SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d ) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED SEPTEMBER 30, 2017

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM ___________ TO _____________.

Commission file number: 333-141907

| TAUTACHROME, INC. |

| (Exact name of registrant as specified in its charter) |

| Delaware | 20-5034780 | |

| (State or other Jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| 1846 e. Innovation Park Drive, Oro Valley, AZ 85755 |

| (Address of principal executive offices) |

| (520) 318-5578 |

| (Registrant’s telephone number, including area code) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | Smaller reporting company | x |

| (do not check if a smaller reporting company) |

| ||

Indicate by check mark whether the registrant is a shell company (as defined in rule 12b-2 of the Exchange Act). Yes o No x

The number of shares of the registrant’s common stock outstanding as of November 3, 2017, was 1,687,982,960.

TAUTACHROME, INC.

FORM 10-Q

|

| |||||

|

|

| 3 |

| ||

| Management’s Discussion And Analysis Of Financial Condition And Results Of Operations |

|

| 16 |

| |

|

|

| 25 |

| ||

|

|

| 25 |

| ||

|

| |||||

|

| |||||

|

|

| 26 |

| ||

|

|

| 26 |

| ||

|

|

| 26 |

| ||

|

|

| 26 |

| ||

|

|

| 26 |

| ||

|

|

| 26 |

| ||

|

|

| 26 |

| ||

|

|

| 28 |

| ||

| 2 |

PART I – FINANCIAL INFORMATION

ITEM 1 – CONSOLIDATED FINANCIAL STATEMENTS

TAUTACHROME, INC.

CONSOLIDATED BALANCE SHEETS

|

|

| 9/30/2017 |

|

| 12/31/2016 |

| ||

| ASSETS |

|

|

|

|

|

| ||

| Current assets: |

|

|

|

|

|

| ||

| Cash |

| $ | 3,624 |

|

| $ | 1,850 |

|

| Total current assets |

|

| 3,624 |

|

|

| 1,850 |

|

| TOTAL ASSETS |

| $ | 3,624 |

|

| $ | 1,850 |

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES |

|

|

|

|

|

|

|

|

| Accounts payable and accrued expenses |

| $ | 311,966 |

|

| $ | 275,760 |

|

| Accounts payable - related party |

|

| 15,555 |

|

|

| 25,486 |

|

| Loans from related parties |

|

| 101,175 |

|

|

| 99,434 |

|

| Convertible notes payable - related party |

|

| 59,160 |

|

|

| 49,160 |

|

| Short-term convertible notes payable, net |

|

| 681,279 |

|

|

| 583,674 |

|

| Short-term notes payable |

|

| 17,236 |

|

|

| 15,858 |

|

| Short-term portion of long-term debt |

|

| - |

|

|

| 11,034 |

|

| Court judgment liability |

|

| 54,000 |

|

|

| 2,382,374 |

|

| Total current liabilities |

|

| 1,240,371 |

|

|

| 3,442,780 |

|

|

|

|

|

|

|

|

|

|

|

| Long-term convertible notes payable, net |

|

| 67,318 |

|

|

| 87,528 |

|

| Long-term notes payable |

|

| - |

|

|

| 19,659 |

|

| Total non-current liabilities |

|

| 67,318 |

|

|

| 107,187 |

|

|

|

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES |

|

| 1,307,689 |

|

|

| 3,549,967 |

|

|

|

|

|

|

|

|

|

|

|

| STOCKHOLDERS' EQUITY (DEFICIT) |

|

|

|

|

|

|

|

|

| Series D Convertible Preferred, par value $0.0001. 13,795,104 shares authorized, 13,795,104 shares issued and outstanding at September 30, 2017 and December 31, 2016 |

|

| 1,380 |

|

|

| 1,380 |

|

| Common stock, $0.00001 par value. Four billion shares authorized. 1,687,982,960 and 1,672,789,717 shares issued and outstanding at September 30, 2017 and December 31, 2016, respectively |

|

| 16,880 |

|

|

| 16,728 |

|

| Additional paid in capital |

|

| 3,775,434 |

|

|

| 3,421,595 |

|

| Common stock payable |

|

| 10,586 |

|

|

| 10,586 |

|

| Accumulated deficit |

|

| (5,121,784 | ) |

|

| (7,081,154 | ) |

| Effect of foreign currency exchange |

|

| 13,439 |

|

|

| 82,748 |

|

| TOTAL STOCKHOLDERS' EQUITY |

|

| (1,304,065 | ) |

|

| (3,548,117 | ) |

|

|

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY |

| $ | 3,624 |

|

| $ | 1,850 |

|

The accompanying notes are an integral part of these consolidated financial statements.

| 3 |

| Table of Contents |

TAUTACHROME, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

|

|

| Nine Months |

|

| Three Months |

| ||||||||||

|

|

| 2017 |

|

| 2016 |

|

| 2017 |

|

| 2016 |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

| OPERATING EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

| ||||

| General and administrative |

| $ | 236,111 |

|

|

| 325,442 |

|

| $ | 31,596 |

|

|

| 102,062 |

|

| Depreciation, depletion and amortization |

|

| - |

|

|

| 92,862 |

|

|

| - |

|

|

| 33,345 |

|

| Total operating expenses |

|

| 236,111 |

|

|

| 418,304 |

|

|

| 31,596 |

|

|

| 135,407 |

|

| Operating loss |

|

| (236,111 | ) |

|

| (418,304 | ) |

|

| (31,596 | ) |

|

| (135,407 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER INCOME / (EXPENSE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gain on litigation |

|

| 2,372,668 |

|

|

| - |

|

|

| 2,372,668 |

|

|

| - |

|

| Interest expense |

|

| (177,187 | ) |

|

| (222,972 | ) |

|

| (46,712 | ) |

|

| (39,618 | ) |

| Total other |

|

| 2,195,481 |

|

|

| (222,972 | ) |

|

| 2,325,956 |

|

|

| (39,618 | ) |

| Net income (loss) |

| $ | 1,959,370 |

|

| $ | (641,276 | ) |

| $ | 2,294,360 |

|

| $ | (175,025 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER COMPREHENSIVE INCOME (LOSS) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Effect of foreign currency exchange |

|

| (69,309 | ) |

|

| (35,005 | ) |

|

| (16,914 | ) |

|

| (18,467 | ) |

| Net comprehensive income (loss) |

| $ | 1,890,061 |

|

| $ | (676,281 | ) |

| $ | 2,277,446 |

|

| $ | (193,492 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) or income per common share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

| $ | 0.00 |

|

| $ | 0.00 |

|

| $ | 0.00 |

|

| $ | 0.00 |

|

| Diluted |

| $ | 0.00 |

|

| $ | 0.00 |

|

| $ | 0.00 |

|

| $ | 0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

| 1,684,825,134 |

|

|

| 2,999,921,751 |

|

|

| 1,687,982,960 |

|

|

| 3,000,633,430 |

|

| Diluted |

|

| 1,828,761,881 |

|

|

| 2,999,921,751 |

|

|

| 1,866,629,731 |

|

|

| 3,000,633,430 |

|

The accompanying notes are an integral part of these consolidated financial statements.

| 4 |

| Table of Contents |

TAUTACHROME, INC.

CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY / (DEFICIT)

(Unaudited)

|

|

| Common Stock |

|

| Preferred |

|

| Additional Paid in |

|

| Stock |

|

| Other Comprehensive Income |

|

| Accumulated |

|

| Total Stockholders' Equity / |

| |||||||||||||||

|

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Capital |

|

| Payable |

|

| (Loss) |

|

| Deficit |

|

| (Deficit) |

| |||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

| Balance, 12/31/15 |

|

| 2,987,633,430 |

|

| $ | 29,876 |

|

|

| - |

|

| $ | - |

|

| $ | 1,539,442 |

|

| $ | - |

|

| $ | 81,301 |

|

| $ | (2,480,423 | ) |

| $ | (829,804 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Acquisition of Photosweep, LLC |

|

| 13,000,000 |

|

|

| 130 |

|

|

|

|

|

|

|

|

|

|

| 353,470 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 353,600 |

|

| Beneficial conversion feature of convertible notes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 335,799 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 335,799 |

|

| Common stock to preferred stock swap |

|

| (1,379,510,380 | ) |

|

| (13,795 | ) |

|

| 13,795,104 |

|

|

| 1,380 |

|

|

| 1,100,746 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1,088,331 |

|

| Conversion of debt |

|

| 51,666,667 |

|

|

| 517 |

|

|

|

|

|

|

|

|

|

|

| 60,104 |

|

|

| 10,586 |

|

|

|

|

|

|

|

|

|

|

| 71,207 |

|

| Effect of debt modifications |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 18,760 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 18,760 |

|

| Imputed interest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 13,274 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 13,274 |

|

| Effect of foreign currency exchange |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1,447 |

|

|

|

|

|

|

| 1,447 |

|

| Net loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (4,600,731 | ) |

|

| (4,600,731 | ) |

| Balance, 12/31/16 |

|

| 1,672,789,717 |

|

| $ | 16,728 |

|

|

| 13,795,104 |

|

|

| 1,380 |

|

| $ | 3,421,595 |

|

| $ | 10,586 |

|

| $ | 82,748 |

|

| $ | (7,081,154 | ) |

| $ | (3,548,117 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shares issued for conversion of debt |

|

| 8,493,243 |

|

|

| 85 |

|

|

|

|

|

|

|

|

|

|

| 54,080 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 54,165 |

|

| Shares issued for services |

|

| 6,700,000 |

|

|

| 67 |

|

|

|

|

|

|

|

|

|

|

| 84,262 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 84,329 |

|

| Beneficial conversion feature of convertible notes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 204,040 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 204,040 |

|

| Imputed interest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 11,457 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 11,457 |

|

| Effect of foreign currency exchange |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (69,309 | ) |

|

|

|

|

|

| (69,309 | ) |

| Net loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1,959,370 |

|

|

| 1,959,370 |

|

| Balance, 9/30/17 |

|

| 1,687,982,960 |

|

| $ | 16,880 |

|

|

| 13,795,104 |

|

| $ | 1,380 |

|

| $ | 3,775,434 |

|

| $ | 10,586 |

|

| $ | 13,439 |

|

| $ | (5,121,784 | ) |

| $ | (1,304,065 | ) |

The accompanying notes are an integral part of these consolidated financial statements.

| 5 |

| Table of Contents |

TAUTACHROME, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

|

|

| Nine Months |

| |||||

|

|

| 2017 |

|

| 2016 |

| ||

| CASH FLOWS FROM OPERATING ACTIVITIES |

|

|

|

|

|

| ||

| Net Loss |

| $ | 1,959,370 |

|

| $ | (641,276 | ) |

| Stock-based compensation |

|

| 84,329 |

|

|

| 92,862 |

|

| Gain on litigation |

|

| (2,372,668 | ) |

|

| - |

|

| Amortization of discounts on notes payable |

|

| 71,743 |

|

|

| 177,030 |

|

| Imputed interest |

|

| 11,457 |

|

|

| 10,655 |

|

|

|

|

|

|

|

|

|

|

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable and accrued expenses |

|

| 128,858 |

|

|

| 120,993 |

|

| Accounts payable - related party |

|

| 494 |

|

|

| 17,602 |

|

| Net cash used in operating activities |

|

| (116,417 | ) |

|

| (222,134 | ) |

|

|

|

|

|

|

|

|

|

|

| CASH FLOWS FROM INVESTING ACTIVITIES |

|

|

|

|

|

|

|

|

| Purchase of Photosweep, LLC |

|

| - |

|

|

| (39,000 | ) |

| Net cash used in investing activities |

|

| - |

|

|

| (39,000 | ) |

|

|

|

|

|

|

|

|

|

|

| CASH FLOWS FROM FINANCING ACTIVITIES |

|

|

|

|

|

|

|

|

| Proceeds from convertible notes payable |

|

| 208,040 |

|

|

| 223,510 |

|

| Principal payments on notes payable |

|

| (30,693 | ) |

|

| (884 | ) |

| Proceeds from related-party loan |

|

| 11,153 |

|

|

| 64,791 |

|

| Principal payments on related-party loans |

|

| (1,000 | ) |

|

| - |

|

| Net cash provided by financing activities |

|

| 187,500 |

|

|

| 287,417 |

|

|

|

|

|

|

|

|

|

|

|

| Effect of exchange rate changes on cash and cash equivalents |

|

| (69,309 | ) |

|

| (35,005 | ) |

|

|

|

|

|

|

|

|

|

|

| Net increase/(decrease) in cash |

|

| 1,774 |

|

|

| (8,722 | ) |

| Cash and equivalents - beginning of period |

|

| 1,850 |

|

|

| 15,428 |

|

| Cash and equivalents - end of period |

| $ | 3,624 |

|

| $ | 6,706 |

|

|

|

|

|

|

|

|

|

|

|

| SUPPLEMENTARY INFORMATION |

|

|

|

|

|

|

|

|

| Cash paid for interest |

| $ | 627 |

|

| $ | - |

|

| Cash paid for income taxes |

| $ | - |

|

| $ | - |

|

|

|

|

|

|

|

|

|

|

|

| SUPPLEMENTAL DISCLOSURES OF NON-CASH FINANCING TRANSACTIONS |

|

|

|

|

|

|

|

|

| Discounts on convertible notes |

| $ | 204,040 |

|

| $ | 249,054 |

|

| Common stock for Photosweep acquisition |

| $ | - |

|

| $ | 353,600 |

|

| Note modification |

| $ | - |

|

| $ | 23,812 |

|

| Conversions of principal and interest to equity |

| $ | 54,167 |

|

| $ | - |

|

| Note payable for trade payable |

| $ | - |

|

| $ | 34,250 |

|

The accompanying notes are an integral part of these consolidated financial statements.

| 6 |

| Table of Contents |

TAUTACHROME, INC.

NOTES TO UNAUDITED FINANCIAL STATEMENTS

SEPTEMBER 30, 2017

Note 1 – Organization and Nature of Business

History

Tautachrome, Inc. (formerly Roadships Holdings, Inc.) was formed in Delaware on June 5, 2006 as Caddystats, Inc. and hereinafter collectively referred to as “Tautachrome”, the “Company”, “we’ or “us”).

The Company adopted the accounting acquirer’s year end, December 31.

Our Business

The Company operates in the internet applications space, a space uniquely able to embrace fast growing and novel business. The iPhone, Google, Facebook, Amazon, Twitter, Android, Uber and numerous other examples are reminders of the ability of the internet applications space to surprise us with the arrival of wholly new business universes.

The Company is developing a system branded “KlickZie” aimed at turning smartphones, including iPhones, Android phones and other smartphones, into trustable imagers and advanced communicators. The pictures and videos from trustable imager will be able to be trusted to be the original, untampered, un-Photoshopped pictures and videos made by the smartphone, and in addition the pictures and videos themselves become advanced communicators, able to be used as living, trusted portals to communicate with others.

The KlickZie system concept consists of downloadable software able to securitize the imaging process in the smartphone, together with an advanced cloud system to authenticate KlickZie pictures and videos and to make possible imagery based communication among people who happen upon KlickZie pictures and videos.

Note 2 – Basis of Presentation and Summary of Significant Accounting Policies

Consolidated Financial Statements

In the opinion of management, the accompanying financial statements includes all adjustments (which include only normal recurring adjustments) necessary to present fairly the financial position, results of operations, and cash flows for the period ending September 30, 2017. Preparing financial statements requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, and expenses. Interim results are not necessarily indicative of results for a full year. The information included in this Form 10-Q should be read in conjunction with information included in our audited financial statements for the period ended December 31, 2016, as reported in Form 10-K filed with the Securities and Exchange Commission.

Management further acknowledges that it is solely responsible for adopting sound accounting practices, establishing and maintaining a system of internal accounting control and preventing and detecting fraud. The Company's system of internal accounting control is designed to assure, among other items, that 1) recorded transactions are valid; 2) valid transactions are recorded; and 3) transactions are recorded in the proper period in a timely manner to produce financial statements which present fairly the financial condition, results of operations and cash flows of the Company for the respective periods being presented.

| 7 |

| Table of Contents |

Principles of Consolidation

Our consolidated financial statements include the accounts of Tautachrome, Inc. and all majority-owned subsidiaries. All significant inter-company accounts and transactions are eliminated in consolidation.

Property, Plant and Equipment

We record our property plant and equipment at historical cost. The estimated useful lives of these assets range from three to seven years and are depreciated using the straight-line method over the asset’s useful life.

Long-Lived Assets, Intangible Assets and Impairment

In accordance with U.S. GAAP, the Company’s long-lived assets and amortizable intangible assets are tested for impairment whenever events or changes in circumstances indicate that their carrying value may not be recoverable. The Company assesses the recoverability of such assets by determining whether their carrying value can be recovered through undiscounted future operating cash flows, including its estimates of revenue driven by assumed market segment share and estimated costs. If impairment is indicated, the Company measures the amount of such impairment by comparing the fair value to the carrying value.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Net Loss Per Share

Basic and diluted net loss per share calculations are calculated on the basis of the weighted average number of common shares outstanding during the year. The per share amounts include the dilutive effect of common stock equivalents in years with net income. Basic and diluted loss per share is the same for the nine months ended September 30, 2017 and 2016 as the effect of our potential common stock equivalents would be anti-dilutive.

Recent Accounting Pronouncements

In January 2017, the FASB issued ASU No. 2017-04, “Intangibles-Goodwill and Other (Topic 350) - Simplifying the Test for Goodwill Impairment" (“ASU 2017-04”). The new standard simplifies the accounting for goodwill impairments by eliminating step 2 from the goodwill quantitative impairment test. Instead, if the carrying amount of a reporting unit exceeds its fair value, an impairment loss shall be recognized in an amount equal to that excess, limited to the total amount of goodwill allocated to that reporting unit. The standard is effective for interim and annual periods beginning after December 15, 2019 and early adoption is permitted. The Company early adopted ASU 2017-04 on January 1, 2017.

| 8 |

| Table of Contents |

Note 3 – Going Concern

We have not begun our core operations in the technology industry and have not yet acquired the assets to enter this markets and we will require additional capital to do so. There is no guarantee that we will acquire the capital to procure the assets to enter this markets or, upon doing so, that we will generate positive cash flows from operations. Substantial doubt exists as to Tautachrome’s ability to continue as a going concern. No adjustment has been made to these financial statements for the outcome of this uncertainty.

Note 4 – Related Party Transactions

For the year ended December 31, 2016, we had the following transactions with the Twenty Second Trust (the "Trust"), the trustee of whom is Sonny Nugent, the son of our major shareholder and former Chief Executive Officer, Micheal Nugent:

· We received $18,331 in cash loans to pay operating expenses and repaid no principal. · We accrued $4,400 in interest payable to the Trust and paid no interest payments. · The outstanding balance at December 31, 2016 to the 22nd Trust was $98,344 and $11,035 for principal and interest, respectively, after adjustments for foreign exchange effect.

For the nine months ended September 30, 2017, we received $153 in cash loans from the 22nd Trust. At September 30, 2017, we owed $100,085 and $14,778 in principal and interest to the Trust, respectively.

According to our agreement with Mr. Nugent, we accrue interest on all unpaid amounts at 5%. Principal and interest are callable at any time. If principal and interest are called and not repaid, the loan is considered in default after which interest is accrued at 10%.

Convertible note payable, related party

On May 5, 2013 (and on August 8, 2013 with an enlargement amendment) the Company entered into a no interest demand-loan agreement with our current Chairman, Jon N. Leonard under which the Company may borrow such money from Jon as Jon in his sole discretion is willing to loan.

The terms of the note provide that at the Company’s option, the Company may make repayments in stock, at a fixed share price of $1.00 per share. Also, because this loan is a no-interest loan an imputed interest expense of $3,345 was recorded as additional paid-in capital for the nine months ended September 30, 2017. The Company evaluated Dr. Leonard’s note for the existence of a beneficial conversion feature and determined that none existed.

During the nine months ended September 30, 2017, we received $11,000 in related-party loans from our Board Chairman and CEO, Dr. Jon Leonard, and repaid $1,000 in principal. At September 30, 2017, we owed Dr. Leonard $59,160.

| 9 |

| Table of Contents |

Note 5 – Capital

On January 15, 2016 we issued 13,000,000 common shares to acquire all of the members’ interests in Photosweep, LLC. We valued the common stock at the grant date fair value, and included this amount in our acquisition cost of $353,600, or $0.027 per share.

On January 1, 2016, we re-negotiated certain convertible promissory notes with certain creditors in order to remove the provisions in the notes which caused of a derivative liability. We recorded this renegotiation by removing the derivative liability at December 31, 2015 and recording an increase to Additional Paid in Capital of $18,760.

In October, 2016, we issued 51,666,667 common shares to convert $60,000 of convertible notes payable, and $604 in accrued interest, to common stock.

In November, 2016, we received a Notice of Conversion from a holder of a US Dollar denominated convertible promissory note requesting a conversion of the outstanding principal and interest into the convertible amount of 2,142,857 common shares . We recorded a reduction of principal and interest of $10,000 and $586 of accrued interest, respectively, and we recorded an offsetting common stock payable in the amount of $10,586.

During the nine months ended September 30, 2017, we issued 8,493,243 shares in conversion of two outstanding convertible promissory notes. We recorded a reduction of the balance of such notes of $37,822 and $15,959, respectively. We recognized no gain or loss on their conversions as they were converted within the terms of conversion.

During the nine months ended September 30, 2017, we issued 6,700,000 shares pursuant to our agreement with four consultants. We valued the shares at their grant-date fair values and recorded expense of $84,329.

At September 30, 2017 and December 31, 2016, we had 1,687,982,960 and 1,672,789,717 common shares issued and outstanding, respectively, from a total of four billion authorized.

Preferred Stock

On September 29, 2016, the Company’s principal shareholders (“Principals”), Dr. Jon N. Leonard, Micheal P. Nugent, and Matthew W. Staker, offered to retire 1,379,510,380 of their common shares in exchange for a new series of non-trading preferred shares.

On October 5, 2016, the Board of Directors voted to accept the share retirement offer, and on October 20, 2016, the Company filed a Certificate of Designations with the State of Delaware creating 13,795,104 shares of Series D Preferred Stock (the “Preferred Shares”) to effect the exchange.

Share Exchange ratio and Preservation of Voting Rights

In the share exchange, each principal received 1 Preferred Share for each 100 common shares retired. Each share of Preferred Shares entitles the holder to 100 votes (and each 1/100th of a Preferred Share entitles the holder to one vote).

| 10 |

| Table of Contents |

Conversion Rights

A holder may convert Preferred Shares to common under the following conditions:

Automatic conversion – each Preferred Share automatically converts to 100 common shares upon the earlier of

· The end of 5 years (5:00 PM EST, October 5, 2021), or · A change of control

Optional conversion - After October 5, 2017, each holder may convert each share into 100 shares of common stock immediately following a period of ten consecutive trading days during which the average closing or last sale price exceeds $3.00 per share. Also, each holder may convert into 110 shares of common stock at any time that the shares are listed on a National exchange (for example, the NYSE or NASDAQ).

Related-Party Stock Exchange

On October 27, 2016, the Company entered into the above outlined Share Exchange Agreement with related-parties

Common stock ownership structure immediately before and after execution of the Share Exchange Agreement was as follows:

|

|

| Common Stock Ownership |

| |||||||||||||||||

|

|

| Immediately Before |

|

| Effect of Agreement |

|

| Immediately After |

| |||||||||||

|

|

| Shares |

|

| % |

|

|

|

|

| Shares |

|

| % |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

| Jon Leonard, PhD |

|

| 1,387,829,545 |

|

|

| 46.5 | % |

|

| (1,009,330,578 | ) |

|

| 378,498,967 |

|

|

| 23.5 | % |

| Micheal Nugent |

|

| 620,756,473 |

|

|

| 20.8 | % |

|

| (92,613,893 | ) |

|

| 528,142,580 |

|

|

| 32.8 | % |

| Matthew Staker |

|

| 346,957,386 |

|

|

| 11.6 | % |

|

| (277,565,909 | ) |

|

| 69,391,477 |

|

|

| 4.3 | % |

| Robert McClelland |

|

| 8,403,524 |

|

|

| 0.3 | % |

|

| - |

|

|

| 8,403,524 |

|

|

| 0.5 | % |

| Patrick Greene |

|

| 2,093,080 |

|

|

| 0.1 | % |

|

| - |

|

|

| 2,093,080 |

|

|

| 0.1 | % |

| Non Affiliates |

|

| 621,593,422 |

|

|

| 20.8 | % |

|

| - |

|

|

| 621,593,422 |

|

|

| 38.7 | % |

| Totals |

|

| 2,987,633,430 |

|

|

| 100.0 | % |

|

| (1,379,510,380 | ) |

|

| 1,608,123,050 |

|

|

| 100.0 | % |

Imputed Interest

Certain of our promissory notes bear no nominal interest. We therefore imputed interest expense and increase Additional Paid in Capital. For the nine months ended September 30, 2017, we imputed $11,457 of such interest.

Beneficial Conversion Features

As discussed in Note 6, we issued certain promissory notes in the United States containing beneficial conversion features. During the nine months ended September 30, 2017, we recorded an increase in Additional Paid in Capital of $204,040. We account for these Beneficial Conversion Features as debt discounts and amortize using the Effective Interest Method.

| 11 |

| Table of Contents |

Note 6 – Debt

Loans from related parties

As is discussed in Note 4, we owed $174,023 in related-party debts consisting of $100,085 and $14,778 unpaid principal and interest, respectively, to the 22nd Trust and $59,160 owed to our CEO, Dr. Jon Leonard.

Convertible notes payable

During the year ended December 31, 2016, we borrowed $193,164 from 26 accredited investors in Australia. These promissory notes can be converted into shares of our common stock at the rate of AU$0.01 per share (the aggregate of which convertible shares for all outstanding Australian convertible notes at December 31, 2016 is 82,873,300). These notes are callable by the makers at any time and accrue interest at 5%. For the year ended December 31, 2016, we accrued $29,343 of interest on these notes and made no interest payments. We evaluated these notes for beneficial conversion features and calculated a value of $147,965, all of which has been immediately expensed as interest expense as the notes are due on demand.

Also during the year ended December 31, 2016, we issued four convertible promissory notes to four accredited investors in exchange for $109,758 in cash. These promissory notes can be converted into shares of our common stock at various separately-negotiated rates (the aggregate of which convertible shares for all outstanding USA convertible notes at December 31, 2016 is 28,473,915).

We evaluated these notes for beneficial conversion features and calculated a value of $77,852 which we are accounting for as debt discounts.

On January 1, 2016, we re-negotiated the eight U.S.-Dollar-denominated promissory notes that were outstanding at December 31, 2015, in order to remove the ratchet provisions which required that we account for those provisions as a derivative liability. The fair value of the derivative liability was the same at January 1, 2016 as it was on December 31, 2015 which was $23,812.

However, in so renegotiating, we granted the creditors new, lower conversion prices, which resulted in new beneficial conversion features of $110,000.

During the year ended December 31, 2016, we amortized $106,628 of debt discounts on convertible promissory notes originating in the United States to interest expense.

The aggregate amount of shares that may be issued upon conversion for convertible notes issued in both Australia and the Unites States is 185,489,928.

| 12 |

| Table of Contents |

Convertible notes payable at September 30, 2017 and December 31, 2016 and their classification into long-term and short-term were as follows:

|

|

| 9/30/17 |

|

| 12/31/16 |

| ||

| Long-term and short-term combined |

|

|

|

|

|

| ||

| Unpaid principal |

| $ | 956,901 |

|

| $ | 747,129 |

|

| Discounts |

|

| (208,304 | ) |

|

| (75,927 | ) |

| Convertible notes payable, net |

| $ | 748,597 |

|

| $ | 671,202 |

|

|

|

|

|

|

|

|

|

|

|

| Classified as short-term |

|

|

|

|

|

|

|

|

| Unpaid principal balance |

| $ | 701,143 |

|

| $ | 597,371 |

|

| Discounts |

|

| (19,864 | ) |

|

| (13,697 | ) |

| Convertible notes payable - short-term, net |

| $ | 681,279 |

|

| $ | 583,674 |

|

|

|

|

|

|

|

|

|

|

|

| Classified as long-term |

|

|

|

|

|

|

|

|

| Unpaid principal balance |

| $ | 255,758 |

|

| $ | 149,758 |

|

| Discounts |

|

| (188,440 | ) |

|

| (62,230 | ) |

| Convertible notes payable - long-term, net |

| $ | 67,318 |

|

| $ | 87,528 |

|

Convertible promissory notes issued in Australia

During the nine months ended September 30, 2017, we had one creditor convert to common stock. We issued 5,250,000 common shares and extinguished $37,822 and $2,049 in interest, respectively and recognized no gain or loss other than a $386 foreign exchange effect.

We accrued $24,469 of nominal interest on these notes for the nine months ended September 30, 2017.

Australian convertible notes payable can convert to 77,873,300 common shares in the aggregate.

Convertible promissory notes issued in the United States

All convertible promissory notes issued in the United States bear interest at 5%, and contain conversion privileges which vary depending upon the date issued, but they may convert to an aggregate of 102,616,628 common shares.

During the nine months ended September 30, 2017, we received $22,040 in loans pursuant to a convertible promissory note issued in 2016 on which the Company and the creditor agreed, on December 31, 2016, to extend the note to additional amounts paid to the Company by the creditor, inheriting the conversion and interest privileges from the original convertible promissory note. We evaluated this tranche of funding for beneficial conversion features and calculated a value of $22,040 which we are accounting for as debt discounts.

Also during the nine months ended September 30, 2017, we received $4,000 on a previously-existing promissory note, written in 2016, for which a creditor had not contributed the full amount. All evaluations for the existence of Beneficial Conversion Features for the full value of this creditor’s note were performed in 2016.

| 13 |

| Table of Contents |

During the nine months ended September 30, 2017, we converted one U.S. convertible promissory note to common stock. We issued 743,243 shares to retire $11,000 and $534 of principal and interest, respectively, recognizing no gain or loss on the conversion. In addition, we issued 2,500,000 to retire an interest payable in the amount of $2,374.

During the nine months ended September 30, 2017, we received $182,000 pursuant to four convertible promissory notes. We evaluated these notes for beneficial conversion features and calculated a value of $182,000 which we are accounting for as debt discounts.

Short-term portion of long-term debt

As discussed in the Long-term notes payable section of this Note, in 2016 we converted a trade account payable balance with a consultant in the amount of $34,250 to a three-year amortizing promissory note. During the nine months ended September 30, 2017, we paid this amortizing note in full.

Short-term notes payable

Short-term notes payable increased from $15,858 at December 31, 2016 to $17,236 which was all due to foreign exchange effect as of September 30, 2017.

Long-term notes payable

On August 9, 2016, we converted a trade account payable balance with a consultant in the amount of $34,250 to a three-year amortizing promissory note with interest at 5%. During the nine months ended September 30, 2017, we paid $30,693 and $627 in principal and interest, respectively, retiring the note.

Note 7 – Litigation

As is discussed in Note 8 to the financial statements on Form 10-K as of December 31, 2016, the Superior Court of Arizona, Pima County, issued a default judgment relating to a lawsuit (the “First Lawsuit”) filed by Richard Morgan in the amount of $2,377,915.

Additionally, a second lawsuit (the “Second Lawsuit) was filed on January 23, 2017, alleging that the Company’s intellectual property assets that were transferred to it by Click Evidence, Inc. (“Click”) under that May 21, 2015 merger of the Company with Click were fraudulently removed from Click and seeks to have them returned.

During the year ended December 31, 2016, we charged $2,377,915 for the judgment itself and $4,459 of accrued interest to December 31, 2016 to Loss on Litigation for the judgment on the First Lawsuit. Additionally, we accrued $44,294 in interest on the judgment for the nine months ended September 30, 2017.

On August 29, 2017, the Court set aside the judgment in the First Lawsuit resulting in the removal of the liability of $2,377,915 and accrued interest of $4,459 at December 31, 2016, as well as the additional accrued interest recorded during 2017 of $44,294, for a total gain of $2,426,668.

The Second Lawsuit remains pending at the date of this report. The Company has evaluated the probability distribution of the amounts, of an award granted to the plaintiff and has determined that the most likely outcome is that the plaintiff will be awarded an award of $5,000. We have therefore accrued $5,000 of judgment liability and recorded a net gain of $2,421,668 to Gain on Litigation.

| 14 |

| Table of Contents |

On October 7, 2017, Eric L. McRae of Sedgwick County, Kansas (“McRae”) filed a complaint against the Company in the United States District Court for the District of Kansas asserting a claim that Tautachrome breached a written agreement for the employment of McRae and seeking an award of damages in excess of $75,000.

Although Tautachrome refutes each and every allegation made by McRae in the complaint and intends to vigorously defend against it, we have accrued $49,000 to expense against this contingency.

Note 8 – Income Taxes

Deferred income taxes reflect the tax consequences on future years of differences between the tax bases:

|

|

| 9/30/17 |

|

| 12/31/16 |

| ||

|

|

|

|

|

|

|

| ||

| Net operating loss carry-forward |

|

| 2,006,171 |

|

|

| 4,048,660 |

|

|

|

|

|

|

|

|

|

|

|

| Deferred tax asset at 39% |

| $ | 782,407 |

|

| $ | 1,578,977 |

|

| Valuation allowance |

|

| (782,407 | ) |

|

| (1,578,977 | ) |

| Net future income taxes |

| $ | - |

|

| $ | - |

|

In assessing the realizability of future tax assets, management considers whether it is more likely than not that some portion or all of the future tax assets will not be realized. The ultimate realization of future tax assets is dependent upon the generation of future taxable income during the periods in which those temporary differences become deductible. Management considers the scheduled reversal of future tax liabilities, projected future taxable income and tax planning strategies in making this assessment. Management has provided for a valuation allowance on all of its losses as there is no assurance that future tax benefits will be realized.

Our tax loss carry-forwards will begin to expire in 2030.

Note 9 – Subsequent Events

On October 7, 2017, Eric L. McRae of Sedgwick County, Kansas (“McRae”) filed a complaint against the Company in the United States District Court for the District of Kansas asserting a claim that Tautachrome breached a written agreement for the employment of McRae and seeking an award of damages in excess of $75,000.

Tautachrome refutes each and every allegation made by McRae in the complaint and intends to vigorously defend against it.

We have evaluated subsequent events through the date of this report.

| 15 |

| Table of Contents |

ITEM 2 – MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This report contains “forward-looking statements”. All statements other than statements of historical fact are “forward-looking statements” for purposes of federal and state securities laws, including: any projections of earnings, revenues or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements concerning proposed new products, services or developments; any statements regarding future economic conditions or performance; any statements of belief; and any statements of assumptions underlying any of the foregoing. “Forward-looking statements” may include the words “may,” “will,” “estimate,” “intend,” “continue,” “believe,” “expect,” “plan” or “anticipate” and other similar words.

Although we believe that the expectations reflected in our “forward-looking statements” are reasonable, actual results could differ materially from those projected or assumed. Our future financial condition and results of operations, as well as any “forward-looking statements”, are subject to change and to inherent risks and uncertainties, such as those disclosed in this report. In light of the significant uncertainties inherent in the “forward-looking statements” included in this report, the inclusion of such information should not be regarded as a representation by the Company or any other person that the objectives and plans of the Company will be achieved. Except for its ongoing obligation to disclose material information as required by the federal securities laws, we do not intend, and undertake no obligation, to update any “forward-looking statement”. Accordingly, the reader should not rely on “forward-looking statements”, because they are subject to known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those contemplated by the “forward-looking statements”.

You should read the following discussion and analysis of our financial condition and results of operations in conjunction with our unaudited financial statements, including the notes to those financial statements, included elsewhere in this report.

Overview

Tautachrome operates in the internet applications space, a space uniquely able to embrace fast growing and novel business.

Tautachrome is currently pursuing three avenues of business activity:

|

| 1. | KlickZie technology-based business development and monetization, our flagship activity to revolutionize smartphone-based picture and video interaction on the web |

|

|

|

|

|

| 2. | KlickZie cryptotoken ecosystem, our KLK cryptotoken development activity, allowing KlickZie users to monetize their pictures and videos with KLK currency in an avalanche of novel ways |

|

|

|

|

|

| 3. | Smartphone app development and digital design, our activity to develop and monetize important in-house apps and to generate digital design revenue, an activity carried out by our wholly owned subsidiary Polybia Studios, Pty Ltd of Mermaid Beach, Queensland Australia |

| 16 |

| Table of Contents |

1. KlickZie technology-based business activity

Tautachrome’s patented and patent pending KlickZie technology addresses a major need and a new opportunity of the internet age.

The need is for a way to trust the pictures and videos we see on the web. The opportunity is to be able to use the pictures and videos we see on the web as impromptu windows of communication between people.

There is current need for a universally available, downloadable system that transparently turns the everyday pictures and videos we take from our smartphones into imagery that is trustable to any third party seeing it. With such a system two kinds of imagery would appear on the web: Imagery whose trustworthiness everybody can be absolutely certain of, and all the rest of the imagery which nobody has any idea of its trustworthiness. The KlickZie system aims to satisfy this fundamental need for automatic and “at your fingertips” trustability.

There is also a new opportunity that pervasive trustable imagery makes makes possible. This is the opportunity for people to use pictures and videos on the web to readily and safely interact with each other via the imagery itself. it is frequently the case that when you run across interesting imagery on the web you won’t know anything about it, including who the author is, who else may have seen it, or what others may think or know about it. By allowing people to interact with interesting or important pictures or videos by using the imagery itself as the portal of communication, the system can add the viewpoints and the information offerings of interacting people to the richness of the pictures and videos. This can be carried by the system into the future along with the imagery, as an evolving tapestry of interaction and imagery.

How KlickZie technology works: The KlickZie Activation Platform Consumers will download KlickZie’s free camera upgrade software into their mobile device (iPhone, Android or other smartphone) which thereafter activates the pictures and videos taken by their device using proprietary KlickZie technology. Behind the scenes, the powerful and secure KlickZie software will capture the imagery and all available metadata related to the imaging event, and mark the imagery and its metadata with advanced, highly undetectable KlickZie marking technology.

KlickZie Activation KlickZie activation will add a new world of usefulness to ordinary pictures and videos. People who come across an activated picture can, by merely clicking or touching the picture, communicate with the author of the picture, or with amenable others who have seen the picture (“touch-to-comm”). The picture itself makes the communication happen. It does not matter where or how you come across an activated picture, you can engage it, interact with it, or share it, just by touching or clicking it.

What happens to an activated picture from its creation onward gets invisibly added to the picture’s data and can be tracked into the future. Activated pictures can answer many questions. For example, in a group photo you could ask: Have any of the people in my contacts list interacted with this picture? Are any of them engaging it right now? Who else besides my contacts have already engaged this picture in some way? And given an amenable author, who took it? Where? When?

KlickZie’s activated pictures and videos will also possess the power to be completely trustable in the sense that any third party can be absolutely confident of the authenticity of the imagery because KlickZie pictures and videos will be secured in the KlickZie cloud at their creation where they remain until their creator or owner deletes them.

The upshot is that activation allows effective touch to comm with the authors and viewers of smartphone pictures and videos from every source, and activated pictures and videos can be completely trusted imagery.

| 17 |

| Table of Contents |

KlickZie Product Rollout. Rolling out KlickZie requires hiring activity to round out the Company technical team. Additional required technical staff include: cloud architects, database engineers, image processing engineers, full stack software engineers, steganography software developers, app development software engineers, and smartphone code defense software engineers.

|

| · | Phase 1: Build the minimal testable KlickZie system –including the smartphone imaging engine and the service cloud (Rev 1 KlickZie system), identifying and fixing functionality deficiencies and user experience and interface hiccups, building a loyal base of early adopters and defining Rev 2. |

|

|

|

|

|

| · | Phase 2: Build and release Rev 2 into a limited audience to optimize user experience and user interfaces, to define, build, test and finalize viral growth methodology, to finalize the smartphone imaging engine, to test/finalize the cloud subsystem for global scale up, to build a seed population of 200,000 contented users, and to plan global rollout. |

|

|

|

|

|

| · | Phase 3: Roll out KlickZie system globally, culture by culture and language by language, adding support staff and services as rollout moves forward. |

Monetizing. As presently conceived, the KlickZie product aims at revenues from four primary sources:

|

| · | Advertising Using pictures and videos as portals of communication allows the presentation of these communications in a framework of the Company’s choice, enabling advertisers to place paid ads within this framework (as is done by Google.) |

|

|

|

|

|

| · | User premium service fees KlickZie is intended to be free to consumers. Since KlickZie is handling user imagery and user imagery-based communications, opportunities for users to gain extra KlickZie service are intended to be provided for a fee-based premium user membership. |

|

|

|

|

|

| · | App Developer Revenue As conceived, the KlickZie imaging engine is a powerful tool for generating trustable imagery. The KlickZie cloud is intended to allow developers access to this powerful engine along with KlickZie-provided developer tools enabling them to develop apps of their own invention, access being granted under a revenue sharing arrangement. |

|

|

|

|

|

| · | Enterprise Revenue Because as conceived the KlickZie imaging engine is a powerful tool for generating trustable imagery, it is able to support the needs of business and industrial enterprises for which trustable imagery from employees, customers or partners is mission critical. Our plans are to license our engine to enterprises on a license fee basis. |

First KlickZie revenues. Our Plan of Operations is prepared for first revenues from enterprise users coming on line within the first year after the receipt of funding sufficient to round out the KlickZie team. Preparations for other KlickZie revenue are geared for the two year and out timeframe.

2. KlickZie cryptotoken ecosystem activity: a cryptotoken for the KlickZie user

People own and are regular users of 2.5 billion smartphones (including tablets and other connected smart digital imaging devices), and each year trillions of pictures and frames of video are created with these devices.

We believe this enormous flow of smartphone digital imagery has substantial and global economic value that can and should be simply and universally tapped by the ordinary smartphone users themselves. Until KlickZie that economic value has been impossible for ordinary users to access. There are two reasons for this.

First, and what KlickZie solves, is that in order to be monetizable, imagery ownership has to be reliably attached to its author together with the level of trustability of the imagery, the meta data associated with its creation, and its degree of modification since creation. Without reliable ownership, monetization can’t happen.

| 18 |

| Table of Contents |

And second, and what blockchain network technology solves, is that for the ordinary smartphone users themselves to avail themselves of the potential value of their smartphone imagery, there needs to be a monetizing ecosystem built upon smartphone imagery that is equipped to trade in it, and that every KlickZie user can access.

Both of these ingredients are essential for the mass monetization of the smartphone generated imagery market for the benefit and use of the smartphone users themselves.

Blockchain technology and the KlickZie blockchain

Blockchain technology, introduced to the world by Bitcoin, is a wholly digital, internet based value exchange system that is not controlled by any central authority and runs on immutable cryptographic algorithms employing cryptographically secured ownership and exchange of the value element of the system, designated BTC in Bitcoin’s blockchain.

The Company’s KlickZie blockchain, currently being developed, will implement a value exchange ecosystem for smartphone imagery employing a cryptotoken value element designated the KLK cryptotoken (KLK pronounced “click”).

The KLK ecosystem will be an autonomous wholly digital, internet based value system that is not controlled by the Company or by any central authority and like Bitcoin, is running on its own block chain using immutable cryptographic algorithms in which the ownership and exchange of the KLK token will be cryptographically secured.

The Company’s aim is to associate KlickZie imagery with KLK tokens, and to foster global usage of the KLK token in the exchange of value related to smartphone imagery. For situations where the KlickZie cloud system facilitates a KLK-based value exchange, KlickZie will receive a small percentage of the KLKs exchanged for its service.

Wikipedia-based description of blockchain technology

A blockchain is a continuously growing list of records, called blocks, which are linked and secured using cryptography. Each block typically contains a hash pointer as a link to a previous block, a timestamp and transaction data. By design, blockchains are inherently resistant to modification of the data. A blockchain can serve as an open, distributed ledger that can record transactions between two parties efficiently and in a verifiable and permanent way. Once recorded, the data in any given block cannot be altered retroactively without the alteration of all subsequent blocks, which cannot happen without a collusion of a magnitude that cannot practically occur.

Blockchains are secure by design and are an example of a distributed computing system with high fault tolerance. Decentralized consensus is achieved with a blockchain. This makes blockchains suitable for the recording of transactions of any kind.

The first distributed blockchain was conceptualized by Satoshi Nakamoto in 2008 and implemented the following year as a core component of the digital currency Bitcoin, where the blockchain serves as the public ledger for all transactions with bitcoin. The invention of the blockchain and its use by bitcoin made bitcoin the first digital currency to solve the double spending problem, without the use of a trusted authority or central server. The bitcoin design has been the inspiration for many other applications.

A blockchain transaction system is fast with a built-in mechanism that establishes trust, requires no specialized equipment, has no chargebacks or monthly fees, and provides a collective bookkeeping solution for ensuring transparency and trust.

| 19 |

| Table of Contents |

The KlickZie Cryptotoken; establishing a monetizing ecosystem for KlickZie users

We believe that the KLK monetizing ecosystem will provide value to KlickZie users as well as to the Company and its shareholders.

With the KLK token in place a new and significant impact may be the transfer of additional wealth into the hands of the consumer. This transfer can be understood by looking at a single example: the advertising business associated with popular social network versus the KlickZie social network.

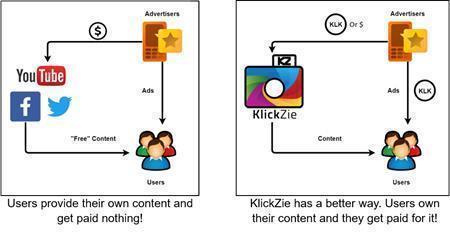

Below, the picture on the left is how it is now. Advertisers feed ads to users and pay money to the social networks who get all the money and who distribute the users’ own content back to them with ads.

The picture on the right is how it is conceived for KlickZie. Advertisers will feed ads plus KLK to users, but only to users who want the ads. KlickZie will be paid in KLK or $, or both, and KlickZie will distribute the users content to them along with the ads.

KlickZie users will own the imagery they create, both normal imagery and the “view only” pictures or videos, if any, that they create using KlickZie’s Private Picture feature. They also will own any proprietary communications they create using KlickZie’s Touch to Comm functionality. Ownership of imagery can be sold for KLK tokens under a standard smart contract provided in the KLK blockchain. Access to view-only private pictures and proprietary communications owned by users can also be sold for KLK tokens under standard smart contracts provided in the KLK blockchain.

KlickZie is intended to activate, encrypt and store imagery and its meta data on the KlickZie cloud as it is created. Activated imagery which is subsequently modified and then shared is also stored in the KlickZie cloud. KlickZie could then provide trustability reports using a standard smart contract provided on the KLK blockchain.

The KLK blockchain would record the ownership of imagery, the ownership of view-only Private Picture imagery and the ownership of proprietary communications as they are created. Sales of imagery-ownership and the sales of access to Private Picture imagery and proprietary communications made under existing KLK standard smart contracts would then be recorded on the KLK blockchain.

Once launched, KlickZie would no longer have control of the blockchain. The picture below shows the separation of the KlickZie cloud activities from the execution of smart contracts on the KLK blockchain.

| 20 |

| Table of Contents |

Interactions in the KlickZie Trusted Imaging Ecosystem

Major Stakeholders in the KlickZie Ecosystem

The major stakeholders in KlickZie and KLK ecosystem remain the same: the business and non-business organizations with mission critical uses of usage of KlickZie trusted imaging, the independent app developers creating innovative apps exploiting KlickZie technology and the KLK ecosystem using KlickZie app-development tools, consumers adopting and using the KlickZie imaging app in their connected devices, and the KlickZie team who will support the broad usage of KlickZie technology and develop and capture intellectual property for the benefit of Tautachrome and other KlickZie stakeholders.

Monetizing the KlickZie Trusted Imagery Ecosystem with the KlickZie “KLK” Token

Independently Developed Apps

The KlickZie app provides a structure for a robust ecosystem that independent developers can take advantage of by creating innovative applications of their own. To assist, the KlickZie team will provide tools for app developers to easily use the KlickZie downloadable software and the KlickZie cloud to create new and valuable ways to use activated imagery.

| 21 |

| Table of Contents |

KLK Payments, App Developers and KlickZie users

KLK payment made by a KlickZie user to an app developer would trigger a revenue sharing payment to Tautachrome under a standard smart contract provided on the blockchain.

Payments in KLK made in an exchange between users in which KlickZie services are used to generate the exchange will also trigger a commission payment to Tautachrome under a standard smart contract on the blockchain.

KlickZie Userbase Growth and KLK Awards

Consumers would be awarded KLK when KlickZie is downloaded and used. New KlickZie users would be supplied with a KlickZie-provided digital wallet containing the awarded KLK. Also, a user whose picture prompts a download by a new adopter would be rewarded with KLK. KlickZie users would be provided options allowing them to advertise KlickZie to others via their pictures and other means, and would be rewarded with KLK tokens as their efforts result in KlickZie downloads. At user option, a KlickZie picture or video would carry the message to the effect “I’m KlickZie the amazing picture and video app. I’m free. Download me now.” These simple KLK token reward features are a natural driver of fastest possible user growth.

New Team members

The Company has entered into a Pilot Agreement with Honeycomb Digital, LLC in Magnolia Texas (www.honeycomb.digital) to develop a “sample system” reflecting the Company’s KlickZie cloud requirements in accordance with the Company’s KlickZie and KLK requirements. Honeycomb has provided 100% web-based scalable private media libraries with advanced security locking, asynchronous access governance (non-centralized), and easy to use transactional digital rights management to national and global companies since 2001. Honeycomb reduces object load, software platform development requirement, datastore and deployment infrastructure resulting in highly scalable private cloud environments comparable to best in class top tier data centers.

The company has entered into a joint effort to develop the KlickZie blockchain and a KLK token offering with a small R&D company, Kelecorix, Inc. of Rockledge. Florida, with personnel in the US, Estonia and the Ukraine. The effort is proceeding well, with a launch target for shortly after year end.

3. Smartphone app development and digital design

Our activity to develop and monetize important in-house apps and to generate digital design revenue, is being carried out by our wholly owned subsidiary Polybia Studios, Pty Ltd of Mermaid Beach, Queensland Australia.

Recent development work by Polybia includes:

|

| · | the internal software systems, database servers and branding for travelKeep, a mobile security and networking application for travelers. |

|

|

|

|

|

| · | websites and branding for companies such as Tautachrome, Novagen Ingenium, Renegade Engines, and Ronna Burton. |

In addition, Polybia will play an important role in the development of the KlickZie Platform by providing the embedded software development for KlickZie’s advanced image capture, marking and securitization of code for smartphones, tablets, PCs, and other state of the art social sharing platforms. Polybia will also lead the company’s graphic, branding and web design optimization for the mobile user.

| 22 |

| Table of Contents |

Funding

The KlickZie product rollout requires additional funding. We have said, and continue to say, that his funding may be accomplished by incurring debt, by equity sale or through any other means.

Token Offering

Presently, a viable funding means is the sale of our KLK cryptotokens. The market for crypto “value elements” such as cryptocurrencies like Bitcoin and cryptotokens like KLK is a global market and is presently receiving significant attention. We believe that the value that KlickZie technology and the KLK ecosystem offer will enable us to achieve a successful KLK token sale deriving funds that will allow the Company to develop both a vibrant KLK ecosystem and the powerful KlickZie technology we envision.

Fortune 50 project

Earlier this year the Company reported a substantial project effort on its part developing a business model for a Fortune 50 US company (code named company F-50). The project was aimed at gaining funding for KlickZie development and using the KlickZie system to solve large scale F-50 operational and revenue problems. At this time the project is stalled, and we do not have an estimate as to when if ever it will become un-stalled. We continue to believe that the economic payoff of KlickZie will be attractive and lucrative for companies such as F-50 with a global reach and with a large number of consumer customers.

No assurances

There can be no assurances given that any of our funding efforts will be successful.

Tautachrome uses its Twitter site to post important information about the Company. To keep current with Tautachrome, Inc., please visit us at our Twitter site at https://twitter.com/tautachrome_inc.

Results of Operations - Nine months ended September 30, 2017 versus 2016

We had general and administrative expenses of $236,111 for the nine months ended September 30, 2017 versus $325,442 for the same period in 2016, or a about a 27% decrease, mostly due to reductions in our operations in Australia.

During the nine months ended September 30, 2016, we amortized $92,862 of the acquisition cost of Photosweep to expense. We had no such amortization in the current year since the asset was fully impaired as of December 31, 2016.

| 23 |

| Table of Contents |

Interest expense decreased from $222,972 during the nine months ended September 30, 2016 to $177,187 during the same period in 2017. During 2016, we issued convertible promissory notes in Australia containing Beneficial Conversion Features which we accounted for immediately as interest expense since the notes were callable by the maker at any time. We issued no new notes in Australia during the current period.

As discussed in Note 7 to the financial statements, we recorded a Gain on Litigation of $2,372,668 relating to our lawsuits with a previous consultant. We had no such gain in the previous year.

During the nine months ended September 30, 2017, we had foreign exchange loss of $69,309 versus a loss of $35,005 during the same period in 2016, all of which are currency translation effects resulting from exchange rate differences between the U.S. and Australian dollars.

Our net comprehensive gains and losses of $1,890,061 (gain) and $676,281 (loss) during the nine months ended September 30, 2017 and 2016 are a result of the above items.

Results of Operations - Three months ended September 30, 2017 versus 2016

We had general and administrative expenses of $31,596 for the three months ended September 30, 2017 versus $102,062 for the same period in 2016, or a 70% decrease, mostly due to decreases in our operations in Australia.

During the three months ended September 30, 2016, we amortized $33,345 of the acquisition cost of Photosweep to expense. We had no such amortization in the current year since the asset was fully impaired as of December 31, 2016.

Interest expense increased from $39,618 during the three months ended September 30, 2016 to $46,712 during the same period in 2017 due to increases in debt levels in the United States.

As discussed in Note 7 to the financial statements, we recorded a Gain on Litigation of $2,372,668 relating to our lawsuits with a previous consultant. We had no such gain in the previous year.

During the three months ended September 30, 2017, we had foreign exchange loss of $16,914 versus a loss of $18,467 during the same period in 2016, all of which are currency translation effects resulting from exchange rate differences between the U.S. and Australian dollars.

Our net comprehensive gain and losses of $2,277,446 (gain) and $193,492 (loss) during the three months ended September 30, 2017 and 2016 are a result of the above items.

Liquidity and Capital Resources

Our financial statements have been prepared on a going concern basis that contemplates the realization of assets and the settlement of liabilities and commitments in the normal course of business.

The Company has $3,624 in cash and liabilities totaling $1,307,689. We are currently seeking financing to attain our business goals, but there is no guarantee that we will obtain such financing or, upon obtaining it, that we will be able to invest in productive assets that will result in positive cash flows from operations.

Going Concern

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As shown in the accompanying financial statements, we had negative cash flows from operations, recurring losses, and negative working capital at September 30, 2017 and December 31, 2016. These conditions raise substantial doubt as to our ability to continue as a going concern. The financial statements do not include any adjustments that might be necessary if we are unable to continue as a going concern. Management intends to finance these deficits by making additional shareholder notes and seeking additional outside financing through either debt or sales of its common stock.

Plan of Operation

Our immediate term plans for operations is discussed extensively in Item 7 – Management’s Discussion and Analysis or Plan of Operation included in our Form 10-K as of December 31, 2016, filed with the Commission on April 19, 2017 and is herein incorporated by reference.

| 24 |

| Table of Contents |

ITEM 3 – QUANTITIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

A smaller reporting company is not required to provide the information required by this item.

ITEM 4 – CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures.

We maintain "disclosure controls and procedures" as such term is defined in Rule 13a-15(e) under the Securities Exchange Act of 1934. In designing and evaluating our disclosure controls and procedures, our management recognized that disclosure controls and procedures, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of disclosure controls and procedures are met. Additionally, in designing disclosure controls and procedures, our management necessarily was required to apply its judgment in evaluating the cost-benefit relationship of possible disclosure controls and procedures. The design of any disclosure controls and procedures also is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions.