantial amount of goodwill on our balance sheet. Future write-offs of goodwill may have the effect of decreasing our earnings or increasing our losses.

We have obtained growth through the acquisition of Quality International. Under existing accounting standards, we are required to periodically review goodwill assets for possible impairment. In the event that we are required to write down the value of any assets under these pronouncements, it may materially and adversely affect our operating results, financial condition, and the price of our common stock. See the more detailed discussion appearing as part of our Management’s Discussion and Analysis of Financial Condition and Results of Operations and in our financial footnotes. The percentage of our goodwill compared to our total assets as of June 30, 2023, was 27.5%.

Our ability to generate the significant amount of cash needed to service our debt obligations and our ability to refinance all or a portion of our indebtedness or obtain additional financing depends on many factors, many of which may be beyond our control.

Our ability to make scheduled payments on, or to refinance our obligations under, our debt, will depend on our financial and operating performance, which, in turn, will be subject to prevailing economic and competitive conditions and to the financial and business factors, many of which may be beyond our control. We cannot assure you that our business will generate sufficient cash flow from operations, that currently anticipated business opportunities will be realized on schedule or at all, or that future borrowings will be available to us in amounts sufficient to enable us to service our indebtedness and any amounts borrowed under future credit facilities, or to fund our other liquidity needs.

We will use cash to pay the principal and interest on our debt. These payments limit funds otherwise available for working capital, capital expenditures, acquisitions, collaborations, and other purposes. As a result of these obligations, our current liabilities may exceed our current assets. We may need to take on additional debt as we expand in our industry, which could increase our ratio of debt to equity. The need to service our debt may limit funds available for other purposes and our inability to service debt in the future could lead to acceleration of our debt and foreclosure on assets.

We cannot assure that we will be able to refinance any of our indebtedness or obtain additional financing as well as prevailing market conditions. As a result, we could face liquidity problems and might be required to dispose of material assets or operations to meet our indebtedness service and other obligations.

Our projections are subject to significant risks, assumptions, estimates and uncertainties, including assumptions regarding future legislation and changes in regulations of the jurisdictions in which we operate, or seek to operate, our business. As a result, our projected revenues, market share, expenses and profitability may differ materially from our expectations.

We operate in a rapidly evolving and highly competitive industry and our projections are subject to the risks and assumptions made by management with respect to this industry. Operating results are difficult to forecast because they generally depend on our assessment of factors that are inherently beyond our control and impossible to predict with certainty, such as the timing of adoption of future legislation and regulations by different jurisdictions.

7

Furthermore, if we invest in the development of new products or distribution channels that do not achieve commercial success, whether because of competition or otherwise, we may not recover the often material “up front” costs of developing and marketing those products and distribution channels or recover the opportunity cost of diverting management and financial resources away from other products or distribution channels.

Additionally, our business may be affected by reductions in customer acquisition, customer persistency and customer spending as a result of numerous factors which may be difficult to predict. This may result in decreased revenue levels, and we may be unable to adopt timely measures to compensate for any unexpected shortfall in income. Our profitability projections make numerous assumptions about the expected future levels of various expense items. Historically most of these expense items have been relatively stable or predictable either in absolute terms or in relation to revenue but there is no certainty that such stability or predictability will continue into the future. These inabilities could cause our operating results in a given period to be higher or lower than expected. If actual results differ from our estimates, analysts may react negatively, and our share price could be adversely impacted.

If we are unable to successfully identify, complete and integrate acquisitions, our results of operations could be adversely affected.

Acquisitions have been and will continue to be a significant component of our growth strategy, including the recent acquisition of Quality International. We seek to identify and complete acquisitions and may continue to make strategic acquisitions. Our previous or future acquisitions may not be successful or may not generate the financial benefits that we expected to achieve at the time of acquisition. In addition, there can be no assurance that we will be able to locate suitable acquisition candidates in the future or acquire them on acceptable terms or, because of competition in the marketplace and limitations imposed by the agreements governing our indebtedness or the availability of capital, that we will be able to finance future acquisitions. We may be unable to identify, negotiate, and complete suitable acquisition opportunities on reasonable terms.

Acquisitions involve special risks, including, without limitation, the potential assumption of unanticipated liabilities and contingencies, difficulty in assimilating the operations and personnel of the acquired businesses, disruption of our existing business, dissipation of our limited management resources and impairment of relationships with employees and customers of the acquired business as a result of changes in ownership. For instance, we considered acquiring a 51% interest in Petro Line FZ-LLC (“Petro Line”), entering into a share purchase agreement on January 27, 2023, (the “Petro Line Share Purchase Agreement”). However, the acquisition never materialized after a fire at a Petro Line factory. An investigation into the fire’s impact led us to subsequently terminate the Petro Line Share Purchase Agreement on July 31, 2023, and no payments to Petro Line were made. Such incidents can significantly affect our financial and operational outlook.

While we believe that strategic acquisitions can improve our competitiveness and profitability, these activities could have a material adverse effect on our business, financial condition, and operating results. We may incur significant costs such as transaction fees, professional service fees and other costs related to future acquisitions. We may also incur integration costs following the completion of any such acquisition as we integrate the acquired business with the rest of our Company. Although we expect that the realization of efficiencies related to the integration of any acquired businesses will offset the incremental transaction and acquisition-related costs over time, this net financial benefit may not be achieved in the near term, or at all.

The Company’s failure to make timely payments under the Quality International share purchase agreement could result in the transaction being terminated by the shareholders of Quality International.

If the Company fails to make any of the payment amounts pursuant to the share purchase agreement and amendments thereto, and such failure is not timely cured by the Company through new negotiated terms or payment date extensions, the shareholders of Quality International have the right but not the obligation to terminate the transaction. If the transaction is terminated as a result of the Company’s failure to make all due payments, the Company would be liable to Quality International for an amount defined under the amended purchase agreement as the break fee, which is capped at $3.5 million. In addition to the break fee, the Company would be potentially exposed to other expenses related to any settlement and recovery of paid amounts to Quality International, including any or all debt incurred, guaranteed and paid by the Company and contemplated as future borrowings used for the

8

continuous operation of the Company and its subsidiary. Therefore, in addition to the financial liabilities mentioned in this paragraph, our investors would be exposed to a potential loss of a portion or all of their investment in the event the transaction with Quality International is terminated.

Risks associated with climate change and other environmental impacts, and increased focus and evolving views of our customers, shareholders, and other stakeholders on climate change issues, could negatively affect our business and operations.

The effects of climate change create short and long-term financial risks to our business, both in the UAE and globally. We have significant operations located in regions that have been, and may in the future be, exposed to significant weather events and other natural disasters. Climate related changes can increase variability in or otherwise impact natural disasters, including weather patterns, with the potential for increased frequency and severity of significant weather events (e.g., flooding, hurricanes, and tropical storms), natural hazards (e.g., increased wildfire risk), rising mean temperature and sea levels, and long-term changes in precipitation patterns (e.g., drought, desertification, and/or poor water quality). We expect climate change could affect our facilities, operations, employees, and communities in the future, particularly at facilities in coastal areas and areas prone to extreme weather events and water scarcity. Our suppliers are also subject to natural disasters that could affect their ability to deliver or perform under our contracts, including as a result of disruptions to their workforce and critical infrastructure. Disruptions also impact the availability and cost of materials needed for manufacturing and could increase insurance and other operating costs.

Increased worldwide focus on climate change has led to legislative and regulatory efforts to combat both potential causes and adverse impacts of climate change, including regulation of greenhouse gas emissions. New or more stringent laws and regulations related to greenhouse gas emissions and other climate change related concerns may adversely affect us, our suppliers, and our customers. Some of our facilities are, for example, engaged in manufacturing processes that produce greenhouse gas emissions, including carbon dioxide, or rely on products from others that do so. We have worked for years to reduce our reliance on fossil-based energy sources, to decrease our greenhouse gas emissions, to reduce our consumption of water and production of waste, and to ensure our compliance with environmental regulations where we operate, enhancing our record of environmental sustainability. However, new, and evolving laws and regulations could mandate different or more restrictive standards, could require capital investments to transition to low carbon technologies, could adversely impact our ongoing operations, and could require changes on a more accelerated time frame. Our suppliers may face similar challenges and incur additional compliance costs that are passed on to us. These direct and indirect costs may adversely impact our results.

We may be adversely affected by the effects of inflation.

Inflation in wages, materials, parts, equipment, and other costs has the potential to adversely affect our results of operations, cash flows and financial position by increasing our overall cost structure, particularly if we are unable to achieve commensurate increases in the prices, we charge our customers for our products and services. In addition, the existence of inflation in the economy has the potential to result in higher interest rates, which could result in higher borrowing costs, supply shortages, increased costs of labor, weakening exchange rates and other similar effects. We have currently experienced inflationary pressures on its supply chain due to increased shipping costs, increased energy prices for manufacture of our commercial products as well as increased prices from suppliers of raw materials. We have so far been able to offset inflationary pressure to consumers, but it cannot be guaranteed that that our results of operations will not be adversely affected by inflation in the future and could reduce sales and/or operating margins, and overall financial performance.

We are dependent on the availability of raw materials, parts, and components used in our products.

While we manufacture certain parts and components used in our products, we also require substantial amounts of raw materials and purchases of certain parts and components from suppliers. The availability of and prices for raw materials, parts and components may be subject to curtailment or change due to, among other things, suppliers’ allocations to other purchasers, interruptions in production by suppliers, including due to geopolitical or civil unrest, unfavorable economic or industry conditions, labor disruptions, supply chain disruptions, catastrophic weather

9

events, natural disasters, the occurrence of a contagious disease or illness, changes in exchange rates and prevailing price levels. Any change in the supply of, or price for, these raw materials or parts and components could materially affect us and our financial condition, results of operations and cash flow.

Increases in the price of commodities could impact the cost or price of our products, which could impact our ability to sustain and grow earnings.

Our manufacturing processes consume significant amounts of raw materials, the costs of which are subject to worldwide supply and demand factors, as well as other factors beyond our control. Raw material price fluctuations may adversely affect our results. We purchase, directly and indirectly through component purchases, significant amounts of plastic, aluminum, steel, and other raw materials. In the past raw material prices have experienced volatility which has been unforeseen and unexpected. Commodity pricing has fluctuated over the past few years and may continue to do so in the future. Such fluctuations could have a material effect on our results of operations, balance sheets and cash flows and impact the comparability of our results between financial periods.

We may be subject to loss in market share and market acceptance as a result of performance failures, manufacturing errors, delays, or shortages.

There is a risk that for unforeseen reasons we may be required to repair or replace products in use or to reimburse customers for products that fail to work or meet strict performance criteria. To date, we have experienced some product failures related to electronic and mechanical components within equipment and vehicles. These are either repaired under warranty or at cost to the customer or under a maintenance agreement.

Other disruptions in the supply chain process or product sales and fulfilment systems for any reason, including equipment malfunction, failure to follow specific protocols and procedures, supplier facility shut-downs, defective raw materials, wars and conflict, natural disasters such as hurricanes, tornadoes or wildfires, property damage from riots, and other environmental factors and the impact of epidemics or pandemics, such as Covid-19, and actions by businesses, communities and governments in response, could lead to launch delays, product shortage, unanticipated costs, lost revenues and damage to our reputation.

We have taken steps to limit remedies for product failure to the repair or replacement of malfunctioning or non-compliant products or services, and also attempt to exclude or minimize exposure to product and related liabilities by including in our standard agreements warranty disclaimers and disclaimers for consequential and related damages as well as limitations on our aggregate liability. From time to time, in certain sales transactions, we may negotiate liability provisions that vary from such standard forms. There is a risk that our contractual provisions may not adequately minimize our product and related liabilities or that such provisions may be unenforceable. We intend to carry product liability insurance, but coverage we secure may not be adequate to cover potential claims. Moreover, to the extent we have to repair, reimburse, or expend funds to cover customer service issues, our results of operations will be negatively affected.

The markets in which we operate are highly competitive which could reduce sales and operating margins.

Most of our products are sold in competitive markets. Maintaining and improving a competitive position will require continued investment in manufacturing, engineering, quality standards, marketing, customer service and support and distribution networks. We may not be successful in maintaining our competitive position. Our competitors may develop products and methods that are more efficient or may adapt quicker to new technologies or evolving customer requirements. We may not be able to compete successfully with existing competitors or with new competitors. Pricing pressures may require us to adjust the prices of products to stay competitive. Failure to continue competing successfully could reduce sales, operating margins, and overall financial performance.

Our business operations may be adversely affected by information systems interruptions or cybersecurity intrusions.

We depend on various information technologies to administer, store, and support multiple business activities. If these systems are damaged, cease to function properly or are subject to cyber-security attacks, such as those involving unauthorized access, malicious software and/or other intrusions, we could experience production downtimes, operational delays, other detrimental impacts on operations or the ability to provide products and services to its customers, the compromising of confidential or otherwise protected information, destruction or

10

corruption of data, security breaches, other manipulation or improper use of our systems or networks, financial losses from remedial actions, loss of business or potential liability, penalties, fines and/or damage to our reputation. We attempt to mitigate these risks by employing a number of measures, including an IT manager employed by ILUS to assist QIND with cyber security expertise, and who reports directly to our management team overseeing the parent company and its subsidiaries regarding employee training, technical security controls and maintenance of backup and protective systems. Despite our efforts to mitigate these risks, our systems, networks, products, and services remain potentially vulnerable to known or unknown threats, any of which could have a material adverse effect on the Company and its financial condition or results of operations. Further, given the unpredictability, nature, and scope of cyber-security attacks, it is possible that potential vulnerabilities could go undetected for an extended period. We have currently not been subject to cybersecurity breaches in our supply chain, software, or services used in our products, services, or business. A severe future cybersecurity incident in our supply chain could however reduce sales, operating margins, and overall financial performance.

Our long-term success depends, in part, on our ability to operate and expand internationally, and our business is susceptible to risks associated with international operations.

Currently, we only maintain operations in the United Arab Emirates, and plan to continue our efforts to expand globally, in jurisdictions where we do not currently operate. We expect international operations and export sales to continue to constitute the majority of our sales and assets in the foreseeable future. Managing a global organization is difficult, time consuming and expensive, and any international expansion efforts that we undertake may not be profitable in the near or long term. Although we have operating experience in many foreign jurisdictions, we must still continue to make significant investments to build our international operations. Our sales from international operations and sales from export are both subject in varying degrees to risks inherent in doing business outside the United States. These risks include the following:

• Costs, risks, and uncertainties associated with tailoring our services in international jurisdictions as needed to better address both the needs of customers, and the threats of local competitors.

• Risks of economic instability, including due to inflation.

• Uncertainties in forecasting revenues and expenses in markets where we have not previously operated.

• Costs and risks associated with local and national laws and regulations governing the industries in which we operate, health and safety, climate change and sustainability, and labor and employment.

• Operational and compliance challenges caused by distance, language, and cultural differences.

• Costs and risks associated with compliance with international tax laws and regulations.

• Costs and risks associated with compliance with the U.S. Foreign Corrupt Practices Act and other laws in the United States related to conducting business outside the United States, as well as the laws and regulations of non-U.S. jurisdictions governing bribery and other corrupt business activities.

• Costs and risks associated with human trafficking, modern slavery and forced labor reporting, training and due diligence laws and regulations in various jurisdictions.

• Being subject to other laws and regulations, including laws governing online advertising and other Internet activities, email and other messaging, collection and use of personal information, ownership of intellectual property, taxation, and other activities important to our online business practices.

• Currency exchange rate fluctuations and restrictions on currency repatriation.

• Competition with companies that understand the local market better than we do or that have preexisting relationships with regulators and customers in those markets.

• Adverse effects resulting from the United Kingdom’s exit from the European Union (commonly known as “Brexit”)

• Reduced or varied protection for intellectual property rights in some countries

• Disruption of operations from labor and political disturbances.

11

• Withdrawal from or renegotiation of international trade agreements and other restrictions on the trade between the United States and other countries

• Changes in tariff and trade barriers; and

• Geopolitical events, including natural disasters, climate change, public health issues, political instability (such as war between Ukraine and Russia), terrorism, insurrection, or war.

Entry into certain transactions with foreign entities now or in the future may be subject to government regulations, including review related to foreign direct investment by U.S. or foreign government entities. If a transaction with a foreign entity is subject to regulatory review, such regulatory review might limit our ability to enter into the desired strategic alliance and thus our ability to carry out our long-term business strategy.

Operating in international markets also requires significant management attention and financial resources. The investment and additional resources required to establish operations and manage growth in other countries may not produce desired levels of revenue or profitability and could instead result in increased costs without a corresponding benefit. We cannot guarantee that our international operations or expansion efforts will be successful.

Any of these events as well as related events not aforementioned, could have a materially adverse impact on our Company and its operations.

Uncertainty related to environmental regulation and industry standards, as well as physical risks of climate change, could impact our results of operations and financial position.

Increased public awareness and concern regarding environmental risks, including global climate change, may result in more international, regional and/or federal requirements or industry standards to reduce or mitigate global warming and other environmental risks. New climate change laws and regulations could require us to change our manufacturing processes or obtain substitute materials that may cost more or be less available for its manufacturing operations. Various jurisdictions in which we do business have implemented, or in the future could implement or amend, restrictions on emissions of carbon dioxide or other greenhouse gases, limitations or restrictions on water use, the production of single use plastics, regulations on energy management and waste management and other climate change-based rules and regulations, which may increase our expenses and adversely affect its operating results. In addition, the physical risks of climate change may impact the availability and cost of materials, sources and supply of energy, product demand and manufacturing and could increase insurance and other operating costs. The expected future increased worldwide regulatory activity relating to climate change could expand the nature, scope, and complexity of matters that we are required to control, assess, and report. If environmental laws or regulations or industry standards are either changed or adopted and impose significant operational restrictions and compliance requirements upon us, our suppliers, our customers, or our products, or our operations are disrupted due to physical impacts of climate change on us, our customers or our suppliers, our business, results of operations and financial condition could be adversely impacted.

Significant fluctuations in foreign currency exchange rates may harm our financial results.

We are exposed to fluctuations in foreign currency exchange rates, particularly with respect to the UAE which is pegged to the U.S. dollar. Any significant change in the value of the currencies of the countries in which we do business against the U.S. dollar could affect our ability to sell products competitively and control its cost structure, which could have a material adverse effect on our results of operations.

A significant or sustained decline in commodity prices including oil could negatively impact the levels of expenditures by certain company customers.

Demand for our products depends, in part, on the level of new and planned expenditures by certain of our customers. The level of expenditures by our customers is dependent on, among other factors, general economic conditions, availability of credit, economic conditions within their respective industries and expectations of future market behavior. Our profitability may be adversely affected during any periods of unexpected or rapid increases in interest rates and volatility in commodity prices, including oil, can negatively affect the level of these activities and impact our subsidiary and can result in postponement of capital spending decisions or the delay or cancellation of existing orders. The ability of our customers to finance capital investment and maintenance may also be affected

12

by the conditions in their industries. Reduced demand for our products could result in the delay or cancellation of existing orders or lead to excess manufacturing capacity, which unfavorably impacts the absorption of fixed manufacturing costs. This reduced demand could have a material adverse effect on our financial condition and results of operations.

We are dependent on financing for the continuation of our operations.

It can at times be difficult to predict our capital needs on a monthly, quarterly, or annual basis. Our future is dependent upon our ability to obtain profitable operations or financing. We reserve the right to seek additional funds through private placements of our common stock and/or through debt financing. We do not have financing in place at this time for all future planned acquisitions. We may not have access to financing or on terms that are acceptable to us. Any lack of funds from operations or fundraising for any shortage could be detrimental to our ability to continue operations and negatively impact us and our financial condition, results of operations and cash flow.

Risks Relating to Our Industry and Market

We occasionally provide integrated project management services in the form of long-term, fixed price contracts that may require us to assume additional risks associated with cost over-runs, operating cost inflation, labor availability and productivity, supplier and contractor pricing and performance, and potential claims for liquidated damages.

We occasionally provide integrated project management services outside our normal discrete business in the form of long-term, fixed price contracts. Some of these contracts are required by our customers, primarily international oil companies. These services include acting as project managers as well as service providers and may require us to assume additional risks associated with cost overruns. These customers may provide us with inaccurate information in relation to their reserves, which is a subjective process that involves location and volume estimation, that may result in cost overruns, delays, and project losses. In addition, our customers often operate in countries with unsettled political conditions, war, civil unrest, or other types of community issues. These issues may also result in cost over-runs, delays, and project losses.

Providing services on an integrated basis may also require us to assume additional risks associated with operating cost inflation, labor availability and productivity, supplier pricing and performance, and potential claims for liquidated damages. We rely on third-party subcontractors and equipment providers to assist us with the completion of these types of contracts. To the extent that we cannot engage subcontractors or acquire equipment or materials in a timely manner and on reasonable terms, our ability to complete a project in accordance with stated deadlines or at a profit may be impaired. If the amount we are required to pay for these goods and services exceeds the amount we have estimated in bidding for fixed-price work, we could experience losses in the performance of these contracts. These delays and additional costs may be substantial, and we may be required to compensate our customers for these delays. This may reduce the profit to be realized or result in a loss on a project.

The success of our business depends on our ability to maintain and enhance our reputation and brand.