Table of Contents

As filed with the Securities and Exchange Commission on May 12, 2015.

Registration No. 333-203505

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

INVUITY, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 3841 | 04-3803169 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

444 De Haro Street

San Francisco, CA 94107

(415) 655-2100

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Philip Sawyer

President and Chief Executive Officer

Invuity, Inc.

444 De Haro Street

San Francisco, CA 94107

(415) 655-2100

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Steven E. Bochner Allison B. Spinner Wilson Sonsini Goodrich & Rosati, P.C. 650 Page Mill Road Palo Alto, California 94304 (650) 493-9300 |

Brett Robertson Vice President of Corporate Development and General Counsel Invuity, Inc. 444 De Haro Street San Francisco, California 94107 (415) 655-2100 |

B. Shayne Kennedy Drew Capurro Latham & Watkins LLP 650 Town Center Drive, 20th Floor Costa Mesa, California 92626 (714) 540-1235 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ |

Accelerated filer ¨ | |

|

Non-accelerated filer x (Do not check if a smaller reporting company) |

Smaller reporting company ¨ |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted. Subject to Completion, dated May 12, 2015 [logo] Invuity registered mark [blank] Shares INVUITY, INC. Common Stock $[blank] per share Invuity, Inc. is offering [blank] shares. We anticipate that the initial public offering price will be between $[blank] and $[blank] per share. This is our initial public offering and no public marker currently exists for our shares. We intend to apply to be listed on the NASDAQ Global Market under the trading symbol: “IVTY.” This investment involves risks. See “Risk Factors” beginning on page 12. We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, and as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings. Per Share Total Initial public offering price $ $ Underwriting discounts and commissions(1) $ $ Proceeds to Invuity, Inc., before expenses $ $ (1) See “Underwriting” for additional information regarding underwriting compensation. We have granted to the underwriters an option to purchase up to [blank] additional shares of common stock from us at the initial public offering price, less the underwriting discounts and commissions, for 30 days after the date of this prospectus. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense. The underwriters expect to deliver the shares of common stock to investors on or about [blank], 2015. Piper Jaffray Leerink Partners Stifel William Blair The date of this prospectus is [blank], 2015.

Table of Contents

INVUITY intelligent photonics. ™ Surgery. Redefined.

Table of Contents

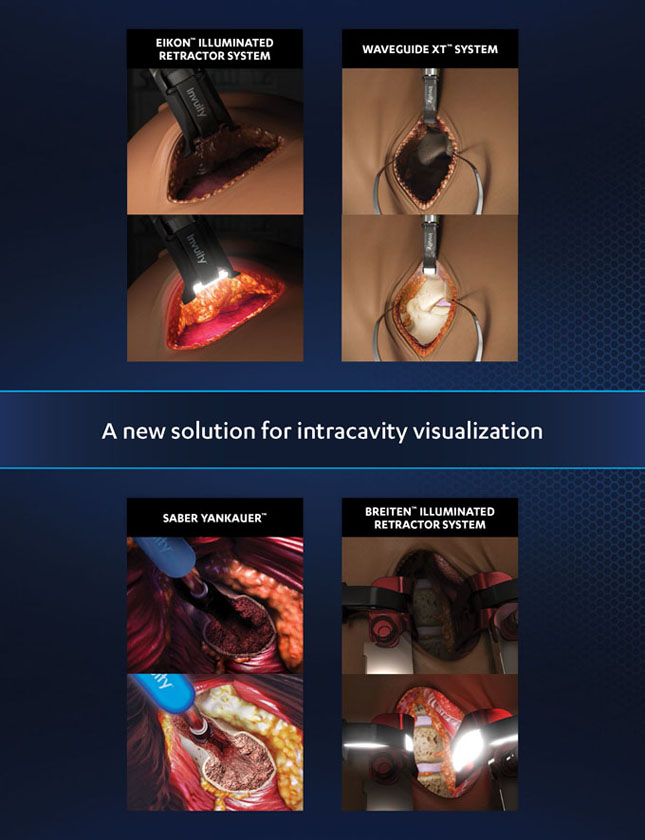

Eikon™ Illuminated Retractor System Waveguide XT™ System Saber Yankauer™ Breiten™ Illuminated Retractor System A new solution for intracavity visualization.

Table of Contents

CERVICAL Breiten™ Saber Frazier™ Eika™ Waveguide XT™ BREAST RECONSTRUCTION Eikon™Saber Yankauer™LUMBARSaber Frazier™ Saber Yankauer™ Eikon™ Waveguide XT™TRAUMA/TUMORSaber Yankauer™ Saber Frazier™ Eivector™ Eipex™ Eikon™THYROIDEika™ Eikon™SHOULDERSaber Yankauer™ Eivector™ Eipex™BREASTEikon™ Saber Yankauer™ Eika™HIPSaber Yankauer™ Eivector™ Eipex™ Other SpecialtiesNeurosurgery; Gynecology; Urology; Ear, Nose and Throat; Craniomaxillofacial; CardiothoracicA portfolio of devices to address a broad spectrum of surgical procedures.Eipex™Saber Eikon™ Eivector™ Frazier™Waveguide Saber Eika™ Breiten™ XT™ System Yankauer™Drop-In Handheld Retractor

Table of Contents

| Page | ||||

| 1 | ||||

| 13 | ||||

| 43 | ||||

| 45 | ||||

| 46 | ||||

| 47 | ||||

| 48 | ||||

| 50 | ||||

| 53 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

55 | |||

| 70 | ||||

| 97 | ||||

| 106 | ||||

| 117 | ||||

| 123 | ||||

| 126 | ||||

| 131 | ||||

| Material U.S. Federal Income Tax Consequences to Non-U.S. Holders |

133 | |||

| 137 | ||||

| 146 | ||||

| 146 | ||||

| 146 | ||||

| F-1 | ||||

Until , 2015, all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

You should rely only on the information contained in this prospectus or any related free writing prospectus we may authorize to be delivered to you. We have not, and the underwriters have not, authorized any other person to provide you with different information. We and the underwriters take no responsibility for, and can provide no assurances as to the reliability of, any information that others may give you. This prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any state where the offer or sale is not permitted. The information in this prospectus is only accurate as of the date of this prospectus, regardless of the time or delivery of this prospectus and any sale of our common stock.

Trademarks

Invuity, Inc. and our logo, as well as Intelligent Photonics, are our trademarks and are used in this prospectus. This prospectus also includes trademarks, tradenames and service marks that are the property of other organizations. Solely for convenience, our trademarks and tradenames referred to in this prospectus appear without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights, or the right of the applicable licensor to these trademarks and tradenames. Additionally, we do not intend for our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, these other companies.

Investors Outside of the United States

Neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about, and to observe any restrictions relating to, this offering and the distribution of this prospectus outside of the United States.

i

Table of Contents

This prospectus summary highlights information contained elsewhere in this prospectus. This prospectus summary is not complete and does not contain all of the information that you should consider before making a decision to invest in our common stock. You should carefully read this entire prospectus, including the information provided under the headings “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and the related notes, before investing in our common stock. Unless otherwise stated in this prospectus, references to “Invuity,” “we,” “us,” “our” or “the Company” refer to Invuity, Inc.

Invuity

We are a commercial-stage medical technology company pioneering the use of advanced photonics to provide surgeons with improved direct visualization of surgical cavities during minimally invasive and minimal access surgical procedures. We integrate our Intelligent Photonics technology platform into our single-use and reusable advanced surgical devices to address some of the critical intracavity illumination and visualization challenges facing surgeons today. We utilize our proprietary Intelligent Photonics technology to develop optical waveguides that direct and shape thermally cool, brilliant light into broad, uniform and volumetric illumination of the surgical target. We believe that improving a surgeon’s ability to see critical anatomical structures can lead to better clinical and aesthetic outcomes, improved patient safety and reduced surgical time and healthcare costs. We sold our devices to approximately 400 hospitals in the first quarter of 2015, as compared to approximately 200 hospitals in the same quarter of 2014. Based on the number of single-use units we have shipped as of March 31, 2015, we estimate that our devices have been used in over 92,000 surgical procedures. We are also using our Intelligent Photonics technology to develop new devices and modalities to broaden the application and adoption of open minimally invasive and minimal access procedures and enable new advanced surgical techniques.

Photonics is the science and technological applications of light. We have applied advanced principles of photonics to develop our Intelligent Photonics technology platform, which enables the transmission, management and manipulation of light in surgical procedures. Our initial application of this technology is integrated into our family of proprietary optical waveguides. Our waveguides are sophisticated devices that rely on the principles of optics to shape and direct light. They are coupled to a modified fiber optic cable and are designed to work with the standard xenon or LED light sources typically found and utilized in the operating room. Our optical waveguides are incorporated into surgical devices, including our customized line of illuminated surgical retractors, handheld illuminated aspiration devices and drop-in intracavity illuminators. Our handheld illuminated aspiration devices and drop-in intracavity illuminators are single-use products. Our retractors are reusable, but utilize a single-use optical waveguide, which we sell separately because a new waveguide must be used for each procedure.

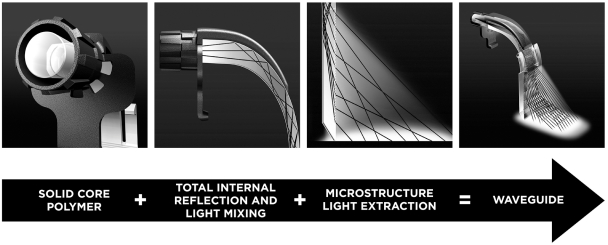

The fundamental attributes of our optical waveguides include a solid core optical-grade polymer, total internal reflection of light waves, light mixing and extraction by a complex geometry of refractive microstructures or microlenses. The solid core optical-grade polymer waveguide is coupled to a fiber optic cable in order to facilitate the efficient transfer of light. This unique coupling results in our waveguides capturing maximum light with minimal heat build-up. Our waveguides use critical angles and the properties of total internal reflection to retain and transmit maximum light as it travels through the device. In addition, each waveguide utilizes various novel optical methods to mix light during the total internal reflection transmission process to enable more uniform light extraction across its output surface. The output surface consists of a complex geometry of refractive microstructures or microlenses that extract, direct and shape volumetric illumination into the surgical cavity while virtually eliminating shadows and glare. This complex geometric structure extracts and directs light at numerous different angles to enable illumination of the surgical target, even if blood or debris accumulates on the surface of

1

Table of Contents

the waveguide. The uniform distribution of light extraction from the microstructures or microlenses throughout the entire output surface of the waveguide, as well as the proprietary solid core optical-grade polymer and patented design of our waveguides, results in thermally cool illumination.

In the last several years, we have transitioned from a focus on research and development to the commercialization of our device portfolio. As of March 31, 2015, we market eight families of illuminated surgical devices, consisting of over 40 devices. We market and sell our devices in the United States primarily through a direct salesforce, which has grown from 16 sales representatives as of December 31, 2012, to 43 as of March 31, 2015. We have plans to increase sales by further expanding this commercial organization. We believe this expansion will allow us to further penetrate and grow our market by demonstrating the benefits of our devices to additional surgeons and hospitals. Our revenue increased from $7.2 million in 2013 to $13.1 million in 2014. We had a net loss of $12.1 million and $20.7 million in the years ended December 31, 2013 and 2014, respectively. Our revenue increased from $2.2 million during the three months ended March 31, 2014 to $4.4 million during the three months ended March 31, 2015. In 2014 and the three months ended March 31, 2015, approximately 80% and 74% of our revenue, respectively, was generated from the sale of single-use devices. We had a net loss of $4.7 million and $9.0 million during the three months ended March 31, 2014 and 2015, respectively. As of March 31, 2015, we had an accumulated deficit of $77.1 million.

Our Market Opportunity

Advances in medical technology have resulted in growing adoption of minimally invasive and minimal access surgical procedures. The increased utilization of these procedures by surgeons is primarily driven by their significant benefits compared to conventional open surgery, including:

| • | smaller incisions resulting in less scarring and fewer complications; |

| • | less trauma to the organs, muscles, nerves, and tissue; |

| • | less bleeding and reduced need for blood transfusions; |

| • | fewer surgical infections; |

| • | shortened hospital stays, potentially reducing hospital costs; |

| • | less postoperative pain and reduced need for associated narcotics; |

| • | faster recovery time; and |

| • | improved aesthetic outcomes. |

Minimally invasive surgery refers to surgery performed through one or more small incisions as compared to conventional open surgery procedures. Some minimally invasive procedures, such as endoscopic, laparoscopic and arthroscopic procedures, use small tubes, tiny cameras and surgical instruments to access, visualize and perform the surgery. Though these procedures have several of the benefits described above, surgeons are only able to view the surgical target through a tiny camera, which can cause reduced depth perception and field of vision, diminished hand-eye coordination, limited mobility of the surgical instruments, and reduced tactile feedback. These limitations can increase the cognitive and physical load on the surgeon and, consequently, increase the possibility of surgical error. Other procedures also use smaller incisions than conventional open surgery but still enable the surgeon direct visualization of the surgical target and the ability to use traditional surgical instruments. We refer to these procedures as open minimally invasive and minimal access procedures. We believe that open minimally invasive and minimal access procedures provide many of the benefits described above. However, the small incisions used in these procedures inherently reduce a surgeon’s ability to directly see the surgical target, particularly deep within the surgical cavity, which can impact surgical precision, procedural efficiency and patient safety.

2

Table of Contents

We estimate that approximately 40% of all surgical procedures in the United States are open minimally invasive and minimal access. Based on the benefits of these procedures over conventional open surgery, we believe this percentage will continue to grow. We have initially targeted our sales and marketing efforts to surgeons in the following specialties: orthopedics, spine, breast oncology, plastics, and thyroid. However, our current illuminated surgical devices have a broader indication for use and can be marketed to other specialties with limited or no additional regulatory clearance. We intend to target other surgical specialties including trauma; cardiothoracic; ear, nose and throat; gynecology; urology; general surgery; neurosurgery and craniomaxilliofacial procedures. We currently estimate the annual total addressable market for our devices in these surgical specialties in the United States to be approximately $2.0 billion, based on the estimate of our average revenue per procedure.

Traditional Illumination Devices and Their Limitations

Lighting is a critical element of every open surgical procedure. Traditional surgical lighting options in the operating room include overhead lighting systems, surgical headlights and on-field fiber optic lighting systems. We are aware of various publications identifying limitations of these devices, including limitations that present particular challenges when the surgical field is accessed through the small incisions used in open minimally invasive and minimal access procedures.

Overhead Lighting Systems

The most common illumination method in the operating room setting today is overhead lighting systems. Overhead lighting systems consist of lighting fixtures that are positioned above the surgical field. Overhead lighting systems are frequently inadequate for surgery in deeper cavities due to the creation of significant shadows within the surgical field and the inability of the light to reach the depths of the incision.

Surgical Headlights

Surgical headlights were developed to address some of the shortcomings of overhead lighting systems. The headlight system consists of a headband worn by the surgeon and, most commonly, coupled with a fiber optic light system that is plugged into a xenon or LED light source. Headlights can be heavy and uncomfortable to use and may be associated with head, neck and shoulder fatigue from the prolonged improper posture required during their use, frequent headaches, neck pain and injury to the cervical spine. Furthermore, because the source of light is still above the surgical cavity, we believe the use of headlights also leads to shadows and glare, caused by hands, instruments and anatomy, which may limit visualization in deep surgical cavities.

On-field Fiber Optic Lighting Systems

Due to the limitations of overhead lighting systems and surgical headlights, on-field fiber optic lighting systems have been developed in an effort to provide intracavity lighting of the surgical field. On-field fiber optic lighting systems consist of a fiber optic cable attached to a fiber optic retractor. However, traditional on-field fiber optic systems have inherent limitations and risks. With traditional fiber optic retractors, light is directed in a straight line in the shape of a cone from the end of the fiber optic. To avoid the light being absorbed by the retractor, the fiber is typically located as close as possible to the distal end. Placing the fiber on the distal end of the retractor puts it in close proximity to the patient’s tissue, which can create a very bright, narrow spot of light that can create hot spots on the patient’s tissue and create glare in the surgeon’s line of vision. In addition, traditional on-field fiber optic lighting systems represent a thermal hazard in the operating room creating the risk of burns to patients, surgeons and hospital staff and operating room fires.

3

Table of Contents

Market Need for Advanced Intracavity Illumination and Visualization Devices

Given the limitations of traditional surgical lighting options in the operating room, we believe there is a significant opportunity to enhance intracavity illumination and visualization during open minimally invasive and minimal access procedures. In addition, we believe that an advanced illumination and visualization technology could broaden the application and adoption of less invasive surgical techniques.

Our Solution

We utilize our Intelligent Photonics technology platform to develop surgical devices designed to overcome the significant limitations of traditional surgical lighting options in the operating room. Based on surgeon feedback, surgeon observation and bench testing, we believe our technology may provide the following benefits:

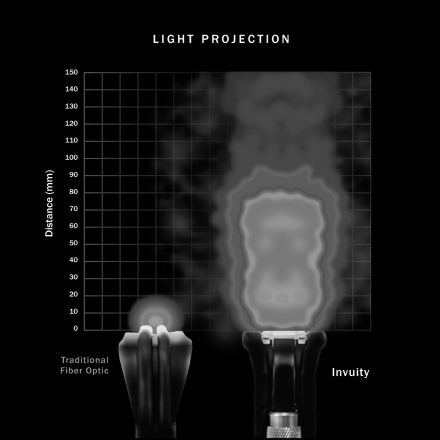

| • | Enhanced illumination and visualization of the surgical field. Our devices are designed to provide enhanced intracavity illumination and visualization of the surgical field during open minimally invasive and minimal access surgeries. The proprietary complex geometry of refractive microstructures or microlenses along the surface of our optical waveguides allow for the extraction of light in a manner that distributes light at different angles in a broad, uniform and volumetric pattern that is intended to reduce shadows, glare and excessive heat that are commonly associated with traditional surgical lighting options. In bench testing comparing light distribution and thermal profile of our Eikon retractor to a traditional fiber optic retractor, we found our Eikon retractor system had approximately five times the illumination area with a thermal profile below the risk of burn. |

| • | Improved surgical precision during open minimally invasive and minimal access procedures. Our technology is designed to improve intracavity visualization to allow surgeons to identify, differentiate and avoid vital anatomical structures. We believe this enables surgeons to dissect with great precision, while also allowing them to differentiate tissue planes, identify and avoid nerves and blood vessels, and quickly locate and control bleeding vessels to achieve rapid hemostasis. With this precise visualization, we believe surgeons may be able to use smaller, and in some cases fewer, incisions. |

| • | Reduced risks to patients and surgeons. Our technology is developed with design elements to help create thermally cool illumination as well as ergonomics to improve ease of use while performing a procedure. By improving visualization, our devices may also decrease the risk of unintended retained foreign objects by improving the surgeon’s ability to see and dispose of such objects that might have otherwise been left in the surgical cavity inadvertently. Additionally, by being directly incorporated into a variety of illuminated surgical retractors, handheld illuminated aspiration devices, and drop-in intracavity illuminators, we believe our technology may help to decrease surgeon fatigue by reducing or eliminating the need for surgical headlights, thereby helping to reduce some of the associated head, neck and shoulder fatigue, frequent headaches, neck pain and injury to the cervical spine. |

| • | Enhanced operating room efficiency. We believe our technology improves operating room workflow by reducing the need for perioperative repositioning of traditional surgical lighting options. Many open minimally invasive and minimal access procedures are time sensitive and the treatment area requires constant attention of the surgeon and operating team. Because our optical waveguides are directly connected to the surgical instrument that is used to access the deep surgical cavity, we believe surgeons are able to clearly illuminate the surgical target and effectively focus on performing the procedure. |

| • | Economic value proposition to healthcare systems. We believe our devices have the potential to substantially reduce procedure costs as well as create incremental revenue |

4

Table of Contents

| opportunities. We believe the improved efficiency of the operating room workflow and the related reduced procedure and anesthesia time can translate to meaningful cost savings for the hospital. In addition, we believe the reduction in procedure times may also create additional capacity in the operating room for surgeons to perform more procedures, which we believe can create incremental revenue for the hospital. A retrospective analysis conducted by a healthcare consulting firm in 2015 demonstrated a 31-minute reduction in anesthesia time, on average, in nipple-sparing mastectomy procedures using our devices. |

Our Strategy

Our goal is to be the global leader in providing advanced photonics systems to surgeons across a broad array of surgical specialties. The key elements of our strategy include:

| • | Establish our Intelligent Photonics technology as the standard illumination technology used in open minimally invasive and minimal access procedures. We intend to continue to educate and train surgeons on the advantages of our Intelligent Photonics technology compared to traditional operating room lighting options. We believe the benefits of our Intelligent Photonics technology should also enable the broader application and adoption of open minimally invasive and minimal access procedures and help enable new advanced surgical techniques. |

| • | Expand our sales organization to support growth. We plan to continue to expand our direct sales organization in the United States to help facilitate further adoption among existing hospital accounts as well as broaden awareness of our Intelligent Photonics technology to new hospitals. As of March 31, 2015, we had 43 direct sales representatives. |

| • | Continue to deliver innovative technologies and broaden our device portfolio. We intend to continue to leverage our Intelligent Photonics technology platform to research, design and develop new devices that extend the benefits of open minimally invasive and minimal access techniques to a broader patient population. We believe our ability to introduce new devices to surgeons will allow us to continue to expand our annual total addressable market opportunity over time. |

| • | Focus on key opinion leader surgeons to facilitate adoption. We are working in collaboration with key opinion leader surgeons in various surgical specialties to explore new product development and clinical applications for our technology and generate surgeon awareness of the clinical and economic value of our technology. |

| • | Introduce our Intelligent Photonics technology in markets outside the United States. While our current commercial plan is to focus our direct sales efforts on continued penetration of the U.S. market, we plan to continue to monitor opportunities to develop a presence internationally. |

Our Products

Our Intelligent Photonics technology has allowed us to design multiple variations of our waveguides in order to target different illumination patterns for different shapes of surgical cavities. Because we can mold our solid core optical-grade polymer into different shapes, we are able to design waveguides that either direct the light narrowly for deep cavities or broadly for larger cavities. Our waveguides also come in narrow or wide configurations to accommodate various retractor blade widths that are designed for various surgical procedures. Our versatile design and manufacturing capabilities allow us to develop waveguides with a variety of extraction patterns. For example, our current retractor-based waveguides utilize a complex geometry of refractive microstructures, whereas our handheld illuminated aspiration devices have integrated microlens arrays.

5

Table of Contents

We currently market eight families of illuminated surgical devices, consisting of over 40 devices. Our Intelligent Photonics technology is integrated into each of these device families. Our device portfolio includes reusable illuminated surgical retractors that include a single-use waveguide, single-use handheld illuminated aspiration devices and single-use drop-in intracavity illuminators. Our optical waveguides are integrated into these customized devices to deliver improved visualization of the surgical cavity without generating excessive heat.

Risks Related to Our Business

Our ability to successfully operate our business is subject to numerous risks, including, without limitation, those that are generally associated with operating in the medical device industry. Some of the principal risks relating to our business and our ability to execute our business strategy include:

| • | We have a history of significant operating losses and expect to incur losses in the future. If we do not achieve and sustain profitability, our financial condition and stock price could suffer. |

| • | All of our revenue is generated from devices incorporating our Intelligent Photonics technology, and any decline in the sales of these devices or failure to gain market acceptance of these devices will negatively impact our business. |

| • | If we are unable to convince hospital facilities to approve the use of our devices, our sales may decrease. |

| • | We must demonstrate to surgeons and hospitals the merits of our devices compared to those of our competitors. |

| • | We have limited experience marketing and selling our devices, and if we fail to develop and retain our direct sales force and independent sales agents, our business could suffer. |

| • | We operate in a highly competitive market segment. If our competitors are better able to market and develop devices than we are able to market or develop devices, our business will be adversely impacted. |

| • | Our ability to sell our devices at prices necessary to support our current business strategies depends on demonstrating that the benefits of devices incorporating our Intelligent Photonics technology outweigh the increased cost of such devices compared to other surgical illumination methods. |

| • | It is difficult to forecast future performance and our financial results may vary from forecasts and may fluctuate from quarter to quarter. |

| • | If our intellectual property rights are not adequately protected, our business will be negatively affected. |

| • | We have identified a material weakness in our internal control over financial reporting. If our remediation of this material weakness is not effective, or if we experience additional material weaknesses in the future or otherwise fail to maintain an effective system of internal control over financial reporting in the future, we may not be able to accurately or timely report our financial condition or results of operations, which may adversely affect investor confidence in us and, as a result, the value of our common stock. |

| • | If we fail to obtain and maintain necessary regulatory clearances or approvals for our devices, or if clearances or approvals for future devices and indications are delayed or not issued, our commercial operations would be harmed. |

6

Table of Contents

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. As an emerging growth company:

| • | We are permitted to present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations in this prospectus. |

| • | We are exempt from the requirement to obtain an attestation report from our independent registered public accounting firm on our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002. |

| • | We are permitted to provide less extensive disclosure about our executive compensation arrangements in our periodic reports, proxy statements and registration statements. |

| • | We are not required to give our stockholders non-binding advisory votes on executive compensation or golden parachute arrangements. |

We may take advantage of these provisions until the last day of the fiscal year following the fifth anniversary of the completion of this offering. However, if certain events occur prior to the end of such five-year period, including (i) if we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, (ii) our annual gross revenue equals or exceeds $1.0 billion or (iii) we issue more than $1.0 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company prior to the end of such five-year period.

We may choose to take advantage of some or all of these reduced burdens. We have taken advantage of reduced reporting requirements in this prospectus. Accordingly, the information contained herein may be different from the information you receive from our competitors that are public companies, or other public companies in which you have made an investment.

In addition, the JOBS Act provides that an emerging growth company may take advantage of an extended transition period for complying with new or revised accounting standards. We have irrevocably elected not to avail ourselves of this exemption and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

Corporate Information

We were incorporated in California in 2004 as Spotlight Surgical, Inc. We changed our name to Invuity, Inc. in 2007. We plan to reincorporate in Delaware prior to the completion of this offering. Our principal executive offices are located at 444 De Haro Street, San Francisco, California, 94107, and our telephone number is (415) 655-2100. Our website is www.invuity.com. Information contained on, or that can be accessed through, our website is not incorporated by reference into this prospectus, and you should not consider information on our website to be part of this prospectus.

7

Table of Contents

THE OFFERING

| Issuer |

Invuity, Inc. | |

| Shares of common stock offered by us |

shares. | |

| Shares of common stock to be outstanding immediately after this offering |

shares (or shares, if the underwriters exercise in full their option to purchase additional shares). | |

| Option to purchase additional shares |

We have granted the underwriters an option to purchase up to additional shares of common stock from us. The underwriters can exercise this option at any time within 30 days from the date of this prospectus. | |

| Use of proceeds |

We intend to use the net proceeds received from this offering primarily to expand sales and marketing activities and research and development efforts, and for working capital and general corporate purposes. We may also use a portion of the net proceeds from this offering to acquire or invest in complementary products, technologies or businesses, although we have no present commitments to complete any such transaction. See “Use of Proceeds” on page 45 of this prospectus for a more complete description of the intended use of proceeds from this offering. | |

| Risk factors |

Investing in our common stock involves risks. See the section entitled “Risk Factors” beginning on page 13 of this prospectus and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. | |

| Directed share program |

At our request, the underwriters have reserved for sale at the initial public offering price up to shares of common stock, or approximately % of the shares offered by this prospectus, for our employees, directors and other persons associated with us. Any directed shares purchased by our officers and directors will be subject to the 180-day lock-up restriction described in the “Underwriting” section of this prospectus. Any other participants in the directed share program will not be subject to any lock-up arrangements with any underwriter with respect to the directed shares sold to them. The number of shares of common stock available for sale to the general public in the offering will be reduced by the number of shares sold pursuant to the directed share program. Any directed shares not so purchased will be offered by the underwriters to the general public on the same terms as the other shares offered by this prospectus. The directed share program will be arranged through . | |

| Proposed NASDAQ Global Market symbol |

“IVTY.” | |

8

Table of Contents

The number of shares of our common stock to be outstanding after this offering is based on 158,438,759 shares of our common stock outstanding as of March 31, 2015, including convertible preferred stock on an as-converted basis, and excludes:

| • | 25,145,974 shares of common stock issuable upon the exercise of options to purchase shares of our common stock outstanding as of March 31, 2015, with a weighted-average exercise price of $0.14 per share; |

| • | 7,114,305 shares of common stock issuable upon the exercise of options to purchase shares of our common stock which were issued in April and May 2015, with a weighted-average exercise price of $0.61 per share; |

| • | 65,353 shares of common stock issuable upon the exercise of warrants outstanding as of March 31, 2015 with a weighted-average exercise price of $0.07 per share; |

| • | 2,489,601 shares of common stock issuable upon conversion of convertible preferred stock issuable upon the exercise of warrants outstanding as of March 31, 2015 with a weighted-average exercise price of $0.72 per share; |

| • | shares of common stock reserved for future grants under our stock-based compensation plans, consisting of: |

| • | 12,634,964 shares of common stock reserved for future grants under our 2005 Stock Incentive Plan as of March 31, 2015, which shares will be added to the shares to be reserved under our 2015 Equity Incentive Plan, which will become effective upon completion of this offering; |

| • | shares of common stock reserved for future grants under our 2015 Equity Incentive Plan, which will become effective upon completion of this offering; and |

| • | any shares that become available under our 2015 Equity Incentive Plan, pursuant to provisions thereof that automatically increase the share reserve under such plan each year, as more fully described in “Executive Compensation—Employee Benefit and Stock Plans.” |

Except as otherwise indicated, all information in this prospectus assumes:

| • | our reincorporation into Delaware; |

| • | a for reverse stock split of our common stock and convertible preferred stock; |

| • | the filing and effectiveness of our amended and restated certificate of incorporation and the adoption of our amended and restated bylaws upon the completion of this offering; |

| • | the automatic conversion of all shares of our convertible preferred stock outstanding as of March 31, 2015 into an aggregate of 145,085,870 shares of common stock upon the completion of this offering; |

| • | the automatic conversion of all outstanding warrants exercisable for shares of our convertible preferred stock as of March 31, 2015 into warrants exercisable for shares of common stock upon the completion of this offering; |

| • | no exercise of outstanding options or warrants subsequent to March 31, 2015; and |

| • | no exercise of the underwriters’ option to purchase additional shares. |

9

Table of Contents

SUMMARY FINANCIAL DATA

The following tables set forth a summary of our historical financial data as of and for the periods indicated. We have derived the summary statements of operations data for the years ended December 31, 2013 and 2014 from our audited financial statements included elsewhere in this prospectus. We have derived the summary statements of operations data for the three months ended March 31, 2014 and 2015, and the summary balance sheet data as of March 31, 2015, from our unaudited interim financial statements included elsewhere in this prospectus. We have prepared the unaudited interim financial statements on the same basis as the audited financial statements and have included, in our opinion, all adjustments, consisting only of normal recurring adjustments that we consider necessary for a fair statement of the financial information set forth in those statements. Our historical results are not necessarily indicative of our future results and our interim results are not necessarily indicative of results to be expected for the full year ending December 31, 2015, or any other period. The following summary financial data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes included elsewhere in this prospectus.

10

Table of Contents

| Year Ended December 31, | Three Months Ended March 31, | |||||||||||||||

| 2013 | 2014 | 2014 | 2015 | |||||||||||||

| (In thousands, except share and per share data) | ||||||||||||||||

| Statements of Operations Data: |

||||||||||||||||

| Revenue |

$ | 7,186 | $ | 13,103 | $ | 2,154 | $ | 4,442 | ||||||||

| Cost of goods sold |

2,294 | 4,871 | 747 | 1,731 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross profit |

4,892 | 8,232 | 1,407 | 2,711 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating expenses: |

||||||||||||||||

| Selling, general and administrative |

12,402 | 22,803 | 4,574 | 8,923 | ||||||||||||

| Research and development |

4,445 | 5,181 | 1,203 | 1,900 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

16,847 | 27,984 | 5,777 | 10,823 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss from operations |

(11,955 | ) | (19,752 | ) | (4,370 | ) | (8,112 | ) | ||||||||

| Interest expense |

(284 | ) | (1,402 | ) | (370 | ) | (369 | ) | ||||||||

| Interest and other income (expense), net |

130 | 492 | 28 | (551 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss |

$ | (12,109 | ) | $ | (20,662 | ) | $ | (4,712 | ) | $ | (9,032 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss per common share, basic and diluted(1) |

$ | (1.03 | ) | $ | (1.70 | ) | $ | (0.40 | ) | $ | (0.69 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted-average shares used to compute net loss per common share, basic and diluted(1) |

11,713,408 | 12,178,182 | 11,915,715 | 13,017,592 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Pro forma net loss per common share, basic and diluted (unaudited)(1) |

$ | (0.17 | ) | $ | (0.06 | ) | ||||||||||

|

|

|

|

|

|||||||||||||

| Weighted-average shares used to compute pro forma net loss per common share, basic and diluted (unaudited)(1) |

123,522,788 | 144,976,946 | ||||||||||||||

|

|

|

|

|

|||||||||||||

| (1) | See Notes 2, 12 and 13 to our financial statements included elsewhere in this prospectus for an explanation of the calculations of our basic and diluted net loss per common share, pro forma basic and diluted net loss per common share, and the weighted-average number of shares used in the computation of the per share amounts. |

11

Table of Contents

| March 31, 2015 | ||||||||||||

| Actual | Pro Forma(1) | Pro Forma As Adjusted(2)(3) |

||||||||||

| (In thousands) | ||||||||||||

| Balance Sheet Data: |

||||||||||||

| Cash and cash equivalents |

$ | 25,251 | $ | 25,251 | $ | |||||||

| Working capital |

28,230 | 28,230 | ||||||||||

| Total assets |

46,151 | 46,151 | ||||||||||

| Convertible preferred stock warrant liability |

640 | — | ||||||||||

| Long-term debt—related party |

14,382 | 14,382 | ||||||||||

| Convertible preferred stock |

96,524 | — | ||||||||||

| Accumulated deficit |

(77,069 | ) | (77,069 | ) | ||||||||

| Total stockholders’ (deficit) equity |

(74,668 | ) | 22,496 | |||||||||

| (1) | Reflects (i) the automatic conversion of the outstanding shares of our convertible preferred stock as of March 31, 2015 into 145,085,870 shares of our common stock upon the completion of this offering and (ii) the automatic conversion of warrants to purchase shares of convertible preferred stock into warrants to purchase shares of common stock upon the completion of this offering and the related reclassification of our convertible preferred stock warrant liability to additional paid-in capital. |

| (2) | Reflects the pro forma adjustments described in footnote (1) and the sale and issuance of shares of our common stock by us in this offering, at the assumed initial public offering price of $ per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. |

| (3) | Each $1.00 increase (decrease) in the assumed initial public offering price of $ per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, would increase (decrease) our pro forma as adjusted cash and cash equivalents, working capital, total assets and total stockholders’ equity by approximately $ million, assuming that the number of shares of our common stock offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. Each increase (decrease) of 1,000,000 shares in the number of shares offered by us would increase (decrease) the amount of our pro forma as adjusted cash and cash equivalents, working capital, total assets and total stockholders’ equity by approximately $ million, assuming an initial public offering price of $ per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. |

12

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information contained in this prospectus, including our financial statements and the related notes thereto, before making a decision to invest in our common stock. The realization of any of the following risks could materially and adversely affect our business, financial condition, operating results and prospects. In that event, the price of our common stock could decline, and you could lose part or all of your investment.

Risks Related to Our Business and Industry

We have a history of significant operating losses and expect to incur losses in the future. If we do not achieve and sustain profitability, our financial condition and stock price could suffer.

We have experienced significant operating losses, and we expect to continue to incur operating losses for the next several years as we implement additional initiatives designed to grow our business, including, among other things, increasing sales and developing new devices. We incurred net losses of $12.1 million and $20.7 million for the years ended December 31, 2013 and 2014, respectively, and $4.7 million and $9.0 million for the three months ended March 31, 2014 and 2015, respectively. As of March 31, 2015, our accumulated deficit was $77.1 million. Our prior losses, combined with expected future losses, have had and will continue to have, for the foreseeable future, an adverse effect on our stockholders’ deficit and working capital. To date, we have financed our operations primarily through private placements of our equity securities, certain debt-related financing arrangements and from sales of our approved devices. We have devoted substantially all of our resources to research and development of our devices, sales and marketing activities and certain clinical and quality assurance initiatives. Our ability to generate sufficient revenue from our existing devices or from any of our device candidates in development, and to transition to profitability and generate consistent positive cash flows is uncertain. We will need to generate significant sales to achieve profitability, and we might not be able to do so. If our revenue grows more slowly than we anticipate, or if our operating expenses are higher than we expect, we may not be able to achieve profitability as anticipated, or ever, our financial condition will suffer and our stock price could decline. Even if we achieve profitability in the future, we may not be able to sustain profitability in subsequent periods.

All of our revenue is generated from devices incorporating our Intelligent Photonics technology, and any decline in the sales of these devices or failure to gain market acceptance of these devices will negatively impact our business.

We have focused heavily on the development and commercialization of devices using our Intelligent Photonics technology platform for the illumination of certain open minimally invasive and minimal access surgeries. For the years ended December 31, 2013 and December 31, 2014 and the three months ended March 31, 2015, our revenue was $7.2 million, $13.1 million and $4.4 million, respectively, and was derived entirely from sales of devices incorporating our Intelligent Photonics technology. Because we expect our revenue to be derived entirely from sales of these devices for the foreseeable future, our ability to execute our growth strategy and become profitable will depend not only upon an increase in the number of hospitals using our devices, but also an increase in the number of specialties using our devices within those hospitals in which our devices are utilized. Intelligent Photonics technology, and the devices that incorporate it, fail to achieve and maintain wide market acceptance for any reason, our business may be adversely affected, as we will be severely constrained in our ability to fund our operations and to develop and commercialize improvements to existing product lines and new product lines.

13

Table of Contents

If we are unable to convince hospital facilities to approve the use of our devices, our sales may decrease.

In the United States, in order for surgeons to use our devices, the hospital facilities where these surgeons treat patients will typically require us to receive approval from the facility’s value analysis committee, or VAC. VACs typically review the comparative effectiveness and cost of medical devices used in the facility. The makeup and evaluation processes for VACs vary considerably, and it can be a lengthy, costly and time-consuming effort to obtain approval by the relevant VAC. For example, even if we have an agreement with a hospital system for purchase of our devices, in most cases, we must obtain VAC approval by each hospital within the system to sell at that particular hospital. Additionally, hospitals typically require separate VAC approval for each specialty in which our device is used, which may result in multiple VAC approval processes within the same hospital even if such device has already been approved for use by a different specialty group. We often need VAC approval for each different device to be used by the surgeons in that specialty. In addition, hospital facilities and group purchasing organizations, or GPOs, which manage purchasing for multiple facilities, may also require us to enter into a purchasing agreement and satisfy numerous elements of their administrative procurement process, which can also be a lengthy, costly, and time-consuming effort. If we do not receive access to hospital facilities in a timely manner, or at all, via these VAC and purchasing contract processes, or otherwise, or if we are unable to secure contracts in a timely manner, or at all, our operating costs will increase, our sales may decrease, and our operating results may be harmed. Furthermore, we may expend significant effort in these costly and time-consuming processes and still may not obtain VAC approval or a purchase contract from such hospitals or GPOs.

We must demonstrate to surgeons and hospitals the merits of our devices to facilitate greater adoption of our devices.

Surgeons play a significant role in determining the devices used in the operating room and in assisting in obtaining approval by the relevant VAC. Educating surgeons on the benefits of our devices requires a significant commitment by our marketing team and sales organization. Surgeons and hospitals may be slow to change their practices because of perceived risks arising from the use of new devices, lack of experience using new devices, lack of clinical data supporting the benefits of such devices or the cost of new devices. We cannot predict when, or if ever, there will be widespread adoption of our devices by surgeons and hospitals. If we are unable to educate surgeons and hospitals about the advantages of devices incorporating our Intelligent Photonics technology, as compared to other surgical illumination methods which do not incorporate this technology, we may face challenges in obtaining approval by the relevant VAC, and we will not achieve significantly greater market acceptance of our devices, gain momentum in our sales activities, significantly grow our market share or grow our revenue, and our business and financial condition will be adversely affected.

We have limited experience marketing and selling our devices, and if we fail to develop and retain our direct salesforce and independent sales agents, our business could suffer.

We began selling our first FDA-cleared device in March 2009. As a result, we have limited experience marketing and selling our devices. We currently sell our devices through our direct sales representatives only in the United States. Our direct salesforce works with independent sales agents or agencies, whom we refer to as independent sales agents, who assist us in educating targeted surgeons. We increased the number of our direct sales representatives from 16 as of December 31, 2012 to 43 as of March 31, 2015. Our operating results are dependent upon the sales and marketing efforts of our direct sales representatives. If our direct salesforce fails to adequately promote, market and sell our devices, our sales may suffer.

As we launch new devices and increase our current marketing efforts with respect to existing devices and expand into new geographies, our future success will depend largely on our ability to continue to hire, train, retain and motivate skilled sales personnel with significant technical knowledge of our devices. We have made, and intend to continue to make, a significant investment in recruiting and training sales

14

Table of Contents

representatives. There is significant competition for sales personnel experienced in relevant medical device sales. Once hired, the training process is lengthy because of the significant education required to achieve the level of competency surgeons expect from sales representatives with respect to understanding our devices. Upon completion of the training, our sales representatives typically require lead time in the field to grow their network of accounts and achieve the productivity levels we expect them to reach. If we are unable to attract, motivate, develop and retain a sufficient number of qualified sales personnel, or if our sales representatives do not achieve the productivity levels we expect them to reach, our revenue will not grow at the rate we expect and our financial performance will suffer. Also, to the extent we hire personnel from our competitors, we may have to wait until applicable non-competition provisions have expired before deploying such personnel in restricted territories or incur costs to relocate personnel outside of such territories, and we may be subject to allegations that these new hires have been improperly solicited, or that they have divulged to us proprietary or other confidential information of their former employers.

We operate in a highly competitive market segment. If our competitors are better able to market and develop devices than we are able to market or develop devices, our business will be adversely impacted.

The medical device industry is highly competitive. Our success depends, in part, upon our ability to maintain a competitive position in the development of technologies and devices for surgical illumination and visualization. Any device we develop will have to compete for market acceptance and market share. We believe that the primary competitive factors in the surgical illumination and visualization market segment are clinical safety and effectiveness, price, surgeon experience and comfort with use of particular illumination systems, reliability and durability, ease of use, device support and service, salesforce experience and relationships. We face significant competition in the United States and internationally in the surgical illumination and visualization market, and we expect the intensity of competition will increase over time. Surgeons and hospitals typically use traditional overhead lighting, headlights and fiber-optic lighting products, and if we cannot convince surgeons and hospitals of the benefits of using our devices in addition to, or as an alternative to, traditional overhead lighting and headlights, or, of the benefits of using our devices instead of using competing fiber-optic lighting products, our business may be harmed. Some of our main competitors are Lumitex, Inc., Scintillant (Engineered Medical Solutions Co. LLC), Stryker Corporation, TeDan Surgical Innovations, LLC and Black & Black Surgical, Inc. and other general surgical instrument companies that supply traditional fiber optic retractors. Many of the companies developing or marketing competing products enjoy several competitive advantages, including:

| • | more established sales and marketing programs and distribution networks; |

| • | long established relationships with surgeons and hospitals; |

| • | contractual relationships with customers; |

| • | products that have already received approval from the relevant VACs; |

| • | greater financial and human resources for product development, sales and marketing; |

| • | greater name recognition; |

| • | the ability to offer rebates or bundle multiple product offerings to offer greater discounts or incentives; and |

| • | greater experience in and resources for conducting research and development, clinical studies, manufacturing, preparing regulatory submissions, obtaining regulatory clearance or approval for products and marketing approved products. |

Our competitors may develop and patent processes or devices earlier than us, obtain regulatory clearance or approvals for competing devices more rapidly than us or develop more effective or less expensive

15

Table of Contents

devices or technologies that render our technology or devices obsolete or less competitive. We also face fierce competition in recruiting and retaining qualified sales, scientific, and management personnel. If our competitors are more successful than us in these matters, our business may be harmed.

Our ability to sell our devices at prices necessary to support our current business strategies depends on demonstrating that the benefits of devices incorporating our Intelligent Photonics technology outweigh the increased cost of such devices compared to other surgical illumination methods.

Hospital and other healthcare provider customers that purchase our devices typically bill various third-party payors to cover all or a portion of the costs and fees associated with the surgical procedures in which our devices are used and bill patients for any deductibles or copayments. Supplies used in surgery, such as our devices, are typically not separately reimbursed by third-party payors, but are rather included in the overall reimbursement for the procedure involved. Because there is no separate reimbursement for medical devices and supplies used in surgical procedures, the additional cost associated with the use of our devices can impact the profit margin of the hospital or surgery center where the surgery is performed. If reimbursement is inadequate, hospitals may choose to use less expensive instruments or devices that do not include illumination. Some of our target customers may be unwilling to adopt our devices in light of the additional associated cost. Our success depends on our ability to convince such cost-restricted customers that the potential benefits of using our devices, such as reduced surgery time, reduced surgery blood transfusion, and reduced post-surgery complications, outweigh the additional cost of such devices.

It is difficult to forecast future performance and our financial results may vary from forecasts and may fluctuate from quarter to quarter.

Our limited operating history and commercial experience make it difficult for us to predict future performance and growth as such forecasts are limited and subject to a number of uncertainties, including our ability to market our devices successfully, our ability to maintain or obtain regulatory clearances, unexpected or serious complications related to our devices or other factors discussed in these risk factors. A number of factors over which we have limited control may contribute to fluctuations in our financial results. These factors include, without limitation:

| • | surgeon and hospital acceptance of our devices; |

| • | the productivity of our sales representatives; |

| • | the introduction of new devices and technologies or acquisitions by us or our competitors; |

| • | fluctuations in our expenses associated with expanding our operations and operating as a public company; |

| • | the timing, expense and results of research and development activities and obtaining future regulatory clearances and approvals; |

| • | buying patterns of the distributors that serve our military customers; |

| • | supplier, manufacturing or quality problems with our devices; and |

| • | changes in our pricing policies or in the pricing policies of our competitors or suppliers. |

Additionally, we may experience seasonal variations in revenue. For example, our revenue tends to be the lowest in the first quarter as the result of the resetting of annual patient healthcare insurance plan deductibles and by hospitals and military facilities working off their inventories of products purchased in the fourth quarter. Revenue in the fourth quarter tends to be the highest as demand may be impacted by the desire of patients to spend their remaining balances in their flexible spending accounts or because they have met their annual deductibles under their health insurance plans. In addition, in the fourth quarter, our results can be impacted by the budgeting and buying patterns of hospitals and military facilities.

16

Table of Contents

The loss of one or more of our key customers could slow our revenue growth or cause our revenue to decline.

A material portion of our total revenue in any given period may come from a relatively small number of customers. Sales to one customer accounted for 12% of our total revenue in each of 2013 and 2014, and sales to another customer accounted for 13% of our total revenue in 2013. We do not expect sales to these customers to increase significantly in the future, and as our revenue increases, we expect sales to these customers to decrease as a percent of revenue. There were no sales to any customer in excess of 10% of our total revenue for the three months ended March 31, 2015. However the loss of any of our key customers for any reason, or a change in our relationship with any of our key customers may cause a significant decrease in our total revenue.

Our manufacturing operations are dependent upon third-party suppliers, making us vulnerable to supply problems and price fluctuations, which could harm our business.

We rely on a number of suppliers who manufacture certain components of our devices, including specialty machining for our retractors and molding for our waveguides and handheld components. We do not have long-term supply agreements with most of our suppliers, and, in many cases, we purchase components on a purchase order basis. Our suppliers may encounter problems during manufacturing for a variety of reasons, including failure to follow specific protocols and procedures, failure to comply with applicable regulations, equipment malfunction and environmental factors, any of which could delay or impede their ability to meet our demand. Our reliance on these third-party suppliers also subjects us to other risks that could harm our business, including:

| • | we are not a major customer of many of our suppliers, and these suppliers may therefore give other customers’ needs higher priority than ours; |

| • | we may not be able to obtain an adequate supply in a timely manner or on commercially reasonable terms; |

| • | price fluctuations due to a lack of long-term supply arrangements with our suppliers for components; |

| • | our suppliers, especially new suppliers, may make errors in manufacturing that could negatively affect the efficacy or safety of our devices or cause delays in shipment; |

| • | we may have difficulty locating and qualifying alternative suppliers; |

| • | switching components or suppliers may require device redesign and possibly premarket submission to the FDA; |

| • | the failure of our suppliers to comply with strictly enforced regulatory requirements, which could result in disruption of supply and/or increased expenses; |

| • | the occurrence of a fire, natural disaster or other catastrophe impacting one or more of our suppliers may affect the supplier’s ability to deliver components to us in a timely manner; and |

| • | our suppliers may encounter financial hardships unrelated to our demand, which could inhibit their ability to fulfill our orders and meet our requirements. |

In addition, we rely on single- and limited-source suppliers for several of our components and sub-assemblies. For example, the optical molding for our waveguides is provided by one supplier. These components are critical to our devices and there are relatively few alternative sources of supply. We do not carry a significant inventory of these components. Identifying and qualifying additional or replacement suppliers for any of these components or sub-assemblies used in our devices could involve significant time and cost.

17

Table of Contents

Although we could temporarily assemble some of these components internally, we may incur greater costs, delay production or divert attention from other critical projects until we find an alternate source. Any interruption or delay in obtaining components from our third-party suppliers, or our inability to obtain components from qualified alternate sources at acceptable prices in a timely manner, could impair our ability to meet the demand of our customers and cause them to switch to competing devices.

We are required to maintain high levels of inventory, which could consume a significant amount of our resources and reduce our cash flows.

We need to maintain substantial levels of inventory to protect ourselves from supply interruptions. In addition, because of the broad choice of devices we offer the many surgeon specialists who use our devices, we must maintain sufficient inventory on hand to ensure each order is filled when received. As a result of our substantial inventory levels, we are subject to the risk that a substantial portion of our inventory becomes obsolete, which could have a material adverse effect on our earnings and cash flows due to the resulting costs associated with the inventory impairment charges and costs required to replace such inventory. We may need to write off inventory for other reasons as well. For example, our gross margin decreased from 68% for the year ended December 31, 2013 to 63% for the year ended December 31, 2014, primarily due to the impact of inventory write-offs for unrecoverable trunk stock inventory provided to direct sales representatives and independent sales agents and related increase to cost of goods sold.

We have no clinical data to support the clinical and cost benefits of use of our devices, which could be a barrier to further surgeon adoption of our devices.

For FDA purposes, our devices are classified as Class I, Class II exempt or Class II devices. Class I and Class II exempt devices do not require a 510(k) premarket notification. Our Class II devices, which require a 510(k) premarket notification, are not in a category that require clinical studies to obtain clearance for marketing. As a result the FDA has not required, and we have not developed, clinical data supporting the safety and efficacy of our devices. Therefore, we currently lack clinical data supporting the benefits and cost effectiveness of our devices compared to other illumination solutions. As a result, surgeons may be slow to adopt or recommend our devices, and we may encounter difficulty obtaining approval from VACs. Further, any clinical studies that we initiate or the clinical experience of surgeons may indicate that our devices do not provide advantages over our competitors’ surgical illumination devices or that our devices do not deliver sufficient benefits to justify their cost. Such results could slow the adoption of our devices and significantly reduce our sales, which could harm our business and reputation.

We may need to conduct clinical studies in the future to support new device regulatory clearances or approvals, gain acceptance of our products in hospitals or to secure approval of the use of our devices in some foreign countries. Clinical testing is time-consuming and expensive and carries uncertain outcomes. The initiation and completion of any of these studies may be prevented, delayed or halted for numerous reasons. Moreover, we cannot assure you that the results of any clinical trials would support the promoted benefits of our devices. Failure or perceived failures in any clinical trials will delay and may prevent our device development and regulatory clearance or approval processes, damage our business prospects and negatively affect our reputation and competitive position.

Our long-term growth depends on our ability to develop and commercialize additional devices.

The medical device industry is highly competitive and subject to rapid change and technological advancements. Therefore, it is important to our business that we continue to enhance our device offerings and introduce new devices. Developing new devices is expensive and time-consuming and could divert management’s attention away from our core business. Even if we are successful in developing additional devices, the success of any new device offering or enhancements to existing devices will depend on several factors, including our ability to:

| • | properly identify and anticipate surgeon and patient needs; |

18

Table of Contents

| • | develop and introduce new devices or device enhancements in a timely manner; |

| • | develop an effective and dedicated sales and marketing team; |

| • | avoid infringing upon the intellectual property rights of third-parties; |

| • | demonstrate, if required, the safety and efficacy of new devices with data from preclinical studies and clinical trials; |

| • | obtain the necessary regulatory clearances or approvals for new devices or device enhancements; |

| • | be fully FDA-compliant with marketing of new devices or modified devices; |

| • | provide adequate training to potential users of our devices; and |

| • | receive adequate coverage and reimbursement for procedures performed with our devices. |

If we are unsuccessful in developing and commercializing additional devices in other areas, our ability to increase our revenue may be impaired.

We may face product liability claims that could result in costly litigation and significant liabilities, and we may not be able to maintain adequate product liability insurance.

Our business exposes us to the risk of product liability claims that are inherent in the testing, manufacturing and marketing of medical devices. This risk exists even if a device is cleared or approved for commercial sale by the FDA and manufactured in facilities licensed and regulated by the FDA or an applicable foreign regulatory authority. Manufacturing and marketing of our commercial devices, and clinical testing of our devices under development, may expose us to product liability and other tort claims. Additionally, regardless of the merit or eventual outcome, product liability claims may result in:

| • | litigation costs; |

| • | distraction of management’s attention from our primary business; |

| • | impairment of our business reputation; |

| • | the inability to commercialize our devices; |

| • | decreased demand for our devices or devices in development, if cleared or approved; |

| • | device recall or withdrawal from the market; |

| • | withdrawal of clinical trial participants; |

| • | substantial monetary awards to patients or other claimants; or |

| • | loss of revenue. |

Although we have, and intend to maintain, liability insurance, the coverage limits of our insurance policies may not be adequate, and one or more successful claims brought against us may have a material adverse effect on our business and results of operations. If we are unable to obtain insurance in the future at an acceptable cost or on acceptable terms with adequate coverage, we will be exposed to significant liabilities.

Our ability to maintain our competitive position depends on our ability to attract, integrate and retain highly qualified personnel.

We believe that our continued success depends to a significant extent upon the efforts and abilities of our executive officers and other key personnel. Our executive officers and other key personnel are critical to the strategic direction and overall management of our company as well as our research and development process. All of our executive officers and other employees are at-will employees, and therefore may terminate employment with us at any time with no advance notice. The loss of any of our executive

19

Table of Contents

officers and other key personnel could adversely affect our business, financial condition and operating results. Our Chief Financial Officer, Michael Gandy, has informed us of his intention to resign from his position to pursue other interests. We are actively engaged in a process to identify and hire a new Chief Financial Officer. While Mr. Gandy has indicated that he will continue in his current role until we have hired his replacement, we cannot assure you that we will be able to identify and hire an appropriate candidate in a timely manner or on terms reasonable to us or at all. Any delay in hiring a new Chief Financial Officer could significantly disrupt our business and operations. In addition, many members of our management team have only joined us in the last year as part of our investment in the expansion of our business, including our Vice President of Research and Development and Vice President of Operations. Our productivity may be adversely affected if we do not integrate and train our new employees quickly and effectively.