Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________________ to ___________________

Commission file number: 001-36204

ENERGY FUELS INC.

(Exact Name of Registrant as Specified in its Charter)

|

| |

Ontario, Canada | 98-1067994 |

(State of other jurisdiction of incorporation or | (I.R.S. Employer Identification No.) |

organization) | |

| |

225 Union Blvd., Suite 600 | |

Lakewood, Colorado | 80228 |

(Address of Principal Executive Offices) | (Zip Code) |

(303) 389-4130

(Registrant’s Telephone Number, including Area Code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

|

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

Common Shares, no par value | | NYSE MKT; TSX |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [X]

Indicate by checkmark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [X] No [ ]

Indicate by checkmark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to the Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See the definitions of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

Large Accelerated Filer [ ] Accelerated Filer [X] Non-Accelerated Filer [ ] Smaller Reporting Company [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes [ ] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $114,602,287

The number of common shares of the Registrant outstanding as of March 8, 2017 was 70,052,022.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required for Items 10, 11, 12, 13 and 14 of Part III of this Annual Report on Form 10-K is incorporated by reference to the registrant’s definitive proxy statement for the 2017 Annual Meeting of Shareholders.

ENERGY FUELS INC.

FORM 10-K

For the Year Ended December 31, 2016

TABLE OF CONTENTS

|

| | |

PART I | | |

| | |

| ITEM 1A. RISK FACTORS | |

| ITEM 1B. UNRESOLVED STAFF COMMENTS | |

| ITEM 2. DESCRIPTION OF PROPERTIES | |

| ITEM 3. LEGAL PROCEEDINGS | |

| ITEM 4. MINE SAFETY DISCLOSURE | |

PART II | | |

| ITEM 5. MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | |

| ITEM 6. SELECTED FINANCIAL DATA | |

| ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | |

| ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | |

| ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | |

| ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | |

| ITEM 9A. CONTROLS AND PROCEDURES | |

| ITEM 9B. OTHER INFORMATION | |

PART III | | |

| ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | |

| ITEM 11. EXECUTIVE COMPENSATION | |

| ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | |

| ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE | |

| ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES | |

PART IV | | |

| ITEM 15. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES | |

| ITEM 16. FORM 10-K SUMMARY | 166 |

SIGNATURES | | |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report and the exhibits attached hereto (the “Annual Report”) contain “forward-looking statements” within the meaning of applicable US and Canadian securities laws. Such forward-looking statements concern Energy Fuels Inc.’s (the “Company’s” or “Energy Fuels’”) anticipated results and progress of the Company’s operations in future periods, planned exploration, and, if warranted, development of its properties, plans related to its business, and other matters that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management.

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, schedules, assumptions, future events, or performance (often, but not always, using words or phrases such as “expects” or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “estimates” or “intends”, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved”) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made. Energy Fuels believes that the expectations reflected in these forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct, and such forward-looking statements included in, or incorporated by reference into, this Annual Report should not be unduly relied upon. This information speaks only as of the date of this Annual Report.

Readers are cautioned that it would be unreasonable to rely on any such forward-looking statements and information as creating any legal rights, and that the statements and information are not guarantees and may involve known and unknown risks and uncertainties, and that actual results are likely to differ (and may differ materially) and objectives and strategies may differ or change from those expressed or implied in the forward-looking statements or information as a result of various factors. Such risks and uncertainties include risks generally encountered in the exploration, development, operation, and closure of mineral properties and processing facilities. Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation:

| |

• | risks associated with mineral reserve and resource estimates, including the risk of errors in assumptions or methodologies; |

| |

• | risks associated with estimating mineral extraction and recovery, forecasting future price levels necessary to support mineral extraction and recovery, and the Company’s ability to increase mineral extraction and recovery in response to any increases in commodity prices or other market conditions; |

| |

• | uncertainties and liabilities inherent to conventional mineral extraction and recovery and/or in-situ uranium recovery operations; |

| |

• | geological, technical and processing problems, including unanticipated metallurgical difficulties, less than expected recoveries, ground control problems, process upsets, and equipment malfunctions; |

| |

• | risks associated with labor costs, labor disturbances, and unavailability of skilled labor; |

| |

• | risks associated with the availability and/or fluctuations in the costs of raw materials and consumables used in the Company’s production processes; |

| |

• | risks associated with environmental compliance and permitting, including those created by changes in environmental legislation and regulation, and delays in obtaining permits and licenses that could impact expected mineral extraction and recovery levels and costs; |

| |

• | actions taken by regulatory authorities with respect to mineral extraction and recovery activities; |

| |

• | risks associated with the Company’s dependence on third parties in the provision of transportation and other critical services; |

| |

• | risks associated with the ability of the Company to extend or renew land tenure, including mineral leases and surface use agreements, on favorable terms or at all; |

| |

• | risks associated with the ability of the Company to negotiate access rights on certain properties on favorable terms or at all; |

| |

• | the adequacy of the Company's insurance coverage; |

| |

• | uncertainty as to reclamation and decommissioning liabilities; |

| |

• | the ability of the Company’s bonding companies to require increases in the collateral required to secure reclamation obligations; |

| |

• | the potential for, and outcome of, litigation and other legal proceedings, including potential injunctions pending the outcome of such litigation and proceedings; |

| |

• | the ability of the Company to meet its obligations to its creditors; |

| |

• | risks associated with paying off indebtedness at its maturity; |

| |

• | risks associated with the Company’s relationships with its business and joint venture partners; |

| |

• | failure to obtain industry partner, government, and other third party consents and approvals, when required; |

| |

• | competition for, among other things, capital, mineral properties, and skilled personnel; |

| |

• | failure to complete proposed acquisitions and incorrect assessments of the value of completed acquisitions; |

| |

• | risks posed by fluctuations in share price levels, exchange rates and interest rates, and general economic conditions; |

| |

• | risks inherent in the Company’s and industry analysts’ forecasts or predictions of future uranium and vanadium price levels; |

| |

• | fluctuations in the market prices of uranium and vanadium, which are cyclical and subject to substantial price fluctuations; |

| |

• | failure to obtain suitable uranium sales terms, including spot and term sale contracts; |

| |

• | risks associated with asset impairment as a result of market conditions; |

| |

• | risks associated with lack of access to markets and the ability to access capital; |

| |

• | the market price of Energy Fuels’ securities; |

| |

• | public resistance to nuclear energy or uranium extraction and recovery; |

| |

• | uranium industry competition and international trade restrictions; |

| |

• | risks related to higher than expected costs related to our Nichols Ranch Project and Canyon Project; |

| |

• | risks related to securities regulations; |

| |

• | risks related to stock price and volume volatility; |

| |

• | risks related to our ability to maintain our listing on the NYSE MKT and Toronto Stock Exchanges; |

| |

• | risks related to our ability to maintain our inclusion in various stock indices; |

| |

• | risks related to dilution of currently outstanding shares; |

| |

• | risks related to our lack of dividends; |

| |

• | risks related to recent market events; |

| |

• | risks related to our issuance of additional common shares; |

| |

• | risks related to acquisition and integration issues; |

| |

• | risks related to defects in title to our mineral properties; |

| |

• | risks related to our outstanding debt; and |

| |

• | risks related to our securities. |

This list is not exhaustive of the factors that may affect our forward-looking statements. Some of the important risks and uncertainties that could affect forward-looking statements are described further under the section headings: Item 1. Description of the Business; Item 1A. Risk Factors; and Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations of this Annual Report. Although we have attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, believed, estimated, or expected. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Except as required by law, we disclaim any obligation to subsequently revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. Statements relating to “Mineral Reserves” or “Mineral Resources” are deemed to be forward-looking statements, as they involve the implied assessment, based on certain estimates and assumptions that the Mineral Reserves and Mineral Resources described may be profitably extracted in the future.

We qualify all the forward-looking statements contained in this Annual Report by the foregoing cautionary statements.

|

|

CAUTIONARY NOTE TO UNITED STATES INVESTORS CONCERNING |

DISCLOSURE OF MINERAL RESOURCES |

This Annual Report contains certain disclosure that has been prepared in accordance with the requirements of Canadian securities laws, which differ from the requirements of United States’ securities laws. Unless otherwise indicated, all reserve and resource estimates included in this Annual Report, and in the documents incorporated by reference herein, have been prepared in accordance with Canadian National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) classification system. NI 43-101 is a rule developed by the Canadian Securities Administrators (the “CSA”) which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects.

Canadian standards, including NI 43-101, differ significantly from the requirements of the United States Securities and Exchange Commission (the “SEC”), and reserve and resource information contained herein, or incorporated by reference in this Annual Report, and in the documents incorporated by reference herein, may not be comparable to similar information disclosed by companies reporting under only United States standards. In particular, and without limiting the generality of the foregoing, the term “resource” does not equate to the term “reserve” under SEC Industry Guide 7. Under United States standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves; the three-year historical average price, to the extent possible, is used in any reserve or cash flow analysis to designate reserves; and the primary environmental analysis or report must be filed with the appropriate governmental authority.

The SEC’s disclosure standards under Industry Guide 7 normally do not permit the inclusion of information concerning “Measured Mineral Resources”, “Indicated Mineral Resources” or “Inferred Mineral Resources” or other descriptions of the amount of mineralization in mineral deposits that do not constitute “reserves” by United States standards in documents filed with the SEC. United States investors should also understand that “Inferred Mineral Resources” have a great amount of uncertainty as to their existence and as to their economic and legal feasibility. It cannot be assumed that all or any part of an “Inferred Mineral Resource” will ever be upgraded to a higher category. Under Canadian rules, estimated “Inferred Mineral Resources” may not form the basis of feasibility or prefeasibility studies. United States investors are cautioned not to assume that all or any part of Measured or Indicated Mineral Resources will ever be converted into mineral reserves. Investors are cautioned not to assume that all or any part of an “Inferred Mineral Resource” exists or is economically or legally mineable.

Disclosure of “contained pounds” or “contained ounces” in a resource estimate is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in-place tonnage and grade without reference to unit measures. The requirements of NI 43-101 for identification of “reserves” are also not the same as those of the SEC, and reserves reported by the Company in compliance with NI 43-101 may not qualify as “reserves” under SEC Industry Guide 7 standards. Accordingly, information concerning mineral deposits set forth herein may not be comparable to information made public by companies that report in accordance with United States standards.

As a company incorporated in Canada, unless otherwise indicated, Energy Fuels estimates and reports our resources and our current reserves according to the definitions set forth in NI 43-101. Any reserves that are reported in this Form 10-K according to the definitions set forth in NI 43-101 are reconciled to the reserves as appropriate to conform to SEC Industry Guide 7 for reporting in the U.S. The definitions for each reporting standard are presented below with supplementary explanation and descriptions of the parallels and differences.

CIM and NI 43-101 Definitions:

| |

• | Feasibility Study: A “feasibility study” is a comprehensive technical and economic study of the selected development option for a mineral project that includes appropriately detailed assessments of applicable modifying factors, together with any other relevant operational factors and detailed financial analysis that are necessary to demonstrate, at the time of reporting, that extraction is reasonably justified (economically minable). The results of the study may reasonably serve as the basis for a final decision by a proponent or financial institution to proceed with, or finance, the development of the project. The confidence level of the study will be higher than that of a pre-feasibility study. |

| |

• | Indicated Mineral Resource1: An “indicated mineral resource” is that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics are estimated with sufficient confidence to allow the application of modifying factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Geological evidence is derived from adequately detailed and reliable exploration, sampling and testing and is sufficient to assume geological and grade or quality continuity between points of observation. An indicated mineral resource has a lower level of confidence than that applied to a measured mineral resource and may only be converted to a probable mineral reserve. |

| |

• | Inferred Mineral Resource2: An “inferred mineral resource” is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply, but not verify, geological and grade or quality continuity. An inferred mineral resource has a lower level of confidence than that applied to an indicated mineral resource and must not be converted to a mineral reserve. It is reasonably expected that the majority of inferred mineral resources could be upgraded to indicated mineral resources with continued exploration. |

| |

• | Measured Mineral Resource3: A “measured mineral resource” is that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics are estimated with confidence sufficient to allow the application of modifying factors to support detailed mine planning and final evaluation of the economic viability of the deposit. Geological evidence is derived from detailed and reliable exploration, sampling, and testing and is sufficient to confirm geological and grade or quality continuity between points of observation. A measured mineral resource has a higher level of confidence than that applied to either an indicated mineral resource or an inferred mineral resource. It may be converted to a proven mineral reserve or to a probable mineral reserve. |

| |

• | Mineral Reserve4: A “mineral reserve” is the economically mineable part of a measured and/or indicated mineral resource. It includes diluting materials and allowances for losses which may occur when the mineral is mined or is extracted and is defined by studies at pre-feasibility or feasibility level as appropriate that include application of modifying factors. Such studies demonstrate that, at the time of reporting, extraction could reasonably be justified. The reference point at which mineral reserves are defined, usually the point where the ore is delivered to the processing plant, must be stated. It is important that, in all situations where the reference point is different, such as for a saleable product, a clarifying statement is included to ensure that the reader is fully informed as to what is being reported. The public disclosure of a mineral reserve must be demonstrated by a pre-feasibility study or feasibility study. |

| |

• | Mineral Resource5: A “mineral resource” is a concentration or occurrence of solid material of economic interest in or on the Earth’s crust in such form, grade or quality and quantity that there are reasonable prospects for eventual economic extraction. The location, quantity, grade or quality, continuity and other geological characteristics of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge, including sampling. |

| |

• | Modifying Factors: “Modifying factors” are considerations used to convert mineral resources to mineral reserves. These include, but are not restricted to, mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social, and governmental factors. |

| |

• | Pre-Feasibility Study: A “pre-feasibility study” is a comprehensive study of a range of options for the technical and economic viability of a mineral project that has advanced to a stage where a preferred mining method, in the case of underground mining, or the pit configuration, in the case of an open pit, is established and an effective method of mineral processing is determined. It includes a financial analysis based on reasonable assumptions on the modifying factors and the evaluation of any other relevant factors which are sufficient for a qualified person, acting reasonably, to determine if all or part of the mineral resource may be converted to a mineral reserve at the time of reporting. A pre-feasibility study is at a lower confidence level than a feasibility study. |

| |

• | Probable Mineral Reserve6: A “probable mineral reserve” is the economically mineable part of an indicated, and in some circumstances, a measured mineral resource. The confidence in the modifying factors applied to a probable mineral reserve is lower than that applied to a proven mineral reserve. |

| |

• | Proven Mineral Reserve7: A “proven mineral reserve” is the economically minable part of a measured mineral resource. A proven mineral reserve implies a high degree of confidence in the modifying factors. |

______________________________________

1 SEC Industry Guide 7 does not recognize the designation of a deposit as an “Indicated Mineral Resource.”

2 SEC Industry Guide 7 does not recognize the designation of a deposit as an “Inferred Mineral Resource.”

3 SEC Industry Guide 7 does not recognize the designation of a deposit as a “Measured Mineral Resource.”

4 SEC Industry Guide 7 does not recognize “reserves” calculated in accordance with NI 43-101.

5 SEC Industry Guide 7 does not recognize the designation of a deposit as a “Mineral Resource.”

6 SEC Industry Guide 7 does not recognize “reserves” calculated in accordance with NI 43-101. SEC Industry Guide 7 requires a final or “bankable” feasibility study for the designation of a deposit as a “reserve” that must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified. Further, all necessary permits must have been filed with the appropriate regulatory authorities including the primary environmental analysis or report.

7 SEC Industry Guide 7 does not recognize “reserves” calculated in accordance with NI 43-101. SEC Industry Guide 7 requires a final or “bankable” feasibility study for the designation of a deposit as a “reserve” that must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified. Further, all necessary permits must have been filed with the appropriate regulatory authorities including the primary environmental analysis or report.

| |

• | Qualified Person8: A “qualified person” is an individual who: (a) is an engineer or geoscientist with a university degree, or equivalent accreditation, in an area of geoscience or engineering, relating to mineral exploration or mining; (b) has at least five years of experience in mineral exploration, mine development or operation, or mineral project assessment, or any combination of these, that is relevant to his or her professional degree or area of practice; (c) has experience relevant to the subject matter of the mineral project and technical report; (d) is in good standing with a professional association; and (e) in the case of a professional association in a non-Canadian jurisdiction, has a membership designation that (i) requires attainment of a position of responsibility in his or her profession that requires the exercise of independent judgment; and (ii) requires (A) a favorable confidential peer evaluation of the individual’s character, professional judgment, experience, and ethical fitness; or (B) a recommendation for membership by at least two peers, and demonstrated prominence or expertise in the field of mineral exploration or mining. |

SEC Industry Guide 7 Definitions:

| |

• | Exploration Stage: Includes all issuers engaged in the search for mineral deposits (reserves) which are not in either the development or production stage. |

| |

• | Development Stage: Includes all issuers engaged in the preparation of an established commercially mineable deposit (reserves) for its extraction which are not yet in the production stage. |

| |

• | Probable (Indicated) Reserves: Reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation. |

| |

• | Production Stage: Includes all issuers engaged in the exploitation of a mineral deposit (reserve). |

| |

• | Proven (Measured) Reserves: Reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, working, or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geological character is so well defined that size, shape, depth, and mineral content of reserves are well established. |

| |

• | Reserve: That part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. |

Note: as the Company does not have any mineral reserves within the meaning of SEC Industry Guide 7, it is considered to be in an Exploration Stage, regardless of its uranium recovery activities.

GLOSSARY OF TECHNICAL TERMS

The following defined technical terms are used in this Annual Report:

| |

• | Breccia: A rock in which angular fragments are surrounded by a mass of fine-grained materials. |

| |

• | Cut-off or cut-off grade: When determining economically viable mineral reserves, the lowest grade of mineralized material that can be mined economically. When determining mineral resources, the lowest grade of mineralized material included in the resources estimate. |

| |

• | eU3O8: This term refers to equivalent U3O8 grade derived by gamma logging of drill holes. |

| |

• | EA: Environmental Assessment prepared under NEPA for a mineral project. |

| |

• | EIS: Environmental Impact Statement prepared under NEPA for a mineral project. |

| |

• | Extraction: The process of physically extracting mineralized material from the ground. Exploration continues during the extraction process and, in many cases, mineralized material is expanded during the life of the extraction activities as the exploration potential of the deposit is realized. |

| |

• | Formation: A distinct layer of sedimentary or volcanic rock of similar composition. |

| |

• | Grade: Quantity or percentage of metal per unit weight of host rock. |

| |

• | Host Rock: The rock containing a mineral or an ore body. |

______________________________________

8 SEC Industry Guide 7 does not require designation of a qualified person.

| |

• | In-situ recovery (ISR): The recovery, by chemical means, of the uranium component of a deposit without the physical extraction of uranium-bearing material from the ground. ISR utilizes injection of appropriate oxidizing chemicals into a uranium-bearing sandstone deposit with of the uranium-bearing solution by extraction by wells; also referred to as “solution mining”. |

| |

• | Mineral: A naturally formed chemical element or compound having a definite chemical composition and, usually, a characteristic crystal form. |

| |

• | Mineralization: A natural occurrence, in rocks or soil, of one or more metal yielding minerals. |

| |

• | Mineralized material: Material that contains mineralization (i.e., uranium or vanadium) and that is not included in an SEC Reserve as it does not meet all of the criteria for adequate demonstration of economic or legal extraction. |

| |

• | National Instrument 43-101 (“NI 43-101”): The National Instrument regarding standards of disclosure for mineral projects in Canada. |

| |

• | NEPA: The United States National Environmental Policy Act of 1969, as amended. |

| |

• | Open pit: Surface mineral extraction in which the mineralized material is extracted from a pit or quarry. |

| |

• | Ore: Mineral bearing rock that can be mined, processed and concentrated profitably under current or immediately foreseeable economic conditions. Under SEC Industry Guide 7, a company may only refer to reserves (as that term is defined in SEC Industry Guide 7) as “ore.” |

| |

• | Ore body: A mostly solid and fairly continuous mass of in-ground mineralization that is estimated to be economically mineable. |

| |

• | Outcrop: That part of a geologic formation or structure that appears at the surface of the Earth. |

| |

• | PEA: A Preliminary Economic Assessment performed under NI 43-101. A Preliminary Economic Assessment is a study, other than a pre-feasibility study or feasibility study, which includes an economic analysis of the potential viability of mineral resources. |

| |

• | PO: Plan of Operations for a mineral project prepared in accordance with applicable U.S. Bureau of Land Management or U.S. Forest Service regulations. |

| |

• | Reclamation: The process by which lands disturbed as a result of mineral extraction activities are modified to support beneficial land use. Reclamation activity may include the removal of buildings, equipment, machinery, and other physical remnants of mining activities, closure of tailings storage facilities, leach pads, and other features, and contouring, covering and re-vegetation of waste rock, and other disturbed areas. |

| |

• | RoD or Record of Decision: The final approval issued by the United States Bureau of Land Management or United States Forest Service for a PO. |

| |

• | SEC Industry Guide 7: U.S. reporting guidelines that apply to registrants engaged, or to be engaged, in significant mining operations. |

| |

• | Uranium: a heavy, naturally radioactive, metallic element of atomic number 92. Uranium in its pure form is a heavy metal. Its two principal isotopes are U-238 and U-235, of which U-235 is the necessary component for the nuclear fuel cycle. However, “uranium” used in this Annual Report refers to triuranium octoxide, also called “U3O8” and the primary component of “yellowcake”, and is produced from uranium deposits. It is the most actively traded uranium-related commodity. |

| |

• | Uranium concentrate: a yellowish to yellow-brownish powder obtained from the chemical processing of uranium-bearing material. Uranium concentrate typically contains 70% to 90% U3O8 by weight. Uranium concentrate is also referred to as “yellowcake.” |

| |

• | V2O5: Vanadium pentoxide, or the form of vanadium typically produced at the White Mesa Mill, also called “blackflake.” |

| |

• | Yellowcake: Another name for Uranium Concentrate. |

PART I

ITEM 1. DESCRIPTION OF BUSINESS

General Development of the Business

Corporate Structure

Energy Fuels Inc. was incorporated on June 24, 1987 in the Province of Alberta under the name “368408 Alberta Inc.” In October 1987, 368408 Alberta Inc. changed its name to “Trevco Oil & Gas Ltd.” In May 1990, Trevco Oil & Gas Ltd. changed its name to “Trev Corp.” In August 1994, Trev Corp. changed its name to “Orogrande Resources Inc.” In April 2001, Orogrande Resources Inc. changed its name to “Volcanic Metals Exploration Inc.” On September 2, 2005, the Company was continued under the Business Corporations Act (Ontario). On March 26, 2006, Volcanic Metals Exploration Inc. acquired 100% of the outstanding shares of “Energy Fuels Resources Corporation.” On May 26, 2006, Volcanic Metals Exploration Inc. changed its name to “Energy Fuels Inc.” On November 5, 2013, the Company amended its Articles to consolidate its issued and outstanding common shares on the basis of one post-consolidation common share for every 50 pre-consolidation Common Shares.

The registered and head office of Energy Fuels is located at 82 Richmond Street East; Suite 308 Toronto, Ontario, M5C 1P1, Canada. Energy Fuels conducts its business and owns its assets in the United States through its U.S. subsidiaries, which have their principal place of business and corporate office at 225 Union Blvd., Suite 600, Lakewood, Colorado 80228, USA. Energy Fuels’ website address is www.energyfuels.com.

Energy Fuels is a U.S. domestic issuer for SEC reporting purposes and is a reporting issuer in all of the Canadian provinces. Energy Fuels’ common shares (the “Common Shares”) are listed on the NYSE MKT under the symbol “UUUU” and on the Toronto Stock Exchange (the “TSX”) under the symbol “EFR”. In addition, Energy Fuels’ Cdn $22 million aggregate amount of convertible debentures are listed on the TSX under the symbol “EFR.DB”. Certain warrants issued by the Company are listed on the TSX under the symbol "EFR.WT" and on the NYSE MKT under the symbol "UUUU-WT." Options on Energy Fuels’ common shares are traded on The Chicago Board Options Exchange. The Designated Primary Market Maker for the options is Group One Trading, LP. KCG Americas LLC is the Company’s Market Maker on the NYSE MKT.

The Company conducts its uranium extraction, recovery, and sales business, and owns its properties, through a number of subsidiaries. A diagram depicting the organizational structure of the Company and its active subsidiaries, including the name, country of incorporation, and proportion of ownership interest, is included as Exhibit 21.1 to this Annual Report. All of the Company’s U.S. assets are held directly or indirectly through the Company’s wholly-owned subsidiaries Energy Fuels Holdings Corp. (“EF Holdings”) and Strathmore Minerals Corp. (“Strathmore”). EF Holdings and Strathmore hold all or a portion of their uranium extraction, recovery, permitting, evaluation and exploration assets through a number of additional subsidiaries, as detailed below. Energy Fuels also owns a number of inactive subsidiaries which have no material liabilities or assets and do not engage in any material business activities.

All of the U.S. properties are operated by Energy Fuels Resources (USA) Inc. (“EFUSA”), a wholly-owned subsidiary of EF Holdings.

In addition, the Company holds 9,439,857 shares of Virginia Energy Resources Inc. (TSX.V:VUI; OTCQX:VEGYF) representing an approximate 16.5% equity interest in that company, and 14,250,000 common shares of enCore Energy Corp (TSX.V:UE) representing an approximate 19.8% equity interest in that company.

Business Overview

Energy Fuels is engaged in conventional and in situ (“ISR”) uranium extraction and recovery, along with the exploration, permitting, and evaluation of uranium properties in the United States. Energy Fuels owns the Nichols Ranch Uranium Recovery Facility in Wyoming (the “Nichols Ranch Project”), which is one of the newest uranium recovery facilities operating in the United States, and the Alta Mesa Project in Texas (the "Alta Mesa Project"), which is an ISR production center currently on care and maintenance. In addition, Energy Fuels owns the White Mesa Mill in Utah (the “White Mesa Mill” or “Mill”), which is the only conventional uranium recovery facility operating in the United States. The Company also owns uranium and uranium/vanadium properties and projects in various stages of exploration, permitting, and evaluation, as well as fully-permitted uranium and uranium/vanadium projects on standby. The White Mesa Mill can also recover vanadium as a co-product of mineralized material produced from certain of its projects in Colorado and Utah. In addition, Energy Fuels recovers uranium from other uranium-bearing materials not derived from conventional material, referred to as “alternate feed materials,” at its White Mesa Mill.

The Company’s activities are divided into two segments: the “ISR Uranium Segment” and the “Conventional Uranium Segment.”

ISR Uranium Segment

The Company conducts its ISR activities through its Nichols Ranch Project in northeast Wyoming, which it acquired in June 2015 through its acquisition of Uranerz Energy Corporation (“Uranerz”), and its Alta Mesa Project in south Texas, which it acquired in June 2016 through its acquisition of Mesteña Uranium, LLC (“Mesteña”), which is now named EFR Alta Mesa LLC ("EFR Alta Mesa").

The Nichols Ranch Project includes: (i) a licensed and operating ISR processing facility (the “Nichols Ranch Plant”); (ii) licensed and operating ISR wellfields (the “Nichols Ranch Wellfields”); (iii) planned ISR wellfields currently in the licensing process (the “Jane Dough Property”), and; (iv) a licensed satellite ISR uranium project (the “Hank Project”), which will include an ISR processing plant (the “Hank Satellite Plant”) that, when constructed, will produce loaded-resin, and associated planned wellfields (the “Hank Property”). See “The Nichols Ranch ISR Project” under Item 2 below. Also through the acquisition of Uranerz, the Company acquired the Reno Creek property (the “Reno Creek Property”), West North Butte property (the “West North Butte Property”), and the North Rolling Pin property (the “North Rolling Pin Property”), as well as the Arkose Mining Venture (the “Arkose Mining Venture”), which is a joint venture of Wyoming ISR properties held 81% by Energy Fuels. See “Non-Material Mineral Properties – Other ISR Projects” under Item 2 below.

The Nichols Ranch Project is an operating ISR facility that recovers uranium through a series of injection and recovery wells. Using groundwater fortified with oxygen and sodium bicarbonate, uranium is dissolved within a deposit. The groundwater is then collected in a series of recovery wells and pumped to the Nichols Ranch Plant. The Nichols Ranch Plant creates a yellowcake slurry that is transported by truck to the White Mesa Mill, where it is dried and packaged into drums that are shipped to uranium conversion facilities.

Construction of the Nichols Ranch Plant, other than the elution, drying and packaging circuits, was completed in 2013, and it commenced uranium recovery activities in the second quarter of 2014. In September of 2015, the Company commenced construction of an elution circuit at the Nichols Ranch Plant, which was completed and began operations in February 2016. During 2016, a total of 335,000 pounds of U3O8 were recovered from the Nichols Ranch Project.

The Alta Mesa Project is a fully licensed, permitted and constructed ISR processing facility that has an operating capacity of 1.5 million pounds of uranium per year and comprises 195,501 contiguous acres of land. The Alta Mesa Project is currently on standby and ready to resume production as market conditions warrant; Alta Mesa can reach commercial production levels with limited required capital within six months of a production decision. See “The Alta Mesa Project” under Item 2 below.

Conventional Uranium Segment

The Company conducts its conventional uranium extraction and recovery activities through its White Mesa Mill, which is the only operating conventional uranium mill in the United States. The White Mesa Mill, located near Blanding Utah, is centrally located such that it can be fed by a number of the Company’s uranium and uranium/vanadium projects in Colorado, Utah, Arizona and New Mexico, as well as by ore purchases or toll milling arrangements with third party miners in the region as market conditions warrant.

The White Mesa Mill is a 2,000 ton per day uranium recovery facility, which can also process vanadium as a co-product of mineralized material extracted from certain uranium/vanadium properties. In addition, the Mill can recycle other uranium-bearing materials not derived from conventional ore, referred to as "alternate feed materials", for the recovery of uranium, alone or in combination with other metals.

The White Mesa Mill has historically operated on a campaign basis, whereby mineral processing occurs as mill feed, contract requirements, and market conditions warrant. Over the years, the Company’s own, and third-party owned, conventional uranium properties in Utah, Colorado, Arizona and New Mexico have been both active and on standby, from time-to-time, in response to changing market conditions. From 2007 through 2014, running on a campaign basis, the White Mesa Mill recovered on average over 1 million pounds of U3O8 per year from conventional sources, including its La Sal Project, Daneros Project, and Tony M property in Utah; its Arizona 1 and Pinenut Projects in Arizona; and alternate feed materials. During 2015, the Mill recovered a total of 296,000 lbs. of U3O8, of which 25,000 pounds were recovered from conventional materials and the remainder from processing alternate feed materials (including 72,000 pounds for the account of a third party). During 2016, the Mill recovered a total of 680,000 lbs. of U3O8, of which 432,816 pounds were recovered from conventional materials from the Company's Pinenut Project and 248,492 pounds from processing alternate feed materials.

The Company’s Pinenut Project, where mineral extraction activities occurred until September 2015, is now depleted, and reclamation activities have commenced. The Company continues to receive and process alternate feed materials at the White Mesa Mill. At the Company’s permitted Canyon Project, shaft-sinking activities and an underground drilling program are taking place and are expected to be completed in the first quarter of 2017. The timing to extract and process mineralized material from the Canyon Project will be based on the evaluation of this underground drilling program, along with market conditions, available

financing, and sales requirements. All of the Company’s other conventional properties and projects are currently in the permitting process or on standby pending improvements in market conditions. No third party conventional properties are active at this time.

The Company also owns the Sheep Mountain Project (the “Sheep Mountain Project”), which is a conventional uranium extraction project located in Wyoming. Due to its distance from the White Mesa Mill, the Sheep Mountain Project is not expected to be a source of feed material for the Mill. The Sheep Mountain Project consists of permitted open pit and underground extraction components (the “Sheep Mountain Extraction Operation”) and a planned processing facility to process extracted mineralized material (the “Sheep Mountain Processing Operation”), which has not yet been permitted.

The Company’s principal conventional properties include the following:

| |

• | the White Mesa Mill, a 2,000 ton per day uranium and vanadium processing facility located near Blanding, Utah, held through the Company’s subsidiary EFR White Mesa LLC. See “The White Mesa Mill” under Item 2 below; |

| |

• | the Arizona Strip uranium properties located in north central Arizona, including: the Canyon Project, which is a fully-permitted uranium project with all surface facilities in place and shaft-sinking underway (see “The Canyon Project” under Item 2 below); the Wate project (the “Wate Project”), which is a uranium deposit in the permitting stage; the Arizona 1 project (the “Arizona 1 Project”), which is a fully-permitted uranium project on standby; the Pinenut Project which is a depleted uranium deposit in reclamation; and the EZ properties (“EZ Properties”), which are uranium deposits in the exploration and evaluation stage. All of the Company’s Arizona Strip properties are held by the Company’s subsidiary EFR Arizona Strip LLC, with the exception of the Wate Project, which is held by the Company’s subsidiary Wate Mining Company LLC. See “Non-Material Mineral Properties – Other Conventional Projects – Arizona Strip” under Item 2 below; |

| |

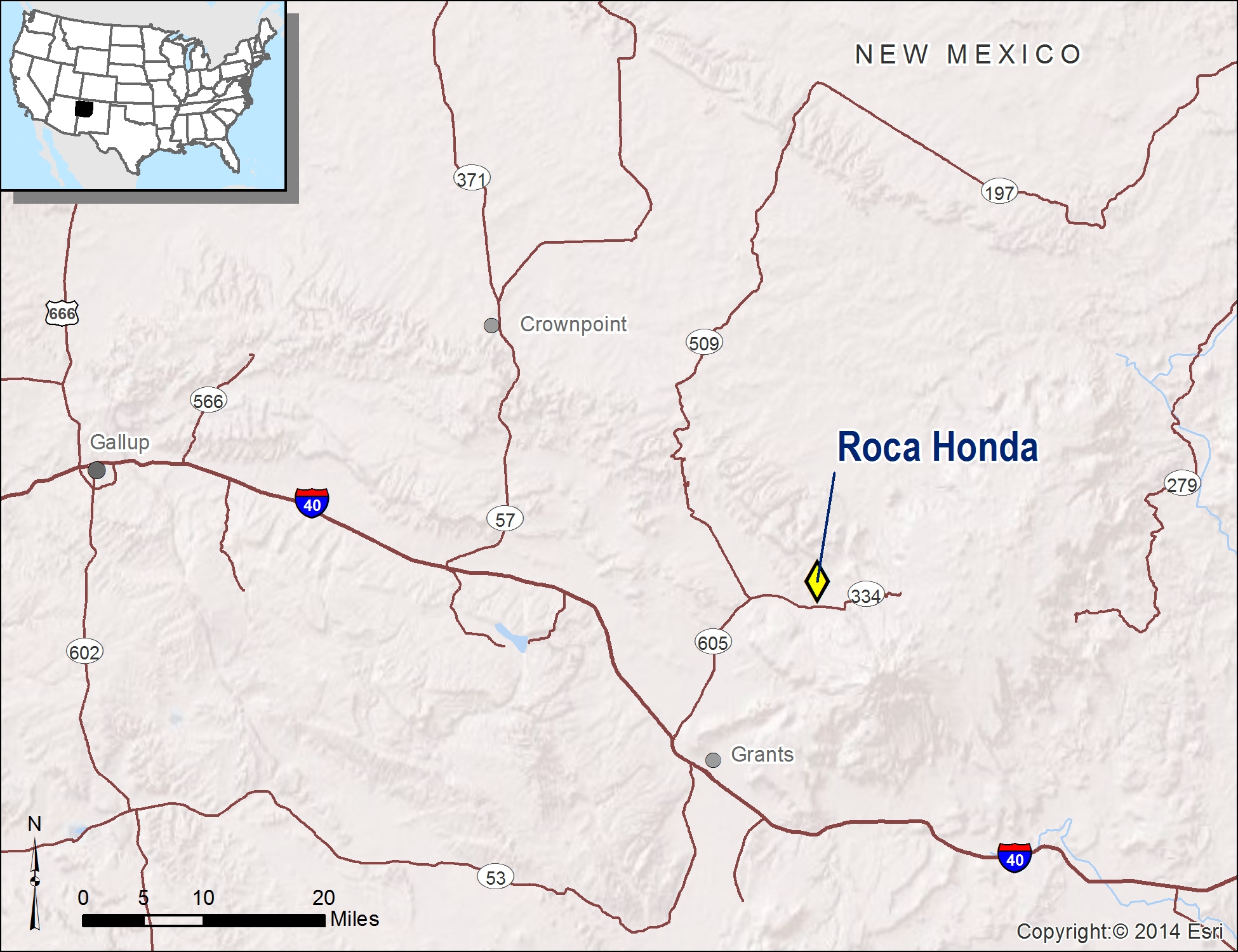

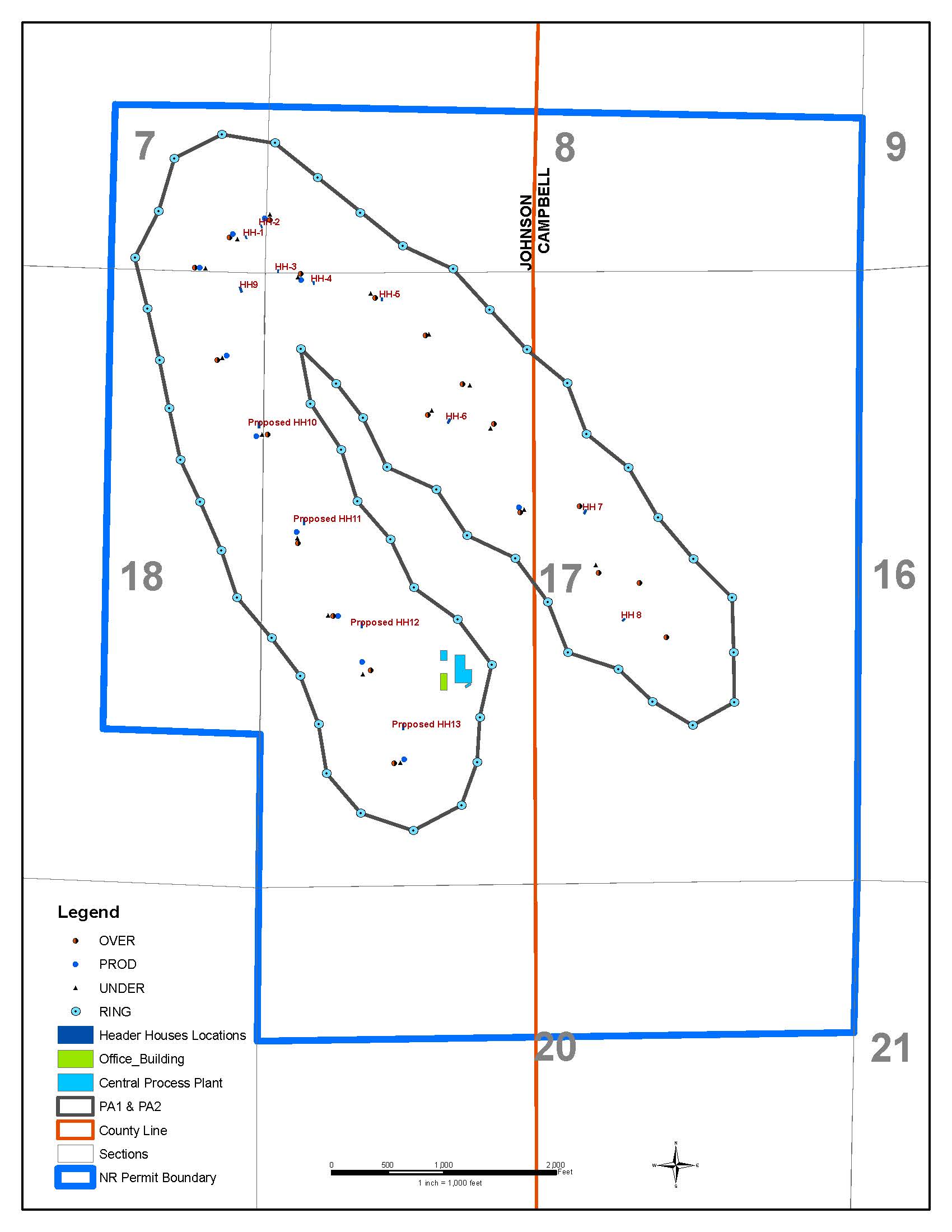

• | the Roca Honda uranium project (the “Roca Honda Project”), which is located near the town of Grants, New Mexico, held by the Company’s subsidiaries Strathmore Resources (US), Ltd., and Roca Honda Resources LLC. See “The Roca Honda Project” under Item 2 below; |

| |

• | the Sheep Mountain Project, which is a uranium project located near Jeffrey City, Wyoming, including permitted open pit and underground components held by the Company’s subsidiary Energy Fuels Wyoming Inc. See “The Sheep Mountain Project” under Item 2 below; |

| |

• | the Henry Mountains complex of uranium projects (the “Henry Mountains Complex”), located in south central Utah near the town of Ticaboo, which is comprised of the Tony M property (the “Tony M Property”) and the Bullfrog property (the “Bullfrog Property”), and which are held by the Company’s subsidiary EFR Henry Mountains LLC. See “The Henry Mountains Complex” under Item 2 below; |

| |

• | the La Sal complex of uranium and uranium/vanadium projects (the “La Sal Project”) (see “The La Sal Project” under Item 2 below), the Whirlwind uranium/vanadium project (the “Whirlwind Project”), and the Sage Plain uranium/vanadium project (the “Sage Plain Project”), all of which are located near the Colorado/Utah border (the “Colorado Plateau”) and, in addition to nearby exploration properties, are held by the Company’s subsidiary EFR Colorado Plateau LLC. See “Non-Material Mineral Properties – Other Conventional Projects – Colorado Plateau” under Item 2 below; |

| |

• | the Daneros uranium project (the “Daneros Project”) located in the White Canyon district in southeastern Utah, which is held by the Company’s subsidiary EFR White Canyon Corp. See “The Daneros Project” under Item 2 below; and |

| |

• | a number of non-core uranium properties, which the Company is evaluating for sale or abandonment, which are held in various of the Company’s subsidiaries. See “Non-Material Mineral Properties” under Item 2 below. |

Mineral Exploration

Energy Fuels holds a number of exploration properties in the Colorado Plateau, White Canyon, Grants, Arizona Strip, and Powder River Basin Districts. Energy Fuels has conducted intermittent exploration drilling on numerous projects in the period from February 2007 through December 2013. Several of those projects have been abandoned or sold. No surface exploration drilling was performed in 2014, 2015 or 2016. See “Non-Material Mineral Properties” under Item 2 below.

Development of the Business -- Major Transactions over the Past Five Years

Over the past five years, the Company has completed the following major transactions:

| |

• | In February 2012, the Company acquired all of the outstanding shares of Titan Uranium Inc. Under that transaction, the Company acquired its 100% interest in the Sheep Mountain Project and Energy Fuels Wyoming Inc., the subsidiary that currently holds that asset (see “The Sheep Mountain Project – History” under Item 2 below); |

| |

• | In June 2012, the Company acquired all of the outstanding shares of the U.S. subsidiaries of Denison Mines Corp. (the “US Mining Division”). Under that transaction, the Company acquired its 100% interest in the White Mesa Mill (see “The White Mesa Mill – History” under Item 2 below), the Arizona Strip Properties, other than the Wate Project (see “The Canyon Project – History” and “Non-Material Mineral Properties – Other Conventional Projects – Arizona Strip” under Item 2 below), the Henry Mountains Complex (see “The Henry Mountains Complex – History” under Item 2 below), the La Sal Project (see “The La Sal Project – History” under Item 2 below), the Daneros Project (see “The Daneros Project – History” under Item 2 below), and the Company’s existing subsidiaries that currently hold those assets, as well as a number of uranium sales contracts and other assets; |

| |

• | In October 2013, the Company acquired all of the outstanding shares of Strathmore Minerals Corp. Under that transaction, the Company acquired a 60% interest in the Roca Honda Project as well as the Company’s 100% interests in other properties and assets, some of which have since been sold. The Roca Honda Project was formerly held in a joint venture until the Company acquired full ownership of the project in May, 2016 when it purchased Sumitomo Corporation's 40% interest in the project. (see “The Roca Honda Project – History” under Item 2 below). The Roca Honda Project and the remaining assets acquired in October 2013 are held in the Company’s subsidiary, Strathmore Resources (US), Ltd. |

| |

• | In two transactions in 2014, the Company sold its interest in the Pinon Ridge uranium/vanadium mill project, which is located in western Colorado, that the Company had previously planned to develop, along with a number of non-core uranium properties; |

| |

• | In June 2015, the Company acquired all of the outstanding shares of Uranerz. Under that transaction, the Company acquired the Nichols Ranch Project, the Hank Project, the Reno Creek Property, the West North Butte Property, the North Rolling Pin Property, the Company’s interest in the Arkose Mining Venture, uranium sales contracts, and other assets, as well as the shares of Uranerz, which holds those assets; |

| |

• | In two separate transactions in February and November of 2015, the Company acquired 100% ownership of the Wate Project through the acquisition of Wate Mining Company LLC; and |

| |

• | In June 2016, the Company acquired EFR Alta Mesa and its primary asset, the Alta Mesa Project (see “2016 Corporate Developments” below). |

2016 Corporate Developments

On January 27, 2016, the Company appointed Hyung Mun Bae as a director to fill the vacancy left by the resignation of Joo Soo Park, who resigned as a director on January 20, 2016. Mr. Bae was the representative of Korea Electric Power Corporation (“KEPCO”) on the Company’s board of directors.

On March 7, 2016, the Company announced that it had entered into a definitive agreement (the “Alta Mesa Purchase Agreement”) to acquire Mesteña Uranium, LLC (now named “EFR Alta Mesa LLC”) (the “Alta Mesa Acquisition”), which owns the Alta Mesa Project, located in South Texas. The Alta Mesa Acquisition closed on June 17, 2016 when the Company issued 4,551,284 Common Shares to the former owners of Alta Mesa. The Company assumed the existing $11.0 million reclamation obligation for the project, but acquired the existing cash collateral backing the reclamation obligation in the amount of approximately $4.4 million.

On March 14, 2016, the Company closed a public offering of units made pursuant to an underwriting agreement dated March 9, 2016 between the Company and a syndicate of underwriters led by Cantor Fitzgerald Canada Corporation, as sole bookrunner, along with Haywood Securities Inc., Roth Capital Partners, LLC, Dundee Securities Ltd., Raymond James Ltd., and Rodman & Renshaw, a unit of H.C. Wainwright & Co., LLC. Pursuant to the offering, the Company sold an aggregate of 5,031,250 Units (which includes 656,250 Units that were issued upon the exercise, in full, of the over-allotment option that was granted to the underwriters) at a price of $2.40 per Unit for gross proceeds of $12.075 million. Each unit consisted of one common share and one half of one common share purchase warrant for a total of 5,031,250 common shares and 2,515,625 warrants. Each full warrant is exercisable until March 14, 2019 and will entitle the holder thereof to acquire one common shares upon exercise at an exercise price of $3.20 per common share.

On May 27, 2016, the Company completed its acquisition of Sumitomo Corporation’s 40% interest in the Roca Honda Project, which is now 100% owned and controlled by the Company. As consideration for the 40% interest, the Company issued to Sumitomo 1,212,173 common shares of the Company and agreed to pay $4.5 million of cash upon the first commercial production of uranium from the Roca Honda Project.

Effective July 1, 2016, the Company appointed Mark Chalmers as its Chief Operating Officer.

On August 4, 2016 the Company obtained approval from holders of its Floating-Rate Convertible Unsecured Subordinated Debentures (the “Debentures”) to amend the terms of the Debentures as follows: the maturity date was extended from June 30, 2017 to December 31, 2020; the conversion price of the Debentures was reduced from Cdn$15.00 to Cdn$4.50 per Common Share; a redemption provision was added to enable the Company to redeem the Debentures upon 30 days notice, in cash, in

whole or in part, any time after June 30, 2019 but prior to maturity at a price of 101% of the aggregate principal amount redeemed; a right was added to enable each Debenture holder to require the Company to purchase, for cash, on June 30, 2017 up to 20% of the Debentures held by such holder at a price equal to 100% of the principal amount purchased; and certain amendments were made to the Indenture as required by the U.S. Trust Indenture Act. As of March 8, 2017 a total of Cdn$22,000,000 principal amount of Debentures were outstanding.

On September 20, 2016, the Company closed an underwritten equity financing with a syndicate of underwriters led by Cantor Fitzgerald Canada Corporation and H.C. Wainwright under which the underwriters bought on an underwritten basis 8,337,500 units, each unit consisting of one Common Share and one half of one warrant at a price of $1.80 per unit for gross proceeds of $15,007,500. Each whole warrant is exercisable for five years after the date of closing and entitles the holder to acquire one Common Share upon exercise at an exercise price of $2.45 per share.

On November 1, 2016, the Company completed the sale of its Gas Hills, Juniper Ridge and Shirley Basin properties, none of which were considered material to the Company.

The Company filed a prospectus supplement on December 23, 2016 in both Canada and the United States to its Canadian base shelf prospectus and U.S. registration statement on Form S-3, both of which were filed on May 4, 2016. Concurrent with the filing of the prospectus supplement, the Company entered into a Controlled Equity Offering Sales Agreement (the “Sales Agreement”) with Cantor Fitzgerald & Co. which enabled the Company, at its discretion from time to time, to sell, through Cantor as agent, up to $20 million worth of Common Shares by way of an “at-the-market” offering (the “ATM”). Under the ATM, sales of the shares are authorized to occur by means of ordinary brokers’ transactions or block trades, with sales only being made on the NYSE MKT at market prices. No Common Shares are authorized to be offered or sold through the ATM on the TSX. The offering of common shares pursuant to the Sales Agreement will terminate upon (a) the sale of all common shares subject to the Sales Agreement or (b) the termination of the Sales Agreement by the Company or by Cantor. Cantor may terminate the Sales Agreement under the circumstances specified in the Sales Agreement. Each of the Company and Cantor may also terminate the Sales Agreement upon giving the other party 10 days notice. From January 1, 2017 to March 8, 2017, a total of 2,990,983 Common Shares have been sold under the ATM, for net proceeds to the Company of $6.65 million.

Company Strategy

Energy Fuels intends to continue to strengthen its position as a leading uranium extraction and recovery company focused on the United States. With the acquisitions of Uranerz and EFR Alta Mesa, the Company has added ISR recovery to our portfolio that, along with certain of the Company’s conventional projects and alternate feed material processing at the White Mesa Mill, sit at the lower end of the Company’s cost curve. With its large uranium resource base and existing conventional projects on standby, under construction, and in permitting, the Company’s strategy is to remain a unique and valuable call option on increases in the price of uranium, with significant scalability in improved market conditions. The Company currently intends to maintain its ISR and conventional uranium recovery capabilities, uranium resource base, and scalability. However, continued weakness in uranium prices and cash needs dictate that the Company engage in further measures to maintain the value of this option. As a result, at this time we intend to conserve cash and focus on our lowest cost uranium sources of uranium recovery, as follows:

| |

• | Produce from existing wellfields (wellfields #1 through #9) at Nichols Ranch and defer further wellfield development at Nichols Ranch until uranium prices improve; |

| |

• | Continue alternate feed processing and recovery of uranium from uranium dissolved in the Mill’s ponds, as well as pursue additional alternate feed materials and other sources of feed for the Mill; |

| |

• | Complete the shaft sinking and evaluation of the Canyon Project. It is currently expected that the shaft sinking will be completed in the first quarter of 2017 and the evaluation will be completed by mid-2017, at which time the project may be put into production or placed on standby depending on the outcome of the evaluation, market conditions at that time and other factors; |

| |

• | Continuing to maintain standby projects and facilities (including the Alta Mesa Project, La Sal Project and the Daneros Project) in a state of readiness for the purpose of restarting mining activities, as market conditions may warrant. At this time, all of the Company’s conventional projects, other than the shaft sinking and evaluation at the Canyon Mine, are expected to remain on standby until market conditions warrant restarting mining activities, or are in the evaluation or permitting process; |

| |

• | Complete permits and permit updates for Jane Dough, Daneros and La Sal projects by mid-2017 and continue permitting activities for the Roca Honda project through the end of 2018; |

| |

• | Continue to evaluate the sale or abandonment of non-core assets that the Company does not believe will add value in order to reduce costs and/or receive sales proceeds; and |

| |

• | Pursue additional cost cutting measures. |

Subsequent Events

On January 10, 2017, the United States Bureau of Land Management ("BLM") issued a final environmental impact statement and record of decision for the Company’s 100%-owned Sheep Mountain Project in the Crooks Gap Mining District in central Wyoming. The issuance of the environmental impact statement and the record of decision, together with the mine permit for the project issued in June 2015, are the last major government approvals required to commence mining at this project, as the Company continues to evaluate options for processing the resources that may be mined at the project, including toll processing at other facilities in the region and the licensing and construction of its own onsite facility.

Effective January 16, 2017, Hyung Mun Bae resigned from the Company’s board of directors. Mr. Bae resigned in connection with the transfer of the Common Shares held by KEPCO to KHNP Canada Energy Ltd., an indirect wholly-owned subsidiary of KEPCO.

Effective January 31, 2017, Harold Roberts, Executive Vice President, Conventional Operations for the Company, retired. Effective February 1, 2017, Mark Chalmers, the Company’s Chief Operating Officer, assumed responsibility for all conventional mining and White Mesa Mill operations for the Company. To ensure a smooth transition, Mr. Roberts entered into a Professional Services Agreement pursuant to which Mr. Roberts will act as a part-time consultant through May 1, 2017 or later as may be agreed to by both parties.

Uranium Sales

The Company has four existing contracts, which require deliveries of 520,000 pounds of U3O8 in 2017, and three existing contracts which require deliveries of 400,000 pounds of U3O8 in 2018. One contract expires after the 2017 deliveries, two contracts expire after the 2018 deliveries, and another contract expires in 2020. Of the 920,000 pounds of deliveries for 2017 and 2018, a total of 520,000 pounds of U3O8 is required to come from the Company’s uranium recovery operations, while Energy Fuels has the option to fulfill the remaining 400,000 pounds of U3O8 from the Company’s uranium recovery operations and/or open market purchases. At December 31, 2016, the Company had approximately 488,000 pounds of finished goods inventory from the Company’s uranium recovery operations.

In 2017 and 2018, the Company expects to have sufficient existing inventory or uranium recovery to meet all of its commitments to sell 920,000 pounds of uranium under its existing contracts.

The average expected realized price per pound under the existing contracts is expected to be lower in 2017 than 2016 levels. While 320,000 pounds of 2017 contract sales are being sold pursuant to long-term contracts that are priced at the minimum floor prices now in effect or the prices being fixed, 200,000 pounds are being sold at spot prices in effect at the times of delivery. Additional selective spot sales may be made in 2017 as necessary to generate cash for operations.

Segment Information

The Company engages in conventional and ISR uranium extraction and recovery, in addition to uranium exploration and project permitting. The Company’s source of conventional uranium recovery is the White Mesa Mill, which generates revenue through conventional processing, alternate feed material processing, and toll processing agreements (the “Conventional Uranium Segment”). The Company's sources of ISR uranium recovery are the Nichols Ranch Project and the Alta Mesa Project (the “ISR Uranium Segment”). Although the principal product of both segments is uranium concentrate, or “yellowcake,” the methods of extraction and recovery differ. In addition, the Conventional Uranium Segment provides services at the White Mesa Mill, namely alternate feed material processing and toll processing, which the Company’s ISR Uranium Segment does not provide.

Set forth below is a chart depicting the two segments of the Company’s business, together with the properties and services associated with each segment:

|

| |

ISR URANIUM SEGMENT | CONVENTIONAL URANIUM SEGMENT |

The ISR Uranium Segment currently includes the Nichols Ranch Project and the Alta Mesa Project. The Nichols Ranch Project includes the Nichols Ranch Plant and surrounding uranium properties which are geographically situated to enable mineralized materials to be transported to the Nichols Ranch Plant either by pipeline or by truck for processing. The Alta Mesa Project includes a fully permitted and constructed ISR processing facility and control of 195,501 contiguous acres of land.

The material properties included in the ISR Uranium Segment include: The Nichols Ranch Project, including the Nichols Ranch Plant, the Nichols Ranch Wellfield and the Jane Dough Property; The Alta Mesa Project, including the Alta Mesa Plant, Wellfield and Property; and the Hank Project, including the permitted, but not constructed, Hank Satellite Plant and the Hank Property. | The Conventional Uranium Segment currently includes the White Mesa Mill, which includes alternate feed material and toll processing at the Mill, and all conventional underground and/or open pit mineral extraction projects which are geographically situated to enable mineralized materials to be transported to the White Mesa Mill by truck for processing under current or reasonably anticipated future economic conditions.

The material properties included in the Conventional Uranium Segment include: the White Mesa Mill, the Henry Mountains Complex, the Roca Honda Project, the Sheep Mountain Project (described below), the Canyon Project, the Daneros Project, and the La Sal Project.

Non-material properties included in the Conventional Uranium Segment include: the Arizona 1 Project, the Wate Project, the EZ Project, the Whirlwind Project, and the Rim Project.

The Company is currently evaluating the possible sale of the Whirlwind Project. |

“Other ISR Properties” includes other ISR properties which are not close enough for mineralized materials to be transported to the Nichols Ranch plant by pipeline or truck, or that are currently in the evaluation stage.

The Other ISR Properties include: The Reno Creek Property, the West North Butte Property, the North Rolling Pin Property, and the Collins Draw, Willow Creek, Verna Ann, Niles Ranch, Cedar Canyon, East Buck, South Collins Draw, Sand Rock, Little Butte, Beecher Draw, Monument and Stage properties (each of which are in the evaluation stage and are considered non-material at this time). | “Other Conventional Properties” include conventional projects which are too geographically distant for mineralized materials to be transported to the White Mesa Mill for processing under current or reasonably anticipated future economic conditions.

The Other Conventional Properties include: the Sheep Mountain Project, which is material. |

Additional segment information, including financial information about segments, is provided in Note 19 to our financial statements under the section heading “Item 8. Financial Statements and Supplementary Data” below.

Overview of Uranium Market

The primary commercial use of uranium is to fuel nuclear power plants for the generation of electricity. All of the uranium extracted from Energy Fuels’ projects is expected to be used for this purpose.

According to the World Nuclear Association (“WNA”), as of January 1, 2017, there are currently 447 operable reactors world-wide, which required approximately 165 million pounds of U3O8 fuel per year at full operation. Worldwide there are currently 60 new reactors under construction with an additional 164 reactors on order, or in the planning stage and another 347 which have been proposed.

According to data from TradeTech LLC (“TradeTech”), the world continues to require more uranium than it produces from primary extraction, largely due to increasing uranium demands in Asia. The gap between demand and primary supply has been filled by stockpiled inventories and secondary supplies.

According to the WNA, the United States currently has 99 operating reactors, four reactors under construction, and another 42 reactors on order, planned or proposed. According to the NEI, the United States produced approximately 19.5% of its electricity from nuclear technology in 2016. According to the U.S. Energy Information Agency (“EIA”), U.S. utilities purchased approximately 56.5 million pounds of U3O8 in 2016. However, in 2015 the U.S. only produced approximately 3.3 million pounds of U3O8. As a result, in 2015, the U.S. filled about 94% of its demand from foreign sources. The EIA estimates that 2016 production was approximately 2.9 million pounds.

Uranium is not traded on an open market or organized commodity exchange such as the London Metal Exchange, although the New York Mercantile Exchange provides financially-settled uranium futures contracts. Typically, buyers and sellers negotiate transactions privately and directly. Spot uranium transactions typically involve deliveries that occur immediately and up to 12 months in the future. Term uranium transactions typically involve deliveries that occur more than 12 months in the future, with long-term transactions involving delivery terms of at least three years. Uranium prices, both spot prices and term prices, are

published by two independent market consulting firms, TradeTech and The Ux Consulting Company (“Ux”), on a weekly and monthly basis.

The spot and term prices of uranium are influenced by a number of global factors. For example, both the spot and term prices of uranium were impacted by the accident at the Fukushima Daiichi Nuclear Plant in March 2011. The events at Fukushima created heightened concerns regarding the safety of nuclear plants and led to both temporary and permanent closures of nuclear plants around the world. The Fukushima incident has created downward pressure on uranium prices over the past six years, which is still being felt today. Alternatively, China is pursuing an aggressive nuclear program, with 36 units now operating, 21 new units under construction, 40 units which are planned, and 139 units that have been proposed, according to March 2017 WNA data.

Historically, most nuclear utilities have sought to purchase a portion of their uranium needs through long-term supply contracts, while other portions are bought on the spot market. Like sellers, buyers seek to balance the security of long term supply with the opportunity to take advantage of lower prices caused by volatility in prices. For this reason, both buyers and sellers track current spot and long-term prices for uranium carefully, make considered projections as to future prices, and negotiate with one another on transactions which each deems favorable to their respective interests. According to data from Trade Tech, levels of long-term contracting in 2016 were well below historical averages.

The graph below shows the monthly spot (blue line) and long-term (red line) uranium price from August 1969 until February 2017 as reported by TradeTech (not adjusted for inflation):

To give a more recent perspective, the graph below shows the monthly spot (blue line) and long-term (red line) uranium price from January 2010 until February 2017 as reported by TradeTech (not adjusted for inflation):

According to monthly price data from TradeTech, uranium prices during 2016 were down $13.95, or 41% for the year. Monthly spot prices began the year at $34.20 per pound of U3O8 on December 31, 2015 and ended the year at $20.25 per pound, reaching a high of $34.65 per pound for the month of January 2016 and a low of $17.75 per pound for the month of November 2016.

According to Trade Tech, the spot price was $25.75 per pound on March 8, 2017. TradeTech price data also indicated that long-term U3O8 prices began 2016 at $44.00 per pound and ended 2016 at $30.00 per pound, the low long-term price for the year. The long-term price at February 28, 2017 was $35.00 per pound. The high long-term price for 2016 was $44.00 per pound. The Company believes the weak uranium markets are the result of excess uranium supplies caused by large quantities of secondary uranium extraction and excess inventories, the availability of low-priced spot material, the delayed restart of Japanese reactors, insufficient production cut-backs, premature reactor closures, continued weak uranium demand, and general weakness in the global economy.

Uranium Market Outlook and Uranium Marketing Strategy

World demand for clean, reliable, and affordable baseload electricity is growing. As a result of the expected growth of nuclear energy, the Company believes the long-term fundamentals of the uranium industry are positive. The Company believes prices must rise to higher levels to support the new primary production that will be required to meet the increasing demand we expect to see as more nuclear units are constructed around the world. According to TradeTech, world uranium requirements continue to exceed primary mine production, with the gap being bridged by secondary supplies and excess uranium inventories in various forms that have already been mined. As excess inventories are drawn down and as production from existing mines drops, the Company believes primary mine production will be required to meet demand over the long-term. According to data from TradeTech, long-term contracting levels in 2016 were low by historical standards. The Company believes uranium prices, and long-term contracting levels in particular, will need to rise to levels that are sufficient to incentivize new mine production. Even if prices rise to these levels, it may be difficult for suppliers to respond in a timely manner, as it typically requires many years of permitting and development to bring new mines into production. The Company expects these permitting and development lead times to put further pressure on prices to increase.

Despite current market uncertainty and recently falling prices throughout most of 2016, the Company believes prices likely hit a bottom in 2016. Since December 1, 2016, spot prices have risen 44% from $17.75 to $25.50 for a variety of reasons. In December 2016, it was announced that the State of Illinois passed legislation to keep three nuclear power plants operating that were previously slated to close. In January 2017, it was announced that Kazakhstan would reduce 2017 uranium production by 10% (5 million+ lbs.) after several years of production increases. On a longer-term basis, according to data from TradeTech and the WNA, Chinese utilities continue to aggressively build new reactors and buy uranium. And, in addition to China, according to the WNA, there are large numbers of new reactors under construction and in various stages of planning around the world.

In the short- and medium-terms, market challenges remain. The world continues to be oversupplied with uranium, mainly due to large quantities of secondary and other inelastic uranium supplies (including enricher underfeeding), high levels of excess inventories, insufficient producer cut-backs, premature reactor shutdowns, delays in new reactor construction, two large new mines coming into production (Cigar Lake and Husab), and decreased demand due to Japanese reactors remaining offline for longer than expected (though it should be noted that Husab has experienced start-up delays). In addition, there is a great deal of uncertainty in uranium prices regarding the timing and level of the recovery, as fundamental, political, technical, and other factors could cause prices to be significantly above or below currently expected ranges.

Nevertheless, according to data from Trade Tech, global utilities have significant uncovered uranium requirements over the next 10 years, which the Company expects will increase levels of market activity in the short- and medium-terms.