UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-K

[ ] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended June 30, 2013

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number 333-141568

CHINA ADVANCED CONSTRUCTION MATERIALS GROUP,

INC.

(Exact name of registrant as specified in its

charter)

| Nevada | 20-8468508 |

| (State or other Jurisdiction of Incorporation or | (I.R.S. Employer Identification No.) |

| Organization) |

9 North West Fourth Ring Road Yingu Mansion Suite

1708

Haidian District Beijing, People’s Republic of China 100190

(Address of Principal Executive Office and Zip Code)

Registrant’s telephone number, including area code: +86 10 82525361

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange On Which Registered |

| Common Stock, Par Value $0.001 | NASDAQ Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports

pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ X ]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such

files).

Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Act).

Yes [ ] No [X]

At December 31, 2012, the last business day of the registrant’s most recently completed second fiscal quarter, there were 17,839,464 shares of the registrant’s common stock outstanding, and the aggregate market value of such shares held by non-affiliates of the registrant (based upon the closing price of such shares as reported on the NASDAQ Global Market) was approximately $21.5 million. Shares of the registrant’s common stock held by the registrant’s executive officers and directors have been excluded because such persons may be deemed to be affiliates of the registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of September 12, 2013, there were 1,486,871 shares of the Registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE : Portions of the registrant’s Proxy Statement related to the 2013 Meeting of Stockholders, which is expected to be filed with the Securities and Exchange Commission on or before October 28, 2013, are incorporated by reference into Part III of this Form 10-K.

TABLE OF CONTENTS

| Page | ||

| Part I | ||

| Item 1. | Business | 2 |

| Item 1A. | Risk Factors | 16 |

| Item 2. | Properties | 32 |

| Item 3. | Legal Proceedings | 33 |

| Item 4. | Mine Safety Disclosures | 33 |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 33 |

| Part II | ||

| Item 6. | Selected Financial Data | 34 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 34 |

| Item 7A. | Quantitative and Qualitative Disclosure of Market Risk | 52 |

| Item 8. | Financial Statements and Supplementary Data | 52 |

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 52 |

| Item 9A. | Controls and Procedures | 52 |

| Item 9B. | Other Information | 54 |

| Part III | ||

| Item 10. | Directors, Executive Officers and Corporate Governance | 54 |

| Item 11. | Executive Compensation | 54 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 55 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 55 |

| Item 14. | Principal Accountant Fees and Services | 55 |

| Part IV | ||

| Item 15. | Exhibits, Financial Statements and Schedules | 55 |

i

INTRODUCTORY NOTE

In this report, unless indicated otherwise, references to

- “China,” “Chinese” and “PRC,” are references to the People’s Republic of China;

- “BVI” are references to the British Virgin Islands

- “China Advanced,” “China-ACM,” “the Company,” “we,” “us,” or “our,” are references to the combined business of China Advanced Construction Materials, Group, Inc. and its wholly-owned subsidiaries, BVI- ACM, China-ACMH and AIH, as well as Xin Ao, but do not include the stockholders of China Advanced;

- “BVI-ACM” are references to Xin Ao Construction Materials, Inc.

- “China-ACMH” are references to Beijing Ao Hang Construction Materials Technology Co., Ltd.;

- “AIH” are references to Advance Investment Holding Co., Inc.

- “Xin Ao” are references to Beijing Xin Ao Concrete Group;

- “RMB” are references to the Renminbi, the legal currency of China; and

- “U.S. dollars,” “dollars” and “$” are references to the legal currency of the United States.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

In addition to historical information, this report contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. You can identify such forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. These forward-looking statements include, among other things, statements relating to:

- our expectations regarding the market for our concrete products and services;

- our expectations regarding the continued growth of the concrete industry;

- our beliefs regarding the competitiveness of our products;

- our expectations regarding the expansion of our manufacturing capacity;

- our expectations with respect to increased revenue growth and our ability to maintain profitability resulting from increases in our production volumes;

- our future business development, results of operations and financial condition;

- competition from other manufacturers of concrete products;

- the loss of any member of our management team;

- our ability to integrate acquired subsidiaries and operations into existing operations;

- market conditions affecting our equity capital;

- our ability to successfully implement our selective acquisition strategy;

- changes in general economic conditions; and

- changes in accounting rules or the application of such rules.

Also, forward-looking statements represent our estimates and assumptions only as of the date of this report. You should read this report and the documents that we reference in this report, or that we filed as exhibits to this report, in their entirety and with the understanding that our actual future results may be materially different from what we expect.

1

Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

PART I

Item 1. Business

OUR BUSINESS

Overview

We are a holding company whose primary business operations are conducted through our wholly-owned subsidiaries BVI-ACM and China-ACMH, and our variable interest entity XinAo. The Company engages in the production of advanced construction materials for large scale infrastructure, commercial and residential developments. The Company is primarily focused on engineering, producing, servicing, delivering and pumping a comprehensive range of advanced ready-mix concrete materials for highly technical, large scale, and environmentally-friendly construction projects. Ready-mixed concrete products are important building materials that are used in a vast majority of commercial, residential and public works construction projects. We are committed to conducting our operations with an emphasis on the extensive use of recycled waste materials, extending product life, the efficient production of our concrete materials with minimal energy usage, dust and air pollution, and innovative products, methods and practices.

During the year ended June 30, 2013, we supplied materials and provided services to our customers through our network of ready-mixed concrete plants in Beijing (two as of June 30, 2013) and our portable plants (three as of June 30, 2013) in Anhui province. We own one concrete plant and its related equipment, and we lease one additional plant in Beijing. Our manufacturing services are used primarily for our national high speed railway projects; almost all of our general contract contractors on the high speed railway projects supply the needed raw materials, which results in higher gross margins for us and reduces our upfront capital investments needed to purchase raw materials. We also produce ready-mix concrete at portable plants, which can be dismantled and moved to new sites for new projects. Our management believes that we may have the ability to capture a greater share of the Beijing market and further expand our footprint in China via expanding relationships and networking, signing new contracts, and continually developing market-leading innovative and eco-friendly ready-mix concrete products.

According to the Investment Research Institute of China’s State Development and Reform Commission, during the 12th Five year plan (FYP), which runs from 2011 to 2015, the Chinese government will invest $460 billion (RMB3.05 trillion) in rural infrastructure.

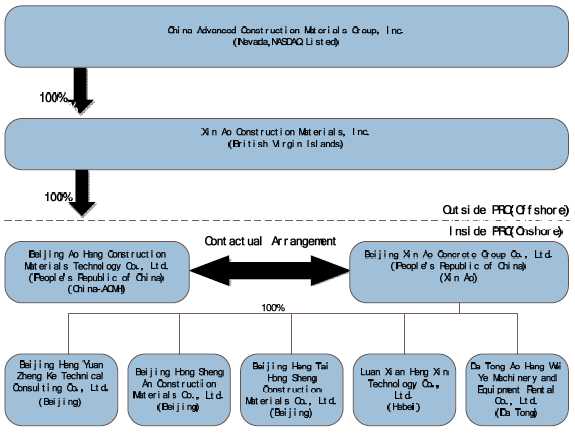

Our Corporate Structure

We own all of the issued and outstanding capital stock of XinAo Construction Materials, Inc., or BVI-ACM, a British Virgin Islands corporation, which in turn owns 100% of the outstanding capital stock of Beijing Ao Hang Construction Materials Technology Co., Ltd., or China-ACMH, a company incorporated under the laws of China. On November 28, 2007, China-ACMH entered into a series of contractual agreements with Beijing XinAo Concrete Group Co., Ltd., or XinAo, a company incorporated under the laws of China, and its two shareholders, in which China-ACMH effectively took over management of the business activities of XinAo and has the right to appoint all executives and senior management and the members of the board of directors of XinAo. The contractual arrangements are comprised of a series of agreements, including an Exclusive Technical Consulting and Services Agreement and an Operating Agreement, through which China-ACMH has the right to advise, consult, manage and operate XinAo for an annual fee in the amount of XinAo’s yearly net profits after tax. Additionally, XinAo’s shareholders have pledged their rights, titles and equity interest in XinAo as security for China-ACMH to collect technical consulting and services fees provided to China-ACMH through an Equity Pledge Agreement. In order to further reinforce China-ACMH’s rights to control and operate XinAo, XinAo’s shareholders have granted China-ACMH the exclusive right and option to acquire all of their equity interests in XinAo through an Option Agreement.

2

The following chart reflects our organizational structure as of the date of this report.

Our Corporate History

China Advanced Construction Materials Group, Inc. was founded as an unincorporated business on September 1, 2005, under the name TJS Wood Flooring, Inc., and became a C corporation in the State of Delaware on February 15, 2007. On April 29, 2008, we changed our name to China Advanced Construction Materials Group, Inc. in connection with a reverse acquisition transaction with BVI-ACM as described below.

On April 29, 2008, we completed a reverse acquisition transaction with BVI-ACM whereby we issued to the stockholders of BVI-ACM 8,809,583 shares of our common stock in exchange for all of the issued and outstanding capital stock of BVI-ACM. BVI-ACM thereby became our wholly owned subsidiary and the former stockholders of BVI-ACM became our controlling stockholders.

3

On August 1, 2013, we consummated a reincorporation merger pursuant to which we merged with and into our wholly-owned subsidiary, China Advanced Construction Materials Group, Inc., a newly formed Nevada corporation and the surviving entity in the merger, pursuant to the terms and conditions of an Agreement and Plan of Merger entered into as of August 1, 2013. As a result of the reincorporation the Company is now governed by the laws of the state of Nevada.

Background and History of BVI-ACM and China-ACMH

BVI-ACM was established on October 9, 2007, under the laws of British Virgin Islands. The majority shareholders of BVI-ACM are Chinese citizens who own 100% of XinAo, a limited liability company formed under laws of China. BVI-ACM was established as a “special purpose vehicle” for foreign fund raising for XinAo. China State Administration of Foreign Exchange, or SAFE, requires the owners of any Chinese companies to obtain SAFE’s approval before establishing any offshore holding company structure for foreign financing as well as subsequent acquisition matters. On September 29, 2007, BVI-ACM was approved by local Chinese SAFE as a “special purpose vehicle” offshore company.

On November 23, 2007, BVI-ACM established a subsidiary, China-ACMH, in China as a wholly owned foreign limited liability company with registered capital of $5 million. Through China-ACMH and its variable interest entity XinAo, we are engaged in producing general ready-mixed concrete, customized mechanical refining concrete, and some other concrete-related products which are mainly sold in China. On September 20, 2010, China ACM established a 100% owned subsidiary, Advanced Investment Holdings Co., Inc., or AIH, in the State of Nevada. AIH never engaged in operations and the Company subsequently dissolved AIH on August 30, 2011.

In March and April 2010, XinAo established five 100% owned subsidiaries in China: Beijing Heng Yuan ZhengKe Technical Consulting Co., Ltd (“Heng Yuan ZhengKe”), Beijing Hong Sheng An Construction Materials Co., Ltd (“Hong Sheng An”), Beijing Heng Tai Hong Sheng Construction Materials Co., Ltd (“Heng Tai”), Da Tong Ao Hang Wei Ye Machinery and Equipment Rental Co., Ltd (“Da Tong”) and Luan Xian HengXin Technology Co., Ltd (“Luan Xian HengXin”). Total registered capital for these five subsidiaries is approximately $2.1 million (RMB 14 million) and none of these XinAo subsidiaries had actual operation as of June 30, 2013. The purpose of these subsidiaries is to support the Company’s future growth.

Business Segment Information

During the year ended June 30, 2013, our operations were comprised of two reportable segments: selling concrete and manufacturing concrete.

For financial information relating to our business segments, see Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 18 of the Consolidated Financial Statements appearing elsewhere in this annual report.

Concrete Sales Business

Our concrete sales business segment is comprised of the formulation, production and delivery of the Company’s line of C10-C100 concrete mixtures primarily through our current fixed plant network of two ready mix concrete batching plants in Beijing. The ready-mixed concrete sales business engages principally in the formulation, preparation and delivery of ready-mixed concrete to the job sites of our customers. For this segment of our business, we procure all of our own raw materials, mix them according to our measured mixing formula, ship the final product in mounted transit mixers to the destination work site, and, for more sophisticated structures, will pump the mixture and set it into structural frame molds as per structural design parameters. The process of delivering and setting the ready mix concrete mixture cannot exceed 90 minutes due to the chemistry of the concrete mixture which hardens thereafter. The deliverable radius of a concrete mixture from any one of our two ready mix plants in Beijing is approximately 25 kilometers. Traffic conditions are considerations which affect the timing and shipment of our concrete mixtures. Since the 2008 Olympics, there are alternating license plate traffic restrictions on many traffic routes in Beijing to ease traffic congestion and associated exhaust pollution. Due to the large amounts of working capital required for the acquisition of raw materials associated for this business segment, a supply shortage or degradation of supplier accounts payable credit terms would pose a potential risk to our business.

4

Our principal market, Beijing, has enjoyed stronger economic growth and a higher demand for construction than other regions of China. As a result, we believe that competitors will try to expand their sales and build up their distribution networks in our principal market. We anticipate that this trend will continue and likely accelerate. Increased competition may have a material adverse effect on our financial condition and results of operations.

Manufacturing Services Business

Our manufacturing services business segment is comprised of the formulation, production and delivery of project-specific concrete mixtures primarily through our current portable plant network of 4.5 rapid assembly and deployment batching plants, located in An’hui province. In this segment, we provide services intended to reduce our customers’ overall construction costs by lowering the installed, or “in-place,” cost of concrete. These services include the formulation of mixtures for specific design uses, on-site and lab-based product quality control, and customized delivery programs to meet our customers’ needs. Our clients will purchase and provide the raw materials in volume on a separate account which we will then proportion and mix according to our formulation for a given project’s specifications. At present, our manufacturing services business segment is primarily dedicated to various high-speed rail projects in China which demand very high quality standards on a time sensitive work schedule. Our high speed rail clients are primarily state-owned conglomerate construction contractors whose business practices follow closely with government policy.

Our ready-mixed concrete plants consist of fixed and portable facilities that produce ready-mixed concrete in batches. Our fixed-plant facilities produce ready-mixed concrete that we transport to job sites by mixer trucks. Our portable plant operations deploy to produce ready-mixed concrete at the job site that we direct into place using a series of conveyors. We use our portable plants to service high-volume projects or projects in remote locations.

Any future decisions we make regarding the construction of additional plants will be impacted by market factors, including the expected production demand for the plant, the expected types of projects the plant will service, and the desired location of the plant.

Mixer trucks slowly rotate their loads en route to job sites in order to maintain product consistency. Our central dispatch system, where available, tracks the status of each mixer truck as to the whereabouts of a particular truck, whether the truck is en route to a particular job site.

Our Industry

Our Industry was influenced by the decline in the macro economy in recent periods. The concrete products industry experienced a slowdown in industry production and economic growth since September 2011. In 2012 and 2013, the slowdown in the industry became more obvious month by month, with profit generally being squeezed by the greater pressure to maintain stable level of production and operation.

5

China averaged annual GDP growth exceeding 10% over the past 30 years. China has become the world’s second largest economy, both in nominal GDP and purchasing power parity terms, after the United States. In line with this macroeconomic growth the Chinese construction and building material industry has grown tremendously. China uses half of the world’s concrete output and one third of its steel output in construction according to an article in China Orbit published in January 2011. The Chinese market, however, faces some uncertainty going forward in the face of projects initiated under the 2008-2009 Government stimulus package which are coming to an end, macro-economic credit tightening measures by the Government to combat inflation, suspended approval of new high speed railway construction projects by the State Planning Commission and the Ministry of Rail, and increasing industry consolidation pressure for more energy efficient, environmentally conscious and quality consistent cement and concrete.

China is already among the world’s largest construction materials producers, ranking first in the world’s annual output of cement, flat glass, building ceramic and ceramic sanitary ware . The construction materials market includes all manufacturers of sand, gravel, aggregates, cement, concrete and bricks. The market does not include other finished or semi-finished building materials. The performance of the market is forecast to decelerate, with an anticipated CAGR of 6.4% for the five year period 2010-2015, which is still expected to drive the market to a value of $335.5 billion by the end of 2015.

According to Nomura Research, in order to meet a possibly higher energy-saving target during 12th FYP period, China has given high priority to industry consolidation to curb capacities and energy consumption. According to one news report (Source: China Cement Net, Cement Industry Restructuring Set to Start, Sept 13, 2010), China aims to increase the market share of the Top 10 cement producers from 25% (as of 2009) to above 35% by 2015, the end of the 12th FYP period, in terms of cement capacity. The government has a two pronged approach to industry consolidation: phasing out outdated capacity and encouraging merger and acquisition activity in the industry.

On August 9, 2010, China announced that it was closing down 19 metric tons (mt) of outdated cement capacity and 88.3mt of outdated clinker capacity, impacting a total of 762 cement producers across the country. In addition, it was reported that China will eliminate all of its outdated capacity by end of the 12th FYP period. (Source: China Cement Net, Cement Industry Restructuring Set to Start, September 13, 2010). On the other hand, China has issued various policies to encourage industry consolidation since 2005, and the latest one, entitiled “Advice to Promote Company M&A and Industry Restructuring” by China’s State Council on September 6, 2010, stipulates that the government will remove rules that limit cross-regional mergers and acquisitions and that local governments may sign agreements on splitting revenue from companies formed through cross-regional mergers and acquisitions, which removes the biggest obstacle for cross-region mergers and acquisitions. Nomura Research expects industry mergers and acquisitions to speed up in the next few years driven by both governments’ efforts and cement producers’ growth needs.

Construction Demand in China

China’s gross national construction output is expected to increase by 15% during the country’s 12th FYP period (2011-2015), according to a statement from China’s Ministry of Housing and Urban-Rural Development of China on August 18, 2011. During the same period consumption of C60 concrete in China is also expected to increase by 10%.

According to the Summary of Construction Outlook in China (the “Summary”), published in August 6, 2013 by the Freedonia Group, an industry research firm, construction expenditures in China are expected to increase 8.5 percent per year in real terms through 2017. Ongoing urbanization and industrialization, rising income levels, further population and household growth, and the government’s continuing efforts to expand and upgrade physical infrastructure in the country will support healthy growth in construction spending.

6

Construction expenditures in China are nearly equally split among residential buildings, nonresidential buildings, and nonbuilding structures. Each of these segments accounted for around one-third of the total construction market in 2012. Nonbuilding construction will see the fastest growth (in real terms) through 2017. Our industry will benefit from stated efforts to expand and upgrade the country’s transportation infrastructure, such as the “7918” highways network, subway systems in major cities, and several airports. Utilities construction will also contribute to nonbuilding construction spending gains, particularly in fast growing urban areas, as the government continues to expand and improve access to such infrastructure as water supply, sewage treatment, rubbish disposal, and gas distribution. Further efforts to increase the country’s power generation capacity and improve electricity transmission networks will also drive spending on nonbuilding construction.

China’s Cement & Concrete Demand

According to the Summary, demand for cement in China is forecast to rise 6.0% annually through 2012 to 1.8 billion mt. Growth will be driven by rising, but decelerating, construction expenditures in China. Further advances in cement manufacturing technology are also expected to help stimulate sales by improving the quality of the product, reflecting the versatility of these types across a range of construction applications, as well as their performance and/or price benefits over other types of cement. Regional cement markets reflect differences in construction expenditures, which in turn are driven by local trends in demographics, industrial output and economic activity. The cement markets in Northwest and Southwest China are expected to grow at a faster pace, as a result of the government’s Great Western Development strategy, which aims to promote investment in these areas. Consumption of cement in Central and Northern China is also expected to perform above the national average, supported by high levels of transportation infrastructure construction and booming urban markets in Beijing and Tianjin. (Summary of the Freedonia Group's January 2009 "Cement in China" report, from Business Wire).

Residential and non-residential buildings in China are increasingly requiring much more concrete due to, among other reasons, the short supply of wood. China is currently the largest consumption market of cement worldwide at over $200 billion annually. At the present rate, it is presumed that China will continue to be an important player in the global construction materials marketplace for at least the next two decades.

Demand for Ready-Mixed Concrete

Construction contractors are expected to continue to represent the largest market for cement. Economic downturns or reductions in government funding of infrastructure projects could significantly reduce our revenues. However, we believe that the ready-mix concrete market could exhibit the strongest growth in the cement industry. Gains are expected to benefit from government regulations banning on-site concrete and mortar mixing. Demand for cement used in concrete products is expected to be driven by the increasing popularity of precast concrete with many construction contractors. In addition, the phase-out of clay bricks will heighten demand for concrete blocks. Recognizing the significant environmental impact created from the large-scale construction activities undertaken in the past few decades, China’s government implemented Decree #341 in 2004 which bans onsite concrete production in over 200 major cities across China in order to reduce environmental damage from onsite cement mixing and improve the quality of concrete used in construction.

Our Competitive Strengths

7

Ready-mixed concrete is a highly versatile construction material that results from combining coarse and fine aggregates, such as gravel, crushed stone and sand, with water, various chemical admixtures and cement. We manufacture ready-mixed concrete in variations, which in each instance may reflect a specific design use. We generally maintain inventory of raw materials for a short period of time to coordinate our daily materials purchases with the time-sensitive delivery requirements of our customers.

The quality of ready-mixed concrete is time-sensitive as it becomes difficult to place within hours after mixing. Consequently, the market for a permanently installed ready-mixed concrete plant is usually limited to an area within certain radius of such plant’s location. We produce ready-mixed concrete in batches at our plants and use mixer and other trucks to complete the production process, distribute and deliver the concrete to the job sites of our customers.

Concrete has many attributes that make it a highly versatile construction material. In recent years, industry participants have developed various uses for concrete products.

We generally obtain contracts through local sales and marketing efforts directed at concrete sub-contractors, general contractors, property owners and developers, governmental agencies and home builders.

Our competition includes a number of state-owned and large private PRC-based manufacturers and distributors that produce and sell products similar to ours. We compete primarily on the basis of quality, technological innovation and price. Essentially all of the contracts on which we bid are awarded through a competitive bid process, with awards often being made to the lowest bidder, though other factors such as shorter schedules or prior experience with the customer are often just as important. Within our markets, we compete with many national, regional and local state-owned and private construction firms some of which have achieved greater market penetration or have greater financial and other resources than us. In addition, there are a number of larger national companies in our industry that could potentially establish a presence in our markets and compete with us for contracts. If we are unable to compete successfully in our markets, our relative market share and profits could be reduced.

We believe that the following competitive strengths enable us to compete effectively and to capitalize on the remaining growth potential of the market for construction materials in China:

• Large Scale Contractor Relationships. We have contracts with major construction contractors which are constructing key infrastructure, commercial and residential projects. Our sales efforts focus on large-scale projects and large customers which place large recurring orders and present less credit risk to us. For the year ended June 30, 2013, five customers accounted for approximately 22% of the Company’s sales and 8.15% of the Company’s account receivables as of June 30, 2013.

Should we lose these customers in the future and are unable to obtain additional customers, our revenues will suffer.

• Experienced Management. Management’s technical knowledge and business relationships gives us the ability to secure major infrastructure projects, which provides us with leverage to acquire less sophisticated operators, increase production volumes, and implement quality standards and environmentally sensitive policies. If there is any significant turnover in our senior management, it could significantly deplete the institutional knowledge held by our existing senior management team.

• Innovation Efforts. We strive to produce the most technically and scientifically advanced products for our customers and maintain close relationships with Tsinghua University, Xi’an University of Architecture and Technology and Beijing DongfangJianyu Institute of Concrete Science &Technology which assist us with our research and development activities. During our five year agreement with the Institute, we have realized an advantage over many of our competitors by gaining access to a wide array of resources and knowledge. In the year ended June 30, 2013, $2.3 million was paid under the agreement to the Institute. The Company incurred research & development expenses of approximately $2.2 million and $2.9 million for the years ended June 30, 2013 and 2012, respectively.

8

Our Growth Strategy

We are committed to enhancing profitability and cash flows through the following strategies:

• Focusing on High Capacity Utilization. We intend to focus on achieving high capacity utilization in order to operate our plants efficiently, by increasing capacity utilization at existing plants or expanding capacity by building new plants to meet existing contracts and anticipated increase in demand and by retiring under-utilized plants in the face of reduced demand. We increased capacity utilization at our four Beijing-based concrete plants significantly in fiscal 2011 when demand was increasing. During fiscal 2012 we retired ten portable stations in view of lower anticipated demand. We may begin to selectively sell or retire portable plant assets in fiscal year 2013 based on slowing demand for railway construction in connection with the suspension of new and ongoing high speed railway projects stemming from a changing policy announced by China’s Ministry of Rail and State Planning Commission.

• Mergers and Acquisitions. When capital permits, we intend to capitalize on the challenges that smaller companies are encountering in our industry by acquiring complementary companies at favorable prices. We believe that buying rather than building capacity is an option that may be attractive to us if replacement costs are higher than purchase prices. We continue to look into acquiring smaller concrete manufacturers in China as part of our expansion plans. We have not identified specified targets or entered into any Letters-of-Intent at this time.

• Vertical Integration. When capital permits, we plan to acquire smaller companies within the construction industry, develop more material recycling centers, and hire additional highly qualified employees. In order to accomplish this, we may be required to offer additional equity or debt securities. Certain of the companies we may seek to acquire are suppliers of the raw materials we purchase to manufacture our products. If we do acquire such companies we will have greater control over our raw material costs.

• Supply Chain Efficiencies and Scale. We intend to streamline our supply chain process and leverage our economies of scale.

• New Product Offering. We plan to produce a lightweight aggregate concrete for use in projects and to expand product offerings to include pre-cast concrete.

Our Operations

We provide materials and services through our network of ready-mixed concrete plants in Beijing (two as of June 30, 2013) and portable plants (three as of June 30, 2013) located in Anhui province. We own one concrete plant and its related equipment, and we lease one additional plant in Beijing.

Our manufacturing services are used primarily for our national high speed railway projects; almost all of our general contract contractors on the high speed railway projects supply the needed raw materials, which results in higher gross margins for us and reduces our upfront capital investments needed to purchase raw materials.

9

We also produce ready-mix concrete at portable plants, which can be dismantled and moved to new sites for new projects in less than a few weeks. The plants are currently located between railway stations and each of these plants is directly tied to contracts we have recently won and are expected to operate near capacity. Almost all of our general contractors supply raw materials for the projects, which results in higher gross margins for the Company and reduces our upfront capital investment on raw material purchases. The one time start-up cost for each portable plant and associated equipment is approximately $3 million, with cost optimization initiatives underway to bring the average cost down below $2.5 million per plant. Each plant is capable of generating approximately $2 million in revenue per year.

Products and Services

As architectural designs have become more complex, challenging, and modern in scope, the need for technology driven companies to provide high-end specialty concrete mixtures has been rapidly accelerating. Increasing demand for state-of-the-art cement mixtures has spurred our technological innovation and our ability to provide advanced mixtures of building materials that meet project specific engineering and environmental specifications. We produce a range of C10 to C100 concrete materials and specialize in an array of specialized ready-mixed concretes tailored to each project’s technical specifications and environmental standards. Our High Speed Rail clients require our concrete products be held to 100 year strength and survivability standard as tested by the local Ministry of Construction authority.

We specialize in “ready-mixed concrete”, a concrete mixture made at our facility with complete computerized operating systems. Such concrete accounts for nearly three-fourths of all concrete produced. Ready-mixed concrete is mixed on demand and is shipped to worksites by concrete mixer trucks.

Our ready-mixed concrete products consist of proportioned mixes we prepare and deliver in an unhardened plastic state for placement and shaping into designed forms at the job site. Selecting the optimum mix for a job entails determining not only the ingredients that will produce the desired permeability, strength, appearance and other properties of the concrete after it has hardened and cured, but also the ingredients necessary to achieve a workable consistency considering the weather and other conditions at the job site. We believe we can achieve product differentiation for the mixes we offer because of the variety of mixes we can produce, our volume production capacity and our scheduling, delivery and placement reliability.

We produce ready-mixed concrete by combining the desired type of cement, other cementitious materials and gravel and crushed stone with water and, typically, one or more admixtures. These admixtures, such as chemicals, minerals and fibers, determine the usefulness of the product for particular applications.

We use a variety of chemical admixtures to relieve internal pressure and increase resistance to cracking in subfreezing weather, retard the hardening process to make concrete more workable in hot weather, strengthen concrete by reducing its water content, accelerate the hardening process and reduce the time required for curing, and facilitate the placement of concrete having low water content.

We frequently use various mineral admixtures as supplements to cement, which we refer to as cementitious materials, to alter the permeability, strength and other properties of concrete.

The ready-mixed concrete sector in the concrete market is growing at a fast rate, largely due to the Chinese government’s implementation of Decree #341 in 2004. This law bans on-site concrete production in over 200 cities across China, with the goal of reducing environmental damages from onsite concrete mixing and improving the quality of concrete used in construction. The use of ready-mix concrete minimizes worksite noise, dirt and congestion, and most additives used in ready-mix concrete are environmentally safe. Our goal is to continue to use at least 30% recyclable components in our concrete mixtures.

10

We are building a comprehensive product portfolio that serves the diverse needs of our developing customer base and its unique construction and infrastructure projects. While we mainly specialize in ready-mix concrete formulations from controlled low-strength material to high-strength concrete, each specifically formulated to meet the individual needs of each project. We provide both industry standard and highly innovative products, including:

| Common Industry Mixtures | Industry Leading Mixtures | ||

| (Customized to Project) | Highly Technical Blends | ||

| [] | Ready-mixed Concrete Blends: C10 to C100 | [] | Compound Admixture Concrete |

| [] | Controlled Low-Strength Material (CLSM) | [] | Lightweight Aggregate Concrete |

| [] | High-Strength Concrete with Customized Fibers | [] | Energy-saving Phase change thermostat concrete |

| [] | Soil Cement, Unique Foundation Concrete | [] | C100 High Performance Concrete |

Our Customers

For the fiscal year ended June 30, 2013, we had no customer, whose sales accounted for more than 10% of our total sales. Five customers accounted for approximately 22% and 11% of the Company’s sales for the years ended June 30, 2013 and 2012, respectively. The total accounts receivable from these customers amounted to approximately $7.8 million and $9.2 million as of June 30, 2013 and 2012, respectively.

Developing New Relationships

Our business will be damaged if project contracts with the Chinese government, for which we may act as a subcontractor are cancelled. Our sales strategy balances these risks focusing on building new long-term cooperative relationships with some of China’s top construction companies in order to benefit from their reputations and to enter new markets. Our sales representatives are actively building relationships with the Chinese government, general contractors, architects, engineers, and other potential sources of new business in our target markets. Our sales efforts are further supported by our executive officers and engineering personnel, who have substantial experience in the design, formulation and implementation of advanced construction and concrete materials projects.

Our Suppliers

We rely on third party suppliers of the raw materials to manufacture our products. Our top five suppliers accounted for approximately 27% and 12% of the Company’s purchases for the years ended June 30, 2013 and 2012, respectively. The total accounts payable to these suppliers amounted to approximately $5.5 million and $7.3 million as of June 30, 2013 and 2012, respectively.

11

Sales and Marketing

General contractors typically select their suppliers of ready-mixed concrete and precast concrete. In large, complex projects, an engineering firm or division within a state transportation or public works department may influence the purchasing decision, particularly if the concrete has complicated design specifications. In connection with large, complex projects and in government-funded projects generally, the general contractor or project engineer usually awards supply orders on the basis of either direct negotiation or a competitive bidding process. Our marketing efforts target general contractors, developers, design engineers, architects and homebuilders whose focus extends beyond the price of our product to quality, consistency and reducing the in-place cost.

Our marketing efforts are geared towards advancing China-ACMH as the supplier of choice for building China’s most modern and challenging projects. The Company is constantly seeking ways to raise its profile and leverage additional publicity. To this end, the Company plans to expand its presence at leading construction industry events and in periodicals to build on its successful reputation. The primary goal when expanding into new markets is to reinforce the sales effort by promoting positive testimonials and success stories from the Company’s strong base of high profile clients and projects. Our marketing and sales strategy emphasizes the sale of value-added products and solutions to customers.

Research and Development

Construction materials companies are under extreme pressure to respond quickly to industry demands with new designs and product innovations that support rapidly changing technical demand and regulatory requirements. We devote a substantial amount of attention to the research and development of advanced construction materials that meet the demands of project specific needs while striving to lead the industry in value, materials and processes. We have sophisticated in house R&D and testing facilities, a highly technical onsite team, access to highly specialized market research, cooperation with a leading research institution, experienced management and advisory board, and close relationships with leading concrete materials experts. Our research and development expense was approximately $2.2 million in the year ended June 30, 2013, as compared to $2.9 million for the year ended June 30, 2012.

University Relationships & Cooperation Agreements

We have strong relationships with Tsinghua University and the Xi’an University of Architecture and Technology. We signed a ten-year cooperation agreement with Xi’an University on June 10, 2007. Xi’an University is a top university in the fields of building and material science research and education and works with the Company to follow the advancements of the cement and concrete industries globally.

Beijing Concrete Institute Partnership

The Beijing DongfangJianyu Institute of Concrete Science & Technology, or Beijing Concrete Institute, has 40 employees, with five senior research fellows, and 15 mid-level researchers. The Institute and its staff have participated and collaborated with national and local government agencies to establish the following industry standards:

- Specification For Mix Proportion Design of Ordinary Concrete JGJ55-2000

- Code for Acceptance of Constructional Quality Of Concrete Structures GB 50204-2002

- Applied Technical Specification of Mineral Admixtures In Concrete DBJ/T01-64-2002

- Ready-Mixed Concrete GB/T 14902-2003

- Practice Code for Application of Ready-Mixed Mortar DBJ 01-99-2005

12

- Management Specification of Quality for Ready-Mixed Concrete

- Technical Requirement for Environmental Labeling Products Ready-Mixed Concrete HJ/T412-2007

We have a close association with the Beijing Concrete Institute and have been able to incorporate many of these research findings into our operations, products, and procedures. We work closely with the institute and, in return for sponsoring multiple research initiatives, have been granted exclusive work space for the development of the materials used for our existing plants’ regional projects.

We are able to use the Research Findings & Technical Publication and Procedures of the Beijing Concrete Institute in our business, which provides us with an advantage over many of our competitors. Because of our five year exclusive contract with the institute, our competitors are unable to benefit from the same findings for commercial use. Some of these findings include:

- Research on Compound Admixture HPC; 3rd Class Award for China Building Materials Science& Technology Progress.

- Research and Application of C100 HPC; 3rd Class Award for Beijing Science & Technology Progress.

- Research on pumping Light Aggregate Concrete; Innovation Award for China Building Materials Science& Technology.

- Research and Application of Green (nontoxic) HPC; First Prize for Beijing Science & Technology Progress.

- Construction Technology of HPC for the Capital International Airport

- Research on Production and Construction Technology of Phase Change Energy-saving Thermostat Concrete and Mortar

- Polycarboxylate Series High Performance Water Reducing Agent Compositing Technique

- State Swimming Center for Concrete Cracking Control Technology

In addition, we are able to collaborate closely with the institute and its executives who play a strong role recommending industry standards, advising on major infrastructure developments, and creating and maintaining strong connections with leading developers, construction companies, and governmental officials.

Successful Innovations

Some of our more advanced products and processes developed through our relationships with research institutes and universities include:

C100 High Performance Concrete

High Strength Concrete is often defined as concrete with a compressive strength greater than 6000 psi (41 MPa). The primary difference between high-strength concrete and normal-strength concrete relates to the compressive strength that refers to the maximum resistance of a concrete sample to applied pressure. Manufacturing high-strength concrete involves making optimal use of the basic ingredients that constitute normal-strength concrete.

Through our collaborative efforts, we have developed a high performance concrete which can be produced at an impermeable grade above P35, and can be used as self-waterproofing concrete for structural engineering, as the water-cement (W/C) ratio and carbonized shrinking is minimal and the structure is close-grained.

Only a limited number of firms in the Beijing area have the expertise to produce C100 High Performance Concrete.

13

Compound Admixture Concrete

This compound mineral mixture is a composite of coal powder, mineral powder and mineral activators blended to specific proportions. This mixture improves activity, filling, and super-additive effects of the concrete and also improves the compatibility between cement and aggregate.

Lightweight Aggregate Concrete & Innovative Pumping Technology

This procedure involves a pumping technology of lightweight aggregate. It is a pretreatment method of lightweight aggregate. Setting appropriate times and pressure, lightweight aggregate will reach an appropriate saturation state under pressure once it is put into a custom designed sealed pressure vessel. Lightweight aggregate concrete prepared using the above pretreatment method, will dry quicker under pumping pressure, and maintain consistency. Accordingly, lightweight aggregate concrete will be easily pumped which can shorten construction time.

Energy-saving Technologies of Phase Change Thermostat Concrete

Energy conservation concrete may adjust and reflect process temperature, and temperature self-control may solve cracking brought about by cement heat of hydration in large-scale concrete pours.

Polycarboxylate Series High Performance Water Reducing Agent Compositing Technique

The research and production of water reducing admixture would improve performance while lowering pollution and environmental impact. Super plasticizer Polycarboxylate series which reduces water requirements is an attractive additive in that it enables high strength concrete, super-strength concrete, high fluidity and super plasticizer concrete, and self-defense concrete. The water reduction of Polycarboxylate may reach 20% to 25%, which is higher than the Naphthaline water reducing agent, which is the current industry standard. The cost of the water reducing agent is competitve, and it may be used to prepare high strength and high performance concrete instead of Naphthaline.

Application of Reused Water in Concrete

The re-use of waste water of a concrete plant to mix concrete is significant as it can reduce production costs, minimize fresh water use and represent an efficient approach to address industrial waste. The practical application of this effort is a further step towards the goal of minimal pollution and emissions.

Our Competition

Our principal market, Beijing, has enjoyed stronger economic growth and a higher demand for construction than other regions of China. As a result, we believe that competitors will try to expand their sales and build up their distribution networks in Beijing. Our future success depends on our ability to establish and maintain a competitive position in the marketplace.

We compete primarily on the basis of quality, technological innovation and price. Our main competitors include JiangongShanggong Center, Jinyu Group Concrete, ZhuzongShanggong Center and ZhonghangKonggang Concrete.

14

Essentially all of the contracts on which we bid are awarded through a competitive bid process, with awards generally being made to the lowest bidder, though other factors such as shorter schedules or prior experience with the customer are often just as important. Within our markets, we compete with many national, regional and local construction firms. Some of these competitors have achieved greater market penetration or have greater financial and other resources than we do. In addition, we compete with a number of state-owned enterprises, which have significantly greater financial resources than we do and which may have a competitive advantage over us.

There are approximately 163 concrete mixture stations in the Beijing area. The concrete production industry is highly segmented, with no single supplier having greater than a 10% market share.

Intellectual Property

We currently own the following intellectual property rights:

C100 High Performance Concrete: Patent #2007102011320 Lightweight Pre-Processing Method and Device: Patent#200710201131.6 Compound mineral mixture with: Patent #200710107881.7

Lightweight Aggregate Pressure Pre-Heating Equipment: Utility Model# ZL200720200683.0

Environmental Matters

We are required to comply with environmental protection laws and regulations promulgated by the Ministry of Construction and the State Environmental Protection Administration. Some specific environmental regulations apply to sealed transportation of dust materials and final products, closed storage of sand and gravel, as well as reduction of noise and dust pollution on production sites and encouragement of the use of waste materials. The governmental regulatory authorities conduct periodic inspections. We have met all the requirements in the past inspections. We are one of 10 companies in the industry that have been awarded the honor of “Green Concrete Producer” by the PRC government.

Regulation

The company has been in compliance with all registrations and requirements for the issuance and maintenance of all licenses and certificates required by the applicable governing authorities, including the Ministry of Construction and the Beijing Administration of Industry & Commerce. The Ministry of Construction awards Level II and Level III qualifications to concrete producers in the PRC construction industry, based on criteria such as production capacity, technical qualification, registered capital and capital equipment, as well as performance on past projects. Level II companies are licensed to produce concrete of all strength levels as well as special concretes, and Level III producers are licensed to produce concrete with strength level C60 and below. We are a Level II concrete producer.

Additionally, to make improvements at our currently existing plants, we do not need to apply for regulatory approval. However, in order to build a new concrete plant, we will need to (i) apply for a business license from the local Administration of Industry and Commerce, (ii) receive environmental approval from the local Environmental Protection Bureau in the relevant district area, and (iii) apply for an Industry Qualification Certificate from the local Municipal Construction Committee. The time estimated to receive each of these approvals is approximately one month. In the past, we have not been rejected by any of these three regulators for approval.

15

Our Labor Force

As of June 30, 2013, we employed 453 full-time employees. The following table sets forth the number of our full-time employees by function as of June 30, 2013.

Employees/Independent Contractors and their Functions

| Management & Administrative Staff | 123 | 27.15% | ||||

| Sales | 21 | 4.64% | ||||

| Technical & Engineering Staff | 18 | 3.97% | ||||

| Production Staff | 19 | 4.19% | ||||

| Equipment & Maintenance | 8 | 1.77% | ||||

| Drivers & Heavy Equipment Operators | 1 | 0.22% | ||||

| Sub-Total | 190 | 41.94% | ||||

| Independent Contractors | 263 | 58.06% | ||||

| Total | 453 | 100% |

As required by applicable PRC law, we have entered into employment contracts with all of our officers, managers and employees. We believe that we maintain a satisfactory working relationship with our employees and we have not experienced any significant labor disputes or any difficulty in recruiting staff for our operations.

In addition, we are required by PRC law to cover employees in China with various types of social insurance and believe that we are in material compliance with the relevant PRC laws.

Insurance

We believe our insurance coverage is customary and standard for companies of comparable size in comparable industries in China.

Item 1A. Risk Factors

16

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

RISKS RELATED TO OUR BUSINESS

Our plans to build additional plants and to improve and upgrade our internal control and management system will require capital expenditures in fiscal year 2014.

Our plans to build additional plants and to maintain and continually upgrade our internal control and management systems in line with our growing scale will require significant capital expenditures in fiscal year 2014. We may also need further funding for working capital, investments, potential acquisitions and joint ventures and other corporate requirements. We cannot assure you that cash generated from our operations will be sufficient to fund these development plans, or that our actual capital expenditures and investments will not significantly exceed our current planned amounts. If either of these conditions arises, we may have to seek external financing to satisfy our capital needs. Our ability to obtain external financing at reasonable costs is subject to a variety of uncertainties. Failure to obtain sufficient external funds for our development plans could adversely affect our business, financial condition and operating performance.

Our business is subject to the risk of supplier concentration.

Our top five suppliers provide approximately 27% of the sourcing of the raw materials for our concrete production business. As a result of this concentration in our supply chain, our business and operations would be negatively affected if any of our key suppliers were to experience significant disruption affecting the price, quality, availability or timely delivery of their products. The partial or complete loss of one of these suppliers, or a significant adverse change in our relationship with any of these suppliers, could result in lost revenue, added costs and distribution delays that could harm our business and customer relationships. In addition, concentration in our supply chain can exacerbate our exposure to risks associated with the termination by key suppliers of our distribution agreements or any adverse change in the terms of such agreements, which could have an adverse impact on our revenues and profitability.

We may experience major accidents in the course of our operations, which may cause significant property damage and personal injuries.

Significant industry-related accidents and natural disasters may cause interruptions to various parts of our operations, or could result in property or environmental damage, increase in operating expenses or loss of revenue. The occurrence of such accidents and the resulting consequences may not be covered adequately, or at all, by the insurance policies we carry. In accordance with customary practice in China, we do not carry any business interruption insurance or third party liability insurance for personal injury or environmental damage arising from accidents on our property or relating to our operations other than our automobiles. Losses or payments incurred may have a material adverse effect on our operating performance if such losses or payments are not fully insured.

Our planned expansion and technical improvement projects could be delayed or adversely affected by, among other things, failures to receive regulatory approvals, difficulties in obtaining sufficient financing, technical difficulties, or human or other resource constraints.

17

We intend to expand new production facilities during the next few years. The costs projected for our planned expansion and technical improvement projects and expansion may exceed those originally contemplated. Costs savings and other economic benefits expected from these projects may not materialize as a result of any such project delays, cost overruns or changes in market circumstances.

To make improvements at our currently existing plants, we do not need to apply for regulatory approval. However, in order to build a new concrete plant, we will need to (i) apply for a business license from the local Administration of Industry and Commerce, (ii) apply for an Industry Qualification Certificate from the local Municipal Construction Committee, and (iii) receive environmental approval from the local Environmental Protection Bureau in the relevant district area. There is no guarantee that we will be able to obtain these regulatory approvals in a timely manner or at all.

Additionally, in order to construct a new concrete plant, we may need to apply for a short term loan from a local commercial bank to be used for working capital. Because the lending policies of the local commercial banks are subject to change, there is no guarantee that we will be able to obtain approval for such a loan with conditions favorable to us in a timely manner or at all.

Failure to obtain intended economic benefits from these new plants and technical improvements projects, either due to cost overruns, our failure to obtain the necessary regulatory approvals or our failure to obtain necessary loan financing on terms favorable to us could adversely affect our business, financial condition and operating performances.

We cannot assure you that our growth strategy will be successful.

One of our strategies is to grow through increasing the distribution and sales of our products by penetrating existing markets in China and entering new geographic markets in China. However, many obstacles to entering such new markets exist including, but not limited to, competition from established companies in such existing markets in the China. We cannot, therefore, assure you that we will be able to successfully overcome such obstacles and establish our products in any additional markets. Our inability to implement this growth strategy successfully may have a negative impact on our growth, future financial condition, results of operations or cash flows.

If we fail to effectively manage our growth and expand our operations, our business, financial condition, results of operations and prospects could be adversely affected.

Our future success depends on our ability to expand our business to address growth in demand for our products and services. In order to maximize potential growth in our current and potential markets, we believe that we must expand our manufacturing and marketing operations. Our ability to accomplish these goals is subject to significant risks and uncertainties, including:

• the need for additional funding to

construct additional manufacturing facilities, which we may be unable to obtain

on reasonable terms or at all;

• delays and cost overruns as a result of a

number of factors, many of which may be beyond our control, such as problems

with equipment vendors and manufacturing services provided by third-party

manufacturers or subcontractors;

• our receipt of any necessary government

approvals or permits that may be required to expand our operations in a timely

manner or at all;

• diversion of significant management attention and other

resources; and

• failure to execute our expansion plan effectively.

18

To accommodate our growth, we will need to implement a variety of new and upgraded operational and financial systems, procedures, and controls, including improvements to our accounting and other internal management systems, by dedicating additional resources to our reporting and accounting function, and improvements to our record keeping and contract tracking system. We will also need to recruit more personnel and train and manage our growing employee base. Furthermore, our management will be required to maintain and expand our relationships with our existing customers and find new customers for our services. There is no guarantee that our management can succeed in maintaining and expanding these relationships.

If we encounter any of the risks described above, or if we are otherwise unable to establish or successfully operate additional capacity or increase our output, we may be unable to grow our business and revenues, reduce our operating costs, maintain our competitiveness or improve our profitability and, consequently, our business, financial condition, results of operations, and prospects will be adversely affected.

If we are unable to accurately estimate the overall risks or costs associated with a project on which we are bidding on, we may achieve a profit lower than anticipated or even incur a loss on the contract.

Substantially all of our revenues and contract backlog are typically derived from fixed unit price contracts. Fixed unit price contracts require us to perform the contract for a fixed unit price irrespective of our actual costs. As a result, we realize a profit on these contracts only if we successfully estimate our costs and then successfully control actual costs and avoid cost overruns. If our cost estimates for a contract are inaccurate, or if we do not execute the contract within our cost estimates, then cost overruns may cause the contract not to be as profitable as we expected, or may cause us to incur losses. This, in turn, could negatively affect our cash flow, earnings and financial position.

The costs incurred and gross profit realized on those contracts can vary, sometimes substantially, from the original projections due to a variety of factors, including, but not limited to:

- onsite conditions that differ from those assumed in the original bid;

- delays caused by weather conditions;

- later contract start dates than expected when we bid the contract;

- contract modifications creating unanticipated costs not covered by change orders;

- changes in availability, proximity and costs of materials, including steel, concrete, aggregate and other construction materials (such as stone, gravel and sand), as well as fuel and lubricants for our equipment;

- availability and skill level of workers in the geographic location of a project;

- our suppliers’ or subcontractors’ failure to perform;

- fraud or theft committed by our employees;

- mechanical problems with our machinery or equipment;

- citations issued by governmental authorities

- difficulties in obtaining required governmental permits or approvals;

- changes in applicable laws and regulations; and

- claims or demands from third parties alleging damages arising from our work or from the project of which our work is part.

Economic downturns or reductions in government funding of infrastructure projects could significantly reduce our revenues.

Our business is highly dependent on the amount of infrastructure work funded by various governmental entities, which, in turn, depends on the overall condition of the economy, the need for new or replacement infrastructure, the priorities placed on various projects funded by governmental entities and national or local government spending levels. Decreases in government funding of infrastructure projects could decrease the number of civil construction contracts available and limit our ability to obtain new contracts, which could reduce our revenues and profits.

19

The worldwide recession and credit crisis could impact our business.

The tightening of credit in financial markets and the general economic downturn could adversely affect the ability of our customers, and suppliers to obtain the financing they need to make purchases from us, to perform their obligations under agreements with us or even to continue their operations. The credit tightening and decreased cash availability could also result in an increase in cancellation of orders for our products and services and/or a decrease in demand for our products and services in the markets in which we operate. While we believe that the effects of the recession and credit crisis have abated, we are unable to predict potential future economic conditions and disruptions in financial markets or their effect on our business and results of operations, but the consequences may be materially adverse.

Our concrete production plants in Beijing may be subject to a general city rezoning plan which, if implemented in the future, may require us to relocate or possibly permanently shut down certain of these plants.

Certain of our concrete production plants in Beijing may be subject to a general city rezoning plan which has been prepared by the Beijing municipal government. Under the rezoning plan, it is intended that the properties where these plants are located will be rezoned from industrial to commercial use. If and when implemented in respect of those properties, the rezoning plan may require us to vacate these properties and relocate the plants. In the event we are required to vacate the above properties, we would implement certain strategies to minimize any loss of production capacity during relocation. There can be no assurance that our strategies to deal with the relocation of the facilities can be implemented, or that such strategies can be implemented before we are required to vacate the above properties due to the proposed general city rezoning plan. If we are required to relocate the facilities, our results of operation and financial condition may be materially and adversely affected.

Our exposure to financially troubled customers or suppliers could harm our business, financial condition and operating results.

We provide manufacturing services to companies, and rely on suppliers, that have in the past and may in the future experience financial difficulty, particularly in light of recent conditions in the credit markets and the overall economy that affected access to capital and liquidity. As a result, we devote significant resources to monitor receivables and inventory balances with certain of our customers. If our customers experience financial difficulty, we could have difficulty recovering amounts owed to us from these customers, or demand for our services from these customers could decline. We have experienced delays in payment on our projects from China’s Ministry of Railways, or MOR. After the Minster of MOR was arrested for corruption charges, the MOR conducted payment chain audits; in addition, the MOR was under pressure to repay its debts incurred during the years of expansion. As a result, the MOR has delayed payments to construction companies, including us. Furthermore, the government tightened monetary policy in order to regulate inflation, which in turn led to delayed payment on our housing construction projects. Due to concern over inflation, the Chinese government began to tighten its monetary policy from October of 2010, which affected the real estate and construction industries adversely. As a result, our accounts receivable increased and the provision for doubtful accounts also increased. Some of our customers appeared to have the problems of declining business and shortage in cash. The allowance for doubtful accounts increased to approximately $36.5 million at June 30, 2013, compared to approximately $24.9 million at June 30, 2012. In fact, our provision for doubtful accounts, as a percentage of our overall accounts receivable, has decreased from approximately 46.6% as of June 30, 2012, to approximately 37.9% as of June 30, 2013. The inability to collect on our outstanding accounts receivable could adversely affect our operating cash flows and reduce our working capital. As a result, we may suffer material write-offs on our accounts receivable to bad debt expense. The inability of our suppliers to supply us with needed raw material could adversely affect our production process and therefore, we may not be able to fulfill our contract arrangements with customers.

20

We rely on internal models to manage risk, to provide accounting estimates and to make other business decisions. Our results could be adversely affected if those models do not provide reliable estimates or predictions of future activity.

We rely heavily on internal models in making a variety of decisions crucial to the successful operation of our business, including allowances for doubtful accounts and other accounting estimates. It is therefore important that our models are accurate, and any failure in this regard could have a material adverse effect on our results. Models are inherently imperfect predictors of actual results because they are based on historical data available to us and our assumptions about factors such as credit demand, payment rates, default rates, delinquency rates and other factors that may overstate or understate future experience. Our models could produce unreliable results for a number of reasons, including the limitations of historical data to predict results due to unprecedented events or circumstances, invalid or incorrect assumptions underlying the models, the need for manual adjustments in response to rapid changes in economic conditions, incorrect coding of the models, incorrect data being used by the models or inappropriate application of a model to products or events outside of the model’s intended use. In particular, models are less dependable when the economic environment is outside of historical experience, as has been the case recently. Due to the factors described above and in "Management’s Discussion and Analysis of Financial Condition and Results of Operations", we may, among other things, experience actual charge-offs that exceed our estimates and which are possibly greater than our allowance for doubtful accounts, or which require material adjustments to the allowance. Unanticipated and excessive default and charge-off experience can adversely affect our profitability and financial condition and adversely affect our ability to finance our business.

Our business will be damaged if project contracts with the Chinese government, for which we may act as a subcontractor are cancelled.

We do not enter into any contracts directly with the Chinese government. For contracts that are funded by the Chinese government, we place bids and enter into subcontracts with the private entity prime contractor. A sudden cancellation of a prime contract, and in turn our subcontract, could cause our equipment and work crews to remain idle for a significant period of time until other comparable work becomes available. This idle time could have a material adverse effect on our business and results of operations.

Our industry is highly competitive, with numerous larger companies with greater resources competing with us, and our failure to compete effectively could reduce the number of new contracts awarded to us or adversely affect our margins on contracts awarded.

Our competition includes a number of state-owned and large private PRC-based manufacturers and distributors that produce and sell products similar to ours. We compete primarily on the basis of quality, technological innovation and price. Essentially all of the contracts on which we bid are awarded through a competitive bid process, with awards generally being made to the lowest bidder, though other factors such as shorter schedules or prior experience with the customer are often just as important. Within our markets, we compete with many national, regional and local state-owned and private construction firms. Some of these competitors have achieved greater market penetration or have greater financial and other resources than us. In addition, there are a number of larger national companies in our industry that could potentially establish a presence in our markets and compete with us for contracts. As a result, we may need to accept lower contract margins in order to compete against these competitors. If we are unable to compete successfully in our markets, our relative market share and profits could be reduced.

21

We could face increased competition in our principal market.