|

Shareholder Letter

|

2

|

|

Disclosure of Fund Expenses

|

10

|

|

Summaries of Portfolio Holdings

|

11

|

|

Growth of $10,000 Investment

|

|

|

Stone Harbor Emerging Markets Debt Fund

|

14

|

|

Stone Harbor High Yield Bond Fund

|

15

|

|

Stone Harbor Local Markets Fund

|

16

|

|

Stone Harbor Emerging Markets Corporate Debt Fund

|

17

|

|

Stone Harbor Investment Grade Fund

|

18

|

|

Stone Harbor Strategic Income Fund

|

19

|

|

Stone Harbor Emerging Markets Debt Allocation Fund

|

20

|

|

Statements of Investments

|

|

|

Stone Harbor Emerging Markets Debt Fund

|

21

|

|

Stone Harbor High Yield Bond Fund

|

32

|

|

Stone Harbor Local Markets Fund

|

41

|

|

Stone Harbor Emerging Markets Corporate Debt Fund

|

46

|

|

Stone Harbor Investment Grade Fund

|

51

|

|

Stone Harbor Strategic Income Fund

|

57

|

|

Stone Harbor Emerging Markets Debt Allocation Fund

|

59

|

|

Statements of Assets & Liabilities

|

60

|

|

Statements of Operations

|

62

|

|

Statements of Changes in Net Assets

|

64

|

|

Financial Highlights

|

|

|

Stone Harbor Emerging Markets Debt Fund

|

68

|

|

Stone Harbor High Yield Bond Fund

|

69

|

|

Stone Harbor Local Markets Fund

|

70

|

|

Stone Harbor Emerging Markets Corporate Debt Fund

|

71

|

|

Stone Harbor Investment Grade Fund

|

72

|

|

Stone Harbor Strategic Income Fund

|

73

|

|

Stone Harbor Emerging Markets Debt Allocation Fund

|

74

|

|

Notes to Financial Statements

|

75

|

|

Additional Information

|

97

|

|

Trustees & Officers

|

99

|

|

Stone Harbor Investment Funds Semi-Annual Report | November 30, 2016

|

1

|

|

Stone Harbor Investment Funds

|

Shareholder Letter

|

November 30, 2016 (Unaudited)

|

2

|

www.shiplp.com

|

|

Stone Harbor Investment Funds

|

Shareholder Letter

|

November 30, 2016 (Unaudited)

|

Stone Harbor Investment Funds Semi-Annual Report | November 30, 2016

|

3

|

|

Stone Harbor Investment Funds

|

Shareholder Letter

|

November 30, 2016 (Unaudited)

|

4

|

www.shiplp.com

|

|

Stone Harbor Investment Funds

|

Shareholder Letter

|

November 30, 2016 (Unaudited)

|

Stone Harbor Investment Funds Semi-Annual Report | November 30, 2016

|

5

|

|

Stone Harbor Investment Funds

|

Shareholder Letter

|

November 30, 2016 (Unaudited)

|

6

|

www.shiplp.com

|

|

Stone Harbor Investment Funds

|

Shareholder Letter

|

November 30, 2016 (Unaudited)

|

Stone Harbor Investment Funds Semi-Annual Report | November 30, 2016

|

7

|

|

Stone Harbor Investment Funds

|

Shareholder Letter

|

November 30, 2016 (Unaudited)

|

8

|

www.shiplp.com

|

|

Stone Harbor Investment Funds

|

Shareholder Letter

|

November 30, 2016 (Unaudited)

|

Stone Harbor Investment Funds Semi-Annual Report | November 30, 2016

|

9

|

|

Stone Harbor Investment Funds

|

Disclosure of Fund Expenses

|

November 30, 2016 (Unaudited)

|

Actual Total Return

|

Beginning Account Value June 1, 2016

|

Ending Account Value November 30, 2016

|

Expense

Ratio(1) |

Expenses Paid During Period(2)

|

|

|

STONE HARBOR EMERGING MARKETS DEBT FUND

|

2.99%

|

$1,000.00

|

$1,029.90

|

0.69%

|

$3.51

|

|

STONE HARBOR HIGH YIELD BOND FUND

|

4.69

|

1,000.00

|

1,046.90

|

0.65

|

3.34

|

|

STONE HARBOR LOCAL MARKETS FUND

|

-0.26

|

1,000.00

|

997.40

|

0.88

|

4.41

|

|

STONE HARBOR EMERGING MARKETS CORPORATE DEBT FUND

|

2.34

|

1,000.00

|

1,023.40

|

1.00

|

5.07

|

|

STONE HARBOR INVESTMENT GRADE FUND

|

-0.59

|

1,000.00

|

994.10

|

0.50

|

2.50

|

|

STONE HARBOR STRATEGIC INCOME FUND

|

2.28

|

1,000.00

|

1,022.80

|

0.12

|

0.61

|

|

STONE HARBOR EMERGING MARKETS DEBT ALLOCATION FUND

|

0.90

|

1,000.00

|

1,009.00

|

0.06

|

0.30

|

|

Hypothetical Annualized Total Return

|

Beginning Account Value June 1, 2016

|

Ending Account Value November 30, 2016

|

Expense

Ratio(1) |

Expenses Paid During Period(2)

|

|

|

STONE HARBOR EMERGING MARKETS DEBT FUND

|

5.00%

|

$1,000.00

|

$1,021.61

|

0.69%

|

$3.50

|

|

STONE HARBOR HIGH YIELD BOND FUND

|

5.00

|

1,000.00

|

1,021.81

|

0.65

|

3.29

|

|

STONE HARBOR LOCAL MARKETS FUND

|

5.00

|

1,000.00

|

1,020.66

|

0.88

|

4.46

|

|

STONE HARBOR EMERGING MARKETS CORPORATE DEBT FUND

|

5.00

|

1,000.00

|

1,020.05

|

1.00

|

5.06

|

|

STONE HARBOR INVESTMENT GRADE FUND

|

5.00

|

1,000.00

|

1,022.56

|

0.50

|

2.54

|

|

STONE HARBOR STRATEGIC INCOME FUND

|

5.00

|

1,000.00

|

1,024.47

|

0.12

|

0.61

|

|

STONE HARBOR EMERGING MARKETS DEBT ALLOCATION FUND

|

5.00

|

1,000.00

|

1,024.77

|

0.06

|

0.30

|

|

(1)

|

Annualized, based on the Fund's most recent fiscal half-year expenses.

|

|

(2)

|

Expenses are equal to the Fund's annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (183), divided by 365. Note this expense example is typically based on a six-month period.

|

|

10

|

www.shiplp.com

|

|

Stone Harbor Investment Funds

|

Summaries of Portfolio Holdings

|

November 30, 2016 (Unaudited)

|

Country Breakdown(1)

|

%

|

|

Mexico

|

8.55%

|

|

Argentina

|

8.05%

|

|

Brazil

|

7.77%

|

|

Indonesia

|

4.75%

|

|

Ukraine

|

4.23%

|

|

Turkey

|

3.74%

|

|

Colombia

|

2.98%

|

|

Dominican Republic

|

2.83%

|

|

Venezuela

|

2.73%

|

|

Azerbaijan

|

2.71%

|

|

Hungary

|

2.67%

|

|

Lebanon

|

2.58%

|

|

Russia

|

2.41%

|

|

Chile

|

2.39%

|

|

South Africa

|

2.29%

|

|

Panama

|

2.24%

|

|

Costa Rica

|

2.19%

|

|

Uruguay

|

2.05%

|

|

Croatia

|

2.02%

|

|

Poland

|

1.94%

|

|

Sri Lanka

|

1.81%

|

|

China

|

1.79%

|

|

Peru

|

1.79%

|

|

Malaysia

|

1.73%

|

|

Ivory Coast

|

1.60%

|

|

Kazakhstan

|

1.37%

|

|

Serbia

|

1.26%

|

|

Ghana

|

1.15%

|

|

El Salvador

|

1.05%

|

|

Philippines

|

0.98%

|

|

Gabon

|

0.85%

|

|

Egypt

|

0.74%

|

|

Ecuador

|

0.73%

|

|

Iraq

|

0.73%

|

|

Jamaica

|

0.68%

|

|

Romania

|

0.64%

|

|

Kenya

|

0.58%

|

|

Namibia

|

0.51%

|

|

Angola

|

0.46%

|

|

Paraguay

|

0.37%

|

|

Nigeria

|

0.36%

|

|

Oman

|

0.33%

|

|

Bahrain

|

0.30%

|

|

Georgia

|

0.28%

|

|

Zambia

|

0.27%

|

|

Montenegro

|

0.24%

|

|

Suriname

|

0.22%

|

|

Macau

|

0.20%

|

|

Trinidad

|

0.20%

|

|

India

|

0.19%

|

|

Ethiopia

|

0.18%

|

|

Morocco

|

0.15%

|

|

Kuwait

|

0.13%

|

|

Cameroon

|

0.12%

|

|

Jordan

|

0.10%

|

|

Lithuania

|

0.10%

|

|

Total

|

95.31%

|

|

Short Term Investments

|

4.03%

|

|

Other Assets in Excess of Liabilities

|

0.66%

|

|

Total Net Assets

|

100.00%

|

|

Industry Breakdown

|

%

|

|

Media Cable

|

9.47%

|

|

Exploration & Production

|

8.34%

|

|

Electric

|

5.97%

|

|

Healthcare

|

5.83%

|

|

Wireless

|

5.04%

|

|

Technology

|

4.88%

|

|

Wirelines

|

4.80%

|

|

Building Products

|

4.79%

|

|

Media Other

|

4.66%

|

|

Chemicals

|

4.23%

|

|

Industrial Other

|

3.96%

|

|

Containers/Packaging

|

3.92%

|

|

Metals/Mining/Steel

|

3.66%

|

|

Food & Beverage

|

3.43%

|

|

Retail Non Food/Drug

|

2.88%

|

|

Gaming

|

2.58%

|

|

Pharmaceuticals

|

2.27%

|

|

Automotive

|

2.26%

|

|

Paper/Forest Products

|

2.26%

|

|

Consumer Products

|

2.25%

|

|

Drillers/Services

|

1.67%

|

|

Retail Food/Drug

|

1.46%

|

|

Leisure

|

1.27%

|

|

Diversified Manufacturing

|

1.10%

|

|

Home Builders

|

0.70%

|

|

Transportation Non Air/Rail

|

0.60%

|

|

Financial Other

|

0.47%

|

|

Textile /Apparel

|

0.45%

|

|

Lodging

|

0.43%

|

|

Restaurants

|

0.42%

|

|

Aerospace /Defense

|

0.30%

|

|

Total

|

96.35%

|

|

Short Term Investments

|

3.02%

|

|

Other Assets in Excess of Liabilities

|

0.63%

|

|

Total Net Assets

|

100.00%

|

|

(1)

|

Country refers to country of primary risk exposure, as determined by Stone Harbor. In certain instances, a security’s country of incorporation may be different from its country of risk.

|

|

Stone Harbor Investment Funds Semi-Annual Report | November 30, 2016

|

11

|

|

Stone Harbor Investment Funds

|

Summaries of Portfolio Holdings

|

November 30, 2016 (Unaudited)

|

Country Breakdown(1)

|

%

|

|

Brazil

|

16.17%

|

|

South Africa

|

11.09%

|

|

Indonesia

|

10.63%

|

|

Malaysia

|

7.98%

|

|

Colombia

|

7.26%

|

|

Russia

|

4.88%

|

|

Poland

|

4.78%

|

|

Mexico

|

4.73%

|

|

Turkey

|

4.66%

|

|

Thailand

|

3.63%

|

|

Romania

|

1.64%

|

|

Argentina

|

1.44%

|

|

Peru

|

0.16%

|

|

Total

|

82.35%

|

|

Short Term Investments

|

0.92%

|

|

Other Assets in Excess of Liabilities

|

16.73%

|

|

Total Net Assets

|

100.00%

|

|

(1)

|

Country refers to country of primary risk exposure, as determined by Stone Harbor. In certain instances, a security’s country of incorporation may be different from its country of risk.

|

|

Country Breakdown(1)

|

%

|

|

Brazil

|

7.84%

|

|

India

|

7.55%

|

|

China

|

7.37%

|

|

Russia

|

7.05%

|

|

Mexico

|

6.57%

|

|

United Arab Emirates

|

5.40%

|

|

Turkey

|

4.77%

|

|

Colombia

|

4.61%

|

|

Hong Kong

|

4.29%

|

|

Chile

|

4.20%

|

|

Thailand

|

3.77%

|

|

Indonesia

|

3.38%

|

|

South Korea

|

3.21%

|

|

Peru

|

3.20%

|

|

Macau

|

2.46%

|

|

Morocco

|

2.36%

|

|

Argentina

|

2.32%

|

|

Israel

|

2.17%

|

|

Guatemala

|

1.85%

|

|

Jamaica

|

1.84%

|

|

Angola

|

1.79%

|

|

Kuwait

|

1.75%

|

|

Malaysia

|

1.39%

|

|

Singapore

|

1.38%

|

|

Kazakhstan

|

1.31%

|

|

Algeria

|

1.00%

|

|

South Africa

|

0.96%

|

|

Philippines

|

0.74%

|

|

Qatar

|

0.65%

|

|

Total

|

97.18%

|

|

Short Term Investments

|

1.77%

|

|

Other Assets in Excess of Liabilities

|

1.05%

|

|

Total Net Assets

|

100.00%

|

|

12

|

www.shiplp.com

|

|

Stone Harbor Investment Funds

|

Summaries of Portfolio Holdings

|

November 30, 2016 (Unaudited)

|

Industry Breakdown

|

%

|

|

U.S. Treasury Bonds/Notes

|

18.51%

|

|

U.S. Government Agency Mortgage Backed

|

18.33%

|

|

Asset Backed/Commercial Mortgage Backed

|

13.61%

|

|

Banking

|

8.67%

|

|

Electric

|

4.32%

|

|

Gas Pipelines

|

2.76%

|

|

Real Estate Investment Trust (REITs)

|

2.17%

|

|

Food and Beverage

|

1.90%

|

|

Pharmaceuticals

|

1.83%

|

|

Technology

|

1.79%

|

|

Automotive

|

1.55%

|

|

Wirelines

|

1.45%

|

|

Media Other

|

1.43%

|

|

Exploration & Production

|

1.27%

|

|

Media Cable

|

1.18%

|

|

Non Captive Finance

|

0.94%

|

|

Transportation Non Air/Rail

|

0.89%

|

|

Retail Food/Drug

|

0.63%

|

|

Chemicals

|

0.61%

|

|

Life Insurance

|

0.59%

|

|

Leisure

|

0.51%

|

|

Metals/Mining/Steel

|

0.51%

|

|

Consumer Products

|

0.48%

|

|

Environmental Services

|

0.48%

|

|

Healthcare

|

0.48%

|

|

Refining

|

0.47%

|

|

Retail Non Food/Drug

|

0.46%

|

|

Drillers/Services

|

0.32%

|

|

Paper/Forest Products

|

0.32%

|

|

Media

|

0.30%

|

|

Wireless

|

0.30%

|

|

Aerospace/Defense

|

0.16%

|

|

Total

|

89.22%

|

|

Short Term Investments

|

9.90%

|

|

Other Assets in Excess of Liabilities

|

0.88%

|

|

Total Net Assets

|

100.00%

|

|

%

|

|

|

Stone Harbor Investment Grade Fund

|

42.18%

|

|

Stone Harbor High Yield Bond Fund

|

35.66%

|

|

Stone Harbor Emerging Markets Debt Fund

|

20.07%

|

|

Total

|

97.91%

|

|

Short Term Investments

|

0.77%

|

|

Other Assets in Excess of Liabilities

|

1.32%

|

|

Total Net Assets

|

100.00%

|

|

%

|

|

|

Stone Harbor Local Markets Fund

|

53.05%

|

|

Stone Harbor Emerging Markets Debt Fund

|

46.86%

|

|

Total

|

99.91%

|

|

Short Term Investments

|

0.01%

|

|

Other Assets in Excess of Liabilities

|

0.08%

|

|

Total Net Assets

|

100.00%

|

|

Stone Harbor Investment Funds Semi-Annual Report | November 30, 2016

|

13

|

|

Stone Harbor Investment Funds

|

Growth of $10,000 Investment

|

November 30, 2016 (Unaudited)

|

6 Months

|

1 Year

|

3 Years

|

5 Years

|

Since Inception

|

|

|

Stone Harbor Emerging Markets Debt Fund

|

2.99%

|

9.38%

|

4.80%

|

4.31%

|

6.98%

|

|

J.P. Morgan EMBI Global Diversified

|

1.87%

|

7.19%

|

5.90%

|

5.86%

|

7.42%

|

|

14

|

www.shiplp.com

|

|

Stone Harbor Investment Funds

|

Growth of $10,000 Investment

|

November 30, 2016 (Unaudited)

|

6 Months

|

1 Year

|

3 Years

|

5 Years

|

Since Inception

|

|

|

Stone Harbor High Yield Bond Fund

|

4.69%

|

7.87%

|

2.14%

|

6.20%

|

6.29%

|

|

Citigroup High Yield Market Capped Index

|

6.53%

|

12.07%

|

3.75%

|

7.02%

|

7.37%

|

|

Stone Harbor Investment Funds Semi-Annual Report | November 30, 2016

|

15

|

|

Stone Harbor Investment Funds

|

Growth of $10,000 Investment

|

|

November 30, 2016 (Unaudited)

|

6 Months

|

1 Year

|

3 Years

|

5 Years

|

Since Inception

|

|

|

Stone Harbor Local Markets Fund

|

‐0.26%

|

3.88%

|

‐6.35%

|

‐3.91%

|

‐1.63%

|

|

J.P. Morgan GBI‐EM Global Diversified

|

0.23%

|

5.52%

|

‐4.87%

|

‐1.94%

|

0.18%

|

|

16

|

www.shiplp.com

|

|

Stone Harbor Investment Funds

|

Growth of $10,000 Investment

|

November 30, 2016 (Unaudited)

|

6 Months

|

1 Year

|

3 Year

|

5 Year

|

Since Inception

|

|

|

Stone Harbor Emerging Markets Corporate Debt Fund

|

2.34%

|

7.37%

|

4.61%

|

5.48%

|

2.94%

|

|

J.P. Morgan CEMBI Broad Diversified

|

2.73%

|

7.46%

|

5.03%

|

5.93%

|

4.94%

|

|

Stone Harbor Investment Funds Semi-Annual Report | November 30, 2016

|

17

|

|

Stone Harbor Investment Funds

|

Growth of $10,000 Investment

|

November 30, 2016 (Unaudited)

|

6 Months

|

1 Year

|

Since Inception

|

|

|

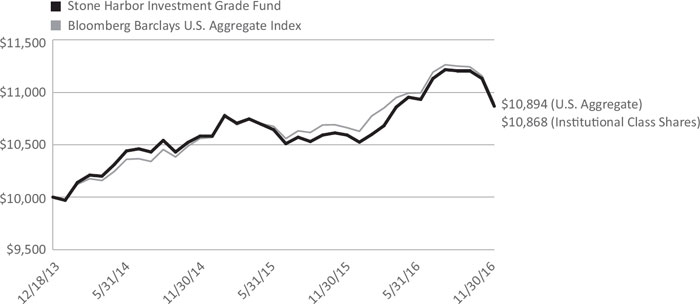

Stone Harbor Investment Grade Fund

|

‐0.59%

|

2.60%

|

2.86%

|

|

Bloomberg Barclays U.S. Aggregate Index

|

‐0.92%

|

2.17%

|

2.95%

|

|

18

|

www.shiplp.com

|

|

Stone Harbor Investment Funds

|

Growth of $10,000 Investment

|

November 30, 2016 (Unaudited)

|

6 Months

|

1 Year

|

Since Inception

|

|

|

Stone Harbor Strategic Income Fund

|

2.28%

|

5.73%

|

3.15%

|

|

Bloomberg Barclays Global Credit Index (Hedged USD)

|

1.47%

|

5.43%

|

4.29%

|

|

Stone Harbor Investment Funds Semi-Annual Report | November 30, 2016

|

19

|

|

Stone Harbor Investment Funds

|

Growth of $10,000 Investment

|

November 30, 2016 (Unaudited)

|

6 Months

|

1 Year

|

Since Inception

|

|

|

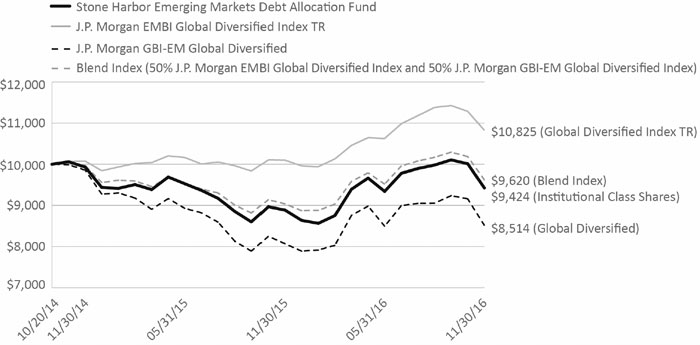

Stone Harbor Emerging Markets Debt Allocation Fund

|

0.90%

|

6.05%

|

‐2.77%

|

|

J.P. Morgan EMBI Global Diversified

|

1.87%

|

7.19%

|

3.82%

|

|

J.P. Morgan GBI‐EM Global Diversified

|

0.23%

|

5.52%

|

‐7.33%

|

|

Blend Index (50% J.P. Morgan EMBI Global Diversified Index and 50% J.P. Morgan GBI‐EM Global Diversified Index)

|

1.07%

|

6.46%

|

‐1.82%

|

|

20

|

www.shiplp.com

|

|

Stone Harbor Emerging Markets Debt Fund

|

Statements of Investments

|

|

|

Reference

Rate |

Currency

|

Rate

|

Maturity

Date |

Principal Amount/Shares*

|

Value Expressed

(in USD) |

||||||||||||

|

SOVEREIGN DEBT OBLIGATIONS ‐ 70.88%

|

||||||||||||||||||

|

Angola ‐ 0.46%

|

||||||||||||||||||

|

Republic of Angola:

|

||||||||||||||||||

|

USD

|

7.00

|

%

|

08/16/19

|

2,459,875

|

$

|

2,460,921

|

(1)

|

|||||||||||

|

USD

|

9.50

|

%

|

11/12/25

|

2,428,000

|

2,262,592

|

(1)

|

||||||||||||

|

USD

|

9.50

|

%

|

11/12/25

|

2,675,000

|

2,492,766

|

(2)

|

||||||||||||

|

7,216,279

|

||||||||||||||||||

|

Argentina ‐ 7.55%

|

||||||||||||||||||

|

Provincia del Chaco

|

USD

|

9.38

|

%

|

08/18/24

|

2,000,000

|

1,895,000

|

(1)

|

|||||||||||

|

Republic of Argentina:

|

||||||||||||||||||

|

USD

|

6.88

|

%

|

04/22/21

|

838,000

|

875,710

|

(1)

|

||||||||||||

|

USD

|

6.88

|

%

|

04/22/21

|

1,602,000

|

1,674,090

|

(2)

|

||||||||||||

|

USD

|

7.50

|

%

|

04/22/26

|

230,000

|

232,300

|

(1)

|

||||||||||||

|

EUR

|

7.82

|

%

|

12/31/33

|

31,163,880

|

31,873,014

|

|||||||||||||

|

EUR

|

7.82

|

%

|

12/31/33

|

44,052,438

|

45,288,295

|

|||||||||||||

|

USD

|

8.28

|

%

|

12/31/33

|

12,326,781

|

12,295,964

|

|||||||||||||

|

EUR

|

0.00

|

%

|

12/15/35

|

127,931,583

|

13,287,649

|

(3)

|

||||||||||||

|

EUR

|

2.26

|

%

|

12/31/38

|

7,502,000

|

4,452,556

|

(4)

|

||||||||||||

|

USD

|

2.50

|

%

|

12/31/38

|

10,510,000

|

6,240,312

|

(4)

|

||||||||||||

|

USD

|

7.65

|

%

|

04/22/46

|

252,000

|

239,715

|

(1)

|

||||||||||||

|

118,354,605

|

||||||||||||||||||

|

Azerbaijan ‐ 2.09%

|

||||||||||||||||||

|

Republic of Azerbaijan:

|

||||||||||||||||||

|

USD

|

4.75

|

%

|

03/18/24

|

1,167,000

|

1,159,706

|

(1)

|

||||||||||||

|

USD

|

4.75

|

%

|

03/18/24

|

31,779,000

|

31,580,381

|

(2)

|

||||||||||||

|

32,740,087

|

||||||||||||||||||

|

Bahrain ‐ 0.30%

|

||||||||||||||||||

|

Kingdom of Baharain

|

USD

|

7.00

|

%

|

10/12/28

|

4,664,000

|

4,710,640

|

(2)

|

|||||||||||

|

Brazil ‐ 3.52%

|

||||||||||||||||||

|

Brazil Minas SPE via State of Minas Gerais:

|

||||||||||||||||||

|

USD

|

5.33

|

%

|

02/15/28

|

496,000

|

472,440

|

(2)

|

||||||||||||

|

USD

|

5.33

|

%

|

02/15/28

|

23,990,000

|

22,850,475

|

(1)

|

||||||||||||

|

Republic of Brazil:

|

||||||||||||||||||

|

USD

|

2.63

|

%

|

01/05/23

|

4,232,000

|

3,766,480

|

|||||||||||||

|

USD

|

4.25

|

%

|

01/07/25

|

3,768,000

|

3,549,456

|

|||||||||||||

|

USD

|

8.75

|

%

|

02/04/25

|

834,000

|

1,032,075

|

|||||||||||||

|

USD

|

6.00

|

%

|

04/07/26

|

16,517,000

|

17,301,558

|

|||||||||||||

|

USD

|

5.00

|

%

|

01/27/45

|

5,555,000

|

4,437,056

|

|||||||||||||

|

USD

|

5.63

|

%

|

02/21/47

|

2,051,000

|

1,784,370

|

|||||||||||||

|

55,193,910

|

||||||||||||||||||

|

Cameroon ‐ 0.12%

|

||||||||||||||||||

|

Republic of Cameroon

|

USD

|

9.50

|

%

|

11/19/25

|

1,834,000

|

1,941,747

|

(2)

|

|||||||||||

|

Chile ‐ 0.42%

|

||||||||||||||||||

|

Republic of Chile:

|

||||||||||||||||||

|

USD

|

3.13

|

%

|

03/27/25

|

1,000,000

|

1,001,250

|

|||||||||||||

|

USD

|

3.13

|

%

|

01/21/26

|

5,541,000

|

5,527,147

|

|||||||||||||

|

6,528,397

|

||||||||||||||||||

|

Colombia ‐ 2.73%

|

||||||||||||||||||

|

Bogota Distrio Capital

|

COP

|

9.75

|

%

|

07/26/28

|

724,000,000

|

240,772

|

(1)

|

|||||||||||

|

Stone Harbor Investment Funds Semi-Annual Report | November 30, 2016

|

21

|

|

Stone Harbor Emerging Markets Debt Fund

|

Statements of Investments

|

|

|

November 30, 2016 (Unaudited)

|

|

|

Reference

Rate |

Currency

|

Rate

|

Maturity

Date |

Principal Amount/Shares*

|

Value Expressed

(in USD) |

|||||||||||||

|

Colombia (continued)

|

|||||||||||||||||||

|

Republic of Colombia:

|

|||||||||||||||||||

|

USD

|

4.38

|

%

|

07/12/21

|

13,792,000

|

$

|

14,343,680

|

|||||||||||||

|

USD

|

4.00

|

%

|

02/26/24

|

17,027,000

|

17,005,716

|

||||||||||||||

|

USD

|

4.50

|

%

|

01/28/26

|

5,300,000

|

5,398,050

|

||||||||||||||

|

USD

|

10.38

|

%

|

01/28/33

|

2,006,000

|

2,953,835

|

||||||||||||||

|

USD

|

7.38

|

%

|

09/18/37

|

1,164,000

|

1,388,070

|

||||||||||||||

|

USD

|

5.63

|

%

|

02/26/44

|

1,403,000

|

1,404,754

|

||||||||||||||

|

42,734,877

|

|||||||||||||||||||

|

Costa Rica ‐ 1.96%

|

|||||||||||||||||||

|

Republic of Costa Rica:

|

|||||||||||||||||||

|

USD

|

4.25

|

%

|

01/26/23

|

13,058,000

|

12,046,005

|

(1)

|

|||||||||||||

|

USD

|

4.38

|

%

|

04/30/25

|

2,881,000

|

2,571,292

|

(2)

|

|||||||||||||

|

USD

|

4.38

|

%

|

04/30/25

|

4,745,000

|

4,234,913

|

(1)

|

|||||||||||||

|

USD

|

7.00

|

%

|

04/04/44

|

12,809,000

|

11,880,347

|

(2)

|

|||||||||||||

|

30,732,557

|

|||||||||||||||||||

|

Croatia ‐ 2.02%

|

|||||||||||||||||||

|

Croatian Government:

|

|||||||||||||||||||

|

USD

|

6.63

|

%

|

07/14/20

|

6,726,000

|

7,317,888

|

(1)

|

|||||||||||||

|

USD

|

6.38

|

%

|

03/24/21

|

4,148,000

|

4,513,024

|

(2)

|

|||||||||||||

|

USD

|

5.50

|

%

|

04/04/23

|

10,734,000

|

11,313,636

|

(1)

|

|||||||||||||

|

USD

|

6.00

|

%

|

01/26/24

|

7,887,000

|

8,549,508

|

(2)

|

|||||||||||||

|

31,694,056

|

|||||||||||||||||||

|

Dominican Republic ‐ 2.83%

|

|||||||||||||||||||

|

Dominican Republic:

|

|||||||||||||||||||

|

USD

|

9.04

|

%

|

01/23/18

|

3,129,148

|

3,254,313

|

(1)

|

|||||||||||||

|

USD

|

7.50

|

%

|

05/06/21

|

16,799,000

|

18,247,914

|

(1)

|

|||||||||||||

|

USD

|

6.60

|

%

|

01/28/24

|

9,856,000

|

10,311,840

|

(1)

|

|||||||||||||

|

USD

|

5.88

|

%

|

04/18/24

|

2,304,000

|

2,318,400

|

(2)

|

|||||||||||||

|

USD

|

5.50

|

%

|

01/27/25

|

3,733,000

|

3,602,345

|

(1)

|

|||||||||||||

|

USD

|

6.88

|

%

|

01/29/26

|

6,392,000

|

6,663,660

|

(1)

|

|||||||||||||

|

44,398,472

|

|||||||||||||||||||

|

Ecuador ‐ 0.33%

|

|||||||||||||||||||

|

Republic of Ecuador:

|

|||||||||||||||||||

|

USD

|

10.75

|

%

|

03/28/22

|

603,000

|

631,643

|

(2)

|

|||||||||||||

|

USD

|

7.95

|

%

|

06/20/24

|

2,157,000

|

1,979,047

|

(2)

|

|||||||||||||

|

USD

|

7.95

|

%

|

06/20/24

|

2,798,000

|

2,567,165

|

(1)

|

|||||||||||||

|

5,177,855

|

|||||||||||||||||||

|

Egypt ‐ 0.74%

|

|||||||||||||||||||

|

Republic of Egypt:

|

|||||||||||||||||||

|

USD

|

5.88

|

%

|

06/11/25

|

10,415,000

|

9,542,744

|

(2)

|

|||||||||||||

|

USD

|

6.88

|

%

|

04/30/40

|

2,350,000

|

2,044,500

|

(2)

|

|||||||||||||

|

11,587,244

|

|||||||||||||||||||

|

El Salvador ‐ 1.05%

|

|||||||||||||||||||

|

Republic of El Salvador:

|

|||||||||||||||||||

|

USD

|

7.38

|

%

|

12/01/19

|

220,000

|

225,500

|

(2)

|

|||||||||||||

|

USD

|

7.75

|

%

|

01/24/23

|

7,184,000

|

7,255,840

|

(1)

|

|||||||||||||

|

USD

|

5.88

|

%

|

01/30/25

|

900,000

|

792,000

|

(1)

|

|||||||||||||

|

USD

|

7.65

|

%

|

06/15/35

|

9,424,000

|

8,269,560

|

(1)

|

|||||||||||||

|

16,542,900

|

|||||||||||||||||||

|

22

|

www.shiplp.com

|

|

Stone Harbor Emerging Markets Debt Fund

|

Statements of Investments

|

|

Reference

Rate |

Currency

|

Rate

|

Maturity

Date |

Principal Amount/Shares*

|

Value Expressed

(in USD) |

|||||||||||||

|

Ethiopia ‐ 0.18%

|

||||||||||||||||||

|

Federal Democratic Republic of Ethiopia

|

USD

|

6.63

|

%

|

12/11/24

|

3,224,000

|

$

|

2,885,480

|

(2)

|

||||||||||

|

Gabon ‐ 0.85%

|

||||||||||||||||||

|

Republic of Gabon:

|

||||||||||||||||||

|

USD

|

8.20

|

%

|

12/12/17

|

50,000

|

51,750

|

(2)

|

||||||||||||

|

USD

|

6.38

|

%

|

12/12/24

|

2,560,000

|

2,252,800

|

(1)

|

||||||||||||

|

USD

|

6.38

|

%

|

12/12/24

|

7,430,995

|

6,539,276

|

(2)

|

||||||||||||

|

USD

|

6.95

|

%

|

06/16/25

|

5,024,000

|

4,427,400

|

(2)

|

||||||||||||

|

13,271,226

|

||||||||||||||||||

|

Georgia ‐ 0.28%

|

||||||||||||||||||

|

Republic of Georgia

|

USD

|

6.88

|

%

|

04/12/21

|

4,081,000

|

4,422,784

|

(2)

|

|||||||||||

|

Ghana ‐ 1.15%

|

||||||||||||||||||

|

Republic of Ghana:

|

||||||||||||||||||

|

USD

|

9.25

|

%

|

09/15/22

|

3,333,000

|

3,395,494

|

(2)

|

||||||||||||

|

USD

|

7.88

|

%

|

08/07/23

|

2,786,193

|

2,591,159

|

(2)

|

||||||||||||

|

USD

|

10.75

|

%

|

10/14/30

|

4,785,000

|

5,383,125

|

(2)

|

||||||||||||

|

USD

|

10.75

|

%

|

10/14/30

|

5,934,000

|

6,675,750

|

(1)

|

||||||||||||

|

18,045,528

|

||||||||||||||||||

|

Hungary ‐ 2.67%

|

||||||||||||||||||

|

Republic of Hungary:

|

||||||||||||||||||

|

USD

|

6.38

|

%

|

03/29/21

|

15,197,000

|

17,153,614

|

|||||||||||||

|

USD

|

5.38

|

%

|

02/21/23

|

16,443,000

|

17,963,978

|

|||||||||||||

|

USD

|

5.75

|

%

|

11/22/23

|

6,028,000

|

6,766,430

|

|||||||||||||

|

USD

|

5.38

|

%

|

03/25/24

|

6,000

|

6,621

|

|||||||||||||

|

41,890,643

|

||||||||||||||||||

|

Indonesia ‐ 3.01%

|

||||||||||||||||||

|

Republic of Indonesia:

|

||||||||||||||||||

|

USD

|

3.38

|

%

|

04/15/23

|

4,068,000

|

4,013,509

|

(1)

|

||||||||||||

|

USD

|

5.38

|

%

|

10/17/23

|

7,084,000

|

7,749,896

|

(1)

|

||||||||||||

|

USD

|

5.88

|

%

|

01/15/24

|

4,540,000

|

5,092,518

|

(1)

|

||||||||||||

|

USD

|

4.75

|

%

|

01/08/26

|

10,313,000

|

10,833,844

|

(1)

|

||||||||||||

|

USD

|

8.50

|

%

|

10/12/35

|

6,681,000

|

9,371,940

|

(1)

|

||||||||||||

|

USD

|

6.63

|

%

|

02/17/37

|

4,117,000

|

4,937,827

|

(1)

|

||||||||||||

|

USD

|

5.25

|

%

|

01/17/42

|

1,600,000

|

1,657,000

|

(1)

|

||||||||||||

|

USD

|

6.75

|

%

|

01/15/44

|

1,100,000

|

1,366,062

|

(1)

|

||||||||||||

|

USD

|

5.13

|

%

|

01/15/45

|

2,053,000

|

2,105,608

|

(1)

|

||||||||||||

|

47,128,204

|

||||||||||||||||||

|

Iraq ‐ 0.31%

|

||||||||||||||||||

|

Republic of Iraq

|

USD

|

5.80

|

%

|

01/15/28

|

6,051,000

|

4,833,236

|

(1)

|

|||||||||||

|

Ivory Coast ‐ 1.60%

|

||||||||||||||||||

|

Ivory Coast Government:

|

||||||||||||||||||

|

USD

|

5.38

|

%

|

07/23/24

|

3,668,000

|

3,539,620

|

(2)

|

||||||||||||

|

USD

|

6.38

|

%

|

03/03/28

|

5,746,000

|

5,587,985

|

(2)

|

||||||||||||

|

USD

|

5.75

|

%

|

12/31/32

|

17,152,740

|

15,930,607

|

(1)(4)

|

||||||||||||

|

25,058,212

|

||||||||||||||||||

|

Jamaica ‐ 0.26%

|

||||||||||||||||||

|

Jamaican Government

|

USD

|

8.00

|

%

|

03/15/39

|

3,749,000

|

4,081,724 | ||||||||||||

|

Jordan ‐ 0.10%

|

||||||||||||||||||

|

Kingdom of Jordan

|

USD

|

5.75

|

%

|

01/31/27

|

1,638,000

|

1,551,595

|

(2)

|

|||||||||||

|

Stone Harbor Investment Funds Semi-Annual Report | November 30, 2016

|

23

|

|

Stone Harbor Emerging Markets Debt Fund

|

Statements of Investments

|

|

|

November 30, 2016 (Unaudited)

|

|

Reference

Rate |

Currency

|

Rate

|

Maturity

Date

|

Principal

Amount/Shares*

|

Value Expressed

(in USD) |

|||||||||||||

|

Kazakhstan ‐ 0.01%

|

||||||||||||||||||

|

Republic of Kazakhstan

|

USD

|

5.13

|

%

|

07/21/25

|

158,000

|

$

|

167,678

|

(2)

|

||||||||||

|

Kenya ‐ 0.58%

|

||||||||||||||||||

|

Republic of Kenya:

|

||||||||||||||||||

|

USD

|

5.88

|

%

|

06/24/19

|

832,000

|

850,720

|

(2)

|

||||||||||||

|

USD

|

6.88

|

%

|

06/24/24

|

618,000

|

589,418

|

(1)

|

||||||||||||

|

USD

|

6.88

|

%

|

06/24/24

|

8,083,000

|

7,709,161

|

(2)

|

||||||||||||

|

9,149,299

|

||||||||||||||||||

|

Lebanon ‐ 2.58%

|

||||||||||||||||||

|

Lebonese Republic:

|

||||||||||||||||||

|

USD

|

6.25

|

%

|

11/04/24

|

8,586,000

|

8,049,375

|

|||||||||||||

|

USD

|

6.60

|

%

|

11/27/26

|

9,180,000

|

8,560,350

|

|||||||||||||

|

USD

|

6.75

|

%

|

11/29/27

|

3,766,000

|

3,549,455

|

|||||||||||||

|

USD

|

6.65

|

%

|

02/26/30

|

16,774,000

|

15,327,242

|

|||||||||||||

|

USD

|

7.05

|

%

|

11/02/35

|

5,277,000

|

4,953,784

|

|||||||||||||

|

40,440,206

|

||||||||||||||||||

|

Lithuania ‐ 0.10%

|

||||||||||||||||||

|

Republic of Lithuania

|

USD

|

7.38

|

%

|

02/11/20

|

1,413,000

|

1,626,716

|

(2)

|

|||||||||||

|

Malaysia ‐ 0.67%

|

||||||||||||||||||

|

1MDB Global Investments Ltd.

|

USD

|

4.40

|

%

|

03/09/23

|

12,500,000

|

10,585,938

|

(1)

|

|||||||||||

|

Mexico ‐ 2.35%

|

||||||||||||||||||

|

United Mexican States:

|

||||||||||||||||||

|

USD

|

4.00

|

%

|

10/02/23

|

21,923,000

|

21,923,000

|

|||||||||||||

|

USD

|

3.60

|

%

|

01/30/25

|

1,401,000

|

1,344,960

|

|||||||||||||

|

USD

|

4.13

|

%

|

01/21/26

|

12,823,000

|

12,694,770

|

|||||||||||||

|

USD

|

4.35

|

%

|

01/15/47

|

984,000

|

821,640

|

|||||||||||||

|

36,784,370

|

||||||||||||||||||

|

Montenegro ‐ 0.24%

|

||||||||||||||||||

|

Republic of Montenegro

|

EUR

|

5.75

|

%

|

03/10/21

|

3,394,000

|

3,737,202

|

(2)

|

|||||||||||

|

Namibia ‐ 0.51%

|

||||||||||||||||||

|

Republic of Namibia

|

USD

|

5.25

|

%

|

10/29/25

|

8,131,000

|

8,049,690

|

(2)

|

|||||||||||

|

Nigeria ‐ 0.36%

|

||||||||||||||||||

|

Republic of Nigeria

|

USD

|

5.13

|

%

|

07/12/18

|

5,664,000

|

5,664,000

|

(1)

|

|||||||||||

|

Oman ‐ 0.33%

|

||||||||||||||||||

|

Oman Government

|

USD

|

4.75

|

%

|

06/15/26

|

5,253,000

|

5,121,675

|

(2)

|

|||||||||||

|

Panama ‐ 2.24%

|

||||||||||||||||||

|

Republic of Panama:

|

||||||||||||||||||

|

USD

|

3.75

|

%

|

03/16/25

|

6,117,000

|

6,132,293

|

|||||||||||||

|

USD

|

8.88

|

%

|

09/30/27

|

1,393,000

|

1,931,046

|

|||||||||||||

|

USD

|

9.38

|

%

|

04/01/29

|

17,070,000

|

24,303,413

|

|||||||||||||

|

USD

|

8.13

|

%

|

04/28/34

|

2,063,000

|

2,720,581

|

|||||||||||||

|

35,087,333

|

||||||||||||||||||

|

Paraguay ‐ 0.37%

|

||||||||||||||||||

|

Republic of Paraguay

|

USD

|

6.10

|

%

|

08/11/44

|

5,798,000

|

5,783,505

|

(2)

|

|||||||||||

|

Peru ‐ 1.57%

|

||||||||||||||||||

|

Republic of Peru:

|

||||||||||||||||||

|

USD

|

4.13

|

%

|

08/25/27

|

5,964,000

|

6,247,290

|

|||||||||||||

|

24

|

www.shiplp.com

|

|

Stone Harbor Emerging Markets Debt Fund

|

Statements of Investments

|

|

|

November 30, 2016 (Unaudited)

|

|

Reference

Rate |

Currency

|

Rate

|

Maturity

Date |

Principal

Amount/Shares* |

Value Expressed

(in USD) |

|||||||||||||

|

Peru (continued)

|

||||||||||||||||||

|

Republic of Peru: (continued)

|

||||||||||||||||||

|

USD

|

8.75

|

%

|

11/21/33

|

7,523,000

|

$

|

11,115,233

|

||||||||||||

|

USD

|

6.55

|

%

|

03/14/37

|

5,762,000

|

7,317,740

|

|||||||||||||

|

24,680,263

|

||||||||||||||||||

|

Philippines ‐ 0.98%

|

||||||||||||||||||

|

Republic of Philippines

|

USD

|

9.50

|

%

|

02/02/30

|

9,716,000

|

15,394,613

|

||||||||||||

|

Poland ‐ 1.94%

|

||||||||||||||||||

|

Republic of Poland:

|

||||||||||||||||||

|

USD

|

5.00

|

%

|

03/23/22

|

2,667,000

|

2,927,032

|

|||||||||||||

|

USD

|

3.00

|

%

|

03/17/23

|

2,043,000

|

2,022,570

|

|||||||||||||

|

USD

|

4.00

|

%

|

01/22/24

|

3,329,000

|

3,455,236

|

|||||||||||||

|

USD

|

3.25

|

%

|

04/06/26

|

22,505,000

|

21,942,375

|

|||||||||||||

|

30,347,213

|

||||||||||||||||||

|

Romania ‐ 0.64%

|

||||||||||||||||||

|

Romanian Government International Bond:

|

||||||||||||||||||

|

USD

|

6.75

|

%

|

02/07/22

|

3,167,000

|

3,637,299

|

(2)

|

||||||||||||

|

USD

|

4.38

|

%

|

08/22/23

|

1,069,000

|

1,103,743

|

(1)

|

||||||||||||

|

USD

|

4.38

|

%

|

08/22/23

|

3,860,000

|

3,985,450

|

(2)

|

||||||||||||

|

USD

|

4.88

|

%

|

01/22/24

|

1,249,000

|

1,333,308

|

(2)

|

||||||||||||

|

10,059,800

|

||||||||||||||||||

|

Russia ‐ 2.41%

|

||||||||||||||||||

|

Russian Federation:

|

||||||||||||||||||

|

USD

|

5.00

|

%

|

04/29/20

|

6,266,000

|

6,610,630

|

(2)

|

||||||||||||

|

USD

|

4.88

|

%

|

09/16/23

|

18,200,000

|

19,173,700

|

(1)

|

||||||||||||

|

USD

|

4.75

|

%

|

05/27/26

|

11,000,000

|

11,225,500

|

(1)

|

||||||||||||

|

USD

|

12.75

|

%

|

06/24/28

|

430,000

|

722,938

|

(1)

|

||||||||||||

|

37,732,768

|

||||||||||||||||||

|

Serbia ‐ 1.26%

|

||||||||||||||||||

|

Republic of Serbia:

|

||||||||||||||||||

|

USD

|

5.88

|

%

|

12/03/18

|

1,505,000

|

1,575,735

|

(1)

|

||||||||||||

|

USD

|

4.88

|

%

|

02/25/20

|

5,989,000

|

6,110,277

|

(2)

|

||||||||||||

|

USD

|

4.88

|

%

|

02/25/20

|

9,790,000

|

9,988,248

|

(1)

|

||||||||||||

|

USD

|

7.25

|

%

|

09/28/21

|

1,812,000

|

2,027,629

|

(1)

|

||||||||||||

|

19,701,889

|

||||||||||||||||||

|

South Africa ‐ 2.05%

|

||||||||||||||||||

|

Republic of South Africa:

|

||||||||||||||||||

|

USD

|

5.88

|

%

|

05/30/22

|

3,342,000

|

3,659,490

|

|||||||||||||

|

USD

|

5.88

|

%

|

09/16/25

|

24,279,000

|

26,051,367

|

|||||||||||||

|

USD

|

4.88

|

%

|

04/14/26

|

1,695,000

|

1,690,339

|

|||||||||||||

|

USD

|

4.30

|

%

|

10/12/28

|

730,000

|

677,531

|

|||||||||||||

|

32,078,727

|

||||||||||||||||||

|

Sri Lanka ‐ 1.81%

|

||||||||||||||||||

|

Republic of Sri Lanka:

|

||||||||||||||||||

|

|

USD

|

5.13

|

%

|

04/11/19

|

484,000

|

491,306

|

(2)

|

|||||||||||

|

USD

|

6.25

|

%

|

10/04/20

|

3,513,000

|

3,654,065

|

(1)

|

||||||||||||

|

USD

|

6.25

|

%

|

07/27/21

|

5,740,000

|

5,882,266

|

(1)

|

||||||||||||

|

USD

|

5.88

|

%

|

07/25/22

|

13,558,000

|

13,517,529

|

(2)

|

||||||||||||

|

USD

|

6.85

|

%

|

11/03/25

|

4,803,000

|

4,838,518

|

(2)

|

||||||||||||

|

28,383,684

|

||||||||||||||||||

|

Stone Harbor Investment Funds Semi-Annual Report | November 30, 2016

|

25

|

|

Stone Harbor Emerging Markets Debt Fund

|

Statements of Investments

|

November 30, 2016 (Unaudited)

|

Reference

Rate |

Currency

|

Rate

|

Maturity

Date |

Principal Amount/Shares*

|

Value Expressed

(in USD) |

|||||||||||||

|

Suriname ‐ 0.22%

|

||||||||||||||||||

|

Republic of Suriname

|

USD

|

9.25

|

%

|

10/26/26

|

|

3,493,000

|

$

|

3,493,000

|

(2)

|

|||||||||

|

Trinidad ‐ 0.20%

|

||||||||||||||||||

|

Republic of Trinidad & Tobago

|

USD

|

4.38

|

%

|

01/16/24

|

3,256,000

|

3,207,160

|

(2)

|

|||||||||||

|

Turkey ‐ 3.56%

|

||||||||||||||||||

|

Republic of Turkey:

|

||||||||||||||||||

|

USD

|

7.00

|

%

|

03/11/19

|

5,103,000

|

5,441,074

|

|||||||||||||

|

USD

|

7.00

|

%

|

06/05/20

|

4,293,000

|

4,620,341

|

|||||||||||||

|

USD

|

5.63

|

%

|

03/30/21

|

4,285,000

|

4,402,837

|

|||||||||||||

|

USD

|

6.25

|

%

|

09/26/22

|

14,999,000

|

15,711,453

|

|||||||||||||

|

USD

|

5.75

|

%

|

03/22/24

|

3,767,000

|

3,809,379

|

|||||||||||||

|

USD

|

6.88

|

%

|

03/17/36

|

7,574,000

|

7,744,566

|

|||||||||||||

|

USD

|

6.75

|

%

|

05/30/40

|

4,378,000

|

4,417,402

|

|||||||||||||

|

USD

|

6.00

|

%

|

01/14/41

|

778,000

|

715,760

|

|||||||||||||

|

USD

|

4.88

|

%

|

04/16/43

|

8,745,000

|

6,996,000

|

|||||||||||||

|

USD

|

6.63

|

%

|

02/17/45

|

1,999,000

|

1,981,509

|

|||||||||||||

|

55,840,321

|

||||||||||||||||||

|

Ukraine ‐ 4.23%

|

||||||||||||||||||

|

Ukraine Government:

|

||||||||||||||||||

|

USD

|

7.75

|

%

|

09/01/19

|

223,000

|

216,867

|

(2)

|

||||||||||||

|

USD

|

7.75

|

%

|

09/01/20

|

22,025,000

|

20,912,739

|

(2)

|

||||||||||||

|

USD

|

7.75

|

%

|

09/01/21

|

13,705,000

|

12,934,094

|

(2)

|

||||||||||||

|

USD

|

7.75

|

%

|

09/01/22

|

7,603,000

|

7,085,996

|

(2)

|

||||||||||||

|

USD

|

7.75

|

%

|

09/01/23

|

7,186,000

|

6,611,120

|

(2)

|

||||||||||||

|

USD

|

7.75

|

%

|

09/01/24

|

655,000

|

594,412

|

(2)

|

||||||||||||

|

USD

|

7.75

|

%

|

09/01/25

|

11,467,000

|

10,334,634

|

(2)

|

||||||||||||

|

USD

|

7.75

|

%

|

09/01/27

|

8,494,000

|

7,580,895

|

(2)

|

||||||||||||

|

66,270,757

|

||||||||||||||||||

|

Uruguay ‐ 2.05%

|

||||||||||||||||||

|

Republic of Uruguay:

|

||||||||||||||||||

|

USD

|

4.50

|

%

|

08/14/24

|

3,971,262

|

4,154,933

|

|||||||||||||

|

USD

|

4.38

|

%

|

10/27/27

|

18,899,000

|

18,922,624

|

|||||||||||||

|

USD

|

5.10

|

%

|

06/18/50

|

10,115,079

|

9,090,927

|

|||||||||||||

|

32,168,484

|

||||||||||||||||||

|

Venezuela ‐ 0.82%

|

||||||||||||||||||

|

Republic of Venezuela:

|

||||||||||||||||||

|

USD

|

13.63

|

%

|

08/15/18

|

6,704,000

|

5,296,160

|

(1)

|

||||||||||||

|

USD

|

7.75

|

%

|

10/13/19

|

15,177,100

|

7,626,493

|

(1)

|

||||||||||||

|

12,922,653

|

||||||||||||||||||

|

Zambia ‐ 0.27%

|

||||||||||||||||||

|

Republic of Zambia:

|

||||||||||||||||||

|

USD

|

5.38

|

%

|

09/20/22

|

1,398,000

|

1,198,785

|

(1)

|

||||||||||||

|

USD

|

8.50

|

%

|

04/14/24

|

1,000,000

|

940,000

|

(1)

|

||||||||||||

|

USD

|

8.97

|

%

|

07/30/27

|

2,177,000

|

2,054,544

|

(2)

|

||||||||||||

|

4,193,329

|

||||||||||||||||||

|

TOTAL SOVEREIGN DEBT OBLIGATIONS (Cost $1,129,991,523)

|

1,111,394,531

|

|||||||||||||||||

|

26

|

www.shiplp.com

|

|

Stone Harbor Emerging Markets Debt Fund

|

Statements of Investments

|

November 30, 2016 (Unaudited)

|

Reference

Rate |

Currency

|

Rate

|

Maturity

Date |

Principal Amount/Shares*

|

Value Expressed

(in USD) |

|||||||||||||

|

BANK LOANS ‐ 1.75%

|

||||||||||||||||||

|

Brazil ‐ 1.74%

|

||||||||||||||||||

|

Banco de Investimentos Credit Suisse Brasil SA ‐ Brazil Loan Tranche A

|

USD

|

6.25

|

%

|

01/10/18

|

|

12,400,000

|

$

|

12,533,096

|

||||||||||

|

Banco de Investimentos Credit Suisse Brasil SA ‐ Brazil Loan Tranche B

|

USD

|

6.25

|

%

|

01/10/18

|

14,600,000

|

14,756,710

|

||||||||||||

|

27,289,806

|

||||||||||||||||||

|

Indonesia ‐ 0.01%

|

||||||||||||||||||

|

PT Bakrie & Brothers TBK

|

USD

|

N/A

|

11/25/14

|

624,912

|

93,737

|

(5)

|

||||||||||||

|

TOTAL BANK LOANS (Cost $27,249,965)

|

27,383,543

|

|||||||||||||||||

|

CORPORATE BONDS ‐ 22.26%

|

||||||||||||||||||

|

Argentina ‐ 0.50%

|

||||||||||||||||||

|

Arcor SAIC

|

USD

|

6.00

|

%

|

07/06/23

|

1,483,000

|

1,520,075

|

(2)

|

|||||||||||

|

Cablevision SA

|

USD

|

6.50

|

%

|

06/15/21

|

1,640,000

|

1,666,650

|

(2)

|

|||||||||||

|

Petrobras Argentina SA

|

USD

|

7.38

|

%

|

07/21/23

|

1,769,000

|

1,726,986

|

(2)

|

|||||||||||

|

YPF SA

|

USD

|

8.75

|

%

|

04/04/24

|

2,778,000

|

2,875,786

|

(2)

|

|||||||||||

|

7,789,497

|

||||||||||||||||||

|

Azerbaijan ‐ 0.62%

|

||||||||||||||||||

|

Southern Gas Corridor CJSC

|

USD

|

6.88

|

%

|

03/24/26

|

1,400,000

|

1,492,400

|

(2)

|

|||||||||||

|

State Oil Co. of the Azerbaijan Republic:

|

||||||||||||||||||

|

USD

|

4.75

|

%

|

03/13/23

|

4,787,000

|

4,540,470

|

|||||||||||||

|

USD

|

6.95

|

%

|

03/18/30

|

3,688,000

|

3,724,880

|

|||||||||||||

|

9,757,750

|

||||||||||||||||||

|

Brazil ‐ 2.51%

|

||||||||||||||||||

|

Cosan Luxembourg SA

|

USD

|

7.00

|

%

|

01/20/27

|

2,472,000

|

2,456,550

|

(2)

|

|||||||||||

|

ESAL GmbH

|

USD

|

6.25

|

%

|

02/05/23

|

2,026,000

|

1,938,375

|

(2)

|

|||||||||||

|

GTL Trade Finance, Inc.

|

USD

|

5.89

|

%

|

04/29/24

|

1,119,000

|

1,102,774

|

(2)

|

|||||||||||

|

Marfrig Holdings Europe BV

|

USD

|

8.00

|

%

|

06/08/23

|

3,654,000

|

3,667,703

|

(2)

|

|||||||||||

|

Minerva Luxembourg SA

|

USD

|

6.50

|

%

|

09/20/26

|

2,689,000

|

2,534,383

|

(2)

|

|||||||||||

|

Petrobras Global Finance BV:

|

||||||||||||||||||

|

USD

|

5.38

|

%

|

01/27/21

|

4,500,000

|

4,404,375

|

|||||||||||||

|

USD

|

8.38

|

%

|

05/23/21

|

3,163,000

|

3,398,564

|

|||||||||||||

|

USD

|

4.38

|

%

|

05/20/23

|

1,274,000

|

1,123,031

|

|||||||||||||

|

USD

|

8.75

|

%

|

05/23/26

|

16,078,000

|

17,299,928

|

|||||||||||||

|

USD

|

5.63

|

%

|

05/20/43

|

2,000,000

|

1,428,200

|

|||||||||||||

|

39,353,883

|

||||||||||||||||||

|

Chile ‐ 1.97%

|

||||||||||||||||||

|

Banco del Estado de Chile

|

USD

|

3.88

|

%

|

02/08/22

|

3,277,000

|

3,367,117 |

(2)

|

|||||||||||

|

Codelco, Inc.:

|

||||||||||||||||||

|

USD

|

3.00

|

%

|

07/17/22

|

17,668,000

|

16,948,824

|

(2)

|

||||||||||||

|

USD

|

4.50

|

%

|

09/16/25

|

468,000

|

472,032

|

(2)

|

||||||||||||

|

USD

|

6.15

|

%

|

10/24/36

|

8,279,000

|

9,230,671

|

(1)

|

||||||||||||

|

VTR Finance BV

|

USD

|

6.88

|

%

|

01/15/24

|

911,000

|

929,220

|

(2)

|

|||||||||||

|

30,947,864

|

||||||||||||||||||

|

China ‐ 1.79%

|

||||||||||||||||||

|

CNOOC Finance 2015 USA LLC

|

USD

|

3.50

|

%

|

05/05/25

|

1,731,000

|

1,693,995

|

||||||||||||

|

Sinochem Overseas Capital Co. Ltd.

|

USD

|

6.30

|

%

|

11/12/40

|

4,353,000

|

5,324,263

|

(1)

|

|||||||||||

|

Sinopec Capital 2013 Ltd.

|

USD

|

3.13

|

%

|

04/24/23

|

2,667,000

|

2,621,730

|

(2)

|

|||||||||||

|

Stone Harbor Investment Funds Semi-Annual Report | November 30, 2016

|

27

|

|

Stone Harbor Emerging Markets Debt Fund

|

Statements of Investments

|

November 30, 2016 (Unaudited)

|

Reference

Rate |

Currency

|

Rate

|

Maturity

Date |

Principal Amount/Shares*

|

Value Expressed

(in USD) |

|||||||||||||

|

China (continued)

|

||||||||||||||||||

|

Sinopec Group Overseas Development Ltd.:

|

||||||||||||||||||

|

USD

|

3.90

|

%

|

05/17/22

|

|

7,614,000

|

$

|

7,892,347

|

(2)

|

||||||||||

|

USD

|

4.38

|

%

|

10/17/23

|

3,138,000

|

3,314,453

|

(1)

|

||||||||||||

|

USD

|

4.38

|

%

|

04/10/24

|

2,815,000

|

2,949,485

|

(2)

|

||||||||||||

|

USD

|

3.50

|

%

|

05/03/26

|

3,552,000

|

3,464,760

|

(2)

|

||||||||||||

|

Three Gorges Finance I Cayman Islands Ltd.

|

USD

|

3.15

|

%

|

06/02/26

|

742,000

|

713,822

|

(2)

|

|||||||||||

|

27,974,855

|

||||||||||||||||||

|

Colombia ‐ 0.25%

|

||||||||||||||||||

|

Ecopetrol SA:

|

||||||||||||||||||

|

USD

|

4.13

|

%

|

01/16/25

|

2,303,000

|

2,090,663

|

|||||||||||||

|

USD

|

7.38

|

%

|

09/18/43

|

943,000

|

910,467

|

|||||||||||||

|

USD

|

5.88

|

%

|

05/28/45

|

1,118,000

|

911,170

|

|||||||||||||

|

3,912,300

|

||||||||||||||||||

|

Costa Rica ‐ 0.23%

|

||||||||||||||||||

|

Banco Nacional de Costa Rica

|

USD

|

5.88

|

%

|

04/25/21

|

3,673,000

|

3,673,000

|

(2)

|

|||||||||||

|

Ecuador ‐ 0.40%

|

||||||||||||||||||

|

EP PetroEcuador via Noble Sovereign Funding I Ltd.

|

Libor+5.63%

|

USD

|

6.49

|

%

|

09/24/19

|

6,370,105

|

6,330,292

|

(1)(3)

|

||||||||||

|

India ‐ 0.19%

|

||||||||||||||||||

|

Vedanta Resources PLC

|

USD

|

6.00

|

%

|

01/31/19

|

2,978,000

|

2,985,445

|

(2)

|

|||||||||||

|

Indonesia ‐ 1.73%

|

||||||||||||||||||

|

Pertamina Persero PT:

|

||||||||||||||||||

|

USD

|

5.25

|

%

|

05/23/21

|

2,900,000

|

3,053,570

|

(1)

|

||||||||||||

|

USD

|

4.88

|

%

|

05/03/22

|

6,500,000

|

6,713,200

|

(2)

|

||||||||||||

|

USD

|

6.00

|

%

|

05/03/42

|

924,000

|

904,827

|

(2)

|

||||||||||||

|

USD

|

6.00

|

%

|

05/03/42

|

2,529,000

|

2,476,523

|

(1)

|

||||||||||||

|

USD

|

5.63

|

%

|

05/20/43

|

5,135,000

|

4,851,137

|

(1)

|

||||||||||||

|

USD

|

6.45

|

%

|

05/30/44

|

8,871,000

|

9,181,219

|

(1)

|

||||||||||||

|

27,180,476

|

||||||||||||||||||

|

Jamaica ‐ 0.42%

|

||||||||||||||||||

|

Digicel Group Ltd.:

|

||||||||||||||||||

|

USD

|

8.25

|

%

|

09/30/20

|

543,000

|

460,328

|

(2)

|

||||||||||||

|

USD

|

7.13

|

%

|

04/01/22

|

8,196,000

|

6,147,000

|

(2)

|

||||||||||||

|

6,607,328

|

||||||||||||||||||

|

Kazakhstan ‐ 1.36%

|

||||||||||||||||||

|

KazMunayGas National Co. JSC:

|

||||||||||||||||||

|

USD

|

9.13

|

%

|

07/02/18