Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22001

db-X Exchange-Traded Funds Inc.

(Exact name of registrant as specified in charter)

60 Wall Street

New York, New York 10005

(Address of principal executive offices) (Zip code)

Alex Depetris

db-X Exchange-Traded Funds Inc.

60 Wall Street

New York, New York 10005

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 250-4352

Date of fiscal year end: May 31

Date of reporting period: November 30, 2014

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Table of Contents

| Item 1. | Reports to Stockholders. |

The Report to Shareholders is attached herewith.

Table of Contents

November 30, 2014

Semi-Annual Report

db-X Exchange-Traded Funds Inc.

Deutsche X-trackers 2010 Target Date ETF (TDD)

Deutsche X-trackers 2020 Target Date ETF (TDH)

Deutsche X-trackers 2030 Target Date ETF (TDN)

Deutsche X-trackers 2040 Target Date ETF (TDV)

Deutsche X-trackers In-Target Date ETF (TDX)

Table of Contents

db-X Exchange-Traded Funds Inc.

| Page | ||||

| 1 | ||||

| Performance Summary |

||||

| 2 | ||||

| 4 | ||||

| 6 | ||||

| 8 | ||||

| 10 | ||||

| 12 | ||||

| Schedules of Investments |

||||

| 13 | ||||

| 18 | ||||

| 24 | ||||

| 30 | ||||

| 36 | ||||

| 42 | ||||

| 44 | ||||

| 46 | ||||

| 49 | ||||

| 52 | ||||

| 60 | ||||

| 61 | ||||

Table of Contents

Dear Shareholder:

I am very pleased to tell you that the db X-trackers exchange-traded funds were renamed Deutsche X-trackers exchange-traded funds effective August 11, 2014, aligning more closely with the Deutsche Asset & Wealth Management brand. We are proud to adopt the Deutsche name – a brand that fully represents the global access, discipline and intelligence that support all of our products and services.

Deutsche Asset & Wealth Management combines the asset management and wealth management divisions of Deutsche Bank to deliver a comprehensive suite of investment capabilities. Your investment in the Deutsche X-trackers exchange-traded funds means you have access to the thought leadership and resources of one of the world’s largest and most influential financial institutions.

In conjunction with your fund’s name change, please note the new Web address for the Deutsche X-trackers exchange-traded funds. The former dbxus.com is now deutsche-etfs.com.

These changes have no effect on the day-to-day management of your investment, and there is no action required on your part. You will continue to experience the benefits that come from our decades of experience, in-depth research and worldwide network of investment professionals.

Thanks for your continued support. We appreciate your trust and the opportunity to put our capabilities to work for you.

Best regards,

s/ Alex Depetris

Alex Depetris

Chairman, President and Chief Executive Officer

1

Table of Contents

db-X Exchange-Traded Funds Inc.

Performance summary (Unaudited)

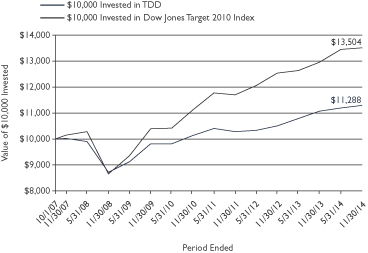

Deutsche X-trackers 2010 Target Date ETF (TDD)

The Deutsche X-trackers 2010 Target Date ETF (the “Fund”) commenced investment operations and its shares began trading on NYSE Arca, Inc. (“NYSE Arca”) on October 1, 2007. The Fund seeks to track the performance, before fees and expenses, of the Zacks 2010 Lifecycle Index. Both the Fund’s equity and bond portfolios held fewer securities than the Zacks 2010 Lifecycle Index, a constraint imposed by the relatively small size of the Fund.

For the six-month period ended November 30, 2014, the Fund’s net asset value increased 0.87%, compared to an increase of 1.10% for the Zacks 2010 Lifecycle Index and an increase of 0.43% for the Dow Jones Target 2010 Index.

Performance as of 11/30/14

| Average Annual Total Returns | ||||||||

| Net Asset Value | Market Price | Zacks 2010 Lifecycle Index |

Dow Jones Target 2010 Index | |||||

| One Year |

2.04% | 2.37% | 2.43% | 4.28% | ||||

| Five Year |

2.86% | 2.11% | 3.35% | 5.42% | ||||

| Since Inception1 |

1.70% | 1.27% | 2.06% | 4.29% | ||||

| Cumulative Total Returns | ||||||||

| Net Asset Value | Market Price | Zacks 2010 Lifecycle Index |

Dow Jones Target 2010 Index | |||||

| Six Months |

0.87% | 0.52% | 1.10% | 0.43% | ||||

| One Year |

2.04% | 2.37% | 2.43% | 4.28% | ||||

| Five Year |

15.14% | 11.01% | 17.93% | 30.19% | ||||

| Since Inception |

12.88% | 9.48% | 15.77% | 35.10% | ||||

1 Total returns are calculated based on the commencement of operations, 10/1/07 (“Inception”).

Performance quoted represents past performance, assumes reinvestment of all dividends and capital gain distributions, and does not guarantee future results. Current performance may be higher or lower than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.deutsche-etfs.com. Investment in the fund poses investment risk including possible loss of principal. The investment return and principal value of an investment will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost. The gross expense ratio, as disclosed in the most recent prospectus dated October 1, 2014, was 1.48%. DBX Strategic Advisors LLC, the advisor to the Fund, has agreed to cap its fees and/or pay certain Fund operating expenses in order to limit Fund net annual operating expenses for shares of the Fund to 0.65% of the Fund’s average net assets until 9/30/15.

The preceding performance chart is provided for comparative purposes and represents the period(s) noted. The net asset value return is based on the changes in the Fund’s net asset value per share (“NAV”). The Fund’s NAV is calculated by dividing the value of the Fund’s total assets less total liabilities by the number of shares outstanding. The market price return is based on the change in the market price on the NYSE Arca of a share of the Fund for the period(s) indicated. The price used to calculate market price returns is the midpoint of the bid/ask spread for Fund shares at 4 p.m. Eastern Time on the NYSE Arca. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. The Dow Jones Target Date Indexes are indexes whose allocations are automatically adjusted to reduce potential risk over time. The Dow Jones Target Date Indexes are designed to measure the performance of multi-asset class portfolios that allocate among U.S. and global stock, bond and cash sub indexes on a monthly basis. The indexes automatically adjust their asset allocation over time to reflect reductions in potential risk as the investor’s target date approaches.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes that a shareholder would pay on Fund distributions or on transactions in Fund shares.

“Target Date” refers to a time in the future, generally a specified year, in which the investor expects to retire or otherwise require the use of the invested funds. Target date funds are generally more aggressive the further the target date is from the present, with an objective of capital appreciation. As the target date approaches, the fund’s objective will generally become more conservative, aiming to achieve a higher level of capital preservation. Upon reaching the target date, the index whose performance the Fund seeks to track will have approximately a 10% allocation to equity securities. Over the next five years, allocations shift from conservative to more moderately-conservative allocations, allowing for a larger exposure to equities than at the target date (“Moderately-Conservative Allocation”).

Investors should note that although target date funds aim to preserve capital as the target date approaches, there is no guarantee that the Fund will achieve this objective.

2

Table of Contents

db-X Exchange-Traded Funds Inc.

Performance summary (Unaudited)

Deutsche X-trackers 2010 Target Date ETF (TDD) (Continued)

3

Table of Contents

db-X Exchange-Traded Funds Inc.

Performance summary (Unaudited)

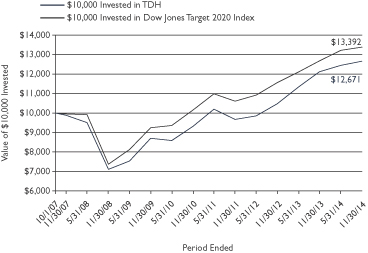

Deutsche X-trackers 2020 Target Date ETF (TDH)

The Deutsche X-trackers 2020 Target Date ETF (the “Fund”) commenced investment operations and its shares began trading on NYSE Arca, Inc. (“NYSE Arca”) on October 1, 2007. The Fund seeks to track the performance, before fees and expenses, of the Zacks 2020 Lifecycle Index. Both the Fund’s equity and bond portfolios held fewer securities than the Zacks 2020 Lifecycle Index, a constraint imposed by the relatively small size of the Fund.

For the six-month period ended November 30, 2014, the Fund’s net asset value increased 1.85%, compared to an increase of 2.20% for the Zacks 2020 Lifecycle Index and 1.24% for the Dow Jones Target 2020 Index.

Performance as of 11/30/14

| Average Annual Total Returns | ||||||||

| Net Asset Value | Market Price | Zacks 2020 Lifecycle Index |

Dow Jones Target 2020 Index | |||||

| One Year |

4.55% | 10.95% | 5.17% | 5.61% | ||||

| Five Year |

7.79% | 7.93% | 8.18% | 7.65% | ||||

| Since Inception1 |

3.36% | 3.12% | 3.63% | 4.14% | ||||

| Cumulative Total Returns | ||||||||

| Net Asset Value | Market Price | Zacks 2020 Lifecycle Index |

Dow Jones Target 2020 Index | |||||

| Six Months |

1.85% | 2.60% | 2.20% | 1.24% | ||||

| One Year |

4.55% | 10.95% | 5.17% | 5.61% | ||||

| Five Year |

45.50% | 46.46% | 48.15% | 44.60% | ||||

| Since Inception1 |

26.71% | 24.63% | 29.12% | 33.78% | ||||

1 Total returns are calculated based on the commencement of operations, 10/1/07 (“Inception”).

Performance quoted represents past performance, assumes reinvestment of all dividends and capital gain distributions, and does not guarantee future results. Current performance may be higher or lower than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.deutsche-etfs.com. Investment in the fund poses investment risk including possible loss of principal. The investment return and principal value of an investment will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost. The gross expense ratio, as disclosed in the most recent prospectus dated October 1, 2014, was 1.15%. DBX Strategic Advisors LLC, the advisor to the Fund, has agreed to cap its fees and/or pay certain Fund operating expenses in order to limit Fund net annual operating expenses for shares of the Fund to 0.65% of the Fund’s average net assets until 9/30/15.

The preceding performance chart is provided for comparative purposes and represents the period(s) noted. The net asset value return is based on the changes in the Fund’s net asset value per share (“NAV”). The Fund’s NAV is calculated by dividing the value of the Fund’s total assets less total liabilities by the number of shares outstanding. The market price return is based on the change in the market price on the NYSE Arca of a share of the Fund for the period(s) indicated. The price used to calculate market price returns is the midpoint of the bid/ask spread for Fund shares at 4 p.m. Eastern Time on the NYSE Arca. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. The Dow Jones Target Date Indexes are indexes whose allocations are automatically adjusted to reduce potential risk over time. The Dow Jones Target Date Indexes are designed to measure the performance of multi-asset class portfolios that allocate among U.S. and global stock, bond and cash subindexes on a monthly basis. The indexes automatically adjust their asset allocation over time to reflect reductions in potential risk as the investor’s target date approaches.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes that a shareholder would pay on Fund distributions or on transactions in Fund shares.

“Target Date” refers to a time in the future, generally a specified year, in which the investor expects to retire or otherwise require the use of the invested funds. Target date funds are generally more aggressive the further the target date is from the present, with an objective of capital appreciation. As the target date approaches, the fund’s objective will generally become more conservative, aiming to achieve a higher level of capital preservation. Upon reaching the target date, the index whose performance the Fund seeks to track will have approximately a 10% allocation to equity securities. Over the next five years, allocations shift from conservative to more moderately-conservative allocations, allowing for a larger exposure to equities than at the target date (“Moderately-Conservative Allocation”).

Investors should note that although target date funds aim to preserve capital as the target date approaches, there is no guarantee that the Fund will achieve this objective.

4

Table of Contents

db-X Exchange-Traded Funds Inc.

Performance summary (Unaudited)

Deutsche X-trackers 2020 Target Date ETF (TDH) (Continued)

5

Table of Contents

db-X Exchange-Traded Funds Inc.

Performance summary (Unaudited)

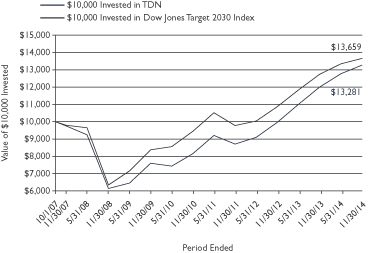

Deutsche X-trackers 2030 Target Date ETF (TDN)

The Deutsche X-trackers 2030 Target Date ETF (the “Fund”) commenced investment operations and its shares began trading on NYSE Arca, Inc. (“NYSE Arca”) on October 1, 2007. The Fund seeks to track the performance, before fees and expenses, of the Zacks 2030 Lifecycle Index. Both the Fund’s equity and bond portfolios held fewer securities than the Zacks 2030 Lifecycle Index, a constraint imposed by the relatively small size of the Fund.

For the six-month period ended November 30, 2014, the Fund’s net asset value increased 3.93%, compared to an increase of 4.38% for the Zacks 2030 Lifecycle Index and 2.28% for the Dow Jones Target 2030 Index.

Performance as of 11/30/14

| Average Annual Total Returns | ||||||||

| Net Asset Value | Market Price | Zacks 2030 Lifecycle Index |

Dow Jones Target 2030 Index | |||||

| One Year |

10.70% | 17.59% | 11.31% | 7.24% | ||||

| Five Year |

11.80% | 12.65% | 12.56% | 10.24% | ||||

| Since Inception1 |

4.04% | 4.53% | 4.54% | 4.44% | ||||

| Cumulative Total Returns | ||||||||

| Net Asset Value | Market Price | Zacks 2030 Lifecycle Index |

Dow Jones Target 2030 Index | |||||

| Six Months |

3.93% | 8.80% | 4.38% | 2.28% | ||||

| One Year |

10.70% | 17.59% | 11.31% | 7.24% | ||||

| Five Year |

74.67% | 81.38% | 80.71% | 62.81% | ||||

| Since Inception1 |

32.81 | 37.38% | 37.48% | 36.55% | ||||

1 Total returns are calculated based on the commencement of operations, 10/1/07 (“Inception”).

Performance quoted represents past performance, assumes reinvestment of all dividends and capital gain distributions, and does not guarantee future results. Current performance may be higher or lower than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.deutsche-etfs.com. Investment in the fund poses investment risk including possible loss of principal. The investment return and principal value of an investment will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost. The gross expense ratio, as disclosed in the most recent prospectus dated October 1, 2014, was 1.11%. DBX Strategic Advisors LLC, the advisor to the Fund, has agreed to cap its fees and/or pay certain Fund operating expenses in order to limit Fund net annual operating expenses for shares of the Fund to 0.65% of the Fund’s average net assets until 9/30/15.

The preceding performance chart is provided for comparative purposes and represents the period(s) noted. The net asset value return is based on the changes in the Fund’s net asset value per share (“NAV”). The Fund’s NAV is calculated by dividing the value of the Fund’s total assets less total liabilities by the number of shares outstanding. The market price return is based on the change in the market price on the NYSE Arca of a share of the Fund for the period(s) indicated. The price used to calculate market price returns is the midpoint of the bid/ask spread for Fund shares at 4 p.m. Eastern Time on the NYSE Arca. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. The Dow Jones Target Date Indexes are indexes whose allocations are automatically adjusted to reduce potential risk over time. The Dow Jones Target Date Indexes are designed to measure the performance of multi-asset class portfolios that allocate among U.S. and global stock, bond and cash subindexes on a monthly basis. The indexes automatically adjust their asset allocation over time to reflect reductions in potential risk as the investor’s target date approaches.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes that a shareholder would pay on Fund distributions or on transactions in Fund shares.

“Target Date” refers to a time in the future, generally a specified year, in which the investor expects to retire or otherwise require the use of the invested funds. Target date funds are generally more aggressive the further the target date is from the present, with an objective of capital appreciation. As the target date approaches, the fund’s objective will generally become more conservative, aiming to achieve a higher level of capital preservation. Upon reaching the target date, the index whose performance the Fund seeks to track will have approximately a 10% allocation to equity securities. Over the next five years, allocations shift from conservative to more moderately-conservative allocations, allowing for a larger exposure to equities than at the target date (“Moderately-Conservative Allocation”).

Investors should note that although target date funds aim to preserve capital as the target date approaches, there is no guarantee that the Fund will achieve this objective.

6

Table of Contents

db-X Exchange-Traded Funds Inc.

Performance summary (Unaudited)

Deutsche X-trackers 2030 Target Date ETF (TDN) (Continued)

7

Table of Contents

db-X Exchange-Traded Funds Inc.

Performance summary (Unaudited)

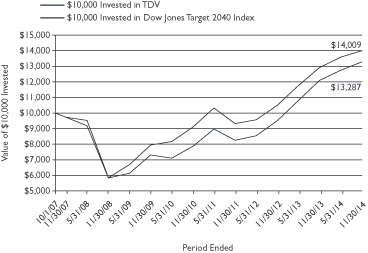

Deutsche X-trackers 2040 Target Date ETF (TDV)

The Deutsche X-trackers 2040 Target Date ETF (the “Fund”) commenced investment operations and its shares began trading on NYSE Arca, Inc. (“NYSE Arca”) on October 1, 2007. The Fund seeks to track the performance, before fees and expenses, of the Zacks 2040 Lifecycle Index. Both the Fund’s equity and bond portfolios held fewer securities than the Zacks 2040 Lifecycle Index, a constraint imposed by the relatively small size of the Fund.

For the six-month period ended November 30, 2014, the Fund’s net asset value increased 4.15%, compared to an increase of 4.44% for the Zacks 2040 Lifecycle Index and 3.10% for the Dow Jones Target 2040 Index.

Performance as of 11/30/14

| Average Annual Total Returns | ||||||||

| Net Asset Value | Market Price | Zacks 2040 Lifecycle Index |

Dow Jones Target 2040 Index | |||||

| One Year |

9.84% | 8.66% | 10.24% | 8.51% | ||||

| Five Year |

12.69% | 12.29% | 12.80% | 11.98% | ||||

| Since Inception1 |

4.04% | 3.80% | 4.12% | 4.83% | ||||

| Cumulative Total Returns | ||||||||

| Net Asset Value | Market Price | Zacks 2040 Lifecycle Index |

Dow Jones Target 2040 Index | |||||

| Six Months |

4.15% | 2.05% | 4.44% | 3.10% | ||||

| One Year |

9.84% | 8.66% | 10.24% | 8.51% | ||||

| Five Year |

81.76% | 78.55% | 82.63% | 76.06% | ||||

| Since Inception1 |

32.87% | 30.66% | 33.57% | 40.21% | ||||

1 Total returns are calculated based on the commencement of operations, 10/1/07 (“Inception”).

Performance quoted represents past performance, assumes reinvestment of all dividends and capital gain distributions, and does not guarantee future results. Current performance may be higher or lower than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.deutsche-etfs.com. Investment in the fund poses investment risk including possible loss of principal. The investment return and principal value of an investment will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost. The gross expense ratio, as disclosed in the most recent prospectus dated October 1, 2014, was 1.12%. DBX Strategic Advisors LLC, the advisor to the Fund, has agreed to cap its fees and/or pay certain Fund operating expenses in order to limit Fund net annual operating expenses for shares of the Fund to 0.65% of the Fund’s average net assets until 9/30/15.

The preceding performance chart is provided for comparative purposes and represents the period(s) noted. The net asset value return is based on the changes in the Fund’s net asset value per share (“NAV”). The Fund’s NAV is calculated by dividing the value of the Fund’s total assets less total liabilities by the number of shares outstanding. The market price return is based on the change in the market price on the NYSE Arca of a share of the Fund for the period(s) indicated. The price used to calculate market price returns is the midpoint of the bid/ask spread for Fund shares at 4 p.m. Eastern Time on the NYSE Arca. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. The Dow Jones Target Date Indexes are indexes whose allocations are automatically adjusted to reduce potential risk over time. The Dow Jones Target Date Indexes are designed to measure the performance of multi-asset class portfolios that allocate among U.S. and global stock, bond and cash subindexes on a monthly basis. The indexes automatically adjust their asset allocation over time to reflect reductions in potential risk as the investor’s target date approaches.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes that a shareholder would pay on Fund distributions or on transactions in Fund shares.

“Target Date” refers to a time in the future, generally a specified year, in which the investor expects to retire or otherwise require the use of the invested funds. Target date funds are generally more aggressive the further the target date is from the present, with an objective of capital appreciation. As the target date approaches, the fund’s objective will generally become more conservative, aiming to achieve a higher level of capital preservation. Upon reaching the target date, the index whose performance the Fund seeks to track will have approximately a 10% allocation to equity securities. Over the next five years, allocations shift from conservative to more moderately-conservative allocations, allowing for a larger exposure to equities than at the target date (“Moderately-Conservative Allocation”).

Investors should note that although target date funds aim to preserve capital as the target date approaches, there is no guarantee that the Fund will achieve this objective.

8

Table of Contents

db-X Exchange-Traded Funds Inc.

Performance summary (Unaudited)

Deutsche X-trackers 2040 Target Date ETF (TDV) (Continued)

9

Table of Contents

db-X Exchange-Traded Funds Inc.

Performance summary (Unaudited)

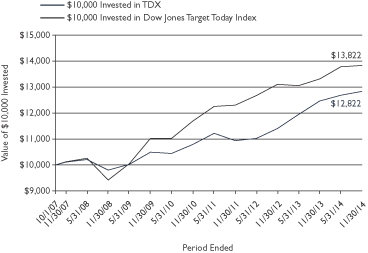

Deutsche X-trackers In-Target Date ETF (TDX)

The Deutsche X-trackers In-Target Date ETF (the “Fund”) commenced investment operations and its shares began trading on NYSE Arca, Inc. (“NYSE Arca”) on October 1, 2007. The Fund seeks to track the performance, before fees and expenses, of the Zacks In-Target Lifecycle Index. Both the Fund’s equity and bond portfolios held fewer securities than the Zacks In-Target Lifecycle Index, a constraint imposed by the relatively small size of the Fund.

For the six-month period ended November 30, 2014, the Fund’s net asset value increased 1.16%, compared to an increase of 1.43% for the Zacks In-Target Lifecycle Index and an increase of 0.34% for the Dow Jones Target Today Index.

Performance as of 11/30/14

| Average Annual Total Returns | ||||||||

| Net Asset Value | Market Price | Zacks In-Target Lifecycle Index |

Dow Jones Target Today Index | |||||

| One Year |

2.88% | 5.10% | 3.32% | 3.85% | ||||

| Five Year |

4.09% | 3.97% | 4.53% | 4.62% | ||||

| Since Inception1 |

3.53% | 3.10% | 3.83% | 4.62% | ||||

| Cumulative Total Returns | ||||||||

| Net Asset Value | Market Price | Zacks In-Target Lifecycle Index |

Dow Jones Target Today Index | |||||

| Six Months |

1.16% | (1.55)% | 1.43% | 0.34% | ||||

| One Year |

2.88% | 5.10% | 3.32% | 3.85% | ||||

| Five Year |

22.22% | 21.46% | 24.78% | 25.36% | ||||

| Since Inception1 |

28.22% | 24.44% | 30.91% | 38.25% | ||||

1 Total returns are calculated based on the commencement of operations, 10/1/07 (“Inception”).

Performance quoted represents past performance, assumes reinvestment of all dividends and capital gain distributions, and does not guarantee future results. Current performance may be higher or lower than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.deutsche-etfs.com. Investment in the fund poses investment risk including possible loss of principal. The investment return and principal value of an investment will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost. The gross expense ratio, as disclosed in the most recent prospectus dated October 1, 2014, was 1.41%. DBX Strategic Advisors LLC, the advisor to the Fund, has agreed to cap its fees and/or pay certain Fund operating expenses in order to limit Fund net annual operating expenses for shares of the Fund to 0.65% of the Fund’s average net assets until 9/30/15.

The preceding performance chart is provided for comparative purposes and represents the period(s) noted. The net asset value return is based on the changes in the Fund’s net asset value per share (“NAV”). The Fund’s NAV is calculated by dividing the value of the Fund’s total assets less total liabilities by the number of shares outstanding. The market price return is based on the change in the market price on the NYSE Arca of a share of the Fund for the period(s) indicated. The price used to calculate market price returns is the midpoint of the bid/ask spread for Fund shares at 4 p.m. Eastern Time on the NYSE Arca. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. The Dow Jones Target Date Indexes are indexes whose allocations are automatically adjusted to reduce potential risk over time. The Dow Jones Target Date Indexes are designed to measure the performance of multi-asset class portfolios that allocate among U.S. and global stock, bond and cash subindexes on a monthly basis. The indexes automatically adjust their asset allocation over time to reflect reductions in potential risk as the investor’s target date approaches.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes that a shareholder would pay on Fund distributions or on transactions in Fund shares.

“Target Date” refers to a time in the future, generally a specified year, in which the investor expects to retire or otherwise require the use of the invested funds. Target date funds are generally more aggressive the further the target date is from the present, with an objective of capital appreciation. As the target date approaches, the fund’s objective will generally become more conservative, aiming to achieve a higher level of capital preservation. Upon reaching the target date, the index whose performance the Fund seeks to track will have approximately a 10% allocation to equity securities. Over the next five years, allocations shift from conservative to more moderately-conservative allocations, allowing for a larger exposure to equities than at the target date (“Moderately-Conservative Allocation”).

Investors should note that although target date funds aim to preserve capital as the target date approaches, there is no guarantee that the Fund will achieve this objective.

10

Table of Contents

db-X Exchange-Traded Funds Inc.

Performance summary (Unaudited)

Deutsche X-trackers In-Target Date ETF (TDX) (Continued)

11

Table of Contents

db-X Exchange-Traded Funds Inc.

As a shareholder of one or more of the funds, you incur two types of costs: (1) transaction costs, including brokerage commissions paid on purchases and sales of fund shares, and (2) ongoing costs, including management fees and other Fund expenses. The expense examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other funds. In the most recent six month period each Fund limited these expenses; had they not done so, expenses would have been higher.

The examples are based on an investment of $1,000 made at the beginning of the period and held through the six-month period ended November 30, 2014 (June 1, 2014 to November 30, 2014).

Actual expenses

The first line in the following tables provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second line in the following tables provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses (which is not the Funds’ actual return). The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only, and do not reflect any transactional costs. Therefore the second line in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning Account Value June 1, 2014 |

Ending Account Value November 30, 2014 |

Annualized Expense Ratio |

Expenses paid During the Period |

|||||||||||||

| Deutsche X-trackers 2010 Target Date ETF | ||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,008.66 | 0.65 | % | $ | 3.27 | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,021.81 | 0.65 | % | $ | 3.29 | ||||||||

| Deutsche X-trackers 2020 Target Date ETF | ||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,018.45 | 0.65 | % | $ | 3.29 | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,021.81 | 0.65 | % | $ | 3.29 | ||||||||

| Deutsche X-trackers 2030 Target Date ETF | ||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,039.35 | 0.65 | % | $ | 3.32 | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,021.81 | 0.65 | % | $ | 3.29 | ||||||||

| Deutsche X-trackers 2040 Target Date ETF | ||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,041.51 | 0.65 | % | $ | 3.33 | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,021.81 | 0.65 | % | $ | 3.29 | ||||||||

| Deutsche X-trackers In-Target Date ETF | ||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,011.58 | 0.65 | % | $ | 3.28 | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,021.81 | 0.65 | % | $ | 3.29 | ||||||||

(1) Expenses are calculated using the annualized expense ratio, which represents the ongoing expenses as a percentage of net assets for the period June 01, 2014 to November 30, 2014. Expenses are calculated by multiplying the Fund’s annualized expense ratio by the average account value for the period; then multiplying the result by 183 days and then dividing the result by 365.

12

Table of Contents

db-X Exchange-Traded Funds Inc.

Schedule of investments

Deutsche X-trackers 2010 Target Date ETF

November 30, 2014 (Unaudited)

| See Notes to Financial Statements. | 13 |

Table of Contents

db-X Exchange-Traded Funds Inc.

Schedule of investments

Deutsche X-trackers 2010 Target Date ETF (Continued)

November 30, 2014 (Unaudited)

| See Notes to Financial Statements. | 14 |

Table of Contents

db-X Exchange-Traded Funds Inc.

Schedule of investments

Deutsche X-trackers 2010 Target Date ETF (Continued)

November 30, 2014 (Unaudited)

| See Notes to Financial Statements. | 15 |

Table of Contents

db-X Exchange-Traded Funds Inc.

Schedule of investments

Deutsche X-trackers 2010 Target Date ETF (Continued)

November 30, 2014 (Unaudited)

| See Notes to Financial Statements. | 16 |

Table of Contents

db-X Exchange-Traded Funds Inc.

Schedule of investments

Deutsche X-trackers 2010 Target Date ETF (Continued)

November 30, 2014 (Unaudited)

| See Notes to Financial Statements. | 17 |

Table of Contents

db-X Exchange-Traded Funds Inc.

Schedule of investments

Deutsche X-trackers 2020 Target Date ETF

November 30, 2014 (Unaudited)

| See Notes to Financial Statements. | 18 |

Table of Contents

db-X Exchange-Traded Funds Inc.

Schedule of investments

Deutsche X-trackers 2020 Target Date ETF (Continued)

November 30, 2014 (Unaudited)

| See Notes to Financial Statements. | 19 |

Table of Contents

db-X Exchange-Traded Funds Inc.

Schedule of investments

Deutsche X-trackers 2020 Target Date ETF (Continued)

November 30, 2014 (Unaudited)

| See Notes to Financial Statements. | 20 |

Table of Contents

db-X Exchange-Traded Funds Inc.

Schedule of investments

Deutsche X-trackers 2020 Target Date ETF (Continued)

November 30, 2014 (Unaudited)

| See Notes to Financial Statements. | 21 |

Table of Contents

db-X Exchange-Traded Funds Inc.

Schedule of investments

Deutsche X-trackers 2020 Target Date ETF (Continued)

November 30, 2014 (Unaudited)

| See Notes to Financial Statements. | 22 |

Table of Contents

db-X Exchange-Traded Funds Inc.

Schedule of investments

Deutsche X-trackers 2020 Target Date ETF (Continued)

November 30, 2014 (Unaudited)

| Principal |

Value |

|||||||

| UNITED STATES GOVERNMENT & AGENCY OBLIGATIONS — 30.3% | ||||||||

| Federal Home Loan Mortgage Corporation — 0.1% | ||||||||

| 1.75%, 9/10/15 |

$ | 33,000 | $ | 33,407 | ||||

|

|

|

|||||||

| Federal National Mortgage Association — 0.1% | ||||||||

| 2.375%, 4/11/16 |

33,000 | 33,943 | ||||||

|

|

|

|||||||

| United States Treasury Bonds/Notes — 30.1% | ||||||||

| 1.875%, 6/30/15 |

1,190,000 | 1,202,458 | ||||||

| 0.25%, 7/31/15 |

1,478,000 | 1,479,502 | ||||||

| 4.25%, 8/15/15 |

1,782,700 | 1,835,066 | ||||||

| 1.25%, 9/30/15 |

1,261,700 | 1,273,626 | ||||||

| 0.25%, 11/30/15 |

686,000 | 686,750 | ||||||

| 2.00%, 1/31/16 |

652,000 | 665,652 | ||||||

| 0.375%, 4/30/16 |

1,481,000 | 1,484,124 | ||||||

|

|

|

|||||||

| 8,627,178 | ||||||||

|

|

|

|||||||

| TOTAL UNITED STATES GOVERNMENT & AGENCY OBLIGATIONS |

8,694,528 | |||||||

|

|

|

|||||||

| SOVEREIGN BOND — 0.3% | ||||||||

| Poland Government International Bond (Poland) |

84,000 | 85,974 | ||||||

|

|

|

|||||||

| TOTAL INVESTMENTS — 99.5% (Cost $25,718,598) |

$ | 28,577,711 | ||||||

| Other assets less liabilities — 0.5% |

149,857 | |||||||

|

|

|

|||||||

| NET ASSETS — 100.0% |

$ | 28,727,568 | ||||||

|

|

|

|||||||

CVR – Contingent Value Rights.

MTN – Medium Term Note.

REIT – Real Estate Investment Trust.

* Non-income producing security.

(a) Affiliated issuer. This security is owned in proportion with its representation in the index.

| See Notes to Financial Statements. | 23 |

Table of Contents

db-X Exchange-Traded Funds Inc.

Schedule of investments

Deutsche X-trackers 2030 Target Date ETF

November 30, 2014 (Unaudited)

| See Notes to Financial Statements. | 24 |

Table of Contents

db-X Exchange-Traded Funds Inc.

Schedule of investments

Deutsche X-trackers 2030 Target Date ETF (Continued)

November 30, 2014 (Unaudited)

| See Notes to Financial Statements. | 25 |

Table of Contents

db-X Exchange-Traded Funds Inc.

Schedule of investments

Deutsche X-trackers 2030 Target Date ETF (Continued)

November 30, 2014 (Unaudited)

| See Notes to Financial Statements. | 26 |

Table of Contents

db-X Exchange-Traded Funds Inc.

Schedule of investments

Deutsche X-trackers 2030 Target Date ETF (Continued)

November 30, 2014 (Unaudited)

| See Notes to Financial Statements. | 27 |

Table of Contents

db-X Exchange-Traded Funds Inc.

Schedule of investments

Deutsche X-trackers 2030 Target Date ETF (Continued)

November 30, 2014 (Unaudited)

| See Notes to Financial Statements. | 28 |

Table of Contents

db-X Exchange-Traded Funds Inc.

Schedule of investments

Deutsche X-trackers 2030 Target Date ETF (Continued)

November 30, 2014 (Unaudited)

| See Notes to Financial Statements. | 29 |

Table of Contents

db-X Exchange-Traded Funds Inc.

Schedule of investments

Deutsche X-trackers 2040 Target Date ETF

November 30, 2014 (Unaudited)

| See Notes to Financial Statements. | 30 |

Table of Contents

db-X Exchange-Traded Funds Inc.

Schedule of investments

Deutsche X-trackers 2040 Target Date ETF (Continued)

November 30, 2014 (Unaudited)

| See Notes to Financial Statements. | 31 |

Table of Contents

db-X Exchange-Traded Funds Inc.

Schedule of investments

Deutsche X-trackers 2040 Target Date ETF (Continued)

November 30, 2014 (Unaudited)

| See Notes to Financial Statements. | 32 |

Table of Contents

db-X Exchange-Traded Funds Inc.

Schedule of investments

Deutsche X-trackers 2040 Target Date ETF (Continued)

November 30, 2014 (Unaudited)

| See Notes to Financial Statements. | 33 |

Table of Contents

db-X Exchange-Traded Funds Inc.

Schedule of investments

Deutsche X-trackers 2040 Target Date ETF (Continued)

November 30, 2014 (Unaudited)

| See Notes to Financial Statements. | 34 |

Table of Contents

db-X Exchange-Traded Funds Inc.

Schedule of investments

Deutsche X-trackers 2040 Target Date ETF (Continued)

November 30, 2014 (Unaudited)

| See Notes to Financial Statements. | 35 |

Table of Contents

db-X Exchange-Traded Funds Inc.

Schedule of investments

Deutsche X-trackers In-Target Date ETF

November 30, 2014 (Unaudited)

| See Notes to Financial Statements. | 36 |

Table of Contents

db-X Exchange-Traded Funds Inc.

Schedule of investments

Deutsche X-trackers In-Target Date ETF (Continued)

November 30, 2014 (Unaudited)

| See Notes to Financial Statements. | 37 |

Table of Contents

db-X Exchange-Traded Funds Inc.

Schedule of investments

Deutsche X-trackers In-Target Date ETF (Continued)

November 30, 2014 (Unaudited)

| See Notes to Financial Statements. | 38 |

Table of Contents

db-X Exchange-Traded Funds Inc.

Schedule of investments

Deutsche X-trackers In-Target Date ETF (Continued)

November 30, 2014 (Unaudited)

| See Notes to Financial Statements. | 39 |

Table of Contents

db-X Exchange-Traded Funds Inc.

Schedule of investments

Deutsche X-trackers In-Target Date ETF (Continued)

November 30, 2014 (Unaudited)

| See Notes to Financial Statements. | 40 |

Table of Contents

db-X Exchange-Traded Funds Inc.

Schedule of investments

Deutsche X-trackers In-Target Date ETF (Continued)

November 30, 2014 (Unaudited)

| See Notes to Financial Statements. | 41 |

Table of Contents

db-X Exchange-Traded Funds Inc.

Statements of assets and liabilities

November 30, 2014 (Unaudited)

| Deutsche X-trackers 2010 Target Date ETF |

Deutsche X-trackers 2020 Target Date ETF |

Deutsche X-trackers 2030 Target Date ETF |

||||||||||

| Assets |

||||||||||||

| Investments in non-affiliated securities at fair value |

$ | 10,159,613 | $ | 28,490,947 | $ | 41,543,246 | ||||||

| Investments in affiliated securities at fair value (See Note 5) |

55,683 | 86,764 | 47,392 | |||||||||

| Cash |

14,926 | 72,929 | 78,171 | |||||||||

| Foreign currency at value |

4,013 | 23,654 | 37,582 | |||||||||

| Due from investment advisor |

7,050 | 11,522 | 13,932 | |||||||||

| Receivables: |

||||||||||||

| Interest and dividends |

61,730 | 125,051 | 179,202 | |||||||||

| Foreign tax reclaim |

830 | 22,205 | 33,387 | |||||||||

| Capital shares |

— | — | 17,797 | |||||||||

| Prepaid expenses |

2,390 | 2,802 | 2,671 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total Assets |

$ | 10,306,235 | $ | 28,835,874 | $ | 41,953,380 | ||||||

|

|

|

|

|

|

|

|||||||

| Liabilities |

||||||||||||

| Payables: |

||||||||||||

| Investment securities purchased |

$ | — | $ | 30,029 | $ | 47,487 | ||||||

| Investment advisory fees |

5,468 | 15,263 | 20,378 | |||||||||

| Accrued expenses and other liabilities |

31,710 | 63,014 | 75,360 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total Liabilities |

37,178 | 108,306 | 143,225 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net Assets |

$ | 10,269,057 | $ | 28,727,568 | $ | 41,810,155 | ||||||

|

|

|

|

|

|

|

|||||||

| Net Assets Consist of |

||||||||||||

| Paid-in capital |

$ | 11,140,420 | $ | 27,668,641 | $ | 37,781,034 | ||||||

| Undistributed net investment income |

28,319 | 231,955 | 759,471 | |||||||||

| Accumulated net realized gain (loss) |

(1,387,611 | ) | (2,029,217 | ) | (2,085,150 | ) | ||||||

| Net unrealized appreciation (depreciation) |

487,929 | 2,856,189 | 5,354,800 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net Assets |

$ | 10,269,057 | $ | 28,727,568 | $ | 41,810,155 | ||||||

|

|

|

|

|

|

|

|||||||

| Number of Common Shares outstanding |

400,800 | 1,000,800 | 1,400,800 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net Assets Value |

$ | 25.62 | $ | 28.70 | $ | 29.85 | ||||||

|

|

|

|

|

|

|

|||||||

| Investments in non-affiliated securities at cost |

$ | 9,669,412 | $ | 25,601,246 | $ | 36,147,932 | ||||||

|

|

|

|

|

|

|

|||||||

| Investments in affiliated securities at cost |

$ | 57,712 | $ | 117,352 | $ | 83,664 | ||||||

|

|

|

|

|

|

|

|||||||

| Foreign currency at cost |

$ | 4,143 | $ | 24,687 | $ | 38,791 | ||||||

|

|

|

|

|

|

|

|||||||

| See Notes to Financial Statements. | 42 |

Table of Contents

db-X Exchange-Traded Funds Inc.

Statements of assets and liabilities (Continued)

November 30, 2014 (Unaudited)

| Deutsche X-trackers 2040 Target Date ETF |

Deutsche X-trackers In-Target Date ETF |

|||||||

| Assets |

||||||||

| Investments in non-affiliated securities at fair value |

$ | 36,303,936 | $ | 11,770,082 | ||||

| Investments in affiliated securities at fair value (See Note 5) |

50,236 | 60,628 | ||||||

| Cash |

59,113 | 19,827 | ||||||

| Foreign currency at value |

35,658 | 9,593 | ||||||

| Due from investment advisor |

13,224 | 7,442 | ||||||

| Receivables: |

||||||||

| Interest and dividends |

96,396 | 65,934 | ||||||

| Foreign tax reclaim |

38,716 | 2,689 | ||||||

| Capital shares |

— | — | ||||||

| Prepaid expenses |

3,025 | 2,416 | ||||||

|

|

|

|

|

|||||

| Total Assets |

$ | 36,600,304 | $ | 11,938,611 | ||||

|

|

|

|

|

|||||

| Liabilities |

||||||||

| Payables: |

||||||||

| Investment securities purchased |

$ | 50,582 | $ | — | ||||

| Investment advisory fees |

19,245 | 6,334 | ||||||

| Accrued expenses and other liabilities |

69,472 | 33,900 | ||||||

|

|

|

|

|

|||||

| Total Liabilities |

139,299 | 40,234 | ||||||

|

|

|

|

|

|||||

| Net Assets |

$ | 36,461,005 | $ | 11,898,377 | ||||

|

|

|

|

|

|||||

| Net Assets Consist of |

||||||||

| Paid-in capital |

$ | 32,518,756 | $ | 10,623,093 | ||||

| Undistributed net investment income |

643,150 | 50,899 | ||||||

| Accumulated net realized gain (loss) |

(3,590,414 | ) | 328,531 | |||||

| Net unrealized appreciation (depreciation) |

6,889,513 | 895,854 | ||||||

|

|

|

|

|

|||||

| Net Assets |

$ | 36,461,005 | $ | 11,898,377 | ||||

|

|

|

|

|

|||||

| Number of Common Shares outstanding |

1,200,800 | 400,800 | ||||||

|

|

|

|

|

|||||

| Net Assets Value |

$ | 30.36 | $ | 29.69 | ||||

|

|

|

|

|

|||||

| Investments in non-affiliated securities at cost |

$ | 29,359,154 | $ | 10,871,000 | ||||

|

|

|

|

|

|||||

| Investments in affiliated securities at cost |

$ | 100,628 | $ | 63,197 | ||||

|

|

|

|

|

|||||

| Foreign currency at cost |

$ | 36,992 | $ | 10,018 | ||||

|

|

|

|

|

|||||

| See Notes to Financial Statements. | 43 |

Table of Contents

db-X Exchange-Traded Funds Inc.

For the Six Months Ended November 30, 2014 (Unaudited)

| Deutsche X-trackers 2010 Target Date ETF |

Deutsche X-trackers 2020 Target Date ETF |

Deutsche X-trackers 2030 Target Date ETF |

||||||||||

| Investment Income |

||||||||||||

| Unaffiliated interest income |

$ | 15,034 | $ | 37,922 | $ | 194,758 | ||||||

| Unaffiliated dividend income* |

25,608 | 136,921 | 265,598 | |||||||||

| Affiliated interest income |

582 | 769 | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Total Investment Income |

41,224 | 175,612 | 460,356 | |||||||||

|

|

|

|

|

|

|

|||||||

| Expenses |

||||||||||||

| Advisory fees |

33,223 | 92,397 | 117,978 | |||||||||

| Audit and tax fees |

11,652 | 11,652 | 11,652 | |||||||||

| Insurance |

9,124 | 9,124 | 9,124 | |||||||||

| Directors |

6,991 | 19,253 | 27,245 | |||||||||

| Listing fees |

6,689 | 6,689 | 6,689 | |||||||||

| Printing |

5,202 | 14,429 | 19,455 | |||||||||

| Legal fees |

3,104 | 8,610 | 11,602 | |||||||||

| Other |

172 | 172 | 172 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total Expenses |

76,157 | 162,326 | 203,917 | |||||||||

| Less fees waived and expenses reimbursed: (See Note 3) |

(42,762 | ) | (69,756 | ) | (85,767 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net Expenses |

33,395 | 92,570 | 118,150 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net Investment Income |

7,829 | 83,042 | 342,206 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net Realized and Unrealized Gain (Loss) |

||||||||||||

| Net realized gain (loss) on: |

||||||||||||

| Investments |

106,241 | 1,014,756 | 1,137,073 | |||||||||

| Foreign currency related transactions |

(232 | ) | (1,129 | ) | (1,730 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net realized gain |

106,009 | 1,013,627 | 1,135,343 | |||||||||

| Net change in unrealized appreciation (depreciation) on: |

||||||||||||

| Investments |

(24,930 | ) | (570,454 | ) | 21,600 | |||||||

| Foreign currency translations |

(339 | ) | (4,001 | ) | (5,582 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net change in unrealized appreciation (depreciation) |

(25,269 | ) | (574,455 | ) | 16,018 | |||||||

|

|

|

|

|

|

|

|||||||

| Net realized and unrealized gain on investments and foreign currency transactions |

80,740 | 439,172 | 1,151,361 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net Increase in Net Assets from Operations |

$ | 88,569 | $ | 522,214 | $ | 1,493,567 | ||||||

|

|

|

|

|

|

|

|||||||

| * Unaffiliated foreign tax withheld |

$ | 980 | $ | 6,929 | $ | 8,913 | ||||||

| See Notes to Financial Statements. | 44 |

Table of Contents

db-X Exchange-Traded Funds Inc.

Statements of operations (Continued)

For the Six Months Ended November 30, 2014 (Unaudited)

| Deutsche X-trackers 2040 Target Date ETF |

Deutsche X-trackers In-Target Date ETF |

|||||||

| Investment Income |

||||||||

| Unaffiliated interest income |

$ | 51,324 | $ | 15,242 | ||||

| Unaffiliated dividend income* |

327,155 | 37,992 | ||||||

| Affiliated interest income |

— | 617 | ||||||

|

|

|

|

|

|||||

| Total Investment Income |

378,479 | 53,851 | ||||||

|

|

|

|

|

|||||

| Expenses |

||||||||

| Advisory fees |

115,357 | 38,448 | ||||||

| Audit and tax fees |

11,652 | 11,652 | ||||||

| Insurance |

9,124 | 9,124 | ||||||

| Directors |

23,683 | 8,059 | ||||||

| Listing fees |

6,689 | 6,689 | ||||||

| Printing |

17,930 | 6,012 | ||||||

| Legal fees |

10,700 | 3,588 | ||||||

| Other |

172 | 172 | ||||||

|

|

|

|

|

|||||

| Total Expenses |

195,307 | 83,744 | ||||||

| Less fees waived and expenses reimbursed: (See Note 3) |

(79,778 | ) | (45,124 | ) | ||||

|

|

|

|

|

|||||

| Net Expenses |

115,529 | 38,620 | ||||||

|

|

|

|

|

|||||

| Net Investment Income |

262,950 | 15,231 | ||||||

|

|

|

|

|

|||||

| Net Realized and Unrealized Gain (Loss) |

||||||||

| Net realized gain (loss) on: |

||||||||

| Investments |

1,663,423 | 288,284 | ||||||

| Foreign currency related transactions |

(2,154 | ) | (353 | ) | ||||

|

|

|

|

|

|||||

| Net realized gain |

1,661,269 | 287,931 | ||||||

| Net change in unrealized appreciation (depreciation) on: |

||||||||

| Investments |

(462,486 | ) | (166,017 | ) | ||||

| Foreign currency translations |

(6,337 | ) | (775 | ) | ||||

|

|

|

|

|

|||||

| Net change in unrealized appreciation (depreciation) |

(468,823 | ) | (166,792 | ) | ||||

|

|

|

|

|

|||||

| Net realized and unrealized gain on investments and foreign currency transactions |

1,192,446 | 121,139 | ||||||

|

|

|

|

|

|||||

| Net Increase in Net Assets from Operations |

$ | 1,455,396 | $ | 136,370 | ||||

|

|

|

|

|

|||||

| * Unaffiliated foreign tax withheld |

$ | 9,655 | $ | 1,132 | ||||

| See Notes to Financial Statements. | 45 |

Table of Contents

db-X Exchange-Traded Funds Inc.

Statements of changes in net assets

| Deutsche X-trackers 2010 Target Date ETF |

Deutsche X-trackers 2020 Target Date ETF |

|||||||||||||||

| For the Six Months Ended November 30, 2014 (Unaudited) |

Year Ended May 31, 2014 |

For the Six Months Ended November 30, 2014 (Unaudited) |

Year Ended May 31, 2014 |

|||||||||||||

| Increase (Decrease) in Net Assets from Operations |

||||||||||||||||

| Net investment income |

$ | 7,829 | $ | 40,831 | $ | 83,042 | $ | 275,112 | ||||||||

| Net realized gain |

106,009 | 159,716 | 1,013,627 | 1,899,246 | ||||||||||||

| Net change in unrealized appreciation (depreciation) |

(25,269 | ) | 176,423 | (574,455 | ) | 371,167 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net increase resulting from operations |

88,569 | 376,970 | 522,214 | 2,545,525 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Distributions to Shareholders from |

||||||||||||||||

| Net investment income |

— | (28,553 | ) | — | (248,749 | ) | ||||||||||

| Net realized gain |

— | — | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total distributions |

— | (28,553 | ) | — | (248,749 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Fund Shares Transactions |

||||||||||||||||

| Proceeds from shares sold |

— | — | — | — | ||||||||||||

| Value of shares redeemed |

— | — | — | (5,188,581 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net increase (decrease) in net assets resulting from fund share transactions |

— | — | — | (5,188,581 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total increase (decrease) in Net Assets |

88,569 | 348,417 | 522,214 | (2,891,805 | ) | |||||||||||

| Net Assets |

||||||||||||||||

| Beginning of period |

10,180,488 | 9,832,071 | 28,205,354 | 31,097,159 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| End of period |

$ | 10,269,057 | $ | 10,180,488 | $ | 28,727,568 | $ | 28,205,354 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Undistributed net investment income |

$ | 28,319 | $ | 20,490 | $ | 231,955 | $ | 148,913 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Changes in Shares Outstanding |

||||||||||||||||

| Shares outstanding, beginning of period |

400,800 | 400,800 | 1,000,800 | 1,200,800 | ||||||||||||

| Shares sold |

— | — | — | — | ||||||||||||

| Shares redeemed |

— | — | — | (200,000 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Shares outstanding, end of period |

400,800 | 400,800 | 1,000,800 | 1,000,800 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| See Notes to Financial Statements. | 46 |

Table of Contents

db-X Exchange-Traded Funds Inc.

Statements of changes in net assets (Continued)

| Deutsche X-trackers 2030 Target Date ETF |

Deutsche X-trackers 2040 Target Date ETF |

|||||||||||||||

| For the Six Months Ended November 30, 2014 (Unaudited) |

Year Ended May 31, 2014 |

For the Six Months Ended November 30, 2014 (Unaudited) |

Year Ended May 31, 2014 |

|||||||||||||

| Increase (Decrease) in Net Assets from Operations |

||||||||||||||||

| Net investment income |

$ | 342,206 | $ | 796,728 | $ | 262,950 | $ | 661,564 | ||||||||

| Net realized gain |

1,135,343 | 2,305,317 | 1,661,269 | 1,876,800 | ||||||||||||

| Net change in unrealized appreciation (depreciation) |

16,018 | 1,974,031 | (468,823 | ) | 2,887,667 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net increase resulting from operations |

1,493,567 | 5,076,076 | 1,455,396 | 5,426,031 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Distributions to Shareholders from |

||||||||||||||||

| Net investment income |

— | (620,525 | ) | — | (482,157 | ) | ||||||||||

| Net realized gain |

— | — | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total distributions |

— | (620,525 | ) | — | (482,157 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Fund Shares Transactions |

||||||||||||||||

| Proceeds from shares sold |

5,896,973 | 10,760,274 | — | — | ||||||||||||

| Value of shares redeemed |

(5,813,743 | ) | (5,246,577 | ) | — | — | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net increase (decrease) in net assets resulting from fund share transactions |

83,230 | 5,513,697 | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total increase (decrease) in Net Assets |

1,576,797 | 9,969,248 | 1,455,396 | 4,943,874 | ||||||||||||

| Net Assets |

||||||||||||||||

| Beginning of period |

40,233,358 | 30,264,110 | 35,005,609 | 30,061,735 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| End of period |

$ | 41,810,155 | $ | 40,233,358 | $ | 36,461,005 | $ | 35,005,609 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Undistributed net investment income |

$ | 759,471 | $ | 417,265 | $ | 643,150 | $ | 380,200 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Changes in Shares Outstanding |

||||||||||||||||

| Shares outstanding, beginning of period |

1,400,800 | 1,200,800 | 1,200,800 | 1,200,800 | ||||||||||||

| Shares sold |

200,000 | 400,000 | — | — | ||||||||||||

| Shares redeemed |

(200,000 | ) | (200,000 | ) | — | — | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Shares outstanding, end of period |

1,400,800 | 1,400,800 | 1,200,800 | 1,200,800 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| See Notes to Financial Statements. | 47 |

Table of Contents

db-X Exchange-Traded Funds Inc.

Statements of changes in net assets (Continued)

| Deutsche X-trackers In-Target Date ETF |

||||||||

| For the Six Months Ended November 30, 2014 (Unaudited) |

Year Ended May 31, 2014 |

|||||||

| Increase (Decrease) in Net Assets from Operations |

||||||||

| Net investment income |

$ | 15,231 | $ | 65,058 | ||||

| Net realized gain |

287,931 | 310,289 | ||||||

| Net change in unrealized appreciation (depreciation) |

(166,792 | ) | 304,919 | |||||

|

|

|

|

|

|||||

| Net increase resulting from operations |

136,370 | 680,266 | ||||||

|

|

|

|

|

|||||

| Distributions to Shareholders from |

||||||||

| Net investment income |

— | (51,246 | ) | |||||

| Net realized gain |

— | (53,935 | ) | |||||

|

|

|

|

|

|||||

| Total distributions |

— | (105,181 | ) | |||||

|

|

|

|

|

|||||

| Fund Shares Transactions |

||||||||

| Proceeds from shares sold |

— | — | ||||||

| Value of shares redeemed |

— | — | ||||||

|

|

|

|

|

|||||

| Net increase (decrease) in net assets resulting from fund share transactions |

— | — | ||||||

|

|

|

|

|

|||||

| Total increase (decrease) in Net Assets |

136,370 | 575,085 | ||||||

| Net Assets |

||||||||

| Beginning of period |

11,762,007 | 11,186,922 | ||||||

|

|

|

|

|

|||||

| End of period |

$ | 11,898,377 | $ | 11,762,007 | ||||

|

|

|

|

|

|||||

| Undistributed net investment income |

$ | 50,899 | $ | 35,668 | ||||

|

|

|

|

|

|||||

| Changes in Shares Outstanding |

||||||||

| Shares outstanding, beginning of period |

400,800 | 400,800 | ||||||

| Shares sold |

— | — | ||||||

| Shares redeemed |

— | — | ||||||

|

|

|

|

|

|||||

| Shares outstanding, end of period |

400,800 | 400,800 | ||||||

|

|

|

|

|

|||||

| See Notes to Financial Statements. | 48 |

Table of Contents

db-X Exchange-Traded Funds Inc.

For a Share outstanding throughout each period

| For the Six Months Ended November 30, 2014 (Unaudited) |

||||||||||||||||||||||||

| Deutsche X-trackers 2010 Target Date ETF | Year Ended May 31, | |||||||||||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||||||

| Net Asset Value, beginning of period |

$ | 25.40 | $ | 24.53 | $ | 23.59 | $ | 23.98 | $ | 23.24 | $ | 22.09 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income from Investment Operations: |

||||||||||||||||||||||||

| Net investment income* |

0.02 | 0.10 | 0.06 | 0.16 | 0.37 | 0.55 | ||||||||||||||||||

| Net realized and unrealized gain (loss) |

0.20 | 0.84 | 0.98 | (0.35 | ) | 0.99 | 1.11 | |||||||||||||||||

| Contributions from advisor |

— | — | — | — | 0.04 | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net increase (decrease) in net asset value from operations |

0.22 | 0.94 | 1.04 | (0.19 | ) | 1.40 | 1.66 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Distributions paid to shareholders from: |

||||||||||||||||||||||||

| Net investment income |

— | (0.07 | ) | (0.10 | ) | (0.20 | ) | (0.66 | ) | (0.51 | ) | |||||||||||||

| Net realized capital gains |

— | — | — | — | — | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total distributions |

— | (0.07 | ) | (0.10 | ) | (0.20 | ) | (0.66 | ) | (0.51 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net Asset Value, end of period |

$ | 25.62 | $ | 25.40 | $ | 24.53 | $ | 23.59 | $ | 23.98 | $ | 23.24 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Return** |

0.87 | % | 3.84 | % | 4.41 | % | (0.79 | )% | 6.09 | % | 7.51 | % | ||||||||||||

| Ratios/Supplemental Data: |

||||||||||||||||||||||||

| Net assets, end of period (000’s omitted) |

$ | 10,269 | $ | 10,180 | $ | 9,832 | $ | 9,454 | $ | 14,408 | $ | 18,610 | ||||||||||||

| Ratios to average net assets: |

||||||||||||||||||||||||

| Expenses, net of fee waiver and expense reimbursements |

0.65 | %† | 0.65 | % | 0.65 | % | 0.65 | % | 0.65 | % | 0.65 | % | ||||||||||||

| Expenses, prior to fee waiver and expense reimbursements |

1.49 | %† | 1.48 | % | 1.53 | % | 1.39 | % | 1.70 | % | 2.10 | % | ||||||||||||

| Net investment income |

0.15 | %† | 0.41 | % | 0.27 | % | 0.67 | % | 1.56 | % | 2.32 | % | ||||||||||||

| Portfolio turnover rate†† |

45 | % | 85 | % | 86 | % | 65 | % | 58 | % | 51 | % | ||||||||||||

| For the Six Months Ended November 30, 2014 (Unaudited) |

||||||||||||||||||||||||

| Deutsche X-trackers 2020 Target Date ETF | Year Ended May 31, | |||||||||||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||||||

| Net Asset Value, beginning of period |

$ | 28.18 | $ | 25.90 | $ | 22.79 | $ | 24.00 | $ | 20.69 | $ | 18.56 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income from Investment Operations: |

||||||||||||||||||||||||

| Net investment income* |

0.08 | 0.27 | 0.26 | 0.28 | 0.44 | 0.51 | ||||||||||||||||||

| Net realized and unrealized gain (loss) |

0.44 | 2.26 | 3.15 | (1.12 | ) | 3.39 | 2.10 | |||||||||||||||||

| Contributions from advisor |

— | — | — | — | 0.01 | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net increase (decrease) in net asset value from operations |

0.52 | 2.53 | 3.41 | (0.84 | ) | 3.84 | 2.61 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Distributions paid to shareholders from: |

||||||||||||||||||||||||

| Net investment income |

— | (0.25 | ) | (0.30 | ) | (0.37 | ) | (0.53 | ) | (0.48 | ) | |||||||||||||

| Net realized capital gains |

— | — | — | — | — | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total distributions |

— | (0.25 | ) | (0.30 | ) | (0.37 | ) | (0.53 | ) | (0.48 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net Asset Value, end of period |

$ | 28.70 | $ | 28.18 | $ | 25.90 | $ | 22.79 | $ | 24.00 | $ | 20.69 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Return** |

1.85 | % | 9.79 | % | 15.04 | % | (3.49 | )% | 18.71 | % | 13.99 | % | ||||||||||||

| Ratios/Supplemental Data: |

||||||||||||||||||||||||

| Net assets, end of period (000’s omitted) |

$ | 28,728 | $ | 28,205 | $ | 31,097 | $ | 31,918 | $ | 38,412 | $ | 41,405 | ||||||||||||

| Ratios to average net assets: |

||||||||||||||||||||||||

| Expenses, net of fee waiver and expense reimbursements |

0.65 | %† | 0.65 | % | 0.65 | % | 0.65 | % | 0.65 | % | 0.65 | % | ||||||||||||

| Expenses, prior to fee waiver and expense reimbursements |

1.14 | %† | 1.15 | % | 1.15 | % | 1.16 | % | 1.42 | % | 1.90 | % | ||||||||||||

| Net investment income |

0.58 | %† | 0.99 | % | 1.08 | % | 1.20 | % | 1.97 | % | 2.43 | % | ||||||||||||

| Portfolio turnover rate†† |

35 | % | 49 | % | 52 | % | 55 | % | 49 | % | 37 | % | ||||||||||||

| * | Based on average shares outstanding. |

| ** | Total Return is calculated assuming an initial investment made at the Net Asset Value at the beginning of the period, reinvestment of all dividends and capital gain distributions at Net Asset Value during the period, and redemption at Net Asset Value on the last day of the period. Total Return calculated for a period of less than one year is not annualized. The Total Return would have been lower if certain fees had not been reimbursed by the investment sub-advisor, Amerivest Investment Management LLC (from October 1, 2007 through October 20, 2010) and the Advisor, DBX Strategic Advisors LLC. |

| † | Annualized. |

| †† | Portfolio turnover rate is not annualized and does not include securities received or delivered from processing creations or redemptions. |

| See Notes to Financial Statements. | 49 |

Table of Contents

db-X Exchange-Traded Funds Inc.

Financial highlights (Continued)

For a Share outstanding throughout each period

| For the Six Months Ended November 30, 2014 (Unaudited) |

||||||||||||||||||||||||

| Deutsche X-trackers 2030 Target Date ETF |

Year Ended May 31, | |||||||||||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||||||

| Net Asset Value, beginning of period |

$ | 28.72 | $ | 25.20 | $ | 21.30 | $ | 22.06 | $ | 18.18 | $ | 16.07 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income from Investment Operations: |

||||||||||||||||||||||||

| Net investment income* |

0.27 | 0.63 | 0.49 | 0.46 | 0.39 | 0.37 | ||||||||||||||||||

| Net realized and unrealized gain (loss) |

0.86 | 3.41 | 3.93 | (0.74 | ) | 3.90 | 2.07 | |||||||||||||||||

| Contributions from advisor |

— | — | — | — | 0.00 | (a) | — | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net increase (decrease) in net asset value from operations |

1.13 | 4.04 | 4.42 | (0.28 | ) | 4.29 | 2.44 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net investment income |

— | (0.52 | ) | (0.52 | ) | (0.48 | ) | (0.41 | ) | (0.33 | ) | |||||||||||||

| Net realized capital gains |

— | — | — | — | — | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total distributions |

— | (0.52 | ) | (0.52 | ) | (0.48 | ) | (0.41 | ) | (0.33 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net Asset Value, end of period |

$ | 29.85 | $ | 28.72 | $ | 25.20 | $ | 21.30 | $ | 22.06 | $ | 18.18 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Return** |

3.93 | % | 16.14 | % | 20.94 | % | (1.17 | )% | 23.74 | % | 15.13 | % | ||||||||||||

| Ratios/Supplemental Data: |

||||||||||||||||||||||||

| Net assets, end of period (000’s omitted) |

$ | 41,810 | $ | 40,233 | $ | 30,264 | $ | 29,834 | $ | 35,307 | $ | 32,740 | ||||||||||||

| Ratios to average net assets: |

||||||||||||||||||||||||

| Expenses, net of fee waiver and expense reimbursements |

0.65 | %† | 0.65 | % | 0.65 | % | 0.65 | % | 0.65 | % | 0.65 | % | ||||||||||||

| Expenses, prior to fee waiver and expense reimbursements |

1.12 | %† | 1.10 | % | 1.16 | % | 1.18 | % | 1.43 | % | 1.95 | % | ||||||||||||

| Net investment income |

1.89 | %† | 2.34 | % | 2.11 | % | 2.17 | % | 1.93 | % | 2.01 | % | ||||||||||||

| Portfolio turnover rate†† |

37 | % | 36 | % | 46 | % | 40 | % | 39 | % | 42 | % | ||||||||||||

| For the Six Months Ended November 30, 2014 (Unaudited) |

||||||||||||||||||||||||

| Deutsche X-trackers 2040 Target Date ETF |

Year Ended May 31, | |||||||||||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||||||

| Net Asset Value, beginning of period |