E

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One) | |

x | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2013

OR

o | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission File Number: 001-33549

Tiptree Financial Inc.

(Exact name of Registrant as Specified in Its Charter)

Maryland | 38-3754322 |

(State or Other Jurisdiction of | (IRS Employer |

Incorporation of Organization) | Identification No.) |

780 Third Avenue, 21st Floor, New York, New York | 10017 |

(Address of Principal Executive Offices) | (Zip Code) |

(212) 446-1400

(Registrant’s Telephone Number, Including Area Code)

Securities Registered Pursuant to Section 12(b) of the Act: Class A Common Stock, par value $0.001 per share

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer ¨

Non-accelerated filer ¨ Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.) Yes ¨ No x

As of June 28, 2013, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the registrant’s voting and non-voting common equity held by non-affiliates of the registrant was $1,177,400, based upon the closing sales price of $7.00 per share as

E

reported on the OTCQX Capital market. For purposes of this calculation, all of the registrant’s directors and executive officers were deemed to be affiliates of the registrant. Since August 9, 2013, the registrant’s Class A common stock has traded on the NASDAQ Capital Market under the symbol “TIPT.”

As of March 17, 2014, there were 10,610,281 shares, par value $0.001, of the registrant’s Class A common stock outstanding and 30,968,877 shares, par value $0.001, of the registrant’s Class B common stock outstanding.

Documents Incorporated by Reference

Certain information in the registrant’s definitive proxy statement to be filed with the Commission relating to the registrant’s 2014 Annual Meeting of Stockholders is incorporated by reference into Part III.

Tiptree Financial Inc.

INDEX

PART I

Forward-Looking Statements

Except for the historical information included and incorporated by reference in this Annual Report on Form 10-K, the information included and incorporated by reference herein are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”). Forward-looking statements provide our current expectations or forecasts of future events and are not statements of historical fact. These forward-looking statements include information about possible or assumed future events, including, among other things, discussion and analysis of our future financial condition, results of operations and our strategic plans and objectives. When we use words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “project,” “should,” “target,” “will,” or similar expressions, we intend to identify forward-looking statements.

The forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, many of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including, but not limited to, those described in the section entitled “Risk Factors” in this Annual Report on Form 10-K.

The factors described herein are not necessarily all of the important factors that could cause actual results or developments to differ materially from those expressed in any of our forward-looking statements. Other unknown or unpredictable factors also could affect our forward-looking statements. Consequently, our actual performance could be materially different from the results described or anticipated by our forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Except as required by the federal securities laws, we undertake no obligation to update any forward-looking statements.

Note to Reader

In reading this Annual Report on Form 10-K, references to:

“Administrative Services Agreement” means the Administrative Services Agreement between Operating Company (as assignee of TFP) and BackOffice Services Group, Inc., dated as of June 12, 2007.

“AUM” means assets under management.

“Care Inc.” means Care Investment Trust Inc. prior to the Contribution Transactions.

“Care LLC” means Care Investment Trust LLC.

“Care” means Care Inc. and Care LLC, collectively.

“CLOs” means collateralized loan obligations.

“COLI/ BOLI” means company owned life insurance and bank owned life insurance.

“Contribution Transactions” means the closing on July 1, 2013 of the transactions pursuant to the Contribution Agreement by and between the Company, Operating Company and TFP, dated as of December 31, 2012.

“Luxury” means Luxury Mortgage Corp.

“Mariner” means Mariner Investment Group LLC.

“MCM” means Muni Capital Management, LLC.

“MFCA” means Muni Funding Company of America LLC.

“NPPF I” means Non-Profit Preferred Funding Trust I.

“Operating Company” means Tiptree Operating Company, LLC.

1

“PFAS” means Philadelphia Financial Administration Services Company, LLC.

“PFAS Transaction” means PFG’s purchase of assets and administrative servicing rights of COLI/BOLI business from The Hartford in 2012.

“PFG” means Philadelphia Financial Group, Inc.

“Siena” means Siena Capital Finance LLC.

“Star Asia Entities” means collectively Star Asia Finance, Limited, Star Asia Opportunity, LLC and Star Asia Opportunity II, LLC.

“TAMCO” means Tiptree Asset Management Company, LLC.

“Telos” means Telos Asset Management, LLC.

“TFP” means Tiptree Financial Partners, L.P.

“Tiptree”, the “Company”, “we”, “its”, “us” and “our” means Tiptree Financial Inc. and its consolidated subsidiaries.

“Tiptree Direct” means Tiptree Direct Holdings LLC.

“Transition Services Agreement” means the Transition Services Agreement among TAMCO, Tricadia and Operating Company (as assignee of TFP), dated as of June 30, 2012.

“Tricadia” means Tricadia Holdings, L.P.

Item 1. Business

OVERVIEW

Tiptree is a diversified holding company engaged through its consolidated subsidiaries in a number of businesses and is an active acquirer of new businesses. Tiptree, whose operations date back to 2007, currently has subsidiaries that operate in four industry segments: insurance and insurance services, specialty finance, asset management and real estate.

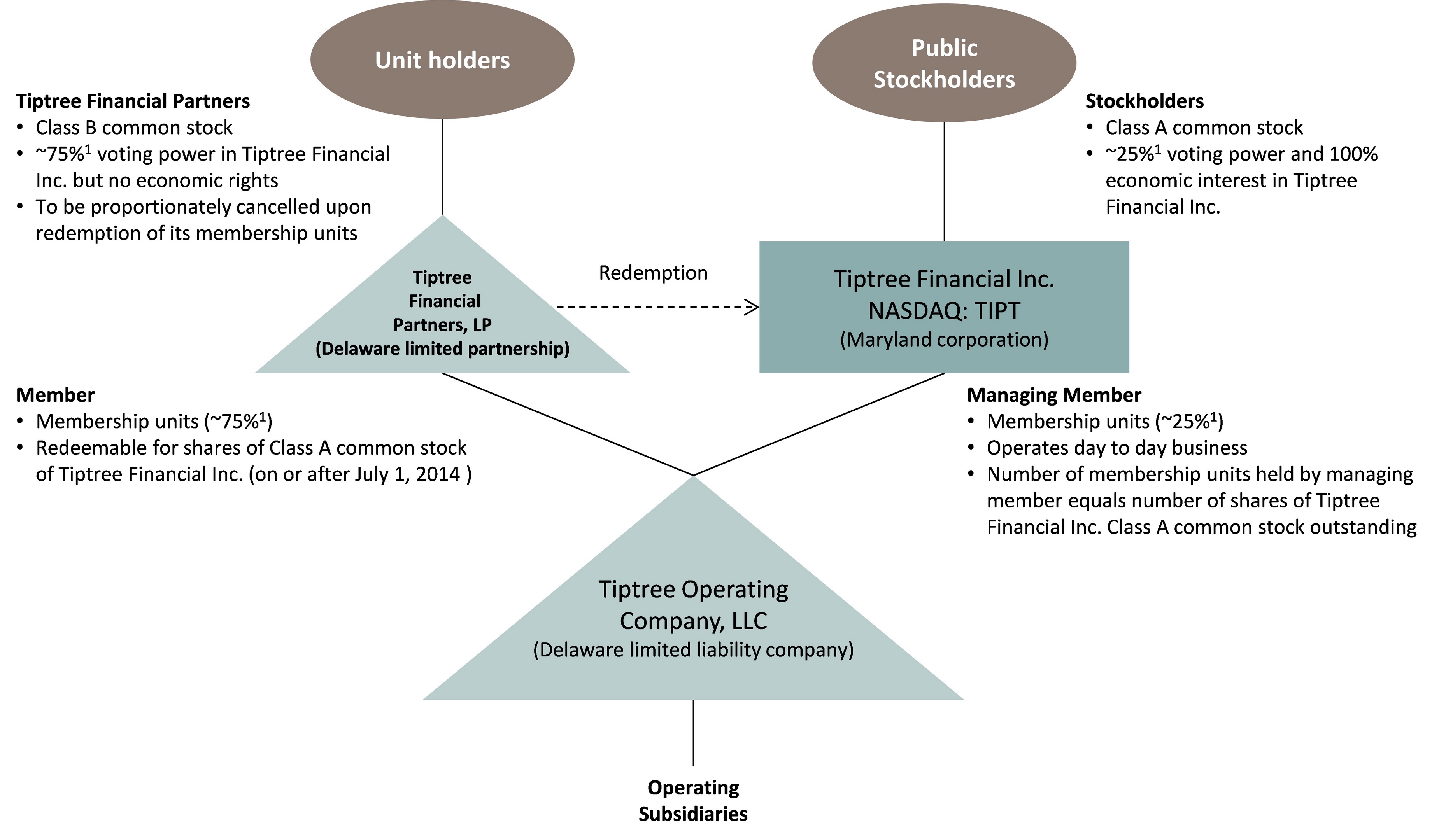

We operate our business through Operating Company, which directly or indirectly owns all of our assets. Operating Company is owned 25% by Tiptree Financial Inc. and 75% by Tiptree Financial Partners, L.P. This report is being filed by Tiptree Financial Inc. but includes information of Operating Company that may be of interest to partners of Tiptree Financial Partners, L.P. Beginning on July 1, 2014, partnership units of Tiptree Financial Partners, L.P. are redeemable for Class A common stock of Tiptree Financial Inc. For more information on our ownership and structure see “—Structure” and Notes 1 and 15 within the accompanying consolidated financial statements.

Strategy

Tiptree’s primary strategy is to acquire controlling interests in a diversified group of businesses. We look for companies that offer sustainable, long-term and stable financial performance. We may also make investments that are not controlling acquisitions, and or invest in debt instruments, and have done so in the past.

Our structure allows us to focus on being long term investors in our companies as some of our companies may require operational turnaround to build shareholder value. We provide managerial assistance to our companies as needed, which at times has included developing growth strategies and providing strategic advice regarding complimentary acquisitions and new business initiatives, as well as providing incremental capital.

As part of our strategy we may also seed new opportunities, which may include new product launches by our existing companies, new asset management products and new businesses to take advantage of market disruptions. Accordingly, over time our mix of businesses may change as a result of new initiatives and new investments.

Business Segments

Tiptree’s activities are organized, for management and financial reporting purposes, into four business segments.

2

Segment | Subsidiaries |

Insurance and insurance services | Philadelphia Financial Group, Inc. and Philadelphia Financial Administration Services Company, LLC |

Specialty finance | Muni Funding Company of America, LLC, Siena Capital Finance LLC, Luxury Mortgage Corp. and Tiptree Direct Holdings LLC |

Asset management | Tiptree Asset Management Company, LLC, Telos Asset Management, LLC and Muni Capital Management, LLC |

Real estate | Care LLC and the Star Asia Entities |

For additional financial information regarding Tiptree’s operating segments see “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Segment Reporting”.

BUSINESS SEGMENTS

Insurance and Insurance Services

Tiptree’s insurance operations include PFG, a life insurance and annuity company and PFAS, a third party administrator of COLI/BOLI policies.

Philadelphia Financial Group

PFG provides annuity and life insurance products within the U.S. and internationally. PFG’s principal insurance activity is the structuring, underwriting, marketing and administration of life insurance and annuity products. PFG’s life insurance products are primarily targeted to high net worth individuals and its annuity products are targeted to both the individual and institutional markets. PFAS, a subsidiary of PFG, also provides administration services of life insurance products in the institutional bank owned and corporate owned life insurance markets. In August 2012, PFG launched its international operations with the establishment of two Bermuda domiciled subsidiaries.

PFG distributes its products through a select network of intermediaries who work directly with individuals, institutions and families or in concert with family offices, wealth managers, private bankers or other professionals.

PFG’s life insurance products are generally marketed to high net worth individuals and families in the form of variable life insurance policies, which give flexibility in investment choices. In variable life products, the premiums are held in separate accounts that may be invested into a variety of investment options. PFG does not receive or participate in management fees on the performance of separate accounts. PFG’s annuity products are marketed to both the individual and institutional markets, in the form of individual and group variable annuities. Variable annuities allow for the contract holder to make deposits into various investment options in a separate account, as determined by the contract holder. In all of PFG’s annuity products, the investment risks associated with such investment options are borne entirely by the contract holder.

PFAS is a third party administrator of group life insurance policies, primarily in the COLI/BOLI market. Employers looking for tax-efficient ways to fund their employee benefit programs have accomplished this goal through the use of COLI/BOLI, by purchasing life insurance policies on employees. The employer pays the premium, owns the cash value of the policy and is the designated beneficiary. PFAS does not structure, underwrite or distribute COLI/BOLI policies. It provides policy service and administration services on behalf of the insurance company issuing the policy.

Reinsurance

PFG reinsures a significant portion of its mortality risk exposure and in connection therewith, pays to the reinsurers a portion of the premiums received. Insurance is ceded principally to reduce the net exposure to mortality risk and protect against large losses. PFG, unlike traditional life insurance companies, reinsures substantially all of its exposure to mortality risk. Reinsurance does not relieve PFG of its obligations to its policyholders and exposes PFG to credit risk with respect to its reinsurers.

Competition

Competition faced by PFG is based on a variety of factors, including service, product features, scale, price, financial strength, rating and name recognition. PFG competes with private and public insurance companies many of whom are significantly larger and have greater access to capital and other resources that may provide competitive advantages. PFG’s ability to compete depends on its ability to develop profitable products, maintain relationships with intermediaries who distribute its products, maintain adequate ratings from ratings agencies, and provide a high quality of service to its customers.

Regulation

3

Insurance companies are subject to supervision and regulation in the states in which they transact business. Such supervision and regulation relate to numerous aspects of an insurance company’s business and financial condition. The purpose of such supervision and regulation is the protection of policyholders. The extent of such supervision and regulation varies, but generally derives from state statutes which delegate regulatory, supervisory and administrative authority to state insurance departments. Accordingly, the authority of the state insurance departments typically includes the establishment of standards of solvency which must be met and maintained by insurers, the licensing to do business of insurers and agents, the nature of and limitations on investments, the approval process for premium rates, the provisions which insurers must make for current losses and future liabilities, the deposit of securities for the benefit of policyholders and the approval of policy forms. Such insurance departments also conduct periodic examinations of the affairs of insurance companies and require the filing of annual and other reports relating to the financial condition of insurance companies. PFG is primarily domiciled in Pennsylvania and is subject to regulation by the Pennsylvania Insurance Department, among other regulatory authorities, with respect to statutory capital and reserve requirements. Certain other subsidiaries are subject to regulation by the New York State Department of Financial Services and the Bermuda Monetary Authority.

PFG’s insurance subsidiaries are generally restricted by the insurance laws of their respective domiciles as to the amount of dividends they may pay to their shareholders without the prior approval of the respective regulatory authorities. Generally, the maximum dividend that may be paid by an insurance subsidiary during any year without prior regulatory approval is limited to a stated percentage of that subsidiary’s statutory surplus as of a certain date, or adjusted net income of the subsidiary for the preceding year.

Employees

PFG and PFAS had 111 employees as of December 31, 2013.

Asset Management

Tiptree’s asset management operations are conducted through TAMCO, an SEC-registered investment adviser that is primarily a holding company for all of Tiptree’s asset management subsidiaries, which include among others, Telos and MCM. Tiptree, through these subsidiaries, manages assets within a variety of investment vehicles, including CLOs, managed accounts and other investment funds. Tiptree seeks to grow its asset management operations through acquisitions and through investments in new products launched and managed by its subsidiaries.

Telos Asset Management

Telos is an investment manager that establishes and manages investment products for various types of investors, including pension funds, hedge funds and other asset management firms, banks, insurance companies and other types of institutional investors. Its core investment products are primarily in the form of collateralized loan obligations ("CLOs") and managed accounts. The term CLO generally refers to a special purpose vehicle that owns a portfolio of senior secured loans and issues various tranches of debt and subordinated note securities to finance the purchase of those investments. The investment activities of a CLO are governed by extensive investment guidelines, generally contained within a CLO’s “indenture” and other governing documents which limit, among other things, the CLO’s maximum exposure to any single industry or obligor and limit the ratings of the CLO’s assets. Most CLOs have a defined investment period during which they are allowed to make investments and reinvest capital as it becomes available. Telos, as investment advisor/ manager of CLOs, selects and actively manages the underlying assets to achieve target investment performance, while seeking to avoid losses.

The investment advisory fees paid to Telos by these investment products are its primary source of revenue and are generally paid on a quarterly basis and are ongoing as long as Telos manages the products. Investment advisory fees typically consist of senior and subordinated management fees based on the amount of assets held in the investment product and, in certain cases, include incentive fees based on the returns generated for certain investors.

Telos is currently the manager of four CLOs: Telos CLO 2006-1, Ltd. (“Telos 1”), Telos CLO 2007‑2, Ltd. (“Telos 2”), Telos CLO 2013-3, Ltd. (“Telos 3”) and Telos CLO 2013-4, Ltd. (“Telos 4”).

Muni Capital Management - MCM

MCM is a manager of investments in securities exempt from U.S. federal income taxes. MCM currently manages Non-Profit Preferred Funding Trust I (“NPPF I”), a structured tax-exempt pass-through (“STEP”) vehicle. Interests in NPPF I are held solely by third parties unaffiliated with Tiptree. MCM is also the external manager and advisor to Tiptree’s subsidiary MFCA, which currently does not invest third party capital.

Competition

4

TAMCO and its subsidiaries compete for asset management clients and assets under management (“AUM”) with numerous other asset managers, including those affiliated with major commercial or investment banks and other financial institutions. Many of these organizations offer products and services that are similar to, or compete with, those TAMCO and its subsidiaries may offer, and many of these organizations have substantially more personnel and greater financial resources. Some of these competitors have proprietary products and distribution channels that make it more difficult for TAMCO and its subsidiaries to compete with them. Some competitors have greater portfolio management resources, have managed client accounts for longer periods of time, have greater experience over a wider range of products or have other competitive advantages. The factors considered by clients in choosing TAMCO and its subsidiaries or a competitor include the past performance of the products managed, the background and experience of key personnel, the experience in managing a particular product, and reputation, investment advisory fees and the structural features of the investment products offered.

Regulation

The asset management industry in the U.S. is subject to extensive regulation under federal and state securities laws as well as the rules of self-regulatory organizations. The Securities and Exchange Commission (“SEC”) is the federal agency charged with administration of federal securities laws. Each of TAMCO, Telos and MCM (collectively, the “Advisers”) are registered with the SEC as investment advisers, and are required to make notice filings in certain states. Virtually all aspects of the asset management business, including related sales and distribution activities, are subject to various federal and state laws and regulations and self-regulatory organization rules. These laws, rules and regulations are primarily intended to protect the asset management clients and generally grant supervisory agencies and bodies broad administrative powers, including the power to limit or restrict an investment advisor from conducting its asset management business in the event that it fails to comply with such laws and regulations. Possible sanctions that may be imposed include the suspension of individual employees, the imposition of limitations on engaging in the asset management business for specified periods of time, the requirement to hire independent compliance consultants, the revocation of licenses or registrations, and imposition of censures and fines. In addition, investment vehicles managed by the Advisers are subject to various securities laws and other laws.

Employees

TAMCO had 19 employees as of December 31, 2013, 8 of whom are dedicated to Telos, 3 dedicated to MCM, and 8 to Tiptree’s corporate activities.

Specialty Finance

Tiptree’s specialty finance operations include: Muni Funding Company of America, which provides financing to tax-exempt organizations; Siena Lending Group, which provides asset-based loans to smaller U.S. businesses; Luxury Mortgage Corp., a residential mortgage lender that originates agency, prime jumbo and super jumbo mortgages; and Tiptree Direct, which holds our principal investments and all non-consolidated minority investments. Tiptree intends to continue to grow its specialty finance operations through acquisitions and by exploring strategic alternatives with respect to new financing products which may provide attractive returns to Tiptree.

Muni Funding Company of America - MFCA

MFCA is a specialty finance company that acquires and invests in the debt and securities of tax-exempt organizations, primarily in the healthcare, educational and social services sectors. MFCA operates in the tax advantaged finance sector, which may include holding or acquiring tax-exempt obligations, mortgage-related holdings, interests in structured credit entities, taxable municipal bonds, derivative instruments, equity interests in real estate (such as affordable housing partnerships), other equity investments, investments in “taxable tails” or tax credits, investments in leases with municipal borrowers and other assets. MFCA derives income from interest on the assets held by it and its subsidiaries and from any gains on the sale or prepayment of assets.

Competition

MFCA competes with mutual funds, closed-end funds, specialty finance companies, hedge funds, insurance companies, institutional investors, investment banking firms and other financial entities specifically focused on acquiring tax-exempt assets many of whom may be significantly larger, have greater access to capital and other resources and may possess other competitive advantages.

Employees

MFCA is externally managed by MCM, a subsidiary of TAMCO, so it does not have any employees. Three TAMCO employees were dedicated to MFCA as of December 31, 2013.

Siena Lending Group

5

Siena is a commercial finance company providing financing solutions to small and medium sized U.S. companies. Siena originates, structures, underwrites and services senior, secured asset-based loans for companies with sales typically between $5 million and $50 million operating across a range of industry sectors. Its core financing solutions include revolving lines of credit and term loans, which may collectively be referred to as asset-based loans and typically range in size from $1 million to $20 million. Siena also has the ability to arrange significantly larger transactions that may be syndicated to others or Siena may participate in large syndications itself.

Siena’s asset-based loans are typically used to fund working capital needs and are secured by eligible, margined collateral, including accounts receivable, inventories, and, to a lesser extent, other long-term assets. In determining a borrowers’ ability and willingness to repay loans, Siena conducts a detailed due diligence investigation to assess financial reporting accuracy and capabilities as well as to verify the values of business assets among other things. Siena employs third parties to conduct field exams to audit financial reporting and to appraise the value of certain types of collateral in order to estimate its liquidation value. Financing arrangements with customers also typically include substantial controls over the application of borrowers’ cash and Siena retains discretion over collateral advance rates and eligibility among other key terms and conditions.

Siena also offers a servicing platform which provides asset based lending solutions for community and regional banks that do not have the expertise or capacity to underwrite or service asset-based loans.

Competition

Siena’s market is competitive, based on factors that vary by product, customer, and geographic region. Competitors include global and domestic commercial and investment banks, regional and community banks, captive finance companies, and other niche specialty finance companies. Many of the larger competitors have greater financial, technological, and marketing resources than Siena.

Employees

Siena had 7 employees as of December 31, 2013.

Luxury Mortgage Corp.

Tiptree completed the acquisition of 67.5% of Luxury in January 2014 and Luxury will be consolidated within Tiptree’s financial statements beginning with the first quarter of 2014. Luxury’s operations include the origination, packaging and sale of agency, prime jumbo and super jumbo mortgage loans into the secondary market through whole loan sales. The loans are typically sold shortly after origination into a liquid secondary market. Loans sold into the secondary market may be sold “servicing-retained” or “servicing-released,” referring to whether the rights to service the mortgage are retained by the originator or released to the secondary market investor at the time of sale. Luxury currently sells all of its loans on a servicing released basis.

Luxury offers a variety of residential adjustable and fixed rate mortgage products . Luxury currently uses two production channels to originate or acquire mortgage loans: retail sales offices (commonly referred to as “retail”), as well as a broker (commonly referred to as “wholesale”). Each production channel produces similar mortgage loan products and generally applies the same underwriting standards. Luxury leverages technology to streamline the mortgage origination process and bring service and convenience to both channels. Brokers are able to register and lock loans, check the status of the loan, and deliver documents in electronic format through the internet and are supported by a sales support team assists brokers where Luxury is licensed to do business.

In the retail channel, loans are originated by mortgage loan originators employed by Luxury. When loans are originated on a retail basis, the origination documentation is completed internally inclusive of customer disclosures and other aspects of the lending process and the funding of the transactions. In the wholesale channel, an unaffiliated bank, mortgage bank, or mortgage brokerage company completes much of the loan paperwork. All loans are underwritten on a loan-level basis to

Luxury’s underwriting standards.

The wholesale channel also includes correspondent transactions, where an unaffiliated bank or mortgage company completes the loan paperwork and also supplies the funding for the loan at closing. Luxury does not currently participate in this channel but may choose to do so in the future.

Luxury’s revenues include interest income earned for the period the loans are on Luxury’s balance sheet, gain on sale income representing the difference between the origination value and the sale value of the loan and fee income earned at origination.

Competition

6

The market for origination of residential mortgages is highly competitive. There are a large number of institutions offering mortgage loans, including many that operate on a national scale, as well as local savings banks, commercial banks, and other lenders. With respect to those products that Luxury offers, the company competes by offering competitive interest rates, fees, and other loan terms and services and by offering efficient and rapid service. Many of Luxury’s competitors are larger and have access to greater financial resources, which can place Luxury at a competitive disadvantage. In addition, many of the largest competitors are banks or are affiliated with banking institutions, the advantages of which include, but are not limited to, the ability to hold mortgage loan originations in an investment portfolio and having access to financing with more favorable terms, including lower interest rate bank deposits as a favorable source of funding.

Regulation

Luxury is subject to extensive regulation by federal, state and local governmental authorities, including the Consumer Financial Protection Bureau, the Federal Trade Commission and various state agencies that license, audit and conduct examinations. Luxury is licensed or qualified to do business in 19 states in the U.S. Luxury must comply with a number of federal, state and local consumer protection laws including, among others, the Gramm-Leach-Bliley Act, the Fair Debt Collection Practices Act, the Real Estate Settlement Procedures Act, the Truth in Lending Act, the Fair Credit Reporting Act, the Servicemembers Civil Relief Act, Homeowners Protection Act, the Federal Trade Commission Act and, more recently, the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”) and state foreclosure laws. These statutes apply to loan origination, debt collection, use of credit reports, safeguarding of non−public personally identifiable information about customers, foreclosure and claims handling, investment of and interest payments on escrow balances and escrow payment features, and mandate certain disclosures and notices to borrowers. These requirements can and do change as statutes and regulations are enacted, promulgated or amended. Over the past few years, state and federal lawmakers and regulators have adopted a variety of new or expanded laws and regulations, including the Dodd-Frank Act.

Employees

Luxury had 103 employees as of December 31, 2013.

Tiptree Direct

Tiptree Direct primarily holds our principal investments, which includes the positions we own in the subordinate notes of CLOs managed by Telos. In addition, Tiptree Direct holds the Company’s non-consolidated investments.

Real Estate

Tiptree’s real estate operations include Care, a real estate investment company, and interests in the Star Asia Entities, which are Tokyo based real estate holding companies formed to invest predominately in Asian properties and real estate related debt instruments. Tipree intends to continue to grow its real estate operations through new acquisitions and investments by Care.

Care LLC

Care is a real estate investment company that primarily acquires and owns senior housing properties within the U.S. Care’s focus is on acquisitions ranging in size from $5 to $200 million in the senior housing and care industry that provide attractive returns. Care’s overall strategy is to identify strong and experienced managers or operators of senior housing facilities who are looking to expand and diversify their operations by entering into strategic relationships with capital partners. Through joint ventures, Care may also operate senior housing properties and hire experienced managers to run the day to day operations at the properties.

Care’s senior housing communities currently include senior apartments, independent and assisted living communities, and communities providing care for individuals with Alzheimer’s disease and other forms of dementia or memory loss. Rent payments and services provided in these facilities are primarily paid for by the residents directly or through private insurance and are less reliant on government reimbursement programs such as Medicaid and Medicare. Care intends to continue to grow its portfolio primarily through the acquisition of senior housing properties, utilizing investments structures such as leases and joint ventures. As Care acquires additional properties and expands its portfolio, it intends to further diversify its concentrations by tenant, asset class and geography within the senior housing sector, including further investments in senior apartments, independent and assisted living communities, memory care communities and skilled nursing facilities.

Competition

Care competes for investments in the senior housing and care sector with other real estate investment companies and real estate investment trusts, real estate partnerships, private equity firms and hedge funds, finance/investment companies, taxable and tax-exempt bond funds, health care operators and developers. Care competes for investments based on a number of factors including

7

investment structures, underwriting criteria and reputation. Care’s ability to successfully compete is impacted by economic and demographic trends, availability of acceptable investment opportunities, ability to negotiate beneficial investment terms, availability and cost of capital and new and existing laws and regulations.

The operators/managers/lessees of Care’s properties compete on a local and regional basis with those of properties that provide comparable services. Operators/managers/lessees compete for residents based on a number of factors including quality of service, reputation, physical appearance of properties, location, services offered, family preferences, physicians, staff and price. Care also faces competition from other health care facilities for tenants, such as physicians and other health care providers that provide comparable facilities and services.

Regulation

Tenants and operators of healthcare properties are typically subject to federal, state and local laws and regulations relating to environmental protection and human health and safety. Federal laws such as the National Environmental Policy Act, the Comprehensive Environmental Response, Compensation, and Liability Act, the Resource Conservation and Recovery Act, the Federal Water Pollution Control Act, the Federal Clean Air Act, the Toxic Substances Control Act, the Emergency Planning and Community Right to Know Act and the Hazard Communication Act govern such matters as wastewater discharges, air emissions, the operation and removal of underground and above-ground storage tanks, the use, storage, treatment, transportation and disposal of solid and hazardous materials and the remediation of contamination associated with disposals. Some of these laws and regulations impose joint and several liabilities on tenants, owners or operators for the costs to investigate or remediate contaminated properties, regardless of fault or whether the acts causing the contamination were legal. In addition, there are various federal, state and local fire, health, life-safety and similar regulations applicable to healthcare properties.

Care’s properties may be affected by Care’s operators’, managers’ and lessees’ operations, the existing condition of land when acquired, operations in the vicinity of our properties, such as the presence of underground storage tanks, or activities of unrelated third parties. The presence of hazardous substances, or the failure to properly remediate these substances, may make it difficult or impossible to sell or rent such property.

In addition, the healthcare industry is highly regulated by federal, state and local licensing requirements, facility inspections, reimbursement policies, regulations concerning capital and other expenditures, certification requirements and other laws, regulations and rules. In addition, regulators require compliance by our tenants and third party operators with a variety of safety, health, staffing and other requirements relating to the design and conditions of the licensed facility and quality of care provided. The failure of any tenant, manager or operator to comply with such laws, requirements and regulations could affect a tenant’s, manager’s or operator’s ability to operate the facilities that Care owns.

Private, federal and state payment programs, including Medicaid and Medicare, and the effect of laws and regulations may also have a significant influence on the profitability of the properties and their tenants.

Employees

Tiptree had 4 employees dedicated to Care as of December 31, 2013.

STRUCTURE

On July 1, 2013, in exchange for interests in the Operating Company, TFP and Care Inc. contributed substantially all of their assets to the Operating Company, which we refer to as the “Contribution Transactions.” Approximately 75% of Operating Company is owned by TFP and the remaining approximately 25% is owned by Tiptree. In connection with the Contribution Transactions, Care Inc. changed its name to “Tiptree Financial Inc.”

TFP was organized in May 2007 and completed a private placement of approximately $139 million in June 2007. From 2007 until the Contribution Transactions, TFP pursued the strategy described above as a private partnership. Prior to June 30, 2012, TFP was externally managed by an affiliate of Tricadia. Care Inc. was incorporated as Care Investment Trust Inc. in Maryland in March 2007 and completed its initial public offering in June 2007. From 2007 until the Contribution Transactions, Care Inc. operated as a real estate investment trust investing in healthcare related real estate assets.

The following chart shows a simplified version of our organizational structure:

8

1 Percentages shown are approximate as of December 31, 2013 and will change accordingly as membership units are redeemed for Class A common stock of Tiptree Financial Inc.

Competition

In addition to the competition our businesses face, we are subject to significant competition in identifying, evaluating and pursuing acquisition opportunities. Many of these competitors are of varying sizes and compete with us to make the types of acquisitions that we plan to make, including strategic corporate buyers, banks, mortgage companies, specialty finance companies, insurance companies, asset managers, private equity funds, hedge funds, family offices, real estate investment trusts, limited partnerships, business development companies and special purpose acquisition vehicles. Many of our competitors are significantly larger, have greater access to capital and other resources and may possess other competitive advantages. We believe that Tiptree’s position as a public company may provide a competitive advantage over privately held entities that may compete to acquire certain target businesses, and unlike private buyers of companies such as private equity firms, Tiptree is able to pay for acquisitions with cash or equity securities.

Employees

As of December 31, 2013, 18 persons provided services to Tiptree (as employees or pursuant to a services agreement) at the holding company and on a consolidated basis, including all of Tiptree’s consolidated subsidiaries, Tiptree had 250 employees.

AVAILABLE INFORMATION

We are required to file annual, quarterly and current reports, proxy statements and other information with the SEC. The public may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov.

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, proxy statements and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as amended (the Exchange Act), are also available free of charge on our Internet site at www.tiptreefinancial.com as soon as reasonably practicable after such reports are electronically filed with or furnished to the SEC. The information on our website is not, and shall not be deemed to be, a part hereof or incorporated into this or any of our other filings with the SEC.

9

Our Investor Relations Department can be contacted at Tiptree Financial Inc., 780 Third Avenue, 21st Floor, New York, NY, 10017, Attn: Investor Relations, telephone: (212) 446-1400, email: IR@tiptreefinancial.com.

Item 1A. Risk Factors

We are a holding company with multiple lines of business, which may adversely impact the market price of our Class A common stock and our ability to raise equity and debt capital.

Operating Company holds and manages multiple lines of business. Research analysts, investors and lenders may have difficulty analyzing and valuing a company with multiple lines of business, which could adversely impact the market price of our Class A common stock and our ability to raise equity and debt capital. Moreover, our management is required to make decisions regarding the allocation of capital among the different lines of business, and such decisions could materially and adversely affect our business.

Because we are a holding company, our ability to make distributions to stockholders will depend on distributions from our subsidiaries that may be subject to restrictions.

Because we are a holding company, our ability to make distributions to stockholders will depend on distributions from our subsidiaries. The amount of dividends that our subsidiaries may distribute to us may be subject to restrictions imposed by state law, restrictions that may be imposed by state regulators and restrictions imposed by the terms of any current or future indebtedness that these subsidiaries may incur. For example, PFG, an insurance holding company in which we own a controlling interest, is required to maintain minimum capital and surplus requirements and is subject to laws and regulations that limit the amount of dividends that PFG can pay to us. PFG may also be required to limit the amount of dividends paid to us to maintain a risk-based capital ratio to maintain or improve its ratings by rating agencies.

We may be limited in the future in utilizing net operating losses incurred during prior periods to offset taxable income.

Care and PFG previously incurred net operating losses. In the event that we experience an “ownership change” within the meaning of Section 382 of the Internal Revenue Code of 1986, as amended, which we refer to as the “Code”, including as a result of the Contribution Transactions, our ability to use those net operating losses to offset taxable income would be subject to an annual limitation. The annual limitation would be equal to a percentage of our equity value at the time the ownership change occurred. In general, such an “ownership change” would occur if the percentage of our stock owned by one or more 5% stockholders were to increase by 50 percentage points during any three-year period. A 5% stockholder is a person (including certain groups of persons acting in concert) that owns at least 5% of our stock. All stockholders that own less than 5% of our stock are treated as a single 5% stockholder. In addition, the Treasury Regulations under Section 382 of the Internal Revenue Code contain additional rules the effect of which is to make it more likely that an ownership change could be deemed to occur. Accordingly, our ability to use prior net operating losses to offset future taxable income would be subject to a limitation if we experience an ownership change.

Compliance with existing and new regulations affecting our businesses in regulated industries may increase costs and limit our ability to pursue business opportunities.

We are subject to extensive laws and regulations administered and enforced by a number of different federal and state governmental authorities. For example, PFG’s insurance subsidiaries are subject to regulation by the Pennsylvania Insurance Department, among other regulatory authorities, with respect to statutory capital and reserve requirements and certain of its subsidiaries are subject to regulation by the New York State Department of Financial Services and the Bermuda Monetary Authority. TAMCO, is an asset management holding company registered with the SEC as an investment advisor and the properties held by our subsidiary Care LLC, are regulated by state and federal laws regarding healthcare facilities. Luxury is subject to extensive regulation by federal, state and local governmental authorities, including the Consumer Financial Protection Bureau, the Federal Trade Commission and various state agencies that license, audit and conduct examinations. Regulation of the industries in which we operate is expected to increase. In the past several years there has been significant legislation affecting financial services, insurance and health care, including the Dodd-Frank Wall Street Reform and Consumer Protection Act and the Patient Protection and Affordable Care Act, and many of the regulations associated with these laws have yet to be written. Accordingly, we cannot predict the impact that any new laws and regulations will have on us. The costs to comply with these laws and regulations may be substantial and could have a significant negative impact on us and limit our ability to pursue business opportunities.

10

A portion of our assets are illiquid or have limited liquidity, which may limit our ability to sell those assets at favorable prices or at all and creates uncertainty in connection with valuing such assets.

Our assets include real estate, non-controlling interests in credit assets and related equity interests which may be illiquid or have limited liquidity. It may be difficult for us to dispose of assets with limited liquidity rapidly, or at favorable prices, if at all. In addition, assets with limited liquidity may be more difficult to value and may be sold at a substantial discount or experience more volatility than more liquid assets. We may not be able to dispose of assets at the carrying value reflected in our financial statements. Our results of operations and cash flows may be materially and adversely affected if our determinations regarding the fair value of our illiquid assets are materially higher than the values ultimately realized upon their disposal.

Certain of our assets are subject to credit risk, market risk, interest rate risk, credit spread risk, selection risk, call and redemption risk and/or tax risk, and any one of these risks may materially and adversely affect the value of our assets, our results of operations and our financial condition.

Some of our specialty finance assets are subject to credit risk, market risk, interest rate risk, credit spread risk, selection risk, call and redemption risk and/or tax risk.

Credit risk is the risk that the obligor will be unable to pay scheduled principal and/or interest payments. In this regard, investing in non-investment grade obligations is riskier than investing in higher quality instruments. In addition, market value fluctuations may be larger and more frequent. Changes in the underlying obligor’s financial results may affect the credit rating or the market’s perception of its creditworthiness, which may affect the market value of the credit assets of that obligor. The degree of credit risk depends on the terms of the obligation as well as on the financial condition of the obligor in respect thereof.

Market risk is the risk that one or more markets to which the assets relate will decline in value, including the possibility that such markets will deteriorate sharply and unpredictably, which will likely impair the market value of the related obligations.

With respect to fixed-rate obligations, interest rate risk is the risk that the market value of these obligations will change in response to changes in the interest rate environment or other developments that may affect the fixed income market generally. When market interest rates go up, the market value of existing fixed rate obligations goes down and obligations with longer maturities are typically affected more by changes in interest rates than obligations with shorter maturities. Because market interest rates continue to be near their lowest levels in many years, there is a greater risk that prevailing interest rates increase in the future and, as a result, that these obligations may decline in market value. With respect to floating-rate obligations, interest rate risk is the risk that defaults on these obligations will increase during periods of rising interest rates and, during periods of declining interest rates, that obligors may exercise their option to prepay principal earlier than scheduled.

Credit spread risk is the risk that the market value of fixed income obligations will change in response to changes in perceived or actual credit risk beyond changes that would be attributable to changes, if any, in interest rates.

Call and redemption risk is the risk that debt instruments will be called or redeemed prior to maturity at a time when yields on other debt instruments in which the call or redemption proceeds could be invested are lower than the yield on the called or redeemed instrument. Any one of these risks may materially and adversely affect the value of our assets, results of operations and financial condition.

We leverage our assets and a decline in the fair value of such assets may adversely affect our financial condition and results of operations.

We leverage our assets, including through borrowings, generally through warehouse facilities, secured loans, derivative instruments such as total return swaps, securitizations (including the issuance of CLOs) and other borrowings. A rapid decline in the fair value of our leveraged assets, such as the declines experienced in the fourth quarter of 2007 and the first quarter of 2008, may adversely affect us. Lenders may require us to post additional collateral to support the borrowing. If we cannot post the additional collateral, we may have to rapidly liquidate assets, which we may be unable to do on favorable terms or at all. Even after liquidating assets, we may still be unable to post the required collateral, further harming our liquidity and subjecting us to liability to lenders for the declines in the fair values of the collateral. A reduction in credit availability may adversely affect our business, financial condition and results of operations.

A reduction in administrative fees paid to PFAS could adversely affect our financial condition and results of operations.

PFAS generates revenue from administrative fees collected from a portfolio of company-owned life insurance policies and bank-owned life insurance policies issued and underwritten by affiliates of The Hartford pursuant to a servicing agreement. A reduction

11

in administrative fees paid to PFAS, due to the lapse or surrender of policies administered or termination of PFAS’s servicing agreement with a subsidiary of The Hartford, could adversely affect our financial condition and results of operations.

The amount of PFG’s required statutory capital can increase because of factors outside of PFG’s control.

PFG’s insurance subsidiaries are subject to statutory capital and reserve requirements established by the applicable insurance regulators based on risk-based capital formulas. As of December 31, 2013, PFG’s insurance subsidiaries maintained statutory capital and reserves of $20.1 million. In any particular year, these requirements may increase or decrease depending on a variety of factors, most of which are outside PFG’s control, such as the amount of statutory income or losses generated, changes in equity market levels, the value of fixed-income and equity securities in PFG’s investment portfolio, changes in interest rates and foreign currency exchange rates, as well as changes to the risk-based capital formulas used by insurance regulators. Increases in the amount of additional statutory reserves that PFG is required to hold can adversely affect our financial condition and results of operations.

A downgrade in PFG’s claims paying ability or financial strength ratings could increase policy surrenders or withdrawals, adversely affecting relationships with distributors and reducing new policy sales.

Claims paying ability ratings, sometimes referred to as financial strength ratings, indicate a rating agency’s view of an insurance company’s ability to meet its obligations to its policy holders. These ratings are therefore key factors underlying the competitive position of life insurers. Some non-affiliated distributors of PFG’s life insurance products may choose not to do business with insurance companies that are rated below certain financial strength ratings. PFG currently has ratings of “A-” from A.M. Best Company, Inc. A ratings downgrade or the potential for such a downgrade in its rating could materially increase the number of policy surrenders or withdrawals by policyholders of cash values from their policies, adversely affect relationships with distributors of PFG’s annuity and life insurance products, reduce new annuity policy sales and adversely affect our ability to compete in the life insurance industry.

A change in law or regulation applicable to PFG’s annuity and insurance products could adversely affect our financial condition and results of operations.

PFG generates revenue from the sale and administration of variable annuity and variable life insurance products. These products enjoy favorable U.S. federal income tax benefits that are conferred by statute or regulation. Should such benefits be curtailed or eliminated by changes in statute or regulation, PFG’s continuing issuance of variable annuity and variable life insurance products could be adversely affected. Any retroactive application of changes could result in surrenders by holders of PFG’s existing variable annuity and variable life insurance products and reduce PFG’s revenues, which could adversely affect our financial condition and results of operations.

PFG may incur losses if its reinsurers are unwilling or unable to meet their obligations under reinsurance contracts.

PFG uses reinsurance to reduce the severity and incidence of claims costs, and to provide relief with regard to certain reserves. As of December 31, 2013, substantially all of the mortality risk on the insurance policies issued by PFG was reinsured by third parties. Under these reinsurance arrangements, other insurers assume a portion of PFG’s losses and related expenses; however, PFG remains liable as the direct insurer on all risks reinsured. Consequently, reinsurance arrangements do not eliminate PFG’s obligation to pay claims and PFG assumes credit risk with respect to its ability to recover amounts due from its reinsurers. The inability or unwillingness of any reinsurer to meet its financial obligations could negatively affect our financial condition and results of operations.

A reduction in fees paid to TAMCO could adversely affect our profitability.

TAMCO generates management, servicing and advisory fees based on the amount of assets managed and, in certain cases, on the returns generated by the assets managed. A reduction in fees paid to TAMCO, due to termination of management agreements, reduction in assets managed or lower than expected returns, could adversely affect our results of operations.

The nature of the assets owned by MFCA presents risks related to the special nature of such assets.

MFCA’s assets may also include certain tax-exempt lease obligations, which may be subject to annual appropriation by the municipality. Failure to appropriate would result in MFCA having to exercise remedies, including repossession of equipment or foreclosure on property, which could result in losses by MFCA, which may materially and adversely affect our results of operations and financial condition.

Prepayment rates on MFCA’s assets could negatively affect the value of MFCA’s assets.

12

The value of MFCA’s assets and derivative arrangements related to its assets, if any, may be adversely affected by prepayment rates of the underlying assets. Prepayment rates are influenced by changes in interest rates and a variety of economic, political, geographic and other factors beyond our control. Consequently, our results of operations may be adversely affected if the underlying obligors prepay the assets at higher-than-projected or estimated rates.

Liability relating to environmental matters may decrease the value of our real estate assets.

Under various federal, state and local laws, an owner or operator of real property may become liable for the costs of cleanup of certain hazardous substances released on or under its property. Such laws often impose liability without regard to whether the owner or operator knew of, or was responsible for, the release of such hazardous substances. The presence of hazardous substances may adversely affect an owner’s ability to sell real estate or borrow using real estate as collateral. To the extent that any of our owned real estate encounters environmental issues, it may adversely affect the value of that real estate. Further, in regard to any mortgage investment, if the owner of the underlying property becomes liable for cleanup costs, the ability of the owner to make debt payments may be reduced, which in turn may adversely affect the value of the relevant mortgage asset held by us. In addition, in certain instances, we may be liable for the cost of any required remediation or clean up.

Violation of fraud and abuse laws applicable to our real estate tenants, lessees and operators may jeopardize a tenant’s, lessee’s or operator’s ability to make payments to us.

The federal government and numerous state governments have passed laws and regulations that attempt to eliminate healthcare fraud and abuse by prohibiting business arrangements that induce patient referrals or inappropriately influence the ordering of specific ancillary services. In addition, numerous federal laws have continued to strengthen the federal fraud and abuse laws to provide for broader interpretations of prohibited conduct and stiffer penalties for violations. Violations of these laws may result in the imposition of criminal and civil penalties, including possible exclusion from federal and state healthcare programs. Imposition of any of these penalties upon any of our tenants, lessees or operators could jeopardize their ability to operate a facility or to make payments to us, thereby potentially adversely affecting us, or our financial condition and results of operations.

In the past several years, federal and state governments have significantly increased investigation and enforcement activity to detect and eliminate fraud and abuse in the Medicare and Medicaid programs. In addition, legislation and regulations have been adopted at state and federal levels, which severely restricts the ability of physicians to refer patients to entities in which they have a financial interest. It is anticipated that the trend toward increased investigation and enforcement activity in the area of fraud and abuse, as well as self-referrals, will continue in future years and could adversely affect our prospective tenants, lessees or operators and their operations, and in turn their ability to make payments to us.

Our real estate operating entities expose us to various operational risks, liabilities and claims that could adversely affect our ability to generate revenues or increase our costs and could adversely affect our financial condition and results of operations.

Our ownership of real estate operating entities exposes us to various operational risks, liabilities and claims that could increase our costs or adversely affect our ability to generate revenues, thereby reducing our profitability. These operational risks include fluctuations in occupancy levels, the inability to achieve economic resident fees (including anticipated increases in those fees), rent control regulations, increases in the cost of food, materials, energy, labor (as a result of unionization or otherwise) or other services, national and regional economic conditions, the imposition of new or increased taxes, capital expenditure requirements, professional and general liability claims, and the availability and cost of professional and general liability insurance. Any one or a combination of these factors could result in operating deficiencies in our operating assets, which could adversely affect our financial condition and results of operations.

Our use of joint ventures may limit our flexibility with respect to such jointly owned investments and could, thereby, have a material adverse affect on our business, results of operations and financial condition and our ability to sell these joint venture interests.

We have invested in joint ventures with other persons or entities when circumstances warrant the use of these structures and may invest in additional joint ventures. Our participation in joint ventures is subject to the risks that:

• | we could experience an impasse on certain decisions because we do not have sole decision-making authority, which could require us to expend additional resources on resolving such impasses or potential disputes; |

• | our joint venture partners could have investment goals that are not consistent with our investment objectives, including the timing, terms and strategies for any investments; |

13

• | our joint venture partners might become bankrupt, fail to fund their share of required capital contributions or fail to fulfill their obligations as joint venture partners, which may require us to infuse our own capital into such venture(s) on behalf of the joint venture partner(s) despite other competing uses for such capital; |

• | our joint venture partners may have competing interests in our markets that could create conflict of interest issues; |

• | any sale or other disposition of our interest in a joint venture may require lender consents which we may not be able to obtain; |

• | such transactions may also trigger other contractual rights held by a joint venture partner, lender or other third party depending on how the transaction is structured; and |

• | there may be disagreements as to whether consents and/or approvals are required in connection with the consummation of a particular transaction with a joint venture partner, lender and/or other third party, or whether such transaction triggers other contractual rights held by a joint venture partner, lender and/or other third party, and in either case, those disagreements may result in litigation. |

We incur increased costs as a result of operating as a public company, and our management will be required to devote substantial time to new compliance initiatives.

As a public company, we incur additional legal, accounting and other costs that we did not incur prior to the Contribution Transactions. Although we are currently unable to estimate these costs with any degree of certainty, they may be material in amount. In addition, the Sarbanes-Oxley Act of 2002, or the “Sarbanes-Oxley Act,” the Dodd-Frank Wall Street Reform and Consumer Protection Act and the rules of the SEC, and Nasdaq, have imposed various requirements on public companies. Our management and other personnel will need to devote a substantial amount of time to these compliance initiatives as well as investor relations. Moreover, these rules and regulations will increase our legal and financial compliance costs and will make some activities more time-consuming and costly.

Furthermore, if we are not able to comply with the requirements of Section 404 of the Sarbanes-Oxley Act in a timely manner, the market price of our common stock could decline and we could be subject to potential delisting by Nasdaq and review by such exchange, the SEC, or other regulatory authorities, which would require the expenditure by us of additional financial and management resources. As a result, our stockholders could lose confidence in our financial reporting, which would harm our business and the market price of our common stock.

Some of our officers and directors currently or may in the future act as members, managers, officers, directors or employees of entities with conflicting business strategies.

Some of our officers and directors currently or may in the future act as members, managers, officers, directors or employees of entities with business strategies that may conflict with our business strategies. Michael Barnes, our Executive Chairman, is a founding partner and Co-Chief Investment Officer of Tricadia Holdings, L.P., an asset management holding company which we refer to as “Tricadia”, and Executive Chairman and a member of the board of directors of TFP. Tricadia’s subsidiaries include, and Mr. Barnes is co-chief investment officer of, companies that manage hedge funds and structured vehicles with business strategies that may compete with ours. Furthermore, Geoffrey Kauffman, our President, Chief Executive Officer and Vice Chairman, is the Chief Executive Officer of TFP and is a limited partner of Tricadia. Julia Wyatt, our Chief Financial Officer is the Chief Financial Officer of Tricadia and TFP and is also a limited partner of Tricadia. Such positions may give rise to actual or potential conflicts of interest, which may not be resolved in a manner that is in the best interests of the Company or the best interests of its stockholders.

Our duties as managing member of Operating Company may come into conflict with the duties that our directors and officers have to the Company and its stockholders.

We and TFP are the sole members of Operating Company, and we are the managing member of Operating Company. Our directors and officers have duties to us and our stockholders under applicable Maryland law in connection with our management. At the same time, we, as managing member of Operating Company, have fiduciary duties and obligations to Operating Company and its members (including TFP) under Delaware law and the Amended and Restated Limited Liability Company Agreement of Operating Company. Our duties as managing member of Operating Company may come into conflict with the duties that our directors and officers have to us and our stockholders. These conflicts may be resolved in a manner that is not in the best interests of the Company or the best interests of its stockholders.

We operate in highly competitive markets for business opportunities and personnel, which could impede our growth and negatively impact our results of operations.

14

We operate in highly competitive markets for business opportunities in each of our operating segments. Many of our competitors have financial, personnel and other resources that are greater than ours and may be better able to react to market conditions. These factors may place us at a competitive disadvantage in successfully competing for future business opportunities and personnel, which could impede our growth and negatively impact our business, financial condition and results of operations.

Maintenance of our 1940 Act exemption will impose limits on our operations.

We intend to continue to conduct our operations so that we are not required to register as an investment company under the 1940 Act. Therefore, we must limit the types and nature of businesses in which we may engage and assets that we may acquire.

Section 3(a)(1)(C) of the 1940 Act defines an investment company as any issuer that is engaged or proposes to engage in the business of investing, reinvesting, owning, holding or trading in securities, and owns or proposes to acquire “investment securities” having a value exceeding 40% of the value of the issuer’s total assets (exclusive of U.S. government securities and cash items) on an unconsolidated basis. Assets that would generally be excluded from the term “investment securities,” include securities issued by majority-owned subsidiaries that are not themselves investment companies and are not relying on certain exceptions from the definition of investment company set forth in the 1940 Act. Assets that generally would constitute “investment securities” include loans, debt securities, preference shares and subordinated notes issued by CLOs.

We monitor our compliance with the 1940 Act on an ongoing basis and may be compelled to take or refrain from taking actions, to acquire additional income or loss generating assets or to forego opportunities that might otherwise be beneficial or advisable, including, but not limited to selling assets that are considered to be investment securities or forgoing the sale of assets that are not investment securities, in order to ensure that we (or a subsidiary) may continue to rely on the applicable exceptions or exemptions. These limitations on our freedom of action could have a material adverse effect on our financial condition and results of operations.

If we fail to maintain an exemption, exception or other exclusion from registration as an investment company, we could, among other things, be required to substantially change the manner in which we conduct our operations either to avoid being required to register as an investment company or to register as an investment company. If we were required to register as an investment company under the 1940 Act, we would become subject to substantial regulation with respect to, among other things, our capital structure (including our ability to use leverage), management, operations, transactions with affiliated persons (as defined in the 1940 Act), portfolio composition, including restrictions with respect to diversification and industry concentration, and our financial condition and results of operations may be adversely affected. If we did not register despite being required to do so, criminal and civil actions could be brought against us, our contracts would be unenforceable unless a court was to require enforcement, and a court could appoint a receiver to take control of us and liquidate our business

Termination of the Transition Services Agreement or the Administrative Services Agreement could materially increase our costs, which could adversely affect our financial condition and results of operations.

Pursuant to the Transition Services Agreement, we pay fees to Tricadia for the services of Michael G. Barnes, our Executive Chairman, Julia Wyatt, our Chief Financial Officer, and for certain back office, administrative, information technology, insurance, legal and accounting services. A portion of the services that Tricadia provides to us are in turn provided to Tricadia by Mariner pursuant to a services agreement that may be terminated by Tricadia or Mariner without our consent. In addition, pursuant to an Administrative Services Agreement, a subsidiary of Mariner provides certain back office services to us directly for a fee. If the Transition Services Agreement is terminated, Tricadia’s services agreement with Mariner is terminated or the Administrative Services Agreement is terminated, we would be required to make alternative arrangements for the performance of these services. We may not be able to obtain these services promptly or at reasonable rates or at all, and our costs of obtaining such services could materially increase, which could adversely affect our results of operations.

Some provisions of our charter may delay, deter or prevent takeovers and business combinations that stockholders consider in their best interests.

Our charter restricts any person that owns 9.8% or more of our capital stock, other than TFP and its affiliates or another stockholder approved by applicable state insurance regulators, from voting in excess of 9.8% of our voting securities. This provision is intended to satisfy the requirements of applicable state regulators in connection with insurance laws and regulations that prohibit any person from acquiring control of a regulated insurance company without the prior approval of the insurance regulators. In addition, our charter provides for the classification of our board of directors into three classes, one of which is to be elected each year. These provisions may delay, deter or prevent takeovers and business combinations that stockholders consider in their best interests.

15

Maryland takeover statutes may prevent a change of our control, which could depress our stock price.

Maryland law provides that “control shares” of a corporation acquired in a “control share acquisition” will have no voting rights except to the extent approved by a vote of two-thirds of the votes entitled to be cast on the matter under the Maryland Control Share Acquisition Act. “Control shares” means voting shares of stock that, if aggregated with all other shares of stock owned by the acquiror or in respect of which the acquiror is able to exercise or direct the exercise of voting power (except solely by virtue of a revocable proxy), would entitle the acquiror to exercise voting power in electing directors within one of the following ranges of voting power: one-tenth or more but less than one-third; one-third or more but less than a majority; or a majority or more of all voting power. A “control share acquisition” means the acquisition of issued and outstanding control shares, subject to certain exceptions.

Under Maryland law, “business combinations” between a Maryland corporation and an interested stockholder or an affiliate of an interested stockholder are prohibited for five years after the most recent date on which such stockholder became an interested stockholder. These business combinations include a merger, consolidation, share exchange or, in circumstances specified in the statute, an asset transfer or issuance or reclassification of equity securities.

Our bylaws contain a provision exempting from the control share statute any and all acquisitions by any person of our shares of stock. Our board of directors has also adopted a resolution which provides that any business combination between us and any other person is exempted from the provisions of the business combination statute, provided that the business combination is first approved by the board of directors. However, our board of directors may amend or eliminate this provision in our bylaws regarding the control share statute or amend or repeal this resolution regarding the business combination statute. If our board takes such action in the future, the control share and business combination statutes may prevent or discourage others from trying to acquire control of us and increase the difficulty of consummating any offer, including potential acquisitions that might involve a premium price for our common stock or otherwise be in the best interest of our stockholders.

Under our charter, as long as TFP owns more than 50% of our then-outstanding voting stock, it will be able to take action by written consent, without prior notice to and without a vote of other stockholders.

Until the date on which TFP, its affiliates and any person who is an express assignee or designee of TFP cease to own, in the aggregate, more than 50% of our then-outstanding voting stock, TFP may take any action required or permitted to be taken at any annual or special meeting of stockholders by written consent, without prior notice, and without a vote, if a consent or consents in writing setting forth the action so taken are signed by holders of the minimum number of votes necessary to authorize or take such action at a meeting at which all outstanding shares of common stock entitled to vote on the action were present and voted. As of the December 31, 2013, TFP and its affiliates owned common stock representing approximately 79.6% of the combined voting power of our stock.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

Administrative Offices

Our principal executive offices are located at 780 Third Avenue, 21st Floor, New York, New York 10017. The table below outlines the Company’s leased properties as of December 31, 2013, all of which are used as administrative offices. All facilities are considered adequate and suitable for the Company’s current level of operations. We do not own any properties for administrative purposes.

16

Leased Properties | ||

Location | Square Footage | Purpose or Segment Used In |

New York, NY | 3,064 | Corporate Offices |