deerconsumer10q093011.htm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

x

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2011

|

|

OR

|

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission file number: 001-34407

DEER CONSUMER PRODUCTS, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

20-5526104

|

|

(State or other jurisdiction of incorporation

or organization)

|

|

(IRS Employer Identification No.)

|

|

Area 2, 1/F, Building M-6,

Central High-Tech Industrial Park,

Nanshan, Shenzhen, China

|

|

518057

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

(86) 755-8602-8285

|

|

(Registrant’s telephone number, including area code)

|

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the last 90 days.

YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

YES x NO ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer, “accelerated filer,” “non-accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨

|

Accelerated filer x

|

|

Non-accelerated filer ¨

|

Smaller reporting company ¨

|

|

(do not check if a smaller reporting company)

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

YES ¨ NO x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: 33,592,562 shares of common stock outstanding as of November 7, 2011.

Deer Consumer Products, Inc.

| |

|

Page |

|

PART I. FINANCIAL INFORMATION

|

|

| |

|

|

|

Item 1.

|

|

3

|

|

Item 2.

|

|

20

|

|

Item 3.

|

|

28

|

|

Item 4.

|

|

29

|

| |

|

|

|

PART II. OTHER INFORMATION

|

|

| |

|

|

|

Item 1.

|

|

30

|

|

Item 1A.

|

|

30

|

|

Item 2.

|

|

30

|

|

Item 3.

|

|

30

|

|

Item 5.

|

|

30

|

|

Item 6.

|

|

30

|

| |

|

|

|

|

31

|

| |

|

|

|

|

32

|

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

DEER CONSUMER PRODUCTS, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

| |

|

SEPTEMBER 30, 2011

|

|

|

DECEMBER 31, 2010

|

|

|

ASSETS

|

|

(UNAUDITED)

|

|

|

|

|

| |

|

|

|

|

|

|

|

CURRENT ASSETS

|

|

|

|

|

|

|

|

Cash & equivalents

|

|

$ |

26,772,793 |

|

|

$ |

33,956,591 |

|

|

Restricted cash

|

|

|

482,683 |

|

|

|

1,347,385 |

|

|

Accounts receivable

|

|

|

55,733,650 |

|

|

|

52,686,494 |

|

|

Advances to suppliers

|

|

|

1,886,933 |

|

|

|

3,018,531 |

|

|

Other receivables

|

|

|

637,098 |

|

|

|

125,580 |

|

|

VAT receivable

|

|

|

3,884,940 |

|

|

|

2,839,718 |

|

|

Prepaid expenses

|

|

|

12,500 |

|

|

|

159,583 |

|

|

Deposits

|

|

|

828,652 |

|

|

|

445,740 |

|

|

Inventories

|

|

|

40,852,119 |

|

|

|

23,015,850 |

|

| |

|

|

|

|

|

|

|

|

|

Total current assets

|

|

|

131,091,367 |

|

|

|

117,595,472 |

|

| |

|

|

|

|

|

|

|

|

|

NON-CURRENT ASSETS

|

|

|

|

|

|

|

|

|

|

Property and equipment, net

|

|

|

21,981,463 |

|

|

|

20,453,404 |

|

|

Advance for construction and equipment

|

|

|

919,306 |

|

|

|

- |

|

|

Prepayment for land use rights

|

|

|

- |

|

|

|

3,367,207 |

|

|

Intangible assets, net

|

|

|

36,602,688 |

|

|

|

38,308,468 |

|

|

Construction in progress

|

|

|

12,735,572 |

|

|

|

8,913,181 |

|

|

Other assets

|

|

|

- |

|

|

|

4,570 |

|

| |

|

|

|

|

|

|

|

|

|

Total noncurrent assets

|

|

|

72,239,029 |

|

|

|

71,046,830 |

|

| |

|

|

|

|

|

|

|

|

|

TOTAL ASSETS

|

|

$ |

203,330,396 |

|

|

$ |

188,642,302 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

11,550,095 |

|

|

$ |

26,247,453 |

|

|

Advance from customers

|

|

|

3,646,510 |

|

|

|

1,759,792 |

|

|

Income tax payable

|

|

|

6,508,184 |

|

|

|

5,536,646 |

|

|

Other payables and accrued expenses

|

|

|

2,567,299 |

|

|

|

3,001,716 |

|

|

Dividend payable

|

|

|

1,679,628 |

|

|

|

- |

|

|

Notes payable

|

|

|

5,420,745 |

|

|

|

8,361,698 |

|

| |

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

|

31,372,460 |

|

|

|

44,907,305 |

|

| |

|

|

|

|

|

|

|

|

|

COMMITMENTS AND CONTINGENCIES

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

Common Stock, $0.001 par value; 75,000,000 shares

authorized; 33,592,562 shares issued and

outstanding as of September 30, 2011 and

December 31, 2010, respectively

|

|

|

33,593 |

|

|

|

33,593 |

|

|

Paid-in capital

|

|

|

91,161,931 |

|

|

|

91,084,958 |

|

|

Statutory reserve

|

|

|

7,674,827 |

|

|

|

6,127,639 |

|

|

Development fund

|

|

|

3,837,413 |

|

|

|

3,063,819 |

|

|

Accumulated other comprehensive income

|

|

|

13,111,668 |

|

|

|

6,315,475 |

|

|

Retained earnings

|

|

|

56,138,503 |

|

|

|

37,109,513 |

|

| |

|

|

|

|

|

|

|

|

|

Total stockholders' equity

|

|

|

171,957,935 |

|

|

|

143,734,997 |

|

| |

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

$ |

203,330,396 |

|

|

$ |

188,642,302 |

|

The accompanying notes are an integral part of these financial statements.

DEER CONSUMER PRODUCTS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME AND OTHER COMPREHENSIVE INCOME

(UNAUDITED)

| |

|

Nine Months Ended September 30,

|

|

|

Three Months Ended September 30,

|

|

| |

|

2011

|

|

|

2010

|

|

|

2011

|

|

|

2010

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

$ |

152,800,171 |

|

|

$ |

113,616,453 |

|

|

$ |

72,996,341 |

|

|

$ |

55,263,309 |

|

|

Cost of revenue

|

|

|

107,439,971 |

|

|

|

81,011,120 |

|

|

|

50,741,986 |

|

|

|

39,417,477 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

45,360,201 |

|

|

|

32,605,333 |

|

|

|

22,254,355 |

|

|

|

15,845,832 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling

|

|

|

10,723,068 |

|

|

|

6,004,777 |

|

|

|

5,193,216 |

|

|

|

2,756,357 |

|

|

General and administrative

|

|

|

3,378,922 |

|

|

|

3,245,637 |

|

|

|

1,104,235 |

|

|

|

1,480,948 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses

|

|

|

14,101,990 |

|

|

|

9,250,414 |

|

|

|

6,297,451 |

|

|

|

4,237,305 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from operations

|

|

|

31,258,211 |

|

|

|

23,354,919 |

|

|

|

15,956,904 |

|

|

|

11,608,527 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-operating income (expenses)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

170,844 |

|

|

|

519,814 |

|

|

|

62,144 |

|

|

|

188,754 |

|

|

Interest expense

|

|

|

- |

|

|

|

(85,438 |

) |

|

|

- |

|

|

|

(35,977 |

) |

|

Exchange loss

|

|

|

(464,225 |

) |

|

|

(884,431 |

) |

|

|

(197,370 |

) |

|

|

(758,621 |

) |

|

Subsidy income

|

|

|

1,046,663 |

|

|

|

- |

|

|

|

39,471 |

|

|

|

- |

|

|

Other

|

|

|

(80,089 |

) |

|

|

17,450 |

|

|

|

1,678 |

|

|

|

9,227 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total non-operating income (expenses), net

|

|

|

673,194 |

|

|

|

(432,605 |

) |

|

|

(94,076 |

) |

|

|

(596,617 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income tax

|

|

|

31,931,404 |

|

|

|

22,922,314 |

|

|

|

15,862,827 |

|

|

|

11,011,910 |

|

|

Income tax expense

|

|

|

5,542,748 |

|

|

|

3,599,127 |

|

|

|

2,614,649 |

|

|

|

1,746,286 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

|

26,388,657 |

|

|

|

19,323,187 |

|

|

|

13,248,179 |

|

|

|

9,265,624 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive item

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation gain

|

|

|

6,796,193 |

|

|

|

2,525,446 |

|

|

|

3,314,324 |

|

|

|

2,127,010 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive Income

|

|

$ |

33,184,850 |

|

|

$ |

21,848,633 |

|

|

$ |

16,562,504 |

|

|

$ |

11,392,634 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic weighted average shares outstanding

|

|

|

33,592,562 |

|

|

|

33,082,481 |

|

|

|

33,592,562 |

|

|

|

33,585,553 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted weighted average shares outstanding

|

|

|

33,592,562 |

|

|

|

33,654,774 |

|

|

|

33,592,562 |

|

|

|

33,591,108 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share

|

|

$ |

0.79 |

|

|

$ |

0.58 |

|

|

$ |

0.39 |

|

|

$ |

0.28 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per share

|

|

$ |

0.79 |

|

|

$ |

0.57 |

|

|

$ |

0.39 |

|

|

$ |

0.28 |

|

The accompanying notes are an integral part of these financial statements.

DEER CONSUMER PRODUCTS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

NINE MONTHS ENDED SEPTEMBER 30, 2011 AND 2010

(UNAUDITED)

| |

|

2011

|

|

|

2010

|

|

| |

|

|

|

|

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

|

|

|

|

|

|

|

Net income

|

|

$ |

26,388,657 |

|

|

$ |

19,323,187 |

|

|

Adjustments to reconcile net income to net cash (used in) provided by operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

2,364,524 |

|

|

|

1,186,426 |

|

|

Stock-based compensation

|

|

|

76,971 |

|

|

|

250,042 |

|

|

(Increase) decrease in current assets:

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

(599,417 |

) |

|

|

(24,271,068 |

) |

|

Advances to suppliers

|

|

|

(567,086 |

) |

|

|

(5,119,133 |

) |

|

Other receivables, prepayments, and deposits

|

|

|

(704,169 |

) |

|

|

46,505 |

|

|

Other assets

|

|

|

4,659 |

|

|

|

(567,302 |

) |

|

Inventories

|

|

|

(16,496,200 |

) |

|

|

(3,321,876 |

) |

|

Increase (decrease) in current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

|

(15,456,607 |

) |

|

|

11,693,505 |

|

|

Advance from customers

|

|

|

1,838,617 |

|

|

|

331,838 |

|

|

Taxes payable

|

|

|

(78,867 |

) |

|

|

1,164,803 |

|

|

Notes payable

|

|

|

(3,221,044 |

) |

|

|

- |

|

|

Other payables and accrued expenses

|

|

|

(677,157 |

) |

|

|

627,255 |

|

| |

|

|

|

|

|

|

|

|

|

Net cash (used in) provided by operating activities

|

|

|

(7,127,119 |

) |

|

|

1,344,182 |

|

| |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

Changes in restricted cash

|

|

|

901,258 |

|

|

|

(1,072,919 |

) |

|

Acquisition of property & equipment

|

|

|

(2,304,935 |

) |

|

|

(1,539,295 |

) |

|

Advance for construction and equipment

|

|

|

899,130 |

|

|

|

- |

|

|

Acquisition of intangible asset

|

|

|

(4,482,149 |

) |

|

|

(22,305,052 |

) |

|

Refund of deposit on land use right

|

|

|

10,450,389 |

|

|

|

- |

|

|

Construction in progress

|

|

|

(3,371,137 |

) |

|

|

(2,195,791 |

) |

| |

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) investing activities

|

|

|

2,092,557 |

|

|

|

(27,113,057 |

) |

| |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

Dividend paid

|

|

|

(3,359,256 |

) |

|

|

- |

|

|

Proceeds from exercise of warrants

|

|

|

- |

|

|

|

6,960,278 |

|

|

Purchase of treasury shares

|

|

|

- |

|

|

|

(6,945,950 |

) |

|

Offering costs paid

|

|

|

- |

|

|

|

(320,000 |

) |

| |

|

|

|

|

|

|

|

|

|

Net cash used in financing activities

|

|

|

(3,359,256 |

) |

|

|

(305,672 |

) |

| |

|

|

|

|

|

|

|

|

|

EFFECT OF EXCHANGE RATE CHANGE ON CASH & EQUIVALENTS

|

|

|

1,210,020 |

|

|

|

1,118,640 |

|

| |

|

|

|

|

|

|

|

|

|

NET DECREASE IN CASH & EQUIVALENTS

|

|

|

(7,183,798 |

) |

|

|

(24,955,907 |

) |

| |

|

|

|

|

|

|

|

|

|

CASH & EQUIVALENTS, BEGINNING OF PERIOD

|

|

|

33,956,591 |

|

|

|

79,333,729 |

|

| |

|

|

|

|

|

|

|

|

|

CASH & EQUIVALENTS, END OF PERIOD

|

|

$ |

26,772,793 |

|

|

$ |

54,377,822 |

|

| |

|

|

|

|

|

|

|

|

|

Supplemental Cash flow data:

|

|

|

|

|

|

|

|

|

|

Income tax paid

|

|

$ |

4,674,141 |

|

|

$ |

2,170,198 |

|

|

Interest paid

|

|

$ |

- |

|

|

$ |

- |

|

The accompanying notes are an integral part of these financial statements.

DEER CONSUMER PRODUCTS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2011 (UNAUDITED) AND DECEMBER 31, 2010

Note 1 – Organization and Basis of Presentation

Organization and Line of Business

Deer Consumer Products, Inc., formerly known as Tag Events Corp., (hereinafter referred to as the “Company,” or “Deer”) was incorporated in the State of Nevada on July 18, 2006.

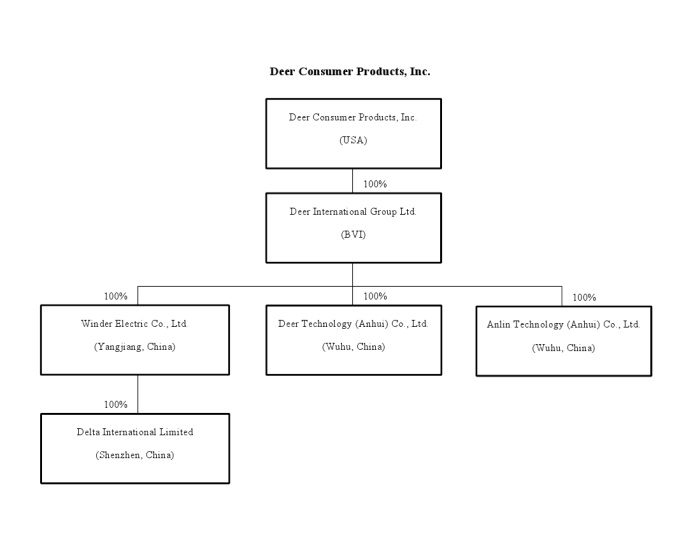

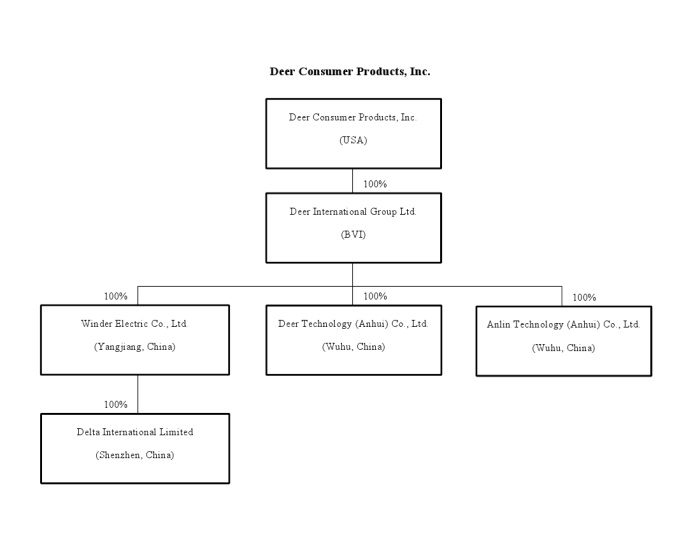

On September 3, 2008, the Company entered into a share exchange agreement and plan of reorganization with Deer International Group Ltd. (“Deer International”), a corporation organized under the laws of the British Virgin Islands on December 3, 2007. Deer International had acquired 100% of the shares of Winder Electric Group Ltd. (“Winder”) on March 11, 2008. Winder has a 100% owned subsidiary, Delta International Limited (“Delta”). Winder and Delta were formed and incorporated in the Guangdong Province of the People’s Republic of China (“PRC”) on July 20, 2001, and February 23, 2006, respectively.

Pursuant to the share exchange agreement, the Company acquired 50,000 ordinary shares from Deer International, consisting of all of Deer International’s issued and outstanding capital stock, for 15,695,706 shares of the Company’s common stock. Concurrently with the closing of the transactions contemplated by the share exchange agreement and as a condition thereof, the Company entered into an agreement with its former Director and Chief Executive Officer, pursuant to which he returned 5,173,914 shares of the Company’s common stock to the Company for cancellation. Upon completion of the foregoing transactions, the Company had 19,652,226 shares of common stock issued and outstanding. In connection with the above transaction, the Company changed its name to Deer Consumer Products, Inc. on September 3, 2008.

The exchange of shares with Deer International was recorded as a reverse acquisition because Deer International obtained control of the Company. Accordingly, the merger of Deer International into the Company was recorded as a recapitalization of Deer International, with Deer International being treated as the continuing entity. The share exchange agreement was treated as a recapitalization and not as a business combination. At the date of this transaction, the net liabilities of the legal acquirer were $0.

The Company is engaged in the manufacture, marketing, distribution and sale of a broad range of small home and kitchen electric appliances and personal care products. The Company provides consumer products to the China domestic market under its “DEER” and “德尔” brands. The Company is also a vertically integrated manufacturer of small household appliances for global consumer product customers who in turn offer products worldwide under numerous brand names and store brands for retailers’ private label programs. The Company also sources products from third party manufacturers to supply certain products from time to time in order to rapidly expand new product offerings through its distribution channels across China. The Company currently manufactures its products in Yangjiang, Guangdong Province, China and anticipates expanding its production and manufacturing capabilities by building new production and distribution facilities in the Wuhu area of central China, a region with access to a neighboring population of more than 400 million. The Company anticipates the new facilities will improve the Company’s ability to deliver its products to customers located throughout China, which is part of the Company’s China domestic market expansion strategy. Once completed, the Company plans for the new facilities to serve primarily as a hub for its China domestic markets, while the Company’s current facilities in Yangjiang, Guangdong Province will serve as a hub for its export markets and as a supply center for markets in south China. The Company’s corporate and administrative offices are located in Shenzhen, China.

The Company operates through its wholly owned subsidiaries in China. Winder, a wholly foreign-owned enterprise (“WFOE”) located in Guangdong Province, is engaged in the research, production and delivery of goods. Delta, also located in Guangdong Province, transferred its material former operations to Winder. Deer Technology (AnHui) Co., Ltd. (“Deer Technology”) and Anlin Technology (AnHui) Co., Ltd. (“Anlin Technology”), also both WFOEs of Deer International, were both incorporated in AnHui Province on April 30, 2010. Deer Technology and Anlin Technology will be engaged in the manufacture and sale of household electric appliances and were formed for the purpose of establishing production and distribution facilities located in the Wuhu area of AnHui Province.

The unaudited financial statements included herein were prepared by the Company, pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”). The information furnished herein reflects all adjustments (consisting of normal recurring accruals and adjustments) that are, in the opinion of management, necessary to fairly present the operating results for the respective periods. Certain information and footnote disclosures normally present in annual financial statements prepared in accordance with accounting principles generally accepted in the United States of America (“US GAAP”) were omitted pursuant to such rules and regulations. These financial statements should be read in conjunction with the audited financial statements and footnotes included in the Company’s 2010 audited financial statements included in the Company’s Annual Report on Form 10-K. The results for the nine months ended September 30, 2011, are not necessarily indicative of the results to be expected for the year ending December 31, 2011.

DEER CONSUMER PRODUCTS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2011 (UNAUDITED) AND DECEMBER 31, 2010

Basis of Presentation

The accompanying consolidated financial statements include the accounts of the Company and its wholly owned subsidiary, Deer International, and Deer International’s wholly owned subsidiaries, Winder, Deer Technology and Anlin Technology, and Winder’s wholly owned subsidiary, Delta. All significant inter-company accounts and transactions were eliminated in consolidation. The Company incorporated and invested $29.8 million in Deer Technology and $10.2 million in Anlin Technology in 2010 as registered capital.

The accompanying consolidated financial statements were prepared in conformity with US GAAP. The functional currency of the Company’s China subsidiaries is the Chinese Yuan Renminbi (“RMB”); the functional currency of Deer International is United States Dollars (“$” or “USD”). The accompanying consolidated financial statements were translated and presented in USD.

Foreign Currency Translation

The accounts of the Company’s China subsidiaries are maintained in RMB, the accounts of the Company’s BVI subsidiary are maintained in USD and the accounts of the U.S. parent company are maintained in USD. The accounts of the China subsidiaries were translated into USD in accordance with Accounting Standards Codification (“ASC”) Topic 830 “Foreign Currency Matters,” with the RMB as the functional currency for the Company’s China subsidiaries. According to Topic 830, all assets and liabilities were translated at the exchange rate on the respective balance sheet date, stockholders’ equity is translated at the historical rates and statement of income items are translated at the weighted average exchange rate for the period. The resulting translation adjustments are reported under other comprehensive income in accordance with ASC Topic 220, “Comprehensive Income.” Gains and losses resulting from the translations of foreign currency transactions and balances are reflected in the statements of income.

The RMB to USD exchange rates in effect as of September 30, 2011, and December 31, 2010, were USD$1 = RMB6.3549 and USD$1 = RMB6.6227, respectively. The weighted average RMB to USD exchange rates in effect for the nine months ended September 30, 2011, and 2010, were USD$1 = RMB6.4975 and USD$1 = RMB6.8068, respectively. The exchange rates used in translation from RMB to USD were published by the People’s Bank of the People’s Republic of China.

Note 2 – Summary of Significant Accounting Policies

Use of Estimates

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Areas that require estimates and assumptions include valuation of accounts receivable and inventory, determination of useful lives of property and equipment, estimation of certain liabilities and sales returns.

Cash and Equivalents

Cash and equivalents include cash in hand and cash in time deposits, certificates of deposit and all highly liquid debt instruments with original maturities of three months or less.

Restricted Cash

Restricted cash consists of monies restricted by the Company’s lender and monies restricted under letters of credit and bank acceptances.

Accounts Receivable

The Company maintains reserves for potential credit losses on accounts receivable. Management reviews the composition of accounts receivable and analyzes historical bad debts, customer concentrations, customer credit worthiness, current economic trends and changes in customer payment patterns to evaluate the adequacy of these reserves. The Company has not incurred any bad debts to date. If the Company finds there is a possibility that the Company may incur a bad debt, the Company will accrue the appropriate allowance based on the aging of our account receivables. The Company’s policy is to accrue the full amount of account receivables when their aging exceeds one year. Based on historical collection activity, the Company did not reserve any bad debt allowance at September 30, 2011, and December 31, 2010.

DEER CONSUMER PRODUCTS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2011 (UNAUDITED) AND DECEMBER 31, 2010

The Company sells products in the China domestic market through a range of distribution outlets including regional and national wholesalers and third party distributors. The standard term of payment of accounts receivables for several of the Company’s large and established China domestic retailer customers is 180 days from the close of the billing cycle, which is 30 – 45 days after the Company’s products are delivered to the customer. This accounts receivable term is customary for large and established China domestic retailers. Historically, the Company has not experienced late payments or bad debts under such terms from these select retailers. The term of payment of accounts receivable for other of the Company’s China domestic customers is 30 – 90 days from the close of the billing cycle. The Company provides its major customers with payment terms based on their payment history, amount they have purchased in the past, and upon any strategic agreement the Company may have with them.

As the Company continues to focus on expanding sales to the China domestic market, the Company anticipates that sales to the China domestic market may represent a larger percentage of the Company’s total revenue. The Company anticipates that its accounts receivable will remain in line with standard industry practice relating to accounts receivable in China, which could be up to seven months.

The Company sells products to overseas customers in the export markets under letters of credit, prepaid arrangements, certain short credit terms or direct customer purchase orders. As of September 30, 2011, and December 31, 2010, approximately 10% and 29%, respectively, of our accounts receivable was from overseas customers. The Company's export sales-related accounts receivable typically are less than three months, depending on customer shipment schedules. Historically, the Company has not experienced significant bad debts from export sales. The Company also maintains a substantial amount of export insurance that covers losses arising from customers’ rejection of its products, political risk, losses arising from business credit and other credit risks including bankruptcy, insolvency and delay in payment.

The Company believes that its accounts receivable will be collected in the ordinary course of business within seven months as the Company has established relationships with many of its major customers. In addition, the Company’s domestic customers typically pay according to the Company’s payment terms and the Company maintains insurance for its accounts receivable with respect to its international customers.

VAT Receivables

VAT receivables are VAT rebates which arise from our purchase of raw materials. VAT receivables are returned to the Company or offset against VAT payable. The Company anticipates collecting its VAT receivables within one year. The Company does not experience credit losses with respect to VAT receivables because they are owed to the Company by the government. The Company classifies VAT receivables as a current asset because it is an asset that is reasonably expected to be realized (or sold or consumed) within one year or within the Company’s normal operating cycle.

Advances to Suppliers

The Company makes advances to certain vendors to purchase material and equipment. The advances are interest-free and unsecured.

Inventories

Inventories are valued at the lower of cost (determined on a weighted average basis) or market. The Company compares the cost of inventories with their market value and allowance is made to write down inventories to their market value, if lower.

Property and Equipment

Property and equipment are stated at cost. Expenditures for maintenance and repairs are charged to earnings as incurred; additions, renewals and betterments are capitalized. When property and equipment are retired or otherwise disposed of, the related cost and accumulated depreciation are removed from the respective accounts, and any gain or loss is included in operations. Depreciation of property and equipment is provided using the straight-line method for substantially all assets with estimated lives as follows:

|

Buildings

|

5-20 years

|

|

Equipment

|

5-10 years

|

|

Vehicles

|

5 years

|

|

Office equipment

|

5-10 years

|

DEER CONSUMER PRODUCTS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2011 (UNAUDITED) AND DECEMBER 31, 2010

The following are the details of property and equipment at September 30, 2011, and December 31, 2010:

| |

|

2011

|

|

|

2010

|

|

|

Building

|

|

$

|

9,665,760

|

|

|

$

|

9,274,909

|

|

|

Equipment

|

|

|

21,807,142

|

|

|

|

18,928,495

|

|

|

Vehicle

|

|

|

450,407

|

|

|

|

485,421

|

|

|

Office equipment

|

|

|

561,244

|

|

|

|

220,800

|

|

|

Total

|

|

|

32,484,553

|

|

|

|

28,909,625

|

|

|

Less accumulated depreciation

|

|

|

(10,503,090

|

)

|

|

|

(8,456,221

|

)

|

|

Property & equipment, net

|

|

$

|

21,981,463

|

|

|

$

|

20,453,404

|

|

Depreciation for the nine months ended September 30, 2011 and 2010, was $1,653,416 and $1,084,183, respectively; for the three months ended September 30, 2011 and 2010, was $557,566 and $376,612, respectively.

Construction in Progress

Construction in progress consists of costs for the construction of workshops, mold and a video monitoring installation for Winder, with total costs of $12.31 million. The construction work for workshops is substantially completed with no major additional costs to be incurred. Once the Company completes its final inspection of the construction, the workshops will be used to manufacture the Company’s products.

Construction in progress also includes costs for the construction of a new plant, office building and power distribution station for Deer Technology. As of September 30, 2011, the Company paid $0.42 million for design, metal work, foundation and other costs. The total construction cost is about $35.85 million, and the Company is committed to pay an additional $35.43 million to complete the construction. This phase of construction is anticipated to be completed in September 2012.

Long-Lived Assets

The Company applies the provisions of ASC Topic 360, “Property, Plant, and Equipment,” which addresses financial accounting and reporting for the impairment or disposal of long-lived assets. ASC 360 requires impairment losses to be recorded on long-lived assets used in operations when indicators of impairment are present and the undiscounted cash flows estimated to be generated by those assets are less than the assets’ carrying amounts. In that event, a loss is recognized based on the amount by which the carrying amount exceeds the fair value of the long-lived assets. Loss on long-lived assets to be disposed of is determined in a similar manner, except that fair values are reduced for the cost of disposal. Based on its review, the Company believes that as of September 30, 2011, and December 31, 2010, there was no significant impairment of its long-lived assets.

Intangible Assets

Intangible assets consist of rights to use land and computer software. The Company evaluates intangible assets for impairment at least annually and whenever events or changes in circumstances indicate that the carrying value may not be recoverable from its estimated future cash flows. Recoverability of intangible assets is measured by comparing their net book value to the related projected undiscounted cash flows from these assets, considering a number of factors including past operating results, budgets, economic projections, market trends and product development cycles. If the net book value of the asset exceeds the related undiscounted cash flows, the asset is considered impaired and a second test is performed to measure the amount of impairment loss.

The following are the details of intangible assets at September 30, 2011, and December 31, 2010:

| |

|

2011

|

|

|

2010

|

|

| |

|

|

|

|

|

|

|

Right to use land

|

|

$

|

37,362,260

|

|

|

$

|

38,519,101

|

|

|

Computer software

|

|

|

82,494

|

|

|

|

79,158

|

|

|

Total

|

|

|

37,444,754

|

|

|

|

38,598,259

|

|

|

Less accumulated amortization

|

|

|

(842,066

|

)

|

|

|

(289,791

|

)

|

|

Intangibles, net

|

|

$

|

36,602,688

|

|

|

$

|

38,308,468

|

|

DEER CONSUMER PRODUCTS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2011 (UNAUDITED) AND DECEMBER 31, 2010

Pursuant to PRC regulations, the PRC government owns all land. The Company recorded the amounts paid for the rights to use land as an intangible asset. The Company amortizes these rights over their respective periods, which range from 45 to 50 years. Computer software is amortized over 1 to 2 years.

In 2010, Deer Technology acquired the land use rights for two parcels of land with a total of 439,640 square meters located in east central China in the city of Wuhu, AnHui Province. The purchase price of the land use rights for these two parcels of land was approximately $35 million, reflecting a price of RMB 4.95 million per hectare and including a 4% PRC government land transfer tax and other government charges. The use right for the first parcel of land covering 289,416 square meters was purchased for approximately RMB 149 million ($22.74 million). The land use right for the second parcel of land covering 150,224 square meters was purchased for RMB 77.37 million ($11.8 million). The Company has received the land use right certificates from the PRC government on these two parcels of land.

The deposit of $10,314,346 (RMB 67,901,400) that was paid in 2010 to acquire a land use right was returned to the Company in the first quarter of 2011, as it failed to win the auction for the land. The Company paid an additional $4,243,283 (RMB 27,934,381) in first quarter of 2011 to make payment in full for the land use rights it acquired in December 2010. As of December 31, 2010, the Company prepaid $3,367,207 for land use rights it acquired in December 2010; the prepayment was transferred into intangible assets in the first quarter of 2011 when the Company received the land use right certificate.

A summary of Company’s land use right acquisitions follows:

|

Name

|

|

Site use right

Phase I

|

|

Site use right

Phase II

|

|

Site use right Phase III

|

|

Land use right

|

|

Land use right

|

|

Size

(In Square Meters)

|

|

33,728

|

|

52,597

|

|

60,900

|

|

289,416

|

|

150,224

|

|

Location

|

|

Yangjiang City

|

|

Yangjiang City

|

|

Yangjiang City

|

|

Wuhu City

|

|

Wuhu City

|

|

Owner

|

|

Winder

|

|

Winder

|

|

Winder

|

|

Deer Technology

|

|

Deer Technology

|

|

Useful life in months

|

|

600

|

|

600

|

|

600

|

|

600

|

|

600

|

|

Purpose

|

|

Plant and workshop

|

|

Plant and workshop

|

|

Plant and workshop

|

|

Plant and workshop

|

|

Plant and workshop

|

|

Purchase date

|

|

November 2002

|

|

June 2005 & March 2010

|

|

November 2010

|

|

September 2010

|

|

December 2010

|

|

Price in RMB/USD

|

|

RMB 1.7 million

($0.3 million)

|

|

RMB 3.9 million

($0.6 million)

|

|

RMB 21.3 million

($3.3 million) (a)

|

|

RMB 149.1 million

($23 million)

|

|

RMB 77.4 million

($12 million)

|

|

As of 9/30/2011

|

|

Paid in full

|

|

Paid in full

|

|

Not yet paid in full

|

|

Paid in full

|

|

Paid in full

|

|

Payment due date

|

|

|

|

|

|

2012

|

|

|

|

|

(a) As of September 30, 2011, the Company paid RMB5.3 million ($0.8 million) for the Site use right Phase III.

There are no regulatory deadlines or commitments to develop the land.

Amortization for the nine months ended September 30, 2011 and 2010, was $711,107 and $102,243, respectively; for the three months ended September 30, 2011 and 2010, was $368,096 and $93,238, respectively.

The following table summarizes the expected amortization over the next five years as of September 30, 2011:

|

Year ended September 30,

|

|

Amount

|

|

|

2012

|

|

$

|

731,301

|

|

|

2013

|

|

|

731,301

|

|

|

2014

|

|

|

731,301

|

|

|

2015

|

|

|

731,301

|

|

|

2016

|

|

|

731,301

|

|

|

Thereafter

|

|

|

32,946,182

|

|

|

Total

|

|

$

|

36,602,688

|

|

DEER CONSUMER PRODUCTS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2011 (UNAUDITED) AND DECEMBER 31, 2010

Fair Value of Financial Instruments

Certain of the Company’s financial instruments, including cash and equivalents, restricted cash, accounts receivable, accounts payable, accrued liabilities and short-term loans and notes payable, have carrying amounts that approximate their fair values due to their short maturities.

ASC Topic 820, “Fair Value Measurements and Disclosures,” requires disclosure of the fair value of financial instruments held by the Company. ASC Topic 825, “Financial Instruments,” defines fair value and establishes a three-level valuation hierarchy for disclosures of fair value measurement that enhances disclosure requirements for fair value measures. The carrying amounts reported in the consolidated balance sheets for receivables and current liabilities each qualify as financial instruments and are a reasonable estimate of their fair values because of the short period of time between the origination of such instruments and their expected realization and their current market rate of interest. The three levels of valuation hierarchy are defined as follows:

| |

§

|

Level 1 inputs to the valuation methodology are quoted prices for identical assets or liabilities in active markets.

|

| |

§

|

Level 2 inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the financial instrument.

|

| |

§

|

Level 3 inputs to the valuation methodology are unobservable and significant to the fair value measurement.

|

The Company analyzes all financial instruments with features of both liabilities and equity under ASC Topic 480, “Distinguishing Liabilities from Equity,” and ASC Topic 815, “Derivatives and Hedging.”

As of September 30, 2011, and December 31, 2010, the Company did not identify any assets and liabilities that are required to be presented on the balance sheet at fair value.

Concentration of Credit Risk

Cash includes cash on hand and demand deposits in accounts maintained within China. Certain financial instruments, which subject the Company to concentration of credit risk, consist of cash. Balances at financial institutions within China are not covered by insurance. The Company has not experienced any losses in such accounts.

Revenue Recognition

The Company’s revenue recognition policies are in compliance with SEC Staff Accounting Bulletin (SAB) 104 (codified in FASB ASC Topic 480). Sales revenue is recognized at the date of shipment to customers when the price is fixed or determinable, no other significant obligations of the Company exist and collectability is reasonably assured.

Sales revenue is the invoiced value of goods, net of value-added tax. All of the Company’s products sold in the PRC are subject to a VAT of 17% of the gross sales price. This VAT may be offset by the VAT paid by the Company on raw materials and other materials included in the cost of producing the Company’s finished product. The Company recorded VAT payable and VAT receivable net of payments in the financial statements. The VAT tax return is filed offsetting the payables against the receivables.

Sales and purchases are recorded net of VAT collected and paid as the Company acts as an agent for the government. VAT taxes are not affected by the income tax holiday.

Sales returns and allowances were $0 for the nine months ended September 30, 2011 and 2010. Sales returns and allowances were $0 for the three months ended September 30, 2011 and 2010. The Company does not provide a right of unconditional return, price protection or any other concessions to its customers.

Cost of Revenue and Selling, General and Administrative Expenses

The Company includes expenses in either cost of revenue or selling, general and administrative expenses based upon the natural classification of the expenses. Cost of revenue includes expenses associated with the acquisition, inspection, manufacturing and receiving of materials for use in the manufacturing process. These costs include inbound freight charges, purchasing and receiving costs, inspection costs, warehousing costs, internal transfer costs as well as depreciation, amortization, wages, benefits and other costs that are incurred directly or indirectly to support the manufacturing process. Selling, general and administrative expenses includes expenses associated with the distribution of our products, sales efforts including commissions payable to in store promotional staff, administration costs and other costs that are not incurred to support the manufacturing process. The Company records distribution costs associated with the sale of inventory as a component of selling, general and administrative expenses in the Statements of Consolidated Income. These expenses include warehousing costs, outbound freight charges and costs associated with distribution personnel.

DEER CONSUMER PRODUCTS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2011 (UNAUDITED) AND DECEMBER 31, 2010

Advance from Customers

The Company records payments received from customers in advance of their future orders to an advance account. Those orders are normally delivered within a reasonable period of time based upon contract terms with the customers.

Advertising Costs

The Company expenses the cost of advertising as incurred or, as appropriate, the first time the advertising takes place. Advertising costs for the nine months ended September 30, 2011 and 2010, were $102,937 and $106,003, respectively. Advertising costs for the three months ended September 30, 2011 and 2010, were $31,498 and $47,410, respectively.

Research and Development

The Company expenses its research and development costs as incurred. Research and development costs for the nine months ended September 30, 2011 and 2010, were $187,506 and $500,963, respectively; for the three months ended September 30, 2011 and 2010, were $1,222 and $244,380, respectively. Research and development costs are included in general and administrative expenses.

Subsidy Income

The Company was awarded grants from local government bureaus to encourage the development of its business. As a general policy across municipal governments in the PRC, local government bureaus commonly provide grants to leading local companies in order to encourage greater economic development and greater employment. The grants are typically based on certain standards which are reviewed periodically. The grants set forth below were awarded to the Company based on the Company’s progress in technological innovation and building a standardized plant and factory. As the exact amount of a grant is uncertain until the local government makes its final determination, the Company records income only when the grant is received or approved. The grants set forth below were made without any conditions and restrictions, and were not required to be repaid.

Set forth below are the grants that were recorded in the nine months ended September 30, 2011.

|

Item

|

|

Amount in ($)

|

|

|

From Yangjiang Science and Technology Information Bureau

|

|

$

|

11,393

|

|

|

From Yangjiang Finance Bureau

|

|

|

15,190

|

|

|

Development fund from Yangjiang Hi-tech Industrial Development Zone

|

|

|

264,839

|

|

|

Innovation fund for Technology from local government

|

|

|

15,190

|

|

|

Reward from Yangjiang Finance Bureau for acting as a lead role model of demonstrating standardized factory construction

|

|

|

692,620

|

|

|

The strategic special fund for executing technology standardization from local government

|

|

|

1,539

|

|

|

Reward of proprietary brand and market development from Yangjiang Finance Bureau

|

|

|

45,892

|

|

|

Total

|

|

$

|

1,046,663

|

|

The above subsidy income attributable to the grants specified was received in full and could be used without restriction.

Stock-Based Compensation

The Company records stock-based compensation in accordance with ASC Topic 718 & 505, “Compensation – Stock Compensation.” ASC 718 requires companies to measure compensation cost for stock-based employee compensation at fair value at the grant date and recognize the expense over the employee’s requisite service period. The Company recognizes in its statement of operations the grant-date fair value of stock options and other equity-based compensation issued to employees and non-employees. There were 50,000 options outstanding as of September 30, 2011.

DEER CONSUMER PRODUCTS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2011 (UNAUDITED) AND DECEMBER 31, 2010

Income Taxes

The Company utilizes Statement of Financial Accounting Standards ("SFAS") No. 109, “Accounting for Income Taxes” (codified in FASB ASC Topic 740), which requires recognition of deferred tax assets and liabilities for expected future tax consequences of events included in the financial statements or tax returns. Under this method, deferred income taxes are recognized for the tax consequences in future years of differences between the tax bases of assets and liabilities and their financial reporting amounts at each period end based on enacted tax laws and statutory tax rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established, when necessary, to reduce deferred tax assets to the amount expected to be realized.

The Company adopted the provisions of the FASB Interpretation No. 48 (“FIN 48”), Accounting for Uncertainty in Income Taxes (codified in FASB ASC Topic 740). When tax returns are filed, it is likely that some positions taken would be sustained upon examination by the taxing authorities, while others are subject to uncertainty about the merits of the position taken or the amount of the position that would be ultimately sustained. The benefit of a tax position is recognized in the financial statements in the period during which, based on all available evidence, management believes it is more likely than not that the position will be sustained upon examination, including the resolution of appeals or litigation processes, if any. Tax positions taken are not offset or aggregated with other positions. Tax positions that meet the more-likely-than-not recognition threshold are measured as the largest amount of tax benefit that is more than 50 percent likely of being realized upon settlement with the applicable taxing authority. The portion of the benefits associated with tax positions taken that exceeds the amount measured as described above is reflected as a liability for unrecognized tax benefits in the accompanying balance sheets along with any associated interest and penalties that would be payable to the taxing authorities upon examination.

Interest associated with unrecognized tax benefits is classified as interest expense and penalties are classified as selling, general and administrative expense in the statements of income. The adoption of FIN 48 did not have a material impact on the Company’s financial statements. At September 30, 2011, and December 31, 2010, the Company had not taken any significant uncertain tax position on its tax return for 2010 and prior years or in computing its tax provision for 2010.

Foreign Currency Transactions and Comprehensive Income

The financial statements’ accounts of the Company’s China subsidiaries were translated into USD in accordance with SFAS No. 52, “Foreign Currency Translation” (codified in FASB ASC Topic 830), with the RMB as the Company’s China subsidiaries’ functional currency. According to SFAS No. 52 (codified in FASB ASC Topic 830), all assets and liabilities were translated at the exchange rate on the balance sheet date, stockholders’ equity are translated at the historical rates and statement of operations items are translated at the weighted average exchange rate for the year. The resulting translation adjustments are reported under other comprehensive income in accordance with SFAS No. 130, “Reporting Comprehensive Income” (codified in FASB ASC Topic 220).

Currency Hedging

The Company from time to time may enter into forward exchange agreements with the Bank of China, whereby the Company agrees to sell U.S. dollars to the Bank of China at certain rates. At September 30, 2011, and December 31, 2010, the Company had no outstanding forward exchange contracts.

Basic and Diluted Earnings Per Share

Earnings per share is calculated in accordance with the ASC Topic 260, “Earnings Per Share.” Basic earnings per share is based upon the weighted average number of common shares outstanding. Diluted earnings per share is based on the assumption that all dilutive convertible shares and stock options were converted or exercised. Dilution is calculated by applying the treasury stock method. Under this method, options and warrants are assumed to be exercised at the beginning of the period (or at the time of issuance, if later), and as if funds obtained thereby were used to purchase common stock at the average market price during the period.

The following is a reconciliation of the number of shares (denominator) used in the basic and diluted earnings per share calculations:

|

Three months ended September 30,

|

|

2011

|

|

|

2010

|

|

| |

|

|

|

|

Per Share

|

|

|

|

|

|

Per Share

|

|

| |

|

Shares

|

|

|

Amount

|

|

|

Shares

|

|

|

Amount

|

|

|

Basic earnings per share

|

|

|

33,592,562

|

|

|

$

|

0.39

|

|

|

|

33,585,553

|

|

|

$

|

0.28

|

|

|

Effect of dilutive stock options and warrants

|

|

|

-

|

|

|

|

-

|

|

|

|

5,555

|

|

|

|

-

|

|

|

Diluted earnings per share

|

|

|

33,592,562

|

|

|

$

|

0.39

|

|

|

|

33,591,108

|

|

|

$

|

0.28

|

|

|

Nine months ended September 30,

|

|

2011

|

|

|

2010

|

|

| |

|

|

|

|

Per Share

|

|

|

|

|

|

Per Share

|

|

| |

|

Shares

|

|

|

Amount

|

|

|

Shares

|

|

|

Amount

|

|

|

Basic earnings per share

|

|

|

33,592,562

|

|

|

$

|

0.79

|

|

|

|

33,082,481

|

|

|

$

|

0..58

|

|

|

Effect of dilutive stock options and warrants

|

|

|

-

|

|

|

|

-

|

|

|

|

572,293

|

|

|

|

(0.01

|

)

|

|

Diluted earnings per share

|

|

|

33,592,562

|

|

|

$

|

0.79

|

|

|

|

33,654,774

|

|

|

$

|

0.57

|

|

DEER CONSUMER PRODUCTS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2011 (UNAUDITED) AND DECEMBER 31, 2010

Statement of Cash Flows

In accordance with ASC Topic 230, “Statement of Cash Flows,” cash flows from the Company’s operations are calculated based upon the local currencies using the average translation rates. As a result, amounts related to assets and liabilities reported on the consolidated statements of cash flows will not necessarily agree with changes in the corresponding balances on the consolidated balance sheets.

Registration Rights Agreement

The Company accounts for payment arrangements under a registration rights agreement in accordance with ASC Topic 825, “Financial Instruments,” which requires the contingent obligation to make future payments or otherwise transfer consideration under a registration payment arrangement, whether issued as a separate agreement or included as a provision of a financial instrument or other agreement, be recognized separately and measured in accordance with ASC Topic 450, “Contingencies.”

Segment Reporting

SFAS No. 131, “Disclosures about Segments of an Enterprise and Related Information” (codified in FASB ASC Topic 280) requires use of the “management approach” model for segment reporting. The management approach model is based on the way a company's management organizes segments within the company for making operating decisions and assessing performance. Reportable segments are based on products and services, geography, legal structure, management structure or any other manner in which management disaggregates a company.

SFAS No. 131 has no effect on the Company's financial statements as substantially all of the Company's operations are conducted in one industry segment. All of the Company's assets are located in the PRC.

Reclassifications

Certain prior year amounts were reclassified to conform to the manner of presentation in the current period.

Recent Pronouncements

In June 2011, FASB issued ASU 2011-05, Comprehensive Income (ASC Topic 220): Presentation of Comprehensive Income. Under the amendments in this update, an entity has the option to present the total of comprehensive income, the components of net income and the components of other comprehensive income either in a single continuous statement of comprehensive income or in two separate but consecutive statements. Under both options, an entity is required to present each component of net income along with total net income, each component of other comprehensive income along with a total for other comprehensive income and a total amount for comprehensive income. In a single continuous statement, the entity is required to present the components of net income and total net income, the components of other comprehensive income and a total for other comprehensive income, along with the total of comprehensive income in that statement. In the two-statement approach, an entity is required to present components of net income and total net income in the statement of net income. The statement of other comprehensive income should immediately follow the statement of net income and include the components of other comprehensive income and a total for other comprehensive income, along with a total for comprehensive income. In addition, the entity is required to present on the face of the financial statements reclassification adjustments for items that are reclassified from other comprehensive income to net income in the statement(s) where the components of net income and the components of other comprehensive income are presented. The amendments in this update should be applied retrospectively and are effective for fiscal years, and interim periods within those years, beginning after December 15, 2011. The Company is currently assessing the effect that the adoption of this pronouncement will have on its financial statements.

Note 3 – Inventories

Inventories consisted of the following at September 30, 2011, and December 31, 2010:

| |

|

2011

|

|

|

2010

|

|

|

Raw material

|

|

$

|

10,228,316

|

|

|

$

|

7,979,205

|

|

|

Work in process

|

|

|

17,572,624

|

|

|

|

11,914,475

|

|

|

Finished goods

|

|

|

13,051,179

|

|

|

|

3,122,170

|

|

|

Total

|

|

$

|

40,852,119

|

|

|

$

|

23,015,850

|

|

DEER CONSUMER PRODUCTS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2011 (UNAUDITED) AND DECEMBER 31, 2010

Note 4 – Other Payables and Accrued Expenses

Other payables and accrued expenses consisted of the following at September 30, 2011, and December 31, 2010:

| |

|

2011

|

|

|

2010

|

|

|

Accrued expenses

|

|

$

|

225,368

|

|

|

$

|

1,010,591

|

|

|

Accrued wages

|

|

|

1,255,861

|

|

|

|

996,542

|

|

|

Welfare payable

|

|

|

20,180

|

|

|

|

21,303

|

|

|

Other payables

|

|

|

1,065,890

|

|

|

|

973,280

|

|

|

Total

|

|

$

|

2,567,299

|

|

|

$

|

3,001,716

|

|

Accrued expenses were for accrued electricity and freight fees. Other payables were for government charges, payable to the local construction management department, and payable for employees’ education fund and labor union fund, etc.

Note 5 – Notes Payable

Notes payable at September 30, 2011, and December 31, 2010, were for multiple bankers’ acceptances from the Bank of China. The terms of the notes range from 3-6 months, bear no interest and pay the bank 0.05% of the note balance as an acceptance fee. The Company deposits a certain percentage of the notes’ par value with the Bank of China, refundable when the notes are re-paid and accounted for as restricted cash in the accompanied consolidated financial statements.

Note 6 – Dividend Payable

On March 9, 2011, the Company’s Board of Directors (“BOD”) declared a first quarter dividend payable from future earnings, of $0.05 per share which was paid on April 14, 2011. On May 9, 2011, the Company’s BOD declared a second quarter dividend of $0.05 per share, payable from future earnings on July 15, 2011, to the shareholders of record as of June 30, 2011. On August 9, 2011, the Company’s BOD declared a third quarter dividend of $0.05 per share, payable from future earnings on October 15, 2011, to the shareholders of record as of September 30, 2011. Dividend payable at September 30, 2011, was $1,679,628 and was paid on October 13, 2011. Declaration and payment of future quarterly dividends will be made at the discretion of the BOD.

Note 7 – Stockholders’ Equity

Stock Options

Following is a summary of the activity of options to an independent director:

| |

|

Options

Outstanding

|

|

|

Weighted

Average

Exercise

Price

|

|

|

Weighted

Average

Remaining

Contractual Life

|

|

|

Aggregate

Intrinsic Value

|

|

|

Outstanding, December 31, 2010

|

|

|

50,000

|

|

|

$

|

10.96

|

|

|

|

3.98

|

|

|

$

|

14,000

|

|

|

Exercisable, December 31, 2010

|

|

|

33,332

|

|

|

$

|

10.96

|

|

|

|

3.98

|

|

|

$

|

9,333

|

|

|

Granted

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

Forfeited

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

Exercised

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

Outstanding, September 30, 2011

|

|

|

50,000

|

|

|

$

|

10.96

|

|

|

|

3.23

|

|

|

$

|

-

|

|

|

Exercisable, September 30, 2011

|

|

|

33,332

|

|

|

$

|

10.96

|

|

|

|

3.23

|

|

|

$

|

-

|

|

DEER CONSUMER PRODUCTS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2011 (UNAUDITED) AND DECEMBER 31, 2010

The exercise price for options outstanding at September 30, 2011, is as follows:

|

Number of Options

|

|

|

Exercise Price

|

|

| |

50,000

|

|

|

$

|

10.96

|

|

The assumptions used in calculating the fair value of options granted using the Black-Scholes option-pricing model are as follows:

|

Risk-free interest rate

|

|

|

2.25

|

%

|

|

Expected life of the options

|

|

3 to 3.5 years

|

|

|

Expected volatility

|

|

|

80

|

%

|

|

Expected dividend yield

|

|

|

0

|

%

|

During nine months ended September 30, 2011 and 2010, the Company recorded $76,971 and $250,042 as stock option expense, respectively. During three months ended September 30, 2011 and 2010, the Company recorded $25,657 and $83,348 as stock option expense, respectively.

Warrants

At the end of 2010, all warrants were exercised. No new warrants were granted during the nine months ended September 30, 2011.

Note 8 – Employee Welfare Plan

Expense for the employee common welfare was $21,643 and $81,223 for the nine months ended September 30, 2011 and 2010, respectively; $2,150 and $37,113 for the three months ended September 30, 2011 and 2010, respectively. The PRC government abolished the 14% welfare plan policy during 2007. The Company is not required to establish welfare and common welfare reserves.

Note 9 – Statutory Reserve and Development Fund

As stipulated by the Company Law of the PRC, net income after taxation can only be distributed as dividends after appropriation has been made for the following:

| |

i.

|

Making up cumulative prior years’ losses, if any;

|

| |

ii.

|