DEF 14A0001388658FALSE00013886582023-01-012023-12-310001388658irtc:QuentinBlackfordMember2023-01-012023-12-31iso4217:USD0001388658irtc:QuentinBlackfordMember2022-01-012022-12-3100013886582022-01-012022-12-310001388658irtc:KevinKingMember2021-01-012021-12-310001388658irtc:MichaelCoyleMember2021-01-012021-12-310001388658irtc:DouglasDevineMember2021-01-012021-12-310001388658irtc:QuentinBlackfordMember2021-01-012021-12-3100013886582021-01-012021-12-310001388658irtc:KevinKingMember2020-01-012020-12-3100013886582020-01-012020-12-3100013886582012-07-012021-01-1100013886582021-01-122021-05-3100013886582021-06-012021-10-0300013886582021-10-042023-12-310001388658ecd:PeoMemberirtc:EquityAwardsReportedValueMemberirtc:QuentinBlackfordMember2023-01-012023-12-310001388658ecd:PeoMemberirtc:EquityAwardAdjustmentsMemberirtc:QuentinBlackfordMember2023-01-012023-12-310001388658ecd:NonPeoNeoMemberirtc:EquityAwardsReportedValueMember2023-01-012023-12-310001388658ecd:NonPeoNeoMemberirtc:EquityAwardAdjustmentsMember2023-01-012023-12-310001388658ecd:PeoMemberirtc:EquityAwardsGrantedDuringTheYearUnvestedMemberirtc:QuentinBlackfordMember2023-01-012023-12-310001388658ecd:PeoMemberirtc:EquityAwardsGrantedInPriorYearsUnvestedMemberirtc:QuentinBlackfordMember2023-01-012023-12-310001388658ecd:PeoMemberirtc:EquityAwardsGrantedDuringTheYearVestedMemberirtc:QuentinBlackfordMember2023-01-012023-12-310001388658ecd:PeoMemberirtc:EquityAwardsGrantedInPriorYearsVestedMemberirtc:QuentinBlackfordMember2023-01-012023-12-310001388658ecd:PeoMemberirtc:EquityAwardsThatFailedToMeetVestingConditionsMemberirtc:QuentinBlackfordMember2023-01-012023-12-310001388658ecd:NonPeoNeoMemberirtc:EquityAwardsGrantedDuringTheYearUnvestedMember2023-01-012023-12-310001388658ecd:NonPeoNeoMemberirtc:EquityAwardsGrantedInPriorYearsUnvestedMember2023-01-012023-12-310001388658ecd:NonPeoNeoMemberirtc:EquityAwardsGrantedDuringTheYearVestedMember2023-01-012023-12-310001388658ecd:NonPeoNeoMemberirtc:EquityAwardsGrantedInPriorYearsVestedMember2023-01-012023-12-310001388658ecd:NonPeoNeoMemberirtc:EquityAwardsThatFailedToMeetVestingConditionsMember2023-01-012023-12-31000138865812023-01-012023-12-31000138865822023-01-012023-12-31000138865832023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________________________________________________________________________________

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

_______________________________________________________________________________________________________________

| | | | | | | | | | | |

| Filed by the Registrant ☒ | | Filed by a Party other than the Registrant ☐ |

| Check the appropriate box: |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

| | | |

| | | |

| IRHYTHM TECHNOLOGIES, INC. |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check all boxes that apply): |

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

April 10, 2024

To Our Stockholders:

You are cordially invited to attend the 2024 Annual Meeting of Stockholders of iRhythm Technologies, Inc. (the “Annual Meeting”), which will be held virtually at www.virtualshareholdermeeting.com/IRTC2024 on Wednesday, May 29, 2024, at 9:00 a.m. Pacific Time. We believe that a virtual stockholder meeting provides greater access to those who may want to attend and therefore we have chosen this over an in-person meeting. This approach also lowers costs and enables participation from our global community. The matters expected to be acted upon at the Annual Meeting are described in the accompanying Notice of Annual Meeting of Stockholders and Proxy Statement. The Annual Meeting materials include the Notice of Annual Meeting of Stockholders, Proxy Statement, and Annual Report to stockholders, each of which has been furnished to you over the internet or, if you have requested a paper copy of the materials, by mail.

Your vote is important. Whether or not you plan to attend the Annual Meeting, please cast your vote as soon as possible by Internet, telephone or, if you received a paper copy of the meeting materials by mail, by completing and returning the enclosed proxy card in the postage-prepaid envelope to ensure that your shares will be represented. Your vote by written proxy will ensure your representation at the Annual Meeting regardless of whether or not you attend virtually. Returning the proxy does not affect your right to attend the Annual Meeting or to vote your shares at the Annual Meeting.

| | | | | | | | |

| | |

| Sincerely, |

| | /s/ Quentin S. Blackford |

| |

| Quentin S. Blackford |

| Chief Executive Officer |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON WEDNESDAY, MAY 29, 2024. THE PROXY STATEMENT AND ANNUAL REPORT ARE AVAILABLE AT WWW.PROXYVOTE.COM.

IRHYTHM TECHNOLOGIES, INC.

699 8th Street, Suite 600

San Francisco, California 94103

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| | | | | | | | |

| Time and Date: | Wednesday, May 29, 2024, at 9:00 a.m. Pacific Time |

| Place: | Virtually at www.virtualshareholdermeeting.com/IRTC2024. There is no physical location for the Annual Meeting. |

| Items of Business: | 1.Elect nine directors to serve until our next annual meeting of stockholders or until their successors are duly elected and qualified. |

| 2.Ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year ending December 31, 2024. |

| 3.Approve, on a non-binding advisory basis, the compensation of our named executive officers. |

| 4.Approve an amendment to our Amended and Restated Certificate of Incorporation to limit the liability of certain officers of the company as permitted pursuant to recent amendments to the Delaware General Corporation Law. |

| 5.Select, on a non-binding advisory basis, whether future advisory votes on the compensation of our named executive officers should be every 1, 2, or 3 years. |

| 6.Transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

| Record Date: | April 3, 2024, which we refer to as our Record Date. Only stockholders of record at the close of business on the Record Date are entitled to notice of, and attendance of and voting at, the meeting and any adjournments thereof. |

Participation in Annual Meeting:

| We are pleased to invite you to participate in our Annual Meeting, which will be conducted exclusively online at www.virtualshareholdermeeting.com/IRTC2024. We believe the virtual format makes it easier for stockholders to attend, and participate fully and equally in, the Annual Meeting because they can join with any internet-connected device from any location around the world at no cost. Our virtual meeting format helps us engage with all stockholders–regardless of size, resources, or physical location, saves us and stockholders’ time and money, and reduces our environmental impact. Please see “General Information About the Meeting” for additional information. Your vote is very important to us. Please act as soon as possible to vote your shares, even if you plan to participate in the Annual Meeting. For specific instructions on how to vote your shares, please see “Information About Solicitation and Voting” beginning on page 11 of the Proxy Statement. |

| Voting: | Each share of common stock that you own represents one vote. For questions regarding your stock ownership, you may contact us through our website at https://investors.irhythmtech.com or, if you are a registered holder, through our transfer agent, Equiniti Trust Company, through its website at www.shareowneronline.com or by phone at (800) 401-1957 (US residents). |

This Notice of the Annual Meeting, Proxy Statement, and form of proxy are being distributed and made available on or about April 10, 2024.

Whether or not you plan to attend the Annual Meeting, we encourage you to vote and submit your proxy through the Internet or by telephone or request and submit your proxy card as soon as possible, so that your shares may be represented at the meeting.

| | | | | | | | |

| | By Order of the Board of Directors, |

| /s/ Quentin S. Blackford |

| Quentin S. Blackford |

| Chief Executive Officer |

| San Francisco, California |

| April 10, 2024 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This proxy statement (“Proxy Statement”) includes forward-looking statements, which are all statements other than statements of historical facts. These statements include, but are not limited to, statements regarding our business, our business strategy and plans, our objectives and future operations and our social responsibility initiatives. In some cases, you can identify forward-looking statements by terms such as “aim,” “may,” “will,” “should,” “expect,” “believe,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential,” “seeks,” or “continue” or the negative of these terms or other similar expressions, although not all forward-looking statements contain these words.

Forward-looking statements are based upon various estimates and assumptions, as well as information known to us as of the date hereof and are subject to risks and uncertainties. Accordingly, actual results could differ materially due to a variety of factors. These risks and uncertainties include, but are not limited to, those described under the caption “Risk Factors” in our Annual Report on Form 10-K (“Annual Report”) for the year ended December 31, 2023, and our other U.S. Securities and Exchange Commission (“SEC”) filings, which are available on the Investor Relations page of our website at https:// investors.irhythmtech.com and on the SEC website at www.sec.gov.

All forward-looking statements contained herein are based on information available to us as of the date hereof and you should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, performance, or achievements. We undertake no obligation to update any of these forward-looking statements for any reason after the date of this Proxy Statement or to conform these statements to actual results or revised expectations, except as required by law. Undue reliance should not be placed on forward-looking statements.

PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all the information that you should consider, and you should read the entire Proxy Statement before voting.

Proposals to be Voted On and Board Voting Recommendations

| | | | | | | | |

Voting Matter | Board Recommendation | Page |

PROPOSAL 1: ELECTION OF DIRECTORS

Our Board of Directors is currently comprised of nine members. In accordance with our Amended and Restated Certificate of Incorporation, beginning with our 2024 annual meeting, each member of our Board of Directors shall be elected for terms expiring at the next succeeding annual meeting of the stockholders, with each director to hold office until his or her successor shall have been duly elected and qualified. We are asking our stockholders to elect nine of our directors for a one-year term expiring at the 2025 annual meeting of stockholders and until such director’s successor is duly elected and qualified or until such director’s earlier death, resignation, disqualification or removal. | FOR all nominees | |

PROPOSAL 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We are asking our stockholders to ratify the Audit Committee’s appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year ending December 31, 2024. | FOR ratification of the appointment | |

PROPOSAL 3: ADVISORY VOTE ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

We are asking our stockholders to approve, on a non-binding advisory basis, the compensation of our named executive officers. | FOR approval on an advisory basis | |

PROPOSAL 4: APPROVAL OF AN AMENDMENT TO OUR AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

We are asking our stockholders to approve the proposed amendment to our Amended and Restated Certificate of Incorporation to limit the liability of certain officers of the company as permitted pursuant to recent amendments to the Delaware General Corporation Law (the “DGCL”). | FOR approval of the proposed amendment to our Amended and Restated Certificate of Incorporation | |

PROPOSAL 5: ADVISORY VOTE ON THE FREQUENCY OF FUTURE ADVISORY VOTES ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

We are asking our stockholders to vote, on a non-binding advisory basis, on the frequency of future stockholder advisory votes on the compensation of our named executive officers. | 1 YEAR | |

Key Business Highlights

We are a leading digital healthcare company that is in the business of designing, developing, and commercializing device- based technology to provide cardiac monitoring services that we believe allow clinicians to diagnose certain arrhythmias quicker and with greater efficiency than other services that rely on traditional technology.

We have developed a proprietary system that combines an FDA-cleared and CE-marked, wire-free, patch-based, 14-day wearable biosensor that continuously records electrocardiogram (“ECG”) data with a proprietary, FDA-cleared, CE-marked cloud-based data analytic software to help physicians monitor patients and diagnose arrhythmias (collectively, the “Zio System”). We have provided our Zio ambulatory cardiac monitoring services, including long-term continuous monitoring, short-term continuous monitoring, and mobile cardiac telemetry (“MCT”) monitoring services (collectively, the “Zio Services”), using our Zio System. These services are offered through three Zio System options — the Zio Monitor System, the Zio XT System, and the Zio AT System.

Since first receiving clearance from the U.S. Food and Drug Administration (“FDA”) for our technology in 2009, we have supported physician and patient use of our technology and provided ambulatory cardiac monitoring services from our Medicare-enrolled independent diagnostic testing facilities (“IDTFs”) and with our qualified technicians. Over this period of time, we have provided the Zio Services to over six million patients and have collected over 1.8 billion hours of curated heartbeat data.

In 2023, we continued to drive significant growth in our core business, and we believe that our ongoing accomplishments and investments will provide the foundation for sustained value creation over the long term. Over the past five years, our revenue compound annual growth rate, or CAGR, grew over 27%, reflecting continued resilience amid various micro- and macro-economic challenges. Our significant financial and operational highlights for 2023 included:

Accelerated momentum in core U.S. commercial business

•Grew full year 2023 patient registrations by 24% compared to full year 2022;

•Drove record full year of new account onboarding for Zio long-term continuous monitoring (“LTCM”) service in the United States;

•Launched our next generation Zio Monitor patch that builds on the high performance of Zio XT, together with an enhanced Zio Monitor Service that includes an updated patient experience to simplify enrollment and improve patient case management, and a refreshed patient mobile application; and

•Published the Cardiac Ambulatory Monitor EvaLuation of Outcomes and Time to Events (“CAMELOT”) study in the peer-reviewed American Heart Journal in December 2023, demonstrating higher clinical diagnostic yield and lower odds of retesting with Zio LTCM compared to other LTCM as well as to event recorder, mobile cardiac telemetry, and Holter.

Advanced initiatives within growth pillars to drive future value creation

•Zio Monitor System granted high medical needs designation by the Japanese Ministry of Health, Labour, and Welfare - reflecting recommendation by the Japanese Heart Rhythm Society - and we submitted a Shonin pre-market application to the Japanese Pharmaceutical and Medical Device Agency for regulatory approval in Japan;

•Received European Union CE marking under Medical Devices Regulation for the Zio monitor and Zio ECG Utilization Software (“ZEUS”) System, which supports the capture and analysis of ECG data recorded by the Zio Monitor patch at the end of the wear period;

•Opened a global business services center in Manila, Philippines, to position us to maintain patient satisfaction, scale globally, and perform more efficiently; and

•Generated additional published evidence of feasibility supporting the potential to expand into predictive models.

Operated with discipline and efficiency to drive financial sustainability

•Revenue of $492.7 million increased by approximately 20% compared to full year 2022;

•Gross margin of 67.3% decreased by 120-basis point compared to full year 2022;

•Net loss of $123.4 million reflected an increased loss of $7.3 million compared to full year 2022;

•Adjusted EBITDA of ($4.9) million reflected a $6.4 million improvement compared to full year 2022; and

•Cash, cash equivalents, and marketable securities balance of $133.8 million as of December 31, 2023.

Key Financial Metrics

(1) Adjusted EBITDA calculated as net loss or income excluding interest, taxes, depreciation and amortization, stock-based compensation expense, impairment and restructuring charges, and business transformation costs. Adjusted EBITDA margin calculated as adjusted EBITDA as a percentage of net revenues. For further discussion refer to the section titled “Non-GAAP Financial Measures.”

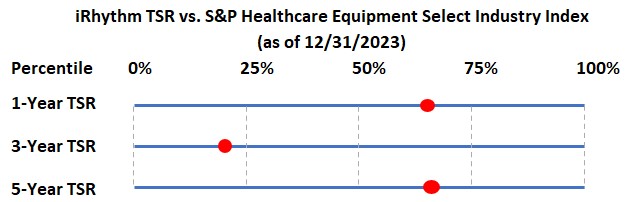

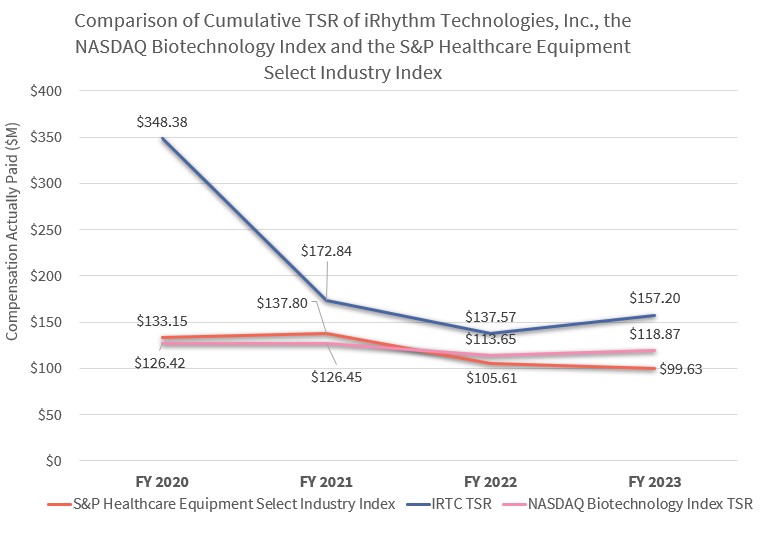

We continue to create and build long-term value for our stockholders. The following depicts our relative Total Stockholder Return (“TSR”) for the one, three and five-year periods ending on December 31, 2023 (represented by the red dot), compared to the S&P Healthcare Equipment Select Industry Index for the same periods.

Corporate Governance Highlights

We are committed to good corporate governance, which strengthens the accountability of our Board of Directors and promotes the long-term interests of our stockholders. Key elements of our independent board and leadership practices are outlined below, and discussed further in this proxy statement:

| | | | | |

Independent Chairman of the Board | Abhijit Y. Talwalkar serves as the independent chairperson of our Board of Directors. Our Board of Directors believes that Mr. Talwalkar’s deep technology knowledge and extensive experience in executive and board leadership roles at other technology companies make him well qualified to serve as chair of our Board of Directors. |

Independent Board and Committee Oversight | Our Corporate Governance Guidelines provide that there will at all times be a majority of independent directors on our Board of Directors. A majority of our current directors are independent (eight out of nine directors). Our independent directors conduct regular executive sessions. All committees of the Board of Directors are composed of independent directors. |

Board Diversity | In evaluating potential members of the Board of Directors, including directors who are eligible for re-election, our Nominating and Corporate Governance committee takes into account diversity including professional background, education, race, ethnicity, and gender.

The Nominating and Corporate Governance Committee, and any search firm it engages, will include women, minority and underrepresented community candidates in the pool of each director search. |

Comprehensive Risk Oversight Practices and Review of Internal Controls | Our Board of Directors oversees our comprehensive risk oversight practices, including cybersecurity, data privacy, compensation, legal and regulatory matters, compensation-related and other critical evolving areas. Our Board of Directors executes its oversight responsibility directly and through its committees, particularly the Audit Committee and the Compensation and Human Capital Management Committee. |

Environmental, Social and Governance Matters | Our Nominating and Corporate Governance committee oversees iRhythm’s strategies, activities, risks and opportunities related to ESG matters. |

Robust Board Evaluation Process

| Our Board of Directors and each of its committees conducts annual self-evaluations to assess performance. Such evaluations help inform board practices and assist the Board of Directors and its committees in identifying how it can improve. |

Declassified Board of Directors | Each member of our Board of Directors serves a one-year term and is subject to re-election at each annual meeting. |

Ownership Guidelines | Each member of our Board of Directors is required to comply with robust stock ownership guidelines. |

Board of Directors Highlights

Our Board of Directors was composed of nine directors during 2023 following the appointments of Mojdeh Poul and Brian Yoor in June 2023. Our directors each serve a one-year term and are subject to re-election at each annual meeting. Each director’s term continues until the election and qualification of his or her successor, or such director’s earlier death, resignation, or removal.

2023 Director Board Composition and Diversity

| | | | | | | | |

Board Independence | Board Tenure | Age Mix |

Independent Directors: 8

Non-Independent Directors: 1 | Average Tenure: 4.7 Years

0-3 Years: 4 3-5 Years: 0 6+ Years: 5 | Average Age: 63

40-49 Years: 1 50-59 Years: 1 60-69 Years: 5 70-79 Years: 1 80-89 Years: 1 |

See below for the diversity matrix of our Board of Directors as of March 27, 2024. The diversity matrix for our Board of Directors as of April 12, 2023 is available in our proxy statement for our 2023 annual meeting of stockholders, filed with the SEC on April 12, 2023:

| | | | | | | | |

33% Gender Diversity | 22% Racial Diversity | 44% Overall Diversity |

| | | | | | | | |

| Female | Male |

Directors (total: 9) | 3 | 6 |

Demographic Background | | |

Asian | 1 | 1 |

White | 2 | 5 |

Director Nominee Expertise, Skills, and Experience

Our director nominees possess relevant individual experiences, qualifications and skills that allow the Board of Directors to effectively oversee the company’s strategy and management. Our directors’ principal areas of expertise include:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Skill | Abhijit Y. Talwalkar

(Chairman) | Quentin Blackford | Bruce G. Bodaken | Karen Ling | C. Noel Bairey Merz, M.D. | Mojdeh Poul | Mark J. Rubash | Ralph Snyderman, M.D. | Brian Yoor |

| Healthcare/Medical Device Industry | | X | X | X | X | X | X | X | X |

| Technology and Data Security | X | | | | | | X | | X |

| Marketing & Commercial | | X | | | X | X | | X | |

| Senior Leadership | X | X | X | X | X | X | X | X | X |

| Finance | X | X | X | | | X | X | X | X |

| Public Company Governance | X | X | X | X | | X | X | X | X |

| Global Operations | X | X | | X | | X | X | | X |

| Medical Experience | | | | | X | | | X | |

| Regulatory & Compliance | | | | | X | X | | X | |

| Human Capital Management | X | X | X | X | | X | | X | X |

| Enterprise Risk Management | X | X | X | | | | X | | X |

| Environmental, Social & Governance | X | | X | X | | X | X | | |

Skill Matrix - Definitions

| | | | | | | | |

| Skill | Definition | Percentage of the Current Board with the Relevant Skill |

| Healthcare/Medical Device Industry | Management-level experience in an industry involving healthcare products or services, including medical devices and IDTF/MCT services. | 89% |

| Technology and Data Security | Significant experience or expertise in the use and deployment of technologies to facilitate business objectives, including cybersecurity and data privacy. | 33% |

| Marketing & Commercial | Significant strategic or management experience in the sales and marketing of medical devices and/or provision of services as an IDTF, and an understanding of the reimbursement environment in the United States and regions the Company has identified as potential areas for growth and expansion. | 44% |

| Senior Leadership | Experience in a senior management position, preferably a C-level executive (i.e., chief executive officer, etc.), at a publicly traded or private company with global operations, or other large complex organization (such as government, academic institution or not-for-profit). | 100% |

| Finance | Significant experience in senior management positions, preferably a C-level executive (i.e., chief executive officer, chief financial officer or chief accounting officer, etc.), requiring financial knowledge and analysis, including in accounting, corporate finance, treasury functions or risk management from a financial perspective. | 78% |

| Public Company Governance | Experience in and understanding of the Board of Directors’ oversight and fiduciary responsibilities and other key corporate governance matters for public companies in the healthcare and/or medical device industry, including legal and regulatory obligations and risks. | 89% |

| Global Operations | Significant strategic or management experience in an organization that operates internationally, especially on a broad basis and/or in the geographic regions the company has identified as potential areas for growth and expansion. | 67% |

| Medical Experience | A medical degree and significant work experience as a cardiac EP or cardiologist or expertise with personalized health care. | 22% |

| Regulatory and Compliance | Significant work experience with relevant regulatory requirements involving the development and distribution of medical devices or the development and provision of IDTF/MCT services. | 33% |

| Human Capital Management | Significant work experience in senior management positions with responsibility for, or to oversee, the Human Resources function (i.e., Chief Human Resources Officer or Chief Executive Officer with a Chief Human Resources Officer as a direct report) for an organization that operates in the US and internationally, including responsibility for attracting, developing, motivating and retaining high-quality people, compensation, DE&I, and succession planning. | 78% |

| Enterprise Risk Management | Experience overseeing corporate risk management process, including the effective identification, prioritization, and management of a broad spectrum of risks relevant to the company. | 56% |

| Environmental, Social & Governance | Experience in environmental, social and broader governance matters to facilitate the long-term sustainability of the company’s business and enable the company to address the needs of various stakeholders. | 56% |

Environment, Social and Governance Highlights

We believe that effectively managing ESG risks and opportunities drives business success, and that when fully integrated into the business, ESG can provide a competitive advantage. In 2022, we set out on a journey to develop iRhythm’s approach to ESG by conducting an ESG Priority Assessment to identify the ESG priority topics that are important to internal and external stakeholders. We also began operationalizing ESG within the organization by forming an ESG Steering Committee and multiple ESG Working Groups, which focus on specific ESG substantive areas or work streams. In addition, in 2023, we established formal board oversight of ESG by revising the charters of two committees of our Board of Directors, including the Nominating and Corporate Governance Committee and the Compensation and Human Capital Management Committee. We continue to work as an organization to advance our strategic ESG roadmap by pursuing ESG work streams.

During 2023 Institutional Shareholder Services group of companies (ISS) provided iRhythm with “Prime” status for the first time. Prime status is for companies achieving what ISS determines to be best in class ESG performance, based on sector exposure to environmental, social and governance impacts.

Our strategic ESG roadmap is continuously evolving based on progress, feedback, and business and external environment changes, and as we move forward, we plan to regularly review and revisit our ESG priority topics, our ESG measures and initiatives, and any ESG goals so that we can dynamically support the success of our business by addressing those topics, that make our business more sustainable. We believe that advancing the interests of our stakeholders supports the sustainability and success of our business, and so as we implement our ESG program, we plan to regularly consult internal and external stakeholders to take into account the views and perspectives of those groups that are critical to our business and which we impact by virtue of operating our business, our employees, customers, suppliers, investors, communities and others.

IRHYTHM TECHNOLOGIES, INC.

699 8th Street, Suite 600

San Francisco, California 94103

PROXY STATEMENT FOR THE 2024 ANNUAL MEETING OF STOCKHOLDERS

April 10, 2024

Information About Solicitation and Voting

The accompanying proxy is solicited on behalf of the Board of Directors of iRhythm Technologies, Inc. for use at our 2024 Annual Meeting of Stockholders (the “Annual Meeting”) to be held virtually at www.virtualshareholdermeeting.com/IRTC2024 on Wednesday, May 29, 2024, at 9:00 a.m. Pacific Time, and any adjournment or postponement thereof. The Notice of Internet Availability of Proxy Materials and this Proxy Statement for the Annual Meeting (the “Proxy Statement”) and the accompanying form of proxy were first distributed and made available on the Internet to stockholders on or about April 10, 2024. Our Annual Report for the fiscal year ended December 31, 2023 is available with this Proxy Statement by following the instructions in the Notice of Internet Availability of Proxy Materials. References to our website in this Proxy Statement are not intended to function as hyperlinks and the information contained on our website is not intended to be incorporated into this Proxy Statement.

Internet Availability of Proxy Materials

In accordance with U.S. Securities and Exchange Commission (“SEC”) rules, we are using the Internet as our primary means of furnishing proxy materials to stockholders. Consequently, most stockholders will not receive paper copies of our proxy materials. We will instead send these stockholders a Notice of Internet Availability of Proxy Materials with instructions for accessing the proxy materials, including our Proxy Statement and Annual Report, and voting via the Internet. The Notice of Internet Availability of Proxy Materials also provides information on how stockholders may obtain paper copies of our proxy materials if they so choose. We believe this rule makes the proxy distribution process more efficient, less costly and helps in conserving natural resources.

General Information About the Meeting

Purpose of the Annual Meeting

You are receiving this Proxy Statement because our Board of Directors is soliciting your proxy to vote your shares at the Annual Meeting with respect to the proposals described in this Proxy Statement. This Proxy Statement includes information that we are required to provide to you pursuant to the rules and regulations of the SEC and is designed to assist you in voting your shares.

We intend to ensure that our stockholders are afforded the same rights and opportunities to participate virtually as they would at an in-person meeting. We believe the virtual format makes it easier for stockholders to attend, and participate fully and equally in, the Annual Meeting because they can join with any Internet-connected device from any location around the world at no cost. Our virtual meeting format helps us engage with all stockholders regardless of size, resources, or physical location, saves us and stockholders’ time and money, and reduces our environmental impact.

Record Date; Quorum

Only holders of record of our common stock at the close of business on April 3, 2024, (the “Record Date”) will be entitled to vote at the Annual Meeting. At the close of business on the Record Date, we had 31,121,015 shares of common stock outstanding and entitled to vote. At the close of business on the Record Date, our directors and executive officers and their respective affiliates beneficially owned and were entitled to vote 157,644 shares of common stock at the Annual Meeting, or approximately 0.51% of the voting power of the shares of our common stock outstanding on such date. For at least ten days prior to the Annual Meeting, a complete list of the stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder for any purpose relating to the Annual Meeting during ordinary business hours at our headquarters, at 699 8th Street, Suite 600, San Francisco, California 94103.

The holders of a majority of the voting power of the shares of our common stock entitled to vote at the Annual Meeting as of the Record Date must be present at the Annual Meeting in order to hold the Annual Meeting and conduct business. This presence is called a quorum. Your shares are counted as present at the Annual Meeting if you are present and vote in person at the Annual Meeting or if you have properly submitted a proxy.

Participating in the Annual Meeting

•Instructions on how to attend the Annual Meeting are posted at www.proxyvote.com.

•You may log in to the meeting platform beginning at 8:45 a.m. Pacific Time on May 29, 2024. The meeting will begin promptly at 9:00 a.m. Pacific Time.

•You will need the 16-digit control number provided in your proxy materials to attend the Annual Meeting at www.virtualshareholdermeeting.com/IRTC2024.

•Stockholders of record and beneficial owners as of the Record Date may vote their shares electronically during the Annual Meeting.

•If you wish to submit a question during the Annual Meeting, log into the virtual meeting platform at www.virtualshareholdermeeting.com/IRTC2024, type your question into the “Ask a Question” field, and click “Submit.” If your question is properly submitted during the relevant portion of the meeting agenda, we will respond to your question during the live webcast, subject to time constraints. Questions that are substantially similar may be grouped and answered together to avoid repetition. We reserve the right to exclude questions that are irrelevant to meeting matters, irrelevant to the business of iRhythm, or derogatory or in bad taste; that relate to pending or threatened litigation; that are personal grievances; or that are otherwise inappropriate (as determined by the chair of the Annual Meeting). A webcast replay of the Annual Meeting, including the Q&A session, will be archived on the “Investor Relations” section of our website, which is located at https://investors.irhythmtech.com.

•If we experience technical difficulties during the meeting (e.g., a temporary or prolonged power outage), we will determine whether the meeting can be promptly reconvened (if the technical difficulty is temporary) or whether the meeting will need to be reconvened on a later day (if the technical difficulty is more prolonged). In any situation, we will promptly notify stockholders of the decision via www.virtualshareholdermeeting.com/IRTC2024. If you encounter technical difficulties accessing our meeting or asking questions during the meeting, a support line will be available on the login page of the virtual meeting website.

Voting Rights; Required Vote

In deciding all matters at the Annual Meeting, as of the close of business on the Record Date, each share of common stock represents one vote. We do not have cumulative voting rights for the election of directors. You may vote all shares owned by you as of the Record Date, including (i) shares held directly in your name as the stockholder of record and (ii) shares held for you as the beneficial owner in street name through a broker, bank, trustee, or other nominee.

Stockholder of Record: Shares Registered in Your Name. If, on the Record Date, your shares were registered directly in your name with our transfer agent, Equiniti Trust Company, then you are considered the stockholder of record with respect to those shares. As a stockholder of record, you may vote at the Annual Meeting or vote by telephone, through the Internet or, if you request or receive paper proxy materials, by filling out and returning the proxy card.

Beneficial Owner: Shares Registered in the Name of a Broker or Nominee. If, on the Record Date, your shares were held in an account with a brokerage firm, bank or other nominee, then you are the beneficial owner of the shares held in street name. As a beneficial owner, you have the right to direct your nominee on how to vote the shares held in your account, and your nominee has enclosed or provided voting instructions for you to use in directing it on how to vote your shares. However, the organization that holds your shares is considered the stockholder of record for purposes of voting at the Annual Meeting. Because you are not the stockholder of record, you may not vote your shares at the Annual Meeting unless you request and obtain a valid proxy from the organization that holds your shares giving you the right to vote the shares at the Annual Meeting.

Each director will be elected by a plurality of the votes cast, which means that the nine individuals nominated for election to our Board of Directors at the Annual Meeting receiving the highest number of “FOR” votes will be elected. You may vote “FOR ALL NOMINEES,” “WITHHOLD AUTHORITY FOR ALL NOMINEES,” or vote “FOR ALL EXCEPT” one or more of the nominees you specify. Ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024, will be obtained if the affirmative vote of a majority of the shares of our common stock present in attendance or by proxy at the virtual Annual Meeting and entitled to vote thereon vote for approval. Approval, on a non-binding advisory basis, of the compensation of our named executive officers (“NEOs”) will be obtained if the majority of the shares of our common stock present in attendance or by proxy at the virtual Annual Meeting and entitled to vote thereon vote for approval. Approval of an amendment to our Amended and Restated Certificate of Incorporation will be obtained if holders of a majority of our outstanding shares vote “FOR” the proposal at the Annual Meeting. You may vote for holding the non-binding advisory vote to approve the compensation of our NEOs every “1 YEAR,” “2 YEARS,” or “3 YEARS,” or vote for “ABSTAIN.” The frequency receiving the greatest number of votes cast by stockholders at the Annual Meeting will be deemed to be the preferred frequency option of our stockholders.

Recommendations of Our Board of Directors on Each of the Proposals Scheduled to be Voted on at the Annual Meeting

| | | | | | | | | | | |

| PROPOSAL | BOARD RECOMMENDATION | PAGE REFERENCE |

| Proposal No. 1 | The election of the nine directors named in this Proxy Statement. | FOR

ALL NOMINEES | |

| Proposal No. 2 | The ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024. | FOR | |

| Proposal No. 3 | The approval, on a non-binding advisory basis, of the compensation of our NEOs. | FOR | |

| Proposal No. 4 | The approval of an amendment to our Amended and Restated Certificate of Incorporation to limit the liability of certain officers of the company as permitted pursuant to recent amendments to the DGCL. | FOR | |

| Proposal No. 5 | The selection, on a non-binding advisory basis, of whether future advisory votes on the compensation of our NEOs should be every 1, 2, or 3 years. | 1 YEAR | |

None of our non-employee directors have any substantial interest in any matter to be acted upon except with respect to the directors so nominated. None of our executive officers have any substantial interest in any matter to be acted upon other than Proposal No. 3, Proposal No. 4 and Proposal No. 5.

Abstentions and Withhold Votes; Broker Non-Votes

Under Delaware law, abstentions are counted as present and entitled to vote for purposes of determining whether a quorum is present. At the Annual Meeting, abstentions or withhold votes will have no effect on Proposal No. 1, Proposal No. 2, Proposal No. 3 or Proposal No. 5 and will have the same effect as a vote against Proposal No. 4.

Broker non-votes occur when shares held by a broker for a beneficial owner are not voted because the broker did not receive voting instructions from the beneficial owner and lacked discretionary authority to vote the shares. Under Delaware law, broker non-votes are counted as present and entitled to vote for purposes of determining whether a quorum is present. However, brokers have limited discretionary authority to vote shares that are beneficially owned. While a broker is entitled to vote shares held for a beneficial owner on “routine” matters without instructions from the beneficial owner of those shares, absent instructions from the beneficial owner of such shares, a broker is not entitled to vote shares held for a beneficial owner on “non-routine” matters. At our Annual Meeting, only Proposal No. 2 is considered a routine matter and brokers have discretionary authority to vote shares that are beneficially owned on Proposal No. 2. If a broker chooses not to vote shares for or against Proposal No. 2, it will have the same effect as an abstention. The other proposals presented at the Annual Meeting are non-routine matters. Broker non-votes are not deemed to be shares entitled to vote on and will have no effect on the outcome of Proposal No. 1, Proposal No. 3 and Proposal No. 5 and will have the same effect as a vote against Proposal No. 4.

Voting Instructions; Voting of Proxies

| | | | | | | | |

| Vote By Internet | Vote By Telephone or Internet | Vote By Mail |

You may vote via the virtual meeting website - any stockholder can attend the Annual Meeting by visiting www.virtualshareholdermeeting.com/IRTC2024 where stockholders may vote and submit questions during the meeting. The meeting starts at 9:00 a.m. Pacific Time. Please have your 16-Digit Control Number to join the Annual Meeting. Instructions on how to attend and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at www.proxyvote.com. | You may vote by telephone or through the Internet - in order to do so, please follow the instructions shown on your proxy card. | You may vote by mail - if you request or receive a paper proxy card and voting instructions by mail, simply complete, sign and date the enclosed proxy card and promptly return it in the envelope provided or, if the envelope is missing, please mail your completed proxy card to Vote Processing, c/o Broadridge Financial Solutions, Inc., 51 Mercedes Way, Edgewood, New York 11717.Your completed, signed, and dated proxy card must be received prior to the Annual Meeting. |

Votes submitted by telephone or through the Internet must be received by 8:59 p.m. Pacific Time /11:59 p.m. Eastern on May 28, 2024. Submitting your proxy, whether by telephone, through the Internet or, if you request or receive a paper proxy card, by mail will not affect your right to vote in person should you decide to attend the Annual Meeting. If you are not the stockholder of record, please refer to the voting instructions provided by your nominee to direct your nominee on how to vote your shares. Your vote is important. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure that your vote is counted.

All proxies will be voted in accordance with the instructions specified on the proxy card. If you sign a physical proxy card and return it without instructions as to how your shares should be voted on a particular proposal at the Annual Meeting, your shares will be voted in accordance with the recommendations of our Board of Directors stated above.

If you do not vote and you hold your shares in street name, and your broker does not have discretionary power to vote your shares, your shares may constitute “broker non-votes” (as described above) and will not be counted in determining the number of shares necessary for approval of the proposals. However, broker non-votes will be counted for the purpose of establishing a quorum for the Annual Meeting.

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. To make certain all of your shares are voted, please follow the instructions included on each proxy card and vote each proxy card by telephone, through the Internet, or by mail. If you requested or received paper proxy materials and you intend to vote by mail, please complete, sign, and return each proxy card you received to ensure that all of your shares are voted.

We strongly recommend that you vote your shares in advance of the meeting as instructed above, even if you plan to attend the Annual Meeting virtually.

Revocability of Proxies

A stockholder of record who has given a proxy may revoke it at any time before it is exercised at the Annual Meeting by:

•delivering to our Corporate Secretary by mail a written notice stating that the proxy is revoked;

•signing and delivering a proxy bearing a later date;

•voting again by telephone or through the Internet; or

•attending virtually and voting during the Annual Meeting (although attendance at the Annual Meeting will not, by itself, revoke a proxy).

Please note, however, that if your shares are held of record by a broker, bank, or other nominee and you wish to revoke a proxy, you must contact that firm to revoke any prior voting instructions.

Expenses of Soliciting Proxies

We will pay the expenses of soliciting proxies, including preparation, assembly, printing, and mailing of this Proxy Statement, the proxy, and any other information furnished to stockholders. Following the original mailing of the soliciting materials, we and our agents, including directors, officers, and other employees, without additional compensation, may solicit proxies by mail, email, telephone, facsimile, by other similar means, or in person. Following the original mailing of the soliciting materials, we will request brokers, custodians, nominees, and other record holders to forward copies of the soliciting materials to persons for whom they hold shares and to request authority for the exercise of proxies. In such cases, we, upon the request of the record holders, will reimburse such holders for their reasonable expenses. If you choose to access the proxy materials or vote through the Internet, you are responsible for any Internet access charges you may incur.

Voting Results

Voting results will be tabulated and certified by the inspector of elections appointed for the Annual Meeting. The preliminary voting results will be announced at the Annual Meeting. The final results will be tallied by the inspector of elections and filed with the SEC in a current report on Form 8-K within four business days of the Annual Meeting.

Corporate Governance Standards and Director Independence

We are strongly committed to good corporate governance practices. These practices provide an important framework within which our Board of Directors and management can pursue our strategic objectives for the benefit of our stockholders.

Corporate Governance Principles

Our Board of Directors has adopted Corporate Governance Guidelines that set forth expectations for directors, director independence standards, board committee structure and functions, and other policies for the governance of the Company. Among other things, our Corporate Governance Guidelines provide:

•To satisfy their duty in overseeing company management and the ethical operation of the company, the directors will take a proactive, focused approach to their position, and set standards to ensure that the company is committed to business excellence, ethical and honest conduct, and highest levels of integrity.

•There will at all times be a majority of independent directors serving on the Board of Directors. Eight out of nine of our directors at the time of the Annual Meeting are independent.

•The Board of Directors shall have responsibility for succession planning concerning the Chief Executive Officer, and the company’s NEOs and the Compensation and Human Capital Management Committee shall plan for and conduct reviews with respect to succession planning for other key employees identified by the Chief Executive Officer.

•The Audit Committee, Compensation and Human Capital Management Committee and Nominating and Corporate Governance Committee must each be, and currently are, composed of a majority of independent directors.

•The Nominating and Corporate Governance Committee and the Board of Directors will evaluate each individual director or potential director in the context of the membership of the Board of Directors as a group, with the objective of having a group that can best perpetuate the success of the business and represent stockholder interests through the exercise of sound judgment using its diversity of background and experience in the various areas.

Our Corporate Governance Guidelines are available without charge on the “Investor Relations” section of our website, which is located at https://investors.irhythmtech.com, by clicking “Governance Documents and Charters” in the “Governance” section of our website. Our Nominating and Corporate Governance Committee reviews the Corporate Governance Guidelines periodically, and changes are recommended to our Board of Directors as warranted.

Board of Directors and Committee Self-Evaluations

Throughout the year, our Board of Directors discusses corporate governance practices with management and third-party advisors, including the company’s outside legal counsel, to ensure that the Board of Directors and its committees follow practices that are optimal for the company and its stockholders. Based on an evaluation process established and implemented by our Nominating and Corporate Governance Committee pursuant to the committee’s authority set forth in its charter, the Board of Directors, each committee thereof and each director conduct an annual self-evaluation in order to determine whether the Board of Directors and its committees and directors are functioning effectively. The Nominating and Corporate Governance Committee is responsible for establishing the evaluation criteria and implementing the process for this evaluation, as well as considering other corporate governance principles that may, from time to time, merit consideration by the Board of Directors.

The assessment of the Board of Directors is administered by the chairman of the Board of Directors, and Committee assessments are administered by the applicable chairperson of each committee.

The Board of Directors and committees assess, on an annual basis, several factors they believe to be essential in the effective performance of the Board of Directors and each committee, including:

•overall effectiveness of the Board of Directors and its committees, including in relation to progress in addressing the annual board or committee priorities;

•structure and composition of the Board of Directors and committees, including with respect to director independent, skills and diversity;

•effective oversight and risk management;

•sufficient and substantive communications between the Board of Directors and the company’s management;

•facilitation of board impact on stockholder value creation; and

•suggested improvements and best practices for the Board of Directors or committees.

The Nominating and Corporate Governance Committee reviews evaluations of the Board of Directors, and each committee reviews its respective report. All evaluation responses are shared with the full Board of Directors. Following the annual evaluation process, the Board of Directors and its committees assess the opportunities and suggestions provided in the feedback received and implement updates and changes as appropriate.

Board Nomination Process

The Board of Directors considers any nominations of director candidates validly made by stockholders in accordance with applicable laws, rules and regulations and the provisions of the company’s bylaws.

In accordance with the Nominating and Corporate Governance Charter, the Nominating and Corporate Governance Committee determines and make recommendations to the full Board of Directors for its approval, the desired qualifications, qualities, skills and other expertise required to be considered in selecting nominees for director, such as character, professional ethics and integrity, judgment, business acumen, proven achievement and competence in one’s field, the ability to exercise sound business judgment, tenure on the Board of Directors and skills that are complementary to the Board of Directors, an understanding of the company’s business, an understanding of the responsibilities that are required of a member of the Board of Directors, other time commitments, diversity with respect to professional background, education, race, ethnicity, gender, being a member of an underrepresented community, age and geography, as well as other individual qualities and attributes that contribute to the total mix of viewpoints and experience represented on the Board of Directors.

Further, the Nominating and Corporate Governance Committee searches for, identifies, evaluates and selects, or recommends for the selection by the Board of Directors, candidates to fill new positions or vacancies on the Board of Directors consistent with the company’s director criteria, as included in the Corporate Governance Guidelines, and reviews any candidates recommended by stockholders, provided such stockholder recommendations are made in compliance with the Corporation’s bylaws and its stockholder nominations and recommendations policies and procedures. The Nominating and Corporate Governance Committee shall select prospective members of the Board of Directors that are of high character and integrity. As stated in our Corporate Governance Guidelines, the composition of the Board of Directors should reflect a diversity of

background and experience to best perpetuate the success of the business and represent stockholder interests through the exercise of sound judgment. Accordingly, the Nominating and Corporate Governance Committee, and any search firm it engages, will include women, minority and underrepresented community candidates in the pool of each director search.

Board Succession

The Nominating and Corporate Governance Committee evaluates the current size, composition, organization and governance of the Board of Directors and its committees, determines future requirements and makes recommendations to the Board of Directors for approval consistent with our director criteria.

As part of the refreshment process for the Board of Directors, the Nominating and Corporate Governance Committee evaluates the performance of individual members of the Board of Directors eligible for re-election, and selects, or recommends for the selection by the Board of Directors, the director nominees for election to the Board of Directors by the stockholders at the company’s annual meeting of stockholders or any special meeting of stockholders at which directors are to be elected.

We also develop and review periodically the policies and procedures for considering stockholder nominees for election to the Board of Directors, and we evaluate and recommend termination of membership of individual directors for cause or for other appropriate reasons.

The Nominating and Corporate Governance Committee does not have a written policy on the consideration of director candidates recommended by stockholders. It is the view of the Board of Directors that all candidates, whether recommended by a stockholder or the Nominating and Corporate Governance Committee, shall be evaluated based on the same established criteria for persons to be nominated for election to the Board of Directors and its committees. The established criteria for persons to be nominated for election to the Board of Directors and its committees, taking into account the composition of the Board of Directors as a whole, at a minimum, includes:

•character, professional ethics and integrity, judgment, and business acumen;

•proven achievement and competence in the candidate’s field;

•the ability to exercise sound business judgment;

•tenure on the Board of Directors and skills that are complementary to the Board of Directors;

•an understanding of the company’s business;

•an understanding of the responsibilities that are required of a member of the Board of Directors;

•other time commitments;

•diversity with respect to professional background, education, race, ethnicity, gender, being a member of an underrepresented community, age and geography, as well as other individual qualities and attributes that contribute to the total mix of viewpoints and experience represented on the Board of Directors; and

•for incumbent members of the Board, the past performance of the incumbent director.

In addition, the Nominating and Corporate Governance Committee and the Board of Directors consider a candidate’s experience in the healthcare industry and other relevant industries. The priorities and emphasis of the Nominating and Corporate Governance Committee and of the Board of Directors with regard to these factors change from time to time to take into account changes in the company’s business and other trends, as well as the portfolio of skills and experience of current and prospective members of the Board of Directors. The Nominating and Corporate Governance Committee and the Board of Directors review and assess the continued relevance of and emphasis on these factors as part of the Board of Directors’ annual self-assessment process and in connection with candidate searches to determine if they are effective in helping to satisfy the Board of Directors’ goal of creating and sustaining a Board of Directors that can appropriately support and oversee the company’s activities.

Independence of Directors

The listing rules of the Nasdaq Stock Market LLC (“Nasdaq”) generally require that independent directors constitute a majority of a listed company’s Board of Directors. In addition, the Nasdaq rules require that, subject to specified exceptions, each member of a listed company’s audit, compensation and nominating and corporate governance committees must be an “independent director.” Under the rules of Nasdaq, a director will only qualify as an “independent director” if, in the opinion of that company’s Board of Directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Additionally, compensation committee members must not have a relationship with the listed company that is material to the director’s ability to be independent from management in connection with the duties of a compensation committee member.

In addition, Audit Committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In order to be considered independent for purposes of Rule 10A-3, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the Board of Directors, or any other board committee: accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the listed company or any of its subsidiaries; or be an affiliated person of the listed company or any of its subsidiaries.

Our Board of Directors has undertaken a review of the independence of each director and considered whether each director has a material relationship with us that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. As a result of this review, our Board of Directors determined that each of our directors other than Mr. Blackford are “independent directors” as defined under the applicable rules and regulations of the Securities and Exchange Commission (the “SEC”) and the listing requirements and rules of Nasdaq. In making these determinations, our Board of Directors reviewed and discussed information provided by the directors and by us with regard to each director’s business and personal activities and relationships as they may relate to us and our management, including the beneficial ownership of our common stock by each non-employee director and the transactions involving them described in the section titled “Certain Relationships and Related Party Transactions.”

Board Leadership Structure

Our Corporate Governance Guidelines provide that our Board of Directors shall be free, in accordance with our bylaws, to choose its chairperson in any way that it considers in the best interests of our company, and in making this determination, directors may take into consideration the interests of other stakeholders.

Currently, our Board of Directors believes that it should maintain flexibility to select the chairperson of our Board of Directors and adjust our board leadership structure from time to time.

| | | | | |

| Independent Chairperson of our Board | Chief Executive Officer |

Abhijit Y. Talwalkar has served as the independent chairperson of our Board of Directors since May 2016.

Our Board of Directors believes that Mr. Talwalkar’s deep technology knowledge and extensive experience in executive and board leadership roles at other technology companies make him well qualified to serve as chair of our Board of Directors. | Quentin Blackford has served our Chief Executive Officer since October 2021.

As CEO, Mr. Blackford manages the business of the company and executes the strategy developed with our Board of Directors. |

Our Corporate Governance Guidelines also provide that, when the Board of Directors does not have an independent chairperson, our Board of Directors will appoint a “lead independent director.” In the event a lead independent director is appointed, he or she will be responsible for calling separate meetings of the independent directors, serving as chairperson of meetings of independent directors, serving as the principal liaison between the chairperson of the Board of Directors and the independent directors, being available for consultation and direct communication with major stockholders as requested and performing such other responsibilities as may be designated by a majority of the independent directors from time to time.

Presiding Director of Non-Employee Director Meetings

The non-employee directors meet in regularly scheduled executive sessions without management directors or management to promote open and honest discussion. Our independent chairman, currently Mr. Talwalkar, is the presiding director at these meetings.

Committees of Our Board of Directors

Our Board of Directors has established an Audit Committee, a Compensation and Human Capital Management Committee, and a Nominating and Corporate Governance Committee. The composition and responsibilities of each committee are described below. Each of these committees has a written charter approved by our Board of Directors. Copies of the charters for each committee are available, without charge, in the “Investor Relations” section of our website, which is located at https://investors.irhythmtech.com, by clicking on “Governance Documents and Charters” in the “Governance” section of our website. Members serve on these committees until their resignations or until otherwise determined by our Board of Directors. Our Board of Directors also has a Special Committee which meets on an ad hoc basis, as further described below.

| | | | | | | | | | | |

| COMMITTEE MEMBERSHIPS |

| Current Members | Audit Committee | Compensation and Human Capital Management Committee | Nominating and Corporate Governance Committee |

Abhijit Y. Talwalkar | | ● | ● |

| C. Noel Bairey Merz, M.D. | | ● | |

| Bruce G. Bodaken | | ● | ○ |

| Karen Ling | | ○ | |

| Mojdeh Poul | ● | | |

| Mark J. Rubash | ○ | | ● |

| Ralph Snyderman, M.D. | ● | | |

| Brian Yoor | ● | | |

| Total Meetings Held in 2023 | 7 | 9 | 4 |

| Average Meeting Attendance | 100% | 97% | 100% |

○ Chair ● Member

Board and Committee Meetings and Attendance

Our Board of Directors and its committees meet regularly throughout the year; they also hold special meetings and act by written consent from time to time. During fiscal 2023, our Board of Directors met seven times, the Audit Committee met seven times, the Compensation and Human Capital Management Committee met nine times, and the Nominating and Corporate Governance Committee met four times. During fiscal 2023, each member of our Board of Directors attended at least 75% of the aggregate of all meetings of our Board of Directors and of all meetings of committees of our Board of Directors on which such member served that were held during the period in which such director served.

Board Attendance at Annual Stockholders’ Meeting

Our policy is to invite and encourage each member of our Board of Directors to be present at our annual meetings of stockholders. All of our then-current directors attended the 2023 annual meeting of stockholders.

Audit Committee

Our Audit Committee is composed of Mojdeh Poul, Mark J. Rubash, Ralph Snyderman, M.D. and Brian Yoor. Mr. Rubash is the chair of our Audit Committee. The members of our Audit Committee meet the independence requirements under Nasdaq and SEC rules and regulations. Each member of our Audit Committee is financially proficient. In addition, our Board of Directors has determined that Mr. Rubash is an “audit committee financial expert” as that term is defined in Item 407(d)(5)(ii) of Regulation S-K promulgated under the Securities Act of 1933, as amended. This designation does not impose any duties, obligations or liabilities that are greater than those generally imposed on other members of our Audit Committee and our Board of Directors.

Our Audit Committee is responsible for, among other things, overseeing:

•our accounting and financial reporting processes and internal controls over financial reporting, as well as the audit and integrity of our financial statements;

•the qualifications, independence and performance of our registered public accounting firm;

•the design, implementation and performance of our internal audit function, if any;

•our compliance with applicable law (including U.S. federal securities laws and other legal and regulatory requirements);

•all matters related to the security of and risks related to computerized information and technology systems across our company, as well as by product and/or service (including privacy, data security, and cybersecurity matters); and

•risk assessment and risk management program, policies and procedures.

Compensation and Human Capital Management Committee

Our Compensation and Human Capital Management Committee is composed of C. Noel Bairey Merz, M.D., Bruce G. Bodaken, Karen Ling and Abhijit Y. Talwalkar. Ms. Ling is the chair of our Compensation and Human Capital Management Committee. The members of our Compensation and Human Capital Management Committee meet the independence requirements under Nasdaq and SEC rules and regulations. Each member of this committee is also a “non-employee director” within the meaning of Rule 16b-3 under the Exchange Act. Our Compensation and Human Capital Management committee is responsible for, among other things:

•providing oversight of our compensation policies, plans and benefits programs and overall compensation philosophy;

•overseeing our strategies and policies related to the management of human capital;

•discharging the Board of Directors’ responsibilities relating to (1) review and recommendations to the Board of Directors regarding the compensation of our Chief Executive Officer and the non-employee directors and (2) the evaluation and approval of compensation of the other individuals who are deemed to be “officers” under Rule 16a-1(f) promulgated under the Exchange Act, or the executive officers; and

•administering our cash- and equity-based compensation plans for our directors, executive officers, and employees and granting equity awards pursuant to plans approved by our stockholders or outside of such plans.

Our Board of Directors has also established an equity award grant committee that is composed of our Chief Executive Officer, our Chief Financial Officer and our Chief People Officer (which for purposes of this committee is currently filled by our Vice President of Total Rewards & HR Operations), to make ordinary course equity awards grants to employees that are not our executive officers or non-employee directors, subject to certain limitations on the equity grant amounts per grantee and aggregate grant amounts.

Compensation and Human Capital Management Committee Interlocks and Insider Participation

The members of our Compensation and Human Capital Management committee during the year ended December 31, 2023 included C. Noel Bairey Merz, M.D., Bruce G. Bodaken, Karen Ling and Abhijit Y. Talwalkar. None of the members of the Compensation and Human Capital Management Committee in fiscal 2023 was at any time during fiscal 2023 or at any other time an officer or employee of ours or any of our subsidiaries, and none had or have any relationships with us that are required to be disclosed under Item 404 of Regulation S-K. During fiscal 2023, none of our executive officers served as a member of our Board of Directors, or as a member of the compensation or similar committee, of any entity that has one or more executive officers who served on our Board of Directors or Compensation and Human Capital Management committee.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee is composed of Bruce G. Bodaken, Mark J. Rubash and Abhijit Y. Talwalkar. Mr. Bodaken is the chair of our Nominating and Corporate Governance Committee. The members of our Nominating and Corporate Governance Committee meet the independence requirements under Nasdaq and SEC rules and regulations. Our Nominating and Corporate Governance Committee is responsible for, among other things:

•assisting the Board of Directors in identifying, considering and recommending candidates for membership on the Board of Directors;

•recommending members for each committee of the Board of Directors;

•developing and maintaining corporate governance policies applicable to the company, and any related matters required by applicable securities laws;

•overseeing the evaluation of the Board of Directors;

•advising the Board of Directors on corporate governance matters;

•overseeing our strategies, activities, risks and opportunities related to ESG matters; and

•reviewing and monitoring key public policy trends, issues, regulatory matters and other concerns that may affect the company.

Special Committee

Our special committee consists of Bruce G. Bodaken, Mark J. Rubash and Abhijit Y. Talwalkar. Mr. Talwalkar is the chair of our special committee. Our special committee is responsible for, among other things:

•overseeing investigations conducted by regulatory authorities and administrative proceedings or court actions related thereto;

•coordinating with management and outside legal counsel on litigation matters brought against us, including securities class action lawsuits;

•monitoring actions related to the FDA, Center for Medicare and Medicaid Services, Medicare Administrative Contractor, and other reimbursement activities; and

•reviewing employment matters including violations of our Code of Business Conduct and Ethics;

provided, that the special committee does not have authority to take or resolve to take final action on the above-listed matters and final action shall be determined by the full Board of Directors or, where applicable, a committee thereof.

Our Board of Directors’ Role in Risk Oversight

Our Board of Directors, as a whole, has responsibility for risk oversight, although the committees of our Board of Directors oversee and review risk areas that are particularly relevant to them. The risk oversight responsibility of our Board of Directors and its committees is supported by our management reporting processes, which are designed to provide visibility to our Board of Directors and to our personnel that are responsible for risk assessment and information about the identification, assessment and management of critical risks and management’s risk mitigation strategies. These areas of focus include competitive, economic, operational, financial (accounting, credit, investment, liquidity and tax), legal, regulatory, cybersecurity, privacy, compliance and reputational risks.

| | | | | | | | |

| THE BOARD |

| Our Board of Directors reviews strategic and operational risk in the context of discussions, question and answer sessions, and reports from the management team at each regular board meeting, as well as reports from other third-party experts from time to time, receives reports on all significant committee activities at each regular board meeting, and evaluates the risks inherent in significant transactions. |

| | |

| AUDIT COMMITTEE |

| Our Audit Committee assists our Board of Directors in fulfilling its oversight responsibilities with respect to risk management. Our Audit Committee reviews our major financial and enterprise risk exposures, including technology, privacy, cybersecurity and other information technology risks, among other things, discusses with management, our independent auditor and our internal auditor guidelines and policies with respect to risk assessment and risk management. |

| | |

| COMPENSATION AND HUMAN CAPITAL MANAGEMENT COMMITTEE | | GOVERNANCE COMMITTEE |

| Our Compensation and Human Capital Management Committee evaluates our major compensation-related risk exposure and the steps management has taken to monitor or mitigate such exposures. | | Our Nominating and Corporate Governance Committee assesses risks relating to ESG matters. |

We believe this division of responsibilities is an effective approach for addressing the risks we face and that our board leadership structure supports this approach. Each committee of our Board of Directors meets with key management personnel and representatives of outside advisors to oversee risks associated with their respective principal areas of focus.

Cybersecurity and Privacy Risk Oversight

Cybersecurity is an important part of our risk management at iRhythm. Our cybersecurity program includes mitigating risks for our company and for other companies that may have access to our data and systems. Our Board of Directors recognizes the critical importance of maintaining the trust and confidence of our customers, clients, business partners, and employees. The cybersecurity and privacy risk oversight responsibility of our Board of Directors and its committees is supported by our cybersecurity management reporting processes, which are designed to provide visibility to our Board of Directors and to our personnel that are responsible for risk assessment and information about the identification, assessment, and management of critical risks and management’s risk mitigation strategies. These areas of focus include risks from cybersecurity threats as well as competitive, economic, operational, financial, legal, regulatory, privacy, compliance, and reputational risks, among others. We understand that our customers, patients, and stakeholders entrust us with sensitive data, including Protected Health Information, and we take this responsibility seriously.

Our Board of Directors has an important role in the oversight of the company’s cybersecurity risk management and strategy and has delegated certain components of such oversight related to the security of and risks related to computerized information and technology systems across the company, as well as by risk area (including privacy, data security, and cybersecurity matters), to the Audit Committee, which regularly interacts with our Vice President of Cybersecurity (“VP of Cybersecurity”) and Chief Risk Officer (“CRO”). We also regularly engage external parties to assist in the review of our cybersecurity risk oversight processes.