Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22037

Stone Harbor Investment Funds

(Exact name of registrant as specified in charter)

1290 Broadway, Suite 1100

Denver, CO 80203

(Address of principal executive offices) (Zip code)

Adam J. Shapiro, Esq.

c/o Stone Harbor Investment Partners LP

31 West 52nd Street, 16th Floor

New York, NY 10019

(Name and address of agent for service)

With copies To:

John M. Loder, Esq.

Ropes & Gray LLP

One International Place

Boston, MA 02110-2624

Registrant’s telephone number, including area code: (303) 623-2577

Date of fiscal year end: May 31

Date of reporting period: June 1, 2011 - November 30, 2011

Table of Contents

Item 1. Report to Stockholders.

Table of Contents

Table of Contents

| Stone Harbor Investment Funds | Table of Contents | |

| November 30, 2011 (Unaudited) |

| 2 | ||

| 7 | ||

| 8 | ||

| 10 | ||

| 14 | ||

| 53 | ||

| 54 | ||

| 55 | ||

| 57 | ||

| 61 | ||

| 71 | ||

Table of Contents

| Stone Harbor Investment Funds | Shareholder Letter | |

| November 30, 2011 (Unaudited) |

Dear Shareholder,

On balance, 2011 was a challenging year for global fixed income markets. Hopes for a continuation of 2010’s economic recovery waned, as convincing signs of a slowdown in global growth surfaced by mid-year. Markets became overwhelmed by the risks of mounting fiscal deficits in developed nations and the inability of politicians to offer acceptable solutions. Fears of European sovereign debt defaults and the capital insufficiency of the Continent’s banks caused markets to become extremely volatile. Investors fled from “risky” assets, seeking the safety of Treasuries and the US dollar. As the year closed, signs of a resolution to the European debt crisis began to surface, and prospects for muted growth in the US economy were revived.

As we look toward 2012, corporate earnings in the US continue to be strong and growth rates in developing nations remain well ahead of those in the developed world. We believe this will provide a favorable backdrop for our specialty asset classes of emerging markets and high yield fixed income. Particularly in these turbulent markets, we thank you for your confidence in Stone Harbor Investment Partners LP, as together we cautiously navigate the shifting currents of global de-leveraging and economic recovery.

Market Overview

The growing contagion in Europe and the inescapable reality of a global economic slowdown dominated the performance of risk assets in the second half of 2011. The inability to resolve a restructuring of Greek debt became the primary catalyst for wider concerns, as official institutions and leaders of the European Union (EU) failed to react with the urgency necessary to contain the crisis. EU governance issues raised doubts of the effectiveness of existing mechanisms like the European Financial Stability Facility (ESFS) to insure the fiscal stability of larger, more meaningful economies like Spain, Italy and France. A deteriorating growth outlook for the region prompted further ratings downgrades to Greece, Portugal, Ireland and Italy, as well as to several prominent French banks, exacerbating global concerns over the health of the European banking system. Expressing evidence of risk aversion, country spreads gapped out significantly. Flight-to-quality moves culminating in a late summer sell-off in global equities coupled with a material spread widening across fixed income sectors to levels not seen since 2009. US Treasury prices surged, rallying nearly 100 basis points (“bps”) in the August-September period. In the fall, plans for a coordinated effort to recapitalize troubled banks materialized, and investors grew cautiously optimistic that Europe might be moving closer to a resolution of its debt crisis. The unveiling of a comprehensive debt deal at the conclusion of the EU summit in October fueled a brief rally, but market momentum dissipated once again at the end of the reporting period, as rescue efforts fell short of expectations.

The outlook for global growth was another key concern throughout the period, with continuing downward revisions contributing to negative market sentiment. The pressure of pending austerity measures taken across the developed economies caused the OECD to lower its growth forecast to 1.9% in 2011 and 1.6% in 2012, from 2.3% and 2.8% predicted in May. In recognition of the global pull-back, the Bundesbank also slashed its estimate of Germany’s economic growth for 2012 from 1.8% to 0.75%. By November, in the latest attempt to provide stimulus and liquidity, the Federal Reserve joined forces with five other central banks to decrease the cost of emergency funds for European banks as part of a globally coordinated response to the sovereign debt crisis. On the same day, China also eased bank reserve requirements for the first time since 2008, hoping to counteract the negative impact on its exports stemming from Europe’s turmoil1.

On the domestic front, the US economy sputtered along on an uneven path, beginning with a soft patch in economic data lasting through mid-year, followed by a downgrade of the US’ credit rating by Standard & Poor’s in August. The downgrade reflected the inability of the US Congress to deal with the nation’s debt problems. By late summer disappointing GDP numbers and a pullback in market momentum led to a downward revision by the Federal Reserve to its outlook for US economic growth in 2012. In September, the Federal Reserve announced QE II, a new version of “Operation Twist2 intended to push down longer term interest rates. Further, it committed to maintaining very low rates “at least until mid-2013”. Market sentiment recovered slightly as the FOMC reported that economic growth in the third quarter “strengthened somewhat” but warned of “significant downside risks to the economic outlook”. From a market perspective, the debt ceiling deadlock also weighed heavily on investors; the failure of the super committee to come to an agreement on budget cuts has triggered $1.2 trillion in automatic cuts to US spending programs beginning in 2013. Considering the slack in economic fundamentals at the beginning of the reporting period, the domestic economy surprisingly remains the one bright spot heading into year-end, as it continues on a path of slow growth with improving unemployment numbers, higher retail sales, positive corporate earnings and better although muted housing starts. Instilling further optimism, US productivity rose in the third quarter for the first time in a year, and consumer confidence in November climbed to its highest level in eight years.

Looking generally at the performance of credit markets during the six-month period ended November 30, risk aversion was the continuous theme. As represented by the Citigroup High Yield Market Index3, high yield spreads began the period at 526 bps and subsequently see-sawed, widening to a level of 873 bps in early October before shedding some losses to end at 748 bps. The average yield during that time increased from 6.79% to 8.57%. Despite the fact that corporate earnings remained strong, default rates continued at low levels, and that refinancing risks had been significantly reduced, investors nonetheless sought the safety of Treasuries and other low risk assets.

| 2 | www.shiplp.com | |

Table of Contents

| Stone Harbor Investment Funds | Shareholder Letter | |

| November 30, 2011 (Unaudited) |

Credit spreads for emerging markets external debt (hard currency) also widened, but due to strong technical factors, this market did not suffer as much as corporate high yield. The yield spread on the JP Morgan Emerging Markets Bond Index (EMBI) Global Diversified4 went from 290 bps to 396 bps during the six months ending November 30, although it reached a period wide of 468 bps on October 4. Returns for external debt were also buoyed by the huge rally in US Treasuries during the period. The emerging local currency debt markets, however, did not fare as well. In late summer investors flocked to dollar assets in risk reduction moves, and investors in local currencies suffered significantly. Even though local interest rates remained stable, the benchmark JP Morgan Emerging Markets Government Bond Index-Emerging Markets (GBI-EM) Global Diversified5 was significantly affected by large currency losses. Emerging markets corporate debt also suffered sharp declines, most notably in the higher yielding component of the index6.

Looking forward into 2012, we are optimistic that European policymakers will eventually solve their debt crisis. We believe that European leaders will conclude that the concept of a common currency is not viable without some form of consolidation of fiscal authority among its member states. We further believe, however, that Europe is headed into a recession, as significant headwinds from deficit reduction and fiscal reform will continue to stifle economic growth in the euro zone in the near-term.

In emerging markets, we think that China’s ability to engineer a soft landing for its economy will be significantly aided by policies that favor continued, unprecedented levels of government investment to support growth, particularly in the upcoming year, which features a transition in political leadership. While we expect growth in other emerging countries to slow from last year’s pace, our forecasts suggest that growth, as well as the policy flexibility in many emerging countries will continue to strongly support the case for investing in emerging debt markets.

In the United States, we believe that the economy is on its way toward a slow recovery. In our view, US interest rates are likely to remain low for an extended period of time; corporate profits should continue to be strong, and the economy may benefit from further monetary accommodation. We believe that these conditions would provide an excellent environment for investing in the high yield asset class.

At Stone Harbor, we will continue to focus on seeking to capture excess return from stable and improving credit situations in corporate and sovereign markets worldwide. We remain vigilant to the credit risks associated with the systematic banking problems in Europe, as well as the slowdown in global growth. To monitor our thinking throughout the year, please visit our website at www.shiplp.com.

Performance Overview

Stone Harbor Emerging Markets Corporate Debt Fund

The Stone Harbor Emerging Markets Corporate Debt Fund return since inception June 1, 2011 to November 30, 2011 was -10.19% (net of expenses) and -9.69% (gross of expenses). This compares to a benchmark return of -2.25% for the JP Morgan Corporate Emerging Markets Bond Index Broad Diversified (CEMBI Broad Diversified) and a return of -8.27% for the high yield segment of the index. During this period, sovereign and corporate debt spreads in most countries widened, reflecting rising macroeconomic risks. The reporting period was marked by significant volatility in fixed income markets, as investors reacted to a global slowdown in growth, an escalating sovereign debt and financial crisis in Europe and fears of a hard landing of the Chinese economy. Emerging market corporate bonds came under significant pressure, particularly in September, as concerns intensified over the solvency of major European banks.

The portfolio favored high yield credits that, in our view, benefit from pricing and rating inefficiencies due, in part, to sovereign ceiling constraints. Many of these companies are also commodity producers in sub-investment grade countries, companies positioned to profit from domestic consumption in higher growth economies, as well as companies which are de-leveraging either organically or via Merger & Acquisition (“M&A”) activity. Throughout the period, the benchmark weighting of investment grade versus non-investment grade securities was approximately 70% investment grade, 30% non-investment grade. At the start of June, approximately 20% of the portfolio was invested in investment grade assets. The portfolio managers increased the investment grade weighting to approximately 30% by the end of June/early July to manager risk. Declining liquidity and the team’s assessments on valuations, however, prevented a further shift into perceived safer assets before the significant market declines in August and September. In August, the sub-investment grade sector of the CEMBI declined by over 4%, and in September it dropped over 10%. Investment grade emerging market corporate bond performance was +0.32% and -3.06% in August and September, respectively.

While a deteriorating fundamental macroeconomic backdrop in developed markets was the most important determinant of market sentiment in emerging market corporates, credit developments in certain sectors and countries also weighed on market sentiment. Reports of declining property prices in tier I cities in China, a result of policies intended to reduce property sales volumes and prices, increased fears of a broader decline in credit quality in the real estate development and management sector. The market also had absorbed significant supply of new issues in this sector earlier in the year, a technical factor that exacerbated downward price movements in less liquid markets. In Kazakhstan, June mid-year reports from BTA bank revealing that the government-supported bank had more aggressive loan loss provisioning and lower recoveries on assets held outside the country than expected by the market triggered a downturn in BTA bonds that continued through the end of the period. Mexico’s cement sector, which relies heavily on the US market, also came under significant pressure as investors factored in the possibility of substantially slowing growth in the US.

| Stone Harbor Investment Funds Semi-Annual Report | November 30, 2011 |

3 | |

Table of Contents

| Stone Harbor Investment Funds | Shareholder Letter | |

| November 30, 2011 (Unaudited) |

Technical factors also clearly weighed on the corporate bond market during the period. Year-to-date through November 30, over $180 billion in new corporate bonds were priced and issued7. In addition, proposed regulations on bank trading operations, intended to reduce the systematic importance of large banks, have likely reduced willingness among dealers to participate as actively as they had in the past in supporting two-way markets. These factors, in our view, require a longer time horizon for investing in what we believe is a strong secular improving story in emerging market corporate credit.

Stone Harbor Emerging Markets Debt Fund

The Stone Harbor Emerging Markets Debt Fund return for the six months ended November 30, 2011 was 0.17% (net of expenses) and 0.54% (gross of expenses). This compares to a benchmark return of 2.25% for the JP Morgan Emerging Markets Bond Index Global Diversified. During this period, emerging market sovereign credit spreads in all of the countries within the benchmark widened, reflecting rising macroeconomic risks, but also the move lower in US Treasury yields despite a downgrade by Credit Rating Agency, Standard & Poor’s of the US Treasury debt rating on August 5. The reporting period was marked by significant volatility in fixed income markets as investors reacted to a global slowdown in growth, an escalating sovereign debt and financial crisis in Europe and fears of a hard landing of the Chinese economy. Emerging market currencies and corporate bonds came under significant pressure, particularly in September, as concerns intensified over the solvency of major European banks.

The portfolio continued to favor select high beta sovereigns that, in our opinion, have strong valuation support, as well as both proven capacity and willingness to pay their debts. These countries include Argentina, Iraq and Venezuela, three of the market’s highest beta sovereign credits. In addition, the portfolio has maintained an allocation to local currency debt in several countries where we continue to see potential for outperformance relative to the sovereign US dollar-denominated bonds in our benchmark. The portfolio was also positioned for an improving environment for corporate prosperity in many key emerging markets. Tactical allocations to select corporate bonds increased throughout the period in recognition of attractive corporate debt valuations, and because of our opportunistic view on the potential for spread compression in many corporate credits. The additions to our corporate allocation were made with a long-term perspective, following the market’s sharp corrections in August and September. Corporate investments in the portfolio focused on commodity producers in sub-investment grade countries, on companies positioned to profit from domestic consumption in higher growth economies and on other companies, which are de-leveraging either organically or via M&A activity.

The path of total returns for the three major sectors of the emerging debt markets – external sovereign debt, local currency debt and corporate debt – reflected how markets reconciled the conflicting cross winds of strong fundamental macroeconomic performance in emerging markets with weakening growth and deteriorating fiscal accounts in many advanced economies. External sovereign debt market total returns remained positive for the period until mid-September, when spread widening offset the benefits of falling US Treasury rates. Corporate debt total returns began to fall earlier in the period, particularly at the end of August, as demand for corporate risk globally declined on fears of the possibility for a globally synchronized recession. But it was the local currency markets, and more particularly foreign exchange markets, that absorbed the brunt of the market’s volatility, as investors sharply reduced short US dollar positions in August, seeking liquidity. Importantly, in local currency terms, local bond markets in many countries fared relatively well, as interest rates fell along with the global trend. All three sectors of the market recovered in October but softened again in mid- November on fears that European policymakers would fail to make the difficult decisions required to ensure a more fiscally viable euro zone.

Technical factors also were important during the period, which was marked by high volatility and lower-than-normal liquidity, particularly for corporate debt. The uncertainty posed by the prospect of new regulations intended to reduce the systematic importance of individual large banks forced many trading desks to limit position-taking. In particular, as sellers of corporate debt surfaced after June, the supply was met with little support from dealer desks, further exacerbating downward price movements.

Key contributors to the Fund’s underperformance relative to the benchmark were the allocations to corporate debt and active positions in local currencies in several countries. Security selection supported performance, with particularly good decisions in Argentina and Venezuela. Our overweight in Iraq and our allocation to the Mexican peso were the largest detractors from performance, while our underweight in Hungary was the largest positive contributor.

Stone Harbor Local Markets Fund

The Stone Harbor Local Markets Fund return for the six months ended November 30, 2011 was –5.97% (net of expenses) and –5.53% (gross of expenses). This compares to a benchmark return of –6.32% for the JP Morgan Global Bond Index-Emerging Markets Global Diversified. Emerging local currency debt markets underperformed all other emerging debt markets in US dollar terms except for non-investment grade corporate bonds, with the principal driver of weakness being the depreciation of local currencies relative to the US dollar. Importantly, most local bond market yields

| 4 | www.shiplp.com | |

Table of Contents

| Stone Harbor Investment Funds | Shareholder Letter | |

| November 30, 2011 (Unaudited) |

remained stable or moved lower, and contributed positively to total returns. The reporting period was marked by significant volatility in fixed income markets as investors reacted to a global slowdown in growth, an escalating sovereign debt and financial crisis in Europe and fears of a sharp pullback in China. While we remained optimistic on the ability of emerging market policymakers to navigate the market turbulence, we partially hedged foreign exchange exposure in select countries in August, a move which enhanced returns. At the end of the reporting period, however, all foreign exchange exposure remained unhedged, reflecting a cautiously optimistic outlook for the months ahead.

Throughout the reporting period, the portfolio favored faster growing economies in Latin America and Asia, with overweight allocations in Brazil, Colombia, Mexico, China, Indonesia and Malaysia. The portfolio’s underweight positions have been concentrated in Central and Eastern Europe, where a mix of more limited growth prospects and short-term policymaking have reduced the attractiveness of local debt markets, in our view. Sharp depreciations of the Turkish lira and Hungarian forint, as well as increases in local bond yields in both countries in September led to tactical reductions in our underweights in the local bond markets from both of these countries, with the change in Turkey the most pronounced. While we have disliked the policy mix in Turkey, the Central Bank of Turkey has reversed its policy of cutting rates in the face of rising inflation, lending important support to the lira. The portfolio has also maintained underweights in Thailand and Peru, both countries with difficult politics. In addition to the fallout in tourism revenue due to wide-scale flooding, Thailand’s markets must also contend with a vacuum in leadership should the ageing Thai king die. In Peru, yields are too low, in our estimation, given the possibility that recently elected President Humala tacks toward his populist campaign agenda, limiting growth potential in the key metals and mining industries.

The reporting period was also characterized by rising frustration due to the plodding of leaders of the euro zone toward necessary political and economic integration. The implications of euro zone policies toward this issue are significant not only for Europe, but also for the global economy. As of the end of November, Europeans, with the aid of US policymakers, seem to be on their way, at least, toward recognition of the need for a closer fiscal union in Europe that may stabilize markets. The improvement in local bond markets at the end of November appears to be the result of these developments.

Signs of a deceleration in inflation began mid-year, a significant change from earlier in the reporting period when most local bond markets forecast higher interest rates on the back of rising inflation expectations. Part of this change, we believe, was a function of policy normalization in many key economies, but also due to the global economic slowdown. While several central banks from emerging countries hiked policy rates during the period, the trend toward lowering rates to spur the economy gained traction in August, as Brazil cut rates in a surprise move. In September, Indonesia also lowered its central bank’s overnight lending rate. And, in November, China reduced its reserve requirement ratio for banks to ease liquidity in the banking system. Throughout this period, the fear that central banks had fallen behind the curve in their willingness to ward off inflation with stringent monetary policy significantly diminished, providing support for local bond markets.

The sources of the Fund’s outperformance relative to its benchmark included both country selection and issue selection decisions. The most important positive contributor to performance was our decision to underweight Hungary. Our decision to allocate to long duration bonds in Brazil and Colombia was also a strong contributor to excess returns over the benchmark. The key positions which detracted from performance were our underweight of Peru and Thailand. Our decision to avoid the longest part of the local bond curve in Indonesia also detracted from performance, as Indonesia’s bond yields fell sharply in a bull flattening of the yield curve.

Stone Harbor High Yield Bond Fund

The Stone Harbor High Yield Bond Fund return for the six months ended November 30, 2011 was -4.66% (net of expenses) and -4.39% (gross of expenses). This compares to a benchmark return of -2.69% for the Citigroup High Yield Market Capped Index. The period under review was generally a difficult one for high yield, as well as all fixed income asset classes, as fears of growing contagion in Europe combined with the inability to determine the magnitude of a global economic slowdown led to renewed risk aversion.

A significant downgrade to Greece sovereign debt was the catalyst for deepening concerns of the impact of the debt crisis on the European banking system. Mounting evidence of a slowdown in global growth reflected in a sharp decline in manufacturing activity added to the uneasiness. In July, a bailout package for Greece, including expanded European Financial Stability Facility (EFSF) powers to purchase euro zone sovereign debt and strong domestic corporate earnings restored investor confidence and buffered high yield bond prices. By mid-summer, however, the global financial markets began to experience an extreme rise in overall volatility. Rating agency downgrades to sovereign debt (including the US and Italy) and several prominent French banks, political brinkmanship in the US over the debt ceiling debate, weak economic numbers out of Europe and China and the Federal Reserve’s (“Fed”) warning of “significant downside risks to the economic outlook including strains in global markets” resulted in material price depreciation. Negative market sentiment culminated in a fresh 52-week low for the S&P 500, a US Treasury rally that sent 10-year yields below two percent and material credit spread widening in high yield, to levels not seen since 2009.

A relief rally occurred in the month of October as new initiatives were introduced to contain the European sovereign debt and banking crisis. Improving US economic data and positive corporate earnings rendered further stability to a technically oversold high yield market. Market sentiment soured, as investors began to question the viability of Europe’s latest debt deal in light of continued economic weakness, this time in

| Stone Harbor Investment Funds Semi-Annual Report | November 30, 2011 |

5 | |

Table of Contents

| Stone Harbor Investment Funds | Shareholder Letter | |

| November 30, 2011 (Unaudited) |

Italy, the largest of the periphery countries, and to a lesser extent in some core countries. High debt levels and weak growth potential in Italy sparked a sell-off in the country’s debt, with 10-year bond yields trading at unsustainable levels over the long-term. Concerns regarding the world economy intensified as the 34-nation OECD lowered growth forecasts to 1.9% this year and 1.6% next year, down from 2.3% and 2.8% predicted in May1. Unexpectedly, on the last day of the reporting period, the Fed led a globally coordinated central bank response to Europe’s sovereign debt crisis, which, coupled with upside surprise in US economic fundamentals, boosted demand for risk assets.

Looking forward we remain optimistic that the US economy will continue to experience a period of slow expansion. We are encouraged by strong corporate earnings, an improving economic backdrop and the possibility of additional monetary stimulus. On a less positive note, we believe that Europe is headed into a recession, as significant headwinds from deficit reduction and fiscal reform will continue to stifle economic growth in the near-term. We remain vigilant to the sovereign and systematic banking problems in Europe, as well as the slowing of growth worldwide. However, we believe that current spread levels and low default rates continue to favor the high yield market, where companies have conservatively leveraged balance sheets and adequate liquidity after terming out maturities over the past several years.

Sincerely,

Thomas W. Brock

Chairman of the Board of Trustees

1 Source: Bloomberg.

2 Operation Twist is a policy, originally from the 1960’s but revived in September 2011, implemented by the Federal Reserve, which involves the selling of short-term Treasuries by the central bank in exchange for the same amount in longer-term bonds, thereby lowering longer-term interest rates.

3 The Citigroup High Yield Market Index (previously the Salomon Smith Barney High Yield Market Index) is a total rate-of-return index which captures the performance of below investment-grade debt issued by corporations domiciled in the United States or Canada. This index comprises Citigroup’s broadest market measure and includes cash-pay and deferred-interest securities. All the bonds in the high-yield indices are publicly placed, have a fixed coupon and are non-convertible. Source: Citigroup Index LLC.

4 The JP Morgan Emerging Markets Bond Index (EMBI) Global Diversified tracks total returns for U.S. dollar-denominated debt instruments issued by emerging markets sovereign and quasi-sovereign entities: Brady bonds, loans, and Eurobonds. Source: JP Morgan Chase.

5 The JP Morgan Government Bond Index – Emerging Markets (GBI-EM) Global Diversified consists of regularly traded, liquid fixed-rate, domestic currency government bonds to which international investors can gain exposure. The weightings among the countries are more evenly distributed within this index. Although not expected to be a principal investment tool, the Portfolio may make use of derivative securities (including futures and options on securities, securities indices or currencies, options on futures, forward currency contracts, and interest rate, currency or credit default) for the purposes of reducing risk and/or obtaining efficient investment exposure. Source: JP Morgan Chase.

6 Emerging markets corporate debt is represented by JP Morgan Corporate Emerging Markets Bond Index (CEMBI) Broad Diversified. The CEMBI tracks total returns of US dollar-denominated debt instruments issued by corporate entities in Emerging Markets countries. Two variations are available: CEMBI Broad and CEMBI. The CEMBI Broad is the most comprehensive corporate benchmark followed by the CEMBI, which consists of an Investable universe of corporate bonds. Both indices are also available in Diversified version. The JPMorgan CEMBI Broad Diversified limits the current face amount allocations of the bonds. Both indices are also available in outstanding countries with larger debt stocks. Qualifying corporate bonds have a face amount greater than USD 300 million, maturity greater than 5 years, verifiable prices and cash flows, and from countries within Asia ex-Japan, Latin America, Eastern Europe, Middle East, and Africa.

7 Source: Bloomberg, JP Morgan.

Beta - is a measurement of the systematic risk of a security or a portfolio in comparison to the market as a whole or a benchmark. A beta of 1.0 implies up and down movements of roughly the same magnitude as the market or the benchmark. A higher beta indicates that the security or portfolio is more volatile than the market or the respective benchmark.

Contagion - refers to the likelihood that significant economic changes in one country will spread to other countries.

The Deutsche Bundesbank - is the central bank of the Federal Republic of Germany.

The Federal Open Market Committee (FOMC) - is a committee within the Federal Reserve System that is charged under United States law with overseeing the nation’s open market operations.

Investment grade - refers to bonds that have a relatively low risk of default, ranging from highest credit quality to good credit quality. Bonds rated below investment grade are considered to have significant speculative characteristics.

The Organization for Economic Co-operation and Development (OECD) - has 34 member nations worldwide, was established in 1961 to promote policies that will improve the economic and social well-being of people around the world.

Sovereign debt - refers to bonds issued by a national government in order to finance the issuing country’s growth. Sovereign debt described as external is denominated in US dollar, while sovereign debt described as local is issued in a foreign currency.

Spread - refers to the yield spread of a bond over the US Treasury yield curve.

The Standard & Poor’s 500 Index (S&P 500) - is free-float capitalization-weighted index of the prices of 500 large-capitalization common stocks actively traded in the US.

It is not possible to invest directly in an index.

| 6 | www.shiplp.com | |

Table of Contents

| Stone Harbor Investment Funds | Disclosure of Fund Expenses | |

| (Unaudited) |

Example. As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and/or redemption fees (if applicable) and (2) ongoing costs, including management fees and other Fund expenses. The below examples are intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on June 1, 2011 and held until November 30, 2011.

Actual Expenses. The first line of each table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line of each table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect transactional costs, such as redemption fees, sales charges (loads) or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning Account Value 06/01/2011 |

Ending Account Value 11/30/2011 |

Expense Ratio(1) |

Expenses Paid During Period(2) |

|||||||||||||

| STONE HARBOR EMERGING MARKETS DEBT FUND |

||||||||||||||||

| Institutional Class |

||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,001.70 | 0.73 | % | $ | 3.65 | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,021.35 | 0.73 | % | $ | 3.69 | ||||||||

| STONE HARBOR HIGH YIELD BOND FUND |

||||||||||||||||

| Institutional Class |

||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 953.40 | 0.55 | % | $ | 2.69 | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,022.25 | 0.55 | % | $ | 2.78 | ||||||||

| STONE HARBOR LOCAL MARKETS FUND |

||||||||||||||||

| Institutional Class |

||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 940.30 | 0.88 | % | $ | 4.27 | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,020.60 | 0.88 | % | $ | 4.45 | ||||||||

| STONE HARBOR EMERGING MARKETS CORPORATE DEBT FUND |

||||||||||||||||

| Institutional Class |

||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 898.10 | 1.00 | % | $ | 4.75 | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,020.00 | 1.00 | % | $ | 5.05 | ||||||||

| (1) | Annualized, based on the Fund’s most recent fiscal half-year expenses. |

| (2) | Expenses are equal to the Fund’s annualized ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (183), divided by 366. Note this expense example is typically based on a six-month period. |

| Stone Harbor Investment Funds Semi-Annual Report | November 30, 2011 |

7 | |

Table of Contents

| Stone Harbor Investment Funds | Summaries of Portfolio Holdings | |

| November 30, 2011(Unaudited) |

Under SEC Rules, all funds are required to include in their annual and semi-annual shareholder reports a presentation of portfolio holdings in a table, chart or graph by reasonably identifiable categories. The following tables, which present holdings as a percent of total net assets (“TNA”), are provided in compliance with such requirements.

| 8 | www.shiplp.com | |

Table of Contents

| Stone Harbor Investment Funds | Summaries of Portfolio Holdings | |

| November 30, 2011(Unaudited) |

| Stone Harbor Investment Funds Semi-Annual Report | November 30, 2011 |

9 | |

Table of Contents

| Stone Harbor Investment Funds | Growth of $10,000 Investment | |

| November 30, 2011(Unaudited) |

STONE HARBOR EMERGING MARKETS DEBT FUND

Comparison of Change in Value of $10,000 Investment in Stone Harbor Emerging Markets Debt Fund and the JP Morgan Emerging Market Bond Global Diversified Index.

The JP Morgan EMBI Global Diversified Index limits the weights of those index countries with larger debt stocks by only including specified portions of these countries’ eligible current face amounts outstanding. The countries covered in the EMBI Global Diversified are identical to those covered by the EMBI Global.

Average Annual Total Returns

| 1 Year | 3 Years | Since Inception | Inception Date | |||||

| Stone Harbor Emerging Markets Debt Fund |

5.45% | 22.83% | 10.21% | 08/16/07 | ||||

| JP Morgan EMBI Global Diversified Index |

5.67% | 18.45% | 9.26% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. Average annual total returns reflect the reinvestment of dividends and capital gains distributions and include all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. The performance data quoted does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Index returns do not include the effects of sales charges, management fees or transaction costs. It is not possible to invest directly in an index.

| 10 | www.shiplp.com | |

Table of Contents

| Stone Harbor Investment Funds | Growth of $10,000 Investment | |

| November 30, 2011(Unaudited) |

STONE HARBOR HIGH YIELD BOND FUND

Comparison of Change in Value of $10,000 Investment in Stone Harbor High Yield Bond Fund and the Citigroup High Yield Market Capped Index.

The Citigroup High Yield Market Capped Index represents a modified version of the High Yield Market Index by delaying the entry of “fallen angel” issues (corporate or municipal bonds that were investment-grade when issued but have since been downgraded) and capping the par value of individual issuers at US $5 billion par amount outstanding.

Average Annual Total Returns

| 1 Year | 3 Years | Since Inception | Inception Date | |||||||||||||

| Stone Harbor High Yield Bond Fund |

2.82% | 18.46% | 6.40% | 08/16/07 | ||||||||||||

| Citigroup HY Market Capped Index |

4.77% | 23.65% | 7.66% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. Average annual total returns reflect the reinvestment of dividends and capital gains distributions and include all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. The performance data quoted does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Index returns do not include the effects of sales charges, management fees or transaction costs. It is not possible to invest directly in an index.

| Stone Harbor Investment Funds Semi-Annual Report | November 30, 2011 |

11 | |

Table of Contents

| Stone Harbor Investment Funds | Growth of $10,000 Investment | |

| November 30, 2011(Unaudited) |

STONE HARBOR LOCAL MARKETS FUND

Comparison of Change in Value of $10,000 Investment in Stone Harbor Local Markets Fund and the JP Morgan GBI-EM Global Diversified Index.

The JP Morgan GBI-EM Global Diversified Index consists of regularly traded, liquid fixed-rate, domestic currency government bonds to which international investors can gain exposure. The weightings among the countries are more evenly distributed within this index.

Average Annual Total Return

| 1 Year | Since Inception | Inception Date | ||||

| Stone Harbor Local Markets Fund |

2.00% | 6.84% | 06/30/10 | |||

| JP Morgan GBI-EM Global Diversified Index |

2.84% | 8.04% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. Average annual total returns reflect the reinvestment of dividends and capital gains distributions and include all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. The performance data quoted does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Index returns do not include the effects of sales charges, management fees or transaction costs. It is not possible to invest directly in an index.

| 12 | www.shiplp.com | |

Table of Contents

| Stone Harbor Investment Funds | Growth of $10,000 Investment | |

| November 30, 2011(Unaudited) |

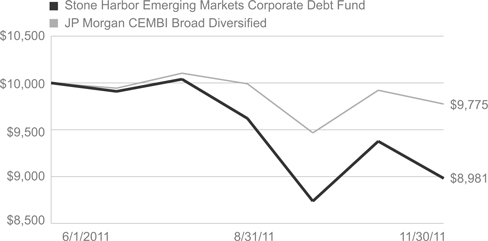

STONE HARBOR EMERGING MARKETS CORPORATE DEBT FUND

Comparison of Change in Value of $10,000 Investment in Stone Harbor Emerging Market Corporate Debt Fund and the JP Morgan CEMBI Broad Diversified.

The JP Morgan CEMBI Broad is a market capitalization weighted index that tracks total returns of US dollar-denominated debt instruments issued by corporate entities in Emerging Markets countries. The CEMBI Broad Diversified limits the current face amount allocations of the bonds in the CEMBI Broad by constraining the total face amount outstanding for countries with larger debt stocks.

Cumulative Returns

| 1 Month | 3 Months | Since Inception | Inception Date | |||||||||||||

| Stone Harbor Emerging Markets Corporate Debt Fund |

-4.22% | -6.65% | -10.19% | 06/01/11 | ||||||||||||

| JP Morgan CEMBI Broad Diversified |

-1.52% | -2.18% | -2.25% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. Average annual total returns reflect the reinvestment of dividends and capital gains distributions and include all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. The performance data quoted does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Index returns do not include the effects of sales charges, management fees or transaction costs. It is not possible to invest directly in an index.

| Stone Harbor Investment Funds Semi-Annual Report | November 30, 2011 |

13 | |

Table of Contents

| Stone Harbor Emerging Markets Debt Fund | Statements of Investments | |

| November 30, 2011(Unaudited) |

| Currency |

Rate | Maturity Date |

Principal Amount * |

Market Value (Expressed in U.S. $) | |||||||||||||||

| SOVEREIGN DEBT OBLIGATIONS - 63.99% |

|||||||||||||||||||

| Argentina - 5.22% |

|||||||||||||||||||

| Republic of Argentina: |

|||||||||||||||||||

| USD | 7.000 | % | 04/17/2017 | 13,527,163 | $ | 10,594,023 | |||||||||||||

| USD | 0.000 | % | 03/31/2023 | 184,000 | 114,080 | (1) | |||||||||||||

| USD | 6.000 | % | 03/31/2023 | 480,000 | 333,600 | (1) | |||||||||||||

| ARS | 5.830 | % | 12/31/2033 | 21,968,850 | 4,605,224 | (2) | |||||||||||||

| EUR | 7.820 | % | 12/31/2033 | 12,289,435 | 9,969,963 | (2) | |||||||||||||

| EUR | 7.820 | % | 12/31/2033 | 19,762,604 | 15,800,311 | (2) | |||||||||||||

| USD | 8.280 | % | 12/31/2033 | 2,496,242 | 1,806,655 | ||||||||||||||

| USD | 8.280 | % | 12/31/2033 | 7,962,772 | 5,573,941 | ||||||||||||||

| EUR | 0.000 | % | 12/15/2035 | 20,252,433 | 2,664,185 | (2) | |||||||||||||

|

|

|

||||||||||||||||||

| 51,461,982 | |||||||||||||||||||

|

|

|

||||||||||||||||||

| Brazil - 4.40% |

|||||||||||||||||||

| Nota Do Tesouro Nacional: |

|||||||||||||||||||

| BRL | 10.000 | % | 01/01/2014 | |

275,000 152,077 |

| |||||||||||||

| BRL | 10.000 | % | 01/01/2021 | 6,205,000 | 3,230,585 | ||||||||||||||

| Republic of Brazil: |

|||||||||||||||||||

| USD | 5.875 | % | 01/15/2019 | 597,000 | 696,998 | ||||||||||||||

| USD | 8.875 | % | 10/14/2019 | 100,000 | 138,000 | ||||||||||||||

| USD | 4.875 | % | 01/22/2021 | 17,606,000 | 19,520,652 | ||||||||||||||

| USD | 8.750 | % | 02/04/2025 | 3,931,000 | 5,817,880 | ||||||||||||||

| USD | 10.125 | % | 05/15/2027 | 32,000 | 51,880 | ||||||||||||||

| USD | 7.125 | % | 01/20/2037 | 7,391,000 | 9,922,418 | ||||||||||||||

| USD | 5.625 | % | 01/07/2041 | 3,321,000 | 3,766,844 | ||||||||||||||

|

|

|

||||||||||||||||||

| 43,297,334 | |||||||||||||||||||

|

|

|

||||||||||||||||||

| Colombia - 5.04% |

|||||||||||||||||||

| Bogota Distrio Capital |

COP | 9.750 | % | 07/26/2028 | 7,800,000,000 | 5,466,463 | (3) | ||||||||||||

| Republic of Colombia: |

|||||||||||||||||||

| USD | 7.375 | % | 01/27/2017 | 7,134,000 | 8,596,470 | ||||||||||||||

| USD | 8.125 | % | 05/21/2024 | 25,000 | 34,250 | ||||||||||||||

| USD | 8.375 | % | 02/15/2027 | 25,000 | 31,500 | ||||||||||||||

| COP | 9.850 | % | 06/28/2027 | 8,375,000,000 | 6,092,750 | ||||||||||||||

| USD | 7.375 | % | 09/18/2037 | 20,914,000 | 28,443,040 | ||||||||||||||

| USD | 6.125 | % | 01/18/2041 | 790,000 | 942,075 | ||||||||||||||

|

|

|

||||||||||||||||||

| 49,606,548 | |||||||||||||||||||

|

|

|

||||||||||||||||||

| Croatia - 0.73% |

|||||||||||||||||||

| Croatian Government |

USD | 6.375 | % | 03/24/2021 | 8,057,000 | 7,190,873 | (4) | ||||||||||||

|

|

|

||||||||||||||||||

| El Salvador - 0.84% |

|||||||||||||||||||

| Republic of El Salvador: |

|||||||||||||||||||

| USD | 7.375 | % | 12/01/2019 | 220,000 | 240,900 | (4) | |||||||||||||

| USD | 7.375 | % | 12/01/2019 | 2,068,000 | 2,264,460 | (3) | |||||||||||||

| USD | 7.750 | % | 01/24/2023 | 15,000 | 16,425 | (3) | |||||||||||||

| USD | 8.250 | % | 04/10/2032 | 1,000,000 | 1,097,500 | (3) | |||||||||||||

| USD | 7.650 | % | 06/15/2035 | 4,495,000 | 4,652,325 | (3) | |||||||||||||

|

|

|

||||||||||||||||||

| 8,271,610 | |||||||||||||||||||

|

|

|

||||||||||||||||||

| See Notes to Financial Statements. | ||

| 14 | www.shiplp.com | |

Table of Contents

| Stone Harbor Emerging Markets Debt Fund |

Statements of Investments | |

| November 30, 2011(Unaudited) |

| Currency | Rate | Maturity Date |

Principal Amount * |

Market

Value (Expressed in U.S. $) |

||||||||||||||

| Gabon - 0.01% |

||||||||||||||||||

| Republic of Gabon |

USD | 8.200 | % | 12/12/2017 | 50,000 | $ | 57,750 | (4) | ||||||||||

|

|

|

|||||||||||||||||

| Ghana - 0.28% |

||||||||||||||||||

| Republic of Ghana |

USD | 8.500 | % | 10/04/2017 | 2,498,000 | 2,766,535 | (3) | |||||||||||

|

|

|

|||||||||||||||||

| Greece - 0.46% |

||||||||||||||||||

| Hellenic Republic Government Bond: |

||||||||||||||||||

| EUR | 4.500 | % | 09/20/2037 | 7,832,000 | 2,580,463 | |||||||||||||

| EUR | 4.600 | % | 09/20/2040 | 5,750,000 | 1,920,975 | |||||||||||||

|

|

|

|||||||||||||||||

| 4,501,438 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| Indonesia - 3.00% |

||||||||||||||||||

| Republic of Indonesia: |

||||||||||||||||||

| USD | 6.875 | % | 01/17/2018 | 1,278,000 | 1,498,455 | (3) | ||||||||||||

| USD | 11.625 | % | 03/04/2019 | 2,170,000 | 3,195,325 | (4) | ||||||||||||

| USD | 11.625 | % | 03/04/2019 | 8,553,000 | 12,594,292 | (3) | ||||||||||||

| USD | 5.875 | % | 03/13/2020 | 2,977,000 | 3,334,240 | (3) | ||||||||||||

| USD | 6.625 | % | 02/17/2037 | 2,050,000 | 2,480,500 | (3) | ||||||||||||

| USD | 7.750 | % | 01/17/2038 | 4,807,000 | 6,465,415 | (3) | ||||||||||||

|

|

|

|||||||||||||||||

| 29,568,227 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| Iraq - 2.65% |

||||||||||||||||||

| Republic of Iraq |

USD | 5.800 | % | 01/15/2028 | 32,012,000 | 26,129,795 | (3) | |||||||||||

|

|

|

|||||||||||||||||

| Lithuania - 1.22% |

||||||||||||||||||

| Republic of Lithuania: |

||||||||||||||||||

| USD | 7.375 | % | 02/11/2020 | 503,000 | 538,210 | (3) | ||||||||||||

| USD | 6.125 | % | 03/09/2021 | 11,853,000 | 11,497,410 | (3) | ||||||||||||

|

|

|

|||||||||||||||||

| 12,035,620 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| Malaysia - 1.60% |

||||||||||||||||||

| Malaysian Government: |

||||||||||||||||||

| MYR | 5.094 | % | 04/30/2014 | 12,240,000 | 4,032,827 | |||||||||||||

| MYR | 3.741 | % | 02/27/2015 | 595,000 | 189,722 | |||||||||||||

| MYR | 3.835 | % | 08/12/2015 | 30,204,000 | 9,697,399 | |||||||||||||

| MYR | 4.262 | % | 09/15/2016 | 5,600,000 | 1,837,508 | |||||||||||||

|

|

|

|||||||||||||||||

| 15,757,456 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| Mexico - 6.52% |

||||||||||||||||||

| Mexican Bonos: |

||||||||||||||||||

| MXN | 7.750 | % | 12/14/2017 | 34,840,000 | 2,860,819 | |||||||||||||

| MXN | 6.500 | % | 06/10/2021 | 175,900,000 | 13,137,569 | |||||||||||||

| MXN | 7.500 | % | 06/03/2027 | 10,000,000 | 765,639 | |||||||||||||

| MXN | 8.500 | % | 05/31/2029 | 22,920,000 | 1,895,022 | |||||||||||||

| MXN | 7.750 | % | 05/29/2031 | 35,900,000 | 2,740,184 | |||||||||||||

| MXN | 8.500 | % | 11/18/2038 | 99,020,000 | 8,033,439 | |||||||||||||

| See Notes to Financial Statements. | ||

| Stone Harbor Investment Funds Semi-Annual Report | November 30, 2011 |

15 | |

Table of Contents

| Stone Harbor Emerging Markets Debt Fund | Statements of Investments | |

| November 30, 2011(Unaudited) |

| Currency | Rate | Maturity Date |

Principal Amount * |

Market

Value (Expressed in U.S. $) |

||||||||||||||

| United Mexican States: |

||||||||||||||||||

| USD | 5.125 | % | 01/15/2020 | 8,292,000 | $ | 9,289,113 | ||||||||||||

| USD | 8.000 | % | 09/24/2022 | 2,012,000 | 2,786,620 | |||||||||||||

| USD | 8.300 | % | 08/15/2031 | 5,417,000 | 7,976,533 | |||||||||||||

| USD | 7.500 | % | 04/08/2033 | 2,442,000 | 3,363,855 | |||||||||||||

| USD | 6.050 | % | 01/11/2040 | 3,288,000 | 3,904,500 | |||||||||||||

| USD | 5.750 | % | 10/12/2110 | 7,270,000 | 7,488,100 | |||||||||||||

|

|

|

|||||||||||||||||

| 64,241,393 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| Panama - 3.04% |

||||||||||||||||||

| Republic of Panama: |

||||||||||||||||||

| USD | 5.200 | % | 01/30/2020 | 7,602,000 | 8,590,260 | |||||||||||||

| USD | 9.375 | % | 01/16/2023 | 25,000 | 34,750 | |||||||||||||

| USD | 7.125 | % | 01/29/2026 | 600,000 | 780,000 | |||||||||||||

| USD | 8.875 | % | 09/30/2027 | 4,255,000 | 6,339,950 | |||||||||||||

| USD | 9.375 | % | 04/01/2029 | 8,883,000 | 14,035,140 | |||||||||||||

| USD | 6.700 | % | 01/26/2036 | 100,000 | 130,000 | |||||||||||||

|

|

|

|||||||||||||||||

| 29,910,100 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| Peru - 0.90% |

||||||||||||||||||

| Republic of Peru |

USD | 8.750 | % | 11/21/2033 | 5,990,000 | 8,835,250 | ||||||||||||

|

|

|

|||||||||||||||||

| Philippines - 2.44% |

||||||||||||||||||

| Republic of Philippines: |

||||||||||||||||||

| PHP | 4.950 | % | 01/15/2021 | 26,000,000 | 590,096 | |||||||||||||

| USD | 10.625 | % | 03/16/2025 | 1,109,000 | 1,754,993 | |||||||||||||

| USD | 5.500 | % | 03/30/2026 | 2,002,000 | 2,229,727 | |||||||||||||

| USD | 9.500 | % | 02/02/2030 | 8,226,000 | 12,606,345 | |||||||||||||

| USD | 7.750 | % | 01/14/2031 | 4,590,000 | 6,150,600 | |||||||||||||

| USD | 6.375 | % | 01/15/2032 | 520,000 | 616,200 | |||||||||||||

| USD | 6.375 | % | 10/23/2034 | 116,000 | 139,200 | |||||||||||||

|

|

|

|||||||||||||||||

| 24,087,161 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| Poland - 4.16% |

||||||||||||||||||

| Republic of Poland: |

||||||||||||||||||

| USD | 6.375 | % | 07/15/2019 | 20,916,000 | 22,929,165 | |||||||||||||

| EUR | 4.000 | % | 03/23/2021 | 665,000 | 794,277 | |||||||||||||

| USD | 5.125 | % | 04/21/2021 | 10,093,000 | 10,111,924 | |||||||||||||

| USD | 5.000 | % | 03/23/2022 | 7,232,000 | 7,096,400 | |||||||||||||

|

|

|

|||||||||||||||||

| 40,931,766 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| Qatar - 0.95% |

||||||||||||||||||

| State of Qatar: |

||||||||||||||||||

| USD | 6.550 | % | 04/09/2019 | 4,477,000 | 5,282,860 | (3) | ||||||||||||

| USD | 5.250 | % | 01/20/2020 | 3,730,000 | 4,032,130 | (3) | ||||||||||||

|

|

|

|||||||||||||||||

| 9,314,990 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| See Notes to Financial Statements. | ||

| 16 | www.shiplp.com | |

Table of Contents

| Stone Harbor Emerging Markets Debt Fund | Statements of Investments | |

| November 30, 2011 (Unaudited) |

| Currency | Rate | Maturity Date |

Principal Amount * |

Market

Value (Expressed in U.S. $) |

||||||||||||||

| Russia - 7.66% |

||||||||||||||||||

| Russian Federation: |

||||||||||||||||||

| USD | 11.000 | % | 07/24/2018 | 437,000 | $ | 604,152 | (3) | |||||||||||

| USD | 5.000 | % | 04/29/2020 | 500,000 | 521,563 | (3) | ||||||||||||

| USD | 12.750 | % | 06/24/2028 | 5,031,000 | 8,766,518 | (3) | ||||||||||||

| USD | 7.500 | % | 03/31/2030 | 55,541,942 | 65,608,919 | (3)(5) | ||||||||||||

|

|

|

|||||||||||||||||

| 75,501,152 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| South Africa - 4.60% |

||||||||||||||||||

| Republic of South Africa: |

||||||||||||||||||

| USD | 8.500 | % | 06/23/2017 | 45,000 | 54,675 | |||||||||||||

| USD | 6.875 | % | 05/27/2019 | 3,141,000 | 3,773,126 | |||||||||||||

| USD | 5.500 | % | 03/09/2020 | 7,373,000 | 8,220,895 | |||||||||||||

| ZAR | 6.750 | % | 03/31/2021 | 116,660,000 | 13,281,257 | |||||||||||||

| USD | 5.875 | % | 05/30/2022 | 10,515,000 | 12,039,675 | |||||||||||||

| ZAR | 10.500 | % | 12/21/2026 | 31,270,000 | 4,507,969 | |||||||||||||

| USD | 6.250 | % | 03/08/2041 | 3,031,000 | 3,478,073 | |||||||||||||

|

|

|

|||||||||||||||||

| 45,355,670 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| Turkey - 2.90% |

||||||||||||||||||

| Republic of Turkey: |

||||||||||||||||||

| USD | 7.000 | % | 09/26/2016 | 159,000 | 176,689 | |||||||||||||

| USD | 7.000 | % | 03/11/2019 | 135,000 | 151,031 | |||||||||||||

| USD | 7.500 | % | 11/07/2019 | 15,038,000 | 17,312,497 | |||||||||||||

| USD | 7.000 | % | 06/05/2020 | 372,000 | 416,175 | |||||||||||||

| USD | 5.125 | % | 03/25/2022 | 4,992,000 | 4,842,240 | |||||||||||||

| USD | 7.375 | % | 02/05/2025 | 1,820,000 | 2,102,100 | |||||||||||||

| USD | 6.875 | % | 03/17/2036 | 2,000,000 | 2,152,500 | |||||||||||||

| USD | 7.250 | % | 03/05/2038 | 1,285,000 | 1,444,019 | |||||||||||||

|

|

|

|||||||||||||||||

| 28,597,251 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| Ukraine - 1.91% |

||||||||||||||||||

| Ukraine Government: |

||||||||||||||||||

| USD | 6.385 | % | 06/26/2012 | 6,505,000 | 6,391,162 | (3) | ||||||||||||

| USD | 7.650 | % | 06/11/2013 | 2,386,000 | 2,308,455 | (3) | ||||||||||||

| USD | 6.875 | % | 09/23/2015 | 1,723,000 | 1,580,853 | (4) | ||||||||||||

| USD | 6.250 | % | 06/17/2016 | 2,600,000 | 2,265,250 | (4) | ||||||||||||

| USD | 6.750 | % | 11/14/2017 | 4,150,000 | 3,589,750 | (3) | ||||||||||||

| USD | 7.750 | % | 09/23/2020 | 3,094,000 | 2,707,250 | (3) | ||||||||||||

|

|

|

|||||||||||||||||

| 18,842,720 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| Uruguay - 2.21% |

||||||||||||||||||

| Republic of Uruguay: |

||||||||||||||||||

| USD | 9.250 | % | 05/17/2017 | 3,467,000 | 4,541,770 | |||||||||||||

| USD | 8.000 | % | 11/18/2022 | 5,310,497 | 7,116,066 | |||||||||||||

| USD | 6.875 | % | 09/28/2025 | 1,448,650 | 1,847,029 | |||||||||||||

| USD | 7.875 | % | 01/15/2033 | 1,390,800 | 1,891,488 | (6) | ||||||||||||

| USD | 7.625 | % | 03/21/2036 | 4,768,176 | 6,389,356 | |||||||||||||

|

|

|

|||||||||||||||||

| 21,785,709 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| See Notes to Financial Statements. | ||

| Stone Harbor Investment Funds Semi-Annual Report | November 30, 2011 |

17 | |

Table of Contents

| Stone Harbor Emerging Markets Debt Fund | Statements of Investments | |

| November 30, 2011 (Unaudited) |

| Currency | Rate | Maturity Date |

Principal Amount * |

Market Value (Expressed in U.S. $) |

||||||||||||||

| Venezuela - 1.25% |

||||||||||||||||||

| Republic of Venezuela: |

||||||||||||||||||

| USD | 13.625 | % | 08/15/2018 | 10,000 | $ | 9,700 | ||||||||||||

| USD | 13.625 | % | 08/15/2018 | 1,669,000 | 1,552,170 | (3) | ||||||||||||

| USD | 7.750 | % | 10/13/2019 | 4,611,000 | 3,216,172 | (3) | ||||||||||||

| USD | 12.750 | % | 08/23/2022 | 8,552,400 | 7,526,112 | (3) | ||||||||||||

|

|

|

|||||||||||||||||

| 12,304,154 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| TOTAL SOVEREIGN DEBT OBLIGATIONS |

630,352,484 | |||||||||||||||||

|

|

|

|||||||||||||||||

| (Cost $624,846,681) |

||||||||||||||||||

| BANK LOANS - 0.50%(7) |

||||||||||||||||||

| Brazil - 0.09% |

||||||||||||||||||

| Virgolino de Oliveira - GVO Loan |

USD | 5.273 | % | 03/11/2015 | 941,176 | 905,882 | (2) | |||||||||||

|

|

|

|||||||||||||||||

| Indonesia - 0.41% |

||||||||||||||||||

| PT Bumi Resources |

USD | 11.250 | % | 08/07/2013 | 1,337,000 | 1,358,392 | (2) | |||||||||||

| PT Bumi Tranche A |

USD | 12.000 | % | 03/02/2012 | 1,777,960 | 1,511,266 | (16) | |||||||||||

| PT Bumi Tranche B |

USD | 12.000 | % | 03/02/2012 | 1,419,040 | 1,206,184 | (16) | |||||||||||

|

|

|

|||||||||||||||||

| 4,075,842 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| TOTAL BANK LOANS |

4,981,724 | |||||||||||||||||

|

|

|

|||||||||||||||||

| (Cost $5,466,624) |

||||||||||||||||||

| CONVERTIBLE CORPORATE BONDS - 0.02% |

||||||||||||||||||

| India - 0.02% |

||||||||||||||||||

| Vedanta Resources Jersey II Ltd. |

USD | 4.000 | % | 03/30/2017 | 200,000 | 169,000 | ||||||||||||

|

|

|

|||||||||||||||||

| TOTAL CONVERTIBLE CORPORATE BONDS |

169,000 | |||||||||||||||||

|

|

|

|||||||||||||||||

| (Cost $167,187) |

||||||||||||||||||

| CORPORATE BONDS - 26.32% |

||||||||||||||||||

| Argentina - 0.39% |

||||||||||||||||||

| Capex SA |

USD | 10.000 | % | 03/10/2018 | 1,642,000 | 1,338,230 | (4) | |||||||||||

| Empresa Distribuidora Y Comercializadora Norte: |

||||||||||||||||||

| USD | 9.750 | % | 10/25/2022 | 500,000 | 410,000 | (3) | ||||||||||||

| USD | 9.750 | % | 10/25/2022 | 1,362,000 | 1,116,840 | (4) | ||||||||||||

| Inversiones y Representaciones SA: |

||||||||||||||||||

| USD | 11.500 | % | 07/20/2020 | 100,000 | 102,119 | (3) | ||||||||||||

| USD | 11.500 | % | 07/20/2020 | 636,000 | 648,524 | (4) | ||||||||||||

| Tarjeta Naranja SA |

USD | 9.000 | % | 01/28/2017 | 209,000 | 201,678 | (4) | |||||||||||

|

|

|

|||||||||||||||||

| 3,817,391 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| Barbados - 0.16% |

||||||||||||||||||

| Columbus International, Inc. |

USD | 11.500 | % | 11/20/2014 | 1,500,000 | 1,560,000 | (3) | |||||||||||

|

|

|

|||||||||||||||||

| Brazil - 3.19% |

||||||||||||||||||

| Banco Cruzeiro do Sul SA: |

||||||||||||||||||

| USD | 8.875 | % | 09/22/2020 | 984,000 | 669,120 | (4) | ||||||||||||

| USD | 8.875 | % | 09/22/2020 | 1,100,000 | 748,000 | (3) | ||||||||||||

| See Notes to Financial Statements. | ||

| 18 | www.shiplp.com | |

Table of Contents

| Stone Harbor Emerging Markets Debt Fund | Statements of Investments | |

| November 30, 2011 (Unaudited) |

| Currency | Rate | Maturity Date |

Principal Amount * |

Market

Value (Expressed in U.S. $) |

||||||||||||||

| BM&FBovespa SA: |

||||||||||||||||||

| USD | 5.500 | % | 07/16/2020 | 842,000 | $ | 863,050 | (4) | |||||||||||

| USD | 5.500 | % | 07/16/2020 | 1,400,000 | 1,435,000 | (3) | ||||||||||||

| BR Malls International Finance Ltd.: |

||||||||||||||||||

| USD | 8.500 | % | 01/21/2049 | 260,000 | 269,750 | (3) | ||||||||||||

| USD | 8.500 | % | 01/21/2049 | 482,000 | 500,075 | (4) | ||||||||||||

| BR Properties SA: |

||||||||||||||||||

| USD | 9.000 | % | 10/07/2015 | 310,000 | 317,750 | (4) | ||||||||||||

| USD | 9.000 | % | 10/07/2049 | 135,000 | 138,375 | (3) | ||||||||||||

| General Shopping Finance Ltd.: |

||||||||||||||||||

| USD | 10.000 | % | 11/09/2015 | 1,824,000 | 1,842,240 | (4) | ||||||||||||

| USD | 10.000 | % | 11/09/2049 | 246,000 | 248,460 | (3) | ||||||||||||

| Hypermarcas SA |

USD | 6.500 | % | 04/20/2021 | 3,349,000 | 2,947,120 | (4) | |||||||||||

| Minerva Overseas II Ltd.: |

||||||||||||||||||

| USD | 10.875 | % | 11/15/2019 | 538,000 | 468,060 | (3) | ||||||||||||

| USD | 10.875 | % | 11/15/2019 | 633,000 | 550,710 | (4) | ||||||||||||

| Mirabela Nickel Ltd. |

USD | 8.750 | % | 04/15/2018 | 392,000 | 350,840 | (4) | |||||||||||

| NET Servicos de Comunicacao SA |

USD | 7.500 | % | 01/27/2020 | 3,102,000 | 3,551,790 | ||||||||||||

| Odebrecht Drilling Norbe VIII/IX Ltd.: |

||||||||||||||||||

| USD | 6.350 | % | 06/30/2021 | 1,650,000 | 1,691,250 | (3) | ||||||||||||

| USD | 6.350 | % | 06/30/2021 | 1,665,000 | 1,706,625 | (4) | ||||||||||||

| Odebrecht Finance Ltd. |

USD | 7.000 | % | 04/21/2020 | 350,000 | 375,375 | (3) | |||||||||||

| OGX Petroleo e Gas Participacoes SA: |

||||||||||||||||||

| USD | 8.500 | % | 06/01/2018 | 500,000 | 480,000 | (3) | ||||||||||||

| USD | 8.500 | % | 06/01/2018 | 3,732,000 | 3,582,720 | (4) | ||||||||||||

| Petrobras International Finance Co. |

USD | 5.375 | % | 01/27/2021 | 430,000 | 439,419 | ||||||||||||

| QGOG Atlantic / Alaskan Rigs Ltd.: |

||||||||||||||||||

| USD | 5.250 | % | 07/30/2018 | 200,000 | 196,500 | (3) | ||||||||||||

| USD | 5.250 | % | 07/30/2018 | 4,006,000 | 3,935,895 | (4) | ||||||||||||

| Telemar Norte Leste SA: |

||||||||||||||||||

| USD | 5.500 | % | 10/23/2020 | 1,006,000 | 990,910 | (3) | ||||||||||||

| USD | 5.500 | % | 10/23/2020 | 2,312,000 | 2,277,320 | (4) | ||||||||||||

| Virgolino de Oliveira Finance Ltd. |

USD | 10.500 | % | 01/28/2018 | 617,000 | 595,405 | (3) | |||||||||||

| Votorantim Cimentos SA |

USD | 7.250 | % | 04/05/2041 | 300,000 | 293,250 | (4) | |||||||||||

|

|

|

|||||||||||||||||

| 31,465,009 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| Chile - 0.80% |

||||||||||||||||||

| Cencosud SA |

USD | 5.500 | % | 01/20/2021 | 2,000,000 | 2,042,852 | (4) | |||||||||||

| Codelco, Inc.: |

||||||||||||||||||

| USD | 7.500 | % | 01/15/2019 | 450,000 | 570,501 | (3) | ||||||||||||

| USD | 6.150 | % | 10/24/2036 | 4,295,000 | 5,302,637 | (3) | ||||||||||||

|

|

|

|||||||||||||||||

| 7,915,990 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| China - 1.19% |

||||||||||||||||||

| China Liansu Group Holdings Ltd. |

USD | 7.875 | % | 05/13/2016 | 1,468,000 | 1,218,440 | (4) | |||||||||||

| Evergrande Real Estate Group Ltd.: |

||||||||||||||||||

| USD | 13.000 | % | 01/27/2015 | 106,000 | 82,150 | (4) | ||||||||||||

| USD | 13.000 | % | 01/27/2015 | 666,000 | 516,150 | (3) | ||||||||||||

| Kaisa Group Holdings Ltd. |

USD | 13.500 | % | 04/28/2015 | 1,149,000 | 924,945 | (3) | |||||||||||

| Mega Advance Investments Ltd. |

USD | 5.000 | % | 05/12/2021 | 661,000 | 669,937 | (4) | |||||||||||

| MIE Holdings Corp. |

USD | 9.750 | % | 05/12/2016 | 1,586,000 | 1,411,540 | (4) | |||||||||||

| Sinochem Overseas Capital Co. Ltd. |

USD | 4.500 | % | 11/12/2020 | 4,384,000 | 4,229,045 | (4) | |||||||||||

| See Notes to Financial Statements. | ||

| Stone Harbor Investment Funds Semi-Annual Report | November 30, 2011 |

19 | |

Table of Contents

| Stone Harbor Emerging Markets Debt Fund | Statements of Investments | |

| November 30, 2011 (Unaudited) |

| Currency |

Rate |

Maturity Date |

Principal Amount * |

Market Value (Expressed in U.S. $) |

||||||||||||||

| Texhong Textile Group Ltd.: |

||||||||||||||||||

| USD | 7.625 | % | 01/19/2016 | 343,000 | $ | 250,390 | (4) | |||||||||||

| USD | 7.625 | % | 01/19/2016 | 858,000 | 626,340 | (3) | ||||||||||||

| West China Cement Ltd.: |

||||||||||||||||||

| USD | 7.500 | % | 01/25/2016 | 824,000 | 675,680 | (3) | ||||||||||||

| USD | 7.500 | % | 01/25/2016 | 1,138,000 | 933,160 | (4) | ||||||||||||

| Yanlord Land Group Ltd. |

USD | 9.500 | % | 05/04/2017 | 235,000 | 177,425 | (3) | |||||||||||

|

|

|

|||||||||||||||||

| 11,715,202 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| Colombia - 0.29% |

||||||||||||||||||

| Gruposura Finance |

USD | 5.700 | % | 05/18/2021 | 2,813,000 | 2,843,943 | (4) | |||||||||||

|

|

|

|||||||||||||||||

| Dominican Republic - 0.07% |

||||||||||||||||||

| Cap Cana SA: |

||||||||||||||||||

| USD | 10.000 | % | 04/30/2016 | 1,103,320 | 386,162 | (1)(3) | ||||||||||||

| USD | 10.000 | % | 04/30/2016 | 1,343,373 | 268,675 | (1)(3) | ||||||||||||

|

|

|

|||||||||||||||||

| 654,837 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| Hong Kong - 0.39% |

||||||||||||||||||

| Hutchison Whampoa International 10 Ltd. |

USD | 6.000 | % | 10/28/2049 | 1,957,000 | 1,947,215 | (2)(3) | |||||||||||

| PCCW- HKT Capital No. 4 Ltd. |

USD | 4.250 | % | 02/24/2016 | 1,849,000 | 1,864,717 | ||||||||||||

|

|

|

|||||||||||||||||

| 3,811,932 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| India - 0.28% |

||||||||||||||||||

| Axis Bank Ltd. |

USD | 7.125 | % | 06/28/2022 | 311,000 | 281,455 | (2) | |||||||||||

| Bank of India |

USD | 6.994 | % | 03/03/2049 | 344,000 | 304,440 | (2) | |||||||||||

| ICICI Bank Ltd.: |

||||||||||||||||||

| USD | 5.750 | % | 11/16/2020 | 200,000 | 185,970 | (3) | ||||||||||||

| USD | 5.750 | % | 11/16/2020 | 608,000 | 565,349 | (4) | ||||||||||||

| Vedanta Resources PLC |

USD | 8.250 | % | 06/07/2021 | 1,715,000 | 1,423,450 | (4) | |||||||||||

|

|

|

|||||||||||||||||

| 2,760,664 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| Indonesia - 0.89% |

||||||||||||||||||

| Bakrie Telecom Pte Ltd. |

USD | 11.500 | % | 05/07/2015 | 1,805,000 | 1,137,150 | (3) | |||||||||||

| Berau Capital Resources Pte Ltd. |

USD | 12.500 | % | 07/08/2015 | 2,000,000 | 2,140,000 | (3) | |||||||||||

| BLT Finance BV |

USD | 7.500 | % | 05/15/2014 | 644,000 | 254,380 | (3) | |||||||||||

| Bumi Investment Pte Ltd.: |

||||||||||||||||||

| USD | 10.750 | % | 10/06/2017 | 325,000 | 318,500 | (4) | ||||||||||||

| USD | 10.750 | % | 10/06/2017 | 2,400,000 | 2,352,000 | (3) | ||||||||||||

| Indosat Palapa Co. BV: |

||||||||||||||||||

| USD | 7.375 | % | 07/29/2020 | 241,000 | 260,280 | (4) | ||||||||||||

| USD | 7.375 | % | 07/29/2020 | 550,000 | 594,000 | (3) | ||||||||||||

| PT Adaro Indonesia |

USD | 7.625 | % | 10/22/2019 | 1,617,000 | 1,714,020 | (3) | |||||||||||

|

|

|

|||||||||||||||||

| 8,770,330 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| Jamaica - 0.45% |

||||||||||||||||||

| Digicel Group Ltd.: |

||||||||||||||||||

| USD | 9.125 | % | 01/15/2015 | 1,878,000 | 1,859,220 | (4) | ||||||||||||

| USD | 8.250 | % | 09/01/2017 | 1,160,000 | 1,154,200 | (3) | ||||||||||||

| USD | 10.500 | % | 04/15/2018 | 1,450,000 | 1,457,250 | (3) | ||||||||||||

|

|

|

|||||||||||||||||

| 4,470,670 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| See Notes to Financial Statements. | ||

| 20 | www.shiplp.com | |

Table of Contents

| Stone Harbor Emerging Markets Debt Fund | Statements of Investments | |

| November 30, 2011 (Unaudited) |

| Currency | Rate | Maturity Date |

Principal Amount * |

Market Value (Expressed in U.S. $) |

||||||||||||||

| Kazakhstan - 2.50% |

||||||||||||||||||

| BTA Bank JSC: |

||||||||||||||||||

| USD | 10.750 | % | 07/01/2018 | 1,159,562 | $ | 382,656 | (4)(5) | |||||||||||

| USD | 10.750 | % | 07/01/2018 | 4,949,274 | 1,633,260 | (3)(5) | ||||||||||||

| USD | 0.000 | % | 07/01/2020 | 500,000 | 19,375 | (3)(8) | ||||||||||||

| USD | 0.000 | % | 07/01/2020 | 2,515,532 | 97,477 | (2)(4) | ||||||||||||

| KazMunayGas National Co.: |

||||||||||||||||||

| USD | 8.375 | % | 07/02/2013 | 5,650,000 | 5,989,000 | (3) | ||||||||||||

| USD | 11.750 | % | 01/23/2015 | 2,300,000 | 2,783,000 | (3) | ||||||||||||

| USD | 9.125 | % | 07/02/2018 | 723,000 | 871,215 | (4) | ||||||||||||

| USD | 7.000 | % | 05/05/2020 | 739,000 | 809,205 | (4) | ||||||||||||

| USD | 7.000 | % | 05/05/2020 | 5,615,000 | 6,148,425 | (3) | ||||||||||||

| USD | 6.375 | % | 04/09/2021 | 2,538,000 | 2,683,935 | (4) | ||||||||||||

| Zhaikmunai LLP: |

||||||||||||||||||

| USD | 10.500 | % | 10/19/2015 | 1,037,000 | 1,021,445 | (4) | ||||||||||||

| USD | 10.500 | % | 10/19/2015 | 2,175,000 | 2,142,375 | (3) | ||||||||||||

|

|

|

|||||||||||||||||

| 24,581,368 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| Malaysia - 3.24% |

||||||||||||||||||

| Penerbangan Malaysia BHD |

USD | 5.625 | % | 03/15/2016 | 1,195,000 | 1,323,642 | (3) | |||||||||||

| Petroliam Nasional BHD: |

||||||||||||||||||

| USD | 7.750 | % | 08/15/2015 | 335,000 | 397,276 | (4) | ||||||||||||

| USD | 7.625 | % | 10/15/2026 | 840,000 | 1,148,910 | (3) | ||||||||||||

| Petronas Capital Ltd.: |

||||||||||||||||||

| USD | 5.250 | % | 08/12/2019 | 630,000 | 701,692 | (4) | ||||||||||||

| USD | 5.250 | % | 08/12/2019 | 2,749,000 | 3,061,830 | (3) | ||||||||||||

| USD | 7.875 | % | 05/22/2022 | 17,019,000 | 22,943,314 | (3) | ||||||||||||

| Petronas Global Sukuk Ltd. |

USD | 4.250 | % | 08/12/2014 | 2,240,000 | 2,357,488 | (4) | |||||||||||

|

|

|

|||||||||||||||||

| 31,934,152 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| Mexico - 2.26% |

||||||||||||||||||

| Alestra SA |

USD | 11.750 | % | 08/11/2014 | 587,000 | 647,168 | ||||||||||||

| America Movil SAB de CV |

USD | 2.375 | % | 09/08/2016 | 3,778,000 | 3,708,583 | ||||||||||||

| Axtel SAB de CV: |

||||||||||||||||||

| USD | 7.625 | % | 02/01/2017 | 347,000 | 261,985 | (4) | ||||||||||||

| USD | 9.000 | % | 09/22/2019 | 1,171,000 | 884,105 | (3) | ||||||||||||

| BBVA Bancomer SA |

USD | 4.500 | % | 03/10/2016 | 585,000 | 579,150 | (3) | |||||||||||

| Cemex Espana Luxembourg: |

||||||||||||||||||

| EUR | 8.875 | % | 05/12/2017 | 54,000 | 47,527 | (3) | ||||||||||||

| USD | 9.250 | % | 05/12/2020 | 2,250,000 | 1,552,500 | (3) | ||||||||||||

| Cemex SAB de CV: |

||||||||||||||||||

| USD | 5.369 | % | 09/30/2015 | 921,000 | 617,070 | (2)(4) | ||||||||||||

| USD | 9.000 | % | 01/11/2018 | 530,000 | 386,900 | (3) | ||||||||||||

| USD | 9.000 | % | 01/11/2018 | 1,047,000 | 764,310 | (4) | ||||||||||||

| Desarrolla Homex SAB de CV |

USD | 7.500 | % | 09/28/2015 | 215,000 | 213,925 | ||||||||||||

| Geo Maquinaria |

USD | 9.625 | % | 05/02/2021 | 3,804,253 | 3,423,827 | (4) | |||||||||||

| Grupo Bimbo SAB de CV |

USD | 4.875 | % | 06/30/2020 | 183,000 | 189,921 | (4) | |||||||||||

| Hipotecaria Su Casita SA de CV |

USD | 7.500 | % | 06/29/2018 | 113,997 | 59,848 | (4) | |||||||||||

| Pemex Finance Ltd. |

USD | 9.150 | % | 11/15/2018 | 1,250,000 | 1,545,387 | ||||||||||||

| See Notes to Financial Statements. | ||

| Stone Harbor Investment Funds Semi-Annual Report | November 30, 2011 |

21 | |

Table of Contents

| Stone Harbor Emerging Markets Debt Fund | Statements of Investments | |

| November 30, 2011 (Unaudited) |

| Currency | Rate | Maturity Date |

Principal Amount * |

Market Value (Expressed in U.S. $) |

||||||||||||||

| Pemex Project Funding Master Trust: |

||||||||||||||||||

| EUR | 5.500 | % | 02/24/2025 | 2,275,000 | $ | 2,867,632 | (3) | |||||||||||

| USD | 6.625 | % | 06/15/2035 | 3,034,000 | 3,344,985 | |||||||||||||

| Telefonos de Mexico SAB de CV |

USD | 5.500 | % | 11/15/2019 | 1,100,000 | 1,201,316 | ||||||||||||

|

|

|

|||||||||||||||||

| 22,296,139 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| Peru - 0.33% |

||||||||||||||||||

| Banco Continental SA via Continental Senior Trustees Cayman Ltd. |

USD | 5.500 | % | 11/18/2020 | 766,000 | 743,020 | (4) | |||||||||||

| Banco de Credito del Peru/Panama |