UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____ to _____

Commission File Number:

(Exact name of registrant as specified in its charter)

|

||

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

||

(Address of principal executive offices) |

|

(Zip Code) |

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

☑ |

|

Accelerated filer |

☐ |

|

Non-accelerated filer |

☐ |

|

Smaller reporting company |

|

|

|

|

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

The aggregate market value of the common stock held by non-affiliates of the registrant was $

As of February 9, 2024, there were

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for the 2024 Annual Meeting of Stockholders, to be filed no later than 120 days after the end of the fiscal year to which this Annual Report on Form 10-K relates, are incorporated by reference into Part III of this Annual Report on Form 10-K.

TABLE OF CONTENTS

PART I |

|

|

|

4 |

|

|

|

26 |

|

|

|

51 |

|

|

|

51 |

|

|

|

52 |

|

|

|

52 |

|

|

|

53 |

|

|

|

PART II |

|

|

|

54 |

|

|

|

55 |

|

|

|

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

56 |

|

|

Item 7A. Quantitative and Qualitative Disclosures About Market Risk. |

72 |

|

|

74 |

|

|

|

Item 9. Changes in and Disagreements With Accountants on Accounting and Financial Disclosure. |

74 |

|

|

74 |

|

|

|

75 |

|

|

|

Item 9C. Disclosure Regarding Foreign Jurisdictions that Prevent Inspections. |

75 |

|

|

PART III |

|

|

|

Item 10. Directors, Executive Officers and Corporate Governance. |

76 |

|

|

79 |

|

|

|

79 |

|

|

|

Item 13. Certain Relationships and Related Transactions, and Director Independence. |

79 |

|

|

80 |

|

|

|

PART IV |

|

|

|

81 |

|

|

|

89 |

|

|

|

SIGNATURES |

|

|

|

90 |

|

1

CAUTIONARY STATEMENT ABOUT FORWARD-LOOKING STATEMENTS

Targa Resources Corp.’s (together with its subsidiaries, including Targa Resources Partners LP (the “Partnership”), “we,” “us,” “our,” “Targa,” “TRGP,” or the “Company”) reports, filings and other public announcements may from time to time contain statements that do not directly or exclusively relate to historical facts. Such statements are “forward-looking statements.” You can typically identify forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, by the use of forward-looking statements, such as “may,” “could,” “project,” “believe,” “anticipate,” “expect,” “estimate,” “potential,” “plan,” “forecast” and other similar words.

All statements that are not statements of historical facts, including statements regarding our future financial position, business strategy, budgets, projected costs and plans and objectives of management for future operations, are forward-looking statements.

These forward-looking statements reflect our intentions, plans, expectations, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors, many of which are outside our control. Important factors that could cause actual results to differ materially from the expectations expressed or implied in the forward-looking statements include known and unknown risks. Known risks and uncertainties include, but are not limited to, the following risks and uncertainties:

Although we believe that the assumptions underlying our forward-looking statements are reasonable, any of the assumptions could be inaccurate, and, therefore, we cannot assure you that the forward-looking statements included in this Annual Report will prove to be accurate. Some of these and other risks and uncertainties that could cause actual results to differ materially from such forward-looking

2

statements are more fully described in “Item 1A. Risk Factors” in this Annual Report. Except as may be required by applicable law, we undertake no obligation to publicly update or advise of any change in any forward-looking statement, whether as a result of new information, future events or otherwise.

As generally used in the energy industry and in this Annual Report, the identified terms have the following meanings:

Bbl |

|

Barrels (equal to 42 U.S. gallons) |

BBtu |

|

Billion British thermal units |

Bcf |

|

Billion cubic feet |

Btu |

|

British thermal units, a measure of heating value |

/d |

|

Per day |

FERC |

|

Federal Energy Regulatory Commission |

GAAP |

|

Accounting principles generally accepted in the United States of America |

gal |

|

U.S. gallons |

LIBOR |

|

London Inter-Bank Offered Rate |

LPG |

|

Liquefied petroleum gas |

MBbl |

|

Thousand barrels |

MMBbl |

|

Million barrels |

MMBtu |

|

Million British thermal units |

MMcf |

|

Million cubic feet |

MMgal |

|

Million U.S. gallons |

NGL(s) |

|

Natural gas liquid(s) |

NYMEX |

|

New York Mercantile Exchange |

NYSE |

|

New York Stock Exchange |

SCOOP |

|

South Central Oklahoma Oil Province |

SOFR |

|

Secured Overnight Financing Rate |

STACK |

|

Sooner Trend, Anadarko, Canadian and Kingfisher |

VLGC |

|

Very large gas carrier |

3

PART I

Item 1. Business.

The following section of this Form 10-K generally refers to business developments during the year ended December 31, 2023. Discussion of prior period business developments that are not included in this Form 10-K can be found in “Part I, Item 1. Business” of our Annual Report on Form 10-K for the year ended December 31, 2022.

Overview

Targa Resources Corp. (NYSE: TRGP) is a publicly traded Delaware corporation formed in October 2005. Targa is a leading provider of midstream services and is one of the largest independent midstream infrastructure companies in North America. We own, operate, acquire, and develop a diversified portfolio of complementary domestic midstream infrastructure assets.

Our Operations

We are engaged primarily in the business of:

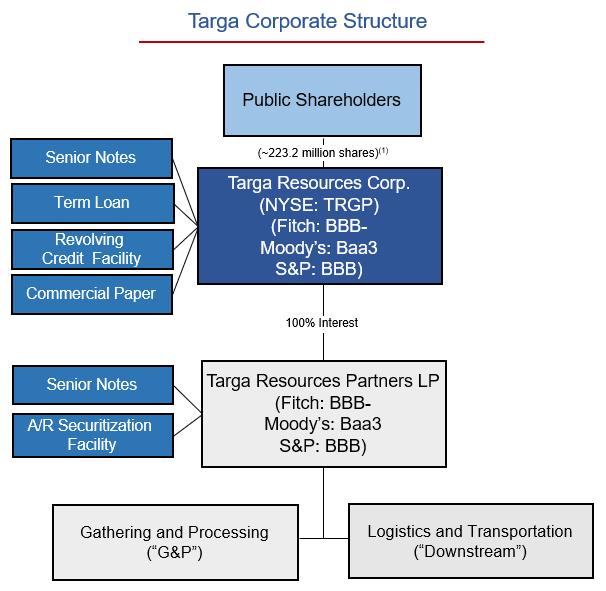

To provide these services, we operate in two primary segments: (i) Gathering and Processing, and (ii) Logistics and Transportation (also referred to as the Downstream Business).

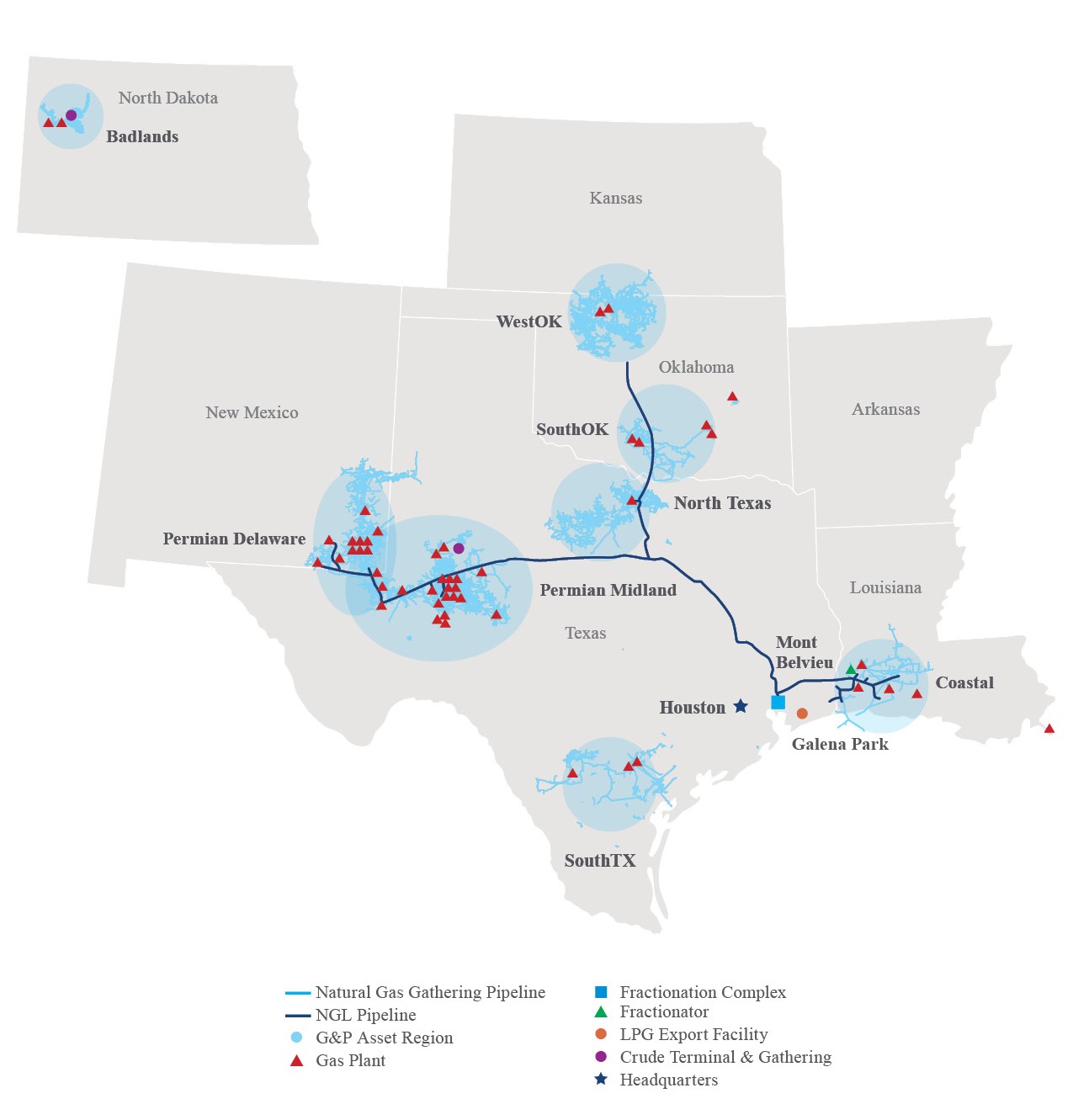

Our Gathering and Processing segment includes assets used in the gathering and/or purchase and sale of natural gas produced from oil and gas wells, removing impurities and processing this raw natural gas into merchantable natural gas by extracting NGLs; and assets used for the gathering and terminaling and/or purchase and sale of crude oil. The Gathering and Processing segment’s assets are located in the Permian Basin of West Texas and Southeast New Mexico (including the Midland, Central and Delaware Basins); the Eagle Ford Shale in South Texas; the Barnett Shale in North Texas; the Anadarko, Ardmore, and Arkoma Basins in Oklahoma (including the SCOOP and STACK) and South Central Kansas; the Williston Basin in North Dakota (including the Bakken and Three Forks plays); and the onshore and near offshore regions of the Louisiana Gulf Coast and the Gulf of Mexico.

Our Logistics and Transportation segment includes the activities and assets necessary to convert mixed NGLs into NGL products and also includes other assets and value-added services such as transporting, storing, fractionating, terminaling, and marketing of NGLs and NGL products, including services to LPG exporters and certain natural gas supply and marketing activities in support of our other businesses. The Logistics and Transportation segment also includes the Grand Prix NGL Pipeline (“Grand Prix”), which connects our gathering and processing positions in the Permian Basin, Southern Oklahoma and North Texas with our Downstream facilities in Mont Belvieu, Texas. Our Downstream facilities are located predominantly in Mont Belvieu and Galena Park, Texas, and in Lake Charles, Louisiana.

Other contains the unrealized mark-to-market gains/losses related to derivative contracts that were not designated as cash flow hedges.

4

The map below highlights our more significant assets as of December 31, 2023:

5

Recent Developments

In response to increasing production and to meet the infrastructure needs of producers and our downstream customers, our major expansion projects include the following:

Permian Midland Processing Expansions

Permian Delaware Processing Expansions

Fractionation Expansion

NGL Pipeline Expansion

Acquisitions

In January 2023, we completed the acquisition of Blackstone Energy Partners’ 25% interest in the entity that owns the Permian to Mont Belvieu segment of Grand Prix (the “Grand Prix Transaction”) for approximately $1.05 billion in cash and a final closing adjustment of $41.9 million. Following the closing of the Grand Prix Transaction, we own 100% of Grand Prix, including the Daytona NGL Pipeline.

6

For further details on our acquisitions and divestitures, see Note 4 - Acquisitions and Divestitures and Note 7 - Investments in Unconsolidated Affiliates to our Consolidated Financial Statements beginning on page F-1 in this Form 10-K.

Capital Allocation

In April 2023, we declared an increase to our common dividend to $0.50 per common share or $2.00 per common share annualized effective for the first quarter of 2023.

In October 2020, our Board of Directors approved a share repurchase program (the “2020 Share Repurchase Program”) for the repurchase of up to $500.0 million of our outstanding common stock. In May 2023, our Board of Directors authorized a new $1.0 billion common share repurchase program (the “2023 Share Repurchase Program”). The amount authorized under the 2023 Share Repurchase Program was in addition to the amount remaining under the 2020 Share Repurchase Program. During the second quarter of 2023, we exhausted the 2020 Share Repurchase Program.

In the fourth quarter of 2023 and for the year ended December 31, 2023, we repurchased 475,040 and 4,870,559 shares of our common stock at a weighted average per share price of $85.52 and $76.72 for a total net cost of $40.6 million and $373.7 million, respectively. There was $770.1 million remaining under the 2023 Share Repurchase Program as of December 31, 2023. We are not obligated to repurchase any specific dollar amount or number of shares under the 2023 Share Repurchase Program and may discontinue the program at any time.

Financing Activities

In January 2023, we completed an underwritten public offering of (i) $900.0 million in aggregate principal amount of our 6.125% Senior Notes due 2033 (the “6.125% Notes”) and (ii) $850.0 million in aggregate principal amount of our 6.500% Senior Notes due 2053 (the “January 2023 6.500% Notes”), resulting in net proceeds of approximately $1.7 billion. We used a portion of the net proceeds from the issuance to fund the Grand Prix Transaction and the remaining net proceeds for general corporate purposes, including to reduce borrowings under our $2.75 billion TRGP senior revolving credit facility (the “TRGP Revolver”) and our unsecured commercial paper note program (the “Commercial Paper Program”).

In August 2023, the Partnership amended its accounts receivable securitization facility (the “Securitization Facility”) to decrease the size of the Securitization Facility from $800.0 million to $600.0 million and to extend the termination date of the Securitization Facility to August 29, 2024.

In November 2023, we completed an underwritten public offering of (i) $1.0 billion in aggregate principal amount of our 6.150% Senior Notes due 2029 (the “2023 6.150% Notes”) and (ii) $1.0 billion in aggregate principal amount of our 6.500% Senior Notes due 2034 (the “November 2023 6.500% Notes”), resulting in net proceeds of approximately $2.0 billion. We used a portion of the net proceeds to repay $1.0 billion in borrowings under the Term Loan Facility and the remaining net proceeds for general corporate purposes, including to repay borrowings under the Commercial Paper Program.

For additional information about our recent debt-related transactions, see Note 8 - Debt Obligations to our Consolidated Financial Statements.

7

Organization Structure

The diagram below shows our corporate structure as of February 15, 2024:

Growth Drivers, Competitive Strengths and Strategies

While we believe that we are well positioned to execute our business strategies based on our growth drivers, competitive strengths and strategies outlined below, our business involves numerous risks and uncertainties which may prevent us from executing our strategies. These risks include the adverse impact of changes in natural gas, NGL and condensate/crude oil prices, the supply of, or demand for, these commodities, and our inability to access sufficient additional supplies to replace natural declines in production. For a more complete description of the risks associated with an investment in us, see “Item 1A. Risk Factors.”

Comprehensive package of midstream services

We provide a comprehensive package of services to natural gas and crude oil producers. These services are essential to gather, process, treat, purchase and sell and transport wellhead gas to meet pipeline standards; extract, transport and fractionate NGLs for sale into petrochemical, industrial, commercial and export markets; and gather and/or purchase and sell crude oil. We believe that our ability to offer these integrated services provides us with an advantage in competing for new supplies because we can provide substantially all of the services that producers, marketers and others require for moving natural gas, NGLs and crude oil from wellhead to market on a cost-effective basis. Additionally, we believe that the significant investment we have made to construct and acquire assets in key strategic positions and the expertise we have in operating such assets make us well-positioned to remain a leading provider of integrated services in the midstream sector.

Our transportation assets further enhance our integrated midstream service offerings across the NGL and natural gas value chain by linking supply to key markets. Grand Prix connects many of our gathering and processing positions, including the Permian Basin, with our Downstream facilities in Mont Belvieu, Texas, the major U.S. NGL market hub. Additionally, our integrated Mont Belvieu and Galena Park Marine Terminal assets allow us to provide the raw product, fractionation, storage, interconnected terminaling, refrigeration and ship loading capabilities to support exports by third-party customers.

8

Strategically located and leading infrastructure positions

We believe our assets are not easily replicated, are located in many attractive and active areas of exploration and production activity and are near key markets and logistics centers. Our gathering and processing infrastructure is located in attractive oil and gas producing basins and is well positioned within each of those basins. Activity in the shale resource plays underlying our gathering assets is driven by the economics of oil, condensate, gas and NGL production from the particular reservoirs in each play impacting the volumes of natural gas and crude oil available to us for gathering, processing and/or purchase and sale on our systems. Producers continue to focus drilling activity on their most attractive acreage, especially in the Permian Basin where we have a large, well-positioned and interconnected footprint, benefiting from rig activity in and around our systems.

As drilling in these areas continues, the supply of NGLs requiring transportation to market hubs and fractionation is expected to continue to grow. Continued demand for transportation, fractionation and export capacity is expected to lead to increased demand for other related fee-based services provided by our logistics and transportation assets as well as provide other growth opportunities. The connectivity of our gathering and processing and Downstream operations provided by Grand Prix further allows us to capture these growth opportunities. Additionally, we are one of the largest fractionators of NGLs along the Gulf Coast. Our fractionation assets are primarily located in key NGL market centers and are near and connected to key consumers of NGL products, including the petrochemical and industrial markets. Our logistics assets, including fractionation facilities, storage wells, our low ethane propane de-ethanizer, and our Galena Park Marine Terminal and related pipeline systems and interconnects, include connections to a number of mixed NGL (“mixed NGLs” or “Y-grade”) supply pipelines, storage, interconnection and takeaway pipelines and other transportation infrastructure. The location and interconnectivity of these assets are not easily replicated, and we have additional capability to expand their capacity.

High quality and efficient assets

Our gathering and processing systems and logistics and transportation assets consist of high-quality, well-maintained facilities, resulting in low-cost, efficient operations. Advanced technologies have been implemented for processing plants (primarily cryogenic units utilizing centralized control systems), measurement systems (essentially all electronic and electronically linked to a central data-base) and operations and maintenance management systems to manage work orders and implement preventative maintenance schedules (computerized maintenance management systems). These applications have allowed proactive management of our operations resulting in lower costs and minimal downtime. We have established a reputation in the midstream industry as a reliable and cost-effective supplier of services to our customers and have a track record of safe, efficient and reliable operation of our facilities. We will continue to pursue new contracts, cost efficiencies and operating improvements of our assets. In the past, such improvements have included new production and acreage commitments, reducing fuel gas and flare volumes and improving facility capacity and NGL recoveries. We will also continue to optimize existing plant assets to improve and maximize capacity and throughput.

In addition to routine annual maintenance expenses, our maintenance capital expenditures have averaged approximately $182 million per year over the last three years. We believe that our assets are well-maintained, and we are focused on continuing to operate both our existing and new assets in a prudent, safe and cost-effective manner.

Financial flexibility

We have historically maintained sufficient liquidity and have funded our growth investments with a mix of cash flow from operations, equity, debt, asset sales and joint ventures over time in order to manage our leverage ratio. Disciplined management of liquidity, leverage and commodity price volatility allow us to be flexible in our long-term growth strategy, as well as allocating our free cash flow after dividends in a manner that maintains a strong credit profile.

Experienced and long-term focused management team

Our current executive management team possesses breadth and depth of experience working in the midstream energy business, including certain members of our executive management team managing our businesses prior to acquisition by Targa. Other officers and key employees have significant experience in the industry, including extensive experience in operating our current assets and developing, permitting and constructing new assets.

9

Attractive cash flow characteristics, with large diverse business mix with favorable contracts and increasing fee-based business

We believe that our strategy, combined with our high-quality asset portfolio, allows us to generate attractive cash flows. Geographic, business and customer diversity enhances our cash flow profile. We provide our services under predominantly fee-based contract terms to a diverse mix of customers across our areas of operation. Our Gathering and Processing segment contract mix has increasing components of fee-based margin driven by: (i) fees added to percent-of-proceeds contracts for natural gas treating and compression, (ii) new/amended contracts with a combination of percent-of-proceeds and fee-based components, including fee floors, and (iii) fee-based gas gathering and processing and crude oil gathering contracts. Contracts for the Coastal portion of our Gathering and Processing segment are primarily hybrid contracts (percent-of-liquids with a fee floor) or percent-of-liquids contracts (whereby we receive an agreed upon percentage of the actual proceeds of the NGLs).

Contracts in the Downstream Business are predominantly fee-based (based on volumes and contracted rates), with a large take-or-pay component. Our contract mix, along with our commodity hedging program, serves to mitigate the impact of commodity price movements on cash flow.

We have hedged the commodity price risk associated with a portion of our expected natural gas, NGL and condensate equity volumes, future commodity purchases and sales, and transportation basis risk by entering into financially settled derivative transactions. We have intentionally tailored our hedges to approximate specific NGL products and to approximate our actual NGL and residue natural gas delivery points. Although the degree of hedging will vary, we intend to continue to manage some of our exposure to commodity prices by entering into hedge transactions. We also monitor and manage our inventory levels with a view to mitigate losses related to downward price exposure.

Our Business Operations

Our operations are reported in two segments: (i) Gathering and Processing, and (ii) Logistics and Transportation (also referred to as the Downstream Business).

Gathering and Processing Segment

Our Gathering and Processing segment consists of gathering, compressing, treating, processing, transporting, and purchasing and selling natural gas and gathering, storing, terminaling and purchasing and selling crude oil. The gathering or purchase of natural gas consists of aggregating natural gas produced from various wells through varying diameter gathering lines to processing plants. Natural gas has a widely varying composition depending on the field, the formation and the reservoir from which it is produced. The processing of natural gas consists of the extraction of embedded NGLs and the removal of water vapor and other contaminants to form (i) a stream of marketable natural gas, commonly referred to as residue gas, and (ii) a stream of mixed NGLs. Once processed, the residue gas is transported to markets through residue gas pipelines. End-users of residue gas include large commercial and industrial customers, as well as natural gas and electric utilities serving individual consumers. We sell our residue gas either directly to such end-users or to marketers into intrastate or interstate pipelines, which are typically located in close proximity or with ready access to our facilities. The gathering or purchase of crude oil consists of aggregating crude oil production through our pipeline gathering systems, which deliver crude oil to a combination of other pipelines, rail and truck.

We continually seek new supplies of natural gas and crude oil, both to offset the natural decline in production from connected wells and to increase throughput volumes. We obtain additional natural gas and crude oil supply in our operating areas by contracting for production from new wells or by capturing existing production currently gathered by others. Competition for new natural gas and crude oil supplies is based primarily on location of assets, commercial terms including pre-existing contracts, service levels and access to markets. The commercial terms of natural gas gathering and processing arrangements and crude oil gathering are driven, in part, by capital costs, which are impacted by the proximity of systems to the supply source and by operating costs, which are impacted by operational efficiencies, facility design and economies of scale.

The Gathering and Processing segment’s assets are located in the Permian Basin of West Texas and Southeast New Mexico (including the Midland, Central and Delaware Basins); the Eagle Ford Shale in South Texas; the Barnett Shale in North Texas; the Anadarko, Ardmore, and Arkoma Basins in Oklahoma (including the SCOOP and STACK) and South Central Kansas; the Williston Basin in North Dakota (including the Bakken and Three Forks plays) and in the onshore and near offshore regions of the Louisiana Gulf Coast and the Gulf of Mexico. The natural gas processed in this segment is supplied through our gathering systems which, in aggregate, consist of approximately 31,000 miles of natural gas pipelines and include 52 owned and operated processing plants.

10

The Gathering and Processing segment’s operations consist of (i) Permian Midland and Permian Delaware (also referred to as “Permian”), (ii) SouthTX, North Texas, SouthOK, WestOK (also referred to as “Central”), (iii) Coastal and (iv) Badlands, each as described below:

Permian Midland

The Permian Midland system consists of approximately 7,400 miles of natural gas gathering pipelines and 19 processing plants with an aggregate processing capacity of 3,589 MMcf/d, all located within the Permian Basin in West Texas. Eleven of these plants and approximately 5,200 miles of gathering pipelines belong to a joint venture (“WestTX”), in which we have an approximate 72.8% ownership. Pioneer Natural Resources (“Pioneer”), a major producer in the Permian Basin, owns the remaining interest in the WestTX system.

In response to increasing production and to meet the infrastructure needs of producers, we are constructing the Greenwood II plant, a new 275 MMcf/d cryogenic natural gas plant, which is expected to begin operations in the fourth quarter of 2024.

Permian Delaware

The Permian Delaware system consists of approximately 7,200 miles of natural gas gathering pipelines and 16 processing plants with an aggregate capacity of 3,055 MMcf/d, within the Delaware Basin and Central Basin in West Texas and Southeastern New Mexico.

In response to increasing production and to meet the infrastructure needs of producers, we are constructing the Bull Moose plant, a new 275 MMcf/d cryogenic natural gas processing plant, which is expected to begin operations in the second quarter of 2025. Additionally, we are transferring an existing cryogenic natural gas processing plant to Permian Delaware, which will be installed as a new 230 MMcf/d Roadrunner II plant, and is expected to begin operations in the second quarter of 2024.

SouthTX

The South Texas system contains approximately 2,100 miles of high-pressure and low-pressure gathering and transmission pipelines and three natural gas processing plants in the Eagle Ford Shale with an aggregate processing capacity of 660 MMcf/d. The South Texas system processes natural gas through the Silver Oak I, Silver Oak II and Raptor gas processing plants.

For most of 2023, we owned a 50% interest in Carnero G&P LLC (“Carnero”). Carnero owns and Targa operates the Silver Oak II plant, the Raptor plant and approximately 50 miles of high-pressure gathering pipeline located in La Salle, Dimmitt and Webb Counties, Texas which connects Mesquite Energy Inc.’s Catarina Ranch gathering system and Comanche Ranch acreage to the Raptor plant. In December 2023, we completed the acquisition of the remaining 50% membership interest in Carnero from our joint venture partner for cash consideration of $27.0 million.

North Texas

North Texas includes the Chico gathering system in the Fort Worth Basin, which gathers gas from the Barnett Shale and Marble Falls plays for processing at the Chico plant with a processing capacity of 265 MMcf/d. The system consists of approximately 4,700 miles of pipelines gathering wellhead natural gas.

SouthOK

The SouthOK gathering system is located in the Ardmore and Anadarko Basins and includes the Golden Trend, SCOOP, and Woodford Shale areas of southern Oklahoma. The gathering system consists of approximately 1,600 miles of pipelines in 12 counties.

The SouthOK system includes five separate processing plants with an aggregate processing capacity of 630 MMcf/d, including: the Stonewall, Hickory Hills and Tupelo facilities, which are owned by our Centrahoma Joint Venture, and our wholly-owned Velma and Velma V-60 plants. We have a 60% ownership interest in Centrahoma. The remaining 40% ownership interest in Centrahoma is held by MPLX, LP.

WestOK

The WestOK gathering system is located in north central Oklahoma and southern Kansas’ Anadarko Basin and includes the Woodford shale and the STACK. The gathering system consists of approximately 6,600 miles of pipelines in 14 counties.

11

The WestOK system has an aggregate processing capacity of 400 MMcf/d with two separate cryogenic natural gas processing plants known as the Waynoka I and Waynoka II facilities.

Coastal

Our Coastal assets, located in and offshore Louisiana, gather and process natural gas produced from shallow-water central and western Gulf of Mexico natural gas wells and from deep shelf and deep-water Gulf of Mexico production via connections to third-party pipelines or through pipelines owned by us. The Coastal system has an aggregate processing capacity of 2,025 MMcf/d and 11 MBbl/d of integrated fractionation capacity, and consists of approximately 1,000 miles of onshore gathering system pipelines, and approximately 100 miles of offshore gathering system pipelines. The processing plants are comprised of three wholly-owned and operated plants, one partially owned and operated plant, and one partially owned, non-operated plant. Our Coastal plants have access to markets across the U.S. through the interstate natural gas pipelines to which they are interconnected. The industry continues to rationalize gas processing capacity along the western Louisiana Gulf Coast with most of the producer volumes going to more efficient plants, such as our Lowry and Gillis plants.

Badlands

Our Badlands operations are located in the Bakken and Three Forks Shale plays of the Williston Basin in North Dakota and include approximately 500 miles of crude oil gathering pipelines, 120 MBbl of operational crude oil storage capacity at the Johnsons Corner Terminal, 30 MBbl of operational crude oil storage capacity at the Alexander Terminal, 30 MBbl of operational crude oil storage at New Town and 25 MBbl of operational crude oil storage at Stanley. The Badlands assets also include approximately 300 miles of natural gas gathering pipelines and the Little Missouri I-III natural gas processing plants, which have a processing capacity of 90 MMcf/d. Additionally, Targa operates the 200 MMcf/d Little Missouri 4 plant (“LM4 plant”), in which Targa Badlands and Hess Midstream Partners LP each own a 50% interest. Targa owns 55% of Targa Badlands through a joint venture with Blackstone Credit and Blackstone Tactical Opportunities (collectively, “Blackstone”). The joint venture is a consolidated subsidiary and its financial results and related statistics are presented on a gross basis. Targa Badlands pays a minimum quarterly distribution (“MQD”) to Blackstone and Targa, with Blackstone having a priority right to the MQDs. Additionally, Blackstone’s capital contributions have a liquidation preference upon a sale of Targa Badlands. Targa Badlands is a discrete entity and the assets and credit of Targa Badlands are not available to satisfy the debts and other obligations of Targa or its other subsidiaries.

The following table lists the Gathering and Processing segment’s processing plants and related volumes for the year ended December 31, 2023:

12

Facility |

|

Process |

|

Operated |

|

% Owned |

|

|

Location |

|

Processing |

|

|

Plant |

|

|

NGL |

|

||||

Permian Midland |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Consolidator (6) |

|

Cryo |

|

Operated |

|

|

72.8 |

|

|

Reagan County, TX |

|

|

150.0 |

|

|

|

|

|

|

|

||

Midkiff (6) |

|

Cryo |

|

Operated |

|

|

72.8 |

|

|

Reagan County, TX |

|

|

70.0 |

|

|

|

|

|

|

|

||

Driver (6) |

|

Cryo |

|

Operated |

|

|

72.8 |

|

|

Midland County, TX |

|

|

220.0 |

|

|

|

|

|

|

|

||

Benedum (6) |

|

Cryo |

|

Operated |

|

|

72.8 |

|

|

Upton County, TX |

|

|

45.0 |

|

|

|

|

|

|

|

||

Edward (6) |

|

Cryo |

|

Operated |

|

|

72.8 |

|

|

Upton County, TX |

|

|

220.0 |

|

|

|

|

|

|

|

||

Buffalo (6) |

|

Cryo |

|

Operated |

|

|

72.8 |

|

|

Martin County, TX |

|

|

220.0 |

|

|

|

|

|

|

|

||

Joyce (6) |

|

Cryo |

|

Operated |

|

|

72.8 |

|

|

Upton County, TX |

|

|

220.0 |

|

|

|

|

|

|

|

||

Johnson (6) |

|

Cryo |

|

Operated |

|

|

72.8 |

|

|

Midland County, TX |

|

|

220.0 |

|

|

|

|

|

|

|

||

Hopson (6) |

|

Cryo |

|

Operated |

|

|

72.8 |

|

|

Midland County, TX |

|

|

275.0 |

|

|

|

|

|

|

|

||

Pembrook (6) |

|

Cryo |

|

Operated |

|

|

72.8 |

|

|

Upton County, TX |

|

|

275.0 |

|

|

|

|

|

|

|

||

Gateway (6) |

|

Cryo |

|

Operated |

|

|

72.8 |

|

|

Reagan County, TX |

|

|

275.0 |

|

|

|

|

|

|

|

||

Mertzon |

|

Cryo |

|

Operated |

|

|

100.0 |

|

|

Irion County, TX |

|

|

52.0 |

|

|

|

|

|

|

|

||

Sterling |

|

Cryo |

|

Operated |

|

|

100.0 |

|

|

Sterling County, TX |

|

|

92.0 |

|

|

|

|

|

|

|

||

Tarzan (7) |

|

Cryo |

|

Operated |

|

|

100.0 |

|

|

Martin County, TX |

|

|

10.0 |

|

|

|

|

|

|

|

||

High Plains |

|

Cryo |

|

Operated |

|

|

100.0 |

|

|

Midland County, TX |

|

|

220.0 |

|

|

|

|

|

|

|

||

Heim (8) |

|

Cryo |

|

Operated |

|

|

100.0 |

|

|

Reagan County, TX |

|

|

200.0 |

|

|

|

|

|

|

|

||

Legacy (8) |

|

Cryo |

|

Operated |

|

|

100.0 |

|

|

Midland County, TX |

|

|

275.0 |

|

|

|

|

|

|

|

||

Legacy II (8) (9) |

|

Cryo |

|

Operated |

|

|

100.0 |

|

|

Midland County, TX |

|

|

275.0 |

|

|

|

|

|

|

|

||

Greenwood (8) (9) |

|

Cryo |

|

Operated |

|

|

100.0 |

|

|

Midland County, TX |

|

|

275.0 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Area Total |

|

|

3,589.0 |

|

|

|

2,535.2 |

|

|

|

367.7 |

|

|

Permian Delaware |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Eunice |

|

Cryo |

|

Operated |

|

|

100.0 |

|

|

Lea County, NM |

|

|

110.0 |

|

|

|

|

|

|

|

||

Monument (10) |

|

Cryo |

|

Operated |

|

|

100.0 |

|

|

Lea County, NM |

|

|

85.0 |

|

|

|

|

|

|

|

||

Loving |

|

Cryo |

|

Operated |

|

|

100.0 |

|

|

Loving County, TX |

|

|

70.0 |

|

|

|

|

|

|

|

||

Oahu |

|

Cryo |

|

Operated |

|

|

100.0 |

|

|

Pecos County, TX |

|

|

60.0 |

|

|

|

|

|

|

|

||

Wildcat |

|

Cryo |

|

Operated |

|

|

100.0 |

|

|

Winkler County, TX |

|

|

250.0 |

|

|

|

|

|

|

|

||

Falcon |

|

Cryo |

|

Operated |

|

|

100.0 |

|

|

Culberson County, TX |

|

|

275.0 |

|

|

|

|

|

|

|

||

Peregrine |

|

Cryo |

|

Operated |

|

|

100.0 |

|

|

Culberson County, TX |

|

|

275.0 |

|

|

|

|

|

|

|

||

Roadrunner |

|

Cryo |

|

Operated |

|

|

100.0 |

|

|

Eddy County, NM |

|

|

230.0 |

|

|

|

|

|

|

|

||

Red Hills I |

|

Cryo |

|

Operated |

|

|

100.0 |

|

|

Lea County, NM |

|

|

60.0 |

|

|

|

|

|

|

|

||

Red Hills II |

|

Cryo |

|

Operated |

|

|

100.0 |

|

|

Lea County, NM |

|

|

200.0 |

|

|

|

|

|

|

|

||

Red Hills III |

|

Cryo |

|

Operated |

|

|

100.0 |

|

|

Lea County, NM |

|

|

200.0 |

|

|

|

|

|

|

|

||

Red Hills IV |

|

Cryo |

|

Operated |

|

|

100.0 |

|

|

Lea County, NM |

|

|

230.0 |

|

|

|

|

|

|

|

||

Red Hills V |

|

Cryo |

|

Operated |

|

|

100.0 |

|

|

Lea County, NM |

|

|

230.0 |

|

|

|

|

|

|

|

||

Red Hills VI |

|

Cryo |

|

Operated |

|

|

100.0 |

|

|

Lea County, NM |

|

|

230.0 |

|

|

|

|

|

|

|

||

Midway (11) |

|

Cryo |

|

Operated |

|

|

100.0 |

|

|

Crane County, TX |

|

|

275.0 |

|

|

|

|

|

|

|

||

Wildcat II (12) |

|

Cryo |

|

Operated |

|

|

100.0 |

|

|

Winkler County, TX |

|

|

275.0 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Area Total |

|

|

3,055.0 |

|

|

|

2,526.5 |

|

|

|

321.6 |

|

|

SouthTX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Silver Oak I |

|

Cryo |

|

Operated |

|

|

100.0 |

|

|

Bee County, TX |

|

|

200.0 |

|

|

|

|

|

|

|

||

Silver Oak II |

|

Cryo |

|

Operated |

|

|

100.0 |

|

|

Bee County, TX |

|

|

200.0 |

|

|

|

|

|

|

|

||

Raptor (7) |

|

Cryo |

|

Operated |

|

|

100.0 |

|

|

La Salle County, TX |

|

|

260.0 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Area Total |

|

|

660.0 |

|

|

|

367.4 |

|

|

|

40.9 |

|

|

North Texas |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Chico |

|

Cryo |

|

Operated |

|

|

100.0 |

|

|

Wise County, TX |

|

|

265.0 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Area Total |

|

|

265.0 |

|

|

|

205.9 |

|

|

|

24.0 |

|

|

SouthOK |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Stonewall |

|

Cryo |

|

Operated |

|

|

60.0 |

|

|

Coal County, OK |

|

|

200.0 |

|

|

|

|

|

|

|

||

Tupelo |

|

Cryo |

|

Operated |

|

|

60.0 |

|

|

Coal County, OK |

|

|

120.0 |

|

|

|

|

|

|

|

||

Hickory Hills |

|

Cryo |

|

Operated |

|

|

60.0 |

|

|

Hughes County, OK |

|

|

150.0 |

|

|

|

|

|

|

|

||

Velma |

|

Cryo |

|

Operated |

|

|

100.0 |

|

|

Stephens County, OK |

|

|

100.0 |

|

|

|

|

|

|

|

||

Velma V-60 (7) |

|

Cryo |

|

Operated |

|

|

100.0 |

|

|

Stephens County, OK |

|

|

60.0 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Area Total |

|

|

630.0 |

|

|

|

385.0 |

|

|

|

43.1 |

|

|

WestOK |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Waynoka I |

|

Cryo |

|

Operated |

|

|

100.0 |

|

|

Woods County, OK |

|

|

200.0 |

|

|

|

|

|

|

|

||

Waynoka II |

|

Cryo |

|

Operated |

|

|

100.0 |

|

|

Woods County, OK |

|

|

200.0 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Area Total |

|

|

400.0 |

|

|

|

207.1 |

|

|

|

12.5 |

|

|

Coastal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Gillis (13) |

|

Cryo |

|

Operated |

|

|

100.0 |

|

|

Calcasieu Parish, LA |

|

|

180.0 |

|

|

|

|

|

|

|

||

Big Lake (7) |

|

Cryo |

|

Operated |

|

|

100.0 |

|

|

Calcasieu Parish, LA |

|

|

180.0 |

|

|

|

|

|

|

|

||

VESCO |

|

Cryo |

|

Operated |

|

|

76.8 |

|

|

Plaquemines Parish, LA |

|

|

750.0 |

|

|

|

|

|

|

|

||

Lowry |

|

Cryo |

|

Operated |

|

|

100.0 |

|

|

Cameron Parish, LA |

|

|

265.0 |

|

|

|

|

|

|

|

||

Sea Robin |

|

Cryo |

|

Non-operated |

|

|

1.2 |

|

|

Vermillion Parish, LA |

|

|

650.0 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Area Total |

|

|

2,025.0 |

|

|

|

541.1 |

|

|

|

39.2 |

|

|

Badlands |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Little Missouri I-III (14) |

|

Cryo/RA |

|

Operated |

|

|

55.0 |

|

|

McKenzie County, ND |

|

|

90.0 |

|

|

|

|

|

|

|

||

Little Missouri IV |

|

Cryo |

|

Operated |

|

|

27.5 |

|

|

McKenzie County, ND |

|

|

200.0 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Area Total |

|

|

290.0 |

|

|

|

130.0 |

|

|

|

15.5 |

|

|

|

|

|

|

|

|

|

|

|

Segment System Total |

|

|

10,914.0 |

|

|

|

6,898.2 |

|

|

|

864.5 |

|

|

13

Logistics and Transportation Segment

Our Logistics and Transportation segment is also referred to as our Downstream Business. Our Downstream Business includes the activities and assets necessary to transport and convert mixed NGLs into NGL products and also includes other assets and value-added services described below. The Logistics and Transportation segment includes Grand Prix and associated assets, which are generally connected to and supplied in part by our Gathering and Processing segment. These assets are located predominantly in Mont Belvieu and Galena Park, Texas, and in Lake Charles, Louisiana. Our fractionation, pipeline transportation, storage and terminaling businesses include approximately 2,300 miles of company-owned pipelines to transport mixed NGLs and specification products.

The Logistics and Transportation segment also transports, distributes, purchases and sells and markets NGLs via terminals and transportation assets across the U.S. We own or market products at terminal facilities in a number of states, including Alabama, Arizona, California, Florida, Indiana, Kentucky, Louisiana, Mississippi, New Jersey, North Carolina, Pennsylvania, Tennessee, Texas and Washington. The geographic diversity of our assets provides direct access to many NGL customers as well as markets via trucks, barges, ships, rail cars and open-access regulated NGL pipelines owned by third parties.

Transportation Pipelines

Our primary pipeline asset is Grand Prix, which connects our gathering and processing positions throughout the Permian Basin, North Texas, and Southern Oklahoma (as well as third-party positions) to our fractionation and storage complex in the NGL market hub at Mont Belvieu, Texas. Grand Prix transports NGLs from the Permian Basin on a 24-inch diameter pipeline, which can transport 600 MBbl/d, and from North Texas and South and Central Oklahoma via a pipeline of varying capacity, which both connect to a 30-inch diameter segment into Mont Belvieu, which is expandable to 1,000 MBbl/d. In January 2023, we announced and closed on the Grand Prix Transaction. Following the closing of the Grand Prix Transaction, we own 100% of Grand Prix.

We are constructing the Daytona NGL Pipeline as an addition to Grand Prix. The pipeline will transport NGLs from the Permian Basin and connect to the 30-inch diameter segment of Grand Prix in North Texas, where volumes will be transported to our fractionation and storage complex in the NGL market hub at Mont Belvieu, Texas. The Daytona NGL Pipeline is expected to be in service in the fourth quarter of 2024.

Through our 50% ownership interest in Cayenne Pipeline, LLC (“Cayenne”), we operate the Cayenne pipeline, which transports mixed NGLs from VESCO in Venice, Louisiana, to an interconnection with a third-party NGL pipeline in Toca, Louisiana.

Fractionation

After being extracted in the field, mixed NGLs are typically transported to a centralized facility for fractionation where the mixed NGLs are separated into discrete NGL products: ethane, ethane-propane mix, propane, normal butane, iso-butane and natural gasoline.

We believe that sufficient volumes of mixed NGLs will be available for fractionation in commercially viable quantities for the foreseeable future due to historical increases in NGL production from shale plays and other shale-technology-driven resource plays in areas of the U.S. that include Texas, New Mexico, Oklahoma and the Rockies and certain other basins accessed by pipelines to Mont

14

Belvieu, as well as from conventional production of NGLs in areas such as the Permian Basin, Mid-Continent, East Texas, South Louisiana and shelf and deep-water Gulf of Mexico.

Although competition for NGL fractionation services is primarily based on the fractionation fee, the ability of an NGL fractionator to obtain mixed NGLs and distribute NGL products is also an important competitive factor. This ability is a function of the existence of storage infrastructure and supply and market connectivity necessary to conduct such operations. We believe that the location, scope and capability of our logistics assets, including our transportation and distribution systems, give us access to both substantial sources of mixed NGLs and a large number of end-use markets.

At our Mont Belvieu operated facility, we have eight fractionation trains, representing an aggregate capacity of 843.0 MBbl/d, including: (i) five fractionation trains with an aggregate capacity of 493.0 MBbl/d that are part of our 88%-owned Cedar Bayou Fractionators, (ii) Train 6, a 110 MBbl/d fractionation train, which is wholly-owned by Targa, (iii) Train 7, a 120 MBbl/d fractionation train, a joint venture between Targa and the Williams Companies, Inc., in which Targa owns an 80% equity interest, and (iv) Train 8, a 120 MBbl/d fractionation train, which is wholly-owned by Targa. Certain fractionation-related infrastructure for Train 7, such as storage caverns and brine handling, were funded and are owned 100% by Targa. Our fractionation trains are fully integrated with our existing Gulf Coast NGL storage, terminaling and delivery infrastructure, which includes an extensive network of connections to key petrochemical and industrial customers as well as our LPG export terminal at Galena Park on the Houston Ship Channel.

We are also constructing Train 9 and Train 10, each 120 MBbl/d fractionation trains, at our Mont Belvieu operated facility, which are expected to begin operations in the second quarter of 2024 and the first quarter of 2025, respectively.

We additionally have a wholly-owned and operated fractionation facility in Lake Charles, Louisiana, representing a capacity of 55.0 MBbl/d.

In addition to our operated facilities, we hold an equity investment in GCF, also located at Mont Belvieu. In January 2021, the GCF facility was temporarily idled. We assumed operatorship of GCF in the first half of 2021. In January 2023, we reached an agreement with our partners to reactivate the GCF facility. The facility is expected to be operational in the second quarter of 2024.

We also own fractionation assets in Monument, New Mexico, and Gillis, Louisiana, which are included in our Gathering and Processing segment. In addition, we have a natural gasoline hydrotreater at Mont Belvieu, Texas, with a capacity of 35.0 MBbl/d that removes sulfur from natural gasoline, allowing customers to meet stringent fuel content standards.

The following table details the Logistics and Transportation segment’s fractionation and treating facilities:

Facility |

|

Location |

|

% Owned |

|

|

Capacity |

|

|

Throughput 2023 (MBbl/d) |

|

|||

Cedar Bayou Fractionators (2) |

|

Mont Belvieu, TX |

|

|

88.0 |

|

|

|

493.0 |

|

|

|

|

|

Train 6 Fractionator |

|

Mont Belvieu, TX |

|

|

100.0 |

|

|

|

110.0 |

|

|

|

|

|

Train 7 Fractionator |

|

Mont Belvieu, TX |

|

|

80.0 |

|

|

|

120.0 |

|

|

|

|

|

Train 8 Fractionator |

|

Mont Belvieu, TX |

|

|

100.0 |

|

|

|

120.0 |

|

|

|

|

|

Lake Charles Fractionator (3) |

|

Lake Charles, LA |

|

|

100.0 |

|

|

|

55.0 |

|

|

|

|

|

Fractionation Total |

|

|

|

|

|

|

|

898.0 |

|

|

|

798.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Gulf Coast Fractionator (4) |

|

Mont Belvieu, TX |

|

|

38.8 |

|

|

|

135.0 |

|

|

|

— |

|

Targa LSNG Hydrotreater |

|

Mont Belvieu, TX |

|

|

100.0 |

|

|

|

35.0 |

|

|

|

35.1 |

|

NGL Storage and Terminaling

In general, our NGL storage assets provide warehousing of mixed NGLs, NGL products and petrochemical products in underground wells, which allows for the injection and withdrawal of such products at various times in order to meet supply and demand cycles. Similarly, our terminaling operations provide the inbound/outbound logistics and warehousing of mixed NGLs, NGL products and petrochemical products in above-ground storage tanks. Our NGL underground storage and terminaling facilities serve single markets, such as propane, as well as multiple products and markets. For example, the Mont Belvieu and Galena Park facilities have extensive pipeline connections for mixed NGL supply and delivery of component NGLs, including Grand Prix. In addition, some of our facilities are connected to marine, rail and truck loading and unloading facilities that provide services and products to our customers. We provide long and short-term storage and terminaling services and throughput capability to third-party customers for a fee.

15

Across the Logistics and Transportation segment, we own 34 storage wells at our facilities with a gross NGL storage capacity of approximately 77 MMBbl and operate seven non-owned wells. The usage of these wells may be limited by brine handling capacity, which is utilized to displace NGLs from storage.

We operate our storage and terminaling facilities to support our key fractionation facilities at Mont Belvieu and Lake Charles for receipt of mixed NGLs and storage of fractionated NGLs to service the petrochemical, refinery, export and heating customers/markets as well as our wholesale domestic terminals that focus on logistics to service the heating market customer base. Our international export assets include our facilities at both Mont Belvieu and the Galena Park Marine Terminal near Houston, Texas, which have the capability to load propane, butanes and international grade low ethane propane. The export facilities have an effective export capacity of approximately 13.5 MMBbl per month, subject to a mix of propane and butane demand, vessel size and availability of supply, and a variety of other factors. We have the capability to load VLGC vessels, alongside small and medium sized export vessels. We continue to experience demand growth for U.S.-based NGLs (both propane and butane) for export into international markets.

The following table details the Logistics and Transportation segment’s NGL storage and terminaling facilities:

Facility |

|

% Owned |

|

Location |

|

Description |

|

Throughput for 2023 (MMgal) |

|

|

Number of Operational Wells |

|

Storage Capacity (MMBbl) |

|

||

Galena Park Marine Terminal (1) |

|

100 |

|

Harris County, TX |

|

NGL import/export terminal |

|

|

7,173.8 |

|

|

N/A |

|

|

0.7 |

|

Mont Belvieu Terminal & Storage |

|

100 |

|

Chambers County, TX |

|

Transport and storage terminal |

|

|

31,995.5 |

|

|

22 |

(2) |

|

54.9 |

|

Hackberry Terminal & Storage |

|

100 |

|

Cameron Parish, LA |

|

Storage terminal |

|

|

831.0 |

|

|

12 |

(3) |

|

22.5 |

|

NGL Distribution and Marketing

We market our own NGL production and also purchase component NGL products from other NGL producers and marketers for resale. We also purchase product for resale in our Logistics and Transportation segment.

We generally purchase mixed NGLs at a monthly pricing index less applicable fractionation, transportation and marketing fees and resell these component products to petrochemical manufacturers, refiners and other marketing and retail companies. This is primarily a physical settlement business in which we earn margins from purchasing and selling NGL products from customers under contract. We also earn margins by purchasing and reselling NGL products in the spot and forward physical markets.

Wholesale Domestic Marketing

Our wholesale domestic propane marketing operations primarily sell propane and related logistics services to major multi-state retailers, independent retailers and other end-users. Our propane supply originates from both our refinery/gas supply contracts and our other owned or managed Logistics and Transportation assets. We sell propane at a fixed posted price or at a market index basis at the time of delivery and in some circumstances, we earn margins on a netback basis.

The wholesale domestic propane marketing business is significantly impacted by seasonal and weather-driven demand, particularly in the winter, which can impact the price and volume of propane sold in the markets we serve.

Refinery Services

In our refinery services business, we typically provide NGL balancing services through contractual arrangements with refiners in several locations to purchase and/or market propane and to supply butanes. We use our commercial transportation assets (discussed below) and contract for and use the storage, transportation and distribution assets included in our Logistics and Transportation segment to assist refinery customers in managing their NGL product demand and production schedules. This includes both feedstocks consumed in refinery processes and the excess NGLs produced by other refining processes. Under typical netback purchase contracts, we retain a portion of the resale price of NGL sales or receive a fixed minimum fee per gallon on products sold. Under netback sales contracts, fees are earned for locating and supplying NGL feedstocks to the refineries based on a percentage of the cost to obtain such supply or a minimum fee per gallon.

Key factors impacting the results of our refinery services business include production volumes, prices of propane and butanes, as well as our ability to perform receipt, delivery and transportation services in order to meet refinery demand.

16

Commercial Transportation

Our NGL transportation and distribution infrastructure includes a wide range of assets supporting both third-party customers and the delivery requirements of our marketing and asset management business. We provide fee-based transportation services to refineries and petrochemical companies throughout the Gulf Coast area. Our assets are also deployed to serve our wholesale domestic distribution terminals, fractionation facilities, underground storage facilities and pipeline injection terminals. These distribution assets provide a variety of ways to transport products to and from our customers.

As of December 31, 2023, we lease and manage 605 railcars and 137 tractors, and own 12 tractors, six vacuum trucks, and two pressurized NGL barges.

The following table details the Logistics and Transportation segment’s propane terminaling facilities:

Facility |

|

% Owned |

|

|

Location |

|

Description |

|

Throughput |

|

|

Usable Storage |

|

|||

Greenville Terminal |

|

|

100 |

|

|

Washington County, MS |

|

Marine propane terminal |

|

|

15.3 |

|

|

|

1.5 |

|

Port Everglades Terminal |

|

|

100 |

|

|

Broward County, FL |

|

Marine propane terminal |

|

|

22.8 |

|

|

|

1.6 |

|

Calvert City Terminal |

|

|

100 |

|

|

Marshall County, KY |

|

Propane terminal |

|

|

16.3 |

|

|

|

0.1 |

|

Chattanooga Terminal |

|

|

100 |

|

|

Hamilton County, TN |

|

Propane terminal |

|

|

12.3 |

|

|

|

0.9 |

|

Hattiesburg Terminal (2) |

|

|

50 |

|

|

Forrest County, MS |

|

Propane terminal |

|

|

373.8 |

|

|

|

190.1 |

|

Sparta Terminal |

|

|

100 |

|

|

Sparta County, NJ |

|

Propane terminal |

|

|

11.6 |

|

|

|

0.2 |

|

Tyler Terminal |

|

|

100 |

|

|

Smith County, TX |

|

Propane terminal |

|

|

5.3 |

|

|

|

0.2 |

|

Winona Terminal |

|

|

100 |

|

|

Flagstaff County, AZ |

|

Propane terminal |

|

|

17.8 |

|

|

|

0.3 |

|

Eagle Lake Transload (3) |

|

|

100 |

|

|

Polk County, FL |

|

Propane transload |

|

|

7.0 |

|

|

|

— |

|

Indianapolis Transload (3) |

|

|

100 |

|

|

Marion County, IN |

|

Propane transload |

|

|

0.1 |

|

|

|

— |

|

Natural Gas Marketing

We also market natural gas available to us from the Gathering and Processing segment, purchase and resell natural gas in selected U.S. markets and manage the scheduling and logistics for these activities.

Seasonality

Parts of our business are impacted by seasonality. Our Downstream marketing business can be significantly impacted by seasonal and weather-driven demand, which can impact the price and volume of product sold in the markets we serve, as well as the level of inventory we hold in order to meet anticipated demand. See further discussion of the extent to which our business is affected by seasonality in “Item 1A. Risk Factors.”

Operational Risks and Insurance

We are subject to all risks inherent in the midstream natural gas, NGLs and crude oil businesses. These risks include, but are not limited to, explosions, fires, mechanical failure, cyber-attacks, terrorist attacks, product spillage, weather, nature and inadequate maintenance of rights of way. These risks could result in damage to or destruction of operating assets and other property, or could result in personal injury, loss of life or environmental pollution, as well as curtailment or suspension of operations at the affected facility. We maintain, on behalf of ourselves and our subsidiaries, general public liability, property, boiler and machinery and business interruption insurance in amounts that we consider to be appropriate for such risks. Such insurance is subject to deductibles or self-insured retentions that we consider reasonable and not excessive given the current insurance market environment.

The occurrence of a significant loss that is not insured, fully insured or indemnified against, or the failure of a party to meet its indemnification obligations, could materially and adversely affect our operations and financial condition. While we currently maintain levels and types of insurance that we believe to be prudent under current insurance industry market conditions, our inability to secure these levels and types of insurance in the future could negatively impact our business operations and financial stability, particularly if an uninsured loss were to occur. No assurance can be given that we will be able to maintain these levels of insurance in the future at rates considered commercially reasonable, particularly named windstorm coverage and contingent business interruption coverage for our onshore operations, and potentially excess liability insurance given the current insurance market environment.

17

Competition

We face strong competition in acquiring new natural gas or crude oil supplies. Competition for natural gas and crude oil supplies is primarily based on the location and available capacity of gathering and processing facilities, pricing arrangements, reputation, efficiency, flexibility, treating capabilities (as applicable), reliability and access to end-use markets or liquid marketing hubs. Our gathering and processing operations competitors are other natural gas gatherers and processors, such as major interstate and intrastate pipeline companies, master limited partnerships and oil and gas producers.

We also compete for NGL supplies for Grand Prix. Competition for NGL supplies is primarily based on the proximity of gathering and processing facilities in relation to one or more NGL pipelines, their connectivity to NGL pipeline takeaway options, access to end-use markets or liquid marketing hubs, pricing and contractual arrangements, available capacity, reputation, efficiency, flexibility, and reliability. Our NGL pipeline competitors are other midstream providers with NGL transportation capabilities, such as major interstate and intrastate pipeline companies, master limited partnerships and midstream natural gas and NGL companies.

Additionally, we face competition for mixed NGLs supplies at our fractionation facilities. The fractionators in which we own an interest in the Mont Belvieu region compete for volumes of mixed NGLs with other fractionators also located in the Mont Belvieu region. In addition, certain producers fractionate mixed NGLs for their own account in captive facilities. The fractionators in the Mont Belvieu region also compete on a more limited basis with fractionators in Conway, Kansas and a number of decentralized, smaller fractionation facilities in Texas, Louisiana and New Mexico. Our other fractionation facilities compete for mixed NGLs with the fractionators at Mont Belvieu as well as other fractionation facilities located in Louisiana. Our customers who are significant producers of mixed NGLs and NGL products or consumers of NGL products may develop their own fractionation facilities in lieu of using our services.

We also compete for NGL products to market through our Logistics and Transportation segment. Our competitors include major oil and gas producers who market NGL products for their own account and for others. Additionally, we compete with several other NGL marketing companies, trading organizations and petrochemical operators.

Human Capital

We believe that our employees are the foundation to fostering the safe operation of our assets and delivery of services to our customers. We foster a collaborative, inclusive, and safety-minded work environment, focused on working safely every day. We seek to identify qualified internal and external talent for our organization, enabling us to execute on our strategic objectives.

As of December 31, 2023, we employed approximately 3,182 people that primarily support our operations through a wholly-owned subsidiary of ours. None of these employees are covered by collective bargaining agreements, and we consider our employee relations to be good.

Employee Health and Safety

Safety is a core value of ours and begins with the protection and safety of our employees, contractors and communities where we operate. We value people above all else and remain committed to making safety and health our top priority. We believe that “Zero is Achievable”, and our goal is to operate and deliver our products without any injuries. We continually seek to maintain and deepen our safety culture by providing a safe working environment that encourages active employee engagement, including implementing safety programs to achieve improvements in our safety culture.

To protect our employees, contractors, and surrounding community from workplace hazards and risks, we implement and maintain an integrated system of policies, practices, and controls, including requirements to complete regular detailed safety and regulatory compliance training for all applicable individuals. For more information on the laws and regulations we are subject to with regard to employee, contractor, and community safety, please see our section below titled Environmental and Occupational Health and Safety Matters.

Employee Experience

We are committed to fostering a work environment in which all employees treat each other with dignity and respect. This commitment extends to providing equal employment and advancement opportunities based on merit and experience. We believe this to be a fundamental principle and is defined in our Equal Employment Opportunity Policy and our Code of Conduct.

18

Employee Talent Development and Retention

As a midstream infrastructure operator, we understand the importance of developing and fostering talent to ensure a skilled and talented diverse workforce both now and in the future. We value and provide opportunities for cross training and increased responsibilities, including leadership learning and formal coaching. These efforts allow us to recruit from within our organization for future vocational and occupational opportunities.

Our management promotes formal and informal learning and development throughout the organization. Candid feedback is provided to employees through our annual performance review process as well as informal meetings throughout the year.

We offer developmental programs focused on building the skills of our employees and to help advance employee careers, knowledge, and skillsets through training and related programs.

To help plan and predict succession needs, we perform annual succession planning, which is discussed and reviewed with management and, for certain levels and positions, with the board of directors. We additionally monitor employee turnover rates and conduct exit interviews with employees who voluntarily leave the company to better understand their reasons for leaving the company.