Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22037

Stone Harbor Investment Funds

(Exact name of registrant as specified in charter)

1290 Broadway, Suite 1100

Denver, CO 80203

(Address of principal executive offices) (Zip code)

Adam J. Shapiro, Esq.

c/o Stone Harbor Investment Partners LP

31 West 52nd Street, 16th Floor

New York, NY 10019

(Name and address of agent for service)

With copies To:

Michael G. Doherty, Esq.

Ropes & Gray LLP

1211 Avenue of the Americas

New York, NY 10036

Registrant’s telephone number, including area code: (303) 623-2577

Date of fiscal year end: May 31

Date of reporting period: May 31, 2015

Table of Contents

Item 1. Report to Stockholders.

Table of Contents

Table of Contents

| 2 | ||||

|

|

||||

| 10 | ||||

|

|

||||

| 12 | ||||

|

|

||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 19 | ||||

| 20 | ||||

| 21 | ||||

| 22 | ||||

|

|

||||

| 23 | ||||

| 35 | ||||

| 45 | ||||

| 50 | ||||

| 56 | ||||

| 62 | ||||

| 64 | ||||

| 65 | ||||

|

|

||||

| 67 | ||||

|

|

||||

| 69 | ||||

|

|

||||

| 73 | ||||

| 74 | ||||

| 75 | ||||

| 76 | ||||

| 77 | ||||

| 78 | ||||

| 79 | ||||

| 80 | ||||

|

|

||||

| 100 | ||||

|

|

||||

| 102 | ||||

|

|

||||

| 105 | ||||

|

|

||||

| Stone Harbor Investment Funds Annual Report | May 31, 2015 |

1 |

Table of Contents

| Stone Harbor Investment Funds | Shareholder Letter | |

|

May 31, 2015 (Unaudited) |

Dear Shareholder,

During the 12 months ended 31 May 2015, credit markets were heavily influenced by several key factors that produced divergent results across asset classes and regions. What began as a relatively calm credit market environment at the start of the period was altered and reshaped – in a disruptive manner, in some cases – by shifting market fundamentals leading to a rise in asset price volatility. The macro-economic themes that had the largest impact on credit market performance were a dramatic decline in commodity prices led by oil; the Federal Reserve’s (“Fed”) wind down of its asset purchase program; weak global growth concerns, particularly as U.S. dollar strength continued to put pressure on emerging market countries and currencies; and ongoing geopolitical conflict in Eastern Europe and the Middle East. While easing global monetary policies lifted market sentiment, the continued uncertainly around economic growth constrained performance in credit markets.

The near 60% drop in oil prices during the period was a significant driver of asset price volatility, particularly in emerging markets and high yield. While the implications of the rapid price decline was the initial market focus many developed and emerging countries and industries are importers of oil and are benefitting from lower oil prices.

Another important theme that continued to occupy market attention was the importance of global monetary policies aimed at supporting growth and reducing deflationary risks. The European Central Bank (ECB) exceeded market expectations with its long awaited quantitative easing program; the People’s Bank of China (PBOC) cut its benchmark rate for the first time since 2012 and three times during the period; and the Bank of Japan (BOJ) surprised the markets with the large scale of its asset purchase program. Although U.S. economic growth slowed during the period, the U.S. Federal Reserve completed its asset purchase program while maintaining its cautious stance on future interest rate hikes.

We believe it is likely that global growth will be sustained, albeit at a modest level, as we continue through the balance of this calendar year. In our view, the next cycle of monetary policy focus is likely to be in the U.S. and we continue to expect a rise in the Fed Funds rate in the latter part of the year with only a gradual pace of appreciation thereafter. In our view, credit markets remain attractively valued for this stage of the cycle.

At Stone Harbor Investment Partners L.P., we will continue to focus on seeking to capture excess return from stable and improving credit situations in corporate and sovereign markets worldwide. As we continue to monitor these developments, please follow our progress throughout the year by visiting our website at www.shiplp.com. There you will find updates on our view of credit markets, as well as related news and research. We appreciate the confidence you have placed in Stone Harbor Investment Partners LP and look forward to providing you with another update in the next six months.

Market Review: Emerging Markets Debt

The 12 months ended 31 May 2015 was a volatile period for emerging markets (“EM”) in general and a particularly difficult period for emerging local markets. While strong technicals, improved market sentiment stemming from prospective European Central Bank (“ECB”) policy actions, and reduced levels of geopolitical risks served as backdrop to a relatively benign market environment at the start of the period, several vital macro-economic themes dominated the latter half of 2014 and into 2015. These drivers included declining core fixed income yields, U.S. dollar strength, and falling oil prices, all of which were underscored by continued EM growth concerns and slower-than-expected U.S. growth. The decline in U.S. Treasury yields was the primary driver of returns for EM hard currency sector in aggregate, while local currency debt returns were largely driven by weakness in energy-related commodity markets combined with the ongoing strength of the U.S. dollar. The Organization of the Petroleum Exporting Countries (OPEC) decision to maintain production at its November 2014 meeting exacerbated a slide in oil prices, which fell by over 40% in the fourth quarter 2014 alone, weighing heavily on oil exporting economies. Returns on EM corporate debt led USD sovereign debt, and remained positive.

In the last several months of the review period, a recovery and a stabilization in commodity prices (particularly in the energy sector) recalibrated market sentiment and demand for risk assets. In addition, reduced concerns around geopolitical risks associated with Russia and Ukraine, better-than-expected European growth data, stronger currencies, and weaker U.S. economic data that tempered expectations for further U.S. dollar strength provided support for emerging markets. These market dynamics had varying degrees of impact across EM sectors, countries, currencies, and industries. In many cases, the drivers of underperformance in 2014 became catalysts for positive performance by the end of the review period.

Stone Harbor Emerging Markets Debt Fund

The total return of the Emerging Markets Debt Fund (the “Fund” or “portfolio”) for the 12 month period ended May 31, 2015 was -1.01% (net of expenses) and -0.33% (gross of expenses). This performance compares to a benchmark return of 2.46% for the J.P. Morgan EMBI Global Diversified. For the period, external sovereign bond credit spreads over comparable maturity U.S. Treasury securities widened by 71 basis points, ending the period at 344 basis points.

| 2 |

www.shiplp.com |

Table of Contents

| Stone Harbor Investment Funds | Shareholder Letter | |

|

May 31, 2015 (Unaudited) |

The Fund underperformed its benchmark primarily as a result of country selection within the hard currency sovereign debt allocation, which detracted 276 basis points from relative returns, and secondarily as a result of Foreign Currency (FX) exposure within the local currency debt allocation. As oil prices stabilized after March 2015, Venezuela bonds have been among the best performing hard currency sovereign debt. However, Venezuela bonds performed poorly in late 2014 as oil prices declined. We held the view then and now that Venezuela’s near term payment obligations are manageable, and that the deeply discounted prices of Venezuela bonds support our overweight.

Based on our independent research, including several research trips to Caracas, we concluded that the probability of default was much lower than the market’s expectation. In our view, Venezuela has large disincentives to default. The country is somewhat unusual in the sense that PDVSA, the state owned oil company, is responsible for almost all FX earnings in the country. In our view, a PDVSA default would almost certainly reduce its ability to continue to generate FX revenue due to legal risk and possible court actions. Moreover, in the event of default, we believe the long-term viability of the oil sector would be greatly at risk as PDVSA relies on foreign partners and cooperation would be made more difficult. In addition, there is a large risk of attachment of foreign assets. As a quasi sovereign entity (government owned, but not guaranteed), PDVSA does not automatically benefit from the same immunities as a sovereign issuer, thus providing more possible legal angles for creditors to go after PDVSA assets than would be available in the case of a sovereign issuer. In addition, securing any new financing would be close to impossible if Venezuela went into default.

During the period, however, our position in Venezuela suffered due to the decline in oil prices and because of a delay in an expected devaluation of the bolivar that, in turn, caused concerns that Venezuela would lose international reserves as it met obligations to pay for imports, government wages as well as debt service. Nevertheless, in the first quarter 2015, the difference in returns between the best and worst performing Venezuelan bond was large, creating a significant opportunity in security selection, in our view. Issue selection in Venezuela enhanced relative returns by 118 basis points during the review period.

In Russia, while issue selection decisions in hard currency sovereign debt enhanced relative performance, emerging market currency and local interest rate exposure detracted from performance as the ruble declined in value relative to the US dollar over the course of the year. Likewise, FX exposure in Colombia, Indonesia, Mexico and Turkey detracted from relative performance. Other detractors within the hard currency debt allocation included underweights in Hungary, Lebanon, Ukraine, and the Philippines.

Positive contributors, other than issue selection in Russia and Venezuela, included overweights in Argentina and Indonesia. Indonesia benefitted from a rebalancing of its economy following the depreciation of the rupiah relative to the US dollar in 2013, as well as reduced political uncertainty following the completion of the presidential election in July 2014. Argentina bonds outperformed the market on speculation of a potential agreement with holdout creditors, which ultimately did not materialize in 2014.

The largest relative exposure changes during the review period included adding to the Fund’s positions in Argentina, Colombia, Dominican Republic, and Kazakhstan. We maintained an overweight position in Argentina throughout the year, but reduced our exposure at the end of 2014 to take advantage of the strong performance of the credit relative to the benchmark. In May 2015, we added to our positions in Argentina, particularly in select corporate bonds and short duration, U.S. dollar denominated local sovereign bonds. In our view, Dominican Republic benefits from strong U.S. growth as tourism and remittance revenues increase, and as we see it, institutional improvements to monetary and fiscal policy should be supportive. Based on our view that some of the market’s most attractive opportunities remained in oil exporters, particularly those with low production costs, we increased our position in Kazakhstan during the year. Our overweight position detracted from performance during the period, but we continue to believe valuations and fundamental credit metrics support the investments.

These changes were funded with reduced exposures in several countries where valuations appear to us unattractive relative to underlying sovereign credit fundamentals. A common theme has been to underweight countries from Central and Eastern Europe where demand from Euro-based investors has driven spreads to very tight levels. We believed this to be the case in Croatia, Hungary, Poland, and Romania. We also reduced our exposure in Brazil, where we are still cautious on the country’s macro-economic environment; however, our primary concern is the currency, the real. We expect the real to continue to weaken and, therefore, have no position in the currency currently in the portfolio. We maintain an overweight in Brazil sovereign debt, albeit a smaller overweight than at the end of first quarter 2015, as Brazil external sovereign debt has outperformed the broader market since March. We have also increased exposure to select Brazil corporate bonds, which are all out of benchmark. We reduced our position in Indonesia on recent outperformance.

As of this writing, the reduced exposure to out-of-benchmark local currency debt reflected two factors. First, we had tactically increased currency exposure in select countries that we believed would benefit most from a pause in the strength in the US dollar. As this view played out in Colombia, India, Indonesia and Russia in April and May 2015, we eliminated our currency positions in these countries. Second, as growth data remained weak, we reduced exposure to the Mexican peso and eliminated positions in the South African rand and the Turkish lira.

| Stone Harbor Investment Funds Annual Report | May 31, 2015 |

3 |

Table of Contents

| Stone Harbor Investment Funds | Shareholder Letter | |

|

May 31, 2015 (Unaudited) |

At the end of the period, the portfolio remained modestly underweight duration given our view that US Treasury yields will gradually increase over the course of 2015.

Stone Harbor Local Markets Fund

The total return of the Stone Harbor Local Markets Fund (the “Fund” or “portfolio”) for the 12 month period ended May 31, 2015 was -14.70% (net of expenses) and -13.83% (gross of expenses). This performance compares to a benchmark return of -13.49% for the J.P. Morgan GBI-EM Global Diversified, with FX accounting for all of the negative return. The largest underperformers for the period at the index level were Russia (-33.09%), Brazil (-22.76%) and Colombia (-21.31%).

The Fund underperformed its benchmark as a result of duration positioning and issue selection decisions. The largest source of underperformance was an overweight in Russia (FX and duration). We had established an overweight in the Russian ruble in mid-2014 after the currency and local debt markets had already adjusted lower to news of EU and US sanctions. We added materially to the position in July-September as the currency weakened further and local interest rates escalated. The securities we held in Russia had a longer average duration than the benchmark; we held this position on the view that as the Russian economy weakens in 2015, inflation levels would fall and allow longer duration securities to outperform. However, the ruble depreciated more than the market and beyond our expectations as oil prices fell and the Central Bank of Russia did not intervene. Despite the drawdown that heavily influenced returns for the entire period, the Fund’s overweight position produced positive results in the last several months of the review period, helped by stabilization of oil prices, a lowering of geopolitical risk following the ceasefire agreement between Russia and Ukraine, and a more conservative policy approach by the Central Bank of Russia that cut rates less aggressively than the market had expected.

Other significant detractors included South Africa (FX and duration) and Thailand (FX and duration). In South Africa, our underweight positions in the rand and in duration contribution reflected our view that the weak growth profile should lead to a steady deterioration of credit-worthiness. However, this position detracted from excess returns as South Africa outperformed due to an increase in economic activity after the cessation of platinum strikes in July 2014 and as the general decline in global interest rates supported this long duration fixed income market. Issue selection in Indonesia and Mexico, as well as a position in US dollar denominated debt from Venezuela also detracted from relative performance.

The top positive contributors to performance during the period included an overweight in Indonesia (FX and duration) and an underweight in Hungary FX. In Indonesia, we held an overweight position since the start of the review period based on our view that Indonesia was rebalancing its economy, growing and had a tailwind of support from a new reform-minded government. We believed that the July 2014 election of Joko Widodo as President further supported this view. President Widodo was successful in implementing key fuel subsidy cuts soon after elections, despite an opposition parliament. We believed these reforms would continue supporting market sentiment toward the rupiah.

The Fund’s positioning at the end of the period reflected recent muted growth data from many of the largest emerging markets and Stone Harbor’s country-specific analyses of the expected returns from currencies and local interest rates. In Latin America, we hold unhedged local bonds in Mexico as the portfolio’s largest active local currency risk with a view that Mexico’s growth rate will benefit from improving growth in the US and from ongoing foreign direct investment in the auto, energy, and telecommunications sectors. Ultimately, we’d expect improving growth to support returns on the peso relative to the US dollar. Local bonds in Mexico also trade at wide yield levels relative to US Treasuries, providing, in our view, an attractive bond return in the current environment if we are right about the timing and pace of potential US Federal Reserve policy rate increases. In Brazil and Colombia, we have either partially or fully hedged currency exposure and hold small currency risk in Chile and none in Peru. Given, in our view, the still attractive valuations and steep local bond yield curve, we have overweighted duration in Colombia. We continue to expect weaker performance of the Eurozone economies and the Euro over the course of the next year and our defensive positioning in Czech Republic reflects this view. In Poland, our position is neutral with the exposure in shorter-than-benchmark unhedged local currency bonds. In Asia, we maintain a positive outlook for the Indonesia economy that has continued to perform well with a growth rate of around 5%. Inflation has eased following fuel price declines and we expect inflation to fall further this year. We believe this environment supports our overweight in local Indonesia interest rate duration.

Stone Harbor Emerging Markets Corporate Debt Fund

The total return of the Stone Harbor Emerging Markets Corporate Debt Fund (the “Fund” or “portfolio”) for the 12 month period ended May 31, 2015 was 3.64% (net of expenses) and 4.64% (gross of expenses). This performance compares to a benchmark return of 3.95% for the J.P. Morgan Corporate Emerging Markets Bond Index Broad Diversified (CEMBI Broad Diversified). The index spread over comparable maturity U.S. Treasury securities widened by 41 basis points, ending the period at 395 basis points. Contributions to the index total return from each of the major EM regions (i.e., Africa, Asia, Europe, Latin America, and the Middle East) were positive for the period. The top performers included Mongolia (+39.70%) and Dominican Republic (+22.90%); the bottom performers included Ukraine (-15.72%), Ghana (-4.62%), and Nigeria (-3.68%). Despite a

| 4 |

www.shiplp.com |

Table of Contents

| Stone Harbor Investment Funds | Shareholder Letter | |

|

May 31, 2015 (Unaudited) |

drawdown that began late in 2014, performance of the EM corporate sector was ultimately helped by the recovery in oil prices, an easing of concerns over a political scandal in Brazil and over geopolitical risks between Russia and Ukraine.

The Fund outperformed its benchmark gross of expenses largely as a result of issue selection decisions in several countries including Brazil and Indonesia. Corporate bonds in Indonesia were supported by election results that secured the presidency for the market favorite candidate, Joko Widodo. Likewise, one of the key drivers of Brazil corporate debt returns was the presidential election in the early part of the period, then later, a corruption scandal at the state-sponsored oil and gas producer Petroleo Brasileiro SA (“Petrobas”). We added to Brazilian corporates given the attractive valuations triggered by the Petrobras scandal and a widening of corporate bond spreads.

Positioning in Ukraine and Russia also enhanced returns. During the period the Fund held underweight exposure in Ukraine corporate bonds. The weakness in Ukraine corporate debt resulted from ongoing hostilities in Ukraine’s Donbass region as well as expectations of continuing decline in Ukraine’s economic activity, along with the associated concerns over support from the west and the International Monetary Fund (IMF). In addition, an overweight exposure to Russian corporate debt enhanced relative returns. The Fund’s positioning in Russia moved from an underweight in fourth quarter 2014 to an overweight in January 2015, and this overweight was maintained even as the Russian corporates were downgraded in February and throughout the remainder of the review period. This positioning eventually enabled us to capture the recovery in Russian corporate bonds that was induced by stabilizing oil prices.

Some of the primary detractors from performance were overweight corporate positions in Ghana, and Venezuela. Exposure in Venezuela as well as an independent oil and gas producer from Ghana suffered as oil price continued to decline during the latter half of the period. Issue selection in China, India, and Kazakhstan also detracted from performance.

Corporate debt spreads have tightened relative to sovereign bonds since the December sell-off driven by fundamental improvements in the Brazil/Petrobras-related complex of credits and following index-driven demand for corporate debt from Russia. Corporate debt remains an attractive sector in the current environment, in our view, though we recognize that risk premiums have declined so far this year. Our strategy continues to focus on identifying companies that are market leaders in their industries. We also currently favor exporters that generate US dollar revenues and companies that benefit from the growth of middle classes. At the sector level, we currently favor consumer goods, wireless telecommunications, and food and beverage companies, among others. In addition, we look for companies that are growing, reducing debt and, as a result, are candidates for rating agency upgrades over the next 18 to 24 months.

Stone Harbor Emerging Markets Debt Allocation Fund

The Emerging Markets Debt Allocation Portfolio (the “Fund”) performance since inception (October 21, 2014) through May 31, 2015 was -4.73% (net of expenses) and -4.21% (gross of expenses). This compares to a blended benchmark (50% J.P. Morgan EMBI Global Diversified / 50% J.P. Morgan GBI- EM Global Diversified) return of -4.69%. At the close of the reporting period, the Fund allocated approximately 51.2% to local currency debt, 43.8% to external sovereign debt, and 3.1% to hard currency corporate debt, with cash representing 1.9% of the Fund. The Fund’s asset allocation mix varied throughout the review period, driven by tactical asset allocation decisions based on portfolio management’s assessment of relative value opportunities and global market risks. The hard currency sovereign allocation enhanced relative returns by 65 basis points, in aggregate, driven by positive attribution from issue selection. Country selection decisions, in total, detracted from excess returns in this sector. Hard currency corporate allocations enhanced relative returns by 4 basis points. Tactical asset allocation decisions, including the decision to reduce local currency exposure in January and then to increase it later in the reporting period, contributed 29 basis points. Nevertheless, local currency allocation decisions detracted 53 basis points from excess returns. The largest contributor to this result was an overweight in the Russian ruble, which detracted from excess returns early in the period as oil prices fell but enhanced performance later in the period as energy prices stabilized and Russian monetary authorities intervened to support the ruble in 2015. Miscellaneous differences compared to benchmark weightings, a result of holding modestly lower U.S. Treasury duration than that of the blended benchmark, detracted 12 basis points from relative total returns.

Within the hard currency sovereign allocation, issue selection decisions in Argentina, Russia and Venezuela were the largest positive contributors to relative returns. While the Fund’s overweight position in Venezuela suffered due to the drop in oil prices and because of a delay in an expected devaluation of the bolivar, the difference in returns between the best and worst performing Venezuelan bonds was large, creating a significant opportunity in security selection, in our view. Issue selection in Venezuela enhanced relative returns by 74 basis points during the period. In Argentina, our decision to invest in out-of-benchmark bonds rather than the defaulted bonds that are included in the J.P. Morgan EMBI Global Diversified Index also enhanced relative performance. The decisions to overweight Argentina and Indonesia also enhanced relative returns. Argentina bonds outperformed on expectations of market friendly political change in presidential elections planned for October 2015. Indonesia benefitted from a rebalancing of its economy following the depreciation of the rupiah relative to the U.S. dollar in 2013, as well as reduced political uncertainty following the completion of the presidential election in July 2014. Other positive contributors to relative returns included an overweight and issue selection in Dominican Republic and Turkey, and underweights in Ecuador and Malaysia.

| Stone Harbor Investment Funds Annual Report | May 31, 2015 |

5 |

Table of Contents

| Stone Harbor Investment Funds | Shareholder Letter | |

|

May 31, 2015 (Unaudited) |

On the other hand, the biggest detractor within the hard currency allocation was an overweight in Venezuela. As oil prices stabilized after March 2015, Venezuela bonds have been among the best performing hard currency sovereign debt. However, Venezuela bonds performed poorly in late 2014 as oil prices declined. We held the view then and now that Venezuela’s near term payment obligations are manageable, and that the deeply discounted prices of Venezuela bonds support our overweight. Underweights in Lebanon, Philippines, and Ukraine also detracted from relative performance, as did issue selection in Brazil.

Within the local currency allocation, an underweight in the Brazil real enhanced relative performance. During the review period, Brazil’s currency depreciated by nearly 20% relative to the U.S. dollar. The top detractors included our decisions to overweight the Russian ruble and to hold longer than benchmark average duration in Russian local bonds. Our currency position in Russia worked poorly at the start of the period, but began to outperform in 2015. The duration position in Russia reflected our view that Russia’s economy was slowing and that inflation would soon fall. Ultimately, this view has proven correct so far in 2015. We also underperformed in Turkey with an overweight in the lira and generally shorter average duration than benchmark exposure in local bonds from Turkey.

During the period, we increased the Fund’s local currency exposure and reduced hard currency exposure. Our largest additions to local currency exposure during the period were in the Polish zloty, Romanian leu, and South African rand. While our relatively large underweight position in the Polish zloty at the end of 2014 was based on our expectation of continued weakness in the euro, we began reducing the Fund’s underweight in Poland in February 2015 as economic activity improved and the country remained a likely beneficiary of better-than- expected economic activity in the Eurozone. We also reduced our underweight in South Africa in order to capture a possible recovery in the rand relative to the US dollar. To fund these additions, we reduced our longstanding overweight to external sovereign debt, which outperformed during the period. The country with the largest reduction was Russia. While we maintained our Russia overweight at the overall portfolio level, we eliminated our active risk in Russia external sovereign debt as Russian credit spreads narrowed substantially from their recent widest spread levels. We also reduced our hard currency exposure in Argentina, Indonesia, Turkey, and Venezuela.

Stone Harbor High Yield Bond Fund

The Stone Harbor High Yield Bond Fund (the “Fund” or “portfolio”) return for the 12 months ended May 31, 2015 was -0.27% (net of expenses) and 0.35% (gross of expenses). This compares to a benchmark return of 1.54% for the Citigroup High Yield Market Capped Index. The high yield market began the fiscal year with tight valuations and was negatively impacted by several macro-economic factors throughout the review period; most significant of which included a dramatic decline in commodity prices, especially oil prices, U.S. dollar strength, and weak market technicals as evidenced by record mutual fund outflow. These drivers were further exacerbated by continuing concerns around weaker-than-expected global economic growth, uncertainty surrounding the timing of the Federal Reserve’s initial rate increase, and ongoing geopolitical risk.

The U.S. Federal Reserve completed its asset purchase program during the first half of the review period despite slower-than-expected economic growth in the U.S., and it maintained the pledge to be “patient” on raising interest rates. Europe benefited from the aggressive European Central Bank (ECB) plan to revive inflation and the euro-area economy with an open-ended quantitative easing program and a stronger U.S. dollar. The decline in commodity prices, particularly oil and coal, had a significant impact on market performance. The decline in oil prices had a disproportionate impact on the high yield market due to its weighting (i.e., over 17%) within the high yield benchmark. High yield spreads, as represented by the Citigroup High Yield Market Capped Index, widened 78 basis points to end the period at 473 basis points, and the average yield rose 0.91% to end the period at 5.99%.

The top performing industries included Retail-Food & Drug and Restaurants, as consumer related sectors are expected to be large beneficiaries of lower energy prices. The bottom performers included Metals & Mining and Energy sectors, driven lower by the decline in commodity prices, due to supply/demand imbalances. Interest rate sensitive BB rated bonds outperformed both B and CCC rated securities within the Citigroup High Yield Market Capped index as they tend to have a longer duration and benefitted from the decline in interest rates. The par-weighted default rate declined to 1.58% from 2.11% at the beginning of the period, well below the long-term average of 3.69%. Although we remain constructive on company fundamentals, we believe that the low point in defaults has been reached for this cycle. Overall, however, company balance sheets are solid, in our view, with reasonable although slightly increasing leverage, high cash balances, and fewer near term maturities. Our current expectations are that the market will experience more negative event risk through increasing downgrades and fallen angels. However, positive event risk, especially due to M&A activity is expected to continue, in our view.

During the 12-month period, we increased the Fund’s industry exposure to the Utility sector, as new issuance during the review period added compelling value, in our view; and the Food/Beverage/Bottling sectors, due to what we believe are strong cash flow characteristics and brand value. We reduced the Fund’s exposure to the Energy sector as existing holdings were refinanced and new energy issuance was not attractive from a valuation perspective; and the Technology sector, due to valuation. Lastly, we increased the Fund’s bank loan exposure during the last 12 months based on our assumption that U.S. Treasury rates will slowly rise.

| 6 |

www.shiplp.com |

Table of Contents

| Stone Harbor Investment Funds | Shareholder Letter | |

|

May 31, 2015 (Unaudited) |

The Fund underperformed its benchmark primarily as a result of issue selection decisions in the Energy sector. The selection of coal companies within the Metals & Mining industry also contributed to negative performance. Industry selection was neutral and cash balances detracted slightly from performance.

The Fund remains positioned for moderate U.S. economic growth. Relative to BB rated bonds, the Fund remains overweight B rated securities as we believe this sector may outperform on lower interest rate sensitivities and attractive valuations. As of the date of this report, the largest portfolio industry overweights are Cable & Media and Food/Beverage/Bottling. The largest industry underweights are Finance-Other and Energy.

Although overall valuation and market technicals are favorable, we believe that certain industry sectors of the U.S. high yield markets are currently fully valued, and the European high yield market is fairly valued. In our view, the largest market risk is that lower commodity prices may be signaling a slower global growth environment. While lower energy prices have pressured the E&P sector’s business model, especially for highly leveraged issuers, the sector is currently benefitting from stable energy prices, access to capital from the equity and leveraged finance markets as well as good liquidity, few near term maturities, and good price hedges. We also expect M&A to increase across the sector. Despite these near-term positives, we believe oil prices will remain volatile and could put pressure on the industry, particularly if current pricing strength retraces previous lows and lower prices persist for an extended period of time. Other market risks include the impact of eventually higher rates on the high yield market (although historically, high yield is the best performing fixed income sector in a rising rate environment due to the higher credit spreads ability to absorb rate increases), and increased geopolitical risk.

Stone Harbor Investment Grade Fund

The total return of the Stone Harbor Investment Grade Fund (the “Fund” or “portfolio”) for the twelve months ended May 31, 2015 was 1.94% (net of expenses) and 2.44% (gross of expenses). This performance compares to a benchmark return of 3.03% for the Barclays Capital U.S. Aggregate Index. The Fund underperformed its benchmark as a result of certain asset allocation and duration management decisions. Part of the Fund’s underperformance is attributable to maintaining a duration position shorter than that of the benchmark during a period when long-term Treasury rates declined. In terms of asset allocation, part of the Fund’s under performance relative to the benchmark can be explained by over weights to corporate bonds and securitized assets during period where credit spreads were generally wider. Security selection was a positive contributor to the Fund’s performance relative to the benchmark. Securitized assets accounted for more than half of the security selection alpha, followed by Treasury and corporate securities.

The first eight months of the period under review were dominated by two main themes: the growing risk of deflation in the Eurozone and the sharp decline in the price of oil. Overall government bond yields declined sharply during this period with U.S. Treasury 10-year yields declining to a low of 1.67% at end January 2015 from a high of 2.65% in July 2014, German 10-year yields to 0.07% from 1.36%, and UK 10-year Gilts declining to 1.33% from 2.76%. Despite the positive environment for government bonds, credit markets during these eight months performed poorly with U.S. investment grade corporate bonds registering an underperformance relative to equivalent maturity U.S. Treasuries of 1.63%. U.S. High Yield Spreads recorded an underperformance relative to equivalent maturity U.S. Treasuries of 3.52%. Emerging market USD bond underperformed relative to equivalent maturity U.S. Treasuries by 2.13%.

During the subsequent and final four months of the year, many markets reversed a significant but not complete part of these moves, helped by the introduction of quantitative easing from the European Central Bank, a stabilizing oil price, and better economic performance in Europe even as first quarter growth in the U.S. disappointed. At the end of the period under review, U.S. 10- year yields had risen to 2.1%, German ten-year yields to 0.49% and UK Gilts to 1.82%. The relative performance of U.S. investment grade corporate bonds continued to languish, registering an underperformance of 1.67% for the twelve months, reflecting the modest performance of the U.S. economy in the early part of 2015. U.S. high yield bonds and EMD outperformed equivalent maturity U.S. Treasuries by some 2.82% and 2.09%, respectively, during these final months allowing them to record modest underperformance for the past twelve months of 0.7% and 0.32%, respectively.

Looking ahead to the next twelve months, we are focusing on a number of issues. Of immediate concern is the situation in Greece. It seems likely, in our view, that the Greece debt profile will ultimately prove to be unsustainable, regardless of whether or not near term financial aid packages can be agreed. However, the Greek economy is less than 2% of that of the euro area and economic and banking sector links have been weak. This suggests that Europe will not be significantly impacted by Greek issues and that market volatility arising from these stresses will offer investment opportunities rather than reasons for deep routed concern, in our view. Beyond the immediate future, it is likely, in our view, that the Federal Reserve will start the process of tightening monetary policy over the coming months. While we currently expect an initial move in September, we think that the key issue is not when they move but ultimately where they move to. We currently estimate that the terminal rate for Fed Funds is likely to be in the order of 3.5% against a current market pricing of 2.7%. This suggests that U.S. Treasuries remain vulnerable to a sell off. Given that, however, the scale of a likely sell off is not sufficient to suggest that there will be a material shock to the system, in our view. Market volatilities are expected to remain broadly stable. Against this backdrop, we believe credit spreads look relatively attractive. Historical analysis suggests that credit spreads are around the center of their historic distributions and with only a limited rise in yields and stable volatility expected

| Stone Harbor Investment Funds Annual Report | May 31, 2015 |

7 |

Table of Contents

| Stone Harbor Investment Funds | Shareholder Letter | |

|

May 31, 2015 (Unaudited) |

to be the order of the day, returns to credit risk are likely to be positive, in our view. In the near term, we believe an expected pick-up in the level of consumer activity is likely to feed through to continuing positive performance for corporate credits. As we move through the year, stronger U.S. growth should feed through to enhance global growth and an upward move in demand for oil and other commodities, along with increased demand for emerging market manufactured exports, in our view. With the U.S. now effectively the world’s swing producer of oil, it is worth noting that despite current high oil stocks, the active rig count in the U.S. has fallen by over 50%, suggesting to us that future production will decline. We believe this may support oil prices and in turn help the emerging markets. Many investors are currently concerned that rising U.S. interest rates may further damage local currency emerging market debt. We would point out that real effective exchanges rates are now some 11% lower than they were in 2013 at the time of the “Taper Tantrum” and that spreads are some 150 basis points wider. Current pricing is attractive relative to an overvaluation at that time, in our view. It is also worth noting that during the 2004 to 2006 Fed tightening cycle real effective exchange rates rose in emerging markets because growth of demand arising from developed markets trumped Fed interest rate rises. As we move to the second half of the coming year, we believe we may potentially see similar dynamics unfold.

Stone Harbor Strategic Income Fund

The total return of the Strategic Income Fund (the “Fund” or “portfolio”) for the 12 month period ended May 31, 2015 was 1.15% (net of expenses) and 1.85% (gross of expenses). This performance compares to a benchmark return of 3.59% for the Barclays Global Credit Index (Hedged into USD). The Fund underperformed its benchmark as a result of certain asset allocation and individual credit decisions. The Fund’s investments in the high yield and emerging debt sectors were negative contributors to performance, as both markets underperformed the investment grade sector. The market weight of the Fund’s investments in high yield and emerging debt exceeded the weight of those sectors represented in the benchmark. This asset allocation effect accounted for less than half of the Fund’s total relative underperformance. In addition to the negative impact of asset allocation, the Fund’s investments in high yield and emerging debt also underperformed benchmarks for their respective sectors. These negative security selection effects accounted for much of the Fund’s underperformance beyond the asset allocation effects discussed earlier.

The first eight months of the period under review were dominated by two main themes: the growing risk of deflation in the Eurozone and the sharp decline in the price of oil. Overall government bond yields declined sharply during this period with U.S. Treasury 10-year yields declining to a low of 1.67% at end January 2015 from a high of 2.65% in July 2014, German 10-year yields to 0.07% from 1.36%, and UK 10-year Gilts declining to 1.33% from 2.76%. Despite the positive environment for government bonds, credit markets during these eight months performed poorly with U.S. investment grade corporate bonds registering an underperformance relative to equivalent maturity U.S. Treasuries of 1.63%. U.S. High Yield Spreads recorded an underperformance relative to equivalent maturity U.S. Treasuries of 3.52%. Emerging market USD bond underperformed relative to equivalent maturity U.S. Treasuries by 2.13%.

During the subsequent and final four months of the year, many markets reversed a significant but not complete part of these moves, helped by the introduction of quantitative easing from the European Central Bank, a stabilizing oil price, and better economic performance in Europe even as first quarter growth in the U.S. disappointed. At the end of the period under review, U.S. 10- year yields had risen to 2.1%, German ten-year yields to 0.49% and UK Gilts to 1.82%. The relative performance of U.S. investment grade corporate bonds continued to languish, registering an underperformance of 1.67% for the twelve months, reflecting the modest performance of the U.S. economy in the early part of 2015. U.S. high yield bonds and Emerging Markets Debt (EMD) outperformed equivalent maturity U.S. Treasuries by some 2.82% and 2.09%, respectively, during these final months allowing them to record modest underperformance for the past twelve months of 0.7% and 0.32%, respectively.

Looking ahead to the next twelve months, we are focusing on a number of issues. Of immediate concern is the situation in Greece. It seems likely, in our view, that the Greece debt profile will ultimately prove to be unsustainable, regardless of whether or not near term financial aid packages can be agreed. However, the Greek economy is less than 2% of that of the euro area and economic and banking sector links have been weak. This suggests that Europe will not be significantly impacted by Greek issues and that market volatility arising from these stresses will offer investment opportunities rather than reasons for deep routed concern, in our view. Beyond the immediate future, it is likely, in our view, that the Federal Reserve will start the process of tightening monetary policy over the coming months. While we currently expect an initial move in September, we think that the key issue is not when they move but ultimately where they move to. We currently estimate that the terminal rate for Fed Funds is likely to be in the order of 3.5% against a current market pricing of 2.7%. This suggests that U.S. Treasuries remain vulnerable to a sell off. Given that, however, the scale of a likely sell off is not sufficient to suggest that there will be a material shock to the system, in our view. Market volatilities are expected to remain broadly stable. Against this backdrop, we believe credit spreads look relatively attractive. Historical analysis suggests that credit spreads are around the center of their historic distributions and with only a limited rise in yields and stable volatility expected to be the order of the day, returns to credit risk are likely to be positive, in our view. In the near term, we believe an expected pick-up in the level of consumer activity is likely to feed through to continuing positive performance for corporate credits. As we move through the year, stronger U.S. growth should feed through to enhance global growth and an upward move in demand for oil and other commodities, along with increased demand for emerging market manufactured exports, in our view. With the U.S. now effectively the world’s swing producer of oil, it is worth noting that despite current high oil stocks, the active rig count in the U.S. has fallen by over 50%, suggesting that future production will decline. We believe this may support oil prices and in turn help the emerging markets. Many investors

| 8 |

www.shiplp.com |

Table of Contents

| Stone Harbor Investment Funds | Shareholder Letter | |

|

May 31, 2015 (Unaudited) |

are currently concerned that rising U.S. interest rates may further damage local currency emerging market debt. We would point out that real effective exchanges rates are now some 11% lower than they were in 2013 at the time of the “Taper Tantrum” and that spreads are some 150 basis points wider. Current pricing is attractive relative to an overvaluation at that time. It is also worth noting that during the 2004 to 2006 Fed tightening cycle real effective exchange rates rose in emerging markets because growth of demand arising from developed markets trumped Fed interest rate rises. As we move to the second half of the coming year, we believe we may potentially see similar dynamics unfold.

| Sincerely, |

|

|

| Thomas K. Flanagan |

| Chairman of the Board of Trustees |

| Stone Harbor Investment Funds Annual Report | May 31, 2015 |

9 |

Table of Contents

| Stone Harbor Investment Funds | Disclosure of Fund Expenses | |

|

May 31, 2015 (Unaudited) |

Example. As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and/or redemption fees (if applicable) and (2) ongoing costs, including management fees and other Fund expenses. The below examples are intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on December 1, 2014 and held until May 31, 2015.

Actual Expenses. The first line of each table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line of each table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect transactional costs, such as redemption fees, sales charges (loads) or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| 10 |

www.shiplp.com |

Table of Contents

| Stone Harbor Investment Funds | Disclosure of Fund Expenses | |

|

May 31, 2015 (Unaudited) |

| Beginning Account Value December 1, 2014 |

Ending Account Value May 31, 2015 |

Expense Ratio(1) |

Expenses Paid During Period(2) |

|||||||||||

|

|

|

|||||||||||||

| STONE HARBOR EMERGING MARKETS DEBT FUND |

||||||||||||||

| Institutional Class |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,005.60 | 0.67% | $ | 3.35 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,021.59 | 0.67% | $ | 3.38 | |||||||

| STONE HARBOR HIGH YIELD BOND FUND |

||||||||||||||

| Institutional Class |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,018.90 | 0.62% | $ | 3.12 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,021.84 | 0.62% | $ | 3.13 | |||||||

| STONE HARBOR LOCAL MARKETS FUND |

||||||||||||||

| Institutional Class |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 913.60 | 0.85% | $ | 4.06 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,020.69 | 0.85% | $ | 4.28 | |||||||

| STONE HARBOR EMERGING MARKETS CORPORATE DEBT FUND |

||||||||||||||

| Institutional Class |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,027.50 | 1.00% | $ | 5.05 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,019.95 | 1.00% | $ | 5.04 | |||||||

| STONE HARBOR INVESTMENT GRADE FUND |

||||||||||||||

| Institutional Class |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,005.80 | 0.50% | $ | 2.50 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,022.44 | 0.50% | $ | 2.52 | |||||||

| STONE HARBOR STRATEGIC INCOME FUND |

||||||||||||||

| Institutional Class |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,011.60 | 0.11% | $ | 0.55 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,024.38 | 0.11% | $ | 0.56 | |||||||

| STONE HARBOR EMERGING MARKETS DEBT ALLOCATION FUND |

||||||||||||||

| Institutional Class |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 959.40 | 0.10% | $ | 0.49 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,024.43 | 0.10% | $ | 0.50 | |||||||

| (1) | Annualized, based on the Fund’s most recent fiscal half-year expenses. |

| (2) | Expenses are equal to the Fund’s annualized ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (182), divided by 365. Note this expense example is typically based on a six-month period. |

| Stone Harbor Investment Funds Annual Report | May 31, 2015 |

11 |

Table of Contents

| Stone Harbor Investment Funds | Summaries of Portfolio Holdings | |

|

May 31, 2015 (Unaudited) |

Under SEC Rules, all funds are required to include in their annual and semi-annual shareholder reports a presentation of portfolio holdings in a table, chart or graph by reasonably identifiable categories. The following tables, which present holdings as a percent of total net assets (“TNA”), are provided in compliance with such requirements.

| 12 |

www.shiplp.com |

Table of Contents

| Stone Harbor Investment Funds | Summaries of Portfolio Holdings | |

|

May 31, 2015 (Unaudited) |

| Stone Harbor Investment Funds Annual Report | May 31, 2015 |

13 |

Table of Contents

| Stone Harbor Investment Funds | Summaries of Portfolio Holdings | |

|

May 31, 2015 (Unaudited) |

| 14 |

www.shiplp.com |

Table of Contents

| Stone Harbor Investment Funds | Growth of $10,000 Investment | |

|

May 31, 2015 (Unaudited) |

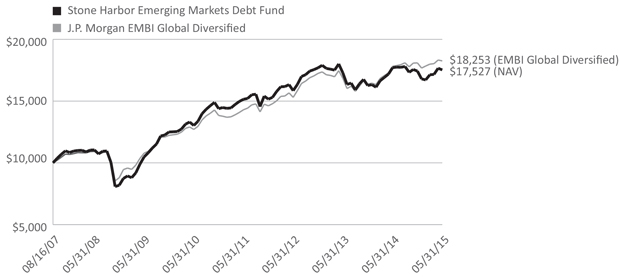

STONE HARBOR EMERGING MARKETS DEBT FUND

Comparison of Change in Value of $10,000 Investment in Stone Harbor Emerging Markets Debt Fund and the J.P. Morgan Emerging Markets Bond Index Global Diversified (J.P. Morgan EMBI Global Diversified). Please refer to page 101 for detailed benchmark descriptions.

Average Annual Total Returns (Commencement of Operations, August 16, 2007)

| 6 Months | 1 Year | 3 Years | 5 Years | Since Inception | ||||||

| Stone Harbor Emerging Markets Debt Fund |

0.56% | -1.01% | 3.42% | 6.12% | 7.47% | |||||

| J.P. Morgan EMBI Global Diversified |

0.89% | 2.46% | 6.06% | 7.51% | 8.03% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. Average annual total returns reflect the reinvestment of dividends and capital gains distributions and include all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. The performance data quoted does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Index returns do not include the effects of sales charges, management fees or transaction costs. It is not possible to invest directly in an index.

| Stone Harbor Investment Funds Annual Report | May 31, 2015 |

15 |

Table of Contents

| Stone Harbor Investment Funds | Growth of $10,000 Investment | |

|

May 31, 2015 (Unaudited) |

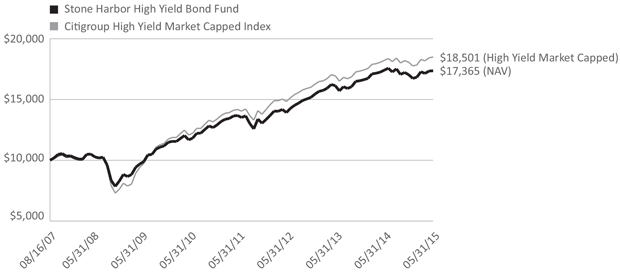

STONE HARBOR HIGH YIELD BOND FUND

Comparison of Change in Value of $10,000 Investment in Stone Harbor High Yield Bond Fund and the Citigroup High Yield Market Capped Index. Please refer to page 101 for detailed benchmark descriptions.

Average Annual Total Returns (Commencement of Operations, August 16, 2007)

| 6 Months | 1 Year | 3 Years | 5 Years | Since Inception | ||||||

| Stone Harbor High Yield Bond Fund |

1.89% | -0.27% | 7.63% | 8.25% | 7.34% | |||||

| Citigroup High Yield Market Capped Index |

2.40% | 1.54% | 7.63% | 8.89% | 8.22% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. Average annual total returns reflect the reinvestment of dividends and capital gains distributions and include all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. The performance data quoted does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Index returns do not include the effects of sales charges, management fees or transaction costs. It is not possible to invest directly in an index.

| 16 |

www.shiplp.com |

Table of Contents

| Stone Harbor Investment Funds | Growth of $10,000 Investment | |

|

May 31, 2015 (Unaudited) |

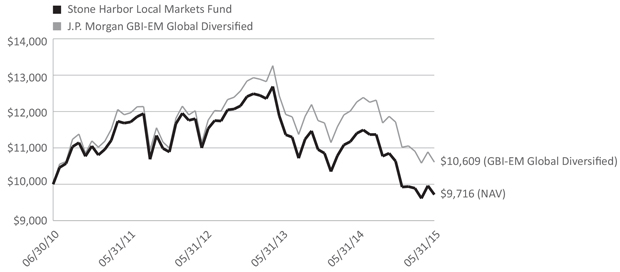

STONE HARBOR LOCAL MARKETS FUND

Comparison of Change in Value of $10,000 Investment in Stone Harbor Local Markets Fund and the J.P. Morgan Global Bond Index – Emerging Markets Global Diversified (J.P. Morgan GBI-EM Global Diversified). Please refer to page 101 for detailed benchmark descriptions.

Average Annual Total Returns (Commencement of Operations, June 30, 2010)

| 6 Months | 1 Year | 3 Years | Since Inception | |||||

| Stone Harbor Local Markets Fund |

-8.64% | -14.70% | -4.05% | -0.58% | ||||

| J.P. Morgan GBI-EM Global Diversified |

-9.42% | -13.49% | -1.62% | 1.21% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. Average annual total returns reflect the reinvestment of dividends and capital gains distributions and include all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. The performance data quoted does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Index returns do not include the effects of sales charges, management fees or transaction costs. It is not possible to invest directly in an index.

| Stone Harbor Investment Funds Annual Report | May 31, 2015 |

17 |

Table of Contents

| Stone Harbor Investment Funds | Growth of $10,000 Investment | |

|

May 31, 2015 (Unaudited) |

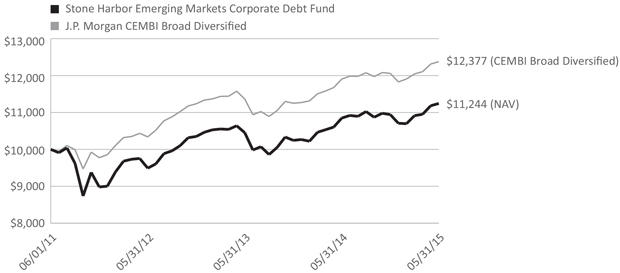

STONE HARBOR EMERGING MARKETS CORPORATE DEBT FUND

Comparison of Change in Value of $10,000 Investment in Stone Harbor Emerging Market Corporate Debt Fund and the J.P. Morgan Corporate Emerging Market Bond Index – Broad Diversified (J.P. Morgan CEMBI Broad Diversified). Please refer to page 101 for detailed benchmark descriptions.

Average Annual Total Returns (Commencement of Operations, June 1, 2011)

| 6 Months | 1 Year | 3 Year | Since Inception | |||||||||||||||||

| Stone Harbor Emerging Markets Corporate Debt Fund |

2.75% | 3.64% | 5.81% | 2.97% | ||||||||||||||||

| J.P. Morgan CEMBI Broad Diversified |

2.63% | 3.95% | 6.18% | 5.48% | ||||||||||||||||

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. Average annual total returns reflect the reinvestment of dividends and capital gains distributions and include all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. The performance data quoted does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Index returns do not include the effects of sales charges, management fees or transaction costs. It is not possible to invest directly in an index.

| 18 |

www.shiplp.com |

Table of Contents

| Stone Harbor Investment Funds | Growth of $10,000 Investment | |

|

May 31, 2015 (Unaudited) |

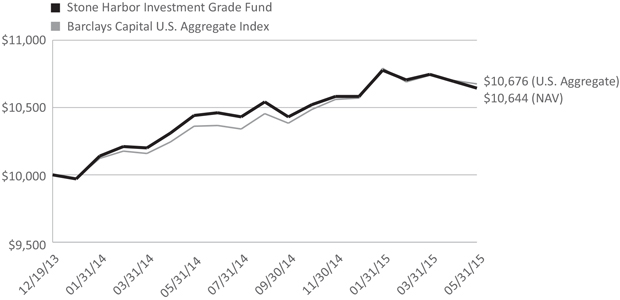

STONE HARBOR INVESTMENT GRADE FUND

Comparison of Change in Value of $10,000 Investment in Stone Harbor Investment Grade Fund and the Barclays Capital U.S. Aggregate Index. Please refer to page 101 for detailed benchmark descriptions.

Cumulative Returns (Commencement of Operations, December 19, 2013)

| 3 Months | 6 Months | 1 Year | Since Inception | |||||

| Stone Harbor Investment Grade Fund |

-0.57% | 0.58% | 1.94% | 4.40% | ||||

| Barclays Capital U.S. Aggregate Index |

-0.14% | 1.09% | 3.03% | 4.61% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. Average annual total returns reflect the reinvestment of dividends and capital gains distributions and include all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. The performance data quoted does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Index returns do not include the effects of sales charges, management fees or transaction costs. It is not possible to invest directly in an index.

| Stone Harbor Investment Funds Annual Report | May 31, 2015 |

19 |

Table of Contents

| Stone Harbor Investment Funds | Growth of $10,000 Investment | |

|

May 31, 2015 (Unaudited) |

STONE HARBOR STRATEGIC INCOME FUND

Comparison of Change in Value of $10,000 Investment in Stone Harbor Strategic Income Fund and the Barclays Global Credit Index (Hedged USD). Please refer to page 101 for detailed benchmark descriptions.

Cumulative Returns (Commencement of Operations, December 19, 2013)

| 3 Months | 6 Months | 1 Year | Since Inception | |||||||||||||||||

| Stone Harbor Strategic Income Fund |

0.30% | 1.16% | 1.15% | 4.81% | ||||||||||||||||

| Barclays Global Credit Index (Hedged USD) |

-0.09% | 1.58% | 3.59% | 5.79% | ||||||||||||||||

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. Average annual total returns reflect the reinvestment of dividends and capital gains distributions and include all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. The performance data quoted does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Index returns do not include the effects of sales charges, management fees or transaction costs. It is not possible to invest directly in an index.

| 20 |

www.shiplp.com |

Table of Contents

| Stone Harbor Investment Funds | Growth of $10,000 Investment | |

|

May 31, 2015 (Unaudited) |

STONE HARBOR EMERGING MARKETS DEBT ALLOCATION FUND

Comparison of Change in Value of $10,000 Investment in Stone Harbor Emerging Markets Debt Allocation Fund and the Blend Index (50% J.P. Morgan EMBI Global Diversified Index and 50% J.P. Morgan GBI-EM Global Diversified Index). Please refer to page 101 for detailed benchmark descriptions.

Cumulative Returns (Commencement of Operations, October 21, 2014)

| 3 Months | 6 Months | Since Inception | |||||||||||||

| Stone Harbor Emerging Markets Debt Allocation Fund |

0.32% | -4.06% | -4.73% | ||||||||||||

| Blend Index (50% J.P. Morgan EMBI Global Diversified Index and 50% J.P. Morgan GBI-EM Global Diversified Index) |

-0.64% | -4.36% | -4.69% | ||||||||||||

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. Average annual total returns reflect the reinvestment of dividends and capital gains distributions and include all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. The performance data quoted does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Index returns do not include the effects of sales charges, management fees or transaction costs. It is not possible to invest directly in an index.

| Stone Harbor Investment Funds Annual Report | May 31, 2015 |

21 |

Table of Contents

| Stone Harbor Investment Funds | Report of Independent Registered Public Accounting Firm |

To the Shareholders and Board of Trustees of Stone Harbor Investment Funds:

We have audited the accompanying statements of assets and liabilities of Stone Harbor Investment Funds (the “Funds”), comprising the Stone Harbor Emerging Markets Debt Fund, Stone Harbor High Yield Bond Fund, Stone Harbor Local Markets Fund, Stone Harbor Emerging Markets Corporate Debt Fund, Stone Harbor Investment Grade Fund, Stone Harbor Strategic Income Fund, and Stone Harbor Emerging Markets Debt Allocation Fund, including the statements of investments, as of May 31, 2015, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the periods presented (as to the Stone Harbor Investment Grade Fund and the Stone Harbor Strategic Income Fund, the related statements of operations for the year then ended, and statements of changes in net assets and the financial highlights for the year then ended and for the period from December 19, 2013 (Commencement of Operations) to May 31, 2014) (as to the Stone Harbor Emerging Markets Debt Allocation Fund, the related statement of operations, statement of changes in net assets and the financial highlights for the period October 21, 2014 (Commencement of Operations) to May 31, 2015). These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Funds are not required to have, nor were we engaged to perform, an audit of their internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Funds’ internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of May 31, 2015, by correspondence with the custodian and brokers; where replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of each of the funds constituting the Stone Harbor Investment Funds as of May 31, 2015, and the results of their operations, the changes in their net assets, and the financial highlights for each of the periods presented, in conformity with accounting principles generally accepted in the United States of America.

DELOITTE & TOUCHE LLP

Denver, Colorado

July 29, 2015

| 22 |

www.shiplp.com |

Table of Contents

| Stone Harbor Emerging Markets Debt Fund | Statements of Investments | |

|

May 31, 2015 |

| Currency |

Rate |

Maturity Date |

Principal |

Market Value |

||||||||||||

| SOVEREIGN DEBT OBLIGATIONS - 64.27% |

||||||||||||||||

| Angola - 0.31% |

||||||||||||||||

| Republic of Angola |

USD | 7.000 | % | 08/16/2019 | 5,857,000 | $ | 6,010,746(1) | |||||||||

|

|

|

|||||||||||||||

| Argentina - 3.49% |

||||||||||||||||

| Republic of Argentina: |

||||||||||||||||

| USD | 7.000 | % | 10/03/2015 | 18,414,966 | 18,117,257 | |||||||||||

| USD | 7.000 | % | 04/17/2017 | 32,613,043 | 31,766,917 | |||||||||||

| EUR | 5.870 | % | 03/31/2023 | 10,755,000 | 7,247,500(2) | |||||||||||

| USD | 0.000 | % | 03/31/2023 | 184,000 | 220,800(2)(3) | |||||||||||

| USD | 6.000 | % | 03/31/2023 | 7,841,000 | 9,409,200(2) | |||||||||||

| EUR | 8.500 | % | 07/01/2049 | 700,000 | 722,681(2) | |||||||||||

|

|

|

|||||||||||||||

| 67,484,355 | ||||||||||||||||

|

|

|

|||||||||||||||

| Azerbaijan - 0.86% |

||||||||||||||||

| Republic of Azerbaijan |

USD | 4.750 | % | 03/18/2024 | 16,005,000 | 16,565,175(4) | ||||||||||

|

|

|

|||||||||||||||

| Brazil - 5.10% |

||||||||||||||||

| Brazil Loan Trust 1 |

USD | 5.477 | % | 07/24/2023 | 18,925,614 | 18,954,002(4) | ||||||||||

| Brazil Minas SPE via State of Minas Gerais: |

||||||||||||||||

| USD | 5.333 | % | 02/15/2028 | 496,000 | 483,600(4) | |||||||||||

| USD | 5.333 | % | 02/15/2028 | 1,479,000 | 1,442,025(1) | |||||||||||

| Republic of Brazil: |

||||||||||||||||

| USD | 4.250 | % | 01/07/2025 | 34,611,000 | 34,143,752 | |||||||||||

| USD | 8.750 | % | 02/04/2025 | 834,000 | 1,117,560 | |||||||||||

| USD | 8.250 | % | 01/20/2034 | 12,755,000 | 16,613,387 | |||||||||||

| USD | 7.125 | % | 01/20/2037 | 21,858,000 | 26,011,020 | |||||||||||

|

|

|

|||||||||||||||

| 98,765,346 | ||||||||||||||||

|

|

|

|||||||||||||||

| Colombia - 4.39% |

||||||||||||||||

| Bogota Distrio Capital |

COP | 9.750 | % | 07/26/2028 | 7,870,000,000 | 3,784,814(1) | ||||||||||

| Republic of Colombia: |

||||||||||||||||

| COP | 12.000 | % | 10/22/2015 | 4,798,000,000 | 1,943,673 | |||||||||||

| USD | 7.375 | % | 01/27/2017 | 1,838,000 | 2,017,205 | |||||||||||

| USD | 11.750 | % | 02/25/2020 | 4,338,000 | 5,943,060 | |||||||||||

| COP | 7.750 | % | 04/14/2021 | 5,210,000,000 | 2,258,149 | |||||||||||

| USD | 4.375 | % | 07/12/2021 | 19,783,000 | 20,969,980 | |||||||||||

| USD | 2.625 | % | 03/15/2023 | 814,000 | 761,090 | |||||||||||

| USD | 4.000 | % | 02/26/2024 | 7,448,000 | 7,615,580 | |||||||||||

| USD | 8.125 | % | 05/21/2024 | 25,000 | 32,906 | |||||||||||

| COP | 9.850 | % | 06/28/2027 | 8,281,000,000 | 4,113,312 | |||||||||||

| COP | 7.750 | % | 09/18/2030 | 9,209,500,000 | 3,684,892 | |||||||||||

| USD | 10.375 | % | 01/28/2033 | 2,006,000 | 3,169,480 | |||||||||||

| USD | 7.375 | % | 09/18/2037 | 13,959,000 | 18,164,149 | |||||||||||

| USD | 6.125 | % | 01/18/2041 | 387,000 | 443,599 | |||||||||||

| USD | 5.625 | % | 02/26/2044 | 5,930,000 | 6,411,812 | |||||||||||

| USD | 5.000 | % | 06/15/2045 | 3,726,000 | 3,693,397 | |||||||||||

|

|

|

|||||||||||||||

| 85,007,098 | ||||||||||||||||

|

|

|

|||||||||||||||

| Costa Rica - 2.16% |

||||||||||||||||

| Republic of Costa Rica: |

||||||||||||||||

| USD | 4.250 | % | 01/26/2023 | 15,042,000 | 14,092,474(1) | |||||||||||

| USD | 4.375 | % | 04/30/2025 | 4,745,000 | 4,356,503(1) | |||||||||||

| USD | 4.375 | % | 04/30/2025 | 5,728,000 | 5,259,020(4) | |||||||||||

| Stone Harbor Investment Funds Annual Report | May 31, 2015 |

23 |

Table of Contents

| Stone Harbor Emerging Markets Debt Fund | Statements of Investments | |

|

May 31, 2015 |

| Currency |

Rate |

Maturity Date |

Principal |

Market Value |

||||||||||||

| Costa Rica (continued) |

||||||||||||||||

| Republic of Costa Rica: (continued) |

||||||||||||||||

| USD | 7.000 | % | 04/04/2044 | 18,275,000 | $ | 18,172,203(4) | ||||||||||

|

|

|

|||||||||||||||

| 41,880,200 | ||||||||||||||||

|

|

|

|||||||||||||||

| Croatia - 1.08% |

||||||||||||||||

| Croatian Government: |

||||||||||||||||

| USD | 5.500 | % | 04/04/2023 | 14,058,000 | 14,831,190(1) | |||||||||||

| USD | 6.000 | % | 01/26/2024 | 5,662,000 | 6,136,192(4) | |||||||||||

|

|

|

|||||||||||||||

| 20,967,382 | ||||||||||||||||

|

|

|

|||||||||||||||

| Dominican Republic - 3.77% |

||||||||||||||||

| Dominican Republic: |

||||||||||||||||

| USD | 9.040 | % | 01/23/2018 | 9,523,326 | 10,297,096(1) | |||||||||||

| USD | 7.500 | % | 05/06/2021 | 36,382,000 | 40,929,750(1) | |||||||||||

| USD | 6.600 | % | 01/28/2024 | 7,818,000 | 8,541,165(1) | |||||||||||

| USD | 5.875 | % | 04/18/2024 | 6,265,000 | 6,593,912(4) | |||||||||||

| USD | 7.450 | % | 04/30/2044 | 5,883,000 | 6,544,838(4) | |||||||||||

|

|

|

|||||||||||||||

| 72,906,761 | ||||||||||||||||

|

|

|

|||||||||||||||

| El Salvador - 1.42% |

||||||||||||||||

| Republic of El Salvador: |

||||||||||||||||

| USD | 7.375 | % | 12/01/2019 | 220,000 | 241,862(4) | |||||||||||

| USD | 7.375 | % | 12/01/2019 | 2,068,000 | 2,273,508(1) | |||||||||||

| USD | 7.750 | % | 01/24/2023 | 4,320,000 | 4,749,300(1) | |||||||||||

| USD | 6.375 | % | 01/18/2027 | 6,844,000 | 6,809,780(4) | |||||||||||

| USD | 7.650 | % | 06/15/2035 | 12,924,000 | 13,384,417(1) | |||||||||||

|

|

|

|||||||||||||||

| 27,458,867 | ||||||||||||||||

|

|

|

|||||||||||||||

| Ethiopia - 0.24% |

||||||||||||||||

| Federal Democratic Republic of Ethiopia |

USD | 6.625 | % | 12/11/2024 | 4,562,000 | 4,601,918(4) | ||||||||||

|

|

|

|||||||||||||||

| Gabon - 0.49% |

||||||||||||||||

| Republic of Gabon: |

||||||||||||||||

| USD | 8.200 | % | 12/12/2017 | 50,000 | 53,688(4) | |||||||||||

| USD | 6.375 | % | 12/12/2024 | 9,674,347 | 9,514,720(4) | |||||||||||

|

|

|

|||||||||||||||

| 9,568,408 | ||||||||||||||||

|

|

|

|||||||||||||||

| Ghana - 0.56% |

||||||||||||||||

| Republic of Ghana: |

||||||||||||||||

| USD | 8.500 | % | 10/04/2017 | 2,641,000 | 2,736,736(1) | |||||||||||

| USD | 7.875 | % | 08/07/2023 | 6,267,000 | 5,922,315(4) | |||||||||||

| USD | 8.125 | % | 01/18/2026 | 2,379,000 | 2,248,155(4) | |||||||||||

|

|

|

|||||||||||||||

| 10,907,206 | ||||||||||||||||

|

|

|

|||||||||||||||

| Honduras - 0.46% |

||||||||||||||||

| Republic of Honduras |

USD | 8.750 | % | 12/16/2020 | 7,720,000 | 8,820,100(1) | ||||||||||

|

|

|

|||||||||||||||

| Hungary - 1.07% |

||||||||||||||||

| Republic of Hungary: |

||||||||||||||||

| GBP | 5.000 | % | 03/30/2016 | 670,000 | 1,055,435 | |||||||||||

| USD | 6.375 | % | 03/29/2021 | 15,182,000 | 17,582,654 | |||||||||||

| USD | 5.750 | % | 11/22/2023 | 1,910,000 | 2,177,400 | |||||||||||

|

|

|

|||||||||||||||

| 20,815,489 | ||||||||||||||||

|

|

|

|||||||||||||||

| Indonesia - 4.80% |

||||||||||||||||

| Republic of Indonesia: |

||||||||||||||||

| USD | 11.625 | % | 03/04/2019 | 1,683,000 | 2,233,341(1) | |||||||||||

| 24 |

www.shiplp.com |

Table of Contents

| Stone Harbor Emerging Markets Debt Fund | Statements of Investments | |

|

May 31, 2015 |

| Currency | Rate | Maturity Date |

Principal Amount* |

Market Value Expressed (in U.S. $) |

||||||||||||

| Indonesia (continued) |

||||||||||||||||

| Republic of Indonesia: (continued) |

||||||||||||||||

| USD | 11.625 | % | 03/04/2019 | 2,170,000 | $ | 2,879,590(4) | ||||||||||

| IDR | 7.875 | % | 04/15/2019 | 59,940,000,000 | 4,521,336 | |||||||||||

| USD | 4.875 | % | 05/05/2021 | 733,000 | 795,305(1) | |||||||||||

| IDR | 7.000 | % | 05/15/2022 | 16,100,000,000 | 1,150,991 | |||||||||||

| USD | 3.375 | % | 04/15/2023 | 13,093,000 | 12,670,751(4) | |||||||||||

| USD | 5.375 | % | 10/17/2023 | 10,407,000 | 11,445,098(1) | |||||||||||

| IDR | 8.375 | % | 03/15/2024 | 116,782,000,000 | 8,974,790 | |||||||||||

| IDR | 9.000 | % | 03/15/2029 | 46,100,000,000 | 3,693,177 | |||||||||||