|

Filed by the Registrant ☑

|

Filed by a Party other than the Registrant ☐

|

|

☐

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☑

|

Definitive Proxy Statement

|

|

|

|

|

☐

|

Definitive Additional Materials

|

|

|

|

|

☐

|

Soliciting Material Pursuant to § 240.14a-12

|

|

|

|

|

|

|

☒

|

No fee required.

|

||

|

|

|

||

|

☐

|

Fee paid previously with preliminary materials.

|

||

|

|

|

||

|

☐

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

||

MESSAGE TO OUR STOCKHOLDERS |

March 12, 2024

Dear Fellow Stockholder:

On behalf of the Board of Directors and our management team, we cordially invite you to attend Archrock, Inc.’s Annual Meeting of Stockholders, which will be held at 11:00 a.m. Eastern Time on Thursday, April 25, 2024 at The Wall Street Hotel – Exchange Room, New York, New York 10005.

At this meeting, you will have a chance to vote on the matters set forth in the accompanying Notice of Annual Meeting and Proxy Statement.

During 2023, market demand for natural gas remained robust and we saw record natural gas production in the U.S. driven in large part by strong activity in oil producing basins with associated gas like the Permian. The powerful combination of expected continued growth in natural gas production and the commendable capital discipline we are seeing across the energy industry began to materialize into what we believe will be a steady and durable upcycle for our business.

For Archrock, 2023 was a year for the history books. We achieved an extensive list of impressive and in many cases record-breaking accomplishments. We are proud of our strategic, operational and financial execution in 2023, from achieving all-time high equipment utilization and pricing to increasing our dividend per share (twice) and implementing a stock-buyback program. Additionally, we exceeded our safety performance goals and continued to harness innovative technologies and processes both internally and through investments in methane mitigation as well as in a cutting-edge carbon capture technology company.

These results, highlighted in our financial statements and throughout this Proxy Statement, reflect years of effort to transform our platform and our commitment to a sustainable future. We believe the actions we’ve taken to high-grade our asset base, utilize innovative technology, refine our capital allocation and prioritize opportunities to help our customers decarbonize will benefit us for years to come and in a variety of markets.

We celebrate 70 years of operations in 2024, a testament to the resilient business we’ve built through a mindset of continuous improvement. There is always more work to be done and the opportunity to deliver the next level of value for all of our stakeholders. We continue to be focused on:

| ● | For our people, preserving our safety-centered culture and offering a best-in-class employee experience; |

| ● | For our customers, service quality, asset uptime and advancing our emissions management solutions; and |

| ● | For our investors, enhancing our profitability, growing our free cash flow and increasing our shareholder returns. |

The future for natural gas and Archrock is bright. We will remain true to our core as an energy infrastructure company, supplying the compression required to keep U.S. natural gas moving while embodying our purpose: WE POWER A CLEANER AMERICA™.

Your vote is important, regardless of how many shares your own. Whether or not you plan to attend the Annual Meeting, please vote by internet, telephone or mail as soon as possible to ensure your vote is recorded promptly. The instructions set forth in the Proxy Statement and on the proxy card explain how to vote your shares.

Thank you for your continued support of Archrock and investment in reliable, affordable and cleaner energy.

| Sincerely, | |

|

|

| Gordon Hall, Chairman of the Board | Brad Childers, President and Chief Executive Officer |

|

NOTICE OF 2024 ANNUAL STOCKHOLDERS’ MEETING |

| ANNUAL MEETING DETAILS |

MEETING AGENDA |

|||

|

DATE Thursday, April 25, 2024

TIME 11:00 a.m. Eastern Time

LOCATION The Wall Street Hotel – Exchange Room 88 Wall Street New York, New York 10005

RECORD DATE March 1, 2024 |

PROPOSAL

1: Election of nine director nominees to serve until the 2025 Annual Meeting of Stockholders or until their respective successors are duly elected and qualified

2: Ratification of the appointment of Deloitte & Touche LLP as Archrock’s independent registered public accounting firm for fiscal year 2024

3: Advisory, non-binding vote to approve the compensation provided to our Named Executive Officers for 2023

|

BOARD’S VOTING

FOR EACH

FOR

FOR

|

PAGE

1

24

27

|

|

The Board recommends that you vote “FOR” each director nominee and “FOR” proposals 2 and 3. The full text of these proposals is set forth in the accompanying Proxy Statement. Stockholders of record at the close of business on March 1, 2024 are entitled to receive notice of and to vote at the Annual Meeting and any adjournment or postponement thereof.

For specific instructions on how to vote your shares, please refer to the Notice of Internet Availability of Proxy Materials you received in the mail, the instructions provided in this document, or, if you requested to receive printed proxy materials, your proxy card.

|

By Order of the Board of Directors,

Stephanie C. Hildebrandt, Secretary March 12, 2024 |

AVAILABILITY OF PROXY MATERIALS This Proxy Statement and our 2023 Annual Report to Stockholders are available at www.archrock.com. Stockholders are encouraged to access and carefully review the proxy materials before voting. We commenced mailing and made this Proxy Statement and proxy card available on the Internet on March 12, 2024. |

|

VOTE AS SOON AS POSSIBLE Vote right away using any of the following methods. Have your proxy card or voting instructions accessible and follow the instructions. If your shares are held in the name of a broker or other nominee, follow the voting instructions you receive from your broker or other nominee. |

|

CONTENTS |

INCORPORATION BY REFERENCE

To the extent that this proxy statement has been or will be specifically incorporated by reference into any other filing of Archrock, Inc. under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the sections of this proxy statement titled “Report of the Audit Committee” (to the extent permitted by the rules of the U.S. Securities and Exchange Commission (“SEC”)) and “Report of the Compensation Committee” shall not be deemed to be so incorporated, unless specifically stated otherwise in such filing. In addition, this proxy statement includes references to websites, website addresses, and additional materials found on those websites. For example, we reference our 2022 Sustainability Report. The content of these materials as well as any websites and other materials named, hyperlinked, or otherwise referenced in this proxy statement are not incorporated by reference into this proxy statement on Schedule 14A or in any other report or document we file with the SEC, and any references to such websites and materials are intended to be inactive textual references only.

2023 IN REVIEW |

FISCAL 2023 HIGHLIGHTS

|

$105M cash returned to |

2.5x dividend coverage |

|

0.05 TRIR Total Recordable Incident Rate |

3.5x year-end leverage ratio |

Strategic

| ● | Closed the sale of non-core smaller compression assets totaling approximately 199,000 horsepower during 2023 to further standardize and high-grade our fleet. |

| ● | Continued our focus on helping our customers decarbonize, including capital commitments toward electric drive compression as well as investments in methane monitoring and capture and carbon capture. |

| ● | Focused on harnessing innovative technology and processes across all aspects of our business to drive operational efficiencies and enhance our value proposition to our customers, including automation of workflows, integration of digital and mobile tools for our field service technicians and expansion of remote monitoring capabilities of our compressor fleet. |

Operational

| ● | Achieved a record period-end compression fleet utilization rate of over 96% for 2023 compared with 93% at the end of 2022. |

| ● | Increased our contract operations gross margin by 300 basis points to 62% in 2023 compared to 2022. |

| ● | Maintained strong safety performance, with a Total Recordable Incident Rate in 2023 of 0.05 and Preventable Vehicle Incident Rate of 0.18, compared to our targets for both of 0.50. |

Financial

| ● | More than doubled earnings per share compared to 2022. |

| ● | Paid out dividends to stockholders of $96 million based on the strength and durability of our business. |

| ● | Initiated a stock-buyback program and repurchased 750,374 common shares at an average price of $11.81 per share, for an aggregate of approximately $8.9 million. |

| ● | Reduced 2023 period-end leverage ratio to an all-time low of 3.5x and pushed out our earliest debt maturity to 2027. |

i

SUSTAINABILITY

Archrock, Inc. (“Archrock,” the “Company,” “we,” “our” or “us”) is committed to a strategy focused on natural gas and a cleaner energy future for us, our customers and other stakeholders. We believe that a multi-faceted approach focused on partnerships, customer expectations and investments in innovative technology and processes will drive long-term business sustainability. Sustainability is embedded in our corporate strategy and reinforced by rigorous corporate governance as we seek to maximize stockholder value. We recognize the focus on reducing emissions intensity and a lower-carbon future will present both challenges and opportunities to the industry and Archrock. We also appreciate the impact of affordable energy on our collective health and wellbeing – and our natural gas compression infrastructure plays a critical role.

|

✓ Added quantifiable sustainability-focused metrics to our short-term incentive program beginning in 2022

✓ Operating safely and in an environmentally conscious way continues to be a core value of the Company and is consistently a performance metric of our annual short-term incentive program

✓ Continued investment in new ventures to be utilized in our fleet and as customer offerings that we believe will assist in reducing emissions associated with the production and transportation of natural gas, including additional funding and work with Ecotec International Holdings, LLC (“ECOTEC”), a global leader in methane emissions monitoring, and serving as the lead investor in a Series A funding for Ionada PLC, a global carbon capture technology company (“Ionada”) |

✓ Our patent-pending methane capture technology moved beyond the pilot phase in 2023

✓ Pursued additional electrification of our fleet by building new electric units

✓ In late 2023 it was announced by Newsweek that Archrock was being recognized as one of America’s Most Responsible Companies 2024

|

We invite our stockholders to learn more about our approach and performance with respect to sustainability by reading our 2022 Sustainability Report and listening to our quarterly earnings calls. Our Sustainability Report can be found at www.archrock.com.

ii

CORPORATE GOVERNANCE

Archrock maintains best practices in governance, with Board oversight of strategy and risk, including environmental, cyber and social risks and opportunities.

| ✓ | Annual election of all directors |

| ✓ | Plurality vote standard which requires that any nominee for director who receives a greater number of “withheld” votes than “for” votes must submit his or her resignation for consideration by the Board |

| ✓ | Separate independent chairman and chief executive officer |

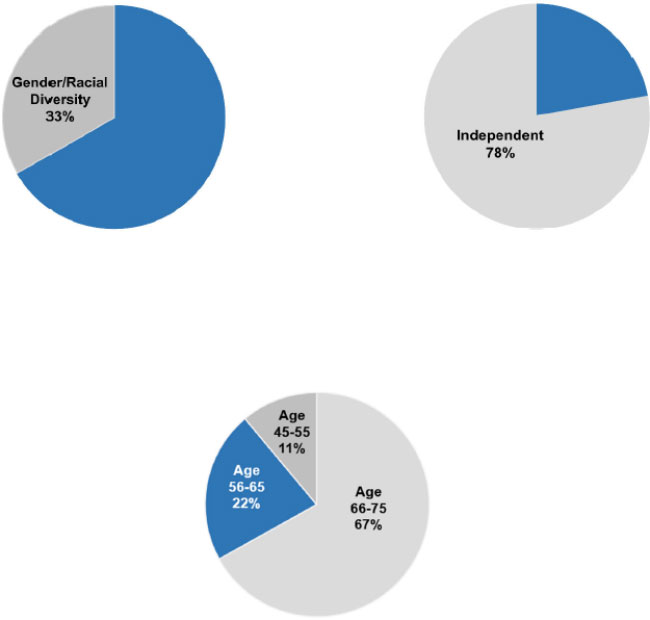

| ✓ | Majority independent Board; seven of our nine directors are independent |

| ✓ | 100% independent Board committees |

| ✓ | Independent directors meet regularly without management present |

| ✓ | 33% gender and racial diversity; 50% of Board leadership roles are held by women |

| ✓ | Below median director compensation with emphasis on equity component |

| ✓ | Officer and director stock ownership guidelines |

| ✓ | No hedging or pledging of Company securities |

| ✓ | Annual Board and committee evaluations |

EXECUTIVE COMPENSATION

Our philosophy is to reward performance with compensation that is a mix of fixed and variable compensation and is balanced between long-term and annual performance objectives. Good governance, adherence to best practices and consideration of stakeholder interests form the foundation of our executive compensation program, developed by a fully independent Compensation Committee with the support of an independent executive compensation consultant. Our best practices include:

| ✓ | Annual review and consideration of our peer group |

| ✓ | Three-year performance periods for long-term incentive awards |

| ✓ | Three-year equity vesting |

| ✓ | Separate performance measures for short-term and long-term incentives |

| ✓ | Caps on performance-based compensation |

| ✓ | Regular review of burn rate and dilution associated with long-term incentives |

| ✓ | Extremely limited perquisites – only an annual executive physical |

| ✓ | Double trigger change of control agreements |

| ✓ | Performance-based compensation clawback policy |

For more information regarding our 2023 executive compensation program, see the “Compensation Discussion and Analysis” in this Proxy Statement.

iii

|

PROPOSAL 1 ELECTION OF DIRECTORS |

Nine directors are nominated to be elected to the Board of Directors (the “Board”) at the Annual Meeting. Each nominee has consented to serve as a director if elected.

|

BOARD RECOMMENDATION The Board recommends a vote “FOR” the election of each director nominee to hold office for a one-year term expiring at the 2025 Annual Meeting of Stockholders or until his or her successor is duly elected and qualified.

|

VOTE REQUIRED

With respect to the election of directors, you may vote “for” or withhold authority to vote for each director nominee. A plurality of the votes present in person or by proxy and entitled to vote is required to elect each director nominee, meaning that the nine director nominees who receive the highest number of shares voted “for” their election are elected. However, our Corporate Governance Principles require that any nominee who receives a greater number of “withhold” votes than “for” votes must submit his or her resignation for consideration by our Board. Broker non-votes will not have an effect on the election of directors. |

ARCHROCK, INC. 2024 PROXY STATEMENT | 1

OVERVIEW OF 2024 DIRECTOR NOMINEES1

_____________

1 Gender/Racial Diversity is calculated based on the number of members of our Board who identify as either a traditionally underrepresented gender or a traditionally underrepresented race/ethnicity divided by the total number of directors.

ARCHROCK, INC. 2024 PROXY STATEMENT | 2

NOMINEES FOR DIRECTOR

The following biographical information is furnished with respect to each director nominee, together with a discussion of each nominee’s experience, qualifications and attributes or skills that were considered in their nomination to the Board.

ARCHROCK, INC. 2024 PROXY STATEMENT | 3

|

ANNE-MARIE N. AINSWORTH Age 67 Independent Director since April 2015 Member, Audit Committee Chair, Governance and Sustainability Committee |

Qualifications • Extensive leadership experience in the oil and gas industry • Familiarity with governance issues, having served as chief executive officer of both public and private energy companies • Experience operating a portfolio of energy assets including direct responsibility for safety |

Career Highlights

| • | President, Chief Executive Officer and director of the general partner of Oiltanking Partners, L.P. (a provider of terminal, storage and transportation services to the crude oil, refined petroleum and liquefied petroleum gas industries) and President and Chief Executive Officer of Oiltanking Holding Americas, Inc. from 2012 to 2014 |

| • | Senior Vice President, Refining of Sunoco, Inc. (a petroleum and petrochemical manufacturer) from 2009 to 2012 |

| • | General Manager of the Motiva Enterprises, LLC, refinery in Norco, Louisiana from 2006 to 2009 |

| • | Director, Management Systems and Process Safety at Shell Oil Products U.S. from 2003 to 2006, and Vice President of Technical Assurance at Shell Deer Park Refining Company from 2000 to 2003 |

Board Service

| • | Director, member of the governance, nominating and corporate social responsibility committee as well as the safety, environment and operational excellence committee of Pembina Pipeline Corporation (a Canadian oil and gas pipeline company) |

| • | Director and member of the audit committee and ESG and nominating committee of Kirby Corporation (an operator of inland and offshore tank barge fleets in the U.S. and provider of diesel engine services) |

| • | Director and chair of the environmental, health, safety and public policy committee of HF Sinclair Corp. (an independent petroleum refiner in the U.S.) |

| • | Former director of Seventy Seven Energy Inc. from 2014 to 2015 |

Education

| • | BS, Chemical Engineering, cum laude, University of Toledo |

| • | MBA, Rice University, where she also served as an Adjunct Professor from 2000 to 2009 |

| • | Graduate, Institute of Corporate Directors Education Program, Rotman School of Management, University of Calgary, with ICD.D designation |

|

D. BRADLEY CHILDERS Age 59 President and Chief Executive Officer, Archrock Non-Independent Director since April 2013 |

Qualifications • Intimate knowledge of our strategy, operations and markets • Deep understanding of operational opportunities and challenges acquired through prior operating roles • Business judgment, management experience and leadership skills that are highly valuable in assessing our business strategies and accompanying risks |

Career Highlights

| • | President and Chief Executive Officer since 2011, Senior Vice President from 2007 to 2011, as well as various senior management roles with Exterran Energy Solutions, L.P., a predecessor subsidiary, from 2008 to 2011, and with Universal Compression Holdings, Inc. (“UCI”), a predecessor company from 2002 to 2007 |

| • | President, Chief Executive Officer and Chairman of the Board of Archrock GP LLC, the managing general partner of Archrock Partners, L.P., a master limited partnership in which we owned an equity interest (the “Partnership”) from 2011 until the Partnership’s merger into a wholly-owned subsidiary of Archrock, Inc. in 2018 (the “Partnership Merger”) |

| • | Various roles with Occidental Petroleum Corporation (an international oil and gas exploration and production company) and its subsidiaries from 1994 to 2002 |

ARCHROCK, INC. 2024 PROXY STATEMENT | 4

Board Service

| • | Director of Ionada as part of Archrock’s 2023 investment in such company |

| • | Director of Yellowstone Academy (a non-profit private school) since 2014 |

| • | Former Chairman of the Board of the Partnership from 2008 until the Partnership Merger in 2018 |

Education

| • | BA, Claremont McKenna College |

| • | JD, University of Southern California |

|

GORDON T. HALL Age 64 Independent Director since March 2002 Member, Audit and Compensation Committees |

Qualifications • Thorough understanding of our operational and strategic opportunities and challenges • Experience as a research analyst covering oil field services companies provides a broad-based understanding of the industry, as well as mergers, acquisitions and capital markets transactions • Extensive energy company board service |

Career Highlights

| • | Independent Chairman of the Board since November 2015, having served as Vice Chairman and Lead Independent Director from 2013 to 2015 |

| • | Chairman of the Board of Exterran Holdings, Inc. from 2007 to 2013 and Chairman of the Board of Hanover Compressor from 2005 to 2007 (both predecessor companies) |

| • | Retired as Managing Director, Senior Oil Field Services Analyst and Co-Head of the Global Energy Group, Credit Suisse (an investment banking firm) in 2002 after 15 years with the firm |

| • | Former non-executive treasurer of Gordon College (2019 to 2023) and professor in the Master of Science in Financial Analysis Program from 2018 to 2020 and interim Chief Financial Officer in 2018 |

Board Service

| • | Member of the board of trustees, and former member of the executive board of trustees, chairman of the finance committee and non-executive treasurer of Gordon College (2019 to 2023) |

| • | Former director of Noble Corporation from 2010 to 2021, of Weatherford International plc from 2019 (upon emergence from Weatherford’s Chapter 11 reorganization) to 2020, of Select Energy Services from 2012 to 2015, of Grant Prideco, Inc. from 2007 until its acquisition by National Oilwell Varco, Inc. in 2008 and of Hydril Company from 2002 until its merger with Tenaris S.A. in 2007 |

Education

| • | BBA, Mathematics, Gordon College |

| • | SM, M.I.T. Sloan School of Management |

|

FRANCES POWELL HAWES Age 69 Independent Director since April 2015 Chair, Audit Committee Member, Governance and Sustainability Committee |

Qualifications • Over 20 years of service as a financial advisor and CFO for both private and public companies resulting in financial expertise, business knowledge and leadership experience • Extensive understanding of the audit function and risk management • Financial consulting and advisory experience • National Association of Corporate Directors Cyber Risk Oversight Certificate |

Career Highlights

| • | CFO of New Process Steel, L.P. (a privately held steel distribution company) from 2012 to 2013 |

| • | Senior Vice President and CFO of American Electric Technologies, Inc. (a publicly traded provider of power delivery solutions) from 2011 to 2012 |

| • | CFO, Executive Vice President and Treasurer of NCI Building Systems, Inc. (a publicly traded firm providing engineered building solutions) from 2005 to 2008 |

ARCHROCK, INC. 2024 PROXY STATEMENT | 5

| • | CFO and Treasurer of Grant Prideco, Inc. (a manufacturer of engineered tubular products for the energy industry) from 2000 to 2001 |

| • | Chief Accounting Officer, Vice President Accounting and Controller of Weatherford International Ltd. (a multinational oil field service company), having advanced through a number of positions of increasing responsibility, from 1989 to 2000 |

Board Service

| • | Director, chair of the audit committee and member of the nominating, corporate governance, environmental and social committee of Vital Energy, Inc. (a company focused on the exploration, development and acquisition of oil and natural gas properties in the Permian region of the U.S.) |

| • | Director and audit committee member of PGT Innovations, Inc. (a manufacturer of premium windows and doors) |

| • | Director of Financial Executives International, Houston Chapter |

| • | Director of Memorial Assistance Ministries (a non-profit focused on basic needs in the Houston area) since 2024 |

| • | Former director of Energen Corporation from 2013 to 2018 and of Express Energy Services from 2011 to 2014 |

Education

| • | BBA, Accounting, University of Houston |

| • | Certified Public Accountant |

|

J.W.G. “WILL” HONEYBOURNE Age 72 Independent Director since April 2006 Member, Compensation and Governance and Sustainability Committees |

Qualifications • Thorough understanding of the challenges and opportunities of markets and financing through current and former energy company board service, for both publicly listed and privately held companies, and as managing director of a private equity firm focused on the energy industry • Executive and operations leadership experience with oilfield services companies • Technical background in petroleum engineering, experience in the commercialization of technical services and prior service on the boards of energy sector technology companies |

Career Highlights

| • | Partner at First Reserve, a private equity firm he joined as Managing Director in 1999. Serves on the firm’s Investment Committee, which is responsible for the investment program supervision including strategy, risk management and capital allocation |

| • | Senior Vice President of Western Atlas International (a seismic and wireline logging company) from 1996 to 1998 |

| • | President and CEO of Alberta-based Computalog from 1993 to 1995 |

| • | Earlier career with Baker Hughes, included positions as Vice President and General Manager at INTEQ and President of EXLOG |

| • | Member of the Society of Petroleum Engineers and the Society of Exploration Geophysicists |

Board Service

| • | Former director of Barra Energia Petróleo e Gás (a private Brazilian oil and gas exploration and production company) from 2010 to 2022 |

| • | Former director of Red Technology Alliance from 2006 to 2010 |

| • | Former director of Acteon Group from 2006 to 2012 |

| • | Former non-executive chairman of KrisEnergy from 2009 to 2017 |

| • | Prior service on multiple energy sector boards of both privately held and publicly listed companies |

| • | Director of Blue Wing Adobe Trust (a non-profit dedicated to the preservation, restoration and adaptive reuse of Sonoma’s historic buildings) |

Education

| • | BSc, Oil Technology, Imperial College, London University |

ARCHROCK, INC. 2024 PROXY STATEMENT | 6

|

JAMES H. LYTAL Age 66 Independent Director since April 2015 Chair, Compensation Committee Member, Governance and Sustainability Committee |

Qualifications • Over 40 years of experience in the midstream oil and gas sector, including executive leadership and advisory roles • Deep familiarity with the management of midstream assets • Through extensive board service, experience with public company executive compensation and governance matters |

Career Highlights

| • | Advisor for Global Infrastructure Partners (a leading global, independent infrastructure investor) from 2009 to June 2021 |

| • | Executive Vice President, Enterprise Products Partners (a North American midstream energy services provider) from 2004 to 2009 |

| • | President of Leviathan Gas Pipeline Partners, which later became El Paso Energy Partners, and then Gulfterra Energy Partners, from 1994 to 2004 |

| • | Held a series of commercial, engineering and business development positions with various companies engaged in oil and gas exploration and production and gas pipeline services from 1980 to 1994 |

Board Service

| • | Director and chairman of the audit committee of Rice Acquisition Corp. II (a special purpose acquisition company) until June, 2023 |

| • | Director of ColdStream Energy, LLC (a privately held oil and gas energy services company) |

| • | Former director and member of the audit committee and chairman of the conflicts committee of Rice Midstream Management LLC, the managing general partner of Rice Midstream Partners, L.P. from 2015 until it was acquired in 2018 |

| • | Former director of Gulfterra Energy Partners from 1994 to 2004 |

| • | Former director of Azure Midstream Partners GP, LLC, the general partner of Azure Midstream Partners, LP from 2013 to 2017, including service as member of the audit committee and chairman of the conflicts committee |

| • | Former director and chairman of the compensation committee and member of the audit committee of SemGroup Corporation from 2011 until it was acquired in 2019 |

Education

| • | BS, Petroleum Engineering, The University of Texas at Austin |

|

LEONARD W. MALLETT Age: 67 Independent Director since January 2021 Member, Compensation Committee |

Qualifications • Significant executive leadership experience with responsibility for engineering, strategic sourcing and health, safety and environmental training, compliance and reporting • Operations experience and technical expertise, including construction, start-up and operation of natural gas and oil pipeline gathering, transportation and processing facilities |

Career Highlights

| • | Executive Vice President and Chief Operations Officer of Summit Midstream Partners, LP (a midstream provider of natural gas, oil and water gathering services) from 2015 to 2019; Interim Chief Executive Officer during 2019 |

| • | Senior Vice President, Engineering, Enterprise Products Partners L.P. (a midstream natural gas and oil pipeline company) from 2008 to 2015 and Senior Vice President of Environmental Health and Safety from 2006 to 2008 |

| • | Served in roles of increasing responsibility with TEPPCO (a master limited partnership that provided oil and natural gas pipelines and storage and related facilities) from 1979 to 2006, including as Senior Vice President of Operations |

| • | Formerly held leadership roles with the Pipeline Research Council International, the Office of Pipeline Safety and the Clean Channel Association |

Board Service

| • | Director of Bravo Infrastructure Group (a privately held holding company for solar panel installation companies) |

| • | Former director of Summit Midstream GP, LLC, the general partner of Summit Midstream Partners, LP, 2019 |

ARCHROCK, INC. 2024 PROXY STATEMENT | 7

Education

| • | BS, Mechanical Engineering, Prairie View A&M University |

| • | MBA, Houston Baptist University |

| • | Kellogg Executive Development Program at Northwestern University |

|

JASON C. REBROOK Age 50 Non-Independent Director since July 2020 |

Qualifications • Over 25 years of experience in capital markets, acquisitions, divestures and operations in both the upstream and midstream sectors • Operating experience and understanding of the unique risks, opportunities and challenges of the oil and gas industry • Leadership experience in a highly entrepreneurial and successful privately-held company |

Career Highlights

| • | Chief Executive Officer and director of Harvest Midstream Company (a privately-held midstream company services provider) since 2018 and Chief Executive Officer of JDH Capital Company |

| • | President of Hilcorp Energy Company (a privately held oil and gas production company) from 2018 to January 2021 and Executive Vice President from 2009 to 2018, having joined Hilcorp in 2008 as Asset Team Manager of the company’s Gulf of Mexico properties |

| • | Previously served as Senior Vice President, Oil & Gas, GE Capital and in both domestic and international assignments with Chevron Corporation |

| • | Member of Young Presidents’ Organization, Duke University’s Energy Task Force, the Society of Petroleum Engineers, the Independent Petroleum Association of America and the Greater Houston Partnership |

Board Service

| • | Director of privately-held companies Hilcorp Energy Company, Baywater Drilling, LLC, Kenai Logistics, LLC and STX Beef, LLC |

| • | Member of the board of trustees for Marietta College |

| • | Former director of privately-held companies Elite Compression Services, LLC from 2012 to 2019 and Texas Coastal Ventures, LLC from 2016 to 2019 |

Education

| • | BS, Petroleum Engineering, Marietta College |

| • | MBA, Duke University’s Fuqua School of Business |

|

EDMUND P. SEGNER, III Age 70 Independent Director since July 2018 Member, Audit and Governance and Sustainability Committees |

Qualifications • Technical experience and financial acumen • Thorough understanding of the energy industry and operational challenges unique to the industry • Experience with compensation, financing matters and the evaluation of acquisition opportunities through service as a president and director of other publicly-traded companies |

Career Highlights

| • | Professor in the Practice of Engineering Management in the Department of Civil and Environmental Engineering at Rice University (Houston) since 2007 |

| • | President, Chief of Staff and Director from 1999 to 2007 and principal financial officer from 2003 to 2007, EOG Resources, Inc. (a publicly traded independent oil and gas exploration and production company) |

Board Service

| • | Director and member of the audit and finance committees of Vital Energy, Inc. (a company focused on the exploration, development and acquisition of oil and natural gas properties in the Permian region of the U.S.) |

ARCHROCK, INC. 2024 PROXY STATEMENT | 8

| • | Former director of HighPoint Resources (a company engaged in exploration and production of natural gas and oil reserves in the U.S. Rocky Mountain region) from 2009 and until its merger with Bonanza Creek Energy, Inc. in 2021 |

Education

| • | BS, Civil Engineering, Rice University |

| • | MA, Economics, University of Houston |

| • | Certified Public Accountant |

ARCHROCK, INC. 2024 PROXY STATEMENT | 9

| GOVERNANCE |

INVESTOR OUTREACH

Highlights of our corporate governance practices are provided at the beginning of this Proxy Statement under “2023 in Review”. The Board is committed to responsible and responsive corporate governance policies and practices that serve the interests of all stockholders. The full Board, at the direction of our Governance and Sustainability Committee, routinely reviews best practices in corporate governance, as well as environmental and social issues, and considers stakeholder interests and feedback. Archrock takes a multipronged approach to investor communications, and during 2023, members of our senior management team attended 16 investor conferences and non-deal roadshows as well as numerous meetings to discuss our mission and vision with our stockholders and receive information on the issues they consider most important as an investor in Archrock.

DIRECTOR INDEPENDENCE AND TENURE

We have adopted a code of business conduct (the “Code of Business Conduct”), which is applicable to our directors, officers, and employees, including our Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer or Controller (or persons performing similar functions). The Code of Business Conduct is posted on our website at www.investors.archrock.com under the “Governance Highlights” tab. We will furnish a copy of the Code of Business Conduct to any person, without charge, upon written request to the address provided under “Company Contact Information.” In the event we amend or waive any of the provisions of the Code of Business Conduct that applies to our Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer or Controller (or persons performing similar functions), we intend to disclose the subsequent information on our website.

The Code of Business Conduct requires all employees, officers and directors to avoid situations that may impact their ability to carry out their duties in an independent and objective fashion. Any circumstance that has the potential to compromise their ability to perform independently must be disclosed. In addition, we distribute director and officer questionnaires at least annually to elicit related-party information. The questionnaire includes our Code of Business Conduct, Corporate Governance Principles and Securities Trading Policy and requires that each director and executive officer certify their review and compliance with such documents. We also require that responses to the questionnaire be updated throughout the year to the extent circumstances change.

Our Governance and Sustainability Committee assesses director independence annually by considering all direct and indirect business relationships between Archrock and each director (including his or her immediate family), as well as relationships with our registered public accounting firm, our compensation consultant, other for-profit concerns and charitable organizations. With our Governance and Sustainability Committee’s recommendation, the Board makes a determination relating to the independence of each member, which is based on applicable laws, regulations, our Corporate Governance Principles and the rules of the New York Stock Exchange (“NYSE”).

During our Governance and Sustainability Committee’s most recent review of independence, in addition to the responses to the director and officer questionnaires, the committee was provided information regarding transactions with any related parties as determined through a search of our accounting records. See “Related Party Information” in this Proxy Statement for more information.

Based on the recommendation of our Governance and Sustainability Committee, the Board determined that the following nominees for director are independent: Mmes. Ainsworth and Hawes and Messrs. Hall, Honeybourne, Lytal, Mallett and Segner.

The Board believes it has a healthy mix of representation based on tenure of the directors currently serving, with one new director added in the last three years.

ARCHROCK, INC. 2024 PROXY STATEMENT | 10

BOARD STRUCTURE AND OVERSIGHT

Our bylaws provide that our Chairman of the Board may be a “non-executive” Chairman or an Executive Chairman. We have selected an independent, non-executive Chairman to lead our Board of Directors. The Board recognizes the time, effort and energy that our Chief Executive Officer is required to devote to his position, the stewardship commitment required to serve as our Chairman and the benefits of having an independent Chairman lead the Board. The Board believes this structure is appropriate for us and is in the best interest of our stockholders because of the size and composition of the Board, the scope of our operations and the responsibilities of the Board and management. In addition, in evaluating the leadership structure of the Board, consideration has been given to the heightened need to monitor the rapidly changing energy environment and markets, to innovate, and to focus on environmental and social performance. Dependent upon one or more of these factors, as well as stockholder sentiment, the Board would consider the adoption of a different leadership structure and in such event would promptly communicate that change to stockholders.

|

The responsibilities of the Board Chairman include:

|

Presides over Board meetings and executive sessions of the independent directors. |

| Oversees the annual Board calendar, and, in consultation with the Company’s Chief Executive Officer (“CEO”), schedules and sets the agendas for the Board meetings. | |

| Oversees the dissemination of the appropriate information to the Board and ensures sufficient time for review and discussion of such materials. | |

| Ensures open communication between the independent directors and executive leadership. | |

| Assists the chairs of the various Board committees in preparing agendas for committee meetings. | |

| Chairs the Company’s Annual Meeting of Stockholders. | |

| Provides input on the appropriate size, structure and composition of the Board and committees of the Board. | |

| Maintains frequent communication with the CEO in between Board meetings to consider issues of importance to the Company, management and the Board. | |

| Performs other functions and responsibilities requested by the Board or CEO, including representation of the Board in communications with stockholders or other stakeholders. |

BOARD COMMITTEES AND MEETING ATTENDANCE

The Board has designated an Audit Committee, a Compensation Committee and a Governance and Sustainability Committee to assist in the discharge of the Board’s responsibilities. The Board and the committees of the Board are governed by our Code of Business Conduct, Corporate Governance Principles and the applicable committee charters, each of which is available to the public on our website at www.archrock.com or in print by submitting a written request to the address provided under “Company Contact Information.” The purpose and composition of each committee is summarized in the following table.

| Audit Committee | |

|

Members Frances Powell Hawes, Chair Anne-Marie N. Ainsworth Gordon T. Hall Edmund P. Segner III

Number of Meetings 4

Independent Directors 100% |

The Audit Committee’s purpose is to assist the Board in its oversight of the integrity of our financial statements, our compliance with legal and regulatory requirements and with the ethical standards adopted by the Company, the independence, qualifications and performance of the independent auditor and our systems of disclosure controls and procedures and internal controls over financial reporting. Further, the Audit Committee also oversees the enterprise risk management (“ERM”) process and cybersecurity risks.

The Board has determined that each of Mmes. Ainsworth and Hawes and Messrs. Hall and Segner qualifies as an “audit committee financial expert,” as that term is defined by the SEC. Further, various Audit Committee members have first-hand or supervisory experience over cybersecurity, and Ms. Hawes has also obtained the National Association of Corporate Directors Cyber Risk Oversight Certificate. No member of our Audit Committee serves on the audit committee of more than two other public companies.

The Report of the Audit Committee is included in this Proxy Statement on pages 25-26. |

ARCHROCK, INC. 2024 PROXY STATEMENT | 11

| Compensation Committee | |

|

Members James H. Lytal, Chair Gordon T. Hall J.W.G. (“Will”) Honeybourne Leonard W. Mallett

Number of Meetings 6

Independent Directors 100%

|

The Compensation Committee’s purpose is to oversee the development and implementation of our compensation philosophy and strategy with the goals of attracting, developing, retaining and compensating the senior executive talent required to achieve corporate objectives and linking pay and performance. In addition, our Compensation Committee is charged with overseeing our broad-based strategies related to human capital management.

The Report of the Compensation Committee is included in this Proxy Statement on page 50.

|

| Governance and Sustainability Committee | |

|

Members Anne-Marie N. Ainsworth, Chair Frances Powell Hawes J.W.G. (“Will”) Honeybourne James H. Lytal Edmund P. Segner III

Number of Meetings 5

Independent Directors 100%

|

The Governance and Sustainability Committee’s purpose is to identify qualified individuals to become Board members, determine whether existing Board members should be nominated for re-election, review the composition of the Board and its committees, develop and maintain our Corporate Governance Principles, oversee the annual evaluation of the Board and its committees and provide oversight of our approach to sustainability and governance matters.

|

The Board met eight times in 2023. Each director attended 100% of the meetings of the Board. Only one director missed one committee meeting on the committees on which he or she served during 2023 due to an unforeseen family emergency. It is our practice that all directors are invited to committee meetings, and all independent directors do customarily attend. Directors are also encouraged to attend each Annual Meeting of Stockholders, and in 2023 all directors attended the meeting.

RISK OVERSIGHT

The Board has an active role, as a whole and through its committees, in oversight of the Company’s risks consistent with the principles outlined in the Committee of Sponsoring Organizations of the Treadway Commission (COSO) 2017 framework and is assisted by management in the exercise of these responsibilities. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board is regularly informed through committee reports; our directors are invited to attend all committee meetings, and the independent directors typically do so. This enables the Board and its committees to coordinate the risk oversight role, particularly with respect to risk interrelationships. The involvement of the Board in reviewing, approving and monitoring our fundamental financial and business strategies, as contemplated by our Corporate Governance Principles, is important to the determination of the types and appropriate levels of risk we undertake.

Management is responsible for identifying risks and opportunities along with the associated risk response which may involve implementing processes and procedures intended to mitigate risks, which can range from risk avoidance or acceptance to reduction or transfer depending on the facts and circumstances. Archrock engages an outside consultant on a periodic basis to assist management with the identification of short-, intermediate- and long-term risks and to provide insight into emerging trends and best practices, with the last engagement occurring in 2023. In addition, risks associated with executive compensation are also reviewed by our independent compensation consultant. Identified risks are ranked based on likelihood of occurrence and potential impact. The assessment considered our risk response and mitigating factors, resulting in the assignment of a management effectiveness score. Risk exposure is considered in the development of our annual and long-term business planning and executive compensation program and informs our approach to business continuity and cybersecurity planning and our compliance and human resource programs. See “Risk Management with Respect to Information Technology and Cybersecurity” below for further information on cybersecurity risk management specifically.

ARCHROCK, INC. 2024 PROXY STATEMENT | 12

Validation of management’s risk response occurs through internal audits or resources independent of the functional area, our disclosure controls and procedures and, with respect to financial reporting, external auditing. While management presents their findings on risk exposure and our response, the Board has the authority to override management on any risk matter.

Risk management is a continuous process comprised of five intertwined components: strategy and objective setting, performance, review and revision, information, communication and reporting and governance and oversight. Through these activities, regular reports are provided to the Board and its committees. Importantly, management’s regular attendance at and in-person reports to the Board and its committees provide direct access to our management team, for example:

| ● | Our Vice President, Health, Safety and Environment provides quarterly updates to our Board. |

| ● | Our Vice President, Internal Audit reports directly to the Chair of our Audit Committee. |

| ● | Our Senior Vice President and General Counsel also serves as our Chief Compliance Officer and provides monthly and quarterly compliance updates to the Audit Committee and more frequent updates as-needed. |

| ● | Our Vice President, Information Technology and Senior Manager Information Technology provide regular cybersecurity updates to our Audit Committee. |

| ● | Members of our senior management team report quarterly to the full Board on operations and financial performance. |

| ● | Our Vice President, Internal Audit, Chief Compliance Officer, Chief Financial Officer, Chief Accounting Officer and independent auditors each meet separately with our Audit Committee in executive session with no other members of management present on a quarterly basis. |

| ● | Our Vice President, Tax provides quarterly updates to our Audit Committee. |

| ● | Our Vice President, Investor Relations, routinely reports on sustainability matters to our Governance and Sustainability Committee. |

| ● | Our Senior Vice President and Chief Human Resource Officer attends all Compensation Committee meetings, and the committee meets privately with our independent compensation consultant. |

ARCHROCK, INC. 2024 PROXY STATEMENT | 13

The following sets forth the responsibility of the Board, Board committees and management with respect to risk oversight:

| Board of Directors |

● Strategic, financial and execution risk associated with the annual performance plan and long-term plan, including major operational and sustainability initiatives ● Risks associated with capital management, including financing, dividends and capital expenditures ● Mergers, acquisitions and divestitures ● Major litigation, disputes and regulatory matters ● Management succession planning ● Emissions-related risks and opportunities that may impact our business strategy ● Oversight of the ERM program |

| Audit Committee |

● Financial reporting, accounting, disclosure and internal controls, including oversight of the internal and independent audit functions ● Assist the Board with oversight of the ERM process for identifying key risks and assessing management’s response ● Cybersecurity risk program ● Compliance, litigation and tax regulatory matters |

|

Compensation Committee |

● Risks related to the overall effectiveness and cost of our compensation and benefit programs ● Risks associated with the design of executive compensation, including a mix of short-term and long-term incentive compensation that does not encourage excessive risk-taking ● Performance management as it relates to our executive officers ● Approach to human capital management ● Assist the Board with management succession planning |

|

Governance and Sustainability Committee |

● Risks associated with corporate governance and board composition and effectiveness and director succession planning ● Monitoring and disclosure of material sustainability risks and integration of Company-wide response ● Review of the annual Sustainability Report prior to publication |

ARCHROCK, INC. 2024 PROXY STATEMENT | 14

| Management |

● Stay abreast of emerging regulatory issues, external and internal threats and best practices ● Annually identify short-, intermediate- or long-term material risks and rank such risks according to likelihood and potential impact ● Develop a risk response and create processes and procedures for risk mitigation, including through our routine disclosure controls and procedures ● Regularly evaluate the adequacy and implementation of risk mitigation processes and procedures ● Integrate risk management into our corporate strategy ● Regularly report to the Board or Board committees, as applicable, regarding risk management ● Regularly communicate with the Board regarding our strategic and financial plans |

Risk Management with Respect to Information Technology and Cybersecurity. Our Board delegates oversight to specific subcommittees and is informed quarterly through committee reports. It is our practice that all directors are invited to committee meetings, and they typically attend these meetings. The Audit Committee of our Board is responsible for overseeing our cybersecurity risk management program. Various Audit Committee members have first-hand or supervisory experience over cybersecurity, and our Audit Committee chair is certified in the National Association of Corporate Directors Cyber Risk Oversight Program.

Our Information Technology (“IT”) senior management team, including our Vice President of IT, is responsible for assessing and managing our material risks from cybersecurity threats and has primary responsibility for our overall cybersecurity risk management program, including supervising both our internal cybersecurity personnel and external cybersecurity consultants. Our Vice President of IT has over 29 years of experience managing enterprise applications, a majority of this time in a global environment adhering to General Data Protection Regulation Compliance and other regulations. Additional experience includes managing large scale technology transformations involving applications, infrastructure and security. Our IT senior management has more than a decade of experience in cybersecurity risk management, including Certified Information Systems Security Professional certification. Our IT management team utilizes various processes and technologies to identify, protect, detect, respond and recover from cybersecurity events and incidents. Cybersecurity events and incidents can be reported to our Vice President of IT in several ways, including through our external managed detection and response provider, system alerts or employees reporting suspicious activity. The Vice President of IT reports to our executive leadership team, who provides cybersecurity risk assessment and response updates to the Audit Committee on a regular basis, or as often as deemed necessary.

DIRECTOR QUALIFICATIONS, DIVERSITY AND NOMINATIONS

Our Governance and Sustainability Committee believes that all Board candidates should be selected for their character, judgment, ethics, integrity, business experience, time commitment and acumen. The Board, as a whole, through its individual members, seeks to have competence in areas of particular importance to us such as finance, accounting, operations, energy industry, health, safety and the environment and relevant technical expertise. Our Governance and Sustainability Committee also considers issues of diversity in the director identification and nomination process and has benefitted from and believes it will continue to benefit from Board diversity. While our Governance and Sustainability Committee does not have a formal policy with respect to diversity, it seeks nominees with a broad diversity of experience, professions, skills, education and backgrounds. Our Governance and Sustainability Committee does not assign specific weights to particular criteria and no particular criterion is necessarily applicable to all prospective nominees. Our Governance and Sustainability Committee believes that the backgrounds and qualifications of the directors, considered as a group, should provide a significant composite mix of experience, knowledge and abilities that will allow the Board to fulfill its responsibilities.

Directors must be committed to enhancing the long-term interests of our stockholders as a whole and should not be biased toward the interests of any particular segment of the stockholder or employee population. Board members should also be prepared to travel to attend meetings of the Board and its committees and should be ready to dedicate sufficient time to prepare in advance of such meetings to allow them to make an effective contribution to the meetings. Further, Board members should ensure that they are not otherwise committed to other activities which would make a commitment to the Board impractical or unadvisable. In addition, Board members should satisfy the independence, qualification and composition requirements of the Board and its committees, as required by law, regulation and the rules of the NYSE, our certificate of incorporation, our bylaws and our Corporate Governance Principles.

Stockholders may propose director nominees to our Governance and Sustainability Committee (for consideration for election at the 2025 Annual Meeting of Stockholders) by submitting, within the time frame set forth in this Proxy Statement, the names and supporting information (including confirmation of the nominee’s willingness to serve as a director) to the address provided under “Company Contact Information.” Any stockholder-recommended nominee will be evaluated in the context of our director qualification standards and the existing size and composition of the Board. See “Additional Information – 2025 Annual Meeting of Stockholders.”

ARCHROCK, INC. 2024 PROXY STATEMENT | 15

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

Messrs. Hall, Honeybourne, Lytal and Mallett served on our Compensation Committee in 2023. There are no matters relating to interlocks or insider participation that we are required to report.

MANAGEMENT SUCCESSION PLANNING

Succession planning is a critical Board function. Our Compensation Committee considers our business strategy in evaluating the skills and experience necessary for us to achieve our objectives and is actively engaged in management succession planning. With input from our Chief Executive Officer, our Compensation Committee routinely reviews management talent and leadership development and advises the Board in this regard. The Board has adopted a management succession plan, as well as a succession policy in the event of an unanticipated vacancy in the Chief Executive Officer position. In addition, the Company has entered into a Retention Incentive Agreement with the Chief Executive Officer. See “Other Compensation Policies, Practices and Guidelines – Agreements with Executive Officers.”

RELATED PARTY INFORMATION

Related Party Policy and Practices. We recognize that transactions with related persons can present potential or actual conflicts of interest and create the appearance that decisions are based on considerations other than the best interests of Archrock and our stockholders. Therefore, our Audit Committee has adopted a written policy on related party transactions to provide guidance and set standards for the approval and reporting of transactions between Archrock and individuals with a direct or indirect affiliation with the Company and to ensure that those transactions are in Archrock’s best interest. Any proposed related party transaction must be submitted to our Audit Committee for approval prior to entering into the transaction. Additionally, our policy requires a review by our Financial Reporting Department of any related party transactions on a quarterly basis. In the event we become aware of any pending or ongoing related party transaction that has not been previously approved or ratified, the transaction must be promptly submitted to our Audit Committee or its Chair for ratification, amendment or termination of the related party transaction. If a related party transaction is ongoing, our Audit Committee may establish guidelines for management and will annually assess the relationship with such related party.

In reviewing a proposed or ongoing related party transaction, our Audit Committee will consider, among other things, the following factors to the extent relevant to the related party transaction:

| ● | whether the terms of the transaction are fair to the Company and would apply on the same basis if the transaction did not involve a related party; |

| ● | whether there are any compelling business reasons for the Company to enter into the transaction; |

| ● | whether the transaction would impair the independence of an otherwise independent director; and |

| ● | whether the transaction would present an improper conflict of interest for any director or executive officer of the Company, taking into account, among other factors our Audit Committee deems relevant, the size of the transaction, the overall financial position of the director, executive officer or other related party, that person’s interest in the transaction and the ongoing nature of any proposed relationship. |

Related Party Transactions During 2023. From August 2019 to present, our Board has included a member affiliated with our customer Hilcorp Energy Company (“Hilcorp”) or its subsidiaries or affiliates. Jason C. Rebrook, who was elected to the Board in July 2020, continues to serve as a director on Archrock’s Board and is Chief Executive Officer and director of Harvest Midstream Company (“Harvest”), a Hilcorp affiliate. See “Election of Directors – Nominees for Director.”

In the normal course of business, the Company and its affiliates provide Hilcorp, Harvest and certain other Hilcorp affiliates with contract operations services and aftermarket parts at standard market rates. For fiscal year 2023, we recognized revenue of approximately $35.4 million from transactions with Hilcorp, Harvest and their affiliates.

ARCHROCK, INC. 2024 PROXY STATEMENT | 16

Pursuant to the ongoing transactions with Hilcorp, Harvest and their affiliates, and his position as a director, Mr. Rebrook is deemed not independent. Therefore, the Board may request that Mr. Rebrook recuse himself from discussions that would reasonably be expected to result in a conflict of interest, including (without limitation) matters relating directly to Hilcorp, Harvest or any of their affiliates, as well as pricing discussions.

DIRECTOR COMPENSATION

Our Compensation Committee is responsible for recommending director compensation to the full Board for approval. Director compensation is designed to ensure we can attract and retain outstanding directors who meet the qualifications outlined in the Board’s Corporate Governance Principles, ensure alignment with long-term stockholder interests and recognize the substantial time commitments associated with service on the Board.

Each non-employee member of the Board is compensated in cash and equity. Mr. Hall receives additional cash compensation to reflect his additional responsibilities as Chairman of the Board. As President and Chief Executive Officer of Archrock, Mr. Childers does not receive additional compensation for service on the Board.

Our independent compensation consultant conducted a comprehensive market review of director compensation in October 2023, evaluating data derived from the proxy statements of our peer companies and the National Association of Corporate Directors Compensation Survey for energy industry companies with 2022 revenues between $500 million and $2 billion. The review indicated that the structure of our director compensation program was consistent with our peer group and our typical director compensation was below the median of the peer group. The Compensation Committee, with input from our independent compensation consultant, continues to monitor director compensation in conjunction with review of our peer group.

ARCHROCK, INC. 2024 PROXY STATEMENT | 17

Cash Compensation. Each non-employee director earned an annual cash retainer (the “Base Retainer”) for his or her service during 2023. The Chairman of the Board and the chairs of our Audit Committee, Compensation Committee and Governance and Sustainability Committee each received an additional retainer for their services. All retainers are paid in arrears in equal quarterly installments. Directors are also reimbursed for reasonable expenses incurred to attend Board and committee meetings. The Base Retainer for 2023 remained the same as 2022 at $100,000.

| Description of Director Remuneration |

Annualized Cash Compensation $ |

|

| Base Retainer | 100,000 | |

| Additional Retainers1 | ||

| Chairman of the Board | 100,000 | |

| Audit Committee Chair | 22,500 | |

| Compensation Committee Chair | 20,000 | |

| Governance and Sustainability Committee Chair | 20,000 |

1 On December 14, 2023 the Compensation Committee, with input from our independent compensation consultant, approved increased additional retainers for the Chairman of the Board and each committee chair ($120,000 for the Chairman of the Board, $30,000 for the Audit Committee Chair and $25,000 for each of the Compensation Committee and Governance and Sustainability Chair) effective January 1, 2024.

Equity-Based Compensation. On January 26, 2023, our Compensation Committee approved the grant of restricted stock or restricted stock units with a deferred delivery date to each non-employee director with a grant date value equal to approximately $130,000. The number of shares awarded was determined based on the market closing price of our common stock on the grant date ($9.42) and resulted in the award of 13,800 restricted shares or restricted stock units to each non-employee director. The equity award was one-quarter vested on the grant date, and on each of June 1, September 1 and December 1, 2023. On December 14, 2023 the Compensation Committee, with input from our independent compensation consultant, approved an increase in the grant of restricted stock or restricted stock units to each non-employee director for 2024 from approximately $130,000 to approximately $135,000, effective January 1, 2024.

Stock Ownership Requirements. Our stock ownership policy requires each non-employee director to own an amount of our common stock equal to at least five times the Base Retainer amount (which equals $500,000 of our common stock) within five years of his or her election to the Board. We measure the stock ownership of our directors annually as of each June 30. All directors are in compliance with our stock ownership policy.

Director Stock and Deferral Plan. Under our Directors’ Stock and Deferral Plan (the “Directors’ Plan”), directors may elect to receive all or a portion of their cash compensation for Board service in the form of our common stock and may defer their receipt of the stock. No director elected to participate in the Directors’ Plan during 2023.

ARCHROCK, INC. 2024 PROXY STATEMENT | 18

Total Director Compensation. The following table shows the total compensation paid to each non-employee director for his or her service during 2023. As shown below, excluding our Chairman of the Board, the equity (at-risk) portion of compensation is greater than 50% of each director’s total compensation.

| Director |

Fees Earned in Cash |

Stock Awards ($)1 |

All Other Compensation ($)2 |

Total ($) |

|||

| Anne-Marie N. Ainsworth | 120,000 | 129,996 | 5,227 | 255,223 | |||

| Gordon T. Hall | 200,000 | 129,996 | 5,227 | 335,223 | |||

| Frances Powell Hawes | 122,500 | 129,996 | 5,227 | 257,723 | |||

| J.W.G. Honeybourne | 100,000 | 129,996 | 5,227 | 235,223 | |||

| James H. Lytal | 120,000 | 129,996 | 5,227 | 255,223 | |||

| Leonard W. Mallett | 100,000 | 129,996 | 5,227 | 235,223 | |||

| Jason C. Rebrook | 100,000 | 129,996 | 5,227 | 235,223 | |||

| Edmund P. Segner, III | 100,000 | 129,996 | — | 229,996 | |||

1 Represents the grant date fair value of our common stock calculated in accordance with ASC 718 (defined below under “Tax and Accounting Considerations – Accounting for Stock-Based and Unit-Based Compensation”). In lieu of restricted stock, Mr. Segner elected to receive restricted stock units with deferred delivery.

2 Represents the payment of dividends on unvested restricted stock. Dividend equivalent rights were accrued on the restricted stock units issued to Mr. Segner and will be paid upon distribution of the shares underlying the units according to the terms of the Archrock, Inc. 2020 Stock Incentive Plan.

ARCHROCK, INC. 2024 PROXY STATEMENT | 19

COMPANY MANAGEMENT TEAM

The following provides information regarding our executive and senior leadership officers as of March 1, 2024. Information concerning the business experience of Mr. Childers is provided under “Nominees for Director” in this Proxy Statement.

| Douglas S. Aron (50) – Senior Vice President and Chief Financial Officer since 2018 | |

|

• Executive Vice President and Chief Financial Officer of HollyFrontier Corporation (an independent petroleum refiner and marketer of petroleum products) from 2011 to 2017 • Prior to Frontier Oil Corporation’s merger with Holly Corporation in 2011, served Frontier as Executive Vice President and Chief Financial Officer, from 2009, as Vice President of Corporate Finance, from 2005 to 2008 and as Director of Investor Relations, from 2001 to 2005 • Executive Vice President and Chief Financial Officer of Nine Energy Service, Inc. (a North America oilfield services company) in 2017 • BA, Journalism, The University of Texas at Austin • MBA, Jesse H. Jones Graduate School of Business, Rice University |

| Donna A. Henderson (56) – Vice President and Chief Accounting Officer since 2016 | |

|

• Vice President, Accounting, of our primary operating subsidiary since 2015 • Vice President and Chief Accounting Officer of Southcross Energy Partners GP, LLC (a provider of natural gas gathering, processing, treating, compression and transportation services) from 2013 to 2015 • Vice President and Chief Audit Executive of GenOn Energy, Inc. (a wholesale electric generator that merged into NRG Energy) from 2011 to 2012 • Assistant Controller of GenOn Energy, Inc. and its predecessor companies, RRI Energy, Inc. and Reliant Energy Inc., from 2005 to 2011, and various other leadership roles within the accounting department of that organization since 2000 • From 1996 to 2000, various accounting positions with Lyondell Chemical (a manufacturer of chemicals and polymers), having begun her career with accounting firms Deloitte & Touche LLP and KPMG LLP • Member of the Executive Committee and Board of Trustees of the Good Samaritan Foundation • BBA, Accounting, Eastern New Mexico University • Member of the American Institute of Certified Public Accountants |

| Stephanie C. Hildebrandt (59) – Senior Vice President, General Counsel and Secretary since 2017 | |

|

|

• Partner, Norton Rose Fulbright (a global law firm) from 2015 to 2017 • Senior Vice President, General Counsel and Secretary of Enterprise Products Partners L.P. (“Enterprise”, a publicly traded pipeline and infrastructure company and consumer energy service provider) from 2010 to 2014, after serving in various other roles at Enterprise • Member of the Board of Directors of FS Crude Parent, LLC • Member of the Tulane Center for Energy Law Advisory Board since 2019 • Member of the executive council, since 2020, and advisory council, since 2014, of The University of Texas Kay Bailey Hutchison Center for Energy, Law & Business • Member of the President’s Advisory Board at the University of St. Thomas since 2016 • Former director and member of the audit committee of WildHorse Resource Development Corporation from 2017 until it was acquired in 2019, and for a portion of her tenure, as chair of the compensation committee • Former director and member of the conflicts committee of Rice Midstream Management LLC, the general partner of Rice Midstream Partners LP from 2016 until it was acquired in 2018 • Former director, chair of the compensation committee and member of the nominating and governance committee of TRC Companies, Inc. from 2014 until it was acquired in 2017 • BS, Foreign Service, Georgetown University • JD, Tulane University Law School |

ARCHROCK, INC. 2024 PROXY STATEMENT | 20

| Jason G. Ingersoll (53) – Senior Vice President, Sales and Operations Support since 2018 and 2020, respectively | |

|

• Senior Vice President, Marketing and Sales of Archrock since 2018 after having served as Vice President from 2015 to 2018 • Vice President, Sales of our predecessor subsidiary Exterran Energy Solutions, L.P. (“EESLP”) from 2013 to 2015, as well as positions of increasing responsibility with EESLP, including as Regional Vice President, from 2012 to 2013, Business Unit Director from 2009 to 2012 • Held positions of increasing responsibility including Country Manager of China with UCI • BS, Mechanical Engineering, Texas A&M University |

| Elspeth A. Inglis (55) – Senior Vice President and Chief Human Resources Officer since 2019 | |

|

• Vice President, Culture Integration at Baker Hughes from 2018 to 2019 • Head of Human Resources, Downstream Technology Services, GE Oil and Gas (a global manufacturing business) from 2013 to 2017 • Vice President, Human Resources supporting the startup operations for the US unconventional shale gas business of Reliance Industries from 2011 to 2013 • From 2002 to 2009, held positions of increasing responsibility at CGG (a geophysical services company) including Marine Human Resource Manager and Vice President Human Resources, Western Hemisphere in Houston and Senior Vice President Geophysical Services based in Paris • Human Resource Manager for Enron Corp. from 1999 to 2001 in both London and Houston • Director and member of the human resource committee of Catholic Charities • Advisory board member of Workforce Next • Graduate member of the Institute of Personnel Development (UK) and Senior Practitioner of Human Resources (US) certification • HR and Management education from Rice University and Henley Business Management School, University of Reading (UK); Associate’s degree from University of the Arts London (UK), Business Management |

| Eric W. Thode (58) – Senior Vice President, Operations since 2020 | |

|

|

• Vice President, Operations since October 2018, having previously served as Vice President and Business Unit Director of the South Texas Business Unit of Archrock Services, L.P., our wholly owned operating subsidiary, since 2018 and 2014, respectively • Director of Archrock’s Barnett Business Unit from 2012 to 2014 • Director of Archrock Business Development, negotiating alliance contracts that generated over $100 million in annual revenue, having served our predecessor subsidiaries, EESLP and UCI, since 2004 • Director, Public Relations of Enron Corporation from 1999 to 2004 • Manager, Government and Public Affairs of TEPPCO Partners from 1991 to 1999 • BS, Economics, Texas A&M University • MPA, Texas A&M University |

ARCHROCK, INC. 2024 PROXY STATEMENT | 21

| STOCK OWNERSHIP |

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following table provides information about beneficial owners, known by us as of March 1, 2024, of 5% or more of our outstanding common stock (the “5% Stockholders”). Unless otherwise noted in the footnotes to the table, the 5% Stockholders named in the table have sole voting and investment power with respect to all shares shown as beneficially owned by them.

| Name and Address of Beneficial Owner | Number of Shares Beneficially Owned |

Percent of Class1 |

| BlackRock, Inc. 50 Hudson Yards New York, New York 10001 |

23,606,5542 | 15.1% |

| The Vanguard Group, Inc. 100 Vanguard Blvd. Malvern, Pennsylvania 19355 |

17,471,8053 | 11.2% |

|

EARNEST Partners, LLC 1180 Peachtree Street NE, Suite 2300

|

13,658,5644 | 8.7% |

|

Dimensional Fund Advisors LP

|

10,625,9825 | 6.8% |

1 Reflects shares of common stock beneficially owned as a percentage of approximately 156 million shares of common stock outstanding as of March 1, 2024.

2 Based solely on a review of the Schedule 13G filed by BlackRock, Inc. on January 22, 2024. BlackRock, Inc. has sole voting power over 22,910,810 shares and sole dispositive power over 23,606,554 shares.

3 Based solely on a review of the Schedule 13G filed on February 13, 2024 by The Vanguard Group, Inc. (“Vanguard”). Vanguard does not have sole power to vote any of the shares reported, but has shared voting power over 133,635 shares. Vanguard has sole dispositive power over 17,203,564 shares and shared dispositive power over 268,241 shares.

4 Based solely on a review of the Schedule 13G filed by EARNEST Partners, LLC on February 12, 2024. EARNEST Partners, LLC has sole voting power over 12,159,357 shares and sole dispositive power over 13,656,564 shares.

5 Based solely on a review of the Schedule 13G filed by Dimensional Fund Advisors LP on February 9, 2024, which provides investment advice to four registered investment companies and acts as investment manager or sub-advisor to certain other commingled funds, group trusts and separate accounts (collectively, the “Funds”). Dimensional Fund Advisors LP and its subsidiaries (collectively, “Dimensional”) may act as an adviser, sub-adviser and/or manager to certain Funds. Dimensional possesses sole voting power over 10,443,664 shares and sole dispositive power over the 10,625,982 shares held by the Funds and may be deemed to be the beneficial owner of the shares held by the Funds. However, all shares are owned by the Funds, and Dimensional disclaims beneficial ownership of such shares.

OWNERSHIP OF MANAGEMENT

The following table provides information, as of March 1, 2024, regarding the beneficial ownership of our common stock by each of our directors, each of our Named Executive Officers and all of our current directors and executive officers as a group. Unless otherwise noted in the footnotes to the table, the persons named in the table have sole voting and investment power with respect to all shares shown as beneficially owned by them. The address for each individual listed below is c/o Archrock, Inc., 9807 Katy Freeway, Suite 100, Houston, Texas 77024.

ARCHROCK, INC. 2024 PROXY STATEMENT | 22

| Name of Beneficial Owner | Shares Owned Directly |

Restricted Units1 |

Right to Acquire Stock |

Indirect Ownership2 |

Total Ownership |

Percent of Class |

|||||

| Non-Employee Directors | |||||||||||

| Anne-Marie N. Ainsworth | 115,419 | 6,328 | — | — | 121,747 | * | |||||

| Gordon T. Hall | 228,589 | 6,328 | — | — | 234,917 | * | |||||

| Frances Powell Hawes | 94,141 | 27,606 | — | — | 121,747 | * | |||||

| J.W.G. Honeybourne | 157,725 | 6,328 | — | — | 164,053 | * | |||||

| James H. Lytal | 115,419 | 6,328 | — | — | 121,747 | * | |||||

| Leonard W. Mallett | 48,515 | 6,328 | — | — | 54,843 | * | |||||

| Jason C. Rebrook | 43,515 | 6,328 | — | — | 49,843 | * | |||||

| Edmund P. Segner, III | 74,476 | 49,843 | — | — | 124,319 | * | |||||

| Named Executive Officers | |||||||||||

| D. Bradley Childers | 1,566,566 | 583,658 | — | — | 2,150,224 | 1.4% | |||||

| Douglas S. Aron | 352,677 | 200,183 | — | — | 552,860 | * | |||||