UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

|

|

o |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

OR

|

|

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the fiscal year ended December 31, 2011

|

|

|

OR

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the transition period from ________________ to ________________

|

|

|

OR

|

|

|

o |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 13(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

Date of the event requiring this shell company report________________

|

Commission file number: 001-33356

GAFISA S.A.

(Exact name of Registrant as specified in its charter)

GAFISA S.A.

(Translation of Registrant’s name into English)

The Federative Republic of Brazil

(Jurisdiction of incorporation or organization)

Av. Nações Unidas No. 8,501, 19th Floor

05425-070 – São Paulo, SP – Brazil

phone: + 55 (11) 3025-9000

fax: + 55(11) 3025-9348

e mail: ri@gafisa.com

Attn: Alceu Duilio Calciolari – Chief Executive Officer

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

|

Common Shares, without par value*

|

New York Stock Exchange

|

* Traded only in the form of American Depositary Shares (as evidenced by American Depositary Receipts), each representing two common shares which are registered under the Securities Act of 1933.

|

Securities registered or to be registered pursuant to Section 12(g) of the Act:

|

|

None

|

|

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

|

|

None

|

|

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

|

|

The number of outstanding shares of each class as of December 31, 2011.

|

|

Title of Class

|

Number of Shares Outstanding

|

|

|

Common Stock

|

432,699,559*

|

|

|

*

|

Includes 599,486 common shares that are held in treasury.

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes x No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. o Yes x No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing: o US GAAP o International Financial Reporting Standards as issued by the International Accounting Standards Board x Other

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. o Item 17 x Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o Yes x No

Page

In this annual report, references to “Gafisa,” “we,” “our,” “us,” “our company” and “the Company” are to Gafisa S.A. and its consolidated subsidiaries (unless the context otherwise requires). In addition, the term “Brazil” refers to the Federative Republic of Brazil, and the phrase “Brazilian government” refers to the federal government of Brazil. All references to “real,” “reais” or “R$” are to the Brazilian real, the official currency of Brazil, and all references to “U.S. dollar,” “U.S. dollars” or “US$” are to U.S. dollars, the official currency of the United States. References to “Brazilian GAAP” are to accounting practices adopted in Brazil and references to “US GAAP” are to generally accepted accounting principles in the United States. Any reference to “financial statement” is related to our consolidated financial statements.

Financial Information

We maintain our books and records in reais. Our financial statements were prepared in accordance with Brazilian GAAP, which are based on:

|

|

·

|

Brazilian Law No. 6,404/76, as amended by Brazilian Law No. 9,457/97, Brazilian Law No. 10,303/01, Brazilian Law No. 11,638/07 and Brazilian Law No. 12,431/11, which we refer to hereinafter as “Brazilian corporate law;”

|

|

|

·

|

the rules and regulations of the Brazilian Securities Commission (Comissão de Valores Mobiliários), or the “CVM”; and

|

|

|

·

|

the accounting standards issued by the Brazilian Federal Accounting Council (Conselho Federal de Contabilidade), or the “CFC” and the Accounting Standards Committee (Comitê de Pronunciamentos Contábeis), or the “CPC.”

|

Brazilian corporate law was amended by Law No. 11,638 dated December 28, 2007 in order to facilitate the convergence of Brazilian GAAP with International Financial Reporting Standards, or “IFRS,” and thereafter, the CPC issued new accounting standards that converged Brazilian GAAP with IFRS. Our Brazilian GAAP financial statements as of and for the years ended December 31, 2008 and 2007 reflect changes introduced by Law 11,638/07 and the new accounting standards issued by the CPC in 2008, which we retroactively applied beginning on January 1, 2006.

Through December 31, 2009, our financial statements were prepared in accordance with Brazilian GAAP in effect at that time. We elected January 1, 2009 as a transition date to full adoption of the new accounting standards (“new CPCs”). Our financial statements as of and for the year ended December 31, 2009 and as of January 1, 2009 have been restated to reflect these adjustments. In preparing our financial statements, we have applied: (1) Guideline OCPC 04 – Application of the Technical Interpretation of ICPC 02 to the Brazilian Real Estate Development Entities – regarding revenue recognition, and the respective costs and expenses arising from real estate development operations over the course of the construction period (percentage of completion method), and (2) CPC 37 (R1), which requires that an entity develops accounting policies based on the standards and interpretations of the CPC. We have adopted all pronouncements, guidelines and interpretations of the CPC issued through December 31, 2011. Consequently, our financial statements are prepared in accordance with the Brazilian GAAP, which allows revenue recognition on a percentage of completion basis for construction companies (i.e., revenue is recorded in accordance with the percentage of financial evolution of the construction project), and are therefore not compliant with IFRS as issued by the International Accounting Standards Board (“IASB”), which require revenue recognition on a delivery basis (i.e., revenue is recorded upon transferring the ownership risks and benefits to the purchaser of real estate, usually after the construction is completed and the unit is delivered). We understand that the IASB continues to consider alternatives to its current revenue recognition principles applicable to construction companies and we continue to follow developments as proposed by the CPC and other accounting standards bodies in other jurisdictions.

Reconciliations and descriptions of the effect of the transition to the newly adopted Brazilian GAAP are provided in Note 2.1.3 to our 2010 audited financial statements not included in this annual report.

Brazilian GAAP differs in significant respects from US GAAP and IFRS. The notes to our financial statements included elsewhere in this annual report contain a reconciliation of equity and net income from Brazilian GAAP to US GAAP. Unless otherwise indicated, all financial information of our company included in this annual report is derived from our Brazilian GAAP financial statements.

Our consolidated financial statements reflect income statement and balance sheet information for all of our subsidiaries, and also separately disclose the interest of noncontrolling shareholders. With respect to our jointly-controlled entities, in accordance with the shareholders agreements, we consolidate income statement and balance sheet information relating to those entities in proportion to the equity interest we hold in the capital of such investees for Brazilian GAAP purposes.

Market Information

Certain industry, demographic, market and competitive data, including market forecasts, used in this annual report were obtained from internal surveys, market research, publicly available information and industry publications. We have made these statements on the basis of information from third-party sources that we believe are reliable, such as the Brazilian Property Studies Company (Empresa Brasileira de Estudos de Patrimônio), or the “EMBRAESP,” the Association of Managers of Real Estate Companies (Associação de Dirigentes de Empresas do Mercado Imobiliário), or the “ADEMI,” the Getulio Vargas Foundation (Fundaçao Getulio Vargas), or the “FGV,” the National Bank of Economic and Social Development (Banco Nacional de Desenvolvimento Econômico e Social), or “BNDES,” the Real Estate Companies’ Union (Sindicato das Empresas de Compra, Venda, Locação e Administração de Imóveis Residenciais e Comerciais), or the “SECOVI,” the Brazilian Institute of Geography and Statistics (Instituto Brasileiro de Geografia e Estatística), or the “IBGE” and the Brazilian Central Bank (Banco Central do Brasil), or the “Central Bank,” among others. Industry and government publications, including those referenced here, generally state that the information presented therein has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Although we have no reason to believe that any of this information or these reports are inaccurate in any material respect, such information has not been independently verified by us. Accordingly, we do not make any representation as to the accuracy of such information.

Rounding and Other Information

Some percentages and certain figures included in this annual report have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables in this annual report may not be an arithmetic aggregation of the figures that precede them.

In this annual report, all references to “contracted sales” are to the aggregate amount of sales resulting from all agreements for the sale of units (including residential communities and land subdivisions) entered into during a certain period, including new units and units in inventory. Further, in this annual report we use the term “value of launches” as a measure of our performance. Value of launches is not a GAAP measurement. Value of launches, as used in this annual report, is calculated by multiplying the total numbers of units in a real estate development by the average unit sales price.

All references to “potential sales value” are to our estimates of the total amount obtained or that can be obtained from the sale of all launched units of a certain real estate development, calculated by multiplying the number of units in a development by the sale price of the unit. Investors should be aware that our potential sales value may not be realized or may significantly differ from the amount of contracted sales, since the total number of units actually sold may be lower than the number of units launched and/or the contracted sales price of each unit may be lower than the launching price.

In addition, we present information in square meters in this annual report. One square meter is equal to approximately 10.76 square feet.

The statements contained in this annual report in relation to our plans, forecasts, expectations regarding future events, strategies, and projections, are forward-looking statements which involve risks and uncertainties and which are therefore not guarantees of future results. Our estimates and forward-looking statements are mainly based on our current expectations and estimates on projections of future events and trends, which affect or may affect our businesses and results of operations. Although we believe that these estimates and forward-looking statements are based upon reasonable assumptions, they are subject to several uncertainties and are made in light of information currently available to us. Our estimates and forward-looking statements may be influenced by the following factors, among others:

|

|

·

|

changes in the overall economic conditions, including employment levels, population growth and consumer confidence;

|

|

|

·

|

changes in real estate market prices and demand, estimated budgeted costs and the preferences and financial condition of our customers;

|

|

|

·

|

demographic factors and available income;

|

|

|

·

|

our ability to repay our indebtedness and comply with our financial obligations;

|

|

|

·

|

our ability to arrange financing and implement our expansion plan;

|

|

|

·

|

our ability to compete and conduct our businesses in the future;

|

|

|

·

|

changes in our business;

|

|

|

·

|

inflation and interest rate fluctuations;

|

|

|

·

|

changes in the laws and regulations applicable to the real estate market;

|

|

|

·

|

government interventions, resulting in changes in the economy, taxes, rates or regulatory environment;

|

|

|

·

|

other factors that may affect our financial condition, liquidity and results of our operations; and

|

|

|

·

|

other risk factors discussed under “Item 3. Key Information—D. Risk Factors.”

|

The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect” and similar words are intended to identify estimates and forward-looking statements. Estimates and forward-looking statements speak only as of the date they were made, and we undertake no obligation to update or to review any estimate and/or forward-looking statement because of new information, future events or other factors. Estimates and forward-looking statements involve risks and uncertainties and are not guarantees of future performance. Our future results may differ materially from those expressed in these estimates and forward-looking statements. In light of the risks and uncertainties described above, the estimates and forward-looking statements discussed in this annual report

might not occur and our future results and our performance may differ materially from those expressed in these forward-looking statements due to, inclusive of, but not limited to, the factors mentioned above.

Not applicable.

Not applicable.

A. Selected Financial Data

The following selected financial data have been derived from our audited consolidated financial statements.

Our financial statements are prepared in accordance with Brazilian GAAP, which differs in significant respects from US GAAP. For a discussion of the significant differences relating to these consolidated financial statements and a reconciliation of net income and equity from Brazilian GAAP to US GAAP, see notes to our consolidated financial statements included elsewhere in this annual report. See also “Presentation of Financial and Other Information.”

This financial information should be read in conjunction with our consolidated financial statements and the related notes included elsewhere in this annual report.

The following table sets forth financial information as of and for the years ended December 31, 2011, 2010 and 2009 and have been prepared in accordance with Brazilian GAAP in effect as of December 31, 2011. Certain information below is presented in accordance with US GAAP.

|

As of and for the year ended December 31,

|

||||||||||||

|

2011

|

2010(1) as restated

|

2009 (1) as restated

|

||||||||||

|

(in thousands except per share, per ADS and operating data)(3)

|

||||||||||||

|

Consolidated Income Statement Data:

|

||||||||||||

|

Brazilian GAAP:

|

||||||||||||

|

Net operating revenue

|

R$ | 2,940,506 | R$ | 3,403,050 | R$ | 3,022,346 | ||||||

|

Operating costs

|

(2,678,338 | ) | (2,460,918 | ) | (2,143,762 | ) | ||||||

|

Gross profit

|

262,168 | 942,132 | 878,584 | |||||||||

|

Operating expenses, net

|

(865,092 | ) | (549,403 | ) | (600,815 | ) | ||||||

|

Financial expenses, net

|

(159,903 | ) | (82,117 | ) | (111,006 | ) | ||||||

|

Income (loss) before income and social contribution taxes

|

(762,827 | ) | 310,612 | 166,763 | ||||||||

|

Income and social contribution taxes

|

(142,362 | ) | (22,128 | ) | (37,812 | ) | ||||||

|

Net income (loss) for the year

|

(905,189 | ) | 288,484 | 142,962 | ||||||||

|

Net income for the year attributable to noncontrolling interest

|

39,679 | 23,919 | 41,222 | |||||||||

|

Net income (loss) for the year attributable to owners of Gafisa S.A

|

R$ | (944,868 | ) | R$ | 264,565 | R$ | 101,740 | |||||

|

Share and ADS data(2):

|

||||||||||||

|

Per common share data—R$ per share:

|

||||||||||||

|

Earnings (loss) per share—Basic

|

(2.1893 | ) | 0.6415 | 0.3808 | ||||||||

|

Earnings (loss) per share—Diluted

|

(2.1893 | ) | 0.6109 | 0.3242 | ||||||||

|

As of and for the year ended December 31,

|

||||||||||||

|

2011

|

2010(1) as restated

|

2009 (1) as restated

|

||||||||||

|

(in thousands except per share, per ADS and operating data)(3)

|

||||||||||||

|

Weighted average number of shares outstanding—in thousands

|

431,586 | 412,434 | 267,174 | |||||||||

|

Dividends and interest on shareholders’ equity declared—in thousands of R$

|

- | 98,812 | 50,716 | |||||||||

|

Earnings (loss) per share—R$ per share

|

(2.1867 | ) | 0.6140 | 0.6100 | ||||||||

|

Number of common shares outstanding as at end of period—in thousands

|

432,099 | 430,916 | 166,778 | |||||||||

|

Earnings (loss) per ADS—R$ per ADS (3)

|

(4.3734 | ) | 1.2279 | 1.2200 | ||||||||

|

US GAAP:

|

||||||||||||

|

Net operating revenue

|

3,250,227 | 1,929,130 | 1,700,940 | |||||||||

|

Operating costs

|

(2,743,144 | ) | (1,472,085 | ) | (1,256,317 | ) | ||||||

|

Gross profit

|

507,083 | 457,045 | 444,623 | |||||||||

|

Operating expenses, net

|

(862,975 | ) | (575,776 | ) | (575,024 | ) | ||||||

|

Financial expenses, net

|

(97,370 | ) | (97,810 | ) | (102,925 | ) | ||||||

|

Loss before income and social contribution taxes and equity pick-up

|

(453,262 | ) | (216,541 | ) | (233,326 | ) | ||||||

|

Income and social contribution taxes

|

(334,410 | ) | 100,811 | 40,367 | ||||||||

|

Equity pick-up

|

59,687 | 42,161 | 88,913 | |||||||||

|

Net loss for the year

|

(727,985 | ) | (73,569 | ) | (104,046 | ) | ||||||

|

Net income attributable to noncontrolling interests

|

(27,784 | ) | (21,214 | ) | (30,333 | ) | ||||||

|

Net loss attributable to owners of Gafisa S.A. (4)

|

(755,769 | ) | (94,783 | ) | (134,379 | ) | ||||||

|

Per share and ADS data(2):

|

||||||||||||

|

Per common share data—R$ per share:

|

||||||||||||

|

Earnings (loss) per share—Basic

|

(1.7511 | ) | (0.2298 | ) | (0.5030 | ) | ||||||

|

Earnings (loss) per share—Diluted

|

(1.7511 | ) | (0.2298 | ) | (0.5030 | ) | ||||||

|

Weighted average number of shares outstanding — in thousands

|

431,586 | 412,434 | 267,174 | |||||||||

|

Dividends declared and interest on equity

|

- | 98,812 | 50,716 | |||||||||

|

Per ADS data—R$ per ADS(3):

|

||||||||||||

|

Earnings (loss) per ADS—Basic (3)

|

(3.5022 | ) | (0.4596 | ) | (1.006 | ) | ||||||

|

Earnings (loss) per ADS—Diluted (3)

|

(3.5022 | ) | (0.4596 | ) | (1.006 | ) | ||||||

|

Weighted average number of ADSs outstanding — in thousands

|

215,793 | 206,217 | 133,587 | |||||||||

|

Dividends and interest on equity declared

|

- | 98,812 | 50,716 | |||||||||

|

Consolidated Balance Sheet Data:

|

||||||||||||

|

Brazilian GAAP:

|

||||||||||||

|

Cash, cash equivalents and short-term investments

|

R$ | 983,660 | R$ | 1,201,148 | R$ | 1,424,053 | ||||||

|

Current and non-current properties for sale

|

2,847,290 | 2,206,072 | 1,748,457 | |||||||||

|

Working capital(5)

|

2,498,419 | 4,808,337 | 3,195,413 | |||||||||

|

Total assets

|

9,506,624 | 9,040,791 | 7,455,421 | |||||||||

|

Total debt(6)

|

3,755,810 | 3,290,109 | 3,122,132 | |||||||||

|

Total equity

|

2,747,094 | 3,632,172 | 2,384,181 | |||||||||

|

US GAAP:

|

||||||||||||

|

Cash and cash equivalents, short-term investments and restricted short-term investments

|

858,351 | 1,127,382 | 1,395,668 | |||||||||

|

Current and non-current properties for sale

|

3,847,858 | 3,690,328 | 3,068,738 | |||||||||

|

Working capital(5)

|

3,353,108 | 4,184,009 | 2,762,165 | |||||||||

|

Total assets

|

8,861,145 | 8,482,267 | 7,320,057 | |||||||||

|

Total debt(6)

|

3,444,478 | 3,081,276 | 3,057,792 | |||||||||

|

Total Gafisa equity

|

1,719,948 | 2,611,844 | 1,679,418 | |||||||||

|

Equity of noncontrolling interests

|

21,174 | 20,833 | 18,426 | |||||||||

|

Total equity

|

1,741,122 | 2,632,677 | 1,697,844 | |||||||||

|

Consolidated Cash Flow Provided By (used in):

|

||||||||||||

|

Brazilian GAAP

|

||||||||||||

|

Operating activities

|

(819,438 | ) | (1,079,643 | ) | (692,084 | ) | ||||||

|

Investing activities

|

3,796 | 122,888 | (762,164 | ) | ||||||||

|

Financing activities

|

696,848 | 920,197 | 1,555,745 | |||||||||

|

Operating data:

|

||||||||||||

|

Number of new developments

|

49 | 127 | 69 | |||||||||

|

Potential sales value(7)

|

3,526,298 | 4,491,835 | 2,301,224 | |||||||||

|

Number of units launched(8)

|

12,224 | 22,233 | 10,810 | |||||||||

|

Launched usable area (m2)(9)

|

2,250,725 | 3,008,648 | 1,415,110 | |||||||||

|

Units sold

|

9,844 | 20,744 | 21,952 | |||||||||

|

(1)

|

Our 2010 consolidated financial statements previously filed with Brazilian Securities Comission (CVM) and those furnished as unaudited form 6K with the U.S. Securities and Exchange Comission, filed on January 17, 2012, were restated to reflect retrospective correction of errors related to budget of costs and certain balance sheet reclassifications as disclosed in Note 2.1.3.

|

|

(2)

|

On February 22, 2010, a stock split of our common shares was approved, giving effect to the split of one existing share into two new issued shares, increasing the number of shares from 167,077,137 to 334,154,274. All Brazilian GAAP and US GAAP information relating to the numbers of shares and ADSs have been adjusted retroactively to reflect the share split on February 22, 2010. All Brazilian GAAP and US GAAP earnings per share and ADS amounts have been adjusted retroactively to reflect the share split on February 22, 2010.

|

|

(3)

|

Earnings per ADS is calculated based on each ADS representing two common shares.

|

|

(4)

|

The following table sets forth reconciliation from US GAAP net loss to US GAAP net loss available to common shareholders:

|

|

As of and for the year ended December 31,

|

||||||||||||

|

2011

|

2010

(restated)

|

2009

(restated)

|

||||||||||

|

Reconciliation from US GAAP net loss attributable to Gafisa to US GAAP net loss available to common shareholders (Basic):

|

||||||||||||

|

US GAAP net loss (Basic)

|

(755,769 | ) | (94,783 | ) | (134,379 | ) | ||||||

|

US GAAP net loss available to common shareholders (Basic earnings loss)

|

(755,769 | ) | (94,783 | ) | (134,379 | ) | ||||||

|

Reconciliation from US GAAP net loss attributable to Gafisa to US GAAP net loss available to common shareholders (Diluted):

|

||||||||||||

|

US GAAP net loss

|

(755,769 | ) | (94,783 | ) | (134,379 | ) | ||||||

|

US GAAP net loss available to common shareholders (Diluted earnings loss)

|

(755,769 | ) | (94,783 | ) | (134,379 | ) | ||||||

|

*

|

Pursuant to ASC 260-10-S99-2 “The Effect on the Calculation of Earnings per Share for the Redemption or Induced Conversion of Preferred Stock,” following the exchange of Class A for Class G Preferred shares, the excess of the fair value of the consideration transferred to the holders of the preferred stock over the carrying amount of the preferred stock in the balance sheet was subtracted from net income to arrive at net earnings available to common shareholders in the calculation of earnings per share. For purposes of displaying earnings per share, the amount is treated in a manner similar to the treatment of dividends paid to the holders of the preferred shares. The conceptual return or dividends on preferred shares are deducted from net earnings to arrive at net earnings available to common shareholders.

|

|

(5)

|

Working capital equals current assets less current liabilities.

|

|

(6)

|

Total debt comprises loans, financings and short term and long term debentures. Amounts exclude loans from real estate development partners.

|

|

(7)

|

Potential sales value is calculated by multiplying the number of units sold in a development by the unit sales price.

|

|

(8)

|

The units delivered in exchange for land pursuant to swap agreements are not included.

|

|

(9)

|

One square meter is equal to approximately 10.76 square feet.

|

The following table sets forth financial information as of and for the years ended December 31, 2008 and 2007 and have been prepared in accordance with Brazilian GAAP in effect at such time. See “Presentation of Financial and Other Information.” Significant changes were introduced to Brazilian GAAP in 2010 which were applied retroactively to January 1, 2009 but not to prior periods. Therefore the financial information as of and for the years as of ended December 31, 2008 and 2007 is not comparable to the financing information as of and for the years ended December 31, 2011, 2010 and 2009. Certain information below is presented in accordance with US GAAP.

|

As of and for the year ended December 31,

|

||||||||

|

2008(1)

|

2007(1)

|

|||||||

|

(in thousands except per share, per ADS and operating data)(2)

|

||||||||

|

Consolidated Income Statement Data:

|

||||||||

|

Brazilian GAAP:

|

||||||||

|

Gross operating revenue

|

R$ | 1,805,468 | R$ | 1,251,894 | ||||

|

Net operating revenue

|

1,740,404 | 1,204,287 | ||||||

|

Operating costs

|

(1,214,401 | ) | (867,996 | ) | ||||

|

Gross profit

|

526,003 | 336,291 | ||||||

|

Operating expenses, net

|

(357,798 | ) | (236,861 | ) | ||||

|

Financial income (expenses), net

|

7,815 | 28,628 | ||||||

|

Income before taxes on income and noncontrolling interest

|

176,020 | 128,058 | ||||||

|

Taxes on income

|

(43,397 | ) | (30,372 | ) | ||||

|

Noncontrolling interest

|

(22,702 | ) | (6,046 | ) | ||||

|

Net income

|

109,921 | 91,640 | ||||||

|

Share and ADS data(2):

|

||||||||

|

Per common share data—R$ pre share:

|

||||||||

|

Earnings (loss) per share—Basic

|

— | — | ||||||

|

Earnings (loss) per share—Diluted

|

— | — | ||||||

|

Weighted average number of shares outstanding—in thousands

|

— | — | ||||||

|

Dividends and interest on equity declared

|

26,104 | 26,981 | ||||||

|

Earnings per share—R$ per share

|

0.8458 | 0.7079 | ||||||

|

Number of common shares outstanding as at end of period—in thousands

|

129,962 | 129,452 | ||||||

|

Earnings per ADS—R$ per ADS (3)

|

1.6916 | 1.4158 | ||||||

|

US GAAP as restated:

|

||||||||

|

Net operating revenue

|

1,306,626 | 997,975 | ||||||

|

Operating costs

|

(979,603 | ) | (817,770 | ) | ||||

|

Gross profit

|

327,023 | 180,205 | ||||||

|

Operating expenses, net

|

(114,658 | ) | (190,430 | ) | ||||

|

Financial income (expenses), net

|

76,653 | 31,629 | ||||||

|

Income before income taxes, equity in results and noncontrolling interest

|

289,018 | 21,404 | ||||||

|

Taxes on income

|

(49,279 | ) | 5,223 | |||||

|

As of and for the year ended December 31,

|

||||||||

|

2008(1)

|

2007(1)

|

|||||||

|

(in thousands except per share, per ADS and operating data)(2)

|

||||||||

|

Equity in results

|

29,873 | 18,997 | ||||||

|

Cumulative effect of a change in an accounting principle:

|

— | — | ||||||

|

Net income

|

269,612 | 45,624 | ||||||

|

Less: Net income attributable to noncontrolling interests

|

(17,485 | ) | (15,236 | ) | ||||

|

Net income attributable to Gafisa

|

252,127 | 30,388 | ||||||

|

Per share and ADS data(2):

|

||||||||

|

Per preferred share data—R$ per share:

|

||||||||

|

Earnings per share—Basic

|

— | — | ||||||

|

Earnings per share—Diluted

|

— | — | ||||||

|

Weighted average number of shares outstanding — in thousands

|

— | — | ||||||

|

Per common share data—R$ per share:

|

||||||||

|

Earnings per share—Basic

|

0.9977 | 0.1227 | ||||||

|

Earnings per share—Diluted

|

0.5895 | 0.0933 | ||||||

|

Weighted average number of shares outstanding — in thousands

|

259,341 | 252,063 | ||||||

|

Dividends declared and interest on equity

|

26,104 | 26,981 | ||||||

|

Per ADS data—R$ per ADS(3):

|

||||||||

|

Earnings per ADS—Basic (3)

|

1.9954 | 0.2454 | ||||||

|

Earnings per ADS—Diluted (3)

|

1.1790 | 0.1866 | ||||||

|

Weighted average number of ADSs outstanding — in thousands

|

129,671 | 126,032 | ||||||

|

Dividends and interest on equity declared

|

26,104 | 26,981 | ||||||

|

Balance sheet data:

|

||||||||

|

Brazilian GAAP:

|

||||||||

|

Cash, cash equivalents and short-term investments

|

R$ | 605,502 | R$ | 517,420 | ||||

|

Current and non-current properties for sale

|

2,028,976 | 1,022,279 | ||||||

|

Working capital(4)

|

2,448,305 | 1,315,406 | ||||||

|

Total assets

|

5,538,858 | 3,004,785 | ||||||

|

Total debt(5)

|

1,552,121 | 695,380 | ||||||

|

Total equity

|

1,612,419 | 1,498,728 | ||||||

|

US GAAP:

|

||||||||

|

Cash and cash equivalents, short-term investments and restricted short-term investments

|

R$ | 587,432 | R$ | 522,034 | ||||

|

Current and non-current properties for sale

|

2,663,737 | 1,204,881 | ||||||

|

Working capital(4)

|

2,653,630 | 1,322,642 | ||||||

|

Total assets

|

5,381,926 | 2,878,331 | ||||||

|

Total debt(5)

|

1,525,138 | 686,524 | ||||||

|

Total Gafisa equity

|

1,465,866 | 1,264,919 | ||||||

|

Noncontrolling interests

|

420,165 | 29,156 | ||||||

|

Total equity

|

1,886,031 | 1,294,075 | ||||||

|

Consolidated Cash flow provided by (used in):

|

||||||||

|

Brazilian GAAP

|

||||||||

|

Operating activities

|

(812,512 | ) | (451,929 | ) | ||||

|

Investing activities

|

(78,300 | ) | (149,290 | ) | ||||

|

Financing activities

|

911,817 | 842,629 | ||||||

|

Operating data:

|

||||||||

|

Number of new developments

|

64 | 53 | ||||||

|

As of and for the year ended December 31,

|

||||||||

|

2008(1)

|

2007(1)

|

|||||||

|

Potential sales value(6)

|

2,763,043 | 2,235,928 | ||||||

|

Number of units launched(7)

|

10,963 | 10,315 | ||||||

|

Launched usable area (m2)(8) (9)

|

1,838,000 | 1,927,821 | ||||||

|

Sold usable area (m2)(8) (9)

|

1,339,729 | 2,364,173 | ||||||

|

Units sold

|

11,803 | 6,120 | ||||||

|

(1)

|

Our Brazilian GAAP financial statements as of and for the years ended December 31, 2008 and 2007 reflect the changes introduced by Law 11,638/07 and the new accounting standards issued by the CPC in 2008. The Brazilian GAAP financial information was restated to correct the accounting treatment for net income attributable to non-controlling interest related to an unincorporated venture to financial expenses.

|

|

(2)

|

On January 26, 2006, all our preferred shares were converted into common shares. On January 27, 2006, a stock split of our common shares was approved, giving effect to the split of one existing share into three newly issued shares, increasing the number of shares from 27,774,775 to 83,324,316. All US GAAP information relating to the numbers of shares and ADSs have been adjusted retroactively to reflect the share split on January 27, 2006. All US GAAP earnings per share and ADS amounts have been adjusted retroactively to reflect the share split on January 27, 2006. Brazilian GAAP earnings per share and ADS amounts have not been adjusted retroactively to reflect the share split on January 27.

|

|

(3)

|

Earnings per ADS is calculated based on each ADS representing two common shares.

|

|

(4)

|

Working capital equals current assets less current liabilities.

|

|

(5)

|

Total debt comprises loans, financings and short term and long term debentures. Amounts exclude loans from real estate development partners.

|

|

(6)

|

Potential sales value is calculated by multiplying the number of units sold in a development by the unit sales price.

|

|

(7)

|

The units delivered in exchange for land pursuant to swap agreements are not included.

|

|

(8)

|

One square meter is equal to approximately 10.76 square feet.

|

|

(9)

|

Does not include data for FIT, Tenda and Bairro Novo.

|

Exchange Rates

All transactions involving foreign currency in the Brazilian market, whether carried out by investors resident or domiciled in Brazil or investors resident or domiciled abroad, must now be conducted on the consolidated exchange market through institutions authorized by the Central Bank and subject to the rules of the Central Bank.

The Central Bank has allowed the real to float freely against the U.S. dollar since January 15, 1999. Since the beginning of 2001, the Brazilian exchange market has been increasingly volatile, and, until early 2003, the value of the real declined relative to the U.S. dollar, primarily due to financial and political instability in Brazil and Argentina. According to the Central Bank, in 2005, 2006 and 2007, however, the period-end value of the real appreciated in relation to the U.S. dollar 13.4%, 9.5% and 20.7%, respectively. In 2008, the period-end value of the real depreciated in relation to the U.S. dollar by 24.2%. In 2009 and 2010, the period-end value of the real appreciated in relation to the U.S. dollar by 34.2% and 4.3%. In 2011, the real depreciated against the U.S. dollar by 11.2%. On December 31, 2011, the period-end real/U.S. dollar exchange rate was R$1.8758 per US$1.00. Although the Central Bank has intervened occasionally to control unstable movements in the foreign exchange rates, the exchange market may continue to be volatile as a result of this instability or other factors, and, therefore, the real may substantially decline or appreciate in value in relation to the U.S. dollar in the future.

The following table shows the selling rate, expressed in reais per U.S. dollar (R$/US$), for the periods and dates indicated.

|

Period-end

|

Average for period(1)

|

Low

|

High

|

|||||||||||||

|

(per U.S. dollar)

|

||||||||||||||||

|

Year Ended:

|

||||||||||||||||

|

December 31, 2007

|

R$ | 1.771 | R$ | 1.793 | R$ | 1.762 | R$ | 1.823 | ||||||||

|

December 31, 2008

|

2.337 | 2.030 | 1.559 | 2.500 | ||||||||||||

|

December 31, 2009

|

1.741 | 2.062 | 1.702 | 2.422 | ||||||||||||

|

December 31, 2010

|

1.665 | 1.759 | 1.655 | 1.880 | ||||||||||||

|

December 31, 2011

|

1.876 | 1.718 | 1.535 | 1.902 | ||||||||||||

|

Month Ended:

|

||||||||||||||||

|

October 2011

|

1.689 | 1.787 | 1.689 | 1.886 | ||||||||||||

|

November 2011

|

1.811 | 1.810 | 1.727 | 1.894 | ||||||||||||

|

December 2011

|

1.876 | 1.829 | 1.783 | 1.876 | ||||||||||||

|

January 2012

|

1.739 | 1.804 | 1.739 | 1.868 | ||||||||||||

|

February 2012

|

1.709 | 1.720 | 1.702 | 1.738 | ||||||||||||

|

March 2012

|

1.822 | 1.774 | 1.715 | 1.833 | ||||||||||||

|

April 2012

|

1.892 | 1.859 | 1.826 | 1.892 | ||||||||||||

|

May 2012

|

2.022 | 1.998 | 1.915 | 2.082 | ||||||||||||

|

June 2012

|

2.021 | 2.054 | 2.018 | 2.090 | ||||||||||||

|

(1)

|

Average of the lowest and highest rates in the periods presented.

|

|

|

Source: Central Bank.

|

On June 29, 2012, the selling rate was R$2.021 to US$1.00. The real/dollar exchange rate fluctuates and, therefore, the selling rate at June 29, 2012 may not be indicative of future exchange rates.

Brazilian law provides that, whenever there is a serious imbalance in Brazil’s balance of payments or serious reasons to foresee such imbalance, temporary restrictions may be imposed on remittances of foreign capital abroad. For approximately six months in 1989, and early 1990, for example, the Federal Government froze all dividend and capital repatriations that were owed to foreign equity investors. These amounts were subsequently released in accordance with Federal Government directives. There can be no assurance that similar measures will not be taken by the Federal Government in the future.

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

This section is intended to be a summary of the more detailed discussion included elsewhere in this annual report. Our business, results of operations, financial condition or prospects could be adversely affected if any of these risks occurs, and as a result, the trading price of our common shares and ADSs could decline. The risks described below are those known to us and those that we currently believe may materially affect us.

Risks Relating to Our Business and to the Brazilian Real Estate Industry

Our business, results of operations, financial condition and the market price of our common shares or the ADSs may be adversely affected by weaknesses in general economic, real estate and other conditions.

The residential homebuilding and land development industry is cyclical and is significantly affected by changes in general and local economic conditions, such as:

|

·

|

employment levels;

|

|

·

|

population growth;

|

|

·

|

consumer demand, confidence, stability of income levels and interest rates;

|

|

·

|

availability of financing for land home site acquisitions and the availability of construction and permanent mortgages;

|

|

·

|

inventory levels of both new and existing homes;

|

|

·

|

supply of rental properties; and

|

|

·

|

conditions in the housing resale market.

|

Furthermore, the market value of undeveloped land, buildable lots and housing inventories held by us can fluctuate significantly as a result of changing economic and real estate market conditions. If there are significant adverse changes in economic or real estate market conditions, we will have to sell homes at a loss or hold land in inventory longer than planned.

For example, in 2008, the global financial crisis adversely impacted Brazil’s gross domestic product, or “GDP,” resulting in a decrease in both the number of developments launched and the rate of sales of our units. Worldwide financial market volatility may also adversely impact government plans for the Brazilian real estate industry, which may have a material adverse effect on our business, our financial condition and results of operations.

We operate in a highly competitive industry and our failure to compete effectively could adversely affect our business.

The Brazilian real estate industry is highly competitive and fragmented. We compete with several developers on the basis of land availability and location, price, funding, design, quality, and reputation as well as for partnerships with other developers. Because our industry does not have high barriers to entry, new competitors, including international companies working in partnership with Brazilian developers, may enter into the industry, further intensifying this competition. Some of our current potential competitors may have greater financial and other resources than we do. Furthermore, a significant portion of our real estate development and construction activity is conducted in the states of São Paulo Rio de Janeiro, Minas Gerais and Salvador, areas where the real estate market is highly competitive due to a scarcity of properties in desirable locations and the relatively large number of local competitors. If we are not able to compete effectively, our business, our financial condition and the results of our operations could be adversely affected.

Problems with the construction and timely completion of our real estate projects, as well as third party projects for which we have been hired as a contractor, may damage our reputation, expose us to civil liability and decrease our profitability.

The quality of work in the construction of our real estate projects and the timely completion of these projects are major factors that affect our reputation, and therefore our sales and growth. We may experience delays in the construction of our projects or there may be defects in materials and/or workmanship. Any defects could delay the completion of our real estate projects, or, if such defects are discovered after completion, expose us to civil lawsuits by purchasers or tenants. These factors may also adversely affect our reputation as a contractor for third party projects, since we are responsible for our construction services and the building itself for five years. Construction projects often involve delays in obtaining, or the inability to obtain, permits or approvals from the relevant authorities. In addition, construction projects may also encounter delays due to adverse weather conditions, natural disasters, fires, delays in the provision of materials or labor, accidents, labor disputes, unforeseen engineering, environmental or geological problems, disputes with contractors and subcontractors, unforeseen conditions at

construction sites, disputes with surrounding landowners, or other events. In addition, we may encounter previously unknown conditions at or near our construction sites that may delay or prevent construction of a particular project. If we encounter a previously unknown condition at or near a site, we may be required to correct the condition prior to continuing construction and there may be a delay in the construction of a particular project. The occurrence of any one or more of these problems in our real estate projects could adversely affect our reputation and our future sales.

We may incur construction and other development costs for a project that exceeds our original estimates due to increases over time in interest rates, real estate taxes or costs associated with materials and labor, among others. We may not be able to pass these increased costs on to purchasers. Construction delays, scarcity of skilled workers, default and or bankruptcy of third party contractors, cost overruns and adverse conditions may also increase project development costs. In addition, delays in the completion of a project may result in a delay in the commencement of cash flow, which would increase our capital needs.

Our inability to acquire adequate capital to finance our projects could delay the launch of new projects and adversely affect our business.

We expect that the continued expansion and development of our business will require significant capital, including working capital, which we may be unable to obtain on acceptable terms, or at all, to fund our capital expenditures and operating expenses, including working capital needs. We may fail to generate sufficient cash flow from our operations to meet our cash requirements. Furthermore, our capital requirements may vary materially from those currently planned if, for example, our revenues do not reach expected levels or we have to incur unforeseen capital expenditures and make investments to maintain our competitive position. If this is the case, we may require additional financing sooner than anticipated, or we may have to delay some of our new development and expansion plans or otherwise forgo market opportunities. Future borrowing instruments such as credit facilities are likely to contain restrictive covenants, particularly in light of the recent economic downturn and unavailability of credit, and/or may require us to pledge assets as security for borrowings under those facilities. Our inability to obtain additional capital on satisfactory terms may delay or prevent the expansion of our business, which would have an adverse effect on our business. As of December 31, 2011, our net debt level payable to venture partners (indebtness from debentures, working capital, project financing and payables to venture partners balance, net of our cash position) was in excess of R$3,245.3 million: our cash and cash equivalents and short-term investments was in excess of R$984 million and our total debt was R$3,755.8 million and obligations to venture partners was R$473.2 million.

Changing market conditions may adversely affect our ability to sell our property inventories at expected prices, which could reduce our margins and adversely affect the market price of our common shares or the ADSs.

We must constantly locate and acquire new tracts of land for development and development home sites to support our homebuilding operations. There is a lag between the time we acquire land for development or development home sites and the time that we can bring the properties to market and sell homes. As a result, we face the risk that demand for housing may decline, costs of labor or materials may increase, interest rates may increase, currencies may fluctuate and political uncertainties may occur during this period and that we will not be able to dispose of developed properties at expected prices or profit margins or within anticipated time frames or at all. Significant expenditures associated with investments in real estate, such as maintenance costs, construction costs and debt payments, cannot generally be reduced if changes in the economy cause a decrease in revenues from our properties. The market value of property inventories, undeveloped tracts of land and desirable locations can fluctuate significantly because of changing market conditions. In addition, inventory carrying costs (including interest on funds unused to acquire land or build homes) can be significant and can adversely affect our performance. Because of these factors, we may be forced to sell homes and other real properties at a loss or for prices that generate lower profit margins than we anticipate. We may also be required to make material write-downs of the book value of our real estate assets in accordance with Brazilian and US GAAP if values decline. The occurrence of any of these factors may adversely affect our business and results of operations.

We are subject to risks normally associated with permitting our purchasers to make payments in installments; if there are higher than anticipated defaults or if our costs of providing such financing increase, then our profitability could be adversely affected.

As is common in our industry, we and the special purpose entities, or “SPEs,” in which we participate permit some purchasers of the units in our projects to make payments in installments. As a result, we are subject to the risks associated with this financing, including the risk of default in the payment of principal or interest on the loans we make as well as the risk of increased costs for the funds raised by us. In addition, our term sales agreements usually bear interest and provide for an inflation adjustment. If the rate of inflation increases, the loan payments under these term sales agreements may increase, which may lead to a higher rate of payment default. If the default rate among our purchasers increases, our cash generation and, therefore, our profitability could be adversely affected.

In the case of a payment default after the delivery of financed units, Brazilian law provides for the filing of a collection claim to recover the amount owed or to repossess the unit following specified procedures. The collection of overdue amounts or the repossession of the property is a lengthy process and involves additional costs. It is uncertain that we can recover the full amount owed to us or that if we repossess a unit, we can re-sell the unit at favorable terms or at all.

The affordable entry-level segment is strongly dependent on the availability of financing, including from the Minha Casa, Minha Vida program and from Caixa Econômica Federal, or the “CEF.” The scarcity of financing, the increase in interest rates, the reduction in financing terms, share of financing per unit and subsidies or any other modification in other financing terms and conditions may adversely affect the performance of the affordable entry-level segment.

If we or the SPEs in which we participate fail to comply with or become subject to more onerous government regulations, our business could be adversely affected.

We and the SPEs in which we participate are subject to various federal, state and municipal laws and regulations, including those relating to construction, zoning, soil use, environmental protection, historical sites, consumer protection and antitrust. We are required to obtain, maintain and renew on a regular basis permits, licenses and authorizations from various governmental authorities in order to carry out our projects. We strive to maintain compliance with these laws and regulations. If we are unable to achieve or maintain compliance with these laws and regulations, we could be subject to fines, project shutdowns, cancellation of licenses and revocation of authorizations or other restrictions on our ability to develop our projects, which could have an adverse impact on our business, financial condition and results of operations. In addition, our contractors and subcontractors are required to comply with various labor and environmental regulations and tax and other regulatory obligations. Because we are secondary obligors to these contractors and subcontractors, if they fail to comply with these regulations or obligations, we may be subject to penalties by the relevant regulatory bodies.

Regulations governing the Brazilian real estate industry as well as environmental laws have tended to become more restrictive over time. We cannot assure you that new and stricter standards will not be adopted or become applicable to us, or that stricter interpretations of existing laws and regulations will not be promulgated. Furthermore, we cannot assure you that any such more onerous regulations would not cause delays in our projects or that we would be able to secure the relevant permits and licenses. Any such event may require us to spend additional funds to achieve compliance with such new rules and therefore make the development of our projects more costly, which can adversely affect our business and the market price of our common shares or the ADSs.

Scarcity of financing and/or increased interest rates could cause a decrease in the demand for real estate properties, which could negatively affect our results of operations, financial condition and the market price of our common shares or the ADSs.

The scarcity of financing and/or an increase in interest rates or in other indirect financing costs may adversely affect the ability or willingness of prospective buyers to purchase our products and services, especially prospective low income buyers. A majority of the bank financing obtained by prospective buyers comes from the Housing Financial System (Sistema Financeiro de Habitação), or the “SFH,” which is financed by funds raised from savings account deposits. The Brazilian Monetary Council (Conselho Monetário Nacional), or the “CMN,” often changes the amount of such funds that banks are required to make available for real estate financing. If the CMN restricts the amount of available funds that can be used to finance the purchase of real estate properties, or if there is an increase in interest rates, there may be a decrease in the demand for our residential and commercial properties and for the development of lots of land, which may adversely affect our business, financial condition and results of operations.

We and other companies in the real estate industry frequently extend credit to our clients. As a result, we are subject to risks associated with providing financing, including the risk of default on amounts owed to us, as well as the risk of increased costs of funding our operations. An increase in inflation would raise the nominal amounts due from our clients, pursuant to their sales agreements, which may increase their rates of default. If this were to occur, our cash generation and, therefore, our operating results may be adversely affected. In addition, we obtain financings from financial institutions at different rates and subject to different indexes and may be unable to match our debt service requirements with the terms of the financings we grant to our clients. The mismatch of rates and terms between the funds we obtain and the financings we grant may adversely affect us.

Some of our subsidiaries use significant funding from the home financing programs of the CEF, including the Minha Casa, Minha Vida program, and, as a result, are subject to institutional and operating changes in the CEF and enhance customer risk profiles associated with clients eligible for these programs.

The CEF has several home financing programs for the low-income segment, which are used by Construtora Tenda S.A., or “Tenda,” to fund its activities. The CEF is a state-owned financial institution and is subject to political influence, which may change the availability or the terms of the home financing programs. The cancelation, suspension, interruption or a significant change in such programs may affect our growth estimates and our business. Furthermore, the suspension, interruption or slowdown in the CEF’s activities to approve projects, grant financing to our clients and evaluate construction process, among other activities, may adversely impact our business, financial position, results of operations and the market price of our common shares and ADSs.

Also, in March 2009, the Brazilian government announced the creation of a public housing program called “Minha Casa, Minha Vida,” with an announcement in 2010 of a second phase of the program from 2011 until 2014, that aims to finance two million houses, twice as much as was financed in the first phase of the program. The program aims to reduce the housing deficit in Brazil, which as of 2010 was estimated to be 5.5 million houses. The program calls for government investment of more than R$30 billion in the first phase and more than R$72 billion during the second phase, to be available made through financing from the “CEF,” and is focused on building one million houses for families with monthly incomes of up to ten times the minimum wage. During the second phase of this program, 800 thousand houses will be built for families with monthly incomes of three to ten times the minimum wage, which make up our target clients under our Tenda brand. This program offers, among other things, long-term financing, lower interest rates, greater share of the property financed to the client, subsidies based on income level, lower insurance costs and the creation of a guarantor fund to refinance debt in case of unemployment. Financing to the affordable entry-level segment is primarily made available through the CEF. Any changes in such financing would force us to seek new sources of financing and the availability of funds under similar conditions is limited, which would have an adverse effect on our results of operations.

We may sell portions of our landbank located in nonstrategic regions, which is in line with our future strategies. As a result, we will prepare an annual analysis for impairment of our landbank.

As part of our strategy to focus our future operations on regions where our developments have historically been successful, and where we believe there is homebuilding potential based on market opportunities, we may sell

portions of our landbank located outside of these regions. As a result, we will prepare an annual impairment analysis of our landbank based on the acquisition cost of the land in our portfolio. In 2011, we decided to sell a portion of our landbank and our evaluation of impairment on landbank and properties for sale resulted in provisions for impairment in the amount of R$92.1 million.

The real estate industry is dependent on the availability of credit, especially in the affordable entry-level segment.

One of our main strategies is to expand our operations to the affordable entry-level segment in which clients are strongly dependent on bank financing to purchase homes. This financing may not be available on favorable terms to our clients, or at all. Changes in the Real Estate Financing System (Sistema de Financiamento Imobiliário), or the “SFI,” and in the SFH rules, the scarcity of available resources or an increase in interest rates may affect the ability or desire of such clients to purchase homes, consequently affecting the demand for homes. These factors would have a material adverse effect on our business, financial condition and results of operations.

Because we recognize sales revenue from our real estate properties under the percentage of completion method of accounting under Brazilian GAAP as generally adopted by construction companies and under US GAAP, when we meet the conditions specified by the respective accounting standards, an adjustment in the cost of a development project may reduce or eliminate previously reported revenue and income.

We recognize revenue from the sale of units in our properties based on the percentage of completion method of accounting, which requires us to recognize revenue as we incur the cost of construction. Total cost estimates are revised on a regular basis as the work progresses, and adjustments based upon such revisions are reflected in our results of operations in accordance with the method of accounting used. To the extent that these adjustments result in an increase, a reduction or an elimination of previously reported income, we will recognize a credit to or a charge against income, which could have an adverse effect on our previously reported revenue and income.

Our participation in SPEs creates additional risks, including potential problems in our financial and business relationships with our partners.

We invest in SPEs with other real estate developers and construction companies in Brazil. The risks involved with SPEs include the potential bankruptcy of our SPE partners and the possibility of diverging or inconsistent economic or business interests between us and our partners. If an SPE partner fails to perform or is financially unable to bear its portion of the required capital contributions, we could be required to make additional investments and provide additional services in order to make up for our partner’s shortfall. In addition, under Brazilian law, the partners of an SPE may be liable for certain obligations of an SPE, including with respect to tax, labor, environmental and consumer protection laws and regulations. These risks could have an adverse effect on us.

We may experience difficulties in finding desirable land tracts and increases in the price of land may increase our cost of sales and decrease our earnings.

Our continued growth depends in large part on our ability to continue to acquire land and to do so at a reasonable cost. As more developers enter or expand their operations in the Brazilian home building industry, land prices could rise significantly and suitable land could become scarce due to increased demand, decreased supply or both. A resulting rise in land prices may increase our cost of sales and decrease our earnings. We may not be able to continue to acquire suitable land at reasonable prices in the future, which could adversely affect our business.

The market value of our inventory of undeveloped land may decrease, thus adversely affecting our results of operations.

We own tracts of undeveloped land that are part of our inventory for future developments. We also intend to increase our inventory and acquire larger tracts of land. The market value of these properties may significantly decrease from the acquisition date to the development of the project as a result of economic downturns or market conditions, which would have an adverse effect on our results of operations.

Increases in the price of raw materials and fixtures may increase our cost of sales and reduce our earnings.

The basic raw materials and fixtures used in the construction of our homes include concrete, concrete block, steel, aluminum, bricks, windows, doors, roof tiles and plumbing fixtures. Increases in the price of these and other raw materials, including increases that may occur as a result of shortages, duties, restrictions, or fluctuations in exchange rates, could increase our cost of sales. Any such cost increases could reduce our earnings and adversely affect our business.

If we are not able to implement our growth strategy as planned, or at all, our business, financial condition and results of operations could be adversely affected.

We plan to grow our business by selectively expanding to meet the growth potential of the Brazilian residential market. We believe that there is increasing competition for suitable real estate development sites. We may not find suitable additional sites for development of new projects or other suitable expansion opportunities.

We anticipate that we will need additional financing to implement our expansion strategy and we may not have access to the funding required for the expansion of our business or such funding may not be available to us on acceptable terms. We may finance the expansion of our business with additional indebtedness or by issuing additional equity securities. We could face financial risks and covenant restrictions associated with incurring additional indebtedness, such as reducing our liquidity and access to financial markets and increasing the amount of cash flow required to service such indebtedness, or associated with issuing additional stock, such as dilution of ownership and earnings.

There are risks for which we do not have insurance coverage or the insurance coverage we have in place may not be sufficient to cover damages that we may suffer.

We maintain insurance policies with coverage for certain risks, including damages arising from engineering defects, fire, landslides, storms, gas explosions and civil liabilities stemming from construction errors. We believe that the level of insurance we have contracted for accidents is consistent with market practice. However, there can be no assurance that such policies will always be available or provide sufficient coverage for certain damages. In addition, there are certain risks that may not be covered by such policies, such as damages resulting from war, force majeure or the interruption of certain activities and, therefore any requirement to pay amounts not covered by our insurance may have a negative impact on our business and our results of operations. Furthermore, we are required to pay penalties and other fines whenever there is delay in the delivery of our units, and such penalties and fines are not covered by our insurance policies.

Moreover, we cannot guarantee that we will be able to renew our current insurance policies under favorable terms, or at all. As a result, insufficient insurance coverage or our inability to renew existing insurance policies could have an adverse effect on our financial condition and results of operations.

Our level of indebtedness could have an adverse effect on our financial health, diminish our ability to raise additional capital to fund our operations and limit our ability to react to changes in the economy or the real estate industry.

As of December 31, 2011, our total debt was R$3.8 billion and our short-term debt was R$3.0 billion. In addition, as of December 31, 2011, our cash and cash equivalents and short-term investments available was R$983.7 million and our net debt represented 118.1% of our shareholders’ equity including the noncontrolling interest. Our indebtedness has variable interest rates. A hypothetical 1% adverse change in interest rates would have had an annualized unfavorable impact of approximately R$115 million on our earnings and cash flows, based on the net debt level as of December 31, 2011.

Our level of indebtedness could have important negative consequences for us. For example, it could:

|

·

|

require us to dedicate a large portion of our cash flow from operations to fund payments on our debt, thereby reducing the availability of our cash flow to fund working capital, capital expenditures and other general corporate purposes;

|

|

·

|

increase our vulnerability to adverse general economic or industry conditions;

|

|

·

|

limit our flexibility in planning for, or reacting to, changes in our business or the industry in which we operate;

|

|

·

|

limit our ability to raise additional debt or equity capital in the future or increase the cost of such funding;

|

|

·

|

restrict us from making strategic acquisitions or exploring business opportunities; and

|

|

·

|

place us at a competitive disadvantage compared to our competitors that have less debt.

|

Certain of our debt agreements contain financial and other covenants and any default under such debt agreements may have a material adverse effect on our financial condition and cash flows.

Certain of our existing debt agreements contain restrictions and covenants and require the maintenance or satisfaction of specified financial ratios, ratings and tests. Our ability to meet these financial ratios, ratings and tests can be affected by events beyond our control and we cannot assure that we will meet those tests, especially given the lower yield environment in which the industry currently operates. Failure to meet or satisfy any of these covenants, financial ratios or financial tests could result in an event of default under these and other agreements, as a result of cross-default provisions. If we are unable to comply with our debt covenants, we could be forced to seek waivers. We cannot guarantee that we will be successful in obtaining any waivers or renewing existing waivers. As of December 31, 2011, the Company and its subsidiary Tenda were in default on the contractual covenants provided for in certain of our debentures, for which we obtained a waiver and renegotiated certain covenant ratios in March 2012. In each of January, April and June 2012, we were in default on restrictive covenants for a bank loan (cédula de crédito imobiliário) or CCB in the amount of R$100 million as a result of a downgrade in our corporate rating. In each instance, we obtained a waiver to avoid early redemption of this indebtedness. If we are unable to renew these and/or receive other waivers, a large portion of our debt could be subject to acceleration. While we do not believe such occurrence to be likely, if it were to happen, we could be required to renegotiate, restructure or refinance our indebtedness, seek additional equity capital or sell assets, which could materially and adversely affect us.

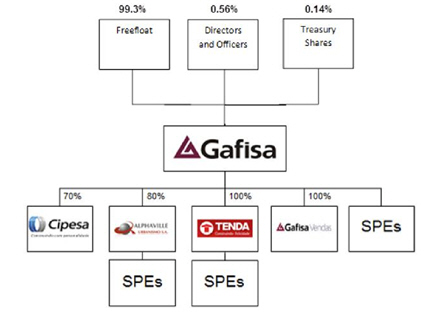

We may not be successful in managing and integrating the businesses and activities of Alphaville, Cipesa and Tenda.

We have acquired controlling stakes in three Brazilian real estate companies: (1) Alphaville Urbanismo S.A., one of the largest residential community development companies in Brazil; (2) Cipesa Empreendimentos Imobiliários S.A., one of the leading homebuilders in the State of Alagoas; and (3) Construtora Tenda S.A., a residential homebuilder with a focus on the affordable entry-level segment. However, we may not be successful in managing and integrating these companies, which could adversely affect our business.

Failures or delays by our third party contractors may adversely affect our reputation and business and expose us to civil liability.

We engage third party contractors to provide services for our projects. Therefore, the quality of work in the construction of our real estate projects and the timely completion of these projects may depend on factors that are beyond our control, including the quality and timely delivery of building materials and the technical skills of the outsourced professionals. Such outsourcing may delay the identification of construction problems and, consequently, the correction of such problems. Any failures, delays or defects in the services provided by our third party contractors may adversely affect our reputation and relationship with our clients, which would adversely affect our business and results of operations.

We may be unable to successfully implement our strategy of reorganizing our operational organization and performance.

We intend to carry out a strategy seeking to reorganize our operational organization and promote performance. This strategy includes the implementation of a new management structure that, among other things, assigns each brand manager direct responsibility for the operating performance of each brand, and implementing a corporate culture shift within our Tenda brand focused on aligning incentives to improve project execution. This strategy is intended to pursue the goal of helping to produce more stable cash flow and contributing toward a return to sustainable growth. However, there we can be no assurance that we will be able to successfully implement such strategy, and therefore we may also be unsuccessful in achieving such goals behind such strategy, which could result in a material adverse effect with respect to our business, financial condition or results of operations.

Unfavorable judicial or administrative decisions may adversely affect us.

We currently are, and may be in the future, defendants in several judicial and administrative proceedings related to civil, labor and tax matters. We cannot assure you that we will obtain favorable decisions in such proceedings, that such proceedings will be dismissed, or that our provisions for such proceedings are sufficient in the event of an unfavorable decision. Unfavorable decisions that impede our operations, as initially planned, or that result in a claim amount that is not adequately covered by provisions in our balance sheet, may adversely affect our business and financial condition.

We may be held responsible for labor liabilities of our third party contractors.

We may be held responsible for the labor liabilities of our third party contractors and obligated to pay for fines imposed by the relevant authorities in the event that our third party contractors do not comply with applicable legislation. As of December 31, 2011, we had a total of R$100.2 million of labor liabilities and provisions for such liabilities in the amount of R$40 million. 81% of the labor claims were commenced by employees of our third party contractors. An adverse result in such claims would cause an adverse effect on our business.

Failure to keep members of our senior management and/or our ability to recruit and retain qualified professionals may have a material adverse effect on our business, financial condition and results of operations.

Our future success depends on the continued service and performance of our senior management and our ability to recruit and retain qualified professionals. None of the members of our senior management are bound to long-term labor contracts or non-compete agreements and there can be no assurance that we will successfully recruit and retain qualified professionals to our management as our business grows. The loss of any key professionals or our inability to recruit or retain qualified professionals may have an adverse effect on our business, financial condition and results of operations.

Changes in Brazilian GAAP due to its migration towards IFRS may adversely affect our results.

Brazilian corporate law was amended by Law No. 11,638 dated December 28, 2007 in order to facilitate the convergence of Brazilian GAAP with IFRS, and thereafter, the CPC issued new accounting standards that converged Brazilian GAAP to IFRS.