UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2017

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from: _____________ to _____________

SURGE HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 000-52522 | 98-0550352 | ||

| (State or Other Jurisdiction of | (Commission | (I.R.S. Employer | ||

| Incorporation or Organization) | File Number) | Identification No.) |

3124 Brother Blvd 104, Bartlett TN 38133

(Address of Principal Executive Offices) (Zip Code)

10624 S. Eastern Ave., Suite A-910, Henderson, NV 89052

(former address)

(800)

760-9689

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class – None

Name of each exchange on which registered – N/A

Securities registered pursuant to Section 12(g) of the Act:

Title of each class – Common Stock, $0.001 Par Value

Name of each exchange on which registered – N/A

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes [ ] No [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer [ ] | Accelerated filer [ ] | Non-accelerated filer [ ] | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. June 30, 2017 - $7,511,927.

Note: If a determination as to whether a particular person or entity is an affiliate cannot be made without involving unreasonable effort and expense, the aggregate market value of the common stock held by non-affiliates may be calculated on the basis of assumptions reasonable under the circumstances, provided that the assumptions are set forth in the Form.

APPLICABLE ONLY TO CORPORATE REGISTRANTS

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. As of March 31, 2018, the registrant had outstanding 79,796,679 shares of its common stock, par value of $0.001.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) under the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980).

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements and information in this Annual Report on Form 10-K may constitute “forward-looking statements.” The words “believe,” “expect,” “anticipate,” “plan,” “intend,” “foresee,” “outlook,” “estimate,” “potential,” “continues,” “may,” “will,” “seek,” “approximately,” “predict,” “anticipate,” “should,” “would,” “could” or other similar expressions are intended to identify forward-looking statements, which are generally not historical in nature. These forward-looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us. While management believes that these forward-looking statements are reasonable as and when made, there can be no assurance that future developments affecting us will be those that we anticipate. All comments concerning our expectations for future revenues and operating results are based on our forecasts for our existing operations and do not include the potential impact of any future acquisitions. Our forward-looking statements involve significant risks and uncertainties (some of which are beyond our control) and assumptions that could cause actual results to differ materially from our historical experience and our present expectations or projections. Known material factors that could cause our actual results to differ from those in the forward-looking statements are described in “Risk Factors” herein.

Readers are cautioned not to place undue reliance on forward-looking statements, which are made only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise.

TABLE OF CONTENTS

| 2 |

REFERENCES WITHIN THIS REPORT

All references to “Ksix Media Holdings”, “Surge Holdings,” the “Company,” “we,” “us,” and “our” refer to Surge, Inc. and its subsidiaries, unless the context otherwise requires or where otherwise indicated.

PART 1 - DESCRIPTION OF BUSINESS

Corporate History and Overview

Surge Holdings, Inc. (“Surge Holdings” or “the Company”), incorporated in Nevada on August 18, 2006, is a company focused on Telecom, Media, Blockchain, FinTech and Cryptocurrency applications serving customers worldwide online and across social media, gaming and mobile platforms.

The Company was previously known as North American Energy Resources, Inc. (“NAER”) and KSIX Media Holdings, Inc. (“KSIX Media”). Prior to April 27, 2015, the Company operated solely as an independent oil and natural gas company engaged in the acquisition, exploration and development of oil and natural gas properties and the production of oil and natural gas through its wholly owned subsidiary, NAER. On April 27, 2015, NAER entered into a Share Exchange Agreement with Ksix Media whereby KSIX Media became a wholly-owned subsidiary of NAER and which resulted in the shareholders of KSIX Media owning approximately 90% of the voting stock of the surviving entity. While the Company continued the oil and gas operations of NAER following this transaction, on August 4, 2015, the Company changed its name to Ksix Media Holdings, Inc. On December 21, 2017, the Company changed its name to Surge Holdings, Inc. to better reflect the diversity of its business operations.

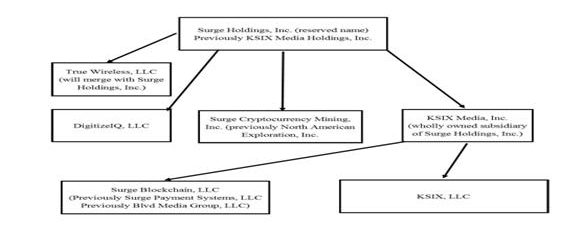

Surge Holdings operates three wholly-owned subsidiaries: (i) DigitizeIQ, LLC (“DIQ”), a digital advertising company which is a full service digital advertising agency specializing in survey generation and landing page optimization specifically designed for mass tort class action lawsuits; (ii) Surge Cryptocurrency Mining, Inc. (formerly North American Energy Resources, Inc.) (“Surge Crypto”), which operates the Company’s cryptocurrency operations and (iii) KSIX Media, Inc., (“KSIX Media”) which is a holding company for (a) Surge Blockchain, LLC (previously Surge Payment Systems, LLC and Blvd Media Group, LLC) (“Surge Blockchain”) which operates the Company’s Blockchain operations and (b) KSIX, LLC (“KSIXLLC”).

KSIXLLC was created as an advertising network designed to create revenue streams for affiliates and provide advertisers with increased measurable audience through targeted cross-platform marketing strategies. KSIXLLC provides performance-based marketing solutions to drive traffic and conversions within a Cost-Per-Lead (“CPl”) business model. The KSIXLLC online advertising network works directly with advertisers and other networks to promote advertiser campaigns. KSIXLLC manages offer tracking, reporting and distribution on the third-party platform.

KSIXLLC deals with incentive-based advertising. Incentive based advertising occurs when a user viewing the advertisement gets some sort of reward for participating in the advertisers offer. These types of transactions are demonstrated frequently in online/mobile video games where users need in game currency to purchase an in-game item. Online and mobile games will pay the users a certain amount of their game currency to participate with the advertisers offer to keep the user engaged in the game for free. Once the user completes the needed task with the advertisers offer, the advertiser pays us a commission for the action or lead generated and we split that commission with the game owner.

KSIXLLC will garner additional revenue through branding, graphic design, web development, mobile software application development, search engine optimization, and social media curation offering a full in-house suite of creative and marking services.

| 3 |

The following is a Company organizational chart:

KSIXLLC and Surge Blockchain were acquired by KSIX Media, Inc. from Paywall, Inc. on or about December 18, 2014 pursuant to the terms of a “Membership Interest Purchase Agreement”. Pursuant such agreement, KSIX Media, Inc. assumed the remaining balance owed to under a Promissory Note to a third party in the original face amount of $362,257. As of December 31, 2016, the then amount outstanding on the Promissory Note was $68,973. Effective April 1, 2016, the Company temporarily suspended its BLVD business operations and is reviewing a potential discontinuation of the business.

On October 15, 2015, KSIXLLC acquired DigitizeIQ, LLC (“DIQ”), a digital advertising company which is a full service digital advertising agency specializing in survey generation and landing page optimization specifically designed for mass tort class action lawsuits.

| 4 |

True Wireless, LLC (now True Wireless, Inc.)

Master Agreement for the Exchange of Common Stock, Management, and Control

On or about December 7, 2016, the Company, entered into a Master Agreement for the Exchange of Common Stock, Management, and Control (the “Exchange Agreement”) with True Wireless, LLC, an Oklahoma Limited Liability Company (“TW”) and the members of TW (the “Members”). Hereinafter, the Company, TW, and its Members may be referred to as a “Party” individually or collectively as the “Parties”.

TW’s primary business operation is a full-service telecommunications company specializing in the Lifeline program as set forth by the Telecommunications Act of 1996 and regulated by the FCC which provides subsidized mobile phone services for low income individuals (“Lifeline Services”). TW currently has an FCC license to offer Lifeline Services in the following states: Oklahoma, Rhode Island, Maryland, Texas, and Arkansas.

Kevin Brian Cox (“Cox”), a resident of the State of Tennessee, is the sole owner of all of TW’s issued and outstanding membership interests, either directly or indirectly through EWP Communications, LLC, a Tennessee limited liability company, the beneficial owner of which is Cox.

Additionally, pursuant to the terms of the Exchange Agreement, the Company executed and entered into a “Management and Marketing Agreement” (“Management Agreement”) with TW (see below).

Pursuant to the Management Agreement, the Company agreed to enter into a Management Agreement with TW whereby the Company would act as the manager of TW until such time as the Exchange Agreement and the transactions contemplated thereunder are approved by the FCC. Following such approval (which has not occurred as of the date of this Report), the Parties will hold a final closing of the Exchange Agreement and TW would become a wholly-owned subsidiary of the Company (collectively, the “Transaction”).

First Addendum to Master Agreement for the Exchange of Equity, Management, and Control

On March 30, 2017, the Parties executed a First Addendum to the Exchange Agreement extending the time for all material deadlines contemplated therein to be completed by May 1, 2017.

Amended Master Agreement for the Exchange of Common Stock, Management, and Control

On July 18, 2017, the Parties entered into an Amended Master Agreement for the Exchange of Common Stock, Management, and Control (the “Amended Exchange Agreement”) which amended and restated the Exchange Agreement. The Amended Exchange Agreement reset certain of the milestones and timetables detailed in the Exchange Agreement. The material terms of the Amended Exchange Agreement are as follows:

TERMS

| ● | The Management Agreement would commence on July 18, 2017, concurrent with the execution of the Amended Exchange Agreement (the “Management Closing”); | |

| ● | All other terms and conditions with respect to the Transaction set forth in this Amended Exchange Agreement required to be completed by the Parties would occur only after all required governmental and regulatory approvals of the Transaction have been delivered. At that time, the Parties agreed to complete the Company’s acquisition of TW (the “Equity Closing”). The Parties agreed to expedite preparation of all financial information and audits to be completed at the earliest feasible time. | |

| ● | The Equity Closing is subject to the completion of due diligence by all Parties to the Amended Exchange Agreement; | |

| ● | The Transaction (including the Equity Closing) is subject to delivery by the Parties of all documents required under the Amended Exchange Agreement; |

| 5 |

| ● | The Company and TW agreed to take all necessary corporate actions to authorize the Management and Equity Closings; and | |

| ● | It was intended that the transaction underlying the Amended Exchange Agreement would qualify for United States federal income tax purposes as a re-organization within the meaning of Section 368 of the Internal Revenue Code of 1986, as amended. However, both Parties recognized that in the event the transaction underlying this Agreement does not qualify for United States federal income tax purposes as a reorganization within the meaning of Section 368 of the Internal Revenue Code of 1986, as amended, each party is separately responsible for any tax consequences and indemnifies and holds harmless the other party from and against any and all claims, demands, actions, suits, proceedings, assessments, judgments, damages, costs, losses and expenses, resulting from the that Parties failure to pay their tax liability for this transaction. |

CLOSINGS

THE MANAGEMENT CLOSING

The Management Closing occurred on July 18, 2017 pursuant to the following material terms or actions which were approved by the Parties:

| ● | The Company agreed, upon execution of the Amended Exchange Agreement, to deliver (a) $1.5 Million Promissory Note issued by the Company in favor of Cox; and (b) undertake to authorize an additional number of shares of common stock as required to fulfill the terms and conditions of the transactions between the parties; | |

| ● | Upon the Equity Closing (which has not yet occurred), the Company agreed to issue to Cox and/or his assigns, approximately 114 million shares of Company Common Stock and Warrants to purchase 45 million Company Common Shares for a period of five years at a purchase price of $0.50 per share (subject to adjustment) which can be exercised on a “cashless” basis. As of the date of this Report, 12 million shares of Company Common Stock have been issued to Cox and assigns; | |

| ● | The Company also agreed to an anti-dilution provision (the “Anti-Dilution Provision”) whereby it would issue such number of additional shares at the Equity Closing as would be necessary to maintain Cox’s percentage ownership of Company Common Stock at the time of the Equity Closing at 69.5% (“Cox Percentage”). This provision applies with respect to any additional stock, warrants or other security issued by the Company prior to the Equity Closing; | |

| ● | It was agreed that 75% of Carter Matzinger’s (“Matzinger”) Series “A” Preferred Stock (“Series A Preferred Stock”) containing specified majority common stock voting rights of the Company would be transferred by Matzinger to Cox upon execution of the Amended Exchange Agreement. This agreement was subsequently amended to provide for the transfer of 100% of the Series A Preferred Stock by Matzinger to Cox; | |

| ● | It was agreed that Matzinger would submit for cancellation and retirement all of his (or his assigns) shares of Company Common Stock in excess of 14 million shares. As a result thereof, Matzinger would hold no more than 14 million shares of Company Common Stock following the Equity Closing. |

Management and Marketing Agreement

On or about July 18, 2017, the Company executed and entered into a “Management and Marketing Agreement” (“Management Agreement”) with Cox. Pursuant to the Management Agreement, the Company is obligated to provide certain management services to Cox as detailed in the Management Agreement. On December 27, 2017, the Company and K. Brian Cox mutually agreed to terminate the Management Agreement and cancel the $1,500,000 Promissory Note issued on July 18, 2017, ab initio and declared that both the Management Agreement and the Promissory Note annulled and would be treated as if they were never consummated.

| 6 |

EQUITY CLOSING (AGREEMENT AND PLAN OF REORGANIZATION)

As of March 30, 2018, the parties to the Transaction have restructured the Transaction and intend to have an Equity Closing during the early part of the Company’s 2nd fiscal quarter of 2018. In March 2018, the parties negotiated an Agreement and Plan of Reorganization among the Company, True Wireless Acquisition, Inc., a Nevada corporation (“Acquisition Subsidiary”) and wholly-owned subsidiary of the Company and True Wireless, Inc., an Oklahoma corporation (“TW”) (“Merger Agreement”) which supersedes all prior agreements with respect to the terms of the Transaction. Pursuant to the terms of the Merger Agreement, TW (successor in interest to True Wireless, LLC) will merge into Acquisition Subsidiary in a transaction where TW will be the surviving company and become a wholly-owned subsidiary of the Company. The transaction is structured as a tax-free reverse triangular merger. In addition to the 12,000,000 shares of Company Common Stock and $500,000 cash which has been paid to the shareholders of TW, at the Closing of the merger transaction, the shareholders of TW will receive the following as additional merger consideration:

| ● | 151,707,516 shares of newly-issued Company Common Stock, which will give the shareholders of TW, on a proforma basis, a 69.5% interest in the Company’s total Common Shares. | |

| ● | An additional number of shares of Company Common Stock, if any, necessary to vest 69.5% of the aggregate issued and outstanding Common Stock in the shareholders of TW at the Closing. | |

| ● | A Promissory Note in the original face amount of $3,000,000, bearing interest at 3% per annum maturing on December 31, 2018. | |

| ● | 3,000,000 shares of newly-issued Company Series A Preferred Stock |

At the closing of the Merger, outstanding shares in TW together with all documentation to reflect the intent of the Parties such that TW would become a wholly owned subsidiary of the Company shall be delivered to the Company.

Pursuant to the terms of the Merger Agreement, the parties confirmed the prior delivery of 12,000,000 shares of Company Common Stock and $500,000 cash which was been paid to the shareholders of TW as a deposit on the Transaction.

Conditioned upon the Parties, having completed all material requirements of the Merger Agreement, including all delivery of all Exhibits and Collateral Agreements contemplated thereby, and the receipt of any required third party approvals, the Parties agreed to proceed with the Equity Closing, as follows:

| 7 |

Company Investment in TW

At the date of this filing, the Company’s investment in TW consists of the following:

| Shares | Amount | |||||||

| Consideration paid | ||||||||

| Cash paid | $ | 500,000 | ||||||

| Common stock issued | 12,000,000 | 1,200,000 | ||||||

| Total consideration paid | 12,000,000 | $ | 1,700,000 | |||||

| Consideration to be paid: | ||||||||

| Common stock to be issued at closing | 151,707,516 | $ | 60,683,006 | |||||

| Series A Preferred Stock to be issued at closing | 3,000,000 | 120,000 | ||||||

| Note payable due December 31, 2018 | 1,500,000 | |||||||

| Total consideration to be paid | $ | 62,303,006 | ||||||

| Total consideration | $ | 64,003,006 | ||||||

Notes to Table Above:

1 Common Stock to be issued at closing at an average price of approximately $0.40 per share.

2 Series A Preferred Stock to be issued at closing at an average price of $0.04 per share.

Status of True Wireless Transaction

As of the date of this Report, the Transaction has not closed and the Company anticipates its closing early in the second quarter of 2018. The terms of the Transaction are subject to change prior to closing.

DigitizeIQ, LLC

On October 12, 2015, the Company entered into an Agreement for the Exchange of Common Stock (“DIQ Agreement”) with DigitizeIQ, LLC (“DIQ”) and its sole owner (“Owner”). DIQ’s primary business is operation of a full service digital advertising agency specializing in survey generation and landing page optimization specifically designed for mass tort action lawsuits. Pursuant to the transaction, DIQ became a wholly owned subsidiary of the Company.

The Agreement provided for a purchase price of $1,250,000, paid as follows:

| ● | Upon execution of the Agreement, the Company paid $250,000 in cash (of which $150,000 was returned after renegotiation) and issued 1,250,000 shares of Company Common Stock valued at $100,000. | |

| ● | The Company issued a non-interest bearing Promissory Note to Owner in the face amount of $250,000, which was due on November 12, 2015; this Promissory Note has now been paid in full. | |

| ● | The Company issued a second non-interest bearing Promissory Note to Owner in the face amount of $250,000, which was due on January 12, 2016. This Promissory Note remains outstanding. | |

| ● | The Company issued a third non-interest bearing Promissory Note to Owner in the amount of $250,000, which was due on March 12, 2016. This Promissory Note remains outstanding. |

| 8 |

As of the date of this filing, the Company owes Owner a total of $485,000 towards the purchase price of DIQ which is represented by the Promissory Notes due on January 12, 2016 and March 12, 2016. Presently, the Company is in default on these Promissory Notes and intends to attempt to negotiate a full settlement with the holder. There is no guarantee that any settlement can be achieved, or if one is achieved, it will be on terms beneficial to the Company.

Blockchain Technology

Surge Blockchain is focused on expanding development and licensing for a Blockchain Service as a Software (SaaS) Payments Platform in order to deliver a real product that improves people’s lives.

Cryptocurrency Mining

Surge Crypto intends to strategically mine Bitcoin, Litecoin and cryptocurrencies. The company is currently working to finalize its first mining farm of 100 Antminer L3+ machines. The mining operation will work 24/7 to both generate revenues and deliver to the Company a commodity.

Trademarked Products and Proprietary Technology:

RewardTool® - A proprietary “offer wall” or “ad container” that promotes hundreds of different advertising campaigns on a single web page. Offer walls, by definition, attract users with the premise of getting virtual currency without having to spend money. Instead they are asked to fill out a survey, download an app, watch a video, or sign up for something in return for the free currency. The RewardTool® displays up to 1,000 offers and automatically rewards users upon completion. It is customizable and completely systematizes all of the processes needed to successfully run these campaigns.

AccessTool® - A proprietary “content locker” that is used to monetize any type of premium digital content like videos, music, or eBooks. Content lockers, by definition, attract users with the premise of access to premium content without having to spend money. Instead, they are asked to complete an advertiser’s offer in return for free access to the content. The AccessTool® displays up to 1,000 offers and is customizable to match the design of any website.

Adsynthe - A proprietary technology used to manage Facebook media buying. This software allows the company to monitor and manage campaigns spending and to leverage rules to limit non-effective campaign spending.

General Business Strategy:

The Company intends to grow by strategic acquisition of niche companies which demonstrate performance-based success in specific digital advertising and marketing platforms and other related industries. Because digital advertising and online marketing strategies are inherently low yield, the ability to make even small gains in efficiency benefits the Company and its network of partners and affiliates exponentially.

Employees and Labor Relations

At December 31, 2017, we had six full-time employees. We plan to add corporate and managerial staff as necessary consistent with the growth of our operations.

We plan to concentrate on the acquisition of companies where the employees are not, and have not historically been, members of unions. However, there is no assurance that any company that we acquire will not be the subject of a successful unionization vote.

Smaller reporting companies are not required to provide the information required by this item.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None

| 9 |

ITEM 2: DESCRIPTION OF PROPERTIES

The Company presently occupies space at 4340 S. Valley View, Suite 230, Las Vegas, NV 89103 on a rent=free basis. The Company will acquire additional office space as its needs warrant.

The following is summary of threatened, pending, asserted or un-asserted claims against the Company or any of its wholly owned subsidiaries.

Claims by River North Equity, LLC against KSIX Media Holdings, Inc.:

On June 29, 2017, River North Equity, LLC (“River North Equity”) filed suit against the Company and Carter Matzinger in the Circuit Court of the 18th Judicial District of DuPage County in Wheaton, IL (Case # 2017AR000989) arising out of an Equity Purchase Agreement the Company entered into with River North Equity on July 11, 2016. The Complaint alleges that the Company entered into a series of convertible promissory notes in the aggregate face amount of $177,500 and that these notes are presently in default. The Complaint also alleges that the Company failed to maintain sufficient authorized capital to allow for conversion of the promissory notes; failed to honor conversion notices delivered with respect to the promissory notes; failed to file a registration statement with the U.S. Securities and Exchange Commission with respect to shares issuable on conversion of the promissory notes and failed to properly disclose the existence of the promissory notes and relevant details in its filings with the U.S. Securities and Exchange Commission. River North Equity is seeking damages in the amount of at least $27,500 plus accrued interest and such other damages as may be proven at trial. As of the date of this Report, this matter has been settled and dismissed.

Claims by TCA Global Credit Master Fund, L.P.

On or about May 9, 2017, TCA Global Credit Master Fund, L.P. (“TCA”) filed a civil action in Broward County Florida against the Company and its subsidiaries regarding an outstanding balance due under a Senior Secured Debt Facility Agreement dated February 26, 2016. This facility was fully paid on December 7, 2017. In all other respects, the action with TCA has been settled and dismissed.

Claims by American Express Bank FSB:

On or about August 26, 2016 American Express Bank FSB (“American Express”) filed a civil complaint against DIQ and Scott Kaplan (an employee of the Company) in the District Court for Clark County, Nevada for approximately $336,726 due on a credit card issued to DIQ, which was allegedly guaranteed by Scott Kaplan, the vice president of business development for KSIX, LLC. This action was subsequently dismissed on July 19, 2017. While the Company was not a party to this action, ostensibly there could be an obligation on the part of the Company to indemnify Mr. Kaplan on this matter. As of this date, no claim for indemnification has been made against the Company and the Company seeks to resolve any issues relating to this matter on an amicable basis without incurring any liability. Failure to resolve this matter could potentially have a material adverse effect on the Company and its business. There is no guarantee that this matter can be resolved on any basis which is favorable to the Company.

West Publishing v DigitizeIQ LLC.

On or about September 28, 2017 West Publishing Corporation (“West Publishing”) filed a civil action in the Superior Court of the State of California County of San Diego, Central Division (Case# 37-201700034215-CU-CL-CTL) for breach of contract and open book account against the Company’s subsidiary DIQ. West Publishing claims an open account of $435,700 against DIQ from an account originating in 2014 wherein DIQ provided lead-generation services for West Publishing. The Company has retained counsel and will vigorously defend this action. The Company contends that the open book account claimed by West Publishing is an accounting error and that, in fact, West Publishing owes DIQ for verified lead generation services during the relevant period. This matter is still pending as of the date of this Report and the outcome cannot be predicted. There is no guarantee that this matter can be resolved on any basis which is favorable to the Company.

ITEM 4: MINE SAFETY DISCLOSURES

Not applicable.

| 10 |

ITEM 5: MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Our Common Stock, $0.001 par value per share, is traded in the OTC Markets Inc. OTCQB Market (“OTCQBs”) under the symbol “SURG” Until we began trading on July 24, 2007, there was no public market for our common stock.

On March 31, 2015, the Company effected a 1 for 23 reverse stock split. All share references included herein have been adjusted as if the change took place before the date of the earliest transaction reported.

The following table sets forth the quarterly high and low daily close for our common stock as reported by OTC Markets Inc. for the two years ended December 31, 2017 and 2016. The bids reflect inter dealer prices without adjustments for retail mark-ups, mark-downs or commissions and may not represent actual transactions. There is a very limited market for the Company’s common stock.

| Period ended | High | Low | ||||||

| December 31, 2017 | $ | 0.850 | $ | 0. 310 | ||||

| September 30, 2017 | $ | 0.420 | $ | 0.016 | ||||

| June 30, 2017 | $ | 0.020 | $ | 0.050 | ||||

| March 31, 2017 | $ | 0.030 | $ | 0.050 | ||||

| December 31, 2016 | $ | 0.450 | $ | 0.050 | ||||

| September 30, 2016 | $ | 0.134 | $ | 0.060 | ||||

| June 30, 2016 | $ | 0.204 | $ | 0.097 | ||||

| March 31, 2016 | $ | 0.450 | $ | 0.060 | ||||

Penny Stock Considerations

Our shares are presently considered a will be “penny stock” as that term is generally defined in the Securities Exchange Act of 1934 to mean equity securities with a price of less than $5.00. Our shares thus will be subject to rules that impose sales practice and disclosure requirements on broker-dealers who engage in certain transactions involving a penny stock.

Under the penny stock regulations, a broker-dealer selling a penny stock to anyone other than an established customer or accredited investor must make a special suitability determination regarding the purchaser and must receive the purchaser’s written consent to the transaction prior to the sale, unless the broker-dealer is otherwise exempt. Generally, an individual with a net worth in excess of $1,000,000, or annual income exceeding $100,000 individually or $300,000 together with his or her spouse, is considered an accredited investor. In addition, under the penny stock regulations the broker-dealer is required to:

| 11 |

| ● | Deliver, prior to any transaction involving a penny stock, a disclosure schedule prepared by the Securities and Exchange Commission relating to the penny stock market, unless the broker-dealer or the transaction is otherwise exempt; | |

| ● | Disclose commissions payable to the broker-dealer and our registered representatives and current bid and offer quotations for the securities; | |

| ● | Send monthly statements disclosing recent price information pertaining to the penny stock held in a customer’s account, the account’s value and information regarding the limited market in penny stocks; and | |

| ● | Make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction, prior to conducting any penny stock transaction in the customer’s account. |

Because of these regulations, broker-dealers may encounter difficulties in their attempt to sell shares of our common stock, which may affect the ability of selling shareholders or other holders to sell their shares in the secondary market and have the effect of reducing the level of trading activity in the secondary market. These additional sales practice and disclosure requirements could impede the sale of our securities, if our securities become publicly traded. In addition, the liquidity for our securities may decrease, with a corresponding decrease in the price of our securities. Our shares in all probability will be subject to such penny stock rules and our shareholders will, in all likelihood, find it difficult to sell their securities.

Recent Sales of Unregistered Securities

During year ended December 31, 2017, the Company issued an aggregate of 32,713,544 shares of common stock in unregistered transactions, including 7,225,000 shares for cash, 3,665,000 shares for services, 9,823,544 shares for convertible notes payable and 12,000,000 shares as a deposit on the acquisition of True Wireless. Such issuances included shares sold to investors in transactions not involving a public offering, shares issued as consideration for transactions, shares issued on conversion of debt instruments and shares issued to consultants. The prices of the shares sold for cash ranged from $0.10-$0.20 per share.

The shares of common stock were issued in reliance on Section 4(2) promulgated under the Securities Act of 1933, as amended (the “Securities Act”). The shares of common stock issued have not been registered under the Securities Act or under any state securities laws and may not be offered or sold without registration with the United States Securities and Exchange Commission or an applicable exemption from the registration requirements.

Holders

As of March 22, 2018, there are approximately 82 shareholders of record of the Company’s common stock, including 13,892,734 shares held by CEDE & Co. as nominee.

Dividend Policy

The Board of Directors has never declared or paid a cash dividend. At this time, the Board of Directors does not anticipate paying dividends in the future. The Company is under no legal or contractual obligation to declare or to pay dividends, and the timing and amount of any future cash dividends and distributions is at the discretion of our Board of Directors and will depend, among other things, on the Company’s future after-tax earnings, operations, capital requirements, borrowing capacity, financial condition and general business conditions. The Company plans to retain any earnings for use in the operation of our business and to fund future growth.

Securities Authorized for Issuance Under Equity Compensation Plans

The Company does not currently have any equity compensation plans.

| 12 |

Issuer Purchases of Equity Securities

During the year ended December 31, 2017, the Company did not purchase any shares of its common stock. As a part of the settlement of litigation with TCA, TCA returned 1,782,000 shares of Company Common Stock it held to the Company treasury.

ITEM 6: SELECTED FINANCIAL DATA

The Company operates as a smaller reporting company and is not required to provide this information.

ITEM 7: MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Disclosure Regarding Forward Looking Statements

This Annual Report on Form 10-K includes forward looking statements (“Forward Looking Statements”). All statements other than statements of historical fact included in this report are Forward Looking Statements. In the normal course of its business, the Company, in an effort to help keep its shareholders and the public informed about the Company’s operations, may from time-to-time issue certain statements, either in writing or orally, that contain or may contain Forward-Looking Statements. Although the Company believes that the expectations reflected in such Forward Looking Statements are reasonable, it can give no assurance that such expectations will prove to have been correct. Generally, these statements relate to business plans or strategies, projected or anticipated benefits or other consequences of such plans or strategies, past and possible future, of acquisitions and projected or anticipated benefits from acquisitions made by or to be made by the Company, or projections involving anticipated revenues, earnings, levels of capital expenditures or other aspects of operating results. All phases of the Company operations are subject to a number of uncertainties, risks and other influences, many of which are outside the control of the Company and any one of which, or a combination of which, could materially affect the results of the Company’s proposed operations and whether Forward Looking Statements made by the Company ultimately prove to be accurate. Such important factors (“Important Factors”) and other factors could cause actual results to differ materially from the Company’s expectations are disclosed in this report. All prior and subsequent written and oral Forward-Looking Statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by the Important Factors described below that could cause actual results to differ materially from the Company’s expectations as set forth in any Forward Looking Statement made by or on behalf of the Company.

Overview

The accompanying consolidated financial statements as of December 31, 2017 and December 31, 2016 and for the years then ended includes the accounts of Surge and its wholly owned subsidiaries.

| 13 |

COMPARISON OF YEARS ENDED DECEMBER 31, 2017 AND 2016

Revenues and cost of revenue for the years ended December 31, 2017 and 2016 consisted of the following:

| 2017 | 2016 | |||||||

| Revenue | $ | 1,429,872 | $ | 3,296,747 | ||||

| Cost of revenue | 733,033 | 2,328,467 | ||||||

| Gross profit | $ | 696,839 | $ | 968,280 | ||||

Revenue and cost of revenue by subsidiary is as follows:

| 2017 | 2016 | |||||||

| Revenue | ||||||||

| DIQ | $ | 893,631 | $ | 2,143,652 | ||||

| KSIX | 535,059 | 1,149,198 | ||||||

| Other | 1,182 | 3,897 | ||||||

| $ | 1,429,872 | $ | 3,296,747 | |||||

| Cost of revenue | ||||||||

| DIQ | 409,916 | 1,723,301 | ||||||

| KSIX | 323,109 | 603,986 | ||||||

| Other | 8 | 1,180 | ||||||

| $ | 733,033 | $ | 2,328,467 | |||||

| Gross profit | ||||||||

| DIQ | 483,715 | 420,351 | ||||||

| KSIX | 211,950 | 545,212 | ||||||

| Other | 1,174 | 2,717 | ||||||

| $ | 696,839 | $ | 968,280 | |||||

DIQ is a full service digital advertising agency specializing in survey generation and landing page optimization specifically designed for mass tort action lawsuits. DIQ revenues represented 62% of 2017 consolidated revenues and 65% of 2016 consolidated revenues. DIQ revenue declined $1,250,021 (58%) in 2017 from the 2016 amount due to the loss of a major advertiser during 2016. DIQ also revised its marketing strategy and increased its gross profit margin from 20% in 2016 to 54% in 2017.

KSIX provides performance based marketing solutions to drive traffic and conversions within a Cost-Per-Lead (“CPL”) business model. KSIX works directly with advertisers and other networks to promote advertiser campaigns through their affiliates. KSIX’ revenues represented 37% of 2017 consolidated revenues and 35% of 2016 consolidated revenues. KSIX revenues declined $614,139 (53%) in 2017 from the 2016 amount due to a shift in advertisers and affiliates to drive leads. KSIX gross profit amounted to 40% in 2017 as compared to 47% in 2016.

Costs and expenses during the years ended December 31, 2017 and 2016 were as follows:

| 2017 | 2016 | |||||||

| Depreciation and amortization | $ | 119,262 | $ | 433,118 | ||||

| Asset impairment | - | 372,706 | ||||||

| Selling, general and administrative | 2,646,647 | 3,269,270 | ||||||

| Total | $ | 2,765,909 | $ | 4,075,094 | ||||

| 14 |

Depreciation and amortization in 2017 represents primarily the amortization of intangible assets associated with the acquisition of DIQ in 2015. Depreciation and amortization in 2016 includes both the amortization of intangible assets which commenced December 23, 2014 (KSIX and BLVD) and October 12, 2015 (DIQ), when acquired. Amortization was lower in 2017 as a result of the impairment of KSIX and BLVD at December 31, 2016.

The Company determined to not continue the operations of BLVD in 2016 temporarily and due to declining cash flow, the Company impaired the remaining net intangible assets associated with its KSIX, LLC operations. Accordingly, an impairment charge in the amount of $372,706 was recorded in 2016.

Selling, general and administrative expense during the years ended December 31, 2017 and 2016 is as follows:

| 2017 | 2016 | |||||||

| Payroll and payroll taxes | $ | 441,681 | $ | 508,697 | ||||

| Outside contractors and consultants | 1,484,613 | 1,485,099 | ||||||

| Bad debt expense | 10,000 | 36,954 | ||||||

| Officer compensation | 239,984 | 451,913 | ||||||

| Professional services | 202,447 | 435,732 | ||||||

| Webhosting and internet | 67,048 | 100,420 | ||||||

| Advertising and marketing | 2,255 | 73,924 | ||||||

| Insurance | 51,845 | 44,345 | ||||||

| Dues and subscriptions | 15,962 | 32,091 | ||||||

| Rent | 17,975 | 20,490 | ||||||

| Other | 112,837 | 79,605 | ||||||

| Total | $ | 2,646,647 | $ | 3,269,270 | ||||

Selling, general and administrative expenses decreased $622,623 (19%) in 2017 as compared to 2016. The following explains the changes in specific expenses from 2016 to 2017.

| ● | Payroll and payroll taxes decreased $67,016 (13%) in 2017 as compared to 2016. This is primarily due to the reduction in personnel due to the lower volume of operations. | |

| ● | Outside contractors and consultants decreased $486 in 2017 from the amount in 2016. | |

| ● | Bad debt expense decreased from $36,954 in 2016 to $10,000 in 2017. | |

| ● | Officer compensation amounted to $451,913 in 2016 and $239,984 in 2017 and includes stock awards. Amortization of the value of stock options issued to Mr. Matzinger is included in both periods. This amortization amounted to $261,913 in 2016. In addition, the 2016 amount includes $190,000 for the value of preferred stock issued to Mr. Matzinger for prior services. | |

| ● | Professional services decreased to $202,447 in 2017 from $435,732 in 2016, a decrease of $233,285 (54%). The 2016 amount includes $112,500 associated with the value of common stock issued to the Company’s attorney pursuant to a legal services agreement. | |

| ● | Webhosting and internet costs decreased from $100,420 in 2016 to $67,048 in 2017, a decrease of $33,372 (33%). | |

| ● | Advertising and marketing costs amounted to $2,255 in 2017 and $73,924 in 2016 as the company substantially eliminated outside advertising. | |

| ● | Insurance costs amounted to $44,345 in 2016 as compared to $51,845 in 2017. | |

| ● | Dues and subscriptions amounted to $32,091 in 2016 and $15,962 in 2017. | |

| ● | Rent expense in 2016 amounted to $20,490 and $07,975 in 2017, a decrease of $2,515 (12%). | |

| ● | Other selling, general and administrative expenses amounted to $79,604 in 2016 and $112,837 in 2017, an increase of $33,233 (42%). |

| 15 |

Other income (expense) during the years ended December 31, 2017 and 2016 is as follows:

| 2017 | 2016 | |||||||

| Interest expense | $ | (416,959 | ) | $ | (1,660,338 | ) | ||

| Other income | 9,585 | 5,844 | ||||||

| Gain (loss) on change in value of derivatives | (504,201 | ) | 268,236 | |||||

| Gain (loss) on debt extinguishment | 1,000,349 | (107,104 | ) | |||||

| Total | $ | 88,774 | $ | (1,493,362 | ) | |||

Interest expense decreased to $416,959 in 2017 from $1,660,338 in 2016. The 2016 amount includes $163,788 in interest accrued on notes payable and long-term debt and $30,000 in loan penalty. The remaining $1,466,550 represents the amortization of loan costs and debt discounts associated with the derivative liabilities which are determined from the Company’s convertible debt. The majority of the 2017 expense is interest on notes payable.

Other income in 2017 is a gain from settlement of a vendor obligation and in 2016 represents the recovery of a bad debt written off in 2015.

The change in value of derivatives occurred in 2016 for the first time when the Company issued convertible debt which resulted in recording a derivative liability. The change results from revaluing the derivative when changes in the debt occur and at the quarterly balance sheet dates.

The gain (loss) on debt settlement arose when the Company settled convertible notes payable.

LIQUIDITY, CAPITAL RESOURCES AND GOING CONCERN

The Company is presently financing its cash needs through private sales of equity and short-term debt. The Company has retired a substantial portion of its debt during 2017 through cash payments and issuing common stock and continues to restructure its remaining debt. There is no guarantee that these efforts will be successful in part or at all. The Company is in a growth mode, which results in increasing receivables and intermittent cash shortages.

On October 12, 2015, the Company acquired DigitizeIQ, LLC, which had a total of $1,000,000 in cash requirements over the subsequent 150 days. As of December 31, 2016, the Company has made $515,000 of the required payments and still owes $485,000 as of December 31, 2017. The Company is negotiating with the seller of DIQ to reduce and restructure these payments.

At December 31, 2017 and 2016, our current assets were $319,560 and $758,837, respectively, and our current liabilities were $2,486,466 and $4,059,894, respectively, which resulted in a working capital deficit of $2,166,906 and $3,301,057, respectively.

Total assets at December 31, 2017 and 2016 amounted to $3,145,707 and $2,357,246, respectively. At December 31, 2017, assets consisted of current assets of $319,560, net property and equipment of $157,444, net intangible assets of $101,921, goodwill of $866,782 and $1,700,000 in deposits on acquisitions. At December 31, 2016, assets consisted of current assets of $758,837, property and equipment of $14,432, net intangible assets of $217,195, goodwill of $866,782 and $500,000 in deposits on acquisitions.

At December 31, 2017, our total liabilities of $2,538,654 decreased $1,633,641 (39%) from $4,172,295 at December 31, 2016. The decrease primarily consists of a reduction in long-term debt of $1,056,552, a reduction of $280,318 in accounts payable and accrued expenses and a reduction in derivative liability of $491,271.

At December 31, 2016, our stockholders’ deficit was $(1,815,049) as compared to stockholders’ equity of $607,053 at December 31, 2017. The principal reason for the increase in stockholders’ equity was the common stock issued for cash, debt, services and advances of acquisition less the operating loss incurred.

| 16 |

The following table sets forth the major sources and uses of cash for the years ended December 31, 2017 and 2016.

| 2017 | 2016 | |||||||

| Net cash used in operating activities | $ | (604,109 | ) | $ | (641,877 | ) | ||

| Net cash provided by (used in) investing activities | (147,000 | ) | (503,000 | ) | ||||

| Net cash provided by financing activities | 903,243 | 1,139,097 | ||||||

| Net increase (decrease) in cash and cash equivalents | $ | 152,134 | $ | (5,780 | ) | |||

At December 31, 2017, the Company had the following material commitments and contingencies.

Acquisitions – See Note 12 to the Consolidated Financial Statements.

Notes payable and long-term debt - $1,094,223 ($304,000 in related party debt), See Notes 7 and 8 to the Consolidated Financial Statements.

Accounts payable and accrued expenses - $495,306.

Advances from related party - $389,502

Cash requirements and capital expenditures – The Company will be required to make a cash payment of $1,500,000 to close the acquisition of True Wireless, LLC as set forth in Note 12 to the Consolidated Financial Statements. In addition, the majority of the Company’s remaining debt is past due and substantial additional cash will be required.

Known trends and uncertainties – The Company is planning to acquire other businesses that are similar to its operations. The uncertainty of the economy may increase the difficulty of raising funds to support the planned business expansion.

Evaluation of the amounts and certainty of cash flows – In 2017, sales declined $1,866,875 (57%) from the 2016 amount. There can be no assurance that the Company will be able to replace the lost business, become proficient in operating its new business or be able to fund operations in the future.

Going Concern – Our financial statements have been presented on the basis that we continue as a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. As shown in the accompanying financial statements, the Company has a working capital deficiency of $2,166,906 as of December 31, 2017, incurred losses and did not generate cash from its operations for the past two years. These factors create an uncertainty about our ability to continue as a going concern. The Company projects that it needs to raise $1-1.5 million of new capital investment in the short term, restructure literally all of its current debt and complete its acquisition of TW in order to reach a level of minimal viability. If these goals can be achieved in the next 90 days, management believes that the Company could achieve positive cash flow by the end of the 2nd quarter of 2018 (June 30, 2018) from ongoing operations by the combination of increased cash flow from its current subsidiaries, as well as restructuring our current debt burden. The Company is constantly seeking new investment from a variety of sources, debt, equity and hybrid. Additionally, the Company believes that it is moving toward the closing of the acquisition of TW. There are no guarantees that any of this will be achieved and the Company’s ability to continue as a going concern is dependent on the success of these plans.

OFF-BALANCE SHEET ARRANGEMENTS

We do not have any off-balance sheet arrangements that are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors.

CRITICAL ACCOUNTING ESTIMATES

Our significant accounting policies are described in Note 2 of the Consolidated Financial Statements. During the year ended December 31, 2017, we were required to make material estimates and assumptions that affect the reported amounts and related disclosures of assets, liabilities, revenue and expenses. The estimates will require us to rely upon assumptions that were highly uncertain at the time the accounting estimates are made, and changes in them are reasonably likely to occur from period to period. Changes in estimates used in these and other items could have a material impact on our financial statements in the future. Our estimates will be based on our experience and our interpretation of economic, political, regulatory, and other factors that affect our business prospects. Actual results may differ significantly from our estimates.

| 17 |

ITEM 7A: QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

| The Company operates as a smaller reporting company and is not required to provide this information. |

| 18 |

ITEM 8: FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The Financial Statements of Surge Holdings, Inc. together with the reports thereon of Paritz & Co., P.A. for the years ended December 31, 2017 and December 31, 2016, is set forth as follows:

Index to Financial Statements

| 19 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of

Surge Holdings, Inc. and Subsidiaries

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheets of Surge Holdings, Inc. and subsidiaries (the “Company”) as of December 31, 2017 and 2016, and the related consolidated statements of operations, stockholders’ equity (deficit), and cash flows for each of the years in the two-year period ended December 31, 2017, and the related notes (collectively referred to as the financial statements). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2017 and 2016, and the results of its operations and its cash flows for each of the years in the two-year period ended December 31, 2017, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As described in Note 3 to the financial statements, the Company has a working capital deficiency of $2,166,906 as of December 31, 2017, incurred losses and did not generate cash from its operations for the past two years. These factors, among others, raise substantial doubt about our ability to continue as a going concern. Management’s plans in regards to these matters are described in Note 3 to the financial statements. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

| |

| We have served as the Company’s auditor since 2010. | |

| Hackensack, NJ | |

| April 10, 2018 | |

| 20 |

SURGE HOLDINGS, INC. AND SUBSIDIARIES

Consolidated Balance Sheets

| December 31, 2017 | December 31, 2016 | |||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 215,843 | $ | 63,709 | ||||

| Accounts receivable, less allowance for doubtful accounts of $17,000 and $17,000, respectively | 56,036 | 126,428 | ||||||

| Prepaid expenses | 47,681 | 568,700 | ||||||

| Total current assets | 319,560 | 758,837 | ||||||

| Property and Equipment, less accumulated depreciation of $8,663 and $4,675, respectively | 157,444 | 14,432 | ||||||

| Intangible assets less accumulated amortization of $282,723 and $167,449, respectively | 101,921 | 217,195 | ||||||

| Goodwill | 866,782 | 866,782 | ||||||

| Deposit on acquisition | 1,700,000 | 500,000 | ||||||

| Total assets | $ | 3,145,707 | $ | 2,357,246 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | ||||||||

| Current liabilities: | ||||||||

| Accounts payable and accrued expenses - others | $ | 482,262 | $ | 775,624 | ||||

| - Related party | 13,044 | - | ||||||

| Credit card liability | 336,726 | 336,726 | ||||||

| Deferred revenue | 130,000 | 165,000 | ||||||

| Derivative liability | 92,897 | 584,168 | ||||||

| Advance from related party | 389,502 | 356,502 | ||||||

| Current portion of long-term debt - related party | 304,000 | 53,750 | ||||||

| Notes payable and current portion of long-term debt, net of discount of $0 and $8,774, respectively | 738,035 | 1,788,124 | ||||||

| Total current liabilities | 2,486,466 | 4,059,894 | ||||||

| Long-term debt - related party | - | 53,750 | ||||||

| Long-term debt less current installments, net of discount of $0 and $87,379, respectively | 52,188 | 58,651 | ||||||

| Total liabilities | 2,538,654 | 4,172,295 | ||||||

| Commitments and contingencies | ||||||||

| Stockholders’ equity (deficit): | ||||||||

| Preferred stock: $0.001 par value; 100,000,000 shares authorized; 10,000,000 and no shares issued and outstanding at December 31, 2017 and 2016, respectively | 10,000 | 10,000 | ||||||

| Common stock: $0.001 par value; 500,000,000 shares authorized; 90,057,445 shares and 57,343,901 shares issued and 88,275,445 and 57,343,901outstanding at December 31, 2017 and December 31, 2016, respectively | 90,058 | 57,344 | ||||||

| Additional paid in capital | 9,584,473 | 4,145,589 | ||||||

| Less treasury stock at cost (1,782,000 shares) | (1,069,200 | ) | - | |||||

| Accumulated deficit | (8,008,278 | ) | (6,027,982 | ) | ||||

| Total stockholders’ equity (deficit) | 607,053 | (1,815,049 | ) | |||||

| Total liabilities and stockholders’ equity (deficit) | $ | 3,145,707 | $ | 2,357,246 | ||||

See accompanying notes to consolidated financial statements

| 21 |

SURGE HOLDINGS, INC. AND SUBSIDIARIES

Consolidated Statements of Operations

Years ended December 31, 2017 and December 31, 2016

| 2017 | 2016 | |||||||

| Revenue | $ | 1,429,872 | $ | 3,296,747 | ||||

| Cost of revenue | 733,033 | 2,328,467 | ||||||

| Gross profit | 696,839 | 968,280 | ||||||

| Costs and expenses | ||||||||

| Depreciation and amortization | 119,262 | 433,118 | ||||||

| Asset impairment | - | 372,706 | ||||||

| Selling, general and administrative | 2,646,647 | 3,269,270 | ||||||

| Total costs and expenses | 2,765,909 | 4,075,094 | ||||||

| Operating loss | (2,069,070 | ) | (3,106,814 | ) | ||||

| Other income (expense): | ||||||||

| Interest expense | (416,959 | ) | (1,660,338 | ) | ||||

| Other income | 9,585 | 5,844 | ||||||

| Change in fair value of derivatives | (504,201 | ) | 268,236 | |||||

| Gain (loss) on debt extinguishment | 1,000,349 | (107,104 | ) | |||||

| Total other income (expense) | 88,774 | (1,493,362 | ) | |||||

| Net loss before provision for income taxes | (1,980,296 | ) | (4,600,176 | ) | ||||

| Provision for income taxes | - | - | ||||||

| Net loss | $ | (1,980,296 | ) | $ | (4,600,176 | ) | ||

| Net loss per common share, basic and diluted | $ | (0.03 | ) | $ | (0.10 | ) | ||

| Weighted average common shares outstanding | 76,183,385 | 44,796,318 | ||||||

See accompanying notes to consolidated financial statements.

| 22 |

SURGE HOLDINGS, INC. AND SUBSIDIARIES

Consolidated Statement of Stockholders’ Equity (Deficit)

Years ended December 31, 2017 and December 31, 2016

| Additional | ||||||||||||||||||||||||||||||||||||

| Preferred Stock | Common Stock | Paid-in | Accumulated | Treasury Stock | ||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Capital | Deficit | Shares | Amount | Total | ||||||||||||||||||||||||||||

| Balance, December 31, 2015 | - | $ | - | 36,130,432 | $ | 36,130 | $ | 784,929 | $ | (1,427,806 | ) | - | $ | - | $ | (606,747 | ) | |||||||||||||||||||

| Common stock issued for: | ||||||||||||||||||||||||||||||||||||

| Cash | - | - | 8,750,000 | 8,750 | 848,750 | - | - | - | 857,500 | |||||||||||||||||||||||||||

| Services | 10,000,000 | 10,000 | 7,890,000 | 7,890 | 1,389,898 | - | - | - | 1,407,788 | |||||||||||||||||||||||||||

| Loan costs | - | - | 1,782,000 | 1,782 | 298,218 | - | - | - | 300,000 | |||||||||||||||||||||||||||

| Convertible notes payable | - | - | 2,791,469 | 2,792 | 507,963 | - | - | - | 510,755 | |||||||||||||||||||||||||||

| Warrant issued for services | - | - | - | - | 389,698 | - | - | - | 389,698 | |||||||||||||||||||||||||||

| Option compensation | - | - | - | - | 301,133 | - | - | - | 301,133 | |||||||||||||||||||||||||||

| Measurement period adjustment | - | - | - | - | (375,000 | ) | - | - | - | (375,000 | ) | |||||||||||||||||||||||||

| Net loss | - | - | - | - | - | (4,600,176 | ) | - | - | (4,600,176 | ) | |||||||||||||||||||||||||

| Balance, December 31, 2016 | 10,000,000 | 10,000 | 57,343,901 | 57,344 | 4,145,589 | (6,027,982 | ) | - | - | (1,815,049 | ) | |||||||||||||||||||||||||

| Common stock issued for: | ||||||||||||||||||||||||||||||||||||

| Cash | - | - | 7,225,000 | 7,225 | 1,167,775 | - | - | - | 1,175,000 | |||||||||||||||||||||||||||

| Services | - | - | 3,665,000 | 3,665 | 936,508 | - | - | - | 940,173 | |||||||||||||||||||||||||||

| Convertible notes payable | - | - | 9,823,544 | 9,824 | 1,906,617 | - | - | - | 1,916,441 | |||||||||||||||||||||||||||

| Deposit for acquisition | - | - | 12,000,000 | 12,000 | 1,188,000 | - | - | - | 1,200,000 | |||||||||||||||||||||||||||

| Treasury stock acquired | - | - | - | - | - | - | 1,782,000 | (1,069,200 | ) | (1,069,200 | ) | |||||||||||||||||||||||||

| Option compensation | - | - | - | - | 239,984 | - | - | - | 239,984 | |||||||||||||||||||||||||||

| Net loss | - | - | - | - | - | (1,980,296 | ) | - | - | (1,980,296 | ) | |||||||||||||||||||||||||

| Balance, December 31, 2017 | 10,000,000 | $ | 10,000 | 90,057,445 | $ | 90,058 | $ | 9,584,473 | $ | (8,008,278 | ) | 1,782,000 | $ | (1,069,200 | ) | $ | 607,053 | |||||||||||||||||||

See accompanying notes to consolidated financial statements.

| 23 |

SURGE HOLDINGS, INC. AND SUBSIDIARIES

Consolidated Statements of Cash Flows

For the years ended December 31, 2017 and December 31, 2016

| 2017 | 2016 | |||||||

| Operating activities | ||||||||

| Net loss | $ | (1,980,296 | ) | $ | (4,600,176 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Amortization and depreciation | 119,262 | 433,118 | ||||||

| Common stock issued for services | 1,701,176 | 1,531,380 | ||||||

| Change in fair value of derivatives | 504,201 | (268,236 | ) | |||||

| (Gain) loss on debt extinguishment | (1,000,349 | ) | 107,105 | |||||

| Bad debt expense | 10,000 | 36,954 | ||||||

| Non-cash interest | 288,110 | 1,466,550 | ||||||

| Loan penalty | - | 30,000 | ||||||

| Asset impairment | - | 372,706 | ||||||

| Gain from accounts payable settlement | (9,585 | ) | - | |||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | 60,392 | 111,711 | ||||||

| Deferred revenue | (35,000 | ) | (353,240 | ) | ||||

| Accounts payable and accrued expenses | (262,020 | ) | 427,660 | |||||

| Credit card liability | - | 62,591 | ||||||

| Net cash used in operating activities | (604,109 | ) | (641,877 | ) | ||||

| Investing activities | ||||||||

| Purchase of property and equipment | (147,000 | ) | (3,000 | ) | ||||

| Cash paid as deposit on acquisition of True Wireless, LLC | - | (500,000 | ) | |||||

| Net cash used in investing activities | (147,000 | ) | (503,000 | ) | ||||

| Financing activities | ||||||||

| Sale of common stock for cash | 1,175,000 | 857,500 | ||||||

| Cash paid for settlement of notes payable | (485,000 | ) | - | |||||

| Advances from related party, net of repayment | 33,000 | 38,500 | ||||||

| Loan proceeds | 519,000 | 770,000 | ||||||

| Loan repayment | (338,757 | ) | (526,903 | ) | ||||

| Net cash provided by financing activities | 903,243 | 1,139,097 | ||||||

| Net increase (decrease) in cash and cash equivalents | 152,134 | (5,780 | ) | |||||

| Cash and cash equivalents, beginning of year | 63,709 | 69,489 | ||||||

| Cash and cash equivalents, end of year | $ | 215,843 | $ | 63,709 | ||||

See accompanying notes to consolidated financial statements

| 24 |

SURGE HOLDINGS, INC. AND SUBSIDIARIES

Consolidated Statements of Cash Flows

For the years ended December 31, 2017 and December 31, 2016, Continued

| 2017 | 2016 | |||||||

| Supplemental cash flow information | ||||||||

| Cash paid for interest and income taxes: | ||||||||

| Interest | $ | 128,850 | $ | 30,268 | ||||

| Income taxes | $ | - | $ | - | ||||

| Non-cash investing and financing activities: | ||||||||

| Common stock for services to be rendered issued included in prepaid expenses | $ | 1,180,157 | $ | 218,111 | ||||

| Common stock issued for deposit on investment | $ | 1,200,000 | $ | - | ||||

| Common stock issued for settlement of notes payable | $ | 1,916,441 | $ | 510,754 | ||||

| Warrant issued for prepaid services | $ | - | $ | 349,127 | ||||

| Treasury stock acquired in settlement of notes payable | $ | 1,069,200 | $ | - | ||||

See accompanying notes to consolidated financial statements

| 25 |

SURGE HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 31, 2017 and 2016

1 BASIS OF PRESENTATION AND BUSINESS

Basis of presentation

The accompanying consolidated financial statements include the accounts of Surge Holdings, Inc. (“Surge”), formerly Ksix Media Holdings, Inc. (the “Holdings”), incorporated in Nevada on August 18, 2006, and its wholly owned subsidiaries, Ksix Media, Inc. (“Media”), incorporated in Nevada on November 5, 2014, Ksix, LLC (“KSIX”), a Nevada limited liability company that was formed on September 14, 2011, Surge Blockchain, LLC (“Blockchain”), formerly Blvd. Media Group, LLC (“BLVD”), a Nevada limited liability company that was formed on January 29, 2009, DigitizeIQ, LLC (“DIQ”) an Illinois limited liability company that was formed on July 23, 2014 and Surge Cryptocurrency Mining, Inc. (“Crypto”), formerly North American Exploration, Inc. (“NAE”), a Nevada corporation that was incorporated on August 18, 2006 (collectively the “Company”). All significant intercompany balances and transactions have been eliminated in consolidation.

Business description

The Company has been doing business through two of its wholly owned subsidiaries. DIQ is a full service digital advertising agency specializing in survey generation and landing page optimization specifically designed for mass tort action lawsuits. KSIX is an Internet marketing company. KSIX is an advertising network designed to create revenue streams for its affiliates and to provide advertisers with increased measurable audience. KSIX provides performance based marketing solutions to drive traffic and conversions within a Cost-Per-Lead (“CPL”) business model. KSIX has an online advertising network that works directly with advertisers and other networks to promote advertiser campaigns and manages offer tracking, reporting and distribution.

Other subsidiaries are inactive as of the date of this consolidated financial statement. In December 2017, the Company renamed Blockchain and Crypto and intend to pursue the following business models.

Blockchain is focused on expanding development and licensing for a Blockchain Service as a Software (SaaS) Payments Platform in order to deliver a real product that improves people’s lives.

Crypto intends to strategically mine Bitcoin, Litecoin and other cryptocurrencies. The company is working to finalize its first mining farm of 100 Antminer L3+ machines. The mining operation will work 24/7 to both generate revenues and deliver to the Company a commodity.

Effective December 7, 2016, the Company executed a Master Exchange Agreement for the exchange of Common Stock, Management and Control (the “Exchange Agreement”) with True Wireless, LLC (“TW”) and Kevin Brian Cox (“Cox”), the sole owner of TW’s issued and outstanding membership interests. TW’s primary business operation is a full-service telecommunications company specializing in the Lifeline program which provides subsidized mobile phone service for low income individuals. The acquisition has not closed as of the date of these financial statements (See Note 12 for details).

| 26 |

2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Use of estimates in the presentation of financial statements

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of net revenue and expenses during each reporting period. Actual results could differ from those estimates.

Accounts receivable and allowance for doubtful accounts

Accounts receivable are generally due thirty days from the invoice date. The Company has a policy of reserving for uncollectible accounts based on their best estimate of the amount of profitable credit losses in its existing accounts receivable. The Company extends credit to its customers based on an evaluation of their financial condition and other factors. The Company generally does not require collateral or other security to support accounts receivable. The Company performs ongoing credit evaluations of its customers and maintains an allowance for potential bad debts if required.

The Company determines whether an allowance for doubtful accounts is required by evaluation of specific accounts where information indicates the customer may have an inability to meet financial obligations. In these cases, the Company uses assumptions and judgment, based on the best available facts and circumstances, to record a specific allowance for those customers against amounts due to reduce the receivable to the amount expected to be collected. These specific allowances are re-evaluated and adjusted as additional information is received. The amounts calculated are analyzed to determine the total amount of the allowance. The Company may also record a general allowance as necessary.

Direct write-offs are taken in the period when the Company has exhausted their efforts to collect overdue and unpaid receivables or otherwise evaluate other circumstances that indicate that the Company should abandon such efforts. For the years ended December 31, 2017 and 2016, the Company reported $10,000 and $36,954 of bad debt expense, respectively.

Credit risk

The Company had cash deposits in certain banks that at times may have exceeded the maximum insured by the Federal Deposit Insurance Corporation. The Company monitors the financial condition of the banks and has experienced no losses on these accounts.

Earnings (loss) per common share

The Company is required to report both basic earnings per share, which is based on the weighted-average number of common shares outstanding, and diluted earnings per share, which is based on the weighted-average number of common shares outstanding plus all potential dilutive shares outstanding. At December 31, 2017 and 2016, there were no potentially dilutive common stock equivalents. Accordingly, basic and diluted earnings (loss) per share are the same for each of the periods presented.

| 27 |

Contingencies

Certain conditions may exist as of the date financial statements are issued, which may result in a loss to the Company, but which will only be resolved when one or more future events occur or fail to occur. Company management and its legal counsel assess such contingencies related to legal proceeding that are pending against the Company or unasserted claims that may result in such proceedings, the Company’s legal counsel evaluates the perceived merits of any legal proceedings or unasserted claims as well as the perceived merits of the amount of relief sought or expected to be sought therein. If the assessment of a contingency indicates that it is probable that a liability has been incurred and the amount of the liability can be estimated, then the estimated liability would be accrued in the Company’s financial statements. If the assessment indicates that a potentially material loss contingency is not probable but is reasonably possible, or if probable but cannot be estimated, then the nature of the contingent liability, together with an estimate of the range of possible loss if determinable would be disclosed.

Share-based compensation

The Company accounts for share-based compensation in accordance with Financial Accounting Standards Board (“FASB”) ASC 718, “Compensation-Stock Compensation.” Under the fair value recognition provisions of this pronouncement, share-based compensation cost is measured at the grant date based on the fair value of the award, reduced as appropriate based on estimated forfeitures, and is recognized as expense over the applicable vesting period of the stock award using the accelerated method. The excess tax benefit associated with stock compensation deductions have not been recorded in additional paid-in capital. When evaluating whether an excess tax benefit has been realized, share based compensation deductions are not considered realized until NOLs are no longer sufficient to offset taxable income. Such excess tax benefits will be recorded when realized.

Property and equipment

Property and equipment and software development costs are stated at cost, less accumulated depreciation. Depreciation is recorded using the straight-line method over the estimated useful lives of the respective assets. Leasehold improvements are amortized over the life of the lease if it is shorter than the estimated useful life. Maintenance and repairs are charged to operations when incurred. Betterments and renewals are capitalized. When property and equipment are sold or otherwise disposed of, the asset account and related accumulated depreciation account are relieved, and any gain or loss is included in operations. Computer and office equipment is generally three to five years and office furniture is generally seven years.

Business combinations

We allocate the fair value of purchase consideration to the tangible and intangible assets acquired and liabilities assumed based on their estimated fair values. The excess of the fair value of purchase consideration over the fair values of these identifiable assets and liabilities is recorded as goodwill.