UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

| | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the quarterly period ended OR | |

| | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from _____ to _____ | |

Commission File Number:

(Exact name of registrant as specified in its charter)

| | |

| (State or other jurisdiction of incorporation or organization | (I.R.S. Employer Identification No.) |

(Address of principal executive offices) (Zip Code)

(

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| | ☐ | Smaller reporting company | |

| Emerging growth company | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| | |

|

As of November 9, 2022, there were

Transitional Small Business Disclosure Format Yes ☐ No ☒

TABLE OF CONTENTS

|

U.S. STEM CELL, INC. |

||

|

PART I. |

FINANCIAL INFORMATION |

Page |

|

Item 1. |

||

|

Condensed Balance Sheets as of September 30, 2022 (Unaudited) and December 31, 2021 |

3 |

|

|

4 |

||

|

5 |

||

|

Condensed Statements of Cash Flows for the Nine Months Ended September 30, 2022 and 2021 (Unaudited) |

7 |

|

|

8 |

||

|

Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

28 |

|

Item 3. |

35 |

|

|

Item 4. |

35 |

|

|

PART II. |

OTHER INFORMATION |

|

|

Item 1. |

37 |

|

|

Item 1A. |

38 |

|

|

Item 2. |

38 |

|

|

Item 3. |

38 |

|

|

Item 4. |

38 |

|

|

Item 5. |

38 |

|

|

Item 6. |

38 |

|

|

41 |

||

PART I — FINANCIAL INFORMATION

Item 1. Financial Statement

|

U.S. STEM CELL, INC. |

|

CONDENSED BALANCE SHEETS |

|

September 30, |

December 31, |

|||||||

|

2022 |

2021 |

|||||||

|

(unaudited) |

||||||||

|

ASSETS |

||||||||

|

Current assets: |

||||||||

|

Cash and cash equivalents |

$ | $ | ||||||

| Accounts receivable, net of allowance of $ |

||||||||

|

Inventories |

||||||||

|

Prepaid expenses and other current assets |

||||||||

|

Total current assets |

||||||||

|

Total assets |

$ | $ | ||||||

|

LIABILITIES AND STOCKHOLDERS' DEFICIT |

||||||||

|

Current liabilities: |

||||||||

|

Accounts payable |

$ | $ | ||||||

|

Accrued expenses |

||||||||

|

Advances - related parties |

||||||||

|

Contract liabilities, current portion |

||||||||

|

Deposits |

||||||||

|

Notes payable - related parties |

||||||||

| Notes payable, current portion, net of debt discount of $ |

||||||||

|

Promissory note payable |

||||||||

| Convertible notes payable, net of debt discount of $ |

||||||||

|

Total current liabilities |

||||||||

|

Long-term liabilities: |

||||||||

|

Contract liabilities |

||||||||

| Notes payable, net of debt discount of $ |

||||||||

|

Total long-term liabilities |

||||||||

|

Total liabilities |

||||||||

|

Commitments and contingencies (See Note 11) |

||||||||

|

Stockholders' deficit: |

||||||||

| Preferred stock, par value $ |

||||||||

| Common stock, par value $ |

||||||||

|

Additional paid-in capital |

||||||||

|

Accumulated deficit |

( |

) | ( |

) | ||||

|

Total stockholders' deficit |

( |

) | ( |

) | ||||

|

Total liabilities and stockholders' deficit |

$ | $ | ||||||

The accompanying notes are an integral part of these unaudited condensed financial statements.

|

U.S. STEM CELL, INC. |

|

CONDENSED STATEMENTS OF OPERATIONS |

|

(unaudited) |

|

For the Three Months Ended September 30, |

For the Nine Months Ended September 30, |

|||||||||||||||

|

2022 |

2021 |

2022 |

2021 |

|||||||||||||

|

Revenue: |

||||||||||||||||

|

Products |

$ | $ | $ | $ | ||||||||||||

|

Services |

||||||||||||||||

|

Total revenue |

||||||||||||||||

|

Cost of revenues |

||||||||||||||||

|

Gross profit |

||||||||||||||||

|

Operating expenses: |

||||||||||||||||

|

Selling, general and administrative |

||||||||||||||||

|

Total operating expenses |

||||||||||||||||

|

Loss from operations |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

|

Other income (expense): |

||||||||||||||||

|

Gain (loss) on settlement of accounts payable and accrued interest, net |

( |

) | ( |

) | ( |

) | ||||||||||

|

Interest expense |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

|

Gain (loss) on debt extinguishment |

( |

) | ||||||||||||||

|

Total other income (expense) |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

|

Net loss before income taxes |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

|

Income taxes (benefit) |

||||||||||||||||

|

NET LOSS |

$ | ( |

) | $ | ( |

) | $ | ( |

) | $ | ( |

) | ||||

|

Net loss per common share, basic and diluted |

$ | ( |

) | $ | ( |

) | $ | ( |

) | $ | ( |

) | ||||

|

Weighted average number of common shares outstanding, basic and diluted |

||||||||||||||||

The accompanying notes are an integral part of these unaudited condensed financial statements.

|

U.S. STEM CELL, INC. |

|

CONDENSED STATEMENT OF CHANGES IN STOCKHOLDERS' DEFICIT |

|

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2022 |

|

(unaudited) |

|

Additional |

||||||||||||||||||||||||||||

|

Preferred Stock |

Common Stock |

Paid-in |

Accumulated |

|||||||||||||||||||||||||

|

Shares |

Amount |

Shares |

Amount |

Capital |

Deficit |

Total |

||||||||||||||||||||||

|

Balance, June 30, 2022 (unaudited) |

$ | $ | $ | $ | ( |

) | $ | ( |

) | |||||||||||||||||||

|

Common shares issued in settlement of accounts payable |

- | - | - | |||||||||||||||||||||||||

|

Common shares issued for services |

- | - | - | |||||||||||||||||||||||||

|

Common shares issued for cash |

- | - | - | |||||||||||||||||||||||||

|

Share-based compensation |

- | - | - | - | - | |||||||||||||||||||||||

|

Net loss |

- | - | - | - | - | ( |

) | ( |

) | |||||||||||||||||||

|

Balance, September 30, 2022 (unaudited) |

$ | $ | $ | $ | ( |

) | $ | ( |

) | |||||||||||||||||||

|

Additional |

||||||||||||||||||||||||||||

|

Preferred Stock |

Common Stock |

Paid-in |

Accumulated |

|||||||||||||||||||||||||

|

Shares |

Amount |

Shares |

Amount |

Capital |

Deficit |

Total |

||||||||||||||||||||||

|

Balance, December 31, 2021 |

$ | $ | $ | $ | ( |

) | $ | ( |

) | |||||||||||||||||||

|

Modified retrospective adoption of ASU 2020-06 |

- | - | - | - | ( |

) | ( |

) | ||||||||||||||||||||

|

Adjusted balance, December 31, 2021 |

( |

) | ( |

) | ||||||||||||||||||||||||

|

Common shares issued in settlement of accounts payable |

- | - | - | |||||||||||||||||||||||||

|

Common shares issued in lieu of interest |

- | - | - | |||||||||||||||||||||||||

|

Common shares issued for services |

- | - | - | |||||||||||||||||||||||||

|

Common shares and warrants issued to noteholders per addendums to convertible notes payable |

- | - | - | |||||||||||||||||||||||||

|

Common shares issued as equity kicker for convertible notes payable |

- | - | - | |||||||||||||||||||||||||

|

Common shares issued upon conversion of convertible notes payable |

- | - | - | |||||||||||||||||||||||||

|

Common shares issued for cash |

- | - | - | |||||||||||||||||||||||||

|

Share-based compensation |

- | - | - | - | - | |||||||||||||||||||||||

|

Net loss |

- | - | - | - | - | ( |

) | ( |

) | |||||||||||||||||||

|

Balance, September 30, 2022 (unaudited) |

$ | $ | $ | $ | ( |

) | $ | ( |

) | |||||||||||||||||||

The accompanying notes are an integral part of these unaudited condensed financial statements.

|

U.S. STEM CELL, INC. |

|

CONDENSED STATEMENT OF CHANGES IN STOCKHOLDERS' DEFICIT |

|

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2021 |

|

(unaudited) |

|

Additional |

||||||||||||||||||||||||||||

|

Preferred Stock |

Common Stock |

Paid-in |

Accumulated |

|||||||||||||||||||||||||

|

Shares |

Amount |

Shares |

Amount |

Capital |

Deficit |

Total |

||||||||||||||||||||||

|

Balance, June 30, 2021 (unaudited) |

$ | $ | $ | $ | ( |

) | $ | ( |

) | |||||||||||||||||||

|

Common shares issued in settlement of accounts payable |

- | - | - | |||||||||||||||||||||||||

|

Common shares issued upon conversion of convertible notes |

- | - | - | |||||||||||||||||||||||||

|

Common shares issued for cash |

- | - | - | |||||||||||||||||||||||||

|

Share-based compensation |

- | - | - | - | - | |||||||||||||||||||||||

|

Net loss |

- | - | - | - | - | ( |

) | ( |

) | |||||||||||||||||||

|

Balance, September 30, 2021 (unaudited) |

$ | $ | $ | $ | ( |

) | $ | ( |

) | |||||||||||||||||||

|

Additional |

||||||||||||||||||||||||||||

|

Preferred Stock |

Common Stock |

Paid-in |

Accumulated |

|||||||||||||||||||||||||

|

Shares |

Amount |

Shares |

Amount |

Capital |

Deficit |

Total |

||||||||||||||||||||||

|

Balance, December 31, 2020 |

$ | $ | $ | $ | ( |

) | $ | ( |

) | |||||||||||||||||||

|

Common shares issued in settlement of accounts payable |

- | - | - | |||||||||||||||||||||||||

|

Common shares issued in lieu of interest |

- | - | - | |||||||||||||||||||||||||

|

Common shares issued for services |

- | - | - | |||||||||||||||||||||||||

|

Beneficial conversion feature recognized on convertible notes |

- | - | - | - | - | |||||||||||||||||||||||

|

Common shares issued upon conversion of convertible notes payable |

- | - | - | |||||||||||||||||||||||||

|

Common shares issued for cash |

- | - | - | |||||||||||||||||||||||||

|

Share-based compensation |

- | - | - | - | - | |||||||||||||||||||||||

|

Net loss |

- | - | - | - | - | ( |

) | ( |

) | |||||||||||||||||||

|

Balance, September 30, 2021 (unaudited) |

$ | $ | $ | $ | ( |

) | $ | ( |

) | |||||||||||||||||||

The accompanying notes are an integral part of these unaudited condensed financial statements.

|

U.S. STEM CELL, INC. |

|

CONDENSED STATEMENTS OF CASH FLOWS |

|

(unaudited) |

|

For the Nine Months Ended September 30, |

||||||||

|

2022 |

2021 |

|||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

||||||||

|

Net loss |

$ | ( |

) | $ | ( |

) | ||

|

Adjustments to reconcile net loss to net cash used in operating activities: |

||||||||

|

Bad debt (recoveries) |

||||||||

|

Interest and amortization of debt discount |

||||||||

|

Loss (gain) on settlement of accounts payable and accrued interest |

( |

) | ||||||

|

Loss on debt extinguishment |

||||||||

|

Related party notes payable issued for services rendered |

||||||||

|

Share-based compensation |

||||||||

|

Changes in operating assets and liabilities: |

||||||||

|

Accounts receivable |

( |

) | ( |

) | ||||

|

Inventories |

( |

) | ||||||

|

Prepaid expenses and other current assets |

( |

) | ||||||

|

Accounts payable |

||||||||

|

Accrued expenses |

||||||||

|

Contract liabilities |

( |

) | ( |

) | ||||

|

Net cash used in operating activities |

( |

) | ( |

) | ||||

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

||||||||

|

Proceeds from sale of common shares |

||||||||

|

Proceeds from related party advances |

||||||||

|

Repayments of notes payable |

( |

) | ( |

) | ||||

|

Proceeds from convertible note payable |

||||||||

|

Repayments of convertible note payable |

( |

) | ||||||

|

Net cash provided by financing activities |

||||||||

|

Net increase (decrease) in cash and cash equivalents |

( |

) | ||||||

|

Cash and cash equivalents, beginning of period |

||||||||

|

Cash and cash equivalents, end of period |

$ | $ | ||||||

|

SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION: |

||||||||

|

Interest paid |

$ | $ | ||||||

|

Income taxes paid |

$ | $ | ||||||

|

SUPPLEMENTAL NON-CASH INVESTING AND FINANCING ACTIVITIES: |

||||||||

|

Modified retrospective adoption of ASU 2020-06 |

$ | $ | ||||||

|

Common shares issued for prepaid services |

$ | $ | ||||||

|

Common shares issued in settlement of accounts payable |

$ | $ | ||||||

|

Common shares issued upon conversion of convertible notes and accrued interest |

$ | $ | ||||||

|

Common shares issued as equity kicker for convertible notes payable |

$ | $ | ||||||

|

Common shares issued in lieu of interest |

$ | $ | ||||||

|

Monthly payments on notes payable made on behalf of the Company |

$ | $ | ||||||

|

Beneficial conversion feature recognized on convertible note |

$ | $ | ||||||

The accompanying notes are an integral part of these unaudited condensed financial statements.

U.S. STEM CELL, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

SEPTEMBER 30, 2022

(unaudited)

NOTE 1 — NATURE OF OPERATIONS

Overview

U.S. Stem Cell, Inc. was incorporated under the laws of the State of Florida in August 1999. The Company is in the cardiovascular sector of the cell technology industry delivering cell therapies and biologics that help address congestive heart failure, lower limb ischemia, chronic heart ischemia, acute myocardial infarctions and other issues. The business includes the development of proprietary cell therapy products as well as revenue generating physician and patient-based regenerative medicine/cell therapy training services, cell collection and cell storage services, the sale of cell collection and treatment kits for humans and animals, and the operation of cell therapy clinics. To date, the Company has not generated significant revenues in that they remain less than their total operating expenses, has incurred expenses, and has sustained losses. Consequently, its operations are subject to all the risks inherent in the establishment of a research and development business enterprise.

Basis of Presentation

The interim unaudited condensed financial statements included herein reflect all material adjustments (consisting of normal recurring adjustments and reclassifications and non-recurring adjustments) which, in the opinion of the Company’s management, are ordinary and necessary for a fair presentation of results for the interim periods. Certain information and footnote disclosures required under generally accepted accounting principles in the United States of America (“GAAP”) have been condensed or omitted pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”). The Company’s management believes the disclosures are adequate to make the information presented not misleading.

The condensed balance sheet information as of December 31, 2021 was derived from the Company’s annual report on Form 10-K for the fiscal year ended December 31, 2021 (“2021 Annual Report”), filed with the SEC pursuant to Section 13 or 15(d) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), on March 31, 2022 (and amended for Item 9 on July 8, 2022). These interim unaudited condensed financial statements should be read in conjunction with the 2021 Annual Report. The results of operations for the three and nine months ended September 30, 2022 are not necessarily indicative of the results to be expected for the entire fiscal year or for any other period.

NOTE 2 – GOING CONCERN AND MANAGEMENT’S LIQUIDITY PLANS

The accompanying financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business.

As shown in the accompanying financial statements, as of September 30, 2022, the Company had cash on hand of $

The Company’s primary source of operating funds has been from revenue generated from sales with additional cash proceeds from the sale of common stock and the issuances of promissory notes and other debt. The Company has experienced net losses from operations since inception, but it expects these conditions to improve in the future as it develops its business model. The Company had a stockholders’ deficit at September 30, 2022 and requires additional financing to fund future operations.

The Company’s existence is dependent upon management’s ability to develop profitable operations and to obtain additional funding sources. There can be no assurance that the Company’s financing efforts will result in profitable operations or the resolution of the Company’s liquidity problems. The accompanying statements do not include any adjustments that might result should the Company be unable to continue as a going concern.

U.S. STEM CELL, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

SEPTEMBER 30, 2022

(unaudited)

NOTE 3 – SIGNIFICANT ACCOUNTING POLICIES

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Significant estimates include stock-based compensation, debt discounts and the valuation allowance related to deferred tax assets. Actual results may differ from these estimates.

Cash

The Company considers cash to consist of cash on hand and temporary investments having an original maturity of 90 days or less that are readily convertible into cash.

Fair Value Measurements

Accounting Standards Codification subtopic 825-10, Financial Instruments (“ASC 825-10”) requires disclosure of the fair value of certain financial instruments. The carrying value of cash and cash equivalents, accounts payable, accrued liabilities, and short-term borrowings, as reflected in the balance sheets, approximate fair value because of the short-term maturity of these instruments. All other significant financial assets, financial liabilities and equity instruments of the Company are either recognized or disclosed in the financial statements together with other information relevant for making a reasonable assessment of future cash flows, interest rate risk and credit risk. Where practicable the fair values of financial assets and financial liabilities have been determined and disclosed; otherwise only available information pertinent to fair value has been disclosed.

The Company follows Accounting Standards Codification subtopic 820-10, Fair Value Measurements and Disclosures (“ASC 820-10”) and Accounting Standards Codification subtopic 825-10, Financial Instruments (“ASC 825-10”), which permits entities to choose to measure many financial instruments and certain other items at fair value.

Accounts Receivable and Allowance for Doubtful Accounts

Accounts receivable are non-interest bearing and are stated at gross invoice amounts less an allowance for doubtful accounts. Credit is extended to customers based on an evaluation of their financial condition, industry reputation, and other judgmental factors considered by the Company’s management. The Company generally does not require collateral or other security interest to support accounts receivable. Based on trends and specific factors, the customer’s credit terms may be modified, including required payment upon delivery.

The Company performs regular on-going credit evaluations of its customers as deemed relevant. As events, trends, and circumstance warrant, the Company’s management estimates the amounts that are more likely than not to be uncollectible. These amounts are recognized as bad debt expense and are reflected within selling, general, administrative and other expenses on the Company’s accompanying statements of operations.

Any charges to the allowance for doubtful accounts on accounts receivable are charged to operations in amounts sufficient to maintain the allowance for uncollectible accounts at a level management believes is adequate to cover any probable losses. Management determines the adequacy of the allowance based on historical write-off percentages and the current status of accounts receivable. Accounts receivable are charged off against the allowance when collectability is determined to be permanently impaired. As of September 30, 2022 and December 31, 2021, the allowance for doubtful accounts was $

Inventories

Inventories are stated at the lower of cost or market with cost being determined on a first-in, first-out (FIFO) basis. The Company writes down its inventory for estimated obsolescence or unmarketable inventory equal to the difference between the cost of inventory and the estimated market value based upon assumptions about future demand and market conditions. If actual market conditions are less favorable than those projected by management, additional inventory write-downs may be required. During the periods presented, there were no inventory write-downs.

U.S. STEM CELL, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

SEPTEMBER 30, 2022

(unaudited)

Investments

The Company follows Accounting Standards Codification subtopic 323-10, Investments-Equity Methods and Joint Ventures (“ASC 323-10”) which requires the accounting for investments where the Company can exert significant influence, but not control of a joint venture or equity investment. The Company accounted for its

Revenue Recognition

The Company recognizes revenue in accordance with Accounting Standards Codification Topic 606 “Revenue from Contracts with Customers” (“ASC 606”). ASC 606 is based on the principle that revenue is recognized to depict the transfer of goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services.

The Company’s primary sources of revenue are from the sale of test kits and equipment, training services, patient treatments, laboratory services and cell banking.

Revenues for kits and equipment sold are not recorded until kits and equipment are received by the customer. Revenues from in-person trainings are recognized when the training occurs and revenues from on demand online trainings are recognized when the customer purchases the rights to the training course. Any cash received as a deposit for trainings are recorded by the Company as a liability.

Patient treatments and laboratory services revenue are recognized when those services have been completed or satisfied.

Revenues for cell banking are accounted for as multiple performance obligations as described in ASC 606 and addresses accounting for arrangements that may involve the delivery or performance of multiple products, services and/or rights to use assets. Because the Company sells its services separately, on more than a limited basis and at a price within a narrow range, the Company was able to allocate revenue based on stand-alone pricing. The multiple performance obligations include stem cell banking, dose retrieval and yearly storage fees. Revenues for stem cell banking and dose retrieval is recognized at the point of service and revenues for the yearly storage fees is recognized over the term of the banking contract, which is typically one year with annual renewals.

At September 30, 2022 and December 31, 2021, the Company had contract liabilities of $

Research and Development

The Company accounts for research and development costs in accordance with Accounting Standards Codification subtopic 730-10, Research and Development (“ASC 730-10”). Under ASC 730-10, all research and development costs must be charged to expense as incurred. Accordingly, internal research and development costs are expensed as incurred. Third-party research and development costs are expensed when the contracted work has been performed or as milestone results have been achieved as defined under the applicable agreement. Company-sponsored research and development costs related to both present and future products are expensed in the period incurred. The Company did not incur any research and development expenses during the periods presented.

Stock-Based Compensation

Stock-based compensation expense is measured at the grant date fair value of the award and is expensed over the requisite service period. For stock-based awards to employees, non-employees and directors, the Company calculates the fair value of the award on the date of grant using the Black-Scholes option pricing model. Determining the fair value of stock-based awards at the grant date under this model requires judgment, including estimating volatility, employee stock option exercise behaviors and forfeiture rates. The assumptions used in calculating the fair value of stock-based awards represent the Company’s best estimates, but these estimates involve inherent uncertainties and the application of management’s judgment.

U.S. STEM CELL, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

SEPTEMBER 30, 2022

(unaudited)

Income Taxes

The Company follows Accounting Standards Codification subtopic 740-10, Income Taxes (“ASC 740-10”) for recording the provision for income taxes. Deferred tax assets and liabilities are computed based upon the difference between the financial statement and income tax basis of assets and liabilities using the enacted marginal tax rate applicable when the related asset or liability is expected to be realized or settled. Deferred income tax expenses or benefits are based on the changes in the asset or liability during each period. If available evidence suggests that it is more likely than not that some portion or all of the deferred tax assets will not be realized, a valuation allowance is required to reduce the deferred tax assets to the amount that is more likely than not to be realized. Future changes in such valuation allowance are included in the provision for deferred income taxes in the period of change. Deferred income taxes may arise from temporary differences resulting from income and expense items reported for financial accounting and tax purposes in different periods.

Deferred taxes are classified as current or non-current, depending on the classification of assets and liabilities to which they relate. Deferred taxes arising from temporary differences that are not related to an asset or liability are classified as current or non-current depending on the periods in which the temporary differences are expected to reverse and are considered immaterial.

Net Loss per Common Share

The Company computes earnings (loss) per share under Accounting Standards Codification subtopic 260-10, Earnings Per Share (“ASC 260-10”). Net loss per common share is computed by dividing net loss by the weighted average number of shares of common stock outstanding during the year. Diluted earnings per share, if presented, would include the dilution that would occur upon the exercise or conversion of all potentially dilutive securities into common stock using the “if converted” method.

The computation of basic and diluted income (loss) per share as excludes potentially dilutive securities when their inclusion would be anti-dilutive, or if their exercise prices were greater than the average market price of the common stock during the period.

Potentially dilutive securities excluded from the computation of basic and diluted net loss per share are as follows:

|

September 30, |

||||||||

|

2022 |

2021 |

|||||||

|

Options |

||||||||

|

Warrants |

||||||||

|

Convertible notes |

||||||||

|

Total potentially dilutive shares |

||||||||

Reclassifications

Certain reclassifications have been made to the prior years’ data to conform to the current year presentation. These reclassifications had no effect on reported income (losses).

Recent Accounting Pronouncements

In August 2020, the FASB issued ASU 2020-06, which simplifies the guidance on accounting for convertible debt instruments by removing the separation models for: (1) convertible debt with a cash conversion feature; and (2) convertible instruments with a beneficial conversion feature. As a result, the Company will not separately present in equity an embedded conversion feature in such debt. Instead, we will account for a convertible debt instrument wholly as debt, unless certain other conditions are met. We expect the elimination of these models will reduce reported interest expense and increase reported net income for the Company’s convertible instruments falling under the scope of those models before the adoption of ASU 2020-06. Also, ASU 2020-06 requires the application of the if-converted method for calculating diluted earnings per share and the treasury stock method will be no longer available. The Company adopted ASU 2020-06 in the first quarter of 2022 utilizing the modified retrospective method. As a result, the Company adjusted its beginning balance sheet with a decrease in additional paid-in capital of $

U.S. STEM CELL, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

SEPTEMBER 30, 2022

(unaudited)

In June 2016, the FASB issued ASU No. 2016-13, “Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments”, which significantly changes how entities will measure credit losses for most financial assets, including accounts receivable. ASU No. 2016-13 will replace today’s “incurred loss” approach with an “expected loss” model, under which companies will recognize allowances based on expected rather than incurred losses. On November 15, 2019, the FASB delayed the effective date of Topic 326 for certain small public companies and other private companies until fiscal years beginning after December 15, 2022 for SEC filers that are eligible to be smaller reporting companies under the SEC’s definition, as well as private companies and not-for-profit entities. The Company does not expect the new guidance will have a material impact on its financial statements.

There are various other updates recently issued, most of which represented technical corrections to the accounting literature or application to specific industries and are not expected to a have a material impact on the Company’s financial position, results of operations or cash flows.

NOTE 4 — INVESTMENTS

During March 2021, we divested ourselves of our Member Interest in U.S. Stem Cell Clinic, LLC, while U.S. Stem Cell Clinic of the Villages, LLC is currently dormant.

U.S. Stem Cell Clinic, LLC

The investment in U.S. Stem Cell Clinic, LLC was comprised of a

Revenues earned from sales to U.S. Stem Clinic, LLC for the three and nine months ended September 30, 2022 were $

An affiliate of one of the Company’s officers is a minority investor in the U.S. Stem Cell Clinic, LLC.

U.S. Stem Cell of the Villages LLC

On January 30, 2018, Greg Knutson, a director of the Company (“Knutson”) and the Company agreed to open and operate a regenerative medicine/cell therapy clinic providing cellular treatments for patients afflicted with neurological, autoimmune, orthopedic and degenerative diseases in Florida.

As of December 31, 2018, upon completion of U.S. Stem Cell of the Villages LLC, the Company received $

At September 30, 2022 and December 31, 2021, accounts receivable for sales of products and services to the Villages was $

During the three and nine months ended September 30, 2022 and 2021, the Company received $

U.S. STEM CELL, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

SEPTEMBER 30, 2022

(unaudited)

As of the date of this filing, U.S. Stem Cell Clinic of the Villages, LLC is currently dormant.

NOTE 5 — ACCRUED EXPENSES

Accrued expenses consisted of the following as of September 30, 2022 and December 31, 2021:

|

September 30, |

December 31, |

|||||||

|

2022 |

2021 |

|||||||

|

Interest and fees payable to the Guarantors of the Company’s loan agreement with Seaside Bank |

$ | $ | ||||||

|

Accrued interest payable |

||||||||

|

Vendor accruals and other |

||||||||

|

Total Accrued expenses |

$ | $ | ||||||

On February 10, 2021, as part of a settlement agreement, the Company transferred its entire member interest in U.S. Stem Cell, LLC to Dr. Kristen Comella as settlement for $

NOTE 6 — NOTES PAYABLE

Notes payable were comprised of the following as of September 30, 2022 and December 31, 2021:

|

September 30, |

December 31, |

|||||||

|

2022 |

2021 |

|||||||

|

Seaside Bank note payable |

$ | $ | ||||||

|

Dr. Comella note payable* |

||||||||

|

Dr. Comella note payable* |

||||||||

|

Dr. Comella note payable* |

||||||||

|

Dr. Comella note payable* |

||||||||

|

Hunton & Williams note payable |

||||||||

|

Weider note payable |

||||||||

|

Mallard note payable |

||||||||

|

EIDL note payable |

||||||||

|

Total notes payable |

||||||||

|

Less unamortized debt discount |

( |

) | ( |

) | ||||

|

Total notes payable net of unamortized debt discount |

||||||||

|

Less current portion |

( |

) | ( |

) | ||||

|

Long-term portion |

$ | $ | ||||||

| * | ||||||||

Seaside Bank

On October 25, 2010, the Company entered into a Loan Agreement with Seaside National Bank and Trust for a $

U.S. STEM CELL, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

SEPTEMBER 30, 2022

(unaudited)

Dr. Comella, former Chief Science Officer

On September 6, 2016, the Company issued a $

On August 7, 2017, the Company issued a $

On May 7, 2018, the Company issued a $

On July 1, 2019, the Company issued a $

On February 10, 2021, as part of a settlement agreement, the Company transferred its entire member interest in U.S. Stem Cell, LLC to Dr. Kristen Comella as settlement for $

Dr. Comella has not served as member of the Board of Directors since September 1, 2019.

Hunton & Williams

At December 31, 2016, the Company has

On August 31, 2017, the Company and the noteholder entered into a Note Forbearance, Modification and Repayment Agreement (“Agreement”). The two notes, $61,150 and $323,822, were payable in one balloon payment upon the date of a written demand and upon certain triggering events occurring. The sum of unpaid principal and accumulated interest for both notes as of August 31, 2017 of $

The noteholder agreed to accept full payment of their obligation over a four (4) year period in 48 monthly installments on an adjusted debt obligation in aggregate of $624,000 (reducing the outstanding balance), with such payments staggered in amounts such that the Company will pay $10,000 monthly the first year, $12,000 monthly the second year, $14,000 monthly the third year, and $16,000 monthly the final year. In addition, the noteholder agreed to suspend accrual interest on the notes commencing September 1, 2017.

The Agreement remains in full force and effect provided the Company continues to make the monthly payments, there is no event of default as defined in the notes and an agreement to a subordination agreement by Northstar Biotech Group, LLC, which has been provided. In May 2019, the Company did not make the required scheduled payment. In September 2019, the noteholder agreed to waive their default rights under the agreement provided a minimum of $5,000 was paid by the end of 2019 and to reduce the required monthly payment to $500 per month commencing in January 2020. The Company satisfied the $5,000 payment requirement by the end of 2019 and commenced making the required $500 monthly payments in January 2020. The Company last made a $500 payment in March 2021 and thereby became delinquent until making three $

U.S. STEM CELL, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

SEPTEMBER 30, 2022

(unaudited)

The Company imputed an interest rate of

Weider

The Company, as one of the parties entered into a Settlement Agreement and General Release (the “Agreement”) dated June 3, 2019 related to certain medical procedures. Without admitting any liability, and as part of that Agreement, the Company agreed to provide a five-year

Mallard

The Company, as one of the parties entered into a Settlement Agreement and General Release (the “Agreement”) dated December 6, 2019 related to certain medical procedures. Without admitting any liability, and as part of that Agreement, the Company agreed to provide a five-year

Economic Injury Disaster Loan (EIDL)

On June 20, 2020, the Company executed the standard loan documents for an EIDL from the U.S. Small Business Administration in light of the impact of the COVID-19 pandemic on our business. Pursuant to that certain Loan Authorization and Agreement (the “SBA Loan Agreement”), the principal amount of the EIDL received was $

NOTE 7 — PROMISSORY NOTE PAYABLE

On June 1, 2015, the Company issued an amended and restated promissory note of $

The note is unsecured and non-interest bearing and required four semi-annual payments of $

U.S. STEM CELL, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

SEPTEMBER 30, 2022

(unaudited)

The Company imputed an interest rate of

NOTE 8 — CONVERTIBLE NOTES PAYABLE

The Company adopted ASU 2020-06 in the first quarter of 2022 utilizing the modified retrospective method. As a result, the Company eliminated an aggregate of $

On February 5, 2020, the Company issued an unsecured convertible promissory note in the principal amount of $

From February 17, 2021 through February 26, 2021, the Company issued unsecured convertible promissory notes in the aggregate principal amount of $

U.S. STEM CELL, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

SEPTEMBER 30, 2022

(unaudited)

On October 29, 2021, the Company issued an unsecured convertible promissory note in the principal amount of $

On February 26, 2022, the Company issued an unsecured convertible promissory note in the principal amount of $

NOTE 9 — RELATED PARTY TRANSACTIONS

Advances – Related Parties

As of September 30, 2022 and December 31, 2021, the Company’s officers and directors have provided advances that are unsecured, non-interest bearing and due on demand. During the nine months ended September 30, 2022 and 2021, the Company received aggregate proceeds from advances $

Notes Payable – Related Parties

Northstar Biotechnology Group, LLC

On February 29, 2012, a promissory note issued to BlueCrest Master Fund Limited (“BlueCrest”) was assigned to Northstar Biotechnology Group, LLC (“Northstar”), owned partly by certain directors and existing shareholders of the Company at the time, including Dr. William P. Murphy Jr., Dr. Samuel Ahn and Charles Hart. At the date of the assignment, the principal amount of the BlueCrest note was $

On March 30, 2012, the Company and Northstar agreed to extend until May 1, 2012 the initial payment date for any and all required monthly under the Note, such that the first of the four monthly payments required under the Note will be due and payable on May 1, 2012 and all subsequent payments will be due on a monthly basis thereafter commencing on June 1, 2012, and to waive any and all defaults and/or events of default under the Note with respect to such payments. The Company did not make the required payment, and as a result, was in default of the revised agreement. The Company renegotiated the terms of the Note and Northstar agreed to suspend the requirement of principal payments by the Company and allow payment of interest-only in common stock.

On September 21, 2012, the Company issued

On October 1, 2012, the Company and Northstar entered into a limited waiver and forbearance agreement providing a recapitalized new note balance comprised of all sums due Northstar with a maturity date extended perpetually. The Company agreed to issue 5,000,000 shares of Series A Convertible Preferred Stock and 10,000 shares of common stock in exchange for $210,000 as payment towards outstanding debt, default interest, penalties, professional fees outstanding and due Northstar. In addition, the Company executed a security agreement granting Northstar a lien on all patents, patent applications, trademarks, service marks, copyrights and intellectual property rights of any nature, as well as the results of all clinical trials, know-how for preparing Myoblasts, old and new clinical data, existing approved trials, all right and title to Myoblasts, clinical trial protocols and other property rights.

U.S. STEM CELL, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

SEPTEMBER 30, 2022

(unaudited)

In addition, the Company granted Northstar a perpetual license on products as described for resale, relicensing, and commercialization outside the United States. In connection with the granted license, Northstar shall pay the Company a royalty of up to

Effective October 1, 2012, the interest rate was

In connection with the consideration paid, Northstar waived, from the effective date through the earlier of termination or expiration of the agreement, satisfaction of the obligations as described in the forbearance agreement.

In 2012, 5,000,000 shares of Series A Convertible Preferred Stock were approved to be issued, which was subsequently increased to

On September 30, 2013, the Company issued

On December 24, 2013, the Company issued

On April 2, 2014, the Company issued

On September 17, 2014, the limited waiver and forbearance agreement entered into on October 1, 2012 to provide that the perpetual license on products as described for resale, relicensing and commercialization outside the United States was amended as such on the condition that Northstar provide certain financing, which financing the Company, in its sole discretion, could decline and retain the license.

On October 3, 2014, the Company issued

On April 3, 2015, the Company issued

On October 2, 2015, the Company issued

On October 7, 2015, the Company issued

On April 7, 2016, the Company issued

On October 6, 2016, the Company issued

U.S. STEM CELL, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

SEPTEMBER 30, 2022

(unaudited)

On March 1, 2017, Northstar and the Company entered into a settlement agreement (“Settlement Agreement “) related to then pending litigation. Pursuant to the terms and conditions of the Settlement Agreement, Northstar converted its outstanding Series A Convertible preferred stock, into twenty million (20,000,000) shares of common stock according to the original conversion terms. In addition, and separate and apart from the conversion, Northstar received eleven million (11,000,000) shares of the Company’s common stock. Northstar will receive ten percent (10%) of all Company international sales (based on a gross sales basis). There was no effect of the 10% obligation as there were no international sales in 2017 or through 2019. Furthermore, a Northstar designee, Greg Knutson, was appointed as a member of the Board of Directors of the Company and two Company directors, Michael Tomas and Kristin Comella, each exercised their prior Northstar options to each receive a five percent (5%) member interest in Northstar. The parties agreed to a mutual release and Northstar agreed to terminate any UCC lien on the Company assets previously filed for the benefit of Northstar. On March 9, 2017 and April 1, 2017, the Company issued

On April 1, 2017, the Company issued

On October 2, 2017, the Company issued

On October 19, 2018, the Company issued

On April 19, 2019, the Company issued

On October 1, 2019, the Company issued

On April 1, 2020, the Company issued

On October 1, 2020, the Company issued

On April 1, 2021, the Company issued

On October 1, 2021, the Company issued

On April 5, 2022, the Company issued

As of September 30, 2022 and December 31, 2021, the remaining carrying value of the note was $

Notes Payable - Mr. Tomas, President and Chief Executive Officer

On August 7, 2017, the Company issued a $

On May 7, 2018, the Company issued a $

U.S. STEM CELL, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

SEPTEMBER 30, 2022

(unaudited)

On July 1, 2019, the Company issued a $

On December 31, 2019, the Company issued a $

On March 31, 2020, the Company issued a $

On June 30, 2020, the Company issued a $

On July 1, 2020, the Company issued a $

On September 30, 2020, the Company issued a $

On December 31, 2020, the Company issued a $

On March 31, 2021, the Company issued a $

On June 30, 2021, the Company issued a $

On September 30, 2021, the Company issued a $

On December 31, 2021, the Company issued a $

On March 31, 2022, the Company issued a $

On June 30, 2022, the Company issued a $

On September 30, 2022, the Company issued a $

U.S. STEM CELL, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

SEPTEMBER 30, 2022

(unaudited)

At September 30, 2022 and December 31, 2021, accrued interest on the notes was $

|

September 30, |

December 31, |

|||||||

|

2022 |

2021 |

|||||||

|

Northstar |

$ | $ | ||||||

|

Note payable, Mr. Tomas |

||||||||

|

Note payable, Mr. Tomas |

||||||||

|

Note payable, Mr. Tomas |

||||||||

|

Note payable, Mr. Tomas |

||||||||

|

Note payable, Mr. Tomas |

||||||||

|

Note payable, Mr. Tomas |

||||||||

|

Note payable, Mr. Tomas |

||||||||

|

Note payable, Mr. Tomas |

||||||||

|

Note payable, Mr. Tomas |

||||||||

|

Note payable, Mr. Tomas |

||||||||

|

Note payable, Mr. Tomas |

||||||||

|

Note payable, Mr. Tomas |

||||||||

|

Note payable, Mr. Tomas |

||||||||

|

Note payable, Mr. Tomas |

||||||||

|

Note payable, Mr. Tomas |

||||||||

|

Note payable, Mr. Tomas |

||||||||

|

Total notes payable - related parties |

$ | $ | ||||||

NOTE 10 — FAIR VALUE MEASUREMENT

The Company adopted the provisions of ASC 825-10. ASC 825-10 defines fair value as the price that would be received from selling an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. When determining the fair value measurements for assets and liabilities required or permitted to be recorded at fair value, the Company considers the principal or most advantageous market in which it would transact and considers assumptions that market participants would use when pricing the asset or liability, such as inherent risk, transfer restrictions, and risk of non-performance. ASC 825-10 establishes a fair value hierarchy that requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. ASC 825-10 establishes three levels of inputs that may be used to measure fair value:

|

● |

Level 1 – Quoted prices in active markets for identical assets or liabilities. |

|

● |

Level 2 – Observable inputs other than Level 1 prices such as quoted prices for similar assets or liabilities; quoted prices in markets with insufficient volume or infrequent transactions (less active markets); or model-derived valuations in which all significant inputs are observable or can be derived principally from or corroborated by observable market data for substantially the full term of the assets or liabilities. |

|

● |

Level 3 – Unobservable inputs to the valuation methodology that are significant to the measurement of fair value of assets or liabilities. |

All items required to be recorded or measured on a recurring basis are based upon Level 3 inputs.

To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement is disclosed and is determined based on the lowest level input that is significant to the fair value measurement.

U.S. STEM CELL, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

SEPTEMBER 30, 2022

(unaudited)

As of September 30, 2022 and December 31, 2021, the Company did not have any items that would be classified as level 1, 2 or 3 disclosures.

As of September 30, 2022 and December 31, 2021, the Company did not have any derivative instruments that were designated as hedges.

NOTE 11 — COMMITMENTS AND CONTINGENCIES

Leases

In October 2019, the Company relocated to a new location within the same city and entered into a month-to-month lease. During the three and nine months ended September 30, 2022 and 2021, lease expense was comprised of the following:

|

For the Three Months Ended September 30, |

For the Nine Months Ended September 30, |

|||||||||||||||

|

2022 |

2021 |

2022 |

2021 |

|||||||||||||

|

Operating lease expense |

$ | $ | $ | $ | ||||||||||||

|

Total lease expense |

$ | $ | $ | $ | ||||||||||||

Royalty Agreement / Middle East

On November 9, 2016, the Company entered into an Intellectual Property License Agreement whereby the Company granted High Rise Group Company the exclusive right to the Company’s intellectual property (as defined) for the licensed use and development in Kuwait and other GCC/Middle East countries for

The intent is for U.S. Stem Cell Middle East to offer regenerative treatment options to patients, based on U.S. Stem Cell, Inc. products and technologies like MyoCell™. To date, the first clinic in Kuwait City has been completed but has not begun operations as High Rising Group has not yet been able to secure regulatory approvals to operate.

Litigation

On September 17, 2015, a product liability lawsuit was filed in Broward County, specifically Patsy Bade v. Bioheart, Inc. US Stem Cell Clinics LLC, Alejandro Perez, ARNP, and Shareen Greenbaum, M.D., and on November 30, 2015, a product liability lawsuit was filed in Broward County, specifically Elizabeth Noble v. Bioheart, Inc. US Stem Cell Clinics LLC, Alejandro Perez, ARNP, and Shareen Greenbaum, M.D. During the year ended December 31, 2016, both matters settled by the Company’s insurance policy with no additional cost to the Company, except for the obligation to pay the insurance company deductible of $

On July 27, 2020, Brenda Leonhardt filed a lawsuit against U.S. Stem Cell, Inc., Mike Tomas, Dr. William P. Murphy, Jr., Richard T. Spencer, III, Mark Borman, Dr. Samuel S. Ahn, Charles Hart, Sheldon T. Anderson, Greg Knutson, and Kristin Comella in Broward County Court, Case No. CACE-10-012095. The lawsuit alleges breach of a settlement agreement, breach of contract with respect to failure to make a balloon payment under a promissory note, and several tort theories such as misrepresentation and fraudulent transfer. The Company denies most of the allegations in the lawsuit and moved to dismiss almost all of the claims. The motions to dismiss was denied. U.S. Stem Cell, Inc. does note that it provided a promissory note to Ms. Leonhardt, which has not been fully satisfied. The stated due date of the promissory note was June 1, 2020 in the amount of $

The Company, as one of the parties entered into a Settlement Agreement and General Release (the “Agreement”) dated June 3, 2019 related to certain medical procedures. Without admitting any liability, and as part of that Agreement, the Company agreed to provide a five-year

U.S. STEM CELL, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

SEPTEMBER 30, 2022

(unaudited)

On February 10, 2021, as part of a settlement agreement, the Company transferred its entire member interest in U.S. Stem Cell Clinic, LLC to Dr. Kristin Comella as settlement for $

The Company is subject at times to other legal proceedings and claims, which arise in the ordinary course of its business. Although occasional adverse decisions or settlements may occur, the Company believes that the final disposition of such matters should not have a material adverse effect on its financial position, results of operations or liquidity. There was no outstanding litigation as of September 30, 2022 other than that described above.

Government Claim

On May 9, 2018, the U.S. Department of Justice filed an injunctive action, specifically United States of America v. U.S. Stem Clinic, LLC, U.S. Stem Cell, Inc., Kristin C. Comella, and Theodore Gradel. The Complaint alleges, among other matters that the defendants manufacture “stromal vascular fraction” (SVF) products from patient adipose (fat) tissue, which the companies then market as stem cell-based treatments, and which U.S. Stem Cell Clinic, LLC administers to patients, without first obtaining what the government alleges are necessary FDA approvals. Although Theodore Gradel was initially listed as a defendant, he subsequently entered into a consent agreement and is no longer party to this case.

The U.S. and the defendants filed cross motions for summary judgment, each asking for a ruling in its favor. On June 3, 2019, the Court entered an order granting Summary Judgment for the government and denying the defendants’ motion for summary judgment. The order focused on the defendants’ actions in providing and marketing SVF therapy. In an order dated June 4, 2019, the Court granted the defendants’ request to allow it the opportunity to work out the language of the form of injunction with the government, and if unsuccessful, to provide a status report to the Court by June 14, 2019, outlining areas of disagreement. The Court further ordered that the defendants (U.S. Stem Clinic, LLC, U.S. Stem Cell, Inc., and Kristin C. Comella) ‘not sell, provide or otherwise engage in any SVF therapy or any other activities to be regulated by the FDA as explained in the Court’s Order on the Parties’ Motions for Summary Judgment.” On June 25, 2019, the Court entered an Order of Permanent Injunction, generally enjoining the defendants with respect to the SVF Product and requiring other actions. The Company filed an appeal on August 23, 2019 and attended oral argument on January 13, 2021. On June 2, 2021, the Eleventh Circuit Court ruled to affirm the lower court’s judgement. The Company is not able to predict the duration, scope, results, or consequences of the U.S. Department of Justice actions and final rulings and management is assessing its options on a going forward basis. The Company, in having divested certain equipment and other assets and assigning its lease, has and will continue to experience a decrease in revenues as the Company both maintains the remainder of the business and transitions into similar or unrelated business opportunities as determined by management. However, management is not able to predict the duration, scope, results, or consequences of the summary judgment and any transition of the business plan.

After the Court’s issuance of the Order of Permanent Injunction, the Company has received demand letters for compensation from persons who store their SVF Product and/or other tissue product with the tissue bank (several of the persons have requested refunds of the monies paid to the tissue bank and one person has requested a full refund of monies paid to an altogether separate company due to her not receiving the full amount of treatments she requested; such requests for compensation, to date, have not been material) and requests that the Company preserve cells in the Company’s possession. The Company sought guidance from the Court, which entered an order generally staying the requirement to destroy any SVF Product, pending a decision on the Company’s appeal. However, that appeal has now been concluded and the stay order is no longer in place. In the meanwhile, the Company entered into a transaction to generally divest itself from the tissue bank business. The Company no longer stores any SVF product.

NOTE 12 — STOCKHOLDERS’ DEFICIT

Adjustment to Opening Balances Upon Adoption of ASU 2020-06

Upon adoption of ASU 2020-06 during the first quarter of 2022, the Company adjusted its beginning balance sheet with a decrease in additional paid-in capital of $

U.S. STEM CELL, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

SEPTEMBER 30, 2022

(unaudited)

Common Stock

During the nine months ended September 30, 2022, the Company issued an aggregate of

During the nine months ended September 30, 2022, the Company issued an aggregate of

During the nine months ended September 30, 2022, the Company issued an aggregate of

During the three months ended March 31, 2022, the Company entered into addendums with certain holders owning an aggregate of $

On February 26, 2022, the Company issued an unsecured convertible promissory note in the principal amount of $

On March 23, 2022, a convertible note with a face value of $

On September 10, 2021, the Company filing of an Offering Circular on Form 1-A, pursuant to Regulation A (File Number: 024-11617) was qualified by the Securities and Exchange Commission. The Company registered

Stock Options

On April 1, 2013, the Board of Directors approved, subject to subsequently received stockholder approval, the establishment of the Bioheart 2013 Omnibus Equity Compensation Plan, or the “2013 Omnibus Plan” (replacing the 1999 Officers and Employees Stock Option Plan, or the Employee Plan, and the 1999 Directors and Consultants Stock Option Plan). The 2013 Omnibus Plan initially reserved up to fifty thousand (

On November 2, 2015, the Company increased the shares reserved under the 2013 Omnibus Plan to five hundred million (

U.S. STEM CELL, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

SEPTEMBER 30, 2022

(unaudited)

A summary of the stock option activity for the nine months ended September 30, 2022 is as follows:

|

Weighted |

Weighted |

|||||||||||||||

|

Average |

Average |

|||||||||||||||

|

Number of |

Exercise |

Remaining Life |

Intrinsic |

|||||||||||||

|

Options |

Price |

In Years |

Value |

|||||||||||||

|

Outstanding, December 31, 2021 |

$ | $ | ||||||||||||||

|

Granted |

||||||||||||||||

|

Exercised |

||||||||||||||||

|

Forfeited/Expired |

( |

) | $ | |||||||||||||

|

Outstanding, September 30, 2022 |

$ | $ | ||||||||||||||

|

Exercisable, September 30, 2022 |

$ | $ | ||||||||||||||

|

Options Outstanding |

Options Exercisable |

||||||||||||||||||||

|

Weighted |

Weighted |

Weighted |

|||||||||||||||||||

|

Outstanding |

Average |

Average |

Exercisable |

Average |

|||||||||||||||||

|

Exercise |

Number of |

Exercise |

Remaining Life |

Number of |

Exercise |

||||||||||||||||

|

Price |

Options |

Price |

In Years |

Options |

Price |

||||||||||||||||

| $ |

$ | $ | |||||||||||||||||||

| $ |

$ | $ | |||||||||||||||||||

| $ |

$ | $ | |||||||||||||||||||

| $ |

$ | $ | |||||||||||||||||||

| $ |

$ | $ | |||||||||||||||||||

| $ |

$ | $ | |||||||||||||||||||

| $ | $ | ||||||||||||||||||||

The aggregate intrinsic value of outstanding stock options was $

The fair value of all options that vested during the nine months ended September 30, 2022 and 2021 was $

U.S. STEM CELL, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

SEPTEMBER 30, 2022

(unaudited)

Warrants

A summary of the warrant activity for the nine months ended September 30, 2022 is as follows:

|

Weighted |

||||||||||||||||

|

Weighted |

Average |

|||||||||||||||

|

Average |

Remaining |

|||||||||||||||

|

Number of |

Exercise |

Life |

Intrinsic |

|||||||||||||

|

Warrants |

Price |

In Years |

Value |

|||||||||||||

|

Outstanding, December 31, 2021 |

$ | $ | ||||||||||||||

|

Granted |

||||||||||||||||

|

Exercised |

||||||||||||||||

|

Expired |

( |

) | ||||||||||||||

|

Outstanding, September 30, 2022 |

$ | $ | - | |||||||||||||

|

Exercisable, September 30, 2022 |

$ | $ | - | |||||||||||||

|

Warrants Outstanding |

Warrants Exercisable |

||||||||||||||||||||

|

Weighted |

Weighted |

Weighted |

|||||||||||||||||||

|

Outstanding |

Average |

Average |

Exercisable |

Average |

|||||||||||||||||

|

Exercise |

Number of |

Exercise |

Remaining Life |

Number of |

Exercise |

||||||||||||||||

|

Price |

Warrants |

Price |

In Years |

Warrants |

Price |

||||||||||||||||

| $ |

$ | $ | |||||||||||||||||||

| $ |

$ | $ | |||||||||||||||||||

| $ |

$ | $ | |||||||||||||||||||

| $ |

$ | $ | |||||||||||||||||||

| $ |

$ | $ | |||||||||||||||||||

| $ | $ | ||||||||||||||||||||

The aggregate intrinsic value of the issued and exercisable warrants of $

NOTE 13 — CONCENTRATIONS

Concentrations of Credit Risk

The Company’s financial instruments that are exposed to a concentration of credit risk are cash and accounts receivable. Generally, the Company’s cash and cash equivalents in interest-bearing accounts does not exceed FDIC insurance limits. The financial stability of these institutions is periodically reviewed by senior management.

U.S. STEM CELL, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

SEPTEMBER 30, 2022

(unaudited)

Concentrations of Revenues

For the three and nine months ended September 30, 2022 and 2021, the following customers accounted for more than 10% of the Company’s net revenues:

|

For the Three Months Ended September 30, |

For the Nine Months Ended September 30, |

|||||||||||||||

|

2022 |

2021 |

2022 |

2021 |

|||||||||||||

|

Customer 1 |

% | % | ||||||||||||||

|

Customer 2 |

% | % | ||||||||||||||

|

Customer 3 |

% | % | ||||||||||||||

|

Customer 4 |

% | % | ||||||||||||||

|

Customer 5 |

% | % | ||||||||||||||

|

Customer 6 |

% | |||||||||||||||

|

Customer 7 |

% | |||||||||||||||

|

Totals |

% | % | % | % | ||||||||||||

Concentrations of Accounts Receivable

As of September 30, 2022 and December 31, 2021, the following customers represented more than 10% of the Company’s accounts receivable:

|

September 30, |

December 31, |

|||||||

|

2022 |

2021 |

|||||||

|

Customer 1 |

% | % | ||||||

|

Totals |

% | % | ||||||

NOTE 14 — SUBSEQUENT EVENTS

On October 1, 2022, the Company issued an aggregate of

On October 1, 2022, the Company issued

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Unless otherwise indicated, references in this Quarterly Report on Form 10-Q to “we,” “us,” and “our” are to the Company, unless the context requires otherwise. The following discussion and analysis by our management of our financial condition and results of operations should be read in conjunction with our unaudited condensed interim financial statements and the accompanying related notes included in this quarterly report and our audited financial statements and related notes and Management’s Discussion and Analysis of Financial Condition and Results of Operations included in our Annual Report on Form 10-K for the year ended December 31, 2021 filed with the Securities and Exchange Commission.

Cautionary Statement Regarding Forward-Looking Statements

This report may contain forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act, and we intend that such forward-looking statements be subject to the safe harbors created thereby. These forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. Any such forward-looking statements would be contained principally in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors.” Forward-looking statements include information concerning our possible or assumed future results of operations, business strategies, financing plans, competitive position, industry environment, potential growth opportunities and the effects of regulation. Forward-looking statements include all statements that are not historical facts and can be identified by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “hopes,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” or similar expressions.

This report may contain forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act, and we intend that such forward-looking statements be subject to the safe harbors created thereby. These forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. Any such forward-looking statements would be contained principally in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors.” Forward-looking statements include information concerning our possible or assumed future results of operations, business strategies, financing plans, competitive position, industry environment, potential growth opportunities and the effects of regulation. Forward-looking statements include all statements that are not historical facts and can be identified by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “hopes,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” or similar expressions.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. We discuss many of these risks in greater detail in “Risk Factors.” Risk factors include, but are not limited to, the economic effects of the pandemic and the short and long term economic impact of the pending recession on the marketplace. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Also, forward-looking statements represent our management’s beliefs and assumptions only as of the date of this report. You should read this report and the documents that we reference in this report and have filed as exhibits to the report completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

Additional information concerning these, and other risks and uncertainties is contained in our filings with the Securities and Exchange Commission, including the section entitled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2020.

Unless otherwise indicated or the context otherwise requires, all references in this Form 10-Q to “we,” “us,” “our,” “our company,” “U. S. Stem Cell, Inc.” or the “Company” refer to U.S. Stem Cell, Inc. and its subsidiaries.

Our Ability to Continue as a Going Concern

Our independent registered public accounting firm has issued its report dated September 30, 2022, in connection with the audit of our annual financial statements as of December 31, 2021, that included an explanatory paragraph describing the existence of conditions that raise substantial doubt about our ability to continue as a going concern and Note 2 to the unaudited financial statements for the period ended September 30, 2022 also describes the existence of conditions that raise substantial doubt about our ability to continue as a going concern.

Our Ability to Continue as a Going Concern

Our independent registered public accounting firm has issued its report dated March 31, 2022 , in connection with the audit of our annual financial statements as of December 31, 2021, that included an explanatory paragraph describing the existence of conditions that raise substantial doubt about our ability to continue as a going concern and Note 2 to the unaudited financial statements for the period ended September 30, 2022 also describes the existence of conditions that raise substantial doubt about our ability to continue as a going concern.

Overview

We are an enterprise in the regenerative medicine/cellular therapy industry. Our prior focus was on the discovery, development, and commercialization of cell based therapeutics. Our business included the development of proprietary cell therapy products as well as revenue generating physician and patient based regenerative medicine/cell therapy training services,

US Stem Cell Training, Inc. (“SCT”), an operating division of our company, is a content developer of regenerative medicine/cell therapy informational and training materials for physicians and patients. SCT also provides in-person and online training courses which are delivered through in-person presentations at SCT’s state of the art facilities and globally at university, hospital and physician’s office locations as well as through online webinars. Additionally, SCT provides hands-on clinical application training for physicians and health care professionals interested in providing regenerative medicine / cell therapy procedures.

Vet biologics, (“VBI”), an operating division of our company, is a veterinary regenerative medicine company committed to providing veterinarians with the ability to deliver the highest quality regenerative medicine therapies to dogs, cats and horses. VBI provides veterinarians with extensive regenerative medicine capabilities including the ability to isolate regenerative stem cells from a patient’s own adipose (fat) tissue directly on-site within their own clinic or stall-side.

During fiscal 2019, we had interests in US Stem Cell Clinic, LLC, (“SCC”), Regenerative Wellness Clinic, LLC, and US Stem Cell Clinic of the Villages, LLC as partially owned investments of our company (in which we had a 49.9%, 49.9% and 49% respectively member interests), which were physician run regenerative medicine/cell therapy clinics providing cellular treatments for patients afflicted with neurological, autoimmune, orthopedic and degenerative diseases. During the last quarter of 2019 (and in early 2021 in the case of SCC), we divested ourselves of our Member Interests in SCC and Regenerative Wellness Clinic, LLC, and US Stem Cell Clinic of the Villages, LLC is currently dormant.

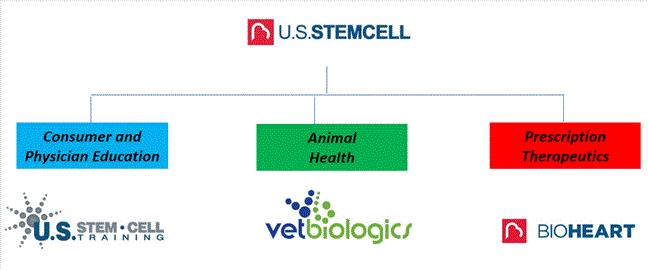

Our comprehensive map of products and services:

Our mission is to advance to market novel regenerative medicine and cellular therapy products that substantially benefit humankind. Our business strategy is, to the extent possible, finance our clinical development pipeline through revenue (cash in-flows) generated through the marketing and sales of unique educational and training services, animal health products and personalized cellular therapeutic treatments. Accordingly, we have developed a multifaceted portfolio of revenue generating products and services in our US Stem Cell Training, Vetbiologics, operating divisions that will, if successful, financially support its clinical development programs. Our goal is to maximize shareholder value through the generation of short-term profits that increase cash in-flows and decrease the need for venture financings – a modern biotechnology company development strategy.

Today, our company is a combination of opportunistic business enterprises. What we are establishing is a foundation of value in the products and services we are and plan to sell from US Stem Cell Training and Vetbiologics. Our strategy is to expand the revenues generated from each of these operating divisions and to reinvest the profits we generate into our clinical development pipeline.