UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For the quarterly period ended:

For the transition period from _____________ to _____________

Commission File No.

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

|

|

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each Class |

| Trading Symbol(s) |

| Name of each Exchange on which registered |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | Accelerated filer ☐ |

Smaller reporting company | |

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ◻

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

Indicate the number of shares outstanding of each of the issuer’s classes of common stock as of the latest practicable date.

Title of Class |

| Number of Shares Outstanding on May 3, 2024 |

Common Stock, $0.001 par value |

|

1 In November 2019, we became a fully remote company. Accordingly, we do not currently have principal executive offices.

TABLE OF CONTENTS

2

PART 1 — FINANCIAL INFORMATION

Item 1. Condensed Consolidated Financial Statements

Research Solutions, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

|

| March 31, |

| ||||

|

| 2024 |

| June 30, | |||

| (unaudited) | 2023 | |||||

Assets |

|

| |||||

Current assets: |

|

|

|

| |||

Cash and cash equivalents | $ | | $ | | |||

Accounts receivable, net of allowance of $ |

| |

| | |||

Prepaid expenses and other current assets |

| |

| | |||

Prepaid royalties |

| |

| | |||

Total current assets |

| |

| | |||

Non-current assets: |

|

|

|

| |||

Property and equipment, net of accumulated depreciation of $ |

| |

| | |||

Intangible assets, net of accumulated amortization of $ | | | |||||

Goodwill (provisional) | | | |||||

Deposits and other assets |

| |

| | |||

Total assets | $ | | $ | | |||

|

|

|

| ||||

Liabilities and Stockholders’ Equity |

|

|

|

| |||

Current liabilities: |

|

| |||||

Accounts payable and accrued expenses | $ | | $ | | |||

Deferred revenue |

| |

| | |||

Total current liabilities |

| |

| | |||

Non-current liabilities: |

|

|

|

| |||

Contingent earnout liability |

| |

| | |||

Total liabilities |

| |

| | |||

|

|

|

| ||||

Commitments and contingencies |

|

|

|

| |||

|

|

|

| ||||

Stockholders’ equity: |

|

|

|

| |||

Preferred stock; $ |

| |

| | |||

Common stock; $ |

| |

| | |||

Additional paid-in capital |

| |

| | |||

Accumulated deficit |

| ( |

| ( | |||

Accumulated other comprehensive loss |

| ( |

| ( | |||

Total stockholders’ equity |

| |

| | |||

Total liabilities and stockholders’ equity | $ | | $ | | |||

See notes to condensed consolidated financial statements

3

Research Solutions, Inc. and Subsidiaries

Condensed Consolidated Statements of Operations and Other Comprehensive Income (Loss)

(Unaudited)

Three Months Ended | Nine Months Ended | ||||||||||||

March 31, | March 31, | ||||||||||||

|

| 2024 |

| 2023 |

| 2024 |

| 2023 | |||||

| |||||||||||||

Revenue: |

|

|

|

|

|

|

| ||||||

Platforms | $ | | $ | | $ | | $ | | |||||

Transactions |

| |

| |

| |

| | |||||

Total revenue |

| |

| |

| |

| | |||||

|

|

|

|

|

|

|

| ||||||

Cost of revenue: |

|

|

|

|

|

|

|

| |||||

Platforms |

| |

| |

| |

| | |||||

Transactions |

| |

| |

| |

| | |||||

Total cost of revenue |

| |

| |

| |

| | |||||

Gross profit |

| |

| |

| |

| | |||||

|

|

|

|

|

|

|

| ||||||

Operating expenses: |

|

|

|

|

|

|

|

| |||||

Selling, general and administrative |

| |

| |

| |

| | |||||

Depreciation and amortization |

| |

| |

| |

| | |||||

Total operating expenses |

| |

| |

| |

| | |||||

Income (loss) from operations |

| |

| |

| ( |

| ( | |||||

|

|

|

|

|

|

|

| ||||||

Other income |

| |

| |

| |

| | |||||

|

|

|

|

|

|

|

| ||||||

Income (loss) from operations before provision for income taxes |

| |

| |

| ( |

| | |||||

Provision for income taxes |

| ( |

| ( |

| ( |

| ( | |||||

|

|

|

|

|

|

|

| ||||||

Net income (loss) | |

| |

| ( |

| | ||||||

|

|

|

|

|

|

|

| ||||||

Other comprehensive income (loss): |

|

|

|

| |||||||||

Foreign currency translation |

| |

| ( |

| |

| ( | |||||

Comprehensive income (loss) | $ | | $ | | $ | ( | $ | | |||||

Basic income (loss) per common share: | |||||||||||||

Net income (loss) per share | $ | - | $ | | $ | ( | $ | | |||||

Weighted average common shares outstanding | | | | | |||||||||

|

|

|

|

|

|

|

| ||||||

Diluted income (loss) per common share: | |||||||||||||

Net income (loss) per share | $ | - | $ | | $ | ( | $ | | |||||

Weighted average common shares outstanding | | | | | |||||||||

See notes to condensed consolidated financial statements

4

Research Solutions, Inc. and Subsidiaries

Condensed Consolidated Statements of Changes in Stockholders’ Equity

For the Three and Nine Months Ended March 31, 2024

(Unaudited)

Additional | Other | Total | |||||||||||||||

Common Stock | Paid-in | Accumulated | Comprehensive | Stockholders’ | |||||||||||||

|

| Shares |

| Amount |

| Capital |

| Deficit |

| Loss |

| Equity | |||||

| |||||||||||||||||

Balance, December 31, 2023 |

| |

| $ | |

| $ | |

| $ | ( |

| $ | ( |

| $ | |

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Fair value of vested stock options |

| — |

| — |

| |

| — |

| — |

| | |||||

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Fair value of vested restricted common stock |

| — |

| — |

| |

| — |

| — |

| | |||||

Forfeited restricted common stock | ( | ( | | — | — | — | |||||||||||

Repurchase of common stock | ( |

| ( |

| ( |

| — |

| — |

| ( | ||||||

Common stock issued upon exercise of stock options | |

| | ( |

| — |

| — |

| — | |||||||

Net income for the period |

| — |

| — |

| — |

| |

| — |

| | |||||

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Foreign currency translation |

| — |

| — |

| — |

| — |

| |

| | |||||

Balance, March 31, 2024 |

| |

| $ | |

| $ | |

| $ | ( |

| $ | ( |

| $ | |

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Balance, July 1, 2023 |

| | $ | | $ | | $ | ( | $ | ( | $ | | |||||

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Fair value of vested stock options |

| — |

| — |

| |

| — |

| — |

| | |||||

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Fair value of vested restricted common stock |

| |

| |

| |

| — |

| — |

| | |||||

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Forfeited restricted common stock | ( | ( | | — | — | — | |||||||||||

Repurchase of common stock |

| ( |

| ( |

| ( |

| — |

| — |

| ( | |||||

Common stock issued upon exercise of stock options |

| |

| | ( |

| — |

| — |

| — | ||||||

Common stock issued for acquisition of Scite | | | | — | — | | |||||||||||

Modification cost of accelerated vesting of restricted common stock | — | — | | — | — | | |||||||||||

|

|

|

|

|

|

| |||||||||||

Net loss for the period |

| — |

| — | — |

| ( |

| — |

| ( | ||||||

|

|

|

|

|

|

| |||||||||||

Foreign currency translation |

| — |

| — |

| — |

| — |

| |

| | |||||

Balance, March 31, 2024 |

| | $ | | $ | | $ | ( | $ | ( | $ | | |||||

See notes to condensed consolidated financial statements

5

Research Solutions, Inc. and Subsidiaries

Condensed Consolidated Statements of Changes in Stockholders’ Equity

For the Three and Nine Months Ended March 31, 2023

(Unaudited)

Additional | Other | Total | |||||||||||||||

Common Stock | Paid-in | Accumulated | Comprehensive | Stockholders’ | |||||||||||||

|

| Shares |

| Amount |

| Capital |

| Deficit |

| Loss |

| Equity | |||||

| |||||||||||||||||

Balance, December 31, 2022 |

| | $ | | $ | | $ | ( | $ | ( | $ | | |||||

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Fair value of vested stock options |

| — |

| — |

| |

| — |

| — |

| | |||||

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Fair value of vested restricted common stock |

| |

| |

| |

| — |

| — |

| | |||||

|

|

|

|

|

| ||||||||||||

Forfeited restricted common stock | ( | ( | | — | — | — | |||||||||||

|

|

|

|

|

| ||||||||||||

Repurchase of common stock | ( |

| ( |

| ( |

| — |

| — |

| ( | ||||||

| |||||||||||||||||

Common stock issued upon exercise of stock options | |

| | |

| — |

| — |

| | |||||||

|

|

|

| ||||||||||||||

Net income for the period |

| — |

| — |

| — |

| |

| — |

| | |||||

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Foreign currency translation |

| — |

| — |

| — |

| — |

| ( |

| ( | |||||

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Balance, March 31, 2023 |

| |

| $ | |

| $ | |

| $ | ( |

| $ | ( |

| $ | |

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Balance, July 1, 2022 |

| | $ | |

| $ | |

| $ | ( |

| $ | ( |

| $ | | |

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Fair value of vested stock options |

| — |

| — |

| |

| — |

| — |

| | |||||

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Fair value of vested restricted common stock |

| |

| |

| |

| — |

| — |

| | |||||

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Forfeited restricted common stock | ( | ( | | — | — | — | |||||||||||

Fair value of vested unrestricted common stock |

| |

| |

| |

| — |

| — |

| | |||||

|

|

|

|

|

|

|

|

|

| ||||||||

Repurchase of common stock |

| ( |

| ( |

| ( |

| — |

| — |

| ( | |||||

|

| ||||||||||||||||

Common stock issued upon exercise of stock options | |

| | |

| — | — | | |||||||||

|

|

|

|

| |||||||||||||

Net income for the period |

| — |

| — |

| — |

| |

| — |

| | |||||

|

|

|

|

|

|

| |||||||||||

Foreign currency translation |

| — |

| — |

| — |

| — |

| ( |

| ( | |||||

Balance, March 31, 2023 |

| | $ | | $ | | $ | ( | $ | ( | $ | | |||||

See notes to condensed consolidated financial statements

6

Research Solutions, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(Unaudited)

Nine Months Ended | |||||||

March 31, | |||||||

|

| 2024 |

| 2023 | |||

| |||||||

Cash flow from operating activities: |

|

|

|

| |||

Net income (loss) | $ | ( | $ | | |||

Adjustment to reconcile net income (loss) to net cash provided by operating activities: |

|

|

|

| |||

Depreciation and amortization |

| |

| | |||

Fair value of vested stock options |

| |

| | |||

Fair value of vested restricted common stock |

| |

| | |||

Fair value of vested unrestricted common stock | | | |||||

Modification cost of accelerated vesting of restricted common stock | | | |||||

Adjustment to contingent earnout liability | ( | | |||||

Changes in operating assets and liabilities: |

|

|

|

| |||

Accounts receivable |

| ( |

| ( | |||

Prepaid expenses and other current assets |

| ( |

| ( | |||

Prepaid royalties |

| |

| | |||

Accounts payable and accrued expenses |

| |

| | |||

Deferred revenue |

| |

| | |||

Net cash provided by operating activities |

| |

| | |||

|

|

|

| ||||

Cash flow from investing activities: |

|

|

|

| |||

Purchase of property and equipment |

| ( |

| ( | |||

Payment for acquisition of Resolute, net of cash acquired | ( | | |||||

Payment for acquisition of Scite, net of cash acquired | ( | | |||||

Payment for non-refundable deposit for asset acquisition | | ( | |||||

Net cash used in investing activities |

| ( |

| ( | |||

|

|

|

| ||||

Cash flow from financing activities: |

| ||||||

Proceeds from the exercise of stock options | | | |||||

Common stock repurchase | ( | ( | |||||

Payment of contingent acquisition consideration | ( | | |||||

Net cash used in financing activities |

| ( |

| ( | |||

|

|

|

| ||||

Effect of exchange rate changes |

| |

| | |||

Net increase (decrease) in cash and cash equivalents |

| ( |

| | |||

Cash and cash equivalents, beginning of period |

| |

| | |||

Cash and cash equivalents, end of period | $ | | $ | | |||

|

|

|

| ||||

Supplemental disclosures of cash flow information: |

|

|

|

| |||

Cash paid for income taxes | $ | | $ | | |||

|

|

|

| ||||

Non-cash investing and financing activities: |

|

|

|

| |||

Contingent consideration accrual on asset acquisition | $ | | $ | | |||

See notes to condensed consolidated financial statements

7

RESEARCH SOLUTIONS, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Nine Months Ended March 31, 2024 and 2023 (Unaudited)

Note 1. Organization, Nature of Business and Basis of Presentation

Organization

Research Solutions, Inc. (the “Company,” “Research Solutions,” “we,” “us” or “our”) was incorporated in the State of Nevada on November 2, 2006, and is a publicly traded holding company with

Nature of Business

We provide software and related services to help research intensive organizations save time and money. We offer various software platforms (“Platform” or “Platforms”) that are typically sold to corporate, academic, government and individual researchers as cloud-based software-as-a-service (“SaaS”) via auto-renewing license agreements. Corporate, academic, and government customers typically sign up under annual agreements. Individual researchers can sign up under an annual or a month-to-month agreement and are typically billed monthly. Our Platforms also facilitate the sale of published scientific, technical, and medical (“STM”) content sold as individual articles (“Transactions”) either stand alone or via one or more of the research Platform solutions we provide. When one or more of the Platform solutions are used to purchase Transactions, customers pay for those transactions through monthly billing or via credit card for individual researchers. Our Platforms enable life science and other research-intensive organizations to accelerate their research and development activities through our advanced discovery tools (i.e. search), tools to access and buy STM articles required to support their research (i.e. acquire), as well as tools that manage that content across the enterprise and on an individual basis (i.e. manage). The Platforms typically deliver an ROI to the customer by reducing the amount of time it takes a research organization to find, acquire and manage content, in addition to also driving down the ultimate cost per article over time.

Platforms

Our cloud-based SaaS Platforms consist of proprietary software and Internet-based interfaces sold to customers through an annual or monthly subscription fee. Legacy functionality falls into three areas.

Discover – These solutions facilitate search (discovery) across virtually all STM articles available. The solutions we offer include free (basic) search solutions and advanced search tools like the Resolute.ai and scite.ai products. These tools allow for searching and identifying relevant research and then purchasing that research through one of our other solutions. In addition, these tools increasingly enable users to find insights in other datasets adjacent to STM content, such as Clinical Trial, Patent, Life Science & MedTech Regulatory information, Competitor and Technology landscape insights in addition to searching the customer’s internal datasets. The advanced search solutions are sold through a seat, enterprise, or individual license.

Acquire – Our Article Galaxy (AG) solution allows for research organizations to load their entitlements (subscriptions, discount or token packages, and their existing library of articles) and AG manages those entitlements in the background enabling the researchers to focus on acquiring articles they need quickly and efficiently at the lowest possible cost. When used in conjunction with our discovery Platforms, customers can initiate orders, route orders based on the lowest cost to acquire, obtain spend and usage reporting, automate authentication, and connect seamlessly to in-house and third-party software systems.

Manage – Our References solution allows users to access the article inside the Platform including setting up personal folders or team folders and allows researchers to markup and take notes on the articles in a supported browser on a desktop or tablet.

8

We use Artificial Intelligence (“AI”) in several parts of the research workflow today and will continually add capability as we move forward. Today we offer an AI based recommendation engine in our Discover, Acquire, and Manage Platform solutions. We also offer an AI based “assistant” in some of our solutions to allow the researcher to ask questions about articles, groups of articles (folders), and more. We also have the capability to provide full text search on STM content in the scite.ai Platform where the publisher gives us the rights to do so.

Using Resolute.ai and scite.ai technology, we plan to release several new Platform solutions to enhance the research workflows described above and add new solutions to support the analysis functions that exist in our typical customer base.

Our Platforms are deployed as a single, multi-tenant system across our entire customer base. Customers securely access the Platform through online web interfaces and via web service APIs that enable customers to leverage Platform features and functionality from within in-house and third-party software systems. The Platform can also be configured to satisfy a customer’s individual preferences. We leverage our Platform efficiencies in scalability, stability and development costs to fuel rapid innovation and to gain a competitive advantage.

Transactions

We provide our researchers with a single source to the universe of published STM content that includes over

Core to many of our Platform solutions is providing our customers with ways to find and download digital versions of STM articles that are critical to their research. Customers submit orders for the articles they need which we source and electronically deliver to them generally in under an hour; in most cases under one minute. This service is generally known in the industry as single article delivery or document delivery. We also obtain the necessary permission licenses from the content publisher or other rights holder so that our customer’s use complies with applicable copyright laws. We have arrangements with hundreds of content publishers that allow us to distribute their content. The majority of these publishers provide us with electronic access to their content, which allows us to electronically deliver single articles to our customers often in a matter of minutes. While a vast majority of the articles are available in electronic form, the Company also has workflows to deliver older paper-based articles through relationships we have built with libraries around the world.

Principles of Consolidation

The accompanying financial statements are consolidated and include the accounts of the Company and its wholly-owned subsidiaries. Intercompany balances and transactions have been eliminated in consolidation.

Basis of Presentation

The accompanying condensed consolidated financial statements are unaudited. These unaudited interim condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) and applicable rules and regulations of the Securities and Exchange Commission (“SEC”) regarding interim financial reporting. Certain information and note disclosures normally included in the financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to such rules and regulations. Accordingly, these interim condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and notes thereto contained in the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2023 filed with the SEC. The condensed consolidated balance sheet as of June 30, 2023 included herein was derived from the audited consolidated financial statements as of that date, but does not include all disclosures, including notes, required by GAAP.

9

In the opinion of management, the accompanying unaudited condensed consolidated financial statements contain all adjustments necessary to fairly present the Company’s financial position and results of operations for the interim periods reflected. Except as noted, all adjustments contained herein are of a normal recurring nature. Results of operations for the fiscal periods presented herein are not necessarily indicative of fiscal year-end results.

Note 2. Summary of Significant Accounting Policies

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting periods. Actual results could differ from these estimates.

These estimates and assumptions include estimates for reserves of uncollectible accounts, accruals for potential liabilities, assumptions made in valuing equity instruments issued for services or acquisitions, impairment related to intangible assets, useful lives of finite-lived intangible assets, realization of deferred tax assets and fair values of assets acquired and liabilities assumed in acquisitions including the resulting intangible assets.

Concentration of Credit Risk

Financial instruments, which potentially subject the Company to concentrations of credit risk, consist of cash and cash equivalents and accounts receivable. The Company places its cash with high quality financial institutions and at times may exceed the FDIC $

Cash denominated in Euros and British Pounds with an aggregate US Dollar equivalent of $

The Company has no customers that represent 10% of revenue or more for the three and nine months ended March 31, 2024 and 2023.

The Company has no customers that accounted for greater than 10% of accounts receivable at March 31, 2024 and June 30, 2023.

The following table summarizes vendor concentrations:

Three Months Ended |

| Nine Months Ended |

| ||||||||||

March 31, |

| March 31, |

| ||||||||||

| 2024 |

|

| 2023 | 2024 |

|

| 2023 | |||||

Vendor A | | % | | % | | % | | % | |||||

Vendor B | | % | | % | | % | | % | |||||

Revenue Recognition

The Company accounts for revenue in accordance with Financial Accounting Standard Board’s (“FASB”) Accounting Standards Codification (“ASC”) Topic 606, Revenue from Contracts with Customers (Topic 606), (“ASC 606”). The underlying principle of ASC 606 is to recognize revenue to depict the transfer of goods or services to customers at the amount expected to be collected.

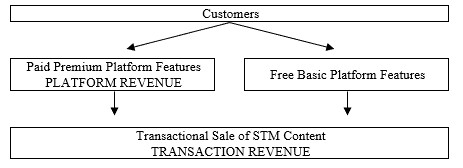

Revenues are recognized when control of the promised goods or services are transferred to a customer, in an amount that reflects the consideration that the Company expects to receive in exchange for those goods or services. The Company derives its revenues from

10

features of our cloud-based SaaS research intelligence platforms (Platforms) and the transactional sale of STM content managed, sourced and delivered through the Platform (Transactions).

The Company applies the following five steps in order to determine the appropriate amount of revenue to be recognized as it fulfills its obligations under each of its agreements:

| ● | identify the contract with a customer; |

| ● | identify the performance obligations in the contract; |

| ● | determine the transaction price; |

| ● | allocate the transaction price to performance obligations in the contract; and |

| ● | recognize revenue as the performance obligation is satisfied. |

Platforms

We charge a subscription fee that allows customers to access and utilize certain premium features of our Platforms. Revenue is recognized ratably over the term of the subscription agreement, which is typically one year, provided all other revenue recognition criteria have been met. Billings or payments received in advance of revenue recognition are recorded as deferred revenue.

Transactions

We charge a transactional service fee for the electronic delivery of single articles, and a corresponding copyright fee for the permitted use of the content. We recognize revenue from single article delivery services upon delivery to the customer provided all other revenue recognition criteria have been met. All articles are in PDF format and delivered to customers via various electronic methods. Each of these delivery methods is trackable, with ability to monitor such things as the date and time when the link was e-mailed and the time and IP address used to download the article.

Revenue by Geographical Region

The following table summarizes revenue by geographical region:

Three Months Ended |

| |||||||||||

March 31, |

| |||||||||||

2024 |

| 2023 | ||||||||||

United States | $ | |

| | % | $ | | | % | |||

Europe |

| |

| | % |

| |

| | % | ||

Rest of World |

| |

| | % |

| |

| | % | ||

Total | $ | |

| | % | $ | |

| | % | ||

11

Nine Months Ended | ||||||||||||

March 31, | ||||||||||||

2024 |

| 2023 | ||||||||||

United States | $ | |

| | % | $ | | | % | |||

Europe |

| |

| | % |

| |

| | % | ||

Rest of World |

| |

| | % |

| |

| | % | ||

Total | $ | |

| | % | $ | |

| | % | ||

Accounts Receivable by Geographical Region

The following table summarizes accounts receivable by geographical region:

As of March 31, 2024 |

| As of June 30, 2023 | ||||||||||

United States |

| $ | |

| | % | $ | | | % | ||

Europe |

| |

| | % |

| |

| | % | ||

Rest of World |

| |

| | % |

| |

| | % | ||

Total | $ | |

| | % | $ | |

| | % | ||

Business Combinations

The Company accounts for its business combinations using the acquisition method of accounting where the purchase consideration is allocated to the tangible and intangible assets acquired, and liabilities assumed, based on their respective fair values as of the acquisition date. The excess of the fair value of the purchase consideration over the estimated fair values of the net assets acquired is recorded as goodwill. When determining the fair values of assets acquired and liabilities assumed, management makes significant estimates and assumptions, especially with respect to intangible assets. Critical estimates in valuing intangible assets include, but are not limited to, expected future cash flows, which includes consideration of future growth and margins, future changes in technology, brand awareness and discount rates. Fair value estimates are based on the assumptions that management believes a market participant would use in pricing the asset or liability.

Intangible Assets

Amortizable finite-lived identifiable intangible assets consist of a developed technology and customer relationships acquired in the acquisition of ResoluteAI effective July 28, 2023 and Scite effective December 1, 2023 (See Note 5), and are stated at cost less accumulated amortization. The developed technology and customer relationships are being amortized over the estimated average useful lives of

Goodwill

Goodwill consists of the excess of the cost of ResoluteAI and Scite (see Note 5) over the fair value of amounts assigned to assets acquired and liabilities assumed. Under the guidance of ASC 350, goodwill is not amortized, rather it is tested for impairment annually, and will be tested for impairment between annual tests if an event occurs or circumstances change that would indicate the carrying amount may be impaired. An impairment loss generally would be recognized when the carrying amount of the reporting unit’s net assets exceeds the estimated fair value of the reporting unit and would be measured as the excess carrying value of goodwill over the derived fair value of goodwill. The Company’s policy is to perform an annual impairment testing for its reporting units on June 30 of each fiscal year.

12

Deferred Revenue

Contract liabilities, such as deferred revenue, exist where the Company has the obligation to transfer services to a customer for which the entity has received consideration, or when the consideration is due, from the customer.

Cash payments received or due in advance of performance are recorded as deferred revenue. Deferred revenue is primarily comprised of cloud-based software subscriptions which are generally billed in advance. The deferred revenue balance is presented as a current liability on the Company's consolidated balance sheets.

Cost of Revenue

Platforms

Cost of Platform revenue consists primarily of personnel costs of our operations team, and to a lesser extent managed hosting providers and other third-party service and data providers.

Transactions

Cost of Transaction revenue consists primarily of the respective copyright fee for the permitted use of the content, less a discount in most cases, and to a much lesser extent, personnel costs of our operations team and third-party service providers.

Stock-Based Compensation

The Company periodically issues stock options and restricted stock awards to employees and non-employees for services. The Company accounts for such grants issued and vesting based on ASC 718, whereby the value of the award is measured on the date of grant and recognized as compensation expense on the straight-line basis over the vesting period. The Company recognizes the fair value of stock-based compensation within its Statements of Operations with classification depending on the nature of the services rendered.

Under ASC 718, Repurchase or Cancellation of equity awards, the amount of cash or other assets transferred (or liabilities incurred) to repurchase an equity award shall be charged to equity, to the extent that the amount paid does not exceed the fair value of the equity instruments repurchased at the repurchase date. Any excess of the repurchase price over the fair value of the instruments repurchased shall be recognized as additional compensation cost.

Foreign Currency

The accompanying condensed consolidated financial statements are presented in United States dollars, the functional currency of the Company. Capital accounts of foreign subsidiaries are translated into US Dollars from foreign currency at their historical exchange rates when the capital transactions occurred. Assets and liabilities are translated at the exchange rate as of the balance sheet date. Income and expenditures are translated at the average exchange rate of the period. Although the majority of our revenue and costs are in US dollars, the costs of Reprints Desk Latin America and ResSoL LA are in Mexican Pesos. As a result, currency exchange fluctuations may impact our revenue and the costs of our operations. We currently do not engage in any currency hedging activities.

Gains and losses from foreign currency transactions, which result from a change in exchange rates between the functional currency and the currency in which a foreign currency transaction is denominated, are included in selling, general and administrative expenses and amounted to losses of $

13

The following table summarizes the exchange rates used:

Nine Months Ended |

| Year Ended | ||||||

March 31, |

| June 30, | ||||||

|

| 2024 |

| 2023 |

| 2023 |

| 2022 |

Period end Euro : US Dollar exchange rate | | | | | ||||

Average period Euro : US Dollar exchange rate |

| |

| | |

| | |

Period end GBP : US Dollar exchange rate | | | | | ||||

Average period GBP : US Dollar exchange rate |

| |

| | |

| | |

|

|

|

|

|

|

| ||

Period end Mexican Peso : US Dollar exchange rate |

| |

| | |

| | |

Average period Mexican Peso : US Dollar exchange rate |

| |

| | |

| | |

Net Income (Loss) Per Share

Basic net income (loss) per share is computed by dividing net income (loss) by the weighted average number of common shares outstanding for the period, excluding shares of unvested restricted common stock. Shares of restricted stock are included in the basic weighted average number of common shares outstanding from the time they vest. Diluted earnings per share is computed by dividing the net income applicable to common stockholders by the weighted average number of common shares outstanding plus the number of additional common shares that would have been outstanding if all dilutive potential common shares had been issued, using the treasury stock method. Shares of restricted stock are included in the diluted weighted average number of common shares outstanding from the date they are granted. Potential common shares are excluded from the computation when their effect is antidilutive. At March 31, 2024 potentially dilutive securities include options to acquire

Basic and diluted net loss per common share is the same for the nine months ended March 31, 2024 because all stock options, warrants, and unvested restricted common stock are anti-dilutive. For the three months ended March 31, 2024 and for the three and nine months ended March 31, 2023, the calculation of diluted earnings per share include unvested restricted common stock, stock options and warrants, calculated under the treasury stock method.

Fair Value of Financial Instruments

Accounting standards require certain assets and liabilities to be reported at fair value in the financial statements and provide a framework for establishing that fair value. Fair value is defined as the price at which an asset could be exchanged or a liability transferred in a transaction between knowledgeable, willing parties in the principal or most advantageous market for the asset or liability. Where available, fair value is based on observable market prices or parameters or derived from such prices or parameters. Where observable prices or parameters are not available, valuation models are applied. A fair value hierarchy prioritizes the inputs used in measuring fair value into three broad levels as follows:

Level 1 – Quoted prices in active markets for identical assets or liabilities.

Level 2 – Inputs, other than the quoted prices in active markets, are observable either directly or indirectly.

Level 3 – Unobservable inputs based on the Company’s assumptions.

The Company is required to use observable market data if such data is available without undue cost and effort.

The carrying amounts of financial assets and liabilities, such as cash and cash equivalents, accounts receivable and accounts payable, approximate their fair values because of the short maturity of these instruments.

14

Recently Issued Accounting Pronouncements

In June 2016, the FASB issued ASU 2016-13, Measurement of Credit Losses on Financial Instruments. ASU 2016-13 requires entities to use a forward-looking approach based on current expected credit losses (“CECL”) to estimate credit losses on certain types of financial instruments, including trade receivables. This may result in the earlier recognition of allowances for losses. ASU 2016-13 is effective for the Company beginning July 1, 2023, and early adoption is permitted. The Company adopted this standard effective July 1, 2023, and there was no material impact of adopting this standard on the Company’s financial statements and related disclosures.

In November 2023, the FASB amended ASC No. 2023-07, “Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures,” that includes requirements for interim segment disclosures and for entities operating under a single segment. The amendment is effective on a retrospective basis for fiscal years beginning after December 15, 2023 and interim periods beginning after January 1, 2025 with early adoption permitted. The Company is currently assessing the impact of the adoption of ASU 2023-07 on its interim and annual disclosures.

In December 2023, the FASB amended ASC 740, Income Taxes (issued under Accounting Standards Update (ASU) 2023-09, “Improvements to Income Tax Disclosures”). This ASU requires additional disclosures related to the rate reconciliation, income taxes paid and other amendments intended to enhance effectiveness and comparability. The amendment is effective for the Company beginning with its fiscal year 2025 annual disclosures. The Company is currently evaluating the impact of the adoption of ASU 2023-09 on its annual disclosures.

Other recent accounting pronouncements issued by the FASB, including its Emerging Issues Task Force, the American Institute of Certified Public Accountants, and the Securities and Exchange Commission did not or are not believed by management to have a material impact on the Company’s present or future consolidated financial statements.

Note 3. Line of Credit

The Company entered into a Loan and Security Agreement with Silicon Valley Bank (“SVB”) on July 23, 2010, which, as amended, provides for a revolving line of credit for the lesser of $

Note 4. Stockholders’ Equity

Stock Options

In December 2007, we established the 2007 Equity Compensation Plan (the “2007 Plan”) and in November 2017 we established the 2017 Omnibus Incentive Plan (the “2017 Plan”), collectively (the “Plans”). The Plans were approved by our board of directors and stockholders. The purpose of the Plans is to grant stock and options to purchase our common stock, and other incentive awards, to our employees, directors and key consultants. On November 10, 2016, the maximum number of shares of common stock that may be issued pursuant to awards granted under the 2007 Plan increased from

15

the 2007 Plan. All incentive stock award grants prior to the adoption of the 2017 Plan on November 21, 2017 were made under the 2007 Plan, and all incentive stock award grants after the adoption of the 2017 Plan on November 21, 2017 were made under the 2017 Plan.

The majority of awards issued under the Plan vest immediately or over , with a cliff vesting period and have a term of . Stock-based compensation cost is measured at the grant date, based on the fair value of the awards that are ultimately expected to vest, and recognized on a straight-line basis over the requisite service period, which is generally the vesting period.

The following table summarizes vested and unvested stock option activity:

All Options | Vested Options | Unvested Options | |||||||||||||

|

|

| Weighted |

|

| Weighted |

|

| Weighted | ||||||

Average | Average | Average | |||||||||||||

Exercise | Exercise | Exercise | |||||||||||||

Shares | Price | Shares | Price | Shares | Price | ||||||||||

Outstanding at June 30, 2023 |

| |

| $ | |

| |

| $ | |

| |

| $ | |

Granted |

| |

| |

| — |

| — |

| |

| | |||

Options vesting |

| — |

| — |

| |

| |

| ( |

| | |||

Exercised |

| ( |

| |

| ( |

| |

| — |

| — | |||

Forfeited |

| ( |

| |

| ( |

| |

| ( |

| | |||

Outstanding at March 31, 2024 |

| | $ | |

| | $ | |

| | $ | | |||

The weighted average remaining contractual life of all options outstanding as of March 31, 2024 was

During the nine months ended March 31, 2024, the Company granted

16

The following table presents the information regarding stock options outstanding and exercisable as of March 31, 2024:

Option |

|

| Remaining |

| |||

Exercise | Options | Contractual | Options | ||||

Price | Outstanding | Life (in years) | Exercisable | ||||

$ | |

| |

|

| | |

|

| |

|

| | ||

|

| |

|

| | ||

|

| |

|

| | ||

|

| |

|

| | ||

|

| |

|

| | ||

|

| |

|

| | ||

|

| |

|

| | ||

|

| |

|

| | ||

|

| |

|

| | ||

| | | |||||

| | | |||||

| | | |||||

| | | |||||

| | | |||||

|

| |

|

| | ||

| | | |||||

| | | |||||

| | | |||||

| | | |||||

| | | |||||

| | | |||||

| | — | |||||

| | | |||||

| | | |||||

| | | |||||

Total |

Restricted Common Stock

Prior to July 1, 2023, the Company issued

17

During the nine months ended March 31, 2024, the Company issued an additional

•

•

•

•

•

Upon a change of control, vesting will accelerate with respect to that portion of the award that would vest if the target 30-day VWAP was achieved at the level above the per share price in such change of control transaction. For example, if we granted an award of

As the vesting of the

The following table summarizes restricted common stock activity:

|

|

|

| Weighted | ||||

Average | ||||||||

Number of | Grant Date | |||||||

Shares | Fair Value | Fair Value | ||||||

Non-vested, June 30, 2023 |

| | $ | | $ | | ||

Granted |

| |

| |

| | ||

Vested |

| ( |

| ( |

| | ||

Forfeited |

| ( |

| ( |

| | ||

Non-vested, March 31, 2024 |

| | $ | | $ | | ||

18

Common Stock Repurchases

Effective as of March 19, 2024, the Compensation Committee of our Board of Directors authorized the repurchase, on the last day of each trading window during which the outstanding awards remain outstanding and otherwise in accordance with our insider trading policies, of an aggregate value not exceeding $

During the nine months ended March 31, 2024, the Company repurchased

Shares repurchased are retired and deducted from common stock for par value and from additional paid in capital for the excess over par value. Direct costs incurred to acquire the shares are included in the total cost of the shares.

Note 5. Acquisitions

FIZ

On September 28, 2022, Reprints Desk entered into an asset purchase agreement with FIZ Karlsruhe – Leibniz-Institut für Informationsinfrastruktur GmbH (“FIZ”). FIZ delivers STM content pursuant to various contracts with its customers through its AutoDoc platform. FIZ agreed to assign and transfer to Reprints Desk certain of these contracts effective January 1, 2023 (the “Sold Contracts”).

On September 30, 2022, Reprints Desk made a non-refundable payment of $

The current contingent consideration for the Base Amount Plus and the Bonus Amount is recorded as a short-term liability on the balance sheet. At March 31, 2024, the Base Amount, the Base Amount Plus and the Bonus Amount were recorded as intangible assets on the balance sheet with an estimated average useful life of

ResoluteAI

On July 28, 2023, the Company acquired

The Company utilized the acquisition method of accounting for the acquisition in accordance with ASC 805, Business Combinations. The Company allocated the purchase price to ResoluteAI’s tangible assets, identifiable intangible assets, and assumed liabilities at their estimated fair values as of the date of acquisition. The excess of the purchase price paid by the Company over the estimated fair value of identified tangible and intangible assets has been recorded as provisional goodwill.

19

The total purchase consideration for ResoluteAI, net of cash acquired, was approximately $

The Company’s allocation of the purchase price at March 31, 2024 included $

The preliminary allocation of purchase price to the assets acquired and liabilities assumed was based upon the estimated fair values at the date of acquisition. As of March 31, 2024, the Company has not completed its analysis for estimating the fair value of the assets acquired and liabilities assumed.

Scite

On December 1, 2023, the Company acquired

The total purchase consideration for Scite, net of cash acquired, was approximately $

The Company’s allocation of the purchase price at March 31, 2024 included $

The preliminary allocation of purchase price to the assets acquired and liabilities assumed was based upon the estimated fair values at the date of acquisition. As of March 31, 2024, the Company has not completed its analysis for estimating the fair value of the assets acquired and liabilities assumed.

20

The following sets out the unaudited pro forma operating results for the three and nine months ended March 31, 2024 and 2023 for the Company had the acquisition occurred as of July 1, 2022. These amounts include amortization of intangible assets:

Pro Forma (Unaudited) | Pro Forma (Unaudited) | |||||||||||

Three Months ended March 31, | Nine Months ended March 31, | |||||||||||

|

| 2024 |

| 2023 |

| 2024 |

| 2023 | ||||

| ||||||||||||

Revenue | $ | | $ | | $ | | $ | | ||||

Cost of revenue |

| |

| |

| |

| | ||||

Gross profit |

| |

| |

| |

| | ||||

|

|

|

|

|

|

|

| |||||

Total operating expenses |

| |

| |

| |

| | ||||

Income (loss) from operations |

| |

| ( |

| ( |

| ( | ||||

|

|

|

|

|

|

|

| |||||

Other income |

| |

| |

| |

| | ||||

|

|

|

|

|

|

|

| |||||

Income (loss) from operations before provision for income taxes |

| |

| |

| ( |

| ( | ||||

Provision for income taxes |

| ( |

| ( |

| ( |

| ( | ||||

|

|

|

|

|

|

|

| |||||

Pro Forma Net income (loss) | $ | | $ | | $ | ( | $ | ( | ||||

Pro Forma Net income (loss) per weighted average share, basic | $ | - | $ | - | $ | ( | $ | ( | ||||

Pro Forma Net income (loss) per weighted average share, diluted | $ | - | $ | - | $ | ( | $ | ( | ||||

Note 6. Contingencies

Inflation Risk

The Company does not believe that inflation has had a material effect on its operations to date, other than its impact on the general economy. However, there is a risk that the Company’s operating costs could become subject to inflationary and interest rate pressures in the future, which would have the effect of increasing the Company’s operating costs, and which would put additional stress on the Company’s working capital resources.

Note 7. Subsequent Events

On April 15, 2024, the Company entered into a Loan Agreement (the “PNC Loan Agreement”) with PNC Bank, National Association (“PNC”), as lender. Pursuant to the PNC Loan Agreement, the Company entered into a Revolving Line of Credit Note (the “PNC Note”) with PNC, which provides for a $

21

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Cautionary Notice Regarding Forward-Looking Statements

The following discussion and analysis of our financial condition and results of operations for the three and nine months ended March 31, 2024 and 2023 should be read in conjunction with our consolidated financial statements and related notes to those financial statements that are included elsewhere in this report. Our discussion includes forward-looking statements based upon current expectations that involve risks and uncertainties, such as our plans, objectives, expectations, and intentions. Actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a result of a number of factors, including those set forth under “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended June 30, 2023.

We use words such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “believe,” “intend,” “may,” “will,” “should,” “could,” and similar expressions to identify forward-looking statements. All forward-looking statements included in this report are based on information available to us on the date hereof and, except as required by law, we assume no obligation to update any such forward-looking statements.

Overview

Research Solutions was incorporated in the State of Nevada on November 2, 2006, and is a publicly traded holding company with five wholly owned subsidiaries as of March 31, 2024: Reprints Desk, Inc., a Delaware corporation, including its wholly owned subsidiary Resolute Innovation, Inc., a Delaware corporation, Scite, LLC., a Delaware Limited Liability Company, Reprints Desk Latin America S. de R.L. de C.V, an entity organized under the laws of Mexico, and RESSOL LA, S. DE R.L. DE C.V., an entity organized under the laws of Mexico.

We provide software and related services to help research intensive organizations save time and money. We offer various software platforms (“Platform” or “Platforms”) that are typically sold to corporate, academic, government and individual researchers as cloud-based software-as-a-service (“SaaS”) via auto-renewing license agreements. Corporate, academic, and government customers typically sign up under annual agreements. Individual researchers can sign up under an annual or a month-to-month agreement and are typically billed monthly. Our Platforms also facilitate the sale of published scientific, technical, and medical (“STM”) content sold as individual articles (“Transactions”) either stand alone or via one or more of the research Platform solutions we provide. When one or more of the Platform solutions are used to purchase Transactions, customers pay for those transactions through monthly billing or via credit card for individual researchers. Our Platforms enable life science and other research-intensive organizations to accelerate their research and development activities through our advanced discovery tools (i.e. search), tools to access and buy STM articles required to support their research (i.e. acquire), as well as tools that manage that content across the enterprise and on an individual basis (i.e. manage). The Platforms typically deliver an ROI to the customer by reducing the amount of time it takes a research organization to find, acquire and manage content, in addition to also driving down the ultimate cost per article over time.

Platforms

Our cloud-based SaaS Platforms consist of proprietary software and Internet-based interfaces sold to customers through an annual or monthly subscription fee. Legacy functionality falls into three areas.

Discover – These solutions facilitate search (discovery) across virtually all STM articles available. The solutions we offer include free (basic) search solutions and advanced search tools like the Resolute.ai and scite.ai products. These tools allow for searching and identifying relevant research and then purchasing that research through one of our other solutions. In addition, these tools increasingly enable users to find insights in other datasets adjacent to STM content, such as Clinical Trial, Patent, Life Science & MedTech Regulatory information, Competitor and Technology landscape insights in addition to searching the customer’s internal datasets. The advanced search solutions are sold through a seat, enterprise, or individual license.

22

Acquire – Our Article Galaxy (AG) solution allows for research organizations to load their entitlements (subscriptions, discount or token packages, and their existing library of articles) and AG manages those entitlements in the background enabling the researchers to focus on acquiring articles they need quickly and efficiently at the lowest possible cost. When used in conjunction with our discovery Platforms, customers can initiate orders, route orders based on the lowest cost to acquire, obtain spend and usage reporting, automate authentication, and connect seamlessly to in-house and third-party software systems.

Manage – Our References solution allows users to access the article inside the Platform including setting up personal folders or team folders and allows researchers to markup and take notes on the articles in a supported browser on a desktop or tablet.

We use Artificial Intelligence (“AI”) in several parts of the research workflow today and will continually add capability as we move forward. Today we offer an AI based recommendation engine in our Discover, Acquire, and Manage Platform solutions. We also offer an AI based “assistant” in some of our solutions to allow the researcher to ask questions about articles, groups of articles (folders), and more. We also have the capability to provide full text search on STM content in the scite.ai Platform where the publisher gives us the rights to do so.

Using Resolute.ai and scite.ai technology, we plan to release several new Platform solutions to enhance the research workflows described above and add new solutions to support the analysis functions that exist in our typical customer base.

Our Platforms are deployed as a single, multi-tenant system across our entire customer base. Customers securely access the Platform through online web interfaces and via web service APIs that enable customers to leverage Platform features and functionality from within in-house and third-party software systems. The Platform can also be configured to satisfy a customer’s individual preferences. We leverage our Platform efficiencies in scalability, stability and development costs to fuel rapid innovation and to gain a competitive advantage.

Transactions

We provide our researchers with a single source to the universe of published STM content that includes over 100 million existing STM articles and over 2 to 4 million newly published STM articles each year. STM content is sold to our customers on a per transaction basis. Researchers and knowledge workers in life science and other research-intensive organizations generally require single copies of published STM journal articles for use in their research activities. These individuals are our primary users and while they typically purchase the articles via one of our Platform solutions, we do have some customers that just order articles from us on behalf of end-users in their organizations.

Core to many of our Platform solutions is providing our customers with ways to find and download digital versions of STM articles that are critical to their research. Customers submit orders for the articles they need which we source and electronically deliver to them generally in under an hour; in most cases under one minute. This service is generally known in the industry as single article delivery or document delivery. We also obtain the necessary permission licenses from the content publisher or other rights holder so that our customer’s use complies with applicable copyright laws. We have arrangements with hundreds of content publishers that allow us to distribute their content. The majority of these publishers provide us with electronic access to their content, which allows us to electronically deliver single articles to our customers often in a matter of minutes. While a vast majority of the articles are available in electronic form, the Company also has workflows to deliver older paper-based articles through relationships we have built with libraries around the world.

Inflation Risk

We do not believe that inflation has had a material effect on its operations to date, other than its impact on the general economy. However, there is a risk that our operating costs could become subject to inflationary and interest rate pressures in the future, which would have the effect of increasing our operating costs, and which would put additional stress on our working capital resources.

23

Critical Accounting Policies and Estimates

The preparation of our consolidated financial statements in conformity with accounting principles generally accepted in the United States, or GAAP, requires us to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue and expenses, and related disclosure of contingent assets and liabilities. When making these estimates and assumptions, we consider our historical experience, our knowledge of economic and market factors and various other factors that we believe to be reasonable under the circumstances. Actual results may differ under different estimates and assumptions.

The accounting estimates and assumptions discussed in this section are those that we consider to be the most critical to an understanding of our financial statements because they inherently involve significant judgments and uncertainties.

Revenue Recognition

We account for revenue in accordance with ASU 2014-09, Revenue from Contracts with Customers (Topic 606), (“ASC 606”). The underlying principle of ASC 606 is to recognize revenue to depict the transfer of goods or services to customers at the amount expected to be collected.

Revenues are recognized when control of the promised goods or services are transferred to a customer, in an amount that reflects the consideration that we expect to receive in exchange for those goods or services. We derive our revenues from two sources: annual licenses that allow customers to access and utilize certain premium features of our cloud-based SaaS research intelligence platforms (Platforms) and the transactional sale of STM content managed, sourced and delivered through the Platform (Transactions).

We apply the following five steps in order to determine the appropriate amount of revenue to be recognized as we fulfill our obligations under each of our agreements:

| ● | identify the contract with a customer; |

| ● | identify the performance obligations in the contract; |

| ● | determine the transaction price; |

| ● | allocate the transaction price to performance obligations in the contract; and |

| ● | recognize revenue as the performance obligation is satisfied. |

Platforms

We charge a subscription fee that allows customers to access and utilize certain premium features of our Platforms. Revenue is recognized ratably over the term of the subscription agreement, which is typically one year, provided

24

all other revenue recognition criteria have been met. Billings or payments received in advance of revenue recognition are recorded as deferred revenue.

Transactions

We charge a transactional service fee for the electronic delivery of single articles, and a corresponding copyright fee for the permitted use of the content. We recognize revenue from single article delivery services upon delivery to the customer provided all other revenue recognition criteria have been met. All articles are in PDF format and delivered to customers via various electronic methods. Each of these delivery methods is trackable, with ability to monitor such things as the date and time when the link was e-mailed and the time and IP address used to download the article.

Stock-Based Compensation

The fair value of our stock options is estimated using the Black-Scholes-Merton Option Pricing model, which uses certain assumptions related to risk-free interest rates, expected volatility, expected life of the stock options or restricted stock, and future dividends. Compensation expense is recorded based upon the value derived from the Black-Scholes-Merton Option Pricing model and based on actual experience. The assumptions used in the Black-Scholes-Merton Option Pricing model could materially affect compensation expense recorded in future periods.

Recent Accounting Pronouncements

Please refer to footnote 2 to the condensed consolidated financial statements contained elsewhere in this Form 10-Q for a discussion of Recent Accounting Pronouncements.

Quarterly Information (Unaudited)

The following table sets forth unaudited and quarterly financial data for the most recent eight quarters:

| Mar. 31, | Dec. 31, |

| Sept. 30, | June 30, |

| Mar. 31, |

| Dec. 31, |

| Sept. 30, |

| June 30, | |||||||||||

2024 |

| 2023 |

| 2023 |

| 2023 |

| 2023 |

| 2022 |

| 2022 |

| 2022 | ||||||||||

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||

Platforms | $ | 3,953,403 | $ | 3,125,584 | $ | 2,600,192 | $ | 2,303,375 | $ | 2,249,632 | $ | 2,110,272 | $ | 2,019,967 | $ | 1,886,845 | ||||||||

Transactions |

| 8,162,269 |

| 7,188,158 |

| 7,460,779 |

| 7,656,342 |

| 8,092,794 |

| 6,606,394 |

| 6,664,676 |

| 6,675,164 | ||||||||

Total revenue |

| 12,115,672 |

| 10,313,742 |

| 10,060,971 |

| 9,959,717 |

| 10,342,426 |

| 8,716,666 |

| 8,684,643 |

| 8,562,009 | ||||||||

Cost of revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Platforms |

| 571,352 |

| 486,185 |

| 382,615 |

| 275,110 |

| 268,630 |

| 253,073 |

| 230,473 |

| 240,214 | ||||||||

Transactions |

| 6,062,388 |

| 5,343,755 |

| 5,646,791 |

| 5,764,064 |

| 6,046,523 |

| 5,059,766 |

| 5,104,922 |

| 5,038,653 | ||||||||

Total cost of revenue |

| 6,633,740 |

| 5,829,940 |

| 6,029,406 |

| 6,039,174 |

| 6,315,153 |

| 5,312,839 |

| 5,335,395 |

| 5,278,867 | ||||||||

Gross profit: |

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||

Platforms |

| 3,382,051 |

| 2,639,399 |

| 2,217,577 |

| 2,028,265 |

| 1,981,002 |

| 1,857,199 |

| 1,789,494 |

| 1,646,631 | ||||||||

Transactions |

| 2,099,881 |

| 1,844,403 |

| 1,813,988 |

| 1,892,278 |

| 2,046,271 |

| 1,546,628 |

| 1,559,754 |

| 1,636,511 | ||||||||

Total gross profit |

| 5,481,932 |

| 4,483,802 |

| 4,031,565 |

| 3,920,543 |

| 4,027,273 |

| 3,403,827 |

| 3,349,248 |

| 3,283,142 | ||||||||

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Sales and marketing |

| 1,122,365 |

| 804,927 |

| 685,016 |

| 455,030 |

| 642,624 |

| 666,608 |

| 521,216 |

| 691,368 | ||||||||

Technology and product dev. |

| 1,371,754 |

| 1,336,558 |

| 1,244,579 |

| 991,093 |

| 953,677 |

| 922,132 |

| 875,290 |

| 1,049,430 | ||||||||

General and administrative |

| 2,027,073 |

| 2,023,848 |

| 2,542,868 |

| 1,649,333 |

| 1,871,590 |

| 1,613,664 |

| 1,519,424 |

| 1,663,671 | ||||||||

Depreciation and amortization |

| 309,898 |

| 155,749 |

| 59,620 |

| 22,163 |

| 18,332 |

| 6,342 |

| 5,812 |

| 5,507 | ||||||||

Stock-based comp. expense |

| 541,002 |

| 596,455 |

| 591,814 |

| 585,384 |

| 480,458 |

| 608,703 |

| 175,361 |

| 225,501 | ||||||||

Foreign currency transaction loss (gain) |

| 22,177 |

| (13,738) |

| 6,620 |

| (37,743) |

| (72,547) |

| (84,179) |

| 72,516 |

| 91,279 | ||||||||

Total operating expenses |

| 5,394,269 |

| 4,903,799 |

| 5,130,517 |

| 3,665,260 |

| 3,894,134 |

| 3,733,270 |

| 3,169,619 |

| 3,726,756 | ||||||||

Other income (expenses and income taxes) |

| (11,362) |

| 366,369 |

| 110,909 |

| 120,463 |

| 103,703 |

| 73,913 |

| 34,936 |

| 5,347 | ||||||||

Net income (loss) |

| 76,301 |

| (53,628) |

| (988,043) |

| 375,746 |

| 236,842 |

| (255,530) |

| 214,565 |

| (438,267) | ||||||||

Basic income (loss) per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Net income (loss) per share | $ | - | $ | - | $ | (0.04) | $ | 0.01 | $ | 0.01 | $ | (0.01) | $ | 0.01 | $ | (0.02) | ||||||||

Basic weighted average common shares outstanding |

| 30,020,652 |

| 28,092,945 |

| 27,052,445 |

| 26,981,813 |

| 26,929,314 |

| 26,816,550 |

| 26,718,171 |

| 26,576,054 | ||||||||

Diluted income (loss) per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Net income (loss) per share | $ | - | $ | - | $ | (0.04) | $ | 0.01 | $ | 0.01 | $ | (0.01) | $ | 0.01 | $ | (0.02) | ||||||||

Diluted weighted average common shares outstanding |

| 33,511,242 |

| 28,092,945 |

| 27,052,445 |

| 30,058,791 |

| 29,791,719 |

| 26,815,550 |

| 27,779,841 |

| 26,576,054 | ||||||||

25

Comparison of the Three and Nine Months Ended March 31, 2024 and 2023

Results of Operations

Three Months Ended March 31, |

| ||||||||||||

| 2024 |

| 2023 |

| $ Change |

| % Change |

| |||||

Revenue: |

|

|

|

|

|

|

|

| |||||

Platforms | $ | 3,953,403 | $ | 2,249,632 | $ | 1,703,771 |

| 75.7 | % | ||||

Transactions |

| 8,162,269 |

| 8,092,794 |

| 69,475 |

| 0.9 | % | ||||

Total revenue |

| 12,115,672 |

| 10,342,426 |

| 1,773,246 |

| 17.1 | % | ||||

Cost of revenue: |

|

|

|

|

|

|

|

| |||||

Platforms |

| 571,352 |

| 268,630 |

| 302,722 |

| 112.7 | % | ||||

Transactions |

| 6,062,388 |

| 6,046,523 |

| 15,865 |

| 0.3 | % | ||||

Total cost of revenue |

| 6,633,740 |

| 6,315,153 |

| 318,587 |

| 5.0 | % | ||||

Gross profit: |

|

|

|

|

|

|

|

| |||||

Platforms |

| 3,382,051 |

| 1,981,002 |

| 1,401,049 |

| 70.7 | % | ||||

Transactions |

| 2,099,881 |

| 2,046,271 |

| 53,610 |

| 2.6 | % | ||||

Total gross profit |

| 5,481,932 |

| 4,027,273 |

| 1,454,659 |

| 36.1 | % | ||||

Operating expenses: |

|

|

|

|

|

|

|

| |||||

Sales and marketing |

| 1,122,365 |

| 642,624 |

| 479,741 |

| 74.7 | % | ||||

Technology and product development |

| 1,371,754 |

| 953,677 |

| 418,077 |

| 43.8 | % | ||||

General and administrative |

| 2,027,073 |

| 1,871,590 |

| 155,483 |

| 8.3 | % | ||||

Depreciation and amortization |

| 309,898 |

| 18,332 |

| 291,566 |

| 1,590.5 | % | ||||

Stock-based compensation expense |

| 541,002 |

| 480,458 |

| 60,544 |

| 12.6 | % | ||||

Foreign currency transaction loss (gain) |

| 22,177 |

| (72,547) |

| 94,724 |

| 130.6 | % | ||||

Total operating expenses |

| 5,394,269 |

| 3,894,134 |

| 1,500,135 |

| 38.5 | % | ||||

Income from operations |

| 87,663 |

| 133,139 |

| (45,476) |

| (34.2) | % | ||||

Other income |

| 31,228 |

| 104,331 |

| (73,103) |

| (70.1) | % | ||||

Income from operations before provision for income taxes |

| 118,891 |

| 237,470 |

| (118,579) |

| (49.9) | % | ||||

Provision for income taxes |

| (42,590) |

| (628) |

| (41,962) |

| (6,681.8) | % | ||||

Net income | $ | 76,301 | $ | 236,842 |

| (160,541) |

| (67.8) | % | ||||

26

Nine Months Ended March 31, |

| ||||||||||||

| 2024 |

| 2023 |

| $ Change |

| % Change |

| |||||

Revenue: |

|

|

|

|

|

|

|

| |||||

Platforms | $ | 9,679,179 | $ | 6,379,871 | $ | 3,299,308 |

| 51.7 | % | ||||

Transactions |

| 22,811,206 |

| 21,363,864 |

| 1,447,342 |

| 6.8 | % | ||||

Total revenue |

| 32,490,385 |

| 27,743,735 |

| 4,746,650 |

| 17.1 | % | ||||

Cost of revenue: |

|

|

|

|

|

|

|

| |||||

Platforms |

| 1,440,151 |

| 752,176 |

| 687,975 |

| 91.5 | % | ||||

Transactions |

| 17,052,934 |

| 16,211,211 |

| 841,723 |

| 5.2 | % | ||||

Total cost of revenue |

| 18,493,085 |

| 16,963,387 |

| 1,529,698 |

| 9.0 | % | ||||

Gross profit: |

|

|

|

|

|

|

|

| |||||

Platforms |

| 8,239,028 |

| 5,627,695 |

| 2,611,333 |

| 46.4 | % | ||||

Transactions |

| 5,758,272 |

| 5,152,653 |

| 605,619 |

| 11.8 | % | ||||

Total gross profit |

| 13,997,300 |

| 10,780,348 |

| 3,216,952 |

| 29.8 | % | ||||

Operating expenses: |

|

|

|

|

|

|

|

| |||||

Sales and marketing |

| 2,612,308 |

| 1,830,448 |

| 781,860 |

| 42.7 | % | ||||

Technology and product development |

| 3,952,891 |

| 2,751,099 |

| 1,201,792 |

| 43.7 | % | ||||

General and administrative |

| 6,593,790 |

| 5,004,678 |

| 1,589,112 |

| 31.8 | % | ||||

Depreciation and amortization |

| 525,267 |

| 30,486 |

| 494,781 |

| 1,623.0 | % | ||||

Stock-based compensation expense |

| 1,729,271 |

| 1,264,522 |

| 464,749 |

| 36.8 | % | ||||

Foreign currency transaction loss (gain) |

| 15,059 |

| (84,210) |

| 99,269 |

| 117.9 | % | ||||

Total operating expenses |

| 15,428,586 |

| 10,797,023 |

| 4,631,563 |

| 42.9 | % | ||||

Loss from operations |

| (1,431,286) |

| (16,675) |

| (1,414,611) |

| (8,483.4) | % | ||||

Other income |

| 547,965 |

| 218,095 |

| 329,870 |

| 151.3 | % | ||||

Income (loss) from operations before provision for income taxes |

| (883,321) |

| 201,420 |

| (1,084,741) |

| (538.5) | % | ||||

Provision for income taxes |

| (82,049) |

| (5,543) |

| (76,506) |

| (1,380.2) | % | ||||

Net income (loss) | $ | (965,370) | $ | 195,877 |

| (1,161,247) |

| (592.8) | % | ||||

Revenue

Three Months Ended March 31, |

| ||||||||||||

| 2024 |

| 2023 |

| $ Change |

| % Change |

| |||||

Revenue: |

|

|

|

|

|

|

|

| |||||

Platforms | $ | 3,953,403 | $ | 2,249,632 | $ | 1,703,771 |

| 75.7 | % | ||||

Transactions |

| 8,162,269 |

| 8,092,794 |

| 69,475 |

| 0.9 | % | ||||

Total revenue | $ | 12,115,672 | $ | 10,342,426 | $ | 1,773,246 |

| 17.1 | % | ||||

27