|

Quaint Oak Bancorp, Inc.

|

|

Quaint Oak Family of Companies

Quaint Oak Bancorp, Inc.

Quaint Oak Bank

Quaint Oak Abstract, LLC I Quaint Oak Mortgage, LLC I Quaint Oak Real Estate, LLC I Quaint Oak Insurance Agency, LLC

Oakmont Capital Holdings, LLC

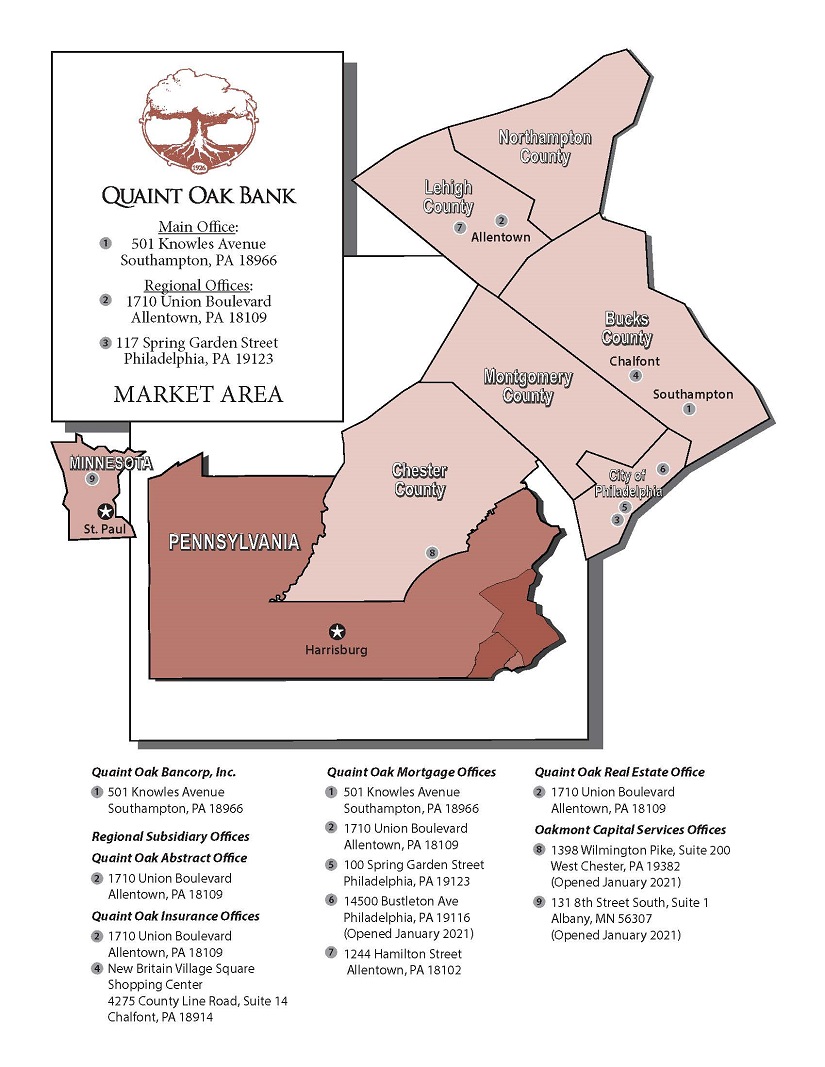

Serving the Delaware Valley, Lehigh Valley, and Greater Philadelphia Markets

|

|

Quaint Oak Bancorp, Inc.

|

|

Page

|

|

|

Selected Consolidated Financial and Other Data

|

1

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

2

|

| Reports of Independent Registered Public Accounting Firm |

19 |

|

Consolidated Balance Sheets

|

21

|

|

Consolidated Statements of Income

|

22

|

|

Consolidated Statements of Comprehensive Income

|

23

|

|

Consolidated Statements of Stockholders’ Equity

|

24

|

|

Consolidated Statements of Cash Flows

|

25

|

|

Notes to Consolidated Financial Statements

|

26

|

|

General Information

|

69

|

|

Locations

|

70

|

|

Quaint Oak Bancorp, Inc.

|

|

At or For the Years Ended December 31,

|

||||||||

|

2020

|

2019

|

|||||||

|

(Dollars in Thousands)

|

||||||||

|

Selected Financial and Other Data:

|

||||||||

|

Total assets

|

$

|

484,075

|

$

|

302,540

|

||||

|

Cash and cash equivalents

|

33,913

|

14,555

|

||||||

|

Investment in interest-earning time deposits

|

9,463

|

10,172

|

||||||

|

Investment securities available for sale at fair value

|

10,725

|

7,623

|

||||||

|

Loans held for sale

|

53,191

|

8,928

|

||||||

|

Loans receivable, net

|

359,122

|

246,692

|

||||||

|

Federal Home Loan Bank stock, at cost

|

1,665

|

1,580

|

||||||

|

Premises and equipment, net

|

2,341

|

2,226

|

||||||

|

Deposits

|

354,845

|

227,458

|

||||||

|

Federal Home Loan Bank borrowings

|

38,193

|

36,271

|

||||||

|

Subordinated debt

|

7,899

|

7,865

|

||||||

|

Stockholders’ Equity

|

28,728

|

25,907

|

||||||

|

Selected Operating Data:

|

||||||||

|

Total interest income

|

$

|

16,323

|

$

|

14,111

|

||||

|

Total interest expense

|

5,488

|

5,426

|

||||||

|

Net interest income

|

10,835

|

8,685

|

||||||

|

Provision for loan losses

|

830

|

303

|

||||||

|

Net interest income after provision for loan losses

|

10,005

|

8,382

|

||||||

|

Total non-interest income

|

6,655

|

4,953

|

||||||

|

Total non-interest expense

|

12,123

|

9,908

|

||||||

|

Income before income taxes

|

4,537

|

3,427

|

||||||

|

Income taxes

|

1,292

|

950

|

||||||

|

Net income

|

$

|

3,245

|

$

|

2,477

|

||||

|

Selected Operating Ratios(1):

|

||||||||

|

Average yield on interest-earning assets

|

4.41

|

%

|

5.17

|

%

|

||||

|

Average rate on interest-bearing liabilities

|

1.74

|

2.25

|

||||||

|

Average interest rate spread(2)

|

2.67

|

2.91

|

||||||

|

Net interest margin(2)

|

2.93

|

3.17

|

||||||

|

Average interest-earning assets to average interest-bearing liabilities

|

117.39

|

113.58

|

||||||

|

Net interest income after provision for loan losses to non-interest expense

|

82.52

|

84.60

|

||||||

|

Total non-interest expense to average assets

|

3.15

|

3.46

|

||||||

|

Efficiency ratio(3)

|

69.32

|

72.65

|

||||||

|

Return on average assets

|

0.84

|

0.87

|

||||||

|

Return on average equity

|

12.16

|

10.03

|

||||||

|

Average equity to average assets

|

6.94

|

8.63

|

||||||

|

Asset Quality Ratios(4):

|

||||||||

|

Non-performing loans as a percent of loans receivable, net(5)

|

0.18

|

%

|

0.15

|

%

|

||||

|

Non-performing assets as a percent of total assets(5)

|

0.19

|

0.72

|

||||||

|

Non-performing assets and troubled debt restructurings as a percent of total assets

|

0.22

|

0.77

|

||||||

|

Allowance for loan losses as a percent of non-performing loans

|

475.83

|

616.30

|

||||||

|

Allowance for loan losses as a percent of total loans receivable

|

0.85

|

0.90

|

||||||

|

Net charge-offs to average loans receivable

|

0.00

|

0.02

|

||||||

|

Capital Ratios(4):

|

||||||||

|

Tier 1 leverage ratio

|

8.56

|

%

|

10.35

|

%

|

||||

|

Common Tier 1 capital ratio

|

13.31

|

13.42

|

||||||

|

Tier 1 risk-based capital ratio

|

13.31

|

13.42

|

||||||

|

Total risk-based capital ratio

|

14.52

|

14.41

|

||||||

| (1) |

With the exception of end of period ratios, all ratios are based on average daily balances during the indicated periods.

|

| (2) |

Average interest rate spread represents the difference between the average yield on interest-earning assets and the average rate paid on interest-bearing liabilities, and net interest margin represents net

interest income as a percentage of average interest-earning assets.

|

| (3) |

The efficiency ratio represents the ratio of non-interest expense divided by the sum of net interest income and non-interest income.

|

| (4) |

Asset quality ratios and capital ratios are end of period ratios, except for net charge-offs to average loans receivable.

|

| (5) |

Non-performing assets consist of non-performing loans and other real estate owned at December 31, 2020 and 2019. Non-performing loans consist of non-accruing loans plus accruing loans 90 days or more past

due.

|

|

Quaint Oak Bancorp, Inc.

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

Quaint Oak Bancorp, Inc.

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

Quaint Oak Bancorp, Inc.

|

|

Quaint Oak Bancorp, Inc.

|

|

Number of

Covid-19

Deferments

|

Balance

(in thousands)

|

Percent of

Total Loans at

December 31,

2020

|

||||||||||

|

One-to-four family residential owner occupied

|

5

|

$

|

2,070

|

27.5

|

%

|

|||||||

|

One-to-four family residential non-owner occupied

|

50

|

8,566

|

22.0

|

|||||||||

|

Multi-family residential

|

12

|

9,042

|

37.6

|

|||||||||

|

Commercial real estate

|

97

|

55,274

|

41.9

|

|||||||||

|

Construction

|

1

|

702

|

14.7

|

|||||||||

|

Home equity

|

4

|

254

|

6.7

|

|||||||||

|

Commercial business

|

62

|

14,685

|

9.5

|

|||||||||

|

Total

|

231

|

$

|

90,593

|

25.8

|

%

|

|||||||

|

As of March 15, 2021

|

||||||||||||

|

Number of

Covid-19

Deferments

|

Balance

(in thousands)

|

Percent of

Total Loans at

December 31,

2020

|

||||||||||

|

One-to-four family residential owner occupied

|

1

|

$

|

415

|

5.5

|

%

|

|||||||

|

Commercial real estate

|

8

|

10,287

|

7.8

|

|||||||||

|

Commercial business

|

4

|

6,561

|

4.2

|

|||||||||

|

Total

|

13

|

$

|

17,263

|

4.9

|

%

|

|||||||

|

Quaint Oak Bancorp, Inc.

|

|

Quaint Oak Bancorp, Inc.

|

|

Quaint Oak Bancorp, Inc.

|

|

Quaint Oak Bancorp, Inc.

|

|

Quaint Oak Bancorp, Inc.

|

|

Quaint Oak Bancorp, Inc.

|

|

Quaint Oak Bancorp, Inc.

|

|

Year Ended December 31,

|

||||||||||||||||||||||||

|

2020

|

2019

|

|||||||||||||||||||||||

|

Average

Balance

|

Interest

|

Average

Yield/

Rate

|

Average

Balance

|

Interest

|

Average

Yield/

Rate

|

|||||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||||||

|

Interest-earning assets:

|

||||||||||||||||||||||||

|

Due from banks, interest-bearing

|

$

|

17,373

|

$

|

72

|

0.42

|

%

|

$

|

16,315

|

$

|

366

|

2.24

|

%

|

||||||||||||

|

Investment in interest-earning time deposits

|

9,760

|

244

|

2.50

|

9,635

|

269

|

2.79

|

||||||||||||||||||

|

Investment securities available for sale

|

9,383

|

261

|

2.78

|

8,321

|

228

|

2.74

|

||||||||||||||||||

|

Loans receivable, net (1) (2)

|

332,146

|

15,657

|

4.71

|

238,238

|

13,167

|

5.53

|

||||||||||||||||||

|

Investment in FHLB stock

|

1,438

|

89

|

6.19

|

1,206

|

81

|

5.16

|

||||||||||||||||||

|

Total interest-earning assets

|

370,100

|

16,323

|

4.41

|

%

|

273,715

|

14,111

|

5.16

|

%

|

||||||||||||||||

|

Non-interest-earning assets

|

14,386

|

12,348

|

||||||||||||||||||||||

|

Total assets

|

$

|

384,486

|

$

|

286,063

|

||||||||||||||||||||

|

Interest-bearing liabilities:

|

||||||||||||||||||||||||

|

Passbook accounts

|

$

|

6

|

$

|

*

|

*

|

%

|

$

|

53

|

$

|

*

|

*

|

%

|

||||||||||||

|

Savings accounts

|

1,826

|

4

|

0.22

|

1,629

|

3

|

0.18

|

||||||||||||||||||

|

Money market accounts

|

47,351

|

392

|

0.83

|

27,550

|

221

|

0.80

|

||||||||||||||||||

|

Certificate of deposit accounts

|

195,401

|

3,820

|

1.95

|

177,000

|

4,063

|

2.30

|

||||||||||||||||||

|

Total deposits

|

244,584

|

4,216

|

1.72

|

206,232

|

4,287

|

2.08

|

||||||||||||||||||

|

FHLB short-term borrowings

|

3,292

|

37

|

1.12

|

5,585

|

141

|

2.52

|

||||||||||||||||||

|

FHLB long-term borrowings

|

28,979

|

607

|

2.09

|

21,327

|

479

|

2.25

|

||||||||||||||||||

|

FRB long-term borrowings

|

30,534

|

108

|

0.35

|

-

|

-

|

-

|

||||||||||||||||||

|

Subordinated debt

|

7,881

|

520

|

6.60

|

7,845

|

519

|

6.62

|

||||||||||||||||||

|

Total interest-bearing liabilities

|

315,270

|

5,488

|

1.74

|

%

|

240,989

|

5,426

|

2.25

|

%

|

||||||||||||||||

|

Non-interest-bearing liabilities

|

42,530

|

20,385

|

||||||||||||||||||||||

|

Total liabilities

|

357,800

|

261,374

|

||||||||||||||||||||||

|

Stockholders’ Equity

|

26,686

|

24,689

|

||||||||||||||||||||||

|

Total liabilities and Stockholders’ Equity

|

$

|

384,486

|

$

|

286,063

|

||||||||||||||||||||

|

Net interest-earning assets

|

$

|

54,830

|

$

|

32,726

|

||||||||||||||||||||

|

Net interest income; average interest rate spread

|

$

|

10,835

|

2.67

|

%

|

$

|

8,685

|

2.91

|

%

|

||||||||||||||||

|

Net interest margin (3)

|

2.93

|

%

|

3.17

|

%

|

||||||||||||||||||||

|

Average interest-earning assets to average interest-bearing liabilities

|

117.39

|

%

|

113.58

|

%

|

||||||||||||||||||||

|

*

|

Not meaningful |

| (1) |

Includes loans held for sale. |

|

(2)

|

Includes non-accrual loans during the respective periods. Calculated net of deferred fees and discounts, loans in process and allowance for loan losses. |

|

(3)

|

Equals net interest income divided by average interest-earning assets. |

|

Quaint Oak Bancorp, Inc.

|

|

2020 vs. 2019

|

2019 vs. 2018

|

|||||||||||||||||||||||||||||||

|

Increase (Decrease) Due to

|

Total Increase

(Decrease)

|

Increase (Decrease) Due to

|

Total Increase

(Decrease)

|

|||||||||||||||||||||||||||||

|

Rate

|

Volume

|

Rate/

Volume

|

Rate

|

Volume

|

Rate/

Volume

|

|||||||||||||||||||||||||||

|

(In Thousands)

|

||||||||||||||||||||||||||||||||

|

Interest income:

|

||||||||||||||||||||||||||||||||

|

Due from banks, interest-bearing

|

$

|

(298

|

)

|

$

|

24

|

$

|

(20

|

)

|

$

|

(294

|

)

|

$

|

64

|

$

|

21

|

$

|

5

|

$

|

90

|

|||||||||||||

|

Investment in interest-earning time deposits

|

(28

|

)

|

3

|

--

|

(25

|

)

|

46

|

88

|

44

|

178

|

||||||||||||||||||||||

|

Investment securities available for sale

|

4

|

29

|

--

|

33

|

51

|

20

|

7

|

78

|

||||||||||||||||||||||||

|

Loans receivable, net (1) (2)

|

(1,937

|

)

|

5,190

|

(763

|

)

|

2,490

|

338

|

1,262

|

37

|

1,637

|

||||||||||||||||||||||

|

Investment in FHLB stock

|

(7

|

)

|

16

|

(1

|

)

|

8

|

3

|

--

|

--

|

3

|

||||||||||||||||||||||

|

Total interest-earning assets

|

(2,266

|

)

|

5,262

|

(784

|

)

|

2,212

|

502

|

1,391

|

93

|

1,986

|

||||||||||||||||||||||

|

Interest expense:

|

||||||||||||||||||||||||||||||||

|

Passbook accounts

|

--

|

--

|

--

|

--

|

--

|

--

|

--

|

--

|

||||||||||||||||||||||||

|

Savings accounts

|

--

|

--

|

--

|

--

|

--

|

(1

|

)

|

--

|

(1

|

)

|

||||||||||||||||||||||

|

Money market accounts

|

8

|

158

|

6

|

172

|

1

|

(19

|

)

|

--

|

(18

|

)

|

||||||||||||||||||||||

|

Certificate of deposit accounts

|

(603

|

)

|

423

|

(63

|

)

|

(243

|

) |

576

|

391

|

75

|

1,042

|

|||||||||||||||||||||

|

Total deposits

|

(595

|

)

|

581

|

(57

|

)

|

(71

|

) |

577

|

371

|

75

|

1,023

|

|||||||||||||||||||||

|

FHLB short-term borrowings

|

(78

|

)

|

(58

|

)

|

32

|

(104

|

)

|

49

|

(84

|

)

|

(21

|

)

|

(56

|

)

|

||||||||||||||||||

|

FHLB long-term borrowings

|

(32

|

)

|

172

|

(12

|

)

|

128

|

35

|

84

|

8

|

127

|

||||||||||||||||||||||

|

FRB long-term borrowings

|

--

|

--

|

108

|

108

|

||||||||||||||||||||||||||||

|

Subordinated debt

|

(1

|

)

|

2

|

--

|

1

|

--

|

521

|

(9

|

)

|

512

|

||||||||||||||||||||||

|

Total interest-bearing liabilities

|

(706

|

)

|

697

|

71

|

62

|

661

|

892

|

53

|

1,606

|

|||||||||||||||||||||||

|

Increase (decrease) in net interest

income

|

$

|

(1,560

|

)

|

$

|

4,565

|

$

|

(855

|

)

|

$

|

2,150

|

$

|

(159

|

)

|

$

|

499

|

$

|

40

|

$

|

380

|

|||||||||||||

| (1) |

Includes loans held for sale.

|

| (2) |

Includes non-accrual loans during the respective periods. Calculated net of deferred fees and discounts, loans in process and allowance for loan losses.

|

|

Quaint Oak Bancorp, Inc.

|

|

Quaint Oak Bancorp, Inc.

|

|

Quaint Oak Bancorp, Inc.

|

|

3 Months

or Less

|

More than

3 Months

to 1 Year

|

More than

1 Year

to 3 Years

|

More than

3 Years

to 5 Years

|

More than

5 Years

|

Total

Amount

|

|||||||||||||||||||

|

(Dollars In Thousands)

|

||||||||||||||||||||||||

|

Interest-earning assets (1):

|

||||||||||||||||||||||||

|

Due from banks, interest-bearing

|

$

|

33,708

|

$

|

--

|

$

|

--

|

$

|

--

|

$

|

--

|

$

|

33,708

|

||||||||||||

|

Investment in interest-earning time deposits

|

1,499

|

2,507

|

4,457

|

1,000

|

--

|

9,463

|

||||||||||||||||||

|

Investment securities available for sale

|

4,737

|

28

|

167

|

170

|

5,623

|

10,725

|

||||||||||||||||||

|

Loans held for sale

|

53,191

|

--

|

--

|

--

|

--

|

53,191

|

||||||||||||||||||

|

Loans receivable (2)

|

28,757

|

46,322

|

143,251

|

90,014

|

56,898

|

365,242

|

||||||||||||||||||

|

Investment in Federal Home Loan Bank stock

|

--

|

--

|

--

|

--

|

1,665

|

1,665

|

||||||||||||||||||

|

Total interest-earning assets

|

$

|

121,892

|

$

|

48,857

|

$

|

147,875

|

$

|

91,184

|

$

|

64,186

|

$

|

473,994

|

||||||||||||

|

Interest-bearing liabilities:

|

||||||||||||||||||||||||

|

Passbook accounts

|

$

|

1

|

$

|

1

|

$

|

5

|

$

|

1

|

$

|

--

|

$

|

8

|

||||||||||||

|

Savings accounts

|

314

|

314

|

628

|

157

|

157

|

1,570

|

||||||||||||||||||

|

Money market accounts

|

19,928

|

19,928

|

39,855

|

9,964

|

9,963

|

99,638

|

||||||||||||||||||

|

Certificate accounts

|

39,826

|

61,345

|

74,822

|

23,434

|

--

|

199,427

|

||||||||||||||||||

|

FHLB borrowings

|

10,000

|

5,000

|

14,171

|

9,022

|

--

|

38,193

|

||||||||||||||||||

|

FRB borrowings

|

--

|

--

|

48,134

|

--

|

--

|

48,134

|

||||||||||||||||||

|

Subordinated debt

|

--

|

--

|

--

|

--

|

7,899

|

7,899

|

||||||||||||||||||

|

Total interest-bearing liabilities

|

$

|

70,069

|

$

|

86,588

|

$

|

177,615

|

$

|

42,578

|

$

|

18,019

|

$

|

394,869

|

||||||||||||

|

Interest-earning assets less interest-bearing liabilities

|

$

|

51,823

|

$

|

(37,731

|

)

|

$

|

(29,740

|

)

|

$

|

46,606

|

$

|

46,167

|

||||||||||||

|

Cumulative interest-rate sensitivity gap (3)

|

$

|

51,823

|

$

|

14,092

|

$

|

(15,648

|

)

|

$

|

32,958

|

$

|

79,125

|

|||||||||||||

|

Cumulative interest-rate gap as a percentage of total assets

at December 31, 2020

|

10.7

|

%

|

2.9

|

%

|

(3.2

|

)%

|

6.8

|

%

|

16.3

|

%

|

||||||||||||||

|

Cumulative interest-earning assets as a percentage of cumulative interest-bearing liabilities

at December 31, 2020

|

174.0

|

%

|

109.0

|

%

|

95.3

|

%

|

108.7

|

%

|

120.0

|

%

|

||||||||||||||

|

(1)

|

Interest-earning assets are included in the period in which the balances are expected to be redeployed and/or repriced as a result of anticipated prepayments, scheduled rate

adjustments and contractual maturities.

|

| (2) |

For purposes of the gap analysis, loans receivable includes non-performing loans gross of the allowance for loan losses and deferred loan fees.

|

| (3) |

Interest-rate sensitivity gap represents the difference between net interest-earning assets and interest-bearing liabilities.

|

|

Quaint Oak Bancorp, Inc.

|

|

Quaint Oak Bancorp, Inc.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

Payments Due By Period

|

||||||||||||||||||||

|

Total

|

To

1 Year

|

1-3

Years

|

4-5

Years

|

After 5

Years

|

||||||||||||||||

|

(In Thousands)

|

||||||||||||||||||||

|

Operating leases

|

$

|

1,220

|

$

|

236

|

$

|

357

|

$

|

173

|

$

|

454

|

||||||||||

|

Certificates of deposit

|

199,427

|

101,170

|

91,453

|

6,804

|

--

|

|||||||||||||||

|

FHLB borrowings

|

38,193

|

15,000

|

14,171

|

9,022

|

--

|

|||||||||||||||

|

FRB borrowings

|

48,134

|

--

|

48,134

|

--

|

--

|

|||||||||||||||

|

Total contractual obligations

|

$

|

286,974

|

$

|

116,406

|

$

|

154,115

|

$

|

15,999

|

$

|

454

|

||||||||||

|

Quaint Oak Bancorp, Inc.

|

|

Quaint Oak Bancorp, Inc.

|

| At December 31, |

At December 31, |

||||||||

| 2020 |

2019 | ||||||||

| (In thousands, except share data) |

|||||||||

| Assets |

|||||||||

|

Due from banks, non-interest-bearing

|

$

|

205

|

$

|

541

|

|||||

|

Due from banks, interest-bearing

|

33,708

|

14,014

|

|||||||

|

Cash and cash equivalents

|

33,913

|

14,555

|

|||||||

|

Investment in interest-earning time deposits

|

9,463

|

10,172

|

|||||||

|

Investment securities available for sale

|

10,725

|

7,623

|

|||||||

|

Loans held for sale

|

53,191

|

8,928

|

|||||||

|

Loans receivable, net of allowance for loan losses (2020 $3,061; 2019 $2,231)

|

359,122

|

246,692

|

|||||||

|

Accrued interest receivable

|

3,054

|

1,349

|

|||||||

|

Investment in Federal Home Loan Bank stock, at cost

|

1,665

|

1,580

|

|||||||

|

Bank-owned life insurance

|

4,054

|

3,974

|

|||||||

|

Premises and equipment, net

|

2,341

|

2,226

|

|||||||

|

Goodwill

|

515

|

515

|

|||||||

|

Other intangible, net of accumulated amortization

|

271

|

319

|

|||||||

|

Other real estate owned, net

|

286

|

1,824

|

|||||||

|

Prepaid expenses and other assets

|

5,475

|

2,783

|

|||||||

|

Total Assets

|

$

|

484,075

|

$

|

302,540

|

|||||

|

Liabilities and Stockholders’ Equity

|

|||||||||

|

Liabilities

|

|||||||||

|

Deposits:

|

|||||||||

|

Non-interest bearing

|

$

|

54,202

|

$

|

15,775

|

|||||

|

Interest-bearing

|

300,643

|

211,683

|

|||||||

|

Total deposits

|

354,845

|

227,458

|

|||||||

|

Federal Home Loan Bank short-term borrowings

|

10,000

|

10,000

|

|||||||

|

Federal Home Loan Bank long-term borrowings

|

28,193

|

26,271

|

|||||||

|

Federal Reserve Bank long-term borrowings

|

48,134

|

--

|

|||||||

|

Subordinated debt

|

7,899

|

7,865

|

|||||||

|

Accrued interest payable

|

362

|

314

|

|||||||

|

Advances from borrowers for taxes and insurance

|

2,486

|

2,780

|

|||||||

|

Accrued expenses and other liabilities

|

3,428

|

1,945

|

|||||||

|

Total Liabilities

|

455,347

|

276,633

|

|||||||

|

Stockholders’ Equity

|

|||||||||

|

Preferred stock – $0.01 par value, 1,000,000 shares

authorized; one issued or outstanding

|

--

|

--

|

|||||||

|

Common stock – $0.01 par value; 9,000,000 shares

|

|||||||||

|

authorized; 2,777,250 issued; 1,986,528 and 1,984,857

outstanding at December 31, 2020 and 2019, respectively

|

28

|

28

|

|||||||

|

Additional paid-in capital

|

15,282

|

14,990

|

|||||||

|

Treasury stock, at cost: 790,722 and 792,393 shares at

December 31, 2020 and 2019, respectively

|

(5,114

|

)

|

(4,950

|

)

|

|||||

|

Unallocated common stock held by:

|

|||||||||

|

Employee Stock Ownership Plan (ESOP)

|

(51

|

)

|

(118

|

)

|

|||||

|

Accumulated other comprehensive income

|

118

|

20

|

|||||||

|

Retained earnings

|

18,465

|

15,937

|

|||||||

|

Total Stockholders’ Equity

|

28,728

|

25,907

|

|||||||

|

Total Liabilities and Stockholders’ Equity

|

$

|

484,075

|

$

|

302,540

|

|||||

|

Quaint Oak Bancorp, Inc.

|

|

Years Ended December 31,

|

||||||||

|

2020

|

2019

|

|||||||

|

(In thousands, except share

|

||||||||

|

and per share data)

|

||||||||

|

Interest Income

|

||||||||

|

Interest on loans, including fees

|

$

|

15,657

|

$

|

13,167

|

||||

|

Interest and dividends on investment securities, interest-bearing deposits with others, and Federal Home Loan Bank stock

|

666

|

944

|

||||||

|

Total Interest Income

|

16,323

|

14,111

|

||||||

|

Interest Expense

|

||||||||

|

Interest on deposits

|

4,216

|

4,287

|

||||||

|

Interest on Federal Home Loan Bank short-term borrowings

|

37

|

141

|

||||||

|

Interest on Federal Home Loan Bank long-term borrowings

|

607

|

479

|

||||||

|

Interest on Federal Reserve Bank long-term borrowings

|

108

|

--

|

||||||

|

Interest on subordinated debt

|

520

|

519

|

||||||

|

Total Interest Expense

|

5,488

|

5,426

|

||||||

| Net Interest Income |

10,835 |

8,685 | ||||||

| Provision for Loan Losses |

830 |

303 | ||||||

| Net Interest Income after Provision for Loan Losses |

10,005 | 8,382 | ||||||

|

Non-Interest Income

|

||||||||

|

Mortgage banking and title abstract fees

|

1,579

|

1,152

|

||||||

|

Real estate sales commissions, net

|

159

|

180

|

||||||

|

Insurance commissions

|

490

|

419

|

||||||

|

Other fees and services charges

|

109

|

68

|

||||||

|

Income from bank-owned life insurance

|

80

|

80

|

||||||

|

Net gain on loans held for sale

|

4,320

|

3,014

|

||||||

|

Gain on the sale of SBA loans

|

115

|

265

|

||||||

|

Loss on sale of investment securities available for sale

|

--

|

(4

|

)

|

|||||

|

Loss on sales and write-downs of other real estate owned

|

(197

|

)

|

(221

|

)

|

||||

|

Total Non-Interest Income, net

|

6,655

|

4,953

|

||||||

|

Non-Interest Expense

|

||||||||

|

Salaries and employee benefits

|

8,427

|

6,947

|

||||||

|

Directors’ fees and expenses

|

232

|

223

|

||||||

|

Occupancy and equipment

|

913

|

692

|

||||||

|

Data processing

|

717

|

508

|

||||||

|

Professional fees

|

541

|

416

|

||||||

|

FDIC deposit insurance assessment

|

121

|

15

|

||||||

|

Other real estate owned expenses

|

42

|

22

|

||||||

|

Advertising

|

113

|

195

|

||||||

|

Amortization of other intangible

|

49

|

49

|

||||||

|

Other

|

968

|

841

|

||||||

|

Total Non-Interest Expense

|

12,123

|

9,908

|

||||||

|

Income before Income Taxes

|

4,537

|

3,427

|

||||||

|

Income Taxes

|

1,292

|

950

|

||||||

|

Net Income

|

$

|

3,245

|

$

|

2,477

|

|

Earnings per share – basic

|

$

|

1.64

|

$

|

1.27

|

||||

|

Average shares outstanding - basic

|

1,975,836

|

1,956,612

|

||||||

|

Earnings per share - diluted

|

$

|

1.61

|

$

|

1.24

|

||||

|

Average shares outstanding - diluted

|

2,012,399

|

2,005,438

|

|

Quaint Oak Bancorp, Inc.

|

|

Years Ended December 31,

|

||||||||

|

2020

|

2019

|

|||||||

|

(In Thousands)

|

||||||||

|

Net Income

|

$

|

3,245

|

$

|

2,477

|

||||

|

Other Comprehensive Income:

|

||||||||

|

Unrealized gains on investment securities available for sale

|

125

|

22

|

||||||

|

Income tax effect

|

(27

|

)

|

(3

|

)

|

||||

|

Reclassification adjustment for losses on sale of investment securities included in net income

|

--

|

4

|

||||||

|

Income tax effect

|

--

|

(1

|

)

|

|||||

|

Net other comprehensive income

|

98

|

22

|

||||||

|

Total Comprehensive Income

|

$

|

3,343

|

$

|

2,499

|

||||

|

Quaint Oak Bancorp, Inc.

|

|

(In thousands, except share and per share data)

|

Common Stock

|

|||||||||||||||||||||||||||||||

|

Number of

Shares

Outstanding

|

Amount

|

Additional

Paid-in

Capital

|

Treasury Stock

|

Unallocated

Common

Stock Held

by Benefit

Plans

|

Accumulated

Other

Comprehensive Income (Loss)

|

Retained

Earnings

|

Total

Stockholders’

Equity

|

|||||||||||||||||||||||||

|

BALANCE – DECEMBER 31, 2018

|

1,975,947

|

$

|

28

|

$

|

14,683

|

$

|

(4,824

|

)

|

$

|

(185

|

)

|

$

|

(2

|

)

|

$

|

14,136

|

$

|

23,836

|

||||||||||||||

|

Common stock allocated by ESOP (14,428 shares)

|

119

|

67

|

186

|

|||||||||||||||||||||||||||||

|

Treasury stock purchased

|

(27,297

|

)

|

(339

|

)

|

(339

|

)

|

||||||||||||||||||||||||||

|

Reissuance of treasury stock under 401(k) Plan

|

2,986

|

20

|

18

|

38

|

||||||||||||||||||||||||||||

|

Reissuance of treasury stock under stock incentive plan

|

9,721

|

(57

|

)

|

57

|

--

|

|||||||||||||||||||||||||||

|

Reissuance of treasury stock for exercised stock

options

|

23,500

|

52

|

138

|

190

|

||||||||||||||||||||||||||||

|

Stock based compensation expense

|

173

|

173

|

||||||||||||||||||||||||||||||

|

Cash dividends declared ($0.34 per share)

|

(676

|

)

|

(676

|

)

|

||||||||||||||||||||||||||||

|

Net income

|

2,477

|

2,477

|

||||||||||||||||||||||||||||||

|

Other comprehensive income, net

|

22

|

22

|

||||||||||||||||||||||||||||||

|

BALANCE – DECEMBER 31, 2019

|

1,984,857

|

$

|

28

|

$

|

14,990

|

$

|

(4,950

|

)

|

$

|

(118

|

)

|

$

|

20

|

$

|

15,937

|

$

|

25,907

|

|||||||||||||||

|

Common stock allocated by ESOP (14,428 shares)

|

106

|

67

|

173

|

|||||||||||||||||||||||||||||

|

Treasury stock purchased

|

(28,891

|

)

|

(349

|

)

|

(349

|

)

|

||||||||||||||||||||||||||

| |

||||||||||||||||||||||||||||||||

|

Reissuance of treasury stock under 401(k) Plan

|

8,641

|

44

|

53

|

97

|

||||||||||||||||||||||||||||

|

Reissuance of treasury stock under stock incentive plan

|

9,421

|

(57

|

)

|

57

|

--

|

|||||||||||||||||||||||||||

|

Reissuance of treasury stock for exercised stock

options

|

12,500

|

26

|

75

|

101

|

||||||||||||||||||||||||||||

|

Stock based compensation expense

|

173

|

173

|

||||||||||||||||||||||||||||||

|

Cash dividends declared ($0.34 per share)

|

(717

|

)

|

(717

|

)

|

||||||||||||||||||||||||||||

|

Net income

|

3,245

|

3,245

|

||||||||||||||||||||||||||||||

|

Other comprehensive income, net

|

98

|

98

|

||||||||||||||||||||||||||||||

|

BALANCE – DECEMBER 31, 2019

|

1,986,528

|

$

|

28

|

$

|

15,282

|

$

|

(5,114

|

)

|

$

|

(51

|

)

|

$

|

118

|

$

|

18,465

|

$

|

28,728

|

|

Quaint Oak Bancorp, Inc.

|

|

Consolidated Statements of Cash Flows

|

||||||||

|

Years Ended December 31,

|

||||||||

|

2020

|

2019

|

|||||||

|

(In Thousands)

|

||||||||

|

Cash Flows from Operating Activities

|

||||||||

|

Net income

|

$

|

3,245

|

$

|

2,477

|

||||

|

Adjustments to reconcile net income to net cash used in operating activities:

|

||||||||

|

Provision for loan losses

|

830

|

303

|

||||||

|

Depreciation expense

|

249

|

200

|

||||||

|

Amortization of operating right-of-use assets

|

145

|

95

|

||||||

|

Amortization of subordinated debt issuance costs

|

34

|

34

|

||||||

|

Amortization of other intangible

|

49

|

49

|

||||||

|

Net amortization of securities premiums

|

11

|

28

|

||||||

|

Accretion of deferred loan fees and costs, net

|

(1,370

|

)

|

(435

|

)

|

||||

|

Deferred income taxes

|

(566

|

)

|

(41

|

)

|

||||

|

Stock-based compensation expense

|

346

|

359

|

||||||

|

Net realized loss on sale of foreclosed real estate

|

92

|

-

|

||||||

|

Loss on sale of investment securities available for sale

|

-

|

4

|

||||||

|

Net gain on loans held for sale

|

(4,319

|

)

|

(3,014

|

)

|

||||

|

Loans held for sale-originations

|

(207,062

|

)

|

(135,310

|

)

|

||||

|

Loans held for sale-proceeds

|

167,118

|

134,499

|

||||||

|

Gain on the sale of SBA loans

|

(115

|

)

|

(265

|

)

|

||||

|

Write-downs of other real estate owned

|

105

|

221

|

||||||

|

Increase in the cash surrender value of bank-owned life insurance

|

(80

|

)

|

(80

|

)

|

||||

|

Changes in assets and liabilities which provided (used) cash:

|

||||||||

|

Accrued interest receivable

|

(1,705

|

)

|

(196

|

)

|

||||

|

Prepaid expenses and other assets

|

(1,640

|

)

|

(395

|

)

|

||||

|

Accrued interest payable

|

48

|

93

|

||||||

|

Accrued expenses and other liabilities

|

824

|

(478

|

)

|

|||||

|

Net Cash Used in Operating Activities

|

(43,761

|

)

|

(1,852

|

)

|

||||

|

Cash Flows from Investing Activities

|

||||||||

|

Purchase of interest-earning time deposits

|

(1,317

|

)

|

(6,849

|

)

|

||||

|

Redemption of interest-earning time deposits

|

2,026

|

1,603

|

||||||

|

Purchase of investment securities available for sale

|

(4,008

|

)

|

(3,319

|

)

|

||||

|

Principal repayments on investment securities available for sale

|

1,020

|

1,341

|

||||||

|

Proceeds from the sales of investment securities available for sale

|

--

|

1,030

|

||||||

|

Net increase in loans receivable

|

(111,775

|

)

|

(29,397

|

)

|

||||

|

Purchase of Federal Home Loan Bank stock

|

(808

|

)

|

(614

|

)

|

||||

|

Redemption of Federal Home Loan Bank stock

|

723

|

120

|

||||||

|

Proceeds from the sale of foreclosed real estate

|

1,611

|

--

|

||||||

|

Capitalized expenditures on other real estate owned

|

(270

|

)

|

(395

|

)

|

||||

|

Purchase of premises and equipment

|

(364

|

)

|

(368

|

)

|

||||

|

Net Cash Used in Investing Activities

|

(113,162

|

)

|

(36,848

|

)

|

||||

|

Cash Flows from Financing Activities

|

||||||||

|

Net increase (decrease) in demand deposits, money markets, and savings accounts

|

112,411

|

(2,689

|

)

|

|||||

|

Net increase in certificate accounts

|

14,976

|

18,236

|

||||||

|

(Decrease) increase in advances from borrowers for taxes and insurance

|

(294

|

)

|

212

|

|||||

|

Proceeds from Federal Home Loan Bank short-term borrowings

|

20,000

|

13,000

|

||||||

|

Repayment of Federal Home Loan Bank short-term borrowings

|

(20,000

|

)

|

(12,000

|

)

|

||||

|

Proceeds from Federal Home Loan Bank long-term borrowings

|

3,922

|

14,271

|

||||||

|

Repayment of Federal Home Loan Bank long-term borrowings

|

(2,000

|

)

|

(3,000

|

)

|

||||

|

Proceeds from Federal Reserve Bank long-term borrowings

|

52,144

|

--

|

||||||

|

Repayment of Federal Reserve Bank long-term borrowings

|

(4,010

|

)

|

--

|

|||||

|

Dividends paid

|

(717

|

)

|

(676

|

)

|

||||

|

Purchase of treasury stock

|

(349

|

)

|

(339

|

)

|

||||

|

Proceeds from the reissuance of treasury stock

|

97

|

38

|

||||||

|

Proceeds from the exercise of stock options

|

101

|

190

|

||||||

|

Net Cash Provided by Financing Activities

|

176,281

|

27,243

|

||||||

|

Net Increase (Decrease) in Cash and Cash Equivalents

|

19,358

|

(11,457

|

)

|

|||||

|

Cash and Cash Equivalents – Beginning of Year

|

14,555

|

26,012

|

||||||

|

Cash and Cash Equivalents – End of Year

|

$

|

33,913

|

$

|

14,555

|

||||

|

Supplementary Disclosure of Cash Flow and Non-Cash Information:

|

||||||||

|

Cash payments for interest

|

$

|

5,441

|

$

|

5,333

|

||||

|

Cash payments for income taxes

|

$

|

1,124

|

$

|

1,034

|

||||

|

Initial recognition of operating lease right-of use assets

|

$

|

658

|

$

|

1,386

|

||||

|

Initial recognition of operating lease obligations

|

$

|

658

|

$

|

1,386

|

||||

|

Quaint Oak Bancorp, Inc.

|

|

Quaint Oak Bancorp, Inc.

|

|

Quaint Oak Bancorp, Inc.

|

|

Quaint Oak Bancorp, Inc.

|

|

Quaint Oak Bancorp, Inc.

|

|

Quaint Oak Bancorp, Inc.

|

|

Quaint Oak Bancorp, Inc.

|

|

Quaint Oak Bancorp, Inc.

|

|

Quaint Oak Bancorp, Inc.

|

|

Quaint Oak Bancorp, Inc.

|

|

Quaint Oak Bancorp, Inc.

|

|

Quaint Oak Bancorp, Inc.

|

|

Quaint Oak Bancorp, Inc.

|

|

For the Year Ended December 31,

|

||||||||

|

2020

|

2019

|

|||||||

|

Net Income

|

$

|

3,245,000

|

$

|

2,477,000

|

||||

|

Weighted average shares outstanding – basic

|

1,975,836

|

1,956,612

|

||||||

|

Effect of dilutive common stock equivalents

|

36,563

|

48,826

|

||||||

|

Adjusted weighted average shares outstanding – diluted

|

2,012,399

|

2,005,438

|

||||||

|

Basic earnings per share

|

$

|

1.64

|

$

|

1.27

|

||||

|

Diluted earnings per share

|

$

|

1.61

|

$

|

1.24

|

||||

|

Unrealized Losses on

Investment Securities

Available for Sale (1)

|

||||||||

|

2020

|

2019

|

|||||||

|

Balance beginning of the year

|

$

|

20

|

$

|

(2

|

)

|

|||

|

Other comprehensive income before reclassifications

|

98

|

19

|

||||||

|

Amount reclassified from accumulated other comprehensive income (loss)

|

--

|

3

|

||||||

|

Total other comprehensive income

|

98

|

22

|

||||||

|

Balance end of the year

|

$

|

118

|

$

|

20

|

||||

|

(1)

|

All amounts are net of tax. Amounts in parentheses indicate debits.

|

| Amount Reclassified from Accumulated |

|||||||

| Details About Other Comprehensive Income |

Other Comprehensive Income (Loss)(1) |

Affected Line Item in the Statement of Income |

|||||

| For the Year Ended December 31, |

|||||||

|

2020

|

2019

|

||||||

|

Unrealized losses on investment securities available for sale

|

$--

|

$(4)

|

Loss on sales of investment securities

|

||||

|

--

|

1

|

Income taxes

|

|||||

|

$--

|

$(3)

|

||||||

| (1) |

Amounts in parentheses indicate debits.

|

|

Quaint Oak Bancorp, Inc.

|

|

2020

|

2019

|

|||||||

|

Due in one year or less

|

$

|

4,006

|

$

|

2,026

|

||||

|

Due after one year through five years

|

5,457

|

8,146

|

||||||

|

Total

|

$

|

9,463

|

$

|

10,172

|

||||

|

December 31, 2020

|

||||||||||||||||

|

Amortized

Cost

|

Gross

Unrealized

Gains

|

Gross

Unrealized

(Losses)

|

Fair Value

|

|||||||||||||

|

Available for Sale:

|

||||||||||||||||

|

Mortgage-backed securities:

|

||||||||||||||||

|

Government National Mortgage Association securities

|

$

|

4,887

|

$

|

27

|

$

|

(1

|

)

|

$

|

4,913

|

|||||||

|

Federal National Mortgage Association securities

|

183

|

6

|

--

|

189

|

||||||||||||

|

Total mortgage-backed securities

|

5,070

|

33

|

(1

|

)

|

5,102

|

|||||||||||

|

Debt securities:

|

||||||||||||||||

|

Corporate notes

|

5,506

|

117

|

--

|

5,623

|

||||||||||||

|

Total available-for-sale-securities

|

$

|

10,576

|

$

|

150

|

$

|

(1

|

)

|

$

|

10,725

|

|||||||

|

December 31, 2019

|

||||||||||||||||

|

Amortized

Cost

|

Gross

Unrealized

Gains

|

Gross

Unrealized

(Losses)

|

Fair Value

|

|||||||||||||

|

Available for Sale:

|

||||||||||||||||

|

Mortgage-backed securities:

|

||||||||||||||||

|

Government National Mortgage Association securities

|

$

|

5,841

|

$

|

13

|

$

|

(1

|

)

|

$

|

5,853

|

|||||||

|

Federal National Mortgage Association securities

|

258

|

2

|

--

|

260

|

||||||||||||

|

Total mortgage-backed securities

|

6,099

|

15

|

(1

|

)

|

6,113

|

|||||||||||

|

Debt securities:

|

||||||||||||||||

|

Corporate notes

|

1,500

|

10

|

--

|

1,510

|

||||||||||||

|

Total available-for-sale-securities

|

$

|

7,599

|

$

|

25

|

$

|

(1

|

)

|

$

|

7,623

|

|||||||

|

Available for Sale

|

||||||||

|

Amortized Cost

|

Fair Value

|

|||||||

|

Due after five through ten years

|

$

|

5,506

|

$

|

5,102

|

||||

|

Due after ten years

|

5,070

|

5,623

|

||||||

|

Total

|

$

|

10,576

|

$

|

10,725

|

||||

|

Quaint Oak Bancorp, Inc.

|

|

|

December 31, 2020

|

|||||||||||||||||||||||||||

|

Less than Twelve Months

|

Twelve Months or Greater

|

Total

|

||||||||||||||||||||||||||

| |

Number of Securities |

Fair Value

|

Gross

Unrealized Losses |

Fair Value

|

Gross

Unrealized Losses |

Fair Value

|

Gross

Unrealized Losses |

|||||||||||||||||||||

|

Government National Mortgage Association securities

|

1

|

$

|

681

|

$

|

(1

|

)

|

$

|

--

|

$

|

--

|

$

|

681

|

$

|

(1

|

)

|

|||||||||||||

|

|

December 31, 2019

|

|||||||||||||||||||||||||||

|

Less than Twelve Months

|

Twelve Months or Greater

|

Total

|

||||||||||||||||||||||||||

| |

Number of

Securities

|

Fair Value

|

Gross

Unrealized Losses |

Fair Value

|

Gross

Unrealized Losses |

Fair Value

|

Gross

Unrealized Losses |

|||||||||||||||||||||

|

Government National Mortgage Association securities

|

4

|

$

|

2,295

|

$

|

(1

|

)

|

$

|

--

|

$

|

--

|

$

|

2,295

|

$

|

(1

|

)

|

|||||||||||||

|

Quaint Oak Bancorp, Inc.

|

|

December 31,

2020

|

December 31,

2019

|

|||||||

|

Real estate loans:

|

||||||||

|

One-to-four family residential:

|

||||||||

|

Owner occupied

|

$

|

7,528

|

$

|

6,298

|

||||

|

Non-owner occupied

|

38,884

|

39,897

|

||||||

|

Total one-to-four family residential

|

46,412

|

46,195

|

||||||

|

Multi-family (five or more) residential

|

24,043

|

22,233

|

||||||

|

Commercial real estate

|

131,820

|

119,323

|

||||||

|

Construction

|

4,775

|

12,523

|

||||||

|

Home equity

|

3,788

|

3,726

|

||||||

|

Total real estate loans

|

210,838

|

204,000

|

||||||

|

Commercial business

|

154,387

|

45,745

|

||||||

|

Other consumer

|

17

|

22

|

||||||

|

Total Loans

|

365,242

|

249,767

|

||||||

|

Deferred loan fees and costs

|

(3,059

|

)

|

(844

|

)

|

||||

|

Allowance for loan losses

|

(3,061

|

)

|

(2,231

|

)

|

||||

|

Net Loans

|

$

|

359,122

|

$

|

246,692

|

||||

|

December 31, 2020

|

||||||||||||||||||||

|

Pass

|

Special

Mention

|

Substandard

|

Doubtful

|

Total

|

||||||||||||||||

|

One-to-four family residential owner occupied

|

$

|

6,942

|

$

|

415

|

$

|

171

|

$

|

--

|

$

|

7,528

|

||||||||||

|

One-to-four family residential non-owner occupied

|

38,567

|

--

|

317

|

--

|

38,884

|

|||||||||||||||

|

Multi-family residential

|

24,043

|

--

|

--

|

--

|

24,043

|

|||||||||||||||

|

Commercial real estate

|

129,236

|

2,292

|

292

|

--

|

131,820

|

|||||||||||||||

|

Construction

|

4,775

|

--

|

--

|

--

|

4,775

|

|||||||||||||||

|

Home equity

|

3,788

|

--

|

--

|

--

|

3,788

|

|||||||||||||||

|

Commercial business

|

154,387

|

--

|

--

|

--

|

154,387

|

|||||||||||||||

|

Other consumer

|

17

|

--

|

--

|

--

|

17

|

|||||||||||||||

|

Total

|

$

|

361,755

|

$

|

2,707

|

$

|

780

|

$

|

--

|

$

|

365,242

|

||||||||||

|

Quaint Oak Bancorp, Inc.

|

|

December 31, 2019

|

||||||||||||||||||||

|

Pass

|

Special Mention

|

Substandard

|

Doubtful

|

Total

|

||||||||||||||||

|

One-to-four family residential owner occupied

|

$

|

6,126

|

$

|

--

|

$

|

172

|

$

|

--

|

$

|

6,298

|

||||||||||

|

One-to-four family residential non-owner occupied

|

39,579

|

--

|

318

|

--

|

39,897

|

|||||||||||||||

|

Multi-family residential

|

22,233

|

--

|

--

|

--

|

22,233

|

|||||||||||||||

|

Commercial real estate

|

118,233

|

798

|

292

|

--

|

119,323

|

|||||||||||||||

|

Construction

|

12,523

|

--

|

--

|

--

|

12,523

|

|||||||||||||||

|

Home equity

|

3,726

|

--

|

--

|

--

|

3,726

|

|||||||||||||||

|

Commercial business

|

45,745

|

--

|

--

|

--

|

45,745

|

|||||||||||||||

|

Other consumer

|

22

|

--

|

--

|

--

|

22

|

|||||||||||||||

|

Total

|

$

|

248,187

|

$

|

798

|

$

|

782

|

$

|

--

|

$

|

249,767

|

||||||||||

|

December 31, 2020

|

||||||||||||||||||||

|

Recorded

Investment

|

Unpaid

Principal

Balance

|

Related

Allowance

|

Average

Recorded

Investment

|

Interest

Income

Recognized

|

||||||||||||||||

|

With no related allowance recorded:

|

||||||||||||||||||||

|

One-to-four family residential owner occupied

|

$

|

171

|

$

|

178

|

$

|

--

|

$

|

171

|

$

|

1

|

||||||||||

|

One-to-four family residential non-owner occupied

|

19

|

19

|

--

|

19

|

3

|

|||||||||||||||

|

Multi-family residential

|

--

|

--

|

--

|

--

|

--

|

|||||||||||||||

|

Commercial real estate

|

131

|

131

|

--

|

131

|

1

|

|||||||||||||||

|

Construction

|

--

|

--

|

--

|

--

|

--

|

|||||||||||||||

|

Home equity

|

--

|

--

|

--

|

--

|

--

|

|||||||||||||||

|

Commercial business

|

--

|

--

|

--

|

--

|

--

|

|||||||||||||||

|

Other consumer

|

--

|

--

|

--

|

--

|

--

|

|||||||||||||||

|

With an allowance recorded:

|

||||||||||||||||||||

|

One-to-four family residential owner occupied

|

$

|

--

|

$

|

--

|

$

|

--

|

$

|

--

|

$

|

--

|

||||||||||

|

One-to-four family residential non-owner occupied

|

--

|

--

|

--

|

--

|

--

|

|||||||||||||||

|

Multi-family residential

|

--

|

--

|

--

|

--

|

--

|

|||||||||||||||

|

Commercial real estate

|

--

|

--

|

--

|

--

|

--

|

|||||||||||||||

|

Construction

|

--

|

--

|

--

|

--

|

--

|

|||||||||||||||

|

Home equity

|

--

|

--

|

--

|

--

|

--

|

|||||||||||||||

|

Commercial business

|

--

|

--

|

--

|

--

|

--

|

|||||||||||||||

|

Other consumer

|

--

|

--

|

--

|

--

|

--

|

|||||||||||||||

|

Total:

|

||||||||||||||||||||

|

One-to-four family residential owner occupied

|

$

|

171

|

178

|

$

|

--

|

$

|

171

|

$

|

1

|

|||||||||||

|

One-to-four family residential non-owner occupied

|

19

|

19

|

--

|

19

|

3

|

|||||||||||||||

|

Multi-family residential

|

--

|

--

|

--

|

--

|

--

|

|||||||||||||||

|

Commercial real estate

|

131

|

131

|

--

|

131

|

1

|

|||||||||||||||

|

Construction

|

--

|

--

|

--

|

--

|

--

|

|||||||||||||||

|

Home equity

|

--

|

--

|

--

|

--

|

--

|

|||||||||||||||

|

Commercial business

|

--

|

--

|

--

|

--

|

--

|

|||||||||||||||

|

Other consumer

|

--

|

--

|

--

|

--

|

--

|

|||||||||||||||

|

Total

|

$

|

321

|

$

|

328

|

$

|

--

|

$

|

321

|

$

|

5

|

||||||||||

|

Quaint Oak Bancorp, Inc.

|

|

December 31, 2019

|

||||||||||||||||||||

|

Recorded

Investment

|

Unpaid

Principal

Balance

|

Related

Allowance |

Average

Recorded

Investment

|

Interest

Income

Recognized

|

||||||||||||||||

|

With no related allowance recorded:

|

||||||||||||||||||||

|

One-to-four family residential owner occupied

|

$

|

172

|

$

|

178

|

$

|

--

|

$

|

178

|

$

|

--

|

||||||||||

|

One-to-four family residential non-owner occupied

|

19

|

19

|

--

|

225

|

13

|

|||||||||||||||

|

Multi-family residential

|

--

|

--

|

--

|

--

|

--

|

|||||||||||||||

|

Commercial real estate

|

--

|

--

|

--

|

--

|

--

|

|||||||||||||||

|

Construction

|

--

|

--

|

--

|

--

|

--

|

|||||||||||||||

|

Home equity

|

--

|

--

|

--

|

--

|

--

|

|||||||||||||||

|

Commercial business

|

--

|

--

|

--

|

--

|

--

|

|||||||||||||||

|

Other consumer

|

--

|

--

|

--

|

--

|

--

|

|||||||||||||||

|

With an allowance recorded:

|

||||||||||||||||||||

|

One-to-four family residential owner occupied

|

$

|

--

|

$

|

--

|

$

|

--

|

$

|

--

|

$

|

--

|

||||||||||

|

One-to-four family residential non-owner occupied

|

--

|

--

|

--

|

--

|

--

|

|||||||||||||||

|

Multi-family residential

|

--

|

--

|

--

|

--

|

--

|

|||||||||||||||

|

Commercial real estate

|

132

|

132

|

4

|

133

|

12

|

|||||||||||||||

|

Construction

|

--

|

--

|

--

|

--

|

--

|

|||||||||||||||

|

Home equity

|

--

|

--

|

--

|

--

|

--

|

|||||||||||||||

|

Commercial business

|

--

|

--

|

--

|

--

|

--

|

|||||||||||||||

|

Other consumer

|

--

|

--

|

--

|

--

|

--

|

|||||||||||||||

|

Total:

|

||||||||||||||||||||

|

One-to-four family residential owner occupied

|

$

|

172

|

178

|

$

|

--

|

$

|

178

|

$

|

--

|

|||||||||||

|

One-to-four family residential non-owner occupied

|

19

|

19

|

--

|

225

|

13

|

|||||||||||||||

|