UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the fiscal year ended

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______, 20 ____, to ______, 20_____.

Commission

File Number

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| (Address of principal executive offices) | (Zip Code) |

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| N/A | N/A | N/A |

Securities registered pursuant to section 12(g) of the Act:

| N/A |

| (Title of class) |

| N/A |

| (Title of class) |

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐

The

aggregate market value of the registrant’s common stock outstanding, other than shares held by persons who may be deemed affiliates

of the registrant, computed by reference to the closing sales price for the registrant’s common stock on June 30, 2021 (the last

business day of the registrant’s most recently completed second fiscal quarter), as reported on the OTC Markets Group, Inc., was

approximately $

As of March 29, 2022, there were shares of common stock, par value $0.001 per share, of the registrant issued and outstanding.

Table of Contents

| 2 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements contained in this annual report may constitute “forward-looking statements” for purposes of the federal securities laws. Our forward-looking statements include, but are not limited to, statements regarding our or our management team’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained in this annual report are based on our current expectations and beliefs concerning future developments and their potential effects on us. There can be no assurance that future developments affecting us will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, the following risks, uncertainties and other factors:

| ● | the implementation of our strategic plans for our business; | |

| ● | our financial performance; | |

| ● | fluctuations in the number of influencers that we contract with and their number of social media followers; | |

| ● | developments relating to our competitors and our industry, including the impact of government regulation; | |

| ● | estimates of our expenses, future revenues, capital requirements and our needs for additional financing; and | |

| ● | other risks and uncertainties, including those listed under the captions “Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” |

Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

| 3 |

PART I

ITEM 1. BUSINESS

In this Annual Report on Form 10-K, unless the context indicates otherwise, “Clubhouse Media,” the “Company,” “we,” “our,” “ours” or “us” refer to Clubhouse Media Group, Inc., a Nevada corporation, and its subsidiaries, including West of Hudson Group, Inc., a Delaware corporation, and its subsidiaries.

Business Overview

We are an influencer-based social media firm and digital talent management agency. Our Company offers management, production and deal-making services to our handpicked influencers, a management division for individual influencer clients, and an investment arm for joint ventures and acquisitions for companies in the social media influencer space. Our management team consists of successful entrepreneurs with financial, legal, marketing, and digital content creation expertise.

Through our subsidiary, West of Hudson Group, Inc. (“WOHG”), we currently generate revenues primarily from (i) through Doiyen, LLC (“Doiyen”), a 100% wholly owned subsidiary of WOHG, talent management of social media influencers; (ii) through WOH Brands, LLC (“WOH Brands”), a 100% wholly owned subsidiary of WOHG, which operates Honeydrip.com, a new digital platform with a focus on the empowerment of creators. The site allows creators to connect with fans and sell exclusive photo and video content; (iii) through Digital Influence Inc. (doing business as Magiclytics), a 100% wholly owned subsidiary of WOHG (“Magiclytics”), providing predictive analytics for content creation brand deals; and (iv) for paid promotion by companies looking to utilize such social media influencers to promote their products or services. We solicit companies for potential marketing collaborations and cultivated content creation, work with the influencers and the marketing entity to negotiate and formalize a brand deal and then execute the deal and receive a certain percentage from the deal. In addition to the in-house brand deals, we generate income by providing talent management and brand partnership deals to external influencers.

WOHG is the 100% owner and sole member and manager of each of these entities pursuant to each of the limited liability company agreements and bylaws, where applicable, that govern these entities, and has complete and exclusive discretion in the management and control of the affairs and business of WOH Brands, Doiyen, and Magiclytics possesses all powers necessary to carry out the purposes and business of these entities. WOHG is entitled to the receipt of all income (and/or losses) that these entities generate.

In addition to the above, WOHG is the 100% owner of two other limited liability companies – Clubhouse Studios, LLC, which holds most of our intellectual property, and DAK Brands, LLC, each incorporated in the State of Delaware on May 13, 2020. However, each of these entities has minimal or no operations, and is not intended to have any material operations in the near future.

For the fiscal year ended December 31, 2021, Clubhouse Media generated revenues of $4,253,765 and reported a net loss of $22,245,656 and negative cash flow from operating activities of $7,970,357. As noted in the consolidated financial statements of Clubhouse Media, as of December 31, 2021, Clubhouse Media had an accumulated deficit of $24,904,074. There is substantial doubt regarding the ability of Clubhouse Media to continue as a going concern as a result of its historical recurring losses and negative cash flows from operations as well as its dependence on private equity and financings. See “Risk Factors—Clubhouse Media has a history of operating losses and its management has concluded that factors raise substantial doubt about its ability to continue as a going concern and the auditor of Clubhouse Media has included explanatory paragraphs relating to its ability to continue as a going concern in its audit report for the twelve months ended December 31, 2021.”

Principal Products and Services

Our current principal products and services are comprised of (i) our talent management services and (ii) our brand development and content creation and (iii) Honeydrip.com.

| 4 |

“The Clubhouse” Online Presence

“The Clubhouse” network previously consisted of physical locations. In 2021, we determined to focus exclusively on our talent management services and our brand development and content creation. Accordingly, we closed our physical Clubhouses in 2021. There are numerous “Clubhouse” accounts owned by The Clubhouse, with a following across Instagram, Snapchat, YouTube, and TikTok. These accounts are directly held by us (as opposed to the Clubhouse team of influencers) and therefore we have direct access to the followers of these accounts, which we consider to be our followers.

Talent Management and Digital Agency Services

Doiyen, our indirectly wholly owned subsidiary, is a talent management company and digital agency for social media influencers and generates revenues based on the earnings of its influencer-clients (or “Creators”) by receiving a percentage of the earnings of its Creators. Certain influencers enter into an Exclusive Management Agreement (each, a “Management Agreement”). Through Doiyen, we seek to represent some of the world’s top talent in the world of social media. We plan to hire experienced talent and management agents as well as build our support and administrative resources seeking to expand operations. Our influencers include entertainers, content creators, and style icons.

We are dedicated to helping Doiyen’s influencer-clients build their brands, maintain creative control of their destinies, and diversify and grow their businesses through “The Clubhouse,” providing them opportunities to increase their monetization potential and amplify their reach.

Paid Promotion

Doiyen and its Creators (both contracted and third party) primarily generate revenue from companies paying for promotion for their brands, products, and/or services.

The primary type of arrangement through which we will receive revenues from these activities through Doiyen is:

| (i) | As a talent management company and digital agency, Doiyen generates revenues based on the earnings of its influencer-clients Creators by receiving a percentage of the earnings of its Creators. Creators are often sought after directly by companies for specific branding and/or promotional opportunities. In these situations, the client-company would contract with the Creator directly, and such services provided by the Creator would fall under the Management Agreement, and Doiyen would receive a percentage of the earnings of the Creator for such services as described above. |

Companies that contract with Doiyen to provide such promotional activities for their advertising campaigns or custom content requests generally either prepay for services or request credit terms. Such agreements typically provide for either a non-refundable deposit, or a cancellation fee if the agreement is canceled by Doiyen prior to completion our promotional services.

Brand Development and Content Creation

Through WOH Brands, a 100% wholly owned subsidiary of WOHG, we engage and also plan to engage in a number of activities with respect to brand development and incubation, content creation, and technology development, as follows:

| ● | Content Creation: original long and short form content creation for streaming services or other platforms involved in content distribution; | |

| ● | Brand Development and Product Sales: acquiring or creating in-house brands and selling products in various categories, including apparel, beauty, and other lifestyle brands; and | |

| ● | Technology: Through Magiclytics, we provide predictive analytics for content creation brand deals. In September 2021, the Company launched its subscription-based site HoneyDrip.com, a new digital platform designed and owned by Clubhouse Media Group with a focus on the empowerment of creators. The site allows creators to connect with fans and sell exclusive photo and video content |

| 5 |

Brand Development

On May 19, 2020, WOH Brands began to engage in brand development, with a focus on creating apparel, beauty, and other lifestyle brands with quality product offerings. Through WOH Brands, our indirectly wholly-owned subsidiary, we intend to acquire, enter into joint ventures or launch best-in-class brands with an objective of innovation and product uniqueness, derived from demographic data, market research, and omni-channel experiences.

WOH Brands is primarily focused on creating brands on our behalf and may consider joint-ventures with other established companies in the consumer-packaged goods space for purposes of brand and production creation. WOH Brands will not provide its branding or product services to third parties outside of the Clubhouse Media-family of companies other than companies with which it may enter into a joint venture or other companies it contracts with to do so.

As of the date of this Prospectus, WOH Brands has only sold a minimal amount of products, and has only generated minimal revenues.

Content Creation

WOH Brands acts as an internal studio for us, with the ability to develop ideas for, produce, and film content.

Magiclytics provides predictive analytics for content creation brand deals.

As of the date of this Annual Report on Form 10-K, WOH Brands’ activities in this area have been limited to assisting in the production of paid-promotional content for companies that have engaged Doiyen or Doiyen’s Creators for brand and product promotion, as well as content-creation for Clubhouse, for which WOH Brands does not receive compensation. WOH Brands’ activities in this capacity include filming, photography, and graphic design.

Planned Operations

| ● | Brand Development. As stated above, WOH Brands intends to acquire, enter into joint ventures with, or create new brands in apparel, beauty, and other lifestyle categories in the future. We believe that we are in a unique position to gather data intelligence from our dealings with paid brand deals. While companies pay Doiyen and our influencers to promote their products or services, we gain firsthand insight into what type of brands (and their corresponding products and services) resonate with our demographic. We believe that this information better positions WOH Brands in deciding what type of product or service to acquire or build. WOH Brands will not provide its brand development services to third parties outside of the Clubhouse Media-family of companies, but may engage in joint ventures with third parties. | |

| ● | Content Creation. In the future, WOH Brands intends to create entertainment content for streaming services and other platforms in the entertainment and/or social media space. WOH Brands expects it could receive ad revenues, revenues for licensing, and/or revenues for sales of content to purchasers in this space. | |

| ● | Technology Development / Software. WOH Brands also intends to continue to develop its Magiclytics software, which provides predictive ROI on influencer campaigns. | |

| ● | Subscription Services. In September 2021, the Company launched its subscription-based site HoneyDrip.com, a new digital platform designed and owned by Clubhouse Media Group with a focus on the empowerment of creators. The site allows creators to connect with fans and sell exclusive photo and video content. We plan to continue to expand the number of users and creators on the site. |

| 6 |

INDUSTRY OVERVIEW

Social Media and Influencer Marketing and Promotion

Around the world, marketing is a key strategy for brands to obtain exposure, achieve better recall, communicate themes and drive increased consumer engagement. Globally, in 2018, there was an estimated spend of $66 billion on sponsorships, up from $43 billion in 2008, according to Statista 2019-Worldwide; IEG; 2007 to 2017. As for the overall advertising landscape, Zenith estimated that global advertising spending will reach $705 billion in 2021, up from $634 billion in 2019, and will rise to $873 billion by 2024.

Advertising has shifted significantly towards social media over the last few years, and social media influencers who are the primary form of advertisement distribution is highly disorganized. We believe that one of the most important aspects of building a company or launching a product is social media marketing. According to Sprout Social, as of January 2022, there are 3.96 billion total social media users across all platforms. This makes social media marketing a great tool for any company.

According to a Business Insider Intelligence report titled “Influencer Marketing: State of the social media influencer market in 2021” originally published in December 2019 and updated February 2021, influencer marketing spending has grown significantly since 2015 and is expected to reach $13.8 billion annually by 2021. According to the same source, currently 78% of companies spend over 10% of their marketing budget on influencer marketing and 11% of companies allocate more than 40% of their marketing budget on influencer marketing and the percentage is expected to grow as more companies become comfortable with the channel. Also according to the same source, companies surveyed about influencer marketing noted that content quality, aligned target audience demographic and engagement rate were the three most important determinants in choosing influencer partners and that the two most important goals for influencer marketing based on survey responses were increasing brand awareness and reaching new audiences in order to expand their existing customer base. Furthermore, according to Influencer Marketing Hub, the influencer marketing spend is projected to reach $16.4 billion in 2022.

We intend to capitalize on this growing social media and influencer based advertising spending, utilizing our Clubhouse influencers to attract advertisers directly, as well as generating business for Creators, for which we will receive compensation pursuant to our Management Agreements.

Competition

As a talent management company through Doiyen, we compete against other talent management companies that are specific to the social media influencer space, such as IZEA and Viral Nation. We compete with these other companies on the basis of our brand name, reputation for access to industry participants and desirable projects, as well as pricing.

For our brands and products, we currently compete primarily with other specialty retailers, higher-end department stores and Internet businesses that engage in the retail sale of women’s and men’s apparel, accessories and similar merchandise targeting customers aged 12 to 30. We believe the principal basis upon which we compete are design, quality, and price. We believe that our primary competitive advantage is high visibility, which we can achieve through our network of Clubhouse influencers.

| 7 |

For our platform Honeydrip.com, we directly compete with OnlyFans, an industry leader. HoneyDrip differentiates itself from OnlyFans by being an Invite only site, our site is female empowering, and we offer an inhouse account management services for creators.

In the future, we expect to compete with other content-creators for placement on streaming services and other content platforms, with technology and software companies in the social media space, and with companies making lifestyle and/or beauty products marketed to social media audiences.

We seek to effectively compete with such competitors by out-scaling our competition, focusing on in-house business infrastructure and providing superior support and management services for our Clubhouse influencers. We strive to have more physical locations than other influencer-house networks. Currently, we are unaware of any other company that is combining into one business the various business aspects in which we engage. In addition, we believe the experience of our management team provides us with a significant advantage in the social media influencer business, as participants in this space have traditionally lacked the business experience that our executive management team possesses, which we intend to use to our advantage. Notwithstanding, we may not be able to effectively compete with such competitors.

Customers

Our customers include our influencer-clients, or Creators (through Doiyen), companies that contract directly with us (through Doiyen) for paid promotion, and the consumers that purchase our products (through WOH Brands).

Doiyen and its Creators have already worked with a number of notable brands, including, but not limited to, Fashion Nova, Spotify, McDonalds, Amazon, and Boohoo.

Sales and Marketing

We generally attract clients through our social media presence across various platforms, including YouTube, Instagram, and TikTok.

As a respected name in the social media influencer industry, we are often approached by influencers who want us to represent them (through DoiyenWe also scout for up-and-coming talented influencers on various social media platforms, who we then attempt to engage as clients.

For paid promotion, we generally receive inbound inquiries for promotional opportunities from companies looking to promote their brands or products. Doiyen also has a sales team to reach out to specific brands that we believe fits a specific influencer’s style, which is another way we generate business.

All products that we sell are marketed through our Clubhouse team of influencers, who provide promotion and marketing social media posts on our behalf.

Government Regulation

We are subject to various federal, state and local laws, both domestically and internationally, governing matters such as:

| ● | licensing laws for talent management companies, such as California’s Talent Agencies Act; | |

| ● | licensing, permitting and zoning; | |

| ● | health, safety and sanitation requirements; | |

| ● | harassment and discrimination, and other similar laws and regulations; | |

| ● | compliance with the Foreign Corrupt Practices Act (“FCPA”) and similar regulations in other countries; | |

| ● | data privacy and information security; | |

| ● | marketing activities; | |

| ● | environmental protection regulations; | |

| ● | imposition by the U.S. and/or foreign countries of trade restrictions, restrictions on the manner in which content is currently licensed and distributed and ownership restrictions; and | |

| ● | government regulation of the entertainment industry. |

| 8 |

We monitor changes in these laws and believe that we are in material compliance with applicable laws and regulations. See “Risk Factors—Risks Related to Our Business—We are subject to extensive U.S. and foreign governmental regulations, and our failure to comply with these regulations could adversely affect our business.”

Our entertainment and content businesses are also subject to certain regulations applicable to our use of Internet web sites and mobile applications such as Tik Tok, Instagram and YouTube. We maintain various web sites and mobile applications that provide information and content regarding our businesses and offer merchandise for sale. The operation of these web sites and applications may be subject to a range of federal, state and local laws.

Due to our involvement in products, we are subject to laws governing advertising and promotions, privacy laws, safety regulations, consumer protection regulations and other laws that regulate retailers and govern the promotion and sale of merchandise. We monitor changes in these laws and believe that we are in material compliance with applicable laws.

Intellectual Property

We currently do not own any patents, trademarks or any other intellectual property at this time.

The Company filed a trademark application on April 15, 2020, with the United States Patent and Trademark Office (“USPTO”) under Application Serial No. 90649015 for the mark “Clubhouse Media Group.” The application can be found at https://tmsearch.uspto.gov/bin/showfield?f=doc&state=4807:hxdnrn.3.1 and is identified with this image:

Overview of the Business of West of Hudson Group, Inc.

WOHG, our directly wholly owned subsidiary, was incorporated on May 19, 2020 under the laws of the State of Delaware. WOHG is primarily a holding company, and operates various aspects of its business through its operating subsidiaries of which WOHG is the 100% owner and sole member, and which are as follows:

| 1. | Doiyen—a talent management company that provides representation to Clubhouse influencers, as further described below. | |

| 2. | WOH Brands—a content-creation studio, social media marketing company, technology developer, and brand incubator, as further described below. It owns and operates HoneyDrip.com, a new digital platform designed and owned by Clubhouse Media Group with a focus on the empowerment of creators. The site allows creators to connect with fans and sell exclusive photo and video content | |

| 3. | Magiclytics—a company that provides predictive analytics for content creation brand deals. |

Doiyen, formerly named WHP Management, LLC, and before that named WHP Entertainment LLC, is a California limited liability company formed on January 2, 2020. Doiyen was acquired by WOHG on July 9, 2020 pursuant to an exchange agreement between WOHG and Doiyen, pursuant to which WOHG acquired 100% of the membership interests of Doiyen in exchange for 100 shares of common stock of WOHG. As described above, Doiyen is a talent management company for social media influencers, and seeks to represent some of the world’s top talent in the world of social media. Doiyen is the entity with which our influencers contract.

| 9 |

WOH Brands is a Delaware limited liability company formed on May 19, 2020 by WOHG. As described above, WOH Brands engages and also plans to engage in a number of activities, with respect to brand development and incubation, content creation, and technology development.

Magiclytics is a Wyoming corporation formed on July 2, 2018. The Company acquired a 100% interest in Magiclytics on February 3, 2021. As described above, Magiclytics provides predictive analytics for content creation brand deals.

WOHG is the 100% owner and sole member and manager of each of these entities pursuant to each of the limited liability company agreements and bylaws, where applicable, that govern these entities, and has complete and exclusive discretion in the management and control of the affairs and business of WOH Brands, Doiyen, and Magiclytics possesses all powers necessary to carry out the purposes and business of these entities. WOHG is entitled to the receipt of all income (and/or losses) that these entities generate.

In addition to the above, WOHG is the 100% owner of two other limited liability companies – Clubhouse Studios, LLC, which holds most of our intellectual property, and DAK Brands, LLC, each incorporated in the State of Delaware on May 13, 2020. However, each of these entities has minimal or no operations as of the date of this Prospectus and are not intended to have any material operations in the near future.

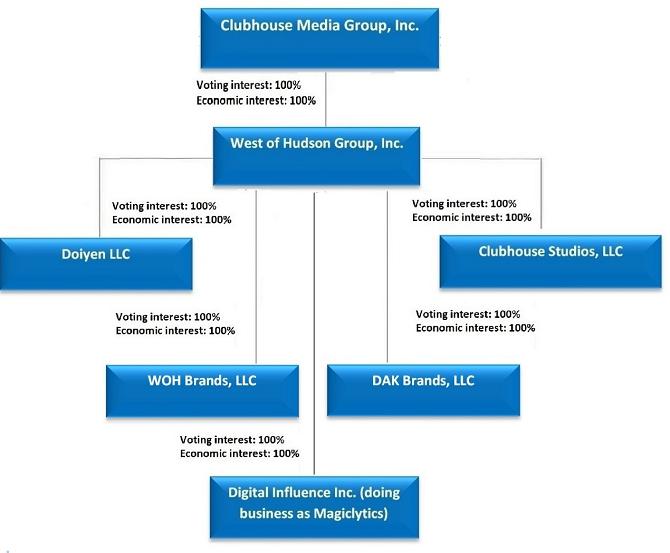

Organizational Structure

The following diagram reflects our organization structure:

Effects of Coronavirus on the Company

Due to the digital/remote nature of our business, we believe that the effects of Coronavirus on the company are limited.

Organizational History

Clubhouse Media Group, Inc. was incorporated under the laws of the State of Nevada on December 19, 2006 with the name Tongji Healthcare Group, Inc. by Nanning Tongji Hospital, Inc. (“NTH”). On the same day, Tongji, Inc., our wholly owned subsidiary, was incorporated in the State of Colorado. Tongji, Inc. was later dissolved on March 25, 2011.

NTH was established in Nanning in the province of Guangxi of the People’s Republic of China (“PRC” or “China”) by the Nanning Tongji Medical Co. Ltd. and an individual on October 30, 2003.

NTH was a designated hospital for medical insurance in the city of Nanning and Guangxi province with 105 licensed beds. NTH specializes in the areas of internal medicine, surgery, gynecology, pediatrics, emergency medicine, ophthalmology, medical cosmetology, rehabilitation, dermatology, otolaryngology, traditional Chinese medicine, medical imaging, anesthesia, acupuncture, physical therapy, health examination, and prevention.

| 10 |

On December 27, 2006, Tongji, Inc. acquired 100% of the equity of NTH pursuant to an Agreement and Plan of Merger, pursuant to which NTH became a wholly owned subsidiary of Tongji Inc. Pursuant to the Agreement and Plan of Merger, we issued 15,652,557 shares of common stock to the shareholders of NTH in exchange for 100% of the issued and outstanding shares of common stock of NTH. The acquisition of NTH was accounted for as a reverse acquisition under the purchase method of accounting since the shareholders of NTH obtained control of the entity. Accordingly, the reorganization of the two companies was recorded as a recapitalization of NTH, with NTH being treated as the continuing operating entity. The Company, through NTH, thereafter operated the hospital, until the Company eventually sold NTH, as described below.

Effective December 31, 2017, under the terms of a Bill of Sale, we agreed to sell, transfer convey and assign forever all of its rights, title and interest in its equity ownership interest in its subsidiary, NTH, to Placer Petroleum Co., LLC, an Arizona limited liability company. Pursuant to the Bill of Sale, consideration for this sale, transfer conveyance and assignment is Placer Petroleum Co, LLC assuming all assets and liabilities of NTH as of December 31, 2017. As a result of the Bill of Sale, the related assets and liabilities of Nanning Tongji Hospital, Inc. was reported as discontinued operations effective December 31, 2017. Thereafter, the Company had minimal operations.

On May 20, 2019, pursuant to Case Number A-19-793075-P, Nevada’s 8th Judicial District, Business Court entered and Order Granting Application of Joseph Arcaro as Custodian of Tongji Healthcare Group, Inc. pursuant to NRS 78.347(1)(b), pursuant to which Joseph Arcaro was appointed custodian of the Company and given authority to reinstate the Company with the State of Nevada under NRS 78.347. On May 23, 2019, Joseph Arcaro filed a Certificate of Reinstatement of the Company with the Secretary of State of the State of Nevada. In addition, on May 23, 2019, Joseph Arcaro filed an Annual List of the Company with the Secretary of State of the State of Nevada, designating himself as President, Secretary, Treasurer and Director of the Company for the filing period of 2017 to 2019. On November 13, 2019, Mr. Arcaro filed a Motion to Terminate Custodianship of Tongji Healthcare Group, Inc. pursuant to NRS 78.650(4) with the District Court in Clark County Nevada. On December 6, 2019, the court granted Mr. Arcaro’s motion, and the custodianship was terminated.

Effective May 29, 2020, Joseph Arcaro, our Chief Executive Officer, President, Secretary, Treasurer and sole director and the beneficial owner, through his ownership of Algonquin Partners Inc. (“Algonquin”), of 65% of the Company’s common stock, entered into a Stock Purchase Agreement (the “Stock Purchase Agreement”) by and among West of Hudson Group, Inc., the Company, Algonquin, and Mr. Arcaro. Pursuant to the terms of the SPA, WOHG agreed to purchase, and Algonquin agreed to sell, 30,000,000 shares of the Company’s common stock in exchange for payment by WOHG to Algonquin of $240,000 (the “Stock Purchase”). Thereafter, WOHG distributed the 30,000,000 shares of the Company among the shareholders of WOHG. The Stock Purchase closed on June 18, 2020, resulting in a change of control of the Company.

On July 7, 2020, we amended our articles of incorporation whereby we increased our authorized capital stock to 550,000,000 shares, comprised of 500,000,000 shares of common stock, par value $0.001 and 50,000,000 shares of preferred stock, par value $0.001.

Share Exchange Agreement – West of Hudson Group, Inc.

On August 11, 2020, we entered into the Share Exchange Agreement with (i) WOHG; (ii) each of the WOHG Shareholders; and (iii) Mr. Ben-Yohanan as the Shareholders’ Representative.

Pursuant to the terms of the Share Exchange Agreement, the parties agreed that the Company would acquire 100% of WOHG’s issued and outstanding capital stock, in exchange for the issuance to the WOHG Shareholders of a number of shares of the Company’s common stock to be determined at the closing of the Share Exchange Agreement.

On November 12, 2020, the Company filed a Certificate of Designations with the Secretary of State of Nevada to designate one share of the preferred stock of the Company as the Series X Preferred Stock of the Company.

The closing of the Share Exchange Agreement occurred on November 12, 2020. Pursuant to the terms of the Share Exchange Agreement, the Company acquired 200 shares WOHG’s common stock, par value $0.0001 per share, representing 100% of the issued and outstanding capital stock of WOHG, in exchange for the issuance to the WOHG Shareholders of 46,811,195 shares of the Company’s common stock (the “Share Exchange”). As a result of the Share Exchange, WOHG became a wholly owned subsidiary of the Company.

| 11 |

In addition, on November 20, 2020, pursuant to the Share Exchange Agreement and subsequent Waiver, the Company issued and sold to Amir Ben-Yohanan one share of Series X Preferred Stock, at a purchase price of $1.00. This one share of Series X Preferred Stock has a number of votes equal to all of the other votes entitled to be cast on any matter by any other shares or securities of the Company plus one, but will not have any economic or other interest in the Company.

The Share Exchange is intended to be a reorganization within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”), and the Share Exchange Agreement is intended to be a “plan of reorganization” within the meaning of the regulations promulgated under Section 368(a) of the Code and for the purpose of qualifying as a tax-free transaction for federal income tax purposes.

On November 12, 2020, pursuant to the closing of the Share Exchange Agreement, we acquired WOHG, and WOHG thereafter became our wholly owned subsidiary, and the business of WOHG became the business of the Company going forward.

Recent Developments of West of Hudson Group, Inc.

On August 3, 2020, on behalf of WOHG, Amir Ben-Yohanan, our Chief Executive Officer, entered into a lease agreement for a term ending July 31, 2021 for $50,000 a month (for the property currently being used for the Dobre Brothers House – Beverly Hills location.) The Company terminated its lease agreement for the Dobre Brothers House effective September 1, 2021. At the time of the termination of this lease, the Company had a month-to-month tenancy at this location, as contemplated under the lease after the expiration of the initial term of the lease on July 31, 2021. This lease was terminated in the 4th quarter of 2021.

On September 4, 2020, on behalf of WOHG, Mr. Ben-Yohanan, our Chief Executive Officer, entered into a one-year lease agreement for $40,000 a month for the “Weheartfans House – Bel-Air” Clubhouse. Neither Amir Ben-Yohanan nor WOHG renewed the lease upon its expiration.

On September 6, 2020, WOHG entered into an agreement to rent the property for Clubhouse Europe until November 5, 2020, for 4,000 euros per month and to be extended month to month thereafter. This lease was terminated in the 4th quarter of 2021.

On August 18, 2020, on behalf of the Company, Amir Ben-Yohanan, our Chief Executive Officer, entered into a one-year lease agreement for a term commencing on February 1, 2021 and ending January 31, 2022 for $12,500 a month (for the property currently being used for the Society Las Vegas – Las Vegas location). As of July 31, 2021, the Company and the landlord mutually agreed to terminate the lease without penalty.

On March 4, 2021, the Company entered into a three-month lease agreement for a term ending June 15, 2021 for $34,000.00 per month (for the property currently being used for the Just a House – Los Angeles location.) This lease was not renewed.

As of December 31, 2021, Mr. Ben-Yohanan, our Chief Executive Officer has advanced $2,269,864 to WOHG to pay WOHG’s operating expenses.

Name Change

On November 2, 2020, the Company filed a Certificate of Amendment with the Secretary of State of Nevada in order to amend its Articles of Incorporation to change the Company’s name from “Tongji Healthcare Group, Inc.” to “Clubhouse Media Group, Inc.”

On January 20, 2021, Financial Industry Regulatory Authority (“FINRA”) approved our name change from “Tongji Healthcare Group, Inc.” to “Clubhouse Media Group, Inc.” and approved the change the symbol of our common stock from “TONJ” to “CMGR.”

| 12 |

Share Exchange Agreement - Magiclytics

On February 3, 2021, the Company entered into an Amended and Restated Share Exchange Agreement (the “A&R Share Exchange Agreement”) by and between the Company, Magiclytics, each of the shareholders of Magiclytics (the “Magiclytics Shareholders”) and Christian Young, as the representative of the Magiclytics Shareholders (the “Shareholders’ Representative”). Christian Young is the President, Secretary, and a Director of the Company, and is also an officer, director, and significant shareholder of Magiclytics.

The A&R Share Exchange Agreement amended and restated in its entirety the previous Share Exchange Agreement between the same parties, which was executed on December 3, 2020 . The A&R Share Exchange Agreement replaces the Share Exchange Agreement in its entirety.

Pursuant to the terms of the A&R Share Exchange Agreement, the Company agreed to acquire from the Magiclytics Shareholders, who hold an aggregate of 5,000 shares of Magiclytics’ common stock, par value $0.01 per share (the “Magiclytics Shares”), all 5,000 Magiclytics Shares, representing 100% of Magiclytics’ issued and outstanding capital stock, in exchange for the issuance by the Company to the Magiclytics Shareholders of the 734,689 shares of the Company’s common stock based on a $3,500,000 valuation of Magiclytics, to be apportioned between the Magiclytics Shareholders pro rata based on their respective ownership of Magiclytics Shares.

On February 3, 2021 (the “Magiclytics Closing Date”), the parties closed on the transactions contemplated in the A&R Share Exchange Agreement, and the Company agreed to issue 734,689 shares of Company common stock to the Magiclytics Shareholders in exchange for all 5,000 Magiclytics Shares (the “Magiclytics Closing”). On February 3, 2021, pursuant to the closing of the Share Exchange Agreement, we acquired Magiclytics, and Magiclytics thereafter became our wholly owned subsidiary.

At the Magiclytics Closing, we agreed to issue to Christian Young and Wilfred Man each 330,610 shares of Company Common Stock, representing 45% each, or 90% in total of the Company common stock which we agreed to issue to the Magiclytics Shareholders at the Magiclytics Closing. As of February 7, 2021, we have not issued the 734,689 shares to the Magiclytics shareholders.

The number of shares of the Company common stock issued at the Magiclytics Closing was based on the fair market value of the Company common stock as initially agreed to by the parties, which is $4.76 per share (the “Base Value”). The fair market value was determined based on the volume weighted average closing price of the Company common stock for the twenty (20) trading day period immediately prior to the Magiclytics,. In the event that the initial public offering price per share of the Company common stock in this offering pursuant to Regulation A is less than the Base Value, then within three (3) business days of the qualification by the Securities and Exchange Commission (the “SEC”) of the Offering Statement forming part of this Prospectus, the Company will issue to the Magiclytics Shareholders a number of additional shares of Company common stock equal to:

| 1. | $3,500,000 divided by the initial public offering price per share of the Company common stock in this offering pursuant to Regulation A, minus | |

| 2. | 734,689. |

The resulting number of shares of the Company common stock pursuant to the above calculation will be referred to as the “Additional Shares”, and such Additional Shares will also be issued to the Magiclytics Shareholders pro rata based on their respective ownership of Magiclytics Shares. The Company issued additional 140,311 shares in November 2021 based on the offering price of $4 in the Regulation A offering.

In addition to the exchange of shares between the Magiclytics Shareholders and the Company described above, on the Magiclytics Closing Date the parties took a number of other actions in connection with the Magiclytics Closing pursuant to the terms of the A&R Share Exchange Agreement:

| (i) | The Board of Directors of Magiclytics (the “Magiclytics Board”) expanded the size of the Magiclytics Board to 3 persons and named Simon Yu, a current officer and director of the Company as a director of the Magiclytics Board. | |

| (ii) | The Magiclytics Board named Wilfred Man as the Chief Executive Officer of Magiclytics, Christian Young as the President and Secretary of the Magiclytics and Simon Yu as the Chief Operating Officer of Magiclytics. |

| 13 |

Further, immediately following the Magiclytics Closing, the Company assumed responsibility for all outstanding accounts payables and operating costs to continue operations of Magiclytics including but not limited to payment to any of its vendors, lenders, or other parties in which Magiclytics engages with in the regular course of its business.

Management Agreement—Alden Reiman Agency

Effective August 20, 2021, the Company entered into an exclusive management agreement with Alden Reiman, an influencer-based marketing and media firm with a vast, global social media reach, announces that Alden Reiman has joined Clubhouse Media as a consultant. In this role, Reiman will, on an exclusive basis, use his best efforts to obtain brand and sponsorship deals for Clubhouse Media, talent and third-party clients.

Management Agreement—TheTinderBlog

Effective June 10, 2021, the Company entered into an exclusive management agreement pursuant to which it will manage, invest in and help grown “TheTinderBlog” (Instagram.com/thetinderblog), a large and highly successful Instagram meme account. TheTinderBlog is an official partner of Facebook. TheTinderBlog boasts over 4.2 million followers acquired over its six-year existence, as well as a seven-figure annual net income built on nearly one billion web impressions per month. TheTinderBlog has also attracted major advertisers, including McDonald’s, Amazon Prime, Dunkin Donuts, Samsung, among others. This management agreement was terminated in the 4th quarter of 2021.

Clubhouse Creator Affiliate Program

In June 2021, we launched the Clubhouse Creator Affiliate Program. Through this program, we invite young social media creators from all over the world to join the Clubhouse network, promote the Clubhouse brand and grow their social media network with us. To date, over 18 creators with a total reach of well over 100 million followers have signed up and partnered with us and we expect many more to do the same. These creators will serve as Clubhouse ambassadors worldwide.

CONVERTIBLE PROMISSORY NOTES

Convertible Promissory Note – Scott Hoey

On September 10, 2020, the Company entered into a note purchase agreement with Scott Hoey, pursuant to which, on same date, the Company issued a convertible promissory note to Mr. Hoey the aggregate principal amount of $7,500 for a purchase price of $7,500 (“Hoey Note”).

The Hoey Note had a maturity date of September 10, 2022 and bore interest at 8% per year. No payments of the principal amount or interest are due prior to the maturity date other than as specifically set forth in the Hoey Note, and the Company may prepay all or any portion of the principal amount and any accrued and unpaid interest at any time without penalty. Mr. Hoey had the right, until the Indebtedness is paid in full, to convert all, but only all, of the then-outstanding Indebtedness into shares of Company common stock at a conversion price of 50% of the volume weighted average of the closing price (“VWAP”) during the 20-trading day period immediately prior to the option conversion date, subject to customary adjustments for stock splits, etc. occurring after the issuance date.

On December 8, 2020, the Company issued to Mr. Hoey 10,833 shares of Company common stock upon the conversion of the $7,500 convertible promissory note issued to Mr. Hoey at a conversion price of $0.69 per share.

Since the conversion price is based on 50% of the VWAP during the 20-trading day period immediately prior to the option conversion date, the Company has determined that the conversion feature is considered a derivative liability for the Company, which is detailed in Note 12.

| 14 |

The balance of the Hoey Note as of December 31, 2021 and 2020 was $0 and $0, respectively.

Convertible Promissory Note – Cary Niu

On September 18, 2020, the Company entered into a note purchase agreement with Cary Niu, pursuant to which, on same date, the Company issued a convertible promissory note to Ms. Niu the aggregate principal amount of $50,000 for a purchase price of $50,000 (“Niu Note”).

The Niu Note has a maturity date of September 18, 2022 and bears interest at 8% per year. No payments of the principal amount or interest are due prior to the maturity date other than as specifically set forth in the Niu Note, and the Company may prepay all or any portion of the principal amount and any accrued and unpaid interest at any time without penalty. Ms. Niu will have the right, until the Indebtedness is paid in full, to convert all, but only all, of the then-outstanding Indebtedness into shares of Company common stock at a conversion price of 30% of the volume weighted average of the closing price during the 20-trading day period immediately prior to the option conversion date, subject to customary adjustments for stock splits, etc. occurring after the issuance date.

Since the conversion price is based on 30% of the VWAP during the 20-trading day period immediately prior to the option conversion date, the Company has determined that the conversion feature is considered a derivative liability for the Company, which is detailed in Note 12.

The balance of the Niu Note as of December 31, 2021 and 2020 was $50,000 and $50,000, respectively.

Convertible Promissory Note – Jesus Galen

On October 6, 2020, the Company entered into a note purchase agreement with Jesus Galen, pursuant to which, on same date, the Company issued a convertible promissory note to Mr. Galen the aggregate principal amount of $30,000 for a purchase price of $30,000 (“Galen Note”).

The Galen Note has a maturity date of October 6, 2022 and bears interest at 8% per year. No payments of the principal amount or interest are due prior to the maturity date other than as specifically set forth in the Galen Note, and the Company may prepay all or any portion of the principal amount and any accrued and unpaid interest at any time without penalty. Mr. Galen will have the right, until the Indebtedness is paid in full, to convert all, but only all, of the then-outstanding Indebtedness into shares of Company common stock at a conversion price of 50% of the volume weighted average of the closing price during the 20-trading day period immediately prior to the option conversion date, subject to customary adjustments for stock splits, etc. occurring after the issuance date.

Since the conversion price is based on 50% of the VWAP during the 20-trading day period immediately prior to the option conversion date, the Company has determined that the conversion feature is considered a derivative liability for the Company, which is detailed in Note 12.

The balance of the Galen Note as of December 31, 2021 and 2020 was $30,000 and $30,000, respectively.

Convertible Promissory Note – Darren Huynh

On October 6, 2020, the Company entered into a note purchase agreement with Darren Huynh, pursuant to which, on same date, the Company issued a convertible promissory note to Mr. Huynh the aggregate principal amount of $50,000 for a purchase price of $50,000 (“Huynh Note”).

The Huynh Note has a maturity date of October 6, 2022, and bears interest at 8% per year. No payments of the principal amount or interest are due prior to the maturity date other than as specifically set forth in the Huynh Note, and the Company may prepay all or any portion of the principal amount and any accrued and unpaid interest at any time without penalty. Mr. Huynh will have the right, until the Indebtedness is paid in full, to convert all, but only all, of the then-outstanding Indebtedness into shares of Company common stock at a conversion price of 50% of the volume weighted average of the closing price during the 20-trading day period immediately prior to the option conversion date, subject to customary adjustments for stock splits, etc. occurring after the issuance date.

| 15 |

Since the conversion price is based on 50% of the VWAP during the 20-trading day period immediately prior to the option conversion date, the Company has determined that the conversion feature is considered a derivative liability for the Company, which is detailed in Note 12.

The balance of the Huynh Note as of December 31, 2021 and 2020 was $0 and $50,000, respectively.

Convertible Promissory Note – Wayne Wong

On October 6, 2020, the Company entered into a note purchase agreement with Wayne Wong, pursuant to which, on same date, the Company issued a convertible promissory note to Mr. Wong the aggregate principal amount of $25,000 for a purchase price of $25,000 (“Wong Note”).

The Wong Note has a maturity date of October 6, 2022, and bears interest at 8% per year. No payments of the principal amount or interest are due prior to the maturity date other than as specifically set forth in the Wong Note, and the Company may prepay all or any portion of the principal amount and any accrued and unpaid interest at any time without penalty. Mr. Wong will have the right, until the Indebtedness is paid in full, to convert all, but only all, of the then-outstanding Indebtedness into shares of Company common stock at a conversion price of 50% of the volume weighted average of the closing price during the 20-trading day period immediately prior to the option conversion date, subject to customary adjustments for stock splits, etc. occurring after the issuance date.

Since the conversion price is based on 50% of the VWAP during the 20-trading day period immediately prior to the option conversion date, the Company has determined that the conversion feature is considered a derivative liability for the Company, which is detailed in Note 12.

The balance of the Wong Note as of December 31, 2021 and 2020 was $0 and $25,000, respectively.

Convertible Promissory Note – Matthew Singer

On January 3, 2021, the Company entered into a note purchase agreement with Matthew Singer, pursuant to which, on same date, the Company issued a convertible promissory note to Mr. Singer the aggregate principal amount of $13,000 for a purchase price of $13,000 (“Singer Note”).

The Singer Note had a maturity date of January 3, 2023, and bore interest at 8% per year. No payments of the principal amount or interest are due prior to the maturity date other than as specifically set forth in the Singer Note, and the Company may prepay all or any portion of the principal amount and any accrued and unpaid interest at any time without penalty. Mr. Singer had the right, until the Indebtedness is paid in full, to convert all, but only all, of the then-outstanding Indebtedness into shares of Company common stock at a conversion price of 70% of the volume weighted average of the closing price during the 20-trading day period immediately prior to the option conversion date, subject to customary adjustments for stock splits, etc. occurring after the issuance date.

On January 26, 2021, the Company issued to Matthew Singer 8,197 shares of Company common stock upon the conversion of the convertible promissory note issued to Mr. Singer in the principal amount of $13,000 on January 3, 2021 at a conversion price of $1.59 per share.

Since the conversion price is based on 70% of the VWAP during the 20-trading day period immediately prior to the option conversion date, the Company has determined that the conversion feature is considered a derivative liability for the Company, which is detailed in Note 12.

The balance of the Singer Note as of December 31, 2021 and 2020 was $0 and $0, respectively.

| 16 |

Convertible Promissory Note – ProActive Capital SPV I, LLC

On January 20, 2021, the Company entered into a securities purchase agreement (the “ProActive Capital SPA”) with ProActive Capital SPV I, LLC, a Delaware limited liability company (“ProActive Capital”), pursuant to which, on same date, the Company (i) issued a convertible promissory note to ProActive Capital the aggregate principal amount of $250,000 for a purchase price of $225,000, reflecting a $25,000 original issue discount (the “ProActive Capital Note”), and in connection therewith, sold to ProActive Capital 50,000 shares of Company Common Stock at a purchase price of $0.001 per share. In addition, at the closing of this sale, the Company reimbursed ProActive Capital the sum of $10,000 for ProActive Capital’s costs in completing the transaction, which amount ProActive Capital withheld from the total purchase price paid to the Company.

The ProActive Capital Note has a maturity date of January 20, 2022 and bears interest at 10% per year. No payments of the principal amount or interest are due prior to the maturity date other than as specifically set forth in the ProActive Capital Note, and the Company may prepay all or any portion of the principal amount and any accrued and unpaid interest at any time without penalty.

The ProActive Capital Note (and the principal amount and any accrued and unpaid interest) is convertible into shares of Company Common Stock at ProActive Capital’s election at any time following the time that the SEC qualifies the Company’s offering statement related to the Regulation A Offering, at a conversion price equal to 70% of the Regulation A Offering Price of the Company Common Stock in the Regulation A Offering, and is subject to a customary beneficial ownership limitation of 9.99%, which may be waived by ProActive Capital on 61 days’ notice to the Company. The conversion price is subject to customary adjustments for any stock splits, etc. which occur following the determination of the conversion price.

The $25,000 original issue discount, the fair value of 50,000 shares issued, and the beneficial conversion features were recorded as debt discounts and amortized over the term of the note. Therefore, the total debt discounts at the inception date of this convertible promissory note were $217,024.

The balance of the ProActive Capital Note as of December 31, 2021 and 2020 was $250,000 and $0, respectively.

First Convertible Promissory Note – GS Capital Partners

On January 25, 2021, the Company entered into a securities purchase agreement (the “GS Capital #1”) with GS Capital Partners, LLC (“GS Capital”), pursuant to which, on same date, the Company (i) issued a convertible promissory note to GS Capital the aggregate principal amount of $288,889 for a purchase price of $260,000, reflecting a $28,889 original issue discount (the “GS Capital Note”), and in connection therewith, sold to GS Capital 50,000 shares of Company Common Stock at a purchase price of $0.001 per share. In addition, at the closing of this sale, the Company reimbursed GS Capital the sum of $10,000 for GS Capital’s costs in completing the transaction, which amount GS Capital withheld from the total purchase price paid to the Company.

The GS Capital Note has a maturity date of January 25, 2022, and bears interest at 10% per year. No payments of the principal amount or interest are due prior to the maturity date other than as specifically set forth in the GS Capital Note, and the Company may prepay all or any portion of the principal amount and any accrued and unpaid interest at any time without penalty.

The GS Capital Note (and the principal amount and any accrued and unpaid interest) is convertible into shares of Company Common Stock at GS Capital’s election at any time following the time that the SEC qualifies the Company’s offering statement related to the Regulation A Offering, at a conversion price equal to 70% of the Regulation A Offering Price of the Company Common Stock in the Regulation A Offering, and is subject to a customary beneficial ownership limitation of 9.99%, which may be waived by GS Capital on 61 days’ notice to the Company. The conversion price is subject to customary adjustments for any stock splits, etc. which occur following the determination of the conversion price.

The $28,889 original issue discounts, the fair value of 50,000 shares issued, and the beneficial conversion features were recorded as debt discounts and amortized over the term of the note. Therefore, the total debt discounts at the inception date of this convertible promissory note were $288,889.

| 17 |

The entire principal balance and interest were converted in the quarter ended June 30, 2021. The balance of the GS Capital #1 as of December 31, 2021 and December 31, 2020 was $0 and $0, respectively. The Company signed the restructuring agreement below to return the shares for the new GS note #1, as if the initial conversion had not occurred.

Convertible Promissory Note – New GS Note #1

On November 26, 2021, the Company entered into an Amendment and Restructuring Agreement (the “Restructuring Agreement”) with GS Capital Partners, LLC to replacement GS Capital #1 as disclosed above. GS Capital sold to the Company, and the Company redeemed from GS Capital, the 107,301 Converted Shares, and in exchange therefor, the Company issued to GS Capital a new convertible promissory note in the aggregate principal amount of $300,445 (the “New GS Note #1”).

The New GS Note #1 has a maturity date of May 31, 2022 and bears interest at 10% per year. No payments of the principal amount or interest are due prior to the Maturity Date, other than as specifically set forth in the Note, and there is no prepayment penalty.

The New GS Note #1 provides GS Capital with conversion rights to convert all or any part of the outstanding and unpaid principal amount of the New Note from time to time into fully paid and non-assessable shares of the Company’s common stock, at a conversion price of $1.00, subject to adjustment as provided in the New Note and subject to a 9.99% equity blocker.

The New GS Note #1 contains customary events of default, including, but not limited to, failure to pay principal or interest on the New Note when due. If an event of default occurs and continues uncured, GS Capital may declare all or any portion of the then outstanding principal amount of the New Note, together with all accrued and unpaid interest thereon, due and payable, and the New Note will thereupon become immediately due and payable.

The balance of the New GS Note #1 as of December 31, 2021 and 2020 was $300,445 and $0, respectively.

Convertible Promissory Note – GS Capital Partners #2

On February 19, 2021, the Company entered into another securities purchase agreement with GS Capital (the “GS Capital #2”), pursuant to which, on same date, the Company issued a convertible promissory note to GS Capital the aggregate principal amount of $577,778 for a purchase price of $520,000, reflecting a $57,778 original issue discount, and in connection therewith, sold to GS Capital 100,000 shares of Company’s common stock, par value $0.001 per share at a purchase price of $100, representing a per share price of $0.001 per share. In addition, at the closing of this sale, the Company reimbursed GS Capital the sum of $10,000 for GS Capital’s costs in completing the transaction, which amount GS Capital withheld from the total purchase price paid to the Company.

The GS Capital Note has a maturity date of February 19, 2022 and bears interest at 10% per year. No payments of the principal amount or interest are due prior to the maturity date other than as specifically set forth in the GS Capital Note, and the Company may prepay all or any portion of the principal amount and any accrued and unpaid interest at any time without penalty.

The GS Capital Note (and the principal amount and any accrued and unpaid interest) is convertible into shares of the Company Common Stock at GS Capital’s election at any time following the time that the Securities and Exchange Commission (the “SEC”) qualifies the Company’s offering statement related to the Company’s planned offering of Company Common Stock pursuant to Regulation A (the “Regulation A Offering”) under the Securities Act of 1933, as amended (the “Securities Act”). At such time, the GS Capital Note (and the principal amount and any accrued and unpaid interest) will be convertible at a conversion price equal to 70% of the initial offering price of the Company Common Stock in the Regulation A Offering, subject to a customary beneficial ownership limitation of 9.99%, which may be waived by GS Capital on 61 days’ notice to the Company. The conversion price is subject to customary adjustments for any stock splits, etc. which occur following the determination of the conversion price.

| 18 |

The $57,778 original issue discounts, the fair value of 100,000 shares issued, and the beneficial conversion features were recorded as debt discounts and amortized over the term of the note. Therefore, the total debt discounts at the inception date of this convertible promissory note were $577,778.

GS Capital converted $96,484 and $3,515 accrued interest in the quarter ended June 30, 2021. The balance of the GS Capital #2 Note as of September 30, 2021 and December 31, 2020 was $481,294 and $0, respectively. The shares have not been issued as of September 30, 2021.

On November 26, 2021, the Company entered into an Amendment and Restructuring Agreement (the “Restructuring Agreement”) with GS Capital Partners, LLC to cancel the conversion exercised in the quarter ended June 30, 2021. The balance of the GS Capital #2 Note as of December 31, 2021 and 2020 was $577,778 and $0, respectively.

Convertible Promissory Note – GS Capital Partners #3

On March 16, 2021, the Company entered into another securities purchase agreement with GS Capital (the “GS Capital #3”), pursuant to which, on same date, the Company issued a convertible promissory note to GS Capital the aggregate principal amount of $577,778 for a purchase price of $520,000, reflecting a $57,778 original issue discount, and in connection therewith, sold to GS Capital 100,000 shares of Company’s common stock, par value $0.001 per share at a purchase price of $100, representing a per share price of $0.001 per share. In addition, at the closing of this sale, the Company reimbursed GS Capital the sum of $10,000 for GS Capital’s costs in completing the transaction, which amount GS Capital withheld from the total purchase price paid to the Company.

The GS Capital Note has a maturity date of March 22, 2022 and bears interest at 10% per year. No payments of the principal amount or interest are due prior to the maturity date other than as specifically set forth in the GS Capital Note, and the Company may prepay all or any portion of the principal amount and any accrued and unpaid interest at any time without penalty.

The GS Capital Note (and the principal amount and any accrued and unpaid interest) is convertible into shares of the Company Common Stock at GS Capital’s election at any time following the time that the SEC qualifies the Company’s offering statement related to the Company’s planned offering of Company Common Stock pursuant to Regulation A under the Securities Act. At such time, the GS Capital Note (and the principal amount and any accrued and unpaid interest) will be convertible at a conversion price equal to 70% of the initial offering price of the Company Common Stock in the Regulation A Offering, subject to a customary beneficial ownership limitation of 9.99%, which may be waived by GS Capital on 61 days’ notice to the Company. The conversion price is subject to customary adjustments for any stock splits, etc. which occur following the determination of the conversion price.

The $57,778 original issue discount, the fair value of 100,000 shares issued, and the beneficial conversion features were recorded as debt discounts and amortized over the term of the note. Therefore, the total debt discounts at the inception date of this convertible promissory note were $577,778.

The balance of the GS Capital #3 Note as of December 31, 2021 and 2020 was $577,778 and $0, respectively.

Convertible Promissory Note – GS Capital Partners #4

On April 1, 2021, the Company entered into another securities purchase agreement with GS Capital (the “GS Capital #4”), pursuant to which, on same date, the Company issued a convertible promissory note to GS Capital the aggregate principal amount of $550,000 for a purchase price of $500,000, reflecting a $50,000 original issue discount, and in connection therewith, sold to GS Capital 45,000 shares of Company’s common stock, par value $0.001 per share at a purchase price of $45, representing a per share price of $0.001 per share. In addition, at the closing of this sale, the Company reimbursed GS Capital the sum of $10,000 for GS Capital’s costs in completing the transaction, which amount GS Capital withheld from the total purchase price paid to the Company.

The GS Capital Note #4 has a maturity date of April 1, 2022 and bears interest at 10% per year. No payments of the principal amount or interest are due prior to the maturity date other than as specifically set forth in the GS Capital Note, and the Company may prepay all or any portion of the principal amount and any accrued and unpaid interest at any time without penalty.

| 19 |

The GS Capital Note (and the principal amount and any accrued and unpaid interest) is convertible into shares of the Company Common Stock at GS Capital’s election at any time following the time that the SEC qualifies the Company’s offering statement related to the Company’s planned offering of Company Common Stock pursuant to Regulation A under the Securities Act. At such time, the GS Capital Note (and the principal amount and any accrued and unpaid interest) will be convertible at a conversion price equal to 70% of the initial offering price of the Company Common Stock in the Regulation A Offering, subject to a customary beneficial ownership limitation of 9.99%, which may be waived by GS Capital on 61 days’ notice to the Company. The conversion price is subject to customary adjustments for any stock splits, etc. which occur following the determination of the conversion price.

The $50,000 original issue discounts, the fair value of 45,000 shares issued, and the beneficial conversion features were recorded as debt discounts and amortized over the term of the note. Therefore, the total debt discount at the inception date of this convertible promissory note were recorded at $550,000.

The balance of the GS Capital Note #4 as of December 31, 2021 and 2020 were $550,000 and $0, respectively.

Convertible Promissory Note – GS Capital Partners #5

On April 29, 2021, the Company entered into a securities purchase agreement (the “Securities Purchase Agreement”) with GS Capital, pursuant to which, on same date, the Company issued a convertible promissory note to GS Capital in the aggregate principal amount of $550,000 for a purchase price of $500,000, reflecting a $50,000 original issue discount (the “GS Capital Note #5”) and, in connection therewith, sold to GS Capital 125,000 shares of the Company’s common stock, par value $0.001 per share (the “Company Common Stock”) at a purchase price of $125, representing a per share price of $0.001 per share. In addition, at the closing of this sale, the Company reimbursed GS Capital the sum of $5,000 for GS Capital’s costs in completing the transaction, which amount GS Capital withheld from the total purchase price paid to the Company.

The April 2021 GS Capital Note #5 has a maturity date of April 29, 2022 and bears interest at 10% per year. No payments of the principal amount or interest are due prior to the maturity date other than as specifically set forth in the GS Capital Note #5, and the Company may prepay all or any portion of the principal amount and any accrued and unpaid interest at any time without penalty.

The GS Capital Note #5 (and the principal amount and any accrued and unpaid interest) is convertible into shares of the Company’s common stock, par value $0.001 per share (the “Company Common Stock”) at GS Capital’s election at any time following the time that the SEC qualifies the Company’s offering statement related to the Company’s planned offering of Company Common Stock pursuant to Regulation A under the Securities Act. At such time, the GS Capital Note #5 (and the principal amount and any accrued and unpaid interest) will be convertible at a conversion price equal to 70% of the initial offering price of the Company Common Stock in the Regulation A Offering, subject to a customary beneficial ownership limitation of 9.99%, which may be waived by GS Capital on 61 days’ notice to the Company. The conversion price is subject to customary adjustments for any stock splits, etc. which occur following the determination of the conversion price.

The $50,000 original issue discounts, the fair value of 125,000 shares issued, and the beneficial conversion features were recorded as debt discounts and amortized over the term of the note. Therefore, the total debt discount at the inception date of this convertible promissory note were recorded at $550,000.

The balance of the GS Capital Note #5 as of December 31, 2021 and 2020 was $550,000 and $0, respectively.

Convertible Promissory Note – GS Capital Partners #6

On June 3, 2021, the Company entered into a securities purchase agreement (the “Securities Purchase Agreement”) with GS Capital, pursuant to which, on same date, the Company issued a convertible promissory note to GS Capital in the aggregate principal amount of $550,000 for a purchase price of $500,000, reflecting a $50,000 original issue discount (the “GS Capital Note #6”) and, in connection therewith, sold to GS Capital 85,000 shares of the Company’s common stock, par value $0.001 per share (the “Company Common Stock”) at a purchase price of $85, representing a per share price of $0.001 per share. In addition, at the closing of this sale, the Company reimbursed GS Capital the sum of $5,000 for GS Capital’s costs in completing the transaction, which amount GS Capital withheld from the total purchase price paid to the Company.

| 20 |

The GS Capital Note #6 has a maturity date of June 3, 2022 and bears interest at 10% per year. No payments of the principal amount or interest are due prior to the maturity date other than as specifically set forth in the GS Capital Note #6, and the Company may prepay all or any portion of the principal amount and any accrued and unpaid interest at any time without penalty.

The GS Capital Note #6 (and the principal amount and any accrued and unpaid interest) is convertible into shares of the Company’s common stock, par value $0.001 per share (the “Company Common Stock”) at GS Capital’s election at any time following the time that the SEC qualifies the Company’s offering statement related to the Company’s planned offering of Company Common Stock pursuant to Regulation A under the Securities Act. At such time, the GS Capital Note #6 (and the principal amount and any accrued and unpaid interest) will be convertible at a conversion price equal to 70% of the initial offering price of the Company Common Stock in the Regulation A Offering, subject to a customary beneficial ownership limitation of 9.99%, which may be waived by GS Capital on 61 days’ notice to the Company. The conversion price is subject to customary adjustments for any stock splits, etc. which occur following the determination of the conversion price.

The $50,000 original issue discounts, the fair value of 85,000 shares issued, and the beneficial conversion features were recorded as debt discounts and amortized over the term of the note. Therefore, the total debt discount at the inception date of this convertible promissory note were recorded at $550,000.

The balance of the GS Capital Note #6 as of December 31, 2021 and 2020 was $550,000 and $0, respectively.

Convertible Promissory Note – Tiger Trout Capital Puerto Rico

On January 29, 2021, the Company entered into a securities purchase agreement (the “Tiger Trout SPA”) with Tiger Trout Capital Puerto Rico, LLC, a Puerto Rico limited liability company (“Tiger Trout”), pursuant to which, on same, date, the Company (i) issued a convertible promissory note in the aggregate principal amount of $1,540,000 for a purchase price of $1,100,000, reflecting a $440,000 original issue discount (the “Tiger Trout Note”), and (ii) sold to Tiger Trout 220,000 shares Company common stock for a purchase price of $220.00.

The Tiger Trout Note has a maturity date of January 29, 2022, and bears interest at 10% per year. No payments of the principal amount or interest are due prior to the maturity date other than as specifically set forth in the Tiger Trout Note, and the Company may prepay all or any portion of the principal amount and any accrued and unpaid interest at any time without penalty, provided however, that if the Company does not pay the principal amount and any accrued and unpaid interest by July 2, 2021, an additional $50,000 is required to be paid to Tiger Trout at the time the Tiger Trout Note is repaid, if the Company repays the Tiger Trout Note prior to its maturity date.

If the principal amount and any accrued and unpaid interest under the Tiger Trout Note has not been repaid on or before the maturity date, that will be an event of default under the Tiger Trout Note. If an event of default has occurred and is continuing, Tiger Trout may declare all or any portion of the then-outstanding principal amount and any accrued and unpaid interest under the Tiger Trout Note (the “Indebtedness”) due and payable, and the Indebtedness will become immediately due and payable in cash by the Company. Further, Tiger Trout will have the right, until the Indebtedness is paid in full, to convert all, but only all, of the then-outstanding Indebtedness into shares of Company common stock at a conversion price of $0.50 per share, subject to customary adjustments for stock splits, etc. occurring after the issuance date. The Tiger Trout Note contains a customary beneficial ownership limitation of 9.99%, which may be waived by Tiger Trout on 61 days’ notice to the Company.

The $440,000 original issue discount, the fair value of 220,000 shares issued, and the beneficial conversion features were recorded as debt discounts and amortized over the term of the note. Therefore, the total debt discounts at the inception date of this convertible promissory note were $1,540,000.

The balance of the Tiger Trout Note as of December 31, 2021 and December 31, 2020 was $1,590,000 and $0, respectively.

| 21 |

Convertible Promissory Note – Eagle Equities LLC