1.1 | “Additional Term” is defined in Section 2.1. |

1.2 | “Affiliate” means any Person that directly or indirectly, through one or more intermediaries, controls or is controlled by or is under common control with another Person. The term “control” (including its derivatives and similar terms) means possessing the power to direct or cause the direction of the management and policies of a Person, whether through ownership, by contract, or otherwise. Without limiting the foregoing, any Person shall be deemed to be an Affiliate of any specified Person if such Person owns fifty percent (50%) or more of the voting securities of the specified Person, or if fifty percent (50%) or more of the voting securities of the specified Person and such Person are under common control. |

1.3 | “Agreement” is defined in the preamble of this agreement. |

1.4 | Annual Volume Commitment” means the product of the Daily Volume Commitment and the number of days in the applicable Contract Year. |

1.5 | “Applicable Law” means (i) any law, statute, regulation, code, ordinance, license, decision, order, writ, injunction, decision, directive, judgment, policy or decree of any Governmental Authority and any judicial or administrative interpretations thereof, or (ii) any applicable license, permit or compliance requirement of any Governmental Authority applicable to either Party, including environmental laws. |

1.6 | “Bankrupt” shall mean a person or entity that (i) is dissolved, other than pursuant to a consolidation, amalgamation or merger, (ii) becomes insolvent or is unable to pay its debts or fails or admits in writing its inability generally to pay its debts as they become due, (iii) makes a general assignment, arrangement or composition with or for the benefit of its creditors, (iv) institutes or has instituted against it a proceeding seeking a judgment of insolvency or bankruptcy or any other relief under any bankruptcy or insolvency law or other similar law affecting creditor's rights, or a petition is presented for its winding-up or liquidation, (v) has a resolution passed for its winding-up, official management or liquidation, other than pursuant to a consolidation, amalgamation or merger, (vi) seeks or becomes subject to the appointment of an administrator, provisional liquidator, conservator, receiver, trustee, custodian or other similar official for all or substantially all of its assets, (vii) has a secured party take possession of all or substantially all of its assets, or has a distress, execution, attachment, sequestration or other legal process levied, enforced or sued on or against all or substantially all of its assets, (viii) causes or is subject to any event which, under Applicable Law, has an analogous effect to any of the events specified in clauses (i) through (vii) above, inclusive, or (ix) takes any action in furtherance of, or indicating its consent to, approval of, or acquiescence in any of the foregoing acts. |

1.7 | “Barrels” means forty-two (42) gallons of 231 cubic inches per gallon at sixty degrees Fahrenheit (60°F). |

1.8 | “Batching Facilities” means the segregated storage and related facilities for batching services. |

1.9 | “Business Day” means any calendar day other than Saturdays and Sundays that commercial banks in Houston, Texas are open for business. |

1.10 | “Carrier” is defined in the preamble of this Agreement. |

1.11 | “Central Clock Time” means Central Standard Time, as adjusted for Central Daylight Time, as applicable. |

1.12 | “Change in Law” shall mean the adoption or implementation of any laws, rules or regulations by any Governmental Authority with jurisdiction subsequent to the Effective Date that was not reasonably foreseeable as of the Effective Date and which |

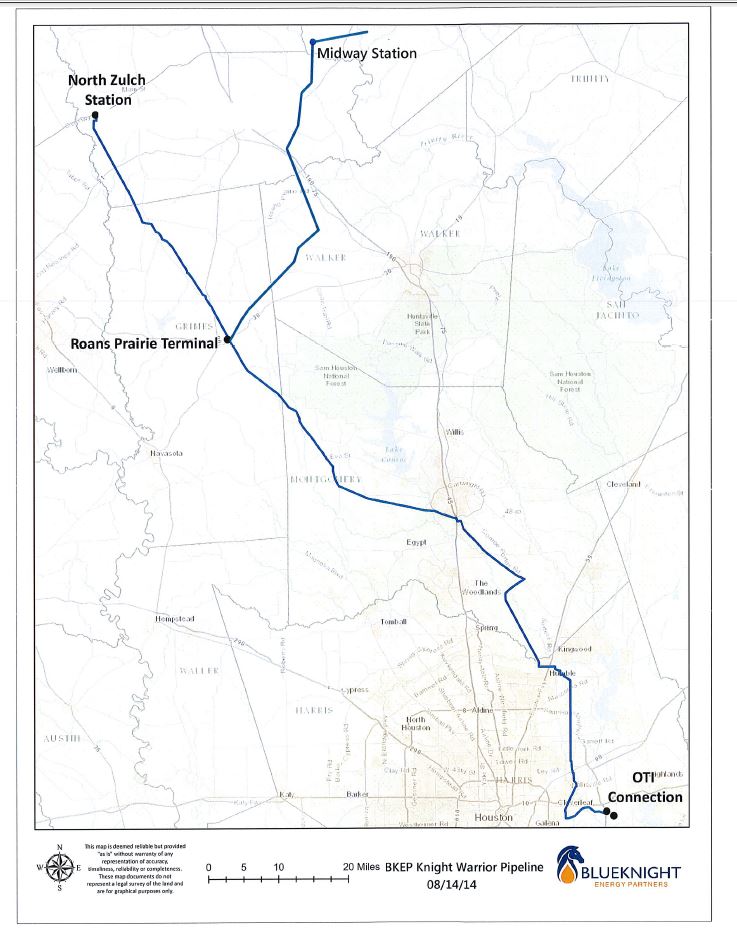

1.13 | “Change in Law Event” shall mean the occurrence of a Change in Law that necessitates the expenditure of Compliance Costs in order to operate the Knight Warrior Pipeline, irrespective of whether such costs are to be incurred as a onetime expenditure or periodically for an extended period. |

1.14 | “Commencement Date” is defined in Section 3.3 of this Agreement. |

1.15 | “Committed Shipper” is defined in the Rules and Regulations. |

1.16 | “Committed Shipper Credit” is defined in Section 5.1 of this Agreement. |

1.17 | “Complete” means the Knight Warrior Pipeline, the Truck Stations, the origin facilities, the delivery facilities, and associated systems and facilities such as the Batching Facilities, etc., are substantially complete and all permits and approvals have been obtained, such that the Knight Warrior Pipeline is ready to commence commercial service with respect to the receipt, transportation, handling, and delivery of Shipper’s Crude Oil in accordance with this Agreement. |

1.18 | “Compliance Costs” means actual non-Affiliate third party out-of-pocket expenditures, without mark-up, in excess of two million dollars ($2,000,000) incurred by Carrier and arising directly from the physical operation of the Knight Warrior Pipeline. |

1.19 | “Compliance Cost Recovery Period” means the period during which a Compliance Costs Surcharge is imposed for the purpose of recovering Compliance Costs. |

1.20 | “Compliance Costs Surcharge” has the meaning set forth in Section 4.6(a). |

1.21 | “Contract Year” means a period commencing at 7:00 a.m., Central Clock Time, on the Commencement Date and ending at 7:00 a.m., Central Clock Time, on the first Day of the Month of the following calendar year that coincides with or next follows the expiration of 12 months and thereafter for succeeding periods of 12 consecutive Months each. |

1.22 | “Credit Enhancement” has the meaning set forth in Section 6.4. |

1.23 | “Crude Oil” means the grade or grades of crude oil or liquid products that meet the specifications and other requirements set forth in the Rules and Regulations. |

1.24 | “Daily Volume Commitment” means a minimum of Forty Thousand (40,000) Barrels per Day (bpd). |

1.25 | “Day” or “Daily” means a period of twenty-four (24) hours, commencing at 7:00 a.m., Central Clock Time, on a calendar day and ending at 7:00 a.m., Central Clock Time, on the next succeeding calendar day. |

1.26 | “Defaulting Party” is defined in Section 15.2(a) of this Agreement. |

1.27 | “Deficiency Payment” is defined in Section 5.2(b) of this Agreement. |

1.28 | “Delivery Point” has the meaning set forth in the Rules and Regulations. |

1.29 | “Disputed Amount” is defined in Section 6.2(b) of this Agreement. |

1.30 | “Effective Date” is defined in the preamble of this Agreement. |

1.31 | “Event of Default” is defined in Section 15.1 of this Agreement. |

1.32 | “Extended Period” is defined in Section 9.3(a) of this Agreement. |

1.33 | “Extraordinary Operating Conditions” means operating conditions that result in the capacity of the Knight Warrior Pipeline available for shipments of Crude Oil, or a segment thereof, being reduced below the then committed volumes on the applicable segment(s), for any reason, including weather conditions, repairs or maintenance, but specifically excluding events of Force Majeure other than those related to weather or repairs or maintenance. |

1.34 | “FERC Index” means the current “Multiplier to Use” as identified in the “Oil Pipeline Index” published annually by the FERC at: http://www.ferc.gov/industries/oil/geninfo/pipeline-index.asp. |

1.35 | “Force Majeure” is defined in Section 9.1 of this Agreement. |

1.36 | “Force Majeure Volume” is defined in Section 9.3(b) of this Agreement. |

1.37 | “Governmental Authority” means (i) the United States of America, (ii) any state, county, parish, municipality or other governmental subdivision within the United States of America, and (iii) any court or any governmental department, commission, board, bureau, agency or other instrumentality of the United States of America or of any state, county, or municipality. |

1.38 | “Increase Threshold” is defined in Section 4.6(b) of this Agreement. |

1.39 | “Initial Term” is defined in Section 2.1 of this Agreement. |

1.40 | “Investment Grade” means a credit rating for Long Term Debt of at least “BBB-”, if rated by S&P, and “Baa3”, if rated by Moody’s. |

1.41 | “Knight Warrior Pipeline” is defined in the recitals of this Agreement. |

1.42 | “Letter of Credit” means an irrevocable standby letter of credit, in form and substance, and issued by a financial institution, reasonably acceptable to Carrier, which, without limitation, allows Carrier to demand full or partial payment thereunder in the event (i) of a Shipper default, or (ii) Carrier is entitled to damages in connection with or arising out of this Agreement or the termination or breach of this Agreement (including a breach arising out of the termination or rejection of this Agreement under the U.S. Bankruptcy Code or other applicable insolvency legal requirements), or (iii) Shipper does not deliver to Carrier a new Letter of Credit or extension, in the amount required by subsection 6.4(a), that satisfies the requirements of subsection 6.4(a). |

1.43 | “Long Term Debt” has the meaning set forth in Section 6.4. |

1.44 | “Losses” means any actual loss, cost, expense, liability, damage to person (including death) or property (including damage to the environment), demand, suit, sanction, claim, judgment, or lien. |

1.45 | “Moody’s” means Moody’s Investor Services, Inc., or its successor. |

1.46 | “Month” means a period of time beginning at 7:00 a.m., Central Clock Time on the first Day of the calendar month and ending at 7:00 a.m., Central Clock Time on the first Day of the next succeeding calendar month. |

1.47 | “Monthly Volume Commitment” means the product of the Daily Volume Commitment and the number of days in the applicable Month. |

1.48 | “Nomination” means Notice from Shipper to Carrier requesting that Carrier transport for Shipper in a given Month a stated volume of Shipper’s Crude Oil from the Origin Point to the Delivery Point under this Agreement, at the times and in the manner provided in the Rules and Regulations. |

1.49 | “Notice” is defined in Section 13.1 of this Agreement. |

1.50 | “Origin Point” has the meaning set forth in the Rules and Regulations. |

1.51 | “Parties” is defined in the preamble of this Agreement. |

1.52 | “Party” is defined in the preamble of this Agreement. |

1.53 | “Performing Party” is defined in Section 15.2(a) of this Agreement. |

1.54 | “Person” means any individual, firm, corporation, trust, partnership, limited partnership, master limited partnership, limited liability company, association, joint venture, other business enterprise or Governmental Authority. |

1.55 | “Prepaid Transportation Credit” is defined in Section 5.2(c)(i) of this Agreement. |

1.56 | “Quarter” means a three (3) consecutive Month period as follows: January through March, April through June, July through September, and October through December. |

1.57 | “Quarterly Deficiency Volume” is defined in Section 5.2(a) of this Agreement. |

1.58 | “Quarterly Volume Commitment” means the product of the Daily Volume Commitment and the number of days in the applicable Quarter. |

1.59 | “Rating Agencies” means Moody’s and S&P. |

1.60 | “RRC” means the Railroad Commission of Texas or any successor agency. |

1.61 | “Rules and Regulations” is defined in Section 4.2 of this Agreement. |

1.62 | “S&P” means Standard & Poor’s Rating Services (a division of McGraw-Hill, Inc.) or its successor. |

1.63 | “Shipper” is defined in the preamble of this Agreement. |

1.64 | “Shipper History” is defined in the Rules and Regulations and shall be deemed to be the Annual Volume Commitment for the first twelve (12) months, and thereafter shall be deemed to be the greater of the Annual Volume Commitment and actual shipments. |

1.65 | “Shipper’s Capacity” is defined in Section 15.2(b) of this Agreement |

1.66 | “Shipper’s Crude Oil” means all Crude Oil delivered by Shipper to the Origin Point for transportation on the Knight Warrior Pipeline by Carrier to the Delivery Point. |

1.67 | “Tank Bottoms” is defined in Section 3.4(a) of this Agreement. |

1.68 | “Taxes” means any or all taxes, fees, levies, charges, assessments and/or other impositions levied, charged, imposed, assessed, or collected by any Governmental Authority having jurisdiction. |

1.69 | “Term” is defined in Section 2.1 of this Agreement. |

1.70 | “Third Party Rates” is defined in Section 16.15 of this Agreement. |

1.71 | “Throughput Fees” are as set forth in Exhibit C. |

1.72 | “Truck Stations” means those facilities identified and described as Truck Stations in Exhibit A. |

1.73 | “Uncommitted Shipper” has the meaning set forth in the Rules and Regulations. |

2.1 | Term. The initial term of this Agreement shall commence on the Commencement Date and, unless terminated as provided below, shall remain in full force and effect until the end of the fifth (5th) Contract Year (the “Initial Term”). Shipper has the option to extend the Initial Term of this Agreement for two additional terms of five (5) consecutive Contract Years each (each an “Additional Term”) by providing Notice to Carrier no later than 12 Months prior to the end of the Initial Term or the first Additional Term, as applicable. The Initial Term, as it may be extended under Section 9.3(a), and any Additional Terms are collectively referred to herein as the “Term.” |

2.2 | Early Termination. This Agreement may be terminated early as follows: |

(a) | by Carrier if (i) Shipper fails to perform any of its material obligations under this Agreement and (ii) such failure is not (x) excused by an event of Force Majeure under Article 9 or (y) cured by Shipper within sixty (60) Days after Notice thereof by Carrier to Shipper, or if such failure cannot be cured within such 60-Day period, Shipper has not commenced remedial action to cure such failure (and continued to diligently and timely pursue the completion of such remedial action); |

(b) | by Shipper if (i) Carrier fails to perform any of its material obligations under this Agreement and (ii) such failure is not (x) excused by an event of Force Majeure under Article 9 or (y) cured by Carrier within sixty (60) Days after Notice thereof by Shipper to Carrier, or if such failure cannot be cured within such 60-Day period, Carrier has not commenced remedial action to cure such failure (and continued to diligently and timely pursue the completion of such remedial action); |

(c) | by Carrier if Shipper fails to pay any undisputed amount when due under this Agreement (or fails to meet any of its other financial obligations hereunder) if such failure is not remedied within ten (10) Business Days after Notice of such failure is given by Carrier to Shipper; |

3.1 | Construction of Facilities. Carrier, at its sole cost and expense, shall design, engineer, construct, and equip, or caused to be designed, engineered, constructed, and equipped, the facilities described in and in accordance with the general specifications in Exhibit A. |

3.2 | Pipeline Construction. As of the Effective Date, subject to the terms of this Agreement, Carrier shall begin project design, permitting, engineering, and other work with respect to the Knight Warrior Pipeline and shall use commercially |

3.3 | Commencement Date. The “Commencement Date” under this Agreement shall be the first day of the Month following the date that is thirty (30) Days after Carrier Notifies Shipper that the Knight Warrior Pipeline is Complete. |

3.4 | Tank Bottoms and Line Fill. |

(a) | Tank Bottoms. Upon Completion of the Knight Warrior Pipeline (but in no event earlier than sixty (60) Days prior to the Commencement Date), and upon commissioning of any additional tanks, Carrier shall deliver to Shipper a request for Shipper’s pro-rata portion of Carrier’s tank bottoms required to be carried by Shipper. Shipper shall be responsible for up to ten (10%) of the shell capacity of any Carrier tank or tanks designated by Carrier as a Shipper designated tank. Shipper or an affiliate of the Shipper shall provide to Carrier, at no cost to Carrier, Crude Oil required for tank bottoms to facilitate operation of the Knight Warrior Pipeline (the “Tank Bottoms”). Carrier will deliver to Shipper or an affiliate of the Shipper, at the Delivery Point, the Tank Bottoms within thirty (30) Days after Shipper ceases making shipments, provided that the parties may agree, if possible, to make physical delivery of the Tank Bottoms, arrange for a trade of like barrels to Shipper or an affiliate of the Shipper, otherwise financially settle the return of the Tank Bottoms, or a different time period for delivery. |

(b) | Line Fill. Subject to and in accordance with the provisions of the Rules and Regulations, when Shipper ceases making shipments, Carrier shall deliver to Shipper at the Delivery Point all of Shipper’s Crude Oil in the Knight Warrior Pipeline or otherwise available for shipment. Redelivery shall be completed as batches transit the Knight Warrior Pipeline with expected transit time based on batch size; provided, however, in no event shall the transit time exceed ninety (90) Days. As shipments are nominated an estimated window of delivery dates will be provided by Carrier. Shipper, an affiliate of the Shipper or a party whom the Shipper has the right to transport that party’s Product will at all times retain title to its Crude Oil in transit and Tank Bottoms and Carrier will provide a monthly statement to Shipper of Crude Oil and Tank Bottoms. |

3.5 | Pre-Commencement Date Service. Upon notification by Carrier to Shipper that a portion of the Knight Warrior Pipeline is operational prior to the Commencement Date, Shipper, at its sole option, may elect to tender Crude Oil to Carrier for service hereunder with respect to such portion of the Knight Warrior Pipeline. If Shipper elects to transport Crude Oil on the Knight Warrior Pipeline prior to the Commencement Date, Shipper will provide its pro rata share of Crude Oil required for line fill on the applicable portion of the Knight Warrior Pipeline (and any |

4.1 | Transportation Services. Upon the Commencement Date, under and subject to the terms and conditions of this Agreement, Carrier shall provide receipt, transportation, and delivery services, including batching, subject to the proration provisions set forth in the Rules and Regulations, for volumes of Shipper’s Crude Oil, which have been properly Nominated and delivered by Shipper at an Origin Point, from such Origin Point to the Delivery Point. Carrier shall also operate and maintain the Knight Warrior Pipeline at a level that is consistent with the level of operation and maintenance that is typical for other similar crude oil pipelines that meet all Applicable Laws and industry regulations and standards. The operator of the Knight Warrior Pipeline shall be BKEP Pipeline, L.L.C. and, notwithstanding the provisions of Article 12, any replacement operator shall be subject to the prior written approval of Shipper, which approval shall not be unreasonably withheld. |

4.2 | Rules and Regulations. The Parties acknowledge that as of the Effective Date, Carrier is a common carrier for hire regulated by the RRC. Shipper is a Committed Shipper for purposes of the Knight Warrior Pipeline. As such, all transportation to be performed hereunder shall be subject to the rules and regulations in Carrier’s applicable tariffs in effect from time to time and on file with the RRC (as amended from time to time, the “Rules and Regulations”). A copy of such Rules and Regulations on file as of the Effective Date with the RRC is attached hereto and incorporated herein as Exhibit B. The Parties agree that the Throughput Fees, the Annual Volume Commitment, and the other provisions contained herein are essential to support the respective commitments of the Parties as described in this Agreement. Except as expressly provided herein, nothing in this Agreement shall be deemed to in any way restrict, waive, or otherwise limit Shipper’s right to initiate or participate in any governmental, regulatory, administrative or judicial proceedings. The Parties further agree that nothing in this Agreement, and none of the rates associated with this Agreement, shall be used by either Party in any other proceeding to attempt to demonstrate any rate not subject to the specific terms of this Agreement is or is not just and reasonable or otherwise in compliance with applicable law, rules, or regulations. |

4.3 | Shipper History. Shipper, an affiliate of the Shipper or a party whom the Shipper has given the right to transport the Shippers’ Crude Oil, shall, at all times during the Term, earn and hold one hundred percent (100%) of the Shipper History in its own name as the “shipper of record” of Shipper’s Crude Oil for purposes of any |

4.4 | Modification to Rules and Regulations. Carrier retains the right to modify the Rules and Regulations applicable to the Knight Warrior Pipeline without the permission of Shipper so long as such modifications will not unreasonably interfere with Shipper’s rights under this Agreement or adversely affect Shipper. Carrier will not support any modification to the applicable Rules and Regulations that would change Shipper’s rights as a Committed Shipper to transport up to the Daily Volume Commitment without proration if nominations by non-Committed Shippers exceed available capacity, except to the extent required by Applicable Law. Carrier will provide written notice to Shipper thirty (30) Days in advance of the proposed effective date for any changes to the Rules and Regulations. |

4.5 | Escalation. Carrier may adjust the Throughput Fee annually each July 1 after the Commencement Date, to reflect inflation adjustments; provided however that in no event shall Carrier be required to reduce its Throughput Fee to reflect a negative inflation adjustment The inflation adjustment will be in accordance with the lower of (a) the inflation adjustment promulgated by the Federal Energy Regulatory Commission (the “FERC Index”) or (b) one hundred and four percent (104%). In the event the FERC Index is greater than four percent (4.0%) in any given year, then the difference between the FERC Index and (b) above will be accrued and carried forward and added to future years FERC Index in subsequent years where the FERC Index is less than four percent (4.0%). For example, if the FERC Index is five percent (5.0%) in a year three post the Commencement Date, and three percent (3.0%) in year four post the Commencement Date, then the FERC Index adjustment shall be capped at four percent (4.0%) in year three when the FERC Index is five percent (5.0%) and the FERC Index adjustment shall be increased to four percent (4.0%) in year four when the calculated FERC Index is three percent (3.0%). If, during the term of this Agreement, the FERC’s indexing methodology is discontinued, the Throughput Fee shall continue pursuant to be escalated annually as of July 1 using the Producer Price index (“PPI”). Shipper agrees to not oppose changes to the Throughput Fee that Carrier makes during the Term pursuant to this Section 4.5. The Throughput Fees are based upon the Annual Volume Commitment, which shall be maintained throughout the Term until this Agreement is terminated or cancelled. |

4.6 | Compliance Costs. |

(a) | Carrier shall deliver written notice to Shipper and every other shipper on the Knight Warrior Pipeline of any Change in Law Event promptly upon learning of such event. If during the Term, Carrier becomes obligated solely as a result of a Change in Law Event to bear Compliance Costs, Carrier shall be entitled to seek recovery of the Compliance Costs in accordance with the terms hereof. Such Compliance Costs shall be recovered through a surcharge (“Compliance Costs Surcharge”) that is applicable equally to each Barrel |

(b) | Carrier shall notify Shipper, not less than ninety (90) Days prior to the implementation of any increase pursuant to this Section of the amount of such proposed increase, the reason for such increase, and the method of calculating such increase. Shipper shall have the right to notify Carrier within thirty (30) Days after Shipper receives Carrier’s notice, of Shipper’s decision not to pay such increase, but only to the extent such increase is greater than twenty percent (20%) (“Increase Threshold”) of the unadjusted rate that is affected. Shipper shall have no right to object to or refuse any increase in the rate up to the Increase Threshold, other than to object to Carrier’s calculations, and shall be bound by any increase up to the Increase Threshold. If Shipper fails to timely notify Carrier of its decision, then it shall be deemed for purposes of this Agreement that Shipper accepts and approves such increase. Carrier may, in its sole discretion, elect whether or not to request any such increase allowed under this Section. If the cost is over the Increase Threshold and Shipper decides not to pay such increase, Carrier may stop operating the Knight Warrior Pipeline with no liability to Shipper. |

(c) | Any Compliance Costs Surcharge implemented, amended or modified by Carrier shall be supported with detailed work papers and reasonable support for the Compliance Costs expended or to be expended and shall be provided to Shipper and all other shippers, if any, on the Knight Warrior Pipeline. Carrier shall have the right, in its sole good faith discretion, but subject to the other provisions of this Section 4.6, to amend or modify the Compliance Costs Surcharge with respect to the amount or duration of the Compliance Costs Surcharge. Any such modification or amendment shall be included in the Rules and Regulations. If Carrier proposes any increase pursuant to this section, Shipper shall be entitled to audit Carrier’s applicable books and |

(d) | Effective as of the date of Carrier’s recovery of the Compliance Costs through the Compliance Costs Surcharge, Carrier shall remove the Compliance Costs Surcharge from the Rules and Regulations and shall immediately stop collecting the Compliance Costs Surcharge from Shipper and all other shippers, if any, on the Knight Warrior Pipeline. In such event, Carrier shall promptly provide written notice to Shipper and all other shippers, if any, on the Knight Warrior Pipeline, that such recovery of the Compliance Costs has been completed, which notice shall include a statement of the total Compliance Costs recovered and the volumes against which the Compliance Costs Surcharge were assessed in recovering such Compliance Costs. |

5.1 | Volume Commitment. |

(a) | During the Term, Shipper agrees to (i) ship Crude Oil on the Knight Warrior Pipeline (A) in accordance with the terms of this Agreement, (B) at the then effective Throughput Fee, and (C) in quantities equal to the Quarterly Volume Commitment for each Quarter, or (ii) pay any Deficiency Payment. |

(b) | Volume Increases. On the Effective Date, the Daily Volume Commitment is 40,000 barrels. Shipper shall have the right to increase the Daily Volume Commitment by any amount up to 30,000 barrels (in increments of 5,000), prior to the Commencement Date, subject to Carrier’s availability on the Knight Warrior Pipeline, by providing written notice to Carrier. After the Commencement Date, Shipper shall have the right to increase the Daily Volume Commitment (in increments of 5,000) by any amount up to 30,000 barrels (in increments of 5,000), less any increases in the Daily Volume Commitment by Shipper pre-Commencement Date, and will notify the Carrier in writing of such volumes within a commercially reasonable timeframe. In the event that Carrier does not have sufficient availability to accommodate the Shipper’s requested increase in the Daily Volume Commitment (after setting aside Available Capacity reserved for committed shippers plus a reserve of ten (10) percent of the Available Capacity of Knight |

(c) | Committed Shipper Volume Commitment Credit. During the initial Term and any Additional Term (if any), the Shipper shall receive a *** reduction in Shipper’s Daily Volume Commitment, up to a maximum Daily Volume Commitment reduction of *** barrels (“Committed Shipper Credit”), for the time during which ***. At no time shall the Shipper’s Daily Volume Commitment, taking into account the Committed Shipper Credit, be lower than *** barrels, during the Term or any Additional Term. The Carrier will be required to provide quarterly notifications to Shipper of the aggregate *** on the Knight Warrior Pipeline within ten (10) days of each calendar quarter end. Prior to the Commencement Date, ***. The Committed Shipper Credit shall not be retro-active. Any Quarterly Deficiency Volume calculated per Section 5.2 shall not be reduced on a retro-active basis by any Committed Shipper Credit. |

(a) | Definition. For purposes of this Agreement, a “Quarterly Deficiency Volume” for a particular Quarter means the amount (in Barrels), determined as of the end of such Quarter, by which the Quarterly Volume Commitment exceeds the total volume (in Barrels) of Shipper’s Crude Oil received by Carrier at an Origin Point during such Quarter under this Agreement. |

(b) | Deficiency Payments. Except as provided in Section 5.2(d), if a Quarterly Deficiency Volume exists as of the end of any Quarter, then Shipper shall pay to Carrier an amount equal to the product of (i) the Quarterly Deficiency Volume for such Quarter and (ii) the Throughput Fee in effect for such Quarter (such product being the “Deficiency Payment”). Any Deficiency Payment due by Shipper hereunder shall be paid by Shipper as provided in Article 6. |

(c) | Prepaid Transportation Credits. |

(i) | If Daily Volume Commitment is 20,000 bpd or more, then any Deficiency Payments made by Shipper to Carrier under the provisions of this Section 5.2 shall constitute prepayment for services hereunder (a “Prepaid Transportation Credit”) that may be carried forward for twelve (12) months; provided, however, such twelve (12) month period shall be extended on a month for month basis for every month that Shipper nominates volume in excess of its Monthly Volume Commitment but is unable to ship such excess volume as a result of the proration policy set forth in the Rules and Regulations. |

(ii) | If this Agreement has Terminated other than for termination pursuant to the provisions of Section 2.2(a), Section 2.2(c), or a Shipper default pursuant to Article 15 hereof, then any available Prepaid Transportation Credit shall carry forward in accordance with the periods set forth above. |

(iii) | Prepaid Transportation Credits may be utilized solely against shipments of Crude Oil in excess of the Quarterly Volume Commitment, which are accepted for transportation by Carrier subject to available space and in accordance with the then-effective proration policy under the Rules and Regulations, and shall be applied against the transportation charges for such volumes at the rates set forth in this Agreement. |

6.1 | Billing. No later than the 15th day of each Month after the Commencement Date, Carrier shall deliver to Shipper a statement for transportation services provided in the preceding Month setting forth (i) the volumes of Shipper’s Crude Oil (in Barrels) received at the Origin Point in that preceding Month, (ii) the Throughput Fees for that preceding Month, (iii) any adjustments for prior periods, and (iv) all other amounts due by Shipper hereunder, including any Deficiency Payments. Carrier’s invoices shall include information reasonably sufficient to explain and support any estimates and charges reflected therein, the reconciliation of any estimates made in a prior Month to any actual measurements, and any adjustments to prior period volumes and quantities. |

6.2 | Payment. |

(a) | Subject to Section 6.2(b), Shipper shall remit to Carrier amounts due under Section 6.1 by wire transfer by the later of (i) ten (10) Days after Shipper’s receipt of the statement referenced above and (ii) the twentieth (20th) Day of each Month, to the bank account specified by Carrier on the face of the statement. If such due date is not a Business Day, payment is due on the next Business Day following such date. |

(b) | If Shipper disputes any portion of any invoice (the “Disputed Amount”), Shipper shall promptly Notify Carrier of the Disputed Amount and pay the undisputed portion according to the terms of this Article 6. After receipt of such Notice, Carrier shall promptly work with Shipper to resolve the dispute. If the Parties are unable to resolve such dispute within thirty (30) Days after receipt of such Notice, the Parties will submit to dispute resolution in accordance with Article 10. |

6.3 | Late Payments. If Shipper fails to pay any amount hereunder when due (including disputed amounts that are not paid by the due date, but are later determined to be owed), interest thereon shall accrue on the unpaid amounts in the manner provided in the Rules and Regulations. |

6.4 | Financial Assurances. |

6.5 | Failure to Provide Credit Enhancement. In the event Shipper fails to comply with any obligation in Section 6.4 on or before the due date therefore, Carrier shall not be obligated to provide Shipper with access to the Knight Warrior Pipeline or to provide Services pursuant to this Agreement until such requirement is fully met. |

6.6 | Use of Credit Enhancement. Credit Enhancement may be applied by Carrier, in its sole discretion, against any losses suffered by Carrier in connection with this Agreement or damages to which Carrier is entitled in connection with this Agreement |

6.7 | Ongoing Payment Obligations. Notwithstanding that any Credit Enhancement shall have been provided under Section 6.4, Shipper shall continue to make ongoing payments under this Agreement, as and when such payments are due and payable under the terms hereof and thereof. |

7.1 | Title Warranty. Shipper represents and warrants to Carrier that Shipper has title to, or the right to transport, all of Shipper’s Crude Oil delivered hereunder. |

7.2 | Title to the Product. Title to the Crude Oil transported, stored and/or handled hereunder shall always remain with Shipper, an affiliate of the Shipper or with a party whom the Shipper has the right to transport that party’s Crude Oil. |

7.3 | Title Indemnity. SHIPPER AGREES TO INDEMNIFY AND HOLD CARRIER HARMLESS FROM ANY AND ALL CLAIMS AND LOSSES INCURRED BY CARRIER IN CONNECTION WITH, OR IN ANY MANNER WHATSOEVER RELATING TO, THE BREACH OF THE REPRESENTATION MADE BY SHIPPER IN SECTION 7.1. |

9.1 | Definition. For purposes of this Agreement, “Force Majeure” means acts of God, acts of federal, state, or local government or any agencies thereof, compliance with rules, regulations, or orders of any Governmental Authority or any office, department, agency, or instrumentality thereof, strikes, lockouts, or other industrial disturbances, acts of the public enemy, acts of terrorism, wars, blockades, insurrections, riots, epidemics, landslides, lightning, earthquakes, fires, hurricanes, floods, or other adverse and severe weather conditions, washouts, civil disturbances, explosions or breakage of machinery, equipment, or lines or pipes of a Party (provided that such breakage is not caused by a Party’s failure to maintain its machinery, equipment and lines of pipes in accordance with standard industry practices), freezing of wells or lines of pipes, embargoes, or expropriations of Governmental Authorities, inability to secure or obtain or delays in securing or obtaining necessary and properly sought rights‑of‑way, easements, or similar property rights or material permits or other authorizations in connection with the Knight Warrior Pipeline, and any other cause or event, not reasonably within the control of the Party claiming suspension, and the inability to deliver Crude Oil to the Delivery Point or receive and take away Crude Oil at the Delivery Point as a result of the foregoing events. Force Majeure shall not include (i) increases in costs of materials, (ii) a Party’s financial difficulties that impair its ability to perform, (iii) conditions resulting from changes in the price of, or the market for, Crude Oil or other hydrocarbons, (iv) the depletion of Shipper’s wells or other failure by Shipper to secure a source of Crude Oil (including by purchase) for a reason not specifically enumerated above; or (v) the inability of a third party to perform a service or supply a product or material, excepting services or supply of product or materials during the construction of facilities prior to the Commencement Date. |

9.2 | Effect of Force Majeure. |

(a) | Effect. Subject to the provisions of this Article 9, if a Party is prevented from performing its obligations under this Agreement due to an event of Force Majeure then, to the extent that it is so prevented, that Party’s failure to perform shall not be considered a breach of its obligations under this Agreement, and the affected obligations of that Party shall be relieved during the continuance of that Party’s inability to perform caused by the event of Force Majeure, but for no longer period. |

(b) | Remedy. The Party affected by an event of Force Majeure shall use commercially reasonable efforts to promptly remedy and mitigate the effects of the event of Force Majeure. No Party shall be compelled to resolve any strikes, lockouts, or other industrial disputes other than as it shall determine to be in its best interests. |

(c) | Termination by Carrier. If an event of Force Majeure that prevents Shipper from delivering any volumes of Shipper’s Crude Oil under this Agreement continues for a period of one hundred eighty (180) consecutive Days or longer or more than one hundred eighty (180) Days at any time during the Term, then Carrier shall have the right to terminate this Agreement upon Notice to Shipper. |

(d) | Termination by Shipper. If, except during the period preceding the Commencement Date, an event of Force Majeure that prevents Carrier from receiving and transporting any volumes of Shipper’s Crude Oil, or providing adequate means for alternate transportation, under this Agreement continues for a period of one hundred eighty (180) consecutive Days or longer or more than one hundred eighty (180) Days at any time during the Term, then Shipper shall have the right to terminate this Agreement upon Notice to Carrier with no liability of Shipper to Carrier for Throughput Fees, Deficiency Payments or Compliance Costs except as the foregoing was incurred prior to the termination by Shipper pursuant to this provision. |

(e) | Notice. If a Force Majeure event renders a Party unable, in whole or in part, to carry out its obligations under this Agreement, that Party shall use commercially reasonable efforts to give a timely notice to the other Party Notice and full particulars and a reasonable, good-faith estimate of the number of days of Force Majeure delay that will be caused thereby. The Party providing the Notice shall use commercially reasonable efforts to ameliorate the Force Majeure conditions |

9.3 | Volume Commitment Adjustments. If a Force Majeure event affects a Party’s ability to deliver or receive and transport hereunder the Daily Volume Commitment of Shipper’s Crude Oil on any Day in a Contract Year, then the following shall occur: |

(a) | the Term shall be extended for a period corresponding to the duration of such event of Force Majeure (the “Extended Period”); |

(b) | the Quarterly Volume Commitment corresponding to the period during which such Force Majeure event occurs will be reduced by an amount equal to the volume of Shipper’s Crude Oil not transported by Carrier due to such Force Majeure event (such volume reduction is referred to herein as the “Force Majeure Volume”); and |

(c) | a new Annual Volume Commitment shall be established for the Extended Period in an amount equal to the Force Majeure Volume and Shipper shall be obligated to deliver the Force Majeure Volume as the Annual Volume Commitment under this Agreement during the Extended Period. |

10.1 | Governing Law. This Agreement is entered into in the State of Texas and shall be governed, interpreted and construed in accordance with the laws of the State of Texas without regard to the conflicts of laws provisions thereof. |

10.2 | Venue. The Parties agree exclusive venue for any suit, action, or proceeding brought by either Party in connection with this Agreement or arising out of the terms or conditions hereof shall be in Harris County, Texas. The Parties hereby irrevocably and unconditionally waive, to the fullest extent they may legally and effectively do so, any objection they may now or hereafter have to the laying of venue of any suit, action, or proceeding arising out of or relating to this Agreement or the transactions contemplated hereby in the state and federal courts situated in the City of Houston, Harris County, Texas. |

10.3 | Negotiation. Prior to submitting any dispute for resolution by a court, a Party shall provide Notice to the other Party of the occurrence of such dispute. If the Parties have failed to resolve the dispute within fifteen (15) Business Days after such Notice was given, the Parties shall seek to resolve the dispute by negotiation between senior management personnel of each Party. Such personnel shall endeavor to meet and attempt to amicably resolve the dispute. If the Parties are unable to resolve the dispute for any reason within thirty (30) Business Days after the original Notice of dispute was given, then either Party shall be entitled to pursue any remedies available at law or in equity; provided, however, this Section 10.3 shall not limit a Party’s right to initiate litigation prior to the expiration of the time periods set forth in this Section 10.3 if application of statutes of limitations (or other principle of law or equity) would prevent a Party from filing a lawsuit or claim within the applicable period for filing lawsuits. |

11.1 | Taxes. Shipper shall pay any and all Taxes levied on Shipper’s Crude Oil including property Taxes on Shipper’s Crude Oil in the Knight Warrior Pipeline. Carrier shall pay any and all Taxes levied on the Knight Warrior Pipeline. Shipper shall not be liable for any Taxes assessed against Carrier based on Carrier’s income, revenues, gross receipts, or ownership of the Knight Warrior Pipeline, and all state franchise, license, and similar taxes required for the maintenance of Carrier’s corporate existence. |

11.2 | Reimbursement. If Carrier is required to pay any Tax or Taxes for Shipper, Shipper shall reimburse Carrier for such taxes within thirty (30) days after receipt of an invoice and supporting documentation provided by Carrier. |

12.1 | Assignment. This Agreement, and the rights and obligations created hereby, may not be assigned, in whole or in part, by either Party without the prior written consent of the other Party, which consent shall not be unreasonably withheld, conditioned, or delayed, except either Party may assign its rights under this Agreement to an Affiliate without such prior written consent, provided such Affiliate has a financial strength at least equal to that of the assignor, and (ii) Carrier may, subject to prior notification to Shipper, assign this Agreement to a third party purchasing substantially all of Carrier’s interest in the Knight Warrior Pipeline. Any such permitted assignment shall require that the assignee assume and agree to discharge the duties and obligations of its assignor under this Agreement. No such permitted assignment by Shipper shall effect or operate to discharge any obligations (including responsibility for and payment of any Deficiency Payment) of Shipper under this Agreement. Notwithstanding the foregoing, either Party may, without the consent of the other Party, pledge, encumber, mortgage, grant a lien or security interest in or assign all or any portion of its interest in this Agreement to one or more third parties in connection with a financing transaction; provided, however, that none of the foregoing shall be deemed to relieve such Party from its obligations hereunder. If the Person which owns or controls a majority of the voting shares/rights in Carrier at any time sells or disposes of such majority of voting shares/rights, or changes its identity for any reason (including a merger, consolidation or reorganization), such change of ownership or control shall constitute an assignment for purposes of this Section 12.1. |

12.2 | Notice of Assignment. No such assignment, nor any succession to the interest of either Party, shall be effective and binding until the other Party is furnished with proper and satisfactory evidence of such assignment or succession. |

13.1 | Notice. Any notice, statement, payment (for which Carrier has not specified an account for wire transfer), claim or other communication required or permitted hereunder (each a “Notice”) shall be in writing and shall be sent by: (i) facsimile transmission (as to all Notices other than payments); (ii) delivered by hand; (iii) sent by United States mail with all postage fully prepaid; or (iv) by courier with charges paid in accordance with the customary arrangements established by such courier, in each of the foregoing cases addressed to the other Party at the following addresses: |

13.2 | Change of Address. Notices of change of address of either of the Parties shall be given in writing to the other Party in the manner aforesaid and shall be observed in the giving of all future Notices required or permitted to be given hereunder. |

14.1 | Indemnification by Shipper. SUBJECT TO ARTICLE 8, SHIPPER AGREES TO DEFEND AND INDEMNIFY CARRIER, ITS AFFILIATES, AND ITS AND THEIR RESPECTIVE DIRECTORS, OFFICERS, AND EMPLOYEES, CUSTOMERS, CONTRACTORS AND OTHER REPRESENTATIVES FROM AND AGAINST ALL LOSSES RESULTING FROM, ASSOCIATED WITH, OR ARISING OUT OF ITS PERFORMANCE OR NON- |

14.2 | Indemnification by Carrier. SUBJECT TO ARTICLE 8, CARRIER AGREES TO DEFEND AND INDEMNIFY SHIPPER, ITS AFFILIATES AND THEIR RESPECTIVE DIRECTORS, OFFICERS, AND EMPLOYEES, CUSTOMERS, CONTRACTORS AND OTHER REPRESENTATIVES FROM AND AGAINST ANY LOSSES RESULTING FROM, ASSOCIATED WITH, OR ARISING OUT OF CARRIER’S PERFORMANCE OR NON-PERFORMANCE OF THIS AGREEMENT, OR ITS NEGLIGENCE, WILLFUL MISCONDUCT, OR GROSS NEGLIGENCE. |

14.3 | Joint Liability. UNDER THE FOREGOING INDEMNITIES, WHERE THE PERSONAL INJURY TO OR DEATH OF ANY PERSON OR LOSS OF OR DAMAGE TO PROPERTY IS THE RESULT OF THE JOINT OR CONCURRENT NEGLIGENCE, GROSS NEGLIGENCE, OR WILLFUL ACTS OR OMISSIONS OF SHIPPER AND CARRIER, EACH PARTY’S DUTY OF INDEMNIFICATION WILL BE IN PROPORTION TO ITS SHARE OF SUCH JOINT OR CONCURRENT NEGLIGENCE, GROSS NEGLIGENCE, OR WILLFUL MISCONDUCT. |

14.4 | Procedures Relating to Indemnification. To receive the foregoing indemnities, the Party seeking indemnification must notify the other in writing of a claim or suit promptly (provided that any failure to provide such notice shall not limit a Party’s right to indemnification except to the extent that the indemnifying Party shall have been materially prejudiced thereby) and provide reasonable cooperation (at the indemnifying Party’s expense) and full authority to defend the claim or suit. Notwithstanding the foregoing, no indemnifying Party shall be entitled to settle any claim or suit without the consent of the indemnified Party unless such settlement contains a full release of the indemnified Party without any liability for any monetary damages or any type of equitable relief. Neither Party shall have any obligation to indemnify the other under any settlement made without its written consent. |

15.1 | Events of Default. Notwithstanding any other provision of this Agreement, an event of default (“Event of Default”) shall be deemed to occur with respect to a Party when: |

(a) | Such Party fails to make any undisputed payment when due under this Agreement, within thirty (30) Business Days of a written demand therefor; |

(b) | Other than an Event of Default described in Paragraph (a) above, such Party fails to perform any obligation or covenant to the other Party under this Agreement and such matter is not in dispute, which failure is not cured to |

(c) | Such Party becomes Bankrupt; or |

(d) | An assignment or purported assignment of this Agreement in violation of the provisions of Article 12. |

(a) | Notwithstanding any other provision of this Agreement, upon the occurrence of an Event of Default with respect to either Party (the “Defaulting Party”), the other Party (the “Performing Party”) shall in its reasonable discretion, in addition to all other remedies available to it and without incurring any liabilities to the Defaulting Party or to third parties, be entitled as long as such Event of Default is continuing, to do one or more of the following: (a) suspend its performance under this Agreement with prior notice of five (5) Business Days to the Defaulting Party, (b) proceed against the Defaulting Party for damages occasioned by the Defaulting Party’s failure to perform, and (c) upon five (5) Business Days’ notice to the Defaulting Party, terminate this Agreement. Notwithstanding the foregoing, in the case of an Event of Default described in Section 15.1(c) above, no prior notice shall be required. The Defaulting Party shall reimburse the Performing Party for all costs and expenses related to the Performing Party’s claim with respect to such breach, including but not limited to reasonable attorneys’ fees. The remedies provided in this provision are in addition to any and all other remedies available to the Performing Party under this Agreement and Applicable Law. |

(b) | If Carrier exercises its termination right under Section 15.2, then, (i) Carrier shall have the right, but absolutely no obligation, to hold an open season with respect to, or otherwise market or offer to third parties, a volume equal to Shipper’s Quarterly Volume Commitment (the “Shipper’s Capacity”) and (ii) if, as a result of any such open season, or otherwise, Carrier enters into one or more new transportation services agreements with respect to some or all of the Shipper’s Capacity, Carrier will credit to Shipper’s Quarterly Volume Commitment any revenues received by Carrier from such new shipper(s) as transportation charges or deficiency payments for committed volumes, as and when actually received by Carrier, less Carrier’s costs in marketing such Shipper’s Capacity to secure a new commitment; provided that Shipper shall not be entitled to any such credit for revenues that may accrue to the extent the tariff rate payable under such new transportation services agreement exceeds the applicable tariff rate for services to Shipper hereunder. Shipper expressly acknowledges that it shall have no right to challenge or dispute the terms and conditions of any new transportation services agreements entered into by Carrier as a result of any such open |

15.3 | Carrier Representations. Carrier hereby represents to Shipper as follows: |

(a) | This Agreement and all documents executed by Carrier required hereby are duly authorized, executed, and delivered by Carrier, are legal, valid, and binding obligations of Carrier, and do not violate any provisions of any agreement to which Carrier is a party or to which it is subject and do not violate any duties to which Carrier is subject. |

(b) | There are no pending, or to Carrier’s knowledge, threatened actions, suits, arbitrations, claims or proceedings, at law or in equity, that could materially and adversely affect the development, ownership or operation of the Knight Warrior Pipeline. |

16.1 | Amendments. All modifications, amendments, or changes to this Agreement, whether made simultaneously with or after the execution of this Agreement, shall be in writing, and executed by both Carrier and Shipper. |

16.2 | Confidentiality. |

(a) | Confidentiality. Each Party agrees that it shall maintain all terms and conditions of this Agreement in strictest confidence, and that it shall not cause or permit disclosure of this Agreement or any provisions contained herein without the written consent of the other Party. |

(b) | Permitted Disclosures. Notwithstanding Section 16.2(a) of this Agreement, disclosures of any terms and provisions of this Agreement otherwise prohibited may be made by either Party: (i) to the extent necessary for such Party to enforce its rights hereunder against the other Party; (ii) to the extent to which a Party is required to disclose all or part of this Agreement by a statute or by the order or rule of a court, agency, or other Governmental Authority, by order, by regulations, or by other compulsory process (including deposition, subpoena, interrogatory, or request for production of documents); (iii) to the extent required by the applicable regulations of a |

(c) | Notification. If either Party (the disclosing Party) is or becomes aware of a fact, obligation, or circumstance that has resulted or may result in a disclosure of any of the terms and conditions of this Agreement in connection with (i) litigation between private parties or (ii) a request or requirement by any legislative, regulatory, or administrative body, and such request or requirement identifies the non-disclosing Party by name, then to the extent permitted by the court or legislative, regulatory, or administrative body, the disclosing Party will provide the non-disclosing Party with prompt notice of such request or requirement in order to afford the non-disclosing Party an opportunity to seek an appropriate protective order or motion to quash. |

(d) | Public Announcements. If Carrier chooses to make a press release with respect to this Agreement or the transaction represented herein using Shipper’s name, Carrier shall provide Shipper with a copy of the proposed announcement or statement. Carrier shall obtain Shipper’s prior written approval of the public announcement or statement. If approval is not granted, Carrier shall remove Shipper’s name before making the press release. Nothing contained in this section shall be construed to require either Party to obtain approval of the other Party to disclose information with respect to this Agreement or the transaction represented herein to any Governmental Authority to the extent required by Applicable Law or necessary to comply with disclosure requirements of the Securities and Exchange Commission, New York Stock Exchange, or any other regulated stock exchange. |

(e) | Survival. The provisions of this Section 16.2 shall survive any expiration or termination of this Agreement for a period of one (1) year. |

16.3 | Waiver. No waiver of any term, provision or condition of this Agreement shall be effective unless in writing signed by the Parties, and no such waiver shall be deemed to be or construed as a further or continuing waiver of any such term, provision or condition or as a waiver of any other term, provision or condition of the Agreement, unless specifically so stated in such written waiver. |

16.4 | No Third Party Beneficiaries. This Agreement does not confer any right, remedy, obligation, or liability upon any Person not a Party hereto. |

16.5 | No Partnership. It is not the intention of the Parties to create, nor is there created hereby, a partnership, trust, joint venture or association. The status of each Party hereunder is solely that of an independent contractor. |

16.6 | Headings. The headings and captions in this Agreement have been inserted for convenience of reference only and shall not define or limit any of the terms and provisions hereof. |

16.7 | Rules of Construction. In construing this Agreement, the following principles shall be followed: |

(a) | examples shall not be construed to limit, expressly or by implication, the matter they illustrate; |

(b) | the word “includes” and its syntactical variants mean “includes, but is not limited to” and corresponding syntactical variant expressions; |

(c) | the plural shall be deemed to include the singular and vice versa, as applicable; |

(d) | all references in this Agreement to an “Article,” “Section,” “subsection,” or “Exhibit” shall be to an Article, Section, subsection, or Exhibit of this Agreement, unless the context requires otherwise; |

(e) | unless the context otherwise requires, the words “this Agreement,” “hereof,” “hereunder,” “herein,” “hereby,” or words of similar import shall refer to this Agreement as a whole and not to a particular Article, Section, subsection, clause, Exhibit or other subdivision hereof; and |

(f) | each Exhibit to this Agreement is attached hereto and incorporated herein as a part of this Agreement, but if there is any conflict or inconsistency between the main body of this Agreement and any Exhibit, the provisions of the main body of this Agreement shall prevail. |

16.8 | Entire Agreement. This Agreement contains the entire agreement between the Parties relating to the subject matter hereof and there are no oral promises, agreements, or warranties affecting same. |

16.9 | Applicable Laws. This Agreement, and the performance hereunder, shall be subject to valid and applicable Federal, State and local laws and rules, orders or regulations, of any Federal, State or local agencies having appropriate jurisdiction; provided however, nothing contained herein shall be construed as a waiver of any right to question or contest any such law, order, rule, or regulation in any forum having appropriate jurisdiction. |

16.10 | Severability. If any provision of this Agreement shall be held to be invalid, illegal or unenforceable, (i) the validity, legality and/or enforceability of the remaining provisions shall not, in any way, be affected or impaired thereby and (ii) in lieu of |

16.11 | Joint Preparation. Shipper and Carrier acknowledge and mutually agree that this Agreement and all contents herein were jointly prepared by the Parties. |

16.12 | Further Assurances. Each Party shall take such acts and execute and deliver such documents as may be reasonably required to effectuate the purposes of this Agreement. |

16.13 | No Inducements. No director, employee, or agent of any Party shall give or receive any commission, fee, rebate, gift, or entertainment of significant cost or value in connection with this Agreement. |

16.14 | Counterpart Execution. This Agreement may be executed in any number of counterparts, each of which shall be considered an original, and all of which shall be considered one and the same instrument. |

16.15 | “Most Favored Nation” Treatment. Carrier agrees that if Carrier extends committed rates for services to any party regarding matters set forth in this Agreement (the “Third Party Rates”), and the Third Party Rates are more favorable than the Throughput Fees under this Agreement, the Throughput Fees under this Agreement shall be adjusted to reflect the Third Party Rates. Shipper and Carrier shall facilitate review by a third party of the Third Party Rates of agreements with other parties or amendments thereto to monitor Carrier’s compliance with this Section. Such agreements may be redacted to conceal the identity of the contracting party and the third party conducting such review shall be subject to appropriate confidentiality obligations. |

16.16 | Area of Mutual Interest (“AMI”). During the Initial Term or any Additional Terms of this Agreement, the Shipper and Shipper’s equity owners, SEI Energy, LLC (“SEI Energy”) and Vitol, Inc, (“Vitol”), collectively the AMI Parties (“AMI Parties”), hereby agree that any crude oil originated or marketed by the AMI Parties from any of the following counties located in the state of Texas: Grimes County, Houston County, Leon County, Madison County and Walker County and being transported via a crude oil pipeline to destinations in either Harris County, TX or Jefferson County, TX shall be transported on the Carrier’s pipeline. |

Carrier | |

By: | /s/ Mark A. Hurley |

Name: | Mark A. Hurley |

Title: | CEO |

Shipper | |

By: | /s/ Thomas Ramsey |

Name: | Thomas Ramsey |

Title: | Manager |

Vitol, Inc. | |

By: | /s/ M. A. Loya |

Name: | M. A. Loya |

Title: | President |

SEI Energy, LLC | |

By: | /s/ John B. Sawyer |

Name: | John B. Sawyer |

Title: | President |

ISSUED: __________, 201_ | EFFECTIVE: __________, 201_ |

Issued by: | Compiled by: |

Mark Hurley, President | Diane Stephens |

Knight Warrior LLC | Knight Warrior LLC |

201 NW 10th, Suite 200 | 201 NW 10th, Suite 200 |

Oklahoma City, Oklahoma 73103 | Oklahoma City, Oklahoma 73103 |

405.278.6448 | |

1. | ALL MARKETABLE OIL TO BE RECEIVED FOR TRANSPORTATION: By the term "marketable oil" is meant any crude petroleum adapted for refining or fuel purposes, properly settled and containing not more than two percent (2%) of basic sediment, water, or other impurities above a point six (6) inches below the pipeline connection with the tank. Pipelines shall receive for transportation all such "marketable oil" tendered; but no pipeline shall be required to receive for shipment from any one person an amount exceeding three thousand (3,000) barrels of petroleum in any one (1) day; and, if the oil tendered for transportation differs materially in character from that usually produced in the field and being transported therefrom by the pipeline, then it shall be transported under such terms as the shipper and the owner of the pipeline may agree or the Commission may require. |

2. | BASIC SEDIMENT, HOW DETERMINED -- TEMPERATURE: In determining the amount of sediment, water or other impurities, a pipeline is authorized to make a test of the oil offered for transportation from an average sample from each such tank, by the use of centrifugal machine, or by the use of any other appliance agreed upon by the pipeline and the Shipper. The same method of ascertaining the amount of the sediment, water or other impurities shall be used in the delivery as in the receipt of oil. A pipeline shall not be required to receive for transportation, nor shall consignee be required to accept as a delivery, any oil of a higher temperature than ninety degrees Fahrenheit (90° F), except that during the summer oil shall be received at any atmospheric temperature, and may be delivered at like temperature. Consignee shall have the same right to test the oil upon delivery at destination that the pipeline has to test before receiving from the Shipper. |

3. | "BARREL" DEFINED: For the purpose of these rules, a "barrel" of crude petroleum is declared to be forty-two (42) gallons of 231 cubic inches per gallon at sixty degrees Fahrenheit (60° F). |

4. | OIL INVOLVED IN LITIGATION, ETC. -- INDEMNITY AGAINST LOSS: When any oil offered for transportation is involved in litigation, or the ownership is in dispute, or when the oil appears to be encumbered by lien or charge of any kind, the pipeline may require of Shippers an indemnity bond to protect it against all loss. |

5. | STORAGE: Each pipeline shall provide, without additional charge, sufficient operational storage, such as is incidental and necessary to the transportation of oil, including storage at destination or so near thereto as to be available for prompt delivery to destination point, for five (5) days from the date of order of delivery at destination. |

6. | IDENTITY OF OIL, MAINTENANCE OF: A pipeline may deliver to Consignee, either the identical oil received for transportation, subject to such consequence of mixing with other oil as are incident to the usual pipeline transportation, or it may make delivery from its common stock at destination; provided, if this last be done, the delivery shall be of substantially like kind and market value. |

7. | MINIMUM QUANTITY TO BE RECEIVED: A pipeline shall not be required to receive less than one (1) tank carload of oil when oil is offered for loading into tank cars at destination of the pipeline. When oil is offered for transportation for other than tank car delivery, a pipeline shall not be required to receive less than five hundred (500) barrels. |

8. | GATHERING CHARGES: Tariffs to be filed by a pipeline shall specify separately the charges for gathering of the oil, for transportation, and for delivery. (See amendment to this rule in Item No. 50, Section hereof.) |

9. | GAUGING, TESTING, AND DEDUCTIONS: All crude oil tendered to a pipeline for transportation shall be measured and tested by a representative of the pipeline prior to its receipt by the pipeline. The Shipper may be present or represented at the gauging and testing. Quantities shall be determined in accordance with applicable A.P.I. Manual of Petroleum Measurement Standards. A pipeline may deduct sediment, water, and other impurities as shown by the centrifugal method, Karl Fischer method or other test agreed upon and two tenths of one percent (.2 %) for evaporation and loss during transportation.* The net balance shall be the quantity deliverable by the pipeline. In allowing the deductions, it is not the intention of the Commission to affect any tax or royalty obligations imposed by the laws of Texas on any producer or shipper of crude oil. |

* | This deviates from Rule 71.9 of the General Conservation Rules in that a deduction of less than one percent (1%) will be made for evaporation and loss during transportation. |

10. | DELIVERY AND DEMURRAGE: Each pipeline shall transport oil with reasonable diligence, considering the quality of the oil, the distance of transportation, and other material elements, but at any time after receipt of a consignment of oil, upon twenty-four (24) hours' notice to the Consignee, may offer oil for delivery from its common stock at the point of destination, conformable to Section 6 of this rule, at a rate not exceeding ten thousand (10,000) barrels per day of twenty-four (24) hours. Computation of time of storage (as provided for in Section 5 of this rule) shall begin at the expiration of such notice. At the expiration of the time allowed in Section 5 of this rule for storage at destination, a pipeline may assess a demurrage charge on oil offered for delivery and remaining undelivered, at a rate for the first ten (10) days of one-tenth of one cent per barrel; and thereafter at a rate of three-fourths of one cent per barrel, for each day of twenty-four (24) hours or fractional part thereof. |

11. | PAYMENT OF TRANSPORTATION AND OTHER CHARGES*: The Shipper or Consignee shall pay all applicable gathering, transportation, and all other lawful charges accruing on petroleum delivered to and accepted by Carrier for shipment, and, if required, shall prepay or guarantee the same before acceptance by the Carrier, or pay the same before delivery. Carrier shall have a lien on all petroleum in its possession belonging to Shipper or Consignee to secure the payment of any and all unpaid gathering, transportation, or any lawful charges that are due Carrier that are unpaid by Shipper or Consignee, and may withhold such petroleum from delivery until all unpaid charged have been paid. |

12. | NOTICE OF CLAIMS: Notice of claims for loss, damage or delay in connection with the shipment of oil must be made in writing to the pipeline within ninety-one (91) days after the damage, loss, or delay occurred. If the claim is for failure to make delivery, the claim must be made within ninety-one (91) days after a reasonable time for delivery has elapsed. |

13. | TELEPHONE-TELEGRAPH LINE -- SHIPPER TO USE: If a pipeline maintains a private telegraph or telephone line, a Shipper may use it without extra charge, for message incident to shipments. However, a pipeline shall not be held liable for failure to delivery any messages away form its office or for delay in transmission or for interruption of service. |

14. | CONTRACTS OF TRANSPORTATION: When a consignment of oil is accepted, the pipeline shall give the Shipper a run ticket, and shall give the Shipper a statement that shows the amount of oil received for transportation, the points of origin and destination, corrections made for temperature, deductions made for impurities, and the rate for such transportation. |

15. | SHIPPER'S TANKS, ETC. --INSPECTION: When a shipment of oil has been offered for transportation, the pipeline shall have the right to go upon the premises where the oil is produced or stored, and have access to any and all tanks or storage receptacles for the purpose of making any examination, inspection, or test authorized by this Rule. |

16. | OFFERS IN EXCESS OF FACILITIES: If oil is offered to any pipeline for transportation in excess of the amount that can be immediately transported, the transportation furnished by the pipeline shall be apportioned among all Shippers in proportion to the amounts offered by each; but no offer for transportation shall be considered beyond the amount which the person requesting the shipment then has ready for shipment by the pipeline. The pipeline shall be considered as a Shipper of oil produced or purchased by itself and held for shipment through its line, and its oil shall be entitled to participate in such apportionment. (This item 16, Section I is amended by item 125, Section II below) |

17. | INTERCHANGE OF TONNAGE: Pipelines shall provide the necessary connections and facilities for the exchange of tonnage at every locality reached by two or more pipelines, when the Commission finds that a necessity exists for connection, and under such regulations as said Commission may determine in each case. |

18. | RECEIPT AND DELIVERY -- NECESSARY FACILITIES FOR: Each pipeline shall install and maintain facilities for the receipt and delivery of marketable crude petroleum of Shippers at any point on its line if the Commission finds that a necessity exists therefor, and under regulations by the Commission. |

19. | FIRES, LIGHTNING AND LEAKAGE, REPORTS OF LOSS FROM: |

A. | Each pipeline shall immediately notify the Commission, by telegraph, telephone, or letter of each fire that occurs at any oil tank owned or controlled by the pipeline, or of any tank struck by lightning. Each pipeline shall in like manner report each break or leak in any of its tanks or pipelines from which more than five (5) barrels escapes. Each pipeline shall report in writing to the Commission, by the fifteenth (15th) day of each Calendar Month, the estimated amount of loss of oil by fire or leakage from its tanks and pipelines for the preceding month; but not including leakage or evaporation ordinarily incident to transportation. |

B. | No risk of fire, storm, flood or act of God, and no risk resulting from riots, insurrection, rebellion, war, or act of the public enemy, or from quarantine or authority of law or any order, requisition or necessity of the government of the United States in time of war, shall be borne by a pipeline, nor shall any liability accrue to it from any damage thereby occasioned. If loss of any crude oil from any such causes occurs after the oil has been received for transportation, and before it has been delivered to the Consignee, the Shipper shall bear a loss in such proportion as the amount of his shipment is to all of the oil held in transportation by the pipeline at the time of such loss, and the Shipper shall be entitled to have delivered only such portion of his shipment as may remain after a deduction of his due proportion of such loss, but in such event the Shipper shall be required to pay charges only on the quantity of oil delivered. This rule shall not apply if the loss occurs because of negligence of the pipeline. |

20. | PRINTING AND POSTING: Each pipeline shall have Sections 1 through 19 of this rule printed on its tariff sheets, and shall post the printed sections in a prominent place in its various offices for the inspection of the shipping public. Each pipeline shall post and publish only such Rules and Regulations as may be adopted by the Commission as general rules or such special rules as may be adopted for any particular field. |

5. | DEFINITIONS: |

10. | APPLICATION OF RATES FROM AND TO INTERMEDIATE POINTS: For shipments accepted for transportation from any point not named in tariffs making reference hereto which is intermediate to a point from which rates are published in said tariffs, through such unnamed point, the rate published therein from the next more distant point specified in the tariff will apply from such unnamed point, and the gathering charge at the next more distant point shall apply when gathering service is performed. For shipments accepted for transportation to any point not named in tariffs making reference hereto which is intermediate to a point to which rates are published in said tariffs, through such unnamed point, the rate published therein to the next more distant point specified in the tariff will apply. |

25. | SPECIFICATIONS AS TO QUALITY AND LEGALITY OF SHIPMENTS: Carrier reserves the right to reject any and all of the following shipments: |

A. | Crude Oil having a vapor pressure in excess of ten (10) pounds absolute at a temperature of 100 degrees Fahrenheit and/or an A.P.I. gravity in excess of 65 degrees. |

B. | Crude Oil where the Shipper or Consignee has failed to comply with all applicable laws, rule, and regulations made by any governmental authorities regulating shipments of Crude Oil. |

C. | Crude Oil received from tanks containing basic sediment, water, or other impurities in excess of one percent (1%) average in suspension above the pipeline connection. Where crude oil is delivered to pipeline through automatic custody transfer measurement facilities, Carrier may require use of a monitor which rejects oil containing in excess of one percent (1%) basic sediment and water. (This limitation by Carrier is supplementary to the two percent (2%) basic sediment and water limit above a point 6 inches below pipeline connection provided for in Item 1 of Railroad Commission of Texas Rule 71.) |

D. | If Carrier determines that a Shipper has delivered to Carrier’s facilities Crude Petroleum that has been contaminated by the existence of and or excess amounts of impure substances, including but not limited to chlorinated and/or oxygenated hydrocarbons, arsenic, lead and/or other metals which results in harm to other shippers, carriers, users of the contaminated Crude Petroleum or Carrier, such Shipper will be excluded from further entry into applicable segments of the pipeline system until such time as the quality of the Crude Petroleum is to the satisfaction of the Carrier. Carrier is not responsible for monitoring receipts or deliveries for contaminants. Further, Carrier reserves the right to dispose of any contaminated Crude Petroleum blocking its pipeline system. Disposal thereof may be made in any reasonable manner including but not limited to commercial sales, and any liability associated with the contamination or disposal of any Crude Petroleum shall be borne by the Shipper introducing the contaminated Crude Petroleum into Carrier’s system. Shipper liability includes claims of cross contamination from other shippers, carriers, or users of the contaminated Crude Petroleum and the costs of any regulatory or judicial proceeding. |

E. | Carrier will not accept Crude Oil containing any of the following: Waste oils, Lube oils, Crankcase oils, PCB’s or Dioxins. |

30. | APPLICATION OF RATES: Crude Oil accepted for gathering and/or transportation shall be subject to the rates in effect on the date of receipt by Carrier, irrespective of the date of the tendered. |

31. | TENDERS REQUIRED: |

A. | Crude Oil for shipment through lines of Carrier will be received only on properly executed tenders from the Shipper showing the point at which the Crude Oil is to be received, point of delivery, consignee, and amount of Crude Oil transported. Carrier may refuse to accept Crude Oil for transportation unless satisfactory evidence be furnished that the Shipper or Consignee has made provision for prompt receipt thereof at destination. |

B. | Any Shipper desiring to tender Crude Oil for transportation shall make such tender to the initial Carrier in writing on or before the twenty-fifth day of the month preceding the month during which the transportation under the tender is to begin; except that, if space is available for current movement, a Shipper may tender Crude Oil for transportation after the twenty-fifth day of the month preceding the month during which the transportation under the tender is to begin. |

36. | LINE FILL AND TANK BOTTOM INVENTORY: Except as may be provided for in a Throughput Agreement with a Committed Shipper, either prior to or after the acceptance of Crude Oil for transportation through the System, Carrier may, upon reasonable notice, require each Shipper to provide a pro rata part of the volume of Crude Oil necessary for pipeline fill, unavailable stocks below tank connections, and reasonable additional minimum quantities required for the efficient operation of the System. Upon the termination of shipments by Shipper, Carrier will deliver to Shipper at the Delivery Point all of Shipper’s Crude Oil in the pipeline or otherwise available for shipment. Redelivery shall be completed as batches transit the pipeline with expected transit time based on batch size. As shipments are nominated an estimated window of delivery dates will be provided by Carrier. Expected transit time is not guaranteed. Tank bottoms belonging to Shipper will be made available for removal by Shipper from the tank within 90 days after Shipper ceases making shipments, provided that the Carrier may, if possible, make physical delivery of the tank bottoms, arrange for a trade of like barrels to Shipper, or otherwise financially settle the inventory. Shipper will at all times retain title to its Crude Oil in transit and tank bottoms and Carrier will, at the discretion of Carrier, provide to or have available for Shipper, a monthly statement of Shipper’s inventory. |

40. | UNLOADING OR TRANSFER CHARGES: |

A. | All common stream shipments and all shipments that are to be moved in batches of less than [10000] bbls that are received from tank truck unloading facilities or gathering pipeline facilities provided by others, either of which delivers into Carrier's trunkline facilities, will be subject to an unloading or transfer charge of nine cents (9¢) per barrel, except that no charge in either case shall be made if the initial trunkline pumping is provided by others. This provision is not applicable to Committed Shippers unless otherwise agreed to in the applicable Throughput Agreement. |