Table of Contents

Confidential Draft Submission No. 2 submitted to the Securities and Exchange Commission on July 26, 2013.

This draft registration statement has not been publicly filed and all information herein remains strictly confidential.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

RINGCENTRAL, INC.

(Exact name of Registrant as specified in its charter)

| Delaware | 7372 |

94-3322844 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

1400 Fashion Island Blvd., 7th Floor,

San Mateo, California 94404

(650) 472-4100

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Vladimir G. Shmunis

Chief Executive Officer

RingCentral, Inc.

1400 Fashion Island Blvd., 7th Floor,

San Mateo, California 94404

(650) 472-4100

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Jeffrey D. Saper Nathaniel P. Gallon Wilson Sonsini Goodrich & Rosati, P.C. 650 Page Mill Road Palo Alto, California 94304 (650) 493-9300 |

John H. Marlow Senior Vice President and General Counsel RingCentral, Inc. 1400 Fashion Island Blvd., 7th Floor, San Mateo, California 94404 (650) 472-4100 |

Eric C. Jensen Andrew S. Williamson Cooley LLP 101 California Street, 5th Floor San Francisco, California 94111 (415) 693-2000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after of this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Fee | ||

| Class A Common Stock, $0.0001 par value per share |

$ | $ | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(o) under the Securities Act. |

| (2) | Includes an additional shares that the underwriters have the option to purchase. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion. Dated , 2013.

Shares

Class A Common Stock

This is the initial public offering of Class A common stock of RingCentral, Inc. Prior to this offering, there has been no public market for our Class A common stock. RingCentral, Inc. is offering shares of Class A common stock, and the selling stockholders are offering shares of Class A common stock. We will not receive any proceeds from the sale of shares by the selling stockholders. The initial public offering price of our Class A common stock is expected to be between $ and $ per share.

Following this offering, we will have two classes of authorized common stock, Class A common stock and Class B common stock. The rights of the holders of Class A common stock and Class B common stock will be identical, except with respect to voting and conversion. Each share of Class A common stock will be entitled to one vote per share. Each share of Class B common stock will be entitled to ten votes per share and will be convertible at any time into one share of Class A common stock. Outstanding shares of Class B common stock will represent approximately % of the voting power of our outstanding capital stock following this offering.

We expect to apply for listing of our Class A common stock on the under the symbol “RNG.”

We are an “emerging growth company” under the federal securities laws and will be subject to reduced public company reporting requirements for so long as we remain an emerging growth company.

Investing in our Class A common stock involves risks. See “Risk Factors” beginning on page 10 to read about factors you should consider before buying shares of our Class A common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discount |

$ | $ | ||||||

| Proceeds to RingCentral, Inc., before expenses |

$ | $ | ||||||

| Proceeds to selling stockholders, before expenses |

$ | $ | ||||||

We and the selling stockholders have granted the underwriters an option to purchase up to additional shares of Class A common stock, with up to an additional shares sold by us and up to an additional shares sold by the selling stockholders.

The underwriters expect to deliver the shares of our Class A common stock on or about , 2013.

| Goldman, Sachs & Co. | J.P. Morgan | BofA Merrill Lynch | ||

| Allen & Company LLC | Raymond James | |||

Prospectus dated , 2013

Table of Contents

| Page | ||||

| 1 | ||||

| 10 | ||||

| 46 | ||||

| 47 | ||||

| 48 | ||||

| 49 | ||||

| 50 | ||||

| 52 | ||||

| 54 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

56 | |||

| 88 | ||||

| 103 | ||||

| 111 | ||||

| 123 | ||||

| 125 | ||||

| 128 | ||||

| 136 | ||||

| 138 | ||||

| 142 | ||||

| 148 | ||||

| 148 | ||||

| 148 | ||||

| F-1 | ||||

Through and including , 2013 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

You should rely only on the information contained in this prospectus and in any related free writing prospectus prepared by or on behalf of us. Neither we, the selling stockholders nor the underwriters have authorized anyone to provide you with information or to make any representations other than those contained in this prospectus or any related free writing prospectus. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

For investors outside the U.S.: neither we, the selling stockholders nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than the U.S. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

-i-

Table of Contents

This summary highlights selected information contained in greater detail elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our Class A common stock. You should read this entire prospectus carefully, especially the risks of investing in our Class A common stock discussed under “Risk Factors” and our consolidated financial statements and related notes included elsewhere in this prospectus, before making an investment decision. Unless otherwise noted or indicated by the context, the term “RingCentral” refers to RingCentral, Inc., and “we,” “us,” and “our” refer to RingCentral and its consolidated subsidiaries.

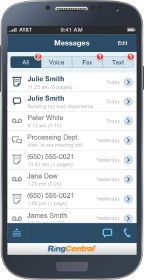

Overview

We are a leading provider of software-as-a-service, or SaaS, solutions for business communications. We believe that our innovative, cloud-based approach disrupts the large market for business communications solutions by providing flexible and cost-effective services that support distributed workforces, mobile employees and the proliferation of “bring-your-own” communications devices. We enable convenient and effective communications for our customers across all their locations, all their employees, all the time, thus fostering a more productive and dynamic workforce. RingCentral Office, our flagship service, is a multi-user, enterprise-grade communications solution that enables our customers and their employees to communicate via voice, text and fax, on multiple devices, including smartphones, tablets, PCs and desk phones.

Traditionally, businesses have used on-premise hardware-based communications systems, commonly referred to as private branch exchanges, or PBXs. These systems generally require specialized and expensive hardware that must be deployed at every business location and are primarily designed for employees working only at that location and using only their desk phones. In addition, these systems generally require significant upfront investment and ongoing maintenance and support costs. Furthermore, according to Gartner’s April 2013 report entitled “Bring Your Own Device: The Facts and the Future,” by 2017, half of employers will require their employees to supply their own devices for work purposes. We believe that this trend will create additional challenges for businesses using legacy communications solutions.

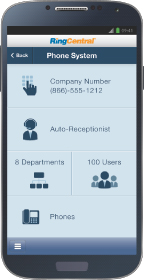

Our solutions have been developed with a mobile-centric approach and can be configured, managed and used from a smartphone or tablet. We have designed our user interfaces to be intuitive and easy to use for both administrators and end-users. We believe that we can provide substantial savings to our customers because our services do not require the significant upfront investment in on-premise infrastructure hardware or ongoing maintenance costs commonly associated with on-premise systems. Our solutions generally use existing broadband connections. We design our solutions to be delivered to our customers with high reliability and quality of service using our proprietary high-availability and scalable infrastructure.

The market for business communications solutions is large. According to Infonetics Research, from 2008 through 2012, there were 61 million PBX lines sold in North America. Assuming our current base selling price of approximately $20 per user per month, we believe that the potential replacement market is approximately $15 billion in North America. We also believe that this estimate significantly understates the potential market opportunity for our cloud-based solutions because a significant number of businesses today have not historically deployed a business communications system due to functionality limitations, cost and other factors.

We primarily generate revenues by selling subscriptions for our cloud-based services. We focus on acquiring and retaining our customers and increasing their spending with us through adding

-1-

Table of Contents

additional users, upselling current customers to premium service editions, and providing additional features and functionality. We market and sell our services directly, through both our website and inside sales teams, as well as indirectly through a network of over 1,000 resellers, including AT&T. We have a differentiated business model that reduces the time and cost to purchase, activate and begin using our services. We generally offer free trials to prospective customers, allowing them to evaluate our solutions before making a purchasing decision.

We have a diverse and growing customer base comprised of over 300,000 businesses across a wide range of industries, including advertising, consulting, finance, healthcare, legal, real estate, retail and technology. To date, we have focused our principal efforts on the market for small and medium-sized businesses, defined by IDC as less than 1,000 employees, in the U.S. and Canada. We are making investments in an effort to address medium-sized and larger customers. We also believe that there is an additional growth opportunity in international markets.

We have experienced significant growth in recent periods, with total revenues of $50.2 million, $78.9 million and $114.5 million in 2010, 2011 and 2012, respectively, generating year-over-year increases of 57% and 45%, respectively. We have continued to make significant expenditures and investments, including in research and development, brand marketing and channel development, infrastructure and operations, and incurred net losses of $7.3 million, $13.9 million and $35.4 million, in 2010, 2011 and 2012, respectively. For the three months ended March 31, 2012 and 2013, our total revenues were $24.8 million and $35.5 million, respectively, and our net losses were $9.7 million and $10.3 million, respectively.

Industry Background

Communications systems are critical to any business. In recent years, there have been significant changes in how people work and communicate with customers, co-workers and other third parties. Traditionally, business personnel worked primarily at a single office, during business hours, and utilized desk phones as their primary communications devices connected through a PBX. With the proliferation of smartphones and tablets that offer much of the functionality of PCs, combined with the pervasiveness of inexpensive broadband Internet access, businesses are increasingly working around the clock across geographically dispersed locations, and their employees are using a broad array of communications devices and utilizing text, along with voice and fax, for business communications.

These changes have created new challenges for business communications. Traditional on-premise systems are generally not designed for workforce mobility, “bring-your-own” communications device environments, or the use of multiple communication channels, including text. Today, businesses require flexible, location- and device-agnostic communications solutions that provide users with a single identity across multiple locations and devices.

Fundamental advances in cloud technologies have enabled a new generation of business software to be delivered as a service over the Internet. Today, mission-critical applications such as customer relationship management, human capital management, enterprise resource planning and information technology, or IT, support are being delivered securely and reliably to businesses through cloud-based platforms. While on-premise systems typically require significant upfront and ongoing costs, as well as trained and dedicated IT personnel, cloud-based services enable cost-effective and easy delivery of business applications to users regardless of location or access device.

-2-

Table of Contents

We believe that there is a significant opportunity to leverage the benefits of cloud computing to provide next-generation, cloud-based business communications solutions that address the new realities of workforce mobility, multi-device environments and multi-channel communications, thereby enabling people to communicate the way they do business.

Our Solutions

Our cloud-based business communications solutions provide a single user identity across multiple locations and devices, including smartphones, tablets, PCs and desk phones, and allow for communication across multiple channels, including voice, text and fax. Our proprietary solutions enable a more productive and dynamic workforce, and have been architected using industry standards to meet modern business communications requirements, including workforce mobility, “bring-your-own” communications device environments and multiple communications channels.

The key benefits of our solutions include:

| Ÿ | Location Independence. We seamlessly connect distributed and mobile users, enabling employees to communicate with a single identity whether working from a central location, a branch office, on the road, or at home. |

| Ÿ | Device Independence. Our solutions are designed to work with a broad range of devices, including smartphones, tablets, PCs and desk phones, enabling businesses to successfully implement a “bring-your-own” communications device strategy. |

| Ÿ | Instant Activation; Easy Account Management. Our solutions are designed for rapid deployment and ease of management. Our simple and intuitive graphical user interfaces allow administrators and users to set up and manage their business communications system with little or no IT expertise, training or dedicated staffing. |

| Ÿ | Scalability. Our cloud-based solutions scale easily and efficiently with the growth of our customers. Customers can add users, regardless of their location, without having to purchase additional infrastructure hardware or software upgrades. |

| Ÿ | Lower Cost of Ownership. We believe that our customers experience significantly lower cost of ownership compared to legacy on-premise systems. Using our cloud-based solutions, our customers can avoid the significant upfront costs of infrastructure hardware, software, ongoing maintenance and upgrade costs, and the need for dedicated and trained IT personnel. |

| Ÿ | Seamless and Intuitive Integration with Other Cloud-Based Applications. Our platform provides seamless and intuitive integration with multiple popular cloud-based business applications such as salesforce.com, Google Drive, Box and Dropbox. |

Our Competitive Strengths

Our competitive strengths include:

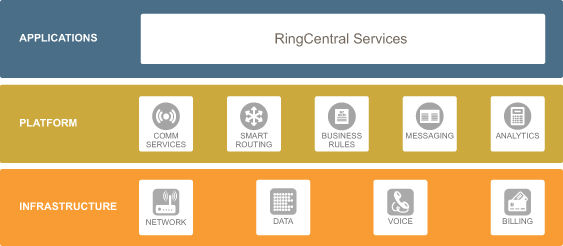

| Ÿ | Proprietary Core Technology Platform. We have developed our core multi-tenant, cloud-based, high-availability, scalable platform in-house over several years using industry standards. Our platform incorporates our communications and messaging services, delivery and billing infrastructure and open application programming interfaces, or APIs, for integration with third parties. |

-3-

Table of Contents

| Ÿ | Mobile-Centric Approach. Our platform was developed with a mobile-centric approach and can be provisioned, configured, managed and used from a smartphone or tablet as well as from PCs and the Web. |

| Ÿ | Rapid Innovation and Release Cycle. We strive to continuously innovate in an effort to regularly release new features and functionality to our customers. |

| Ÿ | Quality and Reliability of Service. Our platform employs a number of technologies and tools to provide the quality of service that our customers expect while using their existing broadband connections. |

| Ÿ | Effective Go-to-Market Strategy. We employ a broad range of direct and indirect marketing channels to target potential customers, including search-engine marketing, search-engine optimization, referral, affiliate, radio and billboard advertising. |

Our Growth Strategy

Key elements of our growth strategy include:

| Ÿ | Focus on Larger RingCentral Office Customers. We believe that these larger customers are more likely to have employees working in distributed locations or multiple offices and are more likely to require additional services, purchase premium service editions, have higher retention rates and enter into longer-term contracts. |

| Ÿ | Continue to Innovate. We intend to continue to invest in development efforts to introduce new features and functionality to our customers. |

| Ÿ | Grow Revenues from Existing Customers. We intend to grow our revenues from our existing customers as they add new users and as we provide them with new features and functionality. |

| Ÿ | Expand Our Distribution Channels. Our indirect sales channel currently consists of a network of over 1,000 resellers, including AT&T. We intend to continue to foster these relationships and to develop additional relationships with other resellers. |

| Ÿ | Scale Internationally. To date, we have focused almost exclusively on the North American market. We believe that there is an additional growth opportunity for our cloud-based business communications solutions in international markets. |

Risks Associated with Our Business

Investing in our common stock involves substantial risks, including, but not limited to, the following:

| Ÿ | Significant Losses. We have incurred significant losses in the past and anticipate continuing to incur losses for the foreseeable future, and we may therefore not be able to achieve or sustain profitability in the future. |

| Ÿ | Limited Operating History. Our limited operating history makes it difficult to evaluate our current business and future prospects, which may increase the risk of your investment. |

| Ÿ | Reliance on Third-Parties. We rely on third parties to deliver all of our services, connectivity and certain features of our services. We also rely on third parties for software development, quality assurance and customer support. |

-4-

Table of Contents

| Ÿ | Third-Party Facilities Risks. Interruptions or delays in service from our third-party data center hosting facilities and co-location facilities could impair the delivery of our services and harm our business. |

| Ÿ | Security Risks. A security breach could delay or interrupt service to our customers, harm our reputation or subject us to significant liability. |

| Ÿ | Threats of IP Infringement. Accusations of infringement of third-party intellectual property rights could materially and adversely affect our business. |

| Ÿ | Interruptions of Services. Interruptions in our services, whether caused by us or third parties, could harm our reputation, result in significant costs to us and impair our ability to sell our services. |

If we are unable to adequately address these and other risks we face, our business, financial condition, results of operations, and prospects may be materially and adversely affected. In addition, there are additional risks related to an investment in our common stock.

You should carefully read “Risk Factors” beginning on page 10 for an explanation of the foregoing risks before investing in our common stock.

Corporate Background and Information

We were incorporated in California in February 1999 and plan to reincorporate in Delaware immediately prior to or upon the closing of this offering. Our principal executive offices are located at 1400 Fashion Island Blvd., 7th Floor, San Mateo, California 94404. The phone number of our principal executive offices is (650) 472-4100, and our main corporate website is www.ringcentral.com. The information on, or that can be accessed through, our website is not part of this prospectus.

We have rights to a number of marks used in this prospectus that are important to our business, including, without limitation, RingCentral, RingCentral Office, RingCentral Professional, RingCentral Fax and Plug&Ring. This prospectus also contains trademarks and trade names of other businesses that are the property of their respective holders. We have omitted the ® and ™ designations, as applicable, for the trademarks we name in this prospectus.

-5-

Table of Contents

THE OFFERING

| Class A common stock offered by us |

shares | |

| Class A common stock offered by selling stockholders |

shares | |

| Class A common stock to be outstanding after this offering |

shares | |

| Class B common stock to be outstanding after this offering |

shares | |

| Total Class A and Class B common stock to be outstanding after this offering |

shares | |

| Option to purchase additional shares of Class A common stock from us and the selling stockholders |

shares | |

| Use of proceeds |

The principal purposes of this offering are to increase our financial flexibility, increase our visibility in the marketplace and create a public market for our Class A common stock. We intend to use the net proceeds that we receive from this offering for working capital or other general corporate purposes, including additional marketing expenditures, the expansion of our sales organization, international expansion and further development of our solutions. We may use a portion of the net proceeds to repay in part or in full the outstanding principal and accrued interest on our term loans with our two lenders, the outstanding principal of which totaled $18.0 million in aggregate as of March 31, 2013. We also may use a portion of the net proceeds for capital expenditures for expansion of our network infrastructure as we grow our customer base in the U.S. and internationally. In addition, we may use a portion of the proceeds for acquisitions of complementary businesses, technologies or other assets. We will not receive any of the proceeds from the sale of shares to be offered by the selling stockholders. See “Use of Proceeds” beginning on page 48. | |

| Concentration of ownership |

Upon completion of this offering, our directors, executive officers and 5% stockholders and their affiliates will beneficially own, in the aggregate, approximately % of the voting power of our outstanding capital stock. | |

| Proposed symbol |

“RNG” | |

-6-

Table of Contents

The total number of shares of our Class A and Class B common stock to be outstanding after this offering used in this prospectus is based on no shares of our Class A common stock and 53,516,680 shares of our Class B common stock (including preferred stock on an as converted basis and 336,967 shares issuable upon the exercise of our outstanding warrants) outstanding as of March 31, 2013, excluding:

| Ÿ | 3,738,378 shares of Class B common stock issuable upon the exercise of outstanding options as of March 31, 2013 granted pursuant to our 2003 Equity Incentive Plan at a weighted-average exercise price of $0.95 per share; |

| Ÿ | 4,988,985 shares of Class B common stock issuable upon the exercise of outstanding options as of March 31, 2013 granted pursuant to our 2010 Equity Incentive Plan at a weighted-average exercise price of $4.75 per share; |

| Ÿ | additional shares of Class A common stock, subject to increase on an annual basis, reserved for future issuance under our 2013 Equity Incentive Plan, which will become effective in connection with this offering, consisting of: |

| Ÿ | shares of our Class A common stock reserved for future grant or issuance under our 2013 Equity Incentive Plan, and |

| Ÿ | shares of our Class B common stock reserved for future grant or issuance under our 2010 Equity Incentive Plan, which shares will be added to the shares of our Class A common stock to be reserved under our 2013 Equity Incentive Plan upon its effectiveness. |

| Ÿ | 336,967 shares of Class B common stock issuable upon exercise of outstanding warrants with a weighted-average exercise price of $2.87 per share. |

Unless otherwise expressly stated or the context otherwise requires, all information contained in this prospectus (except for our historical financial statements) assumes:

| Ÿ | our reincorporation in Delaware immediately prior to or upon the completion of this offering; |

| Ÿ | the reclassification of all of our common stock immediately prior to completion of this offering into an equivalent number of shares of our Class B common stock and the authorization of our Class A common stock; |

| Ÿ | that our amended and restated certificate of incorporation, which we will file in connection with the completion of this offering, is in effect; |

| Ÿ | the automatic conversion of all shares of our outstanding preferred stock into an aggregate of 30,368,527 shares of Class B common stock immediately prior to the completion of this offering and the automatic conversion of warrants to purchase 110,000 shares of our common stock and 226,967 shares of our preferred stock into warrants to purchase 336,967 shares of our Class B common stock upon completion of this offering; and |

| Ÿ | no exercise of the underwriters’ option to purchase up to an additional shares of our Class A common stock from us and the selling stockholders in this offering. |

-7-

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

You should read the summary consolidated financial data set forth below in conjunction with the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in this prospectus.

We have derived the following summary consolidated statements of operations data for the years ended December 31, 2010, 2011 and 2012 from our audited consolidated financial statements included elsewhere in this prospectus. We have derived the summary consolidated statements of operations data for the three months ended March 31, 2012 and 2013 and the summary consolidated balance sheet data as of March 31, 2013 from our unaudited interim consolidated financial statements included elsewhere in this prospectus. Our unaudited interim consolidated financial statements have been prepared on the same basis as our audited consolidated financial statements and, in the opinion of management, reflect all adjustments, consisting only of normal recurring adjustments, that are necessary for the fair statement of our unaudited interim consolidated financial statements. Our historical results are not necessarily indicative of the results that may be expected in the future, and the results for the three months ended March 31, 2013 are not necessarily indicative of the results to be expected for the full year ending December 31, 2013 or any other period.

| Year Ended December 31, | Three Months Ended March 31, |

|||||||||||||||||||

| 2010 | 2011 | 2012 | 2012 | 2013 | ||||||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||||||

| (in thousands, except per share amounts) | ||||||||||||||||||||

| Consolidated Statement of Operations Data: | ||||||||||||||||||||

| Revenues: |

||||||||||||||||||||

| Services |

$ | 46,385 | $ | 71,915 | $ | 105,693 | $ | 22,745 | $ | 32,273 | ||||||||||

| Product |

3,837 | 6,962 | 8,833 | 2,063 | 3,252 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total revenues |

50,222 | 78,877 | 114,526 | 24,808 | 35,525 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Cost of revenues: |

||||||||||||||||||||

| Services(1) |

17,915 | 26,475 | 36,215 | 8,130 | 10,709 | |||||||||||||||

| Product |

4,537 | 6,523 | 8,688 | 2,109 | 3,028 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total cost of revenues |

22,452 | 32,998 | 44,903 | 10,239 | 13,737 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

27,770 | 45,879 | 69,623 | 14,569 | 21,788 | |||||||||||||||

| Operating expenses: |

||||||||||||||||||||

| Research and development(1) |

7,208 | 12,199 | 24,450 | 5,023 | 7,504 | |||||||||||||||

| Sales and marketing(1) |

22,922 | 34,550 | 54,566 | 12,248 | 17,142 | |||||||||||||||

| General and administrative(1) |

4,934 | 12,969 | 24,434 | 7,021 | 6,550 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses |

35,064 | 59,718 | 103,450 | 24,292 | 31,196 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss from operations |

(7,294 | ) | (13,839 | ) | (33,827 | ) | (9,723 | ) | (9,408 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Other income (expense), net: |

||||||||||||||||||||

| Interest expense |

(184 | ) | (158 | ) | (1,503 | ) | (40 | ) | (639 | ) | ||||||||||

| Other income (expense), net |

172 | 109 | 32 | 55 | (203 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Other income (expense), net |

(12 | ) | (49 | ) | (1,471 | ) | 15 | (842 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss before provision for income taxes |

(7,306 | ) | (13,888 | ) | (35,298 | ) | (9,708 | ) | (10,250 | ) | ||||||||||

| Provision for income taxes |

1 | 15 | 92 | 21 | 12 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss |

$ | (7,307 | ) | $ | (13,903 | ) | $ | (35,390 | ) | $ | (9,729 | ) | $ | (10,262 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss per common share: |

||||||||||||||||||||

| Basic and diluted |

$ | (0.35 | ) | $ | (0.64 | ) | $ | (1.58 | ) | $ | (0.44 | ) | $ | (0.45 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted-average number of shares used in computing net loss per share: |

||||||||||||||||||||

| Basic and diluted |

20,871 | 21,678 | 22,353 | 22,185 | 22,631 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Pro forma net loss per share (unaudited): |

||||||||||||||||||||

| Basic and diluted |

$ | (0.67 | ) | $ | (0.19 | ) | ||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Shares used in computing pro forma net loss per share (unaudited): |

||||||||||||||||||||

| Basic and diluted |

52,722 | 53,000 | ||||||||||||||||||

|

|

|

|

|

|||||||||||||||||

-8-

Table of Contents

| (1) | Share-based compensation expense is included in our results of operations as follows (in thousands): |

| Year Ended December 31, | Three Months Ended March 31, |

|||||||||||||||||||

| 2010 | 2011 | 2012 | 2012 | 2013 | ||||||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||||||

| Cost of services revenues |

$ | 58 | $ | 141 | $ | 235 | $ | 56 | $ | 81 | ||||||||||

| Research and development |

111 | 260 | 837 | 131 | 275 | |||||||||||||||

| Sales and marketing |

340 | 297 | 651 | 131 | 179 | |||||||||||||||

| General and administrative |

311 | 490 | 1,379 | 173 | 579 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total share-based compensation expense |

$ | 820 | $ | 1,188 | $ | 3,102 | $ | 491 | $ | 1,114 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Consolidated Balance Sheet Data:

| As of March 31, 2013 |

||||||||||||

| Actual | Pro Forma(1) | Pro Forma As Adjusted(2) |

||||||||||

| (in thousands) | ||||||||||||

| Cash and cash equivalents |

$ | 22,320 | $ | 22,320 | $ | |||||||

| Working capital (deficit) |

(11,211 | ) | (11,211 | ) | ||||||||

| Total assets |

51,974 | 51,974 | ||||||||||

| Deferred revenue |

12,364 | 12,364 | ||||||||||

| Debt and capital lease obligations, current and long-term |

19,047 | 19,047 | ||||||||||

| Convertible preferred stock |

74,020 | - | ||||||||||

| Total shareholders’ equity (deficit) |

(8,615 | ) | (8,615 | ) | ||||||||

| (1) | The pro forma column reflects (i) the automatic conversion of all outstanding shares of preferred stock and common stock into an aggregate of 53,179,713 shares of Class B common stock immediately prior to the completion of this offering and (ii) the conversion of all warrants to purchase preferred stock and common stock into warrants to purchase an aggregate of 336,967 shares of Class B common stock, as if such conversions had occurred on March 31, 2013. |

| (2) | The pro forma as adjusted column gives effect to the pro forma adjustments set forth in footnote 1 above and the sale by us of shares of Class A common stock in this offering, at an assumed initial public offering price of $ per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us, and the sale of shares of Class A common stock by the selling stockholders. |

-9-

Table of Contents

Investing in our Class A common stock involves a high degree of risk. You should carefully consider the following risk factors and all other information contained in this prospectus, including our consolidated financial statements and the related notes, before making a decision to invest in our Class A common stock. The risks and uncertainties described below are not the only ones we face and include risks we consider material of which we are currently aware. If any of the following risks materialize, our business, financial condition, results of operations, and prospects could be materially harmed. In that event, the trading price of our Class A common stock could decline, and you could lose all or part of your investment.

Risks Related to Our Business and Our Industry

We have incurred significant losses and negative cash flows in the past and anticipate continuing to incur losses and negative cash flows for the foreseeable future, and we may therefore not be able to achieve or sustain profitability in the future.

We have incurred substantial net losses since our inception, including net losses of $7.3 million for fiscal 2010, $13.9 million for fiscal 2011, $35.4 million for fiscal 2012 and $10.3 million for the three months ended March 31, 2013, and had an accumulated deficit of $93.9 million as of March 31, 2013. Over the past year, we have spent considerable amounts of time and money to develop new business communications solutions and enhanced versions of our existing business communications solutions to position us for future growth. Additionally, we have incurred substantial losses and expended significant resources upfront to market, promote and sell our solutions and expect to continue to do so in the future. We also expect to continue to invest for future growth, including for advertising, customer acquisition, technology infrastructure, storage capacity, services development and international expansion. In addition, as a public company, we will incur significant accounting, legal and other expenses that we did not incur as a private company.

As a result of our increased expenditures, we will have negative operating cash flows for the foreseeable future and will have to generate and sustain increased revenues to achieve future profitability. Achieving profitability will require us to increase revenues, manage our cost structure and avoid significant liabilities. Revenue growth may slow, revenues may decline or we may incur significant losses in the future for a number of possible reasons, including general macroeconomic conditions, increasing competition, including competitive pricing pressures, a decrease in the growth of the markets in which we compete, or if we fail for any reason to continue to capitalize on growth opportunities. Additionally, we may encounter unforeseen operating expenses, difficulties, complications, delays, service delivery and quality problems and other unknown factors that may result in losses in future periods. If these losses exceed our expectations or our revenue growth expectations are not met in future periods, our financial performance will be harmed and our stock price could be volatile or decline.

Our limited operating history makes it difficult to evaluate our current business and future prospects, which may increase the risk of your investment.

Although we were incorporated in 1999, we did not formally introduce RingCentral Office, our current flagship service, until 2009. We have encountered and expect to continue to encounter risks and uncertainties frequently experienced by growing companies in rapidly changing markets. If our assumptions regarding these uncertainties are incorrect or change in reaction to changes in our markets, or if we do not manage or address these risks successfully, our results of operations could differ materially from our expectations, and our business could suffer. Any success that we may experience in the future will depend, in large part, on our ability to, among other things:

| Ÿ | retain and expand our customer base; |

-10-

Table of Contents

| Ÿ | increase revenues from existing customers as they add users and, in the future, purchase additional functionalities and premium service editions; |

| Ÿ | successfully acquire customers on a cost-effective basis; |

| Ÿ | improve the performance and capabilities of our services and applications through research and development; |

| Ÿ | successfully expand our business domestically and internationally; |

| Ÿ | successfully compete in our markets; |

| Ÿ | continue to innovate and expand our service offerings; |

| Ÿ | successfully protect our intellectual property and defend against intellectual property infringement claims; |

| Ÿ | generate leads and convert potential customers into paying customers; |

| Ÿ | maintain and enhance our third-party data center hosting facilities to minimize interruptions in the use of our services; and |

| Ÿ | hire, integrate, and retain professional and technical talent. |

Our quarterly and annual results of operations have fluctuated in the past and may continue to do so in the future. As a result, we may fail to meet or to exceed the expectations of research analysts or investors, which could cause our stock price to fluctuate.

Our quarterly and annual results of operations have varied historically from period to period, and we expect that they will continue to fluctuate due to a variety of factors, many of which are outside of our control, including:

| Ÿ | our ability to retain existing customers, expand our existing customers’ user base and attract new customers; |

| Ÿ | our ability to introduce new solutions; |

| Ÿ | the actions of our competitors, including pricing changes or the introduction of new solutions; |

| Ÿ | our ability to effectively manage our growth; |

| Ÿ | our ability to successfully penetrate the market for larger businesses; |

| Ÿ | the mix of annual and multi-year subscriptions at any given time; |

| Ÿ | the timing, cost and effectiveness of our advertising and marketing efforts; |

| Ÿ | the timing, operating cost and capital expenditures related to the operation, maintenance and expansion of our business; |

| Ÿ | service outages or security breaches and any related impact on our reputation; |

| Ÿ | our ability to accurately forecast revenues and appropriately plan our expenses; |

| Ÿ | our ability to realize our deferred tax assets; |

| Ÿ | costs associated with defending and resolving intellectual property infringement and other claims; |

| Ÿ | changes in tax laws, regulations, or accounting rules; |

| Ÿ | the timing and cost of developing or acquiring technologies, services or businesses and our ability to successfully manage any such acquisitions; and |

-11-

Table of Contents

| Ÿ | the impact of worldwide economic, industry and market conditions. |

Any one of the factors above, or the cumulative effect of some or all of the factors referred to above, may result in significant fluctuations in our quarterly and annual results of operations. This variability and unpredictability could result in our failure to meet our internal operating plan or the expectations of securities analysts or investors for any period, which could cause our stock price to decline. In addition, a significant percentage of our operating expenses is fixed in nature and is based on forecasted revenues trends. Accordingly, in the event of revenue shortfalls, we may not be able to mitigate the negative impact on net income (loss) and margins in the short term. If we fail to meet or exceed the expectations of research analysts or investors, the market price of our shares could fall substantially, and we could face costly lawsuits, including securities class-action suits.

We rely on third parties to deliver all of our services, connectivity and certain features of our services.

We currently use the infrastructure of third-party network service providers, in particular, the services of Level 3 Communications, Inc. and Bandwidth.com, Inc., to deliver all of our services over their networks rather than deploying our own networks. Our service providers provide access to their Internet protocol, or IP, networks, and public switched telephone networks, or PSTN, and provide call termination and origination services, including 911 emergency calling in the U.S. and equivalent services in Canada and the United Kingdom, and local number portability for our customers. We expect that we will continue to rely heavily on third-party network service providers to provide these services for the foreseeable future. Historically, our reliance on third-party networks has reduced our operating flexibility and ability to make timely service changes, and we expect that this will continue for the foreseeable future. If any of these network service providers stop providing us with access to their infrastructure, fail to provide these services to us on a cost-effective basis, cease operations, or otherwise terminate these services, the delay caused by qualifying and switching to another third-party network service provider, if one is available, could have a material adverse effect on our business and results of operations.

In addition, we currently use and may in the future use third-party service providers to deliver certain features of our services. For example, we rely on Free Conference Call Global, LLC for conference calling features. If any of these service providers elects to stop providing us with access to their services, fails to provide these services to us on a cost-effective basis, ceases operations, or otherwise terminates these services, the delay caused by qualifying and switching to another third-party service provider, if one is available, or building a proprietary replacement solution could have a material adverse effect on our business and results of operations.

Finally, if problems occur with any of these third-party network or service providers, it may cause errors or poor call quality in our service, and we could encounter difficulty identifying the source of the problem. The occurrence of errors or poor call quality in our service, whether caused by our systems or a third-party network or service provider, may result in the loss of our existing customers, delay or loss of market acceptance of our services, termination of our relationships and agreements with our resellers, and may seriously harm our business and results of operations.

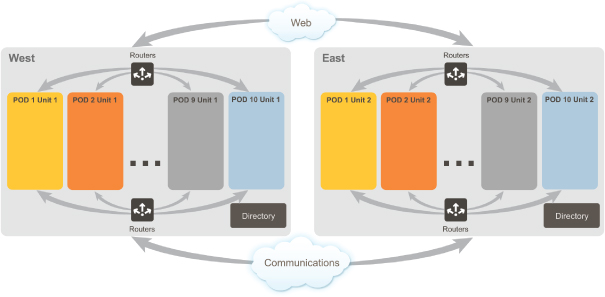

Interruptions or delays in service from our third-party data center hosting facilities and co-location facilities could impair the delivery of our services and harm our business.

We currently serve our North American customers from two data center hosting facilities located in northern California and northern Virginia, where we lease space from Equinix, Inc. In the near future, we expect to serve customers in Europe from two third-party data center hosting facilities in Amsterdam, the Netherlands, and Zurich, Switzerland. In addition, our wholly owned subsidiary,

-12-

Table of Contents

RCLEC, Inc., uses two third-party co-location facilities to provide us with network services, and we expect RCLEC to use additional third-party co-location facilities in the future. Any damage to, or failure of, these facilities, the communications network providers with whom we or they contract, or with the systems by which our communications providers allocate capacity among their customers, including us, could result in interruptions in our service. Additionally, in connection with the expansion or consolidation of our existing data center facilities, we may move or transfer our data and our customers’ data to other data centers. Despite precautions that we take during this process, any unsuccessful data transfers may impair or cause disruptions in the delivery of our service. Interruptions in our service may reduce our revenues, may require us to issue credits or pay penalties, subject us to claims and litigation, cause customers to terminate their subscriptions and adversely affect our renewal rates and our ability to attract new customers. Because our ability to attract and retain customers depends on our ability to provide customers with a highly reliable service, even minor interruptions in our service could harm our brand and reputation and have a material adverse effect on our business.

As part of our current disaster recovery arrangements, our North American infrastructure and all of our North American customers’ data is currently replicated in near real-time at our two data center facilities in the U.S., and our European production environment and all of our United Kingdom and other European customers’ data will be replicated in near real-time at our two European data center facilities. We do not control the operation of these facilities or of RCLEC’s co-location facilities, and they are vulnerable to damage or interruption from earthquakes, floods, fires, power loss, telecommunications failures, and similar events. They may also be subject to break-ins, sabotage, acts of vandalism, and similar misconduct. Despite precautions taken at these facilities, the occurrence of a natural disaster or an act of terrorism or other unanticipated problems at these facilities could result in lengthy interruptions in our service. Even with the disaster recovery arrangements in place, our service could be interrupted.

We may also be required to transfer our servers to new data center facilities in the event that we are unable to renew our leases on acceptable terms, if at all, or the owners of the facilities decide to close their facilities, and we may incur significant costs and possible service interruption in connection with doing so. In addition, any financial difficulties, such as bankruptcy or foreclosure, faced by our third-party data center operators, or any of the service providers with which we or they contract may have negative effects on our business, the nature and extent of which are difficult to predict. Additionally, if our data centers are unable to keep up with our increasing needs for capacity, our ability to grow our business could be materially and adversely impacted.

Failures in Internet infrastructure or interference with broadband access could cause current or potential users to believe that our systems are unreliable, leading our customers to switch to our competitors or to avoid using our services.

Unlike traditional communications services, our services depend on our customers’ high-speed broadband access to the Internet, usually provided through a cable or digital subscriber line, or DSL, connection. Increasing numbers of users and increasing bandwidth requirements may degrade the performance of our services and applications due to capacity constraints and other Internet infrastructure limitations. As our customer base grows and their usage of communications capacity increases, we will be required to make additional investments in network capacity to maintain adequate data transmission speeds, the availability of which may be limited, or the cost of which may be on terms unacceptable to us. If adequate capacity is not available to us as our customers’ usage increases, our network may be unable to achieve or maintain sufficiently high data transmission capacity, reliability or performance. In addition, if Internet service providers and other third parties providing Internet services have outages or deteriorations in their quality of service, our customers will not have access to our services or may experience a decrease in the quality of our services. Furthermore, as the rate of adoption of new technologies increases, the networks on which our

-13-

Table of Contents

services and applications rely may not be able to sufficiently adapt to the increased demand for these services, including ours. Frequent or persistent interruptions could cause current or potential users to believe that our systems are unreliable, leading them to switch to our competitors or to avoid our services, and could permanently harm our reputation and brands.

In addition, users who access our services and applications through mobile devices, such as smartphones and tablets, must have a high-speed connection, such as Wi-Fi, 3G or 4G, to use our services and applications. Currently, this access is provided by companies that have significant and increasing market power in the broadband and Internet access marketplace, including incumbent phone companies, cable companies and wireless companies. Some of these providers offer products and services that directly compete with our own offerings, which can potentially give them a competitive advantage. Also, these providers could take measures that degrade, disrupt or increase the cost of user access to third-party services, including our services, by restricting or prohibiting the use of their infrastructure to support or facilitate third-party services or by charging increased fees to third parties or the users of third-party services, any of which would make our services less attractive to users, and reduce our revenues.

In the U.S., there is some uncertainty regarding whether suppliers of broadband Internet access have a legal obligation to allow their customers to access and use our services without interference. In December 2010, the Federal Communications Commission, or FCC, adopted net neutrality rules that make it more difficult for broadband Internet access service providers to block, degrade or discriminate against our services. These rules apply to wired broadband Internet providers, but not all of the rules apply to wireless broadband service. We cannot assure you that current net neutrality rules will not change in the future. Any instances of broadband interference could result in a loss of existing users and increased costs, which could impair our ability to attract new users, and materially and adversely affect our business and opportunities for growth.

Most of our customers may terminate their subscriptions for our service at any time without penalty, and increased customer turnover, or costs we incur to retain our customers and encourage them to add users and, in the future, to purchase additional functionalities and premium service editions, could materially and adversely affect our financial performance.

Our customers generally do not have long-term contracts with us and these customers may terminate their subscription for our service at any time without penalty or early termination charges. We cannot accurately predict the rate of customer terminations or average monthly service cancellations or failures to renew, which we refer to as turnover. Our customers with subscription agreements have no obligation to renew their subscriptions for our service after the expiration of their initial subscription period, which is typically between 1 and 36 months. In the event that these customers do renew their subscriptions, they may choose to renew for fewer users, shorter contract lengths, or for a less expensive service plan or edition. We cannot predict the renewal rates for customers that have entered into subscription contracts with us.

Customer turnover, as well as reductions in the number of users for which a customer subscribes, each have a significant impact on our results of operations, as does the cost we incur in our efforts to retain our customers and encourage them to upgrade their services and increase their number of users. Our turnover rate could increase in the future if customers are not satisfied with our service, the value proposition of our services or our ability to otherwise meet their needs and expectations. Turnover and reductions in the number of users for whom a customer subscribes may also increase due to factors beyond our control, including the failure or unwillingness of customers to pay their monthly subscription fees due to financial constraints and the impact of a slowing economy. Because of turnover and reductions in the number of users for whom a customer subscribes, we have to acquire new customers, or acquire new users within our existing customer base, on an ongoing basis simply to

-14-

Table of Contents

maintain our existing level of customers and revenues. If a significant number of customers terminate, reduce or fail to renew their subscriptions, we may be required to incur significantly higher marketing expenditures than we currently anticipate in order to increase the number of new customers or to upsell existing customers, and such additional marketing expenditures could harm our business and results of operations.

Our future success also depends in part on our ability to sell additional subscriptions and additional functionalities to our current customers. This may also require increasingly sophisticated and more costly sales efforts and a longer sales cycle. Any increase in the costs necessary to upgrade, expand and retain existing customers could materially and adversely affect our financial performance. If our efforts to convince customers to add users and, in the future, to purchase additional functionalities are not successful, our business may suffer. In addition, such increased costs could cause us to increase our subscription rates, which could increase our turnover rate.

If we are unable to attract new customers to our services on a cost-effective basis, our business will be materially and adversely affected.

In order to grow our business, we must continue to attract new customers and expand the number of users in our existing customer base on a cost-effective basis. We use and periodically adjust the mix of advertising and marketing programs to promote our services. Significant increases in the pricing of one or more of our advertising channels would increase our advertising costs or cause us to choose less expensive and perhaps less effective channels to promote our services. As we add to or change the mix of our advertising and marketing strategies, we may need to expand into channels with significantly higher costs than our current programs, which could materially and adversely affect our results of operations. We will incur advertising and marketing expenses in advance of when we anticipate recognizing any revenues generated by such expenses, and we may fail to otherwise experience an increase in revenues or brand awareness as a result of such expenditures. We have made in the past, and may make in the future, significant expenditures and investments in new advertising campaigns, and we cannot assure you that any such investments will lead to the cost-effective acquisition of additional customers. If we are unable to maintain effective advertising programs, our ability to attract new customers could be materially and adversely affected, our advertising and marketing expenses could increase substantially, and our results of operations may suffer.

Some of our potential customers learn about us through leading search engines, such as Google, Yahoo! and Bing. While we employ search engine optimization and search engine marketing strategies, our ability to maintain and increase the number of visitors directed to our website is not entirely within our control. If search engine companies modify their search algorithms in a manner that reduces the prominence of our listing, or if our competitors’ search engine optimization efforts are more successful than ours, fewer potential customers may click through to our website. In addition, the cost of purchased listings has increased in the past and may increase in the future. A decrease in website traffic or an increase in search costs could materially and adversely affect our customer acquisition efforts and our results of operations.

Our success depends, in part, on the conversion of potential customers that visit our website into paying customers. A number of our customers first try our communications services through free trials, which we offer as part of our overall strategy of developing the market for our services. We seek to convert these free-trial users to paying customers of our solutions. Some potential customers never convert from the trial period, and the rate at which free-trial users do convert to paying customers has varied historically, and we expect it to continue to fluctuate for the foreseeable future. Such variability and unpredictability could result in our failure to meet our operating plans and, to the extent that these

-15-

Table of Contents

customers do not become paying customers, we will not realize the intended benefits of this marketing strategy, and our ability to grow our revenues could be materially and adversely affected.

We market our products and services principally to small and medium-sized businesses, which may have fewer financial resources to weather an economic downturn.

We market our products and services principally to small and medium-sized businesses. These customers may be materially and adversely affected by economic downturns to a greater extent than larger, more established businesses. These businesses typically have more limited financial resources, including capital-borrowing capacity, than larger entities. Because the vast majority of our customers pay for our services through credit and debit cards, weakness in certain segments of the credit markets and in the U.S. and global economies has resulted in and may in the future result in increased numbers of rejected credit and debit card payments, which could materially affect our business by increasing customer cancellations and impacting our ability to engage new customers. If small and medium-sized businesses experience financial hardship as a result of a weak economy, industry consolidation or the overall demand for our services could be materially and adversely affected.

We face significant risks in our strategy to target medium-sized and larger businesses for sales of our services and, if we do not manage these efforts effectively, our business and results of operations could be materially and adversely affected.

We currently derive only a small portion of our revenues from sales from medium-sized businesses. As we target more of our sales efforts to medium-sized and larger businesses, we expect to incur higher costs and longer sales cycles and we may be less effective at predicting when we will complete these sales. In this market segment, the decision to purchase our services may require the approval of more technical personnel and management levels within a potential customer’s organization than we have historically encountered, and if so, these types of sales would require us to invest more time educating these potential customers about the benefits of our services. In addition, larger customers may demand more features, integration services and customization. Also, we have only limited experience in developing and managing sales channels and distribution arrangements for larger businesses. As a result of these factors, these sales opportunities may require us to devote greater research and development resources and sales, support and professional services resources to individual customers, resulting in increased costs and would likely lengthen our typical sales cycle, which could strain our limited sales and professional services resources. Moreover, these larger transactions may require us to delay recognizing the associated revenues we derive from these customers until any technical or implementation requirements have been met. Furthermore, because we have limited experience selling to larger businesses, our investment in marketing our services to these potential customers may not be successful, which could materially and adversely affect our results of operations and our overall ability to grow our customer base. Following sales to medium-sized or larger customers, we may experience fewer opportunities to expand these customers’ user base or sell them additional functionalities, or experience increased subscription terminations as compared to our experience with smaller businesses, any of which could materially and adversely impact our results of operations.

We rely significantly on a network of resellers to sell our services; our failure to effectively develop, manage, and maintain our indirect sales channels could materially and adversely affect our revenues.

Our future success depends on our continued ability to establish and maintain a network of channel relationships, and we expect that we will need to maintain and expand our network as we expand into international markets. An increasing portion of our revenues is derived from our network of over 1,000 resellers, including AT&T, many of which sell or may in the future decide to sell their own

-16-

Table of Contents

services or services from other cloud-based business communications providers. We generally do not have long-term contracts with these resellers, and the loss of or reduction in sales through these third parties could materially reduce our revenues. Our competitors may in some cases be effective in causing our resellers or potential resellers to favor their services or prevent or reduce sales of our services. If we fail to maintain relationships with our resellers, fail to develop relationships with new resellers in new markets or expand the number of resellers in our network in existing markets, or if we fail to manage, train, or provide appropriate incentives to our existing resellers, or if our resellers are not successful in their sales efforts, sales of our services may decrease and our results of operations would suffer.

Recruiting and retaining qualified resellers in our network and training them in our technology and service offerings requires significant time and resources. To develop and expand our indirect sales channels, we must continue to scale and improve our processes and procedures to support these channels, including investment in systems and training. Many resellers may not be willing to invest the time and resources required to train their staff to effectively market our services.

Support for smartphones and tablets are an integral part of our solutions. If we are unable to develop robust mobile applications that operate on mobile platforms that our customers use our business and results of operations could be materially and adversely affected.

Our solutions allow our customers to use and manage our cloud-based business communications solution on smart devices. As new smart devices and operating systems are released, we may encounter difficulties supporting these devices and services, and we may need to devote significant resources to the creation, support, and maintenance of our mobile applications. In addition, if we experience difficulties in the future integrating our mobile applications into smart devices or if problems arise with our relationships with providers of mobile operating systems, such as those of Apple Inc. or Google Inc., our future growth and our results of operations could suffer.

We face intense competition in our markets and may lack sufficient financial or other resources to compete successfully.

The cloud-based business communications industry is competitive, and we expect it to become increasingly competitive in the future. We face intense competition from other providers of business communications systems and solutions. Our competitors include traditional on-premise, hardware business communications providers such as Alcatel-Lucent, S.A., Avaya Inc., Cisco Systems, Inc., Mitel Networks Corporation, ShoreTel, Inc., Siemens Enterprise Networks, LLC and their resellers; and companies such as Microsoft Corporation and Broadsoft, Inc. that generally license their software, and their resellers. In addition, certain of our resellers are also our competitors. For example, AT&T serves as one of our resellers but is also a competitor for business communications. All of these companies may now or in the future also host their solutions through the cloud. We also face competition from other cloud companies such as j2 Global, Inc. and 8x8, Inc., as well as from established communications providers, such as AT&T Inc., Verizon Communications Inc. and Comcast Corporation, that resell on-premise hardware, software and hosted solutions. We may also face competition from other large Internet companies, such as Google Inc., Yahoo! Inc. and Amazon.com, Inc., any of which might launch its own cloud-based business communications services or acquire other cloud-based business communications companies in the future.

Many of our current and potential competitors have longer operating histories, significantly greater resources and name recognition, more diversified service offerings and larger customer bases than we have. As a result, these competitors may have greater credibility with our existing and potential customers and may be better able to withstand an extended period of downward pricing pressure. In addition, certain of our competitors have partnered with, or been acquired by, and may in

-17-

Table of Contents

the future partner with or acquire, other competitors to offer services, leveraging their collective competitive positions, which makes it more difficult to compete with them and could materially and adversely affect our results of operations. They also may be able to adopt more aggressive pricing policies and devote greater resources to the development, promotion and sale of their services than we can to ours. Some of these service providers have in the past and may choose in the future to sacrifice revenues in order to gain market share by offering their services at lower prices or for free. Our competitors may also offer bundled service arrangements offering a more complete service offering, despite the technical merits or advantages of our services. Competition could force us to decrease our prices, slow our growth, increase our customer turnover, reduce our sales or decrease our market share. The adverse impact of a shortfall in our revenues may be magnified if we are unable to adjust spending adequately to compensate for such shortfall.

If we are unable to develop, license or acquire new services or applications on a timely and cost-effective basis, our business, financial condition, and results of operations may be materially and adversely affected.

The cloud-based business communications industry is an emerging market that is characterized by rapid changes in customer requirements, frequent introductions of new and enhanced services, and continuing and rapid technological advancement. We cannot predict the effect of technological changes on our business. To compete successfully in this emerging market, we must anticipate and adapt to technological changes and evolving industry standards, and continue to design, develop, manufacture and sell new and enhanced services that provide increasingly higher levels of performance and reliability at lower cost. Currently, we derive a majority of our revenues from subscriptions to RingCentral Office, and we expect this will continue for the foreseeable future. However, our future success will also depend on our ability to introduce and sell new services, features and functionality that enhance or are beyond the voice, fax and text communications services we currently offer, as well as to improve usability and support and increase customer satisfaction. Our failure to develop solutions that satisfy customer preferences in a timely and cost-effective manner may harm our ability to renew our subscriptions with existing customers and create or increase demand for our services, and may materially and adversely impact our results of operations.

The introduction of new services by competitors or the development of entirely new technologies to replace existing offerings could make our solutions obsolete or adversely affect our business and results of operations. Announcements of future releases and new services and technologies by our competitors or us could cause customers to defer purchases of our existing services, which also could have a material adverse effect on our business, financial condition or results of operations. We may experience difficulties with software development, operations, design or marketing that could delay or prevent our development, introduction or implementation of new or enhanced services and applications. We have in the past experienced delays in the planned release dates of new features and upgrades, and have discovered defects in new services and applications after their introduction. We cannot assure you that new features or upgrades will be released according to schedule, or that, when released, they will not contain defects. Either of these situations could result in adverse publicity, loss of revenues, delay in market acceptance or claims by customers brought against us, all of which could harm our reputation, business, results of operations, and financial condition. Moreover, the development of new or enhanced services or applications may require substantial investment, and we must continue to invest a significant amount of resources in our research and development efforts to develop these services and applications to remain competitive. We do not know whether these investments will be successful. If customers do not widely adopt any new or enhanced services and applications, we may not be able to realize a return on our investment. If we are unable to develop, license, or acquire new or enhanced services and applications on a timely and cost-effective basis, or if such new or enhanced services and applications do not achieve market acceptance, our business, financial condition, and results of operations may be materially and adversely affected.

-18-

Table of Contents

A security breach could delay or interrupt service to our customers, harm our reputation, or subject us to significant liability.