UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22037

Stone Harbor Investment Funds

(Exact name of registrant as specified in charter)

1290 Broadway, Suite 1100

Denver, CO 80203

(Address of principal executive offices) (Zip code)

Adam J. Shapiro, Esq.

c/o Stone Harbor Investment Partners LP

31 West 52nd Street, 16th Floor

New York, NY 10019

(Name and address of agent for service)

With copies To:

Michael G. Doherty, Esq.

Ropes & Gray LLP

1211 Avenue of the Americas

New York, NY 10036

Registrant’s telephone number, including area code: (303) 623-2577

Date of fiscal year end: May 31

Date of reporting period: November 30, 2017

Item 1. Report to Stockholders.

Table of Contents

| Shareholder Letter | 2 |

| Disclosure of Fund Expenses | 8 |

| Summaries of Portfolio Holdings | 9 |

| Growth of $10,000 Investment | |

| Stone Harbor Emerging Markets Debt Fund | 12 |

| Stone Harbor High Yield Bond Fund | 13 |

| Stone Harbor Local Markets Fund | 14 |

| Stone Harbor Emerging Markets Corporate Debt Fund | 15 |

| Stone Harbor Investment Grade Fund | 16 |

| Stone Harbor Strategic Income Fund | 17 |

| Stone Harbor Emerging Markets Debt Allocation Fund | 18 |

| Stone Harbor 500 Plus Fund | 19 |

| Statements of Investments | |

| Stone Harbor Emerging Markets Debt Fund | 20 |

| Stone Harbor High Yield Bond Fund | 30 |

| Stone Harbor Local Markets Fund | 38 |

| Stone Harbor Emerging Markets Corporate Debt Fund | 43 |

| Stone Harbor Investment Grade Fund | 48 |

| Stone Harbor Strategic Income Fund | 54 |

| Stone Harbor Emerging Markets Debt Allocation Fund | 56 |

| Stone Harbor 500 Plus Fund | 57 |

| Statements of Assets & Liabilities | 60 |

| Statements of Operations | 62 |

| Statements of Changes in Net Assets | 64 |

| Financial Highlights | |

| Stone Harbor Emerging Markets Debt Fund | 68 |

| Stone Harbor High Yield Bond Fund | 69 |

| Stone Harbor Local Markets Fund | 70 |

| Stone Harbor Emerging Markets Corporate Debt Fund | 71 |

| Stone Harbor Investment Grade Fund | 72 |

| Stone Harbor Strategic Income Fund | 73 |

| Stone Harbor Emerging Markets Debt Allocation Fund | 74 |

| Stone Harbor 500 Plus Fund | 75 |

| Notes to Financial Statements | 76 |

| Additional Information | 98 |

| Trustees & Officers | 100 |

Stone Harbor Investment Funds Semi-Annual Report | November 30, 2017 |

1 |

| Stone Harbor Investment Funds | Shareholder Letter |

November 30, 2017 (Unaudited)

Dear Shareholder,

The six month period ended November 30, 2017 was broadly positive for global credit markets. Positive market momentum was supported by several important factors, including continued signs of improving growth in the U.S., EU, and several large emerging markets economies; stable inflation; a modest increase in government bond yields; and tighter spreads. Furthermore, a rebound in oil prices from approximately $46 in May to $57 at the end of November contributed to a rise in asset prices -- particularly those credits from oil-exporting emerging markets countries -- and helped produce positive returns across the asset classes.

During the review period, credit markets remained focused on the major themes we have discussed in the recent past. Importantly, improving Gross Domestic Product (GDP) growth allowed the US Federal Reserve (“Fed”) to continue policy tightening at a measured pace with a second rate increase in June, and likely, a third by the end of 2017. This tightening occurred while the European Central Bank (“ECB”) maintained an accommodative monetary policy. U.S. government bond yields moved modestly higher in response to policy rate increases, with 10-year U.S. Treasury yields rising from 2.20% at the end of May to 2.40% at the end of November. In this environment, spreads tightened across our asset classes, with U.S. investment grade, U.S. high yield, European high yield and emerging markets sovereign debt each tightening by 14 to 17 basis points (“bps”). Emerging markets corporate debt spreads tightened by 33 bps.

As we look ahead, we believe global GDP remains poised for moderate growth. A key issue will likely be the extent to which the Fed delivers further interest rate hikes in 2018. The market expectation is one or two hikes, and any hikes beyond this would likely require further labor market tightening, based on our current assessment. As of this writing, another uncertainty regarding the future path of the Fed’s balance sheet drawdown is the leadership direction of the incoming Fed Chair, Jerome Powell. Apart from U.S. monetary policy, other uncertainties include potential changes in U.S. trade policy, which would likely have a pronounced impact on emerging markets, and further developments around Brexit negotiations and the ripple effect on the EU and the UK 7 economies.

Given this backdrop, credit market valuations appear slightly extended, in our view. Overall, we remain modestly biased towards caution with respect to our overall risk level. Across asset classes, we see a potential for continued outperformance in EM, supported by valuation and growth.

At Stone Harbor, we will continue to focus on capturing excess return from stable and improving credit situations in corporate and sovereign markets worldwide. As we continue to monitor these developments, please follow our progress throughout the year by visiting our website at www.shiplp.com. There you will find updates on our view of credit markets, as well as related news and research. We appreciate the confidence you have placed in Stone Harbor Investment Partners LP and look forward to providing you with another update in the next six months.

Market Review: Emerging Markets Debt

Emerging markets (“EM”) debt total returns were positive for the 6-month period ended November 30, 2017. U.S. dollar-denominated sovereign debt, as represented by the JPMorgan EMBI Global Diversified Index, returned 2.92%; local currency debt, as represented by the JPMorgan GBI EM Global Diversified Index, posted a return of 2.80%; and U.S. dollar-denominated corporate bonds were up 2.69%, according to the JPMorgan CEMBI Broad Diversified Index.

The trailing 6-month period ended November 30, 2017 was characterized by continued global growth and strong underlying fundamental trends in developing countries. As the U.S. economy expanded at its most robust pace in over two years, the U.S. Fed remained on track for slow and steady rate increases and delivered a second rate hike in June, with a third hike widely expected in December. At the same time, the ECB maintained its accommodative monetary policy stance, although with an eye towards policy tightening in 2018. Oil price stabilization provided further support to improving economic activity in several large EM countries -- particularly emerging markets exporters. Given this favorable macroeconomic backdrop, EM technical conditions also remained supportive with inflows into all EM asset classes during the period. Inflows into hard currency EMD funds totaled $66 billion through the end of November, which when added to $34 billion of flows into local currency debt accounted for the second highest cumulative annual inflow into emerging markets debt on record.

In hard currency sovereign debt, credits from many EM oil producers, including Angola, Ecuador, Ghana, and Iraq outperformed their peers. The highest returns in Latin America came from Ecuador, El Salvador, Uruguay, and Suriname. The worst performer in the region was Venezuela, whose debt declined nearly 40% in total return during the period, due to U.S. imposed economic sanctions and payment delays. Oil prices and the U.S. dollar rally towards the end of the period were key factors impacting local markets. In the hard currency corporate debt market, Latin America was again a strong contributor to returns, in line with many of the sovereign debt markets that benefitted from improving growth and higher oil prices.

Stone Harbor Emerging Markets Debt Fund

The total return of the Stone Harbor Emerging Markets Debt Fund (the “Fund”) for the 6-month period ended November 30, 2017 was 3.33% (net of expenses) and 3.69% (gross of expenses). This performance compares to a benchmark return of 2.92% for the JPMorgan EMBI Global Diversified Index. For the period, external sovereign bond credit spreads over comparable maturity U.S. Treasury securities tightened by 17 bps, ending the period at 288 bps.

2 |

www.shiplp.com |

| Stone Harbor Investment Funds | Shareholder Letter |

November 30, 2017 (Unaudited)

The Fund outperformed its benchmark as a result of country selection and issue selection decisions. Off benchmark hard currency corporate debt exposure also enhanced relative returns, while off benchmark local currency sovereign debt exposure detracted from performance. Duration- adjusted returns that are explained by U.S. Treasury movements, as well as miscellaneous differences, were negative.

Positioning in Central Europe, the Middle East, and Africa contributed most to returns in excess of the benchmark, driven primarily by an overweight and issue selection in Ukraine. The most important factors driving Ukraine’s outperformance this period, in our view, have been the ongoing recovery in growth, proven success in implementing reforms, and the International Monetary Fund (“IMF”) support. Overweights in Azerbaijan, Iraq, and Ivory Coast also enhance performance. In Iraq, several key factors, including the country’s strong capacity and demonstrated willingness to pay, a successful IMF program, and rising oil prices and oil output, have been supportive of asset prices. In Latin America, the largest positive contributor to relative performance was an overweight and issue selection in Argentina; however, the positive attribution was more than offset by an overweight and issue selection in Venezuela. In Asia, underweights in low-beta, low-yielding credits, such as China and the Philippines, and issue selection in Indonesia and Malaysia enhanced performance.

Other positive contributors included off-benchmark exposure to hard currency corporate debt in Brazil (in line with Brazil sovereign debt, which benefitted from improving growth), and in Ghana.

Off-benchmark exposure to local currency debt, however, detracted from performance. Local bond markets in Turkey and South Africa performed poorly in the third quarter, on a relative basis. Turkey’s lira depreciated at the end of the quarter in reaction to Kurdistan’s vote for independence and continued to fall relative to the U.S. dollar in reaction to political events. We believe that the sell off in the South African rand was largely a response to external events, including the stronger U.S. dollar at the end of the third quarter.

The Fund uses various derivative instruments to implement its strategies. These derivatives are utilized to manage the Fund’s credit risk, interest rate risk and foreign exchange risk. These derivative positions may increase or decrease the Fund’s exposure to these risks. At the end of the reporting period the Fund had net exposure to these derivatives of approximately -$228 thousand. Over the course of the reporting period these derivative positions generated a net realized loss of approximately $5.1 million and $1.2 million in unrealized appreciation for a decrease in operations of $3.9 million. We plan to continue to utilize derivative instruments to implement our strategies related to credit risk, interest rate risk and foreign exchange risk.

Stone Harbor Local Markets Fund

The total return of the Stone Harbor Local Markets Fund (the “Fund”) for the 6-month period ended November 30, 2017 was 2.05% (net of expenses) and 2.50% (gross of expenses). This performance compares to a benchmark return of 2.80% for the JPMorgan GBI-EM Global Diversified Index. Contributions to the index total return from foreign currency exchange ("FX") spot transactions and carry/duration were -0.25% and 0.31%, respectively. The Fund’s positive attribution from duration positioning was offset by FX exposure and issues, taxes and other considerations. Miscellaneous differences also detracted from relative performance.

The largest sources of the Fund’s underperformance were our positioning in Hungary and Thailand. The advance of the Euro relative to the U.S. dollar earlier in the period supported the returns for Hungary, and the Fund’s underweight in both FX and duration detracted from performance. In Asia, markets generally lagged the benchmark, except Thailand, where export-led growth and forecasts of a current account surplus supported the baht. The Fund’s underweights in FX and duration hurt performance during the period.

Other detractors included FX overweights in Argentina, Brazil, and Turkey. In Turkey, the Fund’s tactical overweight positioning reflects our view that the latest political tensions involving President Erdogan and his suspected scheme intended to circumvent U.S. sanctions against Iran, have been fully priced. Issues, taxes, and curve positioning in Brazil, Czech Republic, Poland, Romania, and Russia also detracted from relative returns.

The top contributors to relative performance included off-benchmark U.S. dollar-denominated securities in Argentina, which we added in the third quarter. Argentina’s return to more orthodox economic policies under the new Macri administration supported the hard currency asset prices. Duration positioning in several other countries - underweights in Czech Republic, Romania, and Turkey, and overweights in Brazil and Russia - contributed positively to performance. In Brazil, lower-than-target inflation and the Brazil central bank’s decision to cut policy interest rate continued to support local bond prices.

The Fund uses various derivative instruments to implement its strategies. These derivatives are utilized to manage the Fund’s credit risk, interest rate risk and foreign exchange risk. These derivative positions may increase or decrease the Fund’s exposure to these risks. At the end of the reporting period the Fund had net exposure to these derivatives of approximately $894 thousand. Over the course of the reporting period these derivative positions generated a net realized loss of approximately $19.1 million and $1.3 million in unrealized appreciation, for a decrease in operations of $17.8 million. We plan to continue to utilize derivative instruments to implement our strategies related to credit risk, interest rate risk and foreign exchange risk.

Stone Harbor Investment Funds Semi-Annual Report | November 30, 2017 |

3 |

| Stone Harbor Investment Funds | Shareholder Letter |

November 30, 2017 (Unaudited)

Stone Harbor Emerging Markets Corporate Debt Fund

The total return of the Stone Harbor Emerging Markets Corporate Debt Fund (the “Fund”) for the 6-month period ended November 30, 2017 was 3.75% (net of expenses) and 4.26% (gross of expenses). This performance compares to a benchmark return of 2.69% for the CEMBI Broad Diversified. The index spread over comparable maturity U.S. Treasury securities tightened by 33 basis points, ending the period at 225 basis points. The high yield sub-sector outperformed, returning 3.81%, while the investment grade sector returned 1.90%. Returns from each of the major emerging markets (“EM”) regions (i.e., Africa, Asia, Eastern Europe, Latin America, and the Middle East) were positive, with the exception of the Middle East. Latin America generated the strongest returns, led by Brazil corporates that strengthened in line with sovereign debt. Top country performers included Ukraine (+15.95%), Latvia (+10.85%), and Ghana (+7.48%); the bottom performers included Israel (-3.85%), Qatar (+0.11%), and Bahrain (+0.40%). The positive performance of the EM corporate sector was driven primarily by rising oil prices and several positive company developments.

The Fund outperformed its benchmark due to both country and regional exposures and issue selection decisions. The largest positive contributors to Fund performance were an overweight exposure in Ukraine and an underweight exposure in Israel, which lagged all other country returns, declining primarily in response to the weak performance of Teva Pharmaceutical debt. An overweight exposure in Ghana and an underweight exposure in Qatar also enhanced returns. In Latin America, the top positive contributor to excess returns was an overweight exposure in Brazil, where the energy and mining sectors were the key drivers of strong returns. In Asia, an overweight exposure in Indonesia and an underweight exposure in South Korea contributed positively to excess returns.

In terms of issue selection, positive issue selection in Latin America, particularly in Argentina, Brazil, Chile, Colombia, and Mexico contributed most to excess returns. In other regions, strong issue selection in India, Indonesia, and Macau, as well as in the UAE enhanced relative performance. Some of this positive attribution was offset by issue selection in Ukraine.

From an industry perspective, overweight exposures to exploration & production, and metals/mining/steel, and underweight exposures to banking and pharmaceuticals were among the top contributors to excess returns. Issue selection in several industries, including banking, energy & production, food and beverage, and metals/mining/steel also enhanced performance.

Attribution from credit rating was positive, with the largest contributions from overweight in lower quality CCC rated credits. Overweights in B and BB rated credits also enhanced returns, as did underweights in the higher quality A and BBB rated credits, which underperformed during the review period.

The Fund uses various derivative instruments to implement its strategies. These derivatives are utilized to manage the Fund’s credit risk, interest rate risk and foreign exchange risk. These derivative positions may increase or decrease the Fund’s exposure to these risks. At the end of the reporting period, the Fund did not have exposure to these derivatives.

Stone Harbor Emerging Markets Debt Allocation Fund

The Stone Harbor Emerging Markets Debt Allocation Fund’s (the “Fund”) performance for the 6-month period ended November 30, 2017 was 2.72% (net of direct and indirect expenses) and 3.15% (gross of direct and indirect expenses). This compares to a blended benchmark (50% JPMorgan EMBI Global Diversified Index / 50% JPMorgan GBI-EM Global Diversified Index) return of 2.88%.

The Fund generated positive performance from asset allocation decisions throughout most of the reporting period, except in September and October, when local currency markets underperformed the blended benchmark.

Allocations to hard currency sovereign debt and out-of-benchmark exposure to U.S. dollar-denominated corporate debt enhanced relative performance, while local currency positioning detracted. Relative duration-adjusted returns that are explained by U.S. Treasury movements were positive, while miscellaneous difference, which represents pricing differences among other factors, was negative.

Within the hard currency sovereign debt allocation, positioning in Central Europe, the Middle East, and Africa contributed most to returns in excess of the benchmark, driven primarily by an overweight and issue selection in Ukraine. The most important factors driving Ukraine’s outperformance this period, in our view, have been the ongoing recovery in growth, proven success in implementing reforms, and IMF support. Overweights in Iraq and Ivory Coast also enhanced performance. In Iraq, several key factors, including the country’s strong capacity and demonstrated willingness to pay, a successful IMF program, and rising oil prices and oil output, have been supportive of asset prices. In Latin America, the largest positive contributor to relative performance was an overweight and issue selection in Argentina; however, the positive attribution was more than offset by an overweight and issue selection in Venezuela. In Asia, underweights in low-beta, low-yielding credits, such as China and the Philippines, and issue selection in Indonesia and Malaysia enhanced performance.

Within the local currency debt allocation, positioning in Hungary and Turkey detracted most from relative performance. The advance of the Euro relative to the U.S. dollar earlier in the period supported the returns for Hungary, and the Fund’s underweight in both FX and duration detracted from performance. In Turkey, the latest political tensions involving President Erdogan and his suspected scheme intended to circumvent U.S. sanctions against Iran, drove the weakness, particularly towards the end of the period. The Fund’s tactical overweight position reflects our view that the current developments have been fully priced.

| 4 | www.shiplp.com |

| Stone Harbor Investment Funds | Shareholder Letter |

November 30, 2017 (Unaudited)

Other detractors included FX overweights in South Africa and Thailand. We believe that the sell off in the South African rand was largely a response to external events, including the stronger U.S. dollar at the end of third quarter. In Asia, currency and local bond returns generally lagged the benchmark, except Thailand, where export-led growth and forecasts of a current account surplus supported the baht. The Fund’s underweights in Thailand FX and local duration hurt performance during the period. Issue selection in Poland and Romania also detracted from relative returns.

The top contributors to relative performance in local markets included FX and duration overweights in the Czech Republic, Poland, where appreciation of the Euro relative to the U.S. dollar supported markets, and in Russia, which was supported by rising oil prices.

The Fund uses various derivative instruments to implement its strategies. These derivatives are utilized to manage the Fund’s credit risk, interest rate risk and foreign exchange risk. These derivative positions may increase or decrease the Fund’s exposure to these risks. At the end of the reporting period the Fund had net exposure to these derivatives of less than one thousand dollars. Over the course of the reporting period these derivative positions generated a net realized gain of approximately $1.4 thousand and $4 thousand in unrealized appreciation, for increase in operations of $5.4 thousand. We plan to continue to utilize derivative instruments to implement our strategies related to credit risk, interest rate risk and foreign exchange risk.

Stone Harbor High Yield Bond Fund

The Stone Harbor High Yield Bond Fund (the “Fund”) return for the 6-month period ended November 30, 2017 was 0.99% (net of expenses) and 1.32% (gross of expenses). This compares to a benchmark return of 2.07%. The benchmark was changed from the Citigroup High Yield Market Capped Index to the BofA Merrill Lynch High Yield Constrained Index beginning October 1, 2017.

During the review period, the high yield market was supported by positive earnings trends, improving credit fundamentals, and low default rates. Market performance was also reinforced by strong equity markets, optimism regarding U.S. government fiscal support through reduced regulations and a potential tax plan, and the Fed’s well telegraphed actions to the market. Oil prices rose during the period as OPEC agreements to cut production remained in place. The market was negatively impacted by a significant increase in idiosyncratic risks - an indication of, in our view, the latter part of a credit cycle, particularly on the larger industry sectors and an increase in geopolitical tensions.

High yield issuance increased 16% during the period compared to the same 6-month period in 2016, driven by repayment or refinancing of existing debt as tight spreads and low interest rates remained attractive to issuers. Retail flows were significantly negative for the period, eclipsing the outflow during the same 6-month period in 2016. High yield spreads, as represented by the current Index, tightened 16 basis points to end the period at 373 basis points. The average yield increased from 5.54% to 5.77%.

Top performing sectors at the index level for the period included Electric, which benefitted from mergers and acquisitions (“M&A”) activity, and Transportation. The bottom performers included Retail-Food & Drug, due to poor operating results in an intensely competitive environment, and Wireline with weak operating performance. Higher rated securities significantly outperformed due to a rise in idiosyncratic risk, particularly in the larger index sectors. Longer duration securities significantly outperformed shorter duration bonds.

The Fund underperformed the index largely as a result of negative issue selection. Security selection decisions in the consumer sectors, including Retail-Food & Drug and Retail Stores, detracted from relative returns as did security selection in Consumer Products. Negative contributions were partially offset by positive security selection in the Cable & Media sector. In terms of industry selection, an overweight to Cable & Media and an underweight to Finance detracted from performance. This performance was partially offset by an overweight and strong security selection to the Utilities sector. From a credit quality perspective, weak credit selection decisions in B-rated securities was partly offset by favorable issue selection in BB-rated bonds.

We believe the high yield market is fully valued and the market appears to be incorporating fundamental improvements in corporate earnings and credit trends in both the U.S. and Europe, and expectations of positive policy actions in the U.S. Idiosyncratic issues are increasing in the market and several large sectors are widening due to earnings disappointments in large cap issuers. Further, our concerns center on risks related to volatility in oil prices, policy missteps regarding trade and taxes in the U.S., the pace and the magnitude of the Fed’s interest rate increases, geopolitical tensions, and the result of the Brexit negotiation.

The Fund uses various derivative instruments to implement its strategies. These derivatives are utilized to manage the Fund’s credit risk, interest rate risk and foreign exchange risk. These derivative positions may increase or decrease the Fund’s exposure to these risks. At the end of the reporting period the Fund had net exposure to these derivatives of approximately ($36) thousand. Over the course of the reporting period these derivative positions generated a net realized gain of approximately $400 thousand and $134 thousand in unrealized depreciation for an increase in operations of $266 thousand. We plan to continue to utilize derivative instruments to implement our strategies related to credit risk, interest rate risk and foreign exchange risk.

Stone Harbor Investment Funds Semi-Annual Report | November 30, 2017 |

5 |

| Stone Harbor Investment Funds | Shareholder Letter |

November 30, 2017 (Unaudited)

Stone Harbor Investment Grade Fund

The total return of the Stone Harbor Investment Grade Fund (the “Fund”) for the 6 months ended November 30, 2017 was 0.77% (net of expenses) and 1.03% (gross of expenses). This performance compares to a benchmark return of 0.68% for the Bloomberg Barclays U.S. Aggregate Index. The Fund’s outperformance is primarily attributable to sector weighting and security selection decisions in investment grade corporate and government bonds. Asset allocation effects accounted for a significant portion of the outperformance, with an overweight to corporates and an underweight to Governments serving as the primary driver. The remaining excess returns were attributable to investment grade corporate security selection, led by issues within the bank and electric utility sectors.

The 6-month period was marked by a generally positive investor environment, characterized by improving growth, stable inflation, higher government bond yields, and tighter credit spreads. While growth in Europe remained strong and above trend, U.S. growth jumped to above 3% at an annualized rate during each of the past two quarters. Growth in Japan and the emerging markets was also robust, creating arguably the strongest global growth seen for some time. U.S. unemployment pushed lower to 4.1%, while year-over-year consumer price index remained at around 2.0%. With diminishing spare capacity a core focus of the Fed, the Fed Funds target rate was raised to 1.25% in June with further guidance pointing to the likelihood of a December rate rise and possible further rises through the course of 2018. The ECB indicated that it will commence quantitative easing (“QE”) tapering from January of 2018.

Against this background of strong growth and rising official rates, government bonds yields moved higher. U.S. Treasury ten- year yield rose from 2.20% to 2.40%, and German ten-year yields from 0.30% to 0.35%. These, relatively modest moves, reflected a measured pace of policy tightening adopted by central banks, which in turn allowed further credit spread compression. U.S. investment grade, U.S. High Yield, and European High Yield and emerging markets sovereign debt each tightened by 14 to 17 bps; and emerging markets corporate debt spread tightened by 33 bps. Generally, the Emerging Markets outperformed, reflecting renewed growth momentum in these regions.

The Fund uses various derivative instruments to implement its strategies. These derivatives are utilized to manage the Fund’s credit risk, interest rate risk and foreign exchange risk. These derivative positions may increase or decrease the Fund’s exposure to these risks. At the end of the reporting period the Fund did not have exposure to these derivatives.

Stone Harbor Strategic Income Fund

The total return of the Strategic Income Fund (the “Fund”) for the 6 month period ending November 30, 2017 was 1.12% (net of direct and indirect expenses) and 1.47% (gross of direct and indirect expenses). This performance compares to a benchmark return of 1.94% for the Bloomberg Barclays Global Credit Index (Hedged into USD). The Fund outperformed its benchmark as a result of certain asset allocation, duration and individual credit decisions. During the period the Fund was overweight both the high yield and emerging debt sectors relative to the index, which drove a significant portion of the positive contribution from asset allocation. Partially offsetting these positive effects were costs associated with credit hedges during a period of tighter credit spreads. Within individual portfolio sectors the Fund experienced outperformance in investment grade, hard currency emerging debt and emerging market corporates, while underperforming within the high yield and emerging local currency segments. The Fund’s duration positioning (short relative to the benchmark) also contributed to the underperformance during the period as developed market government rates edged lower.

The 6-month period was marked by a generally positive investor environment, characterized by improving growth, stable inflation, higher government bond yields, and tighter credit spreads. While growth in Europe remained strong and above trend, U.S. growth jumped to above 3% at an annualized rate during each of the past two quarters. Growth in Japan and the emerging markets was also robust, creating arguably the strongest global growth seen for some time. U.S. unemployment pushed lower to 4.1%, while year-over-year consumer price index remained at around 2.0%. With diminishing spare capacity a core focus of the Fed, the Fed Funds target rate was raised to 1.25% in June with further guidance pointing to the likelihood of a December rate rise and possible further rises through the course of 2018. The ECB indicated that it will commence QE tapering from January of 2018.

Against this background of strong growth and rising official rates, government bonds yields moved higher. U.S. Treasury ten- year yield rose from 2.20% to 2.40%, and German ten-year yields from 0.30% to 0.35%. These, relatively modest moves, reflected a measured pace of policy tightening adopted by central banks, which in turn allowed further credit spread compression. U.S. investment grade, U.S. High Yield, and European High Yield and emerging markets sovereign debt each tightened by 14 to 17 bps; and emerging markets corporate debt spread tightened by 33 bps. Generally, the Emerging Markets outperformed, reflecting renewed growth momentum in these regions.

The Fund uses various derivative instruments to implement its strategies. These derivatives are utilized to manage the Fund’s credit risk, interest rate risk and foreign exchange risk. These derivative positions may increase or decrease the Fund’s exposure to these risks. At the end of the reporting period the Fund had net exposure to these derivatives of approximately $121 thousand. Over the course of the reporting period these derivative positions generated a net realized loss of approximately $119 thousand and $12 thousand in unrealized depreciation for a decrease in operations of $131 thousand. We plan to continue to utilize derivative instruments to implement our strategies related to credit risk, interest rate risk and foreign exchange risk.

| 6 | www.shiplp.com |

| Stone Harbor Investment Funds | Shareholder Letter |

November 30, 2017 (Unaudited)

Stone Harbor 500 Plus Fund

The total return of the Stone Harbor 500 Plus Fund (the “Fund”) for the six month period ending November 30, 2017 was 11.16% (net of expenses) and 11.47% (gross of expenses). This performance compares favorably versus the Fund’s benchmark, the S&P 500 Index, which returned 10.89% over that time period.

The Fund’s strategy of purchasing S&P futures, in an attempt to replicate the performance of the S&P 500 Index, while investing the remainder of the Fund’s cash in a portfolio of fixed income instruments designed to outperform USD 3-month LIBOR proved advantageous during the period. The 60 bps of performance above the S&P 500 can be attributed to two key areas: 1) the index replication 2) the overlay portfolio. The Fund’s index replication strategy underperformed the S&P 500 by 10 bps over the time period due mainly to cash drag associated with maintaining the margin on the long futures position. The overlay portfolio, which is comprised of mainly floating rate or short weighted average life fixed rate securitized bonds, outperformed 3-month LIBOR by approximately 70 basis points. At the end of November, the Fund was allocated approximately 40% to non-agency residential mortgage backed securities (RMBS), 22% to commercial mortgage backed securities (CMBS), 16% to asset backed securities (ABS), and 22% cash, which results a yield-to-maturity of 2.25% and AA+ rated average credit quality.

Looking forward, with credit spreads tightening considerably in 2017, we have allowed cash to build in the Fund’s portfolio with the expectation that mortgage spreads are likely to widen modestly when supply from the Fed’s MBS tapering hits the market in 2018. We are applying a defensive strategy to the bonds we are purchasing by focusing on higher rated positions in what are currently less volatile segments of the securitized markets.

The Fund uses various derivative instruments to implement its strategies. These derivatives are utilized to manage the Fund’s credit risk, interest rate risk and foreign exchange risk. These derivative positions may increase or decrease the Fund’s exposure to these risks. At the end of the reporting period the Fund had net exposure to these derivatives of approximately $104 thousand. Over the course of the period these derivative positions generated a net realized gain of approximately $134 thousand and $87 thousand in unrealized appreciation for an increase in operations of $222 thousand. We plan to continue to utilize derivative instruments to implement our strategies related to credit risk, interest rate risk and foreign exchange risk.

Sincerely,

Thomas K. Flanagan

Chairman of the Board of Trustees

Stone Harbor Investment Funds Semi-Annual Report | November 30, 2017 |

7 |

| Stone Harbor Investment Funds | Disclosure of Fund Expenses |

November 30, 2017 (Unaudited)

Example. As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and/or redemption fees (if applicable) and (2) ongoing costs, including management fees and other Fund expenses. The below examples are intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on June 1, 2017 and held until November 30, 2017.

Actual Expenses. The first table below provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect transactional costs, such as redemption fees, sales charges (loads) or exchange fees. Therefore, the second table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

BASED ON ACTUAL TOTAL RETURN

| Actual Total Return | Beginning Account Value June 1, 2017 | Ending Account Value November 30, 2017 | Expense Ratio(1) | Expenses Paid During Period(2) | |

| STONE HARBOR EMERGING MARKETS DEBT FUND | 3.33% | $1,000.00 | $1,033.30 | 0.72% | $3.67 |

| STONE HARBOR HIGH YIELD BOND FUND | 0.99 | 1,000.00 | 1,009.90 | 0.65 | 3.28 |

| STONE HARBOR LOCAL MARKETS FUND | 2.05 | 1,000.00 | 1,020.50 | 0.89 | 4.51 |

| STONE HARBOR EMERGING MARKETS CORPORATE DEBT FUND | 3.75 | 1,000.00 | 1,037.50 | 1.00 | 5.11 |

| STONE HARBOR INVESTMENT GRADE FUND | 0.77 | 1,000.00 | 1,007.70 | 0.51 | 2.57 |

| STONE HARBOR STRATEGIC INCOME FUND | 1.12 | 1,000.00 | 1,011.20 | 0.07 | 0.35 |

| STONE HARBOR EMERGING MARKETS DEBT ALLOCATION FUND | 2.72 | 1,000.00 | 1,027.20 | 0.05 | 0.25 |

| STONE HARBOR 500 PLUS FUND | 11.16 | 1,000.00 | 1,111.60 | 0.61 | 3.23 |

BASED ON HYPOTHETICAL TOTAL RETURN

| Hypothetical Annualized Total Return | Beginning Account Value June 1, 2017 | Ending Account Value November 30, 2017 | Expense Ratio(1) | Expenses Paid During Period(2) | |

| STONE HARBOR EMERGING MARKETS DEBT FUND | 5.00% | $1,000.00 | $1,021.46 | 0.72% | $3.65 |

| STONE HARBOR HIGH YIELD BOND FUND | 5.00 | 1,000.00 | 1,021.81 | 0.65 | 3.29 |

| STONE HARBOR LOCAL MARKETS FUND | 5.00 | 1,000.00 | 1,020.61 | 0.89 | 4.51 |

| STONE HARBOR EMERGING MARKETS CORPORATE DEBT FUND | 5.00 | 1,000.00 | 1,020.05 | 1.00 | 5.06 |

| STONE HARBOR INVESTMENT GRADE FUND | 5.00 | 1,000.00 | 1,022.51 | 0.51 | 2.59 |

| STONE HARBOR STRATEGIC INCOME FUND | 5.00 | 1,000.00 | 1,024.72 | 0.07 | 0.36 |

| STONE HARBOR EMERGING MARKETS DEBT ALLOCATION FUND | 5.00 | 1,000.00 | 1,024.82 | 0.05 | 0.25 |

| STONE HARBOR 500 PLUS FUND | 5.00 | 1,000.00 | 1,022.01 | 0.61 | 3.09 |

| (1) | Annualized, based on the Fund's most recent fiscal half-year expenses. |

| (2) | Expenses are equal to the Fund's annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (183), divided by 365. Note this expense example is typically based on a six-month period. |

| 8 | www.shiplp.com |

| Stone Harbor Investment Funds | Summaries of Portfolio Holdings |

November 30, 2017 (Unaudited)

| STONE HARBOR EMERGING MARKETS DEBT FUND | |

| Country Breakdown(1) | % |

| Brazil | 8.10% |

| Turkey | 7.97% |

| Ukraine | 7.35% |

| Argentina | 6.82% |

| Mexico | 6.43% |

| Iraq | 4.38% |

| Indonesia | 4.20% |

| Dominican Republic | 3.50% |

| Russia | 3.41% |

| Colombia | 3.38% |

| Gabon | 2.35% |

| Costa Rica | 2.32% |

| Egypt | 2.18% |

| Ecuador | 2.17% |

| Azerbaijan | 2.13% |

| Malaysia | 2.07% |

| Ivory Coast | 2.06% |

| Lebanon | 2.02% |

| South Africa | 1.72% |

| Uruguay | 1.66% |

| Sri Lanka | 1.46% |

| Kazakhstan | 1.46% |

| Venezuela | 1.41% |

| China | 1.38% |

| Oman | 1.38% |

| Nigeria | 1.28% |

| El Salvador | 1.24% |

| Cameroon | 1.01% |

| Panama | 0.98% |

| Qatar | 0.97% |

| Peru | 0.81% |

| Kenya | 0.76% |

| Croatia | 0.75% |

| Ghana | 0.75% |

| Jordan | 0.58% |

| Zambia | 0.50% |

| Paraguay | 0.49% |

| Senegal | 0.47% |

| Bahrain | 0.35% |

| Montenegro | 0.32% |

| India | 0.26% |

| Jamaica | 0.25% |

| Angola | 0.22% |

| Georgia | 0.22% |

| Chile | 0.21% |

| Ethiopia | 0.21% |

| Total | 95.94% |

| Short Term Security | 3.11% |

| Other Assets in Excess of Liabilities | 0.95% |

| Total Net Assets | 100.00% |

| STONE HARBOR HIGH YIELD BOND FUND | |

| Industry Breakdown | % |

| Exploration & Production | 9.51% |

| Media Cable | 8.12% |

| Healthcare | 7.43% |

| Media Other | 7.41% |

| Electric | 5.57% |

| Food/Beverage/Tobacco | 4.51% |

| Technology | 4.51% |

| Industrial Other | 3.96% |

| Wireless | 3.94% |

| Building Products | 3.87% |

| Drillers/Services | 3.78% |

| Chemicals | 3.64% |

| Containers/Packaging | 3.53% |

| Gaming | 3.39% |

| Wirelines | 2.79% |

| Paper/Forest Products | 2.66% |

| Automotive | 2.54% |

| Diversified Manufacturing/Industrial | 2.37% |

| Leisure | 2.07% |

| Retail Food/Drug | 1.62% |

| Metals/Mining/Steel | 1.57% |

| Consumer Products | 1.35% |

| Satellite | 1.06% |

| Services Other | 1.01% |

| Retail Non Food/Drug | 0.90% |

| Capital Goods | 0.89% |

| Telecommunications | 0.80% |

| Textile/Apparel | 0.52% |

| Utilities | 0.42% |

| Building Products & Builders | 0.30% |

| Total | 96.04% |

| Money Market Fund | 3.19% |

| Other Assets in Excess of Liabilities | 0.77% |

| Total Net Assets | 100.00% |

| (1) | Country refers to country of primary risk exposure, as determined by Stone Harbor Investment Partners LP (the “Adviser” or “Stone Harbor”). In certain instances, a security’s country of incorporation may be different from its country of risk. |

| Stone Harbor Investment Funds Semi-Annual Report | November 30, 2017 | 9 |

| Stone Harbor Investment Funds | Summaries of Portfolio Holdings |

November 30, 2017 (Unaudited)

| STONE HARBOR LOCAL MARKETS FUND | |

| Country Breakdown(1) | % |

| Mexico | 11.11% |

| Brazil | 10.53% |

| Russia | 10.49% |

| Indonesia | 10.31% |

| South Africa | 9.70% |

| Turkey | 7.16% |

| Colombia | 6.32% |

| Poland | 4.84% |

| Malaysia | 3.12% |

| Thailand | 1.43% |

| Egypt | 0.90% |

| Ukraine | 0.79% |

| Iraq | 0.70% |

| Uruguay | 0.69% |

| Peru | 0.60% |

| Argentina | 0.56% |

| Chile | 0.19% |

| Total | 79.44% |

| Short Term Security | 7.57% |

| Other Assets in Excess of Liabilities | 12.99% |

| Total Net Assets | 100.00% |

| (1) | Country refers to country of primary risk exposure, as determined by Stone Harbor. In certain instances, a security’s country of incorporation may be different from its country of risk. |

| STONE HARBOR EMERGING MARKETS CORPORATE DEBT FUND | |

| Country Breakdown(1) | % |

| China | 8.02% |

| Brazil | 8.02% |

| Mexico | 6.43% |

| Indonesia | 5.37% |

| India | 5.06% |

| United Arab Emirates | 4.91% |

| Colombia | 4.88% |

| Turkey | 4.61% |

| Thailand | 4.29% |

| Chile | 3.74% |

| Ukraine | 3.53% |

| Hong Kong | 3.50% |

| Peru | 3.31% |

| Macau | 3.26% |

| Russia | 2.90% |

| Qatar | 2.70% |

| Argentina | 2.69% |

| Ghana | 1.90% |

| Algeria | 1.82% |

| Saudi Arabia | 1.79% |

| Malaysia | 1.69% |

| Singapore | 1.69% |

| Jamaica | 1.59% |

| South Korea | 1.38% |

| Kuwait | 1.36% |

| Israel | 1.27% |

| Nigeria | 1.16% |

| Guatemala | 0.98% |

| Kazakhstan | 0.92% |

| Philippines | 0.90% |

| South Africa | 0.89% |

| Morocco | 0.44% |

| Total | 97.00% |

| Short Term Security | 2.42% |

| Other Assets in Excess of Liabilities | 0.58% |

| Total Net Assets | 100.00% |

| 10 | www.shiplp.com |

| Stone Harbor Investment Funds | Summaries of Portfolio Holdings |

November 30, 2017 (Unaudited)

| STONE HARBOR INVESTMENT GRADE FUND | |

| Industry Breakdown | % |

| U.S. Treasury Bonds/Notes | 18.75% |

| U.S. Government Agency Mortgage Backed | 18.21% |

| Asset Backed/Commercial Mortgage Backed | 15.23% |

| Banking | 8.60% |

| Electric | 4.01% |

| Gas Pipelines | 2.61% |

| Automotive | 2.21% |

| Technology | 1.72% |

| Media Cable | 1.69% |

| Real Estate Investment Trust (REITs) | 1.69% |

| Wirelines | 1.65% |

| Food and Beverage | 1.49% |

| Non Captive Finance | 1.46% |

| Healthcare | 1.42% |

| Exploration & Production | 1.36% |

| Media Other | 1.27% |

| Retail Non Food/Drug | 1.25% |

| Metals/Mining/Steel | 0.93% |

| Retail Food/Drug | 0.90% |

| Life Insurance | 0.85% |

| Aerospace/Defense | 0.84% |

| Transportation Non Air/Rail | 0.82% |

| Pharmaceuticals | 0.65% |

| Refining | 0.45% |

| Paper/Forest Products | 0.43% |

| Building Products | 0.42% |

| Construction Machinery | 0.41% |

| Wireless | 0.41% |

| Drillers/Services | 0.23% |

| Leisure | 0.21% |

| Total | 92.17% |

| Money Market Fund | 7.53% |

| Other Assets in Excess of Liabilities | 0.30% |

| Total Net Assets | 100.00% |

| STONE HARBOR STRATEGIC INCOME FUND | |

| Industry Breakdown | % |

| Stone Harbor High Yield Bond Fund | 34.82% |

| Stone Harbor Investment Grade Fund | 31.18% |

| Stone Harbor Emerging Markets Debt Fund | 17.44% |

| Stone Harbor Local Markets Fund | 12.68% |

| Stone Harbor Emerging Markets Corporate Debt | 2.52% |

| Total | 98.64% |

| Money Market Fund | 0.15% |

| Other Assets in Excess of Liabilities | 1.21% |

| Total Net Assets | 100.00% |

| STONE HARBOR EMERGING MARKETS DEBT ALLOCATION FUND | |

| Industry Breakdown | % |

| Stone Harbor Local Markets Fund | 56.97% |

| Stone Harbor Emerging Markets Debt Fund | 42.31% |

| Total | 99.28% |

| Money Market Fund | 0.03% |

| Other Assets in Excess of Liabilities | 0.69% |

| Total Net Assets | 100.00% |

| STONE HARBOR 500 PLUS FUND | |

| Industry Breakdown | % |

| Financial Other | 41.20% |

| Other Asset Backed Securities | 16.95% |

| Non Corporate | 4.48% |

| Real Estate Investment Trust (REITs) | 4.28% |

| Retail Non Food/Drug | 4.14% |

| Commercial Mortgage Backed Securities | 4.14% |

| Transportation Non Air/Rail | 4.14% |

| WL Collateralized Mortgage Obligation | 3.60% |

| Total | 82.93% |

| Money Market Fund | 12.02% |

| Other Assets in Excess of Liabilities | 5.05% |

| Total Net Assets | 100.00% |

| Stone Harbor Investment Funds Semi-Annual Report | November 30, 2017 | 11 |

| Stone Harbor Investment Funds | Growth of $10,000 Investment |

November 30, 2017 (Unaudited)

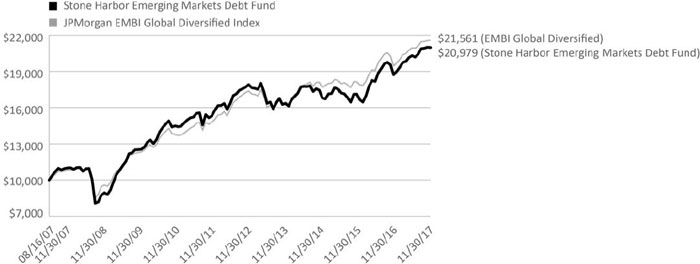

STONE HARBOR EMERGING MARKETS DEBT FUND

Comparison of Change in Value of $10,000 Investment in Stone Harbor Emerging Markets Debt Fund and the JPMorgan Emerging Markets Bond Index Global Diversified (JPMorgan EMBI Global Diversified Index). Please refer to the Additional Information section for detailed benchmark descriptions.

Total Returns (Inception Date, August 16, 2007)

| 6 Month | 1 Year | 3 Year | 5 Year | 10 Year | Since Inception | |

| Stone Harbor Emerging Markets Debt Fund | 3.33% | 12.07% | 6.37% | 3.46% | 6.83% | 7.47% |

| JPMorgan EMBI Global Diversified Index | 2.92% | 10.91% | 6.02% | 4.57% | 7.28% | 7.75% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. Average annual total returns reflect the reinvestment of dividends and capital gains distributions and include all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. The performance data quoted does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Index returns do not include the effects of sales charges, management fees and fund expenses or transaction costs. It is not possible to invest directly in an index.

| 12 | www.shiplp.com |

| Stone Harbor Investment Funds | Growth of $10,000 Investment |

November 30, 2017 (Unaudited)

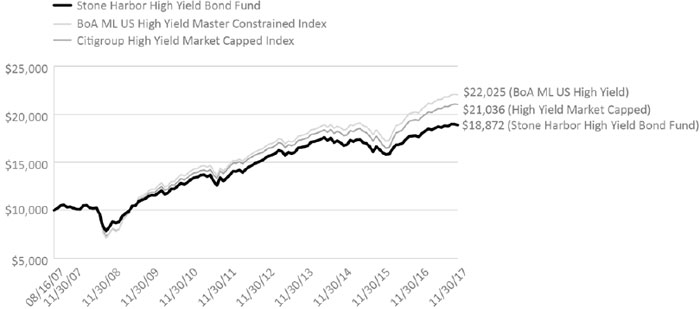

STONE HARBOR HIGH YIELD BOND FUND

Comparison of Change in Value of $10,000 Investment in Stone Harbor High Yield Bond Fund and the Bank of America Merrill Lynch US High Yield Master Constrained Index. Please refer to the Additional Information section for detailed benchmark descriptions.

Total Returns (Inception Date, August 16, 2007)

| 6 Month | 1 Year | 3 Year | 5 Year | 10 Year | Since Inception | |

| Stone Harbor High Yield Bond Fund | 0.99% | 7.05% | 3.46% | 4.46% | 6.20% | 6.37% |

| BoA ML US High Yield Master Constrained Index* | 2.27% | 9.28% | 5.79% | 6.08% | 7.96% | 7.98% |

| Citigroup High Yield Market Capped Index | 2.20% | 8.65% | 5.20% | 5.61% | 7.48% | 7.49% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. Average annual total returns reflect the reinvestment of dividends and capital gains distributions and include all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. The performance data quoted does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Index returns do not include the effects of sales charges, management fees and fund expenses or transaction costs. It is not possible to invest directly in an index.

| * | Effective September 30, 2017, the benchmark of the Fund is the Bank of America (“BoA”) Merrill Lynch US High Yield Master Constrained Index. The BoA Merrill Lynch US High Yield Master Constrained Index is comprised of all securities in the BoA Merrill Lynch US High Yield Index with issuer exposure capped at 2%. The BoA Merrill Lynch US High Yield Master Constrained Index is a broader index, inclusive of European domiciled issuers, and is considered by the Adviser to be a better representation of the Fund’s overall strategy than the Fund’s previous benchmark, the Citigroup High Yield Market Capped Index. |

| Stone Harbor Investment Funds Semi-Annual Report | November 30, 2017 | 13 |

| Stone Harbor Investment Funds | Growth of $10,000 Investment |

November 30, 2017 (Unaudited)

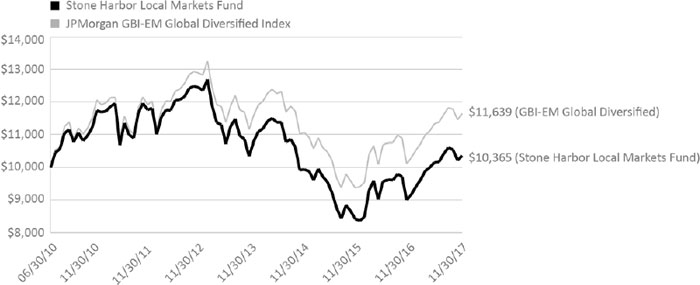

STONE HARBOR LOCAL MARKETS FUND

Comparison of Change in Value of $10,000 Investment in Stone Harbor Local Markets Fund and the JPMorgan Global Bond Index - Emerging Markets Global Diversified (JPMorgan GBI-EM Global Diversified). Please refer to the Additional Information section for detailed benchmark descriptions.

Total Returns (Inception Date, June 30, 2010)

| 6 Month | 1 Year | 3 Year | 5 Year | Since Inception | |

| Stone Harbor Local Markets Fund | 2.05% | 15.21% | -0.85% | -3.14% | 0.48% |

| JPMorgan GBI-EM Global Diversified Index | 2.80% | 15.04% | -0.21% | -1.52% | 2.07% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. Average annual total returns reflect the reinvestment of dividends and capital gains distributions and include all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. The performance data quoted does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Index returns do not include the effects of sales charges, management fees and fund expenses or transaction costs. It is not possible to invest directly in an index.

| 14 | www.shiplp.com |

| Stone Harbor Investment Funds | Growth of $10,000 Investment |

November 30, 2017 (Unaudited)

STONE HARBOR EMERGING MARKETS CORPORATE DEBT FUND

Comparison of Change in Value of $10,000 Investment in Stone Harbor Emerging Market Corporate Debt Fund and the JPMorgan Corporate Emerging Market Bond Index - Broad Diversified (JPMorgan CEMBI Broad Diversified Index). Please refer to the Additional Information section for detailed benchmark descriptions.

Total Returns (Inception Date, June 1, 2011)

| 6 Month | 1 Year | 3 Year | 5 Year | Since Inception | |

| Stone Harbor Emerging Markets Corporate Debt Fund | 3.75% | 9.93% | 5.62% | 4.49% | 3.99% |

| JPMorgan CEMBI Broad Diversified Index | 2.69% | 8.46% | 5.44% | 4.70% | 5.47% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. Average annual total returns reflect the reinvestment of dividends and capital gains distributions and include all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. The performance data quoted does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Index returns do not include the effects of sales charges, management fees and fund expenses or transaction costs. It is not possible to invest directly in an index.

| Stone Harbor Investment Funds Semi-Annual Report | November 30, 2017 | 15 |

| Stone Harbor Investment Funds | Growth of $10,000 Investment |

November 30, 2017 (Unaudited)

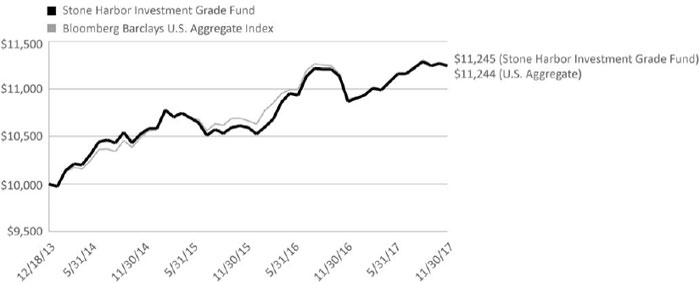

STONE HARBOR INVESTMENT GRADE FUND

Comparison of Change in Value of $10,000 Investment in Stone Harbor Investment Grade Fund and the Bloomberg Barclays U.S. Aggregate Index. Please refer to the Additional Information section for detailed benchmark descriptions.

Total Returns (Inception Date, December 18, 2013)

| 6 Month | 1 Year | 3 Year | Since Inception | |

| Stone Harbor Investment Grade Fund | 0.77% | 3.47% | 2.04% | 3.01% |

| Bloomberg Barclays U.S. Aggregate Index | 0.68% | 3.21% | 2.11% | 3.01% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. Average annual total returns reflect the reinvestment of dividends and capital gains distributions and include all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. The performance data quoted does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Index returns do not include the effects of sales charges, management fees and fund expenses or transaction costs. It is not possible to invest directly in an index.

| 16 | www.shiplp.com |

| Stone Harbor Investment Funds | Growth of $10,000 Investment |

November 30, 2017 (Unaudited)

STONE HARBOR STRATEGIC INCOME FUND

Comparison of Change in Value of $10,000 Investment in Stone Harbor Strategic Income Fund and the Bloomberg Barclays Global Credit Index (Hedged USD). Please refer to the Additional Information section for detailed benchmark descriptions.

Total Returns (Inception Date, December 18, 2013)

| 6 Month | 1 Year | 3 Year | Since Inception | |

| Stone Harbor Strategic Income Fund | 1.12% | 6.13% | 3.23% | 3.90% |

| Bloomberg Barclays Global Credit Index (Hedged USD) | 1.94% | 6.26% | 4.03% | 4.78% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. Average annual total returns reflect the reinvestment of dividends and capital gains distributions and include all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. The performance data quoted does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Index returns do not include the effects of sales charges, management fees and fund expenses or transaction costs. It is not possible to invest directly in an index.

| Stone Harbor Investment Funds Semi-Annual Report | November 30, 2017 | 17 |

| Stone Harbor Investment Funds | Growth of $10,000 Investment |

November 30, 2017 (Unaudited)

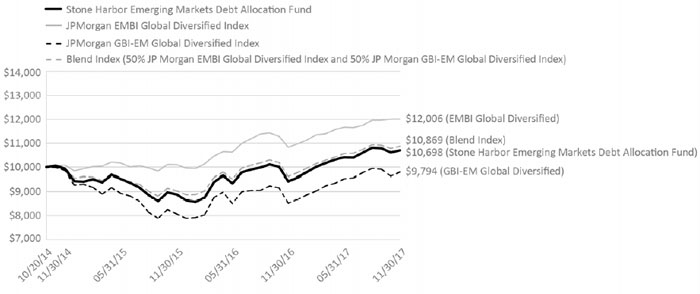

STONE HARBOR EMERGING MARKETS DEBT ALLOCATION FUND

Comparison of Change in Value of $10,000 Investment in Stone Harbor Emerging Markets Debt Allocation Fund, the JPMorgan EMBI Global Diversified Index, JPMorgan GBI-EM Global Diversified Index and the Blend Index (50% JPMorgan EMBI Global Diversified Index and 50% JP Morgan GBI-EM Global Diversified Index). Please refer to the Additional Information section for detailed benchmark descriptions.

Total Returns (Inception Date, October 20, 2014)

| 6 Month | 1 Year | 3 Year | Since Inception | |

| Stone Harbor Emerging Markets Debt Allocation Fund | 2.72% | 13.52% | 2.51% | 2.19% |

| JPMorgan EMBI Global Diversified Index | 2.92% | 10.91% | 6.02% | 6.05% |

| JPMorgan GBI-EM Global Diversified Index | 2.80% | 15.04% | -0.21% | -0.67% |

| Blend Index (50% JPMorgan EMBI Global Diversified Index and 50% JPMorgan GBI-EM Global Diversified Index) | 2.88% | 12.99% | 2.94% | 2.71% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. Average annual total returns reflect the reinvestment of dividends and capital gains distributions and include all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. The performance data quoted does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Index returns do not include the effects of sales charges, management fees and fund expenses or transaction costs. It is not possible to invest directly in an index.

| 18 | www.shiplp.com |

| Stone Harbor Investment Funds | Growth of $10,000 Investment |

November 30, 2017 (Unaudited)

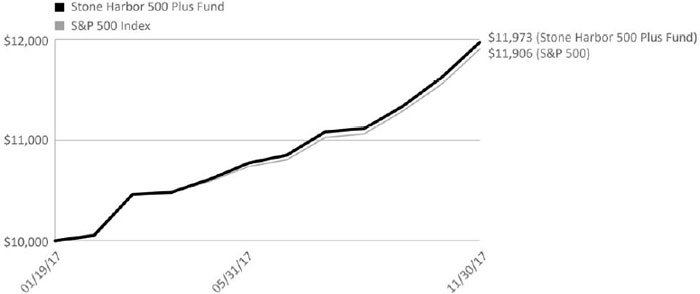

STONE HARBOR 500 PLUS FUND

Comparison of Change in Value of $10,000 Investment in Stone Harbor 500 Plus Fund and S&P 500 Index. Please refer to the Additional Information section for detailed benchmark descriptions.

Total Returns (Inception Date, January 19, 2017)

| 1 Month | 3 Month | 6 Month | YTD | Since Inception | |

| Stone Harbor 500 Plus Fund | 3.04% | 7.73% | 11.16% | 19.73% | 19.73% |

| S&P 500 Index | 3.07% | 7.65% | 10.89% | 19.06% | 19.06% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. Average annual total returns reflect the reinvestment of dividends and capital gains distributions and include all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. The performance data quoted does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Index returns do not include the effects of sales charges, management fees and fund expenses or transaction costs. It is not possible to invest directly in an index.

| Stone Harbor Investment Funds Semi-Annual Report | November 30, 2017 | 19 |

| Stone Harbor Emerging Markets Debt Fund | Statements of Investments |

November 30, 2017 (Unaudited)

| Currency | Rate | Maturity Date | Principal Amount/Shares* | Value (Expressed in USD) | ||||||||||||||

| SOVEREIGN DEBT OBLIGATIONS - 74.83% | ||||||||||||||||||

| Angola - 0.22% | ||||||||||||||||||

| Republic of Angola | USD | 9.50 | % | 11/12/25 | 2,297,000 | $ | 2,594,174 | (1) | ||||||||||

| Argentina - 6.73% | ||||||||||||||||||

| Provincia del Chaco | USD | 9.38 | % | 08/18/24 | 1,886,000 | 2,003,875 | (1) | |||||||||||

| Republic of Argentina: | ||||||||||||||||||

| USD | 6.63 | % | 07/06/28 | 1,707,000 | 1,830,757 | |||||||||||||

| EUR | 7.82 | % | 12/31/33 | 11,305,474 | 15,592,546 | |||||||||||||

| EUR | 7.82 | % | 12/31/33 | 36,015,036 | 49,216,593 | |||||||||||||

| EUR | 2.26 | % | 12/31/38 | 11,720,000 | 9,953,140 | (2) | ||||||||||||

| 78,596,911 | ||||||||||||||||||

| Azerbaijan - 1.21% | ||||||||||||||||||

| Republic of Azerbaijan: | ||||||||||||||||||

| USD | 4.75 | % | 03/18/24 | 2,403,000 | 2,469,082 | (1) | ||||||||||||

| USD | 4.75 | % | 03/18/24 | 11,312,000 | 11,623,080 | (3) | ||||||||||||

| 14,092,162 | ||||||||||||||||||

| Bahrain - 0.35% | ||||||||||||||||||

| Kingdom of Baharain | USD | 7.00 | % | 10/12/28 | 4,022,000 | 4,052,165 | (3) | |||||||||||

| Brazil - 3.69% | ||||||||||||||||||

| Brazil Minas SPE via State of Minas Gerais: | ||||||||||||||||||

| USD | 5.33 | % | 02/15/28 | 1,851,000 | 1,888,020 | (3) | ||||||||||||

| USD | 5.33 | % | 02/15/28 | 13,250,000 | 13,515,000 | (1) | ||||||||||||

| Nota Do Tesouro Nacional: | ||||||||||||||||||

| BRL | 10.00 | % | 01/01/23 | 18,870,000 | 5,768,599 | |||||||||||||

| BRL | 10.00 | % | 01/01/27 | 18,670,000 | 5,584,834 | |||||||||||||

| Republic of Brazil: | ||||||||||||||||||

| USD | 8.25 | % | 01/20/34 | 1,531,000 | 2,009,437 | |||||||||||||

| USD | 5.00 | % | 01/27/45 | 13,246,000 | 12,398,256 | |||||||||||||

| USD | 5.63 | % | 02/21/47 | 1,865,000 | 1,906,963 | |||||||||||||

| 43,071,109 | ||||||||||||||||||

| Cameroon - 1.01% | ||||||||||||||||||

| Republic of Cameroon: | ||||||||||||||||||

| USD | 9.50 | % | 11/19/25 | 400,000 | 479,500 | (1) | ||||||||||||

| USD | 9.50 | % | 11/19/25 | 9,448,000 | 11,325,790 | (3) | ||||||||||||

| 11,805,290 | ||||||||||||||||||

| Colombia - 3.38% | ||||||||||||||||||

| Bogota Distrio Capital | COP | 9.75 | % | 07/26/28 | 624,000,000 | 222,635 | (1) | |||||||||||

| Republic of Colombia: | ||||||||||||||||||

| USD | 4.38 | % | 07/12/21 | 4,480,000 | 4,725,280 | |||||||||||||

| USD | 4.00 | % | 02/26/24 | 16,448,000 | 17,031,904 | |||||||||||||

| COP | 10.00 | % | 07/24/24 | 14,702,000,000 | 5,893,658 | |||||||||||||

| USD | 4.50 | % | 01/28/26 | 801,000 | 857,270 | |||||||||||||

| USD | 5.63 | % | 02/26/44 | 2,617,000 | 2,972,912 | |||||||||||||

| USD | 5.00 | % | 06/15/45 | 7,392,000 | 7,746,816 | |||||||||||||

| 39,450,475 | ||||||||||||||||||

| Costa Rica - 2.04% | ||||||||||||||||||

| Republic of Costa Rica: | ||||||||||||||||||

| USD | 4.25 | % | 01/26/23 | 11,210,000 | 11,027,838 | (1) | ||||||||||||

| USD | 4.38 | % | 04/30/25 | 2,091,000 | 2,032,232 | (1) | ||||||||||||

| USD | 7.00 | % | 04/04/44 | 2,156,000 | 2,247,630 | (1) | ||||||||||||

| 20 | www.shiplp.com |

| Stone Harbor Emerging Markets Debt Fund | Statements of Investments |

November 30, 2017 (Unaudited)

| Currency | Rate | Maturity Date | Principal Amount/Shares* | Value (Expressed in USD) | ||||||||||||||

| Costa Rica (continued) | ||||||||||||||||||

| Republic of Costa Rica: (continued) | ||||||||||||||||||

| USD | 7.00 | % | 04/04/44 | 5,475,000 | $ | 5,707,687 | (3) | |||||||||||

| USD | 7.16 | % | 03/12/45 | 2,673,000 | 2,840,063 | (1) | ||||||||||||

| 23,855,450 | ||||||||||||||||||

| Croatia - 0.75% | ||||||||||||||||||

| Croatian Government: | ||||||||||||||||||

| USD | 6.63 | % | 07/14/20 | 2,652,000 | 2,898,968 | (1) | ||||||||||||

| USD | 5.50 | % | 04/04/23 | 5,258,000 | 5,807,461 | (1) | ||||||||||||

| 8,706,429 | ||||||||||||||||||

| Dominican Republic - 3.50% | ||||||||||||||||||

| Dominican Republic: | ||||||||||||||||||

| USD | 9.04 | % | 01/23/18 | 899,373 | 907,242 | (1) | ||||||||||||

| USD | 7.50 | % | 05/06/21 | 12,750,000 | 13,956,086 | (1) | ||||||||||||

| USD | 6.60 | % | 01/28/24 | 1,632,000 | 1,838,424 | (1) | ||||||||||||

| USD | 5.88 | % | 04/18/24 | 447,000 | 484,995 | (3) | ||||||||||||

| USD | 5.50 | % | 01/27/25 | 7,321,000 | 7,787,714 | (1) | ||||||||||||

| USD | 6.88 | % | 01/29/26 | 5,512,000 | 6,336,788 | (1) | ||||||||||||

| USD | 5.95 | % | 01/25/27 | 4,226,000 | 4,586,161 | (3) | ||||||||||||

| USD | 8.63 | % | 04/20/27 | 1,199,000 | 1,454,993 | (1) | ||||||||||||

| USD | 7.45 | % | 04/30/44 | 2,915,000 | 3,479,781 | (3) | ||||||||||||

| 40,832,184 | ||||||||||||||||||

| Ecuador - 1.73% | ||||||||||||||||||

| Republic of Ecuador: | ||||||||||||||||||

| USD | 7.95 | % | 06/20/24 | 900,000 | 938,250 | (3) | ||||||||||||

| USD | 7.95 | % | 06/20/24 | 8,261,000 | 8,612,092 | (1) | ||||||||||||

| USD | 9.65 | % | 12/13/26 | 1,550,000 | 1,741,813 | (1) | ||||||||||||

| USD | 8.88 | % | 10/23/27 | 8,361,000 | 8,916,463 | (3) | ||||||||||||

| 20,208,618 | ||||||||||||||||||

| Egypt - 2.18% | ||||||||||||||||||

| Republic of Egypt: | ||||||||||||||||||

| EGP | 0.00 | % | 12/26/17 | 112,125,000 | 6,267,174 | (4) | ||||||||||||

| EGP | 0.00 | % | 06/19/18 | 111,300,000 | 5,730,636 | (4) | ||||||||||||

| USD | 6.13 | % | 01/31/22 | 4,732,000 | 4,936,068 | (3) | ||||||||||||

| USD | 6.88 | % | 04/30/40 | 2,026,000 | 2,043,727 | (3) | ||||||||||||

| USD | 8.50 | % | 01/31/47 | 5,675,000 | 6,483,688 | (3) | ||||||||||||

| 25,461,293 | ||||||||||||||||||

| El Salvador - 1.24% | ||||||||||||||||||

| Republic of El Salvador: | ||||||||||||||||||

| USD | 7.38 | % | 12/01/19 | 190,000 | 200,185 | (3) | ||||||||||||

| USD | 7.75 | % | 01/24/23 | 2,955,000 | 3,213,562 | (1) | ||||||||||||

| USD | 5.88 | % | 01/30/25 | 433,000 | 427,047 | (3) | ||||||||||||

| USD | 5.88 | % | 01/30/25 | 1,789,000 | 1,764,401 | (1) | ||||||||||||

| USD | 6.38 | % | 01/18/27 | 819,000 | 819,000 | (3) | ||||||||||||

| USD | 6.38 | % | 01/18/27 | 1,697,000 | 1,697,000 | (1) | ||||||||||||

| USD | 8.25 | % | 04/10/32 | 867,000 | 974,291 | (3) | ||||||||||||

| USD | 7.65 | % | 06/15/35 | 1,892,000 | 1,996,060 | (1) | ||||||||||||

| USD | 7.63 | % | 02/01/41 | 3,241,000 | 3,415,204 | (1) | ||||||||||||

| 14,506,750 | ||||||||||||||||||

| Ethiopia - 0.21% | ||||||||||||||||||

| Federal Democratic Republic of Ethiopia: | ||||||||||||||||||

| USD | 6.63 | % | 12/11/24 | 908,000 | 943,752 | (3) | ||||||||||||

| Stone Harbor Investment Funds Semi-Annual Report | November 30, 2017 | 21 |

| Stone Harbor Emerging Markets Debt Fund | Statements of Investments |

November 30, 2017 (Unaudited)

| Currency | Rate | Maturity Date | Principal Amount/Shares* | Value (Expressed in USD) | ||||||||||||||

| Ethiopia (continued) | ||||||||||||||||||

| Federal Democratic Republic of Ethiopia: (continued) | ||||||||||||||||||

| USD | 6.63 | % | 12/11/24 | 1,400,000 | $ | 1,455,125 | (1) | |||||||||||

| 2,398,877 | ||||||||||||||||||

| Gabon - 2.35% | ||||||||||||||||||

| Republic of Gabon: | ||||||||||||||||||

| USD | 8.20 | % | 12/12/17 | 43,000 | 43,134 | (3) | ||||||||||||

| USD | 6.38 | % | 12/12/24 | 5,937,801 | 5,930,379 | (3) | ||||||||||||

| USD | 6.38 | % | 12/12/24 | 8,284,014 | 8,273,659 | (1) | ||||||||||||

| USD | 6.95 | % | 06/16/25 | 12,927,000 | 13,201,699 | (3) | ||||||||||||

| 27,448,871 | ||||||||||||||||||

| Georgia - 0.22% | ||||||||||||||||||

| Republic of Georgia | USD | 6.88 | % | 04/12/21 | 2,308,000 | 2,590,730 | (3) | |||||||||||

| Ghana - 0.51% | ||||||||||||||||||

| Republic of Ghana | USD | 10.75 | % | 10/14/30 | 4,368,000 | 5,907,720 | (1) | |||||||||||

| Indonesia - 2.05% | ||||||||||||||||||

| Republic of Indonesia: | ||||||||||||||||||

| USD | 5.88 | % | 01/15/24 | 1,936,000 | 2,209,741 | (1) | ||||||||||||

| USD | 4.13 | % | 01/15/25 | 2,723,000 | 2,834,697 | (1) | ||||||||||||

| USD | 4.75 | % | 01/08/26 | 985,000 | 1,066,238 | (1) | ||||||||||||

| USD | 8.50 | % | 10/12/35 | 5,760,000 | 8,578,800 | (1) | ||||||||||||

| USD | 6.63 | % | 02/17/37 | 3,550,000 | 4,530,687 | (1) | ||||||||||||

| USD | 5.25 | % | 01/17/42 | 1,380,000 | 1,542,150 | (1) | ||||||||||||

| USD | 6.75 | % | 01/15/44 | 948,000 | 1,254,323 | (1) | ||||||||||||

| USD | 5.13 | % | 01/15/45 | 1,770,000 | 1,949,213 | (1) | ||||||||||||

| 23,965,849 | ||||||||||||||||||

| Iraq - 3.79% | ||||||||||||||||||

| Republic of Iraq: | ||||||||||||||||||

| USD | 6.75 | % | 03/09/23 | 12,305,000 | 12,458,812 | (3) | ||||||||||||

| USD | 5.80 | % | 01/15/28 | 33,168,000 | 31,799,820 | (1) | ||||||||||||

| 44,258,632 | ||||||||||||||||||

| Ivory Coast - 2.06% | ||||||||||||||||||

| Ivory Coast Government: | ||||||||||||||||||

| USD | 5.38 | % | 07/23/24 | 1,314,000 | 1,332,068 | (1) | ||||||||||||

| USD | 5.38 | % | 07/23/24 | 5,955,000 | 6,036,881 | (3) | ||||||||||||

| EUR | 5.13 | % | 06/15/25 | 3,511,000 | 4,474,110 | (3) | ||||||||||||

| USD | 5.75 | % | 12/31/32 | 3,247,225 | 3,247,225 | (1)(2) | ||||||||||||

| USD | 6.13 | % | 06/15/33 | 8,967,000 | 9,023,044 | (3) | ||||||||||||

| 24,113,328 | ||||||||||||||||||

| Jordan - 0.58% | ||||||||||||||||||

| Kingdom of Jordan: | ||||||||||||||||||

| USD | 6.13 | % | 01/29/26 | 1,060,000 | 1,093,125 | (1) | ||||||||||||

| USD | 5.75 | % | 01/31/27 | 1,412,000 | 1,399,645 | (3) | ||||||||||||

| USD | 5.75 | % | 01/31/27 | 2,750,000 | 2,725,937 | (1) | ||||||||||||

| USD | 7.38 | % | 10/10/47 | 1,485,000 | 1,533,263 | |||||||||||||

| 6,751,970 | ||||||||||||||||||

| Kenya - 0.76% | ||||||||||||||||||

| Republic of Kenya | USD | 6.88 | % | 06/24/24 | 8,441,000 | 8,926,357 | (3) | |||||||||||

| 22 | www.shiplp.com |

| Stone Harbor Emerging Markets Debt Fund | Statements of Investments |

November 30, 2017 (Unaudited)

| Currency | Rate | Maturity Date | Principal Amount/Shares* | Value (Expressed in USD) | ||||||||||||||

| Lebanon - 2.02% | ||||||||||||||||||

| Lebanese Republic: | ||||||||||||||||||

| USD | 5.15 | % | 11/12/18 | 2,622,000 | $ | 2,595,780 | ||||||||||||

| USD | 6.10 | % | 10/04/22 | 7,175,000 | 6,852,125 | |||||||||||||

| USD | 6.40 | % | 05/26/23 | 1,393,000 | 1,337,280 | |||||||||||||

| USD | 6.60 | % | 11/27/26 | 533,000 | 505,017 | |||||||||||||

| USD | 6.85 | % | 03/23/27 | 2,441,000 | 2,337,258 | |||||||||||||

| USD | 6.75 | % | 11/29/27 | 1,643,000 | 1,548,527 | |||||||||||||

| USD | 6.65 | % | 11/03/28 | 9,000,000 | 8,403,750 | |||||||||||||

| 23,579,737 | ||||||||||||||||||

| Malaysia - 2.07% | ||||||||||||||||||

| 1MDB Global Investments Ltd. | USD | 4.40 | % | 03/09/23 | 25,000,000 | 24,218,750 | (1) | |||||||||||

| Mexico - 0.49% | ||||||||||||||||||

| United Mexican States: | ||||||||||||||||||

| USD | 4.75 | % | 03/08/44 | 1,341,000 | 1,371,173 | |||||||||||||

| USD | 4.60 | % | 01/23/46 | 4,300,000 | 4,304,300 | |||||||||||||

| 5,675,473 | ||||||||||||||||||

| Montenegro - 0.32% | ||||||||||||||||||

| Republic of Montenegro | EUR | 5.75 | % | 03/10/21 | 2,891,000 | 3,794,459 | (3) | |||||||||||

| Nigeria - 1.04% | ||||||||||||||||||

| Republic of Nigeria: | ||||||||||||||||||

| USD | 6.50 | % | 11/28/27 | 4,166,000 | 4,254,528 | (3) | ||||||||||||

| USD | 7.88 | % | 02/16/32 | 3,765,000 | 4,174,444 | (3) | ||||||||||||

| USD | 7.63 | % | 11/28/47 | 3,589,000 | 3,705,642 | (3) | ||||||||||||

| 12,134,614 | ||||||||||||||||||

| Oman - 1.38% | ||||||||||||||||||

| Oman Government: | ||||||||||||||||||

| USD | 4.75 | % | 06/15/26 | 1,033,000 | 1,012,340 | (3) | ||||||||||||

| USD | 5.38 | % | 03/08/27 | 5,035,000 | 5,126,259 | (1) | ||||||||||||

| USD | 6.50 | % | 03/08/47 | 9,871,000 | 9,945,033 | (3) | ||||||||||||

| 16,083,632 | ||||||||||||||||||

| Panama - 0.98% | ||||||||||||||||||

| Republic of Panama: | ||||||||||||||||||

| USD | 4.00 | % | 09/22/24 | 1,158,000 | 1,237,323 | |||||||||||||

| USD | 3.75 | % | 03/16/25 | 1,348,000 | 1,411,188 | |||||||||||||

| USD | 9.38 | % | 04/01/29 | 4,138,000 | 6,274,242 | |||||||||||||

| USD | 8.13 | % | 04/28/34 | 1,779,000 | 2,517,285 | |||||||||||||

| 11,440,038 | ||||||||||||||||||

| Paraguay - 0.49% | ||||||||||||||||||

| Republic of Paraguay | USD | 6.10 | % | 08/11/44 | 4,999,000 | 5,736,353 | (3) | |||||||||||

| Peru - 0.58% | ||||||||||||||||||

| Republic of Peru | USD | 6.55 | % | 03/14/37 | 4,968,000 | 6,756,480 | ||||||||||||

| Qatar - 0.97% | ||||||||||||||||||

| State of Qatar | USD | 4.50 | % | 01/20/22 | 10,710,000 | 11,319,131 | (3) | |||||||||||

| Russia - 2.96% | ||||||||||||||||||

| Russian Federation: | ||||||||||||||||||

| USD | 5.00 | % | 04/29/20 | 3,066,000 | 3,233,864 | (3) | ||||||||||||

| RUB | 7.40 | % | 12/07/22 | 382,875,000 | 6,573,910 | |||||||||||||

| USD | 4.75 | % | 05/27/26 | 10,200,000 | 10,819,650 | (1) | ||||||||||||

| Stone Harbor Investment Funds Semi-Annual Report | November 30, 2017 | 23 |

| Stone Harbor Emerging Markets Debt Fund | Statements of Investments |

November 30, 2017 (Unaudited)

| Currency | Rate | Maturity Date | Principal Amount/Shares* | Value (Expressed in USD) | ||||||||||||||

| Russia (continued) | ||||||||||||||||||

| Russian Federation: (continued) | ||||||||||||||||||

| RUB | 8.15 | % | 02/03/27 | 318,000,000 | $ | 5,707,273 | ||||||||||||

| USD | 4.25 | % | 06/23/27 | 1,200,000 | 1,230,300 | (1) | ||||||||||||

| USD | 5.25 | % | 06/23/47 | 6,800,000 | 7,033,750 | (1) | ||||||||||||

| 34,598,747 | ||||||||||||||||||

| Senegal - 0.47% | ||||||||||||||||||

| Republic of Senegal | USD | 6.25 | % | 05/23/33 | 5,206,000 | 5,437,016 | (3) | |||||||||||

| South Africa - 1.61% | ||||||||||||||||||

| Republic of South Africa: | ||||||||||||||||||

| USD | 4.67 | % | 01/17/24 | 2,882,000 | 2,932,435 | |||||||||||||

| USD | 5.88 | % | 09/16/25 | 9,017,000 | 9,732,724 | |||||||||||||

| USD | 4.30 | % | 10/12/28 | 6,441,000 | 6,078,694 | |||||||||||||

| 18,743,853 | ||||||||||||||||||

| Sri Lanka - 1.46% | ||||||||||||||||||

| Republic of Sri Lanka: | ||||||||||||||||||

| USD | 6.25 | % | 10/04/20 | 1,029,000 | 1,089,454 | (1) | ||||||||||||

| USD | 6.25 | % | 07/27/21 | 3,475,000 | 3,713,906 | (1) | ||||||||||||

| USD | 5.88 | % | 07/25/22 | 11,565,000 | 12,242,362 | (3) | ||||||||||||

| 17,045,722 | ||||||||||||||||||

| Turkey - 7.68% | ||||||||||||||||||

| Republic of Turkey: | ||||||||||||||||||

| USD | 5.63 | % | 03/30/21 | 3,695,000 | 3,877,441 | |||||||||||||