Exhibit 13.1

FINANCIAL SECTION

THE BANK OF NEW YORK MELLON CORPORATION

2022 Annual Report

Table of Contents

| | | | | |

| | Page |

Financial Summary | |

| |

| Management’s Discussion and Analysis of Financial Condition and Results of Operations: | |

| Results of Operations: | |

General | |

Overview | |

| |

| Key 2022 events | |

Summary of financial highlights | |

| |

Fee and other revenue | |

Net interest revenue | |

Noninterest expense | |

Income taxes | |

| |

International operations | |

Critical accounting estimates | |

Consolidated balance sheet review | |

Liquidity and dividends | |

| |

| |

Capital | |

Trading activities and risk management | |

Asset/liability management | |

Risk Management | |

Supervision and Regulation | |

Other Matters | |

Risk Factors | |

Recent Accounting Developments | |

| |

Supplemental Information (unaudited): | |

Explanation of GAAP and Non-GAAP financial measures (unaudited) | |

Rate/volume analysis (unaudited) | |

| |

Forward-looking Statements | |

| |

Glossary | |

| |

Report of Management on Internal Control Over Financial Reporting | |

Report of Independent Registered Public Accounting Firm | |

| |

| |

| | | | | | | | |

| | Page |

| Financial Statements: | |

Consolidated Income Statement | |

Consolidated Comprehensive Income Statement | |

Consolidated Balance Sheet | |

Consolidated Statement of Cash Flows | |

Consolidated Statement of Changes in Equity | |

| |

| Notes to Consolidated Financial Statements: | |

Note 1 – Summary of significant accounting and reporting policies | |

Note 2 – Accounting changes and new accounting guidance | |

Note 3 – Acquisitions and dispositions | |

Note 4 – Securities | |

Note 5 – Loans and asset quality | |

Note 6 – Leasing | |

Note 7 – Goodwill and intangible assets | |

Note 8 – Other assets | |

Note 9 – Deposits | |

Note 10 – Contract revenue | |

Note 11 – Net interest revenue | |

Note 12 – Income taxes | |

Note 13 – Long-term debt | |

Note 14 – Variable interest entities | |

Note 15 – Shareholders’ equity | |

Note 16 – Other comprehensive income (loss) | |

Note 17 – Stock-based compensation | |

Note 18 – Employee benefit plans | |

Note 19 – Company financial information (Parent Corporation) | |

Note 20 – Fair value measurement | |

Note 21 – Fair value option | |

Note 22 – Commitments and contingent liabilities | |

Note 23 – Derivative instruments | |

Note 24 – Business segments | |

Note 25 – International operations | |

Note 26 – Supplemental information to the Consolidated Statement of Cash Flows | |

| |

Report of Independent Registered Public Accounting Firm | |

Directors, Executive Committee and Other Executive Officers | |

| |

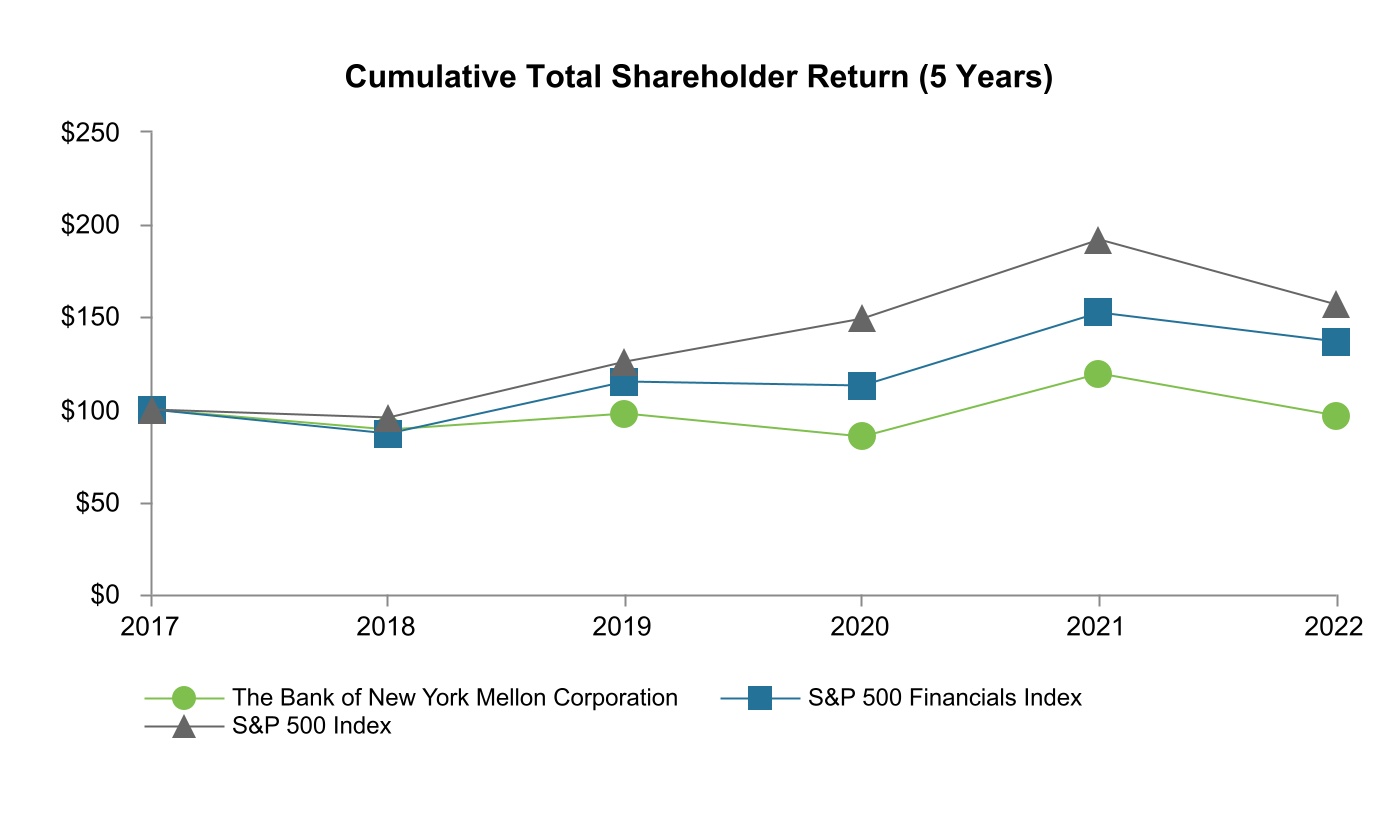

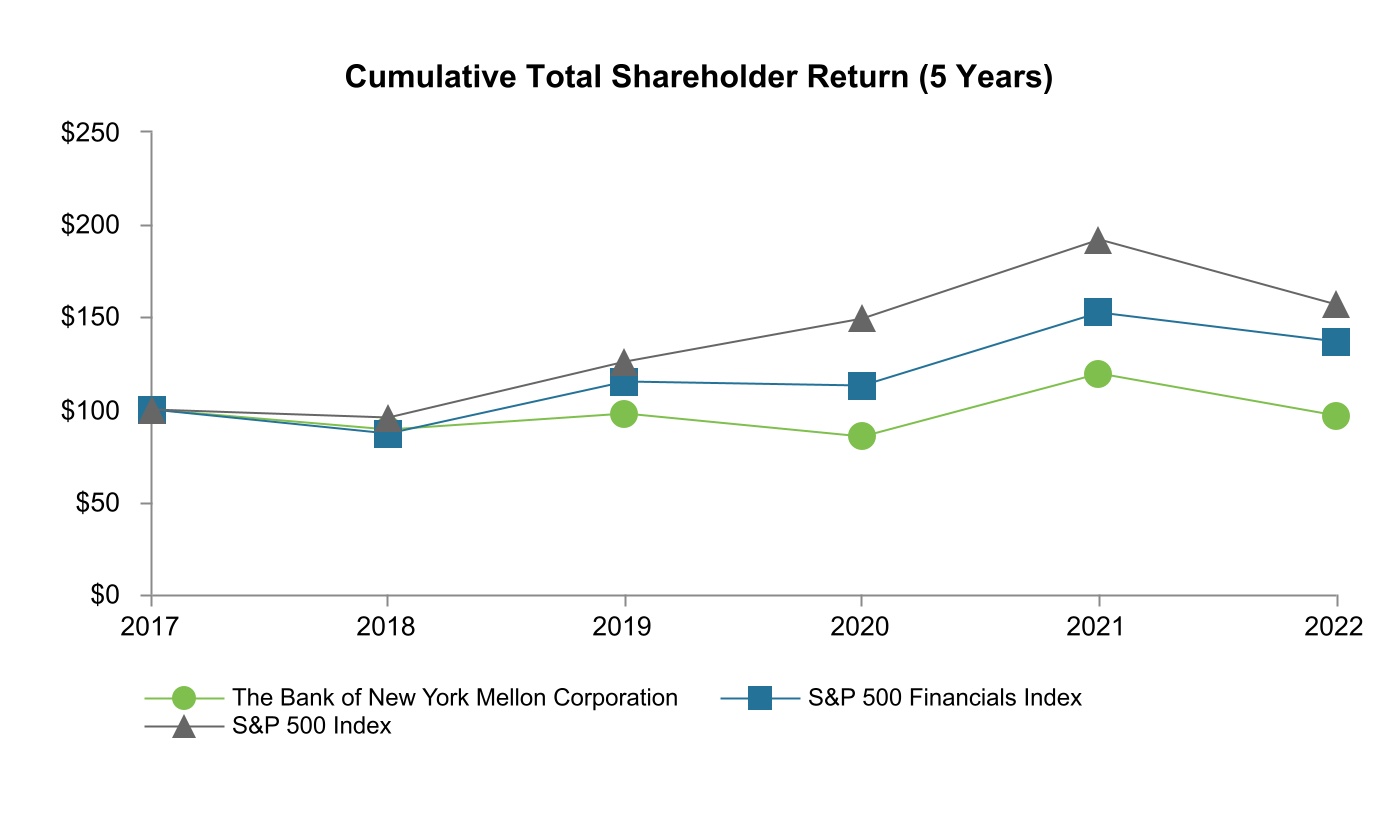

Performance Graph | |

| |

The Bank of New York Mellon Corporation (and its subsidiaries)

Financial Summary

| | | | | | | | | | | |

| (dollars in millions, except per share amounts and unless otherwise noted) | 2022 | 2021 | 2020 |

| Selected income statement information: | | | |

| Fee and other revenue | $ | 12,873 | | $ | 13,313 | | $ | 12,831 | |

| Net interest revenue | 3,504 | | 2,618 | | 2,977 | |

| Total revenue | 16,377 | | 15,931 | | 15,808 | |

| Provision for credit losses | 39 | | (231) | | 336 | |

| Noninterest expense | 13,010 | | 11,514 | | 11,004 | |

| Income before income taxes | 3,328 | | 4,648 | | 4,468 | |

| Provision for income taxes | 768 | | 877 | | 842 | |

| Net income | 2,560 | | 3,771 | | 3,626 | |

Net loss (income) attributable to noncontrolling interests related to consolidated investment management funds | 13 | | (12) | | (9) | |

| Preferred stock dividends | (211) | | (207) | | (194) | |

Net income applicable to common shareholders of The Bank of New York Mellon Corporation | $ | 2,362 | | $ | 3,552 | | $ | 3,423 | |

Earnings per share applicable to common shareholders of The Bank of New York Mellon Corporation: | | | |

| Basic | $ | 2.91 | | $ | 4.17 | | $ | 3.84 | |

| Diluted | $ | 2.90 | | $ | 4.14 | | $ | 3.83 | |

Average common shares and equivalents outstanding (in thousands): | | | |

| Basic | 811,068 | | 851,905 | | 890,839 | |

| Diluted | 814,795 | | 856,359 | | 892,514 | |

| At Dec. 31 | | | |

Assets under custody and/or administration (“AUC/A”) (in trillions) (a) | $ | 44.3 | | $ | 46.7 | | $ | 41.1 | |

Assets under management (“AUM”) (in billions) (b) | 1,836 | | 2,434 | | 2,211 | |

| Selected ratios: | | | |

| Return on common equity | 6.5 | % | 8.9 | % | 8.7 | % |

Return on tangible common equity – Non-GAAP (c) | 13.4 | | 17.1 | | 17.0 | |

| Pre-tax operating margin | 20 | | 29 | | 28 | |

| Net interest margin | 0.97 | | 0.68 | | 0.84 | |

| Cash dividends per common share | $ | 1.42 | | $ | 1.30 | | $ | 1.24 | |

Common dividend payout ratio | 49 | % | 32 | % | 33 | % |

| Common dividend yield | 3.1 | % | 2.2 | % | 2.9 | % |

| At Dec. 31 | | | |

| Closing stock price per common share | $ | 45.52 | | $ | 58.08 | | $ | 42.44 | |

| Market capitalization | $ | 36,800 | | $ | 46,705 | | $ | 37,634 | |

| Book value per common share | $ | 44.40 | | $ | 47.50 | | $ | 46.53 | |

Tangible book value per common share – Non-GAAP (c) | $ | 23.11 | | $ | 24.31 | | $ | 25.44 | |

| Full-time employees | 51,700 | | 49,100 | | 48,500 | |

Common shares outstanding (in thousands) | 808,445 | | 804,145 | | 886,764 | |

Regulatory capital ratios (d) | | | |

| Common Equity Tier 1 (“CET1”) ratio | 11.2 | % | 11.2 | % | 13.1 | % |

| Tier 1 capital ratio | 14.1 | | 14.0 | | 15.8 | |

| Total capital ratio | 14.9 | | 14.9 | | 16.7 | |

| Tier 1 leverage ratio | 5.8 | | 5.5 | | 6.3 | |

Supplementary leverage ratio (“SLR”) (e) | 6.8 | | 6.6 | | 8.6 | |

| | | |

| | | |

(a) Consists of AUC/A primarily from the Asset Servicing line of business and, to a lesser extent, the Clearance and Collateral Management, Issuer Services, Pershing and Wealth Management lines of business. Includes the AUC/A of CIBC Mellon Global Securities Services Company (“CIBC Mellon”), a joint venture with the Canadian Imperial Bank of Commerce, of $1.5 trillion at Dec. 31, 2022, $1.7 trillion at Dec. 31, 2021 and $1.5 trillion at Dec. 31, 2020.

(b) Excludes assets managed outside of the Investment and Wealth Management business segment.

(c) Return on tangible common equity and tangible book value per common share, both Non-GAAP measures, exclude goodwill and intangible assets, net of deferred tax liabilities. See “Supplemental Information – Explanation of GAAP and Non-GAAP financial measures” beginning on page 104 for the reconciliation of these Non-GAAP measures. (d) For our CET1, Tier 1 and Total capital ratios, our effective capital ratios under U.S. capital rules are the lower of the ratios as calculated under the Standardized and Advanced Approaches. For additional information on our regulatory capital ratios, see “Capital” beginning on page 40. (e) The consolidated SLR at Dec. 31, 2020 reflects the temporary exclusion of U.S. Treasury securities from total leverage exposure which increased our consolidated SLR by 72 basis points. The temporary exclusion ceased to apply beginning April 1, 2021.

| | |

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| Results of Operations |

General

In this Annual Report, references to “our,” “we,” “us,” “BNY Mellon,” the “Company” and similar terms refer to The Bank of New York Mellon Corporation and its consolidated subsidiaries. The term “Parent” refers to The Bank of New York Mellon Corporation but not its subsidiaries.

The following should be read in conjunction with the Consolidated Financial Statements included in this report. BNY Mellon’s actual results of future operations may differ from those estimated or anticipated in certain forward-looking statements contained herein due to the factors described under the headings “Forward-looking Statements” and “Risk Factors,” both of which investors should read.

Certain business terms used in this Annual Report are defined in the Glossary.

This Annual Report generally discusses 2022 and 2021 items and comparisons between 2022 and 2021. Discussions of 2020 items and comparisons between 2021 and 2020 that are not included in this Annual Report can be found in our 2021 Annual Report, which was filed as an exhibit to our Form 10-K for the year ended Dec. 31, 2021.

Overview

Established in 1784 by Alexander Hamilton, we were the first company listed on the New York Stock Exchange (NYSE: BK). With a history of more than 235 years, BNY Mellon is a global company dedicated to helping its clients manage and service their financial assets throughout the investment life cycle. Whether providing financial services for institutions, corporations or individual investors, BNY Mellon delivers informed investment and wealth management and investment services in 35 countries.

BNY Mellon has three business segments, Securities Services, Market and Wealth Services and Investment and Wealth Management, which offer a comprehensive set of capabilities and deep expertise across the investment lifecycle, enabling the Company to provide solutions to buy-side and sell-side market participants, as well as leading institutional and wealth management clients globally.

The diagram below presents our three business segments and lines of business, with the remaining operations in the Other segment.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | The Bank of New York Mellon Corporation | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Securities

Services | | | Market and Wealth Services | | | Investment and Wealth Management | |

| | | | | | | | | | | | | | | | |

| | Asset

Servicing | | | | Pershing | | | | Investment

Management |

| | | | | | | |

| | | | | | | | | | | | | | | | |

| | Issuer

Services | | | | Treasury

Services | | | | Wealth

Management |

| | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | Clearance and Collateral Management | | | | | | |

| | | | | | | | | | | | | |

For additional information on our business segments, see “Review of business segments” and Note 24 of the Notes to Consolidated Financial Statements.

Key 2022 events

Alcentra

On Nov. 1, 2022, we completed the sale of BNY Alcentra Group Holdings, Inc. (together with its subsidiaries, “Alcentra”). At Oct. 31, 2022, Alcentra had $32 billion in AUM concentrated in senior secured loans, high yield bonds, private credit, structured credit, special situations and multi-strategy credit strategies.

Repositioning the securities portfolio

In the fourth quarter of 2022, we took actions to reposition the securities portfolio to improve the trajectory of our net interest revenue. We sold approximately $3 billion of longer-dated lower yielding municipal and corporate bonds. These securities were replaced with significantly higher yielding securities. As a result of the repositioning, we recorded net securities losses of $449 million (pre-tax) in investment and other revenue.

Goodwill impairment

In the third quarter of 2022, we recorded a $680 million impairment of the goodwill associated with the Investment Management reporting unit, which

| | |

Results of Operations (continued) |

was driven by lower market values and a higher discount rate. This goodwill impairment represents a non-cash charge and did not affect BNY Mellon’s liquidity position, tangible common equity or regulatory capital ratios. See “Critical accounting estimates” for additional information.

Leadership succession

In March 2022, Todd Gibbons announced his decision to retire as Chief Executive Officer (“CEO”) and member of the Board of Directors effective Aug. 31, 2022. The Board of Directors appointed Robin Vince to the position of President and CEO after Mr. Gibbons retired. Since 2020, Mr. Vince had served as Vice Chair of BNY Mellon and CEO of Global Market Infrastructure, which includes BNY Mellon’s Pershing, Treasury Services, and Clearance and Collateral Management lines of business, as well as Markets & Execution Services.

Dermot McDonogh joined BNY Mellon on Nov. 1, 2022, and effective Feb. 1, 2023, succeeded Emily Portney as the Chief Financial Officer (“CFO”). Ms. Portney served as the CFO since July 19, 2020, and has assumed a new position leading the Company’s Asset Servicing business.

Summary of financial highlights

We reported net income applicable to common shareholders of $2.4 billion, or $2.90 per diluted common share, in 2022, including the negative impact of notable items. Notable items in 2022 include goodwill impairment in the Investment Management reporting unit, a net loss from repositioning the securities portfolio, severance expense, litigation reserves, the accelerated amortization of deferred costs for depositary receipts services related to Russia and net gains on disposals (reflected in investment and other revenue). Excluding notable items, net income applicable to common shareholders was $3.7 billion (Non-GAAP), or $4.59 (Non-GAAP) per diluted common share, in 2022. In 2021, net income applicable to common shareholders of BNY Mellon was $3.6 billion, or $4.14 per diluted common share, including the negative impact of notable items. Notable items in 2021 include litigation reserves, severance expense and net gains on disposals (reflected in investment and other revenue). Excluding notable items, net income applicable to common shareholders was $3.6

billion (Non-GAAP), or $4.24 (Non-GAAP) per diluted common share, in 2021.

The highlights below are based on 2022 compared with 2021, unless otherwise noted.

•Total revenue increased 3%, or 6% (Non-GAAP) excluding notable items, primarily reflecting:

•Fee revenue was essentially flat primarily reflecting lower market values, the unfavorable impact of a stronger U.S. dollar and the accelerated amortization of deferred costs for depositary receipts services related to Russia, partially offset by lower money market fee waivers. (See “Fee and other revenue” beginning on page 6.) •Investment and other revenue decreased, primarily reflecting the net loss from repositioning the securities portfolio. (See “Fee and other revenue” beginning on page 6.) •Net interest revenue increased 34%, primarily driven by higher interest rates on interest-earning assets, partially offset by higher funding expense. (See “Net interest revenue” beginning on page 9.) •The provision for credit losses was $39 million compared with a benefit of $231 million. The increase was primarily driven by changes in the macroeconomic environment forecast. (See “Allowance for credit losses” beginning on page 34.) •Noninterest expense increased 13%, primarily reflecting the goodwill impairment in the Investment Management reporting unit and higher severance expense and litigation reserves. Excluding notable items, noninterest expense increased 5% (Non-GAAP), primarily reflecting higher investments in growth, infrastructure and efficiency initiatives and higher revenue-related expenses, as well as the impact of inflation, partially offset by an approximately 3% favorable impact of a stronger U.S. dollar. (See “Noninterest expense” on page 12.) •Effective tax rate of 23.1%, or 19.1% excluding notable items (Non-GAAP), primarily goodwill impairment, in 2022. (See “Income taxes” on page 12.) •Return on common equity (“ROE”) was 6.5% for 2022. Excluding notable items, the adjusted ROE was 10.3% (Non-GAAP) for 2022.

| | |

Results of Operations (continued) |

•Return on tangible common equity (“ROTCE”) was 13.4% (Non-GAAP) for 2022. Excluding notable items, the adjusted ROTCE was 21.0% (Non-GAAP) for 2022.

See “Supplemental Information – Explanation of GAAP and Non-GAAP financial measures” beginning on page 104 for the reconciliation of the Non-GAAP measures.

Metrics

•AUC/A totaled $44.3 trillion at Dec. 31, 2022 compared with $46.7 trillion at Dec. 31, 2021. The 5% decrease primarily reflects lower market values and the unfavorable impact of a stronger U.S. dollar, partially offset by client inflows and net new business. (See “Fee and other revenue” beginning on page 6.) •AUM totaled $1.8 trillion at Dec. 31, 2022 compared with $2.4 trillion at Dec. 31, 2021. The 25% decrease primarily reflects lower market values, the unfavorable impact of a stronger U.S. dollar and the divestiture of Alcentra, partially offset by net inflows. (See “Investment and Wealth Management business segment” beginning on page 18.)

Capital and liquidity

•Our CET1 ratio calculated under the Advanced Approaches was 11.2% at Dec. 31, 2022 and 11.2% under the Standardized Approach at Dec. 31, 2021. This primarily reflects capital generated through earnings, lower risk-weighted assets (“RWAs”) and the impact of the Alcentra sale, offset by the net decrease in accumulated other comprehensive income and capital

deployed through dividends. (See “Capital” beginning on page 40.) •Our Tier 1 leverage ratio was 5.8% at Dec. 31, 2022, compared with 5.5% at Dec. 31, 2021. The increase reflects lower average assets, partially offset by a decrease in capital. (See “Capital” beginning on page 40.)

Highlights of our principal business segments

Securities Services

•Total revenue increased 11%.

•Income before taxes increased 13%.

•Pre-tax operating margin of 21%.

Market and Wealth Services

•Total revenue increased 11%.

•Income before taxes increased 10%.

•Pre-tax operating margin of 44%.

Investment and Wealth Management

•Total revenue decreased 12%.

•Income before taxes decreased 96%; or 39% excluding notable items (Non-GAAP).

•Pre-tax operating margin of 1%; adjusted pre-tax operating margin of 24% excluding notable items (Non-GAAP).

See “Supplemental Information – Explanation of GAAP and Non-GAAP financial measures” beginning on page 104 for the reconciliation of the Non-GAAP measures. See “Review of business segments” and Note 24 of the Notes to Consolidated Financial Statements for additional information on our business segments.

| | |

Results of Operations (continued) |

Fee and other revenue

| | | | | | | | | | | | | | | | | |

| Fee and other revenue | | | | 2022 | 2021 |

| | | | vs. | vs. |

| (dollars in millions, unless otherwise noted) | 2022 | 2021 | 2020 | 2021 | 2020 |

| Investment services fees | $ | 8,529 | | $ | 8,284 | | $ | 8,047 | | 3 | % | 3 | % |

Investment management and performance fees (a) | 3,299 | | 3,588 | | 3,367 | | (8) | | 7 | |

| Foreign exchange revenue | 822 | | 799 | | 774 | | 3 | | 3 | |

| Financing-related fees | 175 | | 194 | | 212 | | (10) | | (8) | |

| Distribution and servicing fees | 130 | | 112 | | 115 | | 16 | | (3) | |

| Total fee revenue | 12,955 | | 12,977 | | 12,515 | | — | | 4 | |

| Investment and other revenue | (82) | | 336 | | 316 | | N/M | N/M |

| Total fee and other revenue | $ | 12,873 | | $ | 13,313 | | $ | 12,831 | | (3) | % | 4 | % |

| | | | | |

| Fee revenue as a percentage of total revenue | 79 | % | 81 | % | 79 | % | | |

| | | | | |

AUC/A at period end (in trillions) (b) | $ | 44.3 | | $ | 46.7 | | $ | 41.1 | | (5) | % | 14 | % |

AUM at period end (in billions) (c) | $ | 1,836 | | $ | 2,434 | | $ | 2,211 | | (25) | % | 10 | % |

(a) Excludes seed capital gains (losses) related to consolidated investment management funds.

(b) Consists of AUC/A primarily from the Asset Servicing line of business and, to a lesser extent, the Clearance and Collateral Management, Issuer Services, Pershing and Wealth Management lines of business. Includes the AUC/A of CIBC Mellon of $1.5 trillion at Dec. 31, 2022, $1.7 trillion at Dec. 31, 2021 and $1.5 trillion at Dec. 31, 2020.

(c) Excludes assets managed outside of the Investment and Wealth Management business segment.

N/M – Not meaningful.

Fee revenue was essentially flat compared with 2021, primarily reflecting lower market values, the unfavorable impact of a stronger U.S. dollar and the accelerated amortization of deferred costs for depositary receipts services related to Russia in the first quarter of 2022, partially offset by lower money market fee waivers.

Investment and other revenue decreased $418 million in 2022 compared with 2021, primarily reflecting the net loss from repositioning the securities portfolio.

Money market fee waivers

In recent years, low short-term interest rates resulted in money market mutual fund fees and other similar fees being waived to protect investors from negative returns. The fee waivers impacted fee revenues in most of our businesses, but also resulted in lower distribution and servicing expense. Money market fee waivers are highly sensitive to changes in short-term interest rates and, due to increases in interest rates in the second half of 2022, have abated.

The following table presents the impact of money market fee waivers on our consolidated fee revenue, net of distribution and servicing expense. In 2022, the net impact of money market fee waivers was $306 million, down from $916 million in 2021, driven by higher interest rates.

| | | | | | | | | | | |

| Money market fee waivers | | | |

| (in millions) | 2022 | 2021 | 2020 |

| Investment services fees (see table below) | $ | (153) | | $ | (547) | | $ | (209) | |

| Investment management and performance fees | (165) | | (429) | | (142) | |

| Distribution and servicing fees | (13) | | (51) | | (17) | |

| Total fee revenue | (331) | | (1,027) | | (368) | |

| Less: Distribution and servicing expense | 25 | | 111 | | 31 | |

| Net impact of money market fee waivers | $ | (306) | | $ | (916) | | $ | (337) | |

| | | |

Impact to investment services fees by line of business (a): | | | |

| Asset Servicing | $ | (19) | | $ | (105) | | $ | (10) | |

| Issuer Services | (12) | | (62) | | (9) | |

| Pershing | (116) | | (343) | | (186) | |

| Treasury Services | (6) | | (37) | | (4) | |

| Total impact to investment services fees by line of business | $ | (153) | | $ | (547) | | $ | (209) | |

| | | |

Impact to fee revenue by line of business (a): | | | |

| Asset Servicing | $ | (29) | | $ | (176) | | $ | (18) | |

| Issuer Services | (16) | | (83) | | (13) | |

| Pershing | (137) | | (401) | | (227) | |

| Treasury Services | (8) | | (52) | | (6) | |

| Investment Management | (139) | | (303) | | (100) | |

| Wealth Management | (2) | | (12) | | (4) | |

| Total impact to fee revenue by line of business | $ | (331) | | $ | (1,027) | | $ | (368) | |

(a) The line of business revenue for management reporting purposes reflects the impact of revenue transferred between the businesses.

| | |

Results of Operations (continued) |

Investment services fees

Investment services fees increased 3% compared with 2021, primarily reflecting lower money market fee waivers and higher client activity, partially offset by the impact of prior year lost business in Pershing and Corporate Trust, the unfavorable impact of a stronger U.S. dollar, lower market values and the accelerated amortization of deferred costs for depositary receipts services related to Russia in the first quarter of 2022.

AUC/A totaled $44.3 trillion at Dec. 31, 2022, a decrease of 5% compared with Dec. 31, 2021, primarily reflecting lower market values and the unfavorable impact of a stronger U.S. dollar, partially offset by client inflows and net new business. AUC/A consisted of 33% equity securities and 67% fixed-income securities at Dec. 31, 2022 and 37% equity securities and 63% fixed-income securities at Dec. 31, 2021.

See “Securities Services business segment” and “Market and Wealth Services business segment” in “Review of business segments” for additional details.

Investment management and performance fees

Investment management and performance fees decreased 8% compared with 2021, primarily reflecting lower market values, the unfavorable impact of a stronger U.S. dollar, the mix of cumulative net inflows, the impact of the Alcentra divestiture and lower equity income, partially offset by lower money market fee waivers. Performance fees were $75 million in 2022 and $107 million in 2021. On a constant currency basis (Non-GAAP), investment management and performance fees decreased 4% compared with 2021. See “Supplemental Information – Explanation of GAAP and Non-GAAP financial measures” beginning on page 104 for the reconciliation of Non-GAAP measures.

AUM was $1.8 trillion at Dec. 31, 2022, a decrease of 25% compared with Dec. 31, 2021, primarily reflecting lower market values, the unfavorable impact of a stronger U.S. dollar and the divestiture of Alcentra, partially offset by net inflows.

See “Investment and Wealth Management business segment” in “Review of business segments” for additional details regarding the drivers of investment

management and performance fees, AUM and AUM flows.

Foreign exchange revenue

Foreign exchange revenue is primarily driven by the volume of client transactions and the spread realized on these transactions, both of which are impacted by market volatility, the impact of foreign currency hedging activities and foreign currency remeasurement gain (loss). In 2022, foreign exchange revenue increased 3% compared with 2021, primarily reflecting higher volatility, partially offset by lower volumes. Foreign exchange revenue is primarily reported in the Securities Services business segment and, to a lesser extent, the Market and Wealth Services and Investment and Wealth Management business segments and the Other segment.

Financing-related fees

Financing-related fees, which are primarily reported in the Market and Wealth Services and Securities Services business segments, include capital market fees, loan commitment fees and credit-related fees. Financing-related fees decreased 10% in 2022 compared with 2021, primarily reflecting lower capital market fees, including underwriting fees.

Distribution and servicing fees

Distribution and servicing fees earned from mutual funds are primarily based on average assets in the funds and the sales of funds that we manage or administer, and are primarily reported in the Investment Management business. These fees, which include 12b-1 fees, fluctuate with the overall level of net sales, the relative mix of sales between share classes, the funds’ market values and money market fee waivers.

Distribution and servicing fees were $130 million in 2022 compared with $112 million in 2021, driven by lower money market fee waivers. The impact of distribution and servicing fees on income in any one period is partially offset by distribution and servicing expense paid to other financial intermediaries to cover their costs for distribution and servicing of mutual funds. Distribution and servicing expense is recorded as noninterest expense on the income statement.

| | |

Results of Operations (continued) |

Investment and other revenue

Investment and other revenue includes income or loss from consolidated investment management funds, seed capital gains or losses, other trading revenue or loss, renewable energy investments losses, income from corporate and bank-owned life insurance contracts, other investment gains or losses, gains or losses from disposals, expense reimbursements from our CIBC Mellon joint venture, other income or loss and net securities gains or losses. The income or loss from consolidated investment management funds should be considered together with the net income or loss attributable to noncontrolling interests, which reflects the portion of the consolidated funds for which we do not have an economic interest and is reflected below net income as a separate line item on the consolidated income statement. Other trading revenue or loss primarily includes the impact of market-risk hedging activity related to our seed capital investments in investment management funds, non-foreign currency derivative and fixed income trading, and other hedging activity. Investments in renewable energy generate losses in investment and other revenue that are more than offset by benefits and credits recorded to the provision for income taxes. Other investment gains or losses includes fair value changes of non-readily marketable strategic equity, private equity and other investments. Expense reimbursements from our CIBC Mellon joint venture relate to expenses incurred by BNY Mellon on behalf of the CIBC Mellon joint venture. Other income includes various miscellaneous revenues.

The following table provides the components of investment and other revenue.

| | | | | | | | | | | | | | |

| Investment and other revenue | |

| (in millions) | 2022 | | 2021 | 2020 |

| (Loss) income from consolidated investment management funds | $ | (42) | | | $ | 32 | | $ | 84 | |

Seed capital (losses) gains (a) | (37) | | | 40 | | 23 | |

| Other trading revenue | 149 | | | 6 | | 13 | |

| Renewable energy investment (losses) | (164) | | | (201) | | (129) | |

| Corporate/bank-owned life insurance | 128 | | | 140 | | 148 | |

Other investment gains (b) | 159 | | | 159 | | 35 | |

| Disposal gains (losses) | 26 | | | 13 | | (61) | |

| Expense reimbursements from joint venture | 108 | | | 96 | | 85 | |

| Other income | 34 | | | 46 | | 85 | |

| Net securities (losses) gains | (443) | | (c) | 5 | | 33 | |

| Total investment and other revenue | $ | (82) | | | $ | 336 | | $ | 316 | |

(a) Includes gains (losses) on investments in BNY Mellon funds which hedge deferred incentive awards.

(b) Includes strategic equity, private equity and other investments.

(c) Includes a net loss of $449 million related to the repositioning of the securities portfolio.

Investment and other revenue was a loss of $82 million in 2022 compared with revenue of $336 million in 2021. The decrease primarily reflects the net loss from repositioning the securities portfolio.

| | |

Results of Operations (continued) |

Net interest revenue

| | | | | | | | | | | | | | | | | |

| Net interest revenue | | | | 2022 | 2021 |

| | | | vs. | vs. |

| (dollars in millions) | 2022 | 2021 | 2020 | 2021 | 2020 |

| Net interest revenue | $ | 3,504 | | $ | 2,618 | | $ | 2,977 | | 34 | % | (12)% |

| Add: Tax equivalent adjustment | 11 | | 13 | | 9 | | N/M | N/M |

Net interest revenue on a fully taxable equivalent (“FTE”) basis – Non-GAAP (a) | $ | 3,515 | | $ | 2,631 | | $ | 2,986 | | 34 | % | (12)% |

| | | | | |

Average interest-earning assets | $ | 362,180 | | $ | 387,023 | | $ | 354,526 | | (6)% | 9 | % |

| | | | | |

| Net interest margin | 0.97 | % | 0.68 | % | 0.84 | % | 29 | bps | (16) | bps |

Net interest margin (FTE) – Non-GAAP (a) | 0.97 | % | 0.68 | % | 0.84 | % | 29 | bps | (16) | bps |

(a) Net interest revenue (FTE) – Non-GAAP and net interest margin (FTE) – Non-GAAP include the tax equivalent adjustments on tax-exempt income which allows for comparisons of amounts arising from both taxable and tax-exempt sources and is consistent with industry practice. The adjustment to an FTE basis has no impact on net income.

N/M – Not meaningful.

bps – basis points.

Net interest revenue increased 34% compared with 2021, primarily reflecting higher interest rates on interest-earning assets, partially offset by higher funding expense.

Net interest margin increased 29 basis points compared with 2021. The increase primarily reflects the factors mentioned above.

Average interest-earning assets decreased 6% compared with 2021. The decrease primarily reflects lower interest-bearing deposit assets and lower securities balances, partially offset by higher loan balances.

Average non-U.S. dollar deposits comprised approximately 25% of our average total deposits in 2022 and 2021. Approximately 40% of the average non-U.S. dollar deposits in 2022 and 2021 were euro-denominated.

Net interest revenue in future periods will depend on the level and mix of client deposits and deposit rates, as well as the level and shape of the yield curve. Based on the market implied forward interest rates as of the reporting date, we expect net interest revenue for the year ended Dec. 31, 2023 to increase when compared to the year ended Dec. 31, 2022.

| | |

Results of Operations (continued) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Average balances and interest rates | 2022 | | 2021 |

| (dollars in millions) | Average balance | | Interest | | Average rate | | Average balance | | Interest | | Average rate | |

| Assets | | | | | | | | | | | | |

| Interest-earning assets: | | | | | | | | | | | | |

| Interest-bearing deposits with the Federal Reserve and other central banks: | | | | | | | | | | | | |

| Domestic offices | $ | 46,270 | | | $ | 810 | | | 1.75 | % | | $ | 47,070 | | | $ | 60 | | | 0.13 | % | |

| Foreign offices | 51,172 | | | 209 | | | 0.41 | | | 66,276 | | | (137) | | | (0.21) | | |

| Total interest-bearing deposits with the Federal Reserve and other central banks | 97,442 | | | 1,019 | | | 1.05 | | | 113,346 | | | (77) | | | (0.07) | | |

| Interest-bearing deposits with banks | 16,826 | | | 221 | | | 1.31 | | | 20,757 | | | 48 | | | 0.23 | | |

Federal funds sold and securities purchased under resale agreements (a) | 24,953 | | | 1,200 | | | 4.81 | | | 28,530 | | | 120 | | | 0.42 | | |

| Loans: | | | | | | | | | | | | |

| Domestic offices | 62,640 | | | 1,878 | | | 3.00 | | | 55,073 | | | 892 | | | 1.62 | | |

| Foreign offices | 5,185 | | | 121 | | | 2.33 | | | 5,741 | | | 66 | | | 1.15 | | |

Total loans (b) | 67,825 | | | 1,999 | | | 2.95 | | | 60,814 | | | 958 | | | 1.58 | | |

| Securities: | | | | | | | | | | | | |

| U.S. government obligations | 40,583 | | | 607 | | | 1.49 | | | 34,383 | | | 261 | | | 0.76 | | |

| U.S. government agency obligations | 64,041 | | | 1,157 | | | 1.81 | | | 72,552 | | | 985 | | | 1.36 | | |

State and political subdivisions (c) | 1,887 | | | 43 | | | 2.31 | | | 2,623 | | | 54 | | | 2.01 | | |

| Other securities: | | | | | | | | | | | | |

Domestic offices (c) | 17,092 | | | 586 | | | 3.43 | | | 17,145 | | | 333 | | | 1.94 | | |

| Foreign offices | 26,283 | | | 154 | | | 0.59 | | | 30,183 | | | 123 | | | 0.41 | | |

Total other securities (c) | 43,375 | | | 740 | | | 1.71 | | | 47,328 | | | 456 | | | 0.96 | | |

Total investment securities (c) | 149,886 | | | 2,547 | | | 1.70 | | | 156,886 | | | 1,756 | | | 1.12 | | |

Trading securities (primarily domestic) (c) | 5,248 | | | 143 | | | 2.73 | | | 6,690 | | | 53 | | | 0.80 | | |

Total securities (c) | 155,134 | | | 2,690 | | | 1.73 | | | 163,576 | | | 1,809 | | | 1.11 | | |

Total interest-earning assets (c) | $ | 362,180 | | | $ | 7,129 | | | 1.97 | % | | $ | 387,023 | | | $ | 2,858 | | | 0.74 | % | |

| Noninterest-earning assets | 64,721 | | | | | | | 65,209 | | | | | | |

| Total assets | $ | 426,901 | | | | | | | $ | 452,232 | | | | | | |

| Liabilities and equity | | | | | | | | | | | | |

| Interest-bearing liabilities: | | | | | | | | | | | | |

| Interest-bearing deposits: | | | | | | | | | | | | |

Domestic offices | $ | 111,491 | | | $ | 980 | | | 0.88 | % | | $ | 124,716 | | | $ | (27) | | | (0.02) | % | |

| Foreign offices | 101,916 | | | 607 | | | 0.60 | | | 112,493 | | | (148) | | | (0.13) | | |

| Total interest-bearing deposits | 213,407 | | | 1,587 | | | 0.74 | | | 237,209 | | | (175) | | | (0.07) | | |

Federal funds purchased and securities sold under repurchase agreements (a) | 12,940 | | | 934 | | | 7.21 | | | 13,716 | | | (4) | | | (0.03) | | |

| Trading liabilities | 3,432 | | | 68 | | | 1.98 | | | 2,590 | | | 8 | | | 0.31 | | |

| Other borrowed funds: | | | | | | | | | | | | |

| Domestic offices | 181 | | | 7 | | | 4.12 | | | 160 | | | 5 | | | 2.99 | | |

| Foreign offices | 324 | | | 2 | | | 0.51 | | | 223 | | | 3 | | | 1.48 | | |

| Total other borrowed funds | 505 | | | 9 | | | 1.80 | | | 383 | | | 8 | | | 2.11 | | |

| Commercial paper | 5 | | | — | | | 2.06 | | | 3 | | | — | | | 0.07 | | |

| Payables to customers and broker-dealers | 17,111 | | | 156 | | | 0.91 | | | 16,887 | | | (2) | | | (0.01) | | |

| Long-term debt | 27,448 | | | 860 | | | 3.13 | | | 25,788 | | | 392 | | | 1.52 | | |

| Total interest-bearing liabilities | $ | 274,848 | | | $ | 3,614 | | | 1.31 | % | | $ | 296,576 | | | $ | 227 | | | 0.08 | % | |

| Total noninterest-bearing deposits | 85,652 | | | | | | | 86,606 | | | | | | |

| Other noninterest-bearing liabilities | 25,278 | | | | | | | 24,381 | | | | | | |

| Total liabilities | 385,778 | | | | | | | 407,563 | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Total The Bank of New York Mellon Corporation shareholders’ equity | 41,013 | | | | | | | 44,358 | | | | | | |

| Noncontrolling interests | 110 | | | | | | | 311 | | | | | | |

| | | | | | | | | | | | |

| Total liabilities and equity | $ | 426,901 | | | | | | | $ | 452,232 | | | | | | |

Net interest revenue (FTE) – Non-GAAP (c)(d) | | | $ | 3,515 | | | | | | | $ | 2,631 | | | | |

Net interest margin (FTE) – Non-GAAP (c)(d) | | | | | 0.97 | % | | | | | | 0.68 | % | |

| Less: Tax equivalent adjustment | | | 11 | | | | | | | 13 | | | | |

| Net interest revenue – GAAP | | | $ | 3,504 | | | | | | | $ | 2,618 | | | | |

| Net interest margin – GAAP | | | | | 0.97 | % | | | | | | 0.68 | % | |

Percentage of assets attributable to foreign offices (e) | 26 | % | | | | | | 30 | % | | | | | |

Percentage of liabilities attributable to foreign offices (e) | 30 | % | | | | | | 31 | % | | | | | |

(a) Includes the average impact of offsetting under enforceable netting agreements of approximately $43 billion in 2022 and $45 billion in 2021. On a Non-GAAP basis, excluding the impact of offsetting, the yield on federal funds sold and securities purchased under resale agreements would have been 1.77% for 2022 and 0.16% for 2021, and the rate on federal funds purchased and securities sold under repurchase agreements would have been 1.67% for 2022 and (0.01)% for 2021. We believe providing the rates excluding the impact of netting is useful to investors as it is more reflective of the actual rates earned and paid.

(b) Interest income includes fees of $2 million in 2022 and $3 million in 2021. Nonaccrual loans are included in average loans; the associated income, which was recognized on a cash basis, is included in interest income.

(c) Average rates were calculated on an FTE basis, at tax rates of approximately 21% for both 2022 and 2021.

(d) See “Net interest revenue” on page 9 for the reconciliation of this Non-GAAP measure. (e) Includes the Cayman Islands branch office, which existed through August 2021.

| | |

Results of Operations (continued) |

| | | | | | | | | | | | | | |

| Average balances and interest rates | 2020 |

| (dollars in millions) | Average balance | | Interest | | Average rate | |

| Assets | | | | | | |

| Interest-earning assets: | | | | | | |

| Interest-bearing deposits with the Federal Reserve and other central banks: | | | | | | |

| Domestic offices | $ | 45,186 | | | $ | 121 | | | 0.27 | % | |

| Foreign offices | 49,246 | | | (71) | | | (0.14) | | |

| Total interest-bearing deposits with the Federal Reserve and other central banks | 94,432 | | | 50 | | | 0.05 | | |

| Interest-bearing deposits with banks | 19,165 | | | 134 | | | 0.70 | | |

Federal funds sold and securities purchased under resale agreements (a) | 30,768 | | | 545 | | | 1.77 | | |

| Loans: | | | | | | |

| Domestic offices | 44,137 | | | 942 | | | 2.13 | | |

| Foreign offices | 11,091 | | | 200 | | | 1.81 | | |

Total loans (b) | 55,228 | | | 1,142 | | | 2.07 | | |

| Securities: | | | | | | |

| U.S. government obligations | 27,242 | | | 278 | | | 1.02 | | |

| U.S. government agency obligations | 75,430 | | | 1,328 | | | 1.76 | | |

State and political subdivisions (c) | 1,418 | | | 36 | | | 2.51 | | |

| Other securities: | | | | | | |

Domestic offices (c) | 14,335 | | | 300 | | | 2.09 | | |

| Foreign offices | 29,402 | | | 212 | | | 0.72 | | |

Total other securities (c) | 43,737 | | | 512 | | | 1.17 | | |

Total investment securities (c) | 147,827 | | | 2,154 | | | 1.46 | | |

Trading securities (primarily domestic) (c) | 7,106 | | | 93 | | | 1.31 | | |

Total securities (c) | 154,933 | | | 2,247 | | | 1.45 | | |

Total interest-earning assets (c) | $ | 354,526 | | | $ | 4,118 | | | 1.16 | % | |

| Noninterest-earning assets | 58,792 | | | | | | |

| Total assets | $ | 413,318 | | | | | | |

| Liabilities and equity | | | | | | |

| Interest-bearing liabilities: | | | | | | |

| Interest-bearing deposits: | | | | | | |

| Domestic offices | $ | 105,984 | | | $ | 176 | | | 0.17 | % | |

| Foreign offices | 106,836 | | | (15) | | | (0.01) | | |

| Total interest-bearing deposits | 212,820 | | | 161 | | | 0.08 | | |

Federal funds purchased and securities sold under repurchase agreements (a) | 14,862 | | | 283 | | | 1.90 | | |

| Trading liabilities | 2,177 | | | 15 | | | 0.68 | | |

| Other borrowed funds: | | | | | | |

| Domestic offices | 849 | | | 15 | | | 1.81 | | |

| Foreign offices | 199 | | | 1 | | | 0.26 | | |

| Total other borrowed funds | 1,048 | | | 16 | | | 1.52 | | |

| Commercial paper | 1,082 | | | 7 | | | 0.66 | | |

| Payables to customers and broker-dealers | 17,789 | | | 28 | | | 0.16 | | |

| Long-term debt | 26,888 | | | 622 | | | 2.31 | | |

| Total interest-bearing liabilities | $ | 276,666 | | | $ | 1,132 | | | 0.41 | % | |

| Total noninterest-bearing deposits | 69,124 | | | | | | |

| Other noninterest-bearing liabilities | 23,879 | | | | | | |

| Total liabilities | 369,669 | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Total The Bank of New York Mellon Corporation shareholders’ equity | 43,430 | | | | | | |

| Noncontrolling interests | 219 | | | | | | |

| | | | | | |

| Total liabilities and equity | $ | 413,318 | | | | | | |

Net interest revenue (FTE) – Non-GAAP (c)(d) | | | $ | 2,986 | | | | |

Net interest margin (FTE) – Non-GAAP (c)(d) | | | | | 0.84 | % | |

| Less: Tax equivalent adjustment | | | 9 | | | | |

| Net interest revenue – GAAP | | | $ | 2,977 | | | | |

| Net interest margin – GAAP | | | | | 0.84 | % | |

Percentage of assets attributable to foreign offices (e) | 30 | % | | | | | |

Percentage of liabilities attributable to foreign offices (e) | 32 | % | | | | | |

(a) Includes the average impact of offsetting under enforceable netting agreements of approximately $57 billion in 2020. On a Non-GAAP basis, excluding the impact of offsetting, the yield on federal funds sold and securities purchased under resale agreements would have been 0.62%, and the rate on federal funds purchased and securities sold under repurchase agreements would have been 0.39% for 2020. We believe providing the rates excluding the impact of netting is useful to investors as it is more reflective of the actual rates earned and paid.

(b) Interest income includes fees of $6 million in 2020. Nonaccrual loans are included in average loans; the associated income, which was recognized on a cash basis, is included in interest income.

(c) Average rates were calculated on an FTE basis, at tax rates of approximately 21% in 2020.

(d) See “Net interest revenue” on page 9 for the reconciliation of this Non-GAAP measure. (e) Includes the Cayman Islands branch office.

| | |

Results of Operations (continued) |

Noninterest expense

| | | | | | | | | | | | | | | | | |

| Noninterest expense | | | | 2022 | 2021 |

| | | | vs. | vs. |

| (dollars in millions) | 2022 | 2021 | 2020 | 2021 | 2020 |

| Staff | $ | 6,800 | | $ | 6,337 | | $ | 5,966 | | 7 | % | 6 | % |

| Software and equipment | 1,657 | | 1,478 | | 1,370 | | 12 | | 8 | |

| Professional, legal and other purchased services | 1,527 | | 1,459 | | 1,403 | | 5 | | 4 | |

| Net occupancy | 514 | | 498 | | 581 | | 3 | | (14) | |

| Sub-custodian and clearing | 485 | | 505 | | 460 | | (4) | | 10 | |

| Distribution and servicing | 343 | | 298 | | 336 | | 15 | | (11) | |

| Business development | 152 | | 107 | | 105 | | 42 | | 2 | |

| Bank assessment charges | 126 | | 133 | | 124 | | (5) | | 7 | |

| Goodwill impairment | 680 | | — | | — | | N/M | N/M |

| Amortization of intangible assets | 67 | | 82 | | 104 | | (18) | | (21) | |

| Other | 659 | | 617 | | 555 | | 7 | | 11 | |

| Total noninterest expense | $ | 13,010 | | $ | 11,514 | | $ | 11,004 | | 13 | % | 5 | % |

| | | | | |

| Full-time employees at year-end | 51,700 | | 49,100 | | 48,500 | | 5 | % | 1 | % |

Total noninterest expense increased 13% compared with 2021. The increase primarily reflects goodwill impairment in the Investment Management reporting unit and higher severance expense and litigation reserves. Excluding notable items, noninterest expense increased 5% (Non-GAAP), primarily reflecting higher investments in growth, infrastructure and efficiency initiatives and higher revenue-related expenses, as well as the impact of inflation, partially offset by an approximately 3% favorable impact of a stronger U.S. dollar. The investments in growth, infrastructure and efficiency initiatives are primarily included in staff, software and equipment, and professional, legal and other purchased services expenses. See “Supplemental Information – Explanation of GAAP and Non-GAAP financial measures” beginning on page 104 for the reconciliation of the Non-GAAP measure.

We expect noninterest expense for the year ended Dec. 31, 2023 to increase, but at a slower pace when compared with the year ended Dec. 31, 2022; the increase is driven by higher revenue-related expenses and higher investments in growth, infrastructure and efficiency initiatives, as well as the impact of inflation, partially offset by the benefit of efficiency initiatives.

Income taxes

BNY Mellon recorded an income tax provision of $768 million (23.1% effective tax rate) in 2022. Excluding notable items, the income tax provision was $930 million (19.1% effective tax rate) (Non-GAAP) in 2022. The income tax provision was $877 million (18.9% effective tax rate) in 2021. See “Supplemental Information – Explanation of GAAP and Non-GAAP financial measures” beginning on page 104 for the reconciliation of the Non-GAAP measure. For additional information, see Note 12 of the Notes to Consolidated Financial Statements.

| | |

Results of Operations (continued) |

Review of business segments

We have an internal information system that produces performance data along product and service lines for our three principal business segments: Securities Services, Market and Wealth Services and Investment and Wealth Management, and the Other segment.

Business segment accounting principles

Our business segment data has been determined on an internal management basis of accounting, rather than the generally accepted accounting principles (“GAAP”) used for consolidated financial reporting. These measurement principles are designed so that reported results of the business will track their economic performance.

For information on the accounting principles of our business segments, the primary products and services in each line of business, the primary types of revenue by line of business and how our business segments are presented and analyzed, see Note 24 of the Notes to Consolidated Financial Statements.

Business segment results are subject to reclassification when organizational changes are made, or for refinements in revenue and expense allocation methodologies. Refinements are typically reflected on a prospective basis. There were no reclassification or organizational changes in 2022.

The results of our business segments may be influenced by client and other activities that vary by quarter. In the first quarter, staff expense typically increases reflecting the vesting of long-term stock awards for retirement-eligible employees. Prior to 2022, in the third quarter, staff expense typically increased reflecting the annual employee merit increase. In 2022, this increase was reflected in the second quarter. In the third quarter, volume-related fees may decline due to reduced client activity. In the fourth quarter, we typically incur higher business

development and marketing expenses; however, 2020 was an exception due to the impact of the coronavirus pandemic. In our Investment and Wealth Management business segment, performance fees are typically higher in the fourth and first quarters, as those quarters represent the end of the measurement period for many of the performance fee-eligible relationships.

The results of our business segments may also be impacted by the translation of financial results denominated in foreign currencies to the U.S. dollar. We are primarily impacted by activities denominated in the British pound and the euro. On a consolidated basis and in our Securities Services and Market and Wealth Services business segments, we typically have more foreign currency-denominated expenses than revenues. However, our Investment and Wealth Management business segment typically has more foreign currency-denominated revenues than expenses. Overall, currency fluctuations impact the year-over-year growth rate in the Investment and Wealth Management business segment more than the Securities Services and Market and Wealth Services business segments. However, currency fluctuations, in isolation, are not expected to significantly impact net income on a consolidated basis.

Fee revenue in the Investment and Wealth Management business segment, and to a lesser extent the Securities Services and Market and Wealth Services business segments, is impacted by the global market fluctuations. At Dec. 31, 2022, we estimated that a 5% change in global equity markets, spread evenly throughout the year, would impact fee revenue by less than 1% and diluted earnings per common share by $0.04 to $0.07.

See Note 24 of the Notes to Consolidated Financial Statements for the consolidating schedules which show the contribution of our business segments to our overall profitability.

| | |

Results of Operations (continued) |

Securities Services business segment

| | | | | | | | | | | | | | | | | |

| | | | 2022 | 2021 |

| | | | vs. | vs. |

| (dollars in millions, unless otherwise noted) | 2022 | 2021 | 2020 | 2021 | 2020 |

| Revenue: | | | | | |

| Investment services fees: | | | | | |

| Asset Servicing | $ | 3,918 | | $ | 3,876 | | $ | 3,635 | | 1 | % | 7 | % |

| Issuer Services | 1,009 | | 1,061 | | 1,100 | | (5) | | (4) | |

| Total investment services fees | 4,927 | | 4,937 | | 4,735 | | — | | 4 | |

| Foreign exchange revenue | 584 | | 574 | | 602 | | 2 | | (5) | |

Other fees (a) | 202 | | 113 | | 182 | | 79 | | (38) | |

| Total fee revenue | 5,713 | | 5,624 | | 5,519 | | 2 | | 2 | |

| Investment and other revenue | 291 | | 194 | | 159 | | N/M | N/M |

| Total fee and other revenue | 6,004 | | 5,818 | | 5,678 | | 3 | | 2 | |

| Net interest revenue | 2,028 | | 1,426 | | 1,697 | | 42 | | (16) | |

| Total revenue | 8,032 | | 7,244 | | 7,375 | | 11 | | (2) | |

| Provision for credit losses | 8 | | (134) | | 215 | | N/M | N/M |

| Noninterest expense (excluding amortization of intangible assets) | 6,266 | | 5,820 | | 5,522 | | 8 | | 5 | |

| Amortization of intangible assets | 33 | | 32 | | 34 | | 3 | | (6) | |

| Total noninterest expense | 6,299 | | 5,852 | | 5,556 | | 8 | | 5 | |

| Income before income taxes | $ | 1,725 | | $ | 1,526 | | $ | 1,604 | | 13 | % | (5) | % |

| | | | | |

| Pre-tax operating margin | 21 | % | 21 | % | 22 | % | | |

| | | | | |

Securities lending revenue (b) | $ | 182 | | $ | 173 | | $ | 170 | | 5 | % | 2 | % |

| | | | | |

Total revenue by line of business: | | | | | |

| Asset Servicing | $ | 6,323 | | $ | 5,699 | | $ | 5,705 | | 11 | % | — | % |

| Issuer Services | 1,709 | | 1,545 | | 1,670 | | 11 | | (7) | |

| Total revenue by line of business | $ | 8,032 | | $ | 7,244 | | $ | 7,375 | | 11 | % | (2) | % |

| | | | | |

| Selected average balances: | | | | | |

| Average loans | $ | 11,245 | | $ | 8,756 | | $ | 9,225 | | 28 | % | (5) | % |

| Average deposits | $ | 183,990 | | $ | 200,482 | | $ | 177,853 | | (8) | % | 13 | % |

| | | | | |

| Selected metrics: | | | | | |

AUC/A at period end (in trillions) (c) | $ | 31.4 | | $ | 34.6 | | $ | 30.6 | | (9) | % | 13 | % |

Market value of securities on loan at period end (in billions) (d) | $ | 449 | | $ | 447 | | $ | 435 | | — | % | 3 | % |

(a) Other fees primarily includes financing-related fees.

(b) Included in investment services fees reported in the Asset Servicing line of business.

(c) Consists of AUC/A primarily from the Asset Servicing line of business and, to a lesser extent, the Issuer Services line of business. Includes the AUC/A of CIBC Mellon of $1.5 trillion at Dec. 31, 2022 and $1.7 trillion at Dec. 31, 2021 and $1.5 trillion at Dec. 31, 2020.

(d) Represents the total amount of securities on loan in our agency securities lending program. Excludes securities for which BNY Mellon acts as agent on behalf of CIBC Mellon clients, which totaled $68 billion at Dec. 31, 2022, $71 billion at Dec. 31, 2021 and $68 billion at Dec. 31, 2020.

N/M – Not meaningful.

Business segment description

The Securities Services business segment consists of two distinct lines of business, Asset Servicing and Issuer Services, which provide business solutions across the transaction lifecycle to our global asset owner and asset manager clients. We are one of the leading global investment services providers with $31.4 trillion of AUC/A at Dec. 31, 2022. For information on the drivers of the Securities Services

fee revenue, see Note 10 of the Notes to Consolidated Financial Statements.

The Asset Servicing business provides a comprehensive suite of solutions. We are one of the largest global custody and front-to-back outsourcing partners. We offer services for the safekeeping of assets in capital markets globally as well as fund accounting services, exchange-traded funds servicing, transfer agency, trust and depository, front-to-back

| | |

Results of Operations (continued) |

capabilities as well as data and analytics solutions for our clients. We deliver foreign exchange, and securities lending and financing solutions, on both an agency and principal basis. Our agency securities lending program is one of the largest lenders of U.S. and non-U.S. securities, servicing a lendable asset pool of approximately $4.5 trillion in 34 separate markets. Our market-leading liquidity services portal enables cash investments for institutional clients and includes fund research and analytics.

The Issuer Services business includes Corporate Trust and Depositary Receipts. Our Corporate Trust business delivers a full range of issuer and related investor services, including trustee, paying agency, fiduciary, escrow and other financial services. We are a leading provider to the debt capital markets, providing customized and market-driven solutions to investors, bondholders and lenders. Our Depositary Receipts business drives global investing by providing servicing and value-added solutions that enable, facilitate and enhance cross-border trading, clearing, settlement and ownership. We are one of the largest providers of depositary receipts services in the world, partnering with leading companies from more than 50 countries.

Review of financial results

AUC/A of $31.4 trillion decreased 9% compared with Dec. 31, 2021, primarily reflecting lower market values and the unfavorable impact of a stronger U.S. dollar, partially offset by client inflows and net new business.

Total revenue of $8.0 billion increased 11% compared with 2021. The drivers of total revenue by line of business are indicated below.

Asset Servicing revenue of $6.3 billion increased 11% compared with 2021, primarily reflecting higher net interest revenue, lower money market fee waivers and higher client activity, partially offset by the unfavorable impact of a stronger U.S. dollar and lower market values.

Issuer Services revenue of $1.7 billion increased 11% compared with 2021, primarily reflecting higher net interest revenue and lower money market fee waivers, partially offset by the accelerated amortization of deferred costs for depositary receipts services related to Russia.

Market and regulatory trends are driving investable assets toward lower fee asset management products at reduced margins for our clients. These dynamics are also negatively impacting our investment services fees. However, at the same time, these trends are providing additional outsourcing opportunities as clients and other market participants seek to comply with regulations and reduce their operating costs.

Noninterest expense of $6.3 billion increased 8% compared with 2021, primarily reflecting higher investments in growth, infrastructure and efficiency initiatives, as well as the impact of inflation, partially offset by the favorable impact of a stronger U.S. dollar.

| | |

Results of Operations (continued) |

Market and Wealth Services business segment

| | | | | | | | | | | | | | | | | |

| | | | 2022 | 2021 |

| | | | vs. | vs. |

| (dollars in millions, unless otherwise noted) | 2022 | 2021 | 2020 | 2021 | 2020 |

| Revenue: | | | | | |

| Investment services fees: | | | | | |

| Pershing | $ | 1,908 | | $ | 1,737 | | $ | 1,734 | | 10 | % | — | % |

| Treasury Services | 689 | | 662 | | 641 | | 4 | | 3 | |

| Clearance and Collateral Management | 971 | | 918 | | 896 | | 6 | | 2 | |

| Total investment services fees | 3,568 | | 3,317 | | 3,271 | | 8 | | 1 | |

| Foreign exchange revenue | 88 | | 88 | | 79 | | — | | 11 | |

Other fees (a) | 176 | | 131 | | 166 | | 34 | | (21) | |

| Total fee revenue | 3,832 | | 3,536 | | 3,516 | | 8 | | 1 | |

| Investment and other revenue | 40 | | 47 | | 62 | | N/M | N/M |

| Total fee and other revenue | 3,872 | | 3,583 | | 3,578 | | 8 | | — | |

| Net interest revenue | 1,410 | | 1,158 | | 1,228 | | 22 | | (6) | |

| Total revenue | 5,282 | | 4,741 | | 4,806 | | 11 | | (1) | |

| Provision for credit losses | 7 | | (67) | | 100 | | N/M | N/M |

| Noninterest expense (excluding amortization of intangible assets) | 2,924 | | 2,655 | | 2,577 | | 10 | | 3 | |

| Amortization of intangible assets | 8 | | 21 | | 37 | | (62) | | (43) | |

| Total noninterest expense | 2,932 | | 2,676 | | 2,614 | | 10 | | 2 | |

| Income before income taxes | $ | 2,343 | | $ | 2,132 | | $ | 2,092 | | 10 | % | 2 | % |

| | | | | |

| Pre-tax operating margin | 44 | % | 45 | % | 44 | % | | |

| | | | | |

Total revenue by line of business: | | | | | |

| Pershing | $ | 2,537 | | $ | 2,314 | | $ | 2,332 | | 10 | % | (1) | % |

| Treasury Services | 1,483 | | 1,293 | | 1,327 | | 15 | | (3) | |

| Clearance and Collateral Management | 1,262 | | 1,134 | | 1,147 | | 11 | | (1) | |

| Total revenue by line of business | $ | 5,282 | | $ | 4,741 | | $ | 4,806 | | 11 | % | (1) | % |

| | | | | |

| Selected average balances: | | | | | |

| Average loans | $ | 41,300 | | $ | 38,344 | | $ | 32,432 | | 8 | % | 18 | % |

| Average deposits | $ | 91,749 | | $ | 102,948 | | $ | 83,442 | | (11) | % | 23 | % |

| | | | | |

| Selected metrics: | | | | | |

AUC/A at period end (in trillions) (b) | $ | 12.7 | | $ | 11.8 | | $ | 10.2 | | 8 | % | 16 | % |

| | | | | |

Pershing: | | | | | |

AUC/A at period end (in trillions) | $ | 2.3 | | $ | 2.6 | | $ | 2.5 | | (12) | % | 4 | % |

Net new assets (U.S. platform) (in billions) (c) | $ | 121 | | $ | 161 | | $ | 116 | | N/M | N/M |

Average active clearing accounts (in thousands) | 7,483 | | 7,257 | | 6,883 | | 3 | % | 5 | % |

| | | | | |

Treasury Services: | | | | | |

| Average daily U.S. dollar payment volumes | 239,630 | | 235,971 | | 221,755 | | 2 | % | 6 | % |

| | | | | |

Clearance and Collateral Management: | | | | | |

Average tri-party collateral management balances (in billions) | $ | 5,285 | | $ | 4,260 | | $ | 3,566 | | 24 | % | 19 | % |

(a) Other fees primarily include financing-related fees.

(b) Consists of AUC/A from the Clearance and Collateral Management and Pershing businesses.

(c) Net new assets represent net flows of assets (e.g., net cash deposits and net securities transfers, including dividends and interest) in customer accounts in Pershing LLC, a U.S. broker-dealer.

N/M – Not meaningful.

| | |

Results of Operations (continued) |

Business segment description

The Market and Wealth Services business segment consists of three distinct lines of business, Pershing, Treasury Services and Clearance and Collateral Management, which provide business services and technology solutions to entities including financial institutions, corporations, foundations and endowments, public funds and government agencies. For information on the drivers of the Market and Wealth Services fee revenue, see Note 10 of the Notes to Consolidated Financial Statements.

Pershing provides execution, clearing, custody, business and technology solutions, delivering operational support to broker-dealers, wealth managers and registered investment advisors (“RIAs”) globally.

Our Treasury Services business is a leading provider of global payments, liquidity management and trade finance services for financial institutions, corporations and the public sector.

Our Clearance and Collateral Management business clears and settles equity and fixed-income transactions globally and serves as custodian for tri-party repo collateral worldwide. We are the primary provider of U.S. government securities clearance and a provider of non-U.S. government securities clearance. Our collateral services include collateral management, administration and segregation. We offer innovative solutions and industry expertise which help financial institutions and institutional investors with their financing, risk and balance sheet challenges. We are a leading provider of tri-party collateral management

services with an average of $5.3 trillion serviced globally including approximately $4.2 trillion of the U.S. tri-party repo market at Dec. 31, 2022.

Review of financial results

AUC/A of $12.7 trillion increased 8% compared with Dec. 31, 2021, primarily reflecting net client inflows, partially offset by lower market values and the impact of a stronger U.S. Dollar.

Total revenue of $5.3 billion increased 11% compared with 2021. The drivers of total revenue by line of business are indicated below.

Pershing revenue of $2.5 billion increased 10% compared with 2021, primarily reflecting lower money market fee waivers and higher fees on sweep balances, partially offset by the impact of prior year lost business.

Treasury Services revenue of $1.5 billion increased 15% compared with 2021, primarily reflecting higher net interest revenue and lower money market fee waivers.

Clearance and Collateral Management revenue of $1.3 billion increased 11% compared with 2021, primarily reflecting higher net interest revenue and higher U.S. government clearance volumes.

Noninterest expense of $2.9 billion increased 10% compared with 2021, primarily reflecting higher investments in growth, infrastructure and efficiency initiatives and higher revenue-related expenses, as well as the impact of inflation, partially offset by the impact of the stronger U.S. dollar.

| | |

Results of Operations (continued) |

Investment and Wealth Management business segment

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | 2022 | | 2021 |

| | | | | vs. | | vs. |

| (dollars in millions) | 2022 | | 2021 | 2020 | 2021 | | 2020 |

| Revenue: | | | | | | | |

| Investment management fees | $ | 3,215 | | | $ | 3,483 | | $ | 3,261 | | (8) | % | | 7 | % |

| Performance fees | 75 | | | 107 | | 107 | | (30) | | | — | |

Investment management and performance fees (a) | 3,290 | | | 3,590 | | 3,368 | | (8) | | | 7 | |

| Distribution and servicing fees | 192 | | | 112 | | 137 | | 71 | | | (18) | |

Other fees (b) | (133) | | | 80 | | (58) | | N/M | | N/M |

| Total fee revenue | 3,349 | | | 3,782 | | 3,447 | | (11) | | | 10 | |

Investment and other revenue (c) | (27) | | | 67 | | 48 | | N/M | | N/M |

Total fee and other revenue (c) | 3,322 | | | 3,849 | | 3,495 | | (14) | | | 10 | |

| Net interest revenue | 228 | | | 193 | | 197 | | 18 | | | (2) | |

| Total revenue | 3,550 | | | 4,042 | | 3,692 | | (12) | | | 9 | |

| Provision for credit losses | 1 | | | (13) | | 20 | | N/M | | N/M |

| Noninterest expense (excluding goodwill impairment and amortization of intangible assets) | 2,795 | | | 2,796 | | 2,668 | | — | | | 5 | |

| Goodwill impairment | 680 | | | — | | — | | N/M | | N/M |

| Amortization of intangible assets | 26 | | | 29 | | 33 | | (10) | | | (12) | |

| Total noninterest expense | 3,501 | | | 2,825 | | 2,701 | | 24 | | | 5 | |

| Income before income taxes | $ | 48 | | | $ | 1,230 | | $ | 971 | | (96) | % | (d) | 27 | % |

| | | | | | | |

| Pre-tax operating margin | 1 | % | | 30 | % | 26 | % | | | |

Adjusted pre-tax operating margin – Non-GAAP (e) | 2 | % | (f) | 33 | % | 29 | % | | | |

| | | | | | | |

Total revenue by line of business: | | | | | | | |

| Investment Management | $ | 2,390 | | | $ | 2,834 | | $ | 2,596 | | (16) | % | | 9 | % |

| Wealth Management | 1,160 | | | 1,208 | | 1,096 | | (4) | | | 10 | |

| Total revenue by line of business | $ | 3,550 | | | $ | 4,042 | | $ | 3,692 | | (12) | % | | 9 | % |

| | | | | | | |

Selected average balances: | | | | | | | |

| Average loans | $ | 14,055 | | | $ | 12,120 | | $ | 11,728 | | 16 | % | | 3 | % |

| Average deposits | $ | 19,214 | | | $ | 18,068 | | $ | 17,340 | | 6 | % | | 4 | % |

(a) On a constant currency basis, investment management and performance fees decreased 5% (Non-GAAP) compared with 2021. See “Supplemental Information – Explanation of GAAP and Non-GAAP financial measures” beginning on page 104 for the reconciliation of this Non-GAAP measure. (b) Other fees primarily includes investment services fees.

(c) Investment and other revenue and total fee and other revenue are net of income attributable to noncontrolling interests related to consolidated investment management funds.

(d) Excluding notable items, income before income taxes decreased 39% (Non-GAAP) compared with 2021. See “Supplemental Information – Explanation of GAAP and Non-GAAP financial measures” beginning on page 104 for the reconciliation of this Non-GAAP measure. (e) Net of distribution and servicing expense. See “Supplemental Information – Explanation of GAAP and Non-GAAP financial measures” beginning on page 104 for the reconciliation of this Non-GAAP measure. (f) Excluding notable items and net of distribution and servicing expense, the adjusted pre-tax operating margin was 24% (Non-GAAP) in 2022. See “Supplemental Information – Explanation of GAAP and Non-GAAP financial measures” beginning on page 104 for the reconciliation of this Non-GAAP measure. N/M – Not meaningful.

| | |

Results of Operations (continued) |

| | | | | | | | | | | |

| AUM trends | | | |

| (in billions) | 2022 | 2021 | 2020 |

AUM by product type (a): | | | |

| Equity | $ | 135 | | $ | 187 | | $ | 170 | |

| Fixed income | 198 | | 267 | | 259 | |

| Index | 395 | | 467 | | 393 | |

| Liability-driven investments | 570 | | 890 | | 855 | |

| Multi-asset and alternative investments | 153 | | 228 | | 209 | |

| Cash | 385 | | 395 | | 325 | |

| Total AUM | $ | 1,836 | | $ | 2,434 | | $ | 2,211 | |

| | | |

Changes in AUM (a): | | | |

| Beginning balance of AUM | $ | 2,434 | | $ | 2,211 | | $ | 1,910 | |

| Net inflows (outflows): | | | |

| Long-term strategies: | | | |

| Equity | (18) | | (12) | | (10) | |

| Fixed income | (21) | | 17 | | 10 | |

| Liability-driven investments | 78 | | 36 | | 22 | |

| Multi-asset and alternative investments | (11) | | (2) | | (4) | |

| Total long-term active strategies inflows | 28 | | 39 | | 18 | |

| Index | 2 | | (7) | | 6 | |

| Total long-term strategies inflows | 30 | | 32 | | 24 | |

| Short-term strategies: | | | |

| Cash | (12) | | 70 | | 49 | |

| Total net inflows | 18 | | 102 | | 73 | |

| Net market impact | (471) | | 143 | | 186 | |

| Net currency impact | (113) | | (22) | | 42 | |

| Divestiture | (32) | | — | | — | |

| Ending balance of AUM | $ | 1,836 | | $ | 2,434 | | $ | 2,211 | |

| | | |

Wealth Management client assets (b) | $ | 269 | | $ | 321 | | $ | 286 | |

(a) Excludes assets managed outside of the Investment and Wealth Management business segment.

(b) Includes AUM and AUC/A in the Wealth Management line of business.

Business segment description

Our Investment and Wealth Management business segment consists of two distinct lines of business, Investment Management and Wealth Management, which have a combined AUM of $1.8 trillion as of Dec. 31, 2022.

BNY Mellon Investment Management is a leading global asset manager and consists of our seven specialist investment firms and global distribution network to deliver a highly diversified portfolio of investment strategies to institutional and retail clients globally.

Our Investment Management model provides specialized expertise from seven respected investment firms offering solutions across every major asset class, with backing from the proven stewardship and

global presence of BNY Mellon. Each investment firm has its own individual culture, investment philosophy and proprietary investment process. This approach brings our clients clear, independent thinking from highly experienced investment professionals.

The investment firms offer a broad range of actively managed equity, fixed income, alternative and liability-driven investments, along with passive products and cash management. Our six majority-owned investment firms are as follows: ARX, Dreyfus, Insight Investment, Mellon, Newton Investment Management and Walter Scott. BNY Mellon owns a non-controlling interest in Siguler Guff.

In November 2022, BNY Mellon sold Alcentra. As part of the sale agreement, Investment Management will continue to offer Alcentra’s capabilities in BNY Mellon’s sub-advised funds and in select regions via its global distribution platform. BNY Mellon will continue to provide Alcentra with ongoing asset servicing support.

In addition to its investment firms, Investment Management has multiple global distribution entities, which are responsible for distributing the investment solutions developed and managed by the investment firms, as well as responsibility for management and distribution of our U.S. mutual funds and certain offshore money market funds.

BNY Mellon Wealth Management provides investment management, custody, wealth and estate planning, private banking services, investment servicing and information management. BNY Mellon Wealth Management has $269 billion in client assets as of Dec. 31, 2022, and more than 30 offices in the U.S. and internationally.

Wealth Management clients include individuals, families and institutions. Institutions include family offices, charitable gift programs and endowments and foundations. We work with clients to build, manage and sustain wealth across generations and market cycles.

The wealth business differentiates itself with a comprehensive wealth management framework called Active Wealth that seeks to empower clients to build and sustain long-term wealth.

| | |

Results of Operations (continued) |

The results of the Investment and Wealth Management business segment are driven by a blend of daily, monthly and quarterly averages of AUM by product type. The overall level of AUM for a given period is determined by:

•the beginning level of AUM;

•the net flows of new assets during the period resulting from new business wins and existing client inflows, reduced by the loss of clients and existing client outflows; and

•the impact of market price appreciation or depreciation, foreign exchange rates and investment firm acquisitions or divestitures.

The mix of AUM is a result of the historical growth rates of equity and fixed income markets and the cumulative net flows of our investment firms as a result of client asset allocation decisions. Actively managed equity, multi-asset and alternative assets typically generate higher percentage fees than fixed-income and liability-driven investments and cash. Also, actively managed assets typically generate higher management fees than indexed or passively managed assets of the same type. Market and regulatory trends have resulted in increased demand for lower fee asset management products and for performance-based fees.

Investment management fees are dependent on the overall level and mix of AUM and the management fees expressed in basis points (one-hundredth of one percent) charged for managing those assets. Management fees are typically subject to fee schedules based on the overall level of assets managed for a single client or by individual asset class and style. This is most common for institutional clients where we typically manage substantial assets for individual accounts.

Performance fees are generally calculated as a percentage of a portfolio’s performance in excess of a benchmark index or a peer group’s performance.

A key driver of organic growth in investment management and performance fees is the amount of net new AUM flows. Overall market conditions are also key drivers, with a significant long-term economic driver being growth of global financial assets.

Net interest revenue is determined by loan and deposit volumes and the interest rate spread between customer rates and internal funds transfer rates on loans and deposits. Expenses in the Investment and Wealth Management business segment are mainly driven by staff and distribution and servicing expenses.

Review of financial results

AUM of $1.8 trillion decreased 25% compared with Dec. 31, 2021, primarily reflecting lower market values, the unfavorable impact of a stronger U.S. dollar and the divestiture of Alcentra, partially offset by net inflows.

Net long-term strategy inflows were $30 billion in 2022, driven by inflows of liability-driven investments, partially offset by outflows of fixed income, equity and multi-asset and alternative investments. Short-term strategy outflows were $12 billion in 2022.

Total revenue of $3.6 billion decreased 12% compared with 2021. The drivers of total revenue by line of business are indicated below.

Investment Management revenue of $2.4 billion decreased 16% compared with 2021, primarily reflecting lower market values, the unfavorable impact of a stronger U.S. dollar, the mix of cumulative net inflows, lower seed capital results and the impact of the Alcentra divestiture, partially offset by lower money market fee waivers.

Wealth Management revenue of $1.2 billion decreased 4% compared with 2021, primarily reflecting lower market values, partially offset by higher net interest revenue.

Revenue generated in the Investment and Wealth Management business segment included 35% from non-U.S. sources in 2022, compared with 38% in 2021.

Noninterest expense of $3.5 billion increased 24% compared with 2021, primarily reflecting goodwill impairment in the Investment Management reporting unit and investments in growth initiatives, partially offset by the favorable impact of a strong U.S. dollar.

| | |

Results of Operations (continued) |

Other segment

| | | | | | | | | | | | | | |

| | | | |

| (in millions) | 2022 | 2021 | 2020 | |

| Fee revenue | $ | 61 | | $ | 36 | | $ | 34 | | |

| Investment and other revenue | (373) | | 15 | | 37 | | |

| Total fee and other revenue | (312) | | 51 | | 71 | | |

| Net interest expense | (162) | | (159) | | (145) | | |

| Total revenue | (474) | | (108) | | (74) | | |

| Provision for credit losses | 23 | | (17) | | 1 | | |

| Noninterest expense | 278 | | 161 | | 133 | | |

| (Loss) before income taxes | $ | (775) | | $ | (252) | | $ | (208) | | |

| | | | |

| Average loans and leases | $ | 1,225 | | $ | 1,594 | | $ | 1,843 | | |

Segment description

The Other segment primarily includes:

•the leasing portfolio;

•corporate treasury activities, including our securities portfolio;

•derivatives and other trading activity;

•corporate and bank-owned life insurance;

•renewable energy and other corporate investments; and

•certain business exits.

Revenue primarily reflects: