Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________

FORM 10-Q

________________________________

|

| |

ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2016

OR

|

| |

¨

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 001-33958

Galena Biopharma, Inc.

(Exact name of registrant as specified in its charter)

________________________________

|

| | |

Delaware | | 20-8099512 |

(State of incorporation) | | (I.R.S. Employer Identification No.) |

2000 Crow Canyon Place, Suite 380, San Ramon, CA 94583

(855) 855-4253

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices)

________________________________

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter time that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

|

| | | | | | |

Large accelerated filer | | ¨ | | Accelerated filer | | ý |

| | | |

Non-accelerated filer | | ¨ | (Do not check if a smaller reporting company) | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): ¨ Yes ý No

As of October 31, 2016, Galena Biopharma, Inc. had outstanding 217,019,065 shares of common stock, $0.0001 par value per share, exclusive of treasury shares.

GALENA BIOPHARMA, INC.

FORM 10-Q - Quarterly Report

For the Quarter Ended September 30, 2016

TABLE OF CONTENTS

|

| | | | | |

Part No. | | Item No. | | Description | Page No. |

I | | | | | |

| | 1 | | | |

| | | | Condensed Consolidated Balance Sheets as of September 30, 2016 (unaudited) and December 31, 2015 | |

| | | | Condensed Consolidated Statements of Operations (unaudited) for the three and nine months ended September 30, 2016 and 2015 | |

| | | | Condensed Consolidated Statement of Stockholders' Equity (unaudited) for the nine months ended September 30, 2016 | |

| | | | Condensed Consolidated Statements of Cash Flows (unaudited) for the nine months ended September 30, 2016 and 2015 | |

| | | | | |

| | 2 | | | |

| | 3 | | | |

| | 4 | | | |

II | | | | | |

| | 1 | | Legal Proceedings | |

| | 1A | | Risk Factors | |

| | 6 | | | |

| |

| |

EX-10.2 | |

EX-31.1 | |

EX-31.2 | |

EX-32.1 | |

PART I FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

GALENA BIOPHARMA, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Amounts in thousands, except share and per share data)

|

| | | | | | | |

| September 30, 2016 | | December 31, 2015 |

| (Unaudited) | |

ASSETS | | | |

Current assets: | | | |

Cash and cash equivalents | $ | 24,514 |

| | $ | 29,730 |

|

Restricted cash | 18,901 |

| | 401 |

|

Litigation settlement insurance recovery | — |

| | 21,700 |

|

Prepaid expenses and other current assets | 1,043 |

| | 1,398 |

|

Current assets of discontinued operations, net | — |

| | 392 |

|

Total current assets | 44,458 |

| | 53,621 |

|

Equipment and furnishings, net | 226 |

| | 335 |

|

In-process research and development | 12,864 |

| | 12,864 |

|

GALE-401 rights | 9,255 |

| | 9,255 |

|

Goodwill | 5,898 |

| | 5,898 |

|

Deposits and other assets | 145 |

| | 171 |

|

Total assets | $ | 72,846 |

| | $ | 82,144 |

|

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

Current liabilities: | | | |

Accounts payable | $ | 894 |

| | $ | 1,597 |

|

Accrued expenses and other current liabilities | 3,819 |

| | 5,292 |

|

Litigation settlement payable | — |

| | 25,000 |

|

Fair value of warrants potentially settleable in cash | 9,908 |

| | 14,518 |

|

Current portion of long-term debt | 23,722 |

| | 4,739 |

|

Current liabilities of discontinued operations | 4,195 |

| | 5,925 |

|

Total current liabilities | 42,538 |

| | 57,071 |

|

Deferred tax liability | 5,418 |

| | 5,418 |

|

Contingent purchase price consideration | 960 |

| | 6,142 |

|

Total liabilities | 48,916 |

| | 68,631 |

|

Commitments and contingencies |

| |

|

Stockholders’ equity: | | | |

Preferred stock, $0.0001 par value; 5,000,000 shares authorized; no shares issued and outstanding | — |

| | — |

|

Common stock, $0.0001 par value; 350,000,000 shares authorized, 215,176,965 shares issued and 214,501,965 shares outstanding at September 30, 2016; 162,581,753 shares issued and 161,906,753 shares outstanding at December 31, 2015 | 20 |

| | 15 |

|

Additional paid-in capital | 325,175 |

| | 296,730 |

|

Accumulated deficit | (297,416 | ) | | (279,383 | ) |

Less treasury shares at cost, 675,000 shares | (3,849 | ) | | (3,849 | ) |

Total stockholders’ equity | 23,930 |

| | 13,513 |

|

Total liabilities and stockholders’ equity | $ | 72,846 |

| | $ | 82,144 |

|

See accompanying notes to condensed consolidated financial statements.

GALENA BIOPHARMA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in thousands, except share and per share data)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2016 | | 2015 | | 2016 | | 2015 |

Operating expenses: | | | | | | | |

Research and development | $ | 3,624 |

| | $ | 5,740 |

| | $ | 15,242 |

| | $ | 18,762 |

|

General and administrative | 2,848 |

| | 2,895 |

| | 9,490 |

| | 7,869 |

|

Total operating expenses | 6,472 |

| | 8,635 |

| | 24,732 |

| | 26,631 |

|

Operating loss | (6,472 | ) | | (8,635 | ) | | (24,732 | ) | | (26,631 | ) |

Non-operating income (expense): | | | | | | | |

Litigation settlements | — |

| | — |

| | (1,800 | ) | | — |

|

Change in fair value of warrants potentially settleable in cash | 3,652 |

| | 2,134 |

| | 14,172 |

| | (981 | ) |

Interest expense, net | (1,377 | ) | | (158 | ) | | (1,988 | ) | | (607 | ) |

Change in fair value of the contingent purchase price liability | (145 | ) | | 307 |

| | 5,182 |

| | 69 |

|

Total non-operating income (expense), net | 2,130 |

| | 2,283 |

| | 15,566 |

| | (1,519 | ) |

Loss from continuing operations | (4,342 | ) | | (6,352 | ) | | (9,166 | ) | | (28,150 | ) |

Loss from discontinued operations, including $8,071 impairment charge from classification as held for sale for three and nine months ended September 30, 2015 | (2,587 | ) | | (11,674 | ) | | (8,867 | ) | | (16,074 | ) |

Net loss | $ | (6,929 | ) | | $ | (18,026 | ) | | $ | (18,033 | ) | | $ | (44,224 | ) |

| | | | | | | |

Net loss per common share: | | | | | | | |

Basic and diluted net loss per share, continuing operations | $ | (0.02 | ) | | $ | (0.04 | ) | | $ | (0.05 | ) | | $ | (0.18 | ) |

Basic and diluted net loss per share, discontinued operations | $ | (0.01 | ) | | $ | (0.07 | ) | | $ | (0.05 | ) | | $ | (0.11 | ) |

Basic and diluted net loss per share | $ | (0.03 | ) | | $ | (0.11 | ) | | $ | (0.10 | ) | | $ | (0.29 | ) |

Weighted-average common shares outstanding: basic and diluted | 209,303,286 |

| | 161,857,522 |

| | 190,306,319 |

| | 153,000,857 |

|

See accompanying notes to condensed consolidated financial statements.

GALENA BIOPHARMA, INC.

CONDENSED CONSOLIDATED STATEMENT OF STOCKHOLDERS' EQUITY

(Amounts in thousands, except share amounts)

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional Paid-In Capital | | Accumulated Deficit | | Treasury Stock | | Total |

| Shares Issued | | Amount | | | | | | | | |

Balance at December 31, 2015 | 162,581,753 |

| | $ | 15 |

| | $ | 296,730 |

| | $ | (279,383 | ) | | $ | (3,849 | ) | | $ | 13,513 |

|

Issuance of common stock | 47,772,727 |

| | 5 |

| | 31,799 |

| | — |

| | — |

| | 31,804 |

|

Common stock warrants issued in connection with 2016 common stock offerings | — |

| | — |

| | (9,886 | ) | | — |

| | — |

| | (9,886 | ) |

Common stock warrants issued in connection with debt financing | — |

| | — |

| | 1,139 |

| | — |

| | — |

| | 1,139 |

|

Issuance of common stock in connection with litigation settlements | 4,138,065 |

| | — |

| | 2,650 |

| | — |

| | — |

| | 2,650 |

|

Issuance of common stock upon exercise of warrants | 408,058 |

| | — |

| | 557 |

| | — |

| | — |

| | 557 |

|

Issuance of common stock in connection with employee stock purchase plan | 109,532 |

| | — |

| | 95 |

| | — |

| | — |

| | 95 |

|

Stock-based compensation for directors and employees | — |

| | — |

| | 1,830 |

| | — |

| | — |

| | 1,830 |

|

Exercise of stock options | 166,830 |

| | — |

| | 261 |

| | — |

| | — |

| | 261 |

|

Net loss | — |

| | — |

| | — |

| | (18,033 | ) | | — |

| | (18,033 | ) |

Balance at September 30, 2016 | 215,176,965 |

| | $ | 20 |

| | $ | 325,175 |

| | $ | (297,416 | ) | | $ | (3,849 | ) | | $ | 23,930 |

|

See accompanying notes to condensed consolidated financial statements.

GALENA BIOPHARMA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amounts in thousands)

(Unaudited)

|

| | | | | | | | |

| For the Nine Months Ended September 30, |

| 2016 | | 2015 |

Cash flows from operating activities: | | | |

Cash flows from continuing operating activities: | | | |

Net loss from continuing operations | $ | (9,166 | ) | | $ | (28,150 | ) |

Adjustment to reconcile net loss to net cash used in operating activities: | | | |

Depreciation and amortization expense | 1,375 |

| | 304 |

|

Non-cash stock-based compensation | 1,830 |

| | 1,334 |

|

Fair value of common stock issued in connection with litigation settlements | 2,650 |

| | — |

|

Change in fair value of common stock warrants | (14,172 | ) | | 982 |

|

Change in fair value of contingent consideration | (5,182 | ) | | (69 | ) |

Changes in operating assets and liabilities: | | | |

Prepaid expenses and other assets | 381 |

| | (26 | ) |

Litigation settlement insurance recovery | 21,700 |

| | — |

|

Litigation settlement payable | (25,000 | ) | | — |

|

Accounts payable | (703 | ) | | (648 | ) |

Accrued expenses and other current liabilities | (1,473 | ) | | (1,556 | ) |

Net cash used in continuing operating activities | (27,760 | ) | | (27,829 | ) |

Cash flows from discontinued operating activities: | | | |

Net loss from discontinued operations | (8,867 | ) | | (16,074 | ) |

Impairment charge from classification of assets held for sale | — |

| | 8,071 |

|

Changes in operating assets and liabilities attributable to discontinued operations | (288 | ) | | 2,956 |

|

Net cash used in discontinued operating activities | (9,155 | ) | | (5,047 | ) |

Net cash used in operating activities | (36,915 | ) | | (32,876 | ) |

Cash flows from investing activities: | | | |

Change in restricted cash | — |

| | (201 | ) |

Cash paid for purchase of equipment and furnishings | (6 | ) | | (81 | ) |

Net cash used in continuing investing activities | (6 | ) | | (282 | ) |

Selling costs paid for sale of commercial assets | (1,050 | ) | | — |

|

Cash paid for commercial assets | — |

| | (534 | ) |

Net cash used in discontinued investing activities | (1,050 | ) | — |

| (534 | ) |

Net cash used in investing activities | (1,056 | ) | | (816 | ) |

Cash flows from financing activities: | | | |

Net proceeds from issuance of common stock | 31,804 |

| | 47,416 |

|

Net proceeds from exercise of stock options | 261 |

| | 31 |

|

Proceeds from exercise of warrants | 233 |

| | — |

|

Proceeds from common stock issued in connection with ESPP | 95 |

| | 309 |

|

Net proceeds from issuance of long-term debt | 23,641 |

| | — |

|

Minimum cash covenant on long-term debt | (18,500 | ) | | — |

|

Principal payments on long-term debt | (4,779 | ) | | (2,902 | ) |

Net cash provided by financing activities | 32,755 |

| | 44,854 |

|

Net (decrease) increase in cash and cash equivalents | (5,216 | ) | | 11,162 |

|

Cash and cash equivalents at the beginning of period | 29,730 |

| | 23,650 |

|

Cash and cash equivalents at end of period | $ | 24,514 |

| | $ | 34,812 |

|

| | | |

Supplemental disclosure of cash flow information: | | | |

Cash received during the periods for interest | $ | 84 |

| | $ | 12 |

|

Cash paid during the periods for interest | $ | 636 |

| | $ | 437 |

|

Supplemental disclosure of non-cash investing and financing activities: | | | |

Fair value of warrants issued in connection with common stock recorded as cost of equity | $ | 9,886 |

| | $ | 10,296 |

|

Fair value of warrants issued in connection with long-term debt recorded as debt issuance costs | $ | 1,139 |

| | $ | — |

|

Reclassification of warrant liabilities upon exercise | $ | 324 |

| | $ | — |

|

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. Business and Basis of Presentation

Overview

Galena Biopharma, Inc. (“we,” “us,” “our,” “Galena” or the “Company”) is a biopharmaceutical company committed to the development and commercialization of hematology and oncology therapeutics that address unmet medical needs. The Company’s pipeline consists of multiple mid- to late-stage clinical assets, including our hematology asset, GALE-401, our novel cancer immunotherapy programs including NeuVax™ (nelipepimut-S), GALE-301 and GALE-302. GALE-401 is a controlled release version of the approved drug anagrelide for the treatment of elevated platelets in patients with myeloproliferative neoplasms. GALE- 401 has completed a Phase 2 clinical trial and we are advancing the asset into a pivotal trial in patients with essential thrombocythemia (ET). NeuVax is currently in multiple Phase 2 clinical trials. GALE-301 is in a Phase 2a clinical trial in ovarian and endometrial cancers and in a Phase 1b clinical trial given sequentially with GALE-302.

We are seeking to build value for shareholders through pursuit of the following objectives:

| |

• | Develop hematology and oncology assets through clinical development with a focus in areas of unmet medical need. Our hematology asset is targeting the treatment of patients with ET to reduce elevated platelet counts. Our immunotherapy programs are currently targeting two key areas: secondary prevention intended to significantly decrease the risk of disease recurrence in breast, gastric, and ovarian cancers; and primary prevention intended to cease or delay ductal carcinoma in situ (DCIS) from becoming invasive breast cancer. |

| |

• | Expand our development pipeline by enhancing the clinical and geographic footprint of our technologies. We intend to accomplish this through the initiation of new clinical trials and potentially through the acquisition of additional development programs. |

| |

• | Leverage partnerships and collaborations, as well as investigator-sponsored trial arrangements, to maximize the scope of potential clinical opportunities in a cost effective and efficient manner. |

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

Basis of Presentation and Significant Accounting Policies

The accompanying consolidated financial statements included herein have been prepared by Galena pursuant to the generally accepted accounting principles (GAAP). Unless the context otherwise indicates, references in these notes to the “Company,” “we,” “us” or “our” refer (i) to Galena, our wholly owned subsidiaries, Apthera, Inc., or “Apthera,” and our wholly owned subsidiary, Mills Pharmaceuticals, LLC or "Mills."

These condensed consolidated financial statements and accompanying notes should be read in conjunction with the Company's annual consolidated financial statements and the notes hereto included in its Annual Reports on Form 10-K and Form 10-K/A for the year ended December 31, 2015, which was filed on March 10, 2016, and amended on March 11, 2016, April 15, 2016 and April 29, 2016, respectively.

At September 30, 2016, the Company’s capital resources consisted of cash and cash equivalents of $24.5 million which excludes $18.9 million of restricted cash. The Company continues to incur significant expenses to advance our development portfolio and we will need to raise additional capital to finance such activities. The current unrestricted cash and cash equivalents as of the date of this filing will fund the Company's operations for at least nine months.

Additional funding sources that are, or in certain circumstances may be, available to the Company, include 1) approximately $18.5 million of restricted cash associated with our $25.5 million sale of Debenture to the extent we repay the Debenture through issuance of common stock, as detailed further in Note 4; 2) a Purchase Agreement with Lincoln Park Capital, LLC; and 3) At The Market Issuance Sales Agreements (ATM) with FBR & Co. (formerly MLV & Co. LLC) and Maxim Group LLC. The Company cannot provide assurances that its plans for sources and uses of cash will not change or that changed circumstances will not result in the depletion of its capital resources more rapidly than it currently anticipates. The Company is seeking and will need to raise additional capital, whether through a sale of equity or debt securities, a strategic business transaction, the establishment of other funding facilities, licensing arrangements, asset sales or other means, in order to continue the development of the Company's product candidates and to support its other ongoing activities. However, the Company cannot be certain that it will be able to raise additional capital on favorable terms, or at all, which raises substantial doubt about the Company’s ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Goodwill and Intangible Assets — Goodwill and indefinite-lived intangible assets are not amortized but are tested annually for impairment at the reporting unit level, or more frequently if events and circumstances indicate impairment may have occurred. Factors the Company considers important that could trigger an interim review for impairment include, but are not limited to, the following:

| |

• | Significant changes in the manner of its use of acquired assets or the strategy for its overall business; |

•Significant negative industry or economic trends;

•Significant decline in stock price for a sustained period; and

•Significant decline in market capitalization relative to net book value.

Goodwill and other intangible assets with indefinite lives are evaluated for impairment first by a qualitative assessment to determine the likelihood of impairment. If it is determined that impairment is more likely than not, the Company will then proceed to the two step impairment test. The first step is to compare the fair value of the reporting unit to the carrying amount of the reporting unit. If the carrying amount exceeds the fair value, a second step must be followed to calculate impairment. Otherwise, if the fair value of the reporting unit exceeds the carrying amount, the goodwill is not considered to be impaired as of the measurement date. In its review of the carrying value of the goodwill for its single reporting unit and its indefinite-lived intangible assets, the Company determines fair values of its goodwill using the market approach, and its indefinite-lived intangible assets using the income approach.

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

Intangible assets not considered indefinite-lived are reviewed for impairment when facts or circumstances suggest that the carrying value of these assets may not be recoverable. The Company’s policy is to identify and record impairment losses, if necessary, on intangible assets when events and circumstances indicate that the assets might be impaired and the undiscounted cash flows estimated to be generated by those assets are less than the carrying amounts.

In connection with the interim analysis of the PRESENT Phase 3 clinical trial and subsequent closing of the trial, the Company performed an impairment analysis of the intangible asset and goodwill. The fair value was determined to exceed to the carrying amount based on the other ongoing and planned trials with NeuVax. As a result, no impairment was deemed necessary to these assets as of September 30, 2016.

2. Fair Value Measurements

The following tables present information about our assets and liabilities measured at fair value on a recurring basis in the condensed consolidated balance sheets (in thousands):

|

| | | | | | | | | | | | | | | |

Description | September 30, 2016 | | Quoted Prices In Active Markets (Level 1) | | Significant Other Observable Inputs (Level 2) | | Unobservable Inputs (Level 3) |

Assets: | | | | | | | |

Cash equivalents | $ | 23,552 |

| | $ | 23,552 |

| | $ | — |

| | $ | — |

|

Total assets measured and recorded at fair value | $ | 23,552 |

| | $ | 23,552 |

| | $ | — |

| | $ | — |

|

Liabilities: | | | | | | | |

Warrants potentially settleable in cash | $ | 9,908 |

| | $ | — |

| | $ | 9,908 |

| | $ | — |

|

Contingent purchase price consideration | 960 |

| | — |

| | — |

| | 960 |

|

Total liabilities measured and recorded at fair value | $ | 10,868 |

| | $ | — |

| | $ | 9,908 |

| | $ | 960 |

|

|

| | | | | | | | | | | | | | | |

Description | December 31, 2015 | | Quoted Prices In Active Markets (Level 1) | | Significant Other Observable Inputs (Level 2) | | Unobservable Inputs (Level 3) |

Assets: | | | | | | | |

Cash equivalents | $ | 29,171 |

| | $ | 29,171 |

| | $ | — |

| | $ | — |

|

Total assets measured and recorded at fair value | $ | 29,171 |

| | $ | 29,171 |

| | $ | — |

| | $ | — |

|

Liabilities: | | | | | | | |

Warrants potentially settleable in cash | $ | 14,518 |

| | $ | — |

| | $ | 14,518 |

| | $ | — |

|

Contingent purchase price consideration | 6,142 |

| | — |

| | — |

| | 6,142 |

|

Total liabilities measured and recorded at fair value | $ | 20,660 |

| | $ | — |

| | $ | 14,518 |

| | $ | 6,142 |

|

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

The Company did not transfer any financial instruments into or out of Level 3 classification during the nine months ended September 30, 2016 and 2015. A reconciliation of the beginning and ending Level 3 liabilities for the nine months ended September 30, 2016 is as follows (in thousands):

|

| | | |

| Fair Value Measurements Using Significant Unobservable Inputs (Level 3) |

Balance, January 1, 2016 | $ | 6,142 |

|

Change in the estimated fair value of the contingent purchase price consideration | (5,182 | ) |

Balance at September 30, 2016 | $ | 960 |

|

The fair value of the contingent purchase price consideration is measured at the end of each reporting period using Level 3 inputs in a probability-weighted, discounted cash-outflow model. The significant unobservable assumptions include the probability of achieving each milestone, the date we expect to reach the milestone, and a determination of present value factors used to discount future expected cash outflows. The decrease in the estimated fair value of the contingent purchase price consideration during the period reflects a lowering of the probability and lengthening of the timeline for the potential approval of NeuVax, as these assumptions are now based principally on our Phase 2 combination trial with trastuzumab whereas previously, the valuation was based on our Phase 3 PRESENT trial, which was stopped in June 2016 and subsequently closed in the third quarter due to futility as recommended by the Independent Data Monitoring Committee ("IDMC").

See Note 7 for discussion of the Level 2 liabilities relating to warrants accounted for as liabilities.

3. Accrued Expenses and Other Current Liabilities

Accrued expenses and other current liabilities consist of the following (in thousands):

|

| | | | | | | |

| September 30, 2016 | | December 31, 2015 |

Clinical trial costs | $ | 2,436 |

| | $ | 3,294 |

|

Professional fees | 436 |

| | 435 |

|

Compensation and related benefits | 947 |

| | 1,535 |

|

Interest expense | — |

| | 28 |

|

Accrued expenses and other current liabilities | $ | 3,819 |

| | $ | 5,292 |

|

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

4. Long-Term Debt

On May 8, 2013, we entered into a loan and security agreement with Oxford Finance LLC, as collateral agent, and related lenders under which we borrowed the first tranche of $10 million ("Loan"). The Loan payment terms include 12 months of interest-only payments at the fixed coupon rate of 8.45%, followed by 30 months of amortization of principal and interest until maturity in November 2016. In connection with the Loan, we paid the lender a 1% cash facility fee and a 5.5% cash final payment and granted to the lender seven-year warrants to purchase up to 182,186 shares of our common stock at an exercise price of $2.47, which equaled a 20-day average market price of our common stock prior to the date of the grant. On May 10, 2016, the Company prepaid the outstanding principal amount and cash final payment.

On May 10, 2016, the Company entered into a Securities Purchase Agreement ("Purchase Agreement"), with certain purchasers pursuant to which the Company sold, at a 6.375% original issue discount, a total of $25,530,000 Senior Secured Debenture (“Debenture”) and warrants to purchase up to 2.0 million shares of the Company's common stock. Net proceeds to the Company from sale of the Debenture, after payment of commissions and legal fees, were approximately $23,400,000. The Debenture matures November 10, 2018, accrues interest at 9% per year, and did not contain any conversion features into shares of our common stock. On August 22, 2016, the Company, the purchasers and certain other parties entered into an amendment agreement, which provides for the amendment and restatement of the Debenture, an amendment to the terms of the Series A Common Stock Purchase Warrant issued by the Company to the purchasers pursuant to the terms of the Purchase Agreement, and certain other terms and conditions, as summarized below.

The Debenture carries an interest only period of six months, following which interest is due monthly and payable in cash or stock at the election of the Company. Interest deferred during the interest only period is added to and considered principal. Following the interest only period, the Company has the right under the Debenture, commencing November 10, 2016, to pay the monthly redemption amount of the outstanding balance in cash, shares of the Company's common stock or a combination thereof, if certain conditions are met, which maximum monthly redemption amount was increased from $1,100,000 to $1,500,000 under the amended Debenture; provided, that if the trading price of the Company’s common stock is at least $0.40 per share (as adjusted for stock splits, combinations or similar events) during such calendar month, then such maximum monthly redemption amount may be increased to $2,200,000 at the holder's election and if the Company has already elected to satisfy such monthly redemptions in shares of common stock. In addition, notwithstanding the foregoing limitations on the monthly redemption amount, the holder may elect up to three times in any 12-month period to increase the maximum monthly redemption to $2,500,000.

If the Company elects to pay the redemption amount in shares of its common stock, then the shares will be delivered at the lesser of A) 7.5% discount to the average of the 3 lowest volume weighted average prices over the prior 20 trading days or B) a 7.5% discount to the prior trading day’s volume weighted average price. The Company may only opt for payment in shares of common stock if certain equity conditions are met. The Company, at its option, may also force the holder to redeem up to double the monthly redemption principal amount of the Debenture but not less than the monthly payment.

The holder received 1 million warrants upon the closing on the sale of the Debenture at an exercise price of $1.51, maturing 5 years from issuance, and in accordance with the terms of the amendment agreement, the exercise price of the warrant was reduced to $0.43 per share. Additionally, the holder received 1 million warrants upon the Company's public company announcement of the interim analysis on June 29, 2016 at an exercise price of $0.43.

The amendment agreement provides that, following November 10, 2016, the holder may elect to convert any portion of the outstanding balance into shares of common stock at a fixed price of $0.60 per share (as adjusted for stock splits, combinations or similar events).

The Company’s obligations under the Debenture can be accelerated in the event the Company undergoes a change in control and other customary events of default. In the event of default and acceleration of the Company’s obligations, the Company would be required to pay all amounts of principal and interest then outstanding under the Debenture in cash. The Company’s obligations under the Debenture are secured under a security

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

agreement by a senior lien on all of the Company’s assets, including all of the Company’s interests in its consolidated subsidiaries. The Company must also maintain as a compensating cash balance, the lesser of a minimum of $18.5 million in cash or the outstanding principal and accrued and unpaid interest, which such amount is included in restricted cash as of September 30, 2016. The holder of the Debenture has the right, at any time and from time to time, to require the Company to prepay the lesser of $18.5 million plus accrued and unpaid interest or the outstanding principal and accrued and unpaid interest. Therefore, as of September 30, 2016 the Debenture, net of unamortized discounts of $2,198,811, is presented as a current liability on the condensed consolidated balance sheet.

Armentum Partners, LLC (“Placement Agent”) acted as the placement agent in the offering of the Debenture and the Company paid the Placement Agent a fee equal to 2% of the funds received from the sale of the Debenture. The Company paid half of the placement fee upon funding and paid the other half during the third quarter of 2016.

5. Legal Proceedings, Commitments and Contingencies

Legal Proceedings

On June 24, 2016, the U.S. District Court for the District of Oregon entered a final order and judgment in In re Galena Biopharma, Inc. Derivative Litigation, granting final approval to the settlement awarding attorney’s fees of $4.5 million plus costs, which was paid by our insurance carriers. The settlement included a payment of $15 million in cash by our insurance carriers, which we used to fund a portion of the class action settlement, and cancellation of 1,200,000 outstanding director stock options. The settlement also required that we adopt and implement certain corporate governance measures. The settlement did not include any admission of wrongdoing or liability on the part of us or the individual defendants and included a full release of us and the current and former officers and directors in connection with the allegations made in the consolidated federal derivative actions and state court derivative actions.

On June 24, 2016, the U.S. District Court for the District of Oregon entered a final order and partial judgment in In re Galena Biopharma, Inc. Securities Litigation, granting final approval of the settlement awarding attorney’s fees of $4.5 million plus costs, which was paid out of the settlement funds. The settlement agreement provided for a payment of $20 million to the class and the dismissal of all claims against us and our current and former officers and directors in connection with the consolidated federal securities class actions. Of the $20 million settlement payment to the class, $16.7 million was paid by our insurance carriers and $2.3 million in cash was paid by us on July 1, 2016, along with $1 million in shares of our common stock (480,053 shares) issued by us on July 6, 2016. We are responsible for defense costs and any settlements or judgments incurred for any related opt-out lawsuits.

In July 2016, we resolved claims brought by shareholders that relate to the securities litigation mentioned above in one case for $150,000 plus $150,000 in shares (291,262 shares) of our common stock, and in another case for $1.5 million in shares of our common stock (3,366,750 shares). The shares issued in connection with such settlements are included in the secondary offering filed on July 25, 2016. The settlements did not include any admission of wrongdoing or liability on the part of us or any of the current or former directors and officers and included a full release of us and the current and former directors and officers in connection with the allegations made. We are not aware of any other claims made by shareholders who have opted out of the securities litigation.

On October 13, 2016, we filed a complaint in the Circuit Court for the County of Multnomah for the State of Oregon against Aon Risk Insurance Services West, Inc., where we are seeking attorney's fees, costs and expenses incurred by us related to our coverage dispute with a certain insurer and for amounts we were required to contribute to the settlements of In Re Galena Biopharma, Inc. Derivative Litigation and In Re Galena Biopharma, Inc. Securities Litigation as a direct result of certain insurer's failure to pay its full policy limits of liability and other relief.

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

The litigation settlements are summarized as follow as of September 30, 2016 (in thousands)

|

| | | |

| Amount |

Class action settlement | $ | 20,000 |

|

Derivative settlement | 5,000 |

|

Shareholders securities litigation settlements | $ | 1,800 |

|

Total settlements | $ | 26,800 |

|

| |

Paid by the insurance carriers | $ | 21,700 |

|

Paid by the company in cash | 2,450 |

|

Paid by the company in common stock | 2,650 |

|

Total settlements | $ | 26,800 |

|

We are aware that the SEC is investigating certain matters relating to the use of certain outside investor-relations professionals by us and other public companies. We have been in contact with the SEC staff through our counsel and are cooperating with the investigation and in discussions with the SEC staff to resolve the investigation.

A federal investigation of two of the high-prescribing physicians for Abstral has resulted in the criminal prosecution of the two physicians for alleged violations of the federal False Claims Act and other federal statutes. The criminal trial is set for January 2017. We have received a trial subpoena for documents in connection with that investigation and we have been in contact with the U.S. Attorney’s Office for the Southern District of Alabama, which is handling the criminal trial, and are cooperating in the production of documents. On April 28, 2016, a second superseding indictment was filed in the criminal case, which added additional information about the defendant physicians and provided information regarding the facts and circumstances involving a rebate agreement between the Company and the defendant physicians’ pharmacy as well as their ownership of our stock. Certain former employees have received trial subpoenas to appear at the trial and provide oral testimony. We have agreed to reimburse those former employees’ attorney’s fees. To our knowledge, we are not a target or subject of that investigation.

There also have been federal and state investigations of a company that has a product that competes with Abstral in the same therapeutic class, and we have learned that the FDA and other governmental agencies are investigating our Abstral promotion practices. On December 16, 2015, we received a subpoena issued by the U.S. Attorney’s Office for the District of New Jersey requesting the production of a broad range of documents pertaining to our marketing and promotional practices for Abstral. We have been in contact with the U.S. Attorney’s Office for the District of New Jersey and are cooperating in the production of the requested documents. We are unable to predict whether we could become subject to legal or administrative actions as a result of these matters, or the impact of such matters. If we are found to be in violation of the False Claims Act, Anti-Kickback Statute, Patient Protection and Affordable Care Act, or any other applicable state or any federal fraud and abuse laws, we may be subject to penalties, such as civil and criminal penalties, damages, fines, or an administrative action of exclusion from government health care reimbursement programs. We can make no assurances as to the time or resources that will need to be devoted to these matters or their outcome, or the impact, if any, that these matters or any resulting legal or administrative proceedings may have on our business or financial condition.

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

6. Stockholders’ Equity

Preferred Stock — The Company has authorized up to 5,000,000 shares of preferred stock, $0.0001 par value per share, for issuance. The preferred stock will have such rights, preferences, privileges and restrictions, including voting rights, dividend rights, conversion rights, redemption privileges and liquidation preferences, as shall be determined by the Company’s Board of Directors upon its issuance. To date, the Company has not issued any preferred shares.

Common Stock — The Company has authorized up to 350,000,000 shares of common stock, $0.0001 par value per share, for issuance.

November 2014 Purchase Agreement with Lincoln Park Capital, LLC - On November 18, 2014, the Company entered into a purchase agreement with Lincoln Park Capital, LLC ("LPC"), pursuant to which the Company has the right to sell to LPC up to $50 million in shares of the Company's common stock, subject to certain limitations and conditions over the 36-month term of the purchase agreement. Pursuant to the purchase agreement, LPC initially purchased 2.5 million shares of the Company's common stock at $2.00 per share and the Company issued 631,221 shares of common stock to LPC as a commitment fee, which was recorded as a cost of capital. As a result of this initial issuance, the Company received initial net proceeds of $4.9 million, after deducting commissions and other offering expenses. There were no sales of our common stock under the LPC purchase agreement during the nine months ended September 30, 2016. Subsequent to September 30, 2016 the Company issued 2.0 million shares of common stock to LPC for $0.6 million in net proceeds.

At The Market Issuance Sales Agreements - On May 24, 2013 the Company entered into At The Market Issuance Sales Agreements ("ATM") with FBR & Co. (formerly MLV & Co. LLC) and Maxim Group LLC ("Agents"). From time to time during the term of the ATM, we may issue and sell through the Agents, shares of our common stock, and the Agents collect a fee equal to 3% of the gross proceeds from the sale of shares, up to a total of $20 million in gross proceeds. There were no sales of our common stock under the ATM during the nine months ended September 30, 2016. Subsequent to September 30, 2016 the Company issued 0.5 million shares of common stock under the ATM agreements for $0.2 million in net proceeds.

January 2016 Underwritten Public Offering - On January 12, 2016 the Company closed an underwritten public offering of 19,772,727 units at a price to the public of $1.10 per unit for gross proceeds of $21.8 million ("January 2016 Offering"). Each unit consists of one share of common stock, and a warrant to purchase 0.60 of a share of common stock at an exercise price of $1.42 per share. The January 2016 Offering included an over-allotment option for the underwriters to purchase an additional 2,965,909 shares of common stock and/or warrants to purchase up to 1,779,545 shares of common stock. On January 12, 2016, the underwriters exercised their over-allotment option to purchase warrants to purchase an aggregate of 1,779,545 shares of common stock. The underwriters did not exercise their over-allotment option to purchase 2,965,909 shares of our common stock. The total net proceeds of the January 2016 Offering, including the exercise of the over-allotment option to purchase the warrants, were $20.2 million, after deducting underwriting discounts and commissions and offering expense paid by the Company.

July 2016 Registered Direct Offering - On July 13, 2016, we closed the sale to certain institutional investors of 28,000,000 shares of common stock at a purchase price per share of $0.45 in a registered direct offering, and warrants to purchase up to 14,000,000 shares of common stock with an exercise price of $0.65 per share in a concurrent private placement. The warrants are initially exercisable six months and one day following issuance and have a term of five years from the date of issuance. The net proceeds to Galena after deducting placement agent fees and estimated offering expenses were approximately $11.7 million. The Company intends to use the net proceeds from this offering to fund its clinical trials of its product candidates, to augment its working capital, and for general corporate purposes.

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

Shares of common stock for future issuance are reserved for as follows (in thousands):

|

| | |

| As of September 30, 2016 |

Warrants outstanding | 51,393 |

|

Stock options outstanding | 10,369 |

|

Options reserved for future issuance under the Company’s 2007 Incentive Plan | 10,863 |

|

Shares reserved for future issuance under the Employee Stock Purchase Plan | 419 |

|

Total reserved for future issuance | 73,044 |

|

7. Warrants

The following is a summary of warrant activity for the nine months ended September 30, 2016 (in thousands):

|

| | | | | | | | | | | | | | | | | | | | | | | |

| July 2016 | | January 2016 | | March 2015 | | September 2013 | | December 2012 Warrants | | Other Equity Financings | | Warrants issued to Consultants and Debtors | | Total |

Outstanding, January 1, 2016 | — |

| | — |

| | 14,006 |

| | 3,973 |

| | 3,031 |

| | 816 |

| | 482 |

| | 22,308 |

|

Issued | 14,000 |

| | 13,643 |

| | — |

| | — |

| | — |

| | — |

| | 2,000 |

| | 29,643 |

|

Exercised | — |

| | — |

| | — |

| | — |

| | — |

| | (502 | ) | | — |

| | (502 | ) |

Expired | — |

| | — |

| | — |

| | — |

| | — |

| | (56 | ) | | — |

| | (56 | ) |

Outstanding, September 30, 2016 | 14,000 |

| | 13,643 |

| | 14,006 |

| | 3,973 |

| | 3,031 |

| | 258 |

| | 2,482 |

| | 51,393 |

|

Expiration | July 2021 | | January 2021 | | March 2020 | | September 2018 | | December 2017 | | Varies 2016-2017 | | Varies 2014-2021 | | |

Warrants consist of warrants potentially settleable in cash, which are liability-classified warrants, and equity-classified warrants.

Warrants classified as liabilities

Liability-classified warrants consist of warrants to purchase common stock issued in connection with equity financings in July 2016, January 2016, March 2015, September 2013, December 2012, April 2011, March 2011, and March 2010. These warrants are potentially settleable in cash and were determined not to be indexed to our common stock.

The estimated fair value of outstanding warrants accounted for as liabilities is determined at each balance sheet date. Any decrease or increase in the estimated fair value of the warrant liability since the most recent balance sheet date is recorded in the condensed consolidated statement of operations as other income (expense). The fair value of the warrants is estimated using an appropriate pricing model with the following inputs:

|

| | | | | | | | | | | | | | | | | | | | | | | |

| As of September 30, 2016 |

| July 2016 Warrants | | January 2016 Warrants | | March 2015 Warrants | | September 2013 Warrants | | December 2012 Warrants | | April 2011 Warrants |

Strike price | $ | 0.65 |

| | $ | 1.42 |

| | $ | 2.08 |

| | $ | 2.50 |

| | $ | 1.75 |

| | $ | 0.65 |

|

Expected term (years) | 4.79 |

| | 4.28 |

| | 3.47 |

| | 1.97 |

| | 1.23 |

| | 0.56 |

|

Volatility % | 113.36 | % | | 118.32 | % | | 125.48 | % | | 151.79 | % | | 185.54 | % | | 257.89 | % |

Risk-free rate % | 1.11 | % | | 1.05 | % | | 0.94 | % | | 0.76 | % | | 0.63 | % | | 0.47 | % |

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | |

| As of December 31, 2015 |

| March 2015 Warrants | | September 2013 Warrants | | December 2012 Warrants | | April 2011 Warrants | | March 2011 Warrants* | | March 2010 Warrants* |

Strike price | $ | 2.08 |

| | $ | 2.50 |

| | $ | 1.83 |

| | $ | 0.65 |

| | $ | 0.65 |

| | $ | 2.02 |

|

Expected term (years) | 4.22 |

| | 2.72 |

| | 1.98 |

| | 1.31 |

| | 0.18 |

| | 1.00 |

|

Volatility % | 75.85 | % | | 74.70 | % | | 76.37 | % | | 65.60 | % | | 47.98 | % | | 71.41 | % |

Risk-free rate % | 1.58 | % | | 1.24 | % | | 1.05 | % | | 0.77 | % | | — | % | | — | % |

*The March 2011 warrants expired in March 2016. The March 2010 warrants expired in September 2016.

The expected volatility assumptions are based on the Company's implied volatility in combination with the implied volatilities of similar publicly traded entities. The expected life assumption is based on the remaining contractual terms of the warrants. The risk-free rate is based on the zero coupon rates in effect at the time of valuation. The dividend yield used in the pricing model is zero, because the Company has no present intention to pay cash dividends.

The changes in fair value of the warrant liability for the nine months ended September 30, 2016 were as follows (in thousands):

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| July 2016 Warrants | | January 2016 Warrants | | March 2015 Warrants | | September 2013 Warrants | | December 2012 Warrants | | Other Equity Financing Warrants | | Total |

Warrant liability, January 1, 2016 | $ | — |

| | $ | — |

| | $ | 10,337 |

| | $ | 1,933 |

| | $ | 1,565 |

| | $ | 683 |

| | $ | 14,518 |

|

Fair value of warrants issued | 4,296 |

| | 5,590 |

| | — |

| | — |

| | — |

| | — |

| | 9,886 |

|

Fair value of warrants exercised | | | — |

| | — |

| | — |

| | — |

| | (324 | ) | | (324 | ) |

Change in fair value of warrants | (771 | ) | | (2,714 | ) | | (7,866 | ) | | (1,387 | ) | | (1,124 | ) | | (310 | ) | | (14,172 | ) |

Warrant liability, September 30, 2016 | $ | 3,525 |

| | $ | 2,876 |

| | $ | 2,471 |

| | $ | 546 |

| | $ | 441 |

| | $ | 49 |

| | $ | 9,908 |

|

Warrants classified as equity

Equity-classified warrants consist of warrants issued in connection with consulting services provided to us and warrants issued in connection with debt financings. On May 10, 2016 upon closing on the sale of Debenture, we granted the holder warrants to purchase up to 1,000,000 shares of common stock at an exercise price of $1.51, and in accordance with the terms of the amendment agreement, the exercise price of the warrant was reduced to $0.43 per share. The warrants were valued using an appropriate pricing model. The fair value assumptions for the grant included a volatility of 110.77%, expected term of 5.5 years, risk-free rate of 1.18%, and a dividend rate of 0.00%. The fair value of the warrants granted was $0.32 per share. These warrants are recorded in equity at fair value upon issuance. Additionally, on June 29, 2016 upon the public announcement of the interim analysis of the PRESENT trial, we granted the holder warrants to purchase up to 1,000,000 shares of common stock at an exercise price of $0.43.The warrants were valued using an appropriate pricing model. The fair value assumptions for the grant included a volatility of 106.63%, expected term of 5.5 years, risk-free rate of 1.35%, and a dividend rate of 0.00%. The fair value of the warrants granted was $0.27 per share. These warrants are recorded in equity at fair value upon issuance.

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

8. Stock-Based Compensation

Options to Purchase Shares of Common Stock — The Company follows the provisions ASC 718, which requires the measurement and recognition of compensation expense for all share-based payment awards made to employees, non-employee directors, including employee stock options. Stock compensation expense based on the grant date fair value estimated in accordance with the provisions of ASC 718 is recognized as an expense over the requisite service period.

For stock options and warrants granted in consideration for services rendered by non-employees, the Company recognizes compensation expense in accordance with the requirements of ASC Topic 505-50. Non-employee option and warrant grants that do not vest immediately upon grant are recorded as an expense over the vesting period. At the end of each financial reporting period prior to vesting, the value of these options and warrants, as calculated using the Black-Scholes option-pricing model, is re-measured using the fair value of the Company’s common stock and the non-cash compensation recognized during the period is adjusted accordingly. Since the fair market value of options and warrants granted to non-employees is subject to change in the future, the amount of the future compensation expense will include fair value re-measurements until the stock options and warrants are fully vested.

The following table summarizes the components of stock-based compensation expense in the condensed consolidated statements of comprehensive loss for the three and nine months ended September 30, 2016 and 2015, respectively (in thousands):

|

| | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2016 | | 2015 | | 2016 | | 2015 |

Research and development | $ | 50 |

| | $ | 83 |

| | $ | 285 |

| | $ | 253 |

|

General and administrative | 483 |

| | 492 |

| | 1,545 |

| | 1,081 |

|

Total stock-based compensation from continuing operations | $ | 533 |

| | $ | 575 |

| | $ | 1,830 |

| | $ | 1,334 |

|

The Company uses the Black-Scholes option-pricing model and the following weighted-average assumptions to determine the fair value of all its stock options granted:

|

| | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2016 | | 2015* | | 2016 | | 2015 |

Risk free interest rate | 1.23 | % | | — | % | | 1.25 | % | | 1.50 | % |

Volatility | 102.77 | % | | — | % | | 98.91 | % | | 74.20 | % |

Expected lives (years) | 5.47 |

| | 0.00 |

| | 5.58 |

| | 6.09 |

|

Expected dividend yield | — | % | | — | % | | — | % | | — | % |

*There were no stock options granted during the three months ended September 30, 2015.

The weighted-average fair value of options granted during the three and nine months ended September 30, 2016 were $0.45 per share and $0.51 per share, respectively.

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

The Company’s expected common stock price volatility assumption is based upon the Company's own implied volatility in combination with the implied volatility of a basket of comparable companies. The expected life assumptions for employee grants were based upon the simplified method provided for under ASC 718-10, which averages the contractual term of the Company’s options of ten years with the average vesting term of four years for an average of six years. The expected life assumptions for non-employees were based upon the contractual term of the option. The dividend yield assumption is zero, because the Company has never paid cash dividends and presently has no intention to do so. The risk-free interest rate used for each grant was also based upon prevailing short-term interest rates. The Company has estimated an annualized forfeiture rate of 15% for options granted to its employees, 8% for options granted to senior management and zero for non-employee directors. The Company will record additional expense if the actual forfeitures are lower than estimated and will record a recovery of prior expense if the actual forfeiture rates are higher than estimated.

As of September 30, 2016, there was $2,722,000 of unrecognized compensation cost related to outstanding stock options that is expected to be recognized as a component of the Company’s operating expenses over a weighted-average period of 2.34 years.

As of September 30, 2016, an aggregate of 26,500,000 shares of common stock were reserved for issuance under the Company’s 2016 Incentive Plan, including 10,369,000 shares subject to outstanding common stock options granted under the plan. There are 10,863,000 shares available for future grants based on adjustments in the 2016 Incentive Plan. The administrator of the plan determines the terms when a stock option may become exercisable. Vesting periods of stock options granted to date have not exceeded four years. The stock options will expire, unless previously exercised, no later than ten years from the grant date.

The following table summarizes stock option activity of the Company for the nine months ended September 30, 2016:

|

| | | | | | | | | | |

| Total Number of Shares (In Thousands) | | Weighted Average Exercise Price | | Aggregate Intrinsic Value (In Thousands) |

Outstanding at January 1, 2016 | 13,262 |

| | $ | 2.58 |

| |

|

|

Granted | 1,268 |

| | 0.76 |

| |

|

|

Exercised | (167 | ) | | 1.57 |

| | $ | 56 |

|

Canceled | (3,994 | ) | | 2.69 |

| | $ | — |

|

Outstanding at September 30, 2016 | 10,369 |

| | $ | 2.33 |

| | $ | — |

|

Options exercisable at September 30, 2016 | 6,392 |

| | $ | 2.89 |

| | $ | — |

|

The aggregate intrinsic values of outstanding and exercisable stock options at September 30, 2016 were calculated based on the closing price of the Company’s common stock as reported on The NASDAQ Capital Market on September 30, 2016 of $0.35 per share. The aggregate intrinsic value equals the positive difference between the closing fair market value of the Company’s common stock and the exercise price of the underlying stock options.

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

9. Net Loss Per Share

The following table sets forth the potentially dilutive common shares excluded from the calculation of net loss per common share because their inclusion would be anti-dilutive (in thousands):

|

| | | | | |

| 2016 | | 2015 |

Warrants to purchase common stock | 51,393 |

| | 22,308 |

|

Options to purchase common stock | 10,369 |

| | 11,188 |

|

Total | 61,762 |

| | 33,496 |

|

10. Discontinued Operations, Assets Held for Sale

During the fourth quarter of 2015, The Company sold its rights to its commercial products Abstral® (fentanyl) Sublingual Tablets and Zuplenz® (ondansetron) Oral Soluble Film.

The following table presents amounts related to the discontinued operations in the balance sheets (in thousands):

|

| | | | | | | |

| September 30, 2016 | | December 31, 2015 |

Carrying amounts of assets included as part of discontinued operations: |

Accounts receivable, net | $ | — |

| | $ | 392 |

|

Total current assets of discontinued operations, net | — |

| | 392 |

|

| | | |

Carrying amounts of liabilities included as part of discontinued operations: |

Accounts payable | $ | 2,091 |

| | $ | 1,491 |

|

Accrued expenses and other current liabilities | 2,104 |

| | 4,434 |

|

Total current liabilities of discontinued operations | $ | 4,195 |

| | $ | 5,925 |

|

The following table represents the components attributable to the commercial operations that are presented in the condensed consolidated statements of operations as discontinued operations (in thousands):

|

| | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2016 | | 2015 | | 2016 | | 2015 |

Net revenue | $ | — |

| | $ | 2,166 |

| | $ | — |

| | $ | 8,298 |

|

Additional channel obligations | (520 | ) | | — |

| | (2,186 | ) | | — |

|

Cost of revenue | — |

| | (712 | ) | | — |

| | (1,573 | ) |

Amortization of certain acquired intangible assets | — |

| | (208 | ) | | — |

| | (795 | ) |

Research and development | — |

| | (160 | ) | | — |

| | (339 | ) |

Selling, general, and administrative | (2,067 | ) | | (4,672 | ) | | (6,681 | ) | | (13,577 | ) |

Non-operating income (expense) | — |

| | (17 | ) | | — |

| | (17 | ) |

Impairment charge from classification as assets held for sale | — |

| | (8,071 | ) | | — |

| | (8,071 | ) |

Loss from discontinued operations | $ | (2,587 | ) | | $ | (11,674 | ) | | $ | (8,867 | ) | | $ | (16,074 | ) |

Additional channel obligations included in discontinued operations in the first nine months of 2016 is comprised of larger than anticipated rebates of Abstral sales for which we are responsible through the end of the first quarter of 2016. The increase in rebates was driven by larger than expected volumes through these rebate channels and additional price protection provisions over which the Company has no control. The increase in rebates was partially offset by lower than expected patient assistance program reimbursement.

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

Selling, general and administrative expense included in discontinued operations consists of all other expenses of our commercial operations that were required in order to market and sell our marketed products prior to our sales of the rights to these commercial products. These expenses include all personnel related costs, marketing, data, consulting, legal, and other outside services necessary to support the commercial operations. During the three and nine months ended September 30,2016 we incurred $2.1 million and $6.7 million respectively, in selling, general, and administrative expense in discontinued operations, of which $2.0 million and $6.4 million, for the three and nine months ended September 30, 2016, respectively, related to legal fees from external counsel associated with document production for the subpoenas related to the sales and marketing practices of Abstral. These legal proceedings are further disclosed in Part II, Item 1.

The following table presents significant operating non-cash items and capital expenditures related to discontinued operations (in thousands):

|

| | | | | | | |

| September 30, 2016 | | September 30, 2015 |

Impairment of assets held for sale | $ | — |

| | $ | 8,071 |

|

Depreciation and amortization | $ | — |

| | $ | 858 |

|

Stock-based compensation | $ | — |

| | $ | 788 |

|

Purchases of property and equipment | $ | — |

| | $ | (34 | ) |

Cash paid for acquisition of Zuplenz rights | $ | — |

| | $ | (500 | ) |

11. Subsequent Events

The Company evaluated all events or transactions that occurred after September 30, 2016 up through the date these financial statements were issued. Other than as disclosed elsewhere in the notes to the condensed consolidated financial statements and below, the Company did not have any material recognizable or unrecognizable subsequent events.

On October 21, 2016, our stockholders authorized the Board of Directors to set the ratio and timing for any reverse stock split the Board of Directors deemed necessary. On October 31, 2016, th Company issued a press release to announce that its Board of Directors, on October 26, 2016, set the ratio of the reverse stock split of the Company’s outstanding shares of common stock, par value $.0001 per share, at one-for-twenty (1:20).

The reverse stock split will become effective on November 11, 2016 and the Company’s common stock will commence trading on a split-adjusted basis when the market opens on November 14, 2016. The Company’s common stock will continue to trade on the NASDAQ Capital Market under the symbol “GALE” but will trade under the new CUSIP number 363256504.

No fractional shares will be issued as a result of the reverse split and stockholders who otherwise would be entitled to a fractional share will receive, in lieu thereof, a cash payment which shall represent a pro-rata portion of the value per share based upon the closing market price for the five days preceding the effective date of the reverse split. Stockholders who hold their shares in brokerage accounts or in "street name" will not be required to take any action to effect the exchange of their shares. Stockholders of record as of November 11, 2016 who hold share certificates will receive instructions from the Company's transfer agent, Computershare, which is acting as exchange agent for the reverse stock split. Computershare will provide instructions to stockholders of record regarding the process for exchanging shares.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

In this section, "Galena," “we,” “our,” “ours” and “us” refer to Galena Biopharma, Inc. and its consolidated subsidiaries, Apthera, Inc., or “Apthera,” and Mills Pharmaceuticals, LLC, or "Mills."

This management’s discussion and analysis of financial condition as of September 30, 2016 and results of operations for the three and nine months ended September 30, 2016 and 2015, respectively, should be read in conjunction with management’s discussion and analysis of financial condition and results of operations included in our Amended Annual Report on Form 10-K for the year ended December 31, 2015 which was filed with the SEC on March 11, 2016.

The discussion and analysis below includes certain forward-looking statements related to the development of our products in the U.S., our future financial condition and results of operations and potential for profitability, the sufficiency of our cash resources, our ability to obtain additional equity or debt financing, possible partnering or other strategic opportunities for the development of our products, as well as other statements related to the progress and timing of our product commercialization and development activities, present or future licensing, collaborative or financing arrangements or that otherwise relate to future periods, which are all forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. These statements represent, among other things, the expectations, beliefs, plans and objectives of management and/or assumptions underlying or judgments concerning the future financial performance and other matters discussed in this document. The words “may,” “will,” “should,” “plan,” “believe,” “estimate,” “intend,” “anticipate,” “project,” and “expect” and similar expressions are intended to connote forward-looking statements. All forward-looking statements involve certain risks, including the uncertainties and other factors described in our Amended Annual Report on Form 10-K for the year ended December 31, 2015 that could cause our actual development activities, financial condition and results of operations, and business prospects and opportunities to differ materially from these expressed in, or implied by, those forward-looking statements. We caution investors not to place significant reliance on the forward-looking statements contained in this report. These statements, like all statements in this report, speak only as of the date of this report (unless another date is indicated) and we undertake no obligation to update or revise forward-looking statements.

Overview

Galena Biopharma, Inc. (“we,” “us,” “our,” “Galena” or the “Company”) is a biopharmaceutical company committed to the development and commercialization of hematology and oncology therapeutics that address unmet medical needs. The Company’s pipeline consists of multiple mid- to late-stage clinical assets, including our hematology asset, GALE-401, our novel cancer immunotherapy programs including NeuVax™ (nelipepimut-S), GALE-301 and GALE-302. GALE-401 is a controlled release version of the approved drug anagrelide for the treatment of elevated platelets in patients with myeloproliferative neoplasms. GALE- 401 has completed a Phase 2 clinical trial and we are advancing the asset into a pivotal trial in patients with essential thrombocythemia (ET). NeuVax is currently in multiple Phase 2 clinical trials. GALE-301 is in a Phase 2a clinical trial in ovarian and endometrial cancers and in a Phase 1b clinical trial given sequentially with GALE-302.

We are seeking to build value for shareholders through pursuit of the following objectives:

| |

• | Develop hematology and oncology assets through clinical development with a focus in areas of unmet medical need. Our hematology asset is targeting the treatment of patients with ET to reduce elevated platelet counts. Our immunotherapy programs are currently targeting two key areas: secondary prevention intended to significantly decrease the risk of disease recurrence in breast, gastric, and ovarian cancers; and primary prevention intended to cease or delay ductal carcinoma in situ (DCIS) from becoming invasive breast cancer. |

| |

• | Expand our development pipeline by enhancing the clinical and geographic footprint of our technologies. We intend to accomplish this through the initiation of new clinical trials and potentially through the acquisition of additional development programs. |

| |

• | Leverage partnerships and collaborations, as well as investigator-sponsored trial arrangements, to maximize the scope of potential clinical opportunities in a cost effective and efficient manner. |

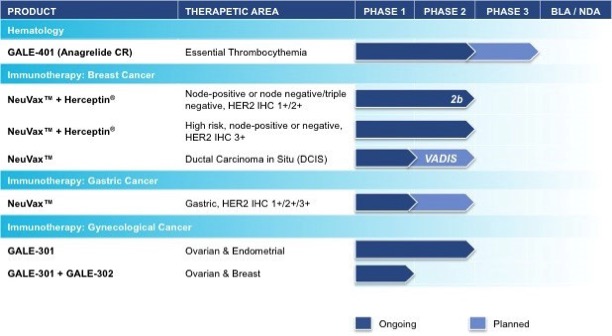

The chart below summarizes the current status of our clinical development pipeline:

Hematology

GALE-401 (anagrelide controlled release (CR))

GALE-401 contains the active ingredient anagrelide, an FDA-approved product, for the treatment of patients with myeloproliferative neoplasms ("MPNs") to lower abnormally elevated platelet levels. The currently available immediate release ("IR") version of anagrelide causes adverse events that are believed to be dose and plasma concentration dependent. These adverse events may limit the use of the IR version of the drug. Therefore, reducing the maximum concentration ("Cmax") is hypothesized to reduce the side effects, but preserve efficacy, potentially allowing a broader use of the drug.

Multiple Phase 1 studies in 98 healthy subjects have shown GALE-401 reduces the Cmax of anagrelide following oral administration, appears to be well tolerated at the doses administered, and to be capable of reducing platelet levels. The Phase 1 program provided the desired PK/PD (pharmacokinetic/pharmacodynamic) profile to enable the initiation of the ongoing Phase 2 proof-of-concept trial. The Phase 2, open label, single arm, proof-of-concept trial enrolled 18 patients in the United States for the treatment of thrombocytosis, or elevated platelet counts, in patients with MPNs. Final safety and efficacy data from this pilot Phase 2 trial were presented in December 2015 and demonstrated a prolonged clinical benefit with a potentially improved safety profile.

We have analyzed our data and the treatment landscape for MPNs, with a current focus on Essential Thrombocythemia ("ET"). We are advancing GALE-401 into a pivotal trial and we plan to meet with the FDA by the end of the year to discuss our Phase 3 clinical trial design, development opportunities in ET patients, and confirmation of the 505(b)2 regulatory pathway for approval.

Thrombocythemia is a myeloproliferative blood disorder. It is characterized by the over production of platelets in the bone marrow. Elevated platelets make normal clotting of blood difficult. It can be either reactive or primary (also termed essential and caused by a myeloproliferative disease). Although often symptomless (particularly when it is a secondary reaction), it can predispose some patients to thrombosis. Primary Thrombocytosis (essential thrombocythemia or "ET") is due to a failure to regulate the production of platelets (autonomous production) and is a feature of a number of myeloproliferative disorders. About a third of patients are asymptomatic at the time of diagnosis.

Novel Cancer Immunotherapies

Our targeted cancer immunotherapy approach is currently based upon two key areas: preventing secondary recurrence of cancer, which is becoming increasingly important as the number of cancer survivors continues to grow; and, primary prevention intended to treat breast cancer earlier in the treatment spectrum. Once a patient’s tumor becomes metastatic, the outcome is often fatal, making the prevention of recurrence a potentially critical component of overall patient care. Our programs primarily target patients in the adjuvant (after-surgery) setting who have relatively healthy immune systems, but may still have residual disease. Minimal residual disease, or single cancer cells (occult cancer cells) or micrometastasis, that are undetectable by current radiographic scanning technologies, can result in disease recurrence.

Our therapies utilize an immunodominant peptide combined with the immune adjuvant, recombinant human granulocyte macrophage-colony stimulating factor (rhGM-CSF), and work by harnessing the patient’s own immune system to seek out and attack any residual cancer cells. Using peptide immunogens has many potential clinical advantages, including a favorable safety profile, since these drugs may lack the toxicities typical of most cancer therapies. They also have the potential to evoke long-lasting protection through activation of the immune system and a convenient, intradermal mode of delivery. We are currently engaged in multiple clinical trials with NeuVax™ (nelipepimut-S), GALE-301, and GALE-302, targeting the prevention of recurrence in breast, gastric, ovarian and endometrial cancers.

NeuVax™ (nelipepimut-S)

NeuVax™ (nelipepimut-S) is a cancer immunotherapy targeting human epidermal growth factor receptor (HER2) expressing cancers. NeuVax is the immunodominant nonapeptide derived from the extracellular domain of the HER2 protein, a well-established and validated target for therapeutic intervention in breast and gastric carcinomas. The NeuVax vaccine is combined with GM-CSF for injection under the skin, or intradermal administration. Data has shown that an increased presence of circulating tumor cells (CTCs) may predict Disease Free Survival (DFS) and Overall Survival (OS) suggesting a presence of isolated micrometastases, not detectable clinically, but, over time, can lead to recurrence, most often in distant sites. After binding to the specific HLA molecules on antigen presenting cells, the nelipepimut-S sequence stimulates specific cytotoxic T lymphocytes, or CTLs, causing significant clonal expansion. These activated CTLs recognize, neutralize and destroy, through cell lysis, HER2 expressing cancer cells, including occult cancer cells and micrometastatic foci. The nelipepimut immune response can also generate CTLs to other immunogenic peptides through inter- and intra-antigenic epitope spreading.

Breast Cancer: According to the National Cancer Institute (NCI), over 230,000 women in the U.S. are diagnosed with breast cancer annually. While improved diagnostics and targeted therapies have decreased breast cancer mortality in the U.S., metastatic breast cancer remains incurable. Approximately 75% to 80% of breast cancer patients have tissue test positive for some increased amount of the HER2 receptor, which is associated with disease progression and decreased survival. Only approximately 20% to 30% of all breast cancer patients-those with HER2 immunohistochemistry (IHC) 3+ disease, or IHC 2+ and fluorescence in situ hybridization (FISH) amplified-have a HER2 directed, approved treatment option available after their initial standard of care. This leaves the majority of breast cancer patients with low-to-intermediate HER2 expression (IHC 1+/2+) ineligible for therapy and without an effective targeted treatment option to prevent cancer recurrence.

We currently have two investigator-sponsored trials ongoing with NeuVax in combination with trastuzumab (Herceptin®; Genentech/Roche). The combination of trastuzumab and NeuVax has been shown pre-clinically and in a pilot study to be synergistic. Our Phase 2b clinical trial is a randomized, multicenter, investigator-sponsored, 300 patient study enrolling HER2 1+ and 2+, HLA A2+, A3+, A24 and/or A26, node positive, and high-risk node negative patients. Eligible patients will be randomized to receive NeuVax + GM-CSF + trastuzumab or trastuzumab + GM-CSF alone. The primary endpoint of the study is disease-free survival. Genentech/Roche is providing the trastuzumab and partial funding for this trial. Data presented in October 2016 demonstrated that this novel combination of trastuzumab and NeuVax with HER2 low-expressing patients is well-toleratted and the cardiac effects of trastuzumab are not impacted by the addition of NeuVax.