UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2015 |

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________ to _________ |

SEC File No. 333-140299

SILVERSTAR RESOURCES, INC. |

(Exact name of registrant as specified in its charter) |

Nevada | 98-0425627 | |

(State or other jurisdiction of incorporation or organization) | (IRS I.D.) |

1440 NW 1st Court, Boca Raton FL. | 33432 | |

(Address of principal executive offices) | (Zip Code) |

Issuer's telephone number: (561) 939-2493.

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K . o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | o | Accelerated filer | o |

Non-accelerated filer | o | Smaller reporting company | x |

(Do not check if a smaller reporting company) | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act.) Yes o No x

The number of shares outstanding of the Company's $.001 Par Value Common Stock as of February 19, 2016 was 3,436,840. The aggregate number of shares of the voting stock held by non-affiliates on February 19, 2016 was 984,524 with a market value of $226,441. For the purposes of the foregoing calculation only, all directors and executive officers of the registrant have been deemed affiliates.

DOCUMENTS INCORPORATED BY REFERENCE: None.

We have 3,436,840 shares of common stock outstanding as of February 19, 2016.

TABLE OF CONTENTS

PART I | |||||

Item 1. | Description of Business | 4 | |||

Item 2. | Description of Property | 12 | |||

Item 3. | Legal Proceedings | 16 | |||

Item 4. | Submission of Matters to a Vote of Security Holders | 16 | |||

Item 5. | Market for Common Equity and Related Stockholder Matters and Small Business Issuer Purchases of Equity Securities | 17 | |||

Item 6. | Selected Consolidated Financial Data | 18 | |||

Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operation | 19 | |||

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 23 | |||

Item 8. | Financial Statements | 24 | |||

Item 9. | Changes In and Disagreements With Accountants on Accounting and Financial Disclosures | 37 | |||

Item 9A. | Controls and Procedures | 37 | |||

Item 9B. | Other Information | 37 | |||

Item 10. | Directors, Executive Officers, Promoters, Control Persons and Corporate Governance; Compliance with Section 16(a) of the Exchange Act | 38 | |||

Item 11. | Executive Compensation | 40 | |||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 41 | |||

Item 13. | Certain Relationships and Related Transactions, and Director Independence. | 43 | |||

Item 14. | Principal Accountant Fees and Services | 43 | |||

Item 15. | Exhibits | 44 | |||

| 2 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS AND INFORMATION

This Annual Report on Form 10-K, the other reports, statements, and information that we have previously filed or that we may subsequently file with the Securities and Exchange Commission, or SEC, and public announcements that we have previously made or may subsequently make include, may include, incorporate by reference or may incorporate by reference certain statements that may be deemed to be "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 and are intended to enjoy the benefits of that act. Unless the context is otherwise, the forward-looking statements included or incorporated by reference in this Form 10-K and those reports, statements, information and announcements address activities, events or developments that Silverstar Resources, Inc. (hereinafter referred to as "we," "us," "our," "our Company" or "SR") expects or anticipates, will or may occur in the future. Any statements in this document about expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and are forward-looking statements. These statements are often, but not always, made through the use of words or phrases such as "may," "should," "could," "predict," "potential," "believe," "will likely result," "expect," "will continue," "anticipate," "seek," "estimate," "intend," "plan," "projection," "would" and "outlook," and similar expressions. Accordingly, these statements involve estimates, assumptions and uncertainties, which could cause actual results to differ materially from those expressed in them. Any forward-looking statements are qualified in their entirety by reference to the factors discussed throughout this document. All forward-looking statements concerning economic conditions, rates of growth, rates of income or values as may be included in this document are based on information available to us on the dates noted, and we assume no obligation to update any such forward-looking statements. It is important to note that our actual results may differ materially from those in such forward-looking statements due to fluctuations in interest rates, inflation, government regulations, economic conditions and competitive product and pricing pressures in the geographic and business areas in which we conduct operations, including our plans, objectives, expectations and intentions and other factors discussed elsewhere in this Report.

Certain risk factors could materially and adversely affect our business, financial conditions and results of operations and cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by us, and you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made and we do not undertake any obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. The risks and uncertainties we currently face are not the only ones we face. New factors emerge from time to time, and it is not possible for us to predict which will arise. There may be additional risks not presently known to us or that we currently believe are immaterial to our business. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. If any such risks occur, our business, operating results, liquidity and financial condition could be materially affected in an adverse manner. Under such circumstances, you may lose all or part of your investment.

The industry and market data contained in this report are based either on our management's own estimates or, where indicated, independent industry publications, reports by governmental agencies or market research firms or other published independent sources and, in each case, are believed by our management to be reasonable estimates. However, industry and market data is subject to change and cannot always be verified with complete certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey of market shares. We have not independently verified market and industry data from third-party sources. In addition, consumption patterns and customer preferences can and do change. As a result, you should be aware that market share, ranking and other similar data set forth herein, and estimates and beliefs based on such data, may not be verifiable or reliable.

3

PART I

Item 1. Description of Business

Overview

The address of our principal executive office is located at 1440 NW 1st Court, Boca Raton, FL 33432. Our telephone number is (561) 939-2493. Our company was incorporated in the State of Nevada on December 5, 2003 under the name Computer Maid, Inc. Our company was inactive until February 2006, when we changed our name to Rose Explorations Inc. and became engaged in the exploration of mining properties.

On March 4, 2008, our company completed a merger with our wholly-owned subsidiary, SilverStar Resources, Inc., which was incorporated solely to effect the name change of our company to SilverStar Resources, Inc.

On March 4, 2008, we affected a 3 for 1 forward stock split of our authorized, issued and outstanding common stock. As a result, our authorized capital increased from 75,000,000 shares of common stock with a par value of $0.001 to 225,000,000 shares of common stock with a par value of $0.001.

On April 13, 2011, we incorporated a wholly owned subsidiary, Silverstar Mining (Canada) Inc., under the federal laws of Canada. The subsidiary's main purpose is to hold title to mineral property rights situated in Canada as the laws of that country require that only local entities can hold title to mineral property rights situated within its borders.

Effective September 26, 2011, we affected a reverse split our common stock on a 1,000 for 1 basis. As a result of the foregoing, we reduced the number of authorized shares of our common stock from 225,000,000 to 225,000.

On February 29, 2012, we filed a Certificate of Amendment to our company's Articles of Incorporation with the Nevada Secretary of State increasing the number of authorized shares from 225,000 to 225,000,000 shares of common stock $0.001 par value.

On July 22, 2013 we entered into settlement agreements with four debt holders of our company pursuant to which we restructured outstanding demand loans payable in the aggregate amount of $175,028 (inclusive of accrued interest) as convertible debentures.

On February 15, 2013, we closed a Share Exchange Agreement pursuant to which we intended to acquire a wholly owned subsidiary, Arriba Resources Inc. However, effective November 13, 2013 our Board of Directors approved the cancellation and reversal of the Share Exchange Agreement due to a failure of consideration on the part of the seller. As a result of the cancellation and reversal of the Share Exchange Agreement, 2,139,926 shares of our common stock and warrants to acquire 2,078,477 shares of our common stock which were previously authorized (but not issued from treasury) have been cancelled with immediate effect. Consequently, the change of control announced in our current report on Form 8-K filed on May 21, 2013 has been reversed.

As a result of the cancellation and reversal of the Share Exchange Agreement with Arriba, the consolidated financial statements of our Company for the quarterly periods ended March 31, 2013 (filed with the SEC on August 14, 2013) and June 30, 2013 (filed with the SEC on May 20, 2013) may no longer be relied upon owing to their inclusion of the financial information of Arriba. We informed our independent accountants of the cancellation and reversal of the Share Exchange Agreement and intend to file amendments to our Quarterly Reports on Form 10-Q for the periods ended March 31 and June 30, 2013 to reflect our financial condition without consolidation of the financial information of Arriba. The financial statements contained in this current report accurately reflect the deconsolidation of the financial information of Arriba.

On January 23, 2015 the board of directors with the consent of a majority of its shareholders approved amended articles of incorporation to include a change of name to Silverstar Resources, Inc. and a reverse split of its common stock resulting in shareholders receiving one share for every five shares (5 to 1) they hold as of record of that date. In addition, the amendment set the authorized shares of common stock at 225,000,000 and preferred stock at 5,000,000 shares both at a par value of $0.001.

On March 10, 2015 the Company formed 1030029 Ltd, an Alberta numbered company as a wholly owned subsidiary to meet the requirements of holding working interest of Alberta producing oil and gas properties

| 4 |

Current Operational Activities

Mineral Exploration

On May 16, 2011, we entered into an Agreement of Purchase and Sale with Jaime Mayo to acquire a 100% in three 3 mineral claims known as the Abhau Lake Property (constituting approximately 1,006 hectares) located in the Caribou Mining District near the city of Quesnel, in east-central British Columbia, Canada. In consideration of the property, we paid $10,000 cash as a deposit and issued 2,000 (now 2,000,000 post-split) common shares upon closing. The claims are subject to a 2% NSR (Net Smelter Royalty). We have an option to purchase 1% of the NSR for $1 million and an additional 0.5% of the NSR $500,000.

On February 7, 2012 we paid Terracad Geoscience Services $4,040 to re-stake the claims, which had expired, in the name of SilverStar Resources, Inc.

On June 12, 2012 we paid Terracad Geoscience Services $10,000 as a pre-payment against an estimated $15,000 charge to prepare the National Instrument 43-101 compliant technical report for the Quesnel property. The work was completed and we received final invoicing for the work on October 1, 2012 in the amount of $15,533 which was recorded as Investment in Mineral Property.

On April 14, 2015 the Company acquired the working interest of two producing oil and gas properties in Alberta Canada for US $80,000.

The Company has determined that the asset does not fit the future plans of the Company. Under the guidelines of ASC 360 Newly Acquired Asset Classified as Held for Sale, the Company is actively seeking to dispose of the asset through a sale. As part of the treatment of the asset for sale the Company under ASC 205 Discontinued Operations has treated the expenses related with its acquisition of $3,942 as discontinued operations expense. During the year ended September 30, 2015, the Company determined that this asset had become impaired and took a charge to earnings of $80,000 which is also reflected in discontinued operations.

Market, Customers and Distribution Methods

Although there can be no assurance, large and well capitalized markets are readily available for energy throughout the world. A very sophisticated futures market for the pricing and delivery of future production also exists. The price for energy is affected by a number of global factors, including economic strength and resultant demand for minerals for production, fluctuating supplies, mining activities and production by others in the industry, and new and or reduced uses for subject minerals.

The mining industry is subject to a number of factors, including intense industry competition, high susceptibility to economic conditions (such as price of minerals, foreign currency exchange rates, and capital and operating costs), and political conditions (which could affect such things as import and export regulations, foreign ownership restrictions). Furthermore, the mining activities are subject to all hazards incidental to mineral exploration, development and production, as well as risk of damage from earthquakes, any of which could result in work stoppages, damage to or loss of property and equipment and possible environmental damage. Hazards such as unusual or unexpected geological formations and other conditions are also involved in mineral exploration and development.

Competition

We compete with other energy resource exploration companies for financing and for the acquisition of new properties. Many of the resource exploration companies with whom we compete have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on acquisitions of properties of merit, on exploration of their properties and on development of their properties. In addition, they may be able to afford more geological expertise in the targeting and exploration of properties. This competition could result in competitors having l properties of greater quality and interest to prospective investors who may finance additional exploration and development. This competition could adversely impact on our ability to achieve the financing necessary for us to conduct further exploration of our mineral properties.

Intellectual Property

We currently do not hold any intellectual property or operate a website.

| 5 |

Government Regulations

Canada

Any mineral properties that we may have will be subject to various Federal and Provincial laws and regulations in Canada which govern prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, protection of the environment, mine safety, hazardous substances and other matters. We will be required to obtain those licenses, permits or other authorizations currently required to conduct exploration and other programs. There are no current orders or directions relating to us or the Newfoundland Property with respect to the foregoing laws and regulations. Such compliance may include feasibility studies on the surface impact of our proposed operations, costs associated with minimizing surface impact, water treatment and protection, reclamation activities, including rehabilitation of various sites, on-going efforts at alleviating the mining impact on wildlife and permits or bonds as may be required to ensure our compliance with applicable regulations. It is possible that the costs and delays associated with such compliance could become so prohibitive that we may decide to not proceed with exploration, development, or mining operations on any of our mineral properties. We are not presently aware of any specific material environmental constraints affecting our property that would preclude the economic development or operation of property in Canada.

Environmental Regulations

We are not aware of any material violations of environmental permits, licenses or approvals that have been issued with respect to our operations. We expect to comply with all applicable laws, rules and regulations relating to our business, and at this time, we do not anticipate incurring any material capital expenditures to comply with any environmental regulations or other requirements.

While our intended projects and business activities do not currently violate any laws, any regulatory changes that impose additional restrictions or requirements on us or on our potential customers could adversely affect us by increasing our operating costs or decreasing demand for our products or services, which could have a material adverse effect on our results of operations.

Subsidiaries

We have one wholly-owned subsidiary, Silverstar Mining Canada, Inc., a company incorporated under the federal laws of Canada.

Research and Development Expenditures

We incurred $0 and $29,893 in mineral property and exploration expenditures during the fiscal years ended September 30, 2015 and 2014, respectively.

Employees

As of September 30, 2015, we had no employees. Our directors and officers provided their services to our company on a consulting basis and without formal employment agreements.

ITEM 1A: RISK FACTORS

There are numerous and varied risks, known and unknown, that may prevent us from achieving our goals. If any of these risks actually occur, our business, financial condition or results of operations may be materially adversely affected. In such case, the trading price of our common stock could decline and shareholders could lose all or part of their investment.

Risks Related to our Business Operations

We have not generated revenues from operations. We have a history of losses and losses are likely to continue in the future.

We have incurred significant losses in the past and we will likely continue to incur losses in the future unless our drilling program proves successful. Even if drilling program is successful, there can be no assurance that we will be able to commercially exploit these resources, generate further revenues or generate sufficient revenues to operate profitably.

We may not be able to generate revenue sufficient to maintain operations.

We have incurred significant losses since inception and there can be no assurance that we will be able to reverse this trend. Even if we are able to successfully identify commercially exploitable gold and silver reserves, there is no assurance that we will have sufficient financing to exploit these reserves, generate revenues or find a willing buyer for the properties.

| 6 |

Exploration for economic deposits of gold and silver is speculative.

Our business is very speculative since there is generally no way to recover any of the funds expended on exploration unless the existence of commercially exploitable reserves are established and our company can exploit those reserves by either commencing drilling operations, selling or leasing its interest in the property, or entering into a joint venture with a larger company that can further develop the property. Unless we can establish and exploit reserves before our funds are exhausted, we will have to discontinue operations, which could make our stock valueless.

The gold and silver industry is highly competitive and the success and future growth of our business depend upon our ability to remain competitive in identifying and developing properties with sufficient reserves for economic exploitation.

The gold and silver industry is highly competitive and fragmented with limited barriers to entry, especially at the exploratory stages. We compete in national, regional and local markets with large multi-national corporations and against start-up operators hoping to identify a gold or silver property. Some of our competitors have significantly greater financial resources than we do. This puts us at a competitive disadvantage if we choose to further exploit drilling opportunities.

The oil and gas industry is highly competitive and the success and future growth of our business depend upon our ability to remain competitive in identifying and developing properties with sufficient reserves for economic exploitation.

The oil and gas industry is highly competitive and fragmented with limited barriers to entry, especially at the exploratory stages. We compete in national, regional and local markets with large multi-national corporations and against start-up operators hoping to identify an oil or gas property. Some of our competitors have significantly greater financial resources than we do. This puts us at a competitive disadvantage if we choose to further exploit drilling opportunities.

Our management has no experience in energy operations.

Our current management has never been involved in the exploration business. As such, there is substantial doubt whether management has the expertise to effectively run our business and implement our business plan. As such, we will have to retain additional officers or board members who have experience in the mining sector. Alternatively, we will have to rely on consultants or other third party suppliers. Reliance on outside consultants will require the expenditure of significant sums of money which we do not have. As such, the successful launch of an exploratory drilling program remains in doubt.

We will require additional financing to continue our operations.

We will require significant working capital to undertake our exploration program. There can be no assurance that we will be able to secure additional funding to meet our objectives or if we are able to identify funding sources, that the funding will be available on terms acceptable to our company. Should this occur, we will have to significantly reduce our drilling and mining programs.

We may not identify proven reserves to develop any of our properties and our estimates may be inaccurate.

There is no certainty that any expenditures made in our exploration program will result in discoveries of commercially recoverable quantities of gold, silver, oil or natural gas. Most exploration projects do not result in the discovery of commercially extractable deposits of gold, silver, oil and gas and no assurance can be given that any particular level of recovery will in fact be realized or that any identified leasehold interest will ever qualify as a commercially developed. Estimates of reserves, deposits and production costs can also be affected by such factors as environmental regulations and requirements, weather, unexpected or unknown results when we re-enter a well, environmental factors, unforeseen technical difficulties, unusual or unexpected geological formations and work interruptions. Material changes in estimated reserves, exploration and mining costs may affect the economic viability of any project.

We have no proven reserves.

Our leasehold interests are without known bodies (reserves) of commercial gold or silver gas and oil. Development of these properties will follow only upon obtaining satisfactory exploration results. The long-term profitability of our company's operations will be in part directly related to the cost and success of its exploration and mining programs. Mining for gold and silver and other base metals as well as oil and gas is a highly speculative business involving a high degree of risk. Few properties which are explored are ultimately developed into producing mines and or wells. There is no assurance that our exploration program will result in any discoveries of commercial quantities of gold or silver, oil and gas. There is also no assurance that, even if commercial quantities of gold or silver are discovered, a mine can be brought into commercial production. Production/discovery of gold and silver, oil and gas is dependent upon a number of factors, not the least of which is the technical skill of the exploration personnel involved. The commercial viability of a mine is also dependent upon a number of factors, many of which are beyond our company's control, such as worldwide economy, the price of gold and silver, the price of oil and gas, government regulations, including regulations relating to royalties, allowable production and environmental protection.

| 7 |

During our operations we may experience certain unanticipated conditions may arise or unexpected or unusual events may occur, including fires, floods, or earthquakes. It is not always possible to fully insure against such risks and we may decide not to take out insurance against such risks as a result of high premiums or for other reasons. Should such liabilities arise, they may reduce or eliminate any future profitability and may result in a decline in the value of the securities of our company.

We have no history as a company engaged in the mining business.

We have no history of earnings or cash flow from mining activities. If we identify proven reserves and are able to proceed to production, commercial viability will be affected by factors that are beyond our control such as the particular attributes of the deposit, the fluctuation in the prices of gold and silver, the cost of construction and operating a mining operation, the availability of economic sources for energy, government regulations including regulations relating to prices, royalties, restrictions on production, quotas on exploration, as the costs of protection of the environment.

Our estimates of resources are subject to uncertainty.

Estimates of resources are subject to considerable uncertainty. Such estimates are arrived at using standard acceptable geological techniques, and are based on the interpretations of geological data obtained from drill holes and other sampling techniques. Engineers use feasibility studies to derive estimates of cash operating costs based on anticipated tonnage and grades of ore to be mined and processed, the predicted configuration of the ore bodies, expected recovery rates of metal from ore, comparable facility and operating costs and other factors. Actual cash operating costs and economic returns on projects may differ significantly from the original estimates, primarily due to fluctuations in the current prices of metal commodities extracted from the deposits, changes in fuel costs, labor rates, changes in permit requirements, and unforeseen variations in the characteristics of the ore body. Due to the presence of these factors, there is no assurance that any geological reports will accurately reflect actual quantities of gold or silver that can be economically processed and mined by us.

We face many operating hazards.

The development and operation of a mining property involves many risks, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. These risks include, among other things, ground fall, flooding, environmental hazards and the discharge of toxic chemicals, explosions and other accidents. Such occurrences may result in work stoppages, delays in production, increased production costs, damage to or destruction of mines and other producing facilities, injury or loss of life, damage to property, environmental damage and possible legal liability for such damages.

We will be subject to compliance with government regulation that may increase the anticipated cost of those operations.

There are significant governmental regulations that materially restrict mineral property operations. We may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land, in order to comply with these regulations. Permits and regulations will control all aspects of our exploration program. Examples of regulatory requirements include:

(a) | Water discharge will have to meet drinking water standards; |

(b) | Dust generation will have to be minimal or otherwise re-mediated; |

(c) | Dumping of material on the surface will have to be re-contoured and re-vegetated with natural vegetation; |

(d) | An assessment of all material to be left on the surface will need to be environmentally benign; |

(e) | Ground water will have to be monitored for any potential contaminants; |

(f) | The socio-economic impact of our operation of the Property will have to be evaluated and, if deemed negative, will have to be re-mediated; and |

(g) | There may have to be an impact report of the work on the local fauna and flora, including a study of potentially endangered species. |

| 8 |

We do not maintain liability insurance.

We do not maintain liability insurance. As such, if we are found liable for any action, whether intentional or unintentional, we will be required to satisfy the liability with our own funds. Currently we have nominal assets and any monetary award would likely result in the close of our operations. Even assuming a significant increase in our assets and we secure liability insurance, the amount of the coverage may be insufficient to cover to insure against any award. Since our company may not be able, or may elect not to insure, this may result in a material adverse change in our company's financial position. The nature of these risks is such that liabilities may exceed policy limits, in which event our company would incur substantial uninsured losses.

Environmental and Occupational Regulations will impact our operations.

We are subject to various federal, provincial, and local international laws and regulations concerning occupational safety and health as well as the discharge of materials into, and the protection of, the environment. Environmental laws and regulations relate to, among other things:

· | assessing the environmental impact of our exploration and mining activities; | |

· | the generation, storage, transportation and disposal of waste materials; | |

· | the emission of certain gases into the atmosphere; | |

· | the monitoring, abandonment, reclamation and remediation of our mining claims, including sites of former operations; and | |

· | the development of emergency response and contingency plans. |

The costs of environmental protection and safety and health compliance are significant. Compliance with environmental, safety and health initiatives can be costly. There is no assurance that we will be able to comply with these regulations. If we cannot comply with these regulations, we will be forced to cease all operations in which case you will lose your entire investment. We cannot predict with any reasonable degree of certainty our future exposure concerning such matters.

Public policy, which includes laws, rules and regulations, can change.

Our operations are generally subject to federal and provincial rules and regulations. In addition, we are also subject to the laws and regulations of local governments. Pursuant to public policy changes, numerous government departments and agencies have issued extensive rules and regulations binding on the mining industry and its individual members, some of which carry substantial penalties for failure to comply. Changes in such public policy have affected, and at times in the future could affect, our operations. Political developments can restrict production levels, enact price controls, change environmental protection requirements, and increase taxes, royalties and other amounts payable to governments or governmental agencies. Existing laws and regulations can also require us to incur substantial costs to maintain regulatory compliance. Our operating and other compliance costs could increase further if existing laws and regulations are revised or reinterpreted or if new laws and regulations become applicable to our operations. Although we are unable to predict changes to existing laws and regulations, such changes could significantly impact our profitability, financial condition and liquidity, particularly changes related to hydraulic fracturing, income taxes and climate change as discussed below.

Drilling operations are hazardous, raise environmental concerns and raise insurance risks.

Drilling operations are by their nature subject to a variety of risks, such as, flooding, environmental hazards, the discharge of toxic chemicals and other hazards. Such occurrences may delay development or production, increase production costs or result in a liability. We may not be able to insure fully or at all against such risks, due to political or other reasons, or we may decide not to take out insurance against such risks as a result of high premiums or other reasons. We intend to conduct our business in a way that safeguards public health and the environment and in compliance with applicable laws and regulations. Environmental hazards may exist on properties in which we hold an interest which are unknown to us and may have been caused by prior owners. Changes to drilling and mining laws and regulations could require additional capital expenditures and increase operating and/or reclamation costs. Although we are unable to predict what additional legislation, if any, might be proposed or enacted, additional regulatory requirements could render certain operations uneconomic.

| 9 |

If we are unable to obtain all of our required governmental permits, our operations could be negatively impacted.

Our future operations, including exploration and development activities, required permits from various governmental authorities. Such operations are and will be governed by laws and regulations governing prospecting, development, production, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. There can be no assurance that we will be able to acquire all required licenses or permits or to maintain continued operations at our properties.

We are subject to numerous environmental and other regulatory requirements.

All phases of drilling and exploration operations are subject to governmental regulation including environmental regulation. Environmental legislation is becoming stricter, with increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and heightened responsibility for companies and their officers, directors and employees. There can be no assurance that possible future changes in environmental regulation will not adversely affect our operations. As well, environmental hazards may exist on a property in which we hold an interest that was caused by previous or existing owners or operators of the properties and of which our company is not aware at present.

Government approvals and permits are required to be maintained in connection with our drilling and exploration activities. We will require permits for our operations and there is no assurance that delays will not occur in connection with obtaining all necessary renewals of such permits for the existing operations or additional permits for any possible future changes to our company's operations, including any proposed capital improvement programs. Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions there under, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in drilling operations may be required to compensate those suffering loss or damage by reason of our activities and may be liable for civil or criminal fines or penalties imposed for violations of applicable laws or regulations. Amendments to current laws, regulations and permitting requirements, or more stringent application of existing laws, may have a material adverse impact on our company resulting in increased capital expenditures or production costs, reduced levels of production at producing properties or abandonment or delays in development of properties.

There is no assurance that there will not be title or boundary disputes.

Although we have investigated the right to explore and exploit our properties and obtained records from government offices, this should not be construed as a guarantee of title. Other parties may dispute the title to any of our properties or that any property may be subject to prior unregistered agreements and transfers. The title may be affected by undetected encumbrances or defects or governmental actions. Should this occur, we face significant delays, costs and the possible loss of any investments or commitment of capital.

Local infrastructure may impact our exploration activities and results of operations.

Our activities depend, to one degree or another, on adequate infrastructure. Reliable roads, bridges and power and water supplies are important determinants that affect capital and operating costs. Unusual or infrequent weather phenomena sabotage or government or other interference in the maintenance or provision of such infrastructure could adversely affect the activities and profitability of our company.

Because of the speculative nature of exploring and/or mining for gold and silver, there is significant risk that our business will fail.

Gold and silver exploration is extremely risky. We cannot provide any assurances that our activities will result in commercially exploitable reserves of gold and silver. Exploration for gold and silver is a speculative venture necessarily involving substantial risk. Any expenditure that we make may not result in the discovery of commercially exploitable reserves.

The market for gold and silver is volatile. This will have a direct impact on our company's revenues (if any) and profits (if any) and will probably have an adverse effect on our ongoing operations.

The price of both gold and silver has fluctuated significantly over the past few years. This has contributed to the renewed interest in gold and silver exploration. However, in the event that the price of either gold or silver falls, the interest in exploratory ventures may decline and the value of our company's business could be adversely affected.

| 10 |

Because of the speculative nature of exploring and/or mining for oil and gas, there is significant risk that our business will fail.

Oil and Gas exploration is extremely risky. We cannot provide any assurances that our activities will result in commercially exploitable reserves of gold and silver. Exploration for oil and gas is a speculative venture necessarily involving substantial risk. Any expenditure that we make may not result in the discovery of commercially exploitable reserves.

The market for oil and gas is volatile. This will have a direct impact on our company's revenues (if any) and profits (if any) and will probably have an adverse effect on our ongoing operations.

The price of both oil and gas has fluctuated significantly over the past few years. This has contributed to the renewed interest in oil and gas exploration. However, in the event that the price of either gold or silver falls, the interest in exploratory ventures may decline and the value of our company's business could be adversely affected.

We are in competition with companies that are larger, more established and better capitalized than we are.

Many of our potential competitors have:

· | greater financial and technical resources; | |

· | longer operating histories and greater experience. |

We may be exposed to potential risks relating to our internal control over financial reporting and our ability to have those controls remediated timely.

Pursuant to rules of the SEC implemented pursuant to Section 404 of the Sarbanes-Oxley Act, the independent registered public accounting firm auditing a public company's financial statements must attest to and report on the operating effectiveness of that public company's internal control over financial reporting.

Pursuant to Section 404 of the Sarbanes-Oxley Act, as amended by SEC Release 33-8934 on June 26, 2008, we are required to include in our annual reports our assessment of the effectiveness of our internal control over financial reporting as of the end of our fiscal years. Furthermore, our independent registered public accounting firm will be required to report separately on whether it believes that we have maintained, in all material respects, effective internal control over financial reporting. We have not yet completed any assessment of the effectiveness of our internal control over financial reporting. We expect to incur additional expenses and diversion of our management's time as a result of performing the system and process evaluation, testing and remediation required in order to comply with our management certification and auditor attestation requirements.

In the event we identify control deficiencies that we cannot remedy in a timely manner, or if we are unable to receive an unqualified attestation report from our independent registered public accounting firm with respect to our internal control over financial reporting, investors and others may lose confidence in the reliability of our financial statements, and the trading price of our common stock, if a market ever develops, and our ability to obtain any necessary financing could suffer.

Our officers have limited experience in managing a public company.

Our officers have limited experience in managing a public company, and we do not have any employees to segregate responsibilities and may be unable to afford increasing our staff or engaging outside consultants or professionals to overcome our lack of employees. During the course of our operations, we may identify other deficiencies that we may not be able to remedy in time to satisfy the requirements imposed by the Sarbanes-Oxley Act for compliance with that Section 404. In addition, if we fail to achieve and maintain the adequacy of our internal controls, as such requirements are modified, supplemented or amended from time to time, we may not be able to ensure that we can conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act. Moreover, effective internal controls, particularly those related to revenue recognition, are necessary for us to produce reliable financial reports and are important to help prevent financial fraud. If we cannot provide reliable financial reports or prevent fraud, our business and operating results could be harmed, investors could lose confidence in our reported financial information, and the trading price of our common stock, if a market for our common stock develops, could drop significantly.

Our officers do not have employment agreements with us and could cease working for us at any time, causing us to cease our operations.

Our officers do not have employment agreements (written or verbal) with us. In the absence of such employment agreements with restrictive covenants on the part of our officers, our officers could leave us at any time or commence working for a competitive business. Furthermore, applicable law under which we operate may cast substantial doubt on the enforceability of any restrictive covenants that we may obtain from our officers in the future. Accordingly, the continued services of our officers cannot be assured. If our officers were to cease working for us, we may have to cease operations.

| 11 |

Risks Related to Our Common Stock

Trading on the OTC Bulletin Board may be volatile and sporadic, which could depress the market price of our common stock and make it difficult for our stockholders to resell their shares.

Our common stock is quoted on the OTC Bulletin Board service of the Financial Industry Regulatory Authority. Trading in stock quoted on the OTC Bulletin Board is often thin and characterized by wide fluctuations in trading prices, due to many factors that may have little to do with our operations or business prospects. This volatility could depress the market price of our common stock for reasons unrelated to operating performance. Moreover, the OTC Bulletin Board is not a stock exchange, and trading of securities on the OTC Bulletin Board is often more sporadic than the trading of securities listed on a quotation system like NASDAQ or a stock exchange like Amex.

The Financial Industry Regulatory Authority sales practice requirements may also limit a stockholder's ability to buy and sell our stock.

In addition to the "penny stock" rules described above, the Financial Industry Regulatory Authority, which we refer to as FINRA, has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, the FINRA believes that there is a high probability that speculative low-priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for shares of our common stock.

ITEM 1B: UNSOLVED STAFF COMMENTS

As a "smaller reporting company", we are not required to provide the information required by this Item.

Additional Information

We are a public company and file annual, quarterly and special reports and other information with the SEC. We are not required to, and do not intend to, deliver an annual report to security holders. You may read and copy any document we file at the SEC's public reference room at 100 F Street, N.E., Washington, D.C. 20549. You can request copies of these documents by writing to the SEC and paying a fee for the copying cost. Please call the SEC at 1-800-SEC-0330 for more information about the operation of the public reference room. Our filings are also available, at no charge, to the public at http://www.sec.gov.

Item 2. Description of Property

Our executive offices are located at 1440 NW 1st Court, Boca Raton FL 33432. These are virtual offices rented for $115 per month on a month to month basis.

Mineral Properties

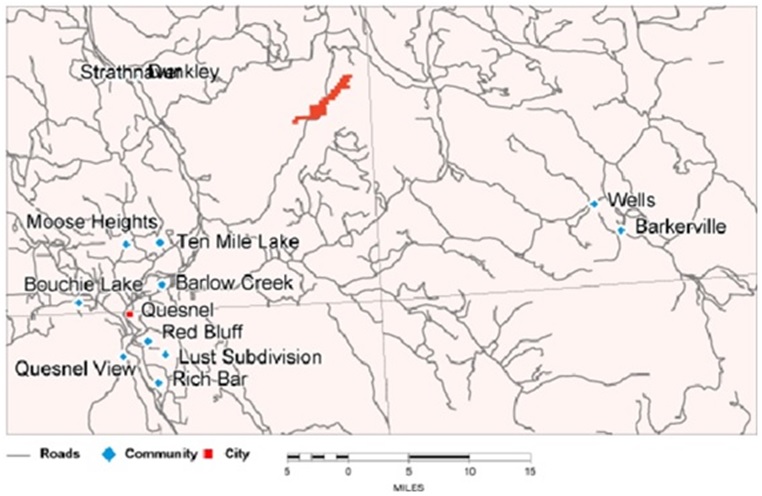

We currently hold property in the Caribou Mining District in east-central British Columbia or approximately 65 km northeast of Quesnel, British Columbia, Canada. We have one mining claims in British Columbia, Canada. Subject to securing additional financing, our goal is to explore these mining claims to determine if there are indicated or proven reserves of either gold, silver or base metals.

| 12 |

Ahbau Lake Property, Caribou Mining District, British Columbia

On May 16, 2011, our wholly owned subsidiary, Silverstar Mining Canada, Inc., entered into an agreement of purchase and sale with Jaime Mayo to acquire 100% of the Ahbau Lake Property, Caribou Mining Division, Quesnel District, British Columbia ("AHB Claims") located in British Columbia, Canada. The AHB Claims consist of 3 claims (approximately 1,006 ha).

Our company paid $10,000 cash as a deposit and issued 2,000,000 common shares upon closing and is subject to a 2% net smelter royalty. Our company has an option to purchase 1% of the net smelter royalty for $1 million and an additional 0.5% of the NSR $500,000.

On February 7, 2012, our company paid Terracad Geoscience Services $4,040 to re-stake the claims, which had expired, in the name of SilverStar Resources, Inc.

As of September 30, 2013, the Company paid Terracad Geoscience Services $15,533 to prepare the National Instrument 43-101 compliant technical report for the Quesnel property, Central British Columbia, Canada. As of September 30, 2013 the Company has recorded $29,893 as investment in the mineral property.

The mineral claims are located in the Caribou Mining District in east-central British Columbia.

Technical Report

We received a technical report dated July 20, 2012, written by Erik A. Ostensoe, P. Geo., with respect to the AHB Claims. Pursuant to the technical report Mr. Ostensoe recommended two phases of work for the AHB Claims. The goal for Phase 1 is to conduct geological reconnaissance and prospecting of the entire property, including testing by panning and taking pan concentrate samples from all streams, and MMI-type (mobile metal ion) soil geochemical samples from a grid of sample lines. Phase 2 will comprise improved access, detailed MMI sampling and other work in selected areas that were identified in Phase 1 as having anomalous geochemical responses. Upon completion of Phase 2 work, it will be possible to determine if further work on the AHB Claims are warranted.

| 13 |

Property Location and Access

There is a growing infrastructure in the region as more of its resources are being exploited by various sized peers and competitors in the area.

The SMCI mineral tenures are located within 65 km northeast of Quesnel, British Columbia, in an area that in part has been logged and re-planted. Access is by forestry road to the vicinity of the Willow River: the tenures lie both east and west of that river. The bridge across Willow River is located approximately 1250 metres upstream from the south boundary and a logging branch road follows the east side of Willow River. The total area is 1006 hectares.

The Silverstar claim is approximately 7 to 15 kilometers away from Barkerville. To the south of our property is Tiex, Inc. (TIX.V), nearby is Hawthorne Gold Corp. (HGC.V), Rogers Gold Corp., Barker Minerals, Ltd. (BML.V), next to our property is Touchdown Resources (TDW.V), and the west side of our property is currently occupied by Richfield Ventures Corp. (RCV.V).

We have conducted feasibility studies on the mining claims and definitive results are still not available; however, contiguous and other properties in the immediate vicinity indicate deposits of gold, silver and copper.

| 14 |

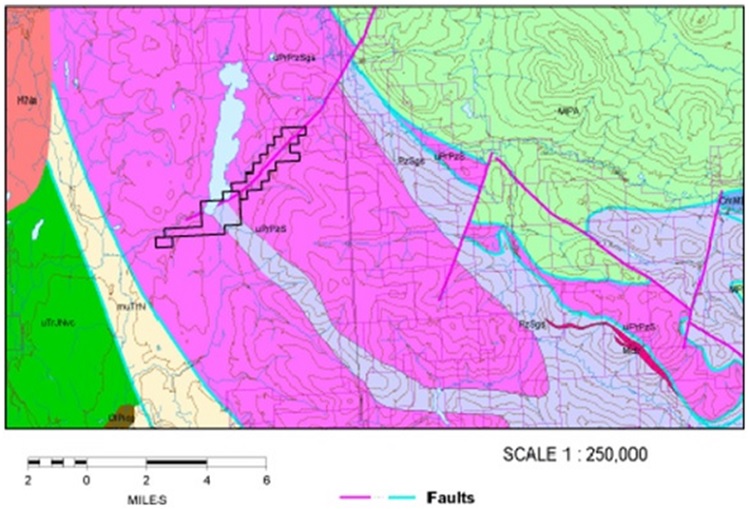

Geology and Mineralization

Soils present on the SMCI property are mostly residual soils developed over clay-rich glacial-fluvial deposits that were deposited in the waning stages of Quaternary glaciations. Such deposits are inherently inhomogeneous and include materials that have been transporteden masseby glacier and stream movement, with periodic episodes of ice ponding during which fine rock flour and silt particles accumulated in quiescent lakes and ponds. During and following de-glaciation, large water flows coupled with post-glacial elastic crustal rebounding modified the landscape to create terrain that approximates that of today. Despite research and various terrain studies, traditional geochemical survey methods have been mostly unsuccessful in relating geochemical analyses to mineral deposits. Multimode interference ("MMI") techniques, initially developed to help explore in areas of deep chemical weathering, were modified to be applicable to many different soil types and have proven successful in recognizing metallic mineralization beneath glacial gravels, sands, and lake clays, as well as wet and sandy organic rich soils. There are many fully licensed laboratories that offer MMI analytical methods, including proprietary extractants specifically designed to treat a variety of multi-element packages. The MMI extractant has the broadest application and is well suited to reconnaissance and early-stage sampling that can be conducted on the SMCI property.

The Ahbau Lake area has been included in several programs of geologic investigation by several different public agencies, specifically the Geological Survey of Canada, the Geological Survey branch of the provincial government, and Geoscience BC. Their programs have been directed to the entire Central British Columbia area or, more particularly, to the Nechako Basin with overlap into nearby terrains. The initiatives have been directed to provision of background data in areas of drift cover that may mask structures and formations that have the potential to host valuable deposits of metals (and also, of oil and natural gas). The most potent technical tools include airborne geophysical surveys, including magnetic, electromagnetic, gravity surveys, and geochemical surveys, including Regional Geochemical Surveys that collect and analyze waters, stream sediments and, on occasion, soils.

The AHB Claims are prospective for deposits of both bedrock and placer gold that may be similar to those that comprise the Barkerville "Caribou" gold district. The geologic model includes quartz veins and quartz vein stockworks in deformed sedimentary formations that have been subjected to lower greenschist facies metamorphism. The initial source of gold may have been as disseminations in the host rocks with subsequent mobilization by tectonic events into quartz veins.

An estimated 1 million grams of placer gold, in the period 1864 to 1874, is estimated to have been recovered from workings located on Ahbau Creek, about two to ten km southwest of the AHB Claims (source: government reports quoted in the Cyprus Anvil property data files). Other placer mining operations, in the mid-1900s, were located between Ahbau and Lodi Lakes, but there appear to be no records of the amount of gold that was recovered. The gold recovered by placer miners is almost certainly derived from nearby bedrock sources but might also have been concentrated by reworking of the extensive deposits of glacially transported materials that may have been carried relatively long distances by the ice sheets.

| 15 |

There is no history of drilling on the land that we have identified. An immediate neighbor, Touchdown Resources, has recently finished a sampling program on their property contiguous to our company's property.

Climate

The general Quesnel area of central British Columbia experiences warm summers with occasional thunderstorms and moderately cold winters. Snow accumulations seldom exceed one metre at lower elevations and two metres at higher levels. Mineral exploration field work can be conducted from May through October; drilling operations can be conducted year-round.

Item 3. Legal Proceedings

We are not a party to any material legal proceedings nor are we aware of any circumstance that may reasonably lead any third party to initiate material legal proceedings against us.

Item 4. Mine Safety Disclosures

None

16

PART II

Item 5. Market for Common Equity and Related Stockholder Matters and Small Business Issuer Purchases of Equity Securities

Our shares of common stock are currently trading on the Over the Counter Market under the Symbol "SLVM". Our shares of common stock were initially approved for quotation on the OTC Bulletin Board on October 18, 2007 under the name "Rose Explorations Inc." under the symbol, "ROEX". On March 4, 2008, we changed our name to "SilverStar Resources, Inc." upon completion of our merger with our wholly owned subsidiary, "SilverStar Resources, Inc.". On January 23, 2015, we changed our name to Silverstar Resources, Inc.

Trading History

Our common stock is quoted on the Over-The-Counter Market under the symbol "SLVM"

Bid Information*

Financial Quarter Ended |

| High Bid |

|

| Low Bid |

| ||

September 30, 2015 |

| $ | 6.00 |

|

|

| 2.25 |

|

June 30, 2015 |

| $ | 6.00 |

|

|

| 2.25 |

|

March 31, 2015 |

| $ | 1.50 |

|

|

| .25 |

|

December 31, 2014 |

| $ | 2.40 |

|

|

| 1.75 |

|

September 30, 2014 |

| $ | 3.95 |

|

| $ | 1.75 |

|

June 30, 2014 |

| $ | 3.00 |

|

| $ | 1.75 |

|

March 31, 2014 |

| $ | 4.00 |

|

| $ | 2.50 |

|

December 31, 2013 |

| $ | 2.55 |

|

| $ | 2.10 |

|

________________

| * | The quotation do not reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions. |

Holders

As of February 17, 2016, there were approximately 98 holders of record of our common stock. As of such date, 3,436,840 common shares were issued and outstanding.

Our transfer agent is Transfer On Line, Inc. Their mailing address is 512 SE Salmon Street, Portland, OR, 97214 and their telephone number is (503)-227-2950.

Equity Compensation Plans

We do not have in effect any compensation plans under which our equity securities are authorized for issuance and we do not have any outstanding stock options.

Purchase of Equity Securities by the Issuer and Affiliated Purchasers

We did not purchase any of our shares of common stock or other securities during our fourth quarter of our fiscal year ended September 30, 2015.

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities

On January 9, 2013 the Company issued 4,950 common shares to a note holder that was entitled to this amount of shares based on the terms pursuant to a note payable of $30,000. The Company was obligated to issue an additional 250 common shares to satisfy the terms of the note.

On March 28, 2013 warrants to purchase 16,000 common shares were exercised by related parties yielding proceeds of $56,000 in cash received

On April 2, 2013 warrants to purchase 1,000 common shares were exercised by related parties yielding proceeds of $3,500 in cash received. The shares were classified as "shares to be issued" in 2013 and issued on March 26, 2014

On June 20, 2013 warrants to purchase 3,571 common shares were exercised by related parties yielding proceeds of $12,500 in cash received. The shares were classified as "shares to be issued" in 2013 and issued on March 26, 2014

| 17 |

On July 17 2013 the Company received $70,000 in a private transaction to purchase 9,333 shares of common stock of the Company. The shares were classified as "shares to be issued" in 2013 and issued on March 26, 2014

On September 10, 2013 warrants to purchase 429 common shares were exercised by related parties yielding proceeds of $1,500 in cash received. The shares were classified as '"shares to be issued" in 2013 and issued on March 26, 2014

On December 23, 2013 the Company issued 2,483,334 shares of common stock with a value of $34,523 for debt.

On March 19, 2014 the Company issued 34,287 shares of common stock with a value of $60,002 for debt.

On March 26, 2014 the Company issued 14,333 shares of common stock with a value of $87,501 which was offset against the liability "shares to be issued "of $88,125. The difference of $624 was offset against interest expense.

On November 18, 2014 the Company issued 3,000 shares with a value of $12,165 to one individual for accounts payable.

On January 15, 2015 the Company issued 40,000 shares of common stock to an officer with a value of $240,000 for services.

On January 15, 2015 the Company issued 2,000 shares to an individual with a value of $12,000 for services.

On January 15, 2015 the Company issued 800,000 shares of common stock to two entities for the conversion of convertible debt with a value of $10,000.

All of the above noted securities were issued without a prospectus pursuant to Regulation S under the Securities Act. Our reliance upon Rule 903 of Regulation S was based on the fact that the sales of the securities were completed in an "offshore transaction", as defined in Rule 902(h) of Regulation S. We did not engage in any directed selling efforts, as defined in Regulation S, in the United States in connection with the sale of the securities. Each investor was not a U.S. person, as defined in Regulation S, and was not acquiring the securities for the account or benefit of a U.S. person.

Dividends

We have never declared or paid any cash dividends on our common stock. For the foreseeable future, we intend to retain any earnings to finance the development and expansion of our business, and we do not anticipate paying any cash dividends on our common stock. Any future determination to pay dividends will be at the discretion of the Board of Directors and will be dependent upon then existing conditions, including our financial condition and results of operations, capital requirements, contractual restrictions, business prospects and other factors that the Board of Directors considers relevant.

There are no restrictions in our articles of incorporation or bylaws that prevent us from declaring dividends. The Nevada Revised Statutes, however, prohibit us from declaring dividends where, after giving effect to the distribution of the dividend:

| ● | we would not be able to pay our debts as they become due in the usual course of business; or |

| ● | our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of stockholders who have preferential rights superior to those receiving the distribution, unless otherwise permitted under our articles of incorporation. |

Securities Authorized for Issuance under Equity Compensation Plans

None

Item 6. Selected Consolidated Financial Data

Not required.

| 18 |

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operation

The following discussion of our financial condition and results of operations should be read in conjunction with our financial statements and the related notes, and other financial information included in this Form 10-K.

Our Management's Discussion and Analysis contains not only statements that are historical facts, but also statements that are forward-looking. Forward-looking statements are, by their very nature, uncertain and risky. These risks and uncertainties include international, national, and local general economic and market conditions; our ability to sustain, manage, or forecast growth; our ability to successfully make and integrate acquisitions; new product development and introduction; existing government regulations and changes in, or the failure to comply with, government regulations; adverse publicity; competition; the loss of significant customers or suppliers; fluctuations and difficulty in forecasting operating results; change in business strategy or development plans; business disruptions; the ability to attract and retain qualified personnel; the ability to protect technology; the risk of foreign currency exchange rate; and other risks that might be detailed from time to time in our filings with the Securities and Exchange Commission.

Although the forward-looking statements in this Report reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by them. Consequently, and because forward-looking statements are inherently subject to risks and uncertainties, the actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking statements. You are urged to carefully review and consider the various disclosures made by us in this report as we attempt to advise interested parties of the risks and factors that may affect our business, financial condition, and results of operations and prospects.

Overview

The address of our principal executive office is located at 1440 NW 1st Court, Boca Raton FL 33432. Our telephone number is (561) 939-2493. Our company was incorporated in the State of Nevada on December 5, 2003 under the name Computer Maid, Inc. Our company was inactive until February 2006, when we changed our name to Rose Explorations Inc. and became engaged in the exploration of mining properties.

On March 4, 2008, our company completed a merger with our wholly-owned subsidiary, SilverStar Resources, Inc., which was incorporated solely to effect the name change of our company to SilverStar Resources, Inc.

On March 4, 2008, we affected a 3 for 1 forward stock split of our authorized, issued and outstanding common stock. As a result, our authorized capital increased from 75,000,000 shares of common stock with a par value of $0.001 to 225,000,000 shares of common stock with a par value of $0.001.

On April 13, 2011, we incorporated a wholly owned subsidiary, Silverstar Mining (Canada) Inc., under the federal laws of Canada. The subsidiary's main purpose is to hold title to mineral property rights situated in Canada as the laws of that country require that only local entities can hold title to mineral property rights situated within its borders.

Effective September 26, 2011, we affected a reverse split our common stock on a 1,000 for 1 basis. As a result of the foregoing, we reduced the number of authorized shares of our common stock from 225,000,000 to 225,000.

On February 29, 2012, we filed a Certificate of Amendment to our company's Articles of Incorporation with the Nevada Secretary of State increasing the number of authorized shares from 225,000 to 225,000,000 shares of common stock $0.001 par value.

On July 22, 2013 we entered into settlement agreements with four debt holders of our company pursuant to which we restructured outstanding demand loans payable in the aggregate amount of $175,028 (inclusive of accrued interest) as convertible debentures.

On February 15, 2013, we closed a Share Exchange Agreement pursuant to which we intended to acquire a wholly owned subsidiary, Arriba Resources Inc. However, effective November 13, 2013 our Board of Directors approved the cancellation and reversal of the Share Exchange Agreement due to a failure of consideration on the part of the seller. As a result of the cancellation and reversal of the Share Exchange Agreement, 2,139,926 shares of our common stock and warrants to acquire 2,078,477 shares of our common stock which were previously authorized (but not issued from treasury) have been cancelled with immediate effect. Consequently, the change of control announced in our current report on Form 8-K filed on May 21, 2013 has been reversed.

| 19 |

As a result of the cancellation and reversal of the Share Exchange Agreement with Arriba, the consolidated financial statements of our Company for the quarterly periods ended March 31, 2013 (filed with the SEC on August 14, 2013) and June 30, 2013 (filed with the SEC on May 20, 2013) may no longer be relied upon owing to their inclusion of the financial information of Arriba. We informed our independent accountants of the cancellation and reversal of the Share Exchange Agreement and intend to file amendments to our Quarterly Reports on Form 10-Q for the periods ended March 31 and June 30, 2013 to reflect our financial condition without consolidation of the financial information of Arriba. The financial statements contained in this current report accurately reflect the deconsolidation of the financial information of Arriba.

On January 23, 2015 the board of directors with the consent of a majority of its shareholders approved amended articles of incorporation to include a change of name to Silverstar Resources, Inc. and a reverse split of its common stock resulting in shareholders receiving one share for every five shares (5 to 1) they hold as of record of that date. In addition, the amendment set the authorized shares of common stock at 225,000,000 and preferred stock at 5,000,000 shares both at a par value of $0.001.

On March 10, 2015 the Company formed 1030029 Ltd, an Alberta numbered company as a wholly owned subsidiary to meet the requirements of holding working interest of Alberta producing oil and gas properties

Results of Operations

OVERVIEW

The following discussion should be read in conjunction with our audited consolidated financial statements and the related notes for the years ended September 30, 2015 and September 30, 2014 that appear elsewhere in this annual report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to those discussed below and elsewhere in this annual report, particularly in the section entitled "Risk Factors" beginning on page 10 of this annual report.

Our consolidated financial statements are stated in United States Dollars and are prepared in accordance with United States Generally Accepted Accounting Principles.

Results of Operations

The following summary of our results of operations should be read in conjunction with our consolidated financial statements for the year ended September 30, 2015, which are included herein.

Expenses

Operating expenses for the year ended September 30, 2015 were $344,232, representing an increase of $53,485 from the $290,747 in expenses incurred during fiscal 2014. The increase was primarily a result of an overall increase in our business operations and corresponding increases in filing fees, insurance, legal and accounting, and office expense.

Revenue, Net Income and Loss

We have had no revenues for the years ended September 30, 2015 and September 30, 2014.

Our net loss for the year ended September 30, 2015 was $4,759,074 compared to a net loss of $314,491 during the year ended September 30, 2014. The increase in the net loss was primarily due to an increase in the derivative liability an increase in the interest expense and an increase in the loss on settlement of accounts payable.

Our operations to date have been financed by the sale of our common stock and third party loans. Our two largest expenses to date have been legal and accounting fees of $85,947 and mine expense of $111,882. Most of our legal and accounting expenses have been incurred in connection with our regulatory filings with the SEC and in connection with ongoing corporate activities.

We do not anticipate generating revenues in the foreseeable future, and any revenues that we generate may not be sufficient to cover our operating expenses. If we do not succeed in raising additional capital, we may have to cease operations and you may lose your entire investment.

| 20 |

Liquidity and Capital Resources

At September 30, 2015 we had cash of $209 as compared to $24 in cash at September 30, 2014. Our accounts payable and accrued expenses at September 30, 2015 were $114,521 and $118,768 as of September 30, 2014. On September 30, 2015 we had convertible debentures of $18,912 outstanding, convertible debentures outstanding due to related parties of $224,896 outstanding, note payables of $141,989, advances to related parties of $55,746 and a derivative liability of $4,152,164. Compared to our outstanding convertible debentures of $28,912, convertible debentures due to related party of $75,754, note payable of $81,989, and advances of 130,508 as of September 30, 2014. Our total liabilities were $4,708,228 on September 30, 2015 as compared to $435,931 as at September 30, 2014. We have a working capital deficit of $4,708,019 as of September 30, 2015 as compared to our working capital deficit of $435,907 as of September 30, 2014.

We have no revenues to satisfy our ongoing liabilities. Our auditors have issued a going concern opinion. Unless we secure equity or debt financing, of which there can be no assurance, or identify an acquisition candidate, we will not be able to continue any operations.

Working Capital

Our total current assets as of September 30, 2015 was cash of $209 as compared to total current assets of $24 as of September 30, 2014. The increase in current assets was an increase in prepaid expenses and cash.

Our total current liabilities as of September 30, 2015 were $4,708,228 as compared to total current liabilities of $435,931 as of September 30, 2014. The increase in current liabilities was primarily attributed to an increase in share issuance liability accounts payable and accrued liabilities, convertible debentures, and derivative liabilities.

Cash Flows

Operating Activities

Cash used in operating activities was $48,445 for the fiscal year ended September 30, 2015 compared to cash used in operating activities of $209,926 for the fiscal year ended September 30, 2014. The decrease in cash used in operating activities was primarily due to an increase in stock based compensation, the loss in faire value of the derivative liability, the amortization of beneficial conversion feature, impairment of asset and the cease demand loans payable, related party loans, accounts payable and accrued liabilities, offset by the share issuance liabilities and write down in mineral property rights.

Investing Activities

Cash used in investing activities was $20,000 for the fiscal year ended September 30, 2015 compared to cash used in investing activities of $0 for the fiscal year ended September 30, 2014.

Financing Activities

Net Cash provided by Financing Activities for the fiscal year ended September 30, 2015 was $68,630 compared to $204,082 in the year ended September 30, 2014. The decrease was primarily due to $68,630 in proceeds in advances from related parties, compared to $123,853 for the year ended September 30, 2014, proceeds of $0 received in 2015 compared to $81,989 in 2014 and no repayment of credit card advances compared to $1,760 for the previous year. .

| 21 |

Income & Operation Taxes

We are subject to income taxes in the U.S.

We paid no income taxes in USA for the fiscal year end ended September 30, 2015 due to the net operation loss in the USA.

Net Loss

We incurred net losses of $4,759,074 and $ 314,491 for the fiscal year end ended September 30, 2015 and 2014, respectively.

Cash Requirements

We will require additional funds to fund our budgeted expenses over the next 12 months. These funds may be raised through equity financing, debt financing, or other sources, which may result in further dilution in the equity ownership of our shares. There is still no assurance that we will be able to maintain operations at a level sufficient for investors to obtain returns on their investments in our common stock. Further, we may continue to be unprofitable. We need to raise additional funds in the immediate future in order to proceed with our budgeted expenses.

Specifically, we estimate our operating expenses and working capital requirements for the next 12 months to be as follows: