Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22037

Stone Harbor Investment Funds

(Exact name of registrant as specified in charter)

1290 Broadway, Suite 1100

Denver, CO 80203

(Address of principal executive offices) (Zip code)

Adam J. Shapiro, Esq.

c/o Stone Harbor Investment Partners LP

31 West 52nd Street, 16th Floor

New York, NY 10019

(Name and address of agent for service)

With copies To:

Michael G. Doherty, Esq.

Ropes & Gray LLP

1211 Avenue of the Americas

New York, NY 10036

Registrant’s telephone number, including area code: (303) 623-2577

Date of fiscal year end: May 31

Date of reporting period: June 1, 2013 - May 31, 2014

1

Table of Contents

| Item 1. | Reports to Stockholders. |

Table of Contents

Table of Contents

| Table of Contents | ||

| 2 | ||||

| 10 | ||||

| 12 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 19 | ||||

| 20 | ||||

| 21 | ||||

| 22 | ||||

| 34 | ||||

| 44 | ||||

| 50 | ||||

| 56 | ||||

| 60 | ||||

| 62 | ||||

| 64 | ||||

| 66 | ||||

| 69 | ||||

| 70 | ||||

| 71 | ||||

| 72 | ||||

| 73 | ||||

| 74 | ||||

| 75 | ||||

| 93 | ||||

| 94 | ||||

| 96 | ||||

| Stone Harbor Investment Funds Annual Report | May 31, 2014 | 1 |

Table of Contents

| Stone Harbor Investment Funds | Shareholder Letter | |

| May 31, 2014 (Unaudited) |

Dear Shareholder,

During the twelve month period ending May 31, 2014, credit market performance was impacted by interest rate volatility due to concerns over U.S. monetary and fiscal policy, fluctuating global growth expectations, retail mutual fund flows, and increased geopolitical risk.

Concerns over U.S. monetary policy evolved significantly over the review period. During the second half of 2013, investors were consumed with the timing and the size of the Federal Reserve’s “taper” of its purchases of U.S. Government securities. This uncertainty triggered heightened market reactions to nearly every U.S. economic release during the period. Higher volatility led to record retail mutual fund outflows in credit markets and caused a severe technical dislocation across all risk markets. Retail mutual fund selling impacted a wide range of fixed income assets and was particularly severe in the Emerging Markets Debt sector. However, investor sentiments turned positive as the Fed indicated commitment to maintaining a highly accommodative monetary policy for the foreseeable future. This policy stance combined with Federal Reserve Chair Janet Yellen’s comments that future rate increases would be tied to a range of economic indicators effectively reduced market volatility.

In addition, global economic growth expectations also contributed to market volatility during the year with the U.S. showing moderate growth and Europe emerging from a record long recession. Emerging markets were impacted by fluctuating growth levels in developed markets and the rising tension in Eastern Europe. Investors also had to contend with heightened emerging market foreign exchange volatility despite aggressive policy responses from central banks.

At the end of the review period, we hold a cautiously optimistic view of credit markets as global growth continues its recovery. Greater Federal Reserve clarity has led to lower credit market volatility and retail mutual fund flows show signs of stabilization, particularly in emerging markets. Central banks continue to support an accommodative monetary policy. We remain aware of the major challenges that will affect the financial markets. These include, among other factors, the impact of rising rates on credit markets, a U.S. and/or global economic slowdown, a disorderly response to changes in the Federal Reserve’s asset purchase program, and geopolitical turmoil.

At Stone Harbor, we will continue to focus on seeking to capture excess return from stable and improving credit situations in corporate and sovereign markets worldwide. As we continue to monitor these developments, please follow our progress throughout the year by visiting our website at www.shiplp.com. There you will find updates on our view of credit markets, as well as related news and research. We appreciate the confidence you have placed in Stone Harbor Investment Partners LP and look forward to providing you with another update in the next six months.

Stone Harbor Emerging Markets Debt Fund

The total return of the Emerging Markets Debt Fund (the “Fund” or “portfolio”) for the 12 month period ended May 31, 2014 was 2.45% (net of expenses) and 3.15% (gross of expenses). This performance compares to a benchmark return of 5.77% for the J.P. Morgan EMBI Global Diversified. For the period, external sovereign bond credit spreads over comparable maturity U.S. Treasury securities tightened by 22 basis points1 , ending the period at 273 basis points. Total returns on all country sub indices were positive for the period. Throughout the summer of 2013, returns on emerging markets (EM) debt were driven down by a broad-based selloff and all EM debt sectors experienced a significant decline. While the thematic drivers of the market downturn — namely, uncertainty around the Federal Reserve’s asset purchase program and continuing global growth concerns — persisted throughout much of the 12 month period, developments in these areas had a generally positive impact on market sentiment and were ultimately catalytic for a market recovery that gained traction after January 2014.

Several factors, both fundamental and technical, contributed to the market volatility of EM assets in the second half of 2013. From a macroeconomic perspective, rising concerns over the timing of the Federal Reserve’s reduction in the pace of its bond purchase program led to a rapid increase in U.S. Treasury yields and a broad-based sell off of fixed income assets. Fears of less accommodative monetary policy in the U.S. contributed to growing concerns about the attractiveness of EM assets that had benefitted from large investor inflows since the end of the global financial crisis. Fundamental factors also played a role in the EM debt decline as growth in many large emerging markets, including China, remained lower than expected and growth expectations fell. At the same time, popular uprisings in Argentina, Brazil, Thailand, Turkey and Ukraine produced headlines about political risks in EMs. These factors imposed a significant influence over investor sentiment across all EM sectors, in our view, particularly for individuals invested in broad EM debt mutual funds. Despite these challenges, emerging markets managed to regain footing beginning in February 2014 as the U.S. growth outlook for 2014 modestly improved. Market technicals improved as investor flows turned positive and EM credit spreads tightened. Subsequently, a rally ensued in select EM currencies; in some cases, too quickly relative to fundamentals during the year-to-date period ending May 31, 2014, in our view. Nevertheless, U.S. growth proved to be weaker-than-expected, EM country economic recovery was uneven, and geopolitical risks increased as the Russia/Ukraine conflict escalated throughout the latter part of the review period.

The Fund underperformed its benchmark primarily as a result of a country overweight in Venezuela and an underweight in Argentina within our hard currency sovereign allocation. We invested in Venezuela based on our assessment of the country’s ability and willingness to repay debt from U.S. dollar cash flows generated from oil exports. We also believed that Venezuela’s government had strong incentives to prioritize oil export cash

| 1 | J.P. Morgan EMBI Global Diversified spreads. |

| 2 |

www.shiplp.com |

Table of Contents

| Stone Harbor Investment Funds | Shareholder Letter | |

| May 31, 2014 (Unaudited) |

flows for debt service of external debt in order to maintain relationships with integrated global oil companies that invest in Venezuela’s Orinoco oil belt, which contains some of the world’s largest proven oil reserves. The market’s concerns over political risks in Venezuela, we believe, created significant value in external bonds. However, Venezuela debt underperformed the broader market in 2013 as investors reacted to President Nicolas Maduro’s populist policies that led to rising opposition and dissent. Venezuela securities subsequently rallied in the first five months of 2014. The Fund’s underweight in Argentina reflected our view that would determine Argentina’s willingness to pay the outcome of a U.S. court case involving holdout creditors from Argentina’s restructuring of debt in 2005 and 2010, rather than fundamental considerations. However, the Fund increased its position in Argentina after a significant decline of Argentina bond prices and a series of positive fundamental credit developments in January 2014; this positioning enhanced performance in the last three months of the reporting period. Other sources of underperformance included local rates and foreign exchange (FX) exposure in Brazil, Indonesia, and South Africa. Issue selection, particularly an allocation to short duration securities in Venezuela enhanced excess returns. Allocations to hard currency corporate bonds, particularly in Indonesia, Mexico, and UAE also contributed positively to excess returns.

As of the end of the period, overweight positions in the Fund were concentrated in country exposures where the portfolio management team identified attractive spread premiums relative to the team’s fundamental assessments of sovereign and corporate credit quality, including both non-investment grade and investment grade countries – examples included Azerbaijan, Dominican Republic, Indonesia, Turkey and Venezuela. Corporate debt exposure was also more limited given our more favorable view on sovereign debt valuations. The Fund reduced exposure to local debt markets over the course of the review period, particularly in countries in which local debt and currencies had outperformed the market since the end of January. The Fund also reduced exposure to corporate debt, particularly in Russia and Peru. Sales of local currency and corporate bonds funded additions of hard currency sovereign bonds.

We maintain our positive assessment of EM sovereign spreads even though EM benchmark spreads have already tightened by over 40 basis points year to date as of May 31, 2014. We continue to recognize the rising risks of a possible move higher in U.S. interest rates later this year, but maintain duration exposure in bonds whose yields are typically closely aligned with U.S. Treasury yields and in countries where we hold positive fundamental outlooks. Brazil, Indonesia and Mexico are good examples. In other countries — Argentina and Venezuela, for example — where yield curves are relatively flat and the historical sensitivity of bond price movements to U.S. Treasury yield changes are low, we hold lower than benchmark duration exposure. While weaker-than-expected growth in the U.S. and in several large emerging markets so far have constrained our willingness to add local currency exposure, we began adding in Mexico’s local bond and currency market in May. In addition, as sovereign spreads contract relative to EM corporates, we will likely look for opportunities to add exposure in the Corporate sector in the months ahead.

Stone Harbor High Yield Bond Fund

The total return of the Stone Harbor High Yield Bond Fund (the “Fund” or “portfolio”) for the 12 month period ended May 31, 2014 was 7.90% (net of expenses) and 8.45% (gross of expenses). This compares to a benchmark return of 7.48% for the Citigroup High Yield Market Capped Index. The high yield market benefited from moderate U.S. economic growth, a stabilizing European economy, global monetary easing, healthy market fundamentals and positive event risk. Market volatility during the period was primarily caused by interest rate volatility due to concerns over U.S. monetary and fiscal policy, fluctuating global growth expectations and increased geopolitical risk. This volatility resulted in record retail mutual fund outflows early in the year and caused a technical dislocation in the high yield market. As the Federal Reserve assured the market that monetary policy would remain highly accommodative for the foreseeable future, investors re-entered the market. This was later reinforced with the appointment of the new Federal Reserve Chair Janet Yellen who made it clear that future rate increases would be tied to a range of economic indicators and an accommodative monetary policy would continue — albeit at reduced levels — for an extended period of time. The market was also impacted during the year by the largest amount of merger and acquisition (M&A) activity since 2007. The 10-year Treasury began the year at 2.13% increasing 35 basis points to end the year at 2.48%. During the year the 10-year Treasury reached a yield of 3.03%, primarily due to investor concerns over U.S. monetary policy. High yield spreads, as represented by the Citigroup High yield Market Capped Index, tightened 74 basis points to end the year at 395 basis points.

As investors became more comfortable with U.S. economic growth, CCC rated bonds outperformed both BB and B rated securities. Furthermore, as concern over interest rate volatility subsided during the second half of the year, longer duration bonds outperformed shorter duration bonds. The new issue market remained healthy (although new issuance was less than last year’s record setting levels), with refinancing being the primary use of proceeds. The second largest high yield bond default on record occurred during the fiscal year with the much anticipated default of Energy Futures Holding (TXU). This increased the par-weighted default rate from a post crisis low of 0.61% in March to a rate of 2.08% at the end of the period. The par-weighted default rate had been below 2% since August 2012 until the TXU default. Despite this, the par-weighted default rate remains significantly below the 25-year long term average of 3.89%. We believe default rates will continue to remain low over the intermediate term, as healthy capital markets conditions enable companies to extend maturities and company fundamentals remain solid. The market had more companies upgraded to investment grade (rising stars) than companies downgraded to high yield (fallen angels) and the number of rating agency issuer upgrades slightly exceeded the number of downgrades for the year.

| Stone Harbor Investment Funds Annual Report | May 31, 2014 | 3 |

Table of Contents

| Stone Harbor Investment Funds | Shareholder Letter | |

| May 31, 2014 (Unaudited) |

Major changes to the Fund’s industry exposures included increasing the Fund’s exposure to the Energy sector, particularly to Exploration & Production (E&P) companies based on our view that the supply/demand balance for natural gas is expected to be more favorable; and reducing the Fund’s underweight to the Metals/Mining sector due to valuation. We also increased exposure to the Technology sector due to our belief that the sector is poised to benefit from a growing global economy and from increases in capital spending in the Telecommunications industry. We reduced the Fund’s overweight to the Food/Beverage industry due to valuation and the Telecommunications industry as the fund’s holdings were reduced by capital market activity. Lastly, we increased the Fund’s bank loan exposure during the year based on the assumption that U.S. Treasury rates will slowly rise.

The Fund outperformed its benchmark as a result of issue selection decisions, particularly in the Utilities, Telecommunications and Healthcare sectors. Industry selection slightly detracted from performance due to an overweight in Food/Beverage/Bottling and Telecommunications, although issue selection offset the underperformance from the Telecommunications sector overweight. This relative underperformance was partially offset by an overweight to the Technology sector. All rating categories, except a small weighting to the BBB sector, contributed to performance, particularly an underweight to BB rated bonds. Issue selection in CCC rated bonds contributed to performance.

The Fund remains positioned for moderate U.S. economic growth. Relative to BB rated bonds, the Fund remains overweight B rated securities as we believe this sector may outperform on lower interest rate sensitivities. As of the date of this report, the largest portfolio industry overweights included: Cable & Media, based primarily on our view that industry consolidation particularly in the Cable sector could benefit the Fund’s holdings; Telecommunications, due primarily to its consistent cash flow characteristics; and Food/Beverage/Bottling, due primarily to positive free cash flow generation and solid asset coverage. The largest industry underweights for the review period included: Services-Other, due primarily to the minimal tangible asset value; and Home Builders and Auto Manufacturing/Vehicle Parts based primarily on valuation. Positive event risk including M&A and IPOs had a positive effect on the market; IPOs enabled highly leveraged companies to reduce debt levels and M&A events were primarily from better quality companies, a positive for high yield bonds. Although fundamentals continue to be favorable, we believe that the U.S. and European high yield markets are currently fully valued. Risk factors include increased geopolitical risk, a disorderly response to the removal of quantitative easing in the U.S., and a slowdown in global growth.

Stone Harbor Local Markets Fund

The total return of the Stone Harbor Local Markets Fund (the “Fund” or “portfolio”) for the 12 month period ended May 31, 2014 was -4.04% (net of expenses) and -3.16% (gross of expenses). This performance compares to a benchmark return of -1.37% for the J.P. Morgan GBI-EM Global Diversified. Depreciation of emerging market currencies relative to the US dollar was the primary source of the market’s downturn over the reporting period, while returns from interest rate movements and yield were mixed and generally positive. Throughout the summer of 2013, emerging markets (EM) continued to be driven down by a broad-based selloff and all EM debt sectors, particularly local currency debt, experienced a significant decline. While the thematic drivers of the market downturn — namely, uncertainty around the Federal Reserve’s asset purchase program and continuing global growth concerns — persisted throughout much of the 12 month period, developments in these areas had a generally positive impact on market sentiments and were ultimately catalytic for a market recovery that gained traction after January 2014.

Several factors, both fundamental and technical, contributed to the market volatility of EM assets in the second half of 2013. From a macroeconomic perspective, rising concerns over the timing of the Federal Reserve’s reduction in the pace of its bond purchase program led to a rapid increase in U.S. Treasury yields and a broad-based sell off of fixed income assets. Fears of less accommodative monetary policy in the U.S. contributed to growing concerns about the attractiveness of EM assets that had benefited from large investor inflows since the end of the global financial crisis. Fundamental factors also played a role in the EM debt decline, in our opinion, as growth in many large emerging markets, including China, remained lower than expected and growth expectations fell. At the same time, popular uprisings in Argentina, Brazil, Thailand, Turkey and Ukraine produced headlines about political risks in EMs. These factors imposed a significant influence over investor sentiment across all EM sectors, in our view, particularly for individuals invested in broad EM debt mutual funds. Despite these challenges, emerging markets managed to regain footing beginning in February 2014 as the U.S. growth outlook for 2014 modestly improved. Market technicals improved as investor flows turned positive and EM credit spreads tightened. Subsequently, a rally ensued in select EM currencies; in some cases, too quickly relative to fundamentals during the year-to-date period ending May 31, 2014, in our view. Nevertheless, U.S. growth proved to be weaker-than-expected, EM country economic recovery was uneven, and geopolitical risks increased as the Russia/Ukraine conflict escalated throughout the latter part of the review period.

The Fund underperformed its benchmark primarily as a result of issue selection decisions in Brazil and Mexico and an underweight in the Hungarian forint. The largest source of portfolio underperformance came from allocation to Brazil long duration nominal fixed rate securities. The Fund’s positioning reflected our expectation that Brazil local bonds would outperform in an environment where the current government was politically motivated to lower interest rates, control inflation, and prevent further meaningful currency depreciation. However, this position underperformed significantly as the wide-spread sell-off driven by the Federal Reserve’s taper discussion resulted in a depreciation of the Brazil real during the May-August period. In Mexico, while the Fund’s overweight to the peso helped performance, issue selection and duration positions detracted from returns as U.S. bond yields rose in the latter half of 2013. We maintained the view that the Hungarian economy’s cyclical upswing disguised

| 4 |

www.shiplp.com |

Table of Contents

| Stone Harbor Investment Funds | Shareholder Letter | |

| May 31, 2014 (Unaudited) |

underlying policy, growth and balance sheet weaknesses. But this underweight position performed poorly as markets reacted favorably to currencies from countries with strong economic ties to the Euro area on the heels of its improving growth expectations. Positions that enhanced returns during the period included an overweight in Brazil real and an underweight in Russia ruble. In Brazil, following significant underperformance in the summer of 2013, the real appreciated sharply in the first quarter of 2014. The underweight in Russia enhanced returns as the ruble weakened on slowing growth, deteriorating external accounts, and the escalating conflict in Ukraine.

The Fund has been rebalanced to favor countries where we see tangible evidence of growth. Examples include countries in Asia and Central Europe. Malaysia’s strong export performance in Q1, we believe, is likely to continue and improve fiscal results this year. Indonesia is another good example. Indonesia’s current account and trade balance are slowly repairing as a weaker currency has helped reduce import demand and improved external competitiveness, in our opinion. In Central Europe, we believe that Turkey has also begun the necessary adjustment after January’s rate hike; however, our positioning will depend to a large degree on whether Turkey’s central bank continues on the path of monetary policy orthodoxy. Poland is currently benefiting from a recovery in Euro area growth and warrants an overweight, in our view.

On the other hand, strong performance of several higher beta currencies and local debt markets in the first few months of 2014 – South Africa and Brazil in particular—were more technical than fundamental, in our view. As a result, exposure to both countries has been reduced as their local currency markets outperformed the broader market since the end of January. We have also increased our underweight in Thailand after a recent military coup as it appeared to us that there is no near-term resolution to the country’s political unrest.

Stone Harbor Emerging Markets Corporate Debt Fund

The total return of the Stone Harbor Emerging Markets Corporate Debt Fund (the “Fund” or “portfolio”) for the twelve month period ended May 31, 2014 was 3.80% (net of expenses) and 4.80% (gross of expenses). This performance compares to a benchmark return of 4.78% for the J.P. Morgan Corporate Emerging Markets Bond Index Broad Diversified (CEMBI Broad Diversified). Corporate bond credit spreads over comparable maturity U.S. Treasury securities tightened by 31 basis points, ending the period at 292 basis points. Relative to sovereign EM debt, which declined sharply in the latter half of 2014, EM corporates total returns benefitted from the sector’s relatively low sensitivity to U.S. interest rates and its stable and growing investor base, which remains largely institutional rather than retail, in our view.

EM corporate debt performance belied significant market volatility during the period, particularly between June and January. Several factors, both fundamental and technical, contributed to the market volatility of EM assets in the second half of 2013. From a macroeconomic perspective, rising concerns over the timing of the Federal Reserve’s reduction in the pace of its bond purchase program led to a rapid increase in U.S. Treasury yields and a broad-based sell off in fixed income asset prices. Fears of less accommodative monetary policy in the U.S. contributed to growing concerns about the attractiveness of EM assets that had benefitted from large investor inflows since the end of the global financial crisis. Fundamental factors also played a role in the EM debt decline as growth in many large emerging markets, including China, remained lower than expected and growth expectations fell. At the same time, popular uprisings in Argentina, Brazil, Thailand, Turkey and Ukraine produced headlines about political risks in EMs. While these factors only indirectly impacted the EM Corporate sector, they imposed a significant influence over investor sentiment across all EM sectors, in our view, particularly for individuals invested in broad EM debt mutual funds.

Corporate debt from each of the major EM regions –Asia, Central Europe/Middle East/Africa and Latin America delivered roughly equivalent positive contributions to the CEMBI Broad Diversified total return. Returns varied considerably at the country level, from minus 33% for Mongolia’s sub index to positive 17.6% for Argentina’s. However, CEMBI Broad Diversified sub indices from only four countries, including Mongolia, had negative total returns during the year, despite higher than usual default rates in Latin America and slowing growth in China and Brazil. From an industry perspective, the largest contributor to total return came from the Banking sector, given its large weight in the index.

On a gross of expenses basis, the Fund outperformed its benchmark largely as a result of issue selection decisions in Argentina, Brazil, India, Indonesia, Mexico and UAE. In addition, issue selection in media and cable and wireless performed well. Another key element of the Fund’s relative outperformance was the avoidance of high profile defaults, particularly in Latin America. As defaults rose in 2013, the Fund successfully avoided the worst performing bonds in Brazil and Chile – two countries where the difference between the best and worst performing corporate bonds within the index varied the most. Primary detractors from performance were corporate positions in Ukraine and Brazil, both of which were overweights on average over the year. Corporate bonds from Ukraine were among the worst performers during the period, underperforming in sympathy with a sovereign credit downgrade that occurred in 3Q 2013, then later as Russia’s incursion into Crimea imposed a significant negative impact on corporate bond prices. In Brazil, macro factors, importantly, social unrest during the summer of 2013 and the subsequent weakening of Brazilian asset prices, influenced returns in the Corporate sector. In addition, select Brazilian banks came under pressure on developments relating to the Brazilian Supreme Court ruling on a long standing class action lawsuit by depositors. The Fund’s exposure, both the overweight position and issue selection decisions, in the Metals/Mining/Steel sector also detracted from relative returns.

| Stone Harbor Investment Funds Annual Report | May 31, 2014 | 5 |

Table of Contents

| Stone Harbor Investment Funds | Shareholder Letter | |

| May 31, 2014 (Unaudited) |

For EM corporate debt in aggregate, valuations relative to comparably rated U.S. corporate debt, in our view, remain fair, even after spread tightening at the end of the reporting period. As sovereign spreads continue to tighten, the relative valuations of EM corporates have improved. We will be looking for opportunities in the primary market to increase exposure selectively in countries like Turkey where we see better valuations along with strong company fundamentals. While we recognize the risk of the upcoming elections in Turkey, political tensions in the months ahead may provide attractive entry points for well-financed corporate bonds outside the Financial sector.

Country developments, particularly in Brazil, China, and Russia, will remain key factors in the Fund’s positioning in the months ahead. We have reduced our overweight in Brazil where drought, recent weakness in economic activity, and lack of growth-supportive policy initiatives have led us to question the effectiveness of ongoing infrastructure investments. In Russia, we also have reduced exposure, in particular in the Financial sector, where risk of western sanctions remains high, in our view. We continue to be mindful of the market’s concerns in China over trust products and the default of a local corporate bond as well as of China’s growth rate, its financial system and recent depreciation of the Yuan.

Stone Harbor Investment Grade Fund

The total return of the Investment Grade Debt Fund (the “Fund” or “portfolio”) for the period since inception on December 19, 2013 through May 31, 2014 was 4.41% (net of expenses) and 4.63% (gross of expenses). This performance compares to a benchmark return of 3.61% for the Barclays Capital U.S. Aggregate Bond Index. The Fund outperformed its benchmark as a result of certain asset allocation and individual credit decisions. The Fund’s overweight to the Corporate Bond sector and its underweight to the U.S. Treasury sector relative to the benchmark were the two most significant positive contributors from an asset allocation perspective. The Fund generated 26 basis points of excess return attributable to security selection, with 80% of the incremental return from credit selection within Corporates.

The start of the reporting period coincided with Federal Reserve Governor Bernanke outlining the Federal Reserve’s intention to taper the pace of quantitative easing. While this was portrayed as a moderation in the pace of accommodation, the impact on the markets was more in line with a tightening of monetary policy. By the end of 2013, the U.S. Treasury market had registered its third worst annual return in twenty years. The proximate impact of the announcement was a rise in U.S. Treasury 10-year yields from 1.67% at the end of May to 3% by early September. Faced with this, fixed income markets adjusted during this period to a new paradigm. Emerging market returns were particularly poor, impacted not only by effective competition from higher U.S. yields but also by continuing weakness in emerging market economic performance. Indeed the differential between U.S. and emerging market growth fell to its lowest level for a number of years. Retail investors, who had committed substantial monies to these markets over the prior few years, reversed course and what resulted was significant outflows with some estimates placing the outflows from emerging market bond funds at 20% of assets under management.

Corporate bond markets (investment grade, loans and high yield) also corrected but found their footing by early summer as investors recognized that the very growth that was giving the Federal Reserve the confidence to adjust monetary policy was likely positive for the outlook for corporate profits. With the U.S. Treasury market fully discounting the likely path of Federal Reserve action by the end of the summer, we saw a great two-way environment which was significantly less volatile than the one experienced during the summer. Indeed the MOVE Index, which measures implied volatility in the U.S. Treasury market, fell nearly 50% between early September and mid-November. While investor outflows from emerging markets diminished, we saw substantial inflows into corporate bonds and loans with the latter recording $95 billion in inflows, representing a near 20% of the market.

While U.S. and U.K. growth improved during the year, European growth remained disappointing as did emerging market growth. With a substantial global output gap inflation measures subsided. Combined with the ongoing pressures post the European crisis of 2010-2012 Eurozone, inflation continued to decline towards 0.5%. Money supply growth remained low and lending data suggested an ongoing contraction of lending in Europe. While European Central Bank (ECB) President Draghi faced significant scepticism from board members representing Northern European countries, investors recognized that a fragile European economy concerned with debt sustainability would eventually require the ECB to act and might ultimately result in quantitative easing. This provided a positive backdrop for global real yields through the first months of 2014. U.S. Treasury 10-year yield declined towards 2.4% from 3% at the start of the year. Ten-year Bund yields fell to within 20 basis points of their cyclical low.

The prospect of a potential seminal change in ECB policy gave further impetus to corporate spread tightening and encouraged a significant recovery in emerging market debt. Over the course of the twelve months ending May 31, 2014, U.S. investment grade corporate bonds, U.S. High Yield Bonds and USD Emerging Market debt outperformed U.S. Treasuries on a duration adjusted basis by some 3%, 7% and 4%, respectively.

Looking ahead to the next twelve months, we are focusing on four key issues. Firstly, at what stage will the Federal Reserve begin to guide us towards the next rate rise? We anticipate that with continued strong growth we will likely see this in the fourth quarter of this year. Secondly, how will the ECB respond to the deflation threat that is evident in Europe? We expect significant action in the near term targeting the level of the Euro and the availability of credit. However, beyond this, we suspect that the ECB will be reluctant to extend action to quantitative easing until late 2014 or early 2015. Combined, these expectations highlight the risk of significant policy divergence towards the end of 2014. Thirdly, what growth will we see in the emerging markets? We anticipate a slightly better outcome this year which will extend into further gains next year. Momentum is

| 6 |

www.shiplp.com |

Table of Contents

| Stone Harbor Investment Funds | Shareholder Letter | |

| May 31, 2014 (Unaudited) |

likely to be most positive in Latin America and Eastern Europe and a little more patchy in Asia. This should provide positive valuation support for Emerging Market Debt, in our view. Finally, what do valuations look like? In aggregate, credit markets look somewhat rich to fair value but not excessively so for this stage of the economic cycle. Looking across markets, the poor performance of Emerging Market assets in 2013 combined with improving economic performance is expected to result in outperformance relative to other asset classes. We have adjusted allocations over the past few months to reflect this expectation.

Stone Harbor Strategic Income Fund

The total return of the Strategic Income Fund (the “Fund” or “portfolio”) for the period since inception on December 19, 2013 through May 31, 2014 was 5.73% (net of expenses) and 6.04% (gross of expenses). This performance compares to a benchmark return of 4.73% for the Barclays Global Credit Total Return Index (Hedged into USD). The Fund outperformed its benchmark as a result of certain asset allocation and individual credit decisions. Approximately one third of the Fund’s excess return over the benchmark was due to credit selection. Issue selection was a positive contributor across all major sectors of the portfolio, lead by the High Yield and Investment Grade fixed income sectors. The remaining positive contribution to the Fund’s excess return was the result of asset allocation effects. The Fund’s overweight to the High Yield fixed income sector and underweight to the Investment Grade fixed income sector were both positive contributors. The largest impact, however, came from the Fund’s overweight to the Emerging Market Hard Currency Sovereign fixed income sector, which was the best performing market sector for the period.

The start of the reporting period coincided with Federal Reserve Governor Bernanke outlining the Federal Reserve’s intention to taper the pace of quantitative easing. While this was portrayed as a moderation in the pace of accommodation, the impact on the markets was more in line with a tightening of monetary policy. By the end of 2013, the U.S. Treasury market had registered its third worst annual return in twenty years. The proximate impact of the announcement was a rise in U.S. Treasury 10-year yields from 1.67% at the end of May to 3% by early September. Faced with this, fixed income markets adjusted during this period to a new paradigm. Emerging market returns were particularly poor, impacted not only by effective competition from higher U.S. yields but also by continuing weakness in emerging market economic performance. Indeed the differential between U.S. and emerging market growth fell to its lowest level for a number of years. Retail investors, who had committed substantial monies to these markets over the prior few years, reversed course and what resulted was significant outflows with some estimates placing the outflows from emerging market bond funds at 20% of assets under management.

Corporate bond markets (investment grade, loans and high yield) also corrected but found their footing by early summer as investors recognized that the very growth that was giving the Federal Reserve the confidence to adjust monetary policy was likely positive for the outlook for corporate profits. With the U.S. Treasury market fully discounting the likely path of Federal Reserve action by the end of the summer, we saw a great two-way environment which was significantly less volatile than the one experienced during the summer. Indeed the MOVE Index, which measures implied volatility in the U.S. Treasury market, fell nearly 50% between early September and mid-November. While investor outflows from emerging markets diminished, we saw substantial inflows into corporate bonds and loans with the latter recording $95 billion in inflows, representing a near 20% of the market.

While U.S. and U.K. growth improved during the year, European growth remained disappointing as did emerging market growth. With a substantial global output gap inflation measures subsided. Combined with the ongoing pressures post the European crisis of 2010-2012 Eurozone, inflation continued to decline towards 0.5%. Money supply growth remained low and lending data suggested an ongoing contraction of lending in Europe.While ECB President Draghi faced significant scepticism from board members representing Northern European countries, investors recognized that a fragile European economy concerned with debt sustainability would eventually require the ECB to act and might ultimately result in quantitative easing. This provided a positive backdrop for global real yields through the first months of 2014. U.S. Treasury 10-year yield declined towards 2.4% from 3% at the start of the year. Ten-year Bund yields fell to within 20 basis points of their cyclical low.

The prospect of a potential seminal change in ECB policy gave further impetus to corporate spread tightening and encouraged a significant recovery in emerging market debt. Over the course of the twelve months ending May 31, 2014, U.S. investment grade corporate bonds, U.S. High Yield Bonds and USD Emerging Market debt outperformed U.S. Treasuries on a duration adjusted basis by some 3%, 7% and 4%, respectively.

Looking ahead to the next twelve months, we are focusing on four key issues. Firstly, at what stage will the Federal Reserve begin to guide us towards the next rate rise? We anticipate that with continued strong growth we will likely see this in the fourth quarter of this year. Secondly, how will the ECB respond to the deflation threat that is evident in Europe? We expect significant action in the near term targeting the level of the Euro and the availability of credit. However, beyond this, we suspect that the ECB will be reluctant to extend action to quantitative easing until late 2014 or early 2015. Combined, these expectations highlight the risk of significant policy divergence towards the end of 2014. Thirdly, what growth will we see in the emerging markets? We anticipate a slightly better outcome this year which will extend into further gains next year. Momentum is likely to be most positive in Latin America and Eastern Europe and a little more patchy in Asia. This should provide positive valuation support for Emerging Market Debt, in our view. Finally, what do valuations look like? In aggregate, credit markets look somewhat rich to fair value but not excessively so for this stage of the economic cycle. Looking across markets, the poor performance of Emerging Market assets in 2013 combined

| Stone Harbor Investment Funds Annual Report | May 31, 2014 | 7 |

Table of Contents

| Stone Harbor Investment Funds | Shareholder Letter | |

| May 31, 2014 (Unaudited) |

with improving economic performance is expected to result in outperformance relative to other asset classes. We have adjusted allocations over the past few months to reflect this expectation.

Sincerely,

Thomas K. Flanagan

Chairman of the Board of Trustees

The Citigroup High Yield Market Index (previously the Salomon Smith Barney High Yield Market Index) is a total rate-of-return index which captures the performance of below investment-grade debt issued by corporations domiciled in the United States or Canada. This index comprises Citigroup’s broadest market measure and includes cash-pay and deferred-interest securities. All the bonds in the high-yield indices are publicly placed, have a fixed coupon and are non-convertible. The Citigroup High Yield Market Capped Index represents a modified version of the High Yield Market Index by delaying the entry of fallen angel issues and capping the par value of individual issuers at U.S. $10 billion par amount outstanding.

The J.P. Morgan CEMBI Broad Diversified tracks total returns of U.S. dollar-denominated debt instruments issued by corporate entities in emerging market countries and consists of an investable universe of corporate bonds. The minimum amount outstanding required is $350 mm for the CEMBI Broad Diversified. Broad-based securities indices are unmanaged and are not subject to fees and expenses typically associated with managed accounts or investment funds. Investments cannot be made directly in a broad-based securities index. The CEMBI Broad Diversified limits the weights of those index countries with larger corporate debt stocks by only including a specified portion of these countries’ eligible current face amounts of debt outstanding.

The J.P. Morgan EMBI Global Index (EMBIG) tracks total returns for U.S. dollar-denominated debt instruments issued by emerging markets sovereign and quasi-sovereign entities: Brady bonds, loans, and Eurobonds. The changes in the benchmark more accurately reflect the investment strategy.

The J.P. Morgan EMBI Global Diversified (EMBI Global Diversified) limits the weights of those index countries with larger debt stocks by only including specified portions of these countries’ eligible current face amounts outstanding. The countries covered in the EMBI Global Diversified are identical to those covered by the EMBI Global.

The J.P. Morgan GBI-EM Global Diversified consists of regularly traded, liquid fixed-rate, domestic currency government bonds to which international investors can gain exposure. The weightings among the countries are more evenly distributed within this index. Return from FX is the difference between the J.P. Morgan GBI EM Global Diversified index total return(Bloomberg ticker JGENVUUG) and the GBI EM Global Diversified index in local currency terms (Bloomberg ticker JGENVLLG). Return from Rates equals the total return of the GBI EM Global Diversified index in local currency terms (Bloomberg ticker JGENVLLG).

It is not possible to invest directly in an index.

Standard and Poor’s ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). A security that has not been given a credit rating by Standard and Poor’s is listed as “not rated”.

Basis Point – a unit equal to one hundredth of a percentage point.

Sovereign Debt – Refers to bonds issued by a national government in order to finance the issuing country’s growth. Sovereign debt described as external is denominated in U.S. dollar, while sovereign debt described as local is issued in a foreign currency.

Investment Grade – Refers to bonds that are considered to have a relatively low risk of default, ranging from highest credit quality to good credit quality. Bonds rated below investment grade are considered to have significant speculative characteristics.

The S&P 500 – is a stock market index based on the market capitalizations of 500 leading companies publicly traded in the U.S. stock market, as determined by Standard & Poor’s. It differs from other U.S. stock market indices such as the Dow Jones Industrial Average and the Nasdaq due to its diverse constituency and weighting methodology.

Quantitative Easing (QE) – is an unconventional monetary policy used by central banks to stimulate the national economy when standard monetary policy has become ineffective. A central bank implements quantitative easing by buying financial assets from commercial banks and other private institutions, thus increasing the monetary base. This is distinguished from the more usual policy of buying or selling government bonds in order to keep market interest rates at a specified target value.

| 8 |

www.shiplp.com |

Table of Contents

| Stone Harbor Investment Funds | Shareholder Letter | |

| May 31, 2014 (Unaudited) |

Barclays Global Credit Total Return Index is a subset of the Global Aggregate Index and is subject to the same quality, liquidity, and maturity requirements and exclusion rules of the latter. Constituents must be rated investment grade by at least two of the three major ratings agencies. Constituents must have a remaining maturity of at least one year. The index does not include Convertibles, floating-rate notes, fixed-rate perpetuals, warrants, linked bonds, and structured products.

The Barclays Capital U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed rate taxable bond market. The index includes Treasuries, government-related and corporate securities, Mortgage Backed Securities (“MBS”) (agency fixed-rate and hybrid Adjustable-Rate Mortgage (“ARMS”) pass-throughs), Asset Backed Securities (“ABS”) and Collateralized Mortgage Obligations (“CMOs”) (agency and non-agency).

| Stone Harbor Investment Funds Annual Report | May 31, 2014 | 9 |

Table of Contents

| Stone Harbor Investment Funds | Disclosure of Fund Expenses | |

| May 31, 2014 (Unaudited) |

Example. As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and/or redemption fees (if applicable) and (2) ongoing costs, including management fees and other Fund expenses. The below examples are intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on December 1, 2013 and held until May 31, 2014.

Actual Expenses. The first line of each table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line of each table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect transactional costs, such as redemption fees, sales charges (loads) or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning Account Value December 1, 2013 |

Ending Account Value May 31, 2014 |

Expense Ratio(1) |

Expenses Paid During Period(2) |

|||||||||||

| STONE HARBOR EMERGING MARKETS DEBT FUND |

|

|||||||||||||

| Institutional Class |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,088.70 | 0.71% | $ | 3.70 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,021.39 | 0.71% | $ | 3.58 | |||||||

| STONE HARBOR HIGH YIELD BOND FUND |

||||||||||||||

| Institutional Class |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,052.50 | 0.55% | $ | 2.81 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,022.19 | 0.55% | $ | 2.77 | |||||||

| STONE HARBOR LOCAL MARKETS FUND |

||||||||||||||

| Institutional Class |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,039.70 | 0.91% | $ | 4.63 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,020.39 | 0.91% | $ | 4.58 | |||||||

| STONE HARBOR EMERGING MARKETS CORPORATE DEBT FUND |

|

|||||||||||||

| Institutional Class |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,059.00 | 1.00% | $ | 5.13 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,019.95 | 1.00% | $ | 5.04 | |||||||

| STONE HARBOR INVESTMENT GRADE FUND(3) |

||||||||||||||

| Institutional Class |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,044.00 | 0.50% | $ | 2.30 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,022.44 | 0.50% | $ | 2.52 | |||||||

| STONE HARBOR STRATEGIC INCOME FUND(4) |

||||||||||||||

| Institutional Class |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,057.30 | 0.12% | $ | 0.55 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,024.33 | 0.12% | $ | 0.61 | |||||||

| (1) | Annualized, based on the Fund’s most recent fiscal half-year expenses. |

| (2) | Expenses are equal to the Fund’s annualized ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (182), divided by 365. Note this expense example is typically based on a six-month period. |

| 10 |

www.shiplp.com |

Table of Contents

| Stone Harbor Investment Funds | Disclosure of Fund Expenses | |

| May 31, 2014 (Unaudited) |

| (3) | Stone Harbor Investment Grade Fund commenced operations on December 19, 2013. For purposes of calculating the “Actual” figures, actual number of days from commencement of operations through May 31, 2014 were used (164 days). |

| (4) | Stone Harbor Strategic Income Fund commenced operations on December 19, 2013. For purposes of calculating the “Actual” figures, actual number of days from commencement of operations through May 31, 2014 were used (164 days). |

| Stone Harbor Investment Funds Annual Report | May 31, 2014 | 11 |

Table of Contents

| Stone Harbor Investment Funds | Summaries of Portfolio Holdings | |

| May 31, 2014 (Unaudited) |

Under SEC Rules, all funds are required to include in their annual and semi-annual shareholder reports a presentation of portfolio holdings in a table, chart or graph by reasonably identifiable categories. The following tables, which present holdings as a percent of total net assets (“TNA”), are provided in compliance with such requirements.

| 12 |

www.shiplp.com |

Table of Contents

| Stone Harbor Investment Funds | Summaries of Portfolio Holdings | |

| May 31, 2014 (Unaudited) |

| Stone Harbor Investment Funds Annual Report | May 31, 2014 | 13 |

Table of Contents

| Stone Harbor Investment Funds | Summaries of Portfolio Holdings | |

| May 31, 2014 (Unaudited) |

| 14 |

www.shiplp.com |

Table of Contents

| Stone Harbor Investment Funds | Growth of $10,000 Investment | |

| May 31, 2014 (Unaudited) |

STONE HARBOR EMERGING MARKETS DEBT FUND

Comparison of Change in Value of $10,000 Investment in Stone Harbor Emerging Markets Debt Fund and the J.P. Morgan Emerging Markets Bond Index Global Diversified (J.P. Morgan EMBI Global Diversified).

The J.P. Morgan EMBI Global Diversified (EMBI Global Diversified) tracks total returns for U.S. dollar-denominated debt instruments issued by emerging markets sovereign and quasi-sovereign entities: Brady bonds, loans, and Eurobonds. The index limits the weights of those index countries with larger debt stocks by only including specified portions of these countries’ eligible current face amounts outstanding. The countries covered in the EMBI Global Diversified are identical to those covered by the EMBI Global.

Average Annual Total Returns (Inception, August 16, 2007)

| 1 Year | 3 Years | 5 Years | Since Inception | |||||

| Stone Harbor Emerging Markets Debt Fund |

2.45% | 5.34% | 11.05% | 8.78% | ||||

| J.P. Morgan EMBI Global Diversified |

5.77% | 7.60% | 10.56% | 8.87% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. Average annual total returns reflect the reinvestment of dividends and capital gains distributions and include all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. The performance data quoted does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Index returns do not include the effects of sales charges, management fees or transaction costs. It is not possible to invest directly in an index.

| Stone Harbor Investment Funds Annual Report | May 31, 2014 | 15 |

Table of Contents

| Stone Harbor Investment Funds | Growth of $10,000 Investment | |

| May 31, 2014 (Unaudited) |

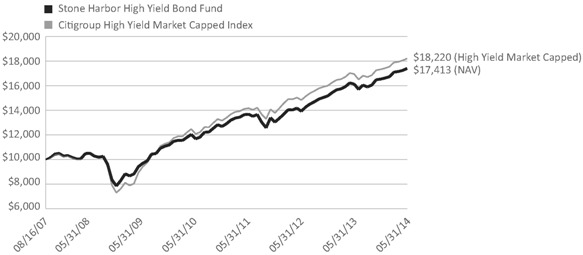

STONE HARBOR HIGH YIELD BOND FUND

Comparison of Change in Value of $10,000 Investment in Stone Harbor High Yield Bond Fund and the Citigroup High Yield Market Capped Index.

The Citigroup High Yield Market Capped Index represents a modified version of the High Yield Market Index by delaying the entry of “fallen angel” issues and capping the par value of individual issuers at US $10 billion par amount outstanding. The index is a total rate of return index which captures the performance of below investment grade debt issued by corporations domiciled in the United States or Canada.

Average Annual Total Returns (Inception, August 16, 2007)

| 1 Year | 3 Years | 5 Years | Since Inception | |||||

| Stone Harbor High Yield Bond Fund |

7.90% | 8.36% | 12.43% | 8.51% | ||||

| Citigroup High Yield Market Capped Index |

7.48% | 8.73% | 14.11% | 9.24% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. Average annual total returns reflect the reinvestment of dividends and capital gains distributions and include all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. The performance data quoted does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Index returns do not include the effects of sales charges, management fees or transaction costs. It is not possible to invest directly in an index.

| 16 |

www.shiplp.com |

Table of Contents

| Stone Harbor Investment Funds | Growth of $10,000 Investment | |

| May 31, 2014 (Unaudited) |

STONE HARBOR LOCAL MARKETS FUND

Comparison of Change in Value of $10,000 Investment in Stone Harbor Local Markets Fund and the J.P. Morgan Global Bond Index – Emerging Markets Global Diversified (J.P. Morgan GBI-EM Global Diversified).

The J.P. Morgan GBI-EM Global Diversified consists of regularly traded, liquid fixed-rate, domestic currency government bonds to which international investors can gain exposure. The weightings among the countries are more evenly distributed within this index.

Average Annual Total Returns (Inception, June 30, 2010)

| 1 Year | 3 Years | Since Inception | ||||

| Stone Harbor Local Markets Fund |

-4.04% | -0.81% | 3.38% | |||

| J.P. Morgan GBI-EM Global Diversified |

-1.37% | 0.97% | 5.35% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. Average annual total returns reflect the reinvestment of dividends and capital gains distributions and include all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. The performance data quoted does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Index returns do not include the effects of sales charges, management fees or transaction costs. It is not possible to invest directly in an index.

| Stone Harbor Investment Funds Annual Report | May 31, 2014 | 17 |

Table of Contents

| Stone Harbor Investment Funds | Growth of $10,000 Investment | |

| May 31, 2014 (Unaudited) |

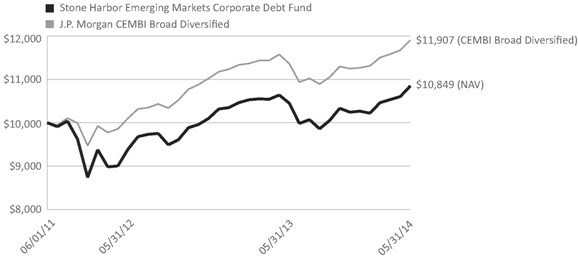

STONE HARBOR EMERGING MARKETS CORPORATE DEBT FUND

Comparison of Change in Value of $10,000 Investment in Stone Harbor Emerging Market Corporate Debt Fund and the J.P. Morgan Corporate Emerging Market Bond Index – Broad Diversified (J.P. Morgan CEMBI Broad Diversified).

The J.P. Morgan CEMBI Broad Diversified tracks total returns of U.S. dollar-denominated debt instruments issued by corporate entities in emerging market countries and consists of an investable universe of corporate bonds. The CEMBI Broad Diversified limits the weights of those index countries with larger corporate debt stocks by only including a specified portion of these countries’ eligible current face amounts of debt outstanding.

Average Annual Total Returns (Inception, June 1, 2011)

| 1 Year | Since Inception | |||

| Stone Harbor Emerging Markets Corporate Debt Fund |

3.80% | 2.75% | ||

| J.P. Morgan CEMBI Broad Diversified |

4.78% | 5.99% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. Average annual total returns reflect the reinvestment of dividends and capital gains distributions and include all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. The performance data quoted does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Index returns do not include the effects of sales charges, management fees or transaction costs. It is not possible to invest directly in an index.

| 18 |

www.shiplp.com |

Table of Contents

| Stone Harbor Investment Funds | Growth of $10,000 Investment | |

| May 31, 2014 (Unaudited) |

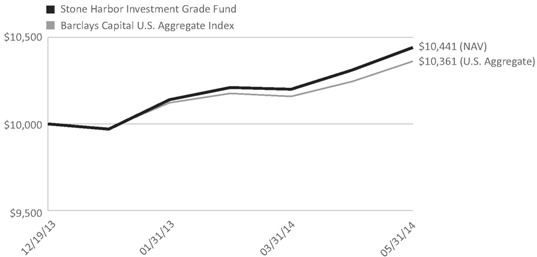

STONE HARBOR INVESTMENT GRADE FUND

Comparison of Change in Value of $10,000 Investment in Stone Harbor Investment Grade Fund and the Barclays Capital U.S. Aggregate Index.

The Barclays Capital U.S. Aggregate Index represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. These major sectors are subdivided into more specific indices that are calculated and reported on a regular basis.

Cumulative Returns (Inception, December 19, 2013)

| 1 Month | 3 Months | Since Inception | ||||

| Stone Harbor Investment Grade Fund |

1.27% | 2.26% | 4.41% | |||

| Barclays Capital U.S. Aggregate Index |

1.14% | 1.82% | 3.61% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. Average annual total returns reflect the reinvestment of dividends and capital gains distributions and include all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. The performance data quoted does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Index returns do not include the effects of sales charges, management fees or transaction costs. It is not possible to invest directly in an index.

| Stone Harbor Investment Funds Annual Report | May 31, 2014 | 19 |

Table of Contents

| Stone Harbor Investment Funds | Growth of $10,000 Investment | |

| May 31, 2014 (Unaudited) |

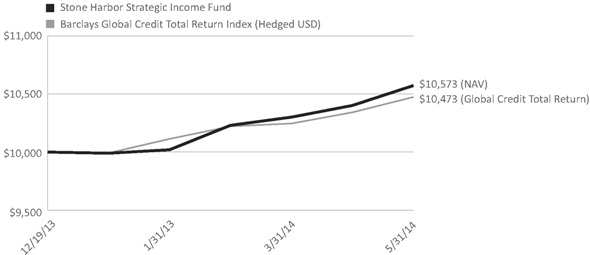

STONE HARBOR STRATEGIC INCOME FUND

Comparison of Change in Value of $10,000 Investment in Stone Harbor Strategic Income Fund and the Barclays Global Credit Total Return Index (Hedged USD).

Barclays Global Credit Total Return Index is a subset of the Global Aggregate Index and is subject to the same quality, liquidity, and maturity requirements and exclusion rules of the latter. Constituents must be rated investment grade by at least two of the three major ratings agencies. Constituents must have a remaining maturity of at least one year. The index does not include convertibles, floating-rate notes, fixed-rate perpetuals, warrants, linked bonds, and structured products.

Cumulative Returns (Inception, December 19, 2013)

| 1 Month | 3 Months | Since Inception | ||||

| Stone Harbor Strategic Income Fund |

1.65% | 3.34% | 5.73% | |||

| Barclays Global Credit Total Return Index (Hedged USD) |

1.27% | 2.46% | 4.73% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. Average annual total returns reflect the reinvestment of dividends and capital gains distributions and include all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. The performance data quoted does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Index returns do not include the effects of sales charges, management fees or transaction costs. It is not possible to invest directly in an index.

| 20 |

www.shiplp.com |

Table of Contents

| Stone Harbor Investment Funds | Report of Independent Registered Public Accounting Firm | |

To the Shareholders and Board of Trustees of Stone Harbor Investment Funds:

We have audited the accompanying statements of assets and liabilities of Stone Harbor Investment Funds (the “Funds”), comprising the Stone Harbor Emerging Markets Debt Fund, Stone Harbor High Yield Bond Fund, Stone Harbor Local Markets Fund, Stone Harbor Emerging Markets Corporate Debt Fund, Stone Harbor Investment Grade Fund, and Stone Harbor Strategic Income Fund, including the statements of investments, as of May 31, 2014, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the periods presented (as to the Stone Harbor Investment Grade Fund and the Stone Harbor Strategic Income Fund, the related statements of operations, statements of changes in net assets, and the financial highlights for the period from December 19, 2013 (commencement of operations) to May 31, 2014). These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Funds are not required to have, nor were we engaged to perform, an audit of their internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Funds’ internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of May 31, 2014, by correspondence with the custodian and brokers; where replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of each of the funds constituting the Stone Harbor Investment Funds as of May 31, 2014, and the results of their operations, the changes in their net assets, and the financial highlights for each of the periods presented, in conformity with accounting principles generally accepted in the United States of America.

DELOITTE & TOUCHE LLP

Denver, Colorado

July 28, 2014

| Stone Harbor Investment Funds Annual Report | May 31, 2014 | 21 |

Table of Contents

| Stone Harbor Emerging Markets Debt Fund | Statements of Investments | |

| May 31, 2014 |

| Currency | Rate |

Maturity Date |

Principal Amount* |

Market Value (Expressed in U.S. $) | ||||||||||||||||||||||

| SOVEREIGN DEBT OBLIGATIONS - 76.11% |

||||||||||||||||||||||||||

| Argentina - 2.59% |

||||||||||||||||||||||||||

| Republic of Argentina: |

||||||||||||||||||||||||||

| USD | 7.000 | % | 10/03/2015 | 19,617,948 | $ | 18,796,719 | ||||||||||||||||||||

| USD | 7.000 | % | 04/17/2017 | 39,319,137 | 35,951,889 | |||||||||||||||||||||

| USD | 8.750 | % | 06/02/2017 | 30,000 | 27,796 | |||||||||||||||||||||

| USD | 0.000 | % | 03/31/2023 | 184,000 | 138,690 | (1) | ||||||||||||||||||||

| USD | 6.000 | % | 03/31/2023 | 480,000 | 374,400 | (1) | ||||||||||||||||||||

| USD | 2.500 | % | 12/31/2038 | 2,497,000 | 1,063,098 | (2) | ||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

| 56,352,592 | ||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

| Azerbaijan - 0.77% |

||||||||||||||||||||||||||

| Republic of Azerbaijan |

USD | 4.750 | % | 03/18/2024 | 16,005,000 | 16,745,231 | (3) | |||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

| Brazil - 7.30% |

||||||||||||||||||||||||||

| Brazil Loan Trust 1 |

USD | 5.477 | % | 07/24/2023 | 19,576,715 | 20,580,022 | (3) | |||||||||||||||||||

| Brazil Minas SPE via State of Minas Gerais |

USD | 5.333 | % | 02/15/2028 | 1,479,000 | 1,484,546 | (4) | |||||||||||||||||||

| Republic of Brazil: |

||||||||||||||||||||||||||

| USD | 4.875 | % | 01/22/2021 | 10,712,000 | 11,791,234 | |||||||||||||||||||||

| USD | 2.625 | % | 01/05/2023 | 26,491,000 | 24,570,403 | |||||||||||||||||||||

| USD | 4.250 | % | 01/07/2025 | 47,658,000 | 48,611,160 | |||||||||||||||||||||

| USD | 8.750 | % | 02/04/2025 | 834,000 | 1,175,940 | |||||||||||||||||||||

| USD | 8.250 | % | 01/20/2034 | 12,755,000 | 17,761,337 | |||||||||||||||||||||

| USD | 7.125 | % | 01/20/2037 | 26,027,000 | 32,989,222 | |||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

| 158,963,864 | ||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

| Colombia - 4.40% |

||||||||||||||||||||||||||

| Bogota Distrio Capital |

COP | 9.750 | % | 07/26/2028 | 7,870,000,000 | 5,304,564 | (4) | |||||||||||||||||||

| Republic of Colombia: |

||||||||||||||||||||||||||

| COP | 12.000 | % | 10/22/2015 | 4,798,000,000 | 2,779,995 | |||||||||||||||||||||

| USD | 7.375 | % | 01/27/2017 | 1,838,000 | 2,122,890 | |||||||||||||||||||||

| USD | 7.375 | % | 03/18/2019 | 6,147,000 | 7,545,443 | |||||||||||||||||||||

| USD | 11.750 | % | 02/25/2020 | 3,935,000 | 5,751,002 | |||||||||||||||||||||

| COP | 7.750 | % | 04/14/2021 | 5,210,000,000 | 3,144,621 | |||||||||||||||||||||

| USD | 4.375 | % | 07/12/2021 | 14,872,000 | 16,061,760 | |||||||||||||||||||||

| USD | 2.625 | % | 03/15/2023 | 6,998,000 | 6,592,116 | |||||||||||||||||||||

| USD | 4.000 | % | 02/26/2024 | 14,139,000 | 14,633,865 | |||||||||||||||||||||

| USD | 8.125 | % | 05/21/2024 | 25,000 | 33,781 | |||||||||||||||||||||

| COP | 9.850 | % | 06/28/2027 | 8,281,000,000 | 5,854,029 | |||||||||||||||||||||

| USD | 10.375 | % | 01/28/2033 | 2,006,000 | 3,169,480 | |||||||||||||||||||||

| USD | 7.375 | % | 09/18/2037 | 14,759,000 | 20,090,689 | |||||||||||||||||||||

| USD | 6.125 | % | 01/18/2041 | 387,000 | 463,916 | |||||||||||||||||||||

| USD | 5.625 | % | 02/26/2044 | 1,969,000 | 2,220,048 | |||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

| 95,768,199 | ||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

| Costa Rica - 1.26% |

||||||||||||||||||||||||||

| Republic of Costa Rica: |

||||||||||||||||||||||||||

| USD | 4.250 | % | 01/26/2023 | 13,395,000 | 12,993,150 | (4) | ||||||||||||||||||||

| USD | 4.375 | % | 04/30/2025 | 3,806,000 | 3,558,610 | (3) | ||||||||||||||||||||

| USD | 7.000 | % | 04/04/2044 | 10,442,000 | 10,964,100 | (3) | ||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

| 27,515,860 | ||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

| Croatia - 3.14% |

||||||||||||||||||||||||||

| Croatian Government: |

||||||||||||||||||||||||||

| USD | 6.750 | % | 11/05/2019 | 14,135,000 | 15,901,875 | (4) | ||||||||||||||||||||

| USD | 5.500 | % | 04/04/2023 | 15,339,000 | 16,048,429 | (4) | ||||||||||||||||||||

| 22 |

www.shiplp.com |

Table of Contents

| Stone Harbor Emerging Markets Debt Fund | Statements of Investments | |

| May 31, 2014 |

| Currency | Rate |

Maturity Date |

Principal Amount* |

Market Value (Expressed in U.S. $) | ||||||||||||||||||||||

| Croatia (continued) |

||||||||||||||||||||||||||

| Croatian Government: (continued) |

||||||||||||||||||||||||||

| USD | 6.000 | % | 01/26/2024 | 33,840,000 | $ | 36,420,300 | (3) | |||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

| 68,370,604 | ||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

| Dominican Republic - 2.43% |

||||||||||||||||||||||||||

| Dominican Republic: |

||||||||||||||||||||||||||

| USD | 9.040 | % | 01/23/2018 | 12,697,768 | 13,951,673 | (4) | ||||||||||||||||||||

| USD | 7.500 | % | 05/06/2021 | 27,015,000 | 31,202,325 | (4) | ||||||||||||||||||||

| USD | 5.875 | % | 04/18/2024 | 3,278,000 | 3,425,510 | (3) | ||||||||||||||||||||

| USD | 7.450 | % | 04/30/2044 | 4,091,000 | 4,428,507 | (3) | ||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

| 53,008,015 | ||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

| El Salvador - 1.22% |

||||||||||||||||||||||||||

| Republic of El Salvador: |

||||||||||||||||||||||||||

| USD | 7.375 | % | 12/01/2019 | 220,000 | 247,500 | (3) | ||||||||||||||||||||

| USD | 7.375 | % | 12/01/2019 | 2,068,000 | 2,326,500 | (4) | ||||||||||||||||||||

| USD | 7.750 | % | 01/24/2023 | 4,320,000 | 4,924,800 | (4) | ||||||||||||||||||||

| USD | 5.875 | % | 01/30/2025 | 304,000 | 302,480 | (4) | ||||||||||||||||||||

| USD | 5.875 | % | 01/30/2025 | 4,407,000 | 4,384,965 | (3) | ||||||||||||||||||||

| USD | 8.250 | % | 04/10/2032 | 1,000,000 | 1,140,000 | (4) | ||||||||||||||||||||

| USD | 7.650 | % | 06/15/2035 | 12,399,000 | 13,204,935 | (4) | ||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

| 26,531,180 | ||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

| Gabon - 0.07% |

||||||||||||||||||||||||||

| Republic of Gabon: |

||||||||||||||||||||||||||

| USD | 8.200 | % | 12/12/2017 | 50,000 | 57,625 | (3) | ||||||||||||||||||||

| USD | 6.375 | % | 12/12/2024 | 1,258,000 | 1,386,945 | (3) | ||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

| 1,444,570 | ||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

| Ghana - 0.31% |

||||||||||||||||||||||||||

| Republic of Ghana |

USD | 8.500 | % | 10/04/2017 | 6,336,000 | 6,738,336 | (4) | |||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

| Honduras - 0.02% |

||||||||||||||||||||||||||

| Honduras Government |

USD | 7.500 | % | 03/15/2024 | 460,000 | 471,500 | (4) | |||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

| Hungary - 2.52% |

||||||||||||||||||||||||||

| Republic of Hungary: |

||||||||||||||||||||||||||

| GBP | 5.000 | % | 03/30/2016 | 670,000 | 1,175,720 | |||||||||||||||||||||

| EUR | 4.375 | % | 07/04/2017 | 7,000 | 10,149 | |||||||||||||||||||||

| USD | 6.250 | % | 01/29/2020 | 2,491,000 | 2,809,549 | |||||||||||||||||||||

| USD | 6.375 | % | 03/29/2021 | 27,838,000 | 31,669,901 | |||||||||||||||||||||

| USD | 5.750 | % | 11/22/2023 | 9,410,000 | 10,305,832 | |||||||||||||||||||||

| USD | 5.375 | % | 03/25/2024 | 8,374,000 | 8,928,820 | |||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

| 54,899,971 | ||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

| Indonesia - 6.70% |

||||||||||||||||||||||||||

| Republic of Indonesia: |

||||||||||||||||||||||||||

| USD | 6.875 | % | 01/17/2018 | 9,123,000 | 10,468,642 | (4) | ||||||||||||||||||||

| USD | 11.625 | % | 03/04/2019 | 2,170,000 | 2,978,325 | (3) | ||||||||||||||||||||

| USD | 11.625 | % | 03/04/2019 | 18,110,000 | 24,855,975 | (4) | ||||||||||||||||||||

| IDR | 7.875 | % | 04/15/2019 | 59,940,000,000 | 5,198,223 | |||||||||||||||||||||

| USD | 5.875 | % | 03/13/2020 | 2,977,000 | 3,345,404 | (4) | ||||||||||||||||||||

| USD | 4.875 | % | 05/05/2021 | 8,484,000 | 9,003,645 | (4) | ||||||||||||||||||||

| USD | 3.750 | % | 04/25/2022 | 418,000 | 410,685 | (4) | ||||||||||||||||||||

| IDR | 7.000 | % | 05/15/2022 | 16,100,000,000 | 1,299,722 | |||||||||||||||||||||

| USD | 3.375 | % | 04/15/2023 | 22,727,000 | 21,391,789 | (3) | ||||||||||||||||||||