Exhibit 99.1

| Company Release – 5/6/14 |

|

First Priority Financial Corp. Reports First Quarter, 2014 Results.

MALVERN, Pa., May 6, 2014 – First Priority Financial Corp. (“First Priority” or the “Company”), parent of First Priority Bank, today reported financial results for the three months ended March 31, 2014.

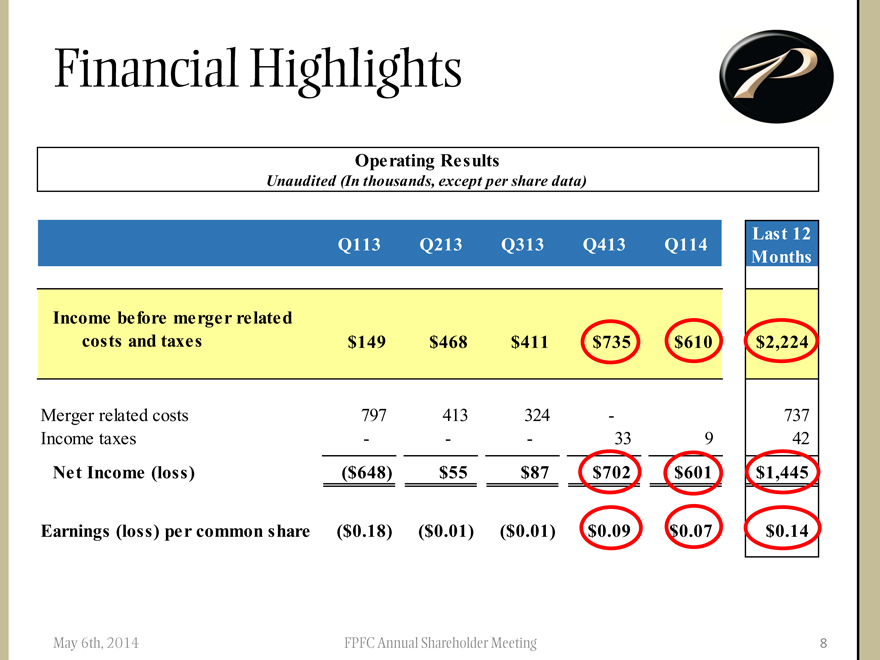

For the three months ended March 31, 2014, First Priority reported consolidated net income of $601 thousand compared to a net loss of $648 thousand for the first quarter of 2013. Net income to common shareholders, after preferred dividends and net warrant amortization totaling $127 thousand, was $474 thousand for the three months ended March 31, 2014, or $0.07 per basic and diluted common share. For the three months ended March 31, 2013, the net loss to common shareholders was $781 thousand, or $0.18 per basic and diluted common share after preferred dividends and net warrant amortization totaling $133 thousand. The results for 2013 included $797 thousand of merger related costs resulting from the merger with Affinity Bancorp, Inc. completed on February 28, 2013.

David E. Sparks, Chairman and CEO, commented: “We expected to report a higher level of financial results as we began to realize the benefits of the merged companies including synergies and cost saves beginning in the fourth quarter of 2013.” Sparks continued: “In addition, our net interest margin has remained strong and the underlying credit quality of our loan portfolio has continued to improve as reflected in the reduction of our non-performing assets ratio which declined to 1.08% of total assets as of March 31, 2014 from 1.18% at the end of 2013.”

Operating Results Highlights:

| • | Total revenues in the first quarter of 2014 were $3.98 million, an increase of $964 thousand, or 31.8%, compared to $3.02 million in the first quarter of 2013. This positive variance resulted from an increase of $865 thousand, or 29.9% in net interest income from $2.90 million to $3.76 million, primarily resulting from average loan growth of $60.0 million, including the impact of loans acquired through the merger with Affinity, and growth of average investment securities of $31.7 million. Net interest margin increased 6 basis points from 3.70% during the first quarter of 2013 to 3.76% during the current quarter. When comparing those same periods, fee income from the wealth management business increased $64 thousand while banking related fees and all other non-interest income increased $35 thousand. |

| • | The provision for loan losses was $105 thousand in the first quarter of 2014, a decrease of $60 thousand compared to $165 thousand recorded in the first quarter of 2013. This decrease was primarily related to an overall improvement in credit quality as reflected in improved credit quality ratios. |

| • | Non-interest expenses were $3.27 million in the first quarter of 2014, a decrease of $234 thousand, or 6.7% from the first quarter of 2013 expenses of $3.50 million. Excluding merger related costs totaling $797 thousand recorded in the first quarter of 2013, operating expenses increased $563 thousand between the periods. Of this increase, approximately $275 thousand in incremental salaries and benefits and $141 thousand in occupancy costs are related to the additional staffing and branch offices resulting from the merger with Affinity with combined results beginning March 2013. |

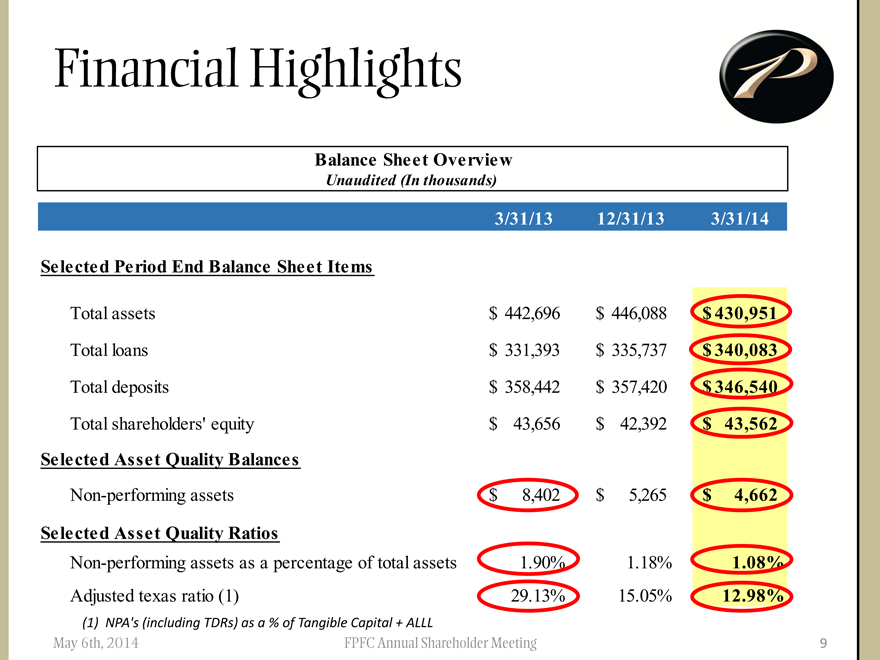

Balance Sheet and Capital Highlights:

| • | Loans outstanding were $340.1 million at March 31, 2014, an increase of $4.4 million, or 1.3% from $335.7 million at December 31, 2013. Net loan growth in the quarter was impacted by continued loan payoffs which totaled approximately $12 million during the current quarter. |

1

| • | The investment portfolio totaled $68.0 million at March 31, 2014, compared to $89.6 million at December 31, 2013. As of March 31, 2014 and December 31, 2013, $53.5 million and $78.6 million of investments, respectively, were classified as available for sale while $14.5 million and $11.0 million, respectively were classified as held to maturity. The Company’s investment portfolio included $25 million of short-term government agency securities as of December 31, 2013 which matured in January 2014. |

| • | Total assets were $431.0 million at March 31, 2014 compared to $446.1 million at December 31, 2013. |

| • | Deposits totaled $346.5 million at March 31, 2014 compared to $357.4 million at December 31, 2013, a decrease of $10.9 million, or 3.0%, primarily related to a decline in brokered and retail time deposits. Of the total deposits at March 31, 2014, $202.0 million, or 58% of total deposits, are core deposits consisting of demand, money market and savings deposits. |

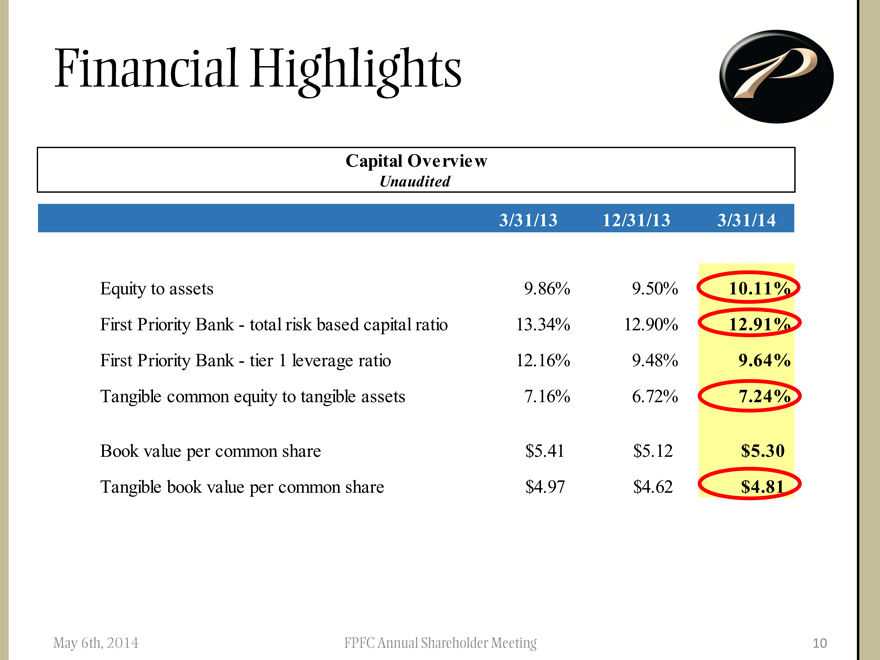

| • | The capital position of First Priority remains strong with regulatory capital ratios exceeding all requirements for First Priority Bank to be classified as “well capitalized” under capital adequacy guidelines. The Bank’s total risk based capital ratio as of March 31, 2014 was 12.91%. |

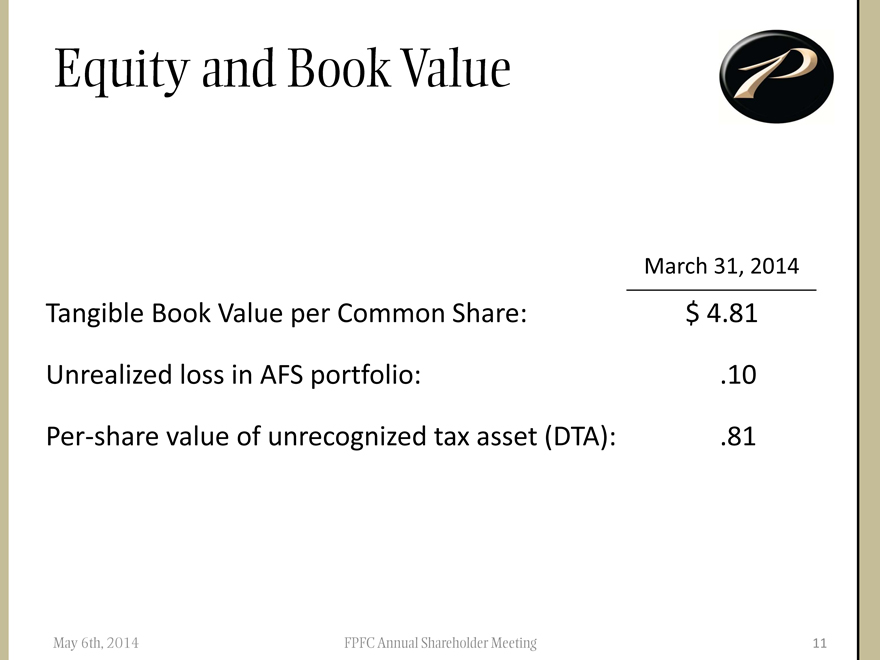

| • | Total shareholders’ equity for the Company was $43.6 million at March 31, 2014, compared to $42.4 million at December 31, 2013. The enhanced capital position is attributable to net income of $601 thousand and $625 thousand related to lower net unrealized losses on investment securities available for sale. These increases were partially offset by preferred dividends paid of $120 thousand. The period end equity to assets ratio was 10.11%, book value and tangible book value per common share at March 31, 2014 were $5.30 and $4.81, respectively, and tangible common equity to tangible assets was 7.24% as of this same date. |

Asset Quality Highlights:

| • | The allowance for loan losses was $2.2 million and $2.3 million as of March 31, 2014 and December 31, 2013, respectively, which represented 0.65% and 0.68% of total loans outstanding at such dates. Under acquisition accounting rules, all acquired loans are recorded on acquisition date at current fair values, including a discount related to potential credit impairment. Accordingly, the carryover of an allowance for loan losses is prohibited as any potential credit losses are initially included in the determination of the fair value. Generally, the allowance for loan losses is available only for loans originated by First Priority prior to and after the consummation of the merger. As of March 31, 2014 and December 31, 2013, the balance of all credit related fair value adjustments on acquired loans totaled $2.1 million and $2.3 million, respectively, and when combined with the allowance for loan losses would equate to 1.28% and 1.36%, respectively, of total loans outstanding. |

| • | Total non-performing loans were $3.4 million, or 1.01% of total loans outstanding, and $4.3 million, or 1.27% of total loans outstanding, as of March 31, 2014 and December 31, 2013, respectively. Total non-performing assets, totaled $4.7 million, or 1.08% of total assets, as of March 31, 2014, compared to $5.3 million, or 1.18% of total assets as of December 31, 2013. Net charge-offs for the Company totaled $159 thousand for the three months ended March 31, 2014 compared to $60 thousand for the same period in 2013. |

About First Priority

First Priority Financial Corp. is a bank holding company, which along with its bank subsidiary, First Priority Bank, is headquartered in Malvern, Pennsylvania. First Priority Bank, with $430.9 million in assets, was chartered in November, 2005 and opened for business to the public in January, 2006 as a full service commercial bank providing personal and business lending, deposit products and wealth management services through its ten offices in Berks, Bucks, Chester and Montgomery Counties, Pennsylvania. The common stock of First Priority Financial Corp. is not currently traded on the open market. First Priority’s website can be accessed at http://www.fpbk.com.

2

This release contains forward-looking statements, which can be identified by reference to a future period or periods or by the use of words such as “would be,” “will,” “estimate,” “project,” “believe,” “intend,” “anticipate,” “plan,” “seek,” “expect,” and similar expressions or the negative thereof. These forward-looking statements include: statements of goals, intentions and expectations; statements regarding prospects and business strategy; statements regarding asset quality and market risk; and estimates of future costs, benefits and results. These forward-looking statements are subject to significant risks, assumptions and uncertainties, including, among other things, the following: (1) general economic conditions, (2) competitive pressures among financial services companies, (3) changes in interest rates, (4) deposit flows, (5) loan demand, (6) changes in legislation or regulation, (7) changes in accounting principles, policies and guidelines, (8) litigation liabilities, including costs, expenses, settlements and judgments and (9) other economic, competitive, governmental, regulatory and technological factors affecting the Company’s operations, pricing, products and services. Because of these and other uncertainties, our actual future results may be materially different from the results indicated by these forward-looking statements. We have no obligation to update or revise any forward-looking statements to reflect any changed assumptions, unanticipated events or any changes in the future.

The Company cautions that the foregoing list of important factors is not exclusive. Readers are also cautioned not to place undue reliance on these forward-looking statements, which reflect management’s analysis only as of the date of this press release, even if subsequently made available by the Company on its website or otherwise. The Company does not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company to reflect events or circumstances occurring after the date of this press release.

For a complete discussion of the assumptions, risks and uncertainties related to our business, you are encouraged to review our filings with the Securities and Exchange Commission (“SEC”), including our most recent annual report on Form 10-K, as supplemented by our quarterly or other reports subsequently filed with the SEC.

FINANCIAL TABLES FOLLOW

3

First Priority Financial Corp.

Condensed Consolidated Statements of Operations

(Unaudited, in thousands, except per share data)

| For the three months ended March 31, |

||||||||

| 2014 | 2013 | |||||||

| Interest income |

$ | 4,474 | $ | 3,690 | ||||

| Interest expense |

712 | 793 | ||||||

|

|

|

|

|

|||||

| Net interest income |

3,762 | 2,897 | ||||||

| Provision for loan losses |

105 | 165 | ||||||

|

|

|

|

|

|||||

| Net interest income after provision for loan losses |

3,657 | 2,732 | ||||||

| Non-interest income |

219 | 120 | ||||||

| Non-interest expenses |

3,266 | 3,500 | ||||||

|

|

|

|

|

|||||

| Income (loss) before income taxes |

610 | (648 | ) | |||||

| Income taxes |

9 | — | ||||||

|

|

|

|

|

|||||

| Net income (loss) |

$ | 601 | $ | (648 | ) | |||

| Preferred dividends, including net amortization |

127 | 133 | ||||||

|

|

|

|

|

|||||

| Income (loss) to common shareholders |

$ | 474 | $ | (781 | ) | |||

|

|

|

|

|

|||||

| Basic earnings (loss) per common share |

$ | 0.07 | $ | (0.18 | ) | |||

| Fully diluted earnings (loss) per common share |

$ | 0.07 | $ | (0.18 | ) | |||

| Weighted average common shares outstanding: |

||||||||

| Basic |

6,439 | 4,241 | ||||||

| Diluted |

6,439 | 4,241 | ||||||

| Net interest margin |

3.76 | % | 3.70 | % | ||||

4

First Priority Financial Corp.

Condensed Consolidated Balance Sheets

Unaudited (In thousands)

| March 31, 2014 |

December 31, 2013 |

|||||||

| Assets | ||||||||

| Cash and cash equivalents |

$ | 10,453 | $ | 11,248 | ||||

| Investment securities |

67,951 | 89,599 | ||||||

| Loans receivable |

340,083 | 335,737 | ||||||

| Less: allowance for loan losses |

2,219 | 2,273 | ||||||

|

|

|

|

|

|||||

| Net loans |

337,864 | 333,464 | ||||||

| Premises and equipment, net |

2,538 | 2,533 | ||||||

| Bank owned life insurance |

3,017 | — | ||||||

| Goodwill and other intangibles |

3,193 | 3,219 | ||||||

| Other assets |

5,935 | 6,025 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 430,951 | $ | 446,088 | ||||

|

|

|

|

|

|||||

| Liabilities and Shareholders’ Equity | ||||||||

| Liabilities: |

||||||||

| Deposits |

$ | 346,540 | $ | 357,420 | ||||

| Borrowings |

33,300 | 44,625 | ||||||

| Other liabilities |

7,549 | 1,651 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

387,389 | 403,696 | ||||||

| Shareholders’ equity |

43,562 | 42,392 | ||||||

|

|

|

|

|

|||||

| Total liabilities and shareholders’ equity |

$ | 430,951 | $ | 446,088 | ||||

|

|

|

|

|

|||||

5

First Priority Financial Corp.

Selected Financial Data

(Unaudited, in thousands, except share and per share data)

| March 31, 2014 |

December 31, 2013 |

|||||||

| Period End Balance Sheet Ratios |

||||||||

| Loan to deposit ratio |

98.1 | % | 93.9 | % | ||||

| Equity to assets |

10.11 | % | 9.50 | % | ||||

| Tangible common equity/Tangible assets |

7.24 | % | 6.72 | % | ||||

| First Priority Bank total risk based capital ratio |

12.91 | % | 12.90 | % | ||||

| Book value per common share |

$ | 5.30 | $ | 5.12 | ||||

| Tangible book value per common share |

$ | 4.81 | $ | 4.62 | ||||

| Selected Asset Quality Balances |

||||||||

| Non-performing loans |

$ | 3,430 | $ | 4,276 | ||||

| Other real estate owned |

1,115 | 914 | ||||||

| Repossessed assets |

117 | 75 | ||||||

|

|

|

|

|

|||||

| Total non-performing assets |

$ | 4,662 | $ | 5,265 | ||||

|

|

|

|

|

|||||

| Selected Asset Quality Ratios |

||||||||

| Non-performing loans as a percentage of total loans |

1.01 | % | 1.27 | % | ||||

| Non-performing assets as a percentage of total assets |

1.08 | % | 1.18 | % | ||||

| Allowance for loan losses as a percentage of total loans |

0.65 | % | 0.68 | % | ||||

# # #

6